Exhibit 99.4

| MANAGEMENT’S DISCUSSION AND ANALYSIS |

| FOR THE YEAR ENDED DECEMBER 31, 2013 |

| |

This Management’s Discussion and Analysis (“MD&A”) should be read in conjunction with the consolidated financial statements of Endeavour Silver Corp. (“Endeavour” or “the Company”) for the year ended December 31, 2013 and 2012 and the related notes contained therein, which are prepared in accordance with International Financial Reporting Standards (“IFRS”) as issued by the International Accounting Standards Board (“IASB”). Additional information relating to the Company, including the most recent Annual Information Form, is available on SEDAR at www.sedar.com, and the Company’s most recent annual report on Form 40-F has been filed with the US Securities and Exchange Commission (the “SEC”). This MD&A contains “forward-looking statements” that are subject to risk factors set out in a cautionary note contained herein. All dollar amounts are expressed in United States (“US”) dollars and tabular amounts are expressed in thousands of dollars unless otherwise indicated. This MD&A is dated as of March 5, 2014 and all-information contained is current as of March 5, 2014 unless otherwise stated.

Cautionary Note to US Investors concerning Estimates of Reserves and Measured, Indicated and Inferred Resources:

This MD&A has been prepared in accordance with the requirements of the securities laws in effect in Canada, which differ from the requirements of US securities laws. The terms “mineral reserve”, “proven mineral reserve” and “probable mineral reserve” are Canadian mining terms as defined in accordance with Canadian National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”) and the Canadian Institute of Mining, Metallurgy and Petroleum (the “CIM”) - CIM Definition Standards on Mineral Resources and Mineral Reserves, adopted by the CIM Council, as amended. These definitions differ from the definitions in SEC Industry Guide 7 under the US Securities Act of 1933, as amended (the “Securities Act”).

Under SEC Industry Guide 7 standards, a “final” or “bankable” feasibility study is required to report reserves, the three-year historical average price is used in any reserve or cash flow analysis to designate reserves and the primary environmental analysis or report must be filed with the appropriate governmental authority.

In addition, the terms “mineral resource”, “measured mineral resource”, “indicated mineral resource” and “inferred mineral resource” are defined in and required to be disclosed by NI 43-101; however, these terms are not defined terms under SEC Industry Guide 7 and are normally not permitted to be used in reports and registration statements filed with the SEC. Investors are cautioned not to assume that any part or all of mineral deposits in these categories will ever be converted into reserves. “Inferred mineral resources” have a great amount of uncertainty as to their existence, and great uncertainty as to their economic and legal feasibility. It cannot be assumed that all or any part of an inferred mineral resource will ever be upgraded to a higher category. Under Canadian rules, estimates of inferred mineral resources may not form the basis of feasibility or pre-feasibility studies, except in rare cases. Investors are cautioned not to assume that all or any part of an inferred mineral resource exists or is economically or legally mineable. Disclosure of “contained ounces” in a resource is permitted disclosure under Canadian regulations; however, the SEC normally only permits issuers to report mineralization that does not constitute “reserves” by SEC Industry Guide 7 standards as in place tonnage and grade without reference to unit measures.

Accordingly, information contained in this MD&A contains descriptions of Endeavour’s mineral deposits that may not be comparable to similar information made public by US companies subject to the reporting and disclosure requirements under the US federal securities laws and the rules and regulations thereunder.

| |

| |

| 700 West Pender Street, Suite 301, Vancouver, B.C., Canada V6C 1G8 |

| Phone: 604.685.9775 | Fax: 604.685.9744| Toll Free: 1.877.685.9775| Email: info@edrsilver.com |

| www.edrsilver.com |

| MANAGEMENT’S DISCUSSION AND ANALYSIS |

| FOR THE YEAR ENDED DECEMBER 31, 2013 |

| |

Forward-Looking Statements

This MD&A contains “forward-looking statements” within the meaning of the United States Private Securities Litigation Reform Act of 1995 and “forward-looking information” within the meaning of applicable Canadian securities legislation.Such forward-looking statements and information herein include, but are not limited to, statements regarding Endeavour’s anticipated performance in 2014, including silver and gold production, timing and expenditures to develop new silver mines and mineralized zones, silver and gold grades and recoveries, cash costs per ounce, capital expenditures and sustaining capital.Forward-looking statements are frequently characterized by words such as “plan”, “expect”, “forecast”, “project”, ”intend”, ”believe”, ”anticipate”, “outlook” and other similar words, or statements that certain events or conditions “may” or “will” occur. Forward- looking statements are based on the opinions and estimates of management at the dates the statements are made, and are subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ materially from those projected in the forward-looking statements.

The Company does not intend to, and does not assume any obligation to update such forward-looking statements or information, other than as required by applicable law. Forward-looking statements or information involve known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of the Company and its operations to be materially different from those expressed or implied by such statements. Such factors include, among others: fluctuations in the prices of silver and gold, fluctuations in the currency markets (particularly the Mexican peso, Canadian dollar and U.S. dollar); changes in national and local governments, legislation, taxation, controls, regulations and political or economic developments in Canada and Mexico; operating or technical difficulties in mineral exploration, development and mining activities; risks and hazards of mineral exploration, development and mining (including, but not limited to environmental hazards, industrial accidents, unusual or unexpected geological conditions, pressures, cave-ins and flooding); inadequate insurance, or inability to obtain insurance; availability of and costs associated with mining inputs and labour; the speculative nature of mineral exploration and development, diminishing quantities or grades of mineral reserves as properties are mined; the ability to successfully integrate acquisitions; risks in obtaining necessary licenses and permits, and challenges to the Company’s title to properties; as well as those factors described in the section “risk factors” contained in the Company’s Annual Information Form filed with the Canadian securities regulatory authorities and as filed with the SEC in our Annual Report on Form 40-F. Although the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements or information, there may be other factors that cause results to be materially different from those anticipated, described, estimated, assessed or intended. There can be no assurance that any forward-looking statements or information will prove to be accurate as actual results and future events could differ materially from those anticipated in such statements or information. Accordingly, readers shouldnot place undue reliance on forward-looking statements or information.

Table of Contents

| Operating Highlights | Page 3 | Financial Results | Page 16 |

| History and Strategy | Page 4 | Non IFRS Measures | Page 20 |

| Consolidated Operations | Page 5 | Quarterly Results and Trends | Page 26 |

| Guanacevi Operations | Page 7 | Annual Outlook | Page 31 |

| Bolañitos Operations | Page 9 | Liquidity and Capital Resources | Page 32 |

| El Cubo Operations | Page 11 | Changes in Accounting Policies | Page 40 |

| Exploration Results | Page 13 | Risks and Uncertainties | Page 43 |

| Reserves and Resources | Page 14 | Controls and Procedures | Page 51 |

| MANAGEMENT’S DISCUSSION AND ANALYSIS |

| FOR THE YEAR ENDED DECEMBER 31, 2013 |

| |

| Three Months Ended Dec. 31 | 2013 Highlights | Year Ended Dec. 31 |

| 2013 | 2012 | % Change | | 2013 | 2012 | % Change |

| | | | Production | | | |

| 1,931,717 | 1,235,026 | 56% | Silver ounces produced | 6,813,069 | 4,485,476 | 52% |

| 17,686 | 12,917 | 37% | Gold ounces produced | 75,578 | 38,687 | 95% |

| 1,855,108 | 1,222,705 | 52% | Payable silver ounces produced | 6,593,805 | 4,440,619 | 48% |

| 16,612 | 12,800 | 30% | Payable gold ounces produced | 72,562 | 38,311 | 89% |

| 2,992,877 | 2,010,046 | 49% | Silver equivalent ounces produced(1) | 11,347,749 | 6,806,696 | 67% |

| 7.46 | 12.25 | -39% | Cash costs per silver ounce(2)(3) | 7.92 | 7.33 | 8% |

| 14.59 | 18.88 | -23% | Total production costs per ounce(2)(4) | 15.69 | 13.80 | 14% |

| 14.24 | 28.06 | -49% | All-in sustaining costs per ounce(2)(5) | 18.31 | 23.06 | -21% |

| 379,480 | 362,779 | 5% | Processed tonnes | 1,148,894 | 1,065,689 | 8% |

| 90.72 | 90.39 | 0% | Direct production costs per tonne(2)(6) | 97.00 | 92.74 | 5% |

| 11.45 | 18.82 | -39% | Silver co-product cash costs(7) | 13.19 | 14.87 | -11% |

| 695.47 | 987.70 | -30% | Gold co-product cash costs(7) | 785.01 | 807.67 | -3% |

| | | | Financial | | | |

| 67.9 | 66.7 | 2% | Revenue ($ millions) | 276.8 | 208.1 | 33% |

| 2,155,326 | 1,345,832 | 60% | Silver ounces sold | 7,151,963 | 4,815,073 | 49% |

| 18,960 | 13,037 | 45% | Gold ounces sold | 81,119 | 35,167 | 131% |

| 20.52 | 32.87 | -38% | Realized silver price per ounce | 23.10 | 30.99 | -25% |

| 1,246 | 1,725 | -28% | Realized gold price per ounce | 1,375 | 1,674 | -18% |

| (115.8) | 14.8 | -881% | Net earnings (loss) ($ millions) | (89.5) | 42.1 | -312% |

| (12.1) | 12.9 | -194% | Adjusted net earnings(8)($ millions) | 11.1 | 40.2 | -72% |

| 9.9 | 17.9 | -45% | Mine operating earnings ($ millions) | 56.9 | 78.0 | -27% |

| 26.4 | 34.8 | -24% | Mine operating cash flow(9)($ millions) | 116.9 | 114.4 | 2% |

| 18.0 | 20.4 | -12% | Operating cash flow before working capital changes(10) | 81.6 | 82.9 | -2% |

| 23.0 | 28.2 | -18% | Earnings before ITDA(11) | 100.0 | 90.5 | 10% |

| 32.2 | 50.9 | -37% | Working capital ($ millions) | 32.2 | 50.9 | -37% |

| Shareholders | | | | | | |

| (1.16) | 0.15 | -100% | Earnings (loss) per share – basic | (0.90) | 0.45 | -300% |

| (0.12) | 0.13 | -193% | Adjusted earnings per share – basic(8) | 0.11 | 0.43 | -74% |

| 0.18 | 0.20 | -12% | Operating cash flow before working capital changes per share(10) | 0.82 | 0.89 | -8% |

| 99,720,704 | 99,539,282 | 0% | Weighted average shares outstanding | 99,770,293 | 93,266,038 | 7% |

| (1) | Silver equivalents are calculated using a 60:1 ratio. |

| (2) | The Company reports non-IFRS measures which include cash costs net of by-products on a payable silver basis, total production costs per ounce, all-in sustaining costs per ounce and direct production costs per tonne, in order to manage and evaluate operating performance at each of the Company’s mines. These measures, some established by the Silver Institute (Production Cost Standards, June 2011), are widely used in the silver mining industry as a benchmark for performance, but do not have a standardized meaning. These measures are reported on a production basis. See Reconciliation to IFRS on page 20. |

| (3) | Cash costs net of by-products per payable silver ounce include mining, processing (including smelting, refining, transportation and selling costs), and direct overhead, net of gold credits. See Reconciliation to IFRS on page 22. |

| (4) | Total production costs per ounce include mining, processing (including smelting, refining, transportation and selling costs), direct overhead, amortization, depletion and amortization at the operation sites. See Reconciliation to IFRS on page 22. |

| (5) | All-in sustaining cost per ounce include mining, processing (including smelting, refining, transportation and selling costs), direct overhead, corporate general and administration, on-site exploration, share-based compensation, reclamation and sustaining capital net of gold credits. |

| (6) | Direct production costs per tonne include mining, processing (including smelting, refining, transportation and selling costs) and direct overhead at the operation sites. See Reconciliation to IFRS on page 22. |

| (7) | Silver co-product cash cost and gold co-product cash cost include mining, processing (including smelting, refining, transportation and selling costs), and direct overhead allocated on pro-rated basis of realized metal value. See Reconciliation to IFRS on page 25. |

| MANAGEMENT’S DISCUSSION AND ANALYSIS |

| FOR THE YEAR ENDED DECEMBER 31, 2013 |

| |

| (8) | Adjusted earnings are calculated by adding back the mark-to-market impact of derivative equities held as a liability on the Company’s balance sheet and impairment charges net of tax. See Reconciliation to IFRS on page 20. |

| (9) | Mine operating cash flow is calculated by adding back amortization, depletion, inventory write downs and share-based compensation to mine operating earnings. Mine operating earnings and mine operating cash flow are before taxes. See Reconciliation to IFRS on page 21. |

| (10) | See Reconciliation to IFRS on page 21 for the reconciliation of operating cash flow before working capital changes, operating cash flow before working capital changes per share. |

| (11) | See Reconciliation of Earnings before interest, taxes, depreciation and amortization on page 22 |

Management’s highlights are key measures used by management, however they should not be the sole measures used in determining the performance of the Company’s operations.

HISTORY AND STRATEGY

The Company is engaged in silver mining in Mexico and related activities including property acquisition, exploration, development, mineral extraction, processing, refining and reclamation. The Company is also engaged in exploration activities in Chile.

Historically, the business philosophy was to acquire and explore early-stage mineral prospects in Canada and the US. In 2002 the Company was re-organized, a new management team was appointed, and the business strategy was revised to focus on acquiring advanced-stage silver mining properties in Mexico. Mexico, despite its long and prolific history of metal production, appeared to be relatively un-explored using modern exploration techniques and offered promising geological potential for precious metals exploration and production.

After evaluating several mineral properties in Mexico in 2003, the Company negotiated an option to purchase the Guanaceví silver mines and process plant located in Durango, Mexico in May 2004. Management recognized that even though the mines had run out of ore, little modern exploration had been carried out to discover new silver ore-bodies. Exploration drilling commenced in June 2004 and quickly met with encouraging results. By September 2004, sufficient high-grade silver mineralization had been outlined to justify the development of an access ramp into the newly discovered North Porvenir ore-body. In December 2004, the Company commenced the mining and processing of ore from the new North Porvenir mine to produce silver doré bars.

In 2007, the Company replicated the success of Guanaceví with the acquisition of the Bolañitos (formerly described as “Guanajuato”) mines project in Guanajuato State. Bolañitos was very similar in that there was a fully built and permitted processing plant, and the mines were running out of ore, so the operation was for sale. The acquisition was finalized in May 2007 and as a result of the successful mine rehabilitation and subsequent exploration work, silver production, reserves and resources are growing rapidly and Bolañitos is now an integral part of the Company’s asset base.

Both Guanaceví and Bolañitos are good examples of Endeavour’s business model of acquiring fully built and permitted silver mines that were about to close for lack of ore. By bringing the money and expertise needed to find new silver ore-bodies, Endeavour has successfully re-opened and expanded these mines to develop their full potential. The benefit of acquiring fully built and permitted mining and milling infrastructure is that if new exploration efforts are successful, the mine development cycle from discovery to production only takes a matter of months instead of the several years normally required in the traditional mining business model.

In 2012, the Company acquired the El Cubo silver-gold mine located in Guanajuato, Mexico. El Cubo has similar challenges to Endeavour’s past acquisitions, but with two significant exceptions; the property came with substantial reserves and resources, and the mine was already operating at 1,100 tonnes per day. After acquisition, the Company is focused on improving the mining methods, increasing brown-fields exploration, while completely refurbishing the existing infrastructure to maximize the potential of El Cubo.

The Company historically funded its exploration and development activities through equity financings and convertible debentures. Equity financings also facilitated the acquisition and development of the Guanaceví and Bolañitos mines projects. However, since 2004, the Company has been able to finance more and more of its acquisition, exploration, development and operating activities from production cash flows. In 2012 the Company obtained a credit facility to help support its acquisition, exploration and capital investment programs. The Company may choose to engage in equity, debt, convertible debt or other financings, on an as-needed basis, in order to facilitate its growth.

| MANAGEMENT’S DISCUSSION AND ANALYSIS |

| FOR THE YEAR ENDED DECEMBER 31, 2013 |

| |

REVIEW OF OPERATING RESULTS

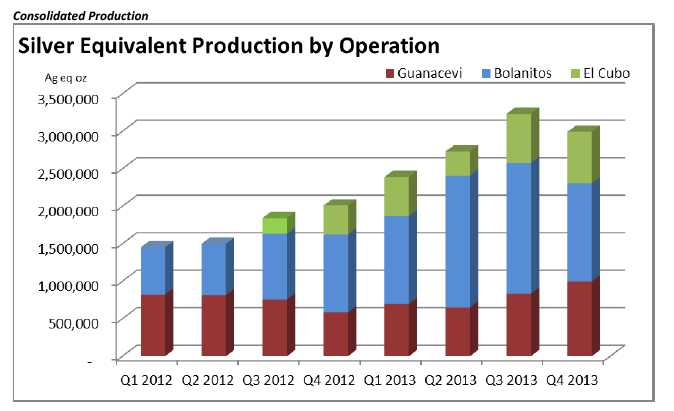

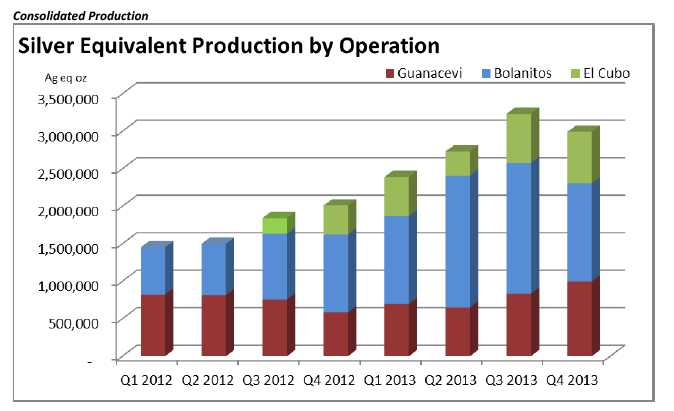

Consolidated Production Results for the Three Months and Years Ended December 31, 2013 and 2012

| Three Months Ended Dec. 31 | CONSOLIDATED | Year Ended Dec. 31 |

| 2013 | 2012 | % Change | | 2013 | 2012 | % Change |

| 379,480 | 362,779 | 5% | Ore tonnes processed | 1,537,984 | 1,065,689 | 44% |

| 181 | 151 | 20% | Average silver grade (gpt) | 168 | 179 | -6% |

| 87.3 | 70.1 | 25% | Silver recovery (%) | 81.6 | 73.2 | 11% |

| 1,931,717 | 1,235,026 | 56% | Total silver ounces produced | 6,813,069 | 4,485,476 | 52% |

| 1,855,108 | 1,222,705 | 52% | Payable silver ounces produced | 6,593,805 | 4,440,619 | 48% |

| 1.78 | 1.55 | 15% | Average gold grade (gpt) | 1.78 | 1.48 | 21% |

| 82.1 | 71.17 | 15% | Gold recovery (%) | 85.6 | 76.5 | 12% |

| 17,686 | 12,917 | 37% | Total gold ounces produced | 75,578 | 38,687 | 95% |

| 16,612 | 12,800 | 30% | Payable gold ounces produced | 72,562 | 38,311 | 89% |

| 2,992,877 | 2,010,046 | 49% | Silver equivalent ounces produced(1) | 11,347,749 | 6,806,696 | 67% |

| 7.46 | 12.25 | -39% | Cash costs per silver ounce(2)(3) | 7.92 | 7.33 | 8% |

| 14.59 | 18.88 | -23% | Total production costs per ounce(2)(4) | 15.69 | 13.80 | 14% |

| 14.24 | 28.06 | -49% | All in sustaining cost per ounce(2)(5) | 18.31 | 23.06 | -21% |

| 90.72 | 90.39 | 0% | Direct production costs per tonne(2)(6) | 97.00 | 92.74 | 5% |

| $11.45 | $18.82 | -39% | Silver co-product cash costs(7) | $13.19 | $14.87 | -11% |

| $695.47 | $987.70 | -30% | Gold co-product cash costs(7) | $785.01 | $807.67 | -3% |

| (1) | Silver equivalents are calculated using a 60:1 ratio . |

| (2) | The Company reports non-IFRS measures which include cash costs net of by-product on a payable silver basis, total production costs per ounce, all-in sustaining costs per ounce and direct production costs per tonne, in order to manage and evaluate operating performance at each of the Company’s mines. These measures, some established by the Silver Institute (Production Cost Standards, June 2011), are widely used in the silver mining industry as a benchmark for performance, but do not have a standardized meaning. These measures are reported on a production basis. See Reconciliation to IFRS on page 20. |

| (3) | Cash costs net of by-products per payable silver ounce include mining, processing (including smelting, refining, transportation and selling costs), and direct overhead, net of gold credits. See Reconciliation to IFRS on page 22. |

| (4) | Total production costs per ounce include mining, processing (including smelting, refining, transportation and selling costs), direct overhead, amortization, depletion and amortization at the operation sites. See Reconciliation to IFRS on page 22. |

| (5) | All-in sustaining costs per ounce include mining, processing (including smelting, refining, transportation and selling costs), direct overhead, corporate general and administration, on-site exploration, share -based compensation, reclamation and sustaining capital net of gold credits. |

| (6) | Direct production costs per tonne include mining, processing (including smelting, refining, transportation and selling costs) and direct overhead at the operation sites. See Reconciliation to IFRS on page 22. |

| (7) | Silver co-product cash cost and gold co-product cash cost include mining, processing (including smelting, refining, transportation and selling costs), and direct overhead allocated on pro -rated basis of realized metal value. See Reconciliation to IFRS on page 25. |

| MANAGEMENT’S DISCUSSION AND ANALYSIS |

| FOR THE YEAR ENDED DECEMBER 31, 2013 |

| |

Three months ended December 31, 2013 (compared to the three months ended December 31, 2012)

Consolidated silver production during Q4, 2013 was 1,931,717 oz, an increase of 56% compared to 1,235,026 oz in Q4, 2012, and gold production was 17,686 oz, an increase of 37% compared to 12,917 oz in Q4, 2012. Plant throughput was 379,480 tonnes at average grades of 181 gpt silver and 1.78 gpt gold compared to 362,779 tonnes grading 151 gpt silver and 1.55 gpt gold. Metal production was significantly higher due to higher tonnage throughput at Guanacevi and El Cubo, higher silver grades and recoveries at all three mines, higher gold grades at Bolanitos and El Cubo and higher gold recoveries at Guanacevi and El Cubo. The higher gold grade was due to the increasing significance of the Bolañitos and El Cubo operations, which have higher gold grades compared to Guanaceví. The higher silver grades were a function of geological variation of the ore bodies at Guanacevi and the improvement of the El Cubo operation in Q4, 2013.

The increased recoveries were partly a function of selling concentrate as opposed to processing the concentrate at the Company’s leach facilities at Guanaceví and El Cubo to produce doré bars. Selling concentrate at current metal prices resulted in higher payable metal production albeit at higher refining charges, resulting in a financial benefit compared to doré production.

Year ended December 31, 2013 (compared to the year ended December 31, 2012)

Consolidated silver production during 2013 was 6,813,069 oz, an increase of 52% compared to 4,485,476 oz in 2012, and gold production was 75,578 oz, an increase of 95% compared to 38,687 oz in 2012. Plant throughput was 1,537,984 tonnes at average grades of 168 gpt silver and 1.78 gpt gold compared to 1,065,689 tonnes grading 179 gpt silver and 1.48 gpt gold. Metal production was significantly higher due to the expansion of the Bolañitos mine, the processing of the extra Bolañitos mine production at the El Cubo facilities, and an entire year of improved operations from the El Cubo mine which was acquired in Q3, 2012. Tonnage throughput, silver grades and silver and gold recoveries were higher at all three mines and gold grades improved at Bolanitos and El Cubo but fell at Guanacevi. The higher grades were due to the increasing significance of the Bolañitos and El Cubo operations, which have higher gold grades compared to Guanaceví. The higher silver grades were a function of geological variation of the ore bodies at Guanacevi and the improved El Cubo operations in 2013.

| MANAGEMENT’S DISCUSSION AND ANALYSIS |

| FOR THE YEAR ENDED DECEMBER 31, 2013 |

| |

The increased recoveries were partly a function of selling concentrate as opposed to processing the concentrate at the Company’s leach facilities at Guanaceví and El Cubo to produce doré bars. Selling concentrate at current metal prices resulted in higher payable metal production albeit at higher refining charges, resulting in a financial benefit compared to doré production.

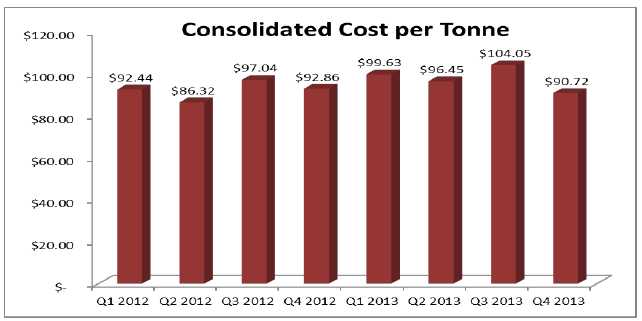

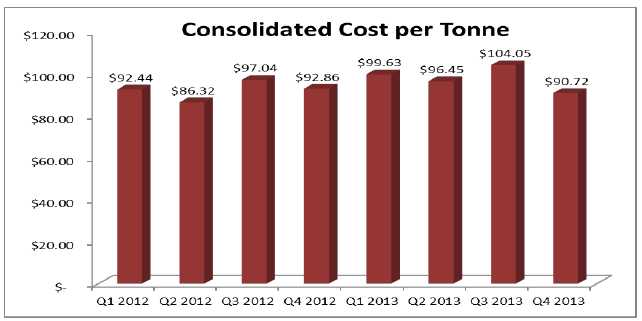

Consolidated Operating Costs

Three months ended December 31, 2013 (compared to the three months ended December 31, 2012)

Per tonne costs remained relatively consistent year over year as wage pressures, use of contractors and higher refining costs were offset by achieving additional economies of scale with the higher output. Cash costs per ounce net of by-product credits, which is a non-IFRS measure and a standard of the Silver Institute, fell 39% to $7.46 per ounce of payable silver compared to $12.25 per ounce in the same period in 2012. The higher grades and recoveries along with improved performance of the El Cubo operations drove cash costs down which was partially offset by the reduced by-product credit because of the lower gold price. All-in sustaining costs fell as mine development and exploration expenditures were curtailed and spread over higher silver production.

Year ended December 31, 2013 (compared to the year ended December 31, 2012)

Per tonne costs increased 5% due to wage pressures, significant restructuring costs, additional use of contractors and higher refining costs offset by achieving additional economies of scale with the higher output. Cash costs per ounce net of by-product credits, which is a non-IFRS measure and a standard of the Silver Institute, rose 8% to $7.92 per ounce of payable silver compared to $7.33 per ounce in 2012. The lower by-product credit because of the lower gold price was the primary contributor to the higher costs, offset by higher consolidated grades and recoveries. All-in sustaining costs fell 21% as mine development and exploration expenditures were curtailed and spread over higher silver production.

Guanaceví Operations

Production Results for the Three Month and Years Ended December 31, 2013 and 2012

| Three Months Ended Dec. 31 | GUANACEV¥ | Year Ended December 31 |

| 2013 | 2012 | % Change | | 2013 | 2012 | % Change |

| 121,008 | 110,763 | 9% | Ore tonnes processed | 435,922 | 418,277 | 4% |

| 272 | 215 | 26% | Average silver grade (g/t) | 253 | 249 | 2% |

| 81.5 | 67.7 | 20% | Silver recovery (%) | 78.0 | 74.6 | 5% |

| 861,495 | 518,207 | 66% | Total silver ounces produced | 2,772,227 | 2,512,943 | 10% |

| 852,880 | 513,025 | 66% | Payable silver ounces produced | 2,744,505 | 2,487,813 | 10% |

| 0.69 | 0.69 | -1% | Average gold grade (g/t) | 0.60 | 0.76 | -21% |

| 85.2 | 44.3 | 92% | Gold recovery (%) | 80.5 | 76.1 | 6% |

| 2,275 | 1,088 | 109% | Total gold ounces produced | 6,784 | 7,874 | -14% |

| 2,244 | 1,077 | 108% | Payable gold ounces produced | 6,708 | 7,795 | -14% |

| 997,995 | 583,487 | 71% | Silver equivalent ounces produced(1) | 3,179,267 | 2,985,383 | 6% |

| 13.09 | 18.20 | -28% | Cash costs per silver ounce(2)(3) | 14.32 | 12.25 | 17% |

| 18.51 | 23.89 | -22% | Total production costs per ounce(2)(4) | 20.10 | 17.45 | 15% |

| 17.43 | 31.51 | -45% | All in sustaining cost per ounce(2)(5) | 22.55 | 23.99 | -6% |

| 114.55 | 99.70 | 15% | Direct production costs per tonne(2)(6) | 110.93 | 103.83 | 7% |

| $13.87 | $19.20 | -28% | Silver co-product cash costs(7) | $15.22 | $14.77 | 3% |

| $841.96 | $1,007.35 | -16% | Gold co-product cash costs(7) | $906.25 | $801.62 | 13% |

| (1) | Silver equivalents are calculated using a 60:1 ratio . |

| (2) | The Company reports non-IFRS measures which include cash costs net of by-product on a payable silver basis, total production costs per ounce, all-in sustaining costs per ounce and direct production costs per tonne, in order to manage and evaluate operating performance at each of the Company’s mines. These measures, some established by the Silver Institute (Production Cost Standards, June 2011), are widely used in the silver mining industry as a benchmark for performance, but do not have a standardized meaning. These measures are reported on a production basis. See Reconciliation to IFRS on page 20. |

| MANAGEMENT’S DISCUSSION AND ANALYSIS |

| FOR THE YEAR ENDED DECEMBER 31, 2013 |

| |

| (3) | Cash costs net of by-product per payable silver ounce include mining, processing (including smelting, refining, transportation and selling costs), and direct overhead, net of gold credits. See Reconciliation to IFRS on page 22. |

| (4) | Total production costs per ounce include mining, processing (including smelting, refining, transportation and selling costs), direct overhead, amortization, depletion and amortization at the operation sites. See Reconciliation to IFRS on page 22. |

| (5) | All-in sustaining cost per ounce include mining, processing (including smelting, refining, transportation and selling costs), direct overhead, corporate general and administration, on-site exploration, share-based compensation, reclamation and sustaining capital net of gold credits |

| (6) | Direct production costs per tonne include mining, processing (including smelting, refining, transportation and selling costs) and direct overhead at the operation sites. See Reconciliation to IFRS on page 22. |

| (7) | Silver co-product cash cost and gold co-product cash cost include mining, processing (including smelting, refining, transportation and selling costs), and direct overhead allocated on pro-rated basis of realized metal value. See Reconciliation to IFRS on page 25. |

The acquisition of Endeavour’s first silver mine, at Guanaceví in 2004, continues to reap rewards for all stakeholders. The mine has since produced more than 15 million ounces of silver and 38,000 ounces of gold, revitalized the local community, and helped establish Endeavour’s successful business model. Although the historic mine was closed and the plant was struggling to process 100 tonnes per day of old tailings in 2004, Guanaceví is now producing 1,200 tonnes of high-grade ore per day. The Company found five high-grade silver-gold ore bodies along a five kilometre length of the prolific Santa Cruz vein and developed four new mines, one of which is now mined out. The Guanaceví operation currently includes three underground silver-gold mines, a cyanidation leach plant, mining camp, and administration and housing facilities. It provides steady employment for more than 450 people and engages over 200 contractors.

Guanaceví Production Results

Three months ended December 31, 2013 (compared to the three months ended December 31, 2012)

Silver production at the Guanaceví mine during Q4, 2013 was 861,495 oz, an increase of 66% compared to 518,207 oz in Q4, 2012, and gold production was 2,275 oz, an increase of 109% compared to 1,088 oz in Q4, 2012. Plant throughput was 121,008 tonnes at average grades of 272 gpt silver and 0.69 gpt gold compared to 110,763 tonnes grading 215 gpt silver and 0.69 gpt gold. Silver production increased due to higher silver grades and recoveries, while higher gold recoveries contributed to higher gold production. Q4, 2012 included adjustments to appropriately allocate processed ounces on behalf of the Bolañitos mine resulting in lower reported recoveries. The change in grades and recoveries were a function of geological variation of the ore bodies in Q4, 2013, with the higher grade Porvenir Cuatro mine contributing a higher tonnage resulting in improved throughput grades.

Year ended December 31, 2013 (compared to the year ended December 31, 2012)

Silver production at the Guanaceví mine during 2013 was 2,772,227 oz, an increase of 10% compared to 2,512,943 oz in 2012, and gold production was 6,784 oz, a decrease of 14% compared to 7,874 oz in 2012. Plant throughput was 435,922 tonnes at average grades of 253 gpt silver and 0.60 gpt gold in 2013 compared to 418,277 tonnes grading 249 gpt silver and 0.76 gpt gold in 2012. Metal production varied due to ore grades fluctuations, with better recoveries in 2013. The lower gold grades were attributable to the lower grade ores being mined at depth at North Porvenir, and increased tonnage in the lower grade Santa Cruz ore-body.

Guanaceví Operating Costs

Three months ended December 31, 2013 (compared to the three months ended December 31, 2012)

Wage increases and mining to greater depths have driven the rise in costs per tonne 15% compared to Q4, 2012. However, cash costs per ounce net of by-product credits, which is a non-IFRS measure and a standard of the Silver Institute, fell 28% to $13.09 per ounce of payable silver compared to $18.20 in 2012. Improved grades and recoveries offset the higher costs per tonne. Decreased mine development and exploration expenditures reduced the all-in sustaining costs compared to prior year.

Year ended December 31, 2013 (compared to the year ended December 31, 2012)

Wage increases and mining to greater depths have driven the rise in costs per tonne of 7% compared to 2012. Cash costs per ounce net of by-product credits, which is a non-IFRS measure and a standard of the Silver Institute, increased 17% to $14.32 per ounce of payable silver compared due to lower gold grades and gold prices. Reduced mine development and exploration expenditures year over year resulted in a 6% lower all-in sustaining costs per silver ounce.

| MANAGEMENT’S DISCUSSION AND ANALYSIS |

| FOR THE YEAR ENDED DECEMBER 31, 2013 |

| |

Bolañitos Operations

Production Results for the Three Months and Years Ended December 31, 2013 and 2012

| Three Months Ended Dec. 31 | BOLAÑITOS | Year Ended December 31 |

| 2013 | 2012 | % Change | | 2013 | 2012 | % Change |

| 159,294 | 161,841 | -2% | Ore tonnes processed | 710,708 | 476,687 | 49% |

| 152 | 140 | 9% | Average silver grade (g/t) | 149 | 148 | 1% |

| 89.5 | 71.3 | 26% | Silver recovery (%) | 84.6 | 73.4 | 15% |

| 698,098 | 518,674 | 35% | Total silver ounces produced | 2,881,816 | 1,668,128 | 73% |

| 660,113 | 513,487 | 29% | Payable silver ounces produced | 2,742,499 | 1,651,446 | 66% |

| 2.61 | 2.20 | 19% | Average gold grade (g/t) | 2.63 | 2.19 | 20% |

| 75.8 | 75.8 | 0% | Gold recovery (%) | 85.6 | 77.0 | 11% |

| 10,142 | 8,660 | 17% | Total gold ounces produced | 51,652 | 25,920 | 99% |

| 9,611 | 8,586 | 12% | Payable gold ounces produced | 49,572 | 25,673 | 93% |

| 1,306,618 | 1,038,274 | 26% | Silver equivalent ounces produced(1) | 5,980,936 | 3,223,328 | 86% |

| 0.60 | (3.73) | 116% | Cash costs per silver ounce(2)(3) | (2.87) | (5.20) | 45% |

| 4.35 | 1.59 | -174% | Total production costs per ounce(2)(4) | 1.30 | 0.31 | -319% |

| 7.68 | 11.67 | -34% | All in sustaining cost per ounce(2)(5) | 7.39 | 12.10 | -39% |

| 72.78 | 75.66 | -4% | Direct production costs per tonne(2)(6) | 79.47 | 74.25 | 7% |

| $8.82 | $12.58 | -30% | Silver co-product cash costs(7) | $9.48 | $11.51 | -18% |

| $535.80 | $660.34 | -19% | Gold co-product cash costs(7) | $564.43 | $624.72 | -10% |

| (1) | Silver equivalents are calculated using a 60:1 ratio . |

| (2) | The Company reports non-IFRS measures which include cash costs net of by-products on a payable silver basis, total production costs per ounce, all-in sustaining costs per ounce and direct production costs per tonne, in order to manage and evaluate operating performance at each of the Company’s mines. These measures, some established by the Silver Institute (Production Cost Standards, June 2011), are widely used in the silver mining industry as a benchmark for performance, but do not have a standardized meaning. These measures are reported on a production basis. See Reconciliation to IFRS on page 20. |

| (3) | Cash costs net of by-product per payable silver ounce include mining, processing (including smelting, refining, transportation and selling costs), and direct overhead, net of gold credits. See Reconciliation to IFRS on page 22. |

| (4) | Total production costs per ounce include mining, processing (including smelting, refining, transportation and selling costs), direct overhead, amortization, depletion and amortization at the operation sites. See Reconciliation to IFRS on page 22. |

| (5) | All-in sustaining cost per ounce include mining, processing (including smelting, refining, transportation and selling costs), direct overhead, corporate general and administration, on-site exploration, share-based compensation, reclamation and sustaining capital net of gold credits |

| (6) | Direct production costs per tonne include mining, processing (including smelting, refining, transportation and selling costs) and direct overhead at the operation sites. See Reconciliation to IFRS on page 22. |

| (7) | Silver co-product cash cost and gold co-product cash cost include mining, processing (including smelting, refining, transportation and selling costs), and direct overhead allocated on pro-rated basis of realized metal value. See Reconciliation to IFRS on page 25. |

Endeavour's second mine acquisition, at Bolañitos in 2007, encompasses three operating silver and gold mines and a floatation plant, located 10 kilometres from the city of Guanajuato in the state of Guanajuato. Following the acquisition, the cash costs of production were as high as $32 per ounce and the operation was struggling to produce 300,000 ounces of silver per year. Following the execution of management’s business strategy, the cash costs of production fell to negative due to economies of scale and the rising gold credits as production grew. Bolañitos’ processing plant was expanded in phases from 500 tonnes per day in 2007 to 1,600 tonnes per day in 2012. In 2013 additional mine output was processed at the El Cubo facilities allowing production to exceed plant capacity.

Bolañitos Production Results

Three months ended December 31, 2013 (compared to the three months ended December 31, 2012)

Silver production at the Bolañitos mine was 698,098 ounces during Q4, 2013, an increase of 35% compared to 518,674 oz in Q4, 2012, and gold production was 10,142 oz, an increase of 17% compared to 8,660 oz in Q4, 2012. Plant throughput in Q4, 2013 was 159,294 tonnes at average grades of 152 gpt silver and 2.61 gpt gold, compared to 161,841 tonnes grading 140 gpt silver and 2.20 gpt gold in Q4, 2012.

| MANAGEMENT’S DISCUSSION AND ANALYSIS |

| FOR THE YEAR ENDED DECEMBER 31, 2013 |

| |

Metal production was up due to higher grades and recoveries. The Bolañitos mine averaged 1,731 tonnes per day (tpd), well above the mine plan due to increased contract mining and more long-hole mining. The Bolañitos plant operated at its 1,600 tpd capacity, and the extra mine tonnage was processed at the leased Las Torres facility near El Cubo until July 22, 2013. Subsequent to July 22, 2013, the mine production in excess of Bolañitos’ plant capacity was processed at the newly refurbished El Cubo plant.

Ore grades were significantly higher than both the prior year and the 2013 mine plan, as mining accessed better ore grades than the planned reserve grades, specifically in the Daniela vein. Mine grades are expected to remain above reserve grades for the foreseeable future. The increased recoveries were partly a function of selling concentrate as opposed to processing the concentrate at the Company’s leach facilities at Guanaceví and El Cubo to produce doré bars. Selling concentrate at current metal prices resulted in higher payable metal production albeit at higher refining charges, resulting in a financial benefit compared to doré production.

Year ended December 31, 2013 (compared to the year ended December 31, 2012)

Silver production at the Bolañitos mine was 2,881,816 ounces in 2013, an increase of 73% compared to 1,668,128 oz, and gold production was 51,652 oz, an increase of 99% compared to 25,920 oz in 2012. Plant throughput in 2013 was 710,708 tonnes at average grades of 149 gpt silver and 2.63 gpt gold, compared to 476,687 tonnes grading 148 gpt silver and 2.19 gpt gold in 2012. Metal production was up due to higher throughput, recoveries and gold grade. In 2012, the Bolañitos plant capacity was expanded from 1,000 tpd to 1,600 tpd, and the mine was expanded to the plant capacity by Q4, 2012. In 2013, the Bolañitos plant operated at its 1,600 tpd capacity, and the extra tonnes were processed at the leased Las Torres facility near the El Cubo operations. The leased Las Torres facility was scheduled to be returned in May; however the counterparty requested a later return date allowing continued access until July 22, 2013. This additional access allowed Bolañitos production to significantly exceed plan. Subsequent to July 22, 2013, mine production in excess of the Bolañitos’ plant capacity was processed at the newly refurbished El Cubo plant.

Ore grades were also significantly higher than both the prior year and the 2013 mine plan, as mining accessed better ore grades than the planned reserve grades, specifically in the Daniela vein. Mine grades are expected to remain above reserve grades in the foreseeable future. The increased recoveries were partly a function of selling concentrate as opposed to processing the concentrate at the Company’s leach facilities at Guanaceví and El Cubo to produce doré bars. Selling concentrate at current metal prices resulted in higher payable metal production albeit at higher refining charges, resulting in a financial benefit compared to doré production.

Bolañitos Operating Costs

Three months ended December 31, 2013 (compared to the three months ended December 31, 2012)

Per tonne costs remained relatively consistent year over year as wage pressures, use of contractors and higher refining costs were offset by achieving additional economies of scale with the higher output. Cash costs per ounce net of by-product credits, which is a non-IFRS measure and a standard of the Silver Institute, rose 116% to $0.60 per ounce of payable silver compared to negative $3.73 per ounce in the same period in 2012. The lower by-product credit because of the lower gold price was the primary contributor to the higher cash costs, offset by higher grades and recoveries. All-in sustaining costs fell as mine development and exploration expenditures were curtailed and spread over higher silver production.

Year ended December 31, 2013 (compared to the year ended December 31, 2012)

Per tonne costs remained relatively consistent year over year as wage pressures, use of contractors and higher refining costs were offset by achieving additional economies of scale with the higher output. Cash costs per ounce net of by-product credits, which is a non-IFRS measure and a standard of the Silver Institute, rose 45% to negative $2.87 per ounce of payable silver compared to negative $5.20 in the same period in 2012. The lower byproduct credit because of the lower gold price was the primary contributor to the higher cash costs, offset by higher grades and recoveries. All-in sustaining costs fell as mine development and exploration expenditures were curtailed and spread over higher silver production.

| MANAGEMENT’S DISCUSSION AND ANALYSIS |

| FOR THE YEAR ENDED DECEMBER 31, 2013 |

| |

El Cubo Operations

Production Results for the Three Months and Years Ended December 31, 2013 and 2012

| Three Months Ended Dec. 31 | EL CUBO | Year Ended December 31 |

| 2013 | 2012 | % Change | | 2013 | 2012 | % Change |

| 99,178 | 90,175 | 10% | Ore tonnes processed | 391,354 | 170,725 | 129% |

| 118 | 96 | 23% | Average silver grade (g/t) | 107 | 94 | 14% |

| 99.1 | 71.2 | 39% | Silver recovery (%) | 85.0 | 58.9 | 44% |

| 372,124 | 198,145 | 88% | Total silver ounces produced | 1,159,026 | 304,405 | 281% |

| 342,115 | 196,193 | 74% | Payable silver ounces produced | 1,106,801 | 301,360 | 267% |

| 1.77 | 1.42 | 25% | Average gold grade (g/t) | 1.57 | 1.42 | 11% |

| 93.2 | 77.0 | 21% | Gold recovery (%) | 93.2 | 62.8 | 48% |

| 5,269 | 3,169 | 66% | Total gold ounces produced | 17,142 | 4,893 | 250% |

| 4,757 | 3,137 | 52% | Payable gold ounces produced | 16,282 | 4,843 | 236% |

| 688,264 | 388,285 | 77% | Silver equivalent ounces produced(1) | 2,187,546 | 597,985 | 266% |

| 6.65 | 38.52 | -83% | Cash costs per silver ounce(2)(3) | 18.77 | 35.27 | -47% |

| 24.58 | 51.04 | -52% | Total production costs per ounce(2)(4) | 40.43 | 57.50 | -30% |

| 18.95 | 61.93 | -69% | All in sustaining cost per ounce(2)(5) | 34.84 | 75.53 | -54% |

| 90.44 | 105.30 | -14% | Direct production costs per tonne(2)(6) | 113.31 | 117.17 | -3% |

| $12.96 | $34.89 | -63% | Silver co-product cash costs(7) | $20.35 | $32.76 | -38% |

| $787.02 | $1,830.76 | -57% | Gold co-product cash costs(7) | $1,211.19 | $1,866.99 | -35% |

| (1) | Silver equivalents are calculated using a 60:1 ratio . |

| (2) | The Company reports non-IFRS measures which include cash costs net of by-products on a payable silver basis, total production costs per ounce, all-in sustaining costs per ounce and direct production costs per tonne, in order to manage and evaluate operating performance at each of the Company’s mines. These measures, some established by the Silver Institute (Production Cost Standards, June 2011), are widely used in the silver mining industry as a benchmark for performance, but do not have a standardized meaning. These measures are reported on a production basis. See Reconciliation to IFRS on page 20. |

| (3) | Cash costs net of by-products per payable silver ounce include mining, processing (including smelting, refining, transportation and selling costs), and direct overhead, net of gold credits. See Reconciliation to IFRS on page 22. |

| (4) | Total production costs per ounce include mining, processing (including smelting, refining, transportation and selling costs), direct overhead, amortization, depletion and amortization at the operation sites. See Reconciliation to IFRS on page 22. |

| (5) | All-in sustaining cost per ounce include mining, processing (including smelting, refining, transportation and selling costs), direct overhead, corporate general and administration, on-site exploration, share-based compensation, reclamation and sustaining capital net of gold credits. |

| (6) | Direct production costs per tonne include mining, processing (including smelting, refining, transportation and selling costs) and direct overhead at the operation sites. See Reconciliation to IFRS on page 22. |

| (7) | Silver co-product cash cost and gold co-product cash cost include mining, processing (including smelting, refining, transportation and selling costs), and direct overhead allocated on pro-rated basis of realized metal value. See Reconciliation to IFRS on page 25. |

The acquisition of Endeavour’s third mine, the El Cubo mine in July 2012, was a good fit with Endeavour's business strategy of buying and rejuvenating struggling old mines in historic mining districts. However, unlike Guanaceví and Bolañitos, which had low throughputs and no reserves, El Cubo offered the potential to quickly become a core asset for Endeavour, already having a 1,100-tonne-per-day output and a reasonable reserve/resource mine life. Located in the southeastern part of the historic Guanajuato mining district, this producing silver and gold mine is only 15 kilometres from Endeavour’s Bolañitos project, and includes many mine adits, ramps, and shafts, as well as a 400-tonne-per-day leach plant. It also held a lease (until July 2013) on the adjacent Las Torres mine and 1,800-tonne-per-day flotation plant owned by Fresnillo PLC. Subsequent to the acquisition in Q3, 2012, Endeavour launched a $67-million, 18-month capital investment program at El Cubo to explore and develop the mine and to rebuild and expand the plant, tailings facility, water supply, electrical supply, surface buildings, and surface infrastructure. This program was substantially completed in Q2 2013 on time and within budget.

| MANAGEMENT’S DISCUSSION AND ANALYSIS |

| FOR THE YEAR ENDED DECEMBER 31, 2013 |

| |

El Cubo Production Results

Endeavour's new mine plan is focused on maintaining the current tonnage throughput at El Cubo of approximately 1,100-1,200 tpd while progressively increasing the production grades by reducing ore dilution. The Company has reorganized the mine operations team, improved supervision and operating efficiencies, improved safety policies, programs and training to reduce lost time accidents and created a Mine Rescue Team for a safer environment. The Company acquired new mining equipment,accelerated mine development and commenced underground drilling. The plant and surface infrastructure reconstruction program was completed on time and budget in Q2, 2013.

During Q2, 2013 the Company announced that the newly rebuilt plant at El Cubo was successfully re-commissioned on May 31st, reaching phase 1 operating capacity of 1,100-1,200 tpd. Work to bring the plant capacity of up to 1,500 – 1,600 tpd was completed in early Q3, 2013, allowing management to facilitate the processing up to 350 tpd of additional ore from the Bolañitos mine. More than 600,000 hours of work were completed on the plant and infrastructure with no lost time accidents, an accomplishment of which the Company is particularly proud. Due to the successful re-commissioning of the El Cubo plant, Endeavour returned the nearby leased Las Torres plant to its owner, Fresnillo PLC, on July 22, 2013.

Three months ended December 31, 2013 (compared to the three months ended December 31, 2012)

Silver production at the El Cubo mine was 372,124 oz in Q4, 2013, an increase of 88% compared to 198,145 oz in Q4, 2012 and gold production was 5,269 oz in Q4, 2013, an increase of 66% compared to 3,169 oz in Q4, 2012. Plant throughput in Q4, 2013 was 99,178 tonnes at average grades of 118 gpt silver and 1.77 gpt gold, compared to 90,175 tonnes grading 96 gpt silver and 1.42 gpt gold in Q4, 2012. The rise year over year was due to the successful implementation of Endeavour’s turn around initiatives. In Q3, 2013, metal production jumped as management turned its focus from the re-construction of the site infrastructure to the optimization of the operations, which continued in Q4, 2013. The Company continues to focus on ensuring that safe, sustainable mining methods will become part of the culture which will lead to improved operating efficiencies. Silver and gold recoveries were both anomalously higher quarter over quarter with additional material flushed from the leach circuit in Q4, 2013 and solely selling a concentrate in Q4 2013. Selling concentrate as opposed to producing doré at the El Cubo plant will increase recoveries going forward. Selling concentrate results in higher payable metal production and higher refining charges, resulting in a net financial benefit. Management expects recoveries to return to be approximately 90% going forward.

Year ended December 31, 2013 (compared to the year ended December 31, 2012)

Silver production at the El Cubo mine was 1,159,026 oz in 2013, an increase of 281% compared to 304,405 oz in 2012 and gold production was 17,142 oz in 2013, an increase of 250% compared to 4,893 oz in 2012. Plant throughput in 2013 was 391,354 tonnes at average grades of 107 gpt silver and 1.57 gpt gold and was 170,725 tonnes grading 94 gpt silver and 1.42 gpt gold in 2012 (not comparable because 2012 production started in July 2012, post-acquisition). The rise year over year was due to owning the assets for the entire fiscal year along with the successful implementation of Endeavour’s turn around initiatives. The Company continues to focus on ensuring that safe, sustainable mining methods will become part of the culture which over time leads to improved operating efficiencies. Metal grades and recoveries have both trended higher since acquisition. Selling concentrate as opposed to producing doré at the El Cubo plant will increase recoveries going forward. Selling concentrate results in higher payable metal production and higher refining charges, resulting in a net financial benefit. Management expects recoveries to return to be approximately 90% going forward.

El Cubo Operating Costs

Three months ended December 31, 2013 (compared to the three months ended December 31, 2012)

Per tonne costs fell 15% quarter over quarter as reorganization plans have taken effect. The Company significantly cut head count in Q2 and Q3 2013, while increasing mined tonnes. Cash costs per ounce net of by-product credits, which is a non-IFRS measure and a standard of the Silver Institute, dropped sharply to $6.65 per ounce of payable silver compared to $38.52 in the same period in 2012. The lower cost per tonne, improved grades and recoveries significantly improved the cash costs on a by-product basis offset by the lower gold price. All-in sustaining costs fell as mine development and exploration expenditures were allocated to significantly higher production. The Company continues to invest in mine development and exploration at El Cubo in order to improve the long term viability of the operation.

| MANAGEMENT’S DISCUSSION AND ANALYSIS |

| FOR THE YEAR ENDED DECEMBER 31, 2013 |

| |

Year ended December 31, 2013 (compared to the year ended December 31, 2012)

Per tonne costs remained relatively consistent year over year. Significant severance costs, training and safety initiatives spending and costs related to the implementation of new processes and procedures were offset by the additional production. Cash costs per ounce net of by-product credits, which is a non-IFRS measure and a standard of the Silver Institute, fell to $18.77 per ounce of payable silver compared to $35.27. Improved grades and recoveries significantly improved the cash costs on a by-product basis. All-in sustaining costs fell as mine development and exploration expenditures were allocated to higher production. The Company continues to invest in mine development and exploration at El Cubo in order to improve the long term viability of the operation.

Exploration Results

In January 2013, Endeavour commenced an aggressive $16.3 million surface exploration drill program to test multiple exploration targets at its three mining districts and five district scale exploration properties. A total of 78,500 metres of surface drilling was planned to test approximately 24 exploration targets. During Q2, 2013, the sharp drop in precious metal prices prompted management to reduce the size of the remaining 2013 exploration program by 25%. Endeavour ended up drilling 178 holes totaling 62,000 metres in 2013 for total expenditures of $12.8 million.

At Bolañitos, the Company drilled 15,337 metres in 51 holes to discover high-grade, gold-silver vein mineralization in the historic La Luz, LL-Asuncion and Plateros veins. Each of the three new mineralized zones is about 200 m long by 100 m deep. The La Luz and Asuncion mineralized zones appear to lie along strike from each other about 900 m apart, suggesting that significant exploration potential remains to be tested in between them. Both mineralized zones are readily accessible for mining from nearby historic workings and underground development is now underway to provide access to these two areas via the operating Asuncion shaft. In 2014, Bolañitos exploration will focus on drilling five high priority brownfields targets northwest and southeast of the mine.

At Guanaceví, the Company drilled 9,910 metres in 19 holes testing the Milache property six kilometres northwest of the plant to more fully delineate the high-grade, silver-gold mineralization over a 300 metre by 300 metre area discovered in the Santa Cruz vein. Management is currently evaluating alternatives for underground development at Milache to commence in 2014 so that production can commence in 2015. In 2014, Guanaceví exploration will focus on drilling a high priority brownfields target southeast of the mine.

At El Cubo, the Company drilled 18,450 metres in 47 holes to discover new high-grade, gold-silver vein mineralization in the historic Villalpando, V-Asuncion and Dolores veins. Drilling at Dolores helped to extend and define the hanging-wall and footwall vein ore-bodies that are currently in production. Drilling in the Villalpando and V-Asuncion veins, discovered in late 2012 and fast-tracked to production last year, successfully extended this newly discovered mineralized zone over 900 m in strike length, still open for expansion. In 2014, exploration will focus on five high-priority brownfield targets northwest and southeast of the mine.

At San Sebastián, the Company released an initial mineral resource estimate for the San Sebastián property that included an indicated resource totaling 1,835,000 tonnes with grades of 193 gpt silver and 1.17 gpt gold containing 11.4 million oz silver and 69,300 oz gold, and an inferred resource totaling 3,095,000 tonnes with grades of 196 gpt silver and 1.39 gpt gold containing 19.5 million oz silver and 138,100 oz gold. During 2013, the Company drilled 8,574 m in 30 holes at San Sebastián to infill and extend the recently discovered, thick, high-grade silver-gold mineralization in the Terronera vein over a 900 m long by 300 m deep portion of the four kilometre long Terronera vein, which is still open for expansion.In 2014, exploration will focus on drilling two high priority target areas to extend the high-grade silver-gold mineralization along strike to the northwest and southeast of the current resource area in the Terronera vein.

At the Panuco-Laberinto property in Durango State, Mexico, drilling intersected geologically interesting but sub-economic results. The Panuco property is sandwiched between the La Preciosa property of Orko Silver to the southeast and the San Lucas property of Oremex Silver to the northwest, which was optioned in 2012. The Panuco property has exploration potential both for bulk tonnage, open pit and high-grade, underground silver-gold deposits. The Company is currently assessing the remaining exploration potential of this area.

| MANAGEMENT’S DISCUSSION AND ANALYSIS |

| FOR THE YEAR ENDED DECEMBER 31, 2013 |

| |

At the El Inca-San Julian properties in northern Chile, surface mapping and target identification were completed and drilling commenced in 2013. The El Inca-San Julian properties have exploration potential for both bulk tonnage, open pit silver-lead-zinc mines like San Cristobal, high-grade, underground silver-gold mines like El Penon (south of El Inca in Chile) and open pit, porphyry copper mines like Chuquicamata. The drilling confirmed the geological potential for a bulk tonnage target, but did no intersect economic mineralization during the first phase of drilling. The Company is currently assessing the remaining exploration potential of this area.

Reserves and Resources

The updated NI 43-101 reserve and resource estimates to December 31, 2013 include the Guanacevi Mine in Durango state, the Bolañitos Mine in Guanajuato state, the El Cubo Mines in Guanajuato state, the Parral project in Chihuahua state, the Arroyo Seco project in the Michoacan state, the Guadelupe y Calvo project in Chihuahua state and the San Sebastián project in Jalisco State.

The Company completed an updated internal estimate of the reserves and resources as of December 31, 2013 for the Guanacevi, Bolañitos, the El Cubo Mines and the San Sebastián project. The Qualified Person for reporting for the four updated estimates is Mike Munroe, MSc, SME Registered Member 4151306RM, an employee of the Company. The Guanacevi, Bolañitos, El Cubo and San Sebastián technical reports will be filed on or before March 31, 2014.

The Company previously retained Micon, to audit the resources to December 15, 2012 for the Guadelupe y Calvo project. The Qualified Persons for reporting for this project are Charley Z. Murahwi, M.Sc., P.Geo, FAusIMM and Alan J. San Martin MAusIMM(CP).

The Company retained Micon, to audit the updated resources to December 31, 2010, based on the then current metal prices for the Parral Project (El Cometa Property). The Qualified Persons for reporting the Parral resources are William J. Lewis, B.Sc., P.Geo, Charley Z. Murahwi, M.Sc., P.Geo, FAusIMM and Dibya Kanti Mukhopadhyay, M.Sc., MAusIMM., who are Micon employees.

The Qualified Persons for reporting the Arroyo Seco resources as of December 31, 2010 are David St Clair Dunn, P.Geo, who is a geological consultant and Barry Devlin, P.Geo who was the Company’s Vice President of Exploration at the time of the report’s preparation.

The reserve and resource statements for the Guanacevi, Bolañitos, El Cubo, Parral, Guadalupe y Calvo, San Sebastián and Arroyo Seco Projects were classified using the definitions and guidelines of the Canadian Institute of Mining, Metallurgy and Petroleum CIM standards on Mineral Resources and Reserves (CIM Standards) and the guidelines of NI 43-101.

| MANAGEMENT’S DISCUSSION AND ANALYSIS |

| FOR THE YEAR ENDED DECEMBER 31, 2013 |

| |

| Silver-Gold Reserves & Resources (as of December 31, 2013) |

| Reserves | Tonnes | Ag g/t | Au g/t | Ag oz | Au oz |

| Guanacevi | 327,800 | 281 | 0.51 | 2,961,900 | 5,300 |

| Bolanitos | 380,530 | 156 | 2.50 | 1,910,300 | 30,500 |

| El Cubo | 752,500 | 138 | 2.16 | 3,330,300 | 52,200 |

| Total Proven | 1,460,830 | 175 | 1.87 | 8,202,500 | 88,000 |

| Guanacevi | 34,600 | 342 | 0.46 | 380,800 | 500 |

| Bolanitos | 98,300 | 134 | 2.17 | 424,200 | 6,800 |

| El Cubo | 615,400 | 131 | 2.23 | 2,595,700 | 44,100 |

| Total Probable | 748,300 | 141 | 2.14 | 3,400,700 | 51,400 |

| Total Proven & Probable | 2,209,130 | 163 | 1.96 | 11,603,200 | 139,400 |

| | | | | | |

| Resources | Tonnes | Ag g/t | Au g/t | Ag oz | Au oz |

| Guanacevi | 132,000 | 163 | 0.29 | 11,603,200 | 139,400 |

| Bolanitos | 75,900 | 132 | 1.39 | 322,800 | 3,400 |

| El Cubo | 660,100 | 158 | 2.87 | 3,357,800 | 60,800 |

| Total Measured | 868,000 | 183 | 2.35 | 777,200 | 203,600 |

| Guanacevi | 1,701,200 | 242 | 0.57 | 13,221,400 | 31,500 |

| Bolanitos | 1,191,800 | 111 | 1.95 | 4,263,300 | 74,700 |

| El Cubo | 1,570,500 | 144 | 2.06 | 7,263,100 | 104,200 |

| San Sebastian | 2,476,000 | 229 | 1.08 | 18,216,200 | 86,300 |

| Guadalupe y calvo | 1,861,000 | 119 | 2.38 | 7,147,300 | 142,500 |

| Total Indicated | 8,800,500 | 177 | 1.55 | 50,111,300 | 439,200 |

| Total Measured & Indicated | 9,668,500 | 176 | 1.62 | 54,569,100 | 504,700 |

| | | | | | |

| Guanacevi | 1,155,100 | 253 | 0.46 | 9,384,300 | 17,100 |

| Bolanitos | 2,145,150 | 140 | 1.62 | 9,642,100 | 111,720 |

| El Cubo | 1,477,900 | 163 | 3.40 | 7,729,500 | 130,100 |

| San Sebastian | 2,376,000 | 175 | 1.66 | 13,390,600 | 126,800 |

| Guadalupe y calvo | 154,000 | 94 | 2.14 | 464,600 | 10,600 |

| Total Inferred | 7,308,150 | 173 | 1.69 | 40,611,100 | 396,320 |

| Silver-Lead-Zinc Reserves & Resources (as of September 30, 2013) |

| Resources | Tonnes | Ag g/t | Au g/t | Ag oz | Au oz |

| Guanacevi | 655,000 | 166 | 0.21 | 3,495,700 | 4,400 |

| Parral | 1,631,000 | 49 | 0.90 | 2,589,900 | 47,200 |

| Total Indicated | 2,286,000 | 83 | 0.70 | 6,085,600 | 51,600 |

| Guanacevi | 646,000 | 129 | 0.15 | 2,687,300 | 3,100 |

| Bolanitos | 1,303,000 | 63 | 0.88 | 2,658,900 | 36,900 |

| El Cubo | 738,000 | 220 | 0.07 | 5,220,000 | 1,700 |

| Total Inferred | 2,687,000 | 122 | 0.48 | 10,566,200 | 41,700 |

| MANAGEMENT’S DISCUSSION AND ANALYSIS |

| FOR THE YEAR ENDED DECEMBER 31, 2013 |

| |

Key

| | 1. | Reserve cut-off at Guanacevi is 217 g/t Silver equivalents |

| | 2. | Reserve cut-off at Bolañitos is 155 g/t Silver equivalents |

| | 3. | Reserve cut off at El Cubo is 130 g/t Silver equivalents |

| | 4. | Mining width is 1.8 metres at Guanacevi |

| | 5. | Mining width of 2.0 metres at Bolañitos |

| | 6. | Mining width of 0.8 metres at El Cubo |

| | 7. | At Guanacevi dilution is 15% after it has been diluted to a minimum mining width if required |

| | 8. | At Bolañitos dilution is 15% on cut and fill and 25% on long-hole mining methods after it has been diluted to a minimum width if required |

| | 9. | At El Cubo, inclusive of dilution to minimum mining width is 75%. |

| | 10. | Resource cut-off for operations are 100 g/t Ag equivalent |

| | 11. | Reserve and Resource Silver equivalent is 60:1 for Silver to Gold |

| | 12. | Resource cut off for the San Sebastián property is 100 g/t Ag equivalent |

| | 13. | Resource cut off for the Guadalupe y Calvo property is 100 g/t Ag equivalent |

| | 14. | At the Parral project a cut-off using NSR of $40 is used with the prices listed below |

| | 15. | The cut-off used for Arroyo Seco was 100 g/t Ag |

Net Smelter Return (NSR) Cut-off Parameters for the Parral Project

| Description | Parameter | Description | Parameter |

| Gold Price | US $1,000/oz | Gold Recovery (Overall) | 75% |

| Silver Price | US $16/oz | Silver Recovery (Overall) | 71% |

| Lead Price | US $0.65/lb | Lead Recovery (Overall) | 80% |

| Zinc Price | US $0.65/lb | Zinc Recovery (Overall) | 74% |

| Smelter Terms | Generic Contract | | |

Consolidated Financial Results

Three months ended December 31, 2013 (compared to the three months ended December 31, 2012)

For the three-month period ended December 31, 2013, the Company’s mine operating earnings were $9.9 million (Q4, 2012: $17.9 million) on sales of $67.9 million (Q4, 2012: $66.7 million) with cost of sales of $58.0 million (Q4, 2012: $48.8 million).

The operating loss in Q4, 2013 was $129.6 million (Q4, 2012:operating earnings of $10.5 million) after exploration costs of $2.1 million (Q4, 2012: $3.8 million), general and administrative costs of $2.2 million (Q4, 2012: $3.6 million) and an impairment of non-current assets and goodwill of $135.1 million (Q4, 2012: nil)

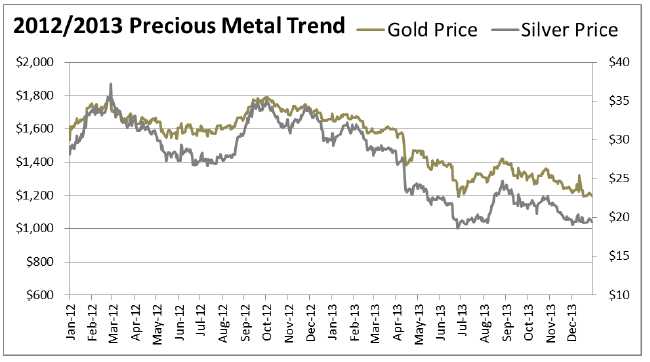

The loss before taxes in Q4, 2013 was $133.8 million (Q4, 2012: earnings before taxes of $17.3 million) after mark-to-market gain on derivative liabilities (see adjusted earnings comment on page 20) of $0.6 million (Q4, 2012: $1.7 million), a foreign exchange loss of $0.4 million (Q4, 2012: gain of $0.5 million), a mark-to-market gain on contingent liabilities of $0.6 million (Q4, 2012: $4.4 million), investment and other loss of $4.7 million (Q4, 2012: income of $0.3 million) and finance costs of $0.4 million (Q4, 2012: $0.3 million). As at December 31, 2013, the Company determined there were several indicators of potential impairment of its producing mineral properties which include the sustained decline in precious metal prices, the Mexican tax reform (see page 30) and a reduction of the Guanacevi estimated reserves and resources. The total impairment charge for the year ended December 31, 2013 is $104.3 million net of tax ($135.1 million before tax) (see page 19). The Company realized a net loss for the period of $115.8 million (Q4, 2012: net income of $19.8 million) after an income tax recovery of $18.1 million (Q4, 2012: recovery of $2.5 million).

| MANAGEMENT’S DISCUSSION AND ANALYSIS |

| FOR THE YEAR ENDED DECEMBER 31, 2013 |

| |

Sales of $67.9 million in Q4, 2013 represent a 2% increase over the $66.7 million for the same period in 2012. There was a 60% increase in silver ounces sold offset by a 38% decrease in the realized silver price resulting in flat silver sales, and there was a 45% increase in gold ounces sold with a 28% decrease in realized gold prices resulting in 5% increase in gold sales. During the period, the Company sold 2,155,326 oz silver and 18,960 oz gold, for realized prices of $20.52 and $1,246 per oz respectively, compared to sales of 1,345,832 oz silver and 13,037 oz gold, for realized prices of $32.87 and $1,725 per oz respectively, in the same period of 2012. The realized prices of silver and gold during the period were within 2% of the average silver spot price during the period of $20.82 and the average gold spot price during the period of $1,275, with differences due to the timing of sales and the mark-to-market adjustments for the concentrate sales that are pending finalization.

The Company depleted its finished goods to 51,000 oz silver and 198 oz gold at December 31, 2013 compared to 385,126 oz silver and 2,473 oz gold at September 30, 2013. The cost allocated to these finished goods was $1.0 million, compared to $10.2 million at September 30, 2013.

Cost of sales for Q4, 2013 was $58.0 million, an increase of 19% over the cost of sales of $48.8 million for the same period of 2012. The 19% increase was a result of a number of factors. The 19% increase was a result of the Company selling 38% more silver ounces, a 50% increase in amortization and depletion due to a higher depletion cost base, and various additional cost pressures at its operations, including labour.

Exploration expenses decreased in Q4, 2013 to $2.1 million from $3.8 million in the same period of 2012 based on both the timing of the exploration activities and the reduction of exploration activities in the current year. During Q2, 2013, the sharp drop in precious metal prices prompted management to reduce the size of the 2013 exploration program by 25%. General and administrative expenses decreased to $2.5 million for the period as compared to $3.6 million in the same period of 2012 primarily due to decreased corporate development costs, legal and human resource costs.

A significant number of the Company’s share purchase warrants are classified and accounted for as a financial liability at fair value with adjustments recognized through net earnings because these warrants have an exercise price denominated in a currency which is different from the functional currency of the Company. During the period, there was a mark-to-market gain on derivative liabilities (see adjusted earnings comment on page 20) of $0.6 million compared to $1.9 million gain in the same period in 2012. The gain in the current period was a reflection of the Company’s share price decreasing from CAN$4.42 at September 30, 2013 to CAN$3.84 at December 31, 2013.

The mark-to-market loss on the contingent liability was a result of a revaluation, based on the Monte Carlo model, of the contingent consideration related to the acquisition of Mexgold (El Cubo). The decrease in the gold price and movement in the forward curve resulted in a $0.6 million mark-to-market gain during Q4, 2013 while the same period in 2012 had a mark-to-market loss on the contingent liability of $4.4 million.

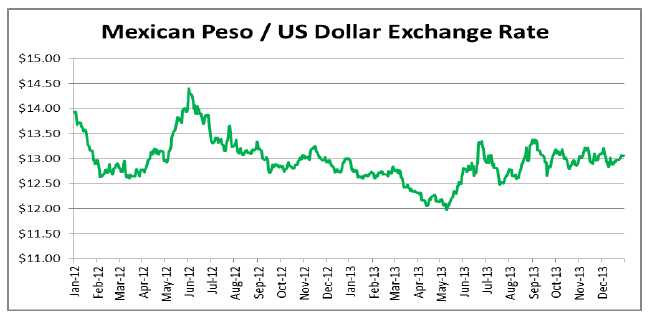

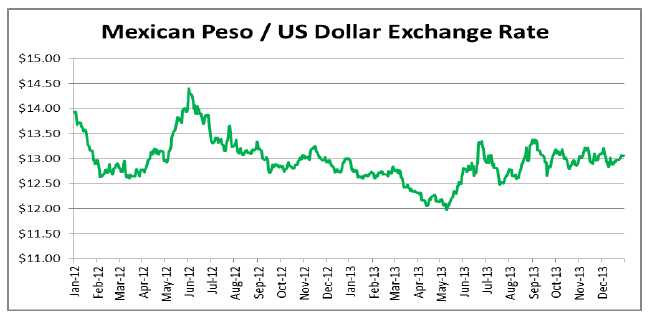

The Company experienced a foreign exchange loss of $0.4 million during the period compared to a gain of $0.5 million for the same period of 2012. The $0.4 million gain was primarily due to the weakening of the Mexican peso against the US dollar during the period, which resulted in lower valuations on the Mexican peso cash and receivable amounts and the Mexican peso denominated inventory amounts.

There was an income tax recovery of $18.1 million during the period compared to $2.5 million recovery for the same period of 2012. In December 2013, the Mexican President passed tax reform legislation that will be effective January 1, 2014. The tax reform includes, among other items, an increase of the Mexican corporate tax rate from 28% to 30%, removal of the flat tax regime, a Special Mining Duty of 7.5% on taxable revenues, less allowable deductions excluding interest and capital depreciation and an 0.5% Environmental Tax on gold and silver revenues. On enactment of the Special Mining Duty, the Company recognized an $18.7 million deferred income tax expense offset by the recognition of loss carry forwards that would be available with the removal of the flat tax regime for the year ended December 31, 2013. Furthermore, a result of the impairment of non-current assets the Company recognized $30.8 million deferred income tax recovery during the period.

| MANAGEMENT’S DISCUSSION AND ANALYSIS |

| FOR THE YEAR ENDED DECEMBER 31, 2013 |

| |

Year ended December 31, 2013 (compared to the year ended December 31, 2012)

For the year ended December 31, 2013, the Company’s mine operating earnings were $56.9 million (2012: $78.0 million) on sales of $276.8 million (2012: $208.1 million) with cost of sales of $219.9 million (2012: $130.1 million).

Operating loss was $102.9 million (2012: operating income of $53.6 million) after exploration costs of $13.2 million (2012: $11.2 million), general and administrative costs of $11.6 million (2012: $13.1 million) and an impairment of non-current assets and goodwill of $135.1 million (Q4, 2012: nil)

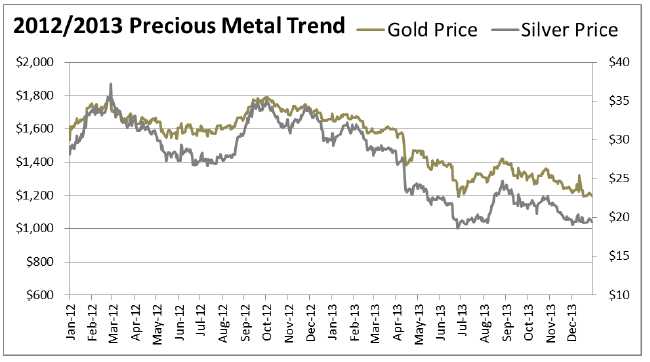

The loss before taxes was $96.0 million (2012: earnings before taxes of $60.1 million) after mark-to-market gain on derivative liabilities (see adjusted earnings comment on page 20) of $3.8 million (2012: $1.9 million), a foreign exchange expense of $2.6 million (2012: gain of $3.5 million), a mark-to-market gain on contingent liabilities of $8.4 million (2012: mark-to-market loss of $0.6 million), investment and other loss of $1.1 million (2012: income of $2.1 million) and finance costs of $1.5 million (2012: $0.5 million). As at December 31, 2013, the Company determined there were several indicators of potential impairment of its producing mineral properties which include the sustained decline in precious metal prices, the Mexican tax reform (see page XX) and a reduction of the Guanacevi estimated reserves and resources. The total impairment charge for the year ended December 31, 2013 is $104.3 million net of tax ($135.1 million before tax) (see page 19). The Company realized a net loss for the period of $89.5 million (2012: net earnings of $42.1 million) after an income tax recovery of $6.5 million (2012: provision of $18.0 million).

Sales of $276.8 million for the year represented a 33% increase over the $208.1 million for 2012. There was a 49% increase in silver ounces sold offset by a 25% decrease in the realized silver price resulting in a 11% increase in silver sales, and there was a 131% increase in gold ounces sold with 18% decrease in realized gold prices resulting in a 89% increase in gold sales. During the year, the Company sold 7,151,963 oz silver and 81,119 oz gold, for realized prices of $23.10 and $1,375 per oz respectively, compared to sales of 4,815,073 oz silver and 35,167 oz gold, for realized prices of $23.10 and $1,674 per oz respectively, in 2012. The realized prices of silver and gold during the year were within 3% of the 2013 average silver spot price of $23.79 and average gold spot price of $1,411, with differences due to the timing of sales and the mark-to-market for the concentrate sales that are pending finalization.

The Company accumulated 51,000 oz silver and 198 oz gold finished goods at December 31, 2013 compared to 611,661 oz silver and 8,934 oz gold at December 31, 2012. The cost allocated to these finished goods is $1.0 million compared to $18.7 million, net of a $1.5 million write-down of the El Cubo finished goods, at December 31, 2012.

Cost of sales for the year was $219.9 million, an increase of 69% over the cost of sales of $130.1 million for 2012. The 69% increase in the cost of sales was due to a number of factors. The Company sold 49% more silver ounces and experienced an 80% increase in amortization and depletion as the Company had higher accumulated cost bases. In addition, the Company experienced additional labour cost pressures at its operations, including severance costs during the year. Furthermore, the Company acquired the El Cubo mine in Q3, 2012, a high cost operation which had been operating at a loss in the early part of the year, resulting in a reduced gross margin on a consolidated basis. During the year the Company took inventory write downs to net realizable value (“NRV”) of $4.9 million at the El Cubo mine and $1.0 million at the Guanaceví mine. The write down for El Cubo was comprised of write downs of both finished goods and work in process inventories, while the write down for Guanaceví was comprised of finished goods at the end of reporting quarters.

Exploration expenses in 2013 increased to $13.2 million from $11.2 million in 2012 based on the timing of the exploration activities, the addition of exploration activities at the El Cubo mine and a more aggressive exploration program in early 2013. General and administrative expenses decreased to $11.6 million in 2013 compared to $13.1 million in 2012 primarily due to slightly decreased corporate development costs, legal and insurance fees and human resource costs.

A significant number of the Company’s share purchase warrants are classified and accounted for as a financial liability at fair value with adjustments recognized through net earnings because these warrants have an exercise price denominated in a currency which is different from the functional currency of the Company. During the year, there was a mark-to-market gain on derivative liabilities (see adjusted earnings comment on page 16) of $3.8 million, while the same period in 2012 had a mark-to-market gain on derivative liabilities of $1.9 million. The gain was a reflection of the Company’s share price decreasing from CAN$7.84 at December 31, 2012 to CAN$3.84 at December 31, 2013.

| MANAGEMENT’S DISCUSSION AND ANALYSIS |

| FOR THE YEAR ENDED DECEMBER 31, 2013 |

| |