Filed by Cole Credit Property Trust II, Inc.

Pursuant to Rule 425 Under the Securities Act of 1933

And Deemed Filed Pursuant to Rule 14a-6

Under the Securities Exchange Act of 1934

Subject Company: Spirit Realty Capital, Inc.

Registration Statement No. 333-187122

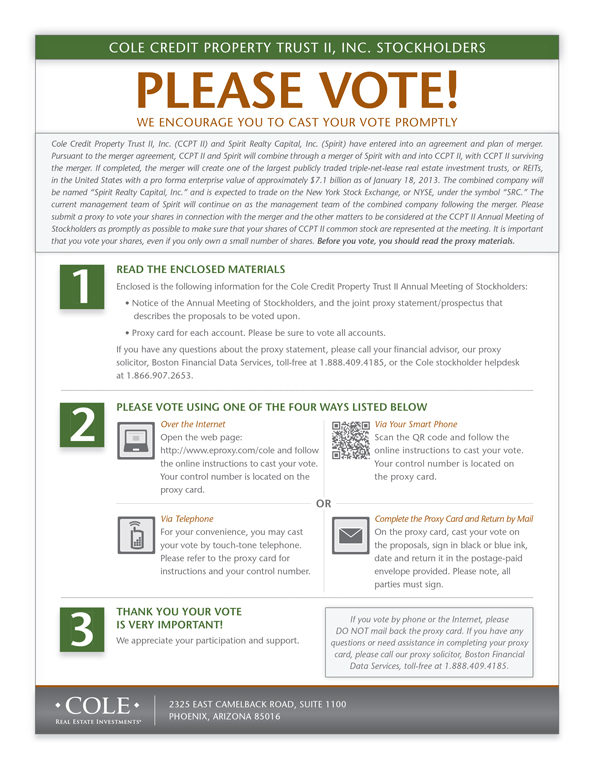

PLEASE VOTE!

WE ENCOURAGE YOU TO CAST YOUR VOTE PROMPTLY

COLE CREDIT PROPERTY TRUST II, INC. STOCKHOLDERS

2325 EAST CAMELBACK ROAD, SUITE 1100

Cole Credit Property Trust II, Inc. (CCPT II) and Spirit Realty Capital, Inc. (Spirit) have entered into an agreement and plan of merger.

1 READ THE ENCLOSED MATERIALS

Enclosed is the following information for the Cole Credit Property Trust II Annual Meeting of Stockholders:

describes the proposals to be voted upon.

at 1.866.907.2653.

3 THANK YOU YOUR VOTE

IS VERY IMPORTANT!

We appreciate your participation and support.

If you vote by phone or the Internet, please

DO NOT mail back the proxy card. If you have any

questions or need assistance in completing your proxy

card, please call our proxy solicitor, Boston Financial

Data Services, toll-free at 1.888.409.4185.

2 PLEASE VOTE USING ONE OF THE FOUR WAYS LISTED BELOW

Over the Internet

Open the web page:

http://www.eproxy.com/cole and follow

the online instructions to cast your vote.

Your control number is located on the

proxy card.

Via Telephone

For your convenience, you may cast

your vote by touch-tone telephone.

Please refer to the proxy card for

instructions and your control number.

Via Your Smart Phone

Scan the QR code and follow the

online instructions to cast your vote.

Your control number is located on

the proxy card.

Complete the Proxy Card and Return by Mail

On the proxy card, cast your vote on

the proposals, sign in black or blue ink,

date and return it in the postage-paid

envelope provided. Please note, all

parties must sign.

OR

PHOENIX, ARIZONA 85016

Pursuant to the merger agreement, CCPT II and Spirit will combine through a merger of Spirit with and into CCPT II, with CCPT II surviving

the merger. If completed, the merger will create one of the largest publicly traded triple-net-lease real estate investment trusts, or REITs,

in the United States with a pro forma enterprise value of approximately $7.1 billion as of January 18, 2013. The combined company will

be named “Spirit Realty Capital, Inc.” and is expected to trade on the New York Stock Exchange, or NYSE, under the symbol “SRC.” The

current management team of Spirit will continue on as the management team of the combined company following the merger. Please

submit a proxy to vote your shares in connection with the merger and the other matters to be considered at the CCPT II Annual Meeting of

Stockholders as promptly as possible to make sure that your shares of CCPT II common stock are represented at the meeting. It is important

that you vote your shares, even if you only own a small number of shares. Before you vote, you should read the proxy materials.

Notice of the Annual Meeting of Stockholders, and the joint proxy statement/prospectus that

Proxy card for each account. Please be sure to vote all accounts.

If you have any questions about the proxy statement, please call your financial advisor, our proxy

solicitor, Boston Financial Data Services, toll-free at 1.888.409.4185, or the Cole stockholder helpdesk

COLE CREDIT PROPERTY TRUST II, INC. STOCKHOLDERS

Additional Information and Where to Find It

This document is not a substitute for the Registration Statement

on Form S-4 (File No. 333-187122) that CCPT II filed with the

SEC in connection with the proposed merger with Spirit, or the

definitive joint proxy statement/prospectus sent to security holders

of CCPT II and Spirit on or about April 2, 2013 seeking their

approval of the proposed merger. INVESTORS AND SECURITY

HOLDERS OF CCPT II AND SPIRIT ARE URGED TO CAREFULLY

READ THE DEFINITIVE JOINT PROXY STATEMENT/PROSPECTUS

DATED APRIL 2, 2013, WHICH WAS SENT TO SECURITY HOLDERS

OF CCPT II AND SPIRIT ON OR ABOUT APRIL 2, 2013, AS IT

CONTAINS IMPORTANT INFORMATION, INCLUDING DETAILED

RISK FACTORS. Investors and security holders may obtain a free

copy of the joint proxy statement/prospectus and other documents

filed by CCPT II and Spirit with the SEC at the SEC’s web

site at www.sec.gov. Copies of the documents filed by CCPT II

with the SEC will be available free of charge by directing a written

request to Cole Credit Property Trust II, Inc., 2325 East Camelback

Road, Suite 1100, Phoenix, Arizona, 85016, Attention: Investor

Relations. Copies of the documents filed by Spirit with the

SEC will be available free of charge on Spirit’s website at www.

spiritrealty.com or by directing a written request to Spirit Realty

Capital, Inc., 16767 North Perimeter Drive, Suite 210, Scottsdale,

Arizona 85260, Attention: Investor Relations.

Participants in the Solicitation

CCPT II and Spirit and their respective directors, executive officers and certain members of management and employees may

be considered “participants in the solicitation” of proxies from

CCPT II’s stockholders and Spirit’s stockholders in connection

with the merger. Information regarding such persons and a description

of their interests in the merger is available in the joint

proxy statement/prospectus filed with the SEC.

This document shall not constitute an offer to sell or the solicitation

of an offer to buy any securities, nor shall there be any sale

of securities in any jurisdiction in which such offer, solicitation

or sale would be unlawful prior to registration or qualification

under the securities laws of any such jurisdiction. No offering of

securities shall be made except by means of a prospectus meeting

the requirements of Section 10 of the U.S. Securities Act of

1933, as amended.

Forward-Looking Statements

Certain statements contained in this document, other than historical

facts, may be considered forward-looking statements

within the meaning of Section 27A of the Securities Act of 1933,

as amended (the “Securities Act”), and Section 21E of the Securities

Exchange Act of 1934, as amended (the “Exchange

Act”), including statements regarding the merger and the ability

to consummate the merger. We intend for all such forwardlooking

statements to be covered by the safe harbor provisions

for forward-looking statements contained in Section 27A of the

Securities Act and Section 21E of the Exchange Act, as applicable.

Such statements include, in particular, statements about

our plans, strategies, and prospects and are subject to certain

risks and uncertainties, as well as known and unknown risks,

which could cause actual results to differ materially from those

projected or anticipated. Therefore, such statements are not intended

to be a guarantee of our performance in future periods.

Such forward-looking statements can generally be identified by

our use of forward-looking terminology such as “may,” “will,”

“would,” “could,” “should,” “expect,” “intend,” “anticipate,”

“estimate,” “believe,” “continue,” or other similar words. Readers

are cautioned not to place undue reliance on these forwardlooking

statements, which speak only as of the date this report

is filed with the Securities and Exchange Commission. We make

no representation or warranty (express or implied) about the

accuracy of any such forward-looking statements contained in

this document, and we do not intend, and undertake no obligation,

to publicly update or revise any forward-looking statements,

whether as a result of new information, future events, or

otherwise.