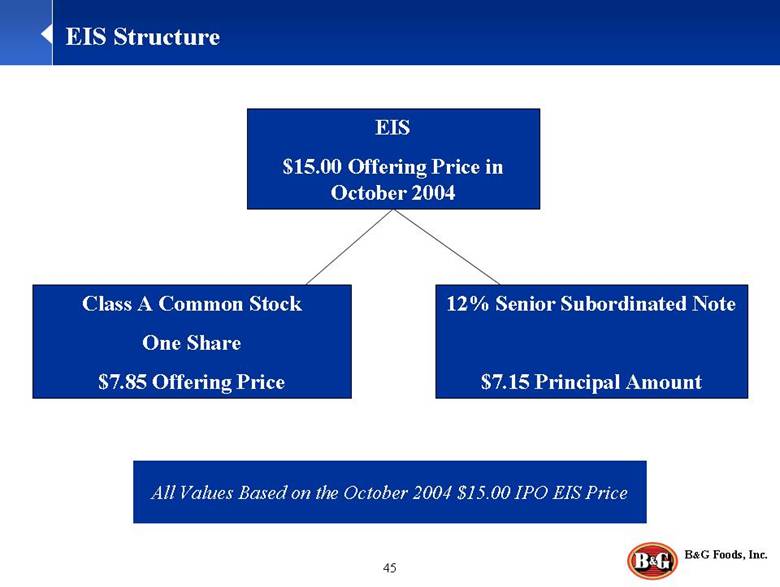

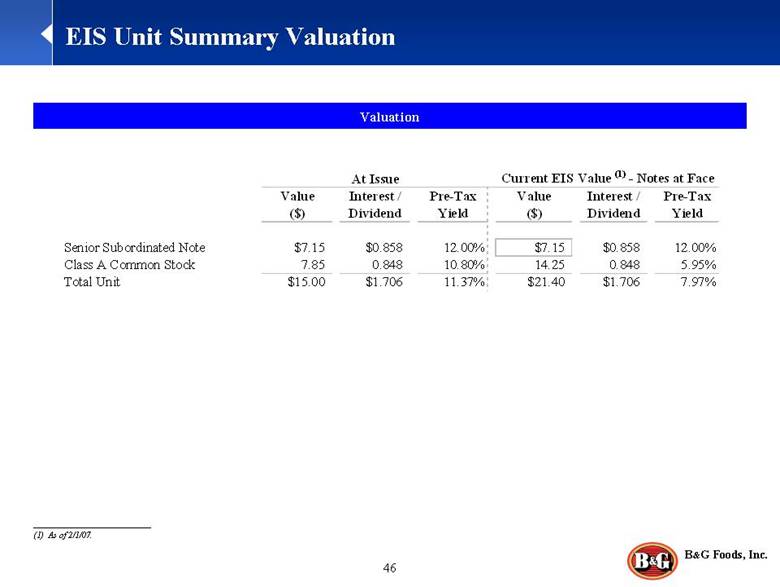

| EIS & Common Stock Overview 20,000,000 EIS units outstanding; each EIS consisting of one share of Class A Common Stock and $7.15 principal amount of 12% Senior Subordinated Notes due 2016. Class A Common Stock: Current dividend policy provides for the payment of quarterly dividends at the intended dividend rate of $0.848 per share per annum. The payment of Class A dividends is subject to the discretion of the Board of Directors and is also contractually subject to an “Excess Cash” test. Class B Common Stock: Subject to subordination provisions, entitled to: From IPO date through Fiscal 2006 dividend payment period: Dividends per share equal to 100% of dividends per share, if any, paid on Class A Common Stock. Fiscal 2007 dividend payment period and later: Dividends per share equal to 110% of dividends per share, if any, paid on Class A Common Stock. Shares of Class B Common Stock continue to be subordinated to shares of Class A Common Stock through the February 20, 2010 Class B dividend payment date (for the fiscal 2009 Class B dividend payment period). During the subordination period, Class B dividends, if any, are annual dividends. After the subordination period, Class B dividends, if any, are quarterly dividends. Subordination of Class B Common Stock: For dividend payment periods ending on or prior to January 2, 2010 (i.e., through the February 20, 2010 Class B payment date), dividends may not be paid on the Class B Common Stock unless: The holders of Class A Common Stock have received four quarterly dividends at the quarterly rate of $0.212 per share; and Balance Sheet Test – The Company’s cash on its balance sheet, net of revolver borrowings, exceeds $10 million plus accrued dividends; and Cash Flow Test – The “Excess Cash” test is satisfied after reducing excess cash by (i) dividends paid on the Class A Common Stock and (ii) a $6.0 million mandatory “cushion” / cash holdback that can be used for any purpose other than the payment of Class B dividends. As a result of the subordination provisions, no dividends have been paid to date on the Class B Common Stock. 7.6 million shares of Class B Common Stock retained by pre-IPO shareholders (including management shares), representing 27.4% of total common shares outstanding. Holders of Class B Common Stock have no registration rights for a period of up to five years. Shares of Class B Common Stock are not convertible / exchangeable into EISs (hence, no contingent debt obligation). |