UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box: |

| | |

£

| | Preliminary Proxy Statement |

| £ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| S | | Definitive Proxy Statement |

£

| | Definitive Additional Materials |

£

| | Soliciting Material under §240.14a-12 |

|

| | | | | |

| MVB Financial Corp. |

| (Name of Registrant as Specified In Its Charter) |

| |

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| |

| Payment of Filing Fee (Check the appropriate box): |

| | | |

| S | | No fee required. |

| | | |

£

| | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| | | | | |

| | | (1 | ) | | Title of each class of securities to which transaction applies: |

| | | | | |

| | | (2 | ) | | Aggregate number of securities to which transaction applies: |

| | | | | |

| | | (3 | ) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | | | |

| | | (4 | ) | | Proposed maximum aggregate value of transaction: |

| | | | | |

| | | (5 | ) | | Total fee paid: |

| | | | | |

| | | | | |

£

| | Fee paid previously with preliminary materials. |

| | | |

£

| | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | | | | |

| | | (1 | ) | | Amount Previously Paid: |

| | | | | |

| | | (2 | ) | | Form, Schedule or Registration Statement No.: |

| | | | | |

| | | (3 | ) | | Filing Party: |

| | | | | |

| | | (4 | ) | | Date Filed: |

| | | | | |

301 VIRGINIA AVENUE

FAIRMONT, WEST VIRGINIA 26554-2777

(304) 363-4800

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD MAY 19, 2020

To the Shareholders:

The 2020 Annual Meeting of Shareholders (the “Annual Meeting”) of MVB Financial Corp. (“MVB” or the “Company”) will be held via webcast this year at 9:00 a.m. EST on May 19, 2020. In light of COVID-19 (Coronavirus), this year's Annual Meeting will be completely virtual, which means that you will be able to participate in the Annual Meeting, vote and submit your questions during the Annual Meeting via live webcast by visiting www.meetingcenter.io/215475574. You will not be able to attend the Annual Meeting in person. Although very unlikely, please be aware of the possibility that this Annual Meeting date, time, or location may change due to the Coronavirus based on MVB's facts and circumstances. This meeting is for the purposes of considering and voting upon the following proposals:

| |

| 1. | To elect three directors for a three-year term. |

| |

| 2. | To approve a non-binding advisory proposal on the compensation of the Named Executive Officers. |

| |

| 3. | To ratify the appointment of Dixon Hughes Goodman LLP as the independent registered accounting firm for MVB for the fiscal year ending December 31, 2020. |

| |

| 4. | Any other business which may properly be brought before the meeting or any adjournment thereof. |

Only those shareholders of record at the close of business on March 25, 2020, shall be entitled to notice of the meeting and to vote at the Annual Meeting. A list of shareholders entitled to vote at the Annual Meeting is available for inspection at our principal executive office at 301 Virginia Avenue, Fairmont, WV 26554. The notice of Annual Meeting, proxy statement, proxy card, and other proxy materials are first being sent or made available to shareholders on or about April 6, 2020.

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Shareholders to be Held Virtually on May 19, 2020.

We have elected to take advantage of Securities and Exchange Commission (“SEC”) rules that allow us to furnish proxy materials to certain shareholders on the Internet. Instead of receiving paper copies of our proxy materials in the mail, shareholders will receive a Notice of Internet Availability of Proxy Materials (“Notice”) which provides an internet website address where shareholders can access electronic copies of proxy materials and vote. This website also has instructions for voting by telephone and for requesting paper copies of the proxy materials and proxy card. The Company's 2020 proxy statement, proxy card and Annual Report for fiscal year 2019 are available online at www.edocumentview.com/MVBF. We encourage you to access and review such materials before voting.

Your vote is very important to us. Whether or not you expect to attend the Annual Meeting via webcast, we urge you to consider the proxy statement carefully and to promptly vote your shares.

|

| |

| | By Order of the Board of Directors, |

| | |

| | Larry F. Mazza |

| | President & Chief Executive Officer |

301 VIRGINIA AVENUE

FAIRMONT, WEST VIRGINIA 26554-2777

(304) 363-4800

PROXY STATEMENT

ANNUAL MEETING OF SHAREHOLDERS

May 19, 2020

This proxy statement is furnished in connection with the solicitation of proxies for use at the 2020 Annual Meeting of Shareholders (the “Annual Meeting”) of MVB Financial Corp. (“MVB” or the “Company”) to be held at 9:00 am EST on May 19, 2020, for the purposes set forth in the accompanying Notice of Annual Meeting of Shareholders. In light of COVID-19 (Coronavirus), this year's Annual Meeting will be held via the live webcast at www.meetingcenter.io/215475574. You will not be able to attend the Annual Meeting in person. Although very unlikely, please be aware of the possibility that this Annual Meeting date, time, or location may change due to the Coronavirus based on MVB's facts and circumstances. A copy of this proxy statement, the proxy card and our Annual Report for fiscal year 2019 (collectively, the “Proxy Materials”) can be found at the web address www.edocumentview.com/MVBF. We first made available these Proxy Materials to our shareholders on or about April 6, 2020.

The Securities and Exchange Commission (the “SEC”) has adopted a “Notice and Access” rule that allows companies to deliver a Notice of Internet Availability of Proxy Materials (the “Notice”) to shareholders in lieu of a paper copy of the Proxy Materials. The Notice provides instructions as to how shares can be voted. Shares must be voted either by telephone, internet or by completing and returning a proxy card. Shares cannot be voted by marking, writing on and/or returning the Notice. Any Notices that are returned will not be counted as votes. Instructions for requesting a paper copy of the Proxy Materials are set forth on the Notice.

Solicitation of Proxies

The solicitation of proxies is made by MVB's Board of Directors (the “Board of Directors”). These proxies enable shareholders to vote on all matters that are scheduled to come before the meeting. If a proxy is submitted where a vote is not indicated, the proxy will be voted “FOR” all of the proposals to be submitted to the vote of shareholders described in the Notice of Annual Meeting and this proxy statement. Other than the matters listed in the Notice of Annual Meeting of Shareholders, the Board of Directors knows of no additional matters that will be presented for consideration at the Annual Meeting.

The expenses of the solicitation of proxies will be paid by MVB. In addition to this solicitation by mail, directors, officers and employees of MVB or one or more of its subsidiaries – MVB Bank, Inc. (“MVB Bank”), Potomac Mortgage Group, Inc., which does business as MVB Mortgage (“MVB Mortgage”), MVB Insurance, LLC, MVB Community Development Corp. (“MVB CDC”) and ProCo Global, Inc. (“ProCo”, which began doing business under the registered trade name Chartwell Compliance “Chartwell”) may solicit proxies personally or by telephone, although no person will be specifically engaged for that purpose.

Attending the Virtual Annual Meeting

We are sensitive to the public health and travel concerns of our shareholders and employees and the protocols that federal, state and local government have imposed, and may continue to impose, due to COVID-19 (Coronavirus). We will, therefore, be hosting the Annual Meeting live via Internet webcast. You will not be able to attend the Annual Meeting in person. Shareholders and guests can listen to and participate in the Annual Meeting live via the Internet at www.meetingcenter.io/215475574. The webcast will start at 9:00 a.m. (EST) on May 19, 2020. Shareholders may vote and submit questions while connected to the Annual Meeting on the Internet, but guests will only be permitted to listen and submit questions.

Instructions on how to connect and participate in the Annual Meeting, including how to demonstrate proof of ownership of our common shares, are posted at www.edocumentview.com/MVBF. If you do not have your 16-digit control number that is printed in the box marked by the arrow on your Notice or your proxy card (if you received a printed copy of the proxy materials), you will

only be able to listen and submit questions at the Annual Meeting.

Voting Without Attending Annual Meeting

If you are the shareholder of record with respect to your shares, you can vote your shares without attending the virtual meeting by submitting your proxy through any of the following methods:

| |

| • | By Internet - You can vote via the Internet at www.investorvote.com/MVBF. Your identification numbers for Internet voting are on the Notice, and voting is available 24 hours a day. Those numbers can also be found on your proxy card if you requested a paper copy of the Proxy Materials. |

| |

| • | By Telephone - 1-800-652-VOTE (8683). You can vote via the telephone by using any touch-tone telephone to transmit your voting instructions up until 11:59 p.m. Eastern Standard Time, on May 18, 2020. Your identification numbers for voting via telephone are on the Notice, and voting is available 24 hours a day. Those numbers can also be found on your proxy card. |

| |

| • | By Mail - Complete, sign and date the proxy card that will be mailed to you if you have requested a paper copy of the Proxy Materials. Return it to the Company in the postage prepaid envelope that will be included in the mailing. |

If your proxy is submitted via the Internet, telephone or mail (and your proxy is not later revoked), your shares will be voted in accordance with your instructions as indicated in the proxy. If, however, you do not indicate the manner in which your shares should be voted in your proxy, your shares will be voted in accordance with the recommendations of the Board of Directors as set forth in this proxy statement.

If you are the beneficial owner of your shares, you can vote your shares without attending the virtual meeting by following the directions contained in the voting instruction card sent to you by your stockbroker, bank or other nominee. Typically, voting instruction cards allow you to direct the voting of your shares by returning the voting instruction card by mail or by submitting your directions via the Internet or by telephone. Your stockbroker, bank or other nominee is required to vote your shares according to the directions you have given.

Voting During the Virtual Annual Meeting

Shares held in your name as the shareholder of record on the record date may be voted during the virtual meeting by following the instructions posted at www.edocumentview.com/MVBF. Shares for which you are the beneficial owner but not the shareholder of record may be voted during the virtual meeting only if you obtain a legal proxy from the broker, trustee, or other nominee that holds your shares giving you the right to vote the shares. Even if you plan to attend the Virtual Annual Meeting via webcast, we recommend that you vote by proxy as described above so that your vote will be counted if you later decide not to attend.

The vote you cast virtually will supersede any previous votes that you may have submitted, whether by Internet, telephone, or mail.

Revocability of Proxies

A shareholder executing the proxy may revoke it at any time before it is voted:

| |

| • | by notifying MVB representatives, Larry F. Mazza or Lisa J. McCormick, in person; |

| |

| • | by giving written notice to MVB. The revocation should be delivered to: |

Lisa J. McCormick, Corporate Secretary,

301 Virginia Avenue, Fairmont, WV 26554;

| |

| • | by submitting to MVB a subsequently dated proxy; or |

| |

| • | by attending the virtual meeting via the webcast and withdrawing the proxy before it is voted at the meeting. |

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting:

The Proxy Materials are available at www.edocumentview.com/MVBF. Enter the control number located on the Notice or proxy card to access the Proxy Materials.

Eligibility of Stock for Voting Purposes

Pursuant to the Bylaws of MVB, the Board of Directors has fixed March 25, 2020, as the record date (the “Record Date”) for the purpose of determining the shareholders entitled to notice of, and to vote at, the meeting or any adjournment thereof, and only shareholders of record at the close of business on that date are entitled to such notice and to vote at such meeting or any adjournment thereof.

Each share of MVB common stock has one vote on each matter. As of the Record Date, there were 11,946,789 shares of MVB common stock outstanding, held by approximately 950 active holders of record. In addition to shareholders of record of MVB’s common stock, beneficial owners of shares held in street name as of the Record Date can vote. There are 20 million shares of common stock authorized.

If you are a beneficial owner of shares held in street name and do not provide the organization that holds your shares with specific voting instructions then, under applicable rules, the organization that holds your shares may generally vote your shares in their discretion on “routine” matters but cannot vote on “non-routine” matters. If the organization that holds your shares does not receive instructions from you on how to vote your shares on a non-routine matter, that organization will inform the inspector of election that it does not have the authority to vote on this matter with respect to your shares. This is generally referred to as a “broker non-vote.”

The ratification of the appointment of Dixon Hughes Goodman LLP as MVB’s independent registered accounting firm for 2020 (“Proposal No. 3”) is considered a routine matter under applicable rules. A broker or other nominee may generally vote on routine matters, and therefore no broker non-votes are expected in connection with Proposal No. 3.

Each of the other proposals, including the election of directors (Proposal No. 1), the proposal to approve a non-binding advisory proposal on the compensation of the Named Executive Officers (Proposal No. 2), are considered non-routine matters under applicable rules. A broker or other nominee cannot vote without instructions on non-routine matters, and therefore, broker non-votes may exist in connection with Proposals No. 1 and No. 2.

The principal holders of MVB common stock are discussed under the section of this proxy statement entitled “Principal Holders of Voting Securities.”

Quorum Requirement

A majority of the outstanding shares of the Company entitled to vote, represented in person or by proxy, shall constitute a quorum at a meeting of shareholders. If less than a majority of the outstanding shares are represented at a meeting, a majority of the shares so represented may adjourn the meeting from time to time without further notice. At such adjourned meeting at which a quorum shall be present or represented, any business may be transacted which might have been transacted at the meeting as originally noticed. The shareholders present at a duly organized meeting may continue to transact business until adjournment, notwithstanding the withdrawal of enough shareholders to leave less than a quorum. Broker non-votes and abstentions are counted for purposes of determining whether a quorum is present.

Voting Requirements

Only “FOR” and “AGAINST” votes are counted for purposes of determining the votes received in connection with Proposal Nos. 2 and 3. Approval of nominees is by plurality of the votes cast and approval of other proposals is by affirmative vote of the majority of the votes cast. An affirmative vote of at least a majority of shares necessary to constitute a quorum is also required.

Broker non-votes and withheld votes have no impact on approval of directors as directors are elected by a plurality of votes cast. Each of Proposal Nos. 2 and 3 require an affirmative vote of the majority of the votes cast. In voting for Proposal Nos. 2 and 3, shares may be voted “FOR” or “AGAINST” or ��ABSTAIN”. Abstentions and broker non-votes which will not be treated as votes cast for approval of Proposal Nos. 2 and 3 and will generally have no impact on such proposals. In order to minimize the number of broker non-votes, MVB encourages you to provide voting instructions on each proposal to the organization that holds your shares by carefully following the instructions provided in the Notice and the voting instruction form.

PURPOSES OF MEETING

1. ELECTION OF DIRECTORS

General

The Bylaws of MVB currently provide for a Board of Directors composed of five (5) to twenty-five (25) members. The Board of Directors currently consists of ten (10) members.

Directors are elected by a plurality of the votes cast. Therefore, a vote withheld may not affect the outcome of the election. As required by West Virginia law, each share is entitled to one vote per nominee, unless a shareholder requests cumulative voting for directors at least 48 hours before the meeting. If a shareholder properly requests cumulative voting for directors, then each MVB shareholder will have the right to vote the number of shares owned by that shareholder for as many persons as there are directors to be elected, or to cumulate such shares and give one candidate a number of votes equal to the number of directors multiplied by the number of shares owned, or to distribute them on the same principle among as many candidates as the shareholder sees fit. If any shares are voted cumulatively for the election of directors, the proxies, unless otherwise directed, shall have full discretion and authority to cumulate their votes and vote for less than all such nominees. For all other purposes, each share is entitled to one vote.

The MVB Articles of Incorporation provide for staggered terms for directors. The three individuals up for election at the Annual Meeting represent the nominees to the Board of Directors for a term to expire in 2023. Following the election of the three nominees referenced below, MVB will have three classes of directors consisting of four board members whose term expires in 2021, three board members whose term expires in 2022 and three board members whose term expires in 2023.

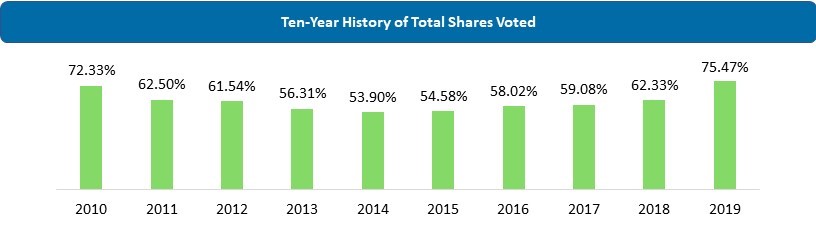

During 2019, the Governance Committee reviewed the concept of moving to a declassified Board of Directors. While the Governance Committee, and ultimately the Board of Directors, recognized the value and is supportive of having a declassified Board of Directors, such a change would require an amendment to the MVB Articles of Incorporation. Furthermore, an amendment to the Articles of Incorporation for the purpose of declassifying the Board of Directors requires an approval by a super majority of 75% of the outstanding shareholders. Over the past ten years, the highest amount of total votes cast by shareholders was 75.47% with the most recent three-year average of 65%.

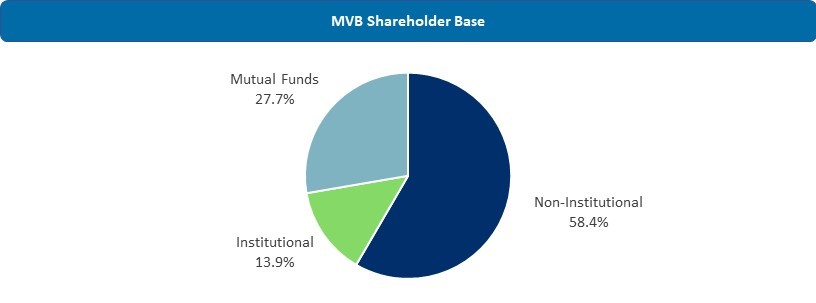

MVB's shareholder base is primarily made up of non-institutional investors.

The Board of Directors has therefore concluded that, based on historical shareholder participation, a proposal to declassify the Board of Directors would likely not receive the required shareholder approval at this time. The Board of Directors has determined that making a recommendation at this time to declassify the Board of Directors would not be in good faith to the shareholders, given the Board of Director's belief that such recommendation would not be approved by the necessary number of shareholders. The Board of Directors will continue to evaluate and monitor the appropriateness of presenting a proposal to declassify the Board of Directors in future years. We believe that as our shareholder base transitions from our legacy 60% retail shareholders to more institutional and mutual funds the voting % is likely to increase allowing us to bring declassification to a vote.

Board of Directors Composition - Qualifications, Expertise, Diversity and Attributes

When analyzing whether directors and nominees have the qualifications, expertise, diversity and attributes to enable the Board of Directors to satisfy its oversight responsibilities effectively in light of the Company’s business and structure, the Governance Committee seeks candidates who will add to our Board of Directors, bringing varied skills, experience and perspective.

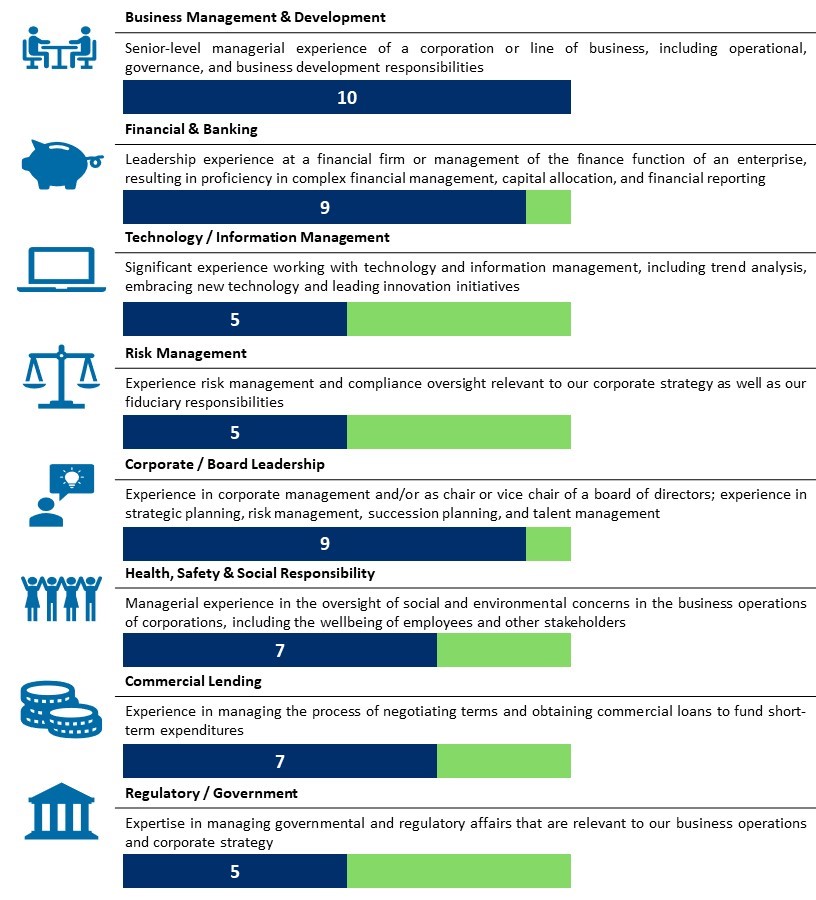

The Board of Directors conducts an annual board assessment including board member peer feedback. This information is used to identify areas of strength or areas that may require additional focus going forward. MVB also maintains a skills profile matrix that reflects the combined background of the current membership of its boards. This matrix is based on various focus areas of experience and expertise determined to be essential for appropriate strategic direction, advisory depth and oversight from all MVB Boards. The Governance Committee works with the boards and leadership of MVB to determine the level of experience or application in each focus area according to limited, basic, skilled and expert experience. Our Board of Directors have a strong mix of this criteria in areas most critical to MVB's success.

The number in each respective bar chart below represents the number of current directors with expert skills in the critical focus areas of our ten directors:

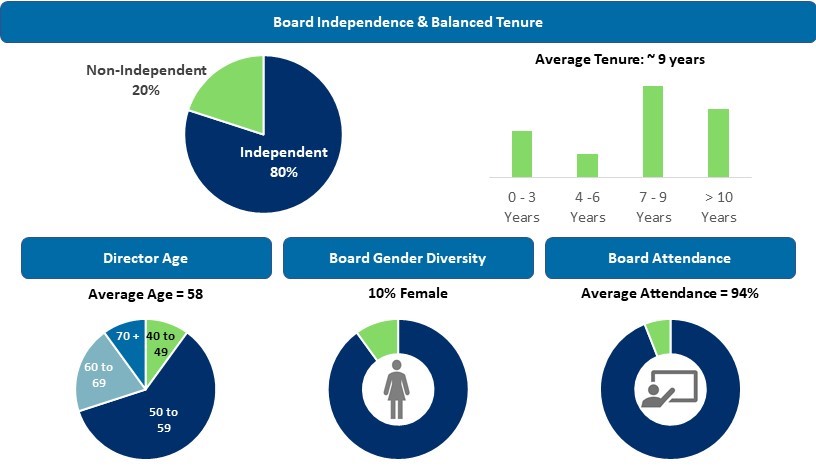

As MVB grows and our strategy evolves, so do the skills, qualifications, attributes and experiences necessary for our directors. As such, we believe that periodically refreshing our Board with new perspectives and ideas is critical to representing the interests of our shareholders effectively. At the same time, it is equally important to benefit from the valuable experience and continuity that longer-serving directors bring to the Board. Our directors reflect a range of tenures, a balanced mix of ages, and a well-rounded range of attributes, viewpoints and experiences reflective of our business and needs.

The Board of Directors does not maintain a formal diversity policy with respect to the identification or selection of directors for nomination to the Board of Directors. Diversity is just one of many factors the Governance Committee considers in the identification and selection of director nominees. The Board defines diversity broadly to include differences in race, gender, ethnicity, age, viewpoint, professional experience, educational background, skills, and other personal attributes that can foster Board heterogeneity in order to encourage and maintain board effectiveness. While diversity and variety of experiences and viewpoints represented on the Board should always be considered, a director nominee should not be chosen nor excluded solely or largely because of race, color, gender, national origin or sexual orientation or identity. In selecting a director nominee, the Governance Committee focuses on skills, expertise or background that would complement the existing Board. The majority of our directors are or have been residents of our primary markets - North Central West Virginia or Northern Virginia; however, with the expansion of our client base and sales footprint, we have added directors throughout the country. Our directors come from diverse backgrounds including the financial, industrial, professional, and information technology.

The three individuals up for election at the Annual Meeting and identified below represent the nominees to the Board of Directors for a term to expire in 2023.

Directors Up for Election

|

| | | | | | | | |

| Directors | | Age as of March 25, 2020 | | Director and/or Officer Since | | Term to Expire | | Principal Occupation During the Last Five Years |

| James J. Cava, Jr. | | 54 | | 2013 | | 2023 | | Chief Financial Officer- Managing Member - Cava & Banko, PLLC, Certified Public Accountants |

| Larry F. Mazza | | 59 | | 2005 | | 2023 | | President & Chief Executive Officer - MVB and MVB Bank |

Cheryl D. Spielman1 | | 65 | | 2019 | | 2023 | | Retired Partner from Ernst & Young |

1 Spielman is a 2020 nominee and joined the boards of MVB and MVB Bank, Inc. in May 2019.

James J. Cava, Jr. – MVB Director. Mr. Cava is Chief Financial Officer (“CFO”) - Managing Member of Cava & Banko, PLLC (“C&B”), Certified Public Accountants. Mr. Cava has been involved in the West Virginia business community for more than 30 years. He is very knowledgeable about the economic activities in the MVB market area. He is a graduate of Fairmont State University with a Bachelor of Science degree in Business Administration and The American University with a master’s degree in Taxation. As the Managing Member of C&B, Mr. Cava is responsible for the strategic direction and growth of the company. He also served as Founder and as CFO for the Information Manufacturing Company (“IMC”). Mr. Cava was instrumental in building their administration team, which resulted in the company posting $63M in revenue prior to its sale to National Interest Security Company. Mr. Cava has founded several other successful business organizations.

Mr. Cava has also served as Member and Manager of Smith, Cochran & Hicks, PLLC. He sits on the board of directors for several companies such as: SAVEN, Inc. and is Chairman of the Best Care Pharmacy Group, LLC.

Mr. Cava currently serves on MVB's Audit/ERM, Finance, Human Resources and Compensation committees as well as the ALCO, Loan Approval, and Loan Review Committees of MVB Bank. He is also a Director of the MVB Mortgage board of directors. The Board of Directors has concluded that Mr. Cava is qualified to serve as Director and is being nominated due to his years of experience with the West Virginia business community and his investment, financial, tax, audit, and accounting expertise.

Larry F. Mazza – President & Chief Executive Officer (“CEO”) of MVB Financial Corp. and Board Director for MVB and MVB Bank. Mr. Mazza joined MVB in 2005 and became CEO on January 1, 2009. Mr. Mazza has 33 years of experience in the banking industry. He is a graduate of West Virginia University with a bachelor’s degree in Business Administration. He began his career as a Certified Public Accountant. Mr. Mazza worked for KPMG (or its predecessors) as a CPA with a focus on auditing, including audits of financial institutions. Prior to joining MVB in 2005, Mr. Mazza was Senior Vice President & Retail Banking Manager for BB&T Bank’s West Virginia North region. Mr. Mazza was employed by BB&T and its predecessors from 1986 to 2005. During such time, Mr. Mazza was President of Empire National Bank, where he was one of the youngest bank presidents and board members in the country, and later served as Regional President of One Valley Bank.

Mr. Mazza is one of seven members of the West Virginia Board of Banking and Financial Institutions, which oversees the operation of financial institutions throughout West Virginia and advises the state Commissioner of Financial Institutions. Mr. Mazza is also an entrepreneur and is co-owner of nationally-recognized sports media business Football Talk, LLC, which is a pro football website and content provider for NBC SportsTalk. The primary website is Profootballtalk.com.

Mr. Mazza serves as a Board Director for Fintech startup BillGO, a digital payment processor with innovative B2B platforms, headquartered in Fort Collins, Colorado. From 2007 to 2019, Mr. Mazza served as a board member for PDC Energy, a Denver based oil and gas Nasdaq-listed company. He served on the Compensation Committee, was Chair of the Nomination & Governance Committee and member of the Audit Committee.

Mr. Mazza currently serves on the ALCO, Loan Approval, and Loan Review Committees of MVB Bank, and as a Board Director of the Chartwell Compliance, MVB Insurance, MVB Mortgage, MVB CDC and MVB Community Development Partners, Inc. Boards. In 2017, he became a National Association of Corporate Directors Board Leadership Fellow. The Board of Directors has concluded that Mr. Mazza is qualified to serve as Director and is being nominated due to his background as a CPA and a CEO. Mr. Mazza is viewed as a visionary leader executing a business model that integrates the fintech industry with traditional banking.

Cheryl D. Spielman – MVB Director. Mrs. Spielman is a retired Partner from Ernst & Young U.S., LLP, retiring in 2014, where she led various groups from 1997 - 2015, serving as Leader of Human Capital for Financial Services for the last eight years there. From 1989 to 1996, she was an executive with the firm. She has been a personal consultant and advisor to CEOs in various industries, including financial services, consumer products and entertainment. She has a great deal of financial experience with an audit background. Upon retirement from Ernst & Young, she served on the board of directors of IPM, a privately held technology systems integration company, which sold in 2017. From 2017 to 2019, she served as a member of the board of directors of First Republic Bank, which is headquartered in California.

Previously, Mrs. Spielman was a tax professional at Arthur Young & Company. She is a trustee of the Cornell University Hillel Board and the Women’s Foundation of South Palm Beach County, and a board member of the Koby Mandel Foundation. Mrs. Spielman also serves on the Board of Governors and is Vice President of the Polo Club of Boca Raton, Fla. She earned a Bachelor of Science degree in 1977 from Cornell University and an M.B.A. in 1980 from the University of Chicago. She is also a Certified Public Accountant.

Mrs. Spielman is currently Chair of MVB's Audit/ERM Committee and serves on the Finance and Information Technology Steering committees. She was designated as an Audit Committee Financial Expert by the Board of Directors of MVB. The Board of Directors has concluded that she is qualified to serve as Director and is being nominated due to her strong background and experience in accounting, client-focused global human resources and tax services, tax risk management and employment related issues.

The Board of Directors unanimously recommends that you vote “FOR ALL” the nominees to be elected to the Board of Directors for the expiring terms indicated.

Directors Not Up for Election

In addition to the directors who are up for election at the Annual Meeting, the following are the remaining directors who are not up for election.

|

| | | | | | | | |

| Directors | | Age as of March 25, 2020 | | Director and/or Officer Since | | Term to Expire | | Principal Occupation During

the Last Five Years |

| David B. Alvarez | | 56 | | 2013 | | 2021 | | President of Energy Transportation, LLC; previously, President of MEC Construction, LLC |

| H. Edward Dean, III | | 51 | | 2012 | | 2022 | | President & CEO - Potomac Mortgage Group, Inc. (dba MVB Mortgage), a wholly-owned subsidiary of MVB Bank (acquired December 2012) |

| John W. Ebert | | 60 | | 2013 | | 2021 | | President - J.W. Ebert Corporation, a McDonald's Restaurant franchise of 40 stores |

| Daniel W. Holt | | 48 | | 2017 | | 2021 | | Co-Founder and CEO of BillGO; previously, President & General Manager, Managed Services at Computer Services Inc. (CSI) |

| Gary A. LeDonne | | 58 | | 2016 | | 2022 | | Executive in Residence at the West Virginia University (“WVU”) John Chambers College of Business and Economics; previously, Partner of Ernst & Young LLP (retired) |

| Dr. Kelly R. Nelson | | 60 | | 2005 | | 2021 | | Owner of Advantage Occupational Medicine and WVU Medicine Coordinator of Provider Relations and Primary Care Provider |

| J. Christopher Pallotta | | 70 | | 1999 | | 2022 | | Director & CEO - Bond Insurance Agency, Inc. |

David B. Alvarez – MVB Chair and Director. Mr. Alvarez is the owner and President of Energy Transportation, LLC (“ET”), which has grown to be a regional service provider for the natural gas industry. Under Mr. Alvarez's leadership, ET now offers EnviroTeam Services. These services include plant environmental waste stream and dike management, emergency spill response, drum service, etc. He was formerly owner and President of MEC Construction, LLC. He has been involved in the construction business throughout the Northeastern United States natural gas fields for more than 24 years. Mr. Alvarez is credited with founding several new companies that continue to benefit the economy of West Virginia and the surrounding states while providing employment for many West Virginians. Companies he has founded include Applied Construction Solutions, Applied Home Solutions, LLC, ET, Enviro-Energy Solutions, LLC, Energy Resource Group, LLC, ET360, LLC and The Wonder Bar Steak House. He is a graduate of West Virginia University with a Bachelor of Science degree in Business Administration. He is extremely involved in various professional,

educational, and philanthropic activities throughout West Virginia, including serving as Chair of the Board of Governors of West Virginia University as well as the Executive Committee. He is a member of the Medbrook Children's Charity Board, the Harrison County Development Authority, and the Richmond Federal Industry Round Table.

Mr. Alvarez is currently Chair of the MVB Board of Directors and serves on the Loan Approval Committee of MVB Bank. He is also a Director of the MVB Mortgage board of directors and MVB CDC board of directors. Mr. Alvarez was previously nominated as a Director because of his knowledge of West Virginia markets, the construction and natural gas industries, and his community involvement.

H. Edward Dean, III – MVB Director. Mr. Dean is President and CEO of Potomac Mortgage Group, Inc. (doing business as MVB Mortgage), a wholly-owned subsidiary of MVB Bank that was acquired December 2012. He is a graduate of West Virginia University with a Bachelor of Science degree in Accounting and pursued advanced degree work at West Virginia Wesleyan College.

Mr. Dean currently serves on MVB Bank's Loan Review Committee. He was previously nominated as a Director because of his extensive knowledge of the mortgage loan industry and his position as CEO of Potomac Mortgage Group, Inc.

John W. Ebert – MVB Director. Mr. Ebert is President of J.W. Ebert Corporation, which owns 40 McDonald’s franchises in West Virginia, Pennsylvania, and Maryland. Mr. Ebert has more than 30 years of retail experience. He is the former Chairman of McDonald’s East Division Profit Team representing 5,000 restaurants. He is the former President of the Pittsburgh Region’s McDonald’s Owner/Operator Association. Mr. Ebert is a 1982 graduate of the University of Notre Dame with a Bachelor of Science degree in Accounting. He began his career as a Certified Public Accountant for a national accounting firm.

Mr. Ebert is currently Chair of MVB's Finance Committee and serves on the Audit/ERM and Nominating and Corporate Governance committees. He is also a Director of the MVB CDC board of directors. Mr. Ebert was previously nominated as a Director because of his knowledge of the North Central West Virginia market, his educational background and his business proficiencies, which include the areas of budget, risk assessment, and human resources.

Daniel W. Holt – MVB Director. Mr. Holt is Co-Founder & CEO of BillGO, Inc. (“BillGO”), a bill payment platform that improves the speed, efficiency and security for consumers, businesses, and billers/suppliers/merchants. BillGO provides billers a lower cost solution and gives payment providers access to a faster, proven bill payments engine. Mr. Holt served 8 years in the military and became a US Air Force Officer. Thereafter, he moved back to Silicon Valley, led groups in start-ups, and then founded HEIT, a SaaS Security company, and served as the CEO. Upon completion of two acquisitions, HEIT was successfully acquired by CSI, where Mr. Holt continued to build the business. He holds a bachelor’s degree from the University of Maryland and an M.B.A. from Colorado State University.

Mr. Holt currently serves on the Nominating and Corporate Governance and Information Technology Steering committees. He was previously nominated as a Director due to his leadership, education, business and professional development accomplishments in the financial and technology industries. WIth MVB's continued expansion and focus on the fintech industry, his expertise is critical for board enhancement.

Gary A. LeDonne – MVB Director. Currently, Mr. LeDonne serves as Executive in Residence at the John Chambers College of Business & Economics of West Virginia University. Mr. LeDonne is a retired Partner of Ernst & Young LLP, retiring in 2014 as East Central Region Tax Managing Partner. Throughout his career with Ernst & Young LLP, Mr. LeDonne served many banking, insurance, and capital market clients. He has an extensive background in strategy development, succession planning, and talent management. Mr. LeDonne received his Bachelor of Science degree from Fairmont State University and his Master of Professional Accountancy degree from West Virginia University. He is a Certified Public Accountant and a member of the American Institute of Certified Public Accountants and the American Accounting Association. Mr. LeDonne currently serves as Chair of the Fairmont State University Foundation board of directors and is a member of the Visiting Committee of the John Chambers College of Business & Economics of West Virginia University.

Mr. LeDonne currently serves as Chair of MVB's Human Resources and Compensation Committee, as well as Chair of the MVB CDC board of directors and MVB Community Development Partners, Inc. board of directors and is a Director of the MVB Mortgage board of directors. He is also a member of MVB's Audit/ ERM, Finance, and ALCO committees. He was designated as an Audit Committee Financial Expert by the Board of Directors of MVB. Mr. LeDonne was previously nominated as a Director because of his extensive knowledge of the Mid-Atlantic region business community and his investment, financial, and accounting expertise.

Dr. Kelly R. Nelson – MVB Director. Dr. Nelson is a physician in Bridgeport, WV and is currently employed by WVU Medicine as Coordinator of Provider Relations and Primary Care Provider. He spent the bulk of his career pioneering the Urgent Care sector and served as Senior Vice President for MedExpress managing their Occupational Medicine and Workman’s Compensation Programs for nearly a decade. He established and managed Medbrook Medical Associates for 25 years before it was acquired by MedExpress. He is extremely active in community organizations and is currently President and board member of the Medbrook Children’s Charity. He is a graduate of Auburn University with a Bachelor of Science degree in Biology and received his medical degree from the University of Alabama School of Medicine.

Dr. Nelson is currently Chair of the Nominating and Corporate Governance Committee and serves on the Audit/ERM, Human Resources and Compensation and Loan Review Committees. Dr. Nelson was previously nominated as a Director due to his understanding of the medical community in North Central West Virginia, his educational and business insight, and his community activities throughout the region.

J. Christopher Pallotta – MVB Founding Director. Mr. Pallotta is Director and CEO of Bond Insurance Agency, Inc. and has been involved in the insurance and related securities businesses in the North Central West Virginia market area for more than 41 years. He is also the owner of other small businesses in the MVB market area. He is a lifelong resident of North Central West Virginia and is active in many community organizations. Mr. Pallotta is a graduate of Fairmont State University with a Bachelor of Science degree in Business Administration.

Mr. Pallotta currently serves as Chair of MVB's ALCO, Loan Approval, and Loan Review Committees. He is a member of MVB's Finance Committee and IT Steering Committee and Director of the MVB Mortgage board of directors. He was previously nominated as a Director because, as a founding director of MVB, Mr. Pallotta has extensive historical knowledge of MVB, its operations and its market area. In addition, his experience and expertise in the areas of insurance and risk-related fields also serve as an asset for MVB.

Executive Officers

|

| | | | | | |

| Executive Officer | | Age as of March 25, 2020 | | Officer Since | | Title During the Last Five Years |

| Donald T. Robinson | | 45 | | 2011 | | Executive Vice President, Chief Financial Officer & Treasurer; previously, Chief Operating Officer – MVB and President – MVB Bank |

| David A. Jones | | 57 | | 2006 | | Senior Vice President & Chief Risk Officer – MVB & MVB Bank; previously, Senior Vice President & Chief Credit Officer – MVB & MVB Bank |

| John T. Schirripa | | 57 | | 2011 | | Executive Vice President, Chief Commercial Lending Officer, Regional President – West Virginia, and Commercial Loan Officer – MVB Bank |

There are no family relationships among the directors, director nominees or executive officers of MVB or MVB Bank.

Other than previously disclosed, no member of the MVB Board of Directors has been a member of the board of directors of another public company during the past five years.

The Board of Directors of MVB had twelve regularly scheduled meetings and six additional special project and strategic initiative meetings during 2019. On a regular basis, inside directors and members of the executive management team are excused from the meetings so the Board can hold an executive session to discuss matters privately. The Chair relays any action items to the CEO if necessary. All current directors attended 75% or more of the meetings held by the Board of Directors and committees thereof in which the director is a member, with an average total attendance record of 94%.

In order to meet their responsibilities, directors are expected to attend board and committee meetings, as well as the Annual Meeting of shareholders. All directors attended the 2019 Annual Meeting of Shareholders.

Leadership Structure of the Board of Directors

The Board Chair and President & CEO are two separate individuals. Throughout MVB’s history, this has been the leadership model. The CEO is responsible for the day-to-day operations and performance of MVB. The Board Chair is involved in presiding over board meetings, matters of governance, and corporate oversight. The Board Chair also focuses on monitoring the

effectiveness of the CEO in implementing MVB’s corporate strategy and ensuring that the directors receive sufficient information, on a timely basis, to provide proper risk oversight. The Board of Directors believes the current separation of these roles helps to ensure good board governance and fosters independent oversight to protect the long-term interests of the Company's private and institutional shareholders. In addition, the Board of Directors believes this separation is presently appropriate as it allows the CEO to focus primarily on leading the Company's day-to-day business and affairs while the Board Chair can focus on leading the Board of Directors in its consideration of strategic issues and monitoring corporate governance and shareholder matters.

The committee structure of MVB is such that the committees are responsible for and review the areas of greatest risk to MVB. Each is chaired by an independent director. MVB staff members provide support to the respective Chairs of each committee in providing requested information necessary for each committee to provide appropriate oversight.

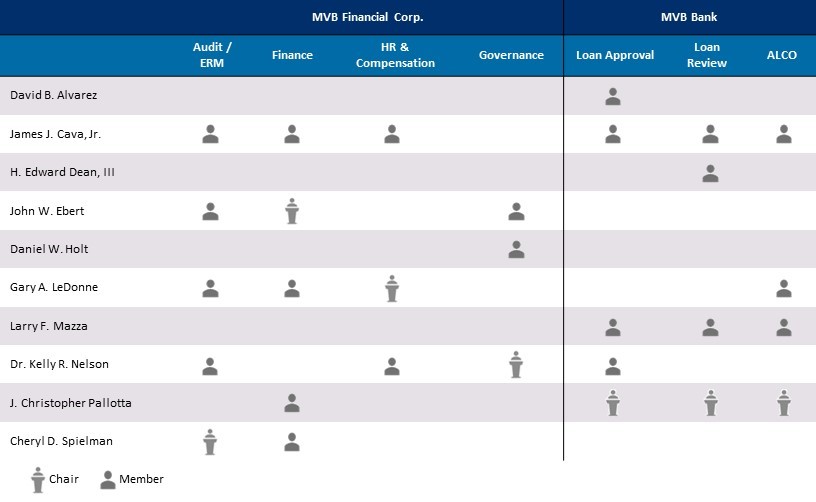

Committees of the Board of Directors

The Board of Directors has a number of standing committees as described below.

Audit / ERM Committee (the “Audit Committee”). Composed of James J. Cava, Jr., John W. Ebert, Gary A. LeDonne, Dr. Kelly R. Nelson and Cheryl D. Spielman (Chair). Spielman was appointed Chair of this Audit Committee, effective November 1, 2019, by the Governance Committee. The purpose of the Audit Committee is to:

i.monitor the integrity of the financial reporting process, systems of internal controls and financial

statements and reports of MVB;

ii.be directly responsible for the appointment, compensation and oversight of the independent auditor

employed by MVB for the purpose of preparing or issuing an audit report or related work;

iii.be responsible for the appointment, compensation and oversight of the internal auditor;

iv.assist the Board of Directors in monitoring compliance by MVB with legal and regulatory requirements,

including holding company, banking, mortgage and insurance regulations and the Sarbanes-Oxley Act of 2002;

v.oversee management corrective actions when such needs have been identified;

vi.oversee MVB’s whistleblower policy;

vii.oversee MVB’s risk management program for effectiveness and ensure that the Board of Directors

incorporates the appropriate risk management processes in its activities; and

viii.report to the Board of Directors on these matters.

The Board of Directors of MVB has designated Gary A. LeDonne and Cheryl D. Spielman as individuals who are considered to be audit committee financial experts. They have both been identified as meeting the guidelines set forth by Section 407 of the Sarbanes-Oxley Act of 2002 for an audit committee financial expert. The audit committee financial experts, along with all Committee members, are independent as defined by applicable listing standards and guidelines. All members of the Board of Directors are successful business owners or organization leaders and have knowledge of the requirements to run such a successful business.

The Audit Committee met twelve (12) times in 2019. The Audit Committee meets with MVB's Chief Audit Executive, who oversees the internal audit function of MVB, and Dixon Hughes Goodman LLP, who is responsible for the annual certified audit, as well as with the members of the regulatory authorities upon completion of their examinations of MVB Bank or MVB. The Chief Audit Executive engages Crowe, LLP to conduct outsourced audits of Information Technology and other selected audit areas requiring specialized expertise. During these meetings, the active management of MVB Bank or MVB, including CEO Mazza and CFO Robinson, may be asked to leave the room to provide comfort of questioners and responders.

In the opinion of MVB’s Board of Directors, none of the Board of Directors, except for Directors Dean and Mazza, has a relationship with MVB that would interfere with the exercise of independent judgment in carrying out their responsibilities as directors. None of them are or have for the past three years been employees of MVB, except for Directors Dean and Mazza and none of their immediate family members are or have for the past three years been executive officers of MVB or MVB Bank. In the opinion of MVB and its Board of Directors, the entire Board of Directors, except for Directors Dean and Mazza are “independent directors,” as that term is defined in Rule 5605(a)(2) of the Nasdaq Marketplace Rules. The Audit Committee Charter was reviewed and approved by the Board of Directors on June 19, 2018 and is available on MVB's Investor Relations website at ir.mvbbanking.com under Overview - Governance Documents.

Report of the Audit Committee

The Audit Committee has reviewed and discussed the audited financial statements for the year ended 2019 with management. The Audit Committee has also discussed the audited financial statements with Dixon Hughes Goodman LLP, MVB’s independent accountants, as well as the matters required to be discussed by Public Company Accounting Oversight Board (United States) (the “PCAOB”) and SEC rules. The Audit Committee has received the written disclosures and the letter from Dixon Hughes Goodman LLP, required by applicable requirements of the PCAOB regarding the independent accountant’s communications concerning independence, and has discussed with Dixon Hughes Goodman LLP the independent accountants’ independence. Based on the above, the Audit Committee recommended to the Board of Directors (and the Board of Directors has approved) that the audited financial statements be included in MVB’s Annual Report on Form 10-K for the year ended 2019 and filed with the SEC.

Submitted by the Audit Committee:

Cheryl D. Spielman, Chair

James J. Cava, Jr.

John W. Ebert

Gary A. LeDonne

Dr. Kelly R. Nelson

This report shall not be deemed to be incorporated by reference into any filing under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended (the “Exchange Act”), unless MVB specifically incorporates this report by reference. It will not otherwise be filed under such Acts.

Finance Committee. Composed of James J. Cava, Jr., John W. Ebert (Chair), Gary A. LeDonne, J. Christopher Pallotta and Cheryl D. Spielman. The purpose of the Finance Committee is to help assure that MVB fulfills the responsibilities for effective board governance of MVB and its subsidiaries by providing oversight and guidance regarding finance, capital, budget, mergers and acquisitions, and facilities matters and to make recommendations, as appropriate and warranted. The Finance Committee reports the results from these meetings to the Board of Directors. The Finance Committee met thirteen (13) times in 2019. All Finance Committee members are independent.

Nominating and Corporate Governance Committee (the “Governance Committee”). Composed of John W. Ebert, Daniel W. Holt, and Dr. Kelly R. Nelson (Chair). The purpose of the Committee is to help assure that MVB fulfills the responsibilities for effective board governance of MVB and its subsidiaries by:

| |

| i. | helping MVB to create and maintain an appropriate board and committee structure; |

| |

| ii. | assessing the skills, experience, and backgrounds necessary to effectively staff MVB boards and committees; |

| |

| iii. | overseeing the development and updating of governance for MVB; |

| |

| iv. | overseeing the emergency succession plan for MVB; |

| |

| v. | leading MVB in periodic assessments of the operation of MVB boards and committees and the contributions of the members; and |

| |

| vi. | monitoring the implementation of MVB governance policies and practices. |

The Governance Committee reports the results from these meetings to the Board of Directors. The Governance Committee met six (6) times in 2019. All Governance Committee members are independent. The Governance Committee Charter was reviewed and approved by the Board of Directors on March 17, 2020 and is available on MVB's Investor Relations website at ir.mvbbanking.com under Overview - Governance Documents.

For reference, the Board of Directors believes that candidates for director should have certain minimum qualifications, including:

| |

| • | Directors should be of the highest ethical character. |

| |

| • | Directors should have excellent personal and professional reputations. |

| |

| • | Directors should be accomplished in their professions or careers. |

| |

| • | Directors should be able to read and understand financial statements and either have knowledge of, or the ability and willingness to learn, financial institution law. |

| |

| • | Directors should have relevant experience and expertise to evaluate financial data and provide direction and advice to the chief executive officer and the ability to exercise sound business judgment. |

| |

| • | Directors must be willing and able to expend the time to attend meetings of the Board of Directors and to serve on board committees. |

| |

| • | The Board of Directors will consider whether a nominee is independent, as legally defined. In addition, directors should avoid the appearance of any conflict and should be independent of any particular constituency and be able to serve all shareholders of MVB. |

| |

| • | Directors must be acceptable to MVB's and MVB Bank's regulatory agencies, including the Federal Reserve Board, the Federal Deposit Insurance Corporation and the West Virginia Division of Financial Institutions and must not be under any legal disability which prevents them from serving on the Board of Directors or participating in the affairs of a financial institution. |

| |

| • | Directors must own or acquire sufficient capital stock to satisfy the requirements of West Virginia law, the Bylaws of MVB and share ownership guidelines as established by MVB. |

| |

| • | Directors must be at least 21 years of age. |

The Board of Directors reserves the right to modify these minimum qualifications from time to time, except where the qualifications are required by the laws relating to financial institutions.

Our Board recognizes the importance of consistent, deliberate Board refreshment and succession planning to ensure that the directors possess a composite set of skills, experience and qualifications necessary for the Board to successfully establish and oversee management’s execution of the Company’s strategic priorities (see “Board of Directors Composition - Qualifications, Expertise, Diversity and Attributes” on page 5).

Diversity is just one of many factors the Governance Committee considers in the identification and selection of director nominees. Although we have no formal policy, the Board of Directors defines diversity broadly to include differences in race, gender, ethnicity, age, viewpoint, professional experience, educational background, skills, and other personal attributes that can foster board heterogeneity in order to encourage and maintain board effectiveness. While diversity and variety of experiences and viewpoints represented on the Board of Directors should always be considered, a director nominee should not be chosen nor excluded solely or largely because of race, color, gender, national origin or sexual orientation or identity.

In selecting a director nominee, the Governance Committee focuses on skills, expertise or background that would complement the existing Board of Directors. The majority of our directors are or have been residents of our primary markets - North Central West Virginia, Eastern West Virginia, or Northern Virginia; however, with the expansion of our client base and sales footprint, we have added directors throughout the country. Our directors come from diverse backgrounds including the financial, industrial, professional, and retail areas and information technology.

In addition, the Governance Committee identifies and evaluates nominees as follows: In the case of incumbent directors whose terms are set to expire, the Governance Committee considers the directors’ overall service to MVB or MVB Bank during their term, including such factors as the number of meetings attended, the level of participation, quality of performance and any transactions between such directors and MVB and MVB Bank. The Governance Committee also reviews the payment history of loans, if any, made to such directors by MVB Bank to ensure that the directors are not chronically delinquent and in default.

The Governance Committee considers whether any transactions between the directors and MVB Bank have been criticized by any banking regulatory agency or MVB Bank’s external auditors and whether corrective action, if required, has been taken and was sufficient. The Governance Committee also confirms that such directors remain eligible to serve on the board of directors of a financial institution under federal and state law.

The Board of Directors will consider director candidates recommended by shareholders for nomination, provided that the recommendations are received at least 90 days prior to the anniversary of the previous year's Annual Meeting. In addition, the procedures set forth below must be followed by shareholders for submitting nominations for directors to the shareholders. The Board of Directors does not intend to alter the manner in which it evaluates candidates, regardless of whether or not the candidate was recommended or nominated by a shareholder.

For new director candidates, the Governance Committee uses its network of contacts in MVB’s market area to compile a list of potential candidates. The Governance Committee then meets to discuss each candidate and whether he or she meets the criteria set forth above. The Governance Committee then discusses each candidate’s qualifications and chooses a candidate by majority vote.

Shareholder Nominations of Directors

MVB’s Bylaws provide that nominations for election to the Board of Directors must be made by a shareholder in writing delivered or mailed to the President not less than 90 days prior to the anniversary of the previous year's Annual Meeting, provided, however, that if the date of the Annual Meeting is more than 30 days before or more than 70 days after the anniversary of the previous year's Annual Meeting, the nominations must be mailed or delivered to the President not later than the close of business on the later of the 90th day prior to such Annual Meeting or the 10th day following the day on which public announcement of the date of such meeting is first made. The notice of nomination must contain the following information, to the extent known:

| |

| • | Name and address of proposed nominee(s); |

| |

| • | Principal occupation of nominee(s); |

| |

| • | Total shares to be voted for each nominee; |

| |

| • | Name and address of notifying shareholder; and |

| |

| • | Number of shares owned by notifying shareholder. |

Nominations not made in accordance with these requirements may be disregarded by the chairman of the meeting and in such case the votes cast for each such nominee will likewise be disregarded. All nominees for election at the meeting are incumbent directors or directors of MVB subsidiaries and are included as nominees in this proxy statement. No shareholder recommendations or nominations have been made for election at the 2020 Annual Meeting.

Human Resources & Compensation Committee (the “Compensation Committee”). Composed of James J. Cava, Jr., Gary A. LeDonne (Chair) and Dr. Kelly R. Nelson. The purpose of this Compensation Committee is to:

| |

| i. | attend to all human resources issues that come before the Board of Directors; |

| |

| ii. | review and set CEO compensation; |

| |

| iii. | conduct an annual CEO performance evaluation and goal setting process; |

| |

| iv. | oversee executive succession planning; |

| |

| v. | approve senior management salaries; and |

| |

| vi. | establish the compensation for the individuals that serve on the Board of Directors. |

This Compensation Committee also is responsible for administration of all incentive plans. The Compensation Committee reports the results from these meetings to the Board of Directors. The Compensation Committee met eleven (11) times in 2019. All Compensation Committee members are independent. The Compensation Committee Charter was reviewed and approved by the Board of Directors on March 17, 2020 and is available on MVB's Investor Relations website at ir.mvbbanking.com under Overview - Governance Documents.

Code of Conduct and Ethics

The MVB Board of Directors has established a Code of Ethics for Senior Financial Officers that applies to our senior executive and financial officers, including our principal executive officer, principal financial officer, principal accounting officer, or persons performing similar functions. We also maintain a Code of Conduct that governs all of our directors, officers and employees. A copy of the Code of Ethics for Senior Financial Officers and the Code of Conduct are available on MVB's Investor Relations website at ir.mvbbanking.com under Overview - Governance Documents. We will promptly disclose any future amendments to these codes on our website, as well as any waivers from these codes for executive officers and directors. Copies of these codes will also be available in print from our Corporate Secretary, without charge, upon request.

Compensation Committee Interlocks and Insider Participation

None of the members of our Compensation Committee are, or have been, an officer or employee of MVB. During fiscal year 2019, no member of our Compensation Committee had any relationship with MVB requiring disclosure under Item 404 of Regulation S-K. None of our executive officers serve as a director or compensation committee member of a company that has an executive officer serving on our Compensation Committee or our Board of Directors.

COMPENSATION DISCUSSION AND ANALYSIS

The following Compensation Discussion and Analysis (“CD&A”) describes the philosophy, objectives and structure of MVB’s 2019 executive compensation program. This includes discussion and background information regarding the compensation of the CEO, CFO and the next three most highly-compensated executive officers of MVB, collectively referred to as the named executive officers (“NEOs”).

The following executive officers constituted MVB’s NEOs in the past fiscal year:

|

| | | | |

| Executive's Name | | Title | | Years of Banking Experience |

| Larry F. Mazza | | President and Chief Executive Officer | | 33 |

| Donald T. Robinson | | EVP, Chief Financial Officer, and Treasurer | | 13 |

| H. Edward Dean III | | CEO, MVB Mortgage | | 28 |

| David A. Jones | | SVP, Chief Risk Officer | | 32 |

| John T. Schirripa | | EVP, Chief Commercial Lending Officer | | 34 |

This CD&A is intended to be read in conjunction with the tables and accompanying footnotes and narrative disclosure that immediately follow this section, which provide further historical compensation information.

Executive Summary

Overall, the Board of Directors believes that MVB’s compensation program is effective in aligning the compensation of executive officers with the long-term interests of MVB shareholders. Incentive compensation programs consist of a blend of annual performance and time-based compensation. Such programs are structured to preclude excessive and unnecessary risk-taking and utilize performance metrics established in advance based on an annual budget and business planning process. MVB’s incentive plans also contain caps or limits on the amounts that can be awarded.

Clawback policies are also imposed on all compensation awards so that awards or payments are adjusted or recovered if the performance measures supporting such an award are subsequently restated or otherwise adjusted to levels which do not support the award or payment.

Business Highlights

MVB fiscal 2019 highlights include achievement of the following:

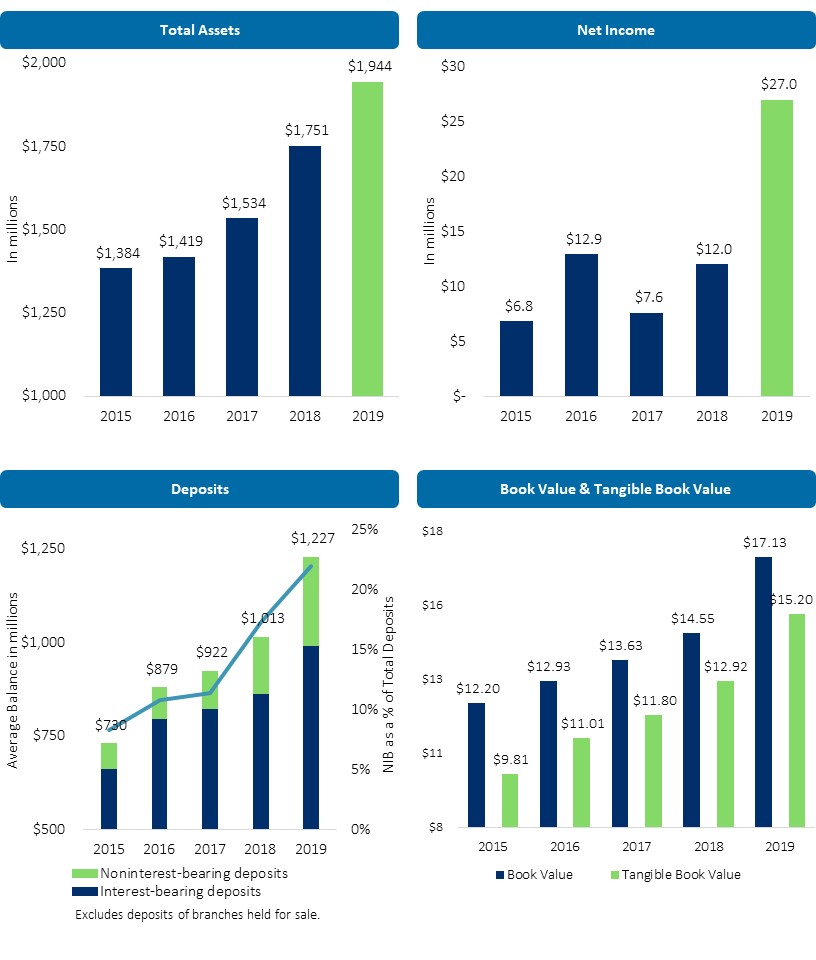

In 2019, MVB continued to execute on its 2019-2021 Strategic Plan of MVB 3.0: Think Bigger. Execution of this strategy saw MVB hit new highs in assets and net income. Also, noninterest bearing deposit growth and loan quality were above industry and peer performance. Net income and earnings per share increased 125% and 117%, respectively, from 2018.

MVB believes that the deposit franchise is a key component to the shareholder value of a bank. A major aspect to the deposit franchise is the deposit mix, including noninterest bearing deposits. MVB continues to improve the deposit mix and noninterest bearing deposits now make up 22% of total deposits. While competition is seeing limited growth in noninterest bearing deposits, MVB grew noninterest bearing deposits by 39% in 2019.

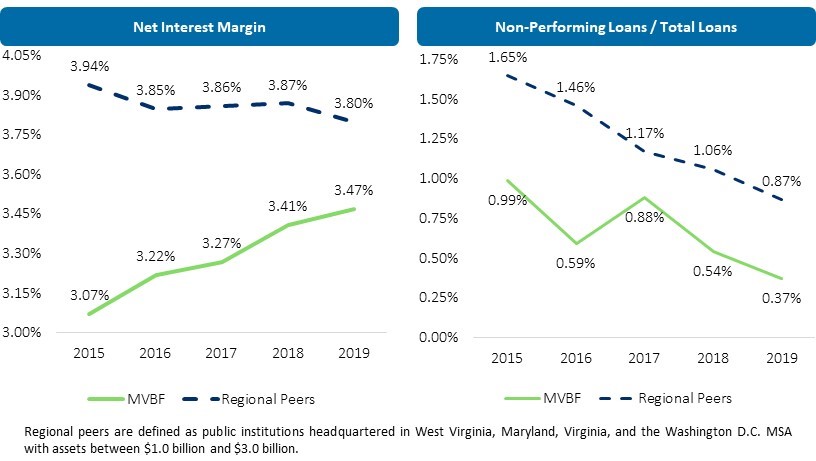

Additionally, Net Interest Margin (NIM) continues to be a major contribution to MVB’s earnings. With the volatile rate environment, NIM has been under pressure across the industry for the last several years. For the fifth consecutive year, MVB reported an increase of NIM. MVB’s NIM increased 6 bps, while peer banks from $1 billion to $3 billion in assets within Virginia, West Virginia, and Maryland saw NIM decrease 7bps during 2019.

MVB believes that asset quality will always remain a key risk to the banking industry and is critical to safety and soundness. MVB’s non-performing assets to total assets as of December 31, 2019 was 34bps, as compared to 88bps for the peer group mentioned above. Additionally, charge offs in 2019 were 7bps as compared to 12 bps for those peers.

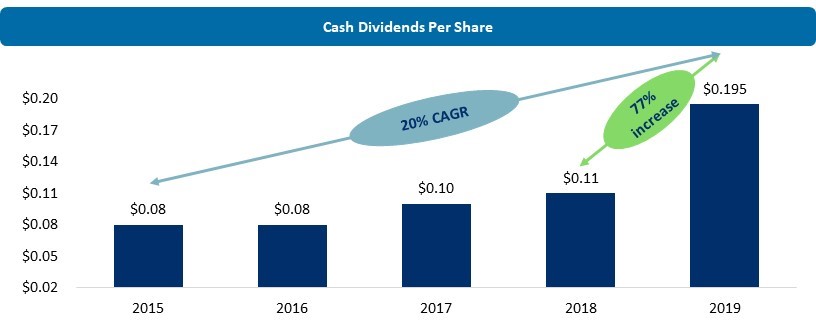

Total shareholder return was increased from MVB stock price appreciation, increased dividend payouts, redemption of outstanding subordinated debt which occurred without diluting shares. Common cash dividends grew from $0.11 in 2018 to $0.195 in 2019 (a 77% increase).

Finally, an important metric to shareholders and shareholder value is MVB’s book value (BV) and tangible book value (TBV). In 2019, BV and TBV increased $2.58 and $2.28 per share or 17.7%, respectively.

Components of MVB’s Compensation Program

Compensation Philosophy and Objectives

MVB’s compensation programs are designed to provide competitive compensation and benefits to promote the interests of MVB and its shareholders while enabling us to attract and retain top-quality executive talent. MVB’s compensation philosophy is built on five core compensation principles:

MVB philosophy is performance-based. The incentive plans are designed to drive and improve individual and business performance. Each plan requires measurable goals and objectives to be set, communicated, achieved and audited prior to any award made.

| |

| 2) | Sound Compensation Practices |

All MVB compensation elements will comply with appropriate regulations and sound compensation practices, which neither pay excessive compensation nor encourage inappropriate risk-taking. All behavior must be consistent with MVB’s vision, mission and values.

Various positions require different levels of skills, knowledge, and personal attributes that drive different rates of pay and/or variable compensation opportunity. Geographic locations will also factor into the process. MVB has an established job structure and evaluation process that provides a formal hierarchy of grades and salary ranges, and a means to determine fairness in job placement within the structure. This pay structure guides us in providing internal equity amongst positions and ensures the maintenance of fairness in compensation practices across divisions of the organization.

| |

| 4) | Market Competitive Compensation |

The “market” sets the framework for opportunity and achievement drives the payout. The intent of the compensation philosophy is to maintain a competitive compensation program and attract and retain top talent across the organization.

| |

| 5) | Profitability Drives the Programs |

Profitability and success are the key drivers in determining compensation opportunity. It is the responsibility of senior management to ensure plans provide a positive return to the Company and shareholders, in addition to appropriately rewarding contributions and successful performance.

How Our Pay Program Works

Our executive compensation philosophy, as outlined above, continues to be based on attracting and retaining top talent while providing competitive compensation that creates a direct, meaningful link between business results and compensation opportunities. We rely on the following three primary elements:

|

| |

| Base Salary | Base pay is used to maintain market competitiveness in attracting and retaining top talent executive officers. Base salaries are reviewed annually, and merit increases are awarded based on performance and in-line with a merit budget. Merit budgets are determined annually based on market conditions and the success of the Company. |

| Short-Term Incentives | Short-term incentives are tied directly to the Company’s business results. Awards are paid only when business performance is strong, and goals are met. |

| Long-Term Incentives | Long-term equity awards incentivize executives to deliver long-term shareholder value, while also providing a retention vehicle for executive talent.

Long-term incentive plan in which RSU performance awards vest based upon internal ROA goals (15%) and relative TSR (15%) performance over a three-year period and the time-based RSU awards (70%) with a 5-year time vesting schedule. (Please see 2020 Long-Term Incentive Plan Enhancement) |

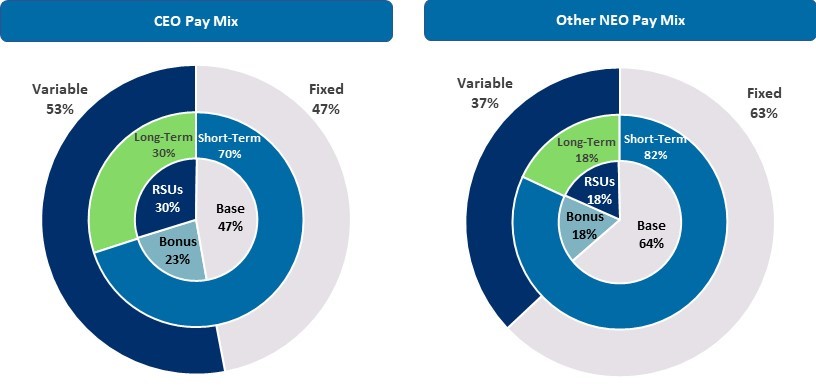

Target Executive Pay Mix

Consistent with our desire to align pay and performance, we take the above-mentioned primary compensation elements and more heavily weight their distribution towards variable (both bonus and equity) pay. Although our Compensation Committee does not target a specific allocation for each pay element, they are nevertheless cognizant of delivering an appropriate balance between fixed and variable elements, as well as short- and long-term incentives, as evidenced here in the following 2019 target pay mix allocation:

Note: Because Mr. Dean has no defined opportunities, he is therefore excluded from the “Other NEO” graphic. Mr. Dean's cash incentive compensation is described in the employment agreement section of the CD&A.

Executive variable compensation (both bonus and equity) reflects competitive total compensation for MVB’s Executives compared to market.

Pay and Performance

Our compensation program is grounded in a pay-for-performance philosophy. Performance goals in both our short and long-term incentive plans are set at challenging levels, with the ultimate goal that performance will drive long-term, sustainable value. When financial and stock performance goals are not met, pay outcomes for our executives should reflect this reality.

Compensation Governance Practices

MVB’s pay-for-performance philosophy and compensation governance practices provide an appropriate framework to executives to achieve financial and strategic goals without encouraging them to take excessive risks in their business decisions. Some practices include:

|

| |

| What MVB Does | ü Pay-for-performance philosophy and culture |

ü Comprehensive clawback policy |

ü Responsible use of shares under MVB’s long-term incentive program |

ü Engage an independent compensation consultant |

ü Perform an annual risk assessment of the compensation programs |

Say-on-Pay Vote Results

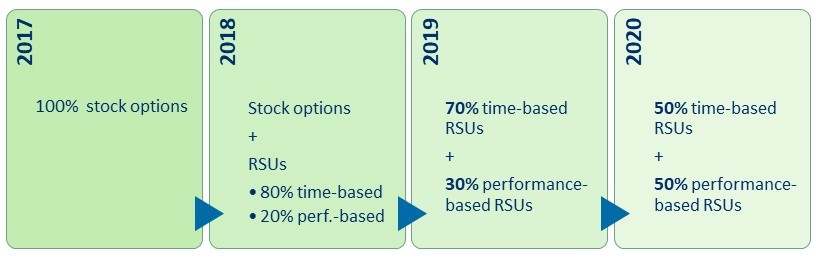

At the 2019 Annual Meeting, 84.49% of the shareholders of MVB voted in favor of our executive compensation proposal (commonly known as “Say-on-Pay” proposal). The Compensation Committee believes this voting result reflects strong shareholder support for our current compensation practices. Based on the results of this vote, changes to the executive long-term incentive plan vesting were made for restricted stock unit awards in 2020. Instead of gradually moving from 70% time, 30% performance vesting, the Committee decided to expedite the move to a 50% performance, 50% time-vested structure for the 2020 long term equity grants. The Compensation Committee will continue to review our executive compensation program as well as consider the outcome of the “Say-on-Pay” votes when making future compensation decisions for the NEOs.

Establishing Executive Compensation

Role of the Compensation Committee

The Compensation Committee’s process begins with establishing individual and corporate performance objectives by the second quarter of each calendar year. The Compensation Committee engages in an active dialogue with the CEO concerning strategic objectives and performance targets. The Compensation Committee also reviews the appropriateness of the financial measures used in incentive plans, the degree of difficulty in achieving performance targets, and appropriate risk levels. Corporate performance objectives typically are established based on a targeted return on assets and return on equity, as well as growth in earnings per share and individual goals for particular business units within MVB.

The Compensation Committee annually reviews the Compensation Committee Charter and all incentive plans used throughout MVB in all business lines. In this review of the incentive plans, the Compensation Committee determines whether the plans, individually or collectively, encourage excessive risk taking, whether each of the plans has reasonable limits and caps, and whether the overall structure of the incentive plans is aligned with the interests of the shareholders.

Role of Management

Management also plays a role in the compensation setting process. Typically, MVB's CEO will evaluate the performance of the other executive officers and other employees and will assist the Compensation Committee in determining appropriate performance targets and objects for the incentive plans. The CEO may participate in Compensation Committee meetings, when requested, to discuss these items as well as recommendations regarding salary increases, bonuses and other compensation-related matters. The Compensation Committee exercises its own independent discretion in approving compensation for all executive officers and assessing corporate performance against the pre-established objectives. The CEO is not present during deliberations or voting with respect to his own compensation.

Investor Outreach

Investing in an outreach program, MVB’s CEO, CFO and in some cases, the Chairman of the Compensation Committee, met with the Company's top investors to share the Strategic Plan, provide an overview of leadership and structure, and present MVB compensation methodology. Other topics included Board governance and executive compensation framework outlining where MVB is adopting best practices and providing alignment with the shareholders. The meetings and discussions were well received by all participants. Throughout the outreach, MVB connected with investors that held over 40% of the outstanding shares of MVB.

Use of Outside Advisors

Pursuant to the authority granted to it in its charter, the Compensation Committee may engage an independent executive compensation consultant. In 2019, McLagan, part of the Reward Solutions practice at Aon, provided consulting services to the Compensation Committee, including advice on compensation philosophy, incentive plan design, executive job compensation analysis, director compensation analysis, and CD&A disclosure, among other compensation topics.

The Compensation Committee conducted a specific review of its relationship with McLagan in 2019, taking into account the independence factors set forth in applicable SEC and Nasdaq rules, and determined that McLagan’s work for the Compensation Committee did not raise any conflicts of interest.

Risk Consideration

The Compensation Committee is responsible for establishing incentive plans for executive officers that achieve an appropriate balance between MVB’s results and risk. The Compensation Committee recognizes that business in the financial industry inherently requires that MVB take on certain risks: in its lending activities, depository activities, and investing activities, as well as other facets of the organization. Upon due consideration of these items, the Compensation Committee believes that MVB incentive plans are designed in such a way as to encourage executives to take only prudent levels of risk in the pursuit of strong performance on behalf of shareholders. Furthermore, the Compensation Committee believes that MVB’s compensation policies and practices do not create risks that are reasonably likely to have a material adverse effect on its business or operations.

Compensation Competitive Analysis

Use of Peer Group

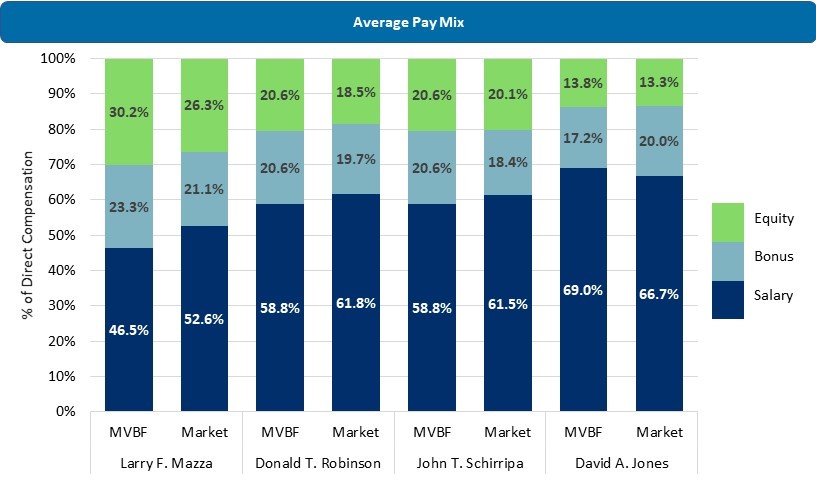

The Compensation Committee seeks to provide total targeted direct compensation that is competitive and dependent on Company performance and other factors, including size of assets and location. MVB adopts the position that annual compensation for all executive officers should provide bonuses based on performance metrics established at the discretion of the Compensation Committee. In evaluating our peer group, the Compensation Committee considered a number of factors including asset size and market capitalization.

MVB’s talent acquisition strategy focuses on attracting and retaining executives with the experience and skills necessary to grow the organization. MVB executives have generally come from larger metropolitan areas and/or institutions that are significantly larger than MVB. In executing talent strategy, it is necessary to provide a base salary that exceeds the median of banks that are comparable to MVB’s current asset size. Other elements of compensation are adjusted to recognize that base salaries are competitive.

2019 Peer Group

Our Compensation Committee, with the support of McLagan, reviewed the continued appropriateness of our peer group composition. In creating an appropriate peer group, the following criteria was considered:

| |

| • | Assets: $750 million - $4 billion |

| |

| • | Revenue: $40 million - $200 million |

| |

| • | Locations: DC, DE, KY, MD, NC, NJ, NY, OH, PA, SC, VA, WV |

| |

| • | Return on Investment: 5-Year CAGR greater than 5% |

| |

| • | Non-Interest Income: greater than 15% of Revenue |

| |

| • | Return on Avg Assets: greater than 0% |

| |

| • | Consumer Loans: greater than 10% of loan portfolio |