financial products and services for institutions and individuals worldwide; Canon Inc., a Japanese manufacturer and distributor of network digital multifunction devices, copying machines, printers and cameras; and Total SA, a French energy supplier that explores for, produces, refines, transports, and markets oil and natural gas.

Companies held in the global equity portfolio are all based in developed-market regions around the world. As of June 30, 2011, 50.0% of these stocks were based in North America, 22.0% were based in Continental Europe (not including the United Kingdom), 15.0% were from the United Kingdom, 6.9% were from Japan, and 6.1% were from the rest of Asia (not including Japan). The global equity portfolio is similarly well-diversified across a number of industry sectors. The top two sectors, by weight, at June 30, 2011, were information technology (19.8%), which includes computer software, technology hardware, semiconductors, and services companies, and health care (18.3%), which includes health care equipment & services and pharmaceuticals biotechnology & life sciences companies. Other sectors in the portfolio include consumer discretionary, consumer staples, energy, industrials, materials, financials, and telecommunication services. The average dividend yield on the securities held in the global equity portfolio was approximately 3.0% as of June 30, 2011.

Global Equity Markets Review

A number of positive and negative factors moved markets during the quarter. Positive factors included strong corporate earnings, low developed-world interest rates, and abundant liquidity. Negative factors centered around sovereign debt concerns, softening economic growth, the Japanese earthquake aftermath, and Middle East and North African turmoil.

Sovereign debt concerns were once again front and center in investors’ minds, as Greece faced internal protests over the austerity measures required to receive the next tranche in foreign assistance. Meanwhile, the unrest in the Middle East and North Africa continued with Syria also cracking down violently on protests. In the United States, a string of negative readings on housing, employment, and manufacturing, as well as the expected ending of the Fed’s quantitative easing, led investors to question whether growth expectations

for the U.S. economy were too high. European markets performed well despite contagion concerns from the sovereign crisis. Germany contributed to the strong performance, as the nation continues to benefit from exports and low unemployment that is beginning to spur domestic consumer spending. In Asia, markets declined slightly on concerns over slowing growth prospects following weaker manufacturing numbers from China and continuing inflation fears in the region. Japan was an exception, as it edged higher in the quarter in anticipation of a recovery beyond the current slowdown from the earthquake. Emerging markets declined during the quarter on the aforementioned slowing growth and inflation concerns.

Sector leadership was mixed with a defensive bias, as consumer staples and health care, two traditionally defensive sectors were joined by consumer discretionary, a traditionally cyclical sector, to lead markets higher. Among the worst performers were the energy and financials sectors. The energy sector declined, driven by a falling oil price, while financials declined on sovereign debt concerns and tightening regulatory capital requirements. Commodities declined on weakening economic data.

In currency markets, the U.S. dollar weakened relative to most major currencies. The euro gained on the dollar, as investors reacted positively to recent European Central Bank interest rate policy, which signaled a widening yield differential between the U.S. dollar and the euro.

What Helped and What Hurt LGI

Among the areas of positive stock selection were the health care and information technology sectors, as well as U.S. stocks. Within the U.S., pharmaceutical company Johnson & Johnson and information technology companies IBM and Intel were notable performers. Johnson & Johnson performed well following discussions to purchase Synthes, a medical products manufacturer. Meanwhile, IBM and Intel performed well following results that displayed renewed corporate demand. In health care, French pharmaceutical company Sanofi also performed strongly.

In contrast, the Fund was negatively impacted by low exposure and stock selection in the consumer discretionary and utilities sectors. Within consumer discretionary, the Fund was hurt by not holding the best

|

| |

Lazard Global Total Return and Income Fund, Inc. |

Investment Overview (continued) |

|

| |

performing securities in the sector such as automobile stocks. In utilities, GDF Suez declined following the French prime minister’s announcement that natural gas prices would be frozen for a year and that regulated power price increases will be limited.

Emerging Market Currency and Debt Portfolio

(32.5% of total leveraged assets)

The Fund also seeks enhanced income through investing in primarily high-yielding, short-duration emerging market forward currency contracts and local currency debt instruments. As of June 30, 2011, this portfolio consisted of forward currency contracts (66.8%) and sovereign debt obligations (33.2%). The average duration of the emerging market currency and debt portfolio decreased from approximately 9 months to approximately 8 months during the second quarter with an average yield of 6.4%2 as of June 30, 2011.

Emerging Market Currency and Debt Market Review

Many emerging market (EM) local currency and debt markets ended the quarter broadly flat. However, investor concerns regarding the lack of policy coordination to address the rising Eurozone debt strains created a significant level of volatility throughout the quarter. Debates continued over whether soft global economic data in the period was a temporary phenomenon, due to the oil price spike and Japanese earthquake-related supply disruption earlier this year, or a longer term issue. Emerging nations continued to tighten monetary policy in conjunction with the withdrawal by developed nations of their extraordinary post-crisis stimulus, which called into question whether potential growth in highly levered developed market economies and in China will be sustainable. The quarter closed on strong footing, as fears receded over the risk of a near-term disorderly Greek restructuring, and the available macro data in China eased worries over a potential “hard landing.”

Many EM nations continued to sustain favorable relative growth and historically low levels of real interest

rates, as the monetary normalization cycle continued through June. Central banks delivered interest rate hikes in such geographically diverse countries as Poland, India, South Korea, China, Taiwan, Brazil, Chile, Colombia, and Uruguay during the period.

What Helped and What Hurt LGI

Latin American exposure contributed strongly to performance, led by Mexico and Brazil, where security selection was particularly helpful as bond holdings rallied, while active foreign currency exchange management in Brazil and Colombia added incremental value.

European exposure also contributed to performance, mostly due to a sizable exposure to Serbia’s top-performing money market and favorable Polish returns. We reduced our exposure to Serbia in May in an effort to protect gains in the Fund.

In Asia, South Korea and India contributed to performance, primarily due to strong economic growth, continued interest rate hikes, and ample inflows which supported the won and rupee. Israel contributed as well, due to active FX management and strong quarterly results from currency and inflation-linked bond holdings. Fundamental economic strength, resilient exports, above-target inflation, record-high central bank FX reserves and continued monetary tightening supported performance in Israel. Uncorrelated attribution from frontier markets such as Ghana, Uruguay, Ukraine, and Nigeria also contributed to returns during the quarter.

The Ugandan shilling detracted from performance, driven primarily by rising inflation, high imports, and central bank policy inconsistencies prior to their June 30, 2011 fiscal year-end.

Turkey also detracted from returns, primarily due to lira weakness, which overwhelmed our inflation-linked bond returns. Other detractors included weakness in the Thai baht on pre-election uncertainties, and our positions in Zambia, Kenya, and Romania.

4

|

| |

Lazard Global Total Return and Income Fund, Inc. |

Investment Overview (continued) |

|

| |

| | |

| | |

Notes to Investment Overview: |

1 | A measure of the average cash weighted term-to-maturity of the investment holdings. Duration is a measure of the price sensitivity of a bond to interest rate movements. Duration for a forward currency contract is equal to its term-to-maturity. |

2 | The quoted yield does not account for the implicit cost of borrowing on the forward currency contracts, which would reduce the yield shown. |

All returns reflect reinvestment of all dividends and distributions. Past performance is not indicative, or a guarantee, of future results.

The performance data of the Index and other market data have been prepared from sources and data that the Investment Manager believes to be reliable, but no representation is made as to their accuracy. The Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed markets. The Index is unmanaged, has no fees or costs and is not available for investment.

The views of the Fund’s Investment Manager and the securities described in this report are as of June 30, 2011; these views and portfolio holdings may have changed subsequent to this date. Nothing herein should be construed as a recommendation to buy, sell, or hold a particular security. There is no assurance that the securities discussed herein will remain in the Fund at the time you receive this report, or that securities sold will not have been repurchased. The specific securities discussed may, in aggregate, represent only a small percentage of the Fund’s holdings. It should not be assumed that securities identified and discussed were, or will be, profitable, or that the investment decisions made in the future will be profitable, or equal the investment performance of the securities discussed herein.

The views and opinions expressed are provided for general information only, and do not constitute specific tax, legal, or investment advice to, or recommendations for, any person. There can be no guarantee as to the accuracy of the outlooks for markets, sectors and securities as discussed herein.

5

|

| |

Lazard Global Total Return and Income Fund, Inc. |

Investment Overview (continued) |

|

| |

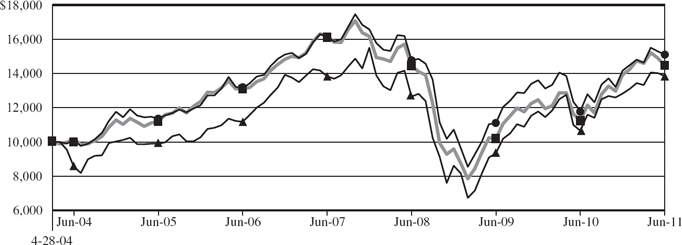

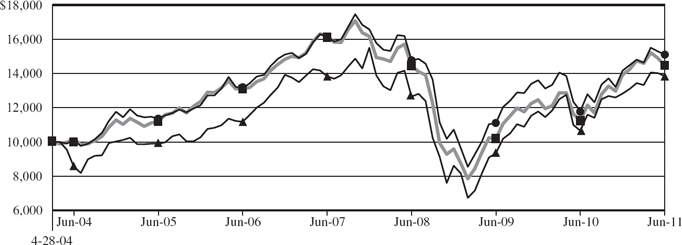

Comparison of Changes in Value of $10,000 Investment in

LGI and MSCI World Index*

| | | | | |

| | | | Value at

6/30/11 | |

| | | | |

| LGI at Market Price | | | $13,846 | |

| LGI at Net Asset Value | | | 15,100 | |

| MSCI World Index | | | 14,447 | |

| | | | | |

| | | | | | | |

Average Annual Total Returns*

Periods Ended June 30, 2011

(unaudited) | | | | | | | |

| | | | | | | |

| | One

Year | | Five

Years | | Since

Inception** | |

| | | | | | | |

Market Price | | 29.95% | | 4.37% | | 4.64% | |

Net Asset Value | | 27.95% | | 2.84% | | 5.91% | |

MSCI World Index | | 30.51% | | 2.28% | | 5.26% | |

| | |

| | |

* | All returns reflect reinvestment of all dividends and distributions. The performance quoted represents past performance. Current performance may be lower or higher than the performance quoted. Past performance is not indicative, or a guarantee, of future results; the investment return, market price and net asset value of the Fund will fluctuate, so that an investor’s shares in the Fund, when sold, may be worth more or less than their original cost. The returns do not reflect the deduction of taxes that a stockholder would pay on the Fund’s distributions or on the sale of Fund shares. |

| |

| The performance data of the Index has been prepared from sources and data that the Investment Manager believes to be reliable, but no representation is made as to its accuracy. The Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed markets. The Index is unmanaged, has no fees or costs and is not available for investment. |

| |

** | The Fund’s inception date was April 28, 2004. |

6

|

| |

Lazard Global Total Return and Income Fund, Inc. |

Investment Overview (concluded) |

|

| |

| | | | | | | | | | |

| Ten Largest Equity Holdings | | | | | | | |

| June 30, 2011 (unaudited) | | | | | | | |

| | | | | | | | | | |

| Security | | | Value | | Percentage of

Net Assets | |

| | | | | | | |

| Johnson & Johnson | | $ | 6,938,036 | | | 4.2 | % | |

| The Home Depot, Inc. | | | 5,994,410 | | | 3.6 | | |

| Microsoft Corp. | | | 5,891,600 | | | 3.5 | | |

| HSBC Holdings PLC Sponsored ADR | | | 5,635,294 | | | 3.4 | | |

| Singapore Telecommunications, Ltd. ADR | | | 5,578,484 | | | 3.3 | | |

| International Business Machines Corp. | | | 5,180,810 | | | 3.1 | | |

| Mitsubishi UFJ Financial Group, Inc. ADR | | | 5,075,847 | | | 3.0 | | |

| United Technologies Corp. | | | 5,053,921 | | | 3.0 | | |

| Oracle Corp. | | | 4,848,959 | | | 2.9 | | |

| Novartis AG ADR | | | 4,821,579 | | | 2.9 | | |

|

| | | | | | | | | | |

| Portfolio Holdings Presented by Sector | | | | | | | | |

| June 30, 2011 (unaudited) | | | | | | | | |

| | | | | | | |

| Sector | | | | | | Percentage of

Total Investments | |

| | | | | | | | |

| Consumer Discretionary | | | | | | 5.6 | % | |

| Consumer Staples | | | | | | 8.8 | | |

| Emerging Markets Debt Obligations | | | | | | 14.6 | | |

| Energy | | | | | | 11.1 | | |

| Financials | | | | | | 13.8 | | |

| Health Care | | | | | | 15.6 | | |

| Industrials | | | | | | 7.1 | | |

| Information Technology | | | | | | 17.0 | | |

| Materials | | | | | | 3.3 | | |

| Telecommunication Services | | | | | | 3.1 | | |

| | | | | | | | | |

| Total Investments | | | | | | 100.0 | % | |

| | | | | | | | | |

| | | | | | | | | |

7

|

| |

Lazard Global Total Return and Income Fund, Inc. |

Portfolio of Investments |

June 30, 2011 (unaudited) |

| |

| | | | | | | |

Description | | Shares | | Value | |

| | | | | | |

|

Common Stocks—90.9% | | | | | | | |

|

Australia—2.2% | | | | | | | |

BHP Billiton, Ltd. Sponsored ADR | | | 38,500 | | $ | 3,643,255 | |

| | | | | | | |

|

Finland—1.1% | | | | | | | |

Sampo Oyj, A Shares ADR | | | 109,500 | | | 1,773,900 | |

| | | | | | | |

|

France—6.4% | | | | | | | |

GDF Suez Sponsored ADR | | | 75,981 | | | 2,792,302 | |

Sanofi SA ADR | | | 105,200 | | | 4,225,884 | |

Total SA Sponsored ADR | | | 64,000 | | | 3,701,760 | |

| | | | | | | |

| | | | | | 10,719,946 | |

| | | | | | | |

|

Germany—2.2% | | | | | | | |

SAP AG Sponsored ADR | | | 59,300 | | | 3,596,545 | |

| | | | | | | |

|

Ireland—1.3% | | | | | | | |

CRH PLC Sponsored ADR | | | 98,300 | | | 2,213,716 | |

| | | | | | | |

|

Italy—1.0% | | | | | | | |

Eni SpA Sponsored ADR | | | 36,350 | | | 1,728,443 | |

| | | | | | | |

|

Japan—6.9% | | | | | | | |

Canon, Inc. Sponsored ADR | | | 44,700 | | | 2,127,273 | |

Hoya Corp. Sponsored ADR (c) | | | 73,500 | | | 1,634,640 | |

Mitsubishi UFJ Financial Group, | | | | | | | |

Inc. ADR | | | 1,050,900 | | | 5,075,847 | |

Nomura Holdings, Inc. ADR (c) | | | 332,600 | | | 1,639,718 | |

Sumitomo Mitsui Financial Group, Inc. | | | | | | | |

Sponsored ADR | | | 160,600 | | | 987,690 | |

| | | | | | | |

| | | | | | 11,465,168 | |

| | | | | | | |

|

Singapore—3.3% | | | | | | | |

Singapore Telecommunications, | | | | | | | |

Ltd. ADR (c) | | | 217,400 | | | 5,578,484 | |

| | | | | | | |

|

Spain—1.5% | | | | | | | |

Banco Santander SA Sponsored ADR | | | 220,693 | | | 2,540,176 | |

| | | | | | | |

|

|

Switzerland—7.8% | | | | | | | |

Novartis AG ADR | | | 78,900 | | | 4,821,579 | |

Roche Holding AG Sponsored ADR | | | 92,400 | | | 3,877,104 | |

UBS AG (a) | | | 107,587 | | | 1,964,539 | |

Zurich Financial Services AG ADR | | | 92,500 | | | 2,343,950 | |

| | | | | | | |

| | | | | | 13,007,172 | |

| | | | | | | |

| | | | | | | |

Description | | Shares | | Value | |

| | | | | | |

|

United Kingdom—13.7% | | | | | | | |

BP PLC Sponsored ADR (c) | | | 98,908 | | $ | 4,380,635 | |

British American Tobacco PLC | | | | | | | |

Sponsored ADR | | | 37,700 | | | 3,317,600 | |

GlaxoSmithKline PLC | | | | | | | |

Sponsored ADR (c) | | | 80,200 | | | 3,440,580 | |

HSBC Holdings PLC | | | | | | | |

Sponsored ADR (c) | | | 113,569 | | | 5,635,294 | |

Unilever PLC Sponsored ADR | | | 99,100 | | | 3,209,849 | |

Wm Morrison Supermarkets | | | | | | | |

PLC ADR | | | 120,300 | | | 2,876,373 | |

| | | | | | | |

| | | | | | 22,860,331 | |

| | | | | | | |

|

United States—43.5% | | | | | | | |

Cisco Systems, Inc. (c) | | | 220,400 | | | 3,440,444 | |

Comcast Corp., Class A | | | 160,900 | | | 3,898,607 | |

ConocoPhillips | | | 32,900 | | | 2,473,751 | |

Emerson Electric Co. | | | 67,600 | | | 3,802,500 | |

Halliburton Co. | | | 89,900 | | | 4,584,900 | |

Honeywell International, Inc. (c) | | | 64,700 | | | 3,855,473 | |

Intel Corp. | | | 155,400 | | | 3,443,664 | |

International Business Machines | | | | | | | |

Corp. (c) | | | 30,200 | | | 5,180,810 | |

Johnson & Johnson (c) | | | 104,300 | | | 6,938,036 | |

Merck & Co., Inc. | | | 75,300 | | | 2,657,337 | |

Microsoft Corp. (c) | | | 226,600 | | | 5,891,600 | |

Oracle Corp. | | | 147,340 | | | 4,848,959 | |

PepsiCo, Inc. | | | 41,100 | | | 2,894,673 | |

Pfizer, Inc. (c) | | | 87,566 | | | 1,803,860 | |

The Bank of New York Mellon | | | | | | | |

Corp. (c) | | | 103,600 | | | 2,654,232 | |

The Home Depot, Inc. (c) | | | 165,500 | | | 5,994,410 | |

United Technologies Corp. | | | 57,100 | | | 5,053,921 | |

Wal-Mart Stores, Inc. | | | 62,800 | | | 3,337,192 | |

| | | | | | | |

| | | | | | 72,754,369 | |

| | | | | | | |

Total Common Stocks | | | | | | | |

(Identified cost $152,582,488) | | | | | | 151,881,505 | |

| | | | | | | |

The accompanying notes are an integral part of these financial statements.

8

|

| |

Lazard Global Total Return and Income Fund, Inc. |

Portfolio of Investments (continued) |

June 30, 2011 (unaudited) |

| |

| | | | | | | |

Description | | Principal

Amount

(000) (d) | | Value | |

| | | | | | |

|

Foreign Government | | | | | | | |

Obligations—15.5% | | | | | | | |

|

Brazil—3.9% | | | | | | | |

Brazil NTN-F: | | | | | | | |

10.00%, 01/01/12 | | | 4,500 | | $ | 2,988,670 | |

10.00%, 01/01/13 | | | 5,795 | | | 3,587,401 | |

| | | | | | | |

| | | | | | 6,576,071 | |

| | | | | | | |

|

Colombia—0.1% | | | | | | | |

Republic of Colombia, | | | | | | | |

12.00%, 10/22/15 | | | 305,000 | | | 218,724 | |

| | | | | | | |

|

Ghana—0.5% | | | | | | | |

Ghana Government Bonds: | | | | | | | |

13.67%, 06/11/12 | | | 790 | | | 529,197 | |

15.00%, 12/10/12 | | | 320 | | | 219,019 | |

| | | | | | | |

| | | | | | 748,216 | |

| | | | | | | |

|

Israel—1.0% | | | | | | | |

Israel Consumer Price Index-Linked | | | | | | | |

Bond, | | | | | | | |

3.00%, 10/31/19 | | | 4,869 | | | 1,618,992 | |

| | | | | | | |

|

Malaysia—1.0% | | | | | | | |

Bank Negara Monetary Note, | | | | | | | |

0.00%, 07/14/11 | | | 5,040 | | | 1,667,231 | |

| | | | | | | |

|

Mexico—2.3% | | | | | | | |

Mexican Bonos, | | | | | | | |

7.75%, 12/14/17 | | | 7,000 | | | 638,618 | |

Mexican Cetes, | | | | | | | |

0.00%, 12/15/11 | | | 104,000 | | | 869,857 | |

Mexican Udibonos: | | | | | | | |

4.50%, 12/18/14 | | | 3,890 | | | 1,656,435 | |

5.00%, 06/16/16 | | | 1,480 | | | 654,166 | |

| | | | | | | |

| | | | | | 3,819,076 | |

| | | | | | | |

|

Poland—1.2% | | | | | | | |

Poland Government Bonds: | | | | | | | |

0.00%, 07/25/12 | | | 4,421 | | | 1,535,002 | |

3.00%, 08/24/16 | | | 1,433 | | | 540,437 | |

| | | | | | | |

| | | | | | 2,075,439 | |

| | | | | | | |

| | | | | | | |

Description | | Principal

Amount

(000) (d) | | Value | |

| | | | | | |

|

Romania—2.0% | | | | | | | |

Romania Government Bonds: | | | | | | | |

6.25%, 10/25/14 | | | 1,290 | | $ | 428,318 | |

6.00%, 04/30/15 | | | 560 | | | 183,764 | |

6.00%, 04/30/16 | | | 530 | | | 171,386 | |

6.75%, 06/11/17 | | | 600 | | | 198,729 | |

Romania Treasury Bills: | | | | | | | |

0.00%, 08/17/11 | | | 4,520 | | | 1,536,514 | |

0.00%, 02/08/12 | | | 610 | | | 201,324 | |

0.00%, 06/06/12 | | | 1,930 | | | 622,768 | |

| | | | | | | |

| | | | | | 3,342,803 | |

| | | | | | | |

|

South Africa—0.4% | | | | | | | |

Eskom Holdings, Ltd., | | | | | | | |

9.25%, 04/20/18 | | | 4,000 | | | 607,227 | |

| | | | | | | |

|

Turkey—3.1% | | | | | | | |

Turkey Government Bonds: | | | | | | | |

0.00%, 08/03/11 | | | 3,156 | | | 1,930,877 | |

0.00%, 11/16/11 | | | 2,156 | | | 1,287,702 | |

4.50%, 02/11/15 | | | 1,535 | | | 1,015,463 | |

4.00%, 04/29/15 | | | 1,449 | | | 946,871 | |

| | | | | | | |

| | | | | | 5,180,913 | |

| | | | | | | |

Total Foreign Government | | | | | | | |

Obligations | | | | | | | |

(Identified cost $24,364,516) | | | | | | 25,854,692 | |

| | | | | | | |

| | | | | | | |

Description | | Shares | | Value | |

| | | | | | |

Short-Term Investment—1.1% | | | | | | | |

State Street Institutional Treasury | | | | | | | |

Money Market Fund | | | | | | | |

(Identified cost $1,882,367) | | | 1,882,367 | | $ | 1,882,367 | |

| | | | | | | |

|

Total Investments—107.5% | | | | | | | |

(Identified cost $178,829,371) (b) | | | | | $ | 179,618,564 | |

|

Liabilities in Excess of Cash | | | | | | | |

and Other Assets—(7.5)% | | | | | | (12,456,349 | ) |

| | | | | | | |

Net Assets—100.0% | | | | | $ | 167,162,215 | |

| | | | | | | |

The accompanying notes are an integral part of these financial statements.

9

|

| |

Lazard Global Total Return and Income Fund, Inc. |

Portfolio of Investments (continued) |

June 30, 2011 (unaudited) |

| |

Forward Currency Purchase Contracts open at June 30, 2011:

| | | | | | | | | | | | | | | | | | | |

Forward Currency

Purchase Contracts | | Counterparty | | Expiration

Date | | Foreign

Currency | | U.S. $ Cost

on Origination

Date | | U.S. $

Current

Value | | Unrealized

Appreciation | | Unrealized

Depreciation | |

| | | | | | | | | | | | | | | | |

ARS | | UBS | | 07/18/11 | | 2,486,400 | | $ | 600,000 | | $ | 603,613 | | $ | 3,613 | | $ | — | |

ARS | | UBS | | 07/25/11 | | 3,528,875 | | | 850,741 | | | 855,494 | | | 4,753 | | | — | |

ARS | | BNP | | 08/08/11 | | 1,676,340 | | | 402,000 | | | 405,245 | | | 3,245 | | | — | |

ARS | | CIT | | 08/31/11 | | 1,609,493 | | | 385,000 | | | 387,218 | | | 2,218 | | | — | |

BRL | | JPM | | 07/05/11 | | 1,332,392 | | | 808,000 | | | 853,741 | | | 45,741 | | | — | |

BRL | | JPM | | 07/05/11 | | 5,842,063 | | | 3,667,334 | | | 3,743,352 | | | 76,018 | | | — | |

BRL | | HSB | | 08/02/11 | | 2,054,901 | | | 1,263,000 | | | 1,308,027 | | | 45,027 | | | — | |

CLP | | BNP | | 07/15/11 | | 189,153,360 | | | 396,000 | | | 404,219 | | | 8,219 | | | — | |

CLP | | BNP | | 07/18/11 | | 208,835,100 | | | 438,177 | | | 446,109 | | | 7,932 | | | — | |

CLP | | CIT | | 08/30/11 | | 250,818,750 | | | 525,000 | | | 533,102 | | | 8,102 | | | — | |

CLP | | CSF | | 09/26/11 | | 392,229,000 | | | 796,000 | | | 830,711 | | | 34,711 | | | — | |

CLP | | BNP | | 02/13/12 | | 476,500,200 | | | 989,000 | | | 993,640 | | | 4,640 | | | — | |

CNY | | BRC | | 07/29/11 | | 254,486 | | | 38,000 | | | 39,365 | | | 1,365 | | | — | |

CNY | | BRC | | 07/29/11 | | 1,097,824 | | | 169,000 | | | 169,819 | | | 819 | | | — | |

CNY | | BRC | | 07/29/11 | | 5,434,092 | | | 813,000 | | | 840,584 | | | 27,584 | | | — | |

CNY | | JPM | | 07/29/11 | | 1,460,246 | | | 222,074 | | | 225,882 | | | 3,808 | | | — | |

CNY | | JPM | | 07/29/11 | | 4,071,165 | | | 609,000 | | | 629,757 | | | 20,757 | | | — | |

CNY | | JPM | | 06/13/12 | | 10,364,580 | | | 1,622,000 | | | 1,624,785 | | | 2,785 | | | — | |

COP | | BNP | | 07/22/11 | | 964,634,000 | | | 538,000 | | | 545,045 | | | 7,045 | | | — | |

COP | | CIT | | 08/18/11 | | 1,551,718,000 | | | 854,000 | | | 875,726 | | | 21,726 | | | — | |

CZK | | ING | | 07/07/11 | | 6,765,269 | | | 396,340 | | | 403,390 | | | 7,050 | | | — | |

CZK | | ING | | 07/07/11 | | 14,056,342 | | | 822,533 | | | 838,132 | | | 15,599 | | | — | |

CZK | | ING | | 07/25/11 | | 14,295,910 | | | 837,676 | | | 852,337 | | | 14,661 | | | — | |

EUR | | BRC | | 07/05/11 | | 154,172 | | | 217,513 | | | 223,572 | | | 6,059 | | | — | |

EUR | | BRC | | 07/05/11 | | 175,401 | | | 247,955 | | | 254,357 | | | 6,402 | | | — | |

EUR | | BRC | | 07/05/11 | | 613,138 | | | 869,046 | | | 889,141 | | | 20,095 | | | — | |

EUR | | CIT | | 07/05/11 | | 407,204 | | | 587,615 | | | 590,506 | | | 2,891 | | | — | |

EUR | | CIT | | 07/05/11 | | 919,907 | | | 1,309,000 | | | 1,334,003 | | | 25,003 | | | — | |

EUR | | ING | | 07/05/11 | | 978,106 | | | 1,399,473 | | | 1,418,400 | | | 18,927 | | | — | |

EUR | | ING | | 07/07/11 | | 324,000 | | | 464,422 | | | 469,823 | | | 5,401 | | | — | |

EUR | | CIT | | 07/18/11 | | 235,845 | | | 348,000 | | | 341,886 | | | — | | | 6,114 | |

EUR | | CIT | | 07/18/11 | | 1,258,052 | | | 1,783,000 | | | 1,823,705 | | | 40,705 | | | — | |

EUR | | CIT | | 07/18/11 | | 1,571,000 | | | 2,267,079 | | | 2,277,362 | | | 10,283 | | | — | |

EUR | | JPM | | 07/18/11 | | 1,232,302 | | | 1,745,654 | | | 1,786,376 | | | 40,722 | | | — | |

EUR | | ING | | 07/20/11 | | 391,838 | | | 565,441 | | | 567,986 | | | 2,545 | | | — | |

GHS | | BRC | | 07/05/11 | | 246,480 | | | 158,000 | | | 162,361 | | | 4,361 | | | — | |

GHS | | JPM | | 07/05/11 | | 269,004 | | | 174,000 | | | 177,198 | | | 3,198 | | | — | |

GHS | | JPM | | 07/11/11 | | 291,653 | | | 190,935 | | | 191,761 | | | 826 | | | — | |

GHS | | SCB | | 07/12/11 | | 972,024 | | | 635,310 | | | 638,905 | | | 3,595 | | | — | |

GHS | | SCB | | 07/18/11 | | 503,304 | | | 329,000 | | | 330,207 | | | 1,207 | | | — | |

GHS | | CIT | | 07/27/11 | | 1,077,120 | | | 704,000 | | | 704,719 | | | 719 | | | — | |

GHS | | BRC | | 08/05/11 | | 246,480 | | | 161,404 | | | 160,845 | | | — | | | 559 | |

GHS | | CIT | | 08/09/11 | | 82,000 | | | 53,074 | | | 53,451 | | | 377 | | | — | |

GHS | | SCB | | 08/09/11 | | 277,000 | | | 180,750 | | | 180,560 | | | — | | | 190 | |

GHS | | SCB | | 08/16/11 | | 507,318 | | | 329,000 | | | 330,048 | | | 1,048 | | | — | |

GHS | | JPM | | 09/06/11 | | 269,004 | | | 174,395 | | | 173,957 | | | — | | | 438 | |

GHS | | CIT | | 09/22/11 | | 117,000 | | | 75,875 | | | 75,296 | | | — | | | 579 | |

GHS | | BRC | | 10/11/11 | | 237,330 | | | 109,369 | | | 151,900 | | | 42,531 | | | — | |

The accompanying notes are an integral part of these financial statements.

10

|

| |

Lazard Global Total Return and Income Fund, Inc. |

Portfolio of Investments (continued) |

June 30, 2011 (unaudited) |

| |

Forward Currency Purchase Contracts open at June 30, 2011 (continued):

| | | | | | | | | | | | | | | | | | | |

Forward Currency

Purchase Contracts | | Counterparty | | Expiration

Date | | Foreign

Currency | | U.S. $ Cost

on Origination

Date | | U.S. $

Current

Value | | Unrealized

Appreciation | | Unrealized

Depreciation | |

| | | | | | | | | | | | | | | | |

GHS | | SCB | | 10/11/11 | | 391,000 | | $ | 246,036 | | $ | 250,254 | | $ | 4,218 | | $ | — | |

IDR | | JPM | | 11/18/11 | | 7,099,422,000 | | | 811,363 | | | 809,848 | | | — | | | 1,515 | |

ILS | | JPM | | 07/18/11 | | 2,844,722 | | | 835,405 | | | 835,583 | | | 178 | | | — | |

INR | | SCB | | 07/15/11 | | 18,207,540 | | | 405,965 | | | 406,681 | | | 716 | | | — | |

INR | | SCB | | 07/21/11 | | 23,782,000 | | | 506,000 | | | 530,650 | | | 24,650 | | | — | |

INR | | JPM | | 07/25/11 | | 19,153,440 | | | 423,000 | | | 427,083 | | | 4,083 | | | — | |

INR | | SCB | | 10/13/11 | | 43,926,800 | | | 965,000 | | | 965,172 | | | 172 | | | — | |

INR | | BRC | | 11/14/11 | | 43,376,800 | | | 944,000 | | | 947,907 | | | 3,907 | | | — | |

INR | | BNP | | 05/21/12 | | 18,207,540 | | | 379,838 | | | 387,433 | | | 7,595 | | | — | |

INR | | BRC | | 05/21/12 | | 42,264,610 | | | 884,567 | | | 899,337 | | | 14,770 | | | — | |

INR | | JPM | | 05/25/12 | | 18,698,400 | | | 392,000 | | | 397,693 | | | 5,693 | | | — | |

INR | | UBS | | 05/25/12 | | 42,064,980 | | | 878,000 | | | 894,672 | | | 16,672 | | | — | |

KES | | CIT | | 07/06/11 | | 32,902,000 | | | 382,004 | | | 368,340 | | | — | | | 13,664 | |

KES | | SCB | | 07/28/11 | | 18,684,200 | | | 206,000 | | | 209,163 | | | 3,163 | | | — | |

KES | | CIT | | 08/08/11 | | 33,998,000 | | | 376,584 | | | 380,585 | | | 4,001 | | | — | |

KRW | | HSB | | 07/28/11 | | 954,700,500 | | | 876,515 | | | 892,935 | | | 16,420 | | | — | |

KRW | | SCB | | 08/11/11 | | 486,080,000 | | | 434,000 | | | 454,245 | | | 20,245 | | | — | |

KRW | | SCB | | 08/11/11 | | 1,154,792,400 | | | 1,061,000 | | | 1,079,160 | | | 18,160 | | | — | |

KRW | | BRC | | 11/23/11 | | 1,019,284,400 | | | 927,170 | | | 947,223 | | | 20,053 | | | — | |

KZT | | BNP | | 07/05/11 | | 54,115,000 | | | 372,719 | | | 370,905 | | | — | | | 1,814 | |

KZT | | BRC | | 07/05/11 | | 61,316,600 | | | 422,000 | | | 420,265 | | | — | | | 1,735 | |

KZT | | CIT | | 07/18/11 | | 49,299,000 | | | 335,025 | | | 337,929 | | | 2,904 | | | — | |

KZT | | BRC | | 08/02/11 | | 66,555,000 | | | 452,447 | | | 456,267 | | | 3,820 | | | — | |

KZT | | BRC | | 08/10/11 | | 17,687,000 | | | 121,694 | | | 121,270 | | | — | | | 424 | |

KZT | | BRC | | 08/10/11 | | 26,490,000 | | | 180,155 | | | 181,627 | | | 1,472 | | | — | |

KZT | | CIT | | 08/10/11 | | 31,412,000 | | | 215,964 | | | 215,374 | | | — | | | 590 | |

KZT | | HSB | | 10/11/11 | | 73,593,000 | | | 507,888 | | | 505,165 | | | — | | | 2,723 | |

KZT | | BRC | | 11/04/11 | | 17,133,600 | | | 118,065 | | | 117,648 | | | — | | | 417 | |

KZT | | BRC | | 12/15/11 | | 17,612,000 | | | 121,074 | | | 120,999 | | | — | | | 75 | |

MXN | | BRC | | 07/11/11 | | 1,919,261 | | | 162,525 | | | 163,835 | | | 1,310 | | | — | |

MXN | | JPM | | 07/11/11 | | 6,762,346 | | | 573,250 | | | 577,258 | | | 4,008 | | | — | |

MXN | | JPM | | 07/11/11 | | 19,316,285 | | | 1,657,979 | | | 1,648,907 | | | — | | | 9,072 | |

MYR | | BRC | | 07/05/11 | | 2,599,740 | | | 858,000 | | | 860,984 | | | 2,984 | | | — | |

MYR | | BRC | | 07/29/11 | | 10,008,918 | | | 3,291,000 | | | 3,308,779 | | | 17,779 | | | — | |

NGN | | JPM | | 07/29/11 | | 57,736,440 | | | 367,000 | | | 378,747 | | | 11,747 | | | — | |

NGN | | JPM | | 08/29/11 | | 36,957,600 | | | 236,000 | | | 237,029 | | | 1,029 | | | — | |

NGN | | CIT | | 09/09/11 | | 36,738,000 | | | 234,000 | | | 235,621 | | | 1,621 | | | — | |

NGN | | JPM | | 09/12/11 | | 37,111,000 | | | 236,000 | | | 238,013 | | | 2,013 | | | — | |

NGN | | SCB | | 09/16/11 | | 35,504,000 | | | 224,000 | | | 227,707 | | | 3,707 | | | — | |

NGN | | HSB | | 09/28/11 | | 52,000,100 | | | 331,000 | | | 331,021 | | | 21 | | | — | |

PHP | | BRC | | 07/27/11 | | 28,605,780 | | | 657,000 | | | 658,786 | | | 1,786 | | | — | |

PHP | | BRC | | 08/19/11 | | 41,620,600 | | | 959,000 | | | 956,648 | | | — | | | 2,352 | |

PLN | | CIT | | 07/05/11 | | 2,346,323 | | | 883,006 | | | 855,448 | | | — | | | 27,558 | |

PLN | | ING | | 07/05/11 | | 1,541,354 | | | 558,259 | | | 561,963 | | | 3,704 | | | — | |

PLN | | JPM | | 07/18/11 | | 4,130,892 | | | 1,513,591 | | | 1,504,051 | | | — | | | 9,540 | |

PLN | | BRC | | 07/20/11 | | 1,569,115 | | | 574,936 | | | 571,193 | | | — | | | 3,743 | |

RON | | CIT | | 07/05/11 | | 1,721,658 | | | 597,341 | | | 589,558 | | | — | | | 7,783 | |

RON | | CIT | | 07/12/11 | | 1,651,000 | | | 564,889 | | | 564,880 | | | — | | | 9 | |

The accompanying notes are an integral part of these financial statements.

11

|

| |

Lazard Global Total Return and Income Fund, Inc. |

Portfolio of Investments (continued) |

June 30, 2011 (unaudited) |

| |

Forward Currency Purchase Contracts open at June 30, 2011 (continued):

| | | | | | | | | | | | | | | | | | | |

Forward Currency

Purchase Contracts | | Counterparty | | Expiration

Date | | Foreign

Currency | | U.S. $ Cost

on Origination

Date | | U.S. $

Current

Value | | Unrealized

Appreciation | | Unrealized

Depreciation | |

| | | | | | | | | | | | | | | | |

RON | | ING | | 07/15/11 | | 1,349,000 | | $ | 470,789 | | $ | 461,383 | | $ | — | | $ | 9,406 | |

RON | | BRC | | 07/18/11 | | 2,644,659 | | | 931,202 | | | 904,192 | | | — | | | 27,010 | |

RSD | | BRC | | 07/05/11 | | 10,882,300 | | | 158,369 | | | 156,753 | | | — | | | 1,616 | |

RSD | | BRC | | 07/05/11 | | 21,624,000 | | | 296,138 | | | 311,480 | | | 15,342 | | | — | |

RSD | | BRC | | 07/14/11 | | 21,890,000 | | | 312,068 | | | 314,348 | | | 2,280 | | | — | |

RSD | | CIT | | 07/15/11 | | 15,200,717 | | | 219,188 | | | 218,213 | | | — | | | 975 | |

RSD | | BRC | | 07/21/11 | | 26,469,000 | | | 376,408 | | | 379,201 | | | 2,793 | | | — | |

RSD | | CIT | | 07/27/11 | | 24,427,470 | | | 352,235 | | | 349,244 | | | — | | | 2,991 | |

RSD | | CIT | | 08/01/11 | | 23,839,200 | | | 335,480 | | | 340,241 | | | 4,761 | | | — | |

RSD | | CIT | | 08/08/11 | | 17,410,000 | | | 260,590 | | | 247,854 | | | — | | | 12,736 | |

RSD | | BRC | | 08/10/11 | | 55,737,450 | | | 729,678 | | | 792,923 | | | 63,245 | | | — | |

RSD | | CIT | | 08/10/11 | | 19,880,000 | | | 262,235 | | | 282,814 | | | 20,579 | | | — | |

RSD | | CIT | | 09/09/11 | | 17,966,080 | | | 264,091 | | | 252,840 | | | — | | | 11,251 | |

RUB | | HSB | | 08/24/11 | | 22,925,256 | | | 807,000 | | | 816,847 | | | 9,847 | | | — | |

SGD | | SCB | | 07/28/11 | | 1,030,307 | | | 835,000 | | | 838,817 | | | 3,817 | | | — | |

SGD | | HSB | | 08/29/11 | | 962,315 | | | 777,000 | | | 783,489 | | | 6,489 | | | — | |

THB | | JPM | | 07/06/11 | | 13,787,160 | | | 459,610 | | | 448,727 | | | — | | | 10,883 | |

THB | | SCB | | 07/25/11 | | 10,844,768 | | | 357,000 | | | 352,516 | | | — | | | 4,484 | |

THB | | SCB | | 08/09/11 | | 15,845,280 | | | 528,000 | | | 514,543 | | | — | | | 13,457 | |

THB | | JPM | | 08/24/11 | | 8,147,580 | | | 266,000 | | | 264,271 | | | — | | | 1,729 | |

THB | | HSB | | 09/06/11 | | 24,660,440 | | | 811,252 | | | 799,075 | | | — | | | 12,177 | |

THB | | JPM | | 09/06/11 | | 15,939,110 | | | 517,000 | | | 516,476 | | | — | | | 524 | |

THB | | HSB | | 11/14/11 | | 25,220,160 | | | 834,000 | | | 813,316 | | | — | | | 20,684 | |

UAH | | CIT | | 07/01/11 | | 2,143,000 | | | 265,223 | | | 268,373 | | | 3,150 | | | — | |

UAH | | CIT | | 07/18/11 | | 1,173,050 | | | 142,968 | | | 146,075 | | | 3,107 | | | — | |

UAH | | HSB | | 07/25/11 | | 1,799,600 | | | 220,000 | | | 223,576 | | | 3,576 | | | — | |

UAH | | BRC | | 08/10/11 | | 1,443,000 | | | 169,765 | | | 178,409 | | | 8,644 | | | — | |

UAH | | BRC | | 08/10/11 | | 1,798,500 | | | 218,000 | | | 222,362 | | | 4,362 | | | — | |

UAH | | ING | | 08/16/11 | | 1,148,000 | | | 139,135 | | | 141,691 | | | 2,556 | | | — | |

UAH | | ING | | 08/16/11 | | 1,849,000 | | | 224,211 | | | 228,211 | | | 4,000 | | | — | |

UAH | | ING | | 08/16/11 | | 2,297,000 | | | 284,212 | | | 283,505 | | | — | | | 707 | |

UAH | | BRC | | 08/17/11 | | 1,137,120 | | | 138,000 | | | 140,307 | | | 2,307 | | | — | |

UAH | | ING | | 08/18/11 | | 1,386,810 | | | 168,296 | | | 171,067 | | | 2,771 | | | — | |

UAH | | CIT | | 08/22/11 | | 1,752,818 | | | 212,979 | | | 215,966 | | | 2,987 | | | — | |

UAH | | ING | | 08/22/11 | | 3,200,107 | | | 394,000 | | | 394,288 | | | 288 | | | — | |

UAH | | ING | | 08/25/11 | | 1,625,830 | | | 199,000 | | | 200,147 | | | 1,147 | | | — | |

UAH | | CSF | | 08/31/11 | | 1,568,640 | | | 192,000 | | | 192,759 | | | 759 | | | — | |

UAH | | CIT | | 09/01/11 | | 1,074,000 | | | 132,839 | | | 132,839 | | | — | | | — | |

UAH | | ING | | 09/02/11 | | 1,138,900 | | | 140,000 | | | 139,860 | | | — | | | 140 | |

UAH | | HSB | | 09/06/11 | | 1,680,960 | | | 206,000 | | | 206,156 | | | 156 | | | — | |

UAH | | ING | | 09/07/11 | | 2,117,000 | | | 248,930 | | | 259,548 | | | 10,618 | | | — | |

UAH | | CIT | | 09/08/11 | | 1,069,000 | | | 132,027 | | | 132,027 | | | — | | | — | |

UAH | | BRC | | 09/12/11 | | 1,761,570 | | | 207,000 | | | 215,619 | | | 8,619 | | | — | |

UGX | | SCB | | 07/08/11 | | 476,784,000 | | | 198,000 | | | 185,461 | | | — | | | 12,539 | |

UGX | | BRC | | 07/18/11 | | 843,050,000 | | | 347,649 | | | 327,008 | | | — | | | 20,641 | |

UGX | | CIT | | 07/26/11 | | 1,179,600,000 | | | 486,433 | | | 456,523 | | | — | | | 29,910 | |

UGX | | CIT | | 07/28/11 | | 149,890,000 | | | 59,836 | | | 57,977 | | | — | | | 1,859 | |

UGX | | CIT | | 08/16/11 | | 268,772,000 | | | 110,017 | | | 103,404 | | | — | | | 6,613 | |

The accompanying notes are an integral part of these financial statements.

12

|

| |

Lazard Global Total Return and Income Fund, Inc. |

Portfolio of Investments (continued) |

June 30, 2011 (unaudited) |

| |

Forward Currency Purchase Contracts open at June 30, 2011 (concluded):

| | | | | | | | | | | | | | | | | | | |

Forward Currency

Purchase Contracts | | Counterparty | | Expiration

Date | | Foreign

Currency | | U.S. $ Cost

on Origination

Date | | U.S. $

Current

Value | | Unrealized

Appreciation | | Unrealized

Depreciation | |

| | | | | | | | | | | | | | | | |

UGX | | CIT | | 08/22/11 | | 1,199,696,000 | | $ | 480,263 | | $ | 460,776 | | $ | — | | $ | 19,487 | |

UGX | | SCB | | 09/30/11 | | 1,000,176,000 | | | 402,000 | | | 379,993 | | | — | | | 22,007 | |

UGX | | CIT | | 10/04/11 | | 279,675,000 | | | 113,000 | | | 106,120 | | | — | | | 6,880 | |

UGX | | CIT | | 10/05/11 | | 486,590,000 | | | 197,000 | | | 184,573 | | | — | | | 12,427 | |

UGX | | CIT | | 10/07/11 | | 517,020,000 | | | 210,000 | | | 195,991 | | | — | | | 14,009 | |

UGX | | SCB | | 06/25/12 | | 294,000,000 | | | 107,182 | | | 103,731 | | | — | | | 3,451 | |

UYU | | CIT | | 07/08/11 | | 6,892,160 | | | 356,000 | | | 374,032 | | | 18,032 | | | — | |

UYU | | CIT | | 07/29/11 | | 2,339,235 | | | 121,835 | | | 126,468 | | | 4,633 | | | — | |

UYU | | JPM | | 08/08/11 | | 3,397,370 | | | 181,000 | | | 183,344 | | | 2,344 | | | — | |

UYU | | JPM | | 08/08/11 | | 3,858,480 | | | 207,000 | | | 208,229 | | | 1,229 | | | — | |

UYU | | CIT | | 08/31/11 | | 2,370,375 | | | 122,563 | | | 127,394 | | | 4,831 | | | — | |

UYU | | JPM | | 09/08/11 | | 3,881,250 | | | 207,000 | | | 208,296 | | | 1,296 | | | — | |

UYU | | CIT | | 10/06/11 | | 2,364,060 | | | 123,000 | | | 126,240 | | | 3,240 | | | — | |

UYU | | CIT | | 10/19/11 | | 3,717,648 | | | 198,000 | | | 198,063 | | | 63 | | | — | |

UYU | | CIT | | 11/16/11 | | 3,731,508 | | | 198,000 | | | 197,818 | | | — | | | 182 | |

UYU | | CIT | | 11/30/11 | | 2,370,375 | | | 121,061 | | | 125,350 | | | 4,289 | | | — | |

UYU | | CIT | | 12/02/11 | | 2,382,510 | | | 123,000 | | | 125,948 | | | 2,948 | | | — | |

UYU | | JPM | | 12/08/11 | | 3,945,420 | | | 207,000 | | | 208,348 | | | 1,348 | | | — | |

UYU | | CIT | | 12/20/11 | | 2,339,235 | | | 124,032 | | | 123,269 | | | — | | | 763 | |

UYU | | CIT | | 12/20/11 | | 3,743,388 | | | 198,000 | | | 197,263 | | | — | | | 737 | |

UYU | | CIT | | 12/30/11 | | 7,053,090 | | | 363,000 | | | 370,997 | | | 7,997 | | | — | |

ZAR | | CIT | | 09/14/11 | | 2,231,620 | | | 325,432 | | | 326,657 | | | 1,225 | | | — | |

ZAR | | JPM | | 09/14/11 | | 706,636 | | | 102,000 | | | 103,435 | | | 1,435 | | | — | |

ZAR | | JPM | | 09/14/11 | | 3,826,078 | | | 556,035 | | | 560,050 | | | 4,015 | | | — | |

ZAR | | JPM | | 09/14/11 | | 5,466,911 | | | 793,802 | | | 800,231 | | | 6,429 | | | — | |

ZMK | | BRC | | 07/11/11 | | 3,086,224,000 | | | 642,027 | | | 637,591 | | | — | | | 4,436 | |

ZMK | | CIT | | 07/28/11 | | 1,502,034,729 | | | 313,000 | | | 309,771 | | | — | | | 3,229 | |

ZMK | | SCB | | 11/25/11 | | 1,746,525,000 | | | 354,265 | | | 351,256 | | | — | | | 3,009 | |

ZMK | | SCB | | 12/19/11 | | 320,101,000 | | | 63,969 | | | 63,985 | | | 16 | | | — | |

ZMK | | SCB | | 12/20/11 | | 650,940,000 | | | 129,515 | | | 130,083 | | | 568 | | | — | |

| | | | | | | | | | | | | | | | | | | |

Total Forward Currency Purchase Contracts | | $ | 86,418,273 | | $ | 87,117,482 | | $ | 1,083,052 | | $ | 383,843 | |

| | | | | | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

13

|

| |

Lazard Global Total Return and Income Fund, Inc. |

Portfolio of Investments (continued) |

June 30, 2011 (unaudited) |

| |

Forward Currency Sale Contracts open at June 30, 2011:

| | | | | | | | | | | | | | | | | | | |

Forward Currency

Sale Contracts | | Counterparty | | Expiration

Date | | Foreign

Currency | | U.S. $ Cost

on Origination

Date | | U.S. $

Current

Value | | Unrealized

Appreciation | | Unrealized

Depreciation | |

| | | | | | | | | | | | | | | | |

ARS | | BNP | | 07/25/11 | | 1,085,927 | | $ | 263,258 | | $ | 263,000 | | $ | — | | $ | 258 | |

BRL | | HSB | | 07/05/11 | | 7,174,455 | | | 4,597,094 | | | 4,391,000 | | | — | | | 206,094 | |

BRL | | JPM | | 08/02/11 | | 6,331,777 | | | 4,030,433 | | | 3,947,000 | | | — | | | 83,433 | |

CLP | | BNP | | 07/15/11 | | 344,448,000 | | | 736,084 | | | 736,000 | | | — | | | 84 | |

CNY | | JPM | | 07/29/11 | | 12,317,813 | | | 1,905,408 | | | 1,875,000 | | | — | | | 30,408 | |

CZK | | ING | | 07/07/11 | | 7,825,896 | | | 466,631 | | | 464,421 | | | — | | | 2,210 | |

EUR | | BRC | | 07/05/11 | | 110,000 | | | 159,516 | | | 158,368 | | | — | | | 1,148 | |

EUR | | BRC | | 07/05/11 | | 204,000 | | | 295,831 | | | 296,139 | | | 308 | | | — | |

EUR | | CIT | | 07/05/11 | | 593,000 | | | 859,939 | | | 883,006 | | | 23,067 | | | — | |

EUR | | CIT | | 07/05/11 | | 416,000 | | | 603,262 | | | 597,341 | | | — | | | 5,921 | |

EUR | | CIT | | 07/05/11 | | 1,533,045 | | | 2,223,144 | | | 2,213,103 | | | — | | | 10,041 | |

EUR | | ING | | 07/05/11 | | 385,339 | | | 558,799 | | | 558,260 | | | — | | | 539 | |

EUR | | ING | | 07/07/11 | | 278,000 | | | 403,119 | | | 396,340 | | | — | | | 6,779 | |

EUR | | ING | | 07/07/11 | | 574,000 | | | 832,340 | | | 822,533 | | | — | | | 9,807 | |

EUR | | CIT | | 07/12/11 | | 390,483 | | | 566,148 | | | 564,889 | | | — | | | 1,259 | |

EUR | | BRC | | 07/14/11 | | 210,988 | | | 305,887 | | | 312,067 | | | 6,180 | | | — | |

EUR | | CIT | | 07/15/11 | | 151,000 | | | 218,912 | | | 219,189 | | | 277 | | | — | |

EUR | | ING | | 07/15/11 | | 323,509 | | | 469,006 | | | 470,790 | | | 1,784 | | | — | |

EUR | | BRC | | 07/18/11 | | 643,250 | | | 932,472 | | | 931,202 | | | — | | | 1,270 | |

EUR | | CIT | | 07/18/11 | | 141,832 | | | 205,603 | | | 201,559 | | | — | | | 4,044 | |

EUR | | CIT | | 07/18/11 | | 470,000 | | | 681,324 | | | 678,119 | | | — | | | 3,205 | |

EUR | | JPM | | 07/18/11 | | 1,047,811 | | | 1,518,934 | | | 1,513,591 | | | — | | | 5,343 | |

EUR | | BRC | | 07/20/11 | | 398,000 | | | 576,919 | | | 574,936 | | | — | | | 1,983 | |

EUR | | BRC | | 07/21/11 | | 254,265 | | | 368,558 | | | 376,407 | | | 7,849 | | | — | |

EUR | | ING | | 07/25/11 | | 586,000 | | | 849,315 | | | 837,677 | | | — | | | 11,638 | |

EUR | | BNP | | 07/27/11 | | 349,000 | | | 505,793 | | | 493,989 | | | — | | | 11,804 | |

EUR | | BRC | | 07/27/11 | | 2,987,686 | | | 4,329,940 | | | 4,355,013 | | | 25,073 | | | — | |

EUR | | CIT | | 07/27/11 | | 240,641 | | | 348,752 | | | 352,235 | | | 3,483 | | | — | |

EUR | | CIT | | 08/01/11 | | 231,000 | | | 334,733 | | | 335,480 | | | 747 | | | — | |

EUR | | CIT | | 08/08/11 | | 171,696 | | | 248,750 | | | 260,590 | | | 11,840 | | | — | |

EUR | | BRC | | 08/10/11 | | 513,000 | | | 743,180 | | | 729,677 | | | — | | | 13,503 | |

EUR | | CIT | | 08/10/11 | | 183,226 | | | 265,438 | | | 262,234 | | | — | | | 3,204 | |

EUR | | HSB | | 08/23/11 | | 1,525,259 | | | 2,208,824 | | | 2,172,000 | | | — | | | 36,824 | |

EUR | | HSB | | 09/07/11 | | 1,805,682 | | | 2,613,811 | | | 2,622,500 | | | 8,689 | | | — | |

EUR | | CIT | | 09/09/11 | | 176,000 | | | 254,754 | | | 264,091 | | | 9,337 | | | — | |

EUR | | ING | | 09/28/11 | | 1,875,023 | | | 2,712,542 | | | 2,650,345 | | | — | | | 62,197 | |

GHS | | BRC | | 07/05/11 | | 246,480 | | | 162,361 | | | 162,693 | | | 332 | | | — | |

GHS | | JPM | | 07/05/11 | | 269,004 | | | 177,198 | | | 177,210 | | | 12 | | | — | |

INR | | BNP | | 07/15/11 | | 18,207,540 | | | 406,681 | | | 399,375 | | | — | | | 7,306 | |

INR | | SCB | | 07/21/11 | | 12,876,300 | | | 287,310 | | | 285,000 | | | — | | | 2,310 | |

JPY | | BRC | | 07/21/11 | | 76,150,854 | | | 945,988 | | | 924,157 | | | — | | | 21,831 | |

JPY | | JPM | | 08/31/11 | | 45,296,487 | | | 562,822 | | | 558,000 | | | — | | | 4,822 | |

JPY | | SCB | | 09/21/11 | | 120,873,990 | | | 1,502,103 | | | 1,510,000 | | | 7,897 | | | — | |

JPY | | HSB | | 11/10/11 | | 5,866,864 | | | 72,941 | | | 73,000 | | | 59 | | | — | |

KES | | CIT | | 07/06/11 | | 32,902,000 | | | 368,340 | | | 367,620 | | | — | | | 720 | |

KRW | | SCB | | 08/11/11 | | 133,774,800 | | | 125,013 | | | 123,000 | | | — | | | 2,013 | |

MXN | | JPM | | 07/11/11 | | 3,289,375 | | | 280,793 | | | 277,000 | | | — | | | 3,793 | |

MXN | | JPM | | 07/11/11 | | 4,914,748 | | | 419,541 | | | 412,000 | | | — | | | 7,541 | |

The accompanying notes are an integral part of these financial statements.

14

|

| |

Lazard Global Total Return and Income Fund, Inc. |

Portfolio of Investments (concluded) |

June 30, 2011 (unaudited) |

| |

Forward Currency Sale Contracts open at June 30, 2011 (concluded):

| | | | | | | | | | | | | | | | | | | |

Forward Currency

Sale Contracts | | Counterparty | | Expiration

Date | | Foreign

Currency | | U.S. $ Cost

on Origination

Date | | U.S. $

Current

Value | | Unrealized

Appreciation | | Unrealized

Depreciation |

| | | | | | | | | | | | | | | |

MXN | | HSB | | 07/28/11 | | 15,072,019 | | $ | 1,284,707 | | $ | 1,289,000 | | $ | 4,293 | | $ | — | |

MYR | | JPM | | 07/05/11 | | 2,599,740 | | | 860,984 | | | 862,841 | | | 1,857 | | | — | |

MYR | | BRC | | 07/29/11 | | 610,600 | | | 201,854 | | | 200,000 | | | — | | | 1,854 | |

PLN | | ING | | 07/05/11 | | 3,887,677 | | | 1,417,412 | | | 1,399,474 | | | — | | | 17,938 | |

PLN | | ING | | 07/20/11 | | 1,569,115 | | | 571,193 | | | 565,441 | | | — | | | 5,752 | |

RON | | CIT | | 07/05/11 | | 1,721,658 | | | 589,558 | | | 587,615 | | | — | | | 1,943 | |

RSD | | BRC | | 07/05/11 | | 15,253,000 | | | 219,710 | | | 217,514 | | | — | | | 2,196 | |

RSD | | BRC | | 07/05/11 | | 17,253,300 | | | 248,523 | | | 247,955 | | | — | | | 568 | |

THB | | JPM | | 07/06/11 | | 13,787,160 | | | 448,728 | | | 449,093 | | | 365 | | | — | |

UAH | | CIT | | 07/01/11 | | 2,143,000 | | | 268,373 | | | 268,547 | | | 174 | | | — | |

ZAR | | CIT | | 09/14/11 | | 4,845,897 | | | 709,328 | | | 706,667 | | | — | | | 2,661 | |

ZAR | | JPM | | 09/14/11 | | 11,065,383 | | | 1,619,718 | | | 1,552,056 | | | — | | | 67,662 | |

| | | | | | | | | | | | | | | | | | | |

Total Forward Currency Sale Contracts | | $ | 52,945,632 | | $ | 52,395,349 | | | 113,623 | | | 663,906 | |

| | | | | | | | | | | | | |

Gross unrealized appreciation/depreciation on Forward Currency Purchase and Sale Contracts | | | | | | | | $ | 1,196,675 | | $ | 1,047,749 | |

| | | | | | | | | | | | | |

| | | | | |

Currency Abbreviations: | | | | |

| | | | | |

ARS | — Argentine Peso | | MXN | — Mexican New Peso |

BRL | — Brazilian Real | | MYR | — Malaysian Ringgit |

CLP | — Chilean Peso | | NGN | — Nigerian Naira |

CNY | — Chinese Renminbi | | PHP | — Philippine Peso |

COP | — Colombian Peso | | PLN | — Polish Zloty |

CZK | — Czech Koruna | | RON | — New Romanian Leu |

EUR | — Euro | | RSD | — Serbian Dinar |

GHS | — Ghanaian Cedi | | RUB | — Russian Ruble |

IDR | — Indonesian Rupiah | | SGD | — Singapore Dollar |

ILS | — Israeli Shekel | | THB | — Thai Baht |

INR | — Indian Rupee | | UAH | — Ukranian Hryvnia |

JPY | — Japanese Yen | | UGX | — Ugandan Shilling |

KES | — Kenyan Shilling | | UYU | — Uruguayan Peso |

KRW | — South Korean Won | | ZAR | — South African Rand |

KZT | — Kazakhstani Tenge | | ZMK | — Zambian Kwacha |

| | |

Counterparty Abbreviations: | |

| | |

BNP | — BNP Paribas SA |

BRC | — Barclays Bank PLC |

CIT | — Citibank NA |

CSF | — Credit Suisse First Boston |

HSB | — HSBC Bank USA |

ING | — ING Bank NV |

JPM | — JPMorgan Chase Bank |

SCB | — Standard Chartered Bank |

UBS | — UBS AG |

The accompanying notes are an integral part of these financial statements.

15

|

| |

Lazard Global Total Return and Income Fund, Inc. |

Notes to Portfolio of Investments |

June 30, 2011 (unaudited) |

| |

| |

(a) | Non-income producing security. |

(b) | For federal income tax purposes, the aggregate cost was $178,829,371, aggregate gross unrealized appreciation was $22,651,679, aggregate gross unrealized depreciation was $21,862,486 and the net unrealized appreciation was $789,193. |

(c) | Segregated security for forward currency contracts. |

(d) | Principal amount denominated in respective country’s currency. |

| | |

Security Abbreviations: | |

| | |

ADR | — American Depositary Receipt |

NTN-F | — Brazil Sovereign “Nota do Tesouro Nacional” Series F |

| | | | |

Portfolio holdings by industry (as percentage of net assets): | | | | |

| | | | | |

Alcohol & Tobacco | | 2.0 | % |

Banking | | 8.5 | |

Cable Television | | 2.3 | |

Computer Software | | 8.6 | |

Energy Integrated | | 7.4 | |

Energy Services | | 2.7 | |

Financial Services | | 3.7 | |

Food & Beverages | | 3.7 | |

Gas Utilities | | 1.7 | |

Housing | | 1.3 | |

Insurance | | 2.5 | |

Manufacturing | | 7.6 | |

Metals & Mining | | 2.2 | |

Pharmaceutical & Biotechnology | | 16.6 | |

Retail | | 7.3 | |

Semiconductor & Components | | 4.3 | |

Technology Hardware | | 5.2 | |

Telecommunications | | 3.3 | |

| | | |

Subtotal | | 90.9 | |

Foreign Government Obligations | | 15.5 | |

Short-Term Investment | | 1.1 | |

| | | |

Total Investments | | 107.5 | % |

| | | |

The accompanying notes are an integral part of these financial statements.

16

|

| |

Lazard Global Total Return and Income Fund, Inc. |

Statement of Assets and Liabilities |

June 30, 2011 (unaudited) |

| |

| | | | |

ASSETS | | | | |

Investments in securities, at value (cost $178,829,371) | | $ | 179,618,564 | |

Cash | | | 121,786 | |

Foreign currency, at value (cost $270,057) | | | 271,433 | |

Dividends and interest receivable | | | 632,633 | |

Gross unrealized appreciation on forward currency contracts | | | 1,196,675 | |

| | | | |

Total assets | | | 181,841,091 | |

| | | | |

| | | | |

LIABILITIES | | | | |

Payables for: | | | | |

Management fees | | | 147,413 | |

Investments purchased | | | 114,576 | |

Line of credit outstanding | | | 13,260,000 | |

Gross unrealized depreciation on forward currency contracts | | | 1,047,749 | |

Other accrued expenses and payables | | | 109,138 | |

| | | | |

Total liabilities | | | 14,678,876 | |

| | | | |

Net assets | | $ | 167,162,215 | |

| | | | |

| | | | |

NET ASSETS | | | | |

Paid in capital (Note 2(g)) | | $ | 167,758,935 | |

Distributions in excess of net investment income (Note 2(g)) | | | (2,719,628 | ) |

Accumulated net realized gain | | | 1,168,549 | |

Net unrealized appreciation on: | | | | |

Investments | | | 789,193 | |

Foreign currency and forward currency contracts | | | 165,166 | |

| | | | |

Net assets | | $ | 167,162,215 | |

| | | | |

| | | | |

Shares of common stock outstanding* | | | 9,605,237 | |

Net asset value per share | | $ | 17.40 | |

Market value per share | | $ | 15.72 | |

* $0.001 par value, 500,000,000 shares authorized for the Fund.

The accompanying notes are an integral part of these financial statements.

17

|

| |

Lazard Global Total Return and Income Fund, Inc. |

Statement of Operations |

For the Six Months Ended June 30, 2011 (unaudited) |

| |

| | | | |

INVESTMENT INCOME | | | | |

| | | | |

Income: | | | | |

Dividends (net of foreign withholding taxes of $148,513) | | $ | 2,549,651 | |

Interest | | | 944,663 | |

| | | | |

Total investment income | | | 3,494,314 | |

| | | | |

| | | | |

Expenses: | | | | |

Management fees (Note 3) | | | 874,370 | |

Professional services | | | 70,675 | |

Shareholders’ reports | | | 55,752 | |

Custodian fees | | | 54,099 | |

Administration fees | | | 37,492 | |

Shareholders’ services | | | 21,235 | |

Shareholders’ meeting | | | 18,304 | |

Directors’ fees and expenses | | | 4,125 | |

Other | | | 41,385 | |

| | | | |

Total expenses before interest expense | | | 1,177,437 | |

Interest expense | | | 46,326 | |

| | | | |

Total expenses | | | 1,223,763 | |

| | | | |

Net investment income | | | 2,270,551 | |

| | | | |

| | | | |

NET REALIZED AND UNREALIZED GAIN (LOSS) ON INVESTMENTS, FOREIGN CURRENCY AND FORWARD CURRENCY CONTRACTS | | | | |

Net realized gain on: | | | | |

Investments (net of foreign capital gains taxes of $26,847) | | | 3,074,555 | |

Foreign currency and forward currency contracts | | | 726,786 | |

| | | | |

Total net realized gain on investments, foreign currency and forward currency contracts | | | 3,801,341 | |

| | | | |

Net change in unrealized appreciation (depreciation) on: | | | | |

Investments | | | 4,559,906 | |

Foreign currency and forward currency contracts | | | (69,651 | ) |

| | | | |

Total net change in unrealized appreciation on investments, foreign currency and forward currency contracts | | | 4,490,255 | |

| | | | |

Net realized and unrealized gain on investments, foreign currency and forward currency contracts | | | 8,291,596 | |

| | | | |

Net increase in net assets resulting from operations | | $ | 10,562,147 | |

| | | | |

The accompanying notes are an integral part of these financial statements.

18

|

| |

Lazard Global Total Return and Income Fund, Inc. |

Statements of Changes in Net Assets |

|

| |

| | | | | | | | | |

| | Six Months Ended

June 30, 2011

(unaudited) | | Year Ended

December 31,

2010 | |

| | | | | |

INCREASE (DECREASE) IN NET ASSETS | | | | | | | | | |

| | | | | | | | | |

Operations: | | | | | | | | | |

Net investment income | | | $ | 2,270,551 | | | $ | 3,711,236 | |

Net realized gain on investments, foreign currency and forward currency contracts | | | | 3,801,341 | | | | 3,348,737 | |

Net change in unrealized appreciation (depreciation) on investments, foreign currency and forward currency contracts | | | | 4,490,255 | | | | (938,139 | ) |

| | | | | | | | | |

Net increase in net assets resulting from operations | | | | 10,562,147 | | | | 6,121,834 | |

| | | | | | | | | |

| | | | | | | | | |

Distributions to Stockholders (Note 2(g)): | | | | | | | | | |

From net investment income | | | | (5,051,970 | ) | | | (6,474,272 | ) |

Return of capital | | | | — | | | | (3,893,621 | ) |

| | | | | | | | | |

Net decrease in net assets resulting from distributions | | | | (5,051,970 | ) | | | (10,367,893 | ) |

| | | | | | | | | |

Total increase (decrease) in net assets | | | | 5,510,177 | | | | (4,246,059 | ) |

Net assets at beginning of period | | | | 161,652,038 | | | | 165,898,097 | |

| | | | | | | | | |

Net assets at end of period* | | | $ | 167,162,215 | | | $ | 161,652,038 | |

| | | | | | | | | |

* Includes undistributed (distributions in excess of) net investment income of (Note 2(g)) | | | $ | (2,719,628 | ) | | $ | 61,791 | |

| | | | | | | | | |

| | | | | | | | | |

Transactions in Capital Shares: | | | | | | | | | |

Common shares outstanding at beginning of period | | | | 9,605,237 | | | | 9,605,237 | |

| | | | | | | | | |

Common shares outstanding at end of period | | | | 9,605,237 | | | | 9,605,237 | |

| | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

19

|

| |

Lazard Global Total Return and Income Fund, Inc. |

Statement of Cash Flows |

For the Six Months Ended June 30, 2011 (unaudited) |

| |

| | | | |

INCREASE (DECREASE) IN CASH AND FOREIGN CURRENCY | | | | |

| |

Cash flows from operating activities: | | | | |

Net increase in net assets from operations | | $ | 10,562,147 | |

Adjustments to reconcile net increase in net assets from operations to net cash provided in operating activities

Decrease in interest and dividends receivable | | | 220,222 | |

Accretion of bond discount and amortization of bond premium | | | (226,793 | ) |

Inflation index adjustment | | | (29,064 | ) |

Decrease in other accrued expenses and payables | | | (26,773 | ) |

Net realized gain on investments, foreign currency and forward currency contracts | | | (3,801,341 | ) |

Net change in unrealized appreciation on investments, foreign currency and forward currency contracts | | | (4,490,255 | ) |

Purchase of long-term investments | | | (34,943,876 | ) |

Proceeds from disposition of long-term investments | | | 26,634,918 | |

Proceeds from disposition of short-term investments, net | | | 861,816 | |

| | | | |

Net cash provided in operating activities | | | (5,238,999 | ) |

| | | | |

| | | | |

Cash flows from financing activities: | | | | |

Cash distribution paid (Note 2(g)) | | | (5,051,970 | ) |

Gross drawdowns in line of credit balance | | | 13,260,000 | |

Gross paydowns in line of credit balance | | | (3,790,000 | ) |

| | | | |

Net cash used in financing activities | | | 4,418,030 | |

| | | | |

| | | | |

Effect of exchange rate changes on cash | | | 726,603 | |

| | | | |

Net decrease in cash and foreign currency | | | (94,366 | ) |

| | | | |

Cash and foreign currency: | | | | |

Beginning balance | | | 487,585 | |

| | | | |

Ending balance | | $ | 393,219 | |

| | | | |

| | | | |

Supplemental disclosure of cash flow information: | | | | |

Cash paid during the period for interest | | $ | (46,326 | ) |

| | | | |

The accompanying notes are an integral part of these financial statements.

20

|

| |

Lazard Global Total Return and Income Fund, Inc. |

Financial Highlights |

Selected data for a share of common stock outstanding throughout each period |

| |

| | | | | | | | | | | | | | | | | | | |

| | Six Months

Ended

6/30/11† | | Year Ended | |

| | | | |

| | | 12/31/10 | | 12/31/09 | | 12/31/08 | | 12/31/07 | | 12/31/06 | |

| | | | | | | | | | | | | |

Net asset value, beginning of period | | $ | 16.83 | | $ | 17.27 | | $ | 14.58 | | $ | 24.37 | | $ | 23.77 | | $ | 21.10 | |

| | | | | | | | | | | | | | | | | | | |

Income (loss) from investment operations: | | | | | | | | | | | | | | | | | | | |

Net investment income | | | 0.25 | | | 0.39 | | | 0.48 | | | 0.66 | | | 0.42 | | | 0.40 | |

Net realized and unrealized gain (loss) | | | 0.85 | | | 0.25 | | | 3.21 | | | (9.02 | ) | | 1.84 | | | 4.61 | |

| | | | | | | | | | | | | | | | | | | |

Total from investment operations | | | 1.10 | | | 0.64 | | | 3.69 | | | (8.36 | ) | | 2.26 | | | 5.01 | |

| | | | | | | | | | | | | | | | | | | |

Less distributions from (Note 2(g)): | | | | | | | | | | | | | | | | | | | |

Net investment income | | | (0.53 | ) | | (0.67 | ) | | (0.08 | ) | | (1.03 | ) | | (1.15 | ) | | (1.12 | ) |

Net realized gains | | | — | | | — | | | — | | | (0.33 | ) | | (0.51 | ) | | (1.22 | ) |

Return of capital | | | — | | | (0.41 | ) | | (0.92 | ) | | (0.07 | ) | | — | | | — | |

| | | | | | | | | | | | | | | | | | | |

Total distributions | | | (0.53 | ) | | (1.08 | ) | | (1.00 | ) | | (1.43 | ) | | (1.66 | ) | | (2.34 | ) |

| | | | | | | | | | | | | | | | | | | |

Net asset value, end of period | | $ | 17.40 | | $ | 16.83 | | $ | 17.27 | | $ | 14.58 | | $ | 24.37 | | $ | 23.77 | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

Market value, end of period | | $ | 15.72 | | $ | 15.06 | | $ | 14.89 | | $ | 11.83 | | $ | 23.34 | | $ | 22.58 | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

Total Return based upon: | | | | | | | | | | | | | | | | | | | |

Net asset value (a) | | | 6.60 | % | | 4.14 | % | | 26.90 | % | | –35.33 | % | | 9.74 | % | | 24.46 | % |

Market value (a) | | | 7.96 | % | | 8.90 | % | | 36.72 | % | | –44.43 | % | | 11.35 | % | | 35.64 | % |

| | | | | | | | | | | | | | | | | | | |

Ratios and Supplemental Data: | | | | | | | | | | | | | | | | | | | |

Net assets, end of period (in thousands) | | $ | 167,162 | | $ | 161,652 | | $ | 165,898 | | $ | 140,026 | | $ | 234,125 | | $ | 228,274 | |

Ratios to average net assets: | | | | | | | | | | | | | | | | | | | |

Net expenses (b) | | | 1.49 | % | | 1.59 | % | | 1.61 | % | | 1.83 | % | | 1.58 | % | | 1.50 | % |

Gross expenses (b) | | | 1.49 | % | | 1.59 | % | | 1.61 | % | | 1.83 | % | | 1.58 | % | | 1.51 | % |

Gross expenses excluding interest expense (b) | | | 1.43 | % | | 1.47 | % | | 1.42 | % | | 1.45 | % | | 1.42 | % | | 1.43 | % |

Net investment income (b) | | | 2.77 | % | | 2.37 | % | | 3.28 | % | | 3.26 | % | | 1.71 | % | | 1.76 | % |

Portfolio turnover rate | | | 15 | % | | 32 | % | | 25 | % | | 25 | % | | 28 | % | | 38 | % |

| |

† | Unaudited. |

(a) | Total return based on per share market price assumes the purchase of common shares at the closing market price on the business day immediately preceding the first day, and sales of common shares at the closing market price on the last day, of each period indicated; dividends and distributions are assumed to be reinvested in accordance with the Fund’s Dividend Reinvestment Plan. The total return based on net asset value, or NAV, assumes the purchase of common shares at the “net asset value, beginning of period” and sales of common shares at the “net asset value, end of period”, for each of the periods indicated; distributions are assumed to be reinvested at NAV. Past performance is not indicative, or a guarantee, of future results; the investment return, market price and net asset value of the Fund will fluctuate, so that an investor’s shares in the Fund, when sold, may be worth more or less than their original cost. The returns do not reflect the deduction of taxes that a stockholder would pay on the Fund’s distributions or on the sale of Fund shares. A Period of less than one year is not annualized. |

(b) | Annualized for a period of less than one year. |

The accompanying notes are an integral part of these financial statements.

21

|

| |

Lazard Global Total Return and Income Fund, Inc. |

Notes to Financial Statements |

June 30, 2011 (unaudited) |

| |

1. Organization

Lazard Global Total Return and Income Fund, Inc. (the “Fund”) was incorporated in Maryland on January 27, 2004 and is registered under the Investment Company Act of 1940, as amended (the “Act”), as a diversified, closed-end management investment company. The Fund trades on the NYSE under the ticker symbol LGI and commenced operations on April 28, 2004. The Fund’s investment objective is total return, consisting of capital appreciation and income.

2. Significant Accounting Policies

The accompanying financial statements are presented in conformity with accounting principles generally accepted in the United States of America (“GAAP”). The following is a summary of significant accounting policies:

(a) Valuation of Investments—Market values for securities are generally based on the last reported sales price on the principal exchange or market on which the security is traded, generally as of the close of regular trading on the NYSE (normally 4:00 p.m. Eastern time) on each valuation date. Any securities not listed, for which current over-the-counter market quotations or bids are readily available, are valued at the last quoted bid price or, if available, the mean of two such prices. Securities listed on foreign exchanges are valued at the last reported sales price except as described below; securities listed on foreign exchanges that are not traded on the valuation date are valued at the last quoted bid price. Forward currency contracts are valued at the current cost of offsetting the contracts. Investments in money market funds are valued at the fund’s net asset value.

Bonds and other fixed-income securities that are not exchange-traded are valued on the basis of prices provided by pricing services which are based primarily on institutional trading in similar groups of securities, or by using brokers’ quotations.

If a significant event materially affecting the value of securities occurs between the close of the exchange or market on which the security is principally traded and the time when the Fund’s net asset value is calculated, or when current market quotations otherwise are determined not to be readily available or reliable (including restricted or other illiquid securities such as derivative instruments), such securities will be valued at their fair values as determined by, or in accordance with procedures approved by, the Board of Directors (the “Board”). The Valuation Committee of the Investment Manager may evaluate a variety of factors to determine the fair value of securities for which market quotations are determined not to be readily available

or reliable. These factors include, but are not limited to, the type of security, the value of comparable securities, observations from financial institutions and relevant news events. Input from the Investment Manager’s analysts also will be considered.

(b) Portfolio Securities Transactions and Investment Income—Portfolio securities transactions are accounted for on trade date. Realized gain (loss) on sales of investments are recorded on a specific identification basis. Dividend income is recorded on the ex-dividend date and interest income is accrued daily. The Fund amortizes premiums and accretes discounts on fixed-income securities using the effective yield method.

The Fund may be subject to taxes imposed by foreign countries in which it invests. Such taxes are generally based upon income earned or capital gains (realized or unrealized). The Fund accrues and applies such taxes to net investment income, net realized gains and net unrealized gains concurrent with the recognition of income or capital gains (realized and unrealized) from the applicable portfolio securities.

(c) Leveraging—The Fund uses leverage to invest Fund assets in currency investments, primarily using forward currency contracts and by borrowing under a credit facility with State Street Bank and Trust Company (“State Street”), up to a maximum of 33⅓% of the Fund’s total leveraged assets. If the assets of the Fund decline due to market conditions such that this 33⅓% threshold will be exceeded, leverage risk will increase.

If the Fund is able to realize a higher return on the leveraged portion of its investment portfolio than the cost of such leverage together with other related expenses, the effect of the leverage will be to cause the Fund to realize a higher net return than if the Fund were not so leveraged. There is no assurance that any leveraging strategy the Fund employs will be successful.

Using leverage is a speculative investment technique and involves certain risks. These include higher volatility of net asset value, the likelihood of more volatility in the market value of the Fund’s common stock and, with respect to borrowings, the possibility either that the Fund’s return will fall if the interest rate on any borrowings rises, or that income will fluctuate because the interest rate of borrowings varies.

If the market value of the Fund’s leveraged currency investments declines, the leverage will result in a greater decrease in net asset value, or less of an increase in net asset value, than if the Fund were not leveraged. Such results also will tend to have a similar effect on the market price of the

22

|

| |

Lazard Global Total Return and Income Fund, Inc. |

Notes to Financial Statements (continued) |

June 30, 2011 (unaudited) |

| |

Fund’s common stock. To the extent that the Fund is required or elects to prepay any borrowings, the Fund may need to liquidate investments to fund such prepayments. Liquidation at times of adverse economic conditions may result in capital losses and may reduce returns.

(d) Foreign Currency Translation and Forward Currency Contracts—The accounting records of the Fund are maintained in U.S. dollars. Portfolio securities and other assets and liabilities denominated in a foreign currency are translated daily into U.S. dollars at the prevailing rates of exchange. Purchases and sales of securities, income receipts and expense payments are translated into U.S. dollars at the prevailing exchange rates on the respective transaction dates.

The Fund does not isolate the portion of operations resulting from changes in foreign exchange rates on investments from the fluctuations arising from changes in their market prices. Such fluctuations are included in net realized and unrealized gain (loss) on investments. Net realized gain (loss) on foreign currency and forward currency contracts represents net foreign currency gain (loss) from forward currency contracts, disposition of foreign currencies, currency gain (loss) realized between the trade and settlement dates on securities transactions, and the difference between the amount of dividends, interest and foreign withholding taxes recorded on the Fund’s accounting records and the U.S. dollar equivalent amounts actually received or paid. Net change in unrealized appreciation (depreciation) on foreign currency reflects the impact of changes in exchange rates on the value of assets and liabilities, other than investments in securities, during the period.

A forward currency contract is an agreement between two parties to buy or sell currency at a set price on a future date. Upon entering into these contracts, risks may arise from the potential inability of counterparties to meet the terms of their contracts and from unanticipated movements in the value of the foreign currency relative to the U.S. dollar.

The U.S. dollar value of forward currency contracts is determined using forward exchange rates provided by quotation services. Daily fluctuations in the value of such contracts are recorded as unrealized appreciation (depreciation) on forward currency contracts. When the contract is closed, the Fund records a realized gain (loss) equal to the difference between the value at the time it was opened and the value at the time it was closed.

(e) Structured Investments—The Fund may invest in structured investments, whose values are linked either directly or inversely to changes in foreign currencies, interest rates,

commodities, indices, or other underlying instruments. The Fund may use these investments to increase or decrease its exposure to different underlying instruments, to gain exposure to markets that might be difficult to invest in through conventional securities or for other purposes. Structured investments may be more volatile than their underlying instruments, but any loss is limited to the amount of the original investment.

(f) Federal Income Tax Policy—It is the Fund’s policy to comply with the requirements of Subchapter M of the Internal Revenue Code applicable to regulated investment companies and to distribute substantially all of its taxable income to its stockholders. Therefore, no provision for federal income taxes is required. The Fund files tax returns with the U.S. Internal Revenue Service and various states.

At December 31, 2010, the Fund had $2,622,804 of unused realized capital loss carryforwards, expiring in 2017.

Under current tax law, certain capital and net foreign currency losses realized after October 31 within the taxable year may be deferred and treated as occurring on the first day of the following tax year. For the tax year ended December 31, 2010, the Fund had no net capital and foreign currency losses arising between November 1, 2010 and December 31, 2010.

On December 22, 2010, the Regulated Investment Company Modernization Act of 2010 (the “RIC Modernization Act”) was signed into law. The RIC Modernization Act includes numerous provisions that generally become effective for taxable years beginning after the date of enactment. Among the new provisions, net capital losses may be carried forward indefinitely, and their character is retained as short-term and/or long-term losses. Previously, net capital losses were carried forward for eight years and treated as short-term losses. The RIC Modernization Act also requires that post-enactment net capital losses be used before pre-enactment net capital losses. As a result, pre-enactment capital loss carryforwards may now expire unused.

Management has analyzed the Fund’s tax positions, and has concluded that no liability for unrecognized tax benefits should be recorded related to uncertain tax positions taken on returns filed for open tax years (2007-2009), or expected to be taken in the Fund’s 2010 tax returns.

(g) Dividends and Distributions—The Fund intends to declare and to pay dividends monthly from net investment income. Distributions to stockholders are recorded on the ex-dividend date. During any particular year, net realized gains from investment transactions in excess of available capital loss carryforwards would be taxable to the Fund, if

23

|

| |

Lazard Global Total Return and Income Fund, Inc. |

Notes to Financial Statements (continued) |

June 30, 2011 (unaudited) |

| |

not distributed. The Fund intends to declare and distribute these amounts, at least annually, to stockholders; however, to avoid taxation, a second distribution may be required.

Income dividends and capital gains distributions are determined in accordance with federal income tax regulations which may differ from GAAP. These book/tax differences, which may result in distribution reclassifications, are primarily due to differing treatments of foreign currency transactions and wash sales. The book/tax differences relating to stockholder distributions may result in reclassifications among certain capital accounts.