- MKTX Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

MarketAxess (MKTX) DEF 14ADefinitive proxy

Filed: 28 Apr 21, 4:32pm

sec

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

PROXY STATEMENT PURSUANT TO SECTION 14(a) OF THE

SECURITIES EXCHANGE ACT OF 1934

(Amendment No. )

Filed by the Registrant ☒ | Filed by a Party other than the Registrant ☐ |

|

Check the appropriate box:

☐ | Preliminary Proxy Statement |

☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

☒ | Definitive Proxy Statement |

☐ | Definitive Additional Materials |

☐ | Soliciting Material Pursuant to § 240.14a-12 |

MarketAxess Holdings Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

☒ | No fee required. |

☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

☐ | Fee paid previously with preliminary materials. |

☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

Market Axess® 2021 Proxy Statement and Notice of Annual Meeting of Stockholders

MarketAxess Holdings Inc.

55 Hudson Yards, 15th Floor

New York, New York 10001

April 28, 2021

TO THE STOCKHOLDERS OF MARKETAXESS HOLDINGS INC.:

You are invited to attend the 2021 Annual Meeting of Stockholders (the “Annual Meeting”) of MarketAxess Holdings Inc. (the “Company”) scheduled for Wednesday, June 9, 2021 at 10:00 a.m., Eastern Daylight Time. The Annual Meeting will be a virtual meeting of stockholders. You will be able to participate in the Annual Meeting, vote and submit your questions via live webcast by visiting www.virtualshareholdermeeting.com/MKTX2021. The Company’s Board of Directors and management look forward to your participation.

Details of the business to be conducted at the Annual Meeting are given in the attached Notice of Annual Meeting and Proxy Statement, which you are urged to read carefully.

We are pleased to take advantage of the Securities and Exchange Commission rules that allow issuers to furnish proxy materials to their stockholders on the Internet. We believe these rules allow us to provide our stockholders with the information they need, while lowering the costs of delivery and reducing the environmental impact of our Annual Meeting. On April 28, 2021, we expect to mail to our stockholders a Notice containing instructions on how to access our Proxy Statement and Annual Report on Form 10-K for the year ended December 31, 2020 and vote online. The Notice contains instructions on how you can receive a paper copy of the Proxy Statement, proxy card and Annual Report if you only received a Notice by mail.

Your vote is important to us. Whether or not you plan to attend the Annual Meeting, your shares should be represented and voted. After reading the enclosed Proxy Statement, please cast your vote via the Internet or telephone or complete, sign, date and return the proxy card in the pre-addressed envelope that we have included for your convenience. If you hold your shares in a stock brokerage account, please check your proxy card or contact your broker or nominee to determine whether you will be able to vote via the Internet or by telephone.

On behalf of the Board of Directors, thank you for your continued support.

Sincerely, |

|

Richard M. McVey |

Chairman and Chief Executive Officer |

NOTICE OF 2021 ANNUAL MEETING OF STOCKHOLDERS | |

Attend the Annual Meeting at:

www.virtualshareholdermeeting.com/MKTX2021

| Your vote is very important, regardless of the number of shares you own. Please read the attached proxy statement carefully and complete and submit your proxy card via the internet or sign and date your paper proxy card as promptly as possible and return it in the enclosed envelope. Alternatively, you may be able to submit your proxy by touch-tone phone as indicated on the proxy card. |

|

|

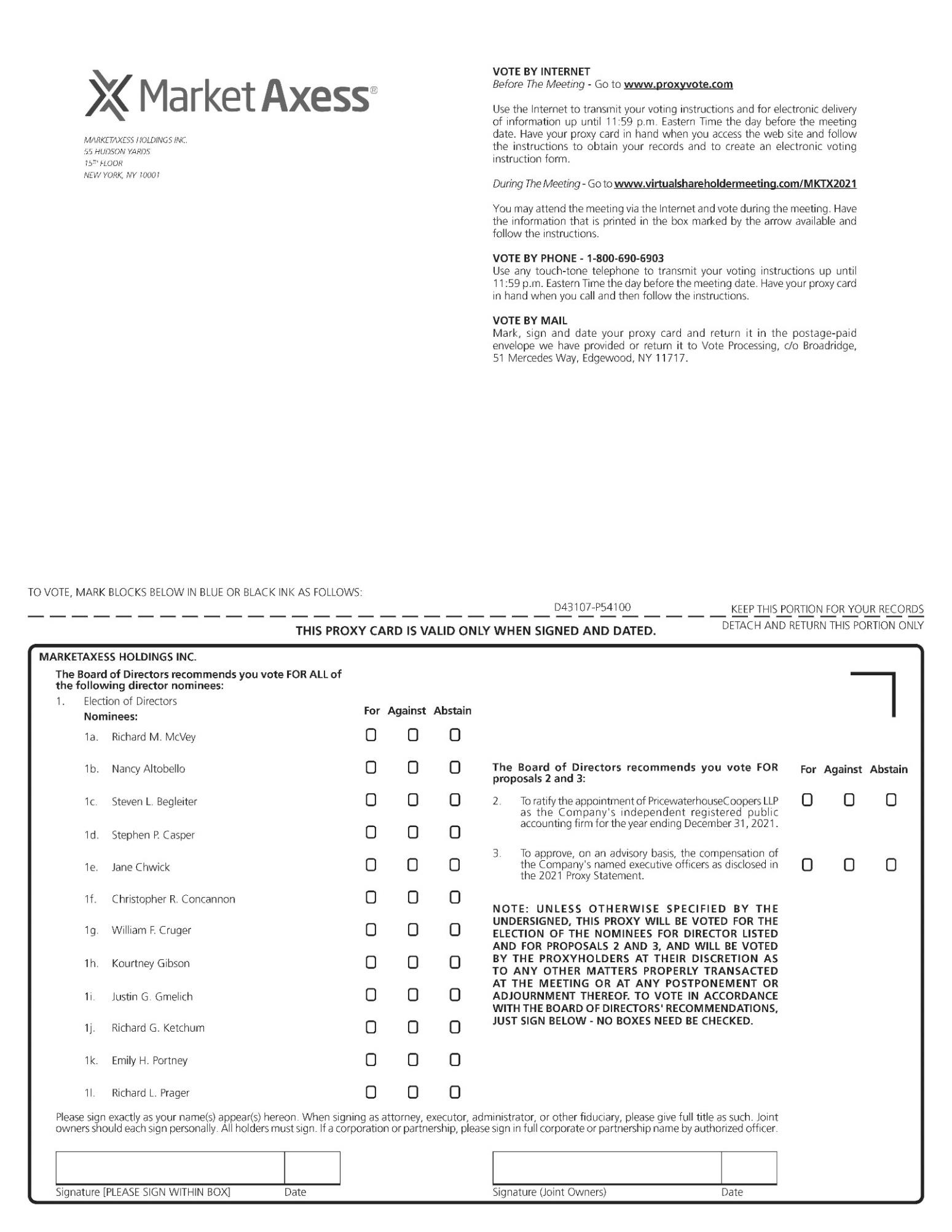

TO THE STOCKHOLDERS OF MARKETAXESS HOLDINGS INC.: NOTICE IS HEREBY GIVEN that the 2021 Annual Meeting of Stockholders (the “Annual Meeting”) of MarketAxess Holdings Inc., a Delaware corporation (the “Company”), will be held via live webcast on Wednesday, June 9, 2021, at 10:00 a.m., Eastern Daylight Time. You can participate in the Annual Meeting, vote and submit your questions during the Annual Meeting by visiting www.virtualshareholdermeeting.com/MKTX2021. You must have your 16-digit control number included on your Notice of Internet Availability of Proxy Materials or your proxy card (if you received a printed copy of the proxy materials) to join the Annual Meeting. At the Annual Meeting we will: 1. vote to elect the 12 nominees named in the attached Proxy Statement as members of the Company’s Board of Directors for terms expiring at the 2022 Annual Meeting of Stockholders; 2. vote to ratify the appointment of PricewaterhouseCoopers LLP as the Company’s independent registered public accounting firm for the year ending December 31, 2021; 3. hold an advisory vote to approve the compensation of the Company’s named executive officers as disclosed in the attached Proxy Statement; and 4. transact such other business as may properly come before the Annual Meeting or any adjournment or postponement thereof. |

|

| BY INTERNET Visit 24/7 www.proxyvote.com |

|

|

| |

|

| BY PHONE Call 1-800-690-6903 in the U.S. or Canada to vote your shares | |

|

|

| |

|

| BY MAIL Cast your ballot, sign your proxy card and return | |

|

|

| |

|

| PARTICIPATE IN THE ANNUAL MEETING Vote during the Annual Meeting at www.virtualshareholdermeeting.com/MKTX2021 using your 16-digit control number

|

These items are more fully described in the Company’s Proxy Statement accompanying this Notice.

The record date for the determination of the stockholders entitled to notice of, and to vote at, the Annual Meeting, or any adjournment or postponement thereof, was the close of business on April 12, 2021. You have the right to receive this Notice and vote at the Annual Meeting if you were a stockholder of record at the close of business on April 12, 2021. Please remember that your shares cannot be voted unless you cast your vote by one of the following methods: (1) vote via the Internet or call the toll-free number as indicated on the proxy card; (2) sign and return a paper proxy card; or (3) vote during the Annual Meeting at www.virtualshareholdermeeting.com/MKTX2021.

By Order of the Board of Directors, |

|

Scott Pintoff |

General Counsel and Corporate Secretary |

New York, New York

April 28, 2021

| 1 | |

|

|

|

| 1 | |

|

|

|

| 1 | |

|

|

|

| 1 | |

|

|

|

| 2 | |

|

|

|

| 2 | |

|

|

|

| 3 | |

|

|

|

| 3 | |

|

|

|

| 4 | |

|

|

|

| 5 | |

|

|

|

| 11 | |

|

|

|

| 11 | |

|

|

|

| 11 | |

|

|

|

| 11 | |

|

|

|

| 12 | |

|

|

|

| 12 | |

|

|

|

| 14 | |

|

|

|

| 14 | |

|

|

|

Board evaluations, succession planning and talent management |

| 15 |

|

|

|

Code of Conduct, Code of Ethics and other governance documents |

| 16 |

|

|

|

| 16 | |

|

|

|

| 16 | |

|

|

|

| 19 | |

|

|

|

ENVIRONMENTAL, SOCIAL AND GOVERNANCE STRATEGY AND INITIATIVES |

| 21 |

|

|

|

| 22 | |

|

|

|

| 22 | |

|

|

|

PROPOSAL 2 — RATIFICATION OF SELECTION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM |

| 23 |

|

|

|

| 23 | |

|

|

|

| 24 | |

|

|

|

| 25 | |

|

|

|

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT |

| 26 |

| 31 | ||

|

|

| |

| 31 | ||

|

|

| |

| 32 | ||

|

|

| |

| 35 | ||

|

|

| |

| 38 | ||

|

|

| |

| 45 | ||

|

|

| |

| 46 | ||

|

|

| |

REPORT OF THE COMPENSATION AND TALENT COMMITTEE OF THE BOARD OF DIRECTORS |

| 57 | |

|

|

| |

| 58 | ||

|

|

| |

| 58 | ||

|

|

| |

| 59 | ||

|

|

| |

| 60 | ||

|

|

| |

| 61 | ||

|

|

| |

| 62 | ||

|

|

| |

Employment agreements and severance arrangements with our Named Executive Officers |

| 63 | |

|

|

| |

Potential termination or change in control payments and benefits |

| 66 | |

|

|

| |

| 73 | ||

|

|

| |

| 74 | ||

| 75 | ||

|

|

| |

| 76 | ||

|

|

| |

| 78 | ||

|

|

| |

| 78 | ||

|

|

| |

| 79 | ||

|

|

| |

| 79 | ||

|

|

| |

| 82 | ||

|

|

| |

| 82 | ||

|

|

| |

| 82 | ||

This summary contains highlights about MarketAxess Holdings Inc. (“MarketAxess”, the “Company”, “we” or “our”) and the upcoming 2021 Annual Meeting of Stockholders (the “Annual Meeting”). This summary does not contain all of the information you should consider in advance of the Annual Meeting and we encourage you to read the entire Proxy Statement before voting.

This Proxy Statement, the accompanying Notice of Annual Meeting of Stockholders and proxy card are first being mailed to stockholders on or about April 28, 2021. Whenever we refer in this Proxy Statement to the “Annual Meeting,” we are also referring to any meeting that results from any postponement or adjournment of the June 9, 2021 meeting.

Date and Time: | Wednesday, June 9, 2021, at 10:00 a.m., Eastern Daylight Time |

Virtual Meeting: | www.virtualshareholdermeeting.com/MKTX2021 |

Record Date: | Monday, April 12, 2021 |

Due to the continuing public health impact of the coronavirus outbreak (COVID-19) (the “Pandemic”) and to support the health and well-being of our stockholders and other participants at the Annual Meeting, the Annual Meeting will be held in virtual format only.

The following table summarizes the items that we are asking our stockholders to vote on at the Annual Meeting, along with the voting recommendations of our Board of Directors (the “Board” or “Board of Directors”).

Item | Board Recommendation | Required Approval | Page Reference |

1. Election of Directors | FOR | Majority of votes cast for each nominee | 2 |

2. Ratification of the appointment of PricewaterhouseCoopers LLP as the Company’s independent registered public accounting firm for the year ending December 31, 2021 | FOR | Majority of shares present and entitled to vote | 23 |

3. Advisory vote to approve the compensation of the Company’s named executive officers as disclosed in the attached Proxy Statement | FOR | Majority of shares present and entitled to vote | 74 |

Your vote is important. Stockholders of record as of the Record Date are entitled to vote through one of the following options:

By Mail: | Cast your ballot, sign your proxy card and return. |

Via the Internet: | To vote before the meeting, visit www.proxyvote.com. To vote at the meeting, visit www.virtualshareholdermeeting.com/MKTX2021. You will need the control number printed on your notice, proxy card or voting instruction form. |

By Telephone: | Call the phone number located on your proxy card. |

| 2021 Proxy Statement | 1 |

PROPOSAL 1 — ELECTION OF DIRECTORS

The first proposal to be voted on at the Annual Meeting is the election of directors. Our Board currently consists of 13 directors, 11 of whom are not our employees. Each of the nominees for director was elected by the Company’s stockholders on June 10, 2020, except for Kourtney Gibson, who was appointed to the Board as of July 16, 2020. The directors are nominated for a term that begins at the Annual Meeting and ends at the 2022 Annual Meeting of Stockholders. Each director will hold office until such director’s successor has been elected and qualified, or until such director’s earlier resignation, retirement or removal. The Board will continue to evaluate its composition as part of its focus on self-assessment and board refreshment.

John Steinhardt, who has been a director since April 2000, has not been re-nominated and will not stand for reelection. Mr. Steinhardt’s service as a director on the Board will cease as of the date of the Annual Meeting. Following the Annual Meeting, and assuming the election of each director nominee, our Board will consist of 12 directors, 10 of whom are not our employees. The Company thanks Mr. Steinhardt for his twenty-one years of service.

If you sign the enclosed proxy card and return it to the Company, your proxy will be voted FOR all directors, for terms expiring at the 2022 Annual Meeting of Stockholders, unless you specifically indicate on the proxy card that you are casting a vote against one or more of the nominees or abstaining from such vote.

A majority of the votes cast by stockholders entitled to vote at the Annual Meeting is required for the election of each director. Abstentions and broker non-votes will have no effect on the outcome of the vote.

|

| BOARD RECOMMENDATION | ||

The board unanimously recommends that you vote “FOR” the election of each of the following nominees: | ||||

| ||||

|

| • Richard M. McVey • Nancy Altobello • Steven L. Begleiter • Stephen P. Casper • Jane Chwick • Christopher R. Concannon

| • William F. Cruger • Kourtney Gibson • Justin G. Gmelich • Richard G. Ketchum • Emily H. Portney • Richard L. Prager

| |

Each of these nominees is currently serving as a director on our Board, and each nominee has agreed to continue to serve on the Board if he or she is elected at the Annual Meeting. If any nominee is unable (or for good cause declines) to serve as a director at any time before the Annual Meeting, proxies may be voted for the election of a qualified substitute designated by the current Board, or else the size of the Board will be reduced accordingly. Biographical information about each of the nominees is included below under Director information.

2 | 2021 Proxy Statement |

|

PROPOSAL 1 — ELECTION OF DIRECTORS

Qualifications for director nominees

Our Board has adopted minimum qualifications for our directors:

• | substantial experience working as an executive officer for, or serving on the board of, a public company; |

• | significant accomplishment in another field of endeavor related to the strategic running of our business; or |

• | an ability to make a meaningful contribution to the oversight and governance of a company having a scope and size similar to our Company. |

A director must have an exemplary reputation and record for honesty in his or her personal dealings and business or professional activity. All directors must demonstrate strong leadership skills and should possess a basic understanding of financial matters; have an ability to review and understand the Company’s financial and other reports; and be able to discuss such matters intelligently and effectively. He or she also needs to exhibit qualities of independence in thought and action. A candidate should be committed first and foremost to the interests of the stockholders of the Company. The key experience, qualifications and skills each of our directors brings to the Board that are important in light of our business are included in their individual biographies below.

Board of Directors skills and expertise

The Company’s directors are selected on the basis of specific criteria set forth in our Corporate Governance Guidelines. All of our directors possess financial industry experience and a history of strategic leadership. In addition to those qualifications, listed below are the skills and experience that we consider important for our director nominees. More detailed information is provided in each director nominee’s biography.

| Corporate Governance | Fixed Income/ Electronic Trading | Regulatory | Technology/ Cybersecurity | Mergers and Acquisitions | Finance / Accounting | Risk Management | Other Public Company Board Experience | Talent Management |

Richard M. McVey | ● | ● | ● | ● | ● |

| ● |

| ● |

Nancy Altobello | ● |

| ● |

| ● | ● | ● | ● | ● |

Steven L. Begleiter | ● |

|

|

| ● | ● | ● | ● | ● |

Stephen P. Casper | ● | ● | ● |

| ● | ● | ● |

| ● |

Jane Chwick | ● | ● |

| ● |

|

| ● | ● | ● |

Christopher R. Concannon | ● | ● | ● | ● | ● |

| ● | ● |

|

William F. Cruger | ● | ● |

|

| ● | ● | ● | ● |

|

Kourtney Gibson |

| ● | ● |

|

| ● | ● |

| ● |

Justin G. Gmelich |

| ● | ● |

|

| ● | ● |

| ● |

Richard G. Ketchum | ● | ● | ● |

|

|

| ● | ● |

|

Emily H. Portney | ● |

|

|

| ● | ● | ● |

| ● |

Richard L. Prager | ● | ● |

| ● | ● |

| ● |

| ● |

| 2021 Proxy Statement | 3 |

PROPOSAL 1 — ELECTION OF DIRECTORS

The Company recognizes and embraces that having a diverse Board enhances both the Board’s effectiveness in fulfilling its oversight role and the Company’s performance. See “Corporate Governance and Board Matters – Board Diversity Policy” for more information. Listed below are the number of director nominees that self-identify as female or as a racial minority as well as the number of director nominees by tenure and age:

GENDER | RACE | TENURE | AGE |

|

|

|

|

|

|

|

|

4 | 2021 Proxy Statement |

|

PROPOSAL 1 — ELECTION OF DIRECTORS

At the recommendation of the Nominating and Corporate Governance Committee, the Board has nominated the persons named below to serve as directors of the Company for a term beginning at the Annual Meeting and ending at the 2022 Annual Meeting of Stockholders.

| 2021 Proxy Statement | 5 |

PROPOSAL 1 — ELECTION OF DIRECTORS

6 | 2021 Proxy Statement |

|

PROPOSAL 1 — ELECTION OF DIRECTORS

| 2021 Proxy Statement | 7 |

PROPOSAL 1 — ELECTION OF DIRECTORS

8 | 2021 Proxy Statement |

|

PROPOSAL 1 — ELECTION OF DIRECTORS

| 2021 Proxy Statement | 9 |

PROPOSAL 1 — ELECTION OF DIRECTORS

10 | 2021 Proxy Statement |

|

CORPORATE GOVERNANCE AND BOARD MATTERS

Director independence and tenure

The Board of Directors has determined that each of our current directors, other than Messrs. McVey, our Chief Executive Officer, and Concannon, our President and Chief Operating Officer, currently meet the independence requirements contained in the NASDAQ listing standards and applicable securities rules and regulations. None of our non-employee directors has a relationship with the Company or its subsidiaries that would interfere with the exercise of independent judgment in carrying out the responsibilities of a director.

We do not have director age or term limits, as we believe our efforts to regularly refresh the Board with new directors, as well as natural turnover, have achieved the appropriate balance between maintaining longer-term directors with deep institutional knowledge and new directors who bring new perspectives and diversity to our Board. Our Board reviews director tenure every year in connection with its director independence determinations. We plan to continue to refresh our Board of Directors to ensure that it is composed of high functioning, qualified and diverse members.

The Company recognizes and embraces that having a diverse Board enhances both the Board’s effectiveness in fulfilling its oversight role and the Company’s performance. The Company’s Board Diversity Statement cites diversity at the Board level as an essential element in the attainment of its strategic objectives and in achieving sustainable and balanced development. In designing the Board’s composition, diversity is considered from a number of aspects, including but not limited to gender, age, race, ethnicity, nationality, cultural and educational background, professional experience, skills, knowledge and length of service. In any formal search for Board candidates, the Nominating and Corporate Governance Committee includes, and requests that any search firm that it engages include, qualified candidates with a diversity of race/ethnicity and gender in the initial pool from which the Committee selects director candidates. The ultimate decision on all Board nominations is based on merit and the contributions that the selected candidates will bring to the Board, having due regard for the benefits of diversity. See Proposal 1—Election of Directors—Director Diversity for more information.

How nominees to our Board are selected

Candidates for election to our Board of Directors are nominated by our Nominating and Corporate Governance Committee and ratified by our full Board of Directors for election by the stockholders. The Nominating and Corporate Governance Committee operates under a charter, which is available in the Investor Relations — Corporate Governance section of our corporate website at www.marketaxess.com.

The Nominating and Corporate Governance Committee will give due consideration to candidates recommended by stockholders. Stockholders may recommend candidates for the Nominating and Corporate Governance Committee’s consideration by submitting such recommendations directly to the Nominating and Corporate Governance Committee as described below under Communicating with our Board members. In making recommendations, stockholders should be mindful of the discussion of minimum qualifications set forth above under Qualifications for director nominees though meeting such minimum qualification standards does not imply that the Nominating and Corporate Governance Committee will necessarily nominate the person recommended by a stockholder. The Nominating and Corporate Governance Committee may also engage outside search firms to assist in identifying or evaluating potential nominees.

| 2021 Proxy Statement | 11 |

CORPORATE GOVERNANCE AND BOARD MATTERS

Our Chief Executive Officer (“CEO”) also serves as the Chairman of the Board (the “Chairman”), and we have a Lead Independent Director who is responsible, among other things, for consulting with the Chairman regarding the agenda and meeting schedules for each Board meeting, coordinating the activities of the non-employee directors, including presiding over the executive sessions of non-employee directors, and serving as a liaison between the Chairman and the non-employee directors. We believe that this structure is appropriate for the Company because it allows one person to speak for and lead the Company and the Board, while also providing for effective oversight by an independent Board through a Lead Independent Director. Our CEO, as the individual with primary responsibility for managing the Company’s strategic direction and day-to-day operations, is in the best position to provide Board leadership that is aligned with our stockholders’ interests, as well as the Company’s needs. Our overall corporate governance policies and practices, combined with the strength of our independent directors, serve to minimize any potential conflicts that may result from combining the roles of CEO and Chairman.

Mr. Casper has been appointed by our independent directors to serve as our Lead Independent Director. Our Corporate Governance Guidelines provide that the Chairman of the Nominating and Corporate Governance Committee shall act as the Lead Independent Director, unless otherwise determined by a majority vote of the independent directors of the Board.

The Board has established other structural safeguards that serve to preserve the Board’s independent oversight of management. The Board is comprised almost entirely of independent directors who are highly qualified and experienced, and who exercise a strong, independent oversight function. The Board’s Audit Committee, Compensation and Talent Committee, Nominating and Corporate Governance Committee, Risk Committee and Finance Committee are comprised entirely of, and are chaired by, independent directors. Independent oversight of our CEO’s performance is provided through a number of Board and committee processes and procedures, including regular executive sessions of non-employee directors and annual evaluations of our CEO’s performance against pre-determined goals. The Board believes that these safeguards preserve the Board’s independent oversight of management and provide a balance between the authority of those who oversee the Company and those who manage it on a day-to-day basis.

Audit Committee

The Audit Committee of the Board of Directors oversees the accounting and financial reporting process of the Company and the audits of the financial statements of the Company. The Audit Committee is also responsible for preparing the audit committee report required to be included in this proxy statement, and the Audit Committee is directly responsible for the appointment, retention, compensation and oversight of the Company’s outside auditor. The Audit Committee currently consists of Ms. Altobello (Chair), Mr. Cruger, Ms. Gibson and Mr. Gmelich.

The Board of Directors has determined that each member of the Audit Committee is an independent director in accordance with NASDAQ listing standards and Rule 10A-3 of the Securities Exchange Act of 1934, as amended. The Board has determined that each member of the Audit Committee is able to read and understand fundamental financial statements, including the Company’s balance sheet, income statement and cash flow statement, as required by NASDAQ rules. In addition, the Board has determined that each member of the Audit Committee satisfies the NASDAQ rule requiring that at least one member of our Board’s Audit Committee have past employment experience in finance or accounting, requisite professional certification in accounting, or any other comparable experience or background that results in the member’s financial sophistication, including being or having been a chief executive officer, chief financial officer or other senior officer with financial oversight responsibilities. The Board has also determined that each member of the Audit Committee is an “audit committee financial expert” as defined by the SEC. For information regarding the experience and qualifications of our Audit Committee members, see the information in this Proxy Statement under the section heading Proposal 1 — Election of Directors — Director information.

12 | 2021 Proxy Statement |

|

CORPORATE GOVERNANCE AND BOARD MATTERS

Compensation and Talent Committee

The Compensation and Talent Committee of the Board of Directors (the “Compensation Committee”) is responsible for reviewing and approving, and, as applicable, recommending to the full Board for approval, the compensation of the CEO and all other officers of the Company, as well as the Company’s compensation philosophy, strategy, program design and administrative practices. The compensation programs reviewed and approved by the Compensation Committee consist of all forms of compensation, including salaries, cash incentives, and stock-based awards and benefits. The Compensation Committee is also responsible for oversight of the Company’s talent management processes, including talent acquisition, leadership development and succession planning for key roles, reviewing the Company’s diversity, equity and inclusion programs, and reviewing the Company’s corporate culture. The Compensation Committee currently consists of Mr. Begleiter (Chair), Ms. Altobello, Mr. Prager and Mr. Steinhardt. The Board of Directors has determined that each member of the Compensation Committee is an “independent director” in accordance with NASDAQ listing standards and a “non-employee director” under the applicable SEC rules and regulations.

Nominating and Corporate Governance Committee

The Nominating and Corporate Governance Committee of the Board of Directors identifies individuals qualified to become Board members and recommends for selection by the Board the director nominees to stand for election at each annual meeting of the Company’s stockholders. In connection therewith, the Nominating and Corporate Governance Committee reviews certain policies regarding the nomination of directors and recommends any changes in such policies to the Board for its approval; identifies individuals qualified to become directors; evaluates and recommends for the Board’s selection nominees to fill positions on the Board; and recommends changes in the Company’s corporate governance policies, including the Corporate Governance Guidelines, to the Board for its approval. The Nominating and Corporate Governance Committee oversees the annual review of the performance of the Board of Directors, each director and each committee. The Nominating and Corporate Governance Committee also oversees the Company’s environmental, social and governance strategy and initiatives. See Environmental, Social and Governance Strategy and Initiatives. The Nominating and Corporate Governance Committee currently consists of Mr. Cruger (Chair), Mr. Casper and Ms. Chwick. The Board of Directors has determined that each member of the Nominating and Corporate Governance Committee is an independent director in accordance with NASDAQ listing standards.

Risk Committee

The Risk Committee assists the Board with its oversight of the Company’s risk management activities, with particular responsibility for overseeing designated areas of risk that are not the primary responsibility of another committee of the Board or retained for the Board’s direct oversight. Items delegated to the Risk Committee by the Board include technology and cyber-security risk, credit risk, clearing risk and regulatory risk. The Risk Committee currently consists of Ms. Chwick (Chair), Mr. Ketchum, Ms. Portney and Mr. Prager.

Finance Committee

The Finance Committee assists the Board with its oversight of the Company’s global treasury activities, mergers, acquisitions, divestitures, and strategic investments, capital structure and capital allocation strategy, financing and liquidity requirements, dividends, stock repurchase authorizations, investor relations activities and insurance and self-insurance programs. The Finance Committee currently consists of Messrs. Steinhardt (Chair), Begleiter and Cruger. Prior to April 2021, the Finance Committee was known as the Investment Committee and assisted the Board in monitoring whether the Company had adopted and adheres to a rational and prudent investment and capital management policy; whether management’s investment and capital management actions were consistent with attainment of the Company’s investment policy, financial objectives and business goals; the Company’s compliance with legal and regulatory requirements pertaining to investment and capital management; the competence, performance and compensation of the Company’s external money managers; and such other matters as the Board or Investment Committee deemed appropriate.

| 2021 Proxy Statement | 13 |

CORPORATE GOVERNANCE AND BOARD MATTERS

The following table sets forth the chairs and membership structure of the Board and each standing Board committee as of April 28, 2021, and the number of Board and Board committee meetings held during 2020.

The non-management directors met in executive session without management directors or employees at each of the meetings of the Board during 2020. We expect each director to attend each meeting of the full Board and of the committees on which he or she serves and to attend the annual meeting of stockholders. All directors attended at least 75% of the meetings of the full Board and the meetings of the committees on which they served, and all directors attended our 2020 annual meeting of stockholders (not counting Ms. Gibson, who was not a director at the time of our 2020 annual meeting).

Board involvement in risk oversight

The Company’s management is responsible for defining the various risks facing the Company, formulating risk management policies and procedures, and managing the Company’s risk exposures on a day-to-day basis. The Board’s responsibility is to monitor the Company’s risk management processes by informing itself of the Company’s material risks and evaluating whether management has reasonable controls in place to address the material risks. The Board is not responsible, however, for defining or managing the Company’s various risks.

The Board of Directors monitors management’s responsibility for risk oversight through regular reports from management to the Risk and Audit Committees and the full Board. Furthermore, the Risk and Audit Committees report on the matters discussed at the committee level to the full Board. The Risk and Audit Committees and the full Board focus on the material risks facing the Company, including strategic, operational, market, technology and cyber-security, credit, liquidity, legal and regulatory risks, to assess whether management has reasonable controls in place to address these risks. In addition, the Compensation Committee is charged with reviewing and discussing with management whether the Company’s compensation arrangements are consistent with effective controls and sound risk management. Risk management is a factor that the Board and the Nominating and Corporate Governance Committee consider when determining who to nominate for election as a director of the Company and which directors serve on the Risk and Audit Committees. In addition, the Nominating and Corporate Governance Committee is charged with overseeing risk related to the Company’s environmental, social and governance strategy and initiatives. The Board believes this division of responsibilities provides an effective and efficient approach for addressing risk management.

14 | 2021 Proxy Statement |

|

CORPORATE GOVERNANCE AND BOARD MATTERS

The Company’s Global Management Team assists management’s efforts to assess and manage risk. The Global Management Team is chaired by the CEO and is comprised of the Company’s senior managers with global oversight. The Global Management Team assesses the Company’s business strategies and plans and ensures that appropriate policies and procedures are in place for identifying, evaluating, monitoring, managing and measuring significant risks. The Chief Risk Officer regularly prepares updates and reports for the Global Management Team, Risk Committee, Audit Committee and the Board of Directors.

We have assembled a cross-functional team, which includes several of our executive officers, for continuously monitoring the impact of the Pandemic on our employee base and business operations. Throughout the Pandemic, the Board has overseen this risk management initiative, working closely with management to maintain information flow and timely review of issues arising from the Pandemic. For information on the effect of the Pandemic on our business, see Management’s Discussion and Analysis—Critical Factors Affecting our Industry and our Company—Economic, Political and Market Factors in the Company’s Annual Report on Form 10-K.

Board evaluations, succession planning and talent management

Each year, the members of the Board of Directors conduct a confidential written assessment of the Board’s performance that is reviewed and summarized by the Company’s Lead Independent Director and the Chair of the Nominating and Corporate Governance Committee. As part of the evaluation process, the Board reviews its overall composition, including director tenure, board leadership structure, diversity and individual skill sets, to ensure it serves the best interests of stockholders and positions the Company for future success. Each Board committee also conducts an annual written self-assessment of its performance during the prior year. The results of the assessments are then summarized and communicated back to the appropriate committee chairpersons and our Lead Independent Director. After the evaluations, the Board and management work to improve upon any issues or focus points disclosed during the evaluation process. As part of the evaluation process, each committee reviews its charter annually.

The Board is committed to positioning MarketAxess for further growth through ongoing talent management, succession planning and the deepening of our leadership bench. Management facilitates a formal talent management and leadership development review on an annual basis for the Board. The review is focused on both immediate, short-term coverage plans for all executives in the event of an unforeseen situation, as well as longer-term, strategic succession planning. A critical element of the review is an evaluation of the Company’s formal leadership development and talent acquisition initiatives in order to ensure that our leadership team has the skills, capabilities and experience to effectively lead our existing, and future, global business. The review also focuses on the retention of key managers. The annual talent management and leadership development review is supplemented by an additional year-end review by the Board of the individual performance and year-end compensation proposals for the executive management team and other key staff.

The Board values diversity among the management team and strives to increase the diversity of the executive management team, as well as the management teams reporting to them. The Board considers formal and informal initiatives to promote diversity as part of their annual talent management review. In addition, in any external searches for executive management team candidates in which the Company considers candidates that are not employees of the Company, the Company will request that any search firm that it engages include qualified candidates with a diversity of race/ethnicity and gender in the initial pool from which the Company selects such executive management team candidates.

The Board has formal exposure to the executive team at Board meetings, as well as at Board committee meetings and other discussions. There are other opportunities for more informal interaction with employees across the organization throughout the year through various events and collaborative experiences.

| 2021 Proxy Statement | 15 |

CORPORATE GOVERNANCE AND BOARD MATTERS

Code of Conduct, Code of Ethics and other governance documents

The Board has adopted a Code of Conduct that applies to all officers, directors and employees, and a Code of Ethics for the CEO and Senior Financial Officers, which includes Mr. DeLise, our Chief Financial Officer. Both the Code of Conduct and the Code of Ethics for the CEO and Senior Financial Officers can be accessed in the Investor Relations — Corporate Governance section of our website at www.marketaxess.com. We intend to satisfy any disclosure obligations regarding waivers of or amendments to our Code of Conduct and Code of Ethics for the CEO and Senior Financial Officers by posting such information on our website at www.marketaxess.com.

You may also obtain a copy of these documents without charge by writing to MarketAxess Holdings Inc., 55 Hudson Yards, 15th Floor, New York, New York 10001, Attention: Investor Relations.

Copies of the charters of our Board’s Audit Committee, Compensation Committee, Finance Committee, Risk Committee and Nominating and Corporate Governance Committee, as well as a copy of the Company’s Corporate Governance Guidelines, can be accessed in the Investor Relations — Corporate Governance section of our website.

Communicating with our Board members

Although our Board of Directors has not adopted a formal process for stockholder communications with the Board, we make every effort to ensure that the views of stockholders are heard by the Board or by individual directors, as applicable, and we believe that this has been an effective process to date. Stockholders may communicate with the Board by sending a letter to the MarketAxess Holdings Inc. Board of Directors, c/o General Counsel, 55 Hudson Yards, 15th Floor, New York, New York 10001. The General Counsel will review the correspondence and forward it to our CEO and Chairman of the Board and the Lead Independent Director, or to any individual director or directors to whom the communication is directed, as appropriate. Notwithstanding the above, the General Counsel has the authority to discard or disregard any communication that is unduly hostile, threatening, illegal or otherwise inappropriate or to take any other appropriate actions with respect to such communications.

In addition, any person, whether or not an employee, who has a concern regarding the conduct of the Company or our employees, including with respect to our accounting, internal accounting controls or auditing issues, may, in a confidential or anonymous manner, communicate that concern in writing by addressing a letter to the Chairman of the Audit Committee, c/o Corporate Secretary, at our corporate headquarters address, which is 55 Hudson Yards, 15th Floor, New York, New York 10001, or electronically, at our corporate website, www.marketaxess.com under the heading Investor Relations — Corporate Governance, by clicking the Confidential Ethics Web Form link.

Our Compensation Committee has retained the services of Grahall LLC (“Grahall”) as its independent compensation consultant for purposes of advising on non-employee director compensation. Grahall reports directly to the Compensation Committee and conducts an annual review of director compensation levels and a bi-annual review of director pay structure and practices, and in each event, shares the results of those reviews with the Compensation Committee. The Compensation Committee then submits any proposed changes in pay level or program structure of our non-employee director compensation to the full Board for its consideration, and if appropriate, approval.

Grahall reviews and recommends compensation structure and adjustments based on the board compensation of the following:

• | Proxy peer group (see Compensation Discussion and Analysis – How We Determine Pay Levels – Peer Group); |

• | ISS peer group (updated by ISS annually); and |

• | Industry data sources, including the National Association of Corporate Directors. |

16 | 2021 Proxy Statement |

|

CORPORATE GOVERNANCE AND BOARD MATTERS

All directors, other than Mr. McVey and Mr. Concannon, are regarded as non-employee directors. Mr. McVey and Mr. Concannon receive no additional compensation for service as a director.

In 2020, the Board member equity retainer was increased from $115,000 to $120,000 per year, as recommended by Grahall. This change was effective June 10, 2020. The change was made to better align director compensation with the above-referenced market data provided by Grahall. The director pay recommendations resulted in pay levels between the projected medians of our proxy peers and ISS’s peer group.

A summary of the structure of our director pay program that is in effect as of June 2020 is as follows:

Director Compensation Pay Structure - Effective June 2020 |

| |||||||||||||||

|

| Cash Board Retainer ($) |

|

| Cash Chair Retainer ($) |

|

| Cash Committee Retainer ($) |

|

| Restricted Stock ($) |

| ||||

Annual Retainer – All |

|

| 85,000 |

|

|

| — |

|

|

| — |

|

|

| 120,000 |

|

Audit Committee |

|

| — |

|

|

| 25,000 |

|

|

| 12,500 |

|

|

| — |

|

Compensation / Talent Committee |

|

| — |

|

|

| 20,000 |

|

|

| 7,500 |

|

|

| — |

|

Governance / Nominating Committee |

|

| — |

|

|

| 15,000 |

|

|

| 7,500 |

|

|

| — |

|

Finance Committee (1) |

|

| — |

|

|

| 10,000 |

|

|

| 2,500 |

|

|

| — |

|

Risk Committee |

|

| — |

|

|

| 20,000 |

|

|

| 7,500 |

|

|

| — |

|

Lead Independent Director (2) |

|

| — |

|

|

| 22,500 |

|

|

| — |

|

|

| 22,500 |

|

(1) | Prior to April 2021, and for the entirety of the 2020 fiscal year, the Finance Committee was known as the Investment Committee. |

(2) | The Lead Independent Director can elect to receive his retainer in cash or in a combination of cash and equity. |

In June 2020, we granted 238 shares of restricted stock to each non-employee director except for Ms. Gibson, who was granted a prorated amount of 209 shares on August 1, 2020 after joining the Board in July 2020. Mr. Casper, as Lead Director, received 45 additional shares equating to half of his applicable retainer. All shares are scheduled to vest on May 31, 2021. The number of shares of restricted stock granted was determined on the grant date by dividing the equity grant value of $120,000 by the average of the closing price of our Common Stock for the ten trading days up to and including the grant date. We expect to continue to compensate our non-employee directors with a combination of cash and equity awards. All equity awards to non-employee directors are made under the Company’s 2020 Equity Incentive Plan.

| 2021 Proxy Statement | 17 |

CORPORATE GOVERNANCE AND BOARD MATTERS

Below is a summary of the amount and form of actual compensation received by each non-employee director in 2020:

Director Compensation for Fiscal 2020 |

| |||||||||||||||

Name |

| Fees Earned or Paid in Cash (1) |

|

| Stock Awards ($)(2)(4) |

|

| All Other Compensation ($)(3) |

|

| Total($) |

| ||||

Stephen P. Casper, Lead Independent Director |

|

| 116,250 |

|

|

| 136,423 |

|

|

| 422 |

|

|

| 253,095 |

|

Nancy Altobello |

|

| 117,077 |

|

|

| 114,730 |

|

|

| 408 |

|

|

| 232,215 |

|

Steven L. Begleiter |

|

| 106,794 |

|

|

| 114,730 |

|

|

| 360 |

|

|

| 221,884 |

|

Jane Chwick |

|

| 112,500 |

|

|

| 114,730 |

|

|

| 360 |

|

|

| 227,590 |

|

William F. Cruger |

|

| 115,000 |

|

|

| 114,730 |

|

|

| 360 |

|

|

| 230,090 |

|

Kourtney Gibson |

|

| 44,819 |

|

|

| 107,990 |

|

|

| — |

|

|

| 152,809 |

|

Justin Gmelich |

|

| 97,500 |

|

|

| 114,730 |

|

|

| 356 |

|

|

| 212,586 |

|

Richard Ketchum |

|

| 92,500 |

|

|

| 114,730 |

|

|

| 360 |

|

|

| 207,590 |

|

Emily Portney |

|

| 103,299 |

|

|

| 114,730 |

|

|

| 360 |

|

|

| 218,389 |

|

Richard Prager |

|

| 100,000 |

|

|

| 114,730 |

|

|

| 320 |

|

|

| 215,050 |

|

John Steinhardt |

|

| 103,206 |

|

|

| 114,730 |

|

|

| 360 |

|

|

| 218,296 |

|

(1) | The amounts represent Board, Committee, Committee Chair and Lead Independent Director retainers earned in 2020. For Ms. Gibson, the amount represents Board and Committee retainers earned for the portion of the year that she served on the Board. |

(2) | The amounts represent the aggregate grant date fair value of stock awards granted by the Company in 2020, computed in accordance with FASB ASC Topic 718. For further information on how we account for stock-based compensation, see Note 11 to the consolidated financial statements included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2020. Ms. Gibson received a prorated number of shares (209 shares) based on her length of service in 2020. |

(3) | Represents accrued dividends paid on restricted stock. |

(4) | The table below sets forth information regarding the aggregate number of stock awards outstanding at the end of fiscal year 2020 for each non-employee director, including unvested stock awards granted in fiscal year 2020 and, in relation to Messrs. Begleiter and Cruger and Ms. Chwick, RSUs for which the director previously elected to defer receipt. There are no stock option awards granted in fiscal year 2020 that were outstanding at fiscal year end. |

Equity Awards Outstanding | |||||

|

| Aggregate Number of Stock Awards Outstanding at Fiscal Year End (#) |

|

| |

Stephen P. Casper, Lead Independent Director |

|

| 283 |

|

|

Nancy Altobello |

|

| 238 |

|

|

Steven L. Begleiter |

|

| 756 |

|

|

Jane Chwick |

|

| 724 |

|

|

William F. Cruger |

|

| 1,210 |

|

|

Kourtney Gibson |

|

| 209 |

|

|

Justin Gmelich |

|

| 238 |

|

|

Richard Ketchum |

|

| 238 |

|

|

Emily Portney |

|

| 238 |

|

|

Richard Prager |

|

| 238 |

|

|

John Steinhardt |

|

| 238 |

|

|

18 | 2021 Proxy Statement |

|

CORPORATE GOVERNANCE AND BOARD MATTERS

Share Ownership & Holding Guidelines

To keep the interests of non-employee directors and stockholders aligned, the Board of Directors has adopted stock ownership guidelines for our non-employee directors. Non-employee directors are required to hold not less than the number of shares of Common Stock equal in value to five times the annual base cash retainer payable to a director, or $425,000. As of April 2021, the holding requirement was equal to 834 shares, calculated using a price of $509.46 per share, which was the average of the daily closing price of our Common Stock for the twelve-month period ended on March 31, 2021. The holding requirement must be achieved within five years after the director has become a Board member and maintained throughout the non-employee director’s service with the Company. All shares of Common Stock beneficially owned by the director, including shares purchased and held personally, vested and unvested restricted shares, vested and unvested restricted stock units, settled performance shares, and shares deferred under a non-qualified deferred compensation arrangement, count toward the minimum ownership requirement. Vested and unvested stock options and unearned performance shares are excluded.

In addition to the ownership guidelines, all non-employee directors must hold all shares granted for service for a minimum of five years from the date of grant. Directors are also required, for a period of six months following his or her departure from the Board, to comply with the Company’s Insider Trading Policy that, among other things, prohibits trading in the Company’s securities during specified blackout periods.

All of our non-employee directors have either achieved the designated level of ownership or are in the five-year period following their appointment or election to the Board during which they are expected to achieve compliance:

Directors' Stock Ownership | ||||||

|

|

|

| Multiple of Cash Retainer | ||

Name |

| Elected |

| Requirement |

| Current Holdings |

Stephen P. Casper, Lead Independent Director |

| April 2004 |

| 5x |

| 320x |

Nancy Altobello |

| April 2019 |

| 5x |

| 4x |

Steven L. Begleiter |

| April 2012 |

| 5x |

| 52x |

Jane Chwick |

| October 2013 |

| 5x |

| 35x |

William F. Cruger |

| November 2013 |

| 5x |

| 35x |

Kourtney Gibson |

| July 2020 |

| 5x |

| 1x |

Justin G. Gmelich |

| October 2019 |

| 5x |

| 3x |

Richard Ketchum |

| April 2017 |

| 5x |

| 11x |

Emily Portney |

| October 2017 |

| 5x |

| 9x |

Richard Prager |

| July 2019 |

| 5x |

| 9x |

John Steinhardt |

| April 2000 |

| 5x |

| 128x |

Our equity plan provides for the accrual of dividends (or dividend equivalents) on unvested shares. However, dividends are not paid and are subject to forfeiture until all restrictions on the shares have lapsed.

We do not provide any retirement benefits or other perquisites to our non-employee directors.

Certain relationships and related party transactions

Review and approval of related party transactions

Our related parties include our directors, director nominees, executive officers, holders of more than five percent of the outstanding shares of our Common Stock and the foregoing persons’ immediate family members. We review relationships and transactions in which the Company and our related parties are or will be participants to determine

| 2021 Proxy Statement | 19 |

CORPORATE GOVERNANCE AND BOARD MATTERS

whether such related persons have a direct or indirect material interest. As required under SEC rules, transactions that are determined to be directly or indirectly material to a related party are disclosed in this Proxy Statement. In addition, the Audit Committee reviews and, if appropriate, approves and ratifies any related party transaction that is required to be disclosed.

Though not considered related party transactions that are required to be disclosed under SEC rules, each of the 5% stockholders that are listed under Security Ownership of Certain Beneficial Owners and Management or their affiliated entities is a party to a user agreement or dealer agreement that governs their access to, and activity on, our electronic trading platforms. These agreements were each entered into in the ordinary course of business and, subject to our usual trade terms, provide for the fees and expenses to be paid by such entities for the use of the platform.

20 | 2021 Proxy Statement |

|

ENVIRONMENTAL, SOCIAL AND GOVERNANCE STRATEGY AND INITIATIVES

MarketAxess is committed to integrating sustainability into our everyday actions to help create long-term value for our stockholders and the communities in which we operate. We aim to operate the company responsibly while managing risks and using our resources wisely. The Company’s environmental, social and governance (“ESG”) strategy and initiatives are overseen by the Board’s Nominating and Corporate Governance Committee. We have also established an ESG Working Group comprised of employees from across the Company, including members of senior management. As further described in the Company’s 2020 ESG Report, MarketAxess demonstrated its ESG commitment in 2020 by practicing sustainability, advocating volunteerism and philanthropy and actively partnering with our employees, clients and others on environmental, social and governance initiatives. Our 2020 ESG Report can be accessed in the Investor Relations — Corporate Governance section of our website.

We believe that our growing role in making the global credit markets work better brings with it the obligation to be a responsible corporate citizen. MarketAxess’ vision of corporate citizenship has four pillars:

• | An enduring commitment to high standards of governance. We believe the touchstones of responsible leadership are integrity and fairness. In 2020, we continued to strengthen our Board of Directors with new members who value the interests of all our stakeholders – clients, employees, investors and business partners. We benefit greatly from having board members who bring proven leadership to our ESG efforts. |

• | Helping communities become more resilient. We expanded our support in 2020 to organizations that are on the frontline of addressing the impact of the Pandemic, particularly the immediate challenge of food insecurity. To address community resilience over the long term, we established the MarketAxess Charitable Foundation, whose mission is to work with organizations that support underserved communities, with an emphasis on youth education, diversity, equity and inclusion. |

• | Building a strong, diverse workforce. We believe a strong culture built on accountability and mutual respect has been a significant factor in our success, and will continue to be even more so in the future. This year’s ESG Report details the initiatives we have taken to sustain our culture and ensure its continued vitality as we grow. Diversity, equity and inclusion must remain a priority if we are to continue to be prosperous over the long term, and our management team is working hard to strengthen this important part of our ESG program. |

• | Adopting sound sustainability practices across our business operations. We are in the process of improving our ability to measure our Company’s impact in areas such as climate, waste, and water use. As an initial part of that effort, we are reporting for 2020 against metrics outlined by the Sustainability Accounting Standards Board (SASB) for the first time for the following sectors: Security & Commodity Exchanges, Professional & Commercial Services and Software and IT. |

| 2021 Proxy Statement | 21 |

ENVIRONMENTAL, SOCIAL AND GOVERNANCE STRATEGY AND INITIATIVES

How MarketAxess defines sustainability

We define sustainability as a business’ commitment to advancing economic prosperity while improving the world in which we operate. Our commitment to sustainability and corporate responsibility is in line with our goal of applying our ingenuity, innovative technology and electronic network to make global credit markets work better for the people who depend on them. In pursuing this commitment, we embrace our responsibility as a corporate citizen to ensure that our global activities positively impact our communities and our environment.

Green bonds are fixed income instruments designed to fund projects that have positive environmental and/or climate benefits. In 2020, $27 billion in corporate and municipal green bond trading volume was executed globally on MarketAxess, an increase of 42% from 2019. In the U.S., where public data is available, MarketAxess ranks as the largest corporate and municipal green bond marketplace with an estimated market share of 20.3% in TRACE-reported corporate and municipal green bond volume.

The second year of our “Trading for Trees” initiative with our partner, One Tree Planted, a 501(c)(3) non-profit that focuses on global reforestation, proved successful. Our clients’ green bond trading on the MarketAxess platform resulted in over 130,000 trees being planted across five continents and eight countries, including India, Papua New Guinea, Canada and New Zealand. In 2020, One Tree Planted created 1,498 jobs and planted over 2 million fruit trees to support almost 30,000 families in critical regions around the world.

22 | 2021 Proxy Statement |

|

PROPOSAL 2 — RATIFICATION OF SELECTION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The Audit Committee of our Board has appointed PricewaterhouseCoopers LLP (“PwC”) as our independent registered public accounting firm to audit our consolidated financial statements for the year ending December 31, 2021 and to audit the Company’s internal control over financial reporting as of December 31, 2021, and the Board is asking stockholders to ratify that selection. PwC has audited our consolidated financial statements each year since our formation in 2000. The Audit Committee periodically considers whether there should be a rotation of independent registered public accounting firms and the Audit Committee currently believes that the continued retention of PwC is in the best interests of the Company and our stockholders. Although current law, rules and regulations, as well as the charter of the Audit Committee, require our independent registered public accounting firm to be engaged, retained and supervised by the Audit Committee, the Board considers the selection of our independent registered public accounting firm to be an important matter of stockholder concern and considers a proposal for stockholders to ratify such selection to be an important opportunity for stockholders to provide direct feedback to the Board on an important issue of corporate governance. In the event that stockholders fail to ratify the appointment, the Audit Committee will reconsider whether or not to retain PwC, but may ultimately determine to retain PwC as our independent registered public accounting firm. Even if the appointment is ratified, the Audit Committee, in its sole discretion, may direct the appointment of a different independent registered public accounting firm at any time during the year if the Audit Committee determines that such a change would be in the best interests of the Company and its stockholders.

In 2011, the Company, in the ordinary course of its business, entered into a bulk data agreement with PwC for the purpose of supporting valuation conclusions reached by PwC in the normal course of PwC’s audit and other work for its clients, which has been amended from time to time. Pursuant to the agreement, the Company provides bond pricing data to PwC on terms consistent with the terms of similar data sales agreements entered into by the Company. The aggregate annual revenue to the Company from the data agreement is $295,000. On an annual basis, the Audit Committee evaluates the effect of such agreement on the independence of PwC and has concurred with the opinion of the Company’s management and PwC that the arrangement constitutes an “arm’s-length” transaction that would not affect PwC’s independence.

Representatives of PwC will be present at our Annual Meeting, will have the opportunity to make a statement if they desire to do so, and will be available to respond to appropriate questions from stockholders.

Unless proxy cards are otherwise marked, the persons named as proxies will vote FOR the ratification of PwC as the Company’s independent registered public accounting firm for the year ending December 31, 2021. Approval of this proposal requires the affirmative vote of the holders of a majority of the shares present in person or represented by proxy and entitled to vote on the proposal.

|

| BOARD RECOMMENDATION |

| The board unanimously recommends that you vote “FOR” ratification of PwC as the Company’s independent registered public accounting firm for the year ending December 31, 2021. |

| 2021 Proxy Statement | 23 |

PROPOSAL 2 — RATIFICATION OF SELECTION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The aggregate fees billed by our independent registered public accounting firm for professional services rendered in connection with the audit of our annual financial statements set forth in our Annual Report on Form 10-K for the years ended December 31, 2020 and 2019 and the audit of our broker-dealer subsidiaries’ annual financial statements, as well as fees paid to PwC for tax compliance and planning, if any, and other services, are set forth below.

Except as set forth in the following sentence, the Audit Committee, or a designated member thereof, pre-approves 100% of all audit, audit-related, tax and other services rendered by PwC to the Company or its subsidiaries. The Audit Committee has authorized the CEO and the Chief Financial Officer to purchase permitted non-audit services rendered by PwC to the Company or its subsidiaries up to, and including, a limit of $10,000 per service and an annual aggregate limit of $20,000 for all such services.

Immediately following the completion of each fiscal year, the Company’s independent registered public accounting firm submits to the Audit Committee (and the Audit Committee requests from the independent registered public accounting firm), as soon as possible, the written disclosures and the letter required by the applicable requirements of the Public Company Accounting Oversight Board (“PCAOB”) regarding the independent registered public accounting firm’s communications with the Audit Committee concerning independence.

Immediately following the completion of each fiscal year, the independent registered public accounting firm also submits to the Audit Committee (and the Audit Committee requests from the independent registered public accounting firm), a formal written statement of the fees billed by the independent registered public accounting firm to the Company in each of the last two fiscal years for each of the following categories of services rendered by the independent registered public accounting firm: (i) the audit of the Company’s annual financial statements and the reviews of the financial statements included in the Company’s Quarterly Reports on Form 10-Q or services that are normally provided by the independent registered public accounting firm in connection with statutory and regulatory filings or engagements; (ii) assurance and related services not included in clause (i) that are reasonably related to the performance of the audit or review of the Company’s financial statements, in the aggregate and by each service; (iii) tax compliance, tax advice and tax planning services, in the aggregate and by each service; and (iv) all other products and services rendered by the independent registered public accounting firm, in the aggregate and by each service.

Set forth below is information regarding fees paid by the Company to PwC during the fiscal years ended December 31, 2020 and 2019.

Fee Category |

| 2020 |

|

| 2019 |

| ||

Audit Fees(1) |

| $ | 2,765,478 |

|

| $ | 2,261,404 |

|

All Other Fees(2) |

|

| 4,460 |

|

|

| 4,838 |

|

Total |

| $ | 2,769,938 |

|

| $ | 2,266,242 |

|

(1) | The aggregate fees incurred include amounts for the audit of the Company’s consolidated financial statements (including fees for the audit of our internal controls over financial reporting) and the audit of our broker-dealer subsidiaries’ annual financial statements. |

(2) | Other Fees are comprised of annual subscription fees for accounting related research and service fees related to XBRL conversion services. |

24 | 2021 Proxy Statement |

|

REPORT OF THE AUDIT COMMITTEE OF THE BOARD OF DIRECTORS

The Audit Committee currently consists of Ms. Altobello (Chair), Mr. Cruger, Ms. Gibson and Mr. Gmelich. Each member of the Audit Committee is independent, as independence is defined for purposes of Audit Committee membership by the listing standards of NASDAQ and the applicable rules and regulations of the SEC.

The Audit Committee appoints our independent registered public accounting firm, reviews the plan for and the results of the independent audit, approves the fees of our independent registered public accounting firm, reviews with management and the independent registered public accounting firm our quarterly and annual financial statements and our internal accounting, financial and disclosure controls, reviews and approves transactions between the Company and its officers, directors and affiliates, and performs other duties and responsibilities as set forth in a charter approved by the Board of Directors.

During fiscal year 2020, the Audit Committee met six times. The Company’s senior financial management and independent registered public accounting firm were in attendance at such meetings. Following each quarterly meeting during 2020, the Audit Committee conducted a private session with the independent registered public accounting firm, without the presence of management. The Audit Committee also had one joint meeting with the Risk Committee during 2020.

The management of the Company is responsible for the preparation and integrity of the financial reporting information and related systems of internal controls. The Audit Committee, in carrying out its role, relies on the Company’s senior management, including particularly its senior financial management, to prepare financial statements with integrity and objectivity and in accordance with generally accepted accounting principles, and relies upon the Company’s independent registered public accounting firm to review or audit, as applicable, such financial statements in accordance with the standards of the Public Company Accounting Oversight Board (United States) (“PCAOB”).

We have reviewed and discussed with senior management the Company’s audited financial statements for the year ended December 31, 2020 which are included in the Company’s 2020 Annual Report on Form 10-K. Management has confirmed to us that such financial statements (i) have been prepared with integrity and objectivity and are the responsibility of management and (ii) have been prepared in conformity with generally accepted accounting principles.

In discharging our oversight responsibility as to the audit process, we have discussed with PwC, the Company’s independent registered public accounting firm, the matters required to be discussed by the applicable requirements of the PCAOB and the SEC.

We have received the written disclosures and the letter from PwC concerning their communications with us concerning independence, as required by applicable requirements of the PCAOB, and we have discussed with PwC their independence.

Based upon the foregoing review and discussions with our independent registered public accounting firm and senior management of the Company, we recommended to our Board that the financial statements prepared by the Company’s management and audited by its independent registered public accounting firm be included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2020, that was filed with the SEC.

Submitted by the Audit Committee of the |

Board of Directors: |

|

Nancy Altobello — Chair |

William F. Cruger |

Kourtney Gibson |

Justin G. Gmelich |

|

| 2021 Proxy Statement | 25 |

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain information regarding the beneficial ownership of the Company’s Common Stock as of April 12, 2021 by (i) each person or group of persons known by us to beneficially own more than five percent of our Common Stock, (ii) each of our named executive officers, (iii) each of our directors and nominees for director and (iv) all of our directors and executive officers as a group.

The following table gives effect to the shares of Common Stock issuable within 60 days of April 12, 2021 upon the exercise of all options and other rights beneficially owned by the indicated stockholders on that date. Beneficial ownership is determined in accordance with Rule 13d-3 promulgated under Section 13 of the Securities Exchange Act of 1934, as amended, and includes voting and investment power with respect to shares. The percentage of beneficial ownership is based on 37,607,108 shares of Common Stock outstanding at the close of business on April 12, 2021. Except as otherwise noted below, each person or entity named in the following table has sole voting and investment power with respect to all shares of our Common Stock that he, she or it beneficially owns.

Unless otherwise indicated, the address of each beneficial owner listed below is c/o MarketAxess Holdings Inc., 55 Hudson Yards, 15th Floor, New York, New York 10001.

|

| Number of Shares Beneficially Owned |

|

| Percentage of Stock Owned |

| ||

5% Stockholders |

|

|

|

|

|

|

|

|

The Vanguard Group (1) |

|

| 4,165,820 |

|

|

| 11.08 | % |

BlackRock, Inc. (2) |

|

| 3,435,510 |

|

|

| 9.14 | % |

Named Executive Officers and Directors |

|

|

|

|

|

|

|

|

Richard M. McVey (3) |

|

| 545,992 |

|

|

| 1.45 | % |

Nancy Altobello (4) |

|

| 606 |

|

| * |

| |

Steven Begleiter (5) |

|

| 8,223 |

|

| * |

| |

Stephen P. Casper (6) |

|

| 53,408 |

|

| * |

| |

Jane Chwick (7) |

|

| 5,877 |

|

| * |

| |

Christopher Concannon (8) |

|

| 27,454 |

|

| * |

| |

William F. Cruger (9) |

|

| 4,892 |

|

| * |

| |

Kourtney Gibson (10) |

|

| 209 |

|

| * |

| |

Justin Gmelich (11) |

|

| 446 |

|

| * |

| |

Richard G. Ketchum (12) |

|

| 1,760 |

|

| * |

| |

Emily H. Portney (13) |

|

| 1,497 |

|

| * |

| |

Richard Prager (14) |

|

| 1,526 |

|

| * |

| |

John Steinhardt (15) |

|

| 21,313 |

|

| * |

| |

Antonio L. DeLise (16) |

|

| 17,041 |

|

| * |

| |

Kevin McPherson (17) |

|

| 91,265 |

|

| * |

| |

Scott Pintoff (18) |

|

| 4,979 |

|

| * |

| |

Christophe Roupie (19) |

|

| 8,331 |

|

| * |

| |

Nicholas Themelis (20) |

|

| 28,362 |

|

| * |

| |

All Executive Officers and Directors as a Group (18 persons) (21) |

|

| 823,181 |

|

|

| 2.19 | % |

* | Less than 1%. |

(1) | Information regarding the number of shares beneficially owned by The Vanguard Group was obtained from a Schedule 13G filed by The Vanguard Group with the SEC on February 10, 2021. The principal business address of The Vanguard Group is 100 Vanguard Blvd., Malvern, PA 19355. |

(2) | Information regarding the number of shares beneficially owned by BlackRock, Inc. was obtained from a Schedule 13G filed by BlackRock, Inc. with the SEC on January 29, 2021. The principal business address of BlackRock, Inc. is 55 East 52nd Street, New York, NY 10055. |

26 | 2021 Proxy Statement |

|

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

(3) | Consists of (i) 431,930 shares of Common Stock owned individually; (ii) 2,000 shares of Common Stock owned by immediate family members; (iii) 41,314 shares of unvested restricted stock; and (iv) 70,748 shares of Common Stock issuable pursuant to stock options granted to Mr. McVey that are or become exercisable within 60 days. Does not include (i) 160,877 shares of Common Stock issuable pursuant to stock options that are not exercisable within 60 days; (ii) 5,735 unvested restricted stock units; (iii) 285,452 deferred restricted stock units or (iv) 7,930 performance shares. |

(4) | Consists of (i) 368 shares of Common Stock owned individually; and (ii) 238 unvested restricted stock units that vest within 60 days. |

(5) | Consists of (i) 7,985 shares of Common Stock owned individually; and (ii) 238 unvested restricted stock units that vest within 60 days. Does not include 518 deferred restricted stock units. |

(6) | Consists of (i) 8,317 shares of Common Stock owned individually; (ii) 44,808 shares held indirectly in a trust for which Mr. Casper’s spouse is the trustee; and (iii) 283 unvested restricted stock units that vest within 60 days. |

(7) | Consists of (i) 5,153 shares of Common Stock owned individually; (ii) 238 unvested restricted stock units that vest within 60 days; and (iii) 486 deferred restricted stock units that will deliver within 60 days. |

(8) | Consists of (i) 8,540 shares of Common Stock owned individually; and (ii) 18,914 shares of unvested restricted stock. Does not include (i) 81,226 shares of Common Stock issuable pursuant to stock options that are not exercisable within 60 days; (ii) 15,522 unvested restricted stock units or (iii) 5,343 performance shares. |

(9) | Consists of (i) 4,654 shares of Common Stock owned individually; and (ii) 238 unvested restricted stock units that vest within 60 days. Does not include 972 deferred restricted stock units. |

(10) | Consists of 209 unvested restricted stock units that vest within 60 days. |