UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-21504

Advent/Claymore Enhanced Growth & Income Fund

(Exact name of registrant as specified in charter)

1271 Avenue of the Americas, 45th Floor, New York, NY 10020

(Address of principal executive offices) (Zip code)

Robert White, Treasurer

1271 Avenue of the Americas, 45th Floor, New York, NY 10020

(Name and address of agent for service)

Registrant's telephone number, including area code: (212) 482-1600

Date of fiscal year end: October 31

Date of reporting period: November 1, 2014 - April 30, 2015

Item 1. Reports to Stockholders.

The registrant's semi-annual report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940, as amended (the “Investment Company Act”), is as follows:

GUGGENHEIMINVESTMENTS.COM/LCM

...YOUR BRIDGE TO THE LATEST, MOST UP-TO-DATE

INFORMATION ABOUT THE ADVENT/CLAYMORE

ENHANCED GROWTH & INCOME FUND

The shareholder report you are reading right now is just the beginning of the story. Online at guggenheiminvestments.com/lcm, you will find:

• Daily, weekly and monthly data on share prices, net asset values, dividends and more |

| |

• Portfolio overviews and performance analyses |

| |

• Announcements, press releases and special notices |

| |

• Fund and adviser contact information |

Advent Capital Management and Guggenheim Investments are continually updating and expanding shareholder information services on the Fund’s website in an ongoing effort to provide you with the most current information about how your Fund’s assets are managed, and the results of our efforts. It is just one more small way we are working to keep you better informed about your investment in the Fund.

DEAR SHAREHOLDER

Tracy V. Maitland

President and Chief Executive Officer

We thank you for your investment in the Advent/Claymore Enhanced Growth & Income Fund (the “Fund”). This report covers the Fund’s performance for the six months ended April 30, 2015.

Advent Capital Management, LLC (“Advent” or the “Investment Manager”), serves as the Fund’s Investment Manager. Based in New York, New York, with additional investment personnel in London, England, Advent is a credit-oriented firm specializing in the management of global convertible, high-yield, and equity securities across three lines of business—long-only strategies, hedge funds, and closed-end funds. As of April 30, 2015, Advent managed approximately $8.5 billion in assets.

Guggenheim Funds Investment Advisors, LLC (the “Investment Adviser”), serves as the Investment Adviser to the Fund. The Investment Adviser is an affiliate of Guggenheim Partners, LLC, a global diversified financial services firm.

The Fund’s primary investment objective is to seek current income and current gains from trading in securities, with a secondary objective of long-term capital appreciation. Under normal market conditions, the Fund invests at least 40% of its managed assets in a diversified portfolio of equity securities and convertible securities of U.S. and non-U.S. issuers, and may invest up to 60% of its managed assets in non-convertible high-yield securities. Additionally, the Fund engages in a strategy of writing (selling) covered call options on a portion of the securities held in the Fund’s portfolio, thus generating option writing premiums. The Fund’s non-fundamental investment policies were changed during the period and took effect in January 2015. Please see the Questions & Answers section following for more information.

Advent seeks international investment opportunities in each asset class, with an emphasis on large multinational companies. Appreciation potential is provided by investments in convertibles and common stock, while the allocation to high-yield securities is primarily a source of income. The balance between convertible securities, equities, and high-yield securities, and the degree to which the Fund engages in a covered call strategy, will vary from time to time based on security valuations, interest rates, equity market volatility, and other economic and market factors.

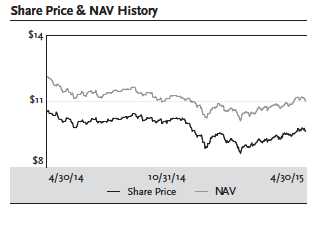

All Fund returns cited—whether based on net asset value (NAV) or market price—assume the reinvestment of all distributions. For the six-month period ended April 30, 2015, the Fund generated a total return based on market price of 5.78% and a return of 5.09% based on NAV. As of April 30, 2015, the Fund’s market price of $9.62 represented a discount of 12.47% to NAV of $10.99.

LCM l ADVENT/CLAYMORE ENHANCED GROWTH & INCOME FUND SEMIANNUAL REPORT l 3

Past performance is not a guarantee of future results. The Fund’s NAV performance data reflect fees and expenses of the Fund. The market price of the Fund’s shares fluctuates from time to time, and it may be higher or lower than the Fund’s NAV.

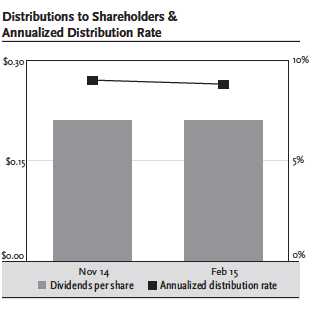

The Fund paid quarterly distributions of $0.210 in November 2014 and February 2015. The most recent dividend represents an annualized distribution rate of 8.73% based on the Fund’s market price on April 30, 2015. There is no guarantee of any future distributions or that the current returns and distribution rate will be maintained. Please see Note 2(l) on page 42 for more information on distributions for the period.

We encourage shareholders to consider the opportunity to reinvest their distributions from the Fund through the Dividend Reinvestment Plan (“DRIP”), which is described in detail on page 56 of this report. When shares trade at a discount to NAV, the DRIP takes advantage of the discount by reinvesting the quarterly dividend distribution in common shares of the Fund purchased in the market at a price less than NAV. Conversely, when the market price of the Fund’s common shares is at a premium above NAV, the DRIP reinvests participants’ dividends in newly-issued common shares at the greater of NAV per share or 95% of the market price per share. The DRIP provides a cost-effective means to accumulate additional shares and enjoy the benefits of compounding returns over time.

The Fund is managed by a team of experienced and seasoned professionals led by myself in my capacity as Chief Investment Officer (as well as President and Founder) of Advent Capital Management, LLC. We encourage you to read the following Questions & Answers section, which provides additional information regarding the factors that influenced the Fund’s performance.

We thank you for your investment in the Fund and we are honored that you have chosen the Advent/Claymore Enhanced Growth & Income Fund as part of your investment portfolio. For the most up-to-date information regarding your investment, including related investment risks, please visit the Fund’s website at guggenheiminvestments.com/lcm.

Sincerely,

Tracy V. Maitland

President and Chief Executive Officer of the Advent/Claymore Enhanced

Growth & Income Fund

May 31, 2015

4 l LCM l ADVENT/CLAYMORE ENHANCED GROWTH & INCOME FUND SEMIANNUAL REPORT

QUESTIONS & ANSWERS | April 30, 2015 |

Advent/Claymore Enhanced Growth & Income Fund (the “Fund”) is managed by a team of seasoned professionals at Advent Capital Management, LLC (“Advent” or the “Investment Manager”), led by Tracy V. Maitland, Advent’s Founder, President, and Chief Investment Officer. In the following interview, the management team discusses the equity, convertible securities, and high-yield markets and Fund performance for the six-month period ended April 30, 2015.

Please describe the Fund’s objective and management strategies.

The Fund’s primary investment objective is to seek current income and current gains from trading in securities, with a secondary objective of long-term capital appreciation. Under normal market conditions, the Fund invests at least 40% of its managed assets in equity securities and convertible securities of U.S. and non-U.S. issuers and may invest up to 60% of its managed assets in non-convertible high yield securities. Prior to January 12, 2015, the Fund invested at least 70% of its managed assets in a diversified portfolio of equity securities and convertible securities of U.S. and non-U.S. issuers, and up to 30% of its managed assets in non-convertible high-yield securities.

Advent seeks international investment opportunities in each asset class, with an emphasis on large multinational companies. The Fund’s investments in convertibles and common stock provide capital appreciation potential, while the allocation to high-yield securities is primarily a source of income.

The Fund also uses a strategy of writing (selling) covered call options, but the percentage of positions to be written against can vary. As the percentage increases, the risks associated with covered call option writing also increase, and the Fund may also limit its ability to benefit from capital appreciation in holdings on which options have been written. In addition, the Fund may invest in other derivatives, such as foreign exchange currency contracts, futures contracts, and swaps.

The Fund uses financial leverage to finance the purchase of additional securities. Although financial leverage may create an opportunity for increased return for shareholders, it also results in additional risks and can magnify the effect of any losses. There is no assurance that the strategy will be successful. If income and gains earned on securities purchased with the financial leverage proceeds are greater than the cost of the financial leverage, shareholders’ return will be greater than if financial leverage had not been used. Conversely, if the income or gains from the securities purchased with the proceeds of financial leverage are less than the cost of the financial leverage, shareholders’ return will be less than if financial leverage had not been used.

Discuss the recent changes to Advent’s non-fundamental investment policies.

Modifications to non-fundamental investment policies approved by the Board of Trustees of the Fund and Advent’s other closed-end funds took effect on January 12, 2015. These modifications were designed to expand the portfolio management flexibility of the Funds and may provide an opportunity to enhance shareholder value through the Investment Manager’s expanded investment capabilities and ability to manage risk.

LCM l ADVENT/CLAYMORE ENHANCED GROWTH & INCOME FUND SEMIANNUAL REPORT l 5

QUESTIONS & ANSWERS continued | April 30, 2015 |

Advent’s institutional strategies, which invest in the same asset classes as the Fund, have provided superior performance relative to applicable benchmarks. Accordingly, Advent has reallocated the Fund’s portfolio to establish a core portfolio of convertible bonds that is managed, subject to the Fund’s investment policies and restrictions, in a manner similar to that of Advent’s Global Balanced Convertible Strategy. Advent’s Global Balanced Convertible Strategy seeks a high total return by investing in a portfolio of global convertible securities that provide equity-like returns while seeking to limit downside risk.

This core portfolio is supplemented by investments in high yield securities selected in a manner similar to that of Advent’s High Yield Strategy. Advent’s High Yield Strategy seeks income and total return by investing primarily in high yielding corporate credit using fundamental and relative value analysis to identify undervalued securities.

Advent now uses a separate portion of the Fund’s portfolio to increase or decrease relative overall exposure to convertible securities, high yield securities, and equities. This portion of the Fund’s portfolio incorporates leverage and operates as an asset allocation tool reflecting Advent’s conservative management philosophy and its views on the relative value of these three asset classes under changing market conditions.

Please describe the economic and market environment over the last six months.

World securities markets generally advanced in the six months ended April 30, 2015, spurred by healthy monetary conditions in the U.S. and direct injections of quantitative easing or other monetary support in various foreign geographies. In the U.S., various equity indices returned roughly mid-single-digits in the period, led by the health care sector, merger and acquisitions activity, and reasonable strength in the overall U.S. economy. Later in the period, however, slowing corporate earnings growth from falling commodity prices, the strong dollar, and a weaker economy in the first quarter of 2015 led to small corrections in the mid- and small-cap markets. Risk-free Treasury rates fell, and prices rose, continuing a trend from earlier in 2014 as the U.S. Federal Reserve (Fed) kept pushing out the normalization of short-term monetary policy. However, high-yield bonds, a key asset class for the Fund, returned less as spreads widened on exposure to the oil & gas sector and lower liquidity from dealer participants from regulatory changes.

Convertible bond returns were satisfactory, compared to equity indices, as the asset class piggybacked off the higher returns from the highly represented sectors of health care and technology and lower risk-free rates to come to returns that mimicked the equity indices. Exposure to foreign convertibles also helped as overseas securities benefitted from much higher equity returns and even more pronounced declines in bond yields and corporate bond spreads than the U.S. The announcement of a large asset purchase program by the European Central Bank (ECB) and expansion of the existing program by the Bank of Japan led to large advances in equity and bond markets there as well as large declines in the respective currencies. The Fund’s policy to hedge foreign currency exposure helped it take advantage of asset price increases without suffering the related currency depreciation.

6 l LCM l ADVENT/CLAYMORE ENHANCED GROWTH & INCOME FUND SEMIANNUAL REPORT

QUESTIONS & ANSWERS continued | April 30, 2015 |

How did the Fund perform in this environment?

All Fund returns cited—whether based on net asset value (NAV) or market price—assume the reinvestment of all distributions. For the six-month period ended April 30, 2015, the Fund generated a total return based on market price of 5.78% and a return of 5.09% based on NAV. As of April 30, 2015, the Fund’s market price of $9.62 represented a discount of 12.47% to NAV of $10.99. As of October 31, 2014, the Fund’s market price of $9.51 represented a discount of 12.51% to NAV of $10.87.

Past performance is not a guarantee of future results. The Fund’s NAV performance data reflect fees and expenses of the Fund. The market price of the Fund’s shares fluctuates from time to time, and it may be higher or lower than the Fund’s NAV.

How has the Fund’s leverage strategy affected performance?

As part of its investment strategy, the Fund utilizes leverage to finance the purchase of additional securities that provide increased income and potentially greater appreciation potential to common shareholders than could be achieved from a portfolio that is not leveraged.

The Fund’s leverage outstanding as of April 30, 2015, including borrowing and reverse repurchase agreements or the issuance of commercial paper or other forms of debt, was $50 million, approximately 25% of the Fund’s total managed assets.

There is no guarantee that the Fund’s leverage strategy will be successful, and the Fund’s use of leverage may cause the Fund’s NAV and market price of common shares to be more volatile.

The Fund’s use of leverage remained unchanged in absolute dollars as the fiscal half-year progressed. The Fund’s total return, defined as the return inclusive of reinvested dividends, was above that of the cost of that leverage for the fiscal half-year. Therefore, on a simple comparison, the use of leverage had an additive effect on shareholder returns for the period.

What was the impact of the Fund’s covered call strategy?

The Fund continues to seek income from occasionally overwriting equity positions and convertibles with call options. Equity allocations in the Fund declined in the six months ended April 30, 2015, as the Investment Manager sought out greater income and better relative value in the high-yield market. That plus a continued low-volatility environment led to lower opportunities to generate call option income than previous years. The CBOE SPX Volatility Index (VIX) averaged 15.5 for the six-month period, slightly higher than the 14.0 of the previous fiscal year, but both are quite low by historical averages, and the figure had dropped again to 12.5 as of this writing in mid-May. While there is a reasonable forecast of higher volatility as the Fed embarks on a rate hike strategy, neither the hikes nor higher volatility have occurred yet, and the Fund will remain in a monitoring state for better opportunities to write option contracts for income in the near future.

How did related market measures perform in this environment?

For the six-month period ended April 30, 2015, the return of the Bank of America Merrill Lynch Global 300 Convertible Index was 6.99% (local currency).

LCM l ADVENT/CLAYMORE ENHANCED GROWTH & INCOME FUND SEMIANNUAL REPORT l 7

QUESTIONS & ANSWERS continued | April 30, 2015 |

The return of the Bank of America Merrill Lynch High Yield Master II Index was 1.51%.

The CBOE S&P 500 2% OTM BuyWrite Index (BXY) returned 1.68%.

The Fund’s mandate differs materially from each of the individual indices. The Fund also maintains leverage and incurs transaction costs, advisory fees, and other expenses, while these indices do not.

Please discuss the Fund’s distributions.

The Fund paid a quarterly distribution of $0.210 in November 2014 and February 2015. The most recent dividend represents an annualized distribution rate of 8.73% based on the Fund’s market price on April 30, 2015. There is no guarantee of any future distributions or that the current returns and distribution rate will be maintained. Please see Note 2(l) on page 42 for more information on distributions for the period.

How was the Fund’s portfolio allocated among asset classes during the six months ended April 30, 2015, and what did this mean for performance?

At April 30, 2015, the Fund’s assets were invested approximately 68.5% in convertible bonds, convertible preferred securities, and mandatory convertibles; 21.4% in corporate bonds; 6.7% in equities; 3.3% in cash and cash equivalents; and 0.1% in senior floating rate interests. At the previous report, on October 31, 2014, the Fund’s assets were invested 70.9% in convertible bonds, convertible preferred securities, and mandatory convertibles; 20.3% in corporate bonds; 8.4% in equities; and 0.4% in senior floating rate interests.

The change in asset allocation, primarily from a slightly higher proportion invested in corporate bonds and slightly lower one in convertibles, reflects changes in the high-yield bond market over the past six months: the sell-off and cheapening that occurred late in calendar year 2014 in this market, as regulation and capital constraints reduced market-making and liquidity by dealers, and richening due to improved credit conditions as 2015 progressed. Foreign securities represented 36% of assets at period end compared to 30% at the start, reflecting greater opportunities in foreign markets, with aggressive quantitative easing occurring in many overseas countries and regions.

Which investment decisions had the greatest effect on the Fund’s performance?

Among the large winners for the Fund over the period were holdings related to Cemex SAB de CV, Omnicare, Inc., and Hologic, Inc.

The stock of global cement producer Cemex SAB de CV rose after two competitors announced plans to merge, and Cemex’s newly issued contingent convertible contract (0.7% of long-term investments at period end) richened.

Two of the Fund’s health care holdings continued to contribute to performance, based on their strong growth and a robust merger/acquisition environment. Convertibles in Omnicare, Inc. (1.4% of long-term investments at period end), a provider of nursing and assisted home services, rose as speculation about a potential sale occurred in late April, speculation that was realized when a merger with CVS

8 l LCM l ADVENT/CLAYMORE ENHANCED GROWTH & INCOME FUND SEMIANNUAL REPORT

QUESTIONS & ANSWERS continued | April 30, 2015 |

Health Corp. was announced in May. Convertibles in Hologic, Inc. (1.0% of long-term investments at period end), a developer and supplier of diagnostic and medical imaging systems, advanced after the company reported strong demand for its mammography and assay test systems.

Among the leading detractors for the Fund over the last year were holdings of Wynn Resorts Ltd., American Airlines Group, Inc., Iconix Brand Group, Inc., and Alcatel-Lucent.

Equity held in casino operator Wynn Resorts Ltd. (0.2% of long-term investments at period end) performed poorly, as the company struggled with a region-wide decline in gaming from corruption crackdowns and a slowing economy in China.

Equity in air carrier American Airlines Group, Inc. (0.3% of long-term investments at period end), declined after concerns percolated about rising domestic capacity as well as rebounding oil prices.

Convertibles in Iconix Brand Group, Inc. (0.5% of long-term investments at period end), a retail brand licensor, declined with the stock after the company reported weaker earnings and suffered the resignation of both its chief financial officer and chief operating officer. The Fund has retained its position anticipating a resumption of earnings growth and the possibility of profiting from a restructured convertible.

Late in the period, a relatively new position in convertibles in Alcatel-Lucent (0.9% of long-term investments at period end), a networking and broadband company, declined after merger suitor Nokia reported its own quarter with declining margins, which sent stocks of both companies lower. We continue with the Alcatel-Lucent position on the back of positive fundamentals at Alcatel and believing the merger’s closure will result in realization of the convertible’s valuable make-whole payment to holders.

Do you have any other comments about the markets and the Fund?

Markets seem to have taken an aware but thus far unbothered attitude toward the specter of the first Fed short-term monetary policy rate increases since 2004. While there is general consensus there will be some level of increases in the Fed funds rate in the second half of 2015, the Open Market Committee’s attitude toward near-term economic data as determining future moves has introduced much uncertainty and debate over the slope and timing of rate increases into 2016. Further increasing uncertainty has been the slowdown in the U.S. economy in the first half of 2015. Foreign bond markets are generally highly priced from the liquidity injections from various central banks but will have that continued support through 2015 or longer with the potential of economic recovery aiding the balance sheets and leverage levels of corporate issuers. Prices of some select commodities have begun to rebound, perhaps reflecting a stronger foreign growth outlook than in the previous months.

Index Definitions

Indices are unmanaged, do not use leverage, and do not experience fees, expenses or transaction costs and it is not possible to invest directly in an index.

Bank of America Merrill Lynch Global 300 Convertible Index measures the performance of convertible securities of issuers throughout the world.

LCM l ADVENT/CLAYMORE ENHANCED GROWTH & INCOME FUND SEMIANNUAL REPORT l 9

QUESTIONS & ANSWERS continued | April 30, 2015 |

Bank of America Merrill Lynch High Yield Master II Index is a commonly used benchmark index for high yield corporate bonds. It is a measure of the broad high yield market.

The CBOE S&P 500 2% OTM BuyWrite Index (BXY) uses the same methodology as the widely accepted CBOE S&P 500 BuyWrite Index (BXM), but the BXY Index is calculated using out-of-the-money S&P 500 Index (SPX) call options, rather than at-the-money SPX call options. The BXY strategy diversifies the buy-write opportunities currently provided by the BXM. The BXY Index yields lower monthly premiums in return for a greater participation in the upside moves of the S&P 500. S&P 500 Index is a capitalization-weighted index of 500 stocks. The index is designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

VIX is the ticker symbol for the Chicago Board Options Exchange Volatility Index, a popular measure of the implied volatility of S&P 500 index options. It is a weighted blend of prices for a range of options on the S&P 500 index.

LCM Risks and Other Considerations

The views expressed in this report reflect those of the Portfolio Managers only through the report period as stated on the cover. These views are subject to change at any time, based on market and other conditions and should not be construed as a recommendation of any kind. The material may also contain forward-looking statements that involve risk and uncertainty, and there is no guarantee they will come to pass. There can be no assurance that the Fund will achieve its investment objectives. The value of the Fund will fluctuate with the value of the underlying securities. Historically, closed-end funds often trade at a discount to their net asset value. Past performance does not guarantee future results. The Fund is subject to investment risk, including the possible loss of the entire amount that you invest.

Please see guggenheiminvestments.com/lcm for a detailed discussion of the Fund’s risks and considerations.

10 l LCM l ADVENT/CLAYMORE ENHANCED GROWTH & INCOME FUND SEMIANNUAL REPORT

FUND SUMMARY (Unaudited) | April 30, 2015 |

Fund Statistics | |

Share Price | $9.62 |

Net Asset Value | $10.99 |

Discount to NAV | -12.47% |

Net Assets ($000) | $149,447 |

AVERAGE ANNUAL TOTAL RETURNS | | | | | |

FOR THE PERIOD ENDED APRIL 30, 2015 | | | | |

| | Six Month | | | | | Since |

| | (non- | One | Three | Five | Ten | Inception |

| | annualized) | Year | Year | Year | Year | (1/31/05) |

Advent/Claymore Enhanced | | | | | | |

Growth & Income Fund | | | | | | |

NAV | 5.09% | 4.33% | 8.40% | 5.52% | 3.77% | 3.05% |

Market | 5.78% | 4.79% | 8.24% | 4.58% | 3.58% | 2.21% |

Portfolio Breakdown | % of Net Assets |

Investments: | |

Convertible Bonds | 83.1% |

Corporate Bonds | 28.7% |

Common Stocks | 8.9% |

Convertible Preferred Stocks | 8.8% |

Short Term Investments | 4.4% |

Senior Floating Rate Interests | 0.2% |

Total Investments | 134.1% |

Other Assets & Liabilities, net | -34.1% |

Net Assets | 100.0% |

Past performance does not guarantee future results and does not reflect the deductions of taxes that a shareholder would pay on fund distributions. NAV performance data reflects fees and expenses of the Fund. All portfolio data is subject to change daily. For more current information, please visit guggenheiminvestments.com/lcm. The above summaries are provided for informational purposes only and should not be viewed as recommendations.

LCM l ADVENT/CLAYMORE ENHANCED GROWTH & INCOME FUND SEMIANNUAL REPORT l 11

FUND SUMMARY (Unaudited) continued | April 30, 2015 |

12 l LCM l ADVENT/CLAYMORE ENHANCED GROWTH & INCOME FUND SEMIANNUAL REPORT

FUND SUMMARY (Unaudited) continued | April 30, 2015 |

Country Breakdown | % of Long-Term Investments |

United States | 64.0% |

Cayman Islands | 4.8% |

Japan | 4.3% |

France | 3.9% |

Netherlands | 3.6% |

Austria | 2.7% |

Bermuda | 1.7% |

United Kingdom | 1.6% |

Spain | 1.4% |

Germany | 1.4% |

Italy | 1.2% |

Ireland | 1.1% |

United Arab Emirates | 1.1% |

Virgin Islands | 1.1% |

Jersey | 0.8% |

Canada | 0.8% |

Luxembourg | 0.7% |

Mexico | 0.7% |

Honk Kong | 0.6% |

Hungary | 0.6% |

India | 0.5% |

Taiwan | 0.4% |

Australia | 0.4% |

Marshall Island | 0.3% |

Liberia | 0.2% |

Greece | 0.1% |

Subject to change daily. | |

LCM l ADVENT/CLAYMORE ENHANCED GROWTH & INCOME FUND SEMIANNUAL REPORT l 13

PORTFOLIO OF INVESTMENTS (Unaudited) | April 30, 2015 |

| | | Shares | | | Value | |

COMMON STOCKS† – 8.9% | | | | | | |

Consumer, Non-cyclical – 1.9% | | | | | | |

GlaxoSmithKline plc ADR1 | | | 30,000 | | | $ | 1,384,499 | |

Gilead Sciences, Inc.1 | | | 5,100 | | | | 512,601 | |

Pfizer, Inc.1 | | | 14,150 | | | | 480,110 | |

Mylan N.V.* | | | 5,600 | | | | 404,656 | |

Total Consumer, Non-cyclical | | | | | | | 2,781,866 | |

| | |

Financial – 1.7% | | | | | | | | |

NorthStar Realty Finance Corp.1 | | | 59,250 | | | | 1,111,530 | |

Hospitality Properties Trust1 | | | 30,300 | | | | 911,424 | |

Citigroup, Inc.1 | | | 11,000 | | | | 586,520 | |

Total Financial | | | | | | | 2,609,474 | |

| | |

Energy – 1.5% | | | | | | | | |

Occidental Petroleum Corp.1 | | | 20,000 | | | | 1,602,000 | |

Royal Dutch Shell plc — Class B ADR1 | | | 9,800 | | | | 632,982 | |

Total Energy | | | | | | | 2,234,982 | |

| | |

Industrial – 1.3% | | | | | | | | |

Greenbrier Companies, Inc. | | | 19,943 | | | | 1,150,512 | |

Koninklijke Philips N.V. | | | 30,000 | | | | 862,431 | |

Total Industrial | | | | | | | 2,012,943 | |

| | |

Basic Materials – 1.0% | | | | | | | | |

Freeport-McMoRan, Inc.1 | | | 31,500 | | | | 733,005 | |

Dow Chemical Co.1 | | | 14,200 | | | | 724,200 | |

Total Basic Materials | | | | | | | 1,457,205 | |

| | |

Communications – 0.8% | | | | | | | | |

Lamar Advertising Co. — Class A1 | | | 20,000 | | | | 1,159,200 | |

| | |

Consumer, Cyclical – 0.7% | | | | | | | | |

American Airlines Group, Inc.1 | | | 12,800 | | | | 618,048 | |

Wynn Resorts Ltd.1 | | | 4,200 | | | | 466,494 | |

Total Consumer, Cyclical | | | | | | | 1,084,542 | |

Total Common Stocks | | | | | | | | |

(Cost $12,966,782) | | | | | | | 13,340,212 | |

| | |

CONVERTIBLE PREFERRED STOCKS† – 8.8% | | | | | | | | |

Consumer, Non-cyclical – 3.1% | | | | | | | | |

Actavis plc 5.50% due 03/01/18 | | | 2,189 | | | | 2,198,576 | |

Tyson Foods, Inc. 4.75% due 07/15/171 | | | 38,314 | | | | 1,884,665 | |

Kindred Healthcare, Inc. 7.50% due 12/01/17 | | | 496 | | | | 572,769 | |

Total Consumer, Non-cyclical | | | | | | | 4,656,010 | |

See notes to financial statements.

14 l LCM l ADVENT/CLAYMORE ENHANCED GROWTH & INCOME FUND SEMIANNUAL REPORT

PORTFOLIO OF INVESTMENTS (Unaudited) continued | April 30, 2015 |

| | | Shares | | | Value | |

CONVERTIBLE PREFERRED STOCKS† – 8.8% (continued) | | | | | | |

Financial – 3.0% | | | | | | |

Wells Fargo & Co. 7.50%1,9 | | | 1,949 | | | $ | 2,375,344 | |

American Tower Corp. 5.25% due 05/15/171 | | | 11,938 | | | | 1,237,732 | |

American Tower Corp. 5.50% due 02/15/18 | | | 8,267 | | | | 848,194 | |

Total Financial | | | | | | | 4,461,270 | |

| | |

Utilities – 0.9% | | | | | | | | |

Dominion Resources, Inc. 6.38% due 07/01/171 | | | 20,979 | | | | 1,041,607 | |

Exelon Corp. 6.50% due 06/01/171 | | | 6,050 | | | | 298,810 | |

Total Utilities | | | | | | | 1,340,417 | |

| | |

Basic Materials – 0.7% | | | | | | | | |

Alcoa, Inc. 5.38% due 10/01/171 | | | 24,014 | | | | 1,095,519 | |

Total Basic Materials | | | | | | | 1,095,519 | |

| | |

Energy – 0.6% | | | | | | | | |

Southwestern Energy Co. 6.25% due 01/15/18 | | | 10,200 | | | | 605,064 | |

Chesapeake Energy Corp. 5.75%1,9 | | | 386 | | | | 339,680 | |

Total Energy | | | | | | | 944,744 | |

| | |

Industrial – 0.5% | | | | | | | | |

Stanley Black & Decker, Inc. 4.75% due 11/17/152 | | | 3,960 | | | | 544,758 | |

United Technologies Corp. 7.50% due 08/01/151 | | | 2,443 | | | | 143,697 | |

Total Industrial | | | | | | | 688,455 | |

Total Convertible Preferred Stocks | | | | | | | | |

(Cost $13,253,867) | | | | | | | 13,186,415 | |

| | |

SHORT TERM INVESTMENTS† – 4.4% | | | | | | | | |

Goldman Sachs Financial Prime Obligations – Administration Share Class2 | | | 6,609,461 | | | | 6,609,461 | |

Total Short Term Investments | | | | | | | | |

(Cost $6,609,461) | | | | | | | 6,609,461 | |

| | |

| | | Face | | | | | |

| | | Amount~ | | | Value | |

CONVERTIBLE BONDS†† – 83.1% | | | | | | | | |

Financial – 18.5% | | | | | | | | |

IMMOFINANZ AG | | | | | | | | |

1.50% due 09/11/19 | | 1,600,000 EUR | | | $ | 2,072,927 | |

4.25% due 03/08/18 | | 96,000 EUR | | | | 514,951 | |

Forest City Enterprises, Inc. | | | | | | | | |

3.63% due 08/15/201 | | | 1,496,000 | | | | 1,691,415 | |

Colony Capital, Inc. | | | | | | | | |

3.88% due 01/15/21 | | | 1,493,000 | | | | 1,632,969 | |

Aabar Investments PJSC | | | | | | | | |

1.00% due 03/27/22 | | 1,200,000 EUR | | | | 1,474,211 | |

See notes to financial statements.

LCM l ADVENT/CLAYMORE ENHANCED GROWTH & INCOME FUND SEMIANNUAL REPORT l 15

| | |

PORTFOLIO OF INVESTMENTS (Unaudited) continued | April 30, 2015 |

| | | Face | | | | |

| | | Amount~ | | | Value | |

CONVERTIBLE BONDS†† – 83.1% (continued) | | | | | | |

Financial – 18.5% (continued) | | | | | | |

Starwood Property Trust, Inc. | | | | | | |

4.00% due 01/15/191 | | | 1,141,000 | | | $ | 1,297,174 | |

Tong Jie Ltd. | | | | | | | | |

0.00% due 02/18/183 | | 9,000,000 HKD | | | | 1,291,743 | |

BNP Paribas S.A. | | | | | | | | |

0.25% due 09/21/15 | | 1,000,000 EUR | | | | 1,198,540 | |

Conwert Immobilien Invest SE | | | | | | | | |

4.50% due 09/06/18 | | 900,000 EUR | | | | 1,189,217 | |

Air Lease Corp. | | | | | | | | |

3.88% due 12/01/181 | | | 789,000 | | | | 1,156,871 | |

Azimut Holding SpA | | | | | | | | |

2.13% due 11/25/20 | | 800,000 EUR | | | | 1,134,624 | |

BENI Stabili SpA | | | | | | | | |

3.38% due 01/17/18 | | 800,000 EUR | | | | 1,127,811 | |

Magyar Nemzeti Vagyonkezelo Zrt | | | | | | | | |

3.38% due 04/02/19 | | 900,000 EUR | | | | 1,112,975 | |

Criteria CaixaHolding S.A. | | | | | | | | |

1.00% due 11/25/17 | | 800,000 EUR | | | | 1,048,924 | |

AYC Finance Ltd. | | | | | | | | |

0.50% due 05/02/19 | | | 870,000 | | | | 988,538 | |

Radian Group, Inc. | | | | | | | | |

2.25% due 03/01/191 | | | 577,000 | | | | 981,621 | |

American Realty Capital Properties, Inc. | | | | | | | | |

3.00% due 08/01/18 | | | 900,000 | | | | 874,125 | |

Hansteen Jersey Securities Ltd. | | | | | | | | |

4.00% due 07/15/18 | | 500,000 EUR | | | | 846,744 | |

Haitong International Securities Group, Ltd. | | | | | | | | |

1.25% due 11/04/19 | | 4,000,000 HKD | | | | 844,195 | |

PRA Group, Inc. | | | | | | | | |

3.00% due 08/01/201 | | | 728,000 | | | | 790,335 | |

Unite Jersey Issuer Ltd. | | | | | | | | |

2.50% due 10/10/18 | | 400,000 GBP | | | | 763,519 | |

Element Financial Corp. | | | | | | | | |

5.13% due 06/30/194 | | 755,000 CAD | | | | 758,896 | |

Hong Kong Exchanges and Clearing Ltd. | | | | | | | | |

0.50% due 10/23/17 | | | 350,000 | | | | 657,125 | |

Unibail-Rodamco SE | | | | | | | | |

0.00% due 01/01/223 | | 1,538 EUR | | | | 628,526 | |

Billion Express Investments Ltd. | | | | | | | | |

0.75% due 10/18/15 | | | 500,000 | | | | 533,750 | |

Fidelity National Financial, Inc. | | | | | | | | |

4.25% due 08/15/181 | | | 247,000 | | | | 494,772 | |

See notes to financial statements.

16 l LCM l ADVENT/CLAYMORE ENHANCED GROWTH & INCOME FUND SEMIANNUAL REPORT

PORTFOLIO OF INVESTMENTS (Unaudited) continued | April 30, 2015 |

| | | Face | | | | |

| | | Amount~ | | | Value | |

CONVERTIBLE BONDS†† – 83.1% (continued) | | | | | | |

Financial – 18.5% (continued) | | | | | | |

Host Hotels & Resorts, LP | | | | | | |

2.50% due 10/15/294 | | | 294,000 | | | $ | 462,683 | |

Total Financial | | | | | | | 27,569,181 | |

| | |

Communications – 13.8% | | | | | | | | |

Twitter, Inc. | | | | | | | | |

1.00% due 09/15/211,4 | | | 2,360,000 | | | | 2,150,551 | |

0.25% due 09/15/191,4 | | | 1,531,000 | | | | 1,406,605 | |

Priceline Group, Inc. | | | | | | | | |

0.35% due 06/15/201 | | | 2,150,000 | | | | 2,545,062 | |

0.90% due 09/15/211,4 | | | 723,000 | | | | 718,481 | |

Ciena Corp. | | | | | | | | |

0.88% due 06/15/171 | | | 2,249,000 | | | | 2,249,000 | |

4.00% due 12/15/201 | | | 468,000 | | | | 624,780 | |

Yahoo!, Inc. | | | | | | | | |

0.00% due 12/01/181,3 | | | 1,991,000 | | | | 2,119,171 | |

Ctrip.com International Ltd. | | | | | | | | |

1.25% due 10/15/181 | | | 1,511,000 | | | | 1,672,489 | |

Alcatel Lucent | | | | | | | | |

0.00% due 01/30/193 | | 326,000 EUR | | | | 1,660,650 | |

Qihoo 360 Technology Company Ltd. | | | | | | | | |

1.75% due 08/15/211,4 | | | 1,000,000 | | | | 860,625 | |

0.50% due 08/15/201,4 | | | 722,000 | | | | 647,093 | |

Liberty Media Corp. | | | | | | | | |

1.38% due 10/15/231 | | | 1,060,000 | | | | 1,066,625 | |

Web.com Group, Inc. | | | | | | | | |

1.00% due 08/15/18 | | | 1,000,000 | | | | 921,874 | |

Liberty Interactive LLC | | | | | | | | |

0.75% due 03/30/431 | | | 615,000 | | | | 893,288 | |

Yandex N.V. | | | | | | | | |

1.13% due 12/15/181 | | | 834,000 | | | | 732,878 | |

LinkedIn Corp. | | | | | | | | |

0.50% due 11/01/194 | | | 363,000 | | | | 404,293 | |

Total Communications | | | | | | | 20,673,465 | |

| | |

Consumer, Non-cyclical – 13.8% | | | | | | | | |

Omnicare, Inc. | | | | | | | | |

3.50% due 02/15/441 | | | 1,084,000 | | | | 1,462,045 | |

3.25% due 12/15/351 | | | 1,000,000 | | | | 1,198,750 | |

Hologic, Inc. | | | | | | | | |

0.00% due 12/15/431,5,6 | | | 1,700,000 | | | | 1,999,625 | |

Anthem, Inc. | | | | | | | | |

2.75% due 10/15/421 | | | 799,000 | | | | 1,615,478 | |

J Sainsbury plc | | | | | | | | |

1.25% due 11/21/19 | | 700,000 GBP | | | | 1,169,635 | |

See notes to financial statements.

LCM l ADVENT/CLAYMORE ENHANCED GROWTH & INCOME FUND SEMIANNUAL REPORT l 17

PORTFOLIO OF INVESTMENTS (Unaudited) continued | April 30, 2015 |

| | | Face | | | | |

| | | Amount~ | | | Value | |

CONVERTIBLE BONDS†† – 83.1% (continued) | | | | | | |

Consumer, Non-cyclical – 13.8% (continued) | | | | | | |

BioMarin Pharmaceutical, Inc. | | | | | | |

1.50% due 10/15/201 | | | 795,000 | | | $ | 1,119,458 | |

Molina Healthcare, Inc. | | | | | | | | |

1.63% due 08/15/44 | | | 575,000 | | | | 682,453 | |

1.13% due 01/15/201 | | | 233,000 | | | | 357,364 | |

Brookdale Senior Living, Inc. | | | | | | | | |

2.75% due 06/15/181 | | | 722,000 | | | | 983,725 | |

Gilead Sciences, Inc. | | | | | | | | |

1.63% due 05/01/161 | | | 213,000 | | | | 940,396 | |

Jazz Investments I Ltd. | | | | | | | | |

1.88% due 08/15/211,4 | | | 750,000 | | | | 900,000 | |

HealthSouth Corp. | | | | | | | | |

2.00% due 12/01/43 | | | 636,000 | | | | 802,553 | |

Isis Pharmaceuticals, Inc. | | | | | | | | |

1.00% due 11/15/214 | | | 699,000 | | | | 759,289 | |

Euronet Worldwide, Inc. | | | | | | | | |

1.50% due 10/01/444 | | | 667,000 | | | | 733,283 | |

Wright Medical Group, Inc. | | | | | | | | |

2.00% due 02/15/204 | | | 689,000 | | | | 725,173 | |

DP World Ltd. | | | | | | | | |

1.75% due 06/19/24 | | | 600,000 | | | | 672,600 | |

Qiagen N.V. | | | | | | | | |

0.88% due 03/19/21 | | | 600,000 | | | | 666,510 | |

Illumina, Inc. | | | | | | | | |

0.50% due 06/15/211,4 | | | 500,000 | | | | 578,750 | |

Spectranetics Corp. | | | | | | | | |

2.63% due 06/01/34 | | | 484,000 | | | | 530,888 | |

Temp Holdings, Co. | | | | | | | | |

0.00% due 09/19/183 | | 42,000,000 JPY | | | | 491,263 | |

Array BioPharma, Inc. | | | | | | | | |

3.00% due 06/01/201 | | | 409,000 | | | | 469,839 | |

Macquarie Infrastructure Company LLC | | | | | | | | |

2.88% due 07/15/19 | | | 400,000 | | | | 468,250 | |

Ligand Pharmaceuticals, Inc. | | | | | | | | |

0.75% due 08/15/194 | | | 308,000 | | | | 374,413 | |

NuVasive, Inc. | | | | | | | | |

2.75% due 07/01/17 | | | 270,000 | | | | 333,956 | |

Incyte Corp. | | | | | | | | |

0.38% due 11/15/18 | | | 159,000 | | | | 305,678 | |

Medivation, Inc. | | | | | | | | |

2.63% due 04/01/17 | | | 127,000 | | | | 298,609 | |

Total Consumer, Non-cyclical | | | | | | | 20,639,983 | |

See notes to financial statements.

18 l LCM l ADVENT/CLAYMORE ENHANCED GROWTH & INCOME FUND SEMIANNUAL REPORT

PORTFOLIO OF INVESTMENTS (Unaudited) continued | April 30, 2015 |

| | | Face | | | | |

| | | Amount~ | | | Value | |

CONVERTIBLE BONDS†† – 83.1% (continued) | | | | | | |

Technology – 11.3% | | | | | | |

Microchip Technology, Inc. | | | | | | |

1.63% due 02/15/254 | | | 2,016,000 | | | $ | 2,071,440 | |

ServiceNow, Inc. | | | | | | | | |

0.00% due 11/01/182,3 | | | 1,348,000 | | | | 1,624,341 | |

Lam Research Corp. | | | | | | | | |

0.50% due 05/15/161 | | | 1,208,000 | | | | 1,531,140 | |

SanDisk Corp. | | | | | | | | |

0.50% due 10/15/201 | | | 1,152,000 | | | | 1,190,880 | |

Cornerstone OnDemand, Inc. | | | | | | | | |

1.50% due 07/01/181 | | | 1,139,000 | | | | 1,114,084 | |

Proofpoint, Inc. | | | | | | | | |

1.25% due 12/15/181 | | | 696,000 | | | | 1,037,910 | |

Intel Corp. | | | | | | | | |

3.48% due 12/15/351 | | | 704,000 | | | | 898,480 | |

ASM Pacific Technology Ltd. | | | | | | | | |

2.00% due 03/28/19 | | 6,000,000 HKD | | | | 880,514 | |

Verint Systems, Inc. | | | | | | | | |

1.50% due 06/01/211 | | | 703,000 | | | | 822,949 | |

Red Hat, Inc. | | | | | | | | |

0.25% due 10/01/191,4 | | | 647,000 | | | | 795,001 | |

Akamai Technologies, Inc. | | | | | | | | |

0.00% due 02/15/193 | | | 715,000 | | | | 781,141 | |

Micron Technology, Inc. | | | | | | | | |

3.00% due 11/15/431 | | | 674,000 | | | | 765,411 | |

NVIDIA Corp. | | | | | | | | |

1.00% due 12/01/181 | | | 600,000 | | | | 736,500 | |

Epistar Corp. | | | | | | | | |

0.00% due 08/07/183 | | | 700,000 | | | | 728,000 | |

Kingsoft Corp. Ltd. | | | | | | | | |

1.25% due 04/11/19 | | 5,000,000 HKD | | | | 674,094 | |

Synchronoss Technologies, Inc. | | | | | | | | |

0.75% due 08/15/19 | | | 522,000 | | | | 604,868 | |

PROS Holdings, Inc. | | | | | | | | |

2.00% due 12/01/194 | | | 600,000 | | | | 593,625 | |

Total Technology | | | | | | | 16,850,378 | |

| | |

Industrial – 10.0% | | | | | | | | |

Cemex SAB de CV | | | | | | | | |

3.72% due 03/15/201,4 | | | 1,169,000 | | | | 1,278,593 | |

Siemens Financieringsmaatschappij N.V. | | | | | | | | |

1.65% due 08/16/19 | | | 1,000,000 | | | | 1,160,505 | |

OSG Corp. | | | | | | | | |

0.00% due 04/04/223 | | 90,000,000 JPY | | | | 1,151,040 | |

Ebara Corp. | | | | | | | | |

0.00% due 03/19/183 | | 110,000,000 JPY | | | | 1,117,281 | |

See notes to financial statements.

LCM l ADVENT/CLAYMORE ENHANCED GROWTH & INCOME FUND SEMIANNUAL REPORT l 19

PORTFOLIO OF INVESTMENTS (Unaudited) continued | April 30, 2015 |

| | | Face | | | | |

| | | Amount~ | | | Value | |

CONVERTIBLE BONDS†† – 83.1% (continued) | | | | | | |

Industrial – 10.0% (continued) | | | | | | |

Fluidigm Corp. | | | | | | |

2.75% due 02/01/341 | | | 1,042,000 | | | $ | 1,058,933 | |

Larsen & Toubro Ltd. | | | | | | | | |

0.68% due 10/22/19 | | | 944,000 | | | | 1,028,016 | |

Deutsche Post A.G. | | | | | | | | |

0.60% due 12/06/19 | | 600,000 EUR | | | | 951,010 | |

MISUMI Group, Inc. | | | | | | | | |

0.00% due 10/22/183 | | | 800,000 | | | | 917,600 | |

BW Group Ltd. | | | | | | | | |

1.75% due 09/10/19 | | | 1,000,000 | | | | 906,000 | |

Zhen Ding Technology Holding Ltd. | | | | | | | | |

0.00% due 06/26/193 | | | 800,000 | | | | 900,200 | |

Greenbrier Companies, Inc. | | | | | | | | |

3.50% due 04/01/18 | | | 500,000 | | | | 757,813 | |

Yaskawa Electric Corp. | | | | | | | | |

0.00% due 03/16/173 | | 55,000,000 JPY | | | | 689,396 | |

Mitsui OSK Lines, Ltd. | | | | | | | | |

0.00% due 04/24/203 | | | 600,000 | | | | 591,450 | |

KUKA A.G. | | | | | | | | |

2.00% due 02/12/18 | | 300,000 EUR | | | | 588,490 | |

Vishay Intertechnology, Inc. | | | | | | | | |

2.25% due 11/15/40 | | | 504,000 | | | | 509,355 | |

Chart Industries, Inc. | | | | | | | | |

2.00% due 08/01/181 | | | 429,000 | | | | 453,131 | |

Nidec Corp. | | | | | | | | |

0.00% due 09/18/153 | | 25,000,000 JPY | | | | 352,480 | |

UTi Worldwide, Inc. | | | | | | | | |

4.50% due 03/01/19 | | | 286,000 | | | | 285,643 | |

Trinity Industries, Inc. | | | | | | | | |

3.88% due 06/01/36 | | | 215,000 | | | | 280,172 | |

Total Industrial | | | | | | | 14,977,108 | |

| | |

Consumer, Cyclical – 8.8% | | | | | | | | |

Jarden Corp. | | | | | | | | |

1.13% due 03/15/341 | | | 1,481,000 | | | | 1,719,811 | |

Fiat Chrysler Automobiles N.V. | | | | | | | | |

7.88% due 12/15/16 | | | 10,400 | | | | 1,341,600 | |

Faurecia | | | | | | | | |

3.25% due 01/01/18 | | 2,582,000 EUR | | | | 1,239,021 | |

Iconix Brand Group, Inc. | | | | | | | | |

1.50% due 03/15/181 | | | 585,000 | | | | 606,206 | |

2.50% due 06/01/16 | | | 436,000 | | | | 453,440 | |

Resorttrust, Inc. | | | | | | | | |

0.00% due 12/01/213 | | 110,000,000 JPY | | | | 1,059,372 | |

See notes to financial statements.

20 l LCM l ADVENT/CLAYMORE ENHANCED GROWTH & INCOME FUND SEMIANNUAL REPORT

PORTFOLIO OF INVESTMENTS (Unaudited) continued | April 30, 2015 |

| | | Face | | | | |

| | | Amount~ | | | Value | |

CONVERTIBLE BONDS†† – 83.1% (continued) | | | | | | |

Consumer, Cyclical – 8.8% (continued) | | | | | | |

Steinhoff Finance Holding GmbH | | | | | | |

4.00% due 01/30/21 | | 600,000 EUR | | | $ | 1,014,277 | |

International Consolidated Airlines Group S.A. | | | | | | | |

1.75% due 05/31/18 | | 500,000 EUR | | | | 996,897 | |

Toray Industries, Inc. | | | | | | | |

0.00% due 08/30/193 | | 80,000,000 JPY | | | | 833,124 | |

Sekisui House Co. | | | | | | | |

0.00% due 07/05/163 | | 40,000,000 JPY | | | | 627,392 | |

Volkswagen International Finance N.V. | | | | | | | |

5.50% due 11/09/151,4 | | 400,000 EUR | | | | 600,888 | |

Adidas A.G. | | | | | | | |

0.25% due 06/14/19 | | 400,000 EUR | | | | 530,110 | |

NHK Spring Co. Ltd. | | | | | | | |

0.00% due 09/20/193 | | | 450,000 | | | | 511,425 | |

Standard Pacific Corp. | | | | | | | | |

1.25% due 08/01/32 | | | 429,000 | | | | 503,003 | |

Sonae Investments B.V. | | | | | | | | |

1.63% due 06/11/19 | | 400,000 EUR | | | | 456,064 | |

Rallye S.A. | | | | | | | | |

1.00% due 10/02/20 | | 350,000 EUR | | | | 442,295 | |

LGI Homes, Inc. | | | | | | | | |

4.25% due 11/15/194 | | | 219,000 | | | | 227,486 | |

Total Consumer, Cyclical | | | | | | | 13,162,411 | |

| | |

Energy – 2.9% | | | | | | | | |

SunEdison, Inc. | | | | | | | | |

0.25% due 01/15/201,4 | | | 1,640,000 | | | | 1,851,150 | |

Whiting Petroleum Corp. | | | | | | | | |

1.25% due 04/01/201,4 | | | 1,107,000 | | | | 1,324,249 | |

CaixaBank S.A. | | | | | | | | |

4.50% due 11/22/16 | | 600,000 EUR | | | | 666,000 | |

| | |

Utilities – 2.0% | | | | | | | | |

Helix Energy Solutions Group, Inc. | | | | | | | | |

3.25% due 03/15/32 | | | 500,000 | | | | 508,750 | |

Total Energy | | | | | | | 4,350,149 | |

ENN Energy Holdings Ltd. | | | | | | | | |

0.00% due 02/26/183 | | | 1,000,000 | | | | 1,260,000 | |

CenterPoint Energy, Inc. | | | | | | | | |

3.94% due 09/15/291,5 | | | 18,995 | | | | 1,256,044 | |

China Power International Development Ltd. | | | | | | | | |

2.75% due 09/18/17 | | 1,500,000 CNY | | | | 523,796 | |

Total Utilities | | | | | | | 3,039,840 | |

See notes to financial statements.

LCM l ADVENT/CLAYMORE ENHANCED GROWTH & INCOME FUND SEMIANNUAL REPORT l 21

PORTFOLIO OF INVESTMENTS (Unaudited) continued | April 30, 2015 |

| | | Face | | | | |

| | | Amount~ | | | Value | |

CONVERTIBLE BONDS†�� – 83.1% (continued) | | | | | | |

Diversified – 1.1% | | | | | | |

Misarte | | | | | | |

3.25% due 01/01/16 | | 430,000 EUR | | | $ | 847,959 | |

Horizon Pharma Investment Ltd. | | | | | | | |

2.50% due 03/15/224 | | | 610,000 | | | | 760,213 | |

Total Diversified | | | | | | | 1,608,172 | |

| | |

Basic Materials – 0.9% | | | | | | | | |

Royal Gold, Inc. | | | | | | | | |

2.88% due 06/15/191 | | | 1,000,000 | | | | 1,046,250 | |

B2Gold Corp. | | | | | | | | |

3.25% due 10/01/18 | | | 300,000 | | | | 258,938 | |

Total Basic Materials | | | | | | | 1,305,188 | |

Total Convertible Bonds | | | | | | | | |

(Cost $119,843,362) | | | | | | | 124,175,875 | |

| | |

CORPORATE BONDS†† – 28.7% | | | | | | | | |

Communications – 6.6% | | | | | | | | |

UPCB Finance III Ltd. | | | | | | | | |

6.63% due 07/01/201,4 | | | 1,400,000 | | | | 1,457,399 | |

Alliance Data Systems Corp. | | | | | | | | |

6.38% due 04/01/204 | | | 1,250,000 | | | | 1,304,688 | |

Numericable-SFR SAS | | | | | | | | |

4.88% due 05/15/191,4 | | | 1,250,000 | | | | 1,265,624 | |

Altice S.A. | | | | | | | | |

7.75% due 05/15/221,4 | | | 1,000,000 | | | | 1,012,510 | |

Sprint Communications, Inc. | | | | | | | | |

9.00% due 11/15/184 | | | 490,000 | | | | 558,752 | |

T-Mobile USA, Inc. | | | | | | | | |

6.63% due 04/28/21 | | | 500,000 | | | | 529,375 | |

EarthLink Holdings Corp. | | | | | | | | |

7.38% due 06/01/201 | | | 500,000 | | | | 522,500 | |

LIN Television Corp. | | | | | | | | |

5.88% due 11/15/221,4 | | | 500,000 | | | | 516,250 | |

Radio One, Inc. | | | | | | | | |

7.38% due 04/15/224 | | | 350,000 | | | | 354,813 | |

DISH DBS Corp. | | | | | | | | |

6.75% due 06/01/21 | | | 300,000 | | | | 318,399 | |

Equinix, Inc. | | | | | | | | |

5.75% due 01/01/25 | | | 300,000 | | | | 317,250 | |

Wind Acquisition Finance S.A. | | | | | | | | |

7.00% due 04/23/21 | | 240,000 EUR | | | | 288,042 | |

Townsquare Media, Inc. | | | | | | | | |

6.50% due 04/01/234 | | | 252,000 | | | | 254,205 | |

See notes to financial statements.

22 l LCM l ADVENT/CLAYMORE ENHANCED GROWTH & INCOME FUND SEMIANNUAL REPORT

PORTFOLIO OF INVESTMENTS (Unaudited) continued | April 30, 2015 |

| | | Face | | | | |

| | | Amount~ | | | Value | |

CORPORATE BONDS†† – 28.7% (continued) | | | | | | |

Communications – 6.6% (continued) | | | | | | |

Univision Communications, Inc. | | | | | | |

5.13% due 02/15/254 | | | 250,000 | | | $ | 252,500 | |

West Corp. | | | | | | | | |

5.38% due 07/15/224 | | | 240,000 | | | | 231,900 | |

Telesat Canada / Telesat LLC | | | | | | | | |

6.00% due 05/15/174 | | | 200,000 | | | | 203,600 | |

Outfront Media Capital LLC / Outfront Media Capital Corp. | | | | | | | | |

5.63% due 02/15/244 | | | 120,000 | | | | 124,950 | |

GCI, Inc. | | | | | | | | |

6.88% due 04/15/254 | | | 120,000 | | | | 123,600 | |

CenturyLink, Inc. | | | | | | | | |

5.63% due 04/01/254 | | | 120,000 | | | | 120,450 | |

Level 3 Financing, Inc. | | | | | | | | |

5.38% due 05/01/254 | | | 120,000 | | | | 120,000 | |

Total Communications | | | | | | | 9,876,807 | |

| | |

Consumer, Non-cyclical – 6.0% | | | | | | | | |

Tenet Healthcare Corp. | | | | | | | | |

6.00% due 10/01/201 | | | 2,425,000 | | | | 2,594,749 | |

8.13% due 04/01/22 | | | 120,000 | | | | 131,250 | |

HCA, Inc. | | | | | | | | |

6.50% due 02/15/201 | | | 700,000 | | | | 799,750 | |

4.75% due 05/01/23 | | | 500,000 | | | | 526,250 | |

United Rentals North America, Inc. | | | | | | | | |

7.38% due 05/15/20 | | | 600,000 | | | | 649,974 | |

5.75% due 11/15/24 | | | 240,000 | | | | 247,800 | |

Prospect Medical Holdings, Inc. | | | | | | | | |

8.38% due 05/01/191,4 | | | 500,000 | | | | 535,000 | |

CHS/Community Health Systems, Inc. | | | | | | | | |

5.13% due 08/15/18 | | | 500,000 | | | | 520,000 | |

Sotheby’s | | | | | | | | |

5.25% due 10/01/221,4 | | | 500,000 | | | | 501,250 | |

Omnicare, Inc. | | | | | | | | |

5.00% due 12/01/24 | | | 360,000 | | | | 394,200 | |

Cott Beverages, Inc. | | | | | | | | |

6.75% due 01/01/204 | | | 360,000 | | | | 378,000 | |

Cenveo Corp. | | | | | | | | |

8.50% due 09/15/224 | | | 250,000 | | | | 210,625 | |

11.50% due 05/15/17 | | | 120,000 | | | | 122,100 | |

HealthSouth Corp. | | | | | | | | |

5.13% due 03/15/23 | | | 300,000 | | | | 310,500 | |

Biomet, Inc. | | | | | | | | |

6.50% due 08/01/20 | | | 250,000 | | | | 265,313 | |

Valeant Pharmaceuticals International | | | | | | | | |

6.38% due 10/15/204 | | | 240,000 | | | | 253,800 | |

See notes to financial statements

LCM l ADVENT/CLAYMORE ENHANCED GROWTH & INCOME FUND SEMIANNUAL REPORT l 23

PORTFOLIO OF INVESTMENTS (Unaudited) continued | April 30, 2015 |

| | | Face | | | | |

| | | Amount~ | | | Value | |

CORPORATE BONDS†† – 28.7% (continued) | | | | | | |

Consumer, Non-cyclical – 6.0% (continued) | | | | | | |

Novasep Holding SAS | | | | | | |

8.00% due 12/15/164 | | | 270,000 | | | $ | 247,725 | |

FAGE Dairy Industry S.A. / FAGE USA Dairy Industry, Inc. | | | | | | | | |

9.88% due 02/01/204 | | | 100,000 | | | | 105,625 | |

Live Nation Entertainment, Inc. | | | | | | | | |

7.00% due 09/01/204 | | | 70,000 | | | | 74,900 | |

Concordia Healthcare Corp. | | | | | | | | |

7.00% due 04/15/234 | | | 60,000 | | | | 61,050 | |

Total Consumer, Non-cyclical | | | | | | | 8,929,861 | |

| | |

Basic Materials – 3.6% | | | | | | | | |

Ashland, Inc. | | | | | | | | |

4.75% due 08/15/221 | | | 1,448,000 | | | | 1,491,440 | |

FMG Resources August 2006 Pty Ltd. | | | | | | | | |

8.25% due 11/01/194 | | | 718,000 | | | | 629,147 | |

9.75% due 03/01/224 | | | 60,000 | | | | 61,988 | |

Sappi Papier Holding GmbH | | | | | | | | |

6.63% due 04/15/214 | | | 500,000 | | | | 525,000 | |

Steel Dynamics, Inc. | | | | | | | | |

5.13% due 10/01/214 | | | 500,000 | | | | 513,750 | |

Commercial Metals Co. | | | | | | | | |

4.88% due 05/15/23 | | | 370,000 | | | | 354,275 | |

Appvion, Inc. | | | | | | | | |

9.00% due 06/01/204 | | | 500,000 | | | | 330,000 | |

Verso Paper Holdings LLC / Verso Paper, Inc. | | | | | | | | |

11.75% due 01/15/19 | | | 360,000 | | | | 316,800 | |

Celanese US Holdings LLC | | | | | | | | |

4.63% due 11/15/22 | | | 300,000 | | | | 308,250 | |

First Quantum Minerals Ltd. | | | | | | | | |

7.00% due 02/15/214 | | | 300,000 | | | | 281,250 | |

Compass Minerals International, Inc. | | | | | | | | |

4.88% due 07/15/244 | | | 240,000 | | | | 243,000 | |

HIG BBC Intermediate Holdings LLC / HIG BBC Holdings Corp. | | | | | | | | |

10.50% due 09/15/184,7 | | | 240,000 | | | | 225,600 | |

Hexion, Inc. | | | | | | | | |

8.88% due 02/01/18 | | | 180,000 | | | | 160,875 | |

Total Basic Materials | | | | | | | 5,441,375 | |

| | |

Consumer, Cyclical – 3.4% | | | | | | | | |

Hilton Worldwide Finance LLC / Hilton Worldwide Finance Corp. | | | | | | | | |

5.63% due 10/15/211 | | | 1,000,000 | | | | 1,060,000 | |

MGM Resorts International | | | | | | | | |

5.25% due 03/31/201 | | | 600,000 | | | | 615,000 | |

6.00% due 03/15/23 | | | 300,000 | | | | 312,188 | |

See notes to financial statements.

24 l LCM l ADVENT/CLAYMORE ENHANCED GROWTH & INCOME FUND SEMIANNUAL REPORT

PORTFOLIO OF INVESTMENTS (Unaudited) continued | April 30, 2015 |

| | | Face | | | | |

| | | Amount~ | | | Value | |

CORPORATE BONDS†† – 28.7% (continued) | | | | | | |

Consumer, Cyclical – 3.4% (continued) | | | | | | |

FCA US LLC / CG Company-Issuer, Inc. | | | | | | |

8.00% due 06/15/191 | | | 500,000 | | | $ | 524,400 | |

Churchill Downs, Inc. | | | | | | | | |

5.38% due 12/15/21 | | | 385,000 | | | | 394,625 | |

Dana Holding Corp. | | | | | | | | |

5.50% due 12/15/24 | | | 300,000 | | | | 309,750 | |

Polymer Group, Inc. | | | | | | | | |

6.88% due 06/01/194 | | | 300,000 | | | | 286,125 | |

Speedway Motorsports, Inc. | | | | | | | | |

5.13% due 02/01/234 | | | 240,000 | | | | 243,288 | |

Wynn Las Vegas LLC / Wynn Las Vegas Capital Corp. | | | | | | | | |

5.50% due 03/01/254 | | | 240,000 | | | | 242,100 | |

Scientific Games International, Inc. | | | | | | | | |

10.00% due 12/01/224 | | | 240,000 | | | | 223,800 | |

Fiat Chrysler Automobiles N.V. | | | | | | | | |

5.25% due 04/15/234 | | | 200,000 | | | | 202,500 | |

First Cash Financial Services, Inc. | | | | | | | | |

6.75% due 04/01/21 | | | 180,000 | | | | 187,200 | |

Global Partners Limited Partnership / GLP Finance Corp. | | | | | | | | |

6.25% due 07/15/22 | | | 180,000 | | | | 178,200 | |

Levi Strauss & Co. | | | | | | | | |

5.00% due 05/01/254 | | | 161,000 | | | | 161,704 | |

Regal Entertainment Group | | | | | | | | |

5.75% due 03/15/22 | | | 120,000 | | | | 123,750 | |

Family Tree Escrow LLC | | | | | | | | |

5.75% due 03/01/234 | | | 60,000 | | | | 63,300 | |

Total Consumer, Cyclical | | | | | | | 5,127,930 | |

| | |

Financial – 2.5% | | | | | | | | |

Synovus Financial Corp. | | | | | | | | |

7.88% due 02/15/191 | | | 669,000 | | | | 759,315 | |

5.13% due 06/15/171 | | | 312,000 | | | | 322,140 | |

CIT Group, Inc. | | | | | | | | |

5.50% due 02/15/194 | | | 860,000 | | | | 901,925 | |

Credit Acceptance Corp. | | | | | | | | |

7.38% due 03/15/234 | | | 360,000 | | | | 359,100 | |

Ally Financial, Inc. | | | | | | | | |

5.13% due 09/30/24 | | | 300,000 | | | | 312,375 | |

E*TRADE Financial Corp. | | | | | | | | |

4.63% due 09/15/23 | | | 300,000 | | | | 307,125 | |

Kennedy-Wilson, Inc. | | | | | | | | |

5.88% due 04/01/24 | | | 300,000 | | | | 304,530 | |

Corrections Corporation of America | | | | | | | | |

4.63% due 05/01/23 | | | 300,000 | | | | 303,750 | |

See notes to financial statements.

LCM l ADVENT/CLAYMORE ENHANCED GROWTH & INCOME FUND SEMIANNUAL REPORT l 25

PORTFOLIO OF INVESTMENTS (Unaudited) continued | April 30, 2015 |

| | | Face | | | | |

| | | Amount~ | | | Value | |

CORPORATE BONDS†† – 28.7% (continued) | | | | | | |

Financial – 2.5% (continued) | | | | | | |

Greystar Real Estate Partners LLC | | | | | | |

8.25% due 12/01/224 | | | 100,000 | | | $ | 106,250 | |

Total Financial | | | | | | | 3,676,510 | |

| | |

Industrial – 2.4% | | | | | | | | |

Pfleiderer GmbH | | | | | | | | |

7.88% due 08/01/19 | | 500,000 EUR | | | | 579,885 | |

Sanmina Corp. | | | | | | | | |

4.38% due 06/01/191,4 | | | 550,000 | | | | 554,125 | |

Reynolds Group Issuer Incorporated / Reynolds Group Issuer LLC / Reynolds Group | | | | | | | | |

Issuer Lu | | | | | | | | |

5.75% due 10/15/20 | | | 420,000 | | | | 439,950 | |

MasTec, Inc. | | | | | | | | |

4.88% due 03/15/231 | | | 445,000 | | | | 422,750 | |

Eletson Holdings | | | | | | | | |

9.63% due 01/15/224 | | | 360,000 | | | | 353,700 | |

Navios Maritime Acquisition Corporation / Navios Acquisition Finance US, Inc. | | | | | | | | |

8.13% due 11/15/214 | | | 318,000 | | | | 326,745 | |

Cleaver-Brooks, Inc. | | | | | | | | |

8.75% due 12/15/194 | | | 300,000 | | | | 306,000 | |

Masco Corp. | | | | | | | | |

4.45% due 04/01/25 | | | 240,000 | | | | 248,400 | |

Navios Maritime Holdings Incorporated / Navios Maritime Finance II US Inc | | | | | | | | |

7.38% due 01/15/224 | | | 250,000 | | | | 231,250 | |

Casella Waste Systems, Inc. | | | | | | | | |

7.75% due 02/15/19 | | | 120,000 | | | | 123,000 | |

KLX, Inc. | | | | | | | | |

5.88% due 12/01/224 | | | 60,000 | | | | 60,675 | |

Total Industrial | | | | | | | 3,646,480 | |

| | |

Energy – 2.4% | | | | | | | | |

PBF Holding Company LLC / PBF Finance Corp. | | | | | | | | |

8.25% due 02/15/201 | | | 1,000,000 | | | | 1,065,000 | |

Tesoro Corp. | | | | | | | | |

5.13% due 04/01/24 | | | 500,000 | | | | 515,000 | |

Regency Energy Partners Limited Partnership / Regency Energy Finance Corp. | | | | | | | | |

5.88% due 03/01/22 | | | 300,000 | | | | 336,750 | |

Continental Resources, Inc. | | | | | | | | |

4.50% due 04/15/23 | | | 300,000 | | | | 302,515 | |

Calumet Specialty Products Partners Limited Partnership / Calumet Finance Corp. | | | | | | | | |

6.50% due 04/15/214 | | | 300,000 | | | | 300,000 | |

Genesis Energy Limited Partnership / Genesis Energy Finance Corp. | | | | | | | | |

5.75% due 02/15/211 | | | 300,000 | | | | 299,250 | |

Alta Mesa Holdings Limited Partnership / Alta Mesa Finance Services Corp. | | | | | | | | |

9.63% due 10/15/18 | | | 300,000 | | | | 251,250 | |

See notes to financial statements.

26 l LCM l ADVENT/CLAYMORE ENHANCED GROWTH & INCOME FUND SEMIANNUAL REPORT

PORTFOLIO OF INVESTMENTS (Unaudited) continued | April 30, 2015 |

| | | Face | | | | |

| | | Amount~ | | | Value | |

CORPORATE BONDS†† – 28.7% (continued) | | | | | | |

Energy – 2.4% (continued) | | | | | | |

CONSOL Energy, Inc. | | | | | | |

5.88% due 04/15/22 | | | 270,000 | | | $ | 249,075 | |

BreitBurn Energy Partners Limited Partnership / BreitBurn Finance Corp. | | | | | | | | |

8.63% due 10/15/20 | | | 180,000 | | | | 153,000 | |

Laredo Petroleum, Inc. | | | | | | �� | | |

6.25% due 03/15/23 | | | 120,000 | | | | 124,800 | |

Western Refining Logistics Limited Partnership / WNRL Finance Corp. | | | | | | | | |

7.50% due 02/15/234 | | | 24,000 | | | | 25,080 | |

Total Energy | | | | | | | 3,621,720 | |

| | |

Technology – 1.8% | | | | | | | | |

First Data Corp. | | | | | | | | |

11.75% due 08/15/212 | | | 500,000 | | | | 576,250 | |

12.63% due 01/15/21 | | | 400,000 | | | | 473,200 | |

Nuance Communications, Inc. | | | | | | | | |

5.38% due 08/15/201,4 | | | 705,000 | | | | 715,575 | |

NXP BV / NXP Funding LLC | | | | | | | | |

5.75% due 02/15/214 | | | 550,000 | | | | 586,438 | |

Project Homestake Merger Corp. | | | | | | | | |

8.88% due 03/01/234 | | | 240,000 | | | | 243,300 | |

Total Technology | | | | | | | 2,594,763 | |

Total Corporate Bonds | | | | | | | | |

(Cost $42,694,500) | | | | | | | 42,915,446 | |

| | |

SENIOR FLOATING RATE INTERESTS††,8 – 0.2% | | | | | | | | |

Basic Materials – 0.2% | | | | | | | | |

Vertellus Specialties, Inc. | | | | | | | | |

10.50% due 10/30/19 | | | 298,500 | | | | 262,182 | |

Total Senior Floating Rate Interests | | | | | | | | |

(Cost $289,047) | | | | | | | 262,182 | |

Total Investments – 134.1% | | | | | | | | |

(Cost $195,657,019) | | | | | | $ | 200,489,591 | |

Other Assets & Liabilities, net – (34.1)% | | | | | | | (51,042,202 | ) |

Total Net Assets – 100.0% | | | | | | $ | 149,447,389 | |

~ | | The face amount is denominated in U.S. Dollars, unless otherwise noted. |

* | | Non-income producing security. |

† | | Value determined based on Level 1 inputs — See Note 2. |

†† | | Value determined based on Level 2 inputs — See Note 2. |

1 | | All or a portion of these securities have been physically segregated in connection with borrowings. As |

| | | of April 30, 2015, the total value of the positions segregated was $83,468,331. |

2 | | All or a portion of these securities are reserved and/or pledged with the custodian for forward foreign |

| | | currency exchange contracts. As of April 30, 2015, the total amount segregated was $8,399,243. |

See notes to financial statements.

LCM l ADVENT/CLAYMORE ENHANCED GROWTH & INCOME FUND SEMIANNUAL REPORT l 27

PORTFOLIO OF INVESTMENTS (Unaudited) continued | April 30, 2015 |

3 | | Zero coupon rate security. |

4 | | Security is a 144A or Section 4(a)(2) security. The total market value of 144A or Section 4(a)(2) |

| | | securities is $40,554,711 (cost $39,984,128), or 27.1% of total net assets. |

5 | | Security is a step up/step down bond. The coupon increases or decreases at regular intervals until |

| | | the bond reaches full maturity. |

6 | | Security becomes an accreting bond after December 15, 2017 with a 4.00% principal accretion rate, |

| | | and then accretes at a 2.00% principal accretion rate until maturity. |

7 | | Payment-In-Kind toggle notes that give the issuer the option to pay 10.50% interest in cash or 11.25% |

| | | interest in additional Payment-In-Kind toggle notes. |

8 | | Variable rate security. Rate indicated is rate effective at April 30, 2015. |

9 | | Perpetual maturity. |

ADR | American Depositary Receipt |

B.V. | Limited Liability Company |

CAD | Canadian Dollar |

CNY | Chinese Yuan |

EUR | Euro |

GBP | British Pound |

GmbH | Limited Liability |

HKD | Hong Kong Dollar |

JPY | Japanese Yen |

N.V. | Publicly Traded Company |

plc | Public Limited Company |

S.A. | Corporation |

SAB de CV | Publicly Traded Company |

SpA | Limited Share Company |

See notes to financial statements.

28 l LCM l ADVENT/CLAYMORE ENHANCED GROWTH & INCOME FUND SEMIANNUAL REPORT

STATEMENT OF ASSETS AND LIABILITIES (Unaudited) | April 30, 2015 |

ASSETS: | | | |

Investments, at value (Cost $195,657,019) | | $ | 200,489,591 | |

Foreign Currency, at value (Cost $411,018) | | | 398,579 | |

Unrealized appreciation on forward foreign currency exchange contracts | | | 134,168 | |

Receivables: | | | | |

Investments sold | | | 2,734,116 | |

Interest | | | 1,066,602 | |

Dividends | | | 56,810 | |

Tax reclaims | | | 11,500 | |

Total assets | | | 204,891,366 | |

LIABILITIES: | | | | |

Borrowings | | | 50,000,000 | |

Unrealized depreciation on forward foreign currency exchange contracts | | | 1,534,184 | |

Interest due on borrowings | | | 4,158 | |

Payable for: | | | | |

Investments purchased | | | 3,553,278 | |

Investment management fees | | | 84,019 | |

Investment advisory fees | | | 80,735 | |

Administration fees | | | 4,449 | |

Trustee fees | | | 1,667 | |

Other fees | | | 181,487 | |

Total liabilities | | | 55,443,977 | |

NET ASSETS | | $ | 149,447,389 | |

NET ASSETS CONSIST OF: | | | | |

Common Stock, $0.001 par value per share, unlimited number of shares authorized, | | | | |

13,603,025 shares issued and outstanding | | $ | 13,603 | |

Additional paid-in capital | | | 208,387,619 | |

Distributions in excess of net investment income | | | (5,641,275 | ) |

Accumulated net realized loss on investments, written options and foreign | | | | |

currency transactions | | | (56,743,087 | ) |

Net unrealized appreciation on investments, written options and foreign | | | | |

currency translations | | | 3,430,529 | |

NET ASSETS | | $ | 149,447,389 | |

Shares outstanding ($0.001 par value with unlimited amount authorized) | | | 13,603,025 | |

Net asset value, offering price and repurchase price per share | | $ | 10.99 | |

See notes to financial statements.

LCM l ADVENT/CLAYMORE ENHANCED GROWTH & INCOME FUND SEMIANNUAL REPORT l 29

STATEMENT OF OPERATIONS | April 30, 2015 |

For the Period Ended April 30, 2015 (Unaudited)

INVESTMENT INCOME: | | | |

Interest | | $ | 2,256,748 | |

Dividends, net of foreign taxes withheld of $930 | | | 655,227 | |

Total investment income | | | 2,911,975 | |

EXPENSES: | | | | |

Investment management fees | | | 494,500 | |

Investment advisory fees | | | 475,108 | |

Interest expense | | | 303,174 | |

Professional fees | | | 81,488 | |

Trustee fees | | | 78,042 | |

Fund accounting fees | | | 29,908 | |

Administration fees | | | 26,658 | |

Printing fees | | | 20,489 | |

Insurance | | | 17,204 | |

Custodian fees | | | 12,546 | |

NYSE listing fees | | | 11,765 | |

Transfer agent fees | | | 10,207 | |

Other fees | | | 543 | |

Total expenses | | | 1,561,632 | |

Net investment income | | | 1,350,343 | |

NET REALIZED AND UNREALIZED GAIN (LOSS): | | | | |

Net realized gain (loss) on: | | | | |

Investments | | | (3,258,777 | ) |

Foreign currency transactions | | | 5,195,996 | |

Written options | | | (7,556 | ) |

Net realized gain | | | 1,929,663 | |

Net change in unrealized appreciation (depreciation) on: | | | | |

Investments | | | 6,555,756 | |

Foreign currency translations | | | (2,518,384 | ) |

Written options | | | 22,043 | |

Net change in unrealized appreciation | | | 4,059,415 | |

Net realized and unrealized gain | | | 5,989,078 | |

Net increase in net assets resulting from operations | | $ | 7,339,421 | |

See notes to financial statements.

30 l LCM l ADVENT/CLAYMORE ENHANCED GROWTH & INCOME FUND SEMIANNUAL REPORT

STATEMENTS OF CHANGES IN NET ASSETS | April 30, 2015 |

| | | Period Ended | | | | |

| | | April 30, 2015 | | | Year Ended | |

| | | (Unaudited) | | | October 31, 2014 | |

INCREASE (DECREASE) IN NET ASSETS FROM OPERATIONS: | | | | | | |

Net investment income | | $ | 1,350,343 | | | $ | 2,893,637 | |

Net realized gain on investments, written options and foreign | | | | | | | | |

currency transactions | | | 1,929,663 | | | | 7,638,378 | |

Net change in unrealized appreciation (depreciation) on | | | | | | | | |

investments, written options and foreign currency translations | | | 4,059,415 | | | | (7,671,316 | ) |

Net increase in net assets resulting from operations | | | 7,339,421 | | | | 2,860,699 | |

DISTRIBUTIONS TO SHAREHOLDERS FROM: | | | | | | | | |

Net investment income | | | (5,713,271 | ) | | | (11,368,513 | ) |

Return of capital | | | — | | | | (58,028 | ) |

Total distributions | | | (5,713,271 | ) | | | (11,426,541 | ) |

Net increase (decrease) in net assets | | | 1,626,150 | | | | (8,565,842 | ) |

NET ASSETS: | | | | | | | | |

Beginning of period | | | 147,821,239 | | | | 156,387,081 | |

End of period | | $ | 149,447,389 | | | $ | 147,821,239 | |

Distributions in excess of net investment income at end of period | | $ | (5,641,275 | ) | | $ | (1,278,347 | ) |

See notes to financial statements.

LCM l ADVENT/CLAYMORE ENHANCED GROWTH & INCOME FUND SEMIANNUAL REPORT l 31

STATEMENT OF CASH FLOWS | April 30, 2015 |

For the Period Ended April 30, 2015(Unaudited)

Cash Flows from Operating Activities: | | | |

Net increase in net assets resulting from operations | | $ | 7,339,421 | |

Adjustments to Reconcile Net Increase in Net Assets Resulting from Operations to | | | | |

Net Cash Used in Operating and Investing Activities: | | | | |

Stock dividend received from corporate action | | | (97,855 | ) |

Net change in unrealized appreciation on investments | | | (6,555,756 | ) |

Net change in unrealized appreciation on written options | | | (22,043 | ) |

Net change in unrealized depreciation on foreign currency translations | | | 2,518,384 | |

Net realized loss on investments | | | 3,258,777 | |

Purchase of long-term investments | | | (130,526,958 | ) |

Proceeds from sale of long-term investments | | | 127,842,197 | |

Net amortization/accretion of premium/discount | | | 71,755 | |

Net proceeds (purchases) from sale of short-term investments | | | (6,333,069 | ) |

Net decrease in premiums received on written options | | | (46,434 | ) |

Decrease in investments sold receivable | | | 1,127,894 | |

Decrease in interest receivable | | | 76,290 | |

Decrease in dividends receivable | | | 108,735 | |

Decrease in tax reclaims receivable | | | 885 | |

Decrease in other assets | | | 17,030 | |

Increase in interest due on borrowings | | | 72 | |

Decrease in investments purchased payable | | | (5,980,741 | ) |

Increase in investment management fees payable | | | 7 | |

Increase in investment advisory fees payable | | | 7 | |

Decrease in administration fees payable | | | (5 | ) |

Decrease in trustees fees payable | | | (5,267 | ) |

Decrease in other fees | | | (9,168 | ) |

Net Cash Used in Operating and Investing Activities | | | (7,215,842 | ) |

Cash Flows From Financing Activities: | | | | |

Distributions to common shareholders | | | (5,713,271 | ) |

Net Cash Used in Financing Activities | | | (5,713,271 | ) |

Net decrease in cash | | | (12,929,113 | ) |

Cash and cash equivalents (including foreign currency) at Beginning of Period | | | 13,327,692 | |

Cash and cash equivalents (including foreign currency) at End of Period | | $ | 398,579 | |

Supplemental Disclosure of Cash Flow Information: | | | | |

Cash paid during the period for interest | | $ | 303,102 | |

Stock dividend received from corporate action | | $ | 97,855 | |

See notes to financial statements.

32 l LCM l ADVENT/CLAYMORE ENHANCED GROWTH & INCOME FUND SEMIANNUAL REPORT

FINANCIAL HIGHLIGHTS | April 30, 2015 |

| | | Period Ended | | | Year Ended | | | Year Ended | | | Year Ended | | | Year Ended | | | Period Ended | |

| | | April 30, 2015 | | | October 31, | | | October 31, | | | October 31, | | | October 31, | | | October 31, | |

| | | (Unaudited) | | | 2014 | | | 2013 | | | 2012 | | | 2011 | | | 2010 | |

Per Share Data: | | | | | | | | | | | | | | | | | | |

Net asset value, beginning of period | | $ | 10.87 | | | $ | 11.50 | | | $ | 10.60 | | | $ | 10.63 | | | $ | 12.11 | | | $ | 11.72 | |

Income from investment operations: | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment income(a) | | | 0.10 | | | | 0.21 | | | | 0.23 | | | | 0.41 | | | | 0.42 | | | | 0.40 | |

Net gain (loss) on investments (realized and unrealized) | | | 0.44 | | | | — | * | | | 1.51 | | | | 0.45 | | | | (0.84 | ) | | | 1.05 | |

Total from investment operations | | | 0.54 | | | | 0.21 | | | | 1.74 | | | | 0.86 | | | | (0.42 | ) | | | 1.45 | |

Less distributions from: | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | (0.42 | ) | | | (0.84 | ) | | | (0.84 | ) | | | (0.86 | ) | | | (0.47 | ) | | | (1.06 | ) |

Return of capital | | | — | | | | — | * | | | — | | | | (0.03 | ) | | | (0.59 | ) | | | — | |

Total distributions to shareholders | | | (0.42 | ) | | | (0.84 | ) | | | (0.84 | ) | | | (0.89 | ) | | | (1.06 | ) | | | (1.06 | ) |

Net asset value, end of period | | $ | 10.99 | | | $ | 10.87 | | | $ | 11.50 | | | $ | 10.60 | | | $ | 10.63 | | | $ | 12.11 | |

Market value, end of period | | $ | 9.62 | | | $ | 9.51 | | | $ | 10.03 | | | $ | 9.46 | | | $ | 9.73 | | | $ | 11.38 | |

| | |

Total Return(b) | | | | | | | | | | | | | | | | | | | | | | | | |

Net asset value | | | 5.09 | % | | | 1.58 | % | | | 17.10 | % | | | 8.59 | % | | | -4.18 | % | | | 13.14 | % |

Market value | | | 5.78 | % | | | 2.90 | % | | | 15.56 | % | | | 6.78 | % | | | -6.27 | % | | | 19.37 | % |

Ratios/Supplemental Data: | | | | | | | | | | | | | | | | | | | | | | | | |

Net assets, end of period (in thousands) | | $ | 149,447 | | | $ | 147,821 | | | $ | 156,387 | | | $ | 144,222 | | | $ | 144,533 | | | $ | 164,684 | |

Ratio to average net assets of: | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | 1.87 | %(f) | | | 1.86 | % | | | 2.05 | % | | | 3.85 | % | | | 3.54 | % | | | 3.43 | % |

Total expenses(c) | | | 2.16 | %(f) | | | 2.10 | %(e) | | | 2.18 | %(e) | | | 2.32 | %(e) | | | 2.11 | % | | | 2.10 | % |

Portfolio turnover rate | | | 68 | % | | | 344 | % | | | 321 | % | | | 141 | % | | | 121 | % | | | 127 | % |

Senior Indebtedness | | | | | | | | | | | | | | | | | | | | | | | | |

Total Borrowings outstanding (in thousands) | | $ | 50,000 | | | $ | 50,000 | | | $ | 50,000 | | | $ | 50,000 | | | $ | 50,000 | | | $ | 50,000 | |

Asset Coverage per $1,000 of indebtedness(d) | | $ | 3,989 | | | $ | 3,956 | | | $ | 4,128 | | | $ | 3,884 | | | $ | 3,891 | | | $ | 4,293 | |

See notes to financial statements.