UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-21504

Advent/Claymore Enhanced Growth & Income Fund

(Exact name of registrant as specified in charter)

1271 Avenue of the Americas, 45th Floor, New York, NY 10020

(Address of principal executive offices) (Zip code)

Robert White, Treasurer

1271 Avenue of the Americas, 45th Floor, New York, NY 10020

(Name and address of agent for service)

Registrant's telephone number, including area code: (212) 482-1600

Date of fiscal year end: October 31

Date of reporting period: October 31, 2011

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 100 F Street, NE, Washington, DC 20549-1090. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

The registrant's annual report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940, as amended (the “Investment Company Act”), is as follows:

www.guggenheimfunds.com/lcm

... your bridge to the LATEST,

most up-to-date INFORMATION about the

Advent/Claymore Enhanced Growth & Income Fund

The shareholder report you are reading right now is just the beginning of the story. Online at www.guggenheimfunds.com/lcm, you will find:

| · | Daily, weekly and monthly data on share prices, net asset values, distributions, and more |

| · | Portfolio overviews and performance analyses |

| · | Announcements, press releases and special notices |

| · | Fund and adviser contact information |

Advent Capital Management and Guggenheim Funds are continually updating and expanding shareholder information services on the Fund’s website in an ongoing effort to provide you with the most current information about how your Fund’s assets are managed, and the results of our efforts. It is just one more small way we are working to keep you better informed about your investment in the Fund.

2 l Annual Report l October 31, 2011

LCM l Advent/Claymore Enhanced Growth & Income Fund (unaudited)

Tracy V. Maitland

President and Chief Executive Officer

Dear Shareholder |

We thank you for your investment in the Advent/Claymore Enhanced Growth & Income Fund (the “Fund”). This report covers the Fund’s performance for the fiscal year ended October 31, 2011.

Advent Capital Management, LLC serves as the Fund’s Investment Manager. Based in New York, New York, with additional investment personnel in London, England, Advent is a credit-oriented firm specializing in the management of global convertible, high-yield and equity securities across three lines of business—long-only strategies, hedge funds and closed-end funds. As of September 30, 2011, Advent managed approximately $6 billion in assets.

Guggenheim Funds Investment Advisors, LLC (“GFIA”) serves as the investment adviser to the Fund. GFIA is an indirect subsidiary of Guggenheim Partners, LLC, a global diversified financial services firm with more than $100 billion in assets under management and supervision.

The Fund’s primary investment objective is to seek current income and current gains from trading securities, with a secondary objective of long-term capital appreciation. Under normal market conditions, the Fund invests at least 70% of its managed assets in a diversified portfolio of equity securities and convertible securities of U.S. and non-U.S. issuers and up to 30% of assets in non-convertible high yield securities. Additionally, the Fund engages in a strategy of writing (selling) covered call options on a portion of the securities held in the Fund’s portfolio, thus generating option writing premiums. In October 2011, the Fund’s Trustees approved a guideline change to eliminate a previous requirement that 50% of all positions in the Fund have covered calls written against them. The Fund intends to continue writing options, especially against domestic equity holdings, but found the requirement difficult to sustain in a Fund with many convertible and high-yield positions. This change will take effect 60 days after written notice is provided to shareholders. Advent seeks international investment opportunities in each asset class, with an emphasis on large multinational companies. Appreciation potential is provided by investments in convertibles and common stock, while the allocation to high-yield securities is primarily a source of income. The balance between convertible securities, equities and high-yield securities and the degree to which the Fund engages in a covered call strategy will vary from time to time based on security valuations, interest rates, equity market volatility and other economic and market factors. This ability to move among the three asset classes is quite beneficial to the Fund’s ability to balance return and risk.

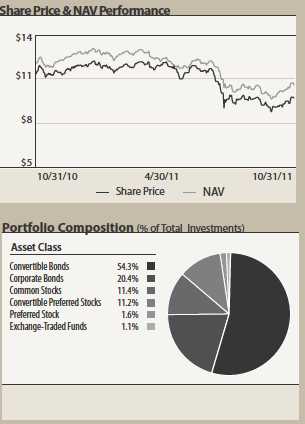

All Fund returns cited—whether based on net asset value (“NAV”) or market price—assume the reinvestment of all distributions. For the 12-month period ended October 31, 2011, the Fund generated a total return based on market price of -6.27% and a return of -4.18% based on NAV. As of October 31, 2011, the Fund’s market price of $9.73 represented a discount of 8.47% to NAV of $10.63. As of October 31, 2010, the Fund’s market price of $11.38 represented a discount of 6.03% to NAV of $12.11. Since the Fund’s return was negative for the period, the use of leverage was detrimental to performance.

The Fund paid quarterly distributions of $0.264 per common share on the last business day of November 2010, February 2011, May 2011, and August 2011. The current quarterly distribution represents an annualized distribution rate of 10.85% based upon the last closing market price of $9.73 as of October 31, 2011. There is no guarantee of any future distributions or that the current returns and distribution rate will be maintained.

Annual Report l October 31, 2011 l 3

LCM l Advent/Claymore Enhanced Growth & Income Fund l Dear Shareholder (unaudited) continued

We encourage shareholders to consider the opportunity to reinvest their distributions from the Fund through the Dividend Reinvestment Plan (“DRIP”), which is described in detail on page 36 of this report. When shares trade at a discount to NAV, the DRIP takes advantage of the discount by reinvesting the quarterly dividend distribution in common shares of the Fund purchased in the market at a price less than NAV. Conversely, when the market price of the Fund’s common shares is at a premium above NAV, the DRIP reinvests participants’ dividends in newly-issued common shares at NAV, subject to an IRS limitation that the purchase price cannot be more than 5% below the market price per share. The DRIP provides a cost-effective means to accumulate additional shares and enjoy the benefits of compounding returns over time. The DRIP effectively provides an income averaging technique, which causes shareholders to accumulate a larger number of Fund shares when the market price is depressed than when the price is higher.

The Fund is managed by a team of experienced and seasoned professionals led by myself in my capacity as Chief Investment Officer (as well as President and Founder) of Advent Capital Management, LLC. We encourage you to read the following Questions & Answers section, which provides more information about the factors that impacted the Fund’s performance.

We thank you for your investment in the Fund and we are honored that you have chosen the Advent/Claymore Enhanced Growth & Income Fund as part of your investment portfolio. For the most up-to-date information on your investment, please visit the Fund’s website at www.guggenheimfunds.com/lcm.

Sincerely,

Tracy V. Maitland

President and Chief Executive Officer of the Advent/Claymore Enhanced Growth & Income Fund

November 30, 2011

4 l Annual Report l October 31, 2011

LCM l Advent/Claymore Enhanced Growth & Income Fund (unaudited)

Questions & Answers |

Advent/Claymore Enhanced Growth & Income Fund (the “Fund”) is managed by a team of seasoned professionals at Advent Capital Management, LLC (“Advent” or the “Investment Manager”), led by Tracy V. Maitland, Advent’s President and Chief Investment Officer. In the following interview, the management team discusses the equity, convertible securities and high-yield markets and the performance of the Fund during the 12-month period ended October 31, 2011.

1. Please describe the Fund’s objectives and management strategies.

The Fund’s primary investment objective is to provide current income and current gains from trading in securities, with a secondary objective of long-term capital appreciation. Under normal market conditions, the Fund invests at least 70% of its assets in a diversified portfolio of equity securities and convertible securities of U.S. and non-U.S. issuers and up to 30% of its managed assets in non-convertible high yield securities. Advent seeks international investment opportunities in each asset class, with an emphasis on large multinational companies. Capital appreciation potential is provided by investments in convertibles and common stock, while the allocation to high-yield securities is primarily a source of income.

The Fund also engages in a strategy of writing (selling) covered call options. In October 2011, the Fund’s Trustees approved a guideline change to eliminate a previous requirement that 50% of all positions in the Fund have covered calls written against them. The Fund intends to continue writing options, especially against domestic equity holdings, but found the requirement difficult to sustain in a Fund with many convertible and high-yield positions. This change will take effect 60 days after written notice is provided to shareholders.

The Fund uses financial leverage (borrowing) to finance the purchase of additional securities that provide increased income and potentially greater appreciation potential for common shareholders than could be achieved from an unleveraged portfolio. The Fund currently uses financial leverage through a credit facility with a major global bank.

Although the use of financial leverage by the Fund may create an opportunity for increased return for common shareholders, it also results in additional risks and can magnify the effect of any losses. If income and gains earned on securities purchased with the financial leverage proceeds are greater than the cost of the financial leverage, common shareholders’ return will be greater than if financial leverage had not been used. Conversely, if the income or gains from the securities purchased with the proceeds of financial leverage are less than the cost of the financial leverage, common shareholders’ return will be less than if financial leverage had not been used. There is no assurance that a financial leverage strategy will be successful.

Most U.S. market indices, both equity and fixed-income, posted positive returns for the 12-month period ended October 31, 2011. However, more than 100% of this return came in the first half of the period, as returns for most indices were negative for the six-month period ended October 31, 2011. International markets were generally weaker than the U.S. market, as there was considerable turmoil caused by concerns about sovereign debt in several European nations, which European authorities are attempting to address.

In the U.S., fundamentals are generally healthier than recent trends in the equity market suggest. In late October, the Department of Commerce reported real growth in gross domestic product (GDP) at an annual rate of 2.5% for the third quarter of 2011, up from 1.3% in the second quarter of the year. The index of leading economic indicators published by the Conference Board suggests continued moderate expansion in economic activity in the months ahead, and that is consistent with the forecasts of most economists. Furthermore, a renewed recession seems unlikely because the excesses and imbalances that typically lead to recession – too much capital equipment, durable goods, labor, housing, inventories – are not present. Stocks of household durable goods and business equipment are low, suggesting that there may be pent-up demand. Although the real estate market remains weak, there has been progress in repairing some of the excesses of the boom.

Internationally, there are issues not only in Europe but also in other parts of the world. Central banks in many emerging market countries such as China, India, Brazil and Australia raised interest rates to combat inflation, and these higher interest rates are slowing growth in these markets. In Europe, austerity plans and the rising Euro began to hurt exporters and slow growth.

For the 12-month period ended October 31, 2011, the S&P 500 Index (the “S&P”), which is generally regarded as a good indicator of the return from larger-capitalization U.S. stocks, returned 8.09%. In the first half of the 12-month period, the S&P returned 16.36%; for the six-month period ended October 31, 2011, the return of the S&P was -7.11%. Return of the Morgan Stanley Capital International Europe-Australasia-Far East Index (the “MSCI EAFE”) Index, which is composed of approximately 1,100 companies in 20 developed countries in Europe and the Pacific Basin, was -3.56% for the 12 months ended October 31, 2011.

Annual Report l October 31, 2011 l 5

LCM l Advent/Claymore Enhanced Growth & Income Fund l Questions & Answers (unaudited) continued

Most bond investments delivered positive returns during the 12 months through October 2011. In late summer, rates on U.S. Treasury bonds plunged to nearly unprecedented levels, as investors sought safety. Return of the Barclays U.S. Aggregate Bond Index (the “Barclays Aggregate”), which measures return of the U.S. investment-grade and government bond market as a whole, was 4.98% for the 12 months ended October 31, 2011. Return of the Merrill Lynch High Yield Index, which measures performance of the U.S. high-yield bond market, was 4.81% for the same period. Return of the Merrill Lynch All U.S. Convertibles Index was 1.03%, and return of the Merrill Lynch Global 300 Convertibles Index was -0.76% for the 12 months ended October 31, 2011.

3. How did the Fund perform in this environment?

All Fund returns cited—whether based on net asset value (“NAV”) or market price—assume the reinvestment of all distributions. For the 12-month period ended October 31, 2011, the Fund generated a total return based on market price of -6.27% and a return of -4.18% based on NAV. As of October 31, 2011, the Fund’s market price of $9.73 represented a discount of 8.47% to NAV of $10.63. As of October 31, 2010, the Fund’s market price of $11.38 represented a discount of 6.03% to NAV of $12.11. Since the Fund’s return was negative for the period, the use of leverage was detrimental to performance.

For comparison, the Merrill Lynch Global 300 index of convertible bonds returned -0.77% for the period, CBOE S&P 500 2% OTM BuyWrite Index (BXY), an index that measures the performance of the S&P 500 equity index with 2% out-of-the-money S&P call options written against it, returned 9.84%, and the Merrill Lynch US High Yield Master II Index returned 4.81%. It is important to remember that the Fund’s mandate differs materially from each of these indices and that the Fund maintains leverage while these indices do not.

The market value and NAV of the Fund’s shares fluctuate from time to time, and the Fund’s market value may be higher or lower than its NAV. The Investment Manager believes that, over the long term, the progress of the NAV will be reflected in the market price return to shareholders.

4. How was the Fund’s portfolio allocated among asset classes over the last year, and what has this meant for performance?

The Fund was designed to be diversified among asset classes but to also have the flexibility to reallocate assets, as appropriate. Investments are allocated globally among stocks, convertible securities and high-yield bonds.

At the end of the previous fiscal year, October 31, 2010, 61.7% of the Fund’s total investments were in convertible securities; of this, 43.0% was in convertible bonds and 18.7% in convertible preferreds. At that time, 13.8% of the Fund’s total investments were invested in common stocks, 17.0% in high yield bonds, and 7.5% in other investments including exchange-traded funds and warrants. As of April 30, 2011, convertibles as a percentage of total investments were 59.6%; of this percentage, 37.7% of total investments were in convertible bonds and 21.9% of total investments were in convertible preferreds. Changes in recent months reflect actions taken by the Investment Manager to reduce the Fund’s risk profile in an uncertain economic environment. The main change was a reduction in convertible preferreds, especially mandatory convertibles, and equities, with a commensurate increase in convertible bonds with attractive upside/downside asymmetry. As of October 31, 2011, 65.5% of the Fund’s total investments were in convertible securities with 54.3% in convertible bonds and 11.2% in convertible preferreds. The equity exposure was reduced to 11.4% at the end of the period, and high-yield bonds comprised 20.4%. As of October 31, 2011, 2.7% of the Fund’s total investments were in other investments including nonconvertible preferred stocks and exchange-traded funds.

Because of turmoil in Europe and slowing growth in many developing nations, the Fund has reduced somewhat its international exposure, which was 22.5% of total investments as of October 31, 2010. As of October 31, 2011, international investments represented 21.4% of the Fund’s total investments. Within international investments, as in domestic investments there was a move away from riskier holdings with greater equity exposure, with more emphasis on convertible securities that are expected to have less price volatility and that have the potential for favorable upside/downside asymmetry, meaning that they are expected to provide greater potential for price appreciation than for downward moves.

5. Which investment decisions had the greatest effect on the Fund’s performance?

A category of investments that was detrimental to performance was preferred stocks of financial institutions. The Fund typically has significant exposure to the financial sector because the securities’ high payouts help the Fund meet distribution goals and as financial companies are large issuers of convertible securities. Convertible preferreds—particularly mandatory preferreds—have high yields but are typically more volatile than convertible bonds. Moreover, the downside protection of preferreds is inherently inferior to that of bonds.

A holding that performed poorly was a mandatory convertible of Synovus Financial Corp. (not held in the portfolio at period end), a regional bank in the Southeast. The market had expected this bank to make more progress with its nonperforming loans

6 l Annual Report l October 31, 2011

LCM l Advent/Claymore Enhanced Growth & Income Fund l Questions & Answers (unaudited) continued

than it did. The company was considered to be an acquisition candidate, but such sentiment has ebbed as legacy problems in housing and other sectors have persisted. Another negative in the financial sector was a mandatory convertible preferred issued by Citigroup, Inc. (1.2% of long-term investments at period end), a global diversified financial services company. The company experienced declines in its investment banking revenues and its brokerage transaction business. And, like other large banks, the stock weakened as the financial crisis in Europe became worse and investors began to question U.S. banks’ exposure to sovereign debt in Europe.

Also negative was a convertible preferred stock issued by auto manufacturer General Motors Co. (1.0% of long-term investments at period end). The company’s revenue was hurt by lower auto sales in Europe and South America and higher costs in its United States operations. A further problem was pension costs becoming a concern in an environment of falling interest rates.

Securities of companies in economically sensitive cyclical industries also tended to perform poorly. A holding that hurt the Fund’s performance was Kloeckner & Co. Financial Services SA (0.5% of long-term investments at period end), a German steel distributor that does business mainly in Europe and the U.S. Falling steel prices late in the period hurt Kloeckner’s revenues and margins. In addition, the rising Euro hurt the export business, as Kloeckner became less competitive with other distributors outside of the Euro zone.

Another negative was a convertible preferred of Stillwater Mining Company, a miner of precious metals including palladium and platinum (not held in the portfolio at period end). This was a mandatory convertible in the shares of Stillwater Mining issued by UBS AG (not held in the portfolio at period end), a major Swiss bank that holds a large equity position in Stillwater. Stillwater has had reasonable performance in its core operations, but it made a large acquisition late in the period and investors began to question the company’s ability to finance its aggressive expansion plans.

An important contributor to performance was a convertible in Newmont Mining Corp., a large gold producer (1.2% of long-term investments at period end). The company repeatedly raised its dividend during the fiscal year, a new trend among gold miners that was met very favorably by investors. Newmont’s basic operations have been strong, with mines in Australia, Indonesia, and the United States performing well. Additionally, gold mining stocks have been pushed up by the rising price of gold, as investors in fear of inflation flock to gold as protection.

Other positives were common stocks of Qualcomm, Inc., which produces chips for mobile phones and other mobile devices; Apple, Inc., which designs, manufactures and markets computers and other electronic devices; and Honeywell International, Inc., a diversified technology and manufacturing company (0.9%, 0.8% and 0.6%, respectively, of long-term investments at period end). Qualcomm has been helped as smart phones replace voice-only phones, both in the U.S. and internationally. Qualcomm also benefits from increasing penetration of the Microsoft Windows phone system, for which Qualcomm is the only provider of chips. Apple performed very well because of increasing penetration of the iPhone, especially with foreign carriers, and the lack of any major competition for the iPad tablet device. Honeywell raised its dividend twice in the last year; this is a company with a number of late-cycle businesses that weren’t previously highly valued by investors, especially in the aerospace area. Honeywell’s margins have also improved based on a company-wide cost efficiency program.

6. What was the impact of the Fund’s covered call strategy?

The income generated by the covered call strategy added modestly to the Fund’s return. During most of the fiscal year, despite some wide market swings, market volatility as represented by the CBOE Volatility index, a measure of market volatility commonly known as the VIX, was relatively low. As a result, the premiums available for writing covered calls were often unattractive relative to the sacrifice of participation in the upside potential of the stocks. Accordingly, the Fund’s covered call strategy was relatively limited for much of the fiscal year. In most cases, calls were written against a smaller proportion of the holdings than in past periods, and most calls were written out of the money.

The VIX was 21.2 at the end of October 2010, fell to 14.8 at end of April 2011 and remained near 15 through the end of June. Market volatility rose near the end of the period and was around 30 for the last few months of the fiscal year ended October 31, 2011.

As volatility increased near the end of the fiscal year, more covered calls were written and they were written on more of the equity positions. In some cases, options were written on 100% of the shares with equity options, and they were written closer to the money. The Fund’s covered call overlay serves mainly to help meet distribution goals and, to a lesser extent, to help maintain the Fund’s NAV during market setbacks. Option premiums, dividends, interest and capital appreciation are all part of the total return. Most of the covered call writing centers on the Fund’s U.S. equity and convertible investments, because the U.S. has a broad and deep options market, while many international companies that we find attractive lack listed options.

Although the Fund has the ability to write calls on the entire portfolio, covered calls are generally written on a subset of the

Annual Report l October 31, 2011 l 7

LCM l Advent/Claymore Enhanced Growth & Income Fund l Questions & Answers (unaudited) continued

total portfolio. Calls are usually written on just a portion of a position so that if the price of the security rises substantially and the call is exercised, a portion of the position is still maintained. Calls with varying maturities and strike prices are typically tiered so that not all expire at the same time or are exercised at the same price.

What is a covered call?

A call is an option (or contract) that gives its holder the right, but not the obligation, to buy shares of the underlying security at a specified price on or before a pre-determined expiration date. After this predetermined date, the option and its corresponding rights expire. A covered call is a call option that is written by an investor that owns the security on which the call is written. Covered call strategies are generally used as a hedge—to limit losses by obtaining premium income from the sale of calls, while still maintaining some of the upside potential. A call is “out of the money” when the option’s strike price is higher than the market price of the underlying asset.

7. Please discuss the Fund’s distributions over the last year.

The Fund paid quarterly distributions of $0.264 per common share on the last business day of November 2010, February 2011, May 2011, and August 2011. The current quarterly distribution represents an annualized distribution rate of 10.85% based upon the last closing market price of $9.73 as of October 31, 2011. There is no guarantee of any future distributions or that the current returns and distribution rate will be maintained.

8. What is the current outlook for the markets and the Fund?

The Fund’s management team continues to see opportunities in equities, convertible securities and high yield bonds. A major advantage of this Fund is its ability to invest in multiple asset classes, adjusting the asset mix according to the opportunities available in various markets around the world. As the equity market rises, the equity sensitivity of a portfolio of convertible securities increases. When the equity markets are weak, convertibles’ declining sensitivity and interest income mitigate the downside risk.

Advent believes that, over the long term, careful security selection and asset allocation will help the Fund’s performance by providing favorable returns in rising markets and a level of income that can help provide some protection for overall returns during down markets.

Index Definitions

Indices are unmanaged and it is not possible to invest directly in an index.

S&P 500 Index is a capitalization-weighted index of 500 stocks. The index is designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

The MSCI EAFE Index is a free float-adjusted market capitalization weighted index designed to reflect the movements of stock markets in developed countries of Europe and the Pacific Basin. The index is calculated in U.S. dollars and is constructed to represent about 60% of market capitalization in each country.

The MSCI Emerging Markets Index is a free float-adjusted market capitalization weighted index that is designed to measure equity market performance in the global emerging markets.

The Merrill Lynch All U.S. Convertibles Index is comprised of approximately 500 issues of convertible bonds and preferred stock of all qualities.

The Barclays Capital U.S. Aggregate Bond Index covers the U.S. dollar-denominated, investment-grade, fixed rate, taxable bond market of SEC-registered securities. The Index includes bonds from the Treasury, government-related, corporate, mortgage-backed securities (agency fixed-rate and hybrid ARM passthroughs), asset-backed securities and collateralized mortgage-backed securities sectors.

Merrill Lynch High Yield Master II Index is a commonly used benchmark index for high yield corporate bonds. It is a measure of the broad high yield market.

The CBOE S&P 500 2% OTM BuyWrite Index (BXY) uses the same methodology as the widely accepted CBOE S&P 500 BuyWrite Index (BXM), but the BXY Index is calculated using out-of-the-money S&P 500 Index (SPX) call options, rather than at-the-money SPX call options. The BXY strategy diversifies the buy-write opportunities currently provided by the BXM. The BXY Index yields lower monthly premiums in return for a greater participation in the upside moves of the S&P 500.

VIX is the ticker symbol for the Chicago Board Options Exchange Market Volatility Index, a popular measure of the implied volatility of S&P 500 Index options. It is a weighted blend of prices for a range of options on the S&P 500 Index.

8 l Annual Report l October 31, 2011

LCM l Advent/Claymore Enhanced Growth & Income Fund l Questions & Answers (unaudited) continued

LCM Additional Risks and Disclosure

The views expressed in this report reflect those of the Portfolio Managers only through the report period as stated on the cover. These views are subject to change at any time, based on market and other conditions and should not be construed as a recommendation of any kind. The material may also contain forward-looking statements that involve risk and uncertainty, and there is no guarantee they will come to pass. There can be no assurance that the Fund will achieve its investment objectives. The value of the Fund will fluctuate with the value of the underlying securities. Historically, closed-end funds often trade at a discount to their net asset value. The Fund is subject to investment risk, including the possible loss of the entire amount that you invest. Past performance does not guarantee future results.

Convertible Securities. The Fund is not limited in the percentage of its assets that may be invested in convertible securities. Convertible securities generally offer lower interest or dividend yields than non-convertible securities of similar quality. The market values of convertible securities tend to decline as interest rates increase and, conversely, to increase as interest rates decline. However, the convertible security’s market value tends to reflect the market price of the common stock of the issuing company when that stock price is greater than the convertible’s “conversion price,” which is the predetermined price at which the convertible security could be exchanged for the associated stock.

Interest Rate Risk. Convertible securities and non-convertible income producing securities are subject to certain risks, including (i) if interest rates go up, the value of convertible securities and non-convertible income-producing securities in the Fund’s portfolio generally will decline; (ii) during periods of declining interest rates, the issuer of a security may exercise its option to prepay principal earlier than scheduled, forcing the Fund to reinvest in lower yielding securities (call or prepayment risk); and (iii) during periods of rising interest rates, the average life of certain types of securities may be extended because of slower than expected principal payments (extension risk).

Credit Risk. Credit risk is the risk that one or more securities in the Fund’s portfolio will decline in price, or fail to pay interest or principal when due, because the issuer of the security experiences a decline in its financial status. The Fund’s investments in convertible and nonconvertible debt securities involve credit risk. However, in general, lower rated securities carry a greater degree of risk that the issuer will lose its ability to make interest and principal payments, which could have a negative impact on the Fund’s net asset value or dividends.

Smaller Company Risk. The general risks associated with corporate income-producing and equity securities are particularly pronounced for securities issued by companies with smaller market capitalizations. These companies may have limited product lines, markets or financial resources, or they may depend on a few key employees. As a result, they may be subject to greater levels of credit, market and issuer risk. Securities of smaller companies may trade less frequently and in lesser volume than more widely held securities and their values may fluctuate more sharply than other securities. Companies with medium-sized market capitalizations may have risks similar to those of smaller companies.

Synthetic Convertible Securities. The value of a synthetic convertible security will respond differently to market fluctuations than a convertible security because a synthetic convertible security is composed of two or more separate securities, each with its own market value. In addition, if the value of the underlying common stock or the level of the index involved in the convertible component falls below the exercise price of the warrant or option, the warrant or option may lose all value.

Equity Securities Risk. Equity risk is the risk that securities held by the Fund will fall due to general market or economic conditions, perceptions regarding the industries in which the issuers of securities held by the Fund participate, and the particular circumstances and performance of particular companies whose securities the Fund holds.

Risk Associated with the Fund’s Covered Call Option Writing Strategy. The ability of the Fund to achieve its investment objective of providing total return through a combination of current income and capital appreciation is partially dependent on the successful implementation of its covered call option strategy. There are significant differences between the securities and options markets that could result in an imperfect correlation between these markets, causing a given transaction not to achieve its objectives. A decision as to whether, when and how to use options involves the exercise of skill and judgment, and even a well conceived transaction may be unsuccessful to some degree because of market behavior or unexpected events. As the writer of a covered call option, the Fund forgoes, during the option’s life, the opportunity to profit from increases in the market value of the security covering the call option above the sum of the premium and the strike price of the call, but has retained the risk of loss should the price of the underlying security decline.

Lower Grade Securities. The Fund may invest an unlimited amount in lower grade securities. Investing in lower grade securities (commonly known as “junk bonds”) involves additional risks, including credit risk. Credit risk is the risk that one or more securities in the Fund’s portfolio will decline in price, or fail to pay interest or principal when due, because the issuer of the security experiences a decline in its financial status.

Leverage Risk. Certain risks are associated with the leveraging of common stock. Both the net asset value and the market value of shares of common stock may be subject to higher volatility and a decline in value.

Foreign Securities and Emerging Markets Risk. Investing in non-U.S. issuers may involve unique risks, such as currency, political, economic and market risk. In addition, investing in emerging markets entails additional risk including, but not limited to (1) news and events unique to a country or region (2) smaller market size, resulting in lack of liquidity and price volatility (3) certain national policies which may restrict the Fund’s investment opportunities (4) less uniformity in accounting and reporting requirements (5) unreliable securities valuation and (6) custody risk.

Illiquid Investments. The Fund may invest without limit in illiquid securities. The Fund may also invest without limit in Rule 144A Securities. Although many of the Rule 144A Securities in which the Fund invests may be, in the view of the Investment Manager, liquid, if qualified institutional buyers are unwilling to purchase these Rule 144A Securities, they may become illiquid. Illiquid securities may be difficult to dispose of at a fair price at the times when the Fund believes it is desirable to do so. The market price of illiquid securities generally is more volatile than that of more liquid securities, which may adversely affect the price that the Fund pays for or recovers upon the sale of illiquid securities.

In addition to the risks described above, the Fund is also subject to: Interest Rate Risk, Credit Risk, Call Risk, Currency Risks, Management Risk, Strategic Transactions, Anti-Takeover Provisions, Derivatives Risk and Market Disruption Risk. Please see www.guggenheimfunds.com/lcm for a more detailed discussion about Fund risks and considerations.

Annual Report l October 31, 2011 l 9

LCM l Advent/Claymore Enhanced Growth & Income Fund

Fund Summary | As of October 31, 2011 (unaudited)

Fund Statistics | ||

Share Price | $9.73 | |

Common Share Net Asset Value | $10.63 | |

Premium/Discount to NAV | -8.47% | |

Net Assets ($000) | $144,533 | |

Total Returns | ||

(Inception 1/31/05) | Market | NAV |

One Year | -6.27% | -4.18% |

Three Year - average annual | 14.50% | 9.09% |

Five Year - average annual | -2.82% | -2.77% |

Since Inception - average annual | -1.05% | 0.04% |

% of Long Term | ||

Top Ten Industries | Investments | |

Telecommunications | 7.6% | |

Diversified Financial Services | 5.8% | |

Pharmaceuticals | 5.5% | |

Banks | 5.4% | |

Computers | 4.9% | |

Oil & Gas | 4.7% | |

REITS | 4.4% | |

Mining | 4.4% | |

Biotechnology | 3.6% | |

Insurance | 3.5% | |

% of Long Term | ||

Top Ten Issuers | Investments | |

Citigroup, Inc. | 2.2% | |

Ford Motor Co. | 1.9% | |

Clear Channel Worldwide Holdings, Inc. | 1.7% | |

Alcatel-Lucent (France) | 1.6% | |

Iconix Brand Group, Inc. | 1.6% | |

Case New Holland, Inc. | 1.6% | |

Toys R Us Property Co. II LLC | 1.5% | |

PPL Corp. | 1.4% | |

Lukoil International Finance BV (Russia) | 1.4% | |

MetLife, Inc. | 1.4% |

Past performance does not guarantee future results. All portfolio data is subject to change daily. For more current information, please visit www.guggenheimfunds.com/lcm. The above summaries are provided for informational purposes only and should not be viewed as recommendations.

10 l Annual Report l October 31, 2011

LCM l Advent/Claymore Enhanced Growth & Income Fund

Portfolio of Investments l October 31, 2011

Principal | Optional Call | |||||||

Amount~ | Description | Rating* | Coupon | Maturity | Provisions** | Value | ||

Long-Term Investments – 130.4% | ||||||||

Convertible Bonds – 70.8% | ||||||||

Agriculture – 1.0% | ||||||||

HKD | 11,900,000 | Glory River Holdings Ltd. (Hong Kong) | NR | 1.00% | 07/29/2015 | N/A | $ 1,488,458 | |

Apparel – 2.1% | ||||||||

| $ | 820,000 | Iconix Brand Group, Inc. | BB- | 1.88% | 06/30/2012 | N/A | 818,975 | |

2,340,000 | Iconix Brand Group, Inc. (a) (i) | NR | 2.50% | 06/01/2016 | N/A | 2,246,400 | ||

3,065,375 | ||||||||

Auto Manufacturers – 2.0% | ||||||||

750,000 | Ford Motor Co. | BB+ | 4.25% | 11/15/2016 | N/A | 1,119,375 | ||

1,600,000 | Navistar International Corp. (i) | B | 3.00% | 10/15/2014 | N/A | 1,800,000 | ||

2,919,375 | ||||||||

Auto Parts & Equipment – 0.3% | ||||||||

500,000 | Meritor, Inc.(b) | CCC+ | 4.63% | 03/01/2026 | 03/01/16 @ 100 | 436,250 | ||

Biotechnology – 4.7% | ||||||||

750,000 | Charles River Laboratories International, Inc. | BB+ | 2.25% | 06/15/2013 | N/A | 742,500 | ||

932,000 | Cubist Pharmaceuticals, Inc. (h) (i) | NR | 2.50% | 11/01/2017 | N/A | 1,346,740 | ||

1,900,000 | Gilead Sciences, Inc., Series B (h) (i) | A- | 0.63% | 05/01/2013 | N/A | 2,253,875 | ||

1,900,000 | Illumina, Inc. (a) (i) | NR | 0.25% | 03/15/2016 | N/A | 1,477,250 | ||

900,000 | Vertex Pharmaceuticals, Inc. | NR | 3.35% | 10/01/2015 | 10/01/13 @ 101 | 968,625 | ||

6,788,990 | ||||||||

Coal – 0.9% | ||||||||

1,200,000 | Peabody Energy Corp. (i) | B+ | 4.75% | 12/15/2041 | 12/20/36 @ 100 | 1,314,000 | ||

Computers – 4.7% | ||||||||

615,000 | EMC Corp., Series A (h) (i) | A- | 1.75% | 12/01/2011 | N/A | 938,644 | ||

756,000 | EMC Corp., Series B (h) (i) | A- | 1.75% | 12/01/2013 | N/A | 1,206,765 | ||

EUR | 2,650,000 | Ingenico, Series ING (France) | NR | 2.75% | 01/01/2017 | N/A | 1,584,451 | |

| $ | 1,600,000 | Netapp, Inc. (h) (i) | NR | 1.75% | 06/01/2013 | N/A | 2,204,000 | |

750,000 | SanDisk Corp. | BB- | 1.50% | 08/15/2017 | N/A | 899,062 | ||

6,832,922 | ||||||||

Diversified Financial Services – 3.8% | ||||||||

GBP | 700,000 | Aberdeen Asset Management PLC, Series ADN (United Kingdom) | NR | 3.50% | 12/17/2014 | N/A | 1,308,955 | |

| $ | 1,000,000 | Affiliated Managers Group, Inc. | BBB- | 3.95% | 08/15/2038 | 08/15/13 @ 100 | 1,088,750 | |

1,900,000 | Janus Capital Group, Inc. | BBB- | 3.25% | 07/15/2014 | N/A | 1,866,750 | ||

HKD | 8,000,000 | Power Regal Group Ltd. (Hong Kong) | NR | 2.25% | 06/02/2014 | N/A | 1,216,227 | |

5,480,682 | ||||||||

Electrical Components & Equipment – 1.8% | ||||||||

| $ | 1,400,000 | General Cable Corp. | B+ | 0.88% | 11/15/2013 | N/A | 1,331,750 | |

1,260,000 | General Cable Corp.(b) | B | 4.50% | 11/15/2029 | N/A | 1,294,650 | ||

2,626,400 | ||||||||

Engineering & Construction – 1.8% | ||||||||

870,000 | Jaiprakash Associates Ltd. (India)(c) (i) | NR | 0.00% | 09/12/2012 | N/A | 1,102,725 | ||

1,400,000 | Larsen & Toubro Ltd. (India) (i) | NR | 3.50% | 10/22/2014 | N/A | 1,449,000 | ||

2,551,725 | ||||||||

Health Care Products – 1.3% | ||||||||

1,950,000 | Hologic, Inc.(b) (g) | BB+ | 2.00% | 12/15/2037 | 12/15/13 @ 100 | 1,845,187 | ||

See notes to financial statements. | ||||||||

Annual Report l October 31, 2011 l 11 | ||||||||

LCM l Advent/Claymore Enhanced Growth & Income Fund l Portfolio of Investments continued

Principal | Optional Call | |||||||

Amount~ | Description | Rating* | Coupon | Maturity | Provisions** | Value | ||

Holding Companies-Diversified – 1.3% | ||||||||

EUR | 1,300,000 | Industrivarden AB, Series INDU (Sweden) | A | 2.50% | 02/27/2015 | N/A | $ 1,955,198 | |

Home Builders – 1.0% | ||||||||

| $ | 328,000 | DR Horton, Inc., Series DHI | BB- | 2.00% | 05/15/2014 | N/A | 362,440 | |

1,000,000 | Lennar Corp.(a) | B+ | 2.75% | 12/15/2020 | 12/20/15 @ 100 | 1,031,250 | ||

1,393,690 | ||||||||

Insurance – 0.7% | ||||||||

1,000,000 | American Equity Investment Life Holding Co. (a) (h) | BB | 3.50% | 09/15/2015 | N/A | 1,050,000 | ||

Internet – 3.5% | ||||||||

1,500,000 | Digital River, Inc.(a) | NR | 2.00% | 11/01/2030 | 11/01/15 @ 100 | 1,252,500 | ||

1,810,000 | Equinix, Inc. (i) | B | 3.00% | 10/15/2014 | N/A | 1,993,263 | ||

2,019,000 | WebMD Health Corp. (a) (i) | NR | 2.50% | 01/31/2018 | N/A | 1,784,291 | ||

5,030,054 | ||||||||

Iron & Steel – 2.8% | ||||||||

1,350,000 | Allegheny Technologies, Inc. (i) | BBB- | 4.25% | 06/01/2014 | N/A | 1,839,375 | ||

EUR | 28,000 | Arcelormittal, Series MT (Luxembourg) | BBB- | 7.25% | 04/01/2014 | N/A | 949,072 | |

| $ | 200,000 | ArcelorMittal (Luxembourg) | BBB- | 5.00% | 05/15/2014 | N/A | 222,250 | |

1,000,000 | Steel Dynamics, Inc. | BB+ | 5.13% | 06/15/2014 | N/A | 1,070,000 | ||

4,080,697 | ||||||||

Lodging – 1.7% | ||||||||

750,000 | Gaylord Entertainment Co.(a) | NR | 3.75% | 10/01/2014 | N/A | 829,688 | ||

1,600,000 | MGM Resorts International | CCC+ | 4.25% | 04/15/2015 | N/A | 1,604,000 | ||

2,433,688 | ||||||||

Machinery-Diversified – 0.9% | ||||||||

1,000,000 | AGCO Corp. | BB+ | 1.25% | 12/15/2036 | 12/19/13 @ 100 | 1,262,500 | ||

Media – 1.3% | ||||||||

1,439,000 | XM Satellite Radio, Inc. (a) (h) (i) | BB | 7.00% | 12/01/2014 | N/A | 1,827,530 | ||

Metal Fabricate & Hardware – 0.6% | ||||||||

EUR | 600,000 | Kloeckner & Co. Financial Services SA, Series KCO (Germany) | B+ | 6.00% | 06/09/2014 | N/A | 866,170 | |

Mining – 4.5% | ||||||||

| $ | 1,000,000 | AngloGold Ashanti Holdings Finance PLC (South Africa)(a) | NR | 3.50% | 05/22/2014 | N/A | 1,157,500 | |

1,600,000 | Kinross Gold Corp. (Canada) (i) | BBB- | 1.75% | 03/15/2028 | 03/20/13 @ 100 | 1,562,000 | ||

1,500,000 | Newmont Mining Corp., Series A (h) (i) | BBB+ | 1.25% | 07/15/2014 | N/A | 2,291,250 | ||

1,600,000 | Vedanta Resources Jersey II Ltd. (United Kingdom) (i) | BB | 4.00% | 03/30/2017 | N/A | 1,456,800 | ||

6,467,550 | ||||||||

Miscellaneous Manufacturing – 1.8% | ||||||||

700,000 | Textron, Inc., Series TXT (h) (i) | BBB- | 4.50% | 05/01/2013 | N/A | 1,118,250 | ||

1,525,000 | Trinity Industries, Inc. (h) (i) | BB- | 3.88% | 06/01/2036 | 06/01/18 @ 100 | 1,464,000 | ||

2,582,250 | ||||||||

Oil & Gas – 3.2% | ||||||||

1,000,000 | Chesapeake Energy Corp. (i) | BB+ | 2.75% | 11/15/2035 | 11/15/15 @ 100 | 1,088,750 | ||

2,500,000 | Lukoil International Finance BV (Russia) (i) | BBB- | 2.63% | 06/16/2015 | N/A | 2,700,625 | ||

1,200,000 | Petroplus Finance Ltd. (Bermuda) | B- | 4.00% | 10/16/2015 | N/A | 774,000 | ||

4,563,375 | ||||||||

See notes to financial statements.

12 l Annual Report l October 31, 2011

LCM l Advent/Claymore Enhanced Growth & Income Fund l Portfolio of Investments continued | ||||||||

Principal | Optional Call | |||||||

Amount~ | Description | Rating* | Coupon | Maturity | Provisions** | Value | ||

Oil & Gas Services – 1.7% | ||||||||

| $ | 780,000 | Hornbeck Offshore Services, Inc.(b) | B+ | 1.63% | 11/15/2026 | 11/15/13 @ 100 | $ 752,700 | |

1,500,000 | Subsea 7 SA, Series ACY (Luxembourg) (i) | NR | 2.25% | 10/11/2013 | N/A | 1,745,250 | ||

2,497,950 | ||||||||

Packaging & Containers – 0.5% | ||||||||

750,000 | Owens-Brockway Glass Container, Inc.(a) | BB | 3.00% | 06/01/2015 | N/A | 694,688 | ||

Pharmaceuticals – 4.2% | ||||||||

801,000 | ENDO Pharmaceuticals Holdings, Inc. | NR | 1.75% | 04/15/2015 | N/A | 999,247 | ||

750,000 | Mylan, Inc. | BB | 1.25% | 03/15/2012 | N/A | 757,500 | ||

500,000 | Omnicare, Inc. | BB | 3.75% | 12/15/2025 | N/A | 624,375 | ||

1,496,000 | Salix Pharmaceuticals Ltd. (i) | NR | 2.75% | 05/15/2015 | N/A | 1,559,580 | ||

JPY | 75,000,000 | Sawai Pharmaceutical Co. Ltd. (Japan)(c) | NR | 0.00% | 09/17/2015 | N/A | 1,003,447 | |

| $ | 1,000,000 | Shire PLC, Series SHP (Channel Islands) | NR | 2.75% | 05/09/2014 | N/A | 1,153,000 | |

6,097,149 | ||||||||

Real Estate – 2.2% | ||||||||

1,040,000 | Forest City Enterprises(a) | B- | 4.25% | 08/15/2018 | N/A | 938,600 | ||

EUR | 445,000 | IMMOFINANZ AG (Austria) | NR | 4.25% | 03/08/2018 | N/A | 2,241,296 | |

3,179,896 | ||||||||

Real Estate Investment Trusts – 4.5% | ||||||||

| $ | 1,350,000 | Annaly Capital Management, Inc. (i) | NR | 4.00% | 02/15/2015 | N/A | 1,566,000 | |

1,190,000 | Boston Properties, LP | A- | 3.75% | 05/15/2036 | 05/18/13 @ 100 | 1,364,038 | ||

1,300,000 | Host Hotels & Resorts, LP (a) (i) | BB+ | 2.50% | 10/15/2029 | 10/20/15 @ 100 | 1,576,250 | ||

1,800,000 | Kilroy Realty, LP (a) (i) | NR | 4.25% | 11/15/2014 | N/A | 2,074,500 | ||

6,580,788 | ||||||||

Retail – 1.9% | ||||||||

HKD | 15,000,000 | Hengdeli Holdings Ltd. (Cayman Islands) | NR | 2.50% | 10/20/2015 | N/A | 2,000,322 | |

| $ | 750,000 | RadioShack Corp.(a) | Ba2 | 2.50% | 08/01/2013 | N/A | 730,312 | |

2,730,634 | ||||||||

Semiconductors – 0.9% | ||||||||

1,000,000 | Rovi Corp. (h) | NR | 2.63% | 02/15/2040 | 02/20/15 @ 100 | 1,266,250 | ||

Software – 1.1% | ||||||||

GBP | 900,000 | Misys PLC (United Kingdom) | NR | 2.50% | 11/22/2015 | N/A | 1,569,632 | |

Telecommunications – 6.1% | ||||||||

| $ | 1,350,000 | Alcatel-Lucent USA, Inc., Series B (France) | B | 2.88% | 06/15/2025 | 06/20/13 @ 100 | 1,282,500 | |

1,000,000 | Anixter International, Inc. (h) (i) | B+ | 1.00% | 02/15/2013 | N/A | 1,118,750 | ||

450,000 | Arris Group, Inc. | NR | 2.00% | 11/15/2026 | 11/15/13 @ 100 | 460,969 | ||

GBP | 1,100,000 | Cable & Wireless Worldwide PLC (United Kingdom) | NR | 5.75% | 11/24/2014 | N/A | 1,620,153 | |

| $ | 1,652,000 | Ciena Corp.(a) (i) | NR | 4.00% | 03/15/2015 | N/A | 1,687,105 | |

1,000,000 | SBA Communications Corp. | NR | 1.88% | 05/01/2013 | N/A | 1,087,500 | ||

1,000,000 | tw telecom inc | B | 2.38% | 04/01/2026 | 04/06/13 @ 100 | 1,157,500 | ||

250,000 | Virgin Media, Inc. | B+ | 6.50% | 11/15/2016 | N/A | 378,750 | ||

8,793,227 | ||||||||

Total Convertible Bonds – 70.8% | ||||||||

(Cost $103,651,203) | 102,272,280 | |||||||

See notes to financial statements.

Annual Report l October 31, 2011 l 13

LCM l Advent/Claymore Enhanced Growth & Income Fund l Portfolio of Investments continued

Principal | Optional Call | |||||||

Amount~ | Description | Rating* | Coupon | Maturity | Provisions** | Value | ||

Corporate Bonds – 26.6% | ||||||||

Advertising – 0.2% | ||||||||

| $ | 250,000 | Lamar Media Corp. | B+ | 7.88% | 04/15/2018 | 04/15/14 @ 104 | $ 263,125 | |

Auto Parts & Equipment – 0.7% | ||||||||

1,000,000 | Dana Holding Corp. | BB- | 6.50% | 02/15/2019 | 02/15/15 @ 103 | 1,012,500 | ||

Banks – 1.0% | ||||||||

1,350,000 | Capital One Capital V (i) | BB | 10.25% | 08/15/2039 | N/A | 1,405,687 | ||

Beverages – 0.8% | ||||||||

1,000,000 | Constellation Brands, Inc. (i) | BB+ | 7.25% | 09/01/2016 | N/A | 1,098,750 | ||

Chemicals – 1.6% | ||||||||

2,042,000 | Lyondell Chemical Co. (i) | BB+ | 11.00% | 05/01/2018 | 05/01/13 @ 100 | 2,284,488 | ||

Computers – 0.6% | ||||||||

800,000 | Seagate Technology International (Cayman Islands)(a) | BBB | 10.00% | 05/01/2014 | 05/01/13 @ 105 | 914,000 | ||

Diversified Financial Services – 2.4% | ||||||||

2,000,000 | Ford Motor Credit Co., LLC (i) | BB+ | 12.00% | 05/15/2015 | N/A | 2,525,246 | ||

250,000 | International Lease Finance Corp. | BBB- | 8.25% | 12/15/2020 | N/A | 259,375 | ||

1,000,000 | Textron Financial Corp.(a) (f) | B | 6.00% | 02/15/2067 | 02/15/17 @ 100 | 765,000 | ||

3,549,621 | ||||||||

Health Care Products – 1.1% | ||||||||

1,500,000 | Biomet, Inc. (i) | B- | 10.00% | 10/15/2017 | 10/15/12 @ 105 | 1,627,500 | ||

Health Care Services – 2.2% | ||||||||

2,500,000 | Apria Healthcare Group, Inc. (i) | BB+ | 11.25% | 11/01/2014 | 11/01/12 @ 103 | 2,443,750 | ||

599,000 | Tenet Healthcare Corp. | BB- | 8.88% | 07/01/2019 | 07/01/14 @ 104 | 679,865 | ||

3,123,615 | ||||||||

Household Products & Housewares – 0.6% | ||||||||

250,000 | Reynolds Group Issuer, Inc. (a) (i) | B- | 9.88% | 08/15/2019 | 08/15/15 @ 105 | 251,250 | ||

500,000 | Spectrum Brands Holdings, Inc. | B | 9.50% | 06/15/2018 | 06/15/14 @ 105 | 557,500 | ||

808,750 | ||||||||

Insurance – 2.1% | ||||||||

1,000,000 | AXA SA (France)(a) (d) (f) | BBB | 6.38% | - | 12/14/36 @ 100 | 757,500 | ||

1,000,000 | Liberty Mutual Group, Inc. (a) (f) (i) | BB | 10.75% | 06/15/2058 | 06/15/38 @ 100 | 1,225,000 | ||

800,000 | MetLife, Inc. (i) | BBB | 10.75% | 08/01/2039 | 08/01/34 @ 100 | 1,058,655 | ||

3,041,155 | ||||||||

Lodging – 1.0% | ||||||||

250,000 | Marina District Finance Co., Inc. | BB- | 9.88% | 08/15/2018 | 08/15/14 @ 105 | 248,125 | ||

1,142,000 | Wynn Las Vegas, LLC/Wynn Las Vegas Capital Corp. | BBB- | 7.75% | 08/15/2020 | 08/15/15 @ 104 | 1,261,910 | ||

1,510,035 | ||||||||

Machinery-Diversified – 2.0% | ||||||||

2,500,000 | Case New Holland, Inc. (i) | BB+ | 7.75% | 09/01/2013 | N/A | 2,675,000 | ||

250,000 | Case New Holland, Inc. | BB+ | 7.88% | 12/01/2017 | N/A | 283,125 | ||

2,958,125 | ||||||||

Media – 2.3% | ||||||||

3,000,000 | Clear Channel Worldwide Holdings, Inc., Series B (i) | B | 9.25% | 12/15/2017 | 12/15/12 @ 107 | 3,270,000 | ||

Mining – 0.7% | ||||||||

1,000,000 | FMG Resources August 2006 Pty Ltd. (Australia)(a) | B+ | 6.88% | 02/01/2018 | 02/01/14 @ 105 | 965,000 | ||

Oil & Gas – 0.8% | ||||||||

1,200,000 | Alta Mesa Holdings, LP/Alta Mesa Finance Services Corp. (i) | B | 9.63% | 10/15/2018 | 10/15/14 @ 105 | 1,122,000 | ||

See notes to financial statements.

14 l Annual Report l October 31, 2011

LCM l Advent/Claymore Enhanced Growth & Income Fund l Portfolio of Investments continued | ||||||||

Principal | Optional Call | |||||||

Amount~ | Description | Rating* | Coupon | Maturity | Provisions** | Value | ||

Pharmaceuticals – 1.2% | ||||||||

| $ | 1,665,000 | Aptalis Pharma, Inc. (i) | B | 12.75% | 03/01/2016 | 03/01/12 @ 106 | $ 1,773,225 | |

Retail – 2.7% | ||||||||

1,000,000 | Ltd. Brands, Inc. (i) | BB+ | 6.63% | 04/01/2021 | N/A | 1,055,000 | ||

2,700,000 | Toys “R” US Property Co. II, LLC (i) | B+ | 8.50% | 12/01/2017 | 12/01/13 @ 104 | 2,865,375 | ||

3,920,375 | ||||||||

Telecommunications – 2.6% | ||||||||

EUR | 1,300,000 | Alcatel-Lucent (France) | B | 8.50% | 01/15/2016 | N/A | 1,799,640 | |

| $ | 500,000 | NII Capital Corp. | B+ | 10.00% | 08/15/2016 | 08/15/13 @ 105 | 565,000 | |

1,000,000 | UPC Holding BV (Netherlands) (a) (i) | B- | 9.88% | 04/15/2018 | 04/15/14 @ 105 | 1,092,500 | ||

EUR | 250,000 | Wind Acquisition Finance SA (Luxembourg)(a) | BB- | 11.75% | 07/15/2017 | 07/15/13 @ 106 | 348,700 | |

3,805,840 | ||||||||

Total Corporate Bonds – 26.6% | ||||||||

(Cost $36,565,429) | 38,453,791 | |||||||

Number | ||||||||

of Shares | Description | Value | ||||||

Convertible Preferred Stocks – 14.5% | ||||||||

Auto Manufacturers – 1.3% | ||||||||

45,881 | General Motors Co., Series B (i) | B+ | 4.75% | 12/01/2013 | 1,906,814 | |||

Banks – 5.5% | ||||||||

2,219 | Bank of America Corp., Series L (d) (i) | BB+ | 7.25% | – | 1,899,464 | |||

23,712 | Citigroup, Inc. (i) | NR | 7.50% | 12/15/2012 | 2,253,588 | |||

15,626 | KeyCorp, Series A (d) (i) | BB | 7.75% | – | 1,640,730 | |||

2,065 | Wells Fargo & Co., Series L (d) (i) | A- | 7.50% | – | 2,180,950 | |||

7,974,732 | ||||||||

Electric – 1.9% | ||||||||

29,379 | PPL Corp. (i) | NR | 9.50% | 07/01/2013 | 1,670,196 | |||

19,000 | PPL Corp. (i) | NR | 8.75% | 05/01/2014 | 1,037,210 | |||

2,707,406 | ||||||||

Hand & Machine Tools – 1.5% | ||||||||

19,253 | Stanley Black & Decker, Inc. (i) | BBB+ | 4.75% | 11/17/2015 | 2,203,891 | |||

Insurance – 1.8% | ||||||||

44,524 | Hartford Financial Services Group, Inc., Series F (i) | BB+ | 7.25% | 04/01/2013 | 933,223 | |||

24,150 | MetLife, Inc. (i) | BBB- | 5.00% | 09/11/2013 | 1,640,027 | |||

2,573,250 | ||||||||

Oil & Gas – 0.8% | ||||||||

20,589 | Apache Corp., Series D (i) | BBB+ | 6.00% | 08/01/2013 | 1,159,161 | |||

Pharmaceuticals – 0.3% | ||||||||

11,800 | Omnicare Capital Trust II, Series B (i) | B | 4.00% | 06/15/2033 | 497,724 | |||

Real Estate – 0.6% | ||||||||

14,996 | Forest City Enterprises, Inc., Series A (d) (i) | CCC+ | 7.00% | – | 791,039 | |||

Real Estate Investment Trusts – 0.8% | ||||||||

50,000 | Alexandria Real Estate Equities, Inc., Series D (d) (i) | NR | 7.00% | – | 1,205,000 | |||

Total Convertible Preferred Stocks – 14.5% | ||||||||

(Cost $19,513,070) | 21,019,017 | |||||||

See notes to financial statements.

Annual Report l October 31, 2011 l 15

LCM l Advent/Claymore Enhanced Growth & Income Fund l Portfolio of Investments continued

Number | ||||

of Shares | Description | Value | ||

Common Stocks – 14.9% | ||||

Banks – 0.5% | ||||

21,200 | JPMorgan Chase & Co. (h) | $ 736,912 | ||

Beverages – 1.0% | ||||

23,000 | PepsiCo, Inc. (h) (i) | 1,447,850 | ||

Computers – 1.0% | ||||

3,700 | Apple, Inc. (e) (h) (i) | 1,497,686 | ||

Cosmetics & Personal Care – 0.4% | ||||

10,000 | Procter & Gamble Co. (h) (i) | 639,900 | ||

Electronics – 0.7% | ||||

20,000 | Honeywell International, Inc. (h) (i) | 1,048,000 | ||

Household Products & Housewares – 0.8% | ||||

16,000 | Kimberly-Clark Corp. (i) | 1,115,360 | ||

Internet – 0.8% | ||||

2,000 | Google, Inc., Class A (e) (h) (i) | 1,185,280 | ||

Leisure Time – 0.4% | ||||

15,000 | Carnival Corp. (Panama) (h) | 528,150 | ||

Mining – 0.6% | ||||

20,000 | Freeport-McMoRan Copper & Gold, Inc. (h) | 805,200 | ||

Miscellaneous Manufacturing – 1.3% | ||||

84,500 | General Electric Co. (h) (i) | 1,411,995 | ||

15,000 | Ingersoll-Rand PLC (Ireland) (h) | 466,950 | ||

1,878,945 | ||||

Oil & Gas – 1.4% | ||||

18,000 | ConocoPhillips (h) (i) | 1,253,700 | ||

8,000 | Occidental Petroleum Corp. (h) | 743,520 | ||

1,997,220 | ||||

Pharmaceuticals – 1.4% | ||||

15,000 | Johnson & Johnson (h) (i) | 965,850 | ||

25,000 | Teva Pharmaceutical Industries Ltd., ADR (Israel) (h) (i) | 1,021,250 | ||

1,987,100 | ||||

Real Estate Investment Trusts – 0.4% | ||||

32,500 | Annaly Capital Management, Inc. (h) (i) | 547,625 | ||

Semiconductors – 1.7% | ||||

20,000 | Microchip Technology, Inc. (h) | 723,200 | ||

34,500 | Qualcomm, Inc. (h) (i) | 1,780,200 | ||

2,503,400 | ||||

Software – 0.7% | ||||

37,000 | Microsoft Corp. (h) (i) | 985,310 | ||

Telecommunications – 1.2% | ||||

33,000 | AT&T, Inc. (h) (i) | 967,230 | ||

21,900 | Verizon Communications, Inc. (i) | 809,862 | ||

1,777,092 | ||||

Transportation – 0.6% | ||||

8,000 | Union Pacific Corp. (h) | 796,560 | ||

Total Common Stocks – 14.9% | ||||

(Cost $19,563,790) | 21,477,590 | |||

See notes to financial statements.

16 l Annual Report l October 31, 2011

LCM l Advent/Claymore Enhanced Growth & Income Fund l Portfolio of Investments continued

Number | ||||||||

of Shares | Description | Rating* | Coupon | Maturity | Value | |||

Preferred Stocks – 2.1% | ||||||||

Diversified Financial Services – 1.3% | ||||||||

75,000 | Citigroup Capital XII (f) (i) | BB+ | 8.50% | 03/30/2040 | $ 1,920,000 | |||

Lodging – 0.8% | ||||||||

10,300 | Las Vegas Sands Corp., Series A (i) | NR | 10.00% | – | 1,160,681 | |||

Total Preferred Stocks – 2.1% | ||||||||

(Cost $3,037,950) | 3,080,681 | |||||||

Exchange Traded Fund – 1.5% | ||||||||

17,000 | SPDR S&P 500 ETF Trust (h) (i) | |||||||

(Cost $2,023,260) | 2,132,650 | |||||||

Total Investments – 130.4% | ||||||||

(Cost $184,354,702) | 188,436,009 | |||||||

Other Assets in excess of Liabilities – 4.7% | 6,791,494 | |||||||

Total value of Options Written – (0.5%) (Premiums received $434,553) | (694,532) | |||||||

Borrowings – (34.6% of Net Assets or 26.5% of Total Investments) | (50,000,000) | |||||||

Net Assets – 100.0% | $ 144,532,971 | |||||||

AB – Stock Company

AG – Stock Corporation

BV – Limited Liability Company

LLC – Limited Liability Company

LP – Limited Partnership

N/A- Not Applicable

PLC – Public Limited Company

SA – Corporation

~ | The principal amount is denominated in U.S. Dollars unless otherwise noted. |

| * | Ratings shown are per Standard & Poor’s, Moody’s or Fitch. Securities classified as NR are not rated. (For securities not rated by Standard & Poor’s Rating Group, the rating by Moody’s Investor Services, Inc. is provided. Likewise, for securities not rated by Standard & Poor’s Rating Group and Moody’s Investor Services, Inc., the rating by Fitch Ratings is provided.) All ratings are unaudited. The ratings apply to the credit worthiness of the issuers of the underlying securities and not to the Fund or its shares. |

| * * | Date and price of the earliest optional call or put provision. There may be other call provisions at varying prices at later dates. All optional call provisions are unaudited. |

| (a) | Securities are exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers. At October 31, 2011 these securities amounted to $26,676,814, which represents 18.5% of net assets. |

| (b) | Security is a “Step down” bond where the coupon decreases at a predetermined date. The rate shown reflects the rate in effect at October 31, 2011. |

| (c) | Zero coupon bond. |

| (d) | Security is perpetual and, thus does not have a predetermined maturity date. The coupon rate shown is in effect as of October 31, 2011. |

| (e) | Non-income producing security. |

| (f) | Security has a fixed rate coupon which will convert to a floating or variable rate coupon on a future date. |

| (g) | Security becomes an accreting bond after December 15, 2013 with a 2.00% principal accretion rate. |

| (h) | All or a portion of this security is segregated as collateral (or potential collateral for future transactions) for written options. |

| (i) | All or a portion of this security has been physically segregated in connection with the line of credit and forward exchange currency contracts. As of October 31, 2011 the total amount segregated was $109,786,872. |

See notes to financial statements.

Annual Report l October 31, 2011 l 17

LCM l Advent/Claymore Enhanced Growth & Income Fund l Portfolio of Investments continued

| Contracts | |||||||||||

| (100 shares | Expiration | Exercise | Market | ||||||||

| per contract) | Call Options Written(a) | Month | Price | Value | |||||||

| (25 | ) | American Equity Investment Life | |||||||||

Holding Co. | Nov 2011 | $ | 10.00 | $ | (2,562 | ) | |||||

| (50 | ) | Anixter International, Inc. | Dec 2011 | 60.00 | (10,750 | ) | |||||

| (37 | ) | Apple, Inc. | Nov 2011 | 420.00 | (13,135 | ) | |||||

| (100 | ) | AT&T, Inc. | Nov 2011 | 29.00 | (6,600 | ) | |||||

| (150 | ) | Carnival Corp. | Dec 2011 | 38.00 | (9,750 | ) | |||||

| (150 | ) | ConocoPhillips | Nov 2011 | 70.00 | (25,500 | ) | |||||

| (20 | ) | Cubist Pharmaceuticals, Inc. | Nov 2011 | 39.00 | (1,600 | ) | |||||

| (300 | ) | EMC Corp. | Nov 2011 | 24.00 | (32,400 | ) | |||||

| (50 | ) | Freeport-McMoRan Copper & Gold, Inc. | Dec 2011 | 45.00 | (5,900 | ) | |||||

| (150 | ) | Freeport-McMoRan Copper & Gold, Inc. | Nov 2011 | 42.00 | (17,700 | ) | |||||

| (245 | ) | General Electric Co. | Nov 2011 | 17.00 | (7,595 | ) | |||||

| (100 | ) | Gilead Sciences, Inc. | Dec 2011 | 44.00 | (5,950 | ) | |||||

| (275 | ) | Gilead Sciences, Inc. | Nov 2011 | 42.00 | (23,925 | ) | |||||

| (20 | ) | Google, Inc. | Nov 2011 | 600.00 | (22,200 | ) | |||||

| (200 | ) | Honeywell International, Inc. | Nov 2011 | 49.00 | (81,800 | ) | |||||

| (100 | ) | Ingersoll-Rand PLC | Dec 2011 | 33.00 | (10,500 | ) | |||||

| (100 | ) | Johnson & Johnson | Nov 2011 | 65.00 | (7,700 | ) | |||||

| (212 | ) | JPMorgan Chase & Co. | Nov 2011 | 33.00 | (54,060 | ) | |||||

| (200 | ) | Microchip Technology, Inc. | Nov 2011 | 36.00 | (24,000 | ) | |||||

| (100 | ) | Microsoft Corp. | Nov 2011 | 28.00 | (1,000 | ) | |||||

| (100 | ) | NetApp, Inc. | Nov 2011 | 42.00 | (14,000 | ) | |||||

| (125 | ) | Newmont Mining Corp. | Dec 2011 | 67.50 | (34,375 | ) | |||||

| (80 | ) | Occidental Petroleum Corp. | Nov 2011 | 87.50 | (63,200 | ) | |||||

| (220 | ) | PepsiCo, Inc. | Nov 2011 | 62.50 | (31,460 | ) | |||||

| (100 | ) | Procter & Gamble Co. | Nov 2011 | 65.00 | (4,700 | ) | |||||

| (330 | ) | Qualcomm, Inc. | Nov 2011 | 57.50 | (9,570 | ) | |||||

| (100 | ) | Rovi Corp. | Dec 2011 | 55.00 | (12,000 | ) | |||||

| (170 | ) | SPDR S&P 500 ETF Trust | Nov 2011 | 127.00 | (34,680 | ) | |||||

| (250 | ) | Teva Pharmaceutical Industries Ltd. | Dec 2011 | 42.50 | (22,000 | ) | |||||

| (300 | ) | Textron, Inc. | Nov 2011 | 19.00 | (38,400 | ) | |||||

| (100 | ) | Trinity Industries, Inc. | Nov 2011 | 28.00 | (12,500 | ) | |||||

| (80 | ) | Union Pacific Corp. | Nov 2011 | 95.00 | (52,720 | ) | |||||

| (100 | ) | XM Satellite Radio, Inc. | Nov 2011 | 2.00 | (300 | ) | |||||

Total Value of Call Options Written | |||||||||||

(Premiums received $(434,553)) | $ | (694,532 | ) | ||||||||

(a) Non-income producing security. |

See notes to financial statements.

18 l Annual Report l October 31, 2011

LCM l Advent/Claymore Enhanced Growth & Income Fund | |||

Statement of Assets and Liabilities | October 31, 2011 | |||

Assets | |||

Investments, at value (cost $184,354,702) | $ | 188,436,009 | |

Restricted Cash | 5,367,691 | ||

Dividends and interest receivable | 1,864,317 | ||

Cash & Cash Equivalents | 184,047 | ||

Tax Reclaims receivable | 5,384 | ||

Other assets | 12,529 | ||

Total assets | 195,869,977 | ||

Liabilities | |||

Borrowings | 50,000,000 | ||

Options written, at value (premiums received of $434,553) | 694,532 | ||

Unrealized depreciation on forward exchange currency contracts | 326,178 | ||

Investment Management fee payable | 81,614 | ||

Investment Advisory fee payable | 78,413 | ||

Interest due on borrowings | 7,663 | ||

Administrative fee payable | 4,325 | ||

Accrued expenses and other liabilities | 144,281 | ||

Total liabilities | 51,337,006 | ||

Net Assets | $ | 144,532,971 | |

Composition of Net Assets | |||

Common stock, $0.001 par value per share; unlimited number of shares authorized, 13,603,025 shares issued and outstanding | $ | 13,603 | |

Additional paid-in capital | 227,763,771 | ||

Accumulated net realized loss on investments, written options, swaps, futures and foreign currency transactions | (86,685,956 | ) | |

Net unrealized appreciation on investments, written options and foreign currency translation | 3,494,652 | ||

Distributions in excess of net investment income | (53,099 | ) | |

Net Assets | $ | 144,532,971 | |

Net Asset Value | |||

(based on 13,603,025 common shares outstanding) | $ | 10.63 | |

See notes to financial statements.

Annual Report l October 31, 2011 l 19

LCM l Advent/Claymore Enhanced Growth & Income Fund | |||||||

Statement of Operations | For the year ended October 31, 2011 | |||||||

Investment Income | |||||||

Interest | $ | 5,438,905 | |||||

Dividends (net of foreign withholding taxes of $5,401) | 3,756,619 | ||||||

| Total income | $ | 9,195,524 | |||||

Expenses | |||||||

Investment Management fee | 1,085,531 | ||||||

Investment Advisory fee | 1,042,961 | ||||||

Professional fees | 166,781 | ||||||

Trustees' fees and expenses | 153,851 | ||||||

Fund accounting | 73,811 | ||||||

Printing expense | 71,121 | ||||||

Custodian fee | 57,596 | ||||||

Administration fee | 57,403 | ||||||

Miscellaneous | 28,422 | ||||||

Insurance | 27,118 | ||||||

NYSE listing fee | 21,170 | ||||||

Transfer agent fee | 18,317 | ||||||

Interest Expense | 632,653 | ||||||

Total expenses | 3,436,735 | ||||||

Net investment income | 5,758,789 | ||||||

| Realized and Unrealized Gain (Loss) on Investments, Written Options, Swaps, Futures Contracts and Foreign Currency Transactions | |||||||

Net realized gain (loss) on: | |||||||

Investments | (74,391 | ) | |||||

Written options | 601,701 | ||||||

Swaps | (76,021 | ) | |||||

Futures contracts | (241,533 | ) | |||||

Foreign currency transactions | (411,040 | ) | |||||

Change in net unrealized appreciation (depreciation) on: | |||||||

Foreign currency translation | 57,750 | ||||||

Swaps | 4,574 | ||||||

Written options | (243,418 | ) | |||||

Investments | (11,162,831 | ) | |||||

| Net realized and unrealized loss on investments, written options, swaps, futures contracts and foreign currency transactions | (11,545,209 | ) | |||||

| Net Decrease in Net Assets Resulting from Operations | $ | (5,786,420 | ) | ||||

See notes to financial statements.

20 l Annual Report l October 31, 2011

LCM l Advent/Claymore Enhanced Growth & Income Fund | |||||||

Statement of Changes in Net Assets | | |||||||

| For the | For the | ||||||

| Year Ended | Year Ended | ||||||

| October 31, 2011 | October 31, 2010 | ||||||

Change in Net Assets from Operations | |||||||

Net investment income | $ | 5,758,789 | $ | 5,510,772 | |||

Net realized gain (loss) on investments, written options, swaps, futures contracts and foreign | |||||||

currency transactions | (201,284 | ) | 11,553,006 | ||||

Net change in unrealized appreciation (depreciation) on investments, written options, swaps, | |||||||

futures contracts and foreign currency translation | (11,343,925 | ) | 2,615,434 | ||||

Net increase (decrease) in net assets resulting from operations | (5,786,420 | ) | 19,679,212 | ||||

Distributions to Common Shareholders from | |||||||

Net investment income | (6,338,770 | ) | (14,364,794 | ) | |||

Return of capital | (8,026,024 | ) | – | ||||

Total dividends and distributions to common shareholders | (14,364,794 | ) | (14,364,794 | ) | |||

Total increase (decrease) in net assets | (20,151,214 | ) | 5,314,418 | ||||

Net Assets | |||||||

Beginning of year | 164,684,185 | 159,369,767 | |||||

End of year (including distributions in excess of net investment income and accumulated | |||||||

undistributed net investment income of $(53,099) and $456,271, respectively) | $ | 144,532,971 | $ | 164,684,185 | |||

See notes to financial statements.

Annual Report l October 31, 2011 l 21

LCM l Advent/Claymore Enhanced Growth & Income Fund | |||

Statement of Cash Flows | For the year ended October 31, 2011 | |||

Cash Flows from Operating Activities: | |||

Net decrease in net assets resulting from operations | $ | (5,786,420 | ) |

| Adjustments to Reconcile Net Decrease in Net Assets Resulting from Operations to Net Cash Provided by Operating and Investing Activities: | |||

Net change in unrealized depreciation on investments | 11,162,831 | ||

Net change in unrealized depreciation on written options | 243,418 | ||

Net change in unrealized appreciation on swaps | (4,574 | ) | |

Net change in unrealized appreciation on foreign currency translation | (57,750 | ) | |

Net realized loss on investments | 74,391 | ||

Purchase of long-term investments | (251,235,380 | ) | |

Proceeds from sale of long-term investments | 255,372,112 | ||

Net Amortization of premium | 27,917 | ||

Decrease in receivable for securities sold | 3,068,659 | ||

Increase in dividends and interest receivable | (162,559 | ) | |

Decrease in foreign currency, at value | 21,264 | ||

Decrease in tax reclaims receivable | 55,913 | ||

Decrease in other assets | 8,476 | ||

Increase in restricted cash | (3,899,402 | ) | |

Decrease in interest due on borrowings | (377 | ) | |

Decrease in payable for securities purchased | (2,595,431 | ) | |

Net increase in premiums received on written options | 357,506 | ||

Decrease in investment management fee payable | (10,726 | ) | |

Decrease in investment advisory fee payable | (10,305 | ) | |

Decrease in administrative fee payable | (494 | ) | |

Decrease in accrued expenses and other liabilities | (37,824 | ) | |

Net Cash Provided by Operating and Investing Activities | 6,591,245 | ||

Cash Flows From Financing Activities: | |||

Dividends paid to common shareholders | (14,364,794 | ) | |

Net Cash Used in by Financing Activities | (14,364,794 | ) | |

Net decrease in cash | (7,773,549 | ) | |

Cash at Beginning of Period | 7,957,596 | ||

Cash at End of Period | $ | 184,047 | |

Supplemental Disclosure of Cash Flow Information: Cash paid during the period for interest | $ | 633,032 | |

Supplemental Disclosure of Cash Flow Information: Restricted cash at period end | $ | 5,367,691 | |

See notes to financial statements.

22 l Annual Report l October 31, 2011

LCM l Advent/Claymore Enhanced Growth & Income Fund | |||||||||||||||||||

Financial Highlights | | |||||||||||||||||||

| For the | For the | For the | For the | For the | |||||||||||||||

Per share operating performance | Year Ended | Year Ended | Year Ended | Year Ended | Year Ended | ||||||||||||||

for a common share outstanding throughout the period | October 31, 2011 | October 31, 2010 | October 31, 2009 | October 31, 2008 | October 31, 2007 | ||||||||||||||

Net asset value, beginning of period | $ | 12.11 | $ | 11.72 | $ | 10.91 | $ | 20.09 | $ | 19.41 | |||||||||

Income from investment operations | |||||||||||||||||||

Net investment income(a) | 0.42 | 0.40 | 0.39 | 0.47 | 0.44 | ||||||||||||||

Net realized and unrealized gain (loss) on investments, | |||||||||||||||||||

written options, swaps, futures contracts and foreign currency transactions | (0.84 | ) | 1.05 | 1.56 | (8.05 | ) | 1.84 | ||||||||||||

Total from investment operations | (0.42 | ) | 1.45 | 1.95 | (7.58 | ) | 2.28 | ||||||||||||

Distributions to Common Shareholders | |||||||||||||||||||

Net investment income | (0.47 | ) | (1.06 | ) | (0.67 | ) | (0.90 | ) | (1.60 | ) | |||||||||

Return of capital | (0.59 | ) | – | (0.47 | ) | (0.70 | ) | – | |||||||||||

Total distributions to Common Shareholders | (1.06 | ) | (1.06 | ) | (1.14 | ) | (1.60 | ) | (1.60 | ) | |||||||||

Net asset value, end of period | $ | 10.63 | $ | 12.11 | $ | 11.72 | $ | 10.91 | $ | 20.09 | |||||||||

Market value, end of period | $ | 9.73 | $ | 11.38 | $ | 10.48 | $ | 8.97 | $ | 17.46 | |||||||||

Total investment return (b) | |||||||||||||||||||

Net asset value | -4.18 | % | 13.14 | % | 19.74 | % | -40.37 | % | 12.24 | % | |||||||||

Market value | -6.27 | % | 19.37 | % | 34.17 | % | -42.88 | % | 1.08 | % | |||||||||

Ratios and supplemental data | |||||||||||||||||||

Net assets, end of period (thousands) | $ | 144,533 | $ | 168,684 | $ | 159,370 | $ | 148,383 | $ | 273,288 | |||||||||

Ratios to Average Net Assets applicable to Common Shares: | |||||||||||||||||||

Operating Expenses | 1.72 | % | 1.71 | % | 1.42 | % | 1.34 | % | 1.26 | % | |||||||||

Interest Expense (c) | 0.39 | % | 0.39 | %(d) | N/A | N/A | N/A | ||||||||||||

Total Expenses | 2.11 | % | 2.10 | % | N/A | N/A | N/A | ||||||||||||

Net investment income | 3.54 | % | 3.43 | % | 3.68 | % | 2.91 | % | 2.21 | % | |||||||||

Portfolio turnover rate | 121 | % | 127 | % | 236 | % | 192 | % | 181 | % | |||||||||

Senior Indebtedness | |||||||||||||||||||

Total Borrowings outstanding (in thousands) | $ | 50,000 | $ | 50,000 | N/A | N/A | N/A | ||||||||||||

Asset Coverage per $1,000 of indebtedness (e) | $ | 3,891 | $ | 4,293 | N/A | N/A | N/A | ||||||||||||

| (a) | Based on average shares outstanding during the period. |

| (b) | Total investment return is calculated assuming a purchase of a common share at the beginning of the period and a sale on the last day of the period reported either at net asset value (“NAV”) or market price per share. Distributions are assumed to be reinvested at NAV for NAV returns or the prices obtained under the Fund's Dividend Reinvestment Plan for market value returns. Total investment return does not reflect brokerage commissions. A return calculated for a period of less than one year is not annualized. |

| (c) | Interest expense ratio relates to interest associated with borrowings. |

| (d) | The ratio is annualized. |

| (e) | Calculated by subtracting the Fund's total liabilities (not including the borrowings) from the Fund's total assets and dividing by the total borrowings. |

See notes to financial statements.

Annual Report l October 31, 2011 l 23

LCM l Advent/Claymore Enhanced Growth & Income Fund

Notes to Financial Statements | October 31, 2011

Note 1 – Organization: