QuickLinks -- Click here to rapidly navigate through this documentAs filed with the Securities and Exchange Commission on February 5, 2004

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-4

REGISTRATION STATEMENT UNDER THE

SECURITIES ACT OF 1933

| Vought Aircraft Industries, Inc. | | Delaware | | 336413 | | 75-2884072 |

| VAC Industries, Inc. | | Delaware | | 336413 | | 52-1784782 |

| Vought Commercial Aircraft Company | | Delaware | | 336413 | | 95-4568095 |

| Contour Aerospace Corporation | | Delaware | | 336413 | | 20-0450975 |

| (Exact names of registrants as specified in their charters) | | (State or other jurisdiction of

incorporation or organization) | | (Primary Standard Industrial

Classification Code Number) | | (I.R.S. Employer

Identification No.) |

9314 West Jefferson Boulevard M/S 2-01

Dallas, Texas 75211

(972) 946-2011

(Address, including zip code, and telephone number, including area code,

of each of the registrants' principal executive offices)

Bruce White, Vice President & General Counsel

Vought Aircraft Industries, Inc.

9314 West Jefferson Boulevard M/S 2-01

Dallas, Texas 75211

(972) 946-2011

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

Gregory A. Ezring, Esq.

Latham & Watkins LLP

885 Third Avenue, Suite 1000

New York, New York 10022

(212) 906-1200

Approximate date of commencement of proposed exchange offer: As soon as practicable after the effective date of this registration statement.

If any of the securities being registered on this form are being offered in connection with the formation of a holding company and there is compliance with General Instruction G, check the following box. o

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

CALCULATION OF REGISTRATION FEE

|

Title of Each Class of

Securities to be Registered

| | Amount to

be Registered

| | Proposed Maximum

Offering Price

per Note(1)

| | Proposed Maximum

Aggregate

Offering Price(1)

| | Amount Of

Registration Fee

|

|---|

|

| 8% Senior Notes due 2011 of Vought Aircraft Industries, Inc | | $270,000,000 | | 100% | | $270,000,000 | | $34,209 |

|

| Guarantees of the 8% Senior Notes due 2011 of the Additional Registrants | | $270,000,000 | | N/A | | N/A | | (2) |

|

- (1)

- Estimated solely for the purpose of calculating the registration fee pursuant to Rule 457(f) under the Securities Act.

- (2)

- No additional registration fee is due for guarantees pursuant to Rule 457(n) under the Securities Act.

The registrants hereby amend this registration statement on such date or dates as may be necessary to delay its effective date until the registrants shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until this registration statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and we are not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

Subject to completion, dated February 5, 2004.

PROSPECTUS

Vought Aircraft Industries, Inc.

Offer to Exchange

$270,000,000 principal amount of their 8% Series B Senior Notes due 2011,

which have been registered under the Securities Act,

for any and all of its outstanding 8% Series A Senior Notes due 2011

We are offering to exchange our currently outstanding 8% Series A Senior Notes due 2011, which we refer to as the outstanding notes, for our registered 8% Series B Senior Notes due 2011, which we refer to as the exchange notes. We refer to both the outstanding notes and the exchange notes as the notes. The exchange notes are substantially identical to the outstanding notes, except that the exchange notes have been registered under the federal securities laws, and therefore will not bear any legend restricting their transfer, and the holders of exchange notes will not be entitled to most of the rights under the registration rights agreement, including the provisions for additional interest. The exchange notes will represent the same debt as the outstanding notes, and we will issue the exchange notes under the same indenture.

The exchange notes will bear interest from the most recent interest payment date for which interest has been paid on the outstanding notes. We will pay interest on the notes on January 15 and July 15 of each year, and the first interest payment on the exchange notes will be made on July 15, 2004. The notes will mature on July 15, 2011. We may redeem all or part of the notes prior to July 15, 2007, by paying a make-whole premium. Thereafter, we may redeem all or part of the notes at the redemption prices set forth herein. Additionally, prior to July 15, 2006, we may redeem up to 35% of the notes from the proceeds of equity offerings.

The exchange notes will be our senior unsecured obligations and will be guaranteed by each of our existing and future domestic subsidiaries. The exchange notes and guarantees will rank equally in right of payment with any of our and such guarantors' existing and future senior unsecured indebtedness and will rank senior in right of payment to all of our and such guarantors' existing and future unsecured subordinated indebtedness. The exchange notes and the guarantees will be effectively subordinated to all of our and the guarantors' secured indebtedness to the extent of the value of the assets securing such indebtedness.

The principal features of the exchange offer are as follows:

- •

- The exchange offer expires at 12:00 midnight, New York City time, on , 2004, unless extended.

- •

- We will exchange all outstanding notes that are validly tendered and not validly withdrawn prior to the expiration of the exchange offer.

- •

- You may withdraw tendered outstanding notes at any time prior to the expiration of the exchange offer.

- •

- The exchange of outstanding notes for exchange notes pursuant to the exchange offer will be made in multiples of $1,000.

- •

- The exchange of outstanding notes for exchange notes pursuant to the exchange offer will not be a taxable event for U.S. federal income tax purposes.

- •

- We will not receive any proceeds from the exchange offer.

- •

- We do not intend to apply for listing of the exchange notes on any securities exchange or automated quotation system.

Broker-dealers receiving exchange notes in exchange for outstanding notes acquired for their own account through market-making or other trading activities must deliver a prospectus in any resale of the exchange notes.

Investing in the exchange notes involves risks. See "Risk Factors" beginning on page 16.

Neither the U.S. Securities and Exchange Commission nor any other federal or state agency has approved or disapproved of these securities to be distributed in the exchange offer, nor have any of these organizations determined that this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this Prospectus is , 2004.

Each broker-dealer that receives exchange notes for its own account pursuant to the exchange offer must acknowledge that it will deliver a prospectus in connection with any resale of such exchange notes. The letter of transmittal delivered with this prospectus states that by so acknowledging and by delivering a prospectus, a broker-dealer will not be deemed to admit that it is an "underwriter" within the meaning of the Securities Act of 1933. This prospectus, as it may be amended or supplemented from time to time, may be used by a broker-dealer in connection with resales of exchange notes received in exchange for outstanding notes where such outstanding notes were acquired by such broker-dealer as a result of market-making activities or other trading activities. We have agreed that, for a period of 180 days after the completion of the exchange offer, we will make this prospectus available to any broker-dealer for use in connection with any such resale. See "Plan of Distribution."

We have not authorized any dealer, salesman or other person to give any information or to make any representation other than those contained or incorporated by reference in this prospectus. You must not rely upon any information or representation not contained or incorporated by reference in this prospectus as if we had authorized it. This prospectus does not constitute an offer to sell or a solicitation of an offer to buy any securities other than the registered securities to which it relates, nor does this prospectus constitute an offer to sell or a solicitation of an offer to buy securities in any jurisdiction to any person to whom it is unlawful to make such offer or solicitation in such jurisdiction.

Table of Contents

| | Page

|

|---|

| Prospectus Summary | | 1 |

| Risk Factors | | 16 |

| Forward-Looking Statements | | 28 |

| The Exchange Offer | | 29 |

| Use of Proceeds | | 38 |

| Capitalization | | 39 |

| Unaudited Pro Forma Condensed Combined Financial Data | | 40 |

| Selected Historical Financial Data | | 45 |

| Management's Discussion and Analysis of Financial Condition and Results of Operations | | 48 |

| Business | | 74 |

| Management | | 91 |

| Security Ownership of Certain Beneficial Owners and Management | | 101 |

| Certain Relationships and Related Party Transactions | | 103 |

| Description of Our Amended Senior Secured Credit Facilities | | 104 |

| Description of the Exchange Notes | | 106 |

| Book Entry; Delivery and Form | | 147 |

| Material Federal Income Tax Consequences | | 149 |

| Plan of Distribution | | 150 |

| Legal Matters | | 150 |

| Experts | | 150 |

| Where You Can Find More Information | | 151 |

| Index to Consolidated Financial Statements | | F-1 |

Industry and market data used throughout this prospectus were obtained through company research, surveys and studies conducted by third parties and industry and general publications. We have not independently verified market and industry data from third-party sources. While we believe this

i

information is reliable and market definitions are appropriate, neither this research, surveys and studies nor these definitions have been verified by any independent sources.

Certain monetary amounts, percentages and other figures included in this prospectus have been subject to rounding adjustments. Accordingly, figures shown as totals in certain tables may not be the arithmetic aggregation of the figures that precede them, and figures expressed as percentages in the text may not total 100% or, as applicable, when aggregated may not be the arithmetic aggregation of the percentages that precede them.

ii

PROSPECTUS SUMMARY

This summary highlights important information about this offering and our business. It does not contain all of the information that may be important to you. This prospectus includes specific terms of the exchange offer, as well as information regarding our business and detailed financial data. You should read this entire prospectus and should consider, among other things, the matters set forth under the headings "Risk Factors" and "Management's Discussion and Analysis of Financial Condition and Results of Operations" and our combined financial statements and related notes thereto appearing elsewhere in this prospectus. In this prospectus:

- •

- "Vought," "we," "our" or "us" refers to Vought Aircraft Industries, Inc. together with its consolidated subsidiaries and its legacy companies;

- •

- "Aerostructures" refers to the historical operations of The Aerostructures Corporation prior to July 2, 2003, the date that Vought acquired Aerostructures;

- •

- "outstanding notes" refers collectively to the 8% Series A Senior Notes due 2011 that were issued on July 2, 2003;

- •

- "exchange notes" refers collectively to the 8% Series B Senior Notes due 2011 offered pursuant to this prospectus; and

- •

- "notes" refers collectively to the outstanding notes and the exchange notes.

The Exchange Offer

The following is a brief summary of terms of the exchange offer. For a more complete description of the exchange offer, see "The Exchange Offer."

| Securities Offered | | $270.0 million in aggregate principal amount of 8% Series B Senior Notes due 2011. |

Exchange Offer |

|

The exchange notes are being offered in exchange for a like principal amount of outstanding notes. We will accept any and all outstanding notes validly tendered and not withdrawn prior to 12:00 midnight, New York City time, on , 2004. Holders may tender some or all of their outstanding notes pursuant to the exchange offer. However, outstanding notes may be tendered only in integral multiples of $1,000 in principal amount. The form and terms of the exchange notes are the same as the form and terms of the outstanding notes except that: |

|

|

• |

|

the exchange notes have been registered under the federal securities laws and will not bear any legend restricting their transfer; |

|

|

• |

|

the exchange notes bear a series B designation and a different CUSIP number than the outstanding notes; and |

|

|

• |

|

the holders of the exchange notes will not be entitled to most of the rights under the registration rights agreement, including the provisions for an increase in the interest rate on the outstanding notes in some circumstances relating to the timing of the exchange offer. |

|

|

See "The Exchange Offer." |

1

Expiration Date |

|

The exchange offer will expire at 12:00 midnight, New York City time, on , 2004, unless we decide to extend the exchange offer. |

Conditions to the Exchange Offer |

|

The exchange offer is subject to customary conditions, some of which may be waived by us. See "The Exchange Offer—Conditions to the Exchange Offer." |

Procedures for Tendering Outstanding Notes |

|

If you wish to accept the exchange offer, you must complete, sign and date the letter of transmittal, or a facsimile of the letter of transmittal, in accordance with the instructions contained in this prospectus and in the letter of transmittal. You should then mail or otherwise deliver the letter of transmittal, or facsimile, together with the outstanding notes to be exchanged and any other required documentation, to the exchange agent at the address set forth in this prospectus and in the letter of transmittal. |

|

|

By executing the letter of transmittal, you will represent to us that, among other things: |

|

|

• |

|

any exchange notes to be received by you will be acquired in the ordinary course of business; |

|

|

• |

|

you have no arrangement or understanding with any person to participate in the distribution (within the meaning of the Securities Act) of the exchange notes in violation of the provisions of the Securities Act; |

|

|

• |

|

you are not an "affiliate" (within the meaning of Rule 405 under Securities Act) of Vought; and |

|

|

• |

|

if you are a broker-dealer that will receive exchange notes for your own account in exchange for outstanding notes that were acquired as a result of market-making or other trading activities, then you will deliver a prospectus in connection with any resale of such exchange notes. |

|

|

See "The Exchange Offer—Procedures for Tendering Outstanding Notes" and "Plan of Distribution." |

Effect of Not Tendering |

|

Any outstanding notes that are not tendered or that are tendered but not accepted will remain subject to the restrictions on transfer. Since the outstanding notes have not been registered under the federal securities laws, they bear a legend restricting their transfer absent registration or the availability of a specific exemption from registration. Upon the completion of the exchange offer, we will have no further obligations, except under limited circumstances, to provide for registration of the outstanding notes under the federal securities laws. See "The Exchange Offer—Effect of Not Tendering." |

2

Interest on the Exchange Notes and the Outstanding Notes |

|

The exchange notes will bear interest from the most recent interest payment date to which interest has been paid on the notes or, if no interest has been paid, from July 2, 2003. Interest on the outstanding notes accepted for exchange will cease to accrue upon the issuance of the exchange notes. |

Withdrawal Rights |

|

Tenders of outstanding notes may be withdrawn at any time prior to 12:00 midnight, New York City time, on the expiration date. |

Federal Tax Consequences |

|

There will be no federal income tax consequences to you if you exchange your outstanding notes for exchange notes in the exchange offer. See "Material Federal Income Tax Consequences." |

Use of Proceeds |

|

We will not receive any proceeds from the issuance of exchange notes pursuant to the exchange offer. |

Exchange Agent |

|

Wells Fargo Bank Minnesota, National Association, the trustee under the indenture, is serving as exchange agent in connection with the exchange offer. |

3

Terms of the Exchange Notes

The following is a brief summary of the terms of the exchange notes. The financial terms and covenants of the exchange notes are the same as the outstanding notes. For a more complete description of the terms of the exchange notes, see "Description of the Exchange Notes."

| Issuer | | Vought Aircraft Industries, Inc., a Delaware Corporation. |

Securities |

|

$270.0 million in aggregate principal amount of 8% Series B Senior Notes due 2011. |

Maturity |

|

July 15, 2011. |

Interest Payment Dates |

|

January 15 and July 15 of each year, commencing on July 15, 2004. |

Guarantees |

|

The notes will be fully and unconditionally guaranteed on a senior unsecured basis by all of our existing and future domestic subsidiaries. As of September 28, 2003, all of our Subsidiaries were domestic Subsidiaries. |

Ranking |

|

The exchange notes will be senior unsecured obligations of Vought Aircraft Industries, Inc. Accordingly, they will rank: |

|

|

• |

|

pari passu in right of payment to all of our existing and future senior unsecured indebtedness; and |

|

|

• |

|

senior in right of payment to all of our existing and future unsecured indebtedness that expressly provides for its subordination to the notes. |

|

|

The exchange notes will be effectively subordinated in right of payment to any secured indebtedness of ours to the extent of the value of the assets serving as security for such secured indebtedness. |

Subsidiary Guarantees and Ranking |

|

The subsidiary guarantee of each subsidiary guarantor will be such subsidiary guarantor's senior unsecured obligations. Accordingly, they will rank: |

|

|

• |

|

pari passu in right of payment to all such subsidiary guarantor's existing and future senior unsecured indebtedness; and |

|

|

• |

|

senior in right of payment to all of such subsidiary guarantor's existing and future unsecured indebtedness that expressly provides for its subordination to such subsidiary's guarantee. |

|

|

The subsidiary guarantees will be effectively subordinated in right of payment to any secured indebtedness of our subsidiaries to the extent of the value of the assets serving as security for such secured indebtedness. |

Indebtedness |

|

As of September 28, 2003, we and our subsidiaries had approximately $570.2 million principal amount of outstanding indebtedness on a consolidated basis, of which approximately $300.2 million was secured, and an additional $150.0 million was available for borrowing on a secured basis under our amended senior secured credit facilities, reduced by outstanding letters of credit which totaled $48.5 million. |

4

Optional Redemption |

|

At any time before July 15, 2006, we may redeem up to 35% of the exchange notes with net cash proceeds of equity offerings, as long as at least 65% of the aggregate principal amount of the exchange notes remains outstanding after the redemption. |

|

|

At any time prior to July 15, 2007, we may redeem some or all of the exchange notes at a redemption price equal to the principal amount of exchange notes redeemed plus the applicable premium (as defined) plus accrued and unpaid interest to the date of redemption. |

|

|

At any time on or after July 15, 2007, we may redeem some or all of the exchange notes at the redemption prices set forth under "Description of the Exchange Notes—Optional Redemption," plus accrued and unpaid interest to the date of redemption. See "Description of the Exchange Notes—Optional Redemption." |

Offer to Purchase |

|

If we sell significant assets or experience specific kinds of changes in control, we must offer to purchase the exchange notes at the prices set forth under "Description of the Exchange Notes—Repurchase at the Option of Holders," plus accrued and unpaid interest to the date of purchase. |

Certain Covenants |

|

We will issue the exchange notes under an indenture among us, the subsidiary guarantors and the trustee. The indenture (among other things) will limit our and our restricted subsidiaries' ability to: |

|

|

• |

|

incur or guarantee additional indebtedness and issue preferred stock; |

|

|

• |

|

pay dividends or make other distributions; |

|

|

• |

|

make investments; |

|

|

• |

|

create liens; |

|

|

• |

|

place restrictions on the ability of our restricted subsidiaries to pay dividends or make other distributions; |

|

|

• |

|

sell assets; |

|

|

• |

|

engage in mergers or consolidations with other entities; |

|

|

• |

|

engage in transactions with affiliates; and |

|

|

• |

|

engage in sale and leaseback transactions. |

|

|

Each of these covenants is subject to a number of important exceptions and qualifications. See "Description of the Exchange Notes—Certain Covenants." |

Absence of Established Market for Exchange Notes |

|

The exchange notes will be new securities for which there is currently no market. Although the initial purchasers of the outstanding notes have informed us that they intend to make a market in the exchange notes, they are not obligated to do so, and they may discontinue market-making at any time without notice. Accordingly, we cannot assure you that a liquid market for the exchange notes will develop or be maintained. See "Plan & Distributions." |

5

The Offering of the Outstanding Notes

On July 2, 2003, we completed an offering of $270 million in aggregate principal amount of 8% Senior Notes due 2011, which was exempt from registration under the Securities Act.

| Outstanding Notes | | We sold the outstanding notes to Lehman Brothers Inc., Goldman Sachs & Co. and Credit Suisse First Boston LLC, the initial purchasers, on July 2, 2003. The initial purchasers subsequently resold the outstanding notes to qualified institutional buyers pursuant to Rule 144A under the Securities Act and to non-U.S. persons outside the United States in reliance on Regulation S under the Securities Act. |

Registration Rights Agreements |

|

In connection with the sale of the outstanding notes, we and the subsidiary guarantors entered into a registration rights agreement with the initial purchasers. Under the terms of the agreement, we each agreed to: |

|

|

• |

|

file a registration statement within 300 days after the issue date of the notes, enabling holders to exchange the notes for publicly registered exchange notes with substantially identical terms; |

|

|

• |

|

use all commercially reasonable efforts to cause the registration statement to become effective within 365 days after the issue date of the notes; |

|

|

• |

|

use all commercially reasonable efforts to consummate the exchange offer within 30 business days of the effective date of the registration statement; and |

|

|

• |

|

file a shelf registration statement for the resale of notes if we cannot effect an exchange offer within the time period listed above and in other limited circumstances. |

|

|

If we do not comply with these registration obligations, we will be required to pay liquidated damages to holders of the notes under circumstances described herein. Liquidated damages would accrue in an amount equal to an additional 1% per annum until all such defaults have been cured. The Exchange Offer is being made pursuant to the registration rights agreement and is intended to satisfy the rights granted under the registration right agreement, which rights substantially terminate upon completion of the exchange offer. |

Risk Factors

See "Risk Factors" for a discussion of factors you should carefully consider before deciding to invest in the exchange notes.

Additional Information

We were incorporated in Delaware on May 26, 2000. Our principal executive offices are located at 9314 West Jefferson Boulevard M/S 2-01, Dallas, TX 75211. Our telephone number is (972) 946-2011.

6

Company Overview

Background Information

On July 2, 2003, Vought acquired Aerostructures pursuant to an Agreement and Plan of Merger, dated as of May 12, 2003, with TA Acquisition Holdings, Inc. (referred to herein as "Holdings") pursuant to which Holdings merged with and into Vought and Vought thereby acquired Holdings' wholly-owned subsidiary, Aerostructures. In this prospectus, we refer to the merger of Holdings with and into Vought as the "Aerostructures Acquisition." In exchange for 100% of the outstanding common and preferred stock of Holdings, Vought (as the surviving entity) issued common stock to Holdings' shareholders that represented 27.5% of the fully-diluted equity of the combined company; paid $44.9 million in cash to Aerostructures, which Aerostructures used to settle certain obligations pursuant to the Agreement and Plan of Merger; and retired $135.2 million of Aerostructures' debt. Aerostructures operated as a wholly-owned subsidiary of Vought from the date of the Aerostructures Acquisition until it merged with and into Vought on January 1, 2004.

The historical information of Vought, including the historical financial data, included in this prospectus for periods prior to July 2, 2003 is that of Vought Aircraft Industries, Inc. together with its subsidiaries but does not include historical information of Aerostructures. From July 2, 2003 until January 1, 2004, Vought and Aerostructures operated as a consolidated company. The Aerostructures Acquisition, the issuance of the outstanding notes and the amendment to our senior credit facilities (as described herein) are collectively referred to in this prospectus as the "Transactions." The Transactions were all completed simultaneously. The pro forma statement of operations provided herein gives effect to the Transactions on the basis set forth under the caption "Unaudited Pro Forma Condensed Consolidated Financial Data."

Business

We are the largest independent manufacturer in North America, and one of the largest independent providers in the world, of aerostructures for commercial, military and business jet aircraft. We develop and manufacture fuselages, wings and wing assemblies, empennages (which are tail assemblies comprised of horizontal and vertical stabilizers, elevators and rudders), aircraft doors, nacelle components (which are the structures around engines) and control surfaces (such as rudders, spoilers, ailerons and flaps). These aerostructures are subsequently integrated by our customers into a wide range of commercial, military and business jet aircraft manufactured by the world's leading aerospace companies. We also provide our customers with testing, logistics and engineering support services. Our customers are the leading prime manufacturers of commercial, military and business jet aircraft, including Airbus S.A.S. ("Airbus"), Bell Helicopter Textron, Inc. ("Bell Helicopter"), The Boeing Company ("Boeing"), Embraer Empresa Brasileira de Aeronautica S.A. ("Embraer"), Gulfstream Aerospace Corp., a General Dynamics Company ("Gulfstream"), Lockheed Martin Corporation ("Lockheed Martin") and Northrop Grumman Corporation ("Northrop Grumman"), among others, and the U.S. Air Force ("Air Force"). For the year ended December 31, 2002 and the nine months ended September 28, 2003, we generated pro forma net sales of $1,499.3 million and $991.7 million, respectively.

We are the sole-source provider of various aerostructures for a diversified group of commercial, military and business jet aircraft programs for which we provide our products and services through

7

long-term contracts. The following table summarizes the major programs that we currently have under long-term contract:

Commercial

| | Military

| | Business Jet

|

|---|

| Airbus A319/320(1) | | Bell/Boeing V-22 Osprey | | Cessna Citation X |

| Airbus A330/340 | | Boeing C-17 Globemaster III | | Gulfstream IV |

| Airbus A340-500/600 | | Boeing F/A-18 E/F Super Hornet | | Gulfstream V |

| Boeing 737 | | Boeing KC-767 Tanker(3) | | Raytheon Hawker 800 |

| Boeing 747 | | Lockheed Martin C-5 Galaxy | | |

| Boeing 757(2) | | Lockheed Martin C-130J Hercules | | |

| Boeing 767 | | Lockheed Martin F-22 Raptor | | |

| Boeing 777 | | Lockheed Martin F-35 Joint Strike Fighter | | |

| Embraer ERJ 170/175(4) | | Lockheed Martin P-3 Orion | | |

| Embraer ERJ 190/195(4) | | Northrop Grumman E-2C Hawkeye | | |

| | | Northrop Grumman E-8C Joint STARS | | |

| | | Northrop Grumman EA-6B Prowler | | |

| | | Northrop Grumman F-14 Tomcat | | |

| | | Northrop Grumman Global Hawk | | |

| | | Northrop Grumman T-38 Talon | | |

- (1)

- Not sole-source.

- (2)

- Final aircraft under 757 program scheduled to be produced in late 2004.

- (3)

- The KC-767 Tanker program is currently under review by the Department of Defense.

- (4)

- Vought and Embraer have not completed negotiation of a program level agreement. Vought is currently performing under instructions to proceed and purchase orders issued by Embraer in anticipation of reaching mutually acceptable terms and conditions.

8

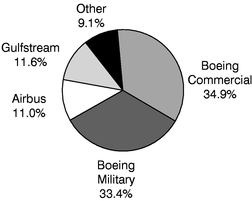

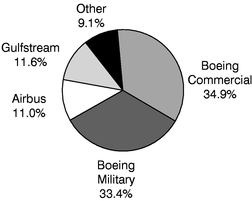

As an independent aerostructures manufacturer, we believe we have leading market share positions in each of the commercial, military and business jet aircraft markets. The following chart summarizes our pro forma net sales by market for the year ended December 31, 2002 and the nine months ended September 28, 2003 after giving effect to the Aerostructures Acquisition:

| | Year Ended December 31, 2002

| | Nine Months Ended September 28, 2003

| |

|

|---|

Market

| | Pro

Forma

Net Sales

| | Percent of

Total Pro

Forma

Net Sales

| | Pro

Forma

Net Sales

| | Percent of

Total Pro

Forma

Net Sales

| | Description

|

|---|

| Commercial Aircraft | | $ | 765.8 | | 51.1 | % | $ | 454.6 | | 45.9 | % | Products such as fuselage panels, empennages, wing components and doors for programs such as the Boeing 747, Airbus A330/A340 and Embraer 190. |

Military Aircraft |

|

|

488.7 |

|

32.6 |

% |

|

394.9 |

|

39.8 |

% |

Products such as fuselage panels, nacelle components, empennages and wing components for programs such as the Bell/Boeing V-22, Boeing C-17 Globemaster III, Lockheed Martin C-130J Hercules and Northrop Grumman Global Hawk. |

Business Jet Aircraft |

|

|

244.8 |

|

16.3 |

% |

|

142.2 |

|

14.3 |

% |

Products such as nacelle components, wings and wing components for programs such as the Gulfstream IV, Gulfstream V and Cessna Citation X. |

Total Net Sales |

|

$ |

1,499.3 |

|

100 |

% |

$ |

991.7 |

|

100 |

% |

|

Commercial Aircraft. We are the largest manufacturer of aerostructures for Boeing Commercial Aircraft Group (referred to herein as "Boeing Commercial"). We have over 30 years of commercial aircraft experience with Boeing Commercial, and we have maintained a formal strategic alliance with Boeing Commercial since 1994. We are also the largest U.S. manufacturer of aerostructures for Airbus. We have over 20 years of commercial aircraft experience with Airbus. In addition, we manufacture commercial aircraft aerostructures for Embraer, General Electric Company ("General Electric"), Goodrich Corporation ("Goodrich") and Pratt & Whitney, a division of United Technologies Corporation ("Pratt & Whitney").

Military Aircraft. We provide aerostructures for a variety of military programs, including fighter/attack, transport, surveillance, tilt rotor and unmanned aircraft. We are the largest subcontractor for the Boeing C-17 Globemaster III program. We have been a partner with Boeing on the C-17 Globemaster III since inception of the program in 1983. We also provide military aerostructures to Bell Helicopter, Lockheed Martin and Northrop Grumman.

Business Jet Aircraft. We are the largest aerostructures manufacturer to Gulfstream for the Gulfstream IV and the Gulfstream V. In addition, we provide business jet aerostructures to Cessna Aircraft Company ("Cessna") and Raytheon Company ("Raytheon").

Market Overview

We participate in the aerospace industry by developing and producing aerostructures, including fuselages, wings and wing assemblies, empennages, aircraft doors, nacelle components, control surfaces and other structures for commercial, military and business jet aircraft. Market and economic trends that

9

impact the rates of growth of the commercial, military and business jet aircraft markets affect our sales of products in these markets.

Commercial Aircraft Market. General economic activity, airline profitability, passenger and cargo traffic rates and aircraft retirements drive demand for new commercial aircraft. The primary manufacturers of large commercial aircraft are Airbus and Boeing. In addition, Embraer and Bombardier Inc. ("Bombardier") are the primary manufacturers of regional jets. From 1980 to 2001, the worldwide fleet of active commercial aircraft increased at an average annual rate of approximately 4.7%, but the rate of growth has declined following the terrorist attacks on September 11, 2001. Boeing's Current Market Outlook (June 2003) projects that the worldwide fleet of active commercial aircraft will more than double over the next 20 years from approximately 15,612 aircraft at the end of 2002 to approximately 33,999 aircraft at the end of 2022 and that approximately 24,276 new aircraft (including replacements and growth of regional and large commercial aircraft) will enter service over that timeframe. Airbus' Global Market Forecast (September 2002) projects that approximately 16,000 new aircraft of 100 seats or more will enter service during the twenty year period from 2000 until 2020.

Military Aircraft Market. The national defense budget and procurement funding decisions drive demand for new military aircraft. In November 2003, President Bush signed a $401 billion defense authorization bill (not including supplemental authorizations), reflecting a 2% increase over fiscal 2003, and reaffirming the U.S. Government's increased focus on a long-term defense plan and national security policy. We expect that Department of Defense spending for procurement, operations, and maintenance will grow with the overall level of defense spending, and we expect to benefit to the extent that such spending is allocated to aircraft and unmanned aerial vehicles ("UAVs").

Business Jet Aircraft Market. General economic activity and corporate profitability drive demand for new business jet aircraft. In addition, since the terrorist attacks of September 11, 2001, business jet aircraft have increasingly been used as an alternative to commercial air transportation due to security concerns and convenience. The primary business jet aircraft manufacturers are Bombardier, Cessna, Dassault Aviation, Gulfstream and Raytheon. Ownership of business jet aircraft has become widely accepted, such that most Fortune 100 companies now own several jets. As the popularity of business jet aircraft has grown over the past decade, several companies have begun to offer fractional jet ownership. The Air Force operates a fleet of business jet aircraft for use by the executive and legislative branches of government as well as the U.S. joint command leadership. In addition, many foreign governments provide business jet aircraft to high ranking officials.

Business Strategy

Integrate the Operations of Aerostructures and Continue to Streamline and Rationalize Operations. We have initiated the integration of Aerostructures' personnel, programs and facilities into our organization in order to leverage purchasing power, reduce corporate overhead, consolidate manufacturing and provide additional products and services to our customers. We plan to continue to streamline and rationalize our combined operations by further reducing overhead, improving working capital management and implementing other initiatives to increase labor efficiencies.

Win New Business. We are highly focused on winning new military and commercial business in order to further diversify our portfolio of products and customers. Since January 2002, we won new military business which we expect to generate revenues of approximately $780 million over the next seven years.

Integrate Quality Throughout the Enterprise. We emphasize quality in the design and production of cost competitive, fully integrated major aircraft assemblies as a support partner to the world's leading aerospace companies.

10

Increase Profitability and Productivity. We focus on lean manufacturing, efficient purchasing and innovation to increase profitability and productivity. We share the benefit of these improvements with our customers in order to further strengthen our strategic relationships. For example, we have developed a worldwide network of suppliers that maximizes production and cost efficiencies and supports our customers' need for strategic work placement. Other initiatives include web-based development and information distribution systems, determinant assembly processes, first-time quality throughout the extended enterprise (including suppliers), flexible tooling and the conversion of 2D to digital and 3D product definition.

Continue as a Strategic Partner to our Customers. We strengthen customer relationships and expand market opportunities by partnering with customers on their business endeavors and providing innovative approaches to aircraft systems integration. We provide prime contractors with development and support services to ensure our participation on their current and future programs while managing the risk/reward of each project and assessing the return on investment, on a case by case basis.

Our Investors

Before the Aerostructures Acquisition, each of Vought and Aerostructures were owned by separate investment funds affiliated with The Carlyle Group. After the Transactions were completed, Carlyle Partners III, L.P. ("CPIII"), Carlyle Partners II, L.P. ("CPII"), their affiliates (together with CPIII, CPII and The Carlyle Group, "Carlyle"), and current and former management own 100% of our equity. Private equity investment funds affiliated with Carlyle own approximately 93% of the equity on a fully diluted basis.

The Transactions

The Transactions summarized below include the Aerostructures Acquisition, the issuance of the outstanding notes and the amendment to our credit facilities. While an understanding of the transactions summarized below is important to your understanding of our future cost structure, results of operations, financial position and cash flows, the transactions do not directly impact your decision as to whether or not to participate in the exchange offer.

Vought entered into an Agreement and Plan of Merger, dated as of May 12, 2003, with TA Acquisition Holdings, Inc. (referred to herein as "Holdings") pursuant to which Holdings merged with and into Vought and Vought thereby acquired Holdings' wholly-owned subsidiary, Aerostructures. In this prospectus, we refer to the merger of Holdings with and into Vought as the "Aerostructures Acquisition." In exchange for 100% of the outstanding common and preferred stock of Holdings, Vought (as the surviving entity) issued common stock to Holdings' shareholders that represented 27.5% of the fully-diluted equity of the combined company; paid $44.9 million in cash to Aerostructures, which Aerostructures used to settle certain obligations pursuant to the Agreement and Plan of Merger; and retired $135.2 million of Aerostructures' debt. The Aerostructures Acquisition was consummated on July 2, 2003, and Aerostructures operated as a wholly-owned subsidiary of Vought until it merged with and into Vought on January 1, 2004. In this prospectus, we have made some estimates of combined costs associated with operating as a combined entity. See "Unaudited Pro Forma Financial Information."

Recent Developments

Boeing has announced its decision to end production of the 757 program, with the final aircraft scheduled to be produced in late 2004. Vought supplies Boeing with the 757 empennage, spoilers, and various doors. Due to these events, management evaluated the estimate to complete the 757 program and recorded a $10.0 million charge in the third quarter of 2003.

11

We have been selected as an Airframe Partner on the proposed Boeing 7E7 aircraft program. Boeing has recently obtained approval from its board of directors to offer the product to the market but we do not have a contract with Boeing to participate in the program. The ultimate business terms may require us to invest significant amounts of money to design, develop, test, produce tools, purchase capital assets and purchase working capital to support this program.

We are under long term contract and/or have termination liability coverage with Boeing to produce the wing center section, horizontal stabilizer, aft body section, doors, nacelles and other components for the KC-767 Tanker Program. In November 2003, Congress approved a program to procure 100 KC-767s through a combination of purchase and lease, allowing the Air Force to begin replacing its KC-135 tanker fleet. This program, as well as several other military contracts awarded to Boeing, is currently under review by the Department of Defense and other governmental agencies.

Goodwill and Identified Intangibles are currently being evaluated by an independent third party for potential impairment. Recent developments in our business including the announced cancellation of the Boeing 757 program, potential delays/restructuring of the Boeing 767 and Boeing KC-767 programs, reduced deliveries of Airbus commercial products, and continuing depressed conditions in our other commercial markets will be factored into this impairment testing. These developments may require a substantial charge during the fourth quarter of 2003 for impaired goodwill and identified intangibles. The actual amounts, if any, will be reflected in our audited 2003 financial statements.

We implemented a corporate reorganization of our Aerostructures subsidiary. First, on December 4, 2003, Aerostructures incorporated a new subsidiary, named Contour Aerospace Corporation, a Delaware corporation ("Contour"). Second, Aerostructures contributed (i) its Everett, Washington facility, that builds fuselage skins, spars, stringers, pylons and machined components, and (ii) its Brea, California facility, that builds wing skins, spars, stringers, chords and ribs to Contour. Third, contemporaneous with the contribution of these assets and operations to Contour, Aerostructures merged with and into Vought, so that the remaining operating assets of Aerostructures are integrated with the ongoing operations of Vought. As a result of the reorganization, Aerostructures does not exist as a separate corporate entity and Contour is a direct subsidiary of Vought. Contour is a guarantor under the indenture governing the notes.

12

Summary Pro Forma Financial Data

The following table sets forth a summary of unaudited pro forma financial data for Vought and Aerostructures as a consolidated company, giving effect to the Transactions as if they had occurred on January 1, 2002 and after giving effect to the pro forma adjustments. The unaudited pro forma consolidated statement of operations data for the year ended December 31, 2002 and the nine months ended September 28, 2003 gives effect to the Transactions as if they occurred on January 1, 2002. The Aerostructures Acquisition is accounted for under the purchase method of accounting.

The pro forma adjustments are based upon available information and assumptions that we consider reasonable. The pro forma results of operations are not necessarily indicative of the results of operations that would have been achieved had the Transactions reflected therein been consummated prior to the period presented. The unaudited pro forma financial data are only a summary and should be read in conjunction with the "Capitalization," "Unaudited Pro Forma Condensed Combined Financial Data," "Selected Historical Financial Information," "Management's Discussion and Analysis of Financial Condition and Results of Operations" and Vought's and Aerostructures' consolidated financial statements and the notes thereto included elsewhere in this prospectus. The unaudited pro forma operating data are presented for informational purposes only and are not necessarily indicative of what the actual combined results of operations of the consolidated company would have been for the period presented, nor do these data purport to represent the results of future periods.

| | Year Ended

December 31, 2002(1)

| | Nine Months Ended

September 28, 2003(1)(2)

| |

|---|

| | ($ in millions)

| | ($ in millions)

| |

|---|

| Statement of Operations Data: | | | | | | | |

| Net sales | | $ | 1,499.3 | | $ | 991.7 | |

| Cost of sales | | | 1,285.3 | | | 792.8 | |

| Selling, general & administrative expenses | | | 213.7 | | | 180.6 | |

| Operating income (loss) | | | (5.6 | ) | | 18.3 | |

| Interest expense, net(3) | | | (63.5 | ) | | (38.5 | ) |

| Income taxes | | | (6.0 | ) | | — | |

| Net (loss) | | | (70.6 | ) | | (13.1 | ) |

| Other Financial Data: | | | | | | | |

| Capital expenditures | | | 27.9 | | | 23.6 | |

- (1)

- The December 2002 and the nine months ended September 28, 2003 pro forma adjustments and allocation of purchase price have been adjusted to reflect the current valuation of the assets acquired and liabilities assumed and are based on management's estimates of their fair value. The pro forma adjustments and allocation of purchase price will be completed after asset and liability valuations are finalized.

- (2)

- The nine month pro forma financial information was derived by adding the Vought unaudited historical financial information for the nine months ended September 28, 2003 (which include the results of Aerostructures from July 2, 2003) to the Aerostructures unaudited historical financial information for the six months ended July 1, 2003, and giving effect to the applicable pro forma adjustments as if the Transactions had occurred at January 1, 2002.

- (3)

- Pro forma interest expense, net includes the gain or loss on interest rate swaps.

13

Summary Financial Information of Vought

The following selected financial data for the years ended December 31, 2001 and 2002 are derived from the audited consolidated financial statements of Vought Aircraft Industries, Inc. The financial data for the nine months ended September 29, 2002 and September 28, 2003 are derived from unaudited consolidated financial statements. The unaudited consolidated financial statements contain all adjustments, consisting of normal recurring adjustments, which Vought considers necessary for a fair presentation of the financial position and the results of operations for these periods.

Operating results for the nine months ended September 28, 2003 are not necessarily indicative of the results that may be expected for the entire year ending December 31, 2003. The information is only a summary and should be read in conjunction with "Capitalization," "Unaudited Pro Forma Condensed Combined Financial Data," "Selected Historical Financial Information," "Management's Discussion and Analysis of Financial Condition and Results of Operations" and our consolidated financial statements and the notes thereto included elsewhere in this prospectus.

| | Year Ended

| | Nine Months Ended

| |

|---|

| | December 31,

2001

| | December 31,

2002

| | September 29,

2002

| | September 28,

2003(3)

| |

|---|

| | ($ in millions)

| |

|---|

| Consolidated Statement of Operations Data: | | | | | | | | | | | | | |

| Net sales | | $ | 1,422.0 | | $ | 1,200.7 | | $ | 926.0 | | $ | 851.8 | |

| Cost of sales | | | 1,198.1 | | | 1,051.9 | | | 804.5 | | | 678.3 | |

| Selling, general & administrative expenses | | | 206.4 | | | 186.8 | | | 135.5 | | | 168.1 | |

| Operating income (loss) | | | 15.5 | | | (43.9 | ) | | (14.0 | ) | | 5.4 | |

| Interest expense, net(1) | | | 71.1 | | | 35.8 | | | 28.5 | | | 20.4 | |

| Income taxes | | | — | | | — | | | — | | | — | |

| Net (loss)(2) | | | (63.4 | ) | | (79.7 | ) | | (42.5 | ) | | (15.0 | ) |

| Other Financial Data: | | | | | | | | | | | | | |

| Cash flow provided by operating activities | | $ | 182.3 | | $ | 166.8 | | $ | 157.7 | | $ | 165.6 | |

| Cash flow used by investing activities | | | (35.4 | ) | | (20.8 | ) | | (11.1 | ) | | (204.0 | ) |

| Cash flow used in financing activities | | | (141.0 | ) | | (109.3 | ) | | (64.9 | ) | | 156.8 | |

| Capital expenditures | | | 35.9 | | | 21.1 | | | 11.1 | | | 20.7 | |

| Consolidated Balance Sheet Data: | | | | | | | | | | | | | |

| Cash and cash equivalents | | $ | 31.9 | | $ | 68.6 | | $ | 113.6 | | $ | 187.0 | |

| Accounts receivable, net | | | 139.8 | | | 86.7 | | | 116.0 | | | 123.8 | |

| Inventories | | | 318.6 | | | 202.7 | | | 199.9 | | | 209.5 | |

| Property, plant and equipment, net | | | 366.5 | | | 334.7 | | | 341.4 | | | 397.7 | |

| Total assets | | | 1,316.0 | | | 873.3 | | | 1,218.6 | | | 1,569.7 | |

| Total debt(4) | | | 505.0 | | | 395.6 | | | 440.0 | | | 570.2 | |

| Stockholders' equity (deficit) | | | 20.9 | | | (502.9 | ) | | (21.5 | ) | | (280.6 | ) |

- (1)

- Interest expense, net includes the gain or loss on interest rate swaps.

- (2)

- Net (loss) is calculated before other comprehensive losses relating to minimum pension liability adjustments of $49.4 million and $444.2 million in 2001 and 2002, respectively.

- (3)

- Includes Aerostructures' financial results from July 2, 2003.

- (4)

- Total debt as of September 28, 2003 includes $4.3 million of capitalized leases.

14

Summary Financial Information of Aerostructures

We are providing the following financial information to assist you in your analysis of the financial aspects of the Aerostructures Acquisition. We derived the historical financial information below from Aerostructures' audited financial statements for the years ended December 28, 2001 and December 27, 2002 and from Aerostructures' unaudited financial statements for the six months ended June 28, 2002 and July 1, 2003. The information is only a summary and should be read in conjunction with "Capitalization," "Unaudited Pro Forma Condensed Combined Financial Data," "Selected Historical Financial Information," "Management's Discussion and Analysis of Financial Condition and Results of Operations" and Aerostructures' consolidated financial statements and the notes thereto included elsewhere in this prospectus. The historical results included below and elsewhere in this document are not indicative of the future performance of Aerostructures or the consolidated company.

| | Year Ended

| | Six Months Ended

| |

|---|

| | December 28,

2001

| | December 27,

2002

| | June 28,

2002

| | July 1,

2003

| |

|---|

| | ($ in millions)

| |

|---|

| Consolidated Statement of Operations Data: | | | | | | | | | | | | | |

| Sales | | $ | 367.5 | | $ | 300.1 | | $ | 164.4 | | $ | 140.5 | |

| Cost of sales | | | 319.4 | | | 250.7 | | | 139.9 | | | 124.7 | |

| Selling, general, administrative and amortization expenses | | | 26.0 | | | 22.8 | | | 11.1 | | | 9.4 | |

| Income from operations | | | 22.1 | | | 26.6 | | | 13.4 | | | 6.4 | |

| Interest expense, net(1) | | | 19.9 | | | 11.9 | | | 7.3 | | | 6.4 | |

| Provision (benefit) for income taxes | | | (18.3 | ) | | 6.0 | | | 2.3 | | | — | |

| Net income(2) | | | 19.5 | | | 8.8 | | | 3.8 | | | — | |

| Other Financial Data: | | | | | | | | | | | | | |

| Cash flow provided by operating activities | | $ | 72.7 | | $ | 39.5 | | $ | 38.2 | | $ | 10.0 | |

| Cash flow used by investing activities | | | (7.6 | ) | | (6.7 | ) | | (2.6 | ) | | (2.9 | ) |

| Cash flow used in financing activities | | | (79.8 | ) | | (32.9 | ) | | (30.8 | ) | | (5.4 | ) |

| Capital expenditures | | | 7.6 | | | 6.8 | | | 2.6 | | | 2.9 | |

| Consolidated Balance Sheet Data: | | | | | | | | | | | | | |

| Cash and cash equivalents | | $ | 0.3 | | $ | 0.2 | | $ | 5.2 | | $ | 1.9 | |

| Accounts receivable, net | | | 30.4 | | | 33.7 | | | 29.0 | | | 28.1 | |

| Inventories | | | 82.5 | | | 70.5 | | | 62.1 | | | 77.6 | |

| Property, plant and equipment, net | | | 102.2 | | | 87.3 | | | 94.4 | | | 83.0 | |

| Total assets | | | 334.2 | | | 298.7 | | | 304.9 | | | 297.8 | |

| Total debt(3) | | | 164.3 | | | 141.3 | | | 139.0 | | | 139.7 | |

| Stockholders' equity | | | 38.9 | | | 4.4 | | | 42.7 | | | 4.4 | |

- (1)

- Interest expense, net includes the gain or loss on interest rate swaps as well as other expenses.

- (2)

- Net income is calculated before a comprehensive loss related to the establishment of a minimum pension liability in the amount of $43.3 million in 2002.

- (3)

- Total debt includes $4.5 million of capitalized leases at Aerostructures as of July 1, 2003. Total debt is presented gross of an original issue discount in the amount of $1.8 million.

15

RISK FACTORS

You should carefully consider the risks described below as well as the other information contained in this prospectus before making a decision to participate in the exchange offer. The risks described below are not the only risks facing us. Additional risks and uncertainties not currently known to us or that we currently deem to be immaterial may also materially adversely affect our business financial condition or results of operations. Any of the following risks could materially adversely affect our business, financial condition or results of operations. In such case, you may lose all or part of your original investment.

Risks Related to the Exchange Notes and the Exchange Offer

Our substantial indebtedness could adversely affect our financial condition and prevent us from fulfilling our obligations under the exchange notes.

We have a significant amount of indebtedness. As of September 28, 2003, our total indebtedness was $570.2 million, excluding unused commitments under our revolving credit facility under our amended senior secured credit facilities.

Our substantial indebtedness could have important consequences for you. For example, it could:

- •

- make it more difficult for us to satisfy our obligations with respect to the notes;

- •

- increase our vulnerability to general adverse economic and industry conditions;

- •

- require us to dedicate a substantial portion of our cash flow from operations to payments on our indebtedness, thereby reducing the availability of our cash flow to fund working capital, capital expenditures, research and development efforts and other general corporate purposes;

- •

- limit our flexibility in planning for, or reacting to, changes in our business and the industry in which we operate;

- •

- restrict us from making strategic acquisitions or exploiting business opportunities;

- •

- place us at a competitive disadvantage compared to our competitors that have less debt; and

- •

- limit, along with the financial and other restrictive covenants in our indebtedness, among other things, our ability to borrow additional funds, dispose of assets or pay cash dividends.

The indenture and our amended senior secured credit facilities contain financial and other restrictive covenants that limit our ability to engage in activities that may be in our long-term best interests. Our failure to comply with those covenants could result in an event of default which, if not cured or waived, could result in the acceleration of our debts.

In addition, a substantial portion of our debt bears interest at variable rates. If market interest rates increase, variable-rate indebtedness will create higher debt service requirements, which would adversely affect our cash flows. While we may enter into agreements limiting our exposure, any such agreements may not offer complete protection from this risk.

To service our indebtedness, we will require a significant amount of cash. Our ability to generate cash depends on many factors beyond our control.

Our ability to make payments on and to refinance our indebtedness, including the exchange notes, and to fund planned capital expenditures will depend on our ability to generate cash in the future. This, to some extent, is subject to general economic, financial, competitive, legislative, regulatory and other factors that are beyond our control.

We cannot assure you that our business will generate sufficient cash flow from operations or that future borrowings will be available to us in an amount sufficient to enable us to pay our indebtedness,

16

including the exchange notes, or to fund our other liquidity needs. We may need to refinance all or a portion of our indebtedness, including the exchange notes on or before maturity. We cannot assure you that we will be able to refinance any of our indebtedness, including our amended senior secured credit facilities and the exchange notes, on commercially reasonable terms or at all.

Despite current indebtedness levels, we may still be able to incur substantially more debt, which would further exacerbate the risks associated with our substantial leverage.

We may be able to incur substantial additional indebtedness in the future because the terms of the indenture do not fully prohibit us, including our subsidiaries, from doing so. As of September 28, 2003, our amended senior secured credit facilities permitted additional borrowing of up to $150.0 million, reduced by outstanding letters of credit of $48.5 million. If new indebtedness is added to our and our subsidiaries' current indebtedness levels, the related risks that we face would be magnified. In addition, the indenture does not prevent us from incurring obligations that do not constitute indebtedness.

Restrictive covenants in the amended senior secured credit facilities and the indenture may restrict our ability to pursue our business strategies.

The indenture and the amended senior secured credit facilities limit our ability, among other things, to:

- •

- incur additional indebtedness or contingent obligations;

- •

- pay dividends or make distributions to our stockholders;

- •

- repurchase or redeem our stock;

- •

- make investments;

- •

- grant liens;

- •

- make capital expenditures;

- •

- enter into transactions with our stockholders and affiliates;

- •

- engage in sale and leaseback transactions;

- •

- sell assets; and

- •

- acquire the assets of, or merge or consolidate with, other companies.

In addition, the amended senior secured credit facilities require us to maintain certain financial ratios. See "Description of Our Amended Senior Secured Credit Facilities." We may not be able to maintain these ratios. The restrictive covenants mentioned above may restrict our ability to pursue our business strategies.

The exchange notes and the exchange guarantees will be unsecured and effectively subordinated to our existing and future secured debt.

Holders of our secured debt will have claims that are prior to your claims as holders of the notes to the extent of the value of the assets securing the secured debt. Notably, we and the guarantors are parties to the amended senior secured credit facilities, which is secured by a perfected first priority security interest in substantially all of our assets including intellectual property, material owned real property and the capital stock of our direct and indirect subsidiaries. The amended senior secured credit facilities is also secured by a pledge of our capital stock owned by private equity investment funds affiliated with Carlyle. We also have particular capital leases that are secured by the underlying assets. The exchange notes will be effectively subordinated to our secured debt. In the event of any distribution or payment of our assets in any foreclosure, dissolution, winding-up, liquidation,

17

reorganization or other bankruptcy proceeding, holders of secured debt will have prior claim to those of our assets that constitute their collateral. Holders of the exchange notes will participate ratably with all holders of our unsecured debt that is deemed to be of the same class as the exchange notes, and potentially with all of our other general creditors, based upon the respective amounts owed to each holder or creditor, in our remaining assets. In any of the foregoing events, we cannot assure you that there will be sufficient assets to pay amounts due on the exchange notes. As a result, holders of exchange notes may receive less, ratably, than holders of secured debt. For a description of our amended senior secured credit facilities, see "Description of Our Amended Senior Secured Credit Facilities."

As of September 28, 2003, the aggregate amount of our secured debt was approximately $300.2 million, and $150.0 million was available for additional borrowings under our amended senior secured credit facilities, reduced by outstanding letters of credit of $48.5 million. We may be permitted to borrow substantial additional debt, including secured debt, in the future under the terms of the indenture governing the exchange notes.

The exchange notes will be structurally subordinated to all future liabilities of our subsidiaries that do not guarantee the notes, if any.

As of September 28, 2003, all of our subsidiaries are domestic subsidiaries and each will be a guarantor of our obligations under the exchange notes. However, any future foreign subsidiaries we may have will not be required by the indenture to guarantee the exchange notes. The exchange notes will be structurally subordinated to all future liabilities, including trade payables, of our subsidiaries that do not guarantee the exchange notes, and the claims of creditors of those subsidiaries, including trade creditors, will have priority as to the assets and cash flows of those subsidiaries. In the event of a bankruptcy, liquidation, dissolution, reorganization or similar proceeding of any of the non-guarantor subsidiaries, holders of their liabilities, including their trade creditors, will generally be entitled to payment on their claims from assets of those subsidiaries before any assets are made available for distribution to us.

We may not have the ability to raise the funds necessary to finance any change of control offer required by the indenture governing the exchange notes.

Upon the occurrence of specific kinds of change of control events, we will be required to offer to repurchase all notes outstanding at 101% of the principal amount thereof plus accrued and unpaid interest and liquidated damages, if any, to the date of repurchase. However, it is possible that we will not have sufficient funds at the time of the change of control to make the required repurchase of exchange notes or that restrictions in our amended senior secured credit facilities will not allow such repurchases. In addition, various important corporate events, such as leveraged recapitalizations that would increase the level of our indebtedness, would not constitute a "Change of Control" under the indenture. See "Description of the Notes—Repurchase at the Option of Holders—Change of Control."

Federal and state laws permit a court to void the guarantees under certain circumstances.

Our payment of consideration to finance a portion of the Transactions (including the issuance of a guarantee of the notes by our subsidiary guarantors) may be subject to review by federal or state fraudulent transfer laws. While the relevant laws may vary from state to state, under such laws the issuance of a guarantee will be a fraudulent conveyance if (1) any of our subsidiaries issued guarantees, with the intent of hindering, delaying or defrauding creditors, or (2) any of the guarantors received less than reasonably equivalent value or fair consideration in return for issuing their respective guarantees, and, in the case of (2) only, one of the following is also true:

- •

- any of the guarantors were insolvent, or became insolvent, when they paid the consideration;

18

- •

- issuing the guarantees left the applicable guarantor with an unreasonably small amount of capital; or

- •

- the applicable guarantor, intended to, or believed that it would, be unable to pay debts as they matured.

If the payment of the consideration or the issuance of any guarantee were a fraudulent conveyance, a court could, among other things, void any of the guarantors' obligations under their respective guarantees, and require the repayment of any amounts paid thereunder.

Generally, an entity will be considered insolvent if:

- •

- the sum of its debts is greater than the fair value of its property;

- •

- the present fair value of its assets is less than the amount that it will be required to pay on its existing debts as they become due; or

- •

- it cannot pay its debts as they become due.

We believe, however, that immediately after issuance of the exchange notes and the exchange guarantees, each of the guarantors will be solvent, will have sufficient capital to carry on its respective businesses and will be able to pay its respective debts as they mature. We cannot be sure, however, as to what standard a court would apply in making such determinations or that a court would reach the same conclusions with regard to these issues.

You cannot be sure an active trading market for the exchange notes will develop.

There is no established trading market for the exchange notes. Although each initial purchaser has informed us that it currently intends to make a market in the exchange notes, it has no obligation to do so and may discontinue making a market at any time without notice.

We intend to apply for the exchange notes to be designated as eligible for trading in PORTAL. However, we do not intend to apply for listing of the exchange notes on any securities exchange or for quotation through NASDAQ.

The liquidity of any market for the exchange notes will depend upon the number of holders of the exchange notes, our performance, the market for similar securities, the interest of securities dealers in making a market in the notes and other factors. A liquid trading market may not develop for the exchange notes. If a market develops, the exchange notes could trade at prices that may be lower than their initial offering price.

The market price for the exchange notes may be volatile.

Historically, the market for non-investment grade debt has been subject to disruptions that have caused substantial volatility in the prices of securities similar to the exchange notes offered hereby. The market for the exchange notes, if any, may be subject to similar disruptions. Any such disruptions may adversely affect the value of your exchange notes.

If you do not properly tender your outstanding notes, you will continue to hold unregistered outstanding notes and your ability to transfer outstanding notes will be adversely affected.

We will only issue exchange notes in exchange for outstanding notes that are timely received by the exchange agent together with all required documents, including a properly completed and signed letter of transmittal. Therefore, you should allow sufficient time to ensure timely delivery of the outstanding notes and you should carefully follow the instructions on how to tender your outstanding notes. Neither we nor the exchange agent are required to tell you of any defects or irregularities with respect to your tender of the outstanding notes. If you do not tender your outstanding notes or if we do not accept

19

your outstanding notes because you did not tender your outstanding notes properly, then, after we consummate the exchange offer, you may continue to hold outstanding notes that are subject to the existing transfer restrictions. In addition, if you tender your outstanding notes for the purpose of participating in a distribution of the exchange notes, you will be required to comply with the registration and prospectus delivery requirements of the Securities Act in connection with any resale of the exchange notes. If you are a broker-dealer that receives exchange notes for your own account in exchange for outstanding notes that you acquired as a result of market-making activities or any other trading activities, you will be required to acknowledge that you will deliver a prospectus in connection with any resale of such exchange notes. After the exchange offer is consummated, if you continue to hold any outstanding notes, you may have difficulty selling them because there will be fewer notes outstanding. In addition, if a large amount of outstanding notes are not tendered or are tendered improperly, the limited amount of exchange notes that would be issued and outstanding after we consummate the exchange offer could lower the market price of such exchange notes.

Risks Related to Our Business

Our commercial business is cyclical and sensitive to commercial airlines' profitability. Our business is, in turn, affected by general economic conditions and world safety considerations.

We compete in the aerostructures segment of the aerospace industry. While our direct customers are aircraft manufacturers, such as Boeing and Airbus, our business is indirectly affected by the financial condition of the commercial airlines and other economic factors that affect the demand for air transportation. Specifically, our commercial business is dependent on the demand from passenger airlines for the production of new aircraft by our customers. Accordingly, demand for our commercial products is tied to the worldwide airline industry's ability to finance the purchase of new aircraft and the industry's forecasted demand for seats, flights and routes. Similarly, the size and age of the worldwide commercial aircraft fleet affects the demand for new aircraft and, consequently, for our products. Such factors, in conjunction with evolving economic conditions, cause the market in which we operate to be cyclical to varying degrees, thereby affecting our business and operating results.

Over the past several years, continued softening of the global and domestic economy, reduced corporate travel spending, excess capacity in the market for commercial air travel, changing pricing models among airlines and significantly increased fuel, security and insurance costs have resulted in many airlines reporting, and continuing to forecast significant net losses. Moreover, during recent years the airline industry has been adversely affected by the September 11, 2001 terrorist attacks, war in the Middle East and concerns relating to the transmission of the severe acute respiratory syndrome, or "SARS." These terrorist and health phenomena, in addition to the generally soft global and domestic economy, have contributed to diminishing demand for air travel and have adversely affected the business and operations of commercial airlines. Many major air carriers have parked or retired some of their fleets and have reduced workforces and flights to match declining demand and to mitigate their large losses. Numerous carriers have rescheduled or canceled orders for aircraft to be purchased from the major aircraft manufacturers. The full impact of these events and circumstances is not yet known and any protracted economic slump or future terrorist attacks, war or health concern could cause airlines to cancel or delay the purchase of additional new aircraft. See "Management's Discussion and Analysis of Financial Condition and Results of Operations" and "Business". Boeing has indicated that the downturn in the commercial aviation market remains severe and that it is experiencing reduced demand across all commercial airplane models. If demand for new aircraft continues to decrease, there will likely be a further decrease in demand for our commercial aircraft products.

20

The significant consolidation occurring in the aerospace industry could adversely affect our business and financial results.

The aerospace industry in which we operate has been experiencing significant consolidation among suppliers, including us and our competitors, and the customers we serve. Commercial airlines have increasingly been merging and creating global alliances to achieve greater economies of scale and enhance their geographic reach. Specifically, aviation suppliers have been consolidating and forming alliances to broaden their product and integrated system offerings and achieve critical mass. This supplier consolidation is in part attributable to aircraft manufacturers more frequently awarding long-term sole-source or preferred supplier contracts to the most capable suppliers, thus reducing the total number of suppliers from whom aerostructures and systems are purchased. We cannot assure you that our business and financial results will not be adversely impacted as a result of consolidation by our competitors, suppliers or customers.

We operate in a very competitive business environment.

Competition in the aerostructures segment of the aerospace industry is intense and concentrated. We face substantial competition from the operating units of some of our largest customers, including Airbus, Boeing, Gulfstream, Lockheed Martin, Northrop Grumman and Raytheon. These original equipment manufacturers may choose not to outsource production of aerostructures due to, among other things, their own direct labor and other overhead considerations and capacity utilization at their own facilities. Consequently, traditional factors affecting competition, such as price and quality of service, may not be significant determinants when original equipment manufacturers decide whether to produce a part in-house or to outsource.

We also face competition from non-OEM suppliers in each of our product areas. Our principal competitors among aerostructures suppliers are Alenia, Fokker Aerostructures, Fuji, Mitsubishi, GKN plc. and Kawasaki. Some of our competitors have greater resources than us, and therefore may be able to adapt more quickly to new or emerging technologies and changes in customer requirements, or devote greater resources to the promotion and sale of their products than we can. Providers of aerostructures have traditionally competed on the basis of cost, technology, quality and service. We believe that developing and maintaining a competitive advantage will require continued investment in product development, engineering, supply chain management and sales and marketing. We cannot assure you that we will have enough resources to make the necessary investments to do so and we cannot assure you that we will be able to compete successfully in this market or against such competitors. See "Business—Competition."