UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-21511

Lazard Global Total Return and Income Fund, Inc.

(Exact name of registrant as specified in charter)

30 Rockefeller Plaza

New York, New York 10112

(Address of principal executive offices) (Zip code)

Mark R. Anderson, Esq.

Lazard Asset Management LLC

30 Rockefeller Plaza

New York, New York 10112

(Name and address of agent for service)

Registrant’s telephone number, including area code: (212) 632-6000

Date of fiscal year end: 12/31

Date of reporting period: 12/31/19

ITEM 1. REPORTS TO STOCKHOLDERS.

Lazard Global Total Return

and Income Fund, Inc.

Annual Report

December 31, 2019

Important Information on Paperless Delivery

Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the Fund’s shareholder reports like this one will no longer be sent by mail, unless you specifically request paper copies of the reports from the Fund or from your financial intermediary, such as a broker-dealer or bank. Instead, the reports will be made available on a website, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. Shareholders who hold accounts directly with the Fund may elect to receive shareholder reports and other communications from the Fund electronically by signing up for paperless delivery at www.icsdelivery.com/lazardassetmanagement. If you own these shares through a financial intermediary, you may contact your financial intermediary.

You may elect to receive all future reports in paper free of charge. You can inform the Fund that you wish to continue receiving paper copies of your shareholder reports by following the instructions included with this disclosure and visiting www.fundreports.com. If you own these shares through a financial intermediary, you may contact your financial intermediary or follow instructions included with this disclosure to elect to continue to receive paper copies of your shareholder reports. Your election to receive reports in paper will apply to all funds held with the fund complex or your financial intermediary.

PRIVACY NOTICE

WHAT DOES LAZARD DO WITH YOUR PERSONAL INFORMATION?

Financial companies choose how they share your personal information. U.S. federal law gives our clients the right to limit some but not all sharing. U.S. federal and other applicable law also requires us to tell you how we collect, share, and protect your personal information. Please read this notice carefully to understand what we do.

We do not disclose nonpublic personal information about our clients or former clients to third parties other than as described below.

Personal information we collect.We collect personal information about you in connection with our providing advisory services to you. The legal basis for our collection of your personal information is our contract with you and our legitimate business interest to provide contractual services to you. The collection of this information is necessary for us to be able to provide advisory services to you and the failure to provide such information will result in our inability to provide our services. This information includes your social security number (for U.S. persons) and may include other information such as your:

| | • | Assets and income; |

| | | |

| | • | Investment experience; |

| | | |

| | • | Transaction history; |

| | | |

| | • | Credit history; and |

| | | |

| | • | Wire transfer instructions. |

How we collect this information.We collect this information from you through various means. For example, when you give us your contact information, enter into an investment advisory contract with us, buy securities (i.e., interests in a fund) from us, direct us to buy or sell securities for your account, tell us where to send money, or make a wire transfer. We also may collect your personal information from other sources, such as our affiliates1 or other non-affiliated companies (such as credit bureaus).

| | 1 | Our affiliates are companiesrelated to us by common ownership or control and can include both financial and nonfinancial companies. Non-affiliates are companies notrelated to us by common ownership or control and can include both financial and nonfinancial companies. |

How we use this information.All financial companies need to share customers’ personal information to run their everyday business and we use the personal information we collect from you for our everyday business purposes. These purposes may include for example:

| | • | To provide advisory services to you; |

| | | |

| | • | To open an account for you; |

| | | |

| | • | To process a transaction for your account; |

| | | |

| | • | To market products and services to you; and/or |

| | | |

| | • | To respond to court orders and legal investigations. |

If you are an investor located within a European Union country, please note that personal information may be collected, shared and/or stored outside of the European Union.

Disclosure to others.We may provide your personal information to our affiliates and to firms that assist us in servicing your account and have a need for such information, such as a broker, counterparty, fund administrator or third party service provider that aggregates data in a central repository for access by a broker, counterparty or fund administrator to provide its services. We may also disclose such information to service providers and financial institutions with which we have a formal agreement to provide services relating to our arrangements with you. We require third party service providers and financial institutions with which we have a formal agreement to provide services relating to our arrangements with you to protect the confidentiality of your information and to use the information only for the purposes for which we disclose the information to them. These sharing practices are consistent with applicable privacy and related laws, and in general, you may not limit our use of your personal information for these purposes under such laws. We note that the U.S. federal privacy laws only give you the right to limit the certain types of information sharing that we do not engage in (e.g., sharing with our affiliates certain information relating to your transaction history or creditworthiness for their use in marketing to you, or sharing any personal information with nonaffiliates for them to market to you). We may also share your personal information with non-affiliates (such as a government agency or regulatory authority) as required by applicable law.

How we protect your personal information.To protect your personal information from unauthorized access and use, we use security measures that comply with applicable law. These measures include computer safeguards and secured files and buildings.

How long we keep your personal information.We retain your personal information for the duration of your advisory relationship with us and for a period of time thereafter as required by applicable law.

Your rights with respect to this information.If you are an investor located within a European Union country, you have the following rights with respect to your personal information:

| | • | The right to request and obtain a copy of your personal information that we maintain; |

| | | |

| | • | The right to correct your personal information that we maintain; |

| | | |

| | • | The right to request the erasure of your personal information from our systems, subject to applicable recordkeeping requirements applicable to us; and |

| | | |

| | • | The right to lodge a complaint with a supervisory authority. |

Who is providing this Privacy Notice.This Privacy Notice relates to the following entities:

| | • | Lazard Asset Management LLC |

| | | |

| | • | Lazard Asset Management (Canada), Inc.2 |

| | | |

| | • | Lazard Asset Management Securities LLC |

Who to contact with questions.If you have any questions about this Privacy Notice, please call (800) 823-6300 or visit our website at http://www.lazardassetmanagement.com.

| | 2 | Lazard Asset Management (Canada), Inc. does not disclose any non-public personal information about its customers to any third party, except as permitted by or required by any applicable law, including the laws of the United States and Canada. |

Lazard Global Total Return and Income Fund, Inc.

Lazard Global Total Return and Income Fund, Inc.

Investment Overview

(unaudited)

Dear Stockholders,

We are pleased to present this report for Lazard Global Total Return and Income Fund, Inc. (“LGI” or the “Fund”), for the year ended December 31, 2019. LGI is a diversified, closed-end management investment company that began trading on the New York Stock Exchange (“NYSE”) on April 28, 2004. Its ticker symbol is “LGI.”

We believe that the Fund has provided investors with an attractive distribution return and diversification, backed by the extensive experience, commitment, and professional management of Lazard Asset Management LLC (the “Investment Manager” or “Lazard”).

Portfolio Update (as of December 31, 2019)

For the year ended December 31, 2019, the Fund’s net asset value (“NAV”) returned 27.5%, outperforming the 26.6% return of its benchmark, a linked index comprised of the MSCI World® Index, from inception through August 31, 2016, and the MSCI All Country World® Index (the “MSCI ACWI”) for all periods after August 31, 2016 (the “MSCI World/ACWI Linked Index”). The three-year performance is also outperforming the benchmark. However, due to weaker performance during the years 2013 through 2015, the Fund’s NAV performance over longer time periods has underperformed the benchmark. The since inception annualized return through December 31, 2019 was 7.2%, slightly behind the 7.3% return for the MSCI World/ACWI Linked Index for the same period. Shares of LGI ended 2019 with a market price of $16.55, representing a 9.3% discount to the Fund’s NAV per share of $18.24.

The Fund’s net assets were $237.3 million as of December 31, 2019, with total leveraged assets (net assets plus line of credit outstanding and net notional value of forward currency contracts) of $327.0 million, representing a 27.4% leverage rate. This leverage rate was lower than that at the end of 2018, and in line with the maximum permitted leverage rate of 33⅓%.

As previously announced in a press release dated December 3, 2019, the merger of Lazard World Dividend & Income Fund, Inc. (“LOR”) with and into LGI, pursuant to an Agreement and Plan of Merger (the “Merger”), was consummated as of the close of business on December 3, 2019 (the “Closing Date”). In the Merger, shares of LOR common stock were converted into shares of LGI common stock, based on the net asset value of each fund as of the close of business on the Closing Date. The exchange ratio at which shares of LOR common stock

2

Lazard Global Total Return and Income Fund, Inc.

Investment Overview(continued)

(unaudited)

were converted into shares of LGI common stock was approximately 0.61852. The combined fund has retained the name “Lazard Global Total Return and Income Fund, Inc.” and the “LGI” ticker symbol. LOR ceased trading as of the close of business on the Closing Date.

Within the global equity portfolio, stock selection in the industrials and health care sectors and within the United States contributed positively to the year’s performance. An underweight position in the energy sector also added value. Conversely, stock selection within the financials and communication services sectors and within France and India detracted from performance.

The smaller, short duration1emerging markets currency and debt portion of the Fund was a positive contributor to performance for 2019.

As of December 31, 2019, 70.5% of the Fund’s total leveraged assets consisted of global equities, 28.6% consisted of emerging markets currency and debt instruments, and 0.9% consisted of cash and other assets.

Declaration of Distributions

Pursuant to LGI’s Level Distribution Policy, the Fund declares a monthly distribution equal to 7.0% (on an annualized basis) of the Fund’s published NAV per share on the last business day of the previous year. This published NAV per share may differ from the NAV per share as of year-end shown elsewhere in this shareholder report, generally as the result of post year-end accounting and tax adjustments to the published NAV per share. Throughout 2019, the monthly distribution rate per share was $0.08879, representing a distribution rate of 6.4% based on the Fund’s market price of $16.55 as of the close of trading on the NYSE on December 31, 2019 (inclusive of returns of capital). Of the $1.06548 per share distributed in 2019, which is inclusive of the Fund’s spillback and annual distribution, approximately $0.82935 was a return of capital. The 2020 monthly distribution rate is set at $0.10646, representing a distribution yield of 7.7% based on the Fund’s year-end market price.

Additional Information

Please note that available on www.lazardassetmanagement.com are frequent updates on the Fund’s performance, press releases, distribution information, and a monthly fact sheet that provides information about the Fund’s major holdings, sector weightings, regional exposures, and other characteristics, including the notices regarding the composition of monthly (and any additional) distributions

3

Lazard Global Total Return and Income Fund, Inc.

Investment Overview(continued)

(unaudited)

required by Section 19(a) of the Investment Company Act of 1940, as amended (the “1940 Act”). You may also reach Lazard by phone at 1-800-823-6300.

On behalf of Lazard, we thank you for your investment in Lazard Global Total Return and Income Fund, Inc. and look forward to continuing to serve your investment needs in the future.

4

Lazard Global Total Return and Income Fund, Inc.

Investment Overview(continued)

(unaudited)

Message from the Portfolio Managers

Global Equity Portfolio

(70.5% of total leveraged assets)

The Fund’s global equity portfolio is invested in approximately 60 to 80 US and non-US equity securities of companies (including those in emerging markets) with market capitalizations greater than $2 billion. Examples include Microsoft, a US-based multinational technology company; Wolters Kluwer, a global information services company headquartered in the Netherlands; and Aon, a global professional services firm that provides risk, retirement, and health consulting services.

The companies held in the global equity portfolio are based in developed and emerging market regions around the world. As of December 31, 2019, 52.4% of the portfolio’s stocks were based in North America, 15.6% were based in continental Europe (not including the United Kingdom), 14.7% were from the United Kingdom, 8.4% were from Asia (not including Japan) and Australia, 6.0% were from Japan, and 2.9% were from Africa and the Middle East.

The global equity portfolio is similarly invested across a number of industry sectors. The top two sectors, by weight, as of December 31, 2019, were information technology (18.9% of the portfolio), which includes companies that produce software, hardware or semiconductor equipment, or companies that provide internet or related services; and industrials (18.4% of the portfolio), which include commercial equipment and services, transportation, and distribution operations, construction and farming machinery, and airlines, railroads, and waste management companies. Other sectors in the portfolio included financials, health care, consumer staples, consumer discretionary, communication services, materials and real estate. The average dividend yield on the securities held in the global equity portfolio was approximately 1.7% as of December 31, 2019.

Global Equity Markets Review

Global equity markets recorded strong gains in 2019, with US stocks, in particular, continuing their winning streak to end the year at record highs on a combination of solid earnings, encouraging economic data, with dovish monetary policies across the globe. Despite slowing global growth and periodic risk aversion throughout the year, stocks and bonds rallied together in 2019 on globally synchronized monetary stimulus and continued share buybacks in the United States. Central bank activity to increase worldwide liquidity played an outsize role in calming markets in the face of growing anxiety about a global economic slowdown, trade wars, and Brexit. The world’s central banks, both in developed

5

Lazard Global Total Return and Income Fund, Inc.

Investment Overview(continued)

(unaudited)

and developing countries, resumed a coordinated monetary response. In addition to the Federal Reserve’s three interest rate cuts, the European Central Bank further reduced negative rates, while the Bank of England indicated that it was ready to reduce rates to offset the impact of a possible Brexit. Meanwhile, in Asia, the Bank of Japan announced that it would expand its balance sheet through further purchases of financial instruments. Near the end of the year, world equity markets were lifted by improved investor confidence in the global economic outlook. The most significant news coming out of the period was that the United States and China had reached an initial deal in their protracted trade war. Although investors were still awaiting the details of the “Phase 1” agreement as of the end of December, optimism about a truce between the world’s two largest economies eased fears of a global recession and led to a rally in global stock markets.

What Helped and What Hurt LGI

Stock selection in the industrials sector contributed to performance. Shares of engineering recruiter Technopro Holdings rose after the company reported strong results, driven by solid organic growth. An underweight position in energy also helped returns. The sector was among the year’s worst performers in the MSCI ACWI index. Stock selection within the healthcare sector and within the US also added value.

In contrast, stock selection in the financials sector and within India detracted from performance. Shares of lender Indiabulls Housing Finance, a mortgage lender based in India, fell amid questions concerning the company’s funding capabilities, as liquidity remained scarce. We sold our position in August, as our thesis was broken. Stock selection in the communication services sector and within France also hurt returns. Shares of videogame maker Ubisoft fell after management issued disappointing 2019 guidance in May, as well as a profit warning for its third quarter. We sold our position in November, as our thesis was broken.

Emerging Markets Currency and Debt Portfolio

(28.6% of total leveraged assets)

The Fund also seeks income through investing in primarily high-yielding, short-duration emerging markets forward currency contracts and local currency debt instruments. As of December 31, 2019, this portfolio consisted of forward currency contracts (65.8%) and sovereign debt obligations (34.2%). The average duration of the emerging markets currency and debt portfolio as of December 31, 2019 was approximately 12 months, similar to the level at the end of 2018.

6

Lazard Global Total Return and Income Fund, Inc.

Investment Overview(continued)

(unaudited)

Emerging Markets Currency and Debt Markets Review

Emerging local money markets were characterized by generally favorable performance in the context of a stable broad US dollar, relative emerging markets yield advantage, and fixed income yield compression. The dramatic deceleration in global trade, global growth angst, and US-China trade tensions failed to deter emerging markets currencies’ positively skewed returns, seen in a wide range of generally +/- 10%. Factoring in the yield component of returns, the majority of emerging money markets delivered positive results for the full year.

What Helped and What Hurt LGI

Attribution from Egypt, Russia, Indonesia, Brazil, and Mexico delivered two-thirds of the full year result from diversified return sources. Egyptian Treasury bills remained the strategy’s largest exposure throughout 2019 and finished as the leading contributor. Egypt’s steadily strengthening currency, high carry, and yield curve rally, which was driven by disinflation and improving fundamentals, contributed to realized return. This return was further helped by the country’s diverse sources of US dollar inflows and interbank market development. Importantly, and as we anticipated, Egypt exhibited a low correlation to the rest of the broader emerging markets universe during the course of the past few years, resulting in high country alpha. In Russia, the ruble and domestic government bond market benefitted from the country’s fiscal and current account surpluses, positive real interest rate, disinflation, monetary easing, and a local yield curve rally. As a result, both country and security selection added value. Elsewhere, high carry and positive real yields in Indonesia and Mexico (supported by a new USMCA trade deal at year-end) buoyed local markets there, while security selection in Brazil greatly enhanced the money market’s outturn, benefiting from the pension reform’s passage and historic interest rate cuts. Elsewhere, diversified positions in the local markets of South Africa, Kazakhstan, Thailand, Peru, the Philippines, and India each contributed.

Detracting markets for the year included Hungary, Uruguay, Argentina, and Chile. Hungarian attribution detracted due to disappointing euro zone demand indicators, a rapidly diminishing Hungarian current account surplus, and the central bank’s loose monetary stance of the country’s central bank, which combined to weaken the forint. In Latin America, political and economic risks evidenced some contagion, dampening results there. Uruguay detracted after the peso declined 15% while local rates failed to fully cushion its fall. While we avoided Argentina debt, the strategy’s light non-deliverable forward exposure detracted in 2019. The year proved to be a turbulent one characterized by a mixture of rising debt, spiraling inflation, and policy and political risks that com-

7

Lazard Global Total Return and Income Fund, Inc.

Investment Overview(concluded)

(unaudited)

bined to weaken the peso sharply in nominal terms. However, high domestic interest rate carry largely compensated for the currency’s decline. Chile’s civil unrest in the fourth quarter resulted in a sharp peso selloff before the central bank intervened forcefully at year-end, which propelled its December rebound. The strategy held minimal to no exposure to other 2019 down markets including Romania and South Korea.

Notes to Investment Overview:

| 1 | A measure of the average cash weighted term-to-maturity of the investment holdings. Duration is a measure of the price sensitivity of a bond to interest rate movements. Duration for a forward currency contract is equal to its term-to-maturity. |

Total returns reflect reinvestment of all dividends and distributions. Past performance is not indicative, or a guarantee, of future results.

The views of the Fund’s Investment Manager and the securities described in this report are as of December 31, 2019; these views and portfolio holdings may have changed subsequent to this date. Nothing herein should be construed as a recommendation to buy, sell, or hold a particular security. There is no assurance that the securities discussed herein will remain in the Fund at the time you receive this report, or that securities sold will not have been repurchased. The specific securities discussed may, in aggregate, represent only a small percentage of the Fund’s holdings. It should not be assumed that securities identified and discussed were, or will be, profitable, or that the investment decisions made in the future will be profitable, or equal the investment performance of the securities discussed herein.

The views and opinions expressed are provided for general information only, and do not constitute specific tax, legal, or investment advice to, or recommendations for, any person. There can be no guarantee as to the accuracy of any outlooks for markets, sectors and securities as discussed herein.

8

Lazard Global Total Return and Income Fund, Inc.

Performance Overview

(unaudited)

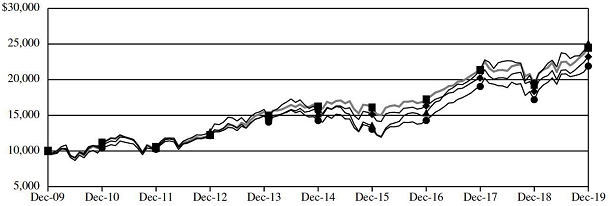

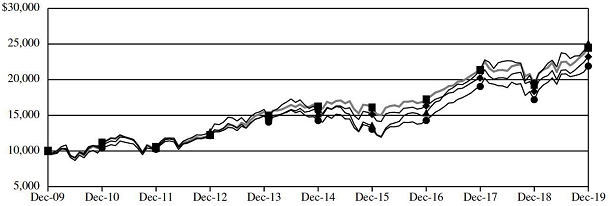

Comparison of Changes in Value of $10,000 Investment in

LGI, MSCI ACWI and MSCI World/ACWI Linked Index*

| | | | | Value at |

| | | | | 12/31/19 |

| | LGI at Market Price | | $ | 25,111 | |

| | LGI at Net Asset Value | | | 21,906 | |

| | MSCI ACWI | | | 23,221 | |

| | MSCI World/ACWI Linked Index | | | 24,487 | |

| Average Annual Total Returns* |

| Periods Ended December 31, 2019 |

| | | One | | Five | | Ten |

| | | Year | | Years | | Years |

| Market Price | | | 30.09 | % | | | 10.49 | % | | | 9.64 | % |

| Net Asset Value | | | 27.51 | % | | | 8.96 | % | | | 8.16 | % |

| MSCI ACWI | | | 26.60 | % | | | 8.41 | % | | | 8.79 | % |

| MSCI World/ACWI Linked Index | | | 26.60 | % | | | 8.54 | % | | | 9.37 | % |

| * | Total returns reflect reinvestment of all dividends and distributions. The performance quoted represents past performance. Current performance may be lower or higher than the performance quoted. Past performance is not indicative, or a guarantee, of future results; the investment return, market price and net asset value of Lazard Global Total Return and Income Fund, Inc. (the “Fund” or “LGI”) will fluctuate, so that Fund shares, when sold, may be worth more or less than their original cost. The returns do not reflect the deduction of taxes that a stockholder would pay on the Fund’s distributions or on the sale of Fund shares. |

| | |

| | Performance results do not include adjustments made for financial reporting purposes in accordance with US Generally Accepted Accounting Principles, if any, and also exclude one-time adjustments related to reimbursed custodian out-of-pocket expenses (Note 4 in the Notes to Financial Statements), and may differ from amounts reported in the financial highlights. |

9

Lazard Global Total Return and Income Fund, Inc.

Performance Overview(concluded)

(unaudited)

The performance data of the indices have been prepared from sources and data that Lazard Asset Management LLC, the Fund’s investment manager (the “Investment Manager”) believes to be reliable, but no representation is made as to their accuracy. The MSCI ACWI is a free-float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed and emerging markets. The MSCI ACWI consists of 49 country indices comprising 23 developed and 26 emerging markets country indices. The MSCI World/ACWI Linked Index is an unmanaged index created by the Investment Manager, which links the performance of the MSCI World Index for all periods through August 31, 2016 (when the Fund changed the investment strategy in its Global Equity Strategy) and the MSCI ACWI for all periods thereafter. The MSCI World Index is a free-float-adjusted market capitalization index that is designed to measure global developed markets equity performance. The MSCI World Index consists of 23 developed markets country indices. The indices are unmanaged, have no fees or costs and are not available for investment.

| Ten Largest Equity Holdings | | | | | | |

| December 31, 2019 | | | | | | |

| | | Fair | | | Percentage of |

| Security | | Value | | | Net Assets |

| Microsoft Corp. | | $ | 8,266,634 | | | | 3.5 | % |

| Thermo Fisher Scientific, Inc. | | | 7,307,951 | | | | 3.1 | |

| Alphabet, Inc., Class A | | | 7,082,694 | | | | 3.0 | |

| Zoetis, Inc. | | | 6,363,388 | | | | 2.7 | |

| Aon PLC | | | 6,286,192 | | | | 2.6 | |

| Wolters Kluwer NV | | | 5,994,444 | | | | 2.5 | |

| The Coca-Cola Co. | | | 5,913,594 | | | | 2.5 | |

| IQVIA Holdings, Inc. | | | 5,895,329 | | | | 2.5 | |

| Unilever PLC | | | 5,858,202 | | | | 2.5 | |

| Johnson & Johnson | | | 5,512,573 | | | | 2.3 | |

| Portfolio Holdings Presented by Sector | | | | | |

| December 31, 2019 | | | | | |

| | | | | | Percentage of |

| Sector | | | | | Total Investments |

| Communication Services | | | | | | 5.2 | % | |

| Consumer Discretionary | | | | | | 7.4 | | |

| Consumer Staples | | | | | | 12.7 | | |

| Financials | | | | | | 14.7 | | |

| Health Care | | | | | | 13.4 | | |

| Industrials | | | | | | 15.0 | | |

| Information Technology | | | | | | 16.4 | | |

| Materials | | | | | | 1.9 | | |

| Real Estate | | | | | | 0.1 | | |

| Sovereign Debt | | | | | | 12.8 | | |

| Short-Term Investments | | | | | | 0.4 | | |

| Total Investments | | | | | | 100.0 | % | |

10

Lazard Global Total Return and Income Fund, Inc.

Portfolio of Investments

December 31, 2019

| Description | | Shares | | | Fair

Value | |

| Common Stocks—97.2% | | | | | | |

| Belgium—0.8% | | | | | | | | |

| Anheuser-Busch InBev SA/NV | | | 22,195 | | | $ | 1,820,023 | |

| Canada—5.3% | | | | | | | | |

| CAE, Inc. | | | 97,515 | | | | 2,581,776 | |

| Canadian National Railway Co. | | | 42,255 | | | | 3,822,490 | |

| Dollarama, Inc. | | | 75,515 | | | | 2,595,383 | |

| National Bank of Canada | | | 62,820 | | | | 3,487,017 | |

| | | | | | | | 12,486,666 | |

| China—2.7% | | | | | | | | |

| Alibaba Group Holding, Ltd. Sponsored ADR (*) | | | 10,215 | | | | 2,166,601 | |

| Tencent Holdings, Ltd. | | | 86,200 | | | | 4,158,163 | |

| | | | | | | | 6,324,764 | |

| Germany—1.2% | | | | | | | | |

| Symrise AG | | | 26,948 | | | | 2,835,031 | |

| Hong Kong—2.8% | | | | | | | | |

| AIA Group, Ltd. | | | 402,400 | | | | 4,233,914 | |

| Hang Seng Bank, Ltd. | | | 121,000 | | | | 2,503,947 | |

| | | | | | | | 6,737,861 | |

| Israel—1.2% | | | | | | | | |

| Bank Leumi Le-Israel BM | | | 401,201 | | | | 2,923,872 | |

| Japan—5.8% | | | | | | | | |

| Daiwa House Industry Co., Ltd. | | | 7,000 | | | | 216,871 | |

| Kansai Paint Co., Ltd. | | | 86,500 | | | | 2,114,106 | |

| Kao Corp. | | | 32,700 | | | | 2,697,030 | |

| Nintendo Co., Ltd. | | | 6,400 | | | | 2,583,336 | |

| TechnoPro Holdings, Inc. | | | 46,300 | | | | 3,249,825 | |

| Yamaha Corp. | | | 52,900 | | | | 2,916,048 | |

| | | | | | | | 13,777,216 | |

| Netherlands—3.6% | | | | | | | | |

| NXP Semiconductors NV | | | 21,050 | | | | 2,678,823 | |

| Wolters Kluwer NV | | | 82,011 | | | | 5,994,444 | |

| | | | | | | | 8,673,267 | |

| Singapore—1.4% | | | | | | | | |

| Oversea-Chinese Banking Corp., Ltd. | | | 398,700 | | | | 3,260,056 | |

The accompanying notes are an integral part of these financial statements.

11

Lazard Global Total Return and Income Fund, Inc.

Portfolio of Investments(continued)

December 31, 2019

| Description | | Shares | | | Fair

Value | |

| South Africa—1.5% | | | | | | |

| Distell Group Holdings, Ltd. | | | 220,541 | | | $ | 2,090,582 | |

| Sanlam, Ltd. | | | 264,553 | | | | 1,495,804 | |

| | | | | | | | 3,586,386 | |

| Sweden—3.2% | | | | | | | | |

| Assa Abloy AB, Class B | | | 76,084 | | | | 1,777,919 | |

| Epiroc AB, Class A | | | 256,193 | | | | 3,130,957 | |

| Hexagon AB, B Shares | | | 46,440 | | | | 2,601,967 | |

| | | | | | | | 7,510,843 | |

| Switzerland—4.3% | | | | | | | | |

| ABB, Ltd. | | | 120,543 | | | | 2,910,015 | |

| Alcon, Inc. (*) | | | 23,732 | | | | 1,344,411 | |

| Novartis AG | | | 35,063 | | | | 3,321,951 | |

| Partners Group Holding AG | | | 3,021 | | | | 2,768,651 | |

| | | | | | | | 10,345,028 | |

| Taiwan—1.3% | | | | | | | | |

| Taiwan Semiconductor Manufacturing Co., Ltd. Sponsored ADR (*) | | | 52,695 | | | | 3,061,580 | |

| United Kingdom—11.6% | | | | | | | | |

| Bunzl PLC | | | 55,428 | | | | 1,516,538 | |

| Coca-Cola European Partners PLC | | | 60,230 | | | | 3,064,503 | |

| Compass Group PLC | | | 122,719 | | | | 3,074,216 | |

| Diageo PLC | | | 121,265 | | | | 5,110,067 | |

| Prudential PLC | | | 157,197 | | | | 3,024,696 | |

| RELX PLC | | | 182,380 | | | | 4,604,638 | |

| The Weir Group PLC | | | 65,872 | | | | 1,318,098 | |

| Unilever PLC | | | 102,328 | | | | 5,858,202 | |

| | | | | | | | 27,570,958 | |

| United States—50.5% | | | | | | | | |

| Accenture PLC, Class A | | | 23,134 | | | | 4,871,326 | |

| Alphabet, Inc., Class A (*) | | | 5,288 | | | | 7,082,694 | |

| Aon PLC | | | 30,180 | | | | 6,286,192 | |

| Boston Scientific Corp. (*) | | | 82,685 | | | | 3,739,016 | |

| Cisco Systems, Inc. | | | 56,485 | | | | 2,709,021 | |

| Dollar General Corp. | | | 18,710 | | | | 2,918,386 | |

| Envista Holdings Corp. | | | 78,385 | | | | 2,323,331 | |

| Honeywell International, Inc. | | | 25,755 | | | | 4,558,635 | |

| Intercontinental Exchange, Inc. | | | 48,120 | | | | 4,453,506 | |

| IQVIA Holdings, Inc. (*) | | | 38,155 | | | | 5,895,329 | |

| Johnson & Johnson | | | 37,791 | | | | 5,512,573 | |

The accompanying notes are an integral part of these financial statements.

12

Lazard Global Total Return and Income Fund, Inc.

Portfolio of Investments(continued)

December 31, 2019

| Description | | Shares | | | Fair

Value | |

| Kimberly-Clark Corp. | | | 23,134 | | | $ | 3,182,082 | |

| Lowe’s Cos., Inc. | | | 19,396 | | | | 2,322,865 | |

| McDonald’s Corp. | | | 19,265 | | | | 3,806,957 | |

| Microsoft Corp. | | | 52,420 | | | | 8,266,634 | |

| Motorola Solutions, Inc. | | | 26,095 | | | | 4,204,948 | |

| Palo Alto Networks, Inc. (*) | | | 9,835 | | | | 2,274,344 | |

| PTC, Inc. (*) | | | 53,730 | | | | 4,023,840 | |

| Rockwell Automation, Inc. | | | 21,735 | | | | 4,405,032 | |

| S&P Global, Inc. | | | 16,600 | | | | 4,532,630 | |

| Texas Instruments, Inc. | | | 27,723 | | | | 3,556,584 | |

| The Coca-Cola Co. | | | 106,840 | | | | 5,913,594 | |

| The Procter & Gamble Co. | | | 31,385 | | | | 3,919,987 | |

| Thermo Fisher Scientific, Inc. | | | 22,495 | | | | 7,307,951 | |

| Visa, Inc., Class A | | | 28,455 | | | | 5,346,694 | |

| Zoetis, Inc. | | | 48,080 | | | | 6,363,388 | |

| | | | | | | | 119,777,539 | |

Total Common Stocks

(Cost $176,580,774) | | | | | | | 230,691,090 | |

| | | | | | | | | |

| Description | | Principal

Amount

(000) («) | | | Fair

Value | |

| Foreign Government Obligations—14.3% | | | | | | | | |

| Brazil—2.8% | | | | | | | | |

| Brazil NTN-B: | | | | | | | | |

| 6.00%, 05/15/21 | | | 1,260 | | | $ | 1,105,325 | |

| 6.00%, 05/15/23 | | | 3,690 | | | | 3,407,958 | |

Brazil NTN-F,

10.00%, 01/01/27 | | | 7,396 | | | | 2,168,005 | |

| | | | | | | | 6,681,288 | |

| Dominican Republic—2.2% | | | | | | | | |

| Dominican Republic Bonds: | | | | | | | | |

| 15.95%, 06/04/21 (#) | | | 33,300 | | | | 679,254 | |

| 16.95%, 02/04/22 (#) | | | 43,800 | | | | 933,705 | |

| 8.90%, 02/15/23 (#) | | | 130,000 | | | | 2,435,520 | |

| 10.50%, 04/07/23 (#) | | | 65,400 | | | | 1,253,214 | |

| | | | | | | | 5,301,693 | |

The accompanying notes are an integral part of these financial statements.

13

Lazard Global Total Return and Income Fund, Inc.

Portfolio of Investments(continued)

December 31, 2019

| Description | | Principal

Amount

(000) («) | | | Fair

Value | |

| Egypt—3.8% | | | | | | | | |

| Egypt Treasury Bills: | | | | | | | | |

| 0.00%, 05/12/20 | | | 137,250 | | | $ | 8,011,466 | |

| 0.00%, 05/26/20 | | | 16,225 | | | | 953,252 | |

| | | | | | | | 8,964,718 | |

| Indonesia—0.6% | | | | | | | | |

Indonesia Government Bonds,

8.375%, 09/15/26 | | | 20,166,000 | | | | 1,558,603 | |

| Malaysia—3.1% | | | | | | | | |

Malaysia Government Bonds,

3.62%, 11/30/21 | | | 29,340 | | | | 7,254,687 | |

| Russia—1.8% | | | | | | | | |

| Russia Government Bonds - OFZ: | | | | | | | | |

| 7.95%, 10/07/26 | | | 72,920 | | | | 1,292,596 | |

| 7.05%, 01/19/28 | | | 174,100 | | | | 2,962,572 | |

| | | | | | | | 4,255,168 | |

Total Foreign Government Obligations

(Cost $34,225,731) | | | | | | | 34,016,157 | |

| Short-Term Investments—0.5% | | | | | | | | |

State Street Institutional Treasury Money Market Fund, Premier Class, 1.52% (7 day yield)

(Cost $1,083,740) | | | 1,083,740 | | | $ | 1,083,740 | |

Total Investments—112.0%

(Cost $211,890,245) (») | | | | | | $ | 265,790,987 | |

| Liabilities in Excess of Cash and Other Assets—(12.0)% | | | | | | | (28,509,563 | ) |

| Net Assets—100.0% | | | | | | $ | 237,281,424 | |

The accompanying notes are an integral part of these financial statements.

14

Lazard Global Total Return and Income Fund, Inc.

Portfolio of Investments(continued)

December 31, 2019

Forward Currency Contracts open at December 31, 2019:

Currency

Purchased | | Quantity | | Currency

Sold | | Quantity | | Counterparty | | Settlement

Date | | Unrealized

Appreciation | | Unrealized

Depreciation |

| AUD | | 1,246,000 | | USD | | 856,500 | | BNP | | 07/20/20 | | | $ | 21,813 | | | | $ | — | |

| AUD | | 3,632,000 | | USD | | 2,496,637 | | BNP | | 07/20/20 | | | | 63,584 | | | | | — | |

| BRL | | 146,500 | | USD | | 35,627 | | BNP | | 05/18/20 | | | | 570 | | | | | — | |

| BRL | | 731,224 | | USD | | 181,607 | | CIT | | 05/18/20 | | | | — | | | | | 941 | |

| BRL | | 2,255,292 | | USD | | 560,126 | | CIT | | 05/18/20 | | | | — | | | | | 2,903 | |

| CLP | | 1,960,816,700 | | USD | | 2,555,143 | | CIT | | 02/18/20 | | | | 53,899 | | | | | — | |

| CNY | | 9,398,225 | | USD | | 1,325,000 | | HSB | | 09/04/20 | | | | 15,562 | | | | | — | |

| CNY | | 26,953,400 | | USD | | 3,800,000 | | HSB | | 09/04/20 | | | | 44,631 | | | | | — | |

| COP | | 14,545,200,000 | | USD | | 4,224,817 | | SCB | | 03/12/20 | | | | 186,246 | | | | | — | |

| CZK | | 15,339,000 | | USD | | 674,320 | | CIT | | 06/08/20 | | | | 2,419 | | | | | — | |

| CZK | | 34,730,000 | | USD | | 1,526,770 | | CIT | | 06/08/20 | | | | 5,478 | | | | | — | |

| CZK | | 17,042,000 | | USD | | 748,981 | | SCB | | 06/08/20 | | | | 2,892 | | | | | — | |

| CZK | | 38,286,000 | | USD | | 1,682,637 | | SCB | | 06/08/20 | | | | 6,498 | | | | | — | |

| GHS | | 3,111,175 | | USD | | 557,808 | | CIT | | 01/02/20 | | | | — | | | | | 11,988 | |

| GHS | | 9,237,800 | | USD | | 1,656,262 | | CIT | | 01/02/20 | | | | — | | | | | 35,595 | |

| HUF | | 250,053,000 | | USD | | 828,868 | | CIT | | 03/27/20 | | | | 22,152 | | | | | — | |

| HUF | | 756,088,000 | | USD | | 2,506,258 | | CIT | | 03/27/20 | | | | 66,981 | | | | | — | |

| IDR | | 3,932,600,000 | | USD | | 273,382 | | JPM | | 05/14/20 | | | | 7,454 | | | | | — | |

| IDR | | 10,263,503,000 | | USD | | 713,486 | | JPM | | 05/14/20 | | | | 19,454 | | | | | — | |

| IDR | | 11,025,325,000 | | USD | | 766,446 | | JPM | | 05/14/20 | | | | 20,898 | | | | | — | |

| IDR | | 36,435,720,000 | | USD | | 2,532,897 | | JPM | | 05/14/20 | | | | 69,064 | | | | | — | |

| ILS | | 1,033,000 | | USD | | 293,008 | | SCB | | 01/24/20 | | | | 6,430 | | | | | — | |

| ILS | | 2,941,000 | | USD | | 834,208 | | SCB | | 01/24/20 | | | | 18,307 | | | | | — | |

| INR | | 29,244,275 | | USD | | 410,000 | | CIT | | 02/06/20 | | | | — | | | | | 684 | |

| INR | | 72,611,395 | | USD | | 1,018,000 | | CIT | | 02/06/20 | | | | — | | | | | 1,699 | |

| INR | | 94,465,942 | | USD | | 1,321,942 | | CIT | | 02/06/20 | | | | 246 | | | | | — | |

| INR | | 289,484,876 | | USD | | 4,051,006 | | CIT | | 02/06/20 | | | | 753 | | | | | — | |

| KES | | 30,681,670 | | USD | | 288,769 | | CIT | | 04/27/20 | | | | 8,276 | | | | | — | |

| KES | | 86,909,530 | | USD | | 817,972 | | CIT | | 04/27/20 | | | | 23,443 | | | | | — | |

| KZT | | 230,308,400 | | USD | | 581,000 | | HSB | | 01/15/20 | | | | 19,929 | | | | | — | |

| KZT | | 533,158,000 | | USD | | 1,345,000 | | HSB | | 01/15/20 | | | | 46,136 | | | | | — | |

| KZT | | 107,845,900 | | USD | | 273,097 | | SCB | | 01/15/20 | | | | 8,299 | | | | | — | |

| KZT | | 430,802,500 | | USD | | 1,090,915 | | SCB | | 01/15/20 | | | | 33,150 | | | | | — | |

| MXN | | 7,573,400 | | USD | | 380,000 | | HSB | | 04/30/20 | | | | 13,651 | | | | | — | |

| MXN | | 14,141,000 | | USD | | 723,436 | | HSB | | 04/30/20 | | | | 11,587 | | | | | — | |

| MXN | | 19,431,750 | | USD | | 975,000 | | HSB | | 04/30/20 | | | | 35,026 | | | | | — | |

| MXN | | 40,501,000 | | USD | | 2,071,980 | | HSB | | 04/30/20 | | | | 33,186 | | | | | — | |

| PEN | | 4,994,578 | | USD | | 1,488,475 | | JPM | | 05/06/20 | | | | 12,749 | | | | | — | |

| PEN | | 14,761,541 | | USD | | 4,399,207 | | JPM | | 05/06/20 | | | | 37,680 | | | | | — | |

| PHP | | 28,944,020 | | USD | | 550,162 | | JPM | | 03/31/20 | | | | 19,096 | | | | | — | |

| PHP | | 85,157,180 | | USD | | 1,618,650 | | JPM | | 03/31/20 | | | | 56,182 | | | | | — | |

| PLN | | 4,665,096 | | USD | | 1,200,000 | | CIT | | 03/04/20 | | | | 29,824 | | | | | — | |

| PLN | | 13,023,393 | | USD | | 3,350,000 | | CIT | | 03/04/20 | | | | 83,260 | | | | | — | |

| RUB | | 9,322,247 | | USD | | 141,891 | | HSB | | 02/11/20 | | | | 7,713 | | | | | — | |

| RUB | | 98,905,891 | | USD | | 1,505,417 | | HSB | | 02/11/20 | | | | 81,837 | | | | | — | |

| SGD | | 1,393,000 | | USD | | 1,018,535 | | SCB | | 04/17/20 | | | | 18,346 | | | | | — | |

| SGD | | 4,066,000 | | USD | | 2,972,983 | | SCB | | 04/17/20 | | | | 53,550 | | | | | — | |

| THB | | 24,625,960 | | USD | | 816,240 | | HSB | | 05/21/20 | | | | 8,462 | | | | | — | |

| THB | | 70,164,200 | | USD | | 2,325,628 | | HSB | | 05/21/20 | | | | 24,109 | | | | | — | |

The accompanying notes are an integral part of these financial statements.

15

Lazard Global Total Return and Income Fund, Inc.

Portfolio of Investments(concluded)

December 31, 2019

Forward Currency Contracts open at December 31, 2019 (concluded):

Currency

Purchased | | Quantity | | Currency

Sold | | Quantity | | Counterparty | | Settlement

Date | | Unrealized

Appreciation | | Unrealized

Depreciation |

| TRY | | 2,416,000 | | USD | | 366,460 | | HSB | | 07/02/20 | | | $ | 21,305 | | | | $ | — | |

| TRY | | 5,605,000 | | USD | | 850,168 | | HSB | | 07/02/20 | | | | 49,426 | | | | | — | |

| UGX | | 1,658,228,000 | | USD | | 444,029 | | CIT | | 01/21/20 | | | | 6,703 | | | | | — | |

| UGX | | 4,688,398,000 | | USD | | 1,255,429 | | CIT | | 01/21/20 | | | | 18,951 | | | | | — | |

| USD | | 1,693,513 | | AUD | | 2,492,000 | | BNP | | 07/20/20 | | | | — | | | | | 63,114 | |

| USD | | 4,936,469 | | AUD | | 7,264,000 | | BNP | | 07/20/20 | | | | — | | | | | 183,972 | |

| USD | | 238,000 | | BRL | | 979,013 | | CIT | | 05/18/20 | | | | — | | | | | 3,888 | |

| USD | | 301,000 | | BRL | | 1,238,164 | | CIT | | 05/18/20 | | | | — | | | | | 4,918 | |

| USD | | 1,300,000 | | CLP | | 975,910,000 | | CIT | | 02/18/20 | | | | 1,465 | | | | | — | |

| USD | | 1,600,000 | | COP | | 5,340,800,000 | | CIT | | 03/12/20 | | | | — | | | | | 19,683 | |

| USD | | 86,072 | | CZK | | 1,992,000 | | CIT | | 06/08/20 | | | | — | | | | | 1,813 | |

| USD | | 318,307 | | CZK | | 7,340,000 | | CIT | | 06/08/20 | | | | — | | | | | 5,525 | |

| USD | | 424,000 | | CZK | | 9,787,616 | | CIT | | 06/08/20 | | | | — | | | | | 7,819 | |

| USD | | 721,785 | | CZK | | 16,644,000 | | CIT | | 06/08/20 | | | | — | | | | | 12,529 | |

| USD | | 961,000 | | CZK | | 22,183,724 | | CIT | | 06/08/20 | | | | — | | | | | 17,721 | |

| USD | | 295,771 | | CZK | | 6,708,000 | | SCB | | 06/08/20 | | | | — | | | | | 178 | |

| USD | | 638,809 | | CZK | | 14,488,000 | | SCB | | 06/08/20 | | | | — | | | | | 385 | |

| USD | | 2,170,600 | | GHS | | 12,348,975 | | CIT | | 01/02/20 | | | | 4,113 | | | | | — | |

| USD | | 377,428 | | TRY | | 2,416,000 | | SCB | | 07/02/20 | | | | — | | | | | 10,336 | |

| USD | | 875,614 | | TRY | | 5,605,000 | | SCB | | 07/02/20 | | | | — | | | | | 23,979 | |

| UYU | | 27,946,342 | | USD | | 731,388 | | CIT | | 02/04/20 | | | | 15,940 | | | | | — | |

| UYU | | 90,912,178 | | USD | | 2,379,277 | | CIT | | 02/04/20 | | | | 51,855 | | | | | — | |

| UYU | | 13,447,544 | | USD | | 356,000 | | HSB | | 05/29/20 | | | | — | | | | | 4,828 | |

| UYU | | 31,616,838 | | USD | | 837,000 | | HSB | | 05/29/20 | | | | — | | | | | 11,351 | |

| ZAR | | 4,100,000 | | USD | | 272,962 | | HSB | | 03/06/20 | | | | 17,351 | | | | | — | |

| ZAR | | 12,061,000 | | USD | | 802,975 | | HSB | | 03/06/20 | | | | 51,042 | | | | | — | |

| Total gross unrealized appreciation/depreciation on Forward Currency Contracts | | $ | 1,538,973 | | | | $ | 425,849 | |

Currency Abbreviations:

| AUD | — | Australian Dollar | | ILS | — | Israeli Shekel | | SGD | — | Singapore Dollar |

| BRL | — | Brazilian Real | | INR | — | Indian Rupee | | THB | — | Thai Baht |

| CLP | — | Chilean Peso | | KES | — | Kenyan Shilling | | TRY | — | New Turkish Lira |

| CNY | — | Chinese Renminbi | | KZT | — | Kazakhstan Tenge | | UGX | — | Ugandan Shilling |

| COP | — | Colombian Peso | | MXN | — | Mexican New Peso | | USD | — | United States Dollar |

| CZK | — | Czech Koruna | | PEN | — | Peruvian New Sol | | UYU | — | Uruguayan Peso |

| GHS | — | Ghanaian Cedi | | PHP | — | Philippine Peso | | ZAR | — | South African Rand |

| HUF | — | Hungarian Forint | | PLN | — | Polish Zloty | | | | |

| IDR | — | Indonesian Rupiah | | RUB | — | Russian Ruble | | | | |

Counterparty Abbreviations:

| BNP | — | BNP Paribas SA |

| CIT | — | Citibank NA |

| HSB | — | HSBC Bank USA NA |

| JPM | — | JPMorgan Chase Bank NA |

| SCB | — | Standard Chartered Bank |

The accompanying notes are an integral part of these financial statements.

16

Lazard Global Total Return and Income Fund, Inc.

Notes to Portfolio of Investments

December 31, 2019

| (*) | Non-income producing security. |

| («) | Principal amount denominated in respective country’s currency. |

| (#) | Pursuant to Rule 144A under the Securities Act of 1933, these securities may only be traded among “qualified institutional buyers.” At December 31, 2019 these securities amounted to 2.2% of net assets. |

| (») | The Fund, at all times, maintains portfolio securities in sufficient amount to cover its obligations related to investments in forward currency contracts. |

Security Abbreviations:

| ADR | — | American Depositary Receipt |

| NTN-B | — | Brazil Sovereign “Nota do Tesouro Nacional” Series B |

| NTN-F | — | Brazil Sovereign “Nota do Tesouro Nacional” Series F |

Portfolio holdings by industry† (as a percentage of net assets):

| Aerospace & Defense | | | 1.1 | % | |

| Banks | | | 5.1 | | |

| Beverages | | | 7.6 | | |

| Building Products | | | 0.8 | | |

| Capital Markets | | | 5.0 | | |

| Chemicals | | | 2.1 | | |

| Communications Equipment | | | 2.9 | | |

| Electrical Equipment | | | 3.1 | | |

| Electronic Equipment, Instruments & Components | | | 1.1 | | |

| Entertainment | | | 1.1 | | |

| Health Care Equipment & Supplies | | | 3.1 | | |

| Hotels, Restaurants & Leisure | | | 2.9 | | |

| Household Products | | | 3.0 | | |

| Industrial Conglomerates | | | 1.9 | | |

| Insurance | | | 6.3 | | |

| Interactive Media & Services | | | 4.7 | | |

| Internet & Direct Marketing Retail | | | 0.9 | | |

| IT Services | | | 4.3 | | |

| Leisure Products | | | 1.2 | | |

| Life Sciences Tools & Services | | | 5.6 | | |

| Machinery | | | 1.9 | | |

| Multiline Retail | | | 2.3 | | |

| Personal Products | | | 3.6 | | |

| Pharmaceuticals | | | 6.4 | | |

| Professional Services | | | 5.8 | | |

| Real Estate Management & Development | | | 0.1 | | |

| Road & Rail | | | 1.6 | | |

| Semiconductors & Semiconductor Equipment | | | 3.9 | | |

| Software | | | 6.2 | | |

| Specialty Retail | | | 1.0 | | |

| Trading Companies & Distributors | | | 0.6 | | |

| Subtotal | | | 97.2 | | |

| Foreign Government Obligations | | | 14.3 | | |

| Short-Term Investments | | | 0.5 | | |

| Total Investments | | | 112.0 | % | |

| † | Industry classifications may be different than those used for compliance monitoring purposes. |

The accompanying notes are an integral part of these financial statements.

17

Lazard Global Total Return and Income Fund, Inc.

Statement of Assets and Liabilities

December 31, 2019

| ASSETS | | | | |

| Investments in securities, at fair value (cost $211,890,245) | | $ | 265,790,987 | |

| Foreign currency, at fair value (cost $356,018) | | | 363,407 | |

| Receivables for: | | | | |

| Dividends and interest | | | 728,948 | |

| Investments sold | | | 25,147 | |

| Gross unrealized appreciation on forward currency contracts | | | 1,538,973 | |

| Total assets | | $ | 268,447,462 | |

| | | | | |

| LIABILITIES | | | | |

| Due to Custodian | | | 308,372 | |

| Management fees payable | | | 235,110 | |

| Line of credit outstanding | | | 29,986,000 | |

| Gross unrealized depreciation on forward currency contracts | | | 425,849 | |

| Other accrued expenses and payables | | | 210,707 | |

| Total liabilities | | $ | 31,166,038 | |

| Net assets | | $ | 237,281,424 | |

| | | | | |

| NET ASSETS | | | | |

| Paid in capital (Note 2(f)) | | $ | 183,463,185 | |

| Distributable earnings (Accumulated loss) | | | 53,818,239 | |

| Net assets | | $ | 237,281,424 | |

| | | | | |

| Shares of common stock outstanding* | | | 13,009,661 | |

| Net asset value per share | | $ | 18.24 | |

| Market value per share | | $ | 16.55 | |

| * | $0.001 par value, 500,000,000 shares authorized for the Fund. |

The accompanying notes are an integral part of these financial statements.

18

Lazard Global Total Return and Income Fund, Inc.

Statement of Operations

For the Year Ended December 31, 2019

| INVESTMENT INCOME (LOSS) | | | | |

| | | | | |

| Income: | | | | |

| Dividends (net of foreign withholding taxes of $218,893) | | $ | 3,065,540 | |

| Interest (net of foreign withholding taxes of $9,109) | | | 2,209,587 | |

| Total investment income | | | 5,275,127 | |

| | | | | |

| Expenses: | | | | |

| Management fees (Note 3) | | | 2,038,673 | |

| Professional services | | | 328,689 | |

| Custodian fees | | | 89,715 | |

| Reorganization (Note 13) | | | 80,360 | |

| Stockholders’ reports | | | 65,275 | |

| Stockholders’ services | | | 34,912 | |

| Administration fees | | | 33,085 | |

| Stockholders’ meeting | | | 29,225 | |

| Directors’ fees and expenses | | | 12,022 | |

| Registration fees | | | 7,343 | |

| Other | | | 62,757 | |

| Total expenses before interest expense | | | 2,782,056 | |

| Interest expense | | | 691,899 | |

| Total expenses | | | 3,473,955 | |

| Net investment income (loss) | | | 1,801,172 | |

| | | | | |

| NET REALIZED AND UNREALIZED GAIN (LOSS) ON INVESTMENTS, FOREIGN CURRENCY TRANSACTIONS AND FORWARD CURRENCY CONTRACTS | | | | |

| Net realized gain (loss) on: | | | | |

| Investments | | | (540,980 | ) |

| Foreign currency transactions | | | (97,262 | ) |

| Forward currency contracts | | | 697,136 | |

| Total net realized gain (loss) on investments, foreign currency transactions and forward currency contracts | | | 58,894 | |

| Net change in unrealized appreciation (depreciation) on: | | | | |

| Investments | | | 39,895,005 | * |

| Foreign currency translations | | | 12,127 | |

| Forward currency contracts | | | 571,996 | |

| Total net change in unrealized appreciation (depreciation) on investments, foreign currency translations and forward currency contracts | | | 40,479,128 | |

| Net realized and unrealized gain (loss) on investments, foreign currency transactions and forward currency contracts | | | 40,538,022 | |

| Net increase (decrease) in net assets resulting from operations | | $ | 42,339,194 | |

| * | Excludes net unrealized gain of $971,018 from the acquisition of Lazard World Dividend & Income Fund, Inc. Refer to Note 13 in the Notes to Financial Statements. |

The accompanying notes are an integral part of these financial statements.

19

Lazard Global Total Return and Income Fund, Inc.

Statements of Changes in Net Assets

| | | | | | | |

| | | Year Ended | | Year Ended |

| | | December 31, | | December 31, |

| | | 2019 | | 2018 |

| | | | | | | | | | | |

| INCREASE (DECREASE) IN NET ASSETS | | | | | | | | | | |

| | | | | | | | | | | |

| Operations: | | | | | | | | | | |

| Net investment income (loss) | | | $ | 1,801,172 | | | | $ | 2,407,480 | |

| Net realized gain (loss) on investments, foreign currency transactions and forward currency contracts | | | | 58,894 | | | | | 6,401,671 | |

| Net change in unrealized appreciation (depreciation) on investments, foreign currency translations and forward currency contracts | | | | 40,479,128 | | | | | (26,900,551 | ) |

| Net increase (decrease) in net assets resulting from operations | | | | 42,339,194 | | | | | (18,091,400 | ) |

| | | | | | | | | | | |

| Distributions to Stockholders (Note 2(f)): | | | | | | | | | | |

| Net investment income and net realized gains | | | | (2,335,077 | ) | | | | (15,174,618 | ) |

| Return of capital | | | | (8,201,474 | ) | | | | (10,837,997 | ) |

| Net decrease in net assets resulting from distributions | | | | (10,536,551 | ) | | | | (26,012,615 | ) |

| | | | | | | | | | | |

| Capital Stock Transactions: | | | | | | | | | | |

| Net assets of shares issued in connection with Reorganization (Note 13) | | | | 59,278,874 | | | | | — | |

| Net increase (decrease) in net assets from capital stock transactions | | | | 59,278,874 | | | | | — | |

| Total increase (decrease) in net assets | | | | 91,081,517 | | | | | (44,104,015 | ) |

| Net assets at beginning of period | | | | 146,199,907 | | | | | 190,303,922 | |

| Net assets at end of period | | | $ | 237,281,424 | | | | $ | 146,199,907 | |

| | | | | | | | | | | |

| Transactions in Capital Shares: | | | | | | | | | | |

| Common shares outstanding at beginning of period | | | | 9,605,237 | | | | | 9,605,237 | |

| Shares issued in connection with Reorganization (Note 13) | | | | 3,404,424 | | | | | — | |

| Net increase (decrease) | | | | 3,404,424 | | | | | — | |

| Common shares outstanding at end of period | | | | 13,009,661 | | | | | 9,605,237 | |

The accompanying notes are an integral part of these financial statements.

20

Lazard Global Total Return and Income Fund, Inc.

Statement of Cash Flows

For the Year Ended December 31, 2019

| INCREASE (DECREASE) IN CASH AND FOREIGN CURRENCY | | | | |

| | | | | |

| Cash flows from operating activities: | | | | |

| Net increase (decrease) in net assets resulting from operations | | $ | 42,339,194 | |

| Adjustments to reconcile net increase (decrease) in net assets resulting from operations to net cash provided by (used in) operating activities | | | | |

| (Increase) Decrease in dividends and interest receivable | | | (195,078 | ) |

| Accretion of bond discount and amortization of bond premium, net | | | (1,011,013 | ) |

| Increase (Decrease) in due to custodian | | | 308,372 | |

| Increase (Decrease) in other accrued expenses and payables | | | 136,688 | |

| Net realized (gain) loss on investments, foreign currency transactions and forward currency contracts | | | (58,894 | ) |

| Net change in unrealized (appreciation) depreciation on investments, foreign currency translations and forward currency contracts* | | | (40,479,128 | ) |

| Net settlement of foreign currency contracts | | | 697,136 | |

| Purchases of long-term investments* | | | (111,592,661 | ) |

| Proceeds from disposition of long-term investments | | | 66,636,525 | |

| Proceeds from disposition of short-term investments, net | | | 4,861,455 | |

| Net cash provided by (used in) operating activities | | | (38,357,404 | ) |

| | | | | |

| Cash flows from financing activities: | | | | |

| Cash distributions paid (Note 2(f)) | | | (10,536,551 | ) |

| Cash received in connection with Reorganization (Note 13) | | | 43,802,837 | |

| Gross drawdowns in line of credit balance | | | 12,928,000 | |

| Gross paydowns in line of credit balance | | | (8,000,000 | ) |

| Net cash provided by (used in) financing activities | | | 38,194,286 | |

| | | | | |

| Effect of exchange rate changes on cash | | | (85,135 | ) |

| Net increase (decrease) in cash and foreign currency | | | (248,253 | ) |

| | | | | |

| Cash, restricted cash and foreign currency:** | | | | |

| Beginning balance | | | 611,660 | |

| Ending balance | | $ | 363,407 | |

| | | | | |

| Supplemental disclosure of cash flow information: | | | | |

| Cash paid during the period for interest expense | | $ | (660,863 | ) |

| * | Excludes net unrealized gain of $971,018 and cost of $14,505,019, respectively, of long-term investments transferred in-kind from the acquisition of Lazard World Dividend & Income Fund, Inc. Refer to Note 13 in the Notes to Financial Statements. |

| ** | Includes cash of $0 and $161,309, cash collateral due from broker on forward currency contracts of $0 and $10,000, and foreign currency of $363,407 and $440,351 as of December 31, 2019 and December 31, 2018, respectively. |

The accompanying notes are an integral part of these financial statements.

21

Lazard Global Total Return and Income Fund, Inc.

Financial Highlights

Selected data for a share of common stock outstanding throughout each period

| | | Year Ended |

| | | 12/31/19 | | | 12/31/18 | | | 12/31/17 | | | 12/31/16 | | | 12/31/15 | |

| Net asset value, beginning of period | | $ | 15.22 | | | $ | 19.81 | | | $ | 15.72 | | | $ | 15.26 | | | $ | 17.82 | |

| Income (loss) from investment operations: | | | | | | | | | | | | | | | | | | | | |

| Net investment income (loss) | | | 0.41 | | | | 0.25 | | | | 0.21 | | | | 0.40 | ^ | | | 0.39 | |

| Net realized and unrealized gain (loss) | | | 3.68 | | | | (2.13 | ) | | | 4.86 | | | | 1.01 | | | | (1.84 | ) |

| Total from investment operations | | | 4.09 | | | | (1.88 | ) | | | 5.07 | | | | 1.41 | | | | (1.45 | ) |

| Less distributions from (Note 2(f)): | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | (0.24 | ) | | | (0.26 | ) | | | (0.98 | ) | | | (0.77 | ) | | | — | |

| Net realized gains | | | — | | | | (1.32 | ) | | | — | | | | — | | | | — | |

| Return of capital | | | (0.83 | ) | | | (1.13 | ) | | | — | | | | (0.18 | ) | | | (1.11 | ) |

| Total distributions | | | (1.07 | ) | | | (2.71 | ) | | | (0.98 | ) | | | (0.95 | ) | | | (1.11 | ) |

| Net asset value, end of period | | $ | 18.24 | | | $ | 15.22 | | | $ | 19.81 | | | $ | 15.72 | | | $ | 15.26 | |

| Market value, end of period | | $ | 16.55 | | | $ | 13.62 | | | $ | 18.00 | | | $ | 13.74 | | | $ | 13.08 | |

| Total Return based upon (a): | | | | | | | | | | | | | | | | | | | | |

| Net asset value | | | 27.44% | | | | –9.80% | | | | 33.07% | | | | 9.75% | ^ | | | –8.58% | |

| Market value | | | 30.09% | | | | –9.81% | | | | 39.20% | | | | 13.02% | | | | –10.78% | |

| Ratios and Supplemental Data: | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of period (in thousands) | | $ | 237,281 | | | $ | 146,200 | | | $ | 190,304 | | | $ | 150,958 | | | $ | 146,592 | |

| Ratios to average net assets: | | | | | | | | | | | | | | | | | | | | |

| Net expenses | | | 2.05% | * | | | 1.82% | | | | 1.72% | | | | 1.72% | ^ | | | 1.46% | |

| Total expenses | | | 2.05% | * | | | 1.82% | | | | 1.72% | | | | 1.73% | | | | 1.46% | |

| Net investment income (loss) | | | 1.06% | | | | 1.32% | | | | 1.15% | | | | 2.69% | ^ | | | 2.30% | |

| Portfolio turnover rate | | | 29% | ** | | | 35% | | | | 42% | | | | 103% | | | | 16% | |

| Asset coverage per $1,000 of loan outstanding (b) | | $ | 8,913 | | | $ | 6,834 | | | $ | 9,323 | | | $ | 7,162 | | | $ | 11,180 | |

| Bank borrowing outstanding (in thousands) . | | $ | 29,986 | | | $ | 25,058 | | | $ | 22,865 | | | $ | 24,500 | | | $ | 14,400 | |

| ^ | Refer to Note 4 in the Notes to Financial Statements for discussion of prior period custodian out-of-pocket expenses that were reimbursed to the Fund in the period. The amount of the reimbursement was less than $0.005 per share. There was a 0.07% impact on the total return of the Fund. There was a 0.01% impact on the net expenses and net investment income (loss) ratios of the Fund. |

| (a) | Total return based on per share market price assumes the purchase of common shares at the closing market price on the business day immediately preceding the first day, and sale of common shares at the closing market price on the last day, of each period indicated; dividends and distributions are assumed to be reinvested in accordance with the Fund’s Dividend Reinvestment Plan. The total return based on net asset value, or NAV, assumes the purchase of common shares at the “net asset value, beginning of period” and sale of common shares at the “net asset value, end of period”, for each of the periods indicated; distributions are assumed to be reinvested at NAV. Past performance is not indicative, or a guarantee, of future results; the investment return, market price and net asset value of the Fund will fluctuate, so that an investor’s shares in the Fund, when sold, may be worth more or less than their original cost. The returns do not reflect the deduction of taxes that a stockholder would pay on the Fund’s distributions or on the sale of Fund shares. Returns for a period of less than one year are not annualized. |

| (b) | Calculated as the sum of the Fund’s Net Assets and line of credit outstanding, as both figures are shown on the Fund’s Statement of Assets and Liabilities, then dividing that sum by the line of credit outstanding and multiplying the result by 1,000. |

| * | Includes reorganization costs associated with the Fund’s reorganization. Without these costs, net expenses and total expenses would have been 2.00% and 2.00%, respectively. Refer to Note 13 in the Notes to Financial Statements. |

| ** | Portfolio turnover rate excludes from purchases the cost of long-term investments transferred in-kind from the reorganization. There was no impact to the portfolio turnover rate. Refer to Note 13 in the Notes to Financial Statements. |

The accompanying notes are an integral part of these financial statements.

22

Lazard Global Total Return and Income Fund, Inc.

Notes to Financial Statements

December 31, 2019

1. Organization

Lazard Global Total Return and Income Fund, Inc. was incorporated in Maryland on January 27, 2004 and is registered under the 1940 Act, as a diversified, closed-end management investment company. The Fund trades on the NYSE under the ticker symbol LGI and commenced operations on April 28, 2004. The Fund’s investment objective is total return, consisting of capital appreciation and income.

2. Significant Accounting Policies

The accompanying financial statements are presented in conformity with US Generally Accepted Accounting Principles (“GAAP”). The Fund is an investment company and therefore applies specialized accounting guidance in accordance with Accounting Standards Codification Topic 946. The following is a summary of significant accounting policies consistently followed by the Fund in the preparation of the financial statements:

(a) Valuation of Investments—Equity securities traded on a securities exchange or market, including exchange-traded option contracts, rights and warrants, are valued at the last reported sales price (for domestic equity securities) or the closing price (for foreign equity securities) on the exchange or market on which the security is principally traded or, for securities trading on the NASDAQ National Market System (“NASDAQ”), the NASDAQ Official Closing Price. If there is no available closing price for a foreign equity security, the last reported sales price is used. If there are no reported sales of a security on the valuation date, the security is valued at the most recent quoted bid price on such date reported by such principal exchange or market. Forward currency contracts generally are valued using quotations from an independent pricing service. Investments in money market funds are valued at the fund’s NAV per share.

Bonds and other fixed-income securities that are not exchange-traded are valued on the basis of prices provided by independent pricing services which are based on, among other things, trading in securities with similar characteristics, brokers’ quotations and/or a matrix system which considers such factors as other security prices, yields and maturities.

Calculation of the Fund’s NAV may not take place contemporaneously with the determination of the prices of portfolio assets used in such calculation. Trading on non-US securities exchanges and in over-the-counter markets may be completed before or after the close of business on each business day in New York (i.e., a day on which the NYSE is open). In addition, non-US securities trading generally, or in a particular country or countries, may not take place on all business days in New York and on which the NAV of the Fund is calculated.

The Valuation Committee of the Investment Manager, which meets periodically under the direction of the Board of Directors (the “Board”), may evaluate a variety of factors to determine the fair value of securities for which market quotations are determined not to be readily available or reliable. These factors include, but are not limited to, the

23

Lazard Global Total Return and Income Fund, Inc.

Notes to Financial Statements(continued)

December 31, 2019

type of security, the value of comparable securities, observations from financial institutions and relevant news events. Input from the Investment Manager’s portfolio managers/analysts also will be considered.

If a significant event materially affecting the value of securities occurs between the close of the exchange or market on which the security is principally traded and the time when the Fund’s NAV is calculated, or when current market quotations otherwise are determined not to be readily available or reliable (including restricted or other illiquid securities such as certain derivative instruments), such securities will be valued at their fair value as determined by, or in accordance with procedures approved by, the Board. The fair value of non-US securities may be determined with the assistance of an independent pricing service using correlations between the movement of prices of such securities and indices of US securities and other appropriate indicators, such as closing market prices of relevant American Depositary Receipts (“ADRs”) or futures contracts. Non-US securities may trade on days when the Fund is not open for business, thus affecting the value of the Fund’s assets on days when Fund stockholders may not be able to buy or sell Fund shares.

The effect of using fair value pricing is that the NAV of the Fund will reflect the affected securities’ values as determined in the judgment of the Board or its designee instead of being determined by the market. Using a fair value pricing methodology to price securities may result in a value that is different from the most recent closing price of a security and from the prices used by other investment companies to calculate their portfolios’ NAVs.

(b) Portfolio Securities Transactions and Investment Income—Portfolio securities transactions are accounted for on trade date. Realized gain (loss) on sales of investments are recorded on a specific identification basis. Dividend income is recorded on the ex-dividend date except for certain dividends from non-US securities where the dividend rate is not available. In such cases, the dividend is recorded as soon as the information is received by the Fund. Interest income is accrued daily. The Fund amortizes premiums and accretes discounts on fixed-income securities using the effective yield method.

The Fund may be subject to taxes imposed by non-US countries in which it invests. Such taxes are generally based upon income earned or capital gains (realized and/or unrealized). The Fund accrues and applies such taxes to net investment income, net realized gains and net unrealized gains concurrent with the recognition of income earned or capital gains (realized and/or unrealized) from the applicable portfolio securities.

As a result of several court cases in certain countries across the European Union, the Fund has filed tax reclaims for previously withheld taxes on dividends earned in certain European Union countries. These filings are subject to various administrative proceedings by the local jurisdictions’ tax authorities within the European Union, as well as a number of related judicial proceedings. Uncertainty exists as to the ultimate resolution of these proceedings, the likelihood of receipt of these claims, and the potential timing of payment, and accordingly no amounts are reflected in the financial state-

24

Lazard Global Total Return and Income Fund, Inc.

Notes to Financial Statements(continued)

December 31, 2019

ments. Such amounts, if and when recorded, could result in an increase in the Fund’s NAV per share.

(c) Leverage—The Fund uses leverage to invest Fund assets in currency investments, primarily using forward currency contracts and by borrowing under a credit facility with State Street Bank and Trust Company (“State Street”), up to a maximum of 33⅓% of the Fund’s total leveraged assets. If the assets of the Fund decline due to market conditions such that this 33⅓% threshold will be exceeded, leverage risk will increase.

If the Fund is able to realize a higher return on the leveraged portion of its investment portfolio than the cost of such leverage together with other related expenses, the effect of the leverage will be to cause the Fund to realize a higher net return than if the Fund were not so leveraged. There is no assurance that any leveraging strategy the Fund employs will be successful.

Using leverage is a speculative investment technique and involves certain risks. These include higher volatility of NAV, the likelihood of more volatility in the market value of the Fund’s common stocks and, with respect to borrowings, the possibility either that the Fund’s return will fall if the interest rate on any borrowings rises, or that income will fluctuate because the interest rate of borrowings varies.

If the market value of the Fund’s leveraged currency investments declines, the leverage will result in a greater decrease in NAV, or less of an increase in NAV, than if the Fund were not leveraged. To the extent that the Fund is required or elects to prepay any borrowings, the Fund may need to liquidate investments to fund such prepayments. Liquidation at times of adverse economic conditions may result in capital losses and may reduce returns.

(d) Foreign Currency Translation and Forward Currency Contracts—The accounting records of the Fund are maintained in US dollars. Portfolio securities and other assets and liabilities denominated in a foreign currency are translated daily into US dollars at the prevailing rates of exchange. Purchases and sales of securities, income receipts and expense payments are translated into US dollars at the prevailing exchange rates on the respective transaction dates.

The Fund does not isolate the portion of operations resulting from changes in foreign exchange rates on investments from the fluctuations arising from changes in their market prices. Such fluctuations are included in net realized and unrealized gain (loss) on investments. Net realized gain (loss) on foreign currency transactions and forward currency contracts represent net foreign currency gain (loss) from forward currency contracts, disposition of foreign currencies, currency gain (loss) realized between the trade and settlement dates on securities transactions, and the difference between the amount of dividends, interest and foreign withholding taxes recorded on the Fund’s accounting records and the US dollar equivalent amounts actually received or paid. Net change in unrealized appreciation (depreciation) on foreign currency translations reflects the

25

Lazard Global Total Return and Income Fund, Inc.

Notes to Financial Statements(continued)

December 31, 2019

impact of changes in exchange rates on the value of assets and liabilities, other than investments in securities, during the period.

A forward currency contract is an agreement between two parties to buy or sell currency at a set price on a future date. Upon entering into these contracts, risks may arise from the potential inability of counterparties to meet the terms of their contracts and from unanticipated movements in the value of the foreign currency relative to the US dollar.

The US dollar value of forward currency contracts is determined using quotations provided by an independent pricing service. Daily fluctuations in the value of such contracts are recorded as unrealized appreciation (depreciation) on forward currency contracts. When the contract is closed, the Fund records a realized gain (loss) equal to the difference between the value at the time it was opened and the value at the time it was closed.

(e) Federal Income Taxes—The Fund’s policy is to qualify as a regulated investment company under Subchapter M of the Internal Revenue Code (the “Code”) and to distribute all of its taxable income, including any net realized capital gains, to stockholders. Therefore, no federal income tax provision is required.

At December 31, 2019, the Fund had unused realized capital loss carryovers which, for federal income tax purposes, could be used to offset future realized capital gains with no expiration date as follows:

| Short-Term | | Long-Term |

| $7,376,693 | | $8,603,948 |

The unused realized capital loss carryovers above include amounts acquired from Lazard World Dividend & Income Fund, Inc. (“LOR”) and may be subject to future limitations.

Under current tax law, post-October capital losses or certain late-year ordinary losses, as defined by the Code, within the taxable year may be deferred and treated as occurring on the first day of the following tax year. For the tax year ended December 31, 2019, the Fund had no such losses to defer.

For federal income tax purposes, the aggregate cost, aggregate gross unrealized appreciation, aggregate gross unrealized depreciation and the net unrealized appreciation (depreciation) were as follows:

Aggregate

Cost | | Aggregate

Gross

Unrealized

Appreciation | | Aggregate

Gross

Unrealized

Depreciation | | Net

Unrealized

Appreciation

(Depreciation) |

| $211,920,514 | | $56,214,403 | | $2,041,283 | | $54,173,120 |

Management has analyzed the Fund’s tax positions, and has concluded that no liability for unrecognized tax benefits should be recorded related to uncertain tax positions taken on tax returns filed for any open tax years (or expected to be taken on future tax

26

Lazard Global Total Return and Income Fund, Inc.

Notes to Financial Statements(continued)

December 31, 2019

returns). Open tax years are those that remain subject to examination and are based on each tax jurisdiction’s statute of limitations. The Fund files a US federal income tax return annually after its fiscal year-end, which is subject to examination by the Internal Revenue Service for a period of three years from the date of filing.

(f) Dividends and Distributions—The Fund intends to declare and to pay dividends monthly. Distributions to stockholders are recorded on the ex-dividend date. During any particular year, net realized gains from investment transactions in excess of available capital loss carryforwards would be taxable to the Fund, if not distributed. The Fund intends to declare and distribute these amounts, at least annually, to stockholders; however, to avoid taxation, a second distribution may be required.