As filed with the Securities and Exchange Commission on February 17, 2005.

Registration Statement No. 333-_____

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM SB-2

REGISTRATION STATEMENT

UNDER THE SECURITIES ACT OF 1933

CHILCO RIVER HOLDINGS, INC.

(Name of small business issuer in its charter)

| | | | | |

Nevada

State or jurisdiction of

incorporation or organization | | 7990

Primary Standard Industrial

Classification Code Number | | 98-0419129

I.R.S. Employer Identification No. |

355 Lemon Ave., Suite C, Walnut, CA 91789

(646) 330-5859

(Address and telephone number of principal executive offices and principal place of business)

Tom Liu

355 Lemon Ave., Suite C,

Walnut, CA 91789

(646) 330-5859

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

Kenneth G. Sam, Esq.

Dorsey & Whitney LLP

Republic Plaza Building, Suite 4700

370 Seventeenth Street

Denver, CO 80202-5647

(303) 629-3445

Approximate date of proposed sale to the public: From time to time after the effective date of this registration statement. |_|

_________________

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, please check the following box. |_|

_________________

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. |_|

_________________

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. |_|

_________________

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. |_|

_________________

If delivery of the prospectus is expected to be made pursuant to Rule 434, please check the following box. |_|

_________________

CALCULATION OF REGISTRATION FEE

|

Title of Shares

to be Registered | Amount to be

Registered | Proposed Maximum

Offering

Price Per Share(1)(4) | Proposed Maximum

Aggregate Offering

Price(1)(4) | Amount of

Registration Fee |

|---|

|

| Common stock to be | | 5,065,667 | | $2.65 | | $13,424,018 | | $1,436.50 | |

| offered for resale by | |

| selling stockholders(2) | |

|

| Common stock acquirable upon | | 1,365,667 | | $2.65 | | $ 3,619,018 | | $ 387.50 | |

| exercise of warrants to be offered | |

| for resale by selling | |

| stockholders(3)(5) | |

|

| | 6,431,334 | | | | $17,043,036 | | $ 1,824 | |

|

| (1) | | Calculated pursuant to Rule 457(c) and (g) under the Securities Act of 1933, as amended. |

| (2) | | Represents shares of common stock held by selling shareholders registered for resale under this registration statement. |

| (3) | | Represents shares of common stock acquirable upon exercise of 1,365,667 warrants held by selling shareholders. |

| (4) | | Estimated pursuant to Rule 457(c) solely for purposes of calculating amount of registration fee, based on the average of the bid and ask sales prices of the Registrant’s common stock on February 16, 2006, as quoted in the National Association of Securities Dealers Over-the-Counter Bulletin Board. |

| (5) | | Pursuant to Rule 416, there are also being registered such indeterminable additional securities as may be issued as a result of the anti-dilution provisions contained in the warrants or options |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until this Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

The information contained in this prospectus is not complete and may be changed. The selling shareholders may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these shares, and the selling shareholders are not soliciting an offer to buy these shares in any state where the offer or sale is not permitted.

PRELIMINARY PROSPECTUS

Subject To Completion: Dated February 17, 2006

Chilco River Holdings, Inc.

6,431,334 Shares of Common Stock

This is a public offering of up to 6,431,334 shares of the common stock, par value $0.001 per share, of Chilco River Holdings, Inc. (“we,” “us,” “Chilco” or “our company”), by selling shareholders listed beginning on page 13 of this prospectus. All of the shares being offered, when sold, will be sold by selling shareholders. The shares of common stock registered for resale under this registration statement includes:

| | 5,065,667 shares of common stock held by selling shareholders; and |

| | 1,365,667 shares of common stock acquirable upon exercise of Class A Warrants at the exercise price of $2.00 per share for a period of one year from the date of issuance. |

The price at which the selling shareholders may sell the shares will be determined by the prevailing market price for the shares or in negotiated transactions.

We will not receive any proceeds from the sale or distribution of the common stock by the selling shareholders. We may receive proceeds from the exercise of the Class A Warrants upon exercise, if they are exercised, and will use the proceeds from any exercise for general working capital purposes.

Our common stock is quoted on the National Association of Securities Dealers (“NASD”) Over-the-Counter Bulletin Board (“OTCBB”) under the symbol “CRVH”. On February 16, 2006, the closing sale price for our common stock was $2.65 on the NASD OTCBB.

Investing in our common stock involves risks. See “Risk Factors and Uncertainties” beginning on page 4.

These securities have not been approved or disapproved by the SEC or any state securities commission nor has the SEC or any state securities commission passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is ___________________, 2006.

TABLE OF CONTENTS

Page

| RISK FACTORS AND UNCERTAINTIES | 4 |

| FORWARD-LOOKING STATEMENTS | 12 |

| DIRECTORS, EXECUTIVE OFFICERS, PROMOTERS AND CONTROL PERSONS | 20 |

| SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT | 26 |

| CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS | 27 |

| DESCRIPTION OF SECURITIE | 27 |

| THE SEC'S POSITION ON INDEMNIFICATION FOR SECURITIES ACT LIABILITIES | 29 |

| DESCRIPTION OF THE BUSINESS | 29 |

| DESCRIPTION OF PROPERTY | 38 |

| MANAGEMENT'S DISCUSSION AND ANALYSIS | 39 |

| MARKET FOR COMMON EQUITY AND RELATED SHAREHOLDER MATTERS | 44 |

| TRANSFER AGENT AND REGISTRAR | 45 |

| EXPERTS AND CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE | 45 |

| WHERE YOU CAN FIND MORE INFORMATION | 45 |

| INDEX TO FINANCIAL STATEMENTS | F-1 |

SUMMARY INFORMATION

The Offering

This is an offering of up to 6,431,334 shares of the common stock of Chilco River Holdings, Inc. (“we,” “us,” “Chilco,” or “our company”) by certain selling shareholders.

Shares Offered By the Selling

Shareholders | 6,431,334 shares of common stock, $0.001 par value per share, including: |

| | —

— | 5,065,667 shares of common stock held by selling shareholders; and

1,365,667 shares of common stock acquirable upon exercise of Class A Warrants at the exercise price of $2.00 per share |

| Offering Price | Determined at the time of sale by the selling shareholders |

Common Stock Outstanding as of

February 16, 2006(1) | 21,815,667 shares |

| Use of Proceeds | We will not receive any of the proceeds of the sale of shares offered by the selling shareholders. |

| Dividend Policy | We intend to use the proceeds from the exercise of Class A Warrants, if any, for general working capital purposes. We currently intend to retain any future earnings to fund the development and growth of our business. Therefore, we do not currently anticipate paying cash dividends. |

| OTC Bulletin Board Symbol | CRVH |

Summary of Our Business

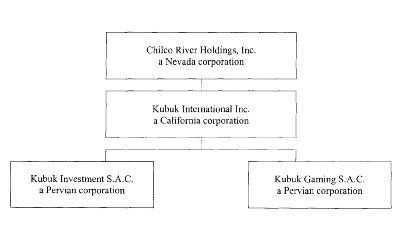

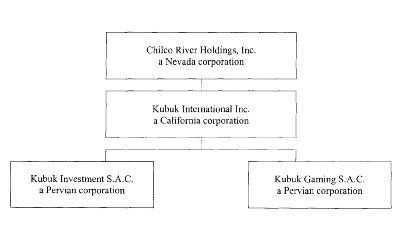

We, Chilco River Holdings, Inc., through our wholly-owned subsidiaries, own all of the assets of and operate the Bruce Hotel and Casino. The Bruce Hotel and Casino is located at Jirón Francisco Bolognesi # 171-191 in the heart of the Miraflores District, Province and Department of Lima, Peru, approximately 30 minutes from Jorge Charvez International Airport. The Bruce Hotel and Casino is a “destination” hotel and casino location for visitors traveling to the Republic of Peru and caters to visitors from the People’s Republic of China. The Bruce Hotel and Casino business consists of a hotel, restaurants, a gaming casino and real property. We acquired the

1

Bruce Hotel and Casino in connection with a Share Exchange transaction with the shareholders of Kubuk International, Inc. (Kubuk) on July 15, 2005.

The Bruce Hotel and Casino is a full-service hospitality facility with standard and premium lodging accommodations (rooms and suites). In addition, the hotel encompasses several dining facilities and a full-featured Gambling Casino with traditional gaming tables and slot machines.

Hotel: The Bruce Hotel and Casino is a 60-room full-service hospitality facility with standard and premium lodging accommodations (rooms and suites) and dining facilities. The amenities include guest suites and rooms, sauna, air conditioning, mini-bar, telephone, hair dryer, wake-up service/alarm-clock, radio, satellite TV and safe deposit boxes. The hotel can accommodate 200 guests. In addition, the hotel offers a gaming room, meeting/banquet facilities and a barber/beauty shop. The room fare ranges from $70 for a standard room to $95 for an executive suite.

The Miraflores District is one of the most important financial and commercial centers of Lima and is located approximately 20 minutes from the historical center of Lima. The Bruce Hotel and Casino is supported by urban infrastructure, such as asphalt roads, concrete sidewalks, city water and sewage, and public electricity and garbage collection as well as phone lines. The Bruce Hotel and Casino is located on commercial property and is located on a major thoroughfare.

Restaurants: The Bruce Hotel and Casino features two full-service restaurants serving Chinese and international cuisine. The restaurants seat 200 guests, respectively. The Bruce Hotel and Casino holds a retail liquor license. The restaurants were closed for renovation in November 2005 and are expected to reopen in the last half of 2006.

Gaming Casino: The gaming casino is a full-featured casino with 20 traditional gaming tables (blackjack, roulette, craps and poker) and approximately 220 slot machines. The casino is located on the second floor of the Hotel and is approximately 622 square meters. The casino will feature two full bars, and VIP area and can accommodate 300 guests.

The gaming casino operates under a gaming license issued to Kubuk Gaming SAC by the Republic of Peru. The gaming casino is currently closed for remodeling and is scheduled to reopen to the public in the last half of 2006.

Real Property: As a result of the Share Exchange with Kubuk, we now own all of the real property and assets used in the operation of the Bruce Hotel and Casino. The property consists of one seven-story building and one fourteen-story building that are physically connected and have been configured for use as a hotel, casino and office space. The property also includes a parking garage. We also own all of the fixtures, improvements, systems, furniture, gaming machines and gaming tables and the other contents currently used in the business of the Bruce Hotel and Casino.

Prior to signing the Share Exchange Agreement with Kubuk, we developed a plan to expand, renovate and modernize the current facilities of the Bruce Hotel and Casino and temporarily suspended the operation of the gaming room in February 2005 and operation of the restaurants and slot room in November 2005. We began renovations to the restaurant and slot area, and in January 2006, we raised $2 million to begin renovation of the casino floor and for marketing of the Bruce Hotel and Casino. We intend to raise an additional $5 million in capital to fund the expansion, renovation and modernization of the Bruce Hotel and Casino. We expect to reopen the casino, slot room and restaurants in the last half of 2006.

We were incorporated on May 8, 2003 under the laws of the State of Nevada. We maintain our registered agent’s office at 6100 Neil Road, Suite 500, Reno, Nevada 89511, and an office at the Bruce Hotel and Casino at Jirón Francisco Bolognesi # 171-191 in the Miraflores District, Province and Department of Lima. Our executive offices are located at 355 Lemon Ave., Suite C, Walnut, CA 91789, and our phone number is (646) 330-5859.

2

Selected Financial Data

Following the share exchange transaction on July 15, 2005, Kubuk International, Inc. became a wholly-owned subsidiary of Chilco River Holdings, Inc. Prior to the share exchange, we had no substantial assets and only nominal operations. Accordingly, the transaction is treated as a reverse acquisition of Chilco River Holdings, Inc. and has been accounted for as a recapitalization rather than a business combination. The historical financial statements of Kubuk International, Inc. are deemed to be the historical statements of Chilco River Holdings, Inc.

The selected financial information presented below as of and for the periods indicated is derived from our financial statements contained elsewhere in this prospectus and should be read in conjunction with those financial statements.

INCOME STATEMENT DATA | Chilco River Holdings, Inc.

Year Ended

December 31 | Kubuk International Inc.

Year Ended

December 31 | Pro Forma(1)

Year Ended

December 31 |

|---|

| 2004 | 2003 | 2004 | 2003 | 2004

(unaudited) |

|---|

|

|

|

|

|

|

| Revenue | | | $ | 0 | | $ | 0 | | $ | 10,694,694 | | $ | 9,044,936 | | $ | 10,694,694 | |

| Operating Expenses | | | $ | 52,632 | | $ | 34,073 | | $ | 4,221,246 | | $ | 3,645,942 | | $ | 4,273,591 | |

| Net Income (Loss) | | | $ | (52,632 | ) | $ | (34,073 | ) | $ | 4,595,393 | | $ | 4,333,941 | | $ | 4,542,761 | |

| Income (Loss) per Common | | | $ | (0.02 | ) | $ | (0.01 | ) | $ | 3.39 | | $ | 3.03 | | $ | .21 | |

| share* | | |

| Weighted Average Number of | | | | 3,032,000 | | | 3,032,000 | | | 1,509,400 | | | 1,509,400 | | | 21,449,999 | |

| Common Shares Outstanding | | |

| | (1) | | Gives effect to the share exchange between Kubuk International, Inc. and Chilco River Holdings, Inc. as if the share exchange occurred on January 1, 2004. Pro forma calculations may not be indicative of actual results. |

INCOME STATEMENT DATA | Three Months Ended September 30 | Nine Months Ended September 30 |

|---|

| 2005 | 2004 | 2005 | 2004 |

|---|

|

|

|

|

|

|

| | (unaudited) | (unaudited) |

|---|

|

|

|

|

|

|

| Revenue | | | $ | 1,097,123 | | $ | 2,245,038 | | $ | 3,758,818 | | $ | 8,897,409 | |

| Operating Expenses | | | $ | 778,212 | | $ | 832,241 | | $ | 2,110,569 | | $ | 3,016,017 | |

| Net Income | | | $ | 189,036 | | $ | 996,730 | | $ | 1,144,026 | | $ | 4,139,698 | |

| Income per Common share* | | | $ | .01 | | $ | .05 | | $ | .05 | | $ | .21 | |

| Weighted Average Number of | | | | 21,431,868 | | | 19,286,000 | | | 21,385,478 | | | 19,826,000 | |

| Common Shares Outstanding | | |

| BALANCE SHEET DATA: | At December 31, 2004 | At September 30, 2005 |

|---|

| | (unaudited) |

|---|

| Working Capital (Deficiency) | | | $ | 2,696,309 | | $ | 1,081,539 | |

| Total Assets | | | $ | 19,801,162 | | $ | 16,722,276 | |

| Retained Earnings | | | $ | 6,371,964 | | $ | 144,819 | |

| Shareholders' Equity | | | $ | 19,034,468 | | $ | 16,473,133 | |

Due to the Share Exchange Agreement and the significance of the Company’s operations, the “development stage” status of Chilco is no longer in effect. The development stage disclosures are no longer required in the Company’s current status. Historical results of operations for Chilco River Holdings, Inc. may differ materially from future results.

3

RISK FACTORS AND UNCERTAINTIES

Readers should carefully consider the risks and uncertainties described below before deciding whether to invest in shares of our common stock.

Our failure to successfully address the risks and uncertainties described below would have a material adverse effect on our business, financial condition and/or results of operations, and the trading price of our common stock may decline and investors may lose all or part of their investment. We cannot assure you that we will successfully address these risks or other unknown risks that may affect our business.

All of our revenues and income are expected to be derived from the Bruce Hotel and Casino.

We anticipate that all of our revenue and income, if any, will be derived from the operations of the Bruce Hotel and Casino. We have no other source of operating revenue. We anticipate that results of operations at the Bruce Hotel and Casino will be lower than historical periods because the gaming casino has been closed for remodeling since February 2005 and the slot room and restaurants were closed for renovation in November 2005. They are not expected to reopen until the last half of 2006. Our revenue is expected to be approximately 10% of historical levels until these renovations are completed and our casino, slot room and restaurants are reopened.

We are subject to extensive regulation from gaming authorities that could adversely affect us.

As owners and operators of gaming facilities, we are subject to extensive regulation. Governmental authorities require us and our subsidiaries to demonstrate suitability to obtain and retain various licenses and require that we have registrations, permits and approvals to conduct gaming operations. The regulatory authorities in Peru may limit, condition, suspend or revoke a license to conduct gaming operations or prevent us from owning the securities of any of our gaming subsidiaries. We may also be deemed responsible for the acts and conduct of our employees. Substantial fines or forfeiture of assets for violations of gaming laws or regulations may be levied against us, our subsidiaries and the persons involved. The suspension or revocation of any of our licenses or the levy on us or our subsidiaries of a substantial fine would have a material adverse effect on our business.

To date, the Bruce Hotel and Casino has demonstrated suitability to obtain and has obtained all governmental licenses, registrations, permits and approvals necessary for us to operate our existing gaming facilities. However, like all gaming operators, we must periodically apply to renew our gaming license. We cannot assure you that we will be able to obtain such renewals. In addition, if we expand our gaming operations as planned to increase the number of tables and slot machines, we will have to meet suitability requirements and obtain additional licenses, registrations, permits and approvals from gaming and non-gaming authorities. Accordingly, the regulation and timing of installation and operation of gaming tables and machines may be delayed or restricted.

The availability and cost of financing could have an adverse effect on business.

We intend to finance our current and future expansion and renovation projects primarily with cash flow from operations and equity or debt financings. If we are unable to finance our current or future expansion projects, we will have to adopt one or more alternatives, such as reducing or delaying planned expansion, development and renovation projects or capital expenditures, or selling assets, securing debt financing, or obtaining additional equity financing or joint venture partners. These sources of funds may not be sufficient to finance our expansion, and other financing may not be available on acceptable terms, in a timely manner or at all. If we are unable to secure additional financing, we could be forced to limit or suspend expansion, development and renovation projects, which may adversely affect our business, financial condition and results of operations.

Potential Changes in Regulatory Environment.

From time to time, legislators and special interest groups have proposed legislation that would expand, restrict or prevent gaming operations. In addition, from time to time, certain anti-gaming groups may propose referenda that, if adopted, would limit our ability to continue to operate in those jurisdictions in which such referenda are adopted. Any expansion of gaming or restriction on or prohibition of our gaming operations could have a material adverse effect on our operating results.

4

We are subject to the possibility of an increase in gaming taxes, which would increase our costs.

Taxing authorities raise a significant amount of revenue through taxes and fees on gaming activities. We believe that the prospect of significant revenue is one of the primary reasons that jurisdictions permit legalized gaming. As a result, gaming companies are typically subject to significant taxes and fees in addition to normal federal and local income taxes, and such taxes and fees are subject to increase at any time. We pay substantial taxes and fees with respect to our operations. From time to time, federal and local legislators and officials have proposed changes in tax laws, or in the administration of such laws, affecting the gaming industry. In addition, poor economic conditions could intensify the efforts of state and local governments to raise revenues through increases in gaming taxes. It is not possible to determine with certainty the likelihood of changes in tax laws or in the administration of such laws. Such changes, if adopted, could have a material adverse effect on our business, financial condition and results of operations.

We are subject to non-gaming regulation that could adversely affect us.

We are subject to a variety of other local rules and regulations, including zoning, environmental, construction and land-use laws and regulations governing the serving of alcoholic beverages. We must maintain a hotel license to operate our hotel and a liquor license to serve alcoholic beverages. The loss of these licenses would have a material adverse impact on our revenues and results of operations. Penalties can be imposed against us if we fail to comply with these regulations. The imposition of a substantial penalty or the loss of service of a gaming facility for a significant period of time would have a material adverse affect on our business.

We intend to make substantial investments in renovating, expanding and improving the Bruce Hotel and Casino.

We intend to raise approximately $5 million during 2006 to fund the expansion, renovation and modernization of the Bruce Hotel and Casino. The gaming casino in the Bruce Hotel and Casino has been closed since February 2005 for remodeling and renovation, and our slot room and restaurants were closed in November 2005 for renovation, as part of the first stage of our renovation project. We estimate that we will be required to raise approximately $5 million during 2006 to complete the renovation and reopen the gaming casino. Our ability to generate sufficient revenue to earn a profit is dependent on our ability to raise the necessary funds to complete the renovation and to open our casino. We are in the process of seeking capital to complete the renovation, but have no firm commitments at this time.

Our ability to benefit from our investments will depend on many factors, including:

| | • | | our ability to successfully complete the renovations; |

| | • | | our ability to successfully integrate the expanded operations; |

| | • | | our ability to attract and retain competent management and employees; |

| | • | | our ability to secure licenses, permits and approvals; and |

| | • | | the availability of adequate financing on acceptable terms. |

Many of these factors are beyond our control. Therefore, we cannot be sure that we will be able to recover our investments in the expansion, renovation and modernization of the Bruce Hotel and Casino.

We may experience construction delays during our expansion project.

We are currently engaged in a substantial renovation project to improve our gaming casino, slot room and restaurants. We also are evaluating other expansion opportunities at the Bruce Hotel and Casino. The anticipated costs and construction periods are based upon budgets, conceptual design documents and construction schedule estimates prepared by us in consultation with our architects and contractors.

5

Construction projects entail significant risks, which can substantially increase costs or delay completion of a project. Such risks include shortages of materials or skilled labor, unforeseen engineering, environmental or geological problems, work stoppages, weather interference and unanticipated cost increases. Most of these factors are beyond our control. In addition, difficulties or delays in obtaining any of the requisite licenses, permits or authorizations from regulatory authorities can increase the cost or delay the completion of an expansion or development. Significant budget overruns or delays with respect to expansion and development projects could adversely affect our results of operations.

If our key personnel leave us, our business will be significantly adversely affected.

Our continued success will depend, among other things, on the efforts and skills of a few key executive officers and the experience of our property managers as well as our ability to attract and retain additional highly qualified personnel with gaming industry experience and qualifications to obtain the requisite licenses. We do not maintain “key man” life insurance for any of our employees. There is no assurance that we would be able to attract and hire suitable replacements for any of our key employees. We need qualified executives, managers and skilled employees with gaming industry experience to continue to successfully operate our business. We believe a shortage of skilled labor in the gaming industry may make it increasingly difficult and expensive to attract and retain qualified employees. We expect that increased competition in the gaming industry will intensify this problem.

Inclement weather and other conditions could seriously disrupt our business, financial condition and results of operations.

Our business is seasonal, and inclement weather conditions could affect the number of visitors to our hotel and casino. Our facilities are subject to risks including loss of service due to casualty, mechanical failure, extended or extraordinary maintenance, or flood, hurricane or other severe weather.

Reduced patronage and the loss of service for any period of time could adversely affect our results of operations. We do not maintain business interruption insurance to compensate us if our hotel and casino experience a closure.

Access to a number of our facilities may also be affected by road conditions, such as construction and traffic.

Energy and fuel price increases may adversely affect our costs of operations and our revenues

Our casino properties use significant amounts of electricity, natural gas and other forms of energy. While no shortages of energy have been experienced, substantial increases in the cost of electricity in Peru will negatively affect our results of operations. In addition, energy and fuel price increases in cities that constitute a significant source of customers for our properties could result in a decline in disposable income of potential customers and a corresponding decrease in visitation to our properties, which would negatively impact our revenues. The extent of the impact is subject to the magnitude and duration of the energy and fuel price increases, but this impact could be material.

A downturn in general economic conditions may adversely affect our results of operations.

Our business operations are subject to changes in international, national and local economic conditions, including changes in the economy related to future security alerts in connection with threatened or actual terrorist attacks in the United States, Spain and London, and related to the war with Iraq, which may affect our customers’ willingness to travel. A recession or downturn in the general economy, or in a region constituting a significant source of customers for our properties, could result in fewer customers visiting our properties, which would adversely affect our results of operations.

6

Our success depends on visitors from the People’s Republic of China and changes to regulations related to tourism may adversely affect our results of operations.

Approximately 70% of the guests at the Bruce Hotel and Casino during the year ended December 31, 2004, were tourists from the People’s Republic of China. We target tourists from the People’s Republic of China through our marketing programs. In 2003 the government of the People’s Republic of China ceased issuing work passports to its citizens and in doing so made it a requirement to secure a visa to travel to the Republic of Peru. The visa requirement significantly curtailed the number of travelers from the People’s Republic of China to the Republic of Peru and the financial results of the Bruce Hotel and Casino suffered from reduced hotel occupancy and reduced casino gaming revenues. In 2004, the Chinese government signed an agreement with the Republic of Peru adding Peru to its list of Approved Destination Status, permitting Chinese to travel more easily in Peru in organized groups. If the Chinese government should change this policy and restrict travel to the Republic of Peru or the Republic of Peru should impose restrictions on entry, these changes would likely have a material adverse effect on our results of operations.

Our results of operations are subject to foreign currency exchange fluctuations between the U.S. dollar and nuevo sol (PEN), the currency of Peru.

Our functional currency is the U.S. dollar. All of our expected revenue and expenses from the operation of the Bruce Hotel and Casino are expected to be in nuevo sol (PEN), the currency of Peru. Recently, the value of the U.S. dollar has declined compared to the PEN, and we expect that the exchange rate will fluctuate in the future. As a result, we may experience losses or declines in our gross profit margins as a result of fluctuations in the foreign currency exchange rates. At the present time, we do not hedge our foreign currency exchange risks.

Risks Related to Peru

Our ownership of Peruvian companies and operation involves certain considerations not typically associated with ownership of U.S. companies, including those discussed below, and therefore should be considered more speculative than investments in the U.S.

Political and economic situation has historically been unstable.

During the past several decades, Peru has had a history of political instability that included military coups and different governmental regimes with changing policies. Past governments have frequently played an interventionist role in the nation’s economy and social structure. Among other things, past governments have imposed controls on prices, exchange rates, local and foreign investment and international trade, have restricted the ability of companies to dismiss employees and have expropriated private sector assets.

Following the resignation of the former president, Alberto Fujimori (1990-2000), after revelations of corruption, the president of Congress, Valentin Paniagua, became interim president in November 2000. In 2001 Mr. Paniagua oversaw free and fair presidential and congressional elections, and transferred power to the newly elected president, Alejandro Toledo of “Peru Posible,” on July 28, 2005. Since 2001, under President Toledo, Peru has pursued an ambitious program to re-establish democracy, following a decade of increasingly authoritarian rule and rampant corruption under the former Fujimori government, and is promoting a market-based economy that will benefit all citizens. Toledo is also devolving more power to the provinces. A weak congressional position and extremely low levels of popularity since 2002 have ensured that Mr. Toledo’s position as president has been fragile throughout, and his leadership of government ineffectual at times.

Inflation as measured by the Lima consumer price index has decreased from 7,650% in 1990 to 39.5% in 1993 to 1.79% in the period from January to May 2005, which is lower than the inflation rate for the same period in the previous year (3.18%). Peru’s gross domestic product, or GDP, grew by 4.8% during 2004, compared to 4.0% in 2003. In April 2005, GDP increased by 6.4%, as compared to the GDP in April 2004, which grew 3.4% as compared to the GDP in April 2003. This rise in GDP growth was largely a result of growth in the non-primary sector, mainly the non-primary manufacturing and construction sectors, which increased 9.3% and 10.6%, respectively, between May 2004 and April 2005.

7

Notwithstanding the progress achieved in restructuring Peru’s political institutions and revitalizing the economy, there can be no assurance that President Toledo’s government, or any successor government, can sustain the progress achieved. In addition, it is possible that Toledo’s support could be eroded as a result of certain effects of current programs. For example, privatizations may result in layoffs due to the reduction in the work force of privatized companies. As in the case of all foreign investments, our investments in Peru could in the future be adversely affected by increases in taxes or by political, economic or diplomatic developments.

Our business and the tourism industry may be subject to terrorism and other threats.

Peru experienced significant terrorist activity in the 1980s and early 1990s, during which period anti-government groups escalated their acts of violence against the government, the private sector and Peruvian residents. The Company’s operations have not been directly affected by the terrorist activity.

There has been substantial progress in suppressing terrorist activity since 1990, in part as a result of the arrest of the leaders and approximately 2,000 members of the two principal terrorist groups. Notwithstanding the success achieved during Fujimori’s regime, Peru during President Toledo’s rule has been swamped with a wave of social protests coupled with an increase in domestic guerilla terrorism activities. In June 2003, President Toledo was forced to declare a state of emergency to handle these issues. We cannot be certain that the progress achieved in combating terrorist activity can be sustained.

Currency fluctuations may have a negative impact on our results of operations.

Our income in Peru is denominated in both Nuevo Soles and US dollars. The expenses and other charges incurred in the company’s daily business are denominated in Nuevo Soles, and the computation of income will be made on the date of our receipt at the currency exchange rate in effect on that date. Accordingly, changes in the value of the Nuevo Sol against the U.S. dollar will result in corresponding changes in the U.S. dollar value of our assets denominated in Nuevos Soles and will change the U.S. dollar value of income and gains derived in Nuevos Soles. It is possible that the value of the Nuevo Sol could fall relative to the U.S. dollar between receipt of income and our distributions or date of accounting. In addition, assuming new proceeds are raised from future offerings, if the value of the Nuevo Sol falls relative to the U.S. dollar between the time we incur expenses in U.S. dollars (i.e., contracting for capital improvements or purchase of equipment) and the time expenses are paid, the amount of Nuevos Soles required to be converted into U.S. dollars in order to pay expenses will be greater than the equivalent amount in Nuevos Soles of such expenses at the time they were incurred.

In September 1991, the Nuevo Sol replaced the inti as the official currency of Peru. In February 1985, the inti had replaced the original Sol. Between 1978 and 1985, the Sol was gradually devalued through a crawling-peg system of mini-devaluations. Multiple exchange rates were utilized in the late 1980s in an attempt to favor manufacturing exports but were abandoned in 1990 in favor of a single-rate system.

8

The following table shows the nuevo sol/U.S. dollar exchange rate for the dates and periods indicated.

| Exchange Rates(1)

(S/. per US$) |

|---|

| End of Period | Average |

|---|

| |

|

|

| 2001 | | 3 | .44 | 3 | .45 |

| 2002 | | 3 | .51 | 3 | .52 |

| 2003 | | 3 | .46 | 3 | .48 |

| 2004 | | 3 | .29 | 3 | .41 |

| 2005 | | 3 | .24 | 3 | .295 |

(1) Official rates offered by banks.

Source:Peru Central Bank. | | |

The Central Bank of Peru has a history of adopting a policy of non-intervention in the exchange rate market. However, since 2003, the Central Bank has conducted regular interventions in the foreign exchange market in order to reduce volatility in the value of Peru’s currency against the U.S. dollar and to meet the demand for Nuevos Soles caused by pension funds and commercial banks restructuring their portfolio to include more assets denominated in Nuevos Soles as compared to foreign currency. The reduced volatility has enabled the Central Bank to increase its international reserves.

Peru has been subject to high levels of inflation in the past

Peru historically has experienced very substantial, and in some periods extremely high and variable, rates of inflation. Annual inflation, as measured by consumer price index (“CPI), averaged 29.2% during the 1970s, accelerated in the 1980s and reached 7,500% in 1990. The economic and monetary program that the government implemented during the early 1990s achieved a drastic reduction in inflation. CPI during 2003 demonstrated relative stability, with an average inflation rate of 2.3%, as compared to 0.2% for 2002 and 2.0% for 2001. This record has served to foster confidence in the stability of the Peruvian currency.

The consumer price index increased 3.5% during 2004. This rise in prices reflected supply shocks, including significant increases in the international prices of petroleum, wheat and soya oil as well as in the prices of some domestic foodstuffs such as rice and sugar, caused by the drought in the northern coast of Peru and restrictions of imports; these factors together account for 2.5 percentage points of annual inflation. These factors were partially attenuated by an appreciation of Peru’s currency. In the period from January to May 2005, the annual inflation rate was 1.79%, lower than the inflation rate for the same period in the previous year (3.18%).

Inflation and rapid changes in inflation rates have had and may continue to have significant effects both on the Peruvian economy and on the Peruvian securities and foreign exchange markets. We cannot assure investors that the government’s economic and monetary reform measures will be any more successful than previous programs in reducing inflation in the long term.

Since we operate our primary business in Peru, we may be adversely affected by high inflation levels.

Exchange controls implemented by Peru may affect our ability to exchange Nuevos Soles for U.S. dollars

Prior to 1991, Peru exercised control over the foreign exchange markets by imposing multiple exchange rates and placing restrictions on the possession and use of foreign currencies. In 1991, the Fujimori administration

9

eliminated all foreign exchange controls and the exchange rates were unified. Currently, foreign exchange rates are determined by market conditions, with regular operations by the Central Bank in the foreign exchange market in order to reduce volatility in the value of Peru’s currency against the U.S. dollar. There can be no guarantee, however, that limits on our ability to remit profits will not be imposed in the future. Furthermore, if Peru were to reinstitute exchange control and if we were to issue promissory notes to raise or borrow funds, our ability to service debt could be adversely affected. We cannot be certain that the Peruvian government will continue its current policy of permitting currency transfers and conversions without restriction.

Availability of information on our competitors in Peru

Although Peruvian generally accepted accounting, auditing and financial reporting standards and practices are similar in some respects to those employed in the United States, they are not equivalent and differ significantly in certain fundamental areas, most notably the treatment of inflation accounting. Moreover, equity research and public information on businesses and individuals is not as common in Peru as it is in the United States. As a consequence, fewer research reports are available on Peruvian hospitality and gaming operations than on similar U.S. operations.

Enforceability of judgments under Peruvian law may be difficult

Substantially all of our assets are located in Peru and are held by the subsidiaries in Peru. In the event that investors were to obtain a judgment in the United States against us, Kubuk International Inc., Kubuk Investment SAC or Kubuk Gaming SAC and seek to enforce such judgment in Peru, the investor’s ability to enforce the judgment in Peru would be subject to Peruvian laws regarding enforcement of foreign judgments. In general, Peruvian law provides that a judgment of a competent court outside of Peru would be recognized and could be enforced against the assets of the debtor in Peru, subject to the following statutory limitations set forth in the Peruvian civil code: (i) the judgment must not resolve matters for which exclusive jurisdiction of Peruvian courts applies (e.g., disputes relating to real estate located in Peru); (ii) the competence of the foreign court which issued the judgment must be recognized by Peruvian conflict of laws rules; (iii) the party against whom the judgment was obtained must have been properly served in connection with the foreign proceedings; (iv) the judgment of the foreign court must be a final judgment, not subject to any further appeal; (v) no pending proceedings may exist in Peru among the same parties and on the same subject; (vi) the judgment by the foreign court cannot be in violation of public policy; and (vii) the foreign court must grant reciprocal treatment to judgments issued by Peruvian courts. Moreover, there can be no assurance that a judgment rendered against us in the United States in a bankruptcy-related action would be enforceable against the assets of our subsidiaries in Peru or that a Peruvian court would not assert jurisdiction in a bankruptcy proceeding.

Risks Related to Securities

New legislation, including the Sarbanes-Oxley Act of 2002, may make it difficult for us to retain or attract officers and directors.

We may be unable to attract and retain qualified officers, directors and members of board committees required to provide for our effective management as a result of the recent and currently proposed changes in the rules and regulations which govern publicly-held companies. Sarbanes-Oxley Act of 2002 has resulted in a series of rules and regulations by the Securities and Exchange Commission that increase responsibilities and liabilities of directors and executive officers. The perceived increased personal risk associated with these recent changes may deter qualified individuals from accepting these roles.

While we believe we have adequate internal control over financial reporting, we are required to evaluate our internal controls under Section 404 of the Sarbanes-Oxley Act of 2002. Any adverse results from such evaluation could result in a loss of investor confidence in our financial reports and have an adverse effect on the price of our shares of common stock.

Pursuant to Section 404 of the Sarbanes-Oxley Act of 2002, we expect that beginning with our annual report on Form 10-KSB for the fiscal year ended December 31, 2007, we will be required to furnish a report by

10

management on our internal control over financial reporting. Such report will contain among other matters, an assessment of the effectiveness of our internal control over financial reporting, including a statement as to whether or not our internal control over financial reporting is effective. This assessment must include disclosure of any material weaknesses in our internal control over financial reporting identified by our management. Such report must also contain a statement that our auditors have issued an attestation report on our management’s assessment of such internal controls. Public Company Accounting Oversight Board Auditing Standard No. 2 provides the professional standards and related performance guidance for auditors to attest to, and report on, our management’s assessment of the effectiveness of internal control over financial reporting under Section 404.

While we believe our internal control over financial reporting is effective, we are still compiling the system and processing documentation and performing the evaluation needed to comply with Section 404, which is both costly and challenging. We cannot be certain that we will be able to complete our evaluation, testing and any required remediation in a timely fashion. During the evaluation and testing process, if we identify one or more material weaknesses in our internal control over financial reporting, we will be unable to assert that such internal control is effective. If we are unable to assert that our internal control over financial reporting is effective as of December 31, 2007 (or if our auditors are unable to attest that our management’s report is fairly stated or they are unable to express an opinion on the effectiveness of our internal controls), we could lose investor confidence in the accuracy and completeness of our financial reports, which would have a material adverse effect on our stock price.

Failure to comply with the new rules may make it more difficult for us to obtain certain types of insurance, including director and officer liability insurance, and we may be forced to accept reduced policy limits and coverage and/or incur substantially higher costs to obtain the same or similar coverage. The impact of these events could also make it more difficult for us to attract and retain qualified persons to serve on our board of directors, on committees of our board of directors, or as executive officers.

You may lose your entire investment in our shares.

An investment in our common stock is highly speculative and may result in the loss of your entire investment. Only investors who are experienced investors in high risk investments and who can afford to lose their entire investment should consider an investment in us.

There is only a limited trading market for our securities.

Our common stock is quoted for trading on the National Association of Securities Dealers over-the-counter bulletin board, and there is currently only a limited trading market for our common stock. There can be no assurance that an active market will develop or be sustained. The lack of an active public market for our common stock could have a material adverse effect on the price and liquidity of the common shares.

Our officers and directors beneficially own approximately 43.00% of our issued and outstanding common stock, which may limit your ability to influence corporate matters.

As of February 16, 2006, Tom Liu, our Chief Executive Officer, beneficially owned 6,463,991 shares of our common stock (approximately 29.63%); David Liu, Tom Liu’s father, beneficially owned 4,322,018 shares of our common stock (approximately 19.81%); Guo Xiu Yan, Tom Liu’s mother, owned 1,620,077 shares of our common stock (approximately 7.43%); and our other officers and directors, collectively, as a group, beneficially owned 2,914,949 shares of our common stock (approximately 13.36%). These shareholders could control the outcome of any corporate transaction or other matter submitted to our shareholders for approval, including mergers, consolidations, or the sale of all or substantially all of our assets, and also could prevent or cause a change in control. The interests of these shareholders may conflict with the interests of our other shareholders.

Third parties may be discouraged from making a tender offer or bid to acquire us because of this concentration of ownership.

11

Broker-dealers may be discouraged from effecting transactions in our common shares because they are considered a penny stock and are subject to the penny stock rules.

Rules 15g-1 through 15g-9 promulgated under the Securities Exchange Act of 1934, as amended impose sales practice and disclosure requirements on certain broker-dealers who engage in certain transactions involving a “penny stock.” Subject to certain exceptions, a penny stock generally includes any non-NASDAQ equity security that has a market price of less than $5.00 per share. Our shares are considered penny stock. The additional sales practice and disclosure requirements imposed upon broker-dealers may discourage broker-dealers from effecting transactions in our shares, which could severely limit the market liquidity of the shares and impede the sale of our shares in the secondary market.

A broker-dealer selling penny stock to anyone other than an established customer or “accredited investor” (generally, an individual with net worth in excess of $1,000,000 or an annual income exceeding $200,000, or $300,000 together with his or her spouse), must make a special suitability determination for the purchaser and must receive the purchaser’s written consent to the transaction prior to sale, unless the broker-dealer or the transaction is otherwise exempt. In addition, the penny stock regulations require the broker-dealer to deliver, prior to any transaction involving a penny stock, a disclosure schedule prepared by the United States Securities and Exchange Commission relating to the penny stock market, unless the broker-dealer or the transaction is otherwise exempt. A broker-dealer is also required to disclose commissions payable to the broker-dealer and the registered representative and current quotations for the securities. Finally, a broker-dealer is required to send monthly statements disclosing recent price information with respect to the penny stock held in a customer’s account and information with respect to the limited market in penny stocks.

Our common stock is quoted on the OTC Bulletin Board. Trading in stock quoted on the OTC Bulletin Board is often thin and characterized by wide fluctuations in trading prices, due to many factors that may have little to do with the company’s operations or business prospects. Moreover, the OTC Bulletin Board is not a stock exchange, and trading of securities on the OTC Bulletin Board is often more sporadic than the trading of securities listed on a quotation system like Nasdaq or a stock exchange like AMEX. Accordingly, you may have difficulty reselling any of the stock you purchase.

In the event that your investment in our shares is for the purpose of deriving dividend income or in expectation of an increase in market price of our shares from the declaration and payment of dividends, your investment will be compromised because we do not intend to pay dividends.

We have never paid a dividend to our shareholders, and we intend to retain our cash for the continued development of our business. We do not intend to pay cash dividends on our common stock in the foreseeable future. As a result, your return on investment will be solely determined by your ability to sell your shares in a secondary market.

FORWARD-LOOKING STATEMENTS

We use words like “expects,” “believes,” “intends,” “anticipates,” “plans,” “targets,” “projects” or “estimates” in this prospectus. When used, these words and other, similar words and phrases or statements that an event, action or result “will,” “may,” “could,” or “should” occur, be taken or be achieved, identify “forward-looking” statements. Such forward-looking statements reflect our current views with respect to future events and are subject to certain risks, uncertainties and assumptions, including, the risks and uncertainties outlined under the sections titled “Risk Factors and Uncertainties” beginning at page 4 of this prospectus, “Description of the Business” beginning at page 30 of this prospectus and “Management’s Discussion and Analysis” beginning at page 40 of this prospectus. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those anticipated, believed, estimated or expected.

These forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause our actual results and performance to be materially different from any future results or performance expressed or implied by these forward-looking statements. These factors include, among other things, those matters discussed under the caption “Risk Factors,” as well as the following:

| | • | | the impact of general economic conditions in the Peru; |

12

| | • | | industry conditions, including competition; |

| | • | | business strategies and intended results; |

| | • | | our ability to integrate acquisitions into our operations and management; |

| | • | | risks associated with the hotel industry and real estate markets in general; |

| | • | | the impact of terrorist activity or war, threats of terrorist activity or war and responses to terrorist activity on the economy in general and the travel and hotel industries in particular; |

| | • | | travelers' fears of exposure to contagious diseases; |

| | • | | legislative or regulatory requirements; and |

| | • | | access to capital markets. |

Although we believe that these statements are based upon reasonable assumptions, we can give no assurance that our goals will be achieved. Given these uncertainties, prospective investors are cautioned not to place undue reliance on these forward-looking statements. These forward-looking statements are made as of the date of this report. We assume no obligation to update or revise them or provide reasons why actual results may differ.

DIVIDEND POLICY

We anticipate that we will retain any earnings to support operations and to finance the growth and development of our business. Therefore, we do not expect to pay cash dividends in the foreseeable future. Any further determination to pay cash dividends will be at the discretion of our board of directors and will be dependent on the financial condition, operating results, capital requirements and other factors that our board deems relevant. We have never declared a dividend.

SELLING SHAREHOLDERS

This prospectus covers the offering of up to 6,431,334 shares of our common stock by Selling Shareholders. We will not receive any proceeds from the sale of the shares by the Selling Shareholders.

If we issue all of the common stock issuable upon exercise of the Class A Warrants held by Selling Shareholders, we will receive proceeds of $2,731,334. We intend to use such proceeds, if any, for general working capital purposes. We cannot assure you that any of the warrants will be exercised.

The shares issued to the Selling Shareholders or issuable to Selling Shareholders upon exercise of the Class A Warrants are “restricted” shares under applicable federal and state securities laws and are being registered to give the Selling Shareholders the opportunity to sell their shares. The registration of such shares does not necessarily mean, however, that any of these shares will be offered or sold by the Selling Shareholders. The Selling Shareholders may from time to time offer and sell all or a portion of their shares in the over-the-counter market, in negotiated transactions, or otherwise, at market prices prevailing at the time of sale or at negotiated prices.

The registered shares may be sold directly or through brokers or dealers, or in a distribution by one or more underwriters on a firm commitment or best efforts basis. To the extent required, the names of any agent or broker-dealer and applicable commissions or discounts and any other required information with respect to any particular offer will be set forth in an accompanying prospectus supplement. See “Plan of Distribution” beginning on page 19 of this prospectus. The Selling Shareholders reserve the sole right to accept or reject, in whole or in part, any proposed purchase of the registered shares to be made directly or through agents. The Selling Shareholders and any agents or broker-dealers that participate with the Selling Shareholders in the distribution of their registered shares may be deemed to be “underwriters” within the meaning of the Securities Act of 1933, as amended, (the “Securities

13

Act”) and any commissions received by them and any profit on the resale of the registered shares may be deemed to be underwriting commissions or discounts under the Securities Act.

We will receive no proceeds from the sale of the registered shares, and we have agreed to bear the expenses of registration of the shares, other than commissions and discounts of agents or broker-dealers and transfer taxes, if any.

Selling Shareholders Information

The following are the Selling Shareholders who own and have the right to acquire pursuant to the exercise of Class A Warrants an aggregate of 3,371,334 shares of our common stock covered in this prospectus. Certain Selling Shareholders have the right to acquire the shares of common stock upon the exercise of Class A Warrants sold in our private placements. See “Transactions with Selling Shareholders” beginning on page 18 of this prospectus for further details. At February 16, 2006, we had 21,815,667 shares of common stock issued and outstanding.

| Before Offering | After Offering |

|---|

|

| Name | Total Number of Shares Beneficially

Owned (1) | Percentage of

Shares Owned (1) | Number of

Shares Offered | Shares Owned

After Offering (2) | Percentage of

Shares owned

After

Offering(3) |

|---|

|

| IFG Investments Services Inc.(4) | | 500,000 | | 2.27% | | 500,000 | | — | | — | |

| Suite 4 Temple Bldg | |

| Prince William & Main Street | |

| Charlestown, Federation of St. Kits & | |

| Nevis, West Indies | |

|

| IFG Investments Services Inc.(4) | | 820,000 | | 3.69% | | 820,000 | | — | | — | |

| Suite 4 Temple Bldg | |

| Prince William & Main Street | |

| Charlestown, Federation of St. Kits & | |

| Nevis, West Indies | |

|

| Merle Lelievre-Parsons(5) | | 20,000 | | * | | 20,000 | | — | | — | |

| #4 - 529 Johnstone Rd | |

| Parksville, BC | |

| Canada V9P 2K1 | |

|

| Lee Yule Investments(6) | | 7,000 | | * | | 7,000 | | — | | — | |

| 17718 - 64 Avenue | |

| Edmonton, AB | |

| Canada T5T 4J5 | |

|

| Frederick H. Drury(7) | | 132,000 | | * | | 132,000 | | — | | — | |

| 229 - 279 Suder Greens Drive | |

| Edmonton, AB | |

| Canada T5T 6X6 | |

|

| T. Ron Harper(8) | | 40,000 | | * | | 40,000 | | — | | — | |

| 3129 - 30th Avenue | |

| Vernon, BC | |

| Canada V1T 2C4 | |

|

14

| Before Offering | After Offering |

|---|

|

| Name | Total Number of Shares Beneficially

Owned (1) | Percentage of

Shares Owned (1) | Number of

Shares Offered | Shares Owned

After Offering (2) | Percentage of

Shares owned

After

Offering(3) |

|---|

|

| | | | | | | | | | | |

| Caroline Gilchrist(9) | | 40,000 | | * | | 40,000 | | — | | — | |

| 370 Poplar Point Drive | |

| Kelowna, BC | |

| Canada V1Y 1Y1 | |

|

| Herbert Woo(10) | | 6,000 | | * | | 6,000 | | — | | — | |

| #439, 1406 Hodgson Way | |

| Edmonton, AB | |

| Canada T6R 3K1 | |

|

| Tough Equities Inc.(11) | | 6,800 | | * | | 6,800 | | — | | — | |

| 9 Paquette Place | |

| St. Albert, Alberta | |

| Canada T8N 5K8 | |

|

| Amir Khoury(12) | | 12,000 | | * | | 12,000 | | — | | — | |

| 3 Lorrain C'r | |

| St. Albert | |

|

| Judson Rich(13) | | 8,000 | | * | | 8,000 | | — | | — | |

| 11107 - 21 Avenue | |

| Edmonton, AB | |

| Canada T6J 5C7 | |

|

| Suhail Khoury(14) | | 13,400 | | * | | 13,400 | | — | | — | |

| #100 Quesnell Crest | |

| Edmonton, AB | |

| Canada | |

|

| Matt Saunders(15) | | 4,000 | | * | | 4,000 | | — | | — | |

| 5891 Vardon Place | |

| Delta, BC | |

| Canada V4L 1E8 | |

|

| Mark Koroll(16) | | 33,300 | | * | | 33,300 | | — | | — | |

| 9300 Aberdeen Rd | |

| Coldstream, BC | |

| Canada V1B 2K5 | |

|

| Ross Parsons(17) | | 33,300 | | * | | 33,300 | | — | | — | |

| 12009 Husband Road | |

| Vernon, BC | |

| Canada V1B 1M9 | |

|

| 695809 B.C. Ltd.(18) | | 4,000 | | * | | 4,000 | | — | | — | |

| 620 - 800 W. Pender St | |

| Vancouver, BC | |

| Canada V6A 4E1 | |

|

| Robert J. Kaplan(19) | | 33,334 | | * | | 33,334 | | — | | — | |

| 245 E. 87th Street | |

| New York NY 10128 | | | | | | | | | | | |

|

15

| Before Offering | After Offering |

|---|

|

| Name | Total Number of Shares Beneficially

Owned (1) | Percentage of

Shares Owned (1) | Number of

Shares Offered | Shares Owned

After Offering (2) | Percentage of

Shares owned

After

Offering(3) |

|---|

|

| | | | | | | | | | | |

| 690044 BC Ltd.(20) | | 70,000 | | * | | 70,000 | | — | | — | |

| 4 - 1037 W. Broadway | |

| Vancouver, BC | |

| Canada V6H 1E3 | |

|

| Raymond Lim(21) | | 6,000 | | * | | 6,000 | | — | | — | |

| 3493 William Street | |

| Vancouver, BC | |

| Canada V5K 2Z5 | |

|

| John Fraser(22) | | 100,000 | | * | | 100,000 | | — | | — | |

| 300 - 31 Bastion Square | |

| Victoria, BC | |

| Canada V8W 1J1 | |

|

| Alan R. Mabee(23) | | 6,000 | | * | | 6,000 | | — | | — | |

| 10205 - 137 St. NW | |

| Edmonton, AB | |

| Canada | |

|

| Clear Channel Inc.(24) | | 1,800,000 | | 8.1% | | 1,000,000 | | — | | — | |

| Temple Financial Centre | |

| Leeward Highway | |

| Providenciales, Turks & Caicos Isl. , | |

| B.W.I | |

|

| Anthony Boyden(25) | | 36,200 | | * | | 36,200 | | — | | — | |

| 14 Willies Round | |

| Stouffville, ON | |

| Canada L1N 4A6 | |

|

| Blackpool Ltd.(26) | | 1,800,000 | | 8.1% | | 800,000 | | — | | — | |

| Temple Financial Centre | |

| Leeward Highway | |

| Providenciales, Turks & Caicos Isl. , | |

| B.W.I | |

|

| David Wong Liu(27)(32) | | 5,942,095 | | 27.74% | | 1,500,000(27) | | 2,942,095(27) | | 13.49% | |

| 355 Lemon Ave., Suite C | |

| Walnut, CA 91789 | |

|

| Lee Kuen Cheung(28)(32) | | 1,399,353 | | 6.41% | | 500,000 | | 899,353 | | 4.12% | |

| RM 1111, 11/F Hang Lung Centre Arcad | |

2-28 Paterson Street, Causeway Bay

Hong Kong | |

|

| Guoxiu Yan(29)(32) | | 5,942,095 | | 27.24% | | 500,000(29) | | 2,942,095(29) | | 13.49% | |

| 355 Lemon Ave., Suite C | |

| Walnut, CA 91789 | |

|

| Zheng Liu(30)(32) | | 215,285 | | 0.99% | | 100,000 | | 115,285 | | * | |

| 355 Lemon Ave., Suite C | |

| Walnut, CA 91789 | |

|

| Luisa Hong Wong(31)(32) | | 215,285 | | 0.99% | | 100,000 | | 115,285 | | * | |

| 355 Lemon Ave., Suite C | |

| Walnut, CA 91789 | |

|

| Total | | 11,503,352 | | 52.73% | | 6,431,334 | | 5,072,018 | | 23.25% | |

|

16

| | (1) | | All percentages are based on 21,815,667 shares of common stock issued and outstanding on February 16, 2006. Beneficial ownership is calculated based on the number of shares of common stock that each selling shareholder owns or controls or has the right to acquire within 60 days of February 16, 2006. |

| | (2) | | This table assumes that the Selling Shareholders will sell all of their shares available for sale during the effectiveness of the registration statement that includes this prospectus. The Selling Shareholders are not required to sell their shares. See “Plan of Distribution” beginning on page 19. |

| | (3) | | Assumes that all shares registered for resale by this prospectus have been issued and sold. |

| | (4) | | IFG Investments Services Inc. is organized under the laws of Nevis. Daniel McMullin has sole investment and voting control over the securities. The Selling Shareholder holds 660,000 shares of common stock of Chilco and Class A Warrants exercisable to acquire 660,000 shares of common stock at $2.00 per share for a period of one year. The Class A warrants may not be exercised if th eexercise would result in the holder beneficially owning more than 9.99% of our issued and outstanding common stock. |

| | (5) | | Merle Lelievre-Parsons holds 10,000 shares of common stock of Chilco and Class A Warrants exercisable to acquire 10,000 shares of common stock at $2.00 per share for a period of one year. |

| | (6) | | Lee Yule Investments is organized under the laws of Alberta. Lee Yule has sole investment and voting control over the securities. The Selling Shareholder holds 3,500 shares of common stock of Chilco and Class A Warrants exercisable to acquire 3,500 shares of common stock at $2.00 per share for a period of one year. |

| | (7) | | Frederick H. Drury holds 66,000 shares of common stock of Chilco and Class A Warrants exercisable to acquire 66,000 shares of common stock at $2.00 per share for a period of one year. |

| | (8) | | T. Ron Harper holds 20,000 shares of common stock of Chilco and Class A Warrants exercisable to acquire 20,000 shares of common stock at $2.00 per share for a period of one year. |

| | (9) | | Caroline Gilchrist holds 20,000 shares of common stock of Chilco and Class A Warrants exercisable to acquire 20,000 shares of common stock at $2.00 per share for a period of one year. |

| | (10) | | Herbert Woo holds 3,000 shares of common stock of Chilco and Class A Warrants exercisable to acquire 3,000 shares of common stock at $2.00 per share for a period of one year. |

| | (11) | | Tough Equities Inc. is organized under the laws of Alberta. Barry Touch and Ruby Tough have sole investment and voting control over the securities. The Selling Shareholder holds 3,400 shares of common stock of Chilco and Class A Warrants exercisable to acquire 3,400 shares of common stock at $2.00 per share for a period of one year. |

| �� | (12) | | Amir Khoury holds 6,000 shares of common stock of Chilco and Class A Warrants exercisable to acquire 6,000 shares of common stock at $2.00 per share for a period of one year. |

| | (13) | | Judson Rich holds 4,000 shares of common stock of Chilco and Class A Warrants exercisable to acquire 4,000 shares of common stock at $2.00 per share for a period of one year. |

| | (14) | | Suhail Khoury holds 6,700 shares of common stock of Chilco and Class A Warrants exercisable to acquire 6,700 shares of common stock at $2.00 per share for a period of one year. |

| | (15) | | Matt Saunders holds 2,000 shares of common stock of Chilco and Class A Warrants exercisable to acquire 2,000 shares of common stock at $2.00 per share for a period of one year. |

| | (16) | | Mark Koroll holds 16,650 shares of common stock of Chilco and Class A Warrants exercisable to acquire 16,650 shares of common stock at $2.00 per share for a period of one year. |

| | (17) | | Ross Parsons holds 16,650 shares of common stock of Chilco and Class A Warrants exercisable to acquire 16,650 shares of common stock at $2.00 per share for a period of one year. |

| | (18) | | 695809 B.C. Ltd. is organized under the laws of British Columbia. The Selling Shareholder holds 2,000 shares of common stock of Chilco and Class A Warrants exercisable to acquire 2,000 shares of common stock at $2.00 per share for a period of one year. |

| | (19) | | Robert J. Kaplan holds 16,667 shares of common stock of Chilco and Class A Warrants exercisable to acquire 16,667 shares of common stock at $2.00 per share for a period of one year. |

| | (20) | | 690044 BC Ltd. is organized under the laws of British Columbia. Andrew Britnell has sole investment and voting control over the securities. The Selling Shareholder holds 35,000 shares of common stock of Chilco and Class A Warrants exercisable to acquire 35,000 shares of common stock at $2.00 per share for a period of one year. |

| | (21) | | Raymond Lim holds 3,000 shares of common stock of Chilco and Class A Warrants exercisable to acquire 3,000 shares of common stock at $2.00 per share for a period of one year. |

| | (22) | | John Fraser holds 50,000 shares of common stock of Chilco and Class A Warrants exercisable to acquire 50,000 shares of common stock at $2.00 per share for a period of one year. |

| | (23) | | Alan R. Mabee holds 3,000 shares of common stock of Chilco and Class A Warrants exercisable to acquire 3,000 shares of common stock at $2.00 per share for a period of one year. |

| | (24) | | Blackpool Ltd. is organized under the laws of Turks & Caicos. Janice Stevens has sole investment and voting control over the securities. Blackpool Ltd. holds 400,000 shares of common stock of Chilco and Class A Warrants exercisable to acquire 400,000 shares of common stock at $2.00 per share for a period of one year. Janice Stevens and John Meyer are married, and consequently, Blackpool Ltd. and Clear Channel Inc. are deemed to have the same beneficial owner. The Class A warrants may not be exercised if the exercise would result in the holder benefically owning more than 9.99% of our issued and outstanding common stock. |

| | (25) | | Anthony Boyden holds 18,100 shares of common stock of Chilco and Class A Warrants exercisable to acquire 18,100 shares of common stock at $2.00 per share for a period of one year. |

| | (26) | | Clear Channel Inc. is organized under the laws of Turks & Caicos, and owns 1,000,000 shares of common stock. John Meyer has sole investment and voting control over the securities. Janice Stevens and John Meyer are married, and consequently, Blackpool Ltd. and Clear Channel Inc. are deemed to have the same beneficial owner. The Class A warrants may not be exercised if the exercise would result in the holder benefically owning more than 9.99% of our issued and outstanding common stock. |

17

| | (27) | | Includes 1,753,640 shares of common stock held in escrow pursuant to escrow arrangements entered into in connection with our acquisition of Kubuk International Inc. David Lui is the father of Tom Liu, our Chief Executive Officer, and husband of Guoxiu Yan, a selling shareholder. The Principal Shareholders of Kubuk, Tom Liu and David Liu, contributed a total of 1,250,000 Exchange Shares into escrow (of which David Liu contributed 499,622 shares) for the purposes of exercising certain co-sale rights granted by the Registrant to the Shareholder Principals. David Liu and Guoxin Yan, as husband and wife, are deemed to beneficially own each other’s common stock. |

| | (28) | | Includes 405,609 shares of common stock held in escrow pursuant to escrow arrangements entered into in connection with our acquisition of Kubuk International Inc. |

| | (29) | | Includes 469,589 shares of common stock held in escrow pursuant to escrow arrangements entered into in connection with our acquisition of Kubuk International Inc. Guoxiu Yan is the mother of Tom Liu, Chief Executive Officer of Chilco River Holdings Inc., and the wife of David Liu, a selling shareholder and major shareholder of Chilco. David Liu and Guoxin Yan, as husband and wife, are deemed to beneficially own each other’s common stock. |

| | (30) | | Includes 62,402 shares of common stock held in escrow pursuant to escrow arrangements entered into in connection with our acquisition of Kubuk International Inc. Zheng Liu is the sister of tom Liu and daughter of David Liu and Guoxin Yan. However, they do not control the right to vote or investment power of each other’s common stock. |

| | (31) | | Includes 62,402 shares of common stock held in escrow pursuant to escrow arrangements entered into in connection with our acquisition of Kubuk International Inc. |

| | (32) | | This shareholder was a shareholder of Kubuk International and received these shares in the Share Exchange, which closed on July 15, 2005. Each Kubuk Shareholder received 0.3749970588 shares of common stock of Chilco River Holdings, Inc. for each share of Kubuk International common stock tendered in connection with the Share Exchange. The Kubuk Shareholders placed a total of 5,000,000 Exchange Shares into escrow to secure certain obligations by Chilco and the Principal Shares to raise $5,000,000 at a minimum share price of $1.00 per share. The Kubuk Shareholders placed a total of 2,000,000 Exchange Shares into escrow to satisfy certain obligations to consultants to Kubuk, which shares were cancelled and returned to treasury on December 30, 2005. The Kubuk Shareholders have voting power over these shares pending release from escrow. |

Based on information provided to us, none of the selling shareholders are affiliated or have been affiliated with any broker-dealer in the United States. Except as otherwise provided in this prospectus, none of the selling shareholders are affiliated or have been affiliated with us, any of our predecessors or affiliates during the past three years.

Transactions with Selling Shareholders

| | Transactions with Private Placement Selling Shareholders |

On December 17, 2005, our Board of Directors authorized an initial direct private placement offering of Units at $1.50 per Unit under the terms of a Unit Purchase Agreement. Each Unit consists of one share of common stock, and a Class A Warrant exercisable at $2.00 per share for one year from the date of Closing. Under the terms of the Unit Purchase Agreement, we are required to use $1 million from proceeds from the offering to renovate the casino floor of the Bruce Hotel and Casino and $1 million for marketing and business development. We also granted the investors registration rights and agreed to file a resale registration statement with the Securities and Exchange Commission within 60 days of the closing date of the private placement. If we failed to file the registration statement within 60 days, we agreed to pay the investors liquidated damages equal to 2% of the number of shares of common stock issued to the investor in the private placement for each month we are in default. We also agreed not to offer and sell shares of common stock or common stock equivalents for a period of 120 days following the effectiveness of the registration statement, except for certain specified transactions, including an offer and sale of up to 2,000,000 shares of common stock at $1.50 per share. The private placement was made to non-U.S. persons in off-shore transactions in reliance upon the exemption from registration available under Rule 903 of Regulation S of the Securities Act and one accredited investor in the United States pursuant to an exemption available under Section 4(2) of the Securities Act.

We issued 1,365,667 Units to raise gross proceeds of $2,048,500.

We are registering the shares of common stock issued in the private placements and the shares of common stock issuable upon exercise of the Class A Warrants for resale by the selling shareholders in the registration statement in which this prospectus is included.

18

| | Transactions with Clear Channel |

Effective on December 29, 2005, we entered into a Consulting Agreement with Clear Channel Inc. under which we retained Clear Channel to provide us with strategic marketing and business planning consulting services and to assist us in developing corporate governance policies, recruiting qualified officers and director candidates and developing a corporate finance strategy. We paid Clear Channel a consulting fee of one million (1,000,000) shares of our common stock. The Consulting Agreement is for a term of one year. We are registering the shares of common stock in the registration statement in which this prospectus is included.

John Meyer has sole investment and voting power over the common stock owned by Clear Channel and is married to Janice Stevens, who has sole investment and voting powre over the common stock owned by Blackpool Ltd. Consequently, Clear Channel and Blackpool are deemed to have the same beneficial owner. Blackpool is named as a selling shareholder in this prospectus.

| | Transactions with Former Shareholders of Kubuk International Inc. |