| MANAGEMENT’S DISCUSSION AND ANALYSIS FOR THE QUARTER ENDED SEPTEMBER30, 2013 |

This Management’s Discussion and Analysis (“MD&A”) should be read in conjunction with the condensed consolidated interim financial statements of Endeavour Silver Corp. (“Endeavour” or “the Company”) for the three and nine months ended September 30, 2013 and 2012 and the related notes contained therein, which are prepared in accordance with International Financial Reporting Standards (“IFRS”) as issued by the International Accounting Standards Board (“IASB”). In addition, the following should be read in conjunction with the audited consolidated financial statements for the year ended December 31, 2012 and the related MD&A. Additional information relating to the Company, including the most recent Annual Information Form, is available on SEDAR at www.sedar.com, and the Company’s most recent annual report on Form 40-F has been filed with the US Securities and Exchange Commission (the “SEC”). This MD&A contains “forward-looking statements” that are subject to risk factors set out in a cautionary note contained herein. All dollar amounts are expressed in United States (“US”) dollars and tabular amounts are expressed in thousands of dollars unless otherwise indicated. This MD&A is dated as of October 30, 2013 and all information contained is current as of October 30, 2013 unless otherwise stated.

Cautionary Note to US Investors concerning Estimates of Reserves and Measured, Indicated and Inferred Resource:

This MD&A has been prepared in accordance with the requirements of the securities laws in effect in Canada, which differ from the requirements of US securities laws. The terms “mineral reserve”, “proven mineral reserve” and “probable mineral reserve” are Canadian mining terms as defined in accordance with Canadian National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”) and the Canadian Institute of Mining, Metallurgy and Petroleum (the “CIM”) - CIM Definition Standards on Mineral Resources and Mineral Reserves, adopted by the CIM Council, as amended. These definitions differ from the definitions in SEC Industry Guide 7 under the US Securities Act of 1933, as amended (the “Securities Act”).

Under SEC Industry Guide 7 standards, a “final” or “bankable” feasibility study is required to report reserves, the three-year historical average price is used in any reserve or cash flow analysis to designate reserves and the primary environmental analysis or report must be filed with the appropriate governmental authority.

In addition, the terms “mineral resource”, “measured mineral resource”, “indicated mineral resource” and “inferred mineral resource” are defined in and required to be disclosed by NI 43-101; however, these terms are not defined terms under SEC Industry Guide 7 and are normally not permitted to be used in reports and registration statements filed with the SEC. Investors are cautioned not to assume that any part or all of mineral deposits in these categories will ever be converted into reserves. “Inferred mineral resources” have a great amount of uncertainty as to their existence, and great uncertainty as to their economic and legal feasibility. It cannot be assumed that all or any part of an inferred mineral resource will ever be upgraded to a higher category. Under Canadian rules, estimates of inferred mineral resources may not form the basis of feasibility or pre-feasibility studies, except in rare cases. Investors are cautioned not to assume that all or any part of an inferred mineral resource exists or is economically or legally mineable. Disclosure of “contained ounces” in a resource is permitted disclosure under Canadian regulations; however, the SEC normally only permits issuers to report mineralization that does not constitute “reserves” by SEC Industry Guide 7 standards as in place tonnage and grade without reference to unit measures.

Accordingly, information contained in this MD&A contain descriptions of Endeavour’s mineral deposits that may not be comparable to similar information made public by US companies subject to the reporting and disclosure requirements under the US federal securities laws and the rules and regulations thereunder.

| 700 West Pender Street, Suite 301, Vancouver, B.C., Canada V6C 1G8 |

| Phone: 604.685.9775 | Fax: 604.685.9744| Toll Free: 1.877.685.9775| Email: info@edrsilver.com |

| www.edrsilver.com |

| MANAGEMENT’S DISCUSSION AND ANALYSIS FOR THE QUARTER ENDED SEPTEMBER30, 2013 |

Forward-Looking Statements

Certain information contained herein constitutes forward-looking statements. Forward-looking statements are frequently characterized by words such as “plan”, “expect”, “forecast”, “project”, ”intend”, ”believe”, ”anticipate”, “outlook” and other similar words, or statements that certain events or conditions “may” or “will” occur. Forward- looking statements are based on the opinions and estimates of management at the dates the statements are made, and are subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ materially from those projected in the forward-looking statements. These factors include the inherent risks involved in the mining, exploration and development of mineral properties, the uncertainties involved in interpreting drilling results and other geological data, fluctuating metal prices, the possibility of project cost overruns or unanticipated operating costs and expenses, uncertainties related to the necessity of financing, the availability of and costs of financing needed in the future, and other factors described in the Company’s Annual Information Form under the heading “Risk Factors”. The Company undertakes no obligation to update forward- looking statements if circumstances or management’s estimates or opinions should change other than as required by securities laws. The reader is cautioned not to place undue reliance on forward-looking statements.

2

| Three Months Ended Sept. 30 | Q3 2013 Highlights | Nine Months Ended Sept. 30 | ||||

| 2013 | 2012 | % Change | 2013 | 2012 | % Change | |

Production | ||||||

| 1,855,846 | 1,137,933 | 63% | Silver ounces produced | 4,881,435 | 3,250,450 | 50% |

| 22,947 | 11,754 | 95% | Gold ounces produced | 57,894 | 25,770 | 125% |

| 1,799,695 | 1,126,553 | 60% | Payable silver ounces produced | 4,739,228 | 3,217,944 | 47% |

| 22,107 | 11,635 | 90% | Payable gold ounces produced | 55,658 | 25,511 | 118% |

| 3,232,666 | 1,843,173 | 75% | Silver equivalent ounces produced(1) | 8,355,075 | 4,796,650 | 74% |

| 5.14 | 4.70 | 10% | Cash costs per silver ounce(2)(3) | 8.09 | 5.46 | 48% |

| 13.17 | 13.18 | 0% | Total production costs per ounce(2)(4) | 15.91 | 11.85 | 34% |

| 12.14 | 21.25 | -43% | All-in sustaining costs per ounce(2)(5) | 20.29 | 20.58 | -1% |

| 389,090 | 306,164 | 27% | Processed tonnes | 1,158,504 | 702,910 | 65% |

| 104.06 | 97.05 | 7% | Direct production costs per tonne(2)(6) | 99.06 | 88.10 | 12% |

| $12.32 | $14.66 | -16% | Silver co-product cash costs(7) | $14.07 | $13.32 | 6% |

| $768.05 | $835.32 | -8% | Gold co-product cash costs(7) | $795.89 | $723.46 | 10% |

Financial | ||||||

| 67.8 | 51.9 | 31% | Revenue ($ millions) | 208.9 | 141.4 | 48% |

| 1,693,989 | 1,294,241 | 31% | Silver ounces sold | 4,996,637 | 3,469,241 | 44% |

| 20,958 | 8,984 | 133% | Gold ounces sold | 62,159 | 22,130 | 181% |

| 22.60 | 28.72 | -21% | Realized silver price per ounce | 25.05 | 30.26 | -17% |

| 1,409 | 1,637 | -14% | Realized gold price per ounce | 1,417 | 1,644 | -14% |

| 12.3 | 0.0 | 100% | Net earnings (loss) ($ millions) | 26.3 | 27.3 | -4% |

| 13.0 | 1.7 | 663% | Adjusted net earnings(6)($ millions) | 23.1 | 27.3 | -15% |

| 21.7 | 17.1 | 27% | Mine operating earnings ($ millions) | 47.1 | 60.0 | -22% |

| 31.8 | 26.9 | 18% | Mine operating cash flow(9)($ millions) | 90.5 | 83.0 | 9% |

| 25.9 | 19.3 | 34% | Operating cash flow before working capital changes(10) | 63.6 | 62.6 | 2% |

| 29.3 | 12.2 | 140% | Earnings before ITDA(11) | 77.0 | 62.3 | 24% |

| 26.8 | 61.8 | -57% | Working capital ($ millions) | 26.8 | 61.8 | -57% |

Shareholders | ||||||

| 0.12 | 0.00 | -100% | Earnings per share – basic | 0.26 | 0.30 | -13% |

| 0.13 | 0.02 | 550% | Adjusted earnings per share – basic(8) | 0.23 | 0.30 | -23% |

| 0.26 | 0.20 | 30% | Operating cash flow before working capital changes per share(10) | 0.64 | 0.69 | -7% |

| 99,741,010 | 97,666,618 | 2% | Weighted average shares outstanding | 99,704,100 | 91,159,694 | 9% |

| (1) | 2013 silver equivalents are calculated using a 60:1 ratio;, 2012 silver equivalents are calculated using a 55:1 ratio. |

| (2) | The Company reports non-IFRS measures which include cash costs net of by-products on a payable silver basis, total production costs per ounce, all-in sustaining costs per ounce and direct production costs per tonne, in order to manage and evaluate operating performance at each of the Company’s mines. These measures, some established by the Silver Institute (Production Cost Standards, June 2011), are widely used in the silver mining industry as a benchmark for performance, but do not have a standardized meaning. These measures are reported on a production basis. See Reconciliation to IFRS on page 18. |

| (3) | Cash costs net of by-products per payable silver ounce include mining, processing (including smelting, refining, transportation and selling costs), and direct overhead, net of gold credits. See Reconciliation to IFRS on page 18. |

| (4) | Total production costs per ounce include mining, processing (including smelting, refining, transportation and selling costs), direct overhead, amortization, depletion and amortization at the operation sites. See Reconciliation to IFRS on page 18. |

| (5) | All-in sustaining cost per ounce include mining, processing (including smelting, refining, transportation and selling costs), direct overhead, corporate general and administration, on-site exploration, share-based compensation, reclamation and sustaining capital net of gold credits. |

| (6) | Direct production costs per tonne include mining, processing (including smelting, refining, transportation and selling costs) and direct overhead at the operation sites. See Reconciliation to IFRS on page 18. |

3

| (7) | Silver co-product cash cost and gold co-product cash cost include mining, processing (including smelting, refining, transportation and selling costs), and direct overhead allocated on pro-rated basis of realized metal value. See Reconciliation to IFRS on page 20. |

| (8) | Adjusted earnings are calculated by adding back the mark-to-market impact of derivative equities held as a liability on the Company’s balance sheet. See Reconciliation to IFRS on page 16. |

| (9) | Mine operating cash flow is calculated by adding back amortization, depletion, inventory write downs and share-based compensation to mine operating earnings. Mine operating earnings and mine operating cash flow are before taxes. See Reconciliation to IFRS on page 16. |

| (10) | See Reconciliation to IFRS on page 17 for the reconciliation of operating cash flow before working capital changes, operating cash flow before working capital changes per share. |

| (11) | See Reconciliation of Earnings before interest, taxes, depreciation and amortization on page 17 |

Management’s highlights are key measures used by management, however they should not be the sole measures used in determining the performance of the Company’s operations.

HISTORY AND STRATEGY

The Company is engaged in silver mining in Mexico and related activities including property acquisition, exploration, development, mineral extraction, processing, refining and reclamation. The Company is also engaged in exploration activities in Chile.

Historically, the business philosophy was to acquire and explore early-stage mineral prospects in Canada and the US. In 2002 the Company was re-organized, a new management team was appointed, and the business strategy was revised to focus on acquiring advanced-stage silver mining properties in Mexico. Mexico, despite its long and prolific history of metal production, appeared to be relatively un-explored using modern exploration techniques and offered promising geological potential for precious metals exploration and production.

After evaluating several mineral properties in Mexico in 2003, the Company negotiated an option to purchase the Guanaceví silver mines and process plant located in Durango, Mexico in May 2004. Management recognized that even though the mines had run out of ore, little modern exploration had been carried out to discover new silver ore-bodies. Exploration drilling commenced in June 2004 and quickly met with encouraging results. By September 2004, sufficient high-grade silver mineralization had been outlined to justify the development of an access ramp into the newly discovered North Porvenir ore-body. In December 2004, the Company commenced the mining and processing of ore from the new North Porvenir mine to produce silver doré bars.

In 2007, the Company replicated the success of Guanaceví with the acquisition of the Bolañitos (formerly described as “Guanajuato”) mines project in Guanajuato State. Bolañitos was very similar in that there was a fully built and permitted processing plant, and the mines were running out of ore, so the operation was for sale. The acquisition was finalized in May 2007 and as a result of the successful mine rehabilitation and subsequent exploration work, silver production, reserves and resources are growing rapidly and Bolañitos is now an integral part of the Company’s asset base.

Both Guanaceví and Bolañitos are good examples of Endeavour’s business model of acquiring fully built and permitted silver mines that were about to close for lack of ore. By bringing the money and expertise needed to find new silver ore-bodies, Endeavour has successfully re-opened and expanded these mines to develop their full potential. The benefit of acquiring fully built and permitted mining and milling infrastructure is that if new exploration efforts are successful, the mine development cycle from discovery to production only takes a matter of months instead of the several years normally required in the traditional mining business model.

In 2012, the Company acquired the El Cubo silver-gold mine located in Guanajuato, Mexico. El Cubo has similar challenges to Endeavour’s past acquisitions, but with two significant exceptions; the property came with substantial reserves and resources, and the mine was already operating at 1,100 tonnes per day. The Company is focused on improving the mining methods, increasing brown-fields exploration and refurbishing the existing infrastructure to maximize the potential of El Cubo.

The Company historically funded its exploration and development activities through equity financings and convertible debentures. Equity financings also facilitated the acquisition and development of the Guanaceví and Bolañitos mines projects. However, since 2004, the Company has been able to finance more and more of its acquisition, exploration, development and operating activities from production cash flows. In 2012 the Company obtained a credit facility to help support its acquisition, exploration and capital investment programs. The Company may choose to engage in equity, debt, convertible debt or other financings, on an as needed basis, in order to facilitate its growth.

4

REVIEW OF OPERATING RESULTS

Consolidated Production Results for the Three and Nine Months Ended September 30, 2013 and 2012

| Three Months Ended Sept. 30 | CONSOLIDATED | Nine Months Ended Sept. 30 | ||||

| 2013 | 2012 | % Change | 2013 | 2012 | % Change | |

| 389,090 | 306,164 | 27% | Ore tonnes processed | 1,158,504 | 702,910 | 65% |

| 171 | 161 | 6% | Average silver grade (gpt) | 164 | 193 | -15% |

| 86.7 | 71.8 | 21% | Silver recovery (%) | 80.1 | 74.4 | 8% |

| 1,855,846 | 1,137,933 | 63% | Total silver ounces produced | 4,881,435 | 3,250,450 | 50% |

| 1,799,695 | 1,126,553 | 60% | Payable silver ounces produced | 4,739,228 | 3,217,944 | 47% |

| 1.89 | 1.49 | 27% | Average gold grade (gpt) | 1.79 | 1.44 | 24% |

| 96.9 | 80.1 | 21% | Gold recovery (%) | 86.8 | 79.2 | 10% |

| 22,947 | 11,754 | 95% | Total gold ounces produced | 57,894 | 25,770 | 125% |

| 22,107 | 11,635 | 90% | Payable gold ounces produced | 55,658 | 25,511 | 118% |

| 3,232,666 | 1,843,173 | 75% | Silver equivalent ounces produced(1) | 8,355,075 | 4,796,650 | 74% |

| 5.14 | 4.70 | 10% | Cash costs per silver ounce(2)(3) | 8.09 | 5.46 | 48% |

| 13.17 | 13.18 | 0% | Total production costs per ounce(2)(4) | 15.91 | 11.85 | 34% |

| 12.14 | 21.25 | -43% | All in sustaining cost per ounce(2)(5) | 20.29 | 20.58 | -1% |

| 104.06 | 97.05 | 7% | Direct production costs per tonne(2)(6) | 99.06 | 88.10 | 12% |

| $12.32 | $14.66 | -16% | Silver co-product cash costs(7) | $14.07 | $13.32 | 6% |

| $768.05 | $835.32 | -8% | Gold co-product cash costs(7) | $795.89 | $723.46 | 10% |

| (1) | 2013 silver equivalents are calculated using a 60:1 ratio;, 2012 silver equivalents are calculated using a 55:1 ratio |

| (2) | The Company reports non-IFRS measures which include cash costs net of by-product on a payable silver basis, total production costs per ounce, all-in sustaining costs per ounce and direct production costs per tonne, in order to manage and evaluate operating performance at each of the Company’s mines. These measures, some established by the Silver Institute (Production Cost Standards, June 2011), are widely used in the silver mining industry as a benchmark for performance, but do not have a standardized meaning. These measures are reported on a production basis. See Reconciliation to IFRS on page 18. |

| (3) | Cash costs net of by-products per payable silver ounce include mining, processing (including smelting, refining, transportation and selling costs), and direct overhead, net of gold credits. |

| (4) | Total production costs per ounce include mining, processing (including smelting, refining, transportation and selling costs), direct overhead, amortization, depletion and amortization at the operation sites. |

| (5) | All-in sustaining costs per ounce include mining, processing (including smelting, refining, transportation and selling costs), direct overhead, corporate general and administration, on-site exploration, share-based compensation, reclamation and sustaining capital net of gold credits. |

| (6) | Direct production costs per tonne include mining, processing (including smelting, refining, transportation and selling costs) and direct overhead at the operation sites. |

| (7) | Silver co-product cash cost and gold co-product cash cost include mining, processing (including smelting, refining, transportation and selling costs), and direct overhead allocated on pro -rated basis of realized metal value. See Reconciliation to IFRS on page 20. |

5

Consolidated Production

Three months ended September 30, 2013 (compared to three months ended September 30, 2012)

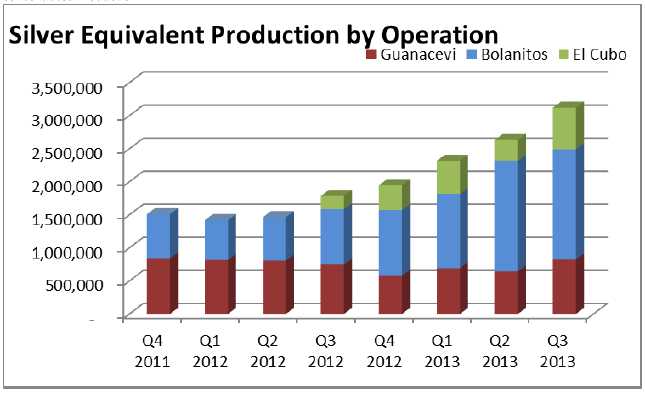

Consolidated silver production during Q3, 2013 was 1,855,846 oz, an increase of 63% compared to 1,137,933 oz, and gold production was 22,947 oz, an increase of 95% compared to 11,754 oz in Q3, 2012. Metal production was significantly higher due to the expansion of the Bolañitos mine above the Bolañitos plant capacity in 2013, the processing of the extra Bolañitos mine production at the nearby Las Torres plant, and the acquisition of the El Cubo operation in Q3, 2012. Plant throughput was 389,090 tonnes at average grades of 171 gpt silver and 1.89 gpt gold compared to 306,164 tonnes grading 161 gpt silver and 1.49 gpt gold. The change in grades was due to the increasing significance of the Bolañitos and El Cubo operations, which have lower silver and higher gold grades compared to Guanaceví.

Nine months ended September 30, 2013 (compared to nine months ended September 30, 2012)

Consolidated silver production during 2013 was 4,881,435 oz, an increase of 50% compared to 3,250,450 oz, and gold production was 57,894 oz, an increase of 125% compared to 25,770 oz in Q3, 2012. Metal production was significantly higher due to the expansion of the Bolañitos mine, the processing of the extra Bolanitos mine production at the Las Torres plant, and the acquisition of the El Cubo operation in Q3, 2012. Plant throughput was 1,158,504 tonnes at average grades of 164 gpt silver and 1.79 gpt gold compared to 702,910 tonnes grading 193 gpt silver and 1.44 gpt gold. The change in grades was due to the increasing significance of the Bolañitos and El Cubo operations, which have lower silver and higher gold grades compared to Guanaceví.

Consolidated Operating Costs

Cash costs per ounce net of by-product credits, which is a non-IFRS measure and a standard of the Silver Institute, were $5.14 per ounce of payable silver for Q3 2013 compared to $4.70 in Q3, 2012. The rise in costs was due to the significantly lower gold prices which reduced the gold credit, the lower silver grades and the addition of the higher cost El Cubo operation, offset by the increasing importance of the lower cost Bolañitos operation. The costs per tonne increased due to the appreciation of the Mexican peso year over year (4% higher compared to same period in 2012 – see Key Economic Trends on page 23), higher wages, and the addition of the higher cost El Cubo operation, offset by the increasing contribution from the lower cost Bolañitos operation.

6

Guanaceví Operations

Production Results for the Three and Nine Months Ended September 30, 2013 and 2012

| Three Months Ended Sept. 30 | GUANACEVÍ | Nine Months Ended Sept. 30 | ||||

| 2013 | 2012 | % Change | 2013 | 2012 | % Change | |

| 107,480 | 108,343 | -1% | Ore tonnes processed | 314,914 | 307,514 | 2% |

| 265 | 227 | 17% | Average silver grade (g/t) | 246 | 262 | -6% |

| 78.0 | 75.7 | 3% | Silver recovery (%) | 76.6 | 77.0 | -1% |

| 715,080 | 598,285 | 20% | Total silver ounces produced | 1,910,732 | 1,994,736 | -4% |

| 707,929 | 592,302 | 20% | Payable silver ounces produced | 1,891,625 | 1,974,788 | -4% |

| 0.70 | 0.87 | -20% | Average gold grade (g/t) | 0.57 | 0.78 | -27% |

| 82.1 | 88.0 | -7% | Gold recovery (%) | 78.6 | 87.5 | -10% |

| 1,977 | 2,667 | -26% | Total gold ounces produced | 4,510 | 6,786 | -34% |

| 1,957 | 2,640 | -26% | Payable gold ounces produced | 4,465 | 6,718 | -34% |

| 833,700 | 758,305 | 10% | Silver equivalent ounces produced(1) | 2,181,332 | 2,401,896 | -9% |

| 12.98 | 10.99 | 18% | Cash costs per silver ounce(2)(3) | 14.87 | 10.71 | 39% |

| 18.76 | 16.54 | 13% | Total production costs per ounce(2)(4) | 20.82 | 15.78 | 32% |

| 19.18 | 22.63 | -15% | All in sustaining cost per ounce(2)(5) | 24.82 | 21.54 | 15% |

| 111.06 | 101.83 | 9% | Direct production costs per tonne(2)(6) | 109.53 | 105.32 | 4% |

| $14.24 | $14.70 | -3% | Silver co-product cash costs(7) | $15.93 | $13.71 | 16% |

| $887.73 | $838.15 | 6% | Gold co-product cash costs(7) | $900.90 | $743.82 | 21% |

| (1) | 2013 silver equivalents are calculated using a 60:1 ratio, 2012 silver equivalents are calculated using a 55:1 ratio |

| (2) | The Company reports non-IFRS measures which include cash costs net of by-product on a payable silver basis, total production costs per ounce, all in sustaining costs per ounce and direct production costs per tonne, in order to manage and evaluate operating performance at each of the Company’s mines. These measures, some established by the Silver Institute (Production Cost Standards, June 2011), are widely used in the silver mining industry as a benchmark for performance, but do not have a standardized meaning. These measures are reported on a production basis. See Reconciliation to IFRS on page 18. |

| (3) | Cash costs net of by-product per payable silver ounce include mining, processing (including smelting, refining, transportation and selling costs), and direct overhead, net of gold credits. |

| (4) | Total production costs per ounce include mining, processing (including smelting, refining, transportation and selling costs), direct overhead, amortization, depletion and amortization at the operation sites. |

| (5) | All in sustaining cost per ounce include mining, processing (including smelting, refining, transportation and selling costs), direct overhead, corporate general and administration, on-site exploration, share-based compensation, reclamation and sustaining capital net of gold credits |

| (6) | Direct production costs per tonne include mining, processing (including smelting, refining, transportation and selling costs) and direct overhead at the operation sites. |

| (7) | Silver co-product cash cost and gold co-product cash cost include mining, processing (including smelting, refining, transportation and selling costs), and direct overhead allocated on pro-rated basis of realized metal value. See Reconciliation to IFRS on page 20. |

The acquisition of Endeavour’s first silver mine, at Guanaceví in 2004, continues to reap rewards for all stakeholders. The mine has since produced more than 15 million ounces of silver and 38,000 ounces of gold, revitalized the local community, and helped establish Endeavour’s successful business model. Although the historic mine was closed and the plant was struggling to process 100 tonnes per day of odd tailings in 2004, Guanaceví is now producing 1,200 tonnes of high-grade ore per day. The Company found five high-grade silver-gold ore bodies along a five kilometre length of the prolific Santa Cruz vein and developed four new mines, one of which is now mined out. The Guanaceví operation currently includes three underground silver-gold mines, a cyanidation leach plant, mining camp, administration and housing facilities. It provides steady employment for more than 450 people and engages over 200 contractors.

7

Guanaceví Production Results

Three months ended September 30, 2013 (compared to three months ended September 30, 2012)

Silver production at the Guanaceví mine during Q3, 2013 was 715,080 oz, an increase of 20% compared to 598,285 oz, and gold production was 1,977 oz, a decrease of 26% compared to 2,667 oz in Q3, 2012. Silver production increased due to higher silver grades and recoveries, while lower gold grade and recoveries contributed to lower gold production. Plant throughput was 107,480 tonnes at average grades of 265 gpt silver and 0.70 gpt gold compared to 108,343 tonnes grading 227 gpt silver and 0.87 gpt gold. The change in grades and recoveries were a function of geological variation of the ore bodies in the third quarter, 2013, the higher grade Porvenir Cuatro mine contributed a higher tonnage resulting in the improved grades.

Nine months ended September 30, 2013 (compared to nine months ended September 30, 2012)

Silver production at the Guanaceví mine during Q3, 2013 was 1,910,732 oz, a decrease of 4% compared to 1,994,736 oz, and gold production was 4,510 oz, a decrease of 34% compared to 6,786 oz in 2012. Metal production was down due to lower metal grades and recoveries. Plant throughput was 314,914 tonnes at average grades of 246 gpt silver and 0.57 gpt gold compared to 307,514 tonnes grading 262 gpt silver and 0.78 gpt gold. The lower grades were attributable to the lower grade ores being mined at depth at North Porvenir, and increased tonnage in the lower grade Santa Cruz ore-body.

Guanaceví Operating Costs

Cash costs per ounce net of by-product credits, which is a non-IFRS measure and a standard of the Silver Institute, for Q3, 2013 were $12.98 per ounce of payable silver compared to $10.99 in Q3, 2012. The rise on a cash cost basis was due to the drop in gold grades and prices reducing the credit on a per ounce basis. On a per tonne basis, the appreciation of the Mexican peso year over year (4% higher compared to same period in 2012 – see Key Economic Trends on page 23), wage increases and mining to greater depths have driven the rise in costs per tonne.

8

Bolañitos Operations

Production Results for the Three and Nine Months Ended September 30, 2013 and 2012

| Three Months Ended Sept. 30 | BOLAÑITOS | Nine Months Ended Sept. 30 | ||||

| 2013 | 2012 | % Change | 2013 | 2012 | % Change | |

| 181,442 | 117,271 | 55% | Ore tonnes processed | 551,414 | 314,846 | 75% |

| 147 | 148 | -1% | Average silver grade (g/t) | 148 | 153 | -3% |

| 92.5 | 77.7 | 19% | Silver recovery (%) | 83.2 | 74.4 | 12% |

| 794,734 | 433,388 | 83% | Total silver ounces produced | 2,183,802 | 1,149,454 | 90% |

| 758,239 | 429,054 | 77% | Payable silver ounces produced | 2,082,918 | 1,137,959 | 83% |

| 2.75 | 2.39 | 15% | Average gold grade (g/t) | 2.64 | 2.19 | 21% |

| 98.9 | 81.7 | 21% | Gold recovery (%) | 88.4 | 77.6 | 14% |

| 15,869 | 7,363 | 116% | Total gold ounces produced | 41,510 | 17,260 | 140% |

| 15,245 | 7,289 | 109% | Payable gold ounces produced | 39,668 | 17,087 | 132% |

| 1,746,874 | 875,168 | 100% | Silver equivalent ounces produced(1) | 4,674,402 | 2,185,054 | 114% |

| (8.10) | (9.98) | 19% | Cash costs per silver ounce(2)(3) | (3.97) | (5.86) | 32% |

| (3.66) | (5.20) | 30% | Total production costs per ounce(2)(4) | 0.33 | (0.27) | 223% |

| (3.29) | 7.65 | -143% | All in sustaining cost per ounce(2)(5) | 7.67 | 13.43 | -43% |

| 84.57 | 77.34 | 9% | Direct production costs per tonne(2)(6) | 81.41 | 73.52 | 11% |

| $8.60 | $10.63 | -19% | Silver co-product cash costs(7) | $9.90 | $11.10 | -11% |

| $536.23 | $606.02 | -12% | Gold co-product cash costs(7) | $560.29 | $602.22 | -7% |

| (1) | 2013 silver equivalents are calculated using a 60:1 ratio; 2012 silver equivalents are calculated using a 55:1 ratio |

| (2) | The Company reports non-IFRS measures which include cash costs net of by-products on a payable silver basis, total production costs per ounce, all-in sustaining costs per ounce and direct production costs per tonne, in order to manage and evaluate operating performance at each of the Company’s mines. These measures, some established by the Silver Institute (Production Cost Standards, June 2011), are widely used in the silver mining industry as a benchmark for performance, but do not have a standardized meaning. These measures are reported on a production basis. See Reconciliation to IFRS on page 18. |

| (3) | Cash costs net of by-product per payable silver ounce include mining, processing (including smelting, refining, transportation and selling costs), and direct overhead, net of gold credits. |

| (4) | Total production costs per ounce include mining, processing (including smelting, refining, transportation and selling costs), direct overhead, amortization, depletion and amortization at the operation sites. |

| (5) | All-in sustaining cost per ounce include mining, processing (including smelting, refining, transportation and selling costs), direct overhead, corporate general and administration, on-site exploration, share-based compensation, reclamation and sustaining capital net of gold credits |

| (6) | Direct production costs per tonne include mining, processing (including smelting, refining, transportation and selling costs) and direct overhead at the operation sites. |

| (7) | Silver co-product cash cost and gold co-product cash cost include mining, processing (including smelting, refining, transportation and selling costs), and direct overhead allocated on pro-rated basis of realized metal value. See Reconciliation to IFRS on page 20. |

Endeavour's second mine acquisition, at Bolañitos in 2007, encompasses three operating silver and gold mines and a floatation plant, located 10 kilometres from the city of Guanajuato in the state of Guanajuato. Following the acquisition, the cash costs of production were as high as $32 per ounce and the operation was struggling to produce 300,000 ounces of silver per year. Following the execution of management’s business strategy, the cash costs of production fell to negative as production grew. Bolañitos’ processing plant was expanded in phases from 500 tonnes per day in 2007 to 1,600 tonnes per day in 2012.

Bolañitos Production Results

Three months ended September 30, 2013 (compared to three months ended September 30, 2012)

Silver production at the Bolañitos mine was 794,734 ounces, an increase of 83% compared to 433,388 oz, and gold production was 15,869 oz, an increase of 116% compared to 7,363 oz in Q3, 2012. Metal production was up due to higher throughput, grades and recoveries. The Bolañitos mine averaged 2,305 tonnes per day (tpd), well above the mine plan due to increased contract mining and more long-hole mining. The Bolañitos plant operated at its 1,600 tpd capacity, and the extra mine tonnage was processed at the leased Las Torres facility near El Cubo until July 22, 2013. Subsequent to July 22, 2013, the mine production in excess of Bolañitos’ plant capacity was processed at the newly refurbished El Cubo plant. Plant throughput was 181,442 tonnes at average grades of 147 gpt silver and 2.75 gpt gold, compared to 117,271 tonnes grading 148 gpt silver and 2.39 gpt gold.

9

Ore grades were significantly higher than both the prior year and the 2013 mine plan, as mining accessed better ore grades than the planned reserve grades, specifically in the Daniela vein. Mine grades are expected to remain above reserve grades in the next quarter. The increased recoveries were partly a function of executing contracts to sell concentrate as opposed to processing the concentrates at the Company’s leach facilities at Guanaceví and El Cubo to produce doré bars. Selling concentrate at current metal prices resulted in higher payable metal production albeit at higher refining charges, resulting in a financial benefit compared to doré production.

Nine months ended September 30, 2013 (compared to nine months ended September 30, 2012)

Silver production at the Bolañitos mine was 2,183,802 ounces, an increase of 90% compared to 1,149,454 oz, and gold production was 41,510 oz, an increase of 140% compared to 17,260 oz in Q3, 2012. Metal production was up due to higher throughput, grades and recoveries. In 2012, the Bolañitos plant was expanded from 1,000 tpd to 1,600 tpd, and the mine was expanded to the plant capacity by Q4, 2012. In 2013, the Bolañitos plant operated at its 1,600 tpd capacity, and the extra tonnes were processed at the leased Las Torres facility near the El Cubo operations. The leased Las Torres facility was scheduled to be returned in May, however the counterparty requested a later return date allowing continued access until July 22, 2013. This additional access allowed Bolañitos production to significantly exceed plan. Subsequent to July 22, 2013, mine production in excess of the Bolañitos’ plant capacity was processed at the newly refurbished El Cubo plant. Plant throughput was 551,414 tonnes at average grades of 148 gpt silver and 2.64 gpt gold, compared to 314,846 tonnes grading 153 gpt silver and 2.19 gpt gold.

Ore grades were also significantly higher than both the prior year and the 2013 mine plan, as mining accessed better ore grades than the planned reserve grades, specifically in the Daniela vein. Mine grades are expected to remain above reserve grades in the next quarter. Silver and gold recoveries were both anomalously higher due three onetime events: the Las Torres flotation plant was cleaned out of concentrate in July on expiry of the lease, the El Cubo leach circuit was cleaned out as El Cubo commenced concentrate sales in September and in Q2 the El Cubo plant held significant work-in-process balance as filter presses were not yet completed at the end of Q2. Management expects recoveries to return to historic levels in Q4, 2013. In addition, the function of executing contracts to sell concentrate as opposed to producing dore at the El Cubo plant will increase recoveries going forward. Selling concentrate results in higher payable metal production and higher refining charges, resulting in a net financial benefit.

Bolañitos Operating Costs

Cash costs per ounce net of by-product credits, which is a non-IFRS measure and a standard of the Silver Institute, for Q3, 2013 were negative $8.10 per ounce of payable silver compared to negative $9.98 in Q3, 2012. The rise in cash costs was primarily due to the drop in gold prices, reducing the gold credit. Costs on a per tonne basis have risen due to the appreciation of the Mexican peso (4% higher compared to same period in 2012 – See Key Economic Trends on page 23), salary and wage increases, increased contractor participation and higher refining costs as Bolañitos began selling concentrate late in Q1, 2013 rather than leaching the concentrate at the Company’s other operations. These additional costs were offset by increased tonnage improving economies of scale.

10

El Cubo Operations

Production Results for the Three and Nine Months Ended September 30, 2013 and 2012

| Three Months Ended Sept. 30 | EL CUBO | Nine Months Ended Sept. 30 | ||||

| 2013 | 2012 | % Change | 2013 | 2012 | % Change | |

| 100,168 | 80,550 | 24% | Ore tonnes processed | 292,176 | 80,550 | 263% |

| 112 | 92 | 22% | Average silver grade (g/t) | 103 | 92 | 12% |

| 95.6 | 44.6 | 114% | Silver recovery (%) | 80.3 | 44.6 | 80% |

| 346,032 | 106,260 | 226% | Total silver ounces produced | 786,901 | 106,260 | 641% |

| 333,527 | 105,197 | 217% | Payable silver ounces produced | 764,685 | 105,197 | 627% |

| 1.62 | 1.42 | 14% | Average gold grade (g/t) | 1.51 | 1.42 | 6% |

| 97.8 | 46.9 | 109% | Gold recovery (%) | 83.2 | 46.9 | 77% |

| 5,101 | 1,724 | 196% | Total gold ounces produced | 11,874 | 1,724 | 589% |

| 4,905 | 1,706 | 188% | Payable gold ounces produced | 11,525 | 1,706 | 576% |

| 652,092 | 209,700 | 211% | Silver equivalent ounces produced(1) | 1,499,341 | 209,700 | 615% |

| 18.61 | 29.21 | -36% | Cash costs per silver ounce(2)(3) | 24.19 | 29.21 | -17% |

| 39.54 | 69.21 | -43% | Total production costs per ounce(2)(4) | 46.24 | 69.21 | -33% |

| 32.27 | 68.96 | -53% | All in sustaining cost per ounce(2)(5) | 43.50 | 79.87 | -46% |

| 131.83 | 119.32 | 10% | Direct production costs per tonne(2)(6) | 121.08 | 119.32 | 1% |

| $19.89 | $31.25 | -36% | Silver co-product cash costs(7) | $24.25 | $31.25 | -22% |

| $1,239.76 | $1,781.37 | -30% | Gold co-product cash costs(7) | $1,371.96 | $1,781.37 | -23% |

| (1) | 2013 silver equivalents are calculated using a 60:1 ratio;, 2012 silver equivalents are calculated using a 55:1 ratio |

| (2) | The Company reports non-IFRS measures which include cash costs net of by-products on a payable silver basis, total production costs per ounce, all-in sustaining costs per ounce and direct production costs per tonne, in order to manage and evaluate operating performance at each of the Company’s mines. These measures, some established by the Silver Institute (Production Cost Standards, June 2011), are widely used in the silver mining industry as a benchmark for performance, but do not have a standardized meaning. These measures are reported on a production basis. See Reconciliation to IFRS on page 18. |

| (3) | Cash costs net of by-products per payable silver ounce include mining, processing (including smelting, refining, transportation and selling costs), and direct overhead, net of gold credits. |

| (4) | Total production costs per ounce include mining, processing (including smelting, refining, transportation and selling costs), direct overhead, amortization, depletion and amortization at the operation sites. |

| (5) | All-iin sustaining cost per ounce include mining, processing (including smelting, refining, transportation and selling costs), direct overhead, corporate general and administration, on-site exploration, share-based compensation, reclamation and sustaining capital net of gold credits. |

| (6) | Direct production costs per tonne include mining, processing (including smelting, refining, transportation and selling costs) and direct overhead at the operation sites. |

| (7) | Silver co-product cash cost and gold co-product cash cost include mining, processing (including smelting, refining, transportation and selling costs), and direct overhead allocated on pro-rated basis of realized metal value. See Reconciliation to IFRS on page 20. |

The acquisition of Endeavour’s third mine, the El Cubo mine in July 2012, was a good fit with Endeavour's business strategy of buying and rejuvenating struggling old mines in historic mining districts. However, unlike Guanaceví and Bolañitos, which had low throughputs and no reserves, El Cubo offered the potential to quickly become a core asset for Endeavour, already having a 1,100-tonne-per-day output and a reasonable reserve/resource mine life. Located in the southeastern part of the historic Guanajuato mining district, this producing silver and gold mine is only 15 kilometres from Endeavour’s Bolañitos project, and includes many mine adits, ramps, and shafts, as well as a 400-tonne-per-day leach plant. It also held a lease (until July 2013) on the adjacent Las Torres mine and 1,800-tonne-per-day flotation plant owned by Fresnillo PLC. Subsequent to the acquisition in Q3, 2012, Endeavour launched a $67-million, 18-month capital investment program at El Cubo to explore and develop the mine and to rebuild and expand the plant, tailings facility, water supply, electrical supply, surface buildings, and surface infrastructure. This facility was substantially completed in Q2 2013 on time and below budget.

11

El Cubo Production Results

Endeavour's new mine plan is focused on maintaining the current tonnage throughput at El Cubo around 1,000-1,200 tpd while progressively increasing the production grades by reducing ore dilution. The Company has reorganized the mine operations team, improved supervision and operating efficiencies, improved safety policies, programs and training to reduce lost time accidents and created a Mine Rescue Team for a safer environment. The Company acquired new mining equipment,accelerated mine development and commenced underground drilling. The plant and surface infrastructure reconstruction program was completed on time and budget in Q2, 2013.

During Q2, 2013 the Company announced that the newly rebuilt plant at El Cubo was successfully re-commisioned on May 31st, reaching phase 1 operating capacity of 1,100-1,200 tpd. Work to bring the plant capacity up to 1,500 – 1,600 tpd was completed in early Q3, 2013, allowing management to facilitate the processing up to 350 tpd of additional ore from the Bolañitos mine located in the same district as El Cubo only 15 kilometres away.

More than 600,000 hours of work were completed on the plant and infrastructure with no lost time accidents, an accomplishment of which the Company is particularly proud. Due to the successful re-commissioning of the El Cubo plant, Endeavour returned the nearby leased Las Torres plant to its owner, Fresnillo plc, on July 22, 2013.

Three months ended September 30, 2013 (compared to three months ended September 30, 2012)

Silver production at the El Cubo mine was 346,032 oz, an increase of 217% compared to 106,260 oz in Q3, 2012 and gold production was 5,101 oz, an increase of 196% compared to 1,724 oz in Q3, 2012. The rise year over year was due to the successful implementation of Endeavour’s turn around initiatives. In Q3, 2013, metal production jumped as management turned its focus from the re-construction of the site infrastructure to the optimization of the operations. The Company continues to focus on ensuring that safe, sustainable mining methods will become part of the culture which over time leads to improved operating efficiencies. Silver and gold recoveries were both anomalously higher due three one-time events: the Las Torres flotation plant was cleaned out of concentrate in July on expiry of the lease, the El Cubo leach circuit was cleaned out as El Cubo commenced concentrate sales in September and in Q2 the El Cubo plant held significant work-in-process balance as filter presses were not yet completed at the end of Q2. Management expects recoveries to return to historic levels in Q4, 2013. In addition, the function of executing contracts to sell concentrate as opposed to producing dore at the El Cubo plant will increase recoveries going forward. Selling concentrate results in higher payable metal production and higher refining charges, resulting in a net financial benefit.

El Cubo Operating Costs

Cash costs per ounce net of by-product credits, which is a non-IFRS measure and a standard of the Silver Institute, were $18.61 per ounce of payable silver for Q3, 2013compared to $29.21 in Q3, 2012. The Company acquired the El Cubo mine in July 2012, launching a two-step strategy to make the operations profitable. Since the acquisition, the Company has invested significantly in the mine and plant operations, improving safety programs, changing the workplace culture, increasing supervision and investing capital to improve productivity and reducing mine dilution. Included in the capital investment is significant exploration to fuel new discoveries and future mine expansions. The two year operational turn-around program has been bearing fruit, with production grades climbing, the lost time accident rate falling and operating costs declining in recent quarters. The costs per tonne during Q2 and Q3, 2013 significantly increased from Q1, 2013 due to the scheduled slowdown of production while management focused on the completion of the plant refurbishment and the severance of 354 on-site employees. Management is continuing to evaluate potential optimization strategies, while focusing on higher grade ore zones to improve economics during periods of lower metal prices.

12

Exploration Results

In January 2013, Endeavour commenced an aggressive $16.3 million surface exploration drill program to test multiple exploration targets at its three mining districts and five district scale exploration properties. A total of 78,500 metres of surface drilling was planned to test approximately 24 exploration targets. During Q2, 2013, the sharp drop in precious metal prices prompted management to reduce the size of the 2013 exploration program by 25%. The amended 2013 program includes 42,000 planned metres drilled for an estimated $12.1 million.

At Bolañitos, the Company continued drilling at the nearby Belen prospect as well as along the La Luz vein system northwest of the Lucero mine. The La Luz drilling resulted in the delineation of three mineralized zones at the Asuncion, La Luz Central and Plateros prospects, the first two which are readily accessible for exploitation from nearby historic workings. These zones are gold-rich extensions of silver mineralized zones in the vicinity of historic mine workings that each extend 200 metres long and 100 metres deep.

At Guanaceví, one drill rig continued testing the Milache property six kilometres northwest of the plant to more fully delineate the high-grade, silver-gold mineralization discovered on the Santa Cruz vein. The Company announced in November 2012 that drilling had extended the mineralized zone 300 metres long by 250 metres deep..

At El Cubo, drilling has tested several veins in and around the old mines, and more recently along the Villalpando vein system south of the active mines. The drilling resulted in the intersection of high grade gold-silver mineralization in two veins near historic mine workings in the Asuncion area of the Villapando vein system. The new mineralized zones extend about 200 metres long by 100 metres deep and have already been accessed by an underground cross cut. Several high priority targets have been identified south of the active mines at El Cubo and will be drilled in future years when surface permits are received.

At San Sebastián, Endeavour announced a significant new resource in the Terronera vein in Q1, 2013 and drilling continues to focus on increasing the resource so that the deposit is large enough to enter into economic evaluation and environmental permitting in 2014. During the first half of 2013, the Company infill drilled the southeast half of the known mineralized zone. With the Terronera vein essentially wide open along strike, and many other outcropping veins yet to be drilled, management views San Sebastián as having the potential to become a high grade, silver-gold, underground mine.

At the Panuco property, drilling in Q2, 2013 continued with geologically interesting but not yet economically viable results. The Panuco property is sandwiched between the La Preciosa property of Orko Silver to the southeast and the San Lucas property of Oremex Silver to the northwest, which was optioned in 2012. The Panuco property has excellent exploration potential both for bulk tonnage, open pit and high-grade, underground silver-gold deposits.

At the El Inca properties in northern Chile, surface mapping and target identification were completed in Q1, 2013 and drilling commenced in Q2, 2013. The El Inca properties have exploration potential for both bulk tonnage, open pit silver-lead-zinc mines like San Cristobal and high-grade, underground silver-gold mines like El Penon (south of El Inca in Chile) and open pit, porphyry copper mines like Chuquicamata. The drilling confirmed the geological potential for a bulk tonnage target, however there were no significant results during the first phase of drilling.

Consolidated Financial Results

Three months ended September 30, 2013 compared with the three months ended September 30, 2012

For the three-month period ended September 30, 2013, the Company’s mine operating earnings were $21.7 million (2012: $17.1 million) on sales of $67.8 million (2012: $51.9 million) with cost of sales of $46.1 million (2012: $34.8 million).

The operating earnings were $17.4 million (2012: $10.8 million) after exploration costs of $1.8 million (2012: $3.4 million) and general and administrative costs of $2.5 million (2012: $2.9 million).

13

Earnings before taxes were $16.4 million (2012: $5.6 million) after mark-to-market loss on derivative liabilities (see adjusted earnings comment on page 16) of $0.6 million (2012: $1.7 million), a foreign exchange loss of $1.2 million (2012: gain of $1.8 million), a mark-to-market loss on contingent liabilities of $0.1 million (2012: $5.0 million), investment and other income of $1.2 million (2012: loss of $0.1 million) and finance costs of $0.3 million (2012: $0.2 million). The Company realized net earnings for the period of $12.3 million (2012: $16 thousand) after an income tax provision of $401 million (2012: $5.6 million).

Sales of $67.8 million for the period represent a 31% increase over the $51.9 million for the same period in 2012. There was a 31% increase in silver ounces sold with a 21% decrease in the realized silver price resulting in a 3% increase in silver sales, and there was a 133% increase in gold ounces sold with a 14% decrease in realized gold prices resulting in a 101% increase in gold sales. During the period, the Company sold 1,693,989 oz silver and 20,958 oz gold, for realized prices of $22.60 and $1,409 per oz respectively, compared to sales of 1,294,241 oz silver and 8,984 oz gold, for realized prices of $28.72 and $1,637 per oz respectively, in the same period of 2012. The realized prices of silver and gold during the period were within 6% of the average silver spot price during the period of $21.40 and the average gold spot price during the period of $1,328, with differences due to the timing of sales and the mark-to-market for the concentrate sales that are pending finalization.

The Company accumulated 385,126 oz silver and 2,473 oz gold finished goods at September 30, 2013 compared to 255,260 oz silver and 1,320 oz gold at June 30, 2013. The cost allocated to these finished goods is $10.2 million, net of a $0.7 million write down of the El Cubo finished goods, compared to $5.7 million, net of a $0.5 million write-down of the El Cubo finished goods and a $1.0 million write down of the Guanaceví finished goods, at June 30, 2013.

Cost of sales for the period was $46.1million, an increase of 47% over the cost of sales of $31.4 million for the same period of 2012. The 47% increase was a result of a number of factors. The Company sold 31% more silver ounces during the period compared to the comparative period, experienced a 98% increase in amortization and depletion as the Company had higher accumulated cost bases, and the Company experienced additional labour cost pressures at both the Guanaceví and Bolañitos operations as well as increases in other input cost. Furthermore, the Company acquired the El Cubo mine in Q3, 2012, a high cost operation which has been operating at a loss since acquisition, resulting in a reduced gross margin on a consolidated basis. During the current period the Company took an inventory write down to net realizable value of $0.7 million at the El Cubo mine. The write down for El Cubo was comprised of a write down of finished goods. During the same period in 2012, the Company took an inventory write down to net realizable value of $3.3 million at the El Cubo mine comprised of both write downs in finished goods and work in process inventories. At September 30, 2013 the Company experienced a full recovery of the $3.4 million write down taken at June 30, 2013of Guanaceví stockpile inventory.

Exploration expenses decreased in Q3, 2013 to $1.8 million from $3.4 million in the same period of 2012 based on both the timing of the exploration activities and the reduction of exploration activities in the current year. During Q2, 2013, the sharp drop in precious metal prices prompted management to reduce the size of the 2013 exploration program by 25%. General and administrative expenses decreased to $2.5 million for the period as compared to $2.9 million in the same period of 2012 primarily due to decreased corporate development costs, legal and human resource costs.

A significant number of the Company’s share purchase warrants are classified and accounted for as a financial liability at fair value with adjustments recognized through net earnings because these warrants have an exercise price denominated in a currency which is different from the functional currency of the Company. During the period, there was a mark-to-market loss on derivative liabilities (see adjusted earnings comment on page 16) of $0.6 million, while the same period in 2012 had a mark-to-market loss on derivative liabilities of $1.7 million. The loss in the current period was a reflection of the Company’s share price increasing from CAN$3.64 at June 30, 2013 to CAN$4.42 at September 30, 2013.

The mark-to-market loss on the contingent liability was a result of a revaluation, based on the Monte Carlo model, of the contingent consideration related to the acquisition of Mexgold (El Cubo). An increase in the gold price and movement in the forward curve resulted in a $0.1 million mark-to-market loss during Q3, 2013 while the same period in 2012 had a mark-to-market loss on the contingent liability of $5.0 million.

14

The Company experienced a foreign exchange loss of $1.2 million during the period compared to a gain of $1.8 million for the same period of 2012. The $1.2 million gain was primarily due to the weakening of the Mexican peso against the US dollar during the period, which resulted in lower valuations on the Mexican peso cash and receivable amounts and the Mexican peso denominated inventory amounts.

There was an income tax provision of $4.1 million during the period compared to $5.6 million for the same period of 2012 due to a decrease in the deferred tax provision the ,offset by $1.2 million in expense recognized in the current period on the settlement of tax disputes.

Nine months ended September 30, 2013 compared with the nine months ended September 30, 2012

For the nine-month period ended September 30, 2013, the Company’s mine operating earnings were $47.0 million (2012: $60.1 million) on sales of $208.9 million (2012: $141.4 million) with cost of sales of $161.9 million (2012: $81.3 million).

Operating earnings were $26.6 million (2012: $43.2 million) after exploration costs of $11.0 million (2012: $7.3 million) and general and administrative costs of $9.4 million (2012: $9.6 million).

Earnings before taxes were $37.9 million (2012: $42.8 million) after mark-to-market gain on derivative liabilities (see adjusted earnings comment on page 16) of $3.2 million (2012: $47 thousand), a foreign exchange expense of $2.2 million (2012: gain of $3.0 million), a mark-to-market gain on contingent liabilities of $7.8 million (2012: mark-to-market loss of $5.0 million), investment and other income of $3.6 million (2012: $1.8 million) and finance costs of $1.1 million (2012: $0.2 million). The Company realized net earnings for the period of $26.3 million (2012: $27.3 million) after an income tax provision of $11.6 million (2012: $15.5 million).

Sales of $208.9 million for the period represented a 48% increase over the $141.4 million for the same period in 2012. There was a 44% increase in silver ounces sold with a 20% decrease in the realized silver price resulting in a 15% increase in silver sales, and there was a 181% increase in gold ounces sold with 14% decrease in realized gold prices resulting in a 142% increase in gold sales. During the period, the Company sold 4,996,637 oz silver and 62,159 oz gold, for realized prices of $24.22 and $1,415 per oz respectively, compared to sales of 3,469,241 oz silver and 22,130 oz gold, for realized prices of $30.26 and $1,644 per oz respectively, in the same period of 2012. The realized prices of silver and gold during the period were within 3% of the average silver spot price during the period of $24.8 and average gold spot price during the period of $1,455, with differences due to the timing of sales and the mark-to-market for the concentrate sales that are pending finalization.

The Company accumulated 385,126 oz silver and 2,473 oz gold finished goods at September 30, 2013 compared to 611,661 oz silver and 8,934 oz gold at December 31, 2012. The cost allocated to these finished goods is $10.2 million, net of a $0.7 million write down of the El Cubo finished, compared to $18.7 million, net of a $1.5 million write-down of the El Cubo finished goods, at December 31, 2012.

In 2012, the increased significance of Bolañitos substantially increased the inventory held as concentrate at December 31, 2012. During 2013 the Company has executed contracts to sell a significant portion of Bolañitos concentrate rather than leaching the concentrates at the Company’s leach facilities at Guanaceví and El Cubo, improving the recovery of contained metal but also raising the processing costs per tonne. However, the net cost produced is comparable to the leach cost.

Cost of sales for the period was $161.9 million, an increase of 99% over the cost of sales of $81.3 million for the same period of 2012. The 99% increase in the cost of sales was due to a number of factors. The Company sold 44% more silver ounces during the period compared to the comparative period, and experienced a 97% increase in amortization and depletion as the Company had higher accumulated cost bases. In addition, the Company experienced additional labour cost pressures at both the Guanaceví and Bolañitos operations as well as increases in other input costs. Furthermore, the Company acquired the El Cubo mine in Q3, 2012, a high cost operation which has been operating at a loss since acquisition, resulting in a reduced gross margin on a consolidated basis. During the period the Company took inventory write downs to net realizable value (“NRV”) of $4.2 million at the El Cubo mine and $1.0 million at the Guanaceví mine. The write down for El Cubo was comprised of write downs of both finished goods and work in process inventories, while the write down for Guanaceví was comprised of finished goods.

15

During the same period in 2012, the Company too an inventory write down to net realizable value of $3.3 million at the El Cubo mine comprised of both write downs in finished goods and work in process inventories.

Exploration expenses increased to $11.0 million from $7.3 million in the same period of 2012 based on the timing of the exploration activities, the addition of exploration activities at the El Cubo mine and a more aggressive exploration program in early 2013. General and administrative expenses decreased to $9.4 million for the period compared to $9.6 million in the same period of 2012 primarily due to slightly decreased corporate development costs, legal and insurance fees and human resource costs.

A significant number of the Company’s share purchase warrants are classified and accounted for as a financial liability at fair value with adjustments recognized through net earnings because these warrants have an exercise price denominated in a currency which is different from the functional currency of the Company. During the period, there was a mark-to-market gain on derivative liabilities (see adjusted earnings comment on page 16) of $3.2 million, while the same period in 2012 had a mark-to-market gain on derivative liabilities of $47 thousand. The gain was a reflection of the Company’s share price decreasing from CAN$7.84 at December 31, 2012 to CAN$4.42 at September 30, 2013.

The mark-to-market gain on the contingent liability was a result of a revaluation, based on the Monte Carlo model, of the contingent consideration related to the acquisition of Mexgold (El Cubo). A decrease in the gold price and movement in the forward curve resulted in a $7.8 million mark-to-market gain during the first three quarters of 2013, while the same period in 2012 had a mark-to-market loss on the contingent liability of $5.0 million.

The Company experienced a foreign exchange loss of $2.2 million during the period compared to a gain of $3.0 million for the same period of 2012. The $2.2 million loss was primarily due to the weakening of the Mexican peso against the US dollar during the period, which resulted in lower valuations on the Mexican peso cash and receivable amounts and the Mexican peso denominated inventory amounts.

There was an income tax provision of $11.6 million during the period compared to $15.5 million for the same period of 2012 due to the decrease in deferred tax expense during the period compared to the same period in 2012, offset by $1.2 million recognized in the current period on the settlement of tax disputes.

NON-IFRS MEASURES

Adjusted earnings and adjusted EPS are non-IFRS measures that do not have standardized meanings prescribed by IFRS and therefore may not be comparable to similar measures presented by other issuers. The Company previously issued share purchase warrants that have an exercise price denominated in a currency which is different from the functional currency of the Company. Under IFRS, the warrants are classified and accounted for as a financial liability at fair value with adjustments recognized through net earnings. These adjustments fluctuate significantly quarter to quarter primarily based on the change in the Company’s quoted share price and have a significant effect on reported earnings, while the dilutive impact remains unchanged. Adjusted earnings are used by management and provided to investors as a measure of the Company’s operating performance.

| Expressed in thousands US dollars | Three months ended Sept. 30 | Nine months ended Sept. 30 | ||

| 2013 | 2012 | 2013 | 2012 | |

| Net earnings (loss) for the period | $12,297 | $16 | $26,293 | $27,296 |

| Mark-to-market loss/(gain) on derivative liabilities | 679 | 1,728 | (3,159) | (47) |

| Adjusted net earnings (loss) | $12,976 | $1,744 | $23,134 | $27,249 |

| Basic weighted average share outstanding | 99,741,010 | 97,666,618 | 99,704,100 | 91,159,694 |

| Adjusted net earnings (loss) per share | $0.13 | $0.02 | $0.23 | $0.30 |

Mine operating cash flow is a non-IFRS measure that does not have a standardized meaning prescribed by IFRS and therefore may not be comparable to similar measures presented by other issuers. Mine operating cash flow is calculated as revenues minus direct production costs and royalties. Mine operating cash flow is used by management and provided to investors as a measure of the Company’s operating performance.

16

| Expressed in thousands US dollars | Three months ended Sept. 30 | Nine months ended Sept. 30 | ||

| 2013 | 2012 | 2013 | 2012 | |

| Mine operating earnings operating earnings | $21,748 | $17,097 | $47,054 | $60,034 |

| Share-based compensation | 131 | 146 | 408 | 421 |

| Amortization and depletion | 12,566 | 6,353 | 37,789 | 19,177 |

| Write down (recovery) of inventory to net realizable value | (2,668) | - | 5,210 | - |

| Mine operating cash flow before taxes | $31,777 | $23,596 | $90,461 | $79,632 |

Operating cash flow before working capital adjustment is a non-IFRS measure that does not have a standardized meaning prescribed by IFRS and therefore may not be comparable to similar measures presented by other issuers. Operating cash flow before working capital (“WC”) adjustments is calculated as operating cash flow minus working capital adjustment. Operating cash flow before working capital adjustments is used by management and provided to investors as a measure of the Company’s operating performance.

| Expressed in thousands US dollars | Three months ended Sept. 30 | Nine months ended Sept. 30 | ||

| 2013 | 2012 | 2013 | 2012 | |

| Cash from operating activities | $22,030 | $15,344 | $51,246 | $56,333 |

| Net changes in non-cash working capital | (3,881) | (3,979) | (12,389) | (6,244) |

| Operating cash flow before working capital adjustments | $25,911 | $19,323 | $63,635 | $62,577 |

Operating cash flow per share is a non-IFRS measure that does not have a standardized meaning prescribed by IFRS and therefore may not be comparable to similar measures presented by other issuers. Operating cash flow per share is calculated by dividing cash from operating activities by the weighted average shares outstanding. Operating cash flow per share is used by management and provided to investors as a measure of the Company’s operating performance.

| Expressed in thousands US dollars | Three months ended Sept. 30 | Nine months ended Sept. 30 | ||

| 2013 | 2012 | 2013 | 2012 | |

| Operating cash flow before working capital adjustments | $25,911 | $15,344 | $51,246 | $56,333 |

| Weighted average shares outstanding | 99,741,010 | 97,666,618 | 99,704,100 | 91,159,694 |

| Operating cash flow before WC changes per share | $0.26 | $0.16 | $0.51 | $0.62 |

EBITDA is a non-IFRS financial measure, which excludes the following from net earnings:

- Income tax expense;

- Finance costs;

- Amortization and depletion

Management believes EBITDA is a valuable indicator of the Company’s ability to generate liquidity by producing operating cash flow to fund working capital needs, service debt obligations, and fund capital expenditures. Management uses EBITDA for this purpose. EBITDA is also frequently used by investors and analysts for valuation purposes whereby EBITDA is multiplied by a factor or “EBITDA multiple” based on an observed or inferred relationship between EBITDA and market values to determine the approximate total enterprise value of a Company.

EBITDA is intended to provide additional information to investors and analysts and does not have any standardized definition under IFRS and should not be considered in isolation or as a substitute for measures of performance prepared in accordance with IFRS. EBITDA excludes the impact of cash costs of financing activities and taxes, and the effects of changes in operating working capital balances, and therefore is not necessarily indicative of operating profit or cash flow from operations as determined by IFRS. Other companies may calculate EBITDA differently.

17

| Expressed in thousands US dollars | Three months ended Sept. 30 | Nine months ended Sept. 30 | ||

| 2013 | 2012 | 2013 | 2012 | |

| Net earnings (loss) for the period | 12,297 | 16 | 26,293 | 27,296 |

| Amortization and depletion – cost of sales | 12,566 | 6,353 | 37,789 | 19,177 |

| Amortization and depletion – exploration | 34 | 32 | 101 | 91 |

| Amortization and depletion – general & admin | 48 | 42 | 134 | 86 |

| Finance costs | 313 | 181 | 1,091 | 191 |

| Current income tax expense | 2,729 | 3,420 | 8,928 | 9,903 |

| Deferred income tax expense | 1,341 | 2,185 | 2,636 | 5,595 |

| Earnings before interest, taxes and amortization | $29,328 | $12,229 | $76,972 | $62,339 |

Cash costs per ounce, total production costs per ounce and direct production costs per tonne are measures developed by precious metals companies in an effort to provide a comparable standard; however, there can be no assurance that Endeavour’s reporting of these non-IFRS measures are similar to those reported by other mining companies. Cash costs per ounce, production costs per ounce and direct production costs per tonne are measures used by the Company to manage and evaluate operating performance at each of the Company’s operating mining units, and are widely reported in the silver mining industry as a benchmark for performance, but do not have a standardized meaning and are disclosed in addition to IFRS measures. The following tables provide a detailed reconciliation of these measures to Endeavour’s cost of sales, as reported in the Company’s consolidated financial statements.

| Three Months Ended September 30, 2013 | Three Months Ended September 30, 2012 | |||||||

| Guanacevi | Bolanitos | El Cubo | Total | Guanacevi | Bolanitos | El Cubo | Total | |

| Direct production costs | $10,159 | $15,509 | $10,070 | $35,738 | $12,604 | $9,460 | $2,421 | $24,485 |

| Royalties | 287 | - | - | 287 | 454 | - | - | 454 |

| Opening finished goods | (3,160) | (753) | (344) | (4,257) | (5,916) | (8,573) | - | (14,489) |

| NRV cost adjustment | - | - | 1,422 | 1,422 | - | - | - | 0 |

| Closing finished goods | 4,651 | 589 | 2,057 | 7,297 | 3,891 | 8,183 | 3,971 | 16,045 |

| Direct production costs | 11,937 | 15,345 | 13,205 | 40,487 | 11,033 | 9,070 | 6,392 | 26,495 |

| By-product gold sales | (2,178) | (21,696) | (5,650) | (29,524) | (4,158) | (8,757) | (1,792) | (14,707) |

| Opening gold inventory fair market value | 457 | 899 | 218 | 1,574 | 1,306 | 8,474 | - | 9,780 |

| Closing gold inventory fair market value | (1,025) | (689) | (1,565) | (3,279) | (1,669) | (13,070) | (1,527) | (16,266) |

| Cash costs net of by-product | 9,191 | (6,141) | 6,208 | 9,258 | 6,512 | (4,283) | 3,073 | 5,302 |

| Amortization and depletion | 3,618 | 3,356 | 5,592 | 12,566 | 3,130 | 2,363 | 859 | 6,352 |

| Stock-based compensation | 43 | 44 | 44 | 131 | 72 | 74 | 0 | 146 |

| Opening finished goods depletion | (1,113) | (198) | (137) | (1,448) | (1,617) | (2,154) | (32) | (3,803) |

| NRV cost adjustment | - | - | 257 | 257 | - | - | - | - |

| Closing finished goods depletion | 1,545 | 162 | 1,222 | 2,929 | 1,700 | 1,771 | 3,381 | 6,852 |

| Total production costs | $13,284 | ($2,777) | $13,186 | $23,693 | $9,797 | ($2,229) | $7,281 | $14,849 |

| Throughput tonnes | 107,480 | 181,442 | 100,168 | 389,090 | 108,343 | 117,271 | 80,550 | 306,164 |

| Payable silver ounces | 707,929 | 758,239 | 333,527 | 1,799,695 | 592,302 | 429,054 | 105,197 | 1,126,553 |

| Cash costs per ounce | $12.98 | ($8.10) | $18.61 | $5.14 | $10.99 | ($9.98) | $29.21 | $4.70 |

| Total production costs per oz | $18.76 | ($3.66) | $39.54 | $13.17 | $16.54 | ($5.20) | $69.21 | $13.18 |

| Direct production costs per tonne | $111.06 | $84.57 | $131.83 | $104.06 | $101.83 | $77.34 | $119.32 | $97.05 |

18

| Nine Months Ended Sep 30, 2013 | Nine Months Ended Sep 30, 2012 | |||||||

| Guanacevi | Bolanitos | El Cubo | Total | Guanacevi | Bolanitos | El Cubo | Total | |

| Direct production costs | $30,376 | $54,741 | $32,256 | $117,373 | $34,963 | $19,602 | $2,421 | $56,986 |

| Royalties | 1,093 | - | - | 1,093 | 1,397 | - | - | 1,397 |

| Opening finished goods | (1,626) | (10,442) | (2,305) | (14,373) | (7,865) | (4,636) | - | (12,501) |

| NRV cost adjustment | - | - | 3,368 | 3,368 | - | - | - | 0 |

| Closing finished goods | 4,651 | 589 | 2,057 | 7,297 | 3,891 | 8,183 | 3,971 | 16,045 |

| Direct production costs | 34,494 | 44,888 | 35,376 | 114,758 | 32,386 | 23,149 | 6,392 | 61,927 |

| By-product gold sales | (5,790) | (65,264) | (16,871) | (87,925) | (11,142) | (23,443) | (1,792) | (36,377) |

| Opening gold inventory fair market value | 455 | 12,789 | 1,560 | 14,804 | 1,577 | 6,701 | NA | 8,278 |

| Closing gold inventory fair market value | (1,025) | (688) | (1,565) | (3,278) | (1,669) | (13,070) | (1,527) | (16,266) |

| Cash costs net of by-product | 28,134 | (8,275) | 18,500 | 38,359 | 21,152 | (6,663) | 3,073 | 17,562 |

| Amortization and depletion | 10,012 | 11,358 | 16,419 | 37,789 | 9,942 | 8,376 | 859 | 19,177 |

| Stock-based compensation | 136 | 136 | 136 | 408 | 204 | 217 | - | 421 |

| NRV cost adjustment | - | - | 257 | 257 | - | - | - | - |

| Opening finished goods depletion | (444) | (2,698) | (1,176) | (4,318) | (1,830) | (4,005) | (32) | (5,867) |

| Closing finished goods depletion | 1,545 | 162 | 1,222 | 2,929 | 1,700 | 1,771 | 3,381 | 6,852 |

| Total production costs | $39,383 | $683 | $35,358 | $75,424 | $31,168 | ($304) | $7,281 | $38,145 |

| Throughput tonnes | 314,914 | 551,414 | 292,176 | 1,158,504 | 307,513 | 314,846 | 80,550 | 702,909 |

| Payable silver ounces | 1,891,625 | 2,082,918 | 764,685 | 4,739,228 | 1,974,789 | 1,137,958 | 105,197 | 3,217,944 |

| Cash costs per ounce | $14.87 | ($3.97) | $24.19 | $8.09 | $10.71 | ($5.86) | $29.21 | $5.46 |

| Total production costs per oz | $20.82 | $0.33 | $46.24 | $15.91 | $15.78 | ($0.27) | $69.21 | $11.85 |

| Direct production costs per tonne | $109.53 | $81.41 | $121.08 | $99.06 | $105.32 | $73.52 | $119.32 | $88.10 |

All-in sustaining costs per ounce and all-in costs per ounces are measures developed by the World Gold Council in an effort to provide a comparable standard within the precious metal industry; however, there can be no assurance that Endeavour’s reporting of these non-IFRS measures are similar to those reported by other mining companies. These measures are used by the Company to manage and evaluate operating performance at each of the Company’s operating mining units and consolidated group, and are widely reported in the silver mining industry as a benchmark for performance, but do not have a standardized meaning and are disclosed in addition to IFRS measures. The following tables provide a detailed reconciliation of these measures to Endeavour’s cost of sales, as reported in the Company’s consolidated financial statements.

19

| Three Months Ended September 30, 2013 | Three Months Ended September 30, 2012 | |||||||

| Guanacevi | Bolanitos | El Cubo | Total | Guanacevi | Bolanitos | El Cubo | Total | |

| Cash costs | $9,191 | ($6,141) | $6,208 | $9,258 | $6,512 | ($4,283) | $3,073 | $5,302 |

| Operations stock based compensation | 43 | 44 | 44 | 131 | 72 | 74 | 0 | 146 |

| Corporate general and administrative | 671 | 719 | 316 | 1,707 | 1,082 | 784 | 192 | 2,058 |

| Corporate stock based compensation | 279 | 299 | 131 | 709 | 394 | 286 | 70 | 750 |

| Reclamation - amortization/accretion | 4 | 1 | 5 | 10 | 4 | 1 | 6 | 11 |

| Mine site expensed exploration | 229 | 135 | 469 | 833 | 666 | 1,631 | 102 | 2,399 |

| Capital expenditures sustaining | 3,158 | 2,449 | 3,589 | 9,196 | 4,674 | 4,789 | 3,811 | 13,274 |

| All In Sustaining Costs | $13,575 | ($2,494) | $10,763 | $21,844 | $13,404 | $3,281 | $7,254 | $23,940 |

| Growth exploration | 987 | 989 | ||||||

| Growth capital expenditures | 9,383 | 4,975 | ||||||

| All In Costs | $32,214 | $29,904 | ||||||

| Throughput tonnes | 107,480 | 181,442 | 100,168 | 389,090 | 108,343 | 117,271 | 80,550 | 306,164 |

| Payable silver ounces | 707,929 | 758,239 | 333,527 | 1,799,695 | 592,302 | 429,054 | 105,197 | 1,126,553 |

| Sustaining cost per ounce | $19.18 | ($3.29) | $32.27 | $12.14 | $22.63 | $7.65 | $68.96 | $21.25 |

| All In costs per ounce | $17.90 | $26.54 | ||||||

| Nine Months Ended September 30, 2013 | Nine Months Ended September 30, 2012 | |||||||

| Guanacevi | Bolanitos | El Cubo | Total | Guanacevi | Bolanitos | El Cubo | Total | |

| Cash costs | $28,134 | ($8,275) | $18,500 | $38,359 | $21,152 | ($6,663) | $3,073 | $17,562 |

| Operations stock based compensation | 136 | 136 | 136 | 408 | 204 | 217 | 0 | 421 |

| Corporate general and administrative | 2,770 | 3,051 | 1,120 | 6,941 | 3,852 | 3,834 | 1,312 | 8,999 |

| Corporate stock based compensation | 920 | 1,013 | 372 | 2,305 | 1,845 | 1,063 | 98 | 3,007 |

| Reclamation - amortization/accretion | 12 | 3 | 15 | 30 | 12 | 3 | 6 | 21 |

| Mine site expensed exploration | 1,630 | 2,082 | 2,222 | 5,934 | 1,742 | 4,164 | 102 | 6,008 |

| Capital expenditures sustaining | 13,352 | 17,956 | 10,896 | 42,204 | 13,738 | 12,666 | 3,811 | 30,215 |

| All In Sustaining Costs | $46,954 | $15,966 | $33,261 | $96,181 | $42,546 | $15,285 | $8,402 | $66,233 |

| Growth exploration | 4,976 | 1,243 | ||||||

| Growth capital expenditures | 36,732 | 48,721 | ||||||

| All In Costs | $137,889 | $116,197 | ||||||

| Throughput tonnes | 314,914 | 551,414 | 292,176 | 1,158,504 | 307,513 | 314,846 | 80,550 | 702,909 |

| Payable silver ounces | 1,891,625 | 2,082,918 | 764,685 | 4,739,228 | 1,974,789 | 1,137,958 | 105,197 | 3,217,944 |

| Sustaining cost per ounce | $24.82 | $7.67 | $43.50 | $20.29 | $21.54 | $13.43 | $79.87 | $20.58 |

| All In costs per ounce | $29.10 | $36.11 | ||||||