UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-21504

Advent/Claymore Enhanced Growth & Income Fund

(Exact name of registrant as specified in charter)

| 2455 Corporate West Drive, Lisle, IL | 60532 | |

| (Address of principal executive offices) | (Zip code) | |

Robert White, Treasurer

Advent/Claymore Enhanced Growth & Income Fund

2455 Corporate West Drive, Lisle, IL 60532

(Name and address of agent for service)

Registrant’s telephone number, including area code: (630) 505-3700

Date of fiscal year end: October 31

Date of reporting period: April 30, 2006

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

The registrant’s semi-annual report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 is as follows: [Provide full text of semi-annual report.]

SemiAnnual Report | Advent/Claymore Enhanced | |||

| LCM | ||||

April 30, 2006 Unaudited | Growth & Income Fund |

|  |

LCM | Advent/Claymore Enhanced Growth & Income Fund

Fund Summary As of April 30, 2006 (unaudited)

Fund Statistics | |||||||

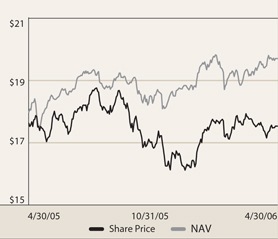

Share Price | $ | 17.51 | |||||

Common Share Net Asset Value | $ | 19.69 | |||||

Premium/Discount to NAV | -11.07 | % | |||||

Net Assets ($000) | $ | 267,343 | |||||

Total Returns (Inception 1/31/05) | Market | NAV | |||||

Six-Month – non-annualized | 8.95 | % | 10.95 | % | |||

One Year | 8.85 | % | 14.31 | % | |||

Since Inception – average annual | -3.36 | % | 9.58 | % | |||

Top Ten Sectors | % of Total Investments | ||||||

Financial Services | 11.0 | % | |||||

Telecommunications | 10.9 | % | |||||

Oil and Gas | 10.9 | % | |||||

Aluminum, Steel and Other Metals | 8.3 | % | |||||

Beverages, Food and Tobacco | 7.9 | % | |||||

Mining | 7.7 | % | |||||

Electronic Equipment and Components | 6.2 | % | |||||

Transportation | 5.5 | % | |||||

Special Purpose Entity | 4.6 | % | |||||

Pharmaceuticals | 4.4 | % | |||||

Top Ten Issuers | % of Total Investments | ||||||

Dow Jones CDX HY | 4.6 | % | |||||

Altria Group, Inc. | 3.8 | % | |||||

Freeport-McMoRan Copper & Gold, Inc., Class B | 2.9 | % | |||||

Ocean Rig ASA | 2.6 | % | |||||

Husky Energy, Inc. | 2.4 | % | |||||

Cameco Corp. | 2.3 | % | |||||

Sprint Nextel Corp. | 2.2 | % | |||||

Lucent Technologies Capital Trust I | 2.2 | % | |||||

Yahoo!, Inc. | 2.0 | % | |||||

Bank of America Corp. | 1.8 | % | |||||

Share Price & NAV Performance

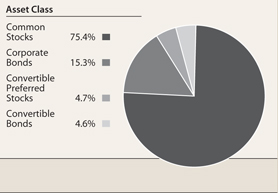

Portfolio Composition (% of Total Investments)

2 | SemiAnnual Report | April 30, 2006

LCM | Advent/Claymore Enhanced Growth & Income Fund

Portfolio of Investments | April 30, 2006 (unaudited)

| Number of Shares | Value | ||||

| Common Stocks – 79.3% | |||||

| Aluminum, Steel and Other Metals – 8.8% | |||||

| 150,000 | Assa Abloy AB, Class B (Sweden) | $ | 2,894,067 | ||

| 160,000 | Cameco Corp. (Canada) (a) | 6,504,000 | |||

| 75,000 | Companhia Siderurgica Nacional SA ADR (Brazil) (a) | 2,640,750 | |||

| 125,000 | Freeport-McMoRan Copper & Gold, Inc., Class B (a)(b) | 8,072,500 | |||

| 2,606,000 | Minmetals Resources Ltd. (Hong Kong) (c) | 781,432 | |||

| 30,000 | Phelps Dodge Corp. (a) | 2,585,700 | |||

| 23,478,449 | |||||

| Beverages, Food and Tobacco – 8.3% | |||||

| 145,000 | Altria Group, Inc. (a)(b) | 10,608,200 | |||

| 438,000 | Aker Seafoods ASA (Norway) | 2,772,286 | |||

| 50,000 | Bunge Ltd. (Bermuda) (a) | 2,667,500 | |||

| 100,000 | Coca-Cola Enterprises, Inc. (a) | 1,953,000 | |||

| 40,100 | Corn Products International, Inc. (a) | 1,122,800 | |||

| 3,046,875 | Pan Fish ASA (Norway) (c) | 3,087,566 | |||

| 22,211,352 | |||||

| Chemicals – 0.7% | |||||

| 40,000 | E.I. Du Pont de Nemours & Co. (a) | 1,764,000 | |||

| Communications, Media and Entertainment – 0.6% | |||||

| 10,000 | Nintendo Co., Ltd. (Japan) | 1,488,616 | |||

| Computers – Software and Peripherals – 2.1% | |||||

| 20,000 | Apple Computer, Inc. (a)(c) | 1,407,800 | |||

| 50,000 | Komag, Inc. (a)(c) | 2,102,000 | |||

| 80,000 | Square Enix Co., Ltd. (Japan) | 1,961,471 | |||

| 5,471,271 | |||||

| Diversified Manufacturing Operations – 0.3% | |||||

| 239,000 | Kawasaki Heavy Industries, Ltd. (Japan) (c) | 864,334 | |||

| Electronic Equipment and Components – 5.4% | |||||

| 100,000 | ATI Technologies, Inc. (Canada) (a)(c) | 1,552,000 | |||

| 25,000 | Hitachi, Ltd. ADR (Japan) (a) | 1,860,250 | |||

| 50,000 | Hoya Corp. (Japan) | 2,018,389 | |||

| 38,000 | Nidec Corp. (Japan) | 2,921,541 | |||

| 46,600 | Nihon Dempa Kogyo Co., Ltd. (Japan) | 1,987,233 | |||

| 30,000 | Novellus Systems, Inc. (a)(c) | 741,000 | |||

| 10,000 | TDK Corp. (Japan) | 834,501 | |||

| 400,000 | Toshiba Corp. (Japan) | 2,539,405 | |||

| 14,454,319 | |||||

| Financial Services – 9.3% | |||||

| 100,000 | Bank of America Corp. (a) | 4,992,000 | |||

| 15,000 | Charles Schwab Corp. (The) (a) | 268,500 | |||

| 50,000 | Federated Investors, Inc., Class B (a) | 1,755,000 | |||

| 50,000 | Fifth Third Bancorp (a) | 2,021,000 | |||

| 20,000 | HSBC Holdings PLC ADR (United Kingdom) (a) | 1,733,600 | |||

| 75,000 | JPMorgan Chase & Co. (a)(b) | 3,403,500 | |||

| 200,000 | Mitsubishi UFJ Financial Group, Inc. ADR (Japan) (a) | 3,132,000 | |||

| 50,000 | New York Community Bancorp, Inc. (a) | 860,500 | |||

| 20,000 | T. Rowe Price Group, Inc. (a) | 1,683,800 | |||

| 175,000 | TD Ameritrade Holding Corp. (a)(c) | 3,248,000 | |||

| 100,000 | UCBH Holdings, Inc. (a) | 1,769,000 | |||

| 24,866,900 | |||||

| Health Care Products and Services – 1.1% | |||||

| 150,000 | MDS, Inc. (Canada) | 3,048,057 | |||

| Household and Personal Care Products – 0.5% | |||||

| 25,000 | Procter & Gamble Co. (The) (a) | 1,455,250 | |||

| Household Durables – 0.6% | |||||

| 105,714 | Sealy Corp. (a)(c) | 1,686,138 | |||

| Industrial Services – 0.2% | |||||

| 60,000 | Arrow Seismic ASA (Norway) (c) | 534,197 | |||

| Internet – 2.6% | |||||

| 70,000 | Expedia, Inc. (a)(c) | 1,305,500 | |||

| 175,000 | Yahoo!, Inc. (a)(b)(c) | 5,736,500 | |||

| 7,042,000 | |||||

| Leisure and Entertainment – 0.9% | |||||

| 50,000 | Boyd Gaming Corp. (a) | 2,491,000 | |||

| Mining – 6.7% | |||||

| 300,000 | Alamos Gold, Inc. (Canada) (c) | 2,824,506 | |||

| 500,000 | Bema Gold Corp. (Canada) (c) | 2,830,000 | |||

| 100,000 | Eldorado Gold Corp. (Canada) (a)(c) | 521,173 | |||

| 64,400 | Frontera Copper Corp. (Canada) (c)(d) | 246,554 | |||

| 70,000 | Glamis Gold Ltd. (a)(c) | 2,747,500 | |||

| 50,000 | Gold Fields Ltd. ADR (South Africa) (a) | 1,270,500 | |||

| 176,500 | Hecla Mining Co. (a)(c) | 1,141,955 | |||

| 50,000 | Meridian Gold, Inc. (Canada) (a)(c) | 1,625,000 | |||

| 120,000 | Silver Wheaton Corp. (Canada) (a)(c) | 1,348,800 | |||

| 20,000 | Southern Copper Corp. (a) | 1,981,000 | |||

| 20,000 | Teck Cominco Ltd. (Canada) | 1,375,753 | |||

| 17,912,741 | |||||

See notes to financial statements.

SemiAnnual Report | April 30, 2006 | 3

LCM | Advent/Claymore Enhanced Growth & Income Fund l Portfolio of Investments (unaudited) continued

Number of Shares | Value | ||||

| Oil and Gas – 10.3% | |||||

| 61,011 | Addax Petroleum Corp. (Canada) (c) | $ | 1,629,065 | ||

| 40,000 | Calfrac Well Services Ltd. (Canada) | 1,288,653 | |||

| 25,000 | EnCana Corp. (Canada) | 1,251,250 | |||

| 75,000 | Encore Acquisition Co. (a)(c) | 2,298,000 | |||

| 116,011 | Husky Energy, Inc. (Canada) | 6,812,301 | |||

| 25,000 | National-Oilwell Varco, Inc. (a)(c) | 1,724,250 | |||

| 531,600 | Ocean Rig ASA (Norway) (c) | 4,216,657 | |||

| 90,000 | SeaDrill Ltd. (Bermuda) (c) | 1,522,461 | |||

| 20,000 | Suncor Energy, Inc. (Canada) (a) | 1,714,800 | |||

| 25,000 | Sunoco, Inc. (a) | 2,026,000 | |||

| 70,000 | Western Refining, Inc. (a) | 1,416,100 | |||

| 31,600 | YPF SA ADR (Argentina) | 1,617,920 | |||

| 27,517,457 | |||||

| Pharmaceuticals – 3.3% | |||||

| 50,000 | Biogen Idec, Inc. (a)(b)(c) | 2,242,500 | |||

| 125,000 | CV Therapeutics, Inc. (a)(c) | 2,481,250 | |||

| 25,000 | Genentech, Inc. (a)(c) | 1,992,750 | |||

| 32,700 | Takeda Pharmaceutical Co., Ltd. (Japan) | 1,992,925 | |||

| 8,709,425 | |||||

| Real Estate Investment Trusts – 1.7% | |||||

| 50,000 | Global Signal, Inc. (a) | 2,485,000 | |||

| 60,000 | Mills Corp. (The) (a) | 1,914,600 | |||

| 4,399,600 | |||||

| Retail – Specialty Stores – 0.7% | |||||

| 100,000 | Gap, Inc. (The) (a) | 1,809,000 | |||

| Telecommunications – 8.9% | |||||

| 25,000 | ALLTEL Corp. (a)(b) | 1,609,250 | |||

| 100,000 | AT&T, Inc. (a) | 2,621,000 | |||

| 30,000 | BCE, Inc. (Canada) (a) | 741,600 | |||

| 25,000 | China Unicom Ltd. ADR (Hong Kong) (a) | 218,250 | |||

| 100,000 | Magyar Telekom Telecommunications ADR (Hungary) | 2,272,000 | |||

| 50,000 | Motorola, Inc. (a) | 1,067,500 | |||

| 198,000 | NTT DoCoMo, Inc. ADR (Japan) (a) | 2,954,160 | |||

| 50,000 | Orascom Telecom Holding SAE GDR (Egypt) | 2,656,760 | |||

| 250,000 | Sprint Nextel Corp. (a) | 6,200,000 | |||

| 100,000 | Telefonaktiebolaget LM Ericsson ADR (Sweden) (a) | 3,547,000 | |||

| 23,887,520 | |||||

| Transportation – 5.8% | |||||

| 105,000 | AMR Corp. (a)(c) | 2,587,200 | |||

| 50,000 | Frontline Ltd. (Bermuda) (a) | 1,608,000 | |||

| 65,000 | General Maritime Corp. (Marshall Islands) (a) | 2,159,300 | |||

| 180,400 | Golar LNG Ltd. (Norway) (c) | 2,569,842 | |||

| 50,000 | Kansas City Southern (a)(b)(c) | 1,215,000 | |||

| 125,000 | SkyWest, Inc. (a) | 2,946,250 | |||

| 100,000 | Southwest Airlines Co. (a)(b) | 1,622,000 | |||

| 20,700 | US Airways Group, Inc. (a)(c) | 895,482 | |||

| 15,603,074 | |||||

| Utilities – 0.5% | |||||

| 24,700 | Edison International (a)(b) | 998,127 | |||

| 20,000 | Nalco Holding Co. (a)(c) | 377,000 | |||

| 1,375,127 | |||||

| Total Common Stocks | |||||

| (Cost $205,539,370) | 212,069,827 | ||||

| Convertible Preferred Stocks – 4.9% | |||||

| Chemicals – 0.9% | |||||

| 55,000 | Huntsman Corp., 5.00%, 2008 (a) | 2,365,000 | |||

| Communications Equipment – 2.3% | |||||

| 6,000 | Lucent Technologies Capital Trust I, 7.75%, 2017 (a) | 6,182,250 | |||

| Health Care Products and Services – 0.7% | |||||

| 2,000 | HEALTHSOUTH Corp., 6.50% (d) | 2,050,000 | |||

| Utilities – 1.0% | |||||

| 2,000 | NRG Energy, Inc., Ser. 4 (2), 4.00% (a) | 2,635,352 | |||

| Total Convertible Preferred Stocks | |||||

| (Cost $12,563,847) | 13,232,602 | ||||

See notes to financial statements.

4 | SemiAnnual Report | April 30, 2006

LCM | Advent/Claymore Enhanced Growth & Income Fund | Portfolio of Investments (unaudited) continued

Principal Amount | Value | |||||

| Corporate Bonds – 16.2% | ||||||

| Communications, Media and Entertainment – 1.4% | ||||||

$3,000,000 | AMC Entertainment, Inc., CCC+ | |||||

| 9.875%, 2/01/12, Senior Subordinated Notes (a)(b) | $ | 3,030,000 | ||||

700,000 | Affinion Group, Inc., B- | |||||

| 11.50%, 10/15/15, Senior Subordinated Notes (d) | 717,500 | |||||

| 3,747,500 | ||||||

| Electronic Equipment and Components – 0.8% | ||||||

2,000,000 | Spansion, Inc., B | |||||

| 11.25%, 1/15/16, Senior Notes (d) | 2,060,000 | |||||

| Financial Services – 1.1% | ||||||

3,000,000 | General Motors Acceptance Corp., BB | |||||

| 8.00%, 11/01/31, Notes (a)(b) | 2,844,636 | |||||

| Investment Companies – 0.4% | ||||||

1,000,000 | RBS Participacoes SA, B | |||||

| 11.00%, 4/01/07, Company Guarantee Notes (Brazil) | 1,020,000 | |||||

| Leisure and Entertainment – 0.7% | ||||||

2,000,000 | Six Flags, Inc., CCC | |||||

| 9.625%, 6/01/14, Senior Notes (a)(b) | 2,025,000 | |||||

| Mining – 1.4% | ||||||

3,500,000 | Hudson Bay Mining and Smelting Co., Ltd., B | |||||

| 9.625%, 1/15/12, Secured Notes (Canada) | 3,858,750 | |||||

| Oil and Gas – 1.2% | ||||||

133,000 | Brigham Exploration Co., B- | |||||

| 9.625%, 5/01/14, Senior Notes (d) | 133,000 | |||||

3,000,000 | Ocean Rig ASA, NR | |||||

| 8.99%, 4/04/11, Senior Notes (Norway) (e) | 3,007,500 | |||||

| 3,140,500 | ||||||

| Retail – Specialty Stores – 1.0% | ||||||

2,000,000 | Harry & David Holdings, Inc., B- | |||||

| 9.00%, 3/01/13, Company Guarantee Notes | 1,865,000 | |||||

888,000 | The Jean Coutu Group, Inc., B- | |||||

| 8.50%, 8/01/14, Senior Subordinated Notes (Canada) | 832,500 | |||||

| 2,697,500 | ||||||

| Special Purpose Entity – 4.9% | ||||||

12,599,996 | Dow Jones CDX HY, Ser. 3-4, NR | |||||

| 10.50%, 12/29/09 (d) | 12,977,995 | |||||

| Telecommunications – 2.6% | ||||||

1,500,000 | CCH I LLC, CCC- | |||||

| 11.00%, 10/01/15, Company Guarantee Notes | 1,335,000 | |||||

1,500,000 | Hawaiian Telcom Communications, Inc., CCC+ | |||||

| 12.50%, 5/01/15, Senior Subordinated Notes (d) | 1,582,500 | |||||

3,000,000 | Level 3 Communications, Inc., CCC- | |||||

| 9.125%, 5/01/08, Senior Notes | 3,000,000 | |||||

1,000,000 | Nortel Networks Corp., B- | |||||

| 6.875%, 9/01/23, Notes (Canada) | 932,500 | |||||

| 6,850,000 | ||||||

| Utilities – 0.7% | ||||||

$2,000,000 | AES Dominicana Energia Finance SA, B- | |||||

| 11.00%, 12/13/15, Senior Notes (Dominican Republic) | 1,985,000 | |||||

| Total Corporate Bonds | ||||||

| (Cost $42,182,536) | 43,206,881 | |||||

| Convertible Bonds – 4.8% | ||||||

| Computers – Software and Peripherals – 0.8% | ||||||

3,000,000 | Gateway, Inc., NR | |||||

| 2.00%, 12/31/11, Senior Convertible Notes (a) | 2,148,750 | |||||

| Electronic Equipment and Components – 0.4% | ||||||

1,000,000 | Mentor Graphics Corp., NR | |||||

| 6.36%, 8/06/23, Subordinated Convertible Notes (a)(e) | 965,000 | |||||

| Financial Services – 1.2% | ||||||

62,138 | Merrill Lynch & Co., Inc., Ser. ECA, A+ | |||||

| 8.00%, 10/26/06, Notes (d)(f) | 3,115,599 | |||||

| Health Care Products and Services – 0.3% | ||||||

1,000,000 | LifePoint Hospitals, Inc., B+ | |||||

| 3.25%, 8/15/25, Senior Subordinated Convertible Notes (a) | 848,750 | |||||

| Pharmaceuticals – 1.3% | ||||||

4,000,000 | Sepracor, Inc., B- | |||||

| 0.00%, 10/15/24, Senior Subordinated Convertible Notes (a) | 3,600,000 | |||||

| Utilities —0.8% | ||||||

2,000,000 | Dominion Resources, Inc., Ser. C, BBB | |||||

| 2.125%, 12/15/23, Senior Unsecured Notes (a) | 2,137,500 | |||||

| Total Convertible Bonds | ||||||

| (Cost $12,778,446) | 12,815,599 | |||||

| Total Investments – 105.2% | ||||||

| (Cost $ 273,064,199) | 281,324,909 | |||||

| Liabilities in excess of other assets – (3.7%) | (10,010,308 | ) | ||||

| Total Options Written – (1.5%) | (3,971,845 | ) | ||||

| Net Assets – 100.0% | $ | 267,342,756 | ||||

ADR – American Depositary Receipt.

GDR – Global Depositary Receipt.

PLC – Public Limited Company.

| (a) | All or a portion of this security position represents cover (directly or through conversion rights) for outstanding options written. |

| (b) | All or a portion of these securities with an aggregate market value of $36,091,073 have been physically segregated to collateralize written call options. |

| (c) | Non-income producing security. |

| (d) | Securities are exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers. At April 30, 2006, these securities amounted to 8.6% of net assets. |

| (e) | Variable rate or floating security. The rate shown is as of April 30, 2006. |

| (f) | Variable principal amount dependent upon the value of EnCana stock. |

Ratings shown are per Standard & Poor’s. Securities classified as NR are not rated by Standard & Poor’s.

See notes to financial statements.

SemiAnnual Report | April 30, 2006 | 5

LCM | Advent/Claymore Enhanced Growth & Income Fund | Portfolio of Investments (unaudited) continued

Contracts | Call Options Written(a) | Expiration Date | Exercise Price | Market Value | ||||||

| 250 | ALLTEL Corp. | June 2006 | $ | 65.00 | $ | 37,500 | ||||

| 1,000 | Altria Group, Inc. | June 2006 | 80.00 | 25,000 | ||||||

| 1 | AMC Entertainment, Inc. (b) | December 2006 | 99.50 | 72,900 | ||||||

| 401 | AMR Corp. | June 2006 | 30.00 | 20,050 | ||||||

| 200 | Apple Computer, Inc. | May 2006 | 72.50 | 29,000 | ||||||

| 500 | AT&T, Inc. | October 2006 | 27.50 | 27,500 | ||||||

| 250 | ATI Technologies, Inc. | June 2006 | 17.50 | 6,250 | ||||||

| 500 | Bank of America Corp. | June 2006 | 50.00 | 50,000 | ||||||

| 500 | Bank of America Corp. | May 2006 | 47.50 | 127,500 | ||||||

| 500 | BCE, Inc. | June 2006 | 25.00 | 25,000 | ||||||

| 500 | Biogen Idec, Inc. | June 2006 | 50.00 | 17,500 | ||||||

| 200 | Boyd Gaming Corp. | June 2006 | 55.00 | 8,000 | ||||||

| 200 | Bunge Ltd. | May 2006 | 55.00 | 12,000 | ||||||

| 828 | Cameco Corp. | June 2006 | 40.00 | 248,400 | ||||||

| 350 | Cameco Corp. | May 2006 | 40.00 | 77,000 | ||||||

| 150 | Charles Schwab Corp. (The) | May 2006 | 17.50 | 10,500 | ||||||

| 100 | China Unicom Ltd. ADR | July 2006 | 10.00 | 1,250 | ||||||

| 100 | Coca-Cola Enterprises, Inc. | May 2006 | 20.00 | 1,000 | ||||||

| 500 | Companhia Siderurgica Nacional SA ADR | May 2006 | 30.00 | 270,000 | ||||||

| 200 | Corn Products International, Inc. | July 2006 | 30.00 | 20,000 | ||||||

| 700 | CV Therapeutics, Inc. | July 2006 | 30.00 | 10,500 | ||||||

| 100 | Dominion Resources, Inc. | May 2006 | 75.00 | 10,500 | ||||||

| 300 | E.I. Du Pont de Nemours & Co. | June 2006 | 45.00 | 16,500 | ||||||

| 250 | Edison International | May 2006 | 45.00 | 1,250 | ||||||

| 7 | Eldorado Gold Corp. | July 2006 | 7.50 | 350 | ||||||

| 700 | Encore Acquisition Co. | May 2006 | 35.00 | 87,500 | ||||||

| 700 | Expedia, Inc. | May 2006 | 20.00 | 21,000 | ||||||

| 400 | Federated Investors, Inc. | May 2006 | 40.00 | 10,000 | ||||||

| 100 | Fifth Third Bancorp. | May 2006 | 45.00 | 500 | ||||||

| 500 | Freeport-McMoRan Copper & Gold, Inc. | August 2006 | 60.00 | 450,000 | ||||||

| 500 | Freeport-McMoRan Copper & Gold, Inc. | August 2006 | 65.00 | 315,000 | ||||||

| 100 | Frontline Ltd. | June 2006 | 35.00 | 3,500 | ||||||

| 100 | Gap, Inc. (The) | May 2006 | 20.00 | 750 | ||||||

| 130 | Gateway, Inc. | January 2007 | 5.00 | 1,300 | ||||||

| 200 | Genentech, Inc. | May 2006 | 85.00 | 8,000 | ||||||

| 250 | General Maritime Corp. | June 2006 | 35.00 | 17,500 | ||||||

| 1 | General Motors Acceptance Corp. (b) | December 2006 | 96.00 | 104,370 | ||||||

| 700 | Glamis Gold Ltd. | May 2006 | 30.00 | 630,000 | ||||||

| 250 | Global Signal, Inc. | May 2006 | 50.00 | 22,500 | ||||||

| 250 | Gold Fields Ltd. ADR | June 2006 | 30.00 | 13,750 | ||||||

| 20 | Hecla Mining Co. | June 2006 | 7.50 | 700 | ||||||

| 250 | Hitachi Ltd. ADR | May 2006 | 75.00 | 30,625 | ||||||

| 200 | HSBC Holdings PLC ADR | May 2006 | 85.00 | 42,000 | ||||||

| 200 | Huntsman Corp. | May 2006 | 22.50 | 3,000 | ||||||

| 600 | JPMorgan Chase & Co. | May 2006 | 42.50 | 180,000 | ||||||

| 500 | Kansas City Southern | May 2006 | 25.00 | 27,500 | ||||||

| 200 | Komag, Inc. | May 2006 | 45.00 | 16,000 | ||||||

| 100 | LifePoint Hospitals, Inc. | June 2006 | 35.00 | 3,000 | ||||||

| 400 | Lucent Technologies, Inc. | January 2007 | 5.00 | 2,000 | ||||||

| 100 | Mentor Graphics Corp. | July 2006 | 15.00 | 2,500 | ||||||

| 250 | Meridian Gold, Inc. | May 2006 | 35.00 | 16,250 | ||||||

| 600 | Mills Corp. (The) | June 2006 | 45.00 | 15,000 | ||||||

| 300 | Mitsubishi UFJ Financial Group, Inc. ADR | June 2006 | 17.50 | 3,000 | ||||||

| 500 | Motorola, Inc. | June 2006 | 25.00 | 3,750 | ||||||

| 200 | Nalco Holding Co. | June 2006 | 20.00 | 7,000 | ||||||

| 100 | National-Oilwell Varco, Inc. | May 2006 | 75.00 | 7,000 | ||||||

| 250 | New York Community Bancorp, Inc. | June 2006 | 17.50 | 8,750 | ||||||

| 300 | Novellus Systems, Inc. | May 2006 | 25.00 | 16,500 | ||||||

| 200 | NRG Energy, Inc. | June 2006 | 50.00 | 15,500 | ||||||

| 200 | NTT DoCoMo, Inc. ADR | July 2006 | 17.50 | 2,000 | ||||||

| 100 | NTT DoCoMo, Inc. ADR | May 2006 | 15.00 | 2,500 | ||||||

| 300 | Phelps Dodge Corp. | May 2006 | 90.00 | 45,000 | ||||||

| 250 | Procter & Gamble Co. (The) | May 2006 | 60.00 | 7,500 | ||||||

| 100 | Sealy Corp. | June 2006 | 17.50 | 2,000 | ||||||

| 250 | Sepracor, Inc. | May 2006 | 50.00 | 15,000 | ||||||

| 176 | Silver Wheaton Corp. | May 2006 | 10.00 | 25,520 | ||||||

| 1 | Six Flags, Inc. (b) | December 2006 | 101.50 | 30,100 | ||||||

| 200 | SkyWest, Inc. | July 2006 | 30.00 | 4,000 | ||||||

| 200 | Southern Copper Corp. | May 2006 | 100.00 | 52,000 | ||||||

| 710 | Southwest Airlines Co. | June 2006 | 17.50 | 14,200 | ||||||

| 500 | Sprint Nextel Corp. | June 2006 | 25.00 | 37,500 | ||||||

| 200 | Suncor Energy, Inc. | May 2006 | 90.00 | 30,000 | ||||||

| 200 | Sunoco, Inc. | May 2006 | 85.00 | 25,000 | ||||||

| 200 | T. Rowe Price Group, Inc. | July 2006 | 80.00 | 134,000 | ||||||

| 466 | TD Ameritrade Holding Corp. | May 2006 | 22.50 | 2,330 | ||||||

| 1,000 | Telefonaktiebolaget LM Ericsson ADR | May 2006 | 35.00 | 100,000 | ||||||

| 250 | UCBH Holdings, Inc. | September 2006 | 20.00 | 8,750 | ||||||

| 200 | US Airways Group, Inc. | May 2006 | 45.00 | 35,000 | ||||||

| 200 | Western Refining, Inc. | May 2006 | 22.50 | 4,500 | ||||||

| 1,750 | Yahoo!, Inc. | July 2006 | 35.00 | 183,750 | ||||||

| Total Call Options Written | ||||||||||

| (Premiums received $2,077,822) | $ | 3,971,845 | ||||||||

| (a) | Non-income producing security. |

| (b) | Each contract represents the entire principal amount of the fixed-income security that covers the written option. |

See notes to financial statements.

6 | SemiAnnual Report | April 30, 2006

LCM | Advent/Claymore Enhanced Growth & Income Fund

Statement of Assets and Liabilities | April 30, 2006 (unaudited)

Assets | ||||

Investments, at value (cost $273,064,199) | $ | 281,324,909 | ||

Foreign currency, at value (cost $18,577) | 18,568 | |||

Cash | 34,195,812 | |||

Receivable for securities sold | 6,174,483 | |||

Dividends and interest receivable | 2,110,203 | |||

Other assets | 29,000 | |||

Total assets | 323,852,975 | |||

Liabilities | ||||

Payable for securities purchased | 51,994,860 | |||

Options written, at value (premiums received of $2,077,822) | 3,971,845 | |||

Investment Management fee payable | 111,262 | |||

Investment Advisory fee payable | 106,899 | |||

Net unrealized depreciation on forward currency contracts | 12,944 | |||

Accrued expenses and other liabilities | 312,409 | |||

Total liabilities | 56,510,219 | |||

Net Assets | $ | 267,342,756 | ||

Composition of Net Assets | ||||

Common stock, $.001 par value per share; unlimited number of shares authorized, 13,580,240 shares issued and outstanding | $ | 13,580 | ||

Additional paid-in capital | 258,826,004 | |||

Accumulated net realized gain on investments, options and foreign currency transactions | 9,243,094 | |||

Accumulated unrealized appreciation on investments, options and foreign currency translation | 6,326,004 | |||

Accumulated undistributed net investment income | (7,065,926 | ) | ||

Net Assets | $ | 267,342,756 | ||

Net Asset Value | ||||

(based on 13,580,240 common shares outstanding) | $ | 19.69 | ||

See notes to financial statements.

SemiAnnual Report | April 30, 2006 | 7

LCM | Advent/Claymore Enhanced Growth & Income Fund

Statement of Operations | For the six months ended April 30, 2006 (unaudited)

Investment Income | |||||||

Dividends (net of foreign withholding taxes of $139,187) | $ | 3,277,706 | |||||

Interest | 2,182,141 | ||||||

Total income | $ | 5,459,847 | |||||

Expenses | |||||||

Investment Management fee | 655,744 | ||||||

Investment Advisory fee | 630,029 | ||||||

Custodian fee | 78,943 | ||||||

Professional fees | 73,463 | ||||||

Trustees’ fees and expenses | 64,942 | ||||||

Printing expense | 51,737 | ||||||

Administration fee | 40,592 | ||||||

Fund accounting | 39,361 | ||||||

Transfer agent fee | 18,552 | ||||||

Insurance | 14,858 | ||||||

NYSE listing fee | 10,402 | ||||||

Miscellaneous | 4,619 | ||||||

Total expenses | 1,683,242 | ||||||

Net investment income | 3,776,605 | ||||||

Realized and Unrealized Gain (Loss) on Investments, Options and Foreign Currency Transactions | |||||||

Net realized gain (loss) on: | |||||||

Investments | 5,411,684 | ||||||

Options | 1,986,036 | ||||||

Foreign currency forwards and currency transactions | (782,554 | ) | |||||

Net change in unrealized appreciation (depreciation) on: | |||||||

Investments | 18,536,962 | ||||||

Options | (2,030,424 | ) | |||||

Foreign currency forwards and currency transactions | (40,254 | ) | |||||

Net gain on investments, options and foreign currency transactions | 23,081,450 | ||||||

Net Increase in Net Assets Resulting from Operations | $ | 26,858,055 | |||||

See notes to financial statements.

8 | SemiAnnual Report | April 30, 2006

LCM | Advent/Claymore Enhanced Growth & Income Fund

Statement of Changes in Net Assets |

| For the Six Months Ended April 30, 2006 (Unaudited) | For the Period October 31, 2005 | |||||||

Increase in Net Assets from Operations | ||||||||

Net investment income | $ | 3,776,605 | $ | 6,402,515 | ||||

Net realized gain on investments, options and foreign currency transactions | 6,615,166 | 7,111,266 | ||||||

Net change in unrealized appreciation (depreciation) on investments, options and foreign currency translation | 16,466,284 | (10,140,280 | ) | |||||

Net increase in net assets resulting from operations | 26,858,055 | 3,373,501 | ||||||

Distributions to Common Shareholders from | ||||||||

Net investment income | (10,864,192 | ) | (10,864,192 | ) | ||||

Capital Share Transactions | ||||||||

Proceeds from the issuance of common shares | – | 259,282,500 | ||||||

Common share offering costs charged to paid-in capital | – | (543,000 | ) | |||||

Net increase from capital share transactions | – | 258,739,500 | ||||||

Total increase in net assets | 15,993,863 | 251,248,809 | ||||||

Net Assets | ||||||||

Beginning of period | 251,348,893 | 100,084 | ||||||

End of period (including undistributed net investment income of ($7,065,926) and $21,661, respectively) | $ | 267,342,756 | $ | 251,348,893 | ||||

| * | Commencement of investment operations. |

See notes to financial statements.

SemiAnnual Report | April 30, 2006 | 9

LCM | Advent/Claymore Enhanced Growth & Income Fund

Financial Highlights |

Per share operating performance for a common share outstanding throughout the period | For the Six Months Ended | For the Period through | ||||||

Net asset value, beginning of period | $ | 18.51 | $ | 19.10 | (a) | |||

Income from investment operations | ||||||||

Net investment income(b) | 0.28 | 0.47 | ||||||

Net realized and unrealized gain (loss) on investments, options and foreign currency transactions | 1.70 | (0.22 | ) | |||||

Total from investment operations | 1.98 | 0.25 | ||||||

Common shares’ offering expenses charged to paid-in capital | – | (0.04 | ) | |||||

Distributions to Common Shareholders | ||||||||

Net investment income | (0.80 | ) | (0.80 | ) | ||||

Net asset value, end of period | $ | 19.69 | $ | 18.51 | ||||

Market value, end of period | $ | 17.51 | $ | 16.83 | ||||

Total investment return(c) | ||||||||

Net asset value | 10.95 | % | 1.12 | % | ||||

Market value | 8.95 | % | -12.08 | % | ||||

Ratios and supplemental data | ||||||||

Net assets, end of period (thousands) | $ | 267,343 | $ | 251,349 | ||||

Ratio of net expenses to average net assets | 1.31 | %(d) | 1.38 | %(d) | ||||

Ratio of net investment income to average net assets | 2.94 | %(d) | 3.37 | %(d) | ||||

Portfolio turnover rate | 258 | % | 246 | % | ||||

| * | Commencement of investment operations. |

| (a) | Before deduction of offering expenses charged to capital. |

| (b) | Based on average shares outstanding during the period. |

| (c) | Total investment return is calculated assuming a purchase of a common share at the beginning of the period and a sale on the last day of the period reported either at net asset value (“NAV”) or market price per share. Dividends and distributions are assumed to be reinvested at NAV for NAV returns or the prices obtained under the Fund’s Dividend Reinvestment Plan for market value returns.Total investment return does not reflect brokerage commissions. A return calculated for a period of less than one year is not annualized. |

| (d) | Annualized. |

See notes to financial statements.

10 | SemiAnnual Report | April 30, 2006

LCM | Advent/Claymore Enhanced Growth & Income Fund

Notes to Financial Statements | April 30, 2006 (unaudited)

Note 1 – Organization:

Advent/Claymore Enhanced Growth & Income Fund (the “Fund”) was organized as a Delaware statutory trust on January 30, 2004. The Fund is registered as a diversified, closed-end management investment company under the Investment Company Act of 1940, as amended.

The Fund’s primary investment objective is to provide current income and current gains from trading in securities, with a secondary objective of long-term capital appreciation. The Fund will pursue its investment objectives by investing its assets in dividend and interest paying equity securities, convertible securities and non-convertible high-yield securities. Also, in pursuit of the Fund’s primary investment objective, the Fund intends to engage in an option strategy of writing (selling) covered call options on at least 50% of the securities held in the portfolio. There can be no assurance the Fund will achieve its investment objectives.

Note 2 –Accounting Policies:

The preparation of the financial statements in accordance with U.S. generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts and disclosures in the financial statements. Actual results could differ from these estimates.

The following is a summary of significant accounting policies followed by the Fund.

(a) Valuation of Investments

Equity securities listed on an exchange are valued at the last reported sale price on the primary exchange on which they are traded. Equity securities traded on an exchange for which there are no transactions on a given day are valued at the mean of the closing bid and asked prices. Securities traded on NASDAQ are valued at the NASDAQ Official Closing Price. Equity securities not listed on a securities exchange or NASDAQ are valued at the mean of the closing bid and asked prices. Debt securities are valued by independent pricing services or dealers using the closing bid prices for such securities or, if such prices are not available, at prices for securities of comparable maturity, quality and type. For those securities where quotations or prices are not available, valuations are determined in accordance with procedures established in good faith by the Board of Trustees. Futures contracts are valued using the settlement price established each day on the exchange on which they are traded. Exchange-traded options are valued at the closing price, if traded that day. If not traded, they are valued at the mean of the bid and asked prices on the primary exchange on which they are traded. Short-term securities with remaining maturities of 60 days or less are valued at amortized cost, which approximates market value.

(b) Investment Transactions and Investment Income

Investment transactions are accounted for on the trade date. Realized gains and losses on investments are determined on the identified cost basis. Dividend income is recorded on the ex-dividend date and interest income is recorded on an accrual basis. Discounts or premiums on corporate debt securities purchased are accreted or amortized to interest income over the lives of the respective securities using the effective interest method. Discounts or premiums on convertible debt securities are not amortized.

(c) Currency Translation

Assets and liabilities denominated in foreign currencies are translated into U.S. dollars at the mean of the bid and asked price of respective exchange rates on the last day of the period. Purchases and sales of investments denominated in foreign currencies are translated at the exchange rate on the date of the transaction.

Foreign exchange gain or loss resulting from the sale of an investment, holding of a foreign currency, expiration of a currency exchange contract, difference in exchange rates between the trade date and settlement date of an investment purchased or sold, and the difference between dividends actually received compared to the amount shown in a Fund’s accounting records on the date of receipt are shown as net realized gains or losses on foreign currency translation in the Fund’s Statement of Operations.

Foreign exchange gain or loss on assets and liabilities, other than investments, are shown as unrealized appreciation (depreciation) on foreign currency translation.

(d) Covered Call Options

The Fund will pursue its primary objective by employing an option strategy of writing (selling) covered call options on at least 50% of the securities held in the portfolio of the Fund. The Fund seeks to produce a high level of current income and gains generated from option writing premiums and, to a lesser extent, from dividends.

An option on a security is a contract that gives the holder of the option, in return for a premium, the right to buy from (in the case of a call) or sell to (in the case of a put) the writer of the option the security underlying the option at a specified exercise or “strike” price. The writer of an option on a security has the obligation upon exercise of the option to deliver the underlying security upon payment of the exercise price (in the case of a call) or to pay the exercise price upon delivery of the underlying security (in the case of a put).

There are several risks associated with transactions in options on securities. As the writer of a covered call option, the Fund forgoes, during the option’s life, the opportunity to profit from increases in the market value of the security covering the call option above the sum of the premium and the strike price of the call, but has retained the risk of loss should the price of the underlying security decline.The writer of an option has no control over the time when it may be required to fulfill its obligation as writer of the option. Once an option writer has received an exercise notice, it cannot effect a closing purchase transaction in order to terminate its obligation under the option and must deliver the underlying security at the exercise price.

When an option is written, the premium received is recorded as an asset with an equal liability and is subsequently marked to market to reflect the current market value of the option written. These liabilities are reflected as options written in the Statement of Assets and Liabilities. Premiums received from writing options which expire unexercised are recorded on the expiration date as a realized gain. The difference between the premium received and the amount paid on effecting a closing purchase transaction, including brokerage commissions, is also treated as a realized gain, or if the premium is less than the amount paid for the closing purchase transactions, as a realized loss. If a call option is exercised, the premium is added to the proceeds from the sale of the underlying security in determining whether there has been a realized gain or loss.

SemiAnnual Report | April 30, 2006 | 11

LCM | Advent/Claymore Enhanced Growth & Income Fund | Notes to Financial Statements (unaudited) continued

(e) Forward Exchange Currency Contracts

The Fund may enter into forward exchange currency contracts in order to hedge its exposure to changes in foreign currency exchange rates on its foreign portfolio holdings, to hedge certain firm purchases and sales commitments denominated in foreign currencies and for investment purposes. A forward exchange currency contract is a commitment to purchase or sell a foreign currency on a future date at a negotiated forward rate.The gain or loss arising from the difference between the original contracts and the closing of such contracts would be included in net realized gain or loss on foreign currency transactions.

Fluctuations in the value of open forward exchange currency contracts are recorded for financial reporting purposes as unrealized appreciation and depreciation by the Fund.

Risk may arise from the potential inability of a counterparty to meet the terms of a contract and from unanticipated movements in the value of a foreign currency relative to the U.S. dollar.The face or contract amount, in U.S. dollars, reflects the total exposure the Fund has in that particular currency contract.

| (f) | Distributions to Shareholders |

The Fund declares and pays quarterly dividends to common shareholders. These dividends consist of investment company taxable income, which generally includes qualified dividend income, ordinary income and short-term capital gains. Any net realized long-term gains are distributed annually to common shareholders.

Distributions to shareholders are recorded on the ex-dividend date. The amount and timing of distributions are determined in accordance with federal income tax regulations, which may differ from U.S. generally accepted accounting principles.

Note 3 – Investment Advisory Agreement, Investment Management Agreement and Other Agreements:

Pursuant to an Investment Advisory Agreement (the “Agreement”) between Claymore Advisors, LLC (the “Advisor”) and the Fund, the Advisor furnishes offices, necessary facilities and equipment, provides administrative services to the Fund, oversees the activities of Advent Capital Management, LLC (the “Investment Manager”), provides personnel and pays the compensation of all Trustees and Officers of the Fund who are its affiliates. As compensation for these services, the Fund pays the Advisor an annual fee, payable monthly in arrears, at an annual rate equal to 0.49% of the average Managed Assets during such month. Managed Assets means the total of assets of the Fund (including any assets attributable to any preferred shares or otherwise attributable to the use of financial leverage, if any) less the sum of accrued liabilities.

Pursuant to an Investment Management Agreement between the Investment Manager and the Fund, the Fund has agreed to pay the Investment Manager an annual fee, payable monthly in arrears, at an annual rate equal to 0.51% of the average Managed Assets during such month for the services and facilities provided by the Investment Manager to the Fund. These services include the day-to-day management of the Fund’s portfolio of securities, which includes buying and selling securities for the Fund and investment research. The Investment Manager also provides personnel to the Fund and pays the compensation of all Trustees and Officers of the Fund who are its affiliates.

The Bank of New York (“BNY”) acts as the Fund’s custodian, administrator and transfer agent. As custodian, BNY is responsible for the custody of the Fund’s assets. As administrator, BNY is responsible for maintaining the books and records of the Fund’s securities and cash. As transfer agent, BNY is responsible for performing transfer agency services for the Fund. Fimat USA, LLC and Credit Suisse First Boston act as the Fund’s custodian for covered call options.

Certain Officers and Trustees of the Fund are also Officers and Directors of the Advisor or Servicing Agent.The Fund does not compensate its Officers or Trustees who are Officers of the aforementioned firms.

Note 4 – Federal Income Taxes:

The Fund intends to comply with the requirements of Subchapter M of the Internal Revenue Code of 1986, as amended, applicable to regulated investment companies. Accordingly, no provision for U.S. federal income taxes is required. In addition, by distributing substantially all of its ordinary income and long-term capital gains, if any, during each calendar year, the Fund intends not to be subject to U.S. federal excise tax.

At April 30, 2006, the cost and related gross unrealized appreciation and depreciation, excluding written options and foreign currency translations are as follows:

| Cost of Investments for Tax Purposes | Gross Tax Unrealized Appreciation | Gross Tax Unrealized Depreciation | Net Tax Unrealized on Investments | |||||||

| $274,342,150 | $ | 12,393,183 | $ | (5,410,424 | ) | $ | 6,982,759 | |||

For the period ended October 31, 2005, the tax character of distributions paid, as reflected in the Statement of Changes in Net Assets of $10,864,192, was ordinary income. The final determination of the source of the 2006 distributions for tax purposes will be made after the end of the Fund’s fiscal year and will be reported to shareholders in January 2007 on Form 1099-DIV.

Note 5 – Investments in Securities:

For the six months ended April 30, 2006, purchases and sales of investments, excluding options and short-term securities, were $678,482,980 and $671,488,089, respectively.

The Fund entered into written option contracts during the six months ended April 30, 2006. Details of the transactions were as follows:

| Number of Contracts | Premiums Received | ||||||

Options outstanding, beginning of period | 28,923 | $ | 2,755,762 | ||||

Options written during the period | 100,402 | 8,331,348 | |||||

Options expired during the period | (32,842 | ) | (2,461,022 | ) | |||

Options closed during the period | (33,941 | ) | (3,054,223 | ) | |||

Options assigned during the period | (36,351 | ) | (3,494,043 | ) | |||

Options outstanding, end of period | 26,191 | $ | 2,077,822 | ||||

12 | SemiAnnual Report | April 30, 2006

LCM | Advent/Claymore Enhanced Growth & Income Fund | Notes to Financial Statements (unaudited) continued

Note 6 – Derivatives:

At April 30, 2006, the following forward exchange currency contracts were outstanding:

Long Contracts | Current Value | Unrealized Appreciation (Depreciation) | |||||

Canadian Dollar, 811,417 expiring 5/01/06 | $ | 724,124 | $ | 807 | |||

Canadian Dollar, 1,766,220 expiring 5/02/06 | 1,576,208 | (1,901 | ) | ||||

Japanese Yen, 258,093,876 expiring 5/01/06 | 2,260,016 | (7,147 | ) | ||||

Norwegian Krone, 9,568,620 expiring 5/02/06 | 1,548,947 | (4,703 | ) | ||||

| $ | (12,944 | ) | |||||

Note 7 – Capital:

Common Shares

In connection with its organization process, the Fund sold 5,240 shares of beneficial interest to Claymore Securities, Inc., an affiliate of the Advisor, for consideration of $100,084.The Fund has an unlimited amount of common shares, $0.001 par value, authorized and 13,580,240 issued and outstanding. Of this amount, the Fund issued 12,550,000 shares of common stock in its initial public offering and issued, pursuant to an over-allotment option to the underwriters, an additional 700,000 shares on February 11, 2005, 300,000 shares on February 23, 2005 and 25,000 shares on March 11, 2005. All of these shares were issued at $19.10 per share after deducting the sales load but before reimbursement of expenses to the underwriters of $0.00667 per share.

Offering expenses, of $543,000 or $0.04 per share, in connection with the issuance of common shares have been borne by the Fund and were charged to paid-in capital.The Advisor and Investment Manager have agreed to pay offering expenses (other than sales load, but including reimbursement of expenses to the underwriters) in excess of $0.04 per common share.

Note 8 – Indemnifications:

In the normal course of business, the Fund enters into contracts that contain a variety of representations, which provide general indemnifications.The Fund’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Fund that have not yet occurred. However, the Fund expects the risk of loss to be remote.

Note 9 – Subsequent Event:

On May 1, 2006, the Board of Trustees declared a quarterly dividend of $0.40 per common share.This dividend was payable on May 31 to shareholders of record on May 15.

SemiAnnual Report | April 30, 2006 | 13

LCM | Advent/Claymore Enhanced Growth & Income Fund

Supplemental Information | (unaudited)

Trustees

The Trustees of the Advent/Claymore Enhanced Growth & Income Fund and their principal occupations during the past five years:

Name, Address*, Year of Birth and Position(s) held with Registrant | Term of Office** and Length of Time Served | Principal Occupation During | Number of Funds in Fund Complex Overseen by Trustee | Other Directorships Held by Trustee | ||||

| Independent Trustees: | ||||||||

| Daniel Black The Wicks Group of Companies, LLC 405 Park Avenue New York, NY 10022 Year of birth: 1960 Trustee | Since 2005 | Partner, the Wicks Group of Companies, LLC (2001-present). Formerly, Managing Director and Co-head of the Merchant Banking Group at BNY Capital Markets, a division of The Bank of New York Company, Inc. (1998-2003). | 2 | Trustee, Bank Street College of Education | ||||

| Randall C. Barnes Year of birth: 1952 Trustee | Since 2005 | Investor, (2001-present). Formerly, Senior Vice President,Treasurer (1993-1997), President, Pizza Hut International (1991-1993) and Senior Vice President, Strategic Planning and New Business Development (1987-1990) of PepsiCo, Inc. (1987-1997). | 13 | Trustee of five Canadian investment companies in the Claymore Canada fund complex. | ||||

| Derek Medina ABC News 47 West 66th Street New York, NY 10023 Year of birth: 1967 Trustee | 3 years/ since inception | Vice President, Business Affairs and News Planning at ABC News (2003-present). Formerly, Executive Director, Office of the President at ABC News (2000-2003). Former Associate at Cleary Gottlieb Steen & Hamilton (law firm) (1995-1998). Former associate in Corporate Finance at J.P. Morgan/ Morgan Guaranty (1988-1990). | 2 | Director of Young Scholar’s Institute. | ||||

| Ronald A. Nyberg Year of birth: 1953 Trustee | 3 years/ since inception | Principal of Ronald A. Nyberg, Ltd., a law firm specializing in corporate law, estate planning and business transactions (2000-present). Formerly, Executive Vice President, General Counsel and Corporate Secretary of Van Kampen Investments (1982-1999). | 16 | None | ||||

| Gerald L. Seizert, CFP Seizert Capital Partners LLC 1668 S.Telegraph, Suite 120 Bloomfield Hills, MI 48302 Year of birth: 1952 Trustee | 3 years/ since inception | Chief Executive Officer of Seizert Capital Partners, LLC, where he directs the equity disciplines of the firm and serves as a co-manager of the firm’s hedge fund, Proper Associates, LLC (2000-present). Formerly, Co-Chief Executive (1998-1999) and a Managing Partner and Chief Investment Officer-Equities of Munder Capital Management, LLC (1995-1999). Former Vice President and Portfolio Manager of Loomis, Sayles & Co., L.P. (asset manager) (1984-1995). Former Vice President and Portfolio Manager at First of America Bank (1978-1984). | 2 | Former Director of Loomis, Sayles and Co., L.P. | ||||

| Michael A. Smart Williams Capital Partners, L.P. 650 Fifth Avenue New York, NY 10019 Year of birth: 1960 Trustee | 3 years/ since inception | Managing Partner, Cordova, Smart & Williams, LLC, Advisor to First Atlantic Capital Ltd., equity firm (2001-present). Formerly, a Managing Director in Investment Banking-The Private Equity Group (1995-2001) and a Vice President in Investment Banking-Corporate Finance (1992-1995) at Merrill Lynch & Co. Founding Partner of The Carpediem Group, a private placement firm (1991-1992). Former Associate at Dillon, Read and Co. (investment bank) (1988-1990). | 2 | Director,Country Pure Foods.Director,Berkshire Blanket,Inc. | ||||

| Interested Trustees: | ||||||||

| Tracy V. Maitland† 1065 Avenue of the Americas, 31st Floor New York, NY 10018 Year of birth: 1960 Trustee, President and Chief Executive Officer | 3 years/ since inception | President of Advent Capital Management, LLC, which he founded in June, 2001. Prior to June 2001, President of Advent Capital Management, a division of Utendahl Capital. | 2 | |||||

| Nicholas Dalmaso†† Year of birth: 1965 Trustee | 3 years/ since inception | Senior Managing Director and General Counsel of Claymore Advisors, LLC and Claymore Securities, Inc. (2001-present). Formerly, Assistant General Counsel, John Nuveen and Co., Inc. (asset manager) (1999-2001). Former Vice President and Associate General Counsel of Van Kampen Investments, Inc. (1992-1999). | 16 | None | ||||

| * | Address for all Trustees unless otherwise noted: 2455 Corporate West Drive, Lisle, IL 60532 |

| ** | After a Trustee’s initial term, each Trustee is expected to serve a three-year term concurrent with the class of Trustees for which he serves: |

| – | Messrs. Smart, Nyberg and Black, as Class I Trustees, are expected to stand for re-election at the Fund’s 2008 annual meeting of shareholders. |

| – | Messrs. Maitland and Dalmaso, as Class II Trustees, are expected to stand for re-election at the Fund’s 2006 annual meeting of shareholders. |

| – | Messrs. Seizert, Medina and Barnes, as Class III Trustees, are expected to stand for re-election at the Fund’s 2007 annual meeting of shareholders. |

| † | Mr. Maitland is an “interested person” (as defined in section 2(a)(19) of the 1940 Act) of the Fund because of his position as an officer of Advent Capital Management, LLC, the Fund’s Investment Manager. |

| † | Mr. Dalmaso is an “interested person” (as defined in section 2(a)(19) of the 1940 Act) of the Fund because of his position as an officer of Claymore Advisors, LLC, the Fund’s Investment Advisor. |

14 | SemiAnnual Report | April 30, 2006

LCM | Advent/Claymore Enhanced Growth & Income Fund | Supplemental Information (unaudited) continued

Officers

The Officers of the Advent/Claymore Enhanced Growth & Income Fund and their principal occupations during the past five years:

Name, Address*, Year of Birth and Position(s) | Term of Office** | Principal Occupation During the Past Five Years and Other Affiliations | ||

Officers: | ||||

F. Barry Nelson Year of birth: 1943 Vice President | Since 2005 | Co-Portfolio Manager and Research Director at Advent Capital Management, LLC from June 2001 to present. Prior to June 2001, Mr. Nelson held the same position at Advent Capital Management, a division of Utendahl Capital. | ||

Robert White Year of birth: 1965 Treasurer and Chief Financial Officer | Since 2005 | Chief Financial Officer, Advent Capital Management, LLC (July 2005-present). Previously,Vice President, Client Service Manager, Goldman Sachs Prime Brokerage (1997-2005). | ||

Rodd Baxter Year of birth: 1950 Secretary and Chief Compliance Officer | Since 2005 | Advent Capital Management, LLC: General Counsel – Legal (2002-present). SG Cowen Securities Corp.: Director and Senior Counsel (1998-2002). | ||

Steven M. Hill 2455 Corporate West Drive Lisle, IL 60532 Year of birth: 1964 Assistant Treasurer | Since 2005 | Senior Managing Director and Chief Financial Officer of Claymore Advisors, LLC and Claymore Securities, Inc. (2005-present). Managing Director of Claymore Advisors, LLC and Claymore Securities, Inc. (2003-2005). Previously,Treasurer of Henderson Global Funds and Operations Manager for Henderson Global Investors (North America) Inc., from 2002-2003; Managing Director, FrontPoint Partners LLC (2001-2002);Vice President, Nuveen Investments (1999-2001); Chief Financial Officer, Skyline Asset Management LP (1999);Vice President,Van Kampen Investments and Assistant Treasurer,Van Kampen mutual funds (1989-1999). | ||

| * | Address for all Officers unless otherwise noted: 1065 Avenue of the Americas, 31st Floor, New York, NY 10018 |

| ** | Officers serve at the pleasure of the Board of Trustees and until his or her successor is appointed and qualified or until his or her earlier resignation or removal. |

SemiAnnual Report | April 30, 2006 | 15

LCM | Advent/Claymore Enhanced Growth & Income Fund

Dividend Reinvestment Plan | (unaudited)

Unless the registered owner of common shares elects to receive cash by contacting The Bank of New York (the “Plan Administrator’), all dividends declared on common shares of the Fund will be automatically reinvested by the Plan Administrator for shareholders in the Fund’s Dividend Reinvestment Plan (the “Plan”), in additional common shares of the Fund. Participation in the Plan is completely voluntary and may be terminated or resumed at any time without penalty by notice if received and processed by the Plan Administrator prior to the dividend record date; otherwise such termination or resumption will be effective with respect to any subsequently declared dividend or other distribution. Some brokers may automatically elect to receive cash on your behalf and may re-invest that cash in additional common shares of the Fund for you. If you wish for all dividends declared on your common shares of the Fund to be automatically reinvested pursuant to the Plan, please contact your broker.

The Plan Administrator will open an account for each common shareholder under the Plan in the same name in which such common shareholder’s common shares are registered. Whenever the Fund declares a dividend or other distribution (together, a “Dividend”) payable in cash, non-participants in the Plan will receive cash and participants in the Plan will receive the equivalent in common shares. The common shares will be acquired by the Plan Administrator for the participants’ accounts, depending upon the circumstances described below, either (i) through receipt of additional unissued but authorized common shares from the Fund (“Newly Issued Common Shares”) or (ii) by purchase of outstanding common shares on the open market (“Open-Market Purchases”) on the New York Stock Exchange or elsewhere. If, on the payment date for any Dividend, the closing market price plus estimated brokerage commission per common share is equal to or greater than the net asset value per common share, the Plan Administrator will invest the Dividend amount in Newly Issued Common Shares on behalf of the participants. The number of Newly Issued Common Shares to be credited to each participant’s account will be determined by dividing the dollar amount of the Dividend by the net asset value per common share on the payment date; provided that, if the net asset value is less than or equal to 95% of the closing market value on the payment date, the dollar amount of the Dividend will be divided by 95% of the closing market price per common share on the payment date. If, on the payment date for any Dividend, the net asset value per common share is greater than the closing market value plus estimated brokerage commission, the Plan Administrator will invest the Dividend amount in common shares acquired on behalf of the participants in Open-Market Purchases.

If, before the Plan Administrator has completed its Open-Market Purchases, the market price per common share exceeds the net asset value per common share, the average per common share purchase price paid by the Plan Administrator may exceed the net asset value of the common shares, resulting in the acquisition of fewer common shares than if the Dividend had been paid in Newly Issued Common Shares on the Dividend payment date. Because of the foregoing difficulty with respect to Open-Market Purchases, the Plan provides that if the Plan Administrator is unable to invest the full Dividend amount in Open-Market Purchases during the purchase period or if the market discount shifts to a market premium during the purchase period, the Plan Administrator may cease making Open-Market Purchases and may invest the uninvested portion of the Dividend amount in Newly Issued Common Shares at net asset value per common share at the close of business on the Last Purchase Date provided that, if the net asset value is less than or equal to 95% of the then current market price per common share; the dollar amount of the Dividend will be divided by 95% of the market price on the payment date.

The Plan Administrator maintains all shareholders’ accounts in the Plan and furnishes written confirmation of all transactions in the accounts, including information needed by shareholders for tax records. Common shares in the account of each Plan participant will be held by the Plan Administrator on behalf of the Plan participant, and each shareholder proxy will include those shares purchased or received pursuant to the Plan.The Plan Administrator will forward all proxy solicitation materials to participants and vote proxies for shares held under the Plan in accordance with the instruction of the participants.

There will be no brokerage charges with respect to common shares issued directly by the Fund. However, each participant will pay a pro rata share of brokerage commission incurred in connection with Open-Market Purchases. The automatic reinvestment of Dividends will not relieve participants of any Federal, state or local income tax that may be payable (or required to be withheld) on such Dividends.

The Fund reserves the right to amend or terminate the Plan. There is no direct service charge to participants with regard to purchases in the Plan; however, the Fund reserves the right to amend the Plan to include a service charge payable by the participants.

All correspondence or questions concerning the Plan should be directed to the Plan Administrator, The Bank of New York, P.O. Box 463, East Syracuse, New York 13057-0463, Attention: Shareholder Services Department, Phone Number: (800) 701-8178.

16 | SemiAnnual Report | April 30, 2006

LCM | Advent/Claymore Enhanced Growth & Income Fund

Investment Management Agreement and

Investment Advisory Agreement Contract Re-approvals |

The Board reviewed and approved, during the most recent six month period covered by this report, the investment management agreement (the “Management Agreement”) among the Fund, Claymore Advisors, LLC (the “Advisor”) and Advent Capital Management, LLC (the “Investment Manager”) and the investment advisory agreement (the “Advisory Agreement”) between the Fund and the Advisor.

More specifically, at a meeting held on March 14, 2006, the Board, including the Independent Trustees advised by their independent legal counsel, considered the factors and reached the conclusions described below relating to the selection of the Investment Manager and the Advisor and the re-approval of the Management Agreement and the Advisory Agreement (collectively, the “Agreements”).

Nature, Extent and Quality of Services

The Board received and considered various data and information regarding the nature, extent and quality of services provided to the Fund by the Investment Manager and the Advisor under the Agreements. Responses of the Investment Manager and the Advisor to a detailed series of requests submitted by the Independent Trustees’ independent legal counsel on behalf of such Trustees were provided to the Board. The Board reviewed and analyzed these materials which included, among other things, information about the background and experience of the senior management and the expertise of, and amount of attention devoted to the Fund by, personnel of the Investment Manager and the Advisor. In this regard, the Board specifically reviewed the qualifications, background and responsibilities of the officers primarily responsible for day-to-day portfolio management services for the Fund.

The Board evaluated the ability of the Investment Manager and the Advisor, including their resources, reputation and other attributes, to attract and retain highly qualified investment professionals, including research, advisory and supervisory personnel. In this connection, the Board considered information regarding the Investment Manager’s and the Advisor’s compensation structure for its personnel involved in the management of the Fund.

Based on the above factors, together with those referenced below, the Board concluded that it was generally satisfied with the nature, extent and quality of the investment management and advisory services provided to the Fund by the Investment Manager and the Advisor.

Fund Performance and Expenses

The Board considered the most recent one year, three-month and year-to-date performance results for the Fund. It also considered these results in comparison to the performance results of a group of nine other closed-end funds that were determined to be the most similar to the Fund (the “Peer Group”).

The Board received and considered statistical information regarding the Fund’s total expense ratio and its various components. It also considered comparisons of these expenses to the expense information for the Fund’s Peer Group.

Based on the above-referenced considerations and other factors, the Board concluded that the overall performance and expense results supported the re-approval of the Agreements.

Investment Management and Advisory Fee Rates

The Board reviewed and considered the contractual investment management fee rate and the investment advisory fee rate (collectively. the “Management Agreement Rates”) payable by the Fund to the Investment Manager and the Advisor for investment management and advisory services, respectively. In addition, the Board reviewed and considered the fee waiver arrangements applicable to the Management Agreement Rates and considered the Management Agreement Rates after taking the waivers into account (the “Net Management Rates”).

Additionally, the Board received and considered information comparing the Management Agreement Rates (on a stand-alone basis) with those of the other funds in its Peer Group. The Board concluded that the fees were fair and equitable based on relevant factors, including the Fund’s performance results and total expenses ranking relative to its Peer Group.

Profitability

The Board received and considered an estimated profitability analysis of the Investment Manager and the Advisor based on the Net Management Rates. The Board concluded that, in light of the costs of providing investment management and investment advisory services to the Fund, the profits and other ancillary benefits that the Investment Manager and the Advisor received with regard to providing these services to the Fund were not unreasonable.

Economies of Scale

The Board received and considered information regarding whether there have been economies of scale with respect to the management of the Fund, whether the Fund has appropriately benefited from any economies of scale, and whether there is potential for realization of any further economies of scale. The Board concluded that that the opportunity to benefit from economies of scale were diminished in the context of a closed-end fund.

Information about Services to Other Clients

The Board also received and considered information about the nature, extent and quality of services and fee rates offered by the Investment Manager and the Advisor to their other clients.

Other Factors and Broader Review

The Board reviewed detailed materials received from the Investment Manager and the Advisor as part of the approval process. The Board also regularly reviews and assesses the quality of the services that the Fund receives throughout the year.In this regard, the Board reviews reports of the Investment Manager and the Advisor at least in each of its quarterly meetings, which include, among other things, a portfolio review and Fund performance reports.

After considering the above-described factors and based on the deliberations and its evaluation of the information provided to it, the Board concluded that re-approval of the Agreements was in the best interest of the Fund and its shareholders. Accordingly, the Board unanimously approved the Agreements.

SemiAnnual Report | April 30, 2006 | 17

LCM | Advent/Claymore Enhanced Growth & Income Fund

Fund Information |

Board of Trustees Daniel Black

Randall C. Barnes

Nicholas Dalmaso*

Tracy V. Maitland*, Chairman

Derek Medina

Ronald A. Nyberg

Gerald L. Seizert

Michael A. Smart | Officers Tracy V. Maitland Chief Executive Officer

F. Barry Nelson Vice President

Robert White Treasurer and Chief Financial Officer

Steven M. Hill Assistant Treasurer

Rodd Baxter Secretary and Chief Compliance Officer | Investment Manager Advent Capital Management, LLC 1065 Avenue of the Americas, 31st Floor New York, New York 10018

Investment Advisor Claymore Securities, LLC Lisle, Illinois

Administrator, Custodian and Transfer Agent The Bank of New York New York, New York

Legal Counsel Skadden, Arps, Slate, Meagher & Flom LLP New York, New York

Independent Registered Public Accounting Firm PricewaterhouseCoopers LLP New York, New York |

| * | Trustee is an “interested person” of the Fund as defined in the Investment Company Act of 1940, as amended. |

Privacy Principles of the Fund

The Fund is committed to maintaining the privacy of its shareholders and to safeguarding their non-public personal information.The following information is provided to help you understand what personal information the Fund collects, how the Fund protects that information and why, in certain cases, the Fund may share information with select other parties.

Generally, the Fund does not receive any non-public personal information relating to its shareholders, although certain non-public personal information of its shareholders may become available to the Fund.The Fund does not disclose any non-public personal information about its shareholders or former shareholders to anyone, except as permitted by law or as is necessary in order to service shareholder accounts (for example, to a transfer agent or third party administrator).

The Fund restricts access to non-public personal information about its shareholders to employees of the Fund’s investment advisor and its affiliates with a legitimate business need for the information. The Fund maintains physical, electronic and procedural safeguards designed to protect the non-public personal information of its shareholders.

Questions concerning your shares of Advent/Claymore Enhanced Growth & Income Fund?

| • | If your shares are held in a Brokerage Account, contact your Broker. |

| • | If you have physical possession of your shares in certificate form, contact the Fund’s Administrator, Custodian and Transfer Agent: |

The Bank of New York, 111 Sanders Creek Parkway, East Syracuse, New York 13057 (800) 701-8178

This report is sent to shareholders of Advent/Claymore Enhanced Growth & Income Fund for their information. It is not a Prospectus, circular or representation intended for use in the purchase or sale of shares of the Fund or of any securities mentioned in this report.

A description of the Fund’s proxy voting policies and procedures related to portfolio securities is available without charge, upon request, by calling the Fund at (800) 345-7999 or on the Securities & Exchange Commission’s (“SEC’s”) website at http://www.sec.gov.

Information regarding how the Fund voted proxies for portfolio securities, if applicable, during the most recent 12-month period ended June 30, is also available, without charge and upon request by calling the Fund at (800) 345-7999 or by accessing the Fund’s Form N-PX on the SEC’s website at http://www.sec.gov.

The Fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. The Fund’s Form N-Q is available on the SEC website at http://www.sec.gov. The Fund’s Form N-Q may also be viewed and copied at the SEC’s Public Reference Room in Washington, DC; information on the operation of the Public Reference Room may be obtained by calling (800) SEC-0330 or at www.adventclaymore.com.

In January 2005, the Fund submitted a CEO annual certification to the New York Stock Exchange (“NYSE”) in which the Fund’s principal executive officer certified that he was not aware, as of the date of the certification, of any violation by the Fund of the NYSE’s Corporate Governance listing standards. In addition, as required by Section 302 of the Sarbanes-Oxley Act of 2002 and related SEC rules, the Fund’s principal executive and principal financial officers have made quarterly certifications, included in filings with the SEC on Forms N-CSR and N-Q, relating to, among other things, the Fund’s disclosure controls and procedures and internal control over financial reporting.

18 | SemiAnnual Report | April 30, 2006

Advent Capital Management, LLC 1065 Avenue of the Americas New York, New York 10018 |  |

Item 2. Code of Ethics.

Not applicable for a semi-annual reporting period.

Item 3. Audit Committee Financial Expert.

Not applicable for a semi-annual reporting period.

Item 4. Principal Accountant Fees and Services.

Not applicable for a semi-annual reporting period.

Item 5. Audit Committee of Listed Registrants.

Not applicable for a semi-annual reporting period.

Item 6. Schedule of Investments.

The Schedule of Investments is included as part of Item 1.

Item 7. Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies.

Not applicable for a semi-annual reporting period.

Item 8. Portfolio Managers of Closed-End Management Investment Companies.

Not applicable for a semi-annual reporting period.

Item 9. Purchases of Equity Securities by Closed-End Management Investment Company and Affiliated Purchasers.

None.

Item 10. Submission of Matters to a Vote of Security Holders.

The registrant has not made any material changes to the procedures by which shareholders may recommend nominees to the registrant’s Board of Trustees.

Item 11. Controls and Procedures.

(a) The registrant’s principal executive officer and principal financial officer have evaluated the registrant’s disclosure controls and procedures within 90 days of this filing and have concluded based on such evaluation that the registrant’s disclosure controls and procedures were effective, as of that date, in ensuring that information required to be disclosed by the registrant in this Form N-CSR was recorded, processed, summarized, and reported within the time periods specified in the Securities and Exchange Commission’s rules and forms.

(b) The registrant’s principal executive officer and principal financial officer are aware of no changes in the registrant’s internal control over financial reporting that occurred during the registrant’s most recent fiscal quarter that have materially affected, or are reasonably likely to materially affect, the Registrant’s internal control over financial reporting.

Item 12. Exhibits.

(a)(1) Not applicable.

(a)(2) Certification of principal executive officer and principal financial officer pursuant to Section 302 of the Sarbanes-Oxley Act of 2002.

(b) Certification of principal executive officer and principal financial officer pursuant to Section 906 of the Sarbanes-Oxley Act of 2002.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

(Registrant) Advent/Claymore Enhanced Growth & Income Fund

| By: | /s/ Tracy V. Maitland | |

| Name: | Tracy V. Maitland | |

| Title: | President and Chief Executive Officer | |

| Date: | July 6, 2006 | |

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

| By: | /s/ Tracy V. Maitland | |

| Name: | Tracy V. Maitland | |

| Title: | President and Chief Executive Officer | |

| Date: | July 6, 2006 |

| By: | /s/ Robert White | |

| Name: | Robert White | |

| Title: | Treasurer and Chief Financial Officer | |

| Date: | July 6, 2006 |