QuickLinks -- Click here to rapidly navigate through this document

The information in this prospectus supplement is not complete and may change. This prospectus supplement is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Filed Pursuant to Rule 424(b)(5)

File No. 333-139206

Subject to Completion, Dated May 9, 2007

Prospectus Supplement

(To Prospectus Dated February 2, 2007)

13,900,000 Shares

Class A Common Stock

We are selling 13,900,000 shares of our Class A common stock in this offering. This is an initial public offering of our Class A common stock as a separately traded security. Prior to this offering, no public market existed for the separate shares of our Class A common stock. Our shares of Class A common stock have been approved for listing on the New York Stock Exchange under the trading symbol "BGS." We anticipate the initial public offering price of our Class A common stock will be between $12.00 and $14.00.

We intend to use a portion of the proceeds to repurchase 6,762,455 shares of our Class B common stock, which are held by, among others, our former financial sponsor investors and certain of our executive officers. Accordingly, certain of our executive officers will receive a portion of the proceeds from this offering through such repurchase.

Our Enhanced Income Securities (EISs)™ are separately listed for trading on the American Stock Exchange under the trading symbol "BGF." Each EIS represents one share of our Class A common stock and $7.15 principal amount of our 12.0% senior subordinated notes due 2016. As of May 8, 2007, 20,000,000 shares of our Class A common stock were outstanding, all of which were represented by EISs. Holders of our EISs have the right to separate the EISs into the shares of Class A common stock and senior subordinated notes represented thereby at any time.

The underwriters have an option to purchase a maximum of 2,085,000 additional shares of Class A common stock.

Investing in our Class A common stock involves risks. See "Risk Factors" beginning on page S-12 of this prospectus supplement.

| | Price to Public | Underwriting Discounts and Commissions | Proceeds to B&G Foods | |||

|---|---|---|---|---|---|---|

| Per Share | $ | $ | $ | |||

| Total | $ | $ | $ |

Delivery of the shares of Class A common stock will be made on or about May , 2007.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus supplement or the prospectus to which it relates is accurate or complete. Any representation to the contrary is a criminal offense.

| CREDIT SUISSE | LEHMAN BROTHERS | |||

RBC CAPITAL MARKETS | ||||

The date of this prospectus supplement is May , 2007

PROSPECTUS SUPPLEMENT

| | Page | |

|---|---|---|

| Summary | S-1 | |

| Summary Historical and Pro Forma Consolidated Financial Data | S-9 | |

| Risk Factors | S-12 | |

| Special Note Regarding Forward-Looking Statements | S-21 | |

| Use of Proceeds | S-22 | |

| Market Price of EISs | S-23 | |

| Dividend Policy and Restrictions | S-24 | |

| Capitalization | S-28 | |

| Selected Historical Consolidated Financial Data | S-30 | |

| Unaudited Pro Forma Condensed Combined Financial Data | S-33 | |

| Management's Discussion and Analysis of Financial Condition and Results of Operations | S-39 | |

| Business | S-57 | |

| Our Management | S-68 | |

| Ownership of Capital Stock | S-71 | |

| Certain Relationships and Related Transactions | S-73 | |

| Description of Capital Stock | S-76 | |

| Description of Enhanced Income Securities (EISs) | S-85 | |

| Description of Certain Indebtedness | S-90 | |

| Shares Eligible for Future Sale | S-94 | |

| Material U.S. Federal Income Tax Considerations | S-95 | |

| Underwriting | S-99 | |

| Legal Matters | S-104 | |

| Experts | S-104 | |

| Where You Can Find More Information | S-104 | |

| Incorporation by Reference | S-105 | |

| Index to Consolidated Financial Statements | F-1 |

PROSPECTUS

| | Page | |

|---|---|---|

| About this Prospectus | i | |

| Special Note Regarding Forward-Looking Statements | ii | |

| The Company | 1 | |

| Use of Proceeds | 1 | |

| Risk Factors | 1 | |

| General Description of the Securities We May Offer | 2 | |

| Description of Capital Stock | 2 | |

| Description of Enhanced Income Securities (EISs) | 10 | |

| Description of Debt Securities | 16 | |

| Description of Warrants | 25 | |

| Description of Units | 27 | |

| Plan of Distribution | 28 | |

| Ratio of Earnings to Fixed Charges | 29 | |

| Legal Matters | 29 | |

| Experts | 29 | |

| Where You Can Find More Information | 30 | |

| Incorporation by Reference | 30 |

This document is in two parts. The first part is this prospectus supplement, which describes, adds to, updates and changes information contained in the accompanying prospectus and the documents incorporated by reference. The second part is the accompanying prospectus, which gives more general information. To the extent the information contained in this prospectus supplement differs or varies from the information contained in the accompanying prospectus or any document incorporated by reference, the information in this prospectus supplement controls.

You should rely only on the information contained in or incorporated by reference into this prospectus supplement and the accompanying prospectus or any free writing prospectus prepared by or on behalf of us, or on any information to which we have referred you. We have not authorized anyone to provide you with information that is different. This prospectus supplement is not an offer to sell or solicitation of an offer to buy these shares of Class A common stock in any circumstances under which the offer or sale is unlawful. You should not assume that the information we have included in this prospectus supplement or the accompanying prospectus is accurate as of any date other than the date of this prospectus supplement or the accompanying prospectus or that any information we have incorporated by reference is accurate as of any date other than the date of the document incorporated by reference regardless of the time of delivery of this prospectus supplement or of any such shares of our Class A common stock. Our financial condition, results of operations and business prospects may have changed since those dates.

S-i

The terms "B&G Foods," "our," "we" and "us," as used in this prospectus supplement, refer to B&G Foods, Inc. and its wholly-owned subsidiaries, except where it is clear that the term refers only to the parent company.

Throughout this prospectus supplement, we refer to our fiscal years ended December 28, 2002, January 3, 2004, January 1, 2005, December 31, 2005, December 30, 2006 and December 29, 2007 as "fiscal 2002," "fiscal 2003," "fiscal 2004," "fiscal 2005," "fiscal 2006" and "fiscal 2007," respectively, and we refer to our thirteen week periods ended April 1, 2006 and March 31, 2007 as "first quarter 2006" and "first quarter 2007," respectively.

The description of our business in this prospectus supplement reflects the acquisition of theCream of Wheat andCream of Rice brands from Kraft, effective February 25, 2007 (which we refer to in this prospectus supplement as the "Cream of Wheat acquisition"), unless the context otherwise requires.

In this prospectus supplement we rely on and refer to information and statistics regarding the food industry. We obtained this information and these statistics from various third-party sources, discussions with our customers and our own internal estimates. We believe that these sources and estimates are reliable. Unless otherwise indicated, all statements in this prospectus supplement regarding market share and brand position are measured by retail dollar share.

AC'CENT®, B&G®, B&M®,B&G SANDWICH TOPPERS®, BRER RABBIT®, CREAM OF RICE®, CREAM OF WHEAT®, COZY COTTAGE®, GRANDMA'S®, JOAN OF ARC®, LAS PALMAS®, MAPLE GROVE FARMS OF VERMONT®, ORTEGA®, POLANER®, POLANER ALL FRUIT®, REGINA®, SA-SÓN AC'CENT®, TRAPPEY'S®, UNDERWOOD®, VERMONT MAID®, andWRIGHT'S® are registered trademarks of our company or one of our subsidiaries, andBLOCH & GUGGENHEIMERTM, RED DEVILTMandSA-SÓNTM are trademarks of our company or one of our subsidiaries.

EMERIL'S® is a registered trademark of Emeril's Food of Love Productions, L.L.C. (EFLP).

Enhanced Income Securities (EISs)TM is a trademark owned by Royal Bank of Canada.

All other trademarks used in this prospectus supplement are trademarks or registered trademarks of their respective owners.

S-ii

This summary highlights certain information appearing elsewhere in this prospectus supplement and should be read together with the more detailed information and financial data and statements contained elsewhere in this prospectus supplement.

Overview

We manufacture, sell and distribute a diverse portfolio of high quality, shelf-stable food products. Many of our branded food products hold either the number one or number two market position in their relevant markets. Our business is characterized by a stable and growing revenue base from our existing product portfolio and is augmented by acquisitions of highly attractive, shelf-stable brands. On a consolidated basis, our operating income margin is among the highest in the packaged food industry. Additionally, we generate strong cash flows as a result of our attractive margins, efficient working capital management, modest capital expenditure requirements and tax efficiencies achieved through our acquisitions. We believe that these characteristics enable us to be a leader in successfully achieving sales growth for shelf-stable branded food products and executing an aggressive, disciplined acquisition strategy.

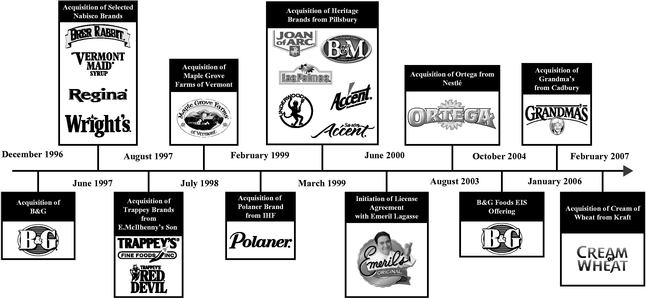

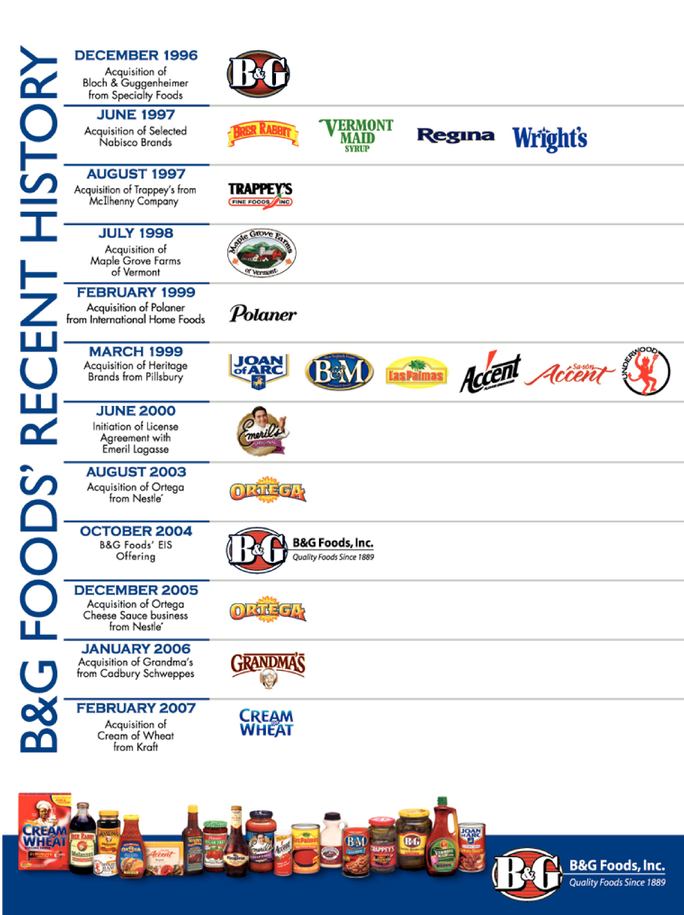

B&G Foods, including our subsidiaries and predecessors, has more than 100 years of experience in the marketplace. We have a well-established sales, marketing and distribution infrastructure that enables us to sell our products in all major U.S. food distribution channels. These channels include supermarkets, mass merchants, warehouse clubs, wholesalers, food service accounts, specialty food distributors, military commissaries and non-food outlets such as drug store chains and dollar stores. We have developed and leveraged this infrastructure through our acquisition of 18 high quality food brands since 1996. Our history includes a number of acquisitions of non-core brands from large, global packaged food companies, such as theB&M, Underwood, Ac'cent, Joan of Arc, Sa-són Ac'cent andLas Palmas brands from Pillsbury in 1999, theOrtega brand from Nestlé in 2003, theGrandma's Molasses brand from Cadbury Schweppes in January 2006 and our most recent acquisition of theCream of Wheat andCream of Rice brands from Kraft in February 2007. Based on our demonstrated record of successful acquisitions, we believe that we are well-positioned as a strategic acquirer of non-core brands from large, global packaged food companies.

Our first quarter 2007 net sales and EBITDA were $103.7 million and $21.1 million, respectively, as compared to first quarter 2006 net sales and EBITDA of $93.0 million and $17.5 million, respectively. Our fiscal 2006 net sales and EBITDA, pro forma for theCream of Wheat acquisition, were $473.1 million and $104.7 million, respectively. In comparison, our fiscal 2002 net sales and EBITDA were $293.7 million and $56.4 million, respectively. Beginning in fiscal 2007, we expect to spend approximately $3.5 million per year more than Kraft spent in fiscal 2006 in trade spending and consumer marketing to promote theCream of Wheat andCream of Rice businesses. If we had included such trade spending and consumer marketing in our pro forma results for fiscal 2006, our pro forma EBITDA would have been $101.2 million.

S-1

The following table summarizes our selected brand positions:

Retail Market Position of Selected Brands

| Brand | Category(1) | Retail Market Share Position(2) | ||

|---|---|---|---|---|

| Ortega | Taco Sauce | #1 National | ||

| Grandma's | Molasses | #1 National | ||

| Las Palmas | Enchilada Sauce | #1 California | ||

| Bloch & Guggenheimer | Pickles and Peppers | #1 Greater NY Metro | ||

| B&M | Baked Beans | #1 Boston | ||

| Regina | Wine Vinegar | #2 National | ||

| Cream of Wheat | Hot Cereal | #2 National | ||

| Polaner | All Fruit and Sugar Free Preserves | #2 National | ||

| Maple Grove Farms of Vermont | Pure Maple Syrup | #2 National | ||

| Emeril | Specialty Pasta Sauce(3) | #2 National | ||

| Wright's | Liquid Smoke | #2 National | ||

| Brer Rabbit | Molasses | #2 National | ||

| Underwood | Deviled Meats | Unique Product | ||

| Ac'cent | All-natural Flavor Enhancer | Unique Product |

- (1)

- Categories are as defined by Information Resources, Inc.

- (2)

- Based on retail dollar share in the corresponding market as of March 25, 2007.

- (3)

- We define the Specialty Pasta Sauce category as including brands where the average selling price is above $3.50/unit.

Our Competitive Strengths

We believe that our success in the packaged food industry and our financial results are due in large part to the following competitive strengths:

Portfolio of high-margin brands with leading market positions in key growth segments. We are focused on operating smaller, high-margin brands. We have assembled a diverse portfolio of brands consisting primarily of niche or specialty products with strong market positions and high operating income margins. Several of our brands compete in high growth categories that benefit from positive consumer spending trends. For example, ourCream of Wheat andPolaner Sugar Free Preserves products compete in the health and wellness market segment. OurOrtega, Las Palmas andSa-són Ac'cent brands compete in the U.S. Mexican and Hispanic market segment. Each of these categories has experienced among the highest growth in the packaged food industry. We believe that our diverse product portfolio provides a strong platform to capture growth in the packaged food industry and to generate strong profitability and significant cash flows while mitigating the financial impact of competitive pressure or commodity cost increases in any single brand or product.

Well-developed and proven acquisition platform. We believe that our focus on shelf-stable food products, favorable relationships with retailers, operations and marketing expertise and leading acquisition integration capabilities allow us to be highly successful in growing our product and brand portfolio. We have acquired and successfully integrated 18 shelf-stable food brands since 1996. We seek to acquire shelf-stable food products with leading market positions, identifiable growth opportunities and high and sustainable margins that will be accretive to our cash flows and return on capital. As a result, we seek to avoid brands in commodity driven categories. Our focus on shelf-stable branded food products allows us to drive attractive profitability and gain efficiencies from our sales and distribution and general and administrative systems. We believe that our acquisition expertise and ability to integrate businesses quickly lead to successful expansion of acquired brands and the realization of significant cost synergies. As a result, we believe that we are a preferred acquirer by large, global

S-2

packaged food companies for their non-core brands. We have successfully completed acquisitions from sellers such as Nabisco, Pillsbury, Nestlé, Cadbury Schweppes and Kraft. Our recent acquisition of theCream of Wheat business is an example of our ability to acquire a leading shelf-stable brand with high profitability from a large packaged food company. We often integrate sales, marketing and distribution and achieve enhanced profitability of acquired products and businesses within 30 days.

Track record of innovative new product introductions. We have demonstrated the ability to develop new products and product extensions rapidly, and we have been able to deliver these new products to our customers quickly. We have generally been able to develop these products from concept to final product and deliver these products to our customers' shelves within six months of development. We work directly with certain of our customers to implement new product introduction in markets where we expect significant growth.

Diversity of customers and distribution channels. We sell our products through all major U.S. food distribution channels, including supermarkets, mass merchants, warehouse clubs, wholesalers, food service accounts, specialty food distributors, military commissaries and non-food outlets such as drug store chains and dollar stores. We have strong, long standing, national relationships with all our major customers. Our customers include Wal-Mart, Kroger, Giant supermarkets, Safeway, Sysco, Target and Costco. The breadth of our multiple-channel sales and distribution system allows us to capitalize on above-average growth trends within certain of these distribution channels and expand distribution of acquired brands. Our diverse distribution channels have also contributed to our ability to maintain a broad customer base, with sales to our ten largest customers accounting for 43.6% of our net sales in fiscal 2006.

Strong cash flow generation. We have generated significant cash flows from our operations. Our strong financial performance is a result of our attractive operating income margins, efficient working capital management, modest capital expenditure requirements and tax efficiencies achieved through our acquisitions. Our core business, together with the newly-acquiredCream of Wheat business, positions us to continue generating strong cash flows.

Experienced management team with proven track record. Our management team has extensive food industry experience and long standing experience managing our company in a highly competitive environment. Our six most senior executives have an average of 14 years of experience with us. Our management team has acquired and integrated 18 businesses successfully since 1996 and has developed and implemented a business strategy which has enabled us to become a highly successful manufacturer and distributor of a diverse portfolio of shelf-stable branded food products.

Growth Strategy

Our goal is to continue to increase sales, profitability and cash flows by enhancing our existing portfolio of branded shelf-stable products and by capitalizing on our competitive strengths. We intend to implement our growth strategy through the following initiatives:

Expand brand portfolio with acquisitions of complementary branded businesses. We intend to continue expanding our brand portfolio by acquiring shelf-stable brands with leading market positions, strong brand equity, distribution expansion opportunities and compelling cost efficiencies at attractive valuations. We believe we can continue our track record of building and improving acquired brands post-acquisition through increased management focus and integration into our well-established manufacturing, sales, distribution and administrative infrastructure. We believe we are well-positioned as a preferred acquirer to capitalize on the trend of large packaged food companies divesting smaller, non-core, yet profitable, brands to increase their focus on their large, global brands.

S-3

Continue to develop innovative new products and deliver them to market quickly. We intend to continue to leverage our new product development capability and our sales and distribution breadth to introduce new products and product extensions. Our management has demonstrated the ability to launch innovative new products quickly. For example, new products we have introduced in recent years include theOrtega Grande Dinner Kit, theOrtega Pizza Kit,Ortega Salsa Con Queso,Ortega Salsa Verde,Polaner Sugar Free Preserves,Polaner Organic Preserves,B&M No Sugar Added Baked Beans andEmeril's Beef, Chicken and Organic Vegetable Stocks. We also have a number of new products that we expect to introduce in 2007.

Leverage our unique multiple-channel sales and distribution system. Our unique multiple-channel sales and distribution system allows us to capitalize on growth opportunities through the quick and efficient introduction of new and acquired products to our customers. We continue to strengthen our sales and distribution system in order to realize distribution economies of scale and provide an efficient, national platform for new products by expanding distribution channels, enlarging geographic reach, more effectively managing trade spending, improving packaging and introducing line extensions.

Continue to focus on higher growth customers and distribution channels. We sell our products through all major U.S. food distribution channels, including supermarkets, mass merchants, warehouse clubs, wholesalers, food service accounts, specialty food distributors, military commissaries and non-food outlets such as drug store chains and dollar stores. Our distribution breadth allows us to benefit from high growth channels such as mass merchants, warehouse and club stores, specialty food distributors, convenience stores, drug stores, vending machines and food services. We intend to continue to create products specific to our higher growth distribution channels and customers.

Recent Developments

Effective February 25, 2007, we successfully completed the acquisition of theCream of Wheat andCream of Rice hot cereal businesses from Kraft for $200.9 million, including transaction costs. We refer to these businesses collectively as theCream of Wheat business. Introduced in 1893,Cream of Wheat is among the leading and most widely recognized brands of hot cereals in the United States and is the number two brand in this category. For fiscal 2006, theCream of Wheat business generated net sales of $61.8 million while under Kraft's ownership. The brand was not a significant focus for Kraft over the past several years and, as a result, Kraft did not dedicate significant resources to growing the brand despite its strong profitability. We believe that theCream of Wheat andCream of Rice brands have a strong heritage and excellent name recognition and, therefore, have significant potential to grow through increased management focus and investment. We have completed the transition and integration of theCream of Wheat business into our sales, marketing and distribution infrastructure, and we have begun to implement a marketing strategy to enhance long-term growth. Beginning in fiscal 2007, we expect to spend approximately $3.5 million per year more than Kraft spent in fiscal 2006 in trade spending and consumer marketing to promote theCream of Wheat andCream of Rice businesses.

Our 2004 Offering of EISs and the Concurrent Offerings

Prior to the consummation of our EIS offering on October 14, 2004, which we refer to as our "2004 offering," we were known as B&G Foods Holdings Corp. and were majority-owned by Bruckmann, Rosser, Sherrill & Co., L.P. (BRS), a private equity investment firm, and minority-owned by management, directors and certain other investors.

In October 2004, we consummated the offering of 20,000,000 EISs and concurrent offerings of $22.8 million aggregate principal amount of 12.0% senior subordinated notes due 2016 separate from the EISs and $240.0 million aggregate principal amount of 8.0% senior notes due 2011, raising total net proceeds of $527.5 million. The 12.0% senior subordinated notes issued as part of the EISs and the

S-4

identical 12.0% senior subordinated notes sold separately from the EISs are referred to collectively as our "senior subordinated notes." We refer to the 8.0% senior notes as our "senior notes." Each EIS represents one share of our Class A common stock and $7.15 principal amount of our senior subordinated notes. See "Description of Enhanced Income Securities (EISs)" for a further discussion of the EISs.

Simultaneously with the 2004 offering, B&G Foods, Inc., our wholly owned subsidiary, merged with and into us and we were renamed B&G Foods, Inc. In addition, all of our then existing common stock was reclassified and converted into shares of Class B common stock. We used the proceeds of the 2004 offering and cash on hand to repay all then outstanding indebtedness, to repurchase all of our outstanding preferred stock from the existing stockholders, and to repurchase shares of our Class B common stock, options and warrants from the existing stockholders.

This Offering and the Related Transactions

This Offering

Pursuant to this prospectus supplement, we are offering 13,900,000 shares of our Class A common stock, or 15,985,000 shares of our Class A common stock assuming the underwriters' option to purchase additional shares of Class A common stock is exercised in full. The information in this prospectus supplement, unless otherwise indicated, does not take into account the exercise of the underwriters' option to purchase additional shares of Class A common stock.

The Related Transactions

Treatment of Class B Common Stock. In connection with this offering and the related transactions, including the application of proceeds from this offering, 6,762,455 shares of our Class B common stock will be repurchased for cash at the Class A common stock public offering price per share less underwriting discounts and commissions, and the remaining 793,988 shares held by management and former management will be exchanged for shares of our Class A common stock. There will not be any shares of Class B common stock outstanding after the completion of this offering and the related transactions.

Termination of Securities Holders Agreement, Registration Rights Agreement and Transaction Services Agreement. BRS and certain of our other former sponsor investors, entities and individuals affiliated with our former sponsor investors and certain present and former members of our board of directors and executive officers are parties to a second amended and restated securities holders agreement and a registration rights agreement with respect to the Class B common stock, EISs and corporate governance of B&G Foods and its subsidiaries. In addition, an affiliate of BRS is party to a transaction services agreement pursuant to which the BRS affiliate may be paid a transaction fee for management, financial and other corporate advisory services rendered by the BRS affiliate in connection with acquisitions, divestitures and financings by us. Upon the consummation of this offering, the securities holders agreement, the registration rights agreement and the transaction services agreement will be terminated. BRS will not receive any transaction fees associated with this offering and the related transactions. See "Certain Relationships and Related Transactions."

Repayment of Term Loan Borrowings. We expect to use a portion of the net proceeds from this offering to repay $85.3 million of term loan borrowings under our senior secured revolving credit facility (see Note 5 to our interim unaudited consolidated financial statements) which were incurred in connection with theCream of Wheat acquisition. See "Use of Proceeds."

Unless the context otherwise requires, references in this prospectus supplement to "this offering" refer to our offering of shares of Class A common stock, and references to "this offering and the

S-5

related transactions" refer, collectively, to this offering, the repurchase for cash or exchange for shares of Class A common stock of all of our outstanding shares of Class B common stock, the termination of the securities holders agreement, the registration right agreement and the transaction services agreement, the repayment of a portion of our term loan borrowings and the payment of fees and expenses related to these transactions.

We are a Delaware corporation. Our corporate headquarters are located at Four Gatehall Drive, Suite 110, Parsippany, New Jersey 07054, and our telephone number is (973) 401-6500. Our web site address is www.bgfoods.com. The information contained on our web site is not part of this prospectus supplement and is not incorporated in this prospectus supplement by reference.

S-6

Summary of the Offering and Our Common Stock

| Issuer | B&G Foods, Inc. | ||||

Common stock to be outstanding immediately following this offering: | |||||

Class A common stock outstanding prior to this offering | 20,000,000 shares. As of May 8, 2007, all 20,000,000 shares of Class A common stock were represented by EISs. Holders of our EISs have the right to separate the EISs into the shares of Class A common stock and senior subordinated notes represented thereby at any time, and upon separation, the shares of Class A common stock will be freely tradeable with the shares of Class A common stock issued in this offering. | ||||

Class A common stock issued in this offering | 13,900,000 shares, or 15,985,000 shares assuming the underwriters' option to purchase additional shares of Class A common stock is exercised in full. | ||||

Class B common stock outstanding prior to and following this offering | Until the completion of this offering, 7,556,443 shares of our Class B common stock will be outstanding. In connection with this offering and the related transactions, 6,762,455 shares of our Class B common stock will be repurchased for cash and the remaining 793,988 shares of our Class B common stock will be exchanged for shares of our Class A common stock on a one-for-one basis. There will not be any shares of Class B common stock outstanding after the completion of this offering and the related transactions. See "Use of Proceeds." | ||||

Total Class A common stock outstanding following this offering | 34,693,988 shares, or 36,778,988 shares assuming the underwriters' option to purchase additional shares of Class A common stock is exercised in full. | ||||

Class A common stock NYSE symbol | BGS. | ||||

Use of Proceeds | We intend to use the net proceeds of this offering to: | ||||

• | repurchase 6,762,455 shares of Class B common stock for $82.4 million based upon an assumed price of $13.00 per share; | ||||

• | repay approximately $85.3 million of our senior secured term loans incurred in connection with theCream of Wheat acquisition; and | ||||

• | pay related transaction fees and expenses of approximately $13.0 million. | ||||

Any additional proceeds will be used for general corporate purposes. | |||||

S-7

Current and former executive officers of our company currently hold 1,285,716 shares of our Class B common stock, and will receive a portion of the proceeds from the offering through the repurchase of 491,728 of such shares. See "Ownership of Capital Stock." | |||||

Affiliates of Credit Suisse Securities (USA) LLC and Lehman Brothers Inc. are lenders under our credit facility and, as such, will receive a portion of the proceeds from our repayment of term loan borrowings in connection with this offering. See "Underwriting—Other Arrangements; NASD Conduct Rules." | |||||

Voting rights | Subject to applicable law, each outstanding share of our Class A common stock and Class B common stock carries one vote per share and vote together as a single class on all matters presented to the stockholders for a vote. | ||||

Dividends | We have declared and paid quarterly dividends on our Class A common stock of $0.212 (equal to $0.848 per share annually) since the 2004 offering. We currently intend to continue paying dividends at this rate on our Class A common stock quarterly on January 30, April 30, July 30 and October 30 of each year to holders of record on the preceding December 31, March 31, June 30 and September 30, respectively. See "Dividend Policy and Restrictions" and "Risk Factors—Risks Relating to Our Securities and this Offering—You may not receive the level of dividends provided for in our dividend policy or any dividends at all." | ||||

Transfer restrictions | The shares of our Class A common stock offered hereby will be freely tradeable without restriction or further registration under the Securities Act unless they are purchased by "affiliates" as this term is defined in Rule 144 under the Securities Act of 1933. | ||||

Transfer agent | The Bank of New York is the transfer agent and registrar for our Class A common stock. | ||||

Book-entry form | The shares of Class A common stock offered hereby will initially be issued in book-entry form and will be represented by a global stock certificate. The shares will be fully-registered in the name of a nominee of The Depository Trust Company (DTC). | ||||

See "Description of Capital Stock" for a more detailed discussion of our common stock.

You should carefully consider the information under the caption "Risk Factors" and all other information in this prospectus supplement before investing in our Class A common stock.

S-8

SUMMARY HISTORICAL AND PRO FORMA CONSOLIDATED FINANCIAL DATA

The following summary historical and pro forma consolidated financial data should be read in conjunction with "Management's Discussion and Analysis of Financial Condition and Results of Operations," "Selected Historical Consolidated Financial Data," "Unaudited Pro Forma Condensed Combined Financial Data" and our audited and unaudited consolidated financial statements and notes to those statements included elsewhere in or incorporated by reference into this prospectus supplement. Our historical consolidated statement of operations data for fiscal 2005 and fiscal 2006 have been derived from our audited consolidated financial statements included elsewhere in this prospectus supplement. Our historical consolidated statements of operations data for first quarter 2006 and first quarter 2007 have been derived from our unaudited consolidated financial statements included elsewhere in this prospectus supplement. First quarter 2007 includes results of theCream of Wheat business from and after February 25, 2007.

The following unaudited pro forma statement of operations data for fiscal 2006 reflects the effect of theCream of Wheat acquisition as if it had occurred on January 1, 2006. The unaudited pro forma consolidated financial data do not purport to represent what our results would have been if theCream of Wheat acquisition and the relating financing transaction had occurred at the dates indicated and it does not purport to represent a projection of our future results. Furthermore, no effect has been given in the unaudited pro forma statement of operations data for synergistic benefits that may be realized through the combination of B&G Foods and theCream of Wheat business; the costs that will be incurred in integrating the operations of theCream of Wheat business, including estimated additional capital expenditures of approximately $8.0 million in the aggregate expected to be incurred over the course of fiscal 2007 and fiscal 2008; or approximately $3.5 million per year more than Kraft spent in fiscal 2006 in trade spending and consumer marketing that we expect to spend beginning in fiscal 2007 to promote theCream of Wheat business.

| | Fiscal 2005 | Fiscal 2006 | Fiscal 2006 | First Quarter 2006 | First Quarter 2007 | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | Actual | Actual | Pro Forma | Actual | Actual | |||||||||||

| | | | (Unaudited) | (Unaudited) | (Unaudited) | |||||||||||

| | (Dollars in thousands) | |||||||||||||||

| Consolidated Statement of Operations Data(1): | ||||||||||||||||

| Net sales | $ | 379,262 | $ | 411,306 | $ | 473,148 | $ | 92,980 | $ | 103,745 | ||||||

| Cost of goods sold | 271,929 | 297,053 | 320,323 | 65,114 | 71,062 | |||||||||||

| Cost of goods sold—restructuring charge | 3,839 | — | — | — | — | |||||||||||

| Gross profit | 103,494 | 114,253 | 152,825 | 27,866 | 32,683 | |||||||||||

| Sales, marketing and distribution expenses | 41,522 | 45,343 | 48,374 | 10,481 | 11,504 | |||||||||||

| General and administrative expenses | 6,965 | 7,688 | 7,864 | 1,688 | 1,830 | |||||||||||

| Gain on sale of property, plant and equipment(2) | — | (525 | ) | (525 | ) | — | — | |||||||||

| Amortization expense—customer relationships(3) | — | 731 | 6,426 | — | 663 | |||||||||||

| Operating income | 55,007 | 61,016 | 90,686 | 15,697 | 18,686 | |||||||||||

| Interest expense, net | 41,767 | 43,481 | 58,886 | 10,858 | 12,125 | |||||||||||

| Income before income tax expense | 13,240 | 17,535 | 31,800 | 4,839 | 6,561 | |||||||||||

| Income tax expense | 5,235 | 5,962 | 11,368 | 1,887 | 2,487 | |||||||||||

| Net income | $ | 8,005 | $ | 11,573 | $ | 20,432 | $ | 2,952 | $ | 4,074 | ||||||

S-9

| | Fiscal 2005 | Fiscal 2006 | Fiscal 2006 | First Quarter 2006 | First Quarter 2007 | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | Actual | Actual | Pro Forma | Actual | Actual | |||||||||||

| | | | (Unaudited) | (Unaudited) | (Unaudited) | |||||||||||

| | (Dollars in thousands) | |||||||||||||||

| Other Financial Data(1): | ||||||||||||||||

EBITDA(4) | $ | 61,919 | $ | 69,000 | $ | 104,651 | $ | 17,468 | $ | 21,144 | ||||||

Net cash provided by operating activities | 22,523 | 32,771 | N/A | 8,648 | 4,817 | |||||||||||

| Capital expenditures | (6,659 | ) | (7,306 | ) | N/A | (1,592 | ) | (2,283 | ) | |||||||

| Payments for acquisition of businesses | (2,513 | ) | (30,102 | ) | N/A | (30,085 | ) | (200,887 | ) | |||||||

| Net proceeds from sale of property, plant and equipment | — | 1,275 | N/A | — | — | |||||||||||

| Net cash (used in) provided by financing activities | (16,448 | ) | 7,621 | N/A | 20,356 | 196,769 | ||||||||||

The table below shows our summary balance sheet data as of March 31, 2007 on an actual basis derived from our unaudited consolidated financial statements included elsewhere in this prospectus supplement and on an as adjusted basis to reflect the application of the proceeds of this offering and the related transactions as if they had occurred on March 31, 2007.

| | As of March 31, 2007 | |||||

|---|---|---|---|---|---|---|

| | Actual | As Adjusted | ||||

| | (Unaudited) | (Unaudited) | ||||

| | (Dollars in thousands) | |||||

| Summary Balance Sheet Data: | ||||||

| Cash and cash equivalents | $ | 28,046 | $ | 28,046 | ||

| Total assets | 830,225 | 828,679 | ||||

| Long-term debt | 635,800 | 550,456 | ||||

| Total stockholders' equity(6)(7) | 74,639 | 158,437 | ||||

- (1)

- We completed the acquisition of theOrtega food service dispensing pouch and dipping cup cheese sauce businesses from Nestlé on December 1, 2005, which we refer to in this prospectus supplement as the "Ortega food service dispensing pouch and dipping cup acquisition." We completed the acquisition of theGrandma's molasses business from Cadbury Schweppes, on January 10, 2006, which we refer to in this prospectus supplement as theGrandma's molasses acquisition. We completed theCream of Wheat acquisition, effective February 25, 2007. TheOrtega food service dispensing pouch and dipping cups acquisition, theGrandma's molasses acquisition and theCream of Wheat acquisition have been accounted for using the purchase method of accounting and, accordingly, the assets acquired, liabilities assumed and results of operations of the acquired businesses are included in our consolidated financial statements from the respective dates of acquisition. These acquisitions and the application of the purchase method of accounting for these acquisitions affect comparability between periods.

- (2)

- The gain on sale of property, plant and equipment of $0.5 million in fiscal 2006 relates to the sale of our New Iberia, Louisiana manufacturing facility on July 9, 2006.

- (3)

- Amortization expense of customer relationships are amortized over their useful lives of 20 years and includes the amortization expense relating to the amortization of customer relationship intangibles acquired in theGrandma's molasses acquisition and theCream of Wheat acquisition. Amortization expense of customer relationship intangibles acquired in theGrandma's molasses acquisition was $0.7 million for fiscal 2006 and $0.0 million and $0.2 million for first quarter 2006 and first quarter 2007, respectively. Amortization expense of customer relationship intangibles acquired in theCream of Wheat acquisition was $0.5 million for first quarter 2007. We had no customer relationship intangibles in fiscal 2005.

- (4)

- EBITDA is a measure used by management to measure operating performance. EBITDA is defined as net income before net interest expense, income taxes, depreciation, and amortization. Management believes that it is useful to eliminate net interest expense, income taxes, depreciation, and amortization because it allows management to focus on what it deems to be a more reliable indicator of ongoing operating performance and our ability to generate cash flow from operations. We use EBITDA in our business operations, among other things, to evaluate our operating performance, develop budgets and measure our performance against those budgets, determine employee bonuses and evaluate our cash flows in terms of cash

S-10

needs. We also present EBITDA because we believe it is a useful indicator of our historical debt capacity and ability to service debt and because covenants in our credit facility and the indentures governing the senior notes and the senior subordinated notes contain ratios based on these measures. As a result, internal management reports used during monthly operating reviews feature the EBITDA metric. However, management uses this metric in conjunction with traditional GAAP operating performance and liquidity measures as part of its overall assessment of company performance and liquidity and therefore does not place undue reliance on this measure as its only measure of operating performance and liquidity.

- EBITDA is not a recognized term under GAAP and does not purport to be an alternative to operating income or net income as an indicator of operating performance or any other GAAP measure. EBITDA is not a complete net cash flow measure because EBITDA is a measure of liquidity that does not include reductions for cash payments for an entity's obligation to service its debt, fund its working capital, capital expenditures and acquisitions, if any, and pay its income taxes and dividends, if any. Rather, EBITDA is a potential indicator of an entity's ability to fund these cash requirements. EBITDA also is not a complete measure of an entity's profitability because it does not include costs and expenses for depreciation and amortization, interest and related expenses and income taxes. Because not all companies use identical calculations, this presentation of EBITDA may not be comparable to other similarly-titled measures of other companies. However, EBITDA can still be useful in evaluating our performance against our peer companies because management believes this measure provides users with valuable insight into key components of GAAP amounts. For example, a company with greater GAAP net income may not be as appealing to investors if its net income is more heavily comprised of gains on asset sales. Likewise, eliminating the effects of interest income and expense reduces the impact of a company's capital structure on its performance. In addition, removing the provision for income taxes from EBITDA permits users to assess returns on a pre-tax basis.

- The following is a reconciliation of EBITDA to net income for the periods presented below:

| | Fiscal 2005 | Fiscal 2006 | Fiscal 2006 | First Quarter 2006 | First Quarter 2007 | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | Actual | Actual | Pro Forma | Actual | Actual | ||||||||||

| | | | (Unaudited) | (Unaudited) | (Unaudited) | ||||||||||

| | (Dollars in thousands) | ||||||||||||||

| Net income | $ | 8,005 | $ | 11,573 | $ | 20,432 | $ | 2,952 | $ | 4,074 | |||||

| Income tax expense | 5,235 | 5,962 | 11,368 | 1,887 | 2,487 | ||||||||||

| Interest expense, net | 41,767 | 43,481 | 58,886 | 10,858 | 12,125 | ||||||||||

| Depreciation and amortization | 6,912 | 7,984 | 13,965 | 1,771 | 2,458 | ||||||||||

| EBITDA | $ | 61,919 | $ | 69,000 | $ | 104,651 | (5) | $ | 17,468 | $ | 21,144 | ||||

- (5)

- Beginning in fiscal 2007, we expect to spend approximately $3.5 million per year more than Kraft spent in fiscal 2006 in trade spending and consumer marketing to promote theCream of Wheat business. If we had included such trade spending and consumer marketing expenses in our pro forma results for fiscal 2006, our pro forma EBITDA would have been $101.2 million.

- (6)

- We adopted SFAS No. 158, "Employer's Accounting for Defined Benefit Pension and Other Postretirement Plans, an Amendment of FASB Statements No. 87, 88, 106, and 132R" (SFAS No. 158) effective December 30, 2006. For fiscal 2006, the adoption of SFAS No. 158 resulted in the recognition of an incremental $2.6 million of additional pension obligations, an increase in deferred tax assets of $1.0 million and a decrease to stockholders' equity of $1.6 million, with no impact to our statements of operations or cash flows. See "Management's Discussion and Analysis of Financial Condition and Results of Operations—Recent Accounting Pronouncements."

- (7)

- We adopted SAB No. 108, "Considering the Effects of Prior Year Misstatements when Quantifying Misstatements in Current Year Financial Statements" (SAB No. 108) effective January 1, 2006. The adoption of SAB No. 108 allowed a one-time transitional cumulative effect adjustment to beginning retained earnings as of January 1, 2006 for errors that were not previously deemed material, but are material under the guidance in SAB No. 108. In accordance with SAB No. 108, we have adjusted our opening accumulated deficit for fiscal 2006 in the amount of $0.6 million to re-establish certain deferred tax liabilities that were reversed prior to fiscal 2001. See "Management's Discussion and Analysis of Financial Condition and Results of Operations—Recent Accounting Pronouncements."

S-11

An investment in the shares of our Class A common stock involves a number of risks. In addition to the other information contained in this prospectus supplement, prospective investors should give careful consideration to the following risk factors. Any of the following risks could materially and adversely affect our business, consolidated financial condition, results of operations or liquidity. In that case, the market price for our Class A common stock could decline and you may lose all or part of your investment.

Risks Specific to Our Company

The packaged food industry is highly competitive.

The packaged food industry is highly competitive. Numerous brands and products, including private label products, compete for shelf space and sales, with competition based primarily on product quality, convenience, price, trade promotion, brand recognition and loyalty, customer service, effective consumer advertising and promotional activities and the ability to identify and satisfy emerging consumer preferences. We compete with a significant number of companies of varying sizes, including divisions or subsidiaries of larger companies. Many of these competitors have multiple product lines, substantially greater financial and other resources available to them and may have lower fixed costs and/or are substantially less leveraged than our company. If we are unable to continue to compete successfully with these companies or if competitive pressures or other factors cause our products to lose market share or result in significant price erosion, our business, consolidated financial condition, results of operations or liquidity could be materially and adversely affected.

We may be unable to maintain our profitability in the face of a consolidating retail environment.

Our largest customer, Wal-Mart, accounted for 10.4% of our fiscal 2006 net sales, and our ten largest customers together accounted for 43.6% of our fiscal 2006 net sales. As the retail grocery trade continues to consolidate and our retail customers grow larger and become more sophisticated, our retail customers may demand lower pricing and increased promotional programs. Further, these customers are reducing their inventories and increasing their emphasis on private label products. If we fail to use our marketing expertise and unique products and category leadership positions to respond to these trends, or if we lower our prices or increase promotional support of our products and are unable to increase the volume of our products sold, our profitability may be adversely affected.

We are vulnerable to decreases in the supply and increases in the price of raw materials and labor, manufacturing, distribution and other costs, and we may not be able to offset increasing costs by increasing prices to our customers.

We purchase agricultural products, meat and poultry, other raw materials and packaging supplies from growers, commodity processors, other food companies and packaging manufacturers. While all such materials are available from numerous independent suppliers, raw materials and packaging supplies are subject to increases in price attributable to a number of factors, including changes in crop size, federal and state agricultural programs, export demand, energy and fuel costs, weather conditions during the growing and harvesting seasons, insects, plant diseases and fungi, and glass and metal prices. Although we enter into advance commodities purchase agreements from time to time, these contracts do not protect us from all increases in raw material costs. In addition, the cost of labor, manufacturing, energy, fuel, packaging materials, pork and chicken and other costs related to the production and distribution of our food products have risen in recent years, and we believe that they may continue to rise in the foreseeable future. If the cost of labor, raw materials or manufacturing or other costs of production and distribution of our food products continue to increase, and we are unable to fully offset these increases by raising prices or other measures, our profitability and financial condition could be negatively impacted.

S-12

We may be unable to offset any reduction in, or increase, net sales in our mature food product categories through an increase in trade spending for these categories or an increase in net sales in other categories.

Most of our food product categories are mature and certain categories have experienced declining consumption rates from time to time. If consumption rates and sales in our mature food product categories decline, our revenue and operating income may be adversely affected, and we may not be able to offset this decrease in business with increased trade spending or an increase in sales or profitability of other products and product categories.

We may have difficulties integrating recent or future acquisitions or identifying new acquisitions.

We completed theCream of Wheat acquisition in February 2007 and we expect to pursue additional acquisitions of food product lines and businesses. However, we may be unable to identify additional acquisitions or may be unable to successfully integrate and manage the product lines or businesses that we have recently acquired or that we may acquire in the future. In addition, we may be unable to achieve a substantial portion of any anticipated cost savings from recent or future acquisitions or other anticipated benefits in the timeframe we anticipate, or at all. In addition, any acquired product lines or businesses may require a greater amount of trade, promotional and capital spending than we anticipate. Historically, we have grown net sales for some but not all of the brands we have acquired. Acquisitions involve numerous risks, including difficulties in the assimilation of the operations, technologies, services and products of the acquired companies, personnel turnover and the diversion of management's attention from other business concerns. Any inability by us to integrate and manage any acquired product lines or businesses in a timely and efficient manner, any inability to achieve a substantial portion of any anticipated cost savings or other anticipated benefits from these acquisitions in the time frame we anticipate or any unanticipated required increases in trade, promotional or capital spending could adversely affect our business, consolidated financial condition, results of operations or liquidity. Moreover, future acquisitions by us could result in our incurring substantial additional indebtedness, being exposed to contingent liabilities or incurring the impairment of goodwill and other intangible assets, all of which could adversely affect our financial condition, results of operations and liquidity.

We have substantial indebtedness, which could restrict our ability to pay dividends and consummate acquisitions and impact our financing options and liquidity position.

At March 31, 2007, we had total long-term indebtedness of $635.8 million. Following the completion of this offering, we expect to have total long-term indebtedness of $550.5 million. Our ability to pay dividends is subject to contractual restrictions contained in the instruments governing our indebtedness. While our credit facility, our senior notes indenture and our senior subordinated notes indenture contain covenants that restrict our ability to incur debt, as long as we meet these covenants we will be allowed to incur additional indebtedness. The degree to which we are leveraged on a consolidated basis could have important consequences to the holders of our Class A common stock, including:

- •

- our ability in the future to obtain additional financing for working capital, capital expenditures or acquisitions may be limited;

- •

- we may not be able to refinance our indebtedness when it comes due, on terms acceptable to us or at all;

- •

- a significant portion of our cash flow is likely to be dedicated to the payment of interest on our indebtedness, thereby reducing funds available for future operations, capital expenditures, acquisitions and/or dividends on our Class A common stock; and

S-13

- •

- we may be more vulnerable to economic downturns and be limited in our ability to withstand competitive pressures.

We are subject to restrictive debt covenants and other requirements related to our debt that limit our business flexibility by imposing operating and financial restrictions on our operations.

The agreements governing our indebtedness impose significant operating and financial restrictions on us. These restrictions prohibit or limit, among other things:

- •

- the incurrence of additional indebtedness and the issuance of certain preferred stock or redeemable capital stock;

- •

- the payment of dividends on, and purchase or redemption of, capital stock;

- •

- a number of other restricted payments, including investments;

- •

- specified sales of assets;

- •

- specified transactions with affiliates;

- •

- the creation of a number of liens; and

- •

- consolidations, mergers and transfers of all or substantially all of our assets.

Our credit facility and our senior notes indenture include other and more restrictive covenants and prohibit us from prepaying our other indebtedness, including our senior subordinated notes, while senior indebtedness is outstanding. Our credit facility requires us to maintain specified financial ratios and satisfy financial condition tests, including, without limitation, the following: a maximum leverage ratio, a minimum interest coverage ratio and a maximum senior leverage ratio.

Our ability to comply with the ratios or tests may be affected by events beyond our control, including prevailing economic, financial and industry conditions. A breach of any of these covenants, or failure to meet or maintain ratios or tests could result in a default under our credit facility, the terms of our senior notes indenture and/or our senior subordinated notes indenture. Certain events of default under our credit facility and the terms of our senior notes indenture would prohibit us from making payments on our senior subordinated notes, including payment of interest when due, and from paying dividends on our common stock. In addition, upon the occurrence of an event of default under our credit facility or the terms of our senior notes indenture, the lenders could elect to declare all amounts outstanding under our credit facility and our senior notes, together with accrued interest, to be immediately due and payable. If we were unable to repay those amounts, the lenders could proceed against the security granted to them to secure that indebtedness. If the lenders accelerate the payment of the indebtedness, our assets may not be sufficient to repay in full this indebtedness and our other indebtedness, including our senior subordinated notes.

We rely on co-packers for a significant portion of our manufacturing needs, and the inability to enter into additional or future co-packing agreements may result in our failure to meet customer demand.

We rely upon co-packers for a significant portion of our manufacturing needs. The success of our business depends, in part, on maintaining a strong sourcing and manufacturing platform. We believe that there are a limited number of competent, high-quality co-packers in the industry, and if we were required to obtain additional or alternative co-packing agreements or arrangements in the future, we can provide no assurance that we would be able to do so on satisfactory terms or in a timely manner. Our inability to enter into satisfactory co-packing agreements could limit our ability to implement our business plan or meet customer demand.

S-14

We rely on the performance of major retailers, wholesalers, specialty distributors and mass merchants for the success of our business, and should they perform poorly or give higher priority to other brands or products, our business could be adversely affected.

We sell our products principally to retail outlets and wholesale distributors including, traditional supermarkets, mass merchants, warehouse clubs, wholesalers, food service accounts, specialty food distributors, military commissaries and non-food outlets such as drug store chains and dollar stores. The replacement by or poor performance of our major wholesalers, retailers or chains or our inability to collect accounts receivable from our customers could materially and adversely affect our results of operations and financial condition. In addition, our customers offer branded and private label products that compete directly with our products for retail shelf space and consumer purchases. Accordingly, there is a risk that our customers may give higher priority to their own products or to the products of our competitors. In the future, our customers may not continue to purchase our products or provide our products with adequate levels of promotional support.

We may be unable to anticipate changes in consumer preferences, which may result in decreased demand for our products.

Our success depends in part on our ability to anticipate and offer products that appeal to the changing tastes, dietary habits and product packaging preferences of consumers in the market categories in which we compete. If we are not able to anticipate, identify or develop and market products that respond to these changes in consumer preferences, demand for our products may decline and our operating results may be adversely affected. In addition, we may incur significant costs related to developing and marketing new products or expanding our existing product lines in reaction to what we perceive to be increased consumer preference or demand. Such development or marketing may not result in the volume of sales or profitability anticipated.

Severe weather conditions and natural disasters can affect crop supplies and reduce our operating results.

Severe weather conditions and natural disasters, such as floods, droughts, frosts, earthquakes or pestilence, may affect the supply of the raw materials that we use for our products. Our maple syrup products, for instance, are particularly susceptible to severe freezing conditions in Québec, Canada and Vermont during the season in which maple syrup is produced. Competing manufacturers can be affected differently by weather conditions and natural disasters depending on the location of their supplies. If our supplies of raw materials are reduced, we may not be able to find supplemental supply sources on favorable terms or at all, which could adversely affect our business and operating results.

We are subject to environmental laws and regulations relating to hazardous materials, substances and waste used in or resulting from our operations. Liabilities or claims with respect to environmental matters could have a significant negative impact on our business.

As with other companies engaged in similar businesses, the nature of our operations expose us to the risk of liabilities and claims with respect to environmental matters, including those relating to the disposal and release of hazardous substances. Furthermore, our operations are governed by laws and regulations relating to workplace safety and worker health which, among other things, regulate employee exposure to hazardous chemicals in the workplace. Any material costs incurred in connection with such liabilities or claims could have a material adverse effect on our business, consolidated financial condition, results of operations or liquidity. Any environmental or health and safety legislation or regulations enacted in the future, or any changes in how existing or future laws or regulations will be enforced, administered or interpreted may lead to an increase in compliance costs or expose us to additional risk of liabilities and claims, which could have a material adverse effect on our business, consolidated financial condition, results of operations or liquidity.

S-15

Our operations are subject to numerous laws and governmental regulations, exposing us to potential claims and compliance costs that could adversely affect our business.

Our operations are subject to extensive regulation by the U.S. Food and Drug Administration (FDA), the U.S. Department of Agriculture (USDA) and other national, state and local authorities. For example, we are subject to the Food, Drug and Cosmetic Act and regulations promulgated thereunder by the FDA. This comprehensive regulatory program governs, among other things, the manufacturing, composition and ingredients, packaging and safety of foods. Under this program the FDA regulates manufacturing practices for foods through its current "good manufacturing practices" regulations and specifies the recipes for certain foods. Furthermore, our processing facilities and products are subject to periodic inspection by federal, state and local authorities. Any changes in these laws and regulations could increase the cost of developing and distributing our products and otherwise increase the cost of conducting our business, which would adversely affect our financial condition and results of operations. In addition, failure by us to comply with applicable laws and regulations, including future laws and regulations, could subject us to civil remedies, including fines, injunctions, recalls or seizures, as well as potential criminal sanctions, which could have a material adverse effect on our business, consolidated financial condition, results of operations or liquidity. See "Business—Government Regulation."

Failure by third-party co-packers to comply with environmental or other regulations may disrupt our supply of certain products and adversely affect our business.

We rely on co-packers to produce certain of our products. Such co-packers, whether in the United States or outside the United States, are subject to a number of regulations, including environmental regulations. Failure by any of our co-packers to comply with regulations, or allegations of compliance failure, may disrupt their operations. Disruption of the operations of a co-packer could disrupt our supply of product, which could have an adverse effect on our business, consolidated financial condition, results of operations or liquidity. Additionally, actions we may take to mitigate the impact of any such disruption or potential disruption, including increasing inventory in anticipation of a potential production interruption, may adversely affect our results of operations.

We may be subject to significant liability should the consumption of any of our products cause injury, illness or death.

The sale of food products for human consumption involves the risk of injury to consumers. Such injuries may result from tampering by unauthorized third parties or product contamination or spoilage, including the presence of foreign objects, substances, chemicals, other agents or residues introduced during the growing, manufacturing, storage, handling or transportation phases of production. We have from time to time been involved in product liability lawsuits, none of which have been material to our business. While we are subject to governmental inspection and regulations and believe our facilities comply in all material respects with all applicable laws and regulations, if the consumption of any of our products causes, or is alleged to have caused, a health-related illness in the future we may become subject to claims or lawsuits relating to such matters. Even if a product liability claim is unsuccessful or is not fully pursued, the negative publicity surrounding any assertion that our products caused injury, illness or death could adversely affect our reputation with existing and potential customers and our corporate and brand image. Moreover, claims or liabilities of this sort might not be covered by our insurance or by any rights of indemnity or contribution that we may have against others. We maintain product liability insurance in an amount that we believe to be adequate. However, we cannot be sure that we will not incur claims or liabilities for which we are not insured or that exceed the amount of our insurance coverage.

Furthermore, our products could potentially suffer from product tampering, contamination or spoilage or be mislabeled or otherwise damaged. Under certain circumstances, we may be required to recall products, leading to a material adverse effect on our business. Even if a situation does not

S-16

necessitate a recall, product liability claims might be asserted against us. A product liability judgment against us or a product recall could have a material adverse effect on our business, consolidated financial condition, results of operations or liquidity.

Consumer concern regarding genetically modified organisms or health concerns could adversely affect sales of certain of our products.

If consumers in our principal markets lose confidence in the safety and quality of our products even without a product liability claim or a product recall, our business could be adversely affected. The food industry is subject to scrutiny relating to genetically modified organisms and the health implications of obesity. We have been and will continue to be impacted by publicity concerning the ingredients and health implications of food products generally, which could negatively influence consumer perception and acceptance of our products and marketing programs. Developments in any of these areas could cause our results to differ materially from results that have been or may be projected.

Risk associated with foreign suppliers and co-packers, including changes in import/export duties, wage rates, political or economic climates, or exchange rates, may adversely affect our operations.

Our relationships with foreign suppliers and co-packers subject us to the risks of doing business outside the United States. The countries from which we source our products may be subject to political and economic instability, and may periodically enact new or revise existing laws, taxes, duties, quotas, tariffs, currency controls or other restrictions to which we are subject. Our products are subject to import duties and other restrictions, and the U.S. government may periodically impose new or revise existing duties, quotas, tariffs or other restrictions to which we are subject. In addition, changes in respective wage rates among the countries from which we and our competitors source product could substantially impact our competitive position. Changes in exchange rates, import/export duties or relative international wage rates applicable to us or our competitors could adversely impact our business, financial condition and results of operations. These changes may impact us in a different manner than our competitors.

Litigation regarding our trademarks and any other proprietary rights and intellectual property infringement claims may have a significant negative impact on our business.

We own 113 trademarks that are registered in the United States, 29 trademarks that are registered with certain U.S. states and Puerto Rico, and 401 trademarks that are registered in foreign countries as of May 2, 2007. In addition, we have 14 trademark applications pending in the United States and foreign countries. We consider our trademarks to be of significant importance in our business. If the actions we take to establish and protect our trademarks and other proprietary rights are not adequate to prevent imitation of our products by others or to prevent others from seeking to block sales of our products as an alleged violation of their trademarks and proprietary rights, it may be necessary for us to initiate or enter into litigation in the future to enforce our trademark rights or to defend ourselves against claimed infringement of the rights of others. Any legal proceedings could result in an adverse determination that could have a material adverse effect on our business, consolidated financial condition, results of operations or liquidity.

Our financial well-being could be jeopardized by unforeseen changes in our employees' collective bargaining agreements, shifts in union policy or labor disruptions in the food industry.

As of December 30, 2006, approximately 284 of our 721 employees were covered by collective bargaining agreements. A prolonged work stoppage or strike at any of our facilities with union employees or a significant work disruption from other labor disputes in the food or related industries could have a material adverse effect on our business, consolidated financial condition, results of operations or liquidity. In addition, if prior to the expiration of any of our existing collective bargaining agreements we are unable to reach new agreements without union action or any such new agreements

S-17

are not on terms satisfactory to us, our business, consolidated financial condition, results of operations or liquidity could be materially and adversely affected.

If we are unable to retain our key management personnel, our growth and future success may be impaired and our results of operations could suffer as a result.

Our success depends to a significant degree upon the continued contributions of senior management, certain of whom would be difficult to replace. As a result, departure by members of our senior management could have a material adverse effect on our business and results of operations. In addition, we do not maintain key-man life insurance on any of our executive officers.

We are a holding company and we rely on dividends, interest and other payments, advances and transfers of funds from our subsidiaries to meet our obligations.

We are a holding company, with all of our assets held by our direct and indirect subsidiaries, and we rely on dividends and other payments or distributions from our subsidiaries to meet our obligations and to enable us to pay dividends. The ability of our subsidiaries to pay dividends or make other payments or distributions to us depends on their respective operating results and may be restricted by, among other things, the laws of their jurisdiction of organization (which may limit the amount of funds available for the payment of dividends), agreements of those subsidiaries, our credit facility, the terms of our senior notes indenture and our senior subordinated notes indenture, and the covenants of any future outstanding indebtedness we or our subsidiaries incur.

Future changes that increase cash taxes payable by us could significantly decrease our future cash flow available to make dividend payments with respect to our securities.

We are able to amortize goodwill and certain intangible assets within the meaning of Section 197 of the Internal Revenue Code of 1986. After giving effect to theCream of Wheat acquisition (which will increase our amortization of intangibles for tax purposes), we expect to be able to amortize for tax purposes approximately $29.1 million annually through 2007, approximately $31.3 million for fiscal 2008 through 2011, approximately $29.6 million for fiscal 2012, approximately $28.1 million for fiscal 2013, approximately $23.4 million for fiscal 2014, approximately $22.2 million for fiscal 2015 through 2017, approximately $19.6 million for fiscal 2018, approximately $15.2 million for fiscal 2019 and 2020, approximately $13.2 million for fiscal 2021 and approximately $2.2 million for fiscal 2022. If there is a change in U.S. federal tax policy that reduces any of these available deductions or results in an increase in our corporate tax rate, our cash taxes payable may increase, which could significantly reduce our future cash and impact our ability to make dividend payments.

Risks Relating to our Securities and this Offering

You may not receive the level of dividends provided for in our dividend policy or any dividends at all.

Dividend payments are not mandatory or guaranteed, and holders of our common stock do not have any legal right to receive, or require us to pay, dividends. Our board of directors may, in its sole discretion, decrease the level of dividends provided for in our dividend policy or entirely discontinue the payment of dividends. Future dividends with respect to shares of our capital stock, if any, will depend on, among other things, our results of operations, cash requirements, financial condition, contractual restrictions (including restrictions in our senior notes indenture, our senior subordinated notes indenture and our credit facility), business opportunities, provisions of applicable law (including certain provisions of the Delaware General Corporation Law) and other factors that our board of directors may deem relevant.

If our cash flows from operating activities were to fall below our minimum expectations (or if our assumptions as to capital expenditures or interest expense were too low or our assumptions as to the sufficiency of our credit facility to finance our working capital needs were to prove incorrect), we may

S-18

need either to reduce or eliminate dividends or, to the extent permitted under our senior notes indenture, our senior subordinated notes indenture and the terms of our credit facility, fund a portion of our dividends with borrowings or from other sources. If we were to use working capital or permanent borrowings to fund dividends, we would have less cash and/or borrowing capacity available for future dividends and other purposes, which could negatively impact our financial condition, results of operations, liquidity and ability to maintain or expand our business.

Our dividend policy may negatively impact our ability to finance capital expenditures, operations or acquisition opportunities.

Because a substantial portion of our cash generated by our business in excess of operating needs, interest and principal payments on indebtedness, capital expenditures sufficient to maintain our properties and assets is in general distributed as regular quarterly cash dividends to the holders of our common stock under our dividend policy, we may not retain a sufficient amount of cash to finance growth opportunities or unanticipated capital expenditure needs or to fund our operations in the event of a significant business downturn. We may have to forego growth opportunities or capital expenditures that would otherwise be necessary or desirable if we do not find alternative sources of financing. If we do not have sufficient cash for these purposes, our financial condition and our business will suffer.

Our certificate of incorporation authorizes us to issue without stockholder approval preferred stock and Class B common stock that may be senior to our Class A common stock in certain respects.

Our certificate of incorporation authorizes the issuance of preferred stock and Class B common stock without stockholder approval and in the case of preferred stock, upon such terms as the board of directors may determine. The rights of the holders of shares of our common stock will be subject to, and may be adversely affected by, the rights of holders of any class or series of preferred stock that may be issued in the future, including any preferential rights that we may grant to the holders of such stock. The terms of any preferred stock we issue may place restrictions on the payment of dividends to the holders of our common stock. If we issue preferred stock or Class B common stock that is senior to our Class A common stock in right of dividend payment, and our cash flows from operating activities or surplus are insufficient to support dividend payments to the holders of preferred stock and/or Class B common stock, on the one hand and to the holders of our Class A common stock, on the other hand, we may be forced to reduce or eliminate dividends to the holders of our Class A common stock.

The separate public trading market for EISs and the ability to separate and create EISs may diminish the value of your investment in shares of Class A common stock.