Names of Directors, Principal

Occupation and Other Information | | | Year in Which Service

As Director Began | | | Term to Expire

At Annual Meeting | |

| |

|

| |

|

| |

| | | | | | | | |

| Donald W. Delson, 55, has been a director since 2004. Mr. Delson has over 20 years of experience as an investment banker specializing in financial institutions. Mr. Delson has been a Managing Director, Corporate Finance Group, at Keefe, Bruyette & Woods, Inc. since 1997, and before that was a Managing Director in the Corporate Finance Group at Alex. Brown & Sons from 1982 to 1997. | | | 2004 | | | 2007 | |

| | | | | | | | |

| Class III Directors with Terms Expiring in 2008: | | | | | | | |

| Edward E. Cohen, 67, has been the Chairman of the Board and the Company’s Chief Executive Officer and President since the Company’s formation in 2000. He has been Chairman of the board of directors of RAI since 1990 and was its Chief Executive Officer from 1988 until 2004, and President from 2000 until 2003. In addition, Mr. Cohen has been Chairman of the managing board of Atlas Pipeline Partners GP, LLC since its formation in 1999, Chairman of the Board of Resource Capital Corp. since its formation in 2005, a director of TRM Corporation (a publicly-traded consumer services company) since 1998 and Chairman of the Board of Brandywine Construction & Management, Inc. (a property management company) since 1994. Mr. Cohen is the father of Jonathan Z. Cohen. | | | 2000 | | | 2008 | |

| | | | | | | | |

| Dennis A. Holtz, 65, has been a director since 2004. Mr. Holtz has maintained a corporate law practice with D.A. Holtz, Esquire & Associates in Philadelphia and New Jersey since 1988. | | | 2004 | | | 2008 | |

The Board of Directors appoints officers each year at its annual meeting following the annual stockholders meeting and from time to time as necessary.

Nancy J. McGurk has been the Chief Accounting Officer since 2001, Senior Vice President since 2002. Ms. McGurk was a Vice President of RAI from 1992 until 2004, and its Treasurer and Chief Accounting Officer from 1989 until 2004. Ms. McGurk has been Senior Vice President of Atlas Resources, Inc. since 2002 and Chief Financial Officer and Chief Accounting Officer since 2001.

Jeffrey C. Simmons has been an Executive Vice President since 2001 and was a director from 2002 until 2004. He has been Executive Vice President – Operations and a director of Atlas Resources, Inc. since 2001. Mr. Simmons was a Vice President of RAI from 2001 until 2004. Mr. Simmons joined RAI in 1986 as a senior petroleum engineer and served in various executive positions with its energy subsidiaries thereafter.

Michael L. Staines has been an Executive Vice President since the Company’s formation in 2000. Mr. Staines was a Senior Vice President of RAI from 1989 until 2004, a director from 1989 to 2000 and Secretary from 1989 to 1998. Mr. Staines has been President of Atlas Pipeline Partners GP, LLC since 2001 and its Chief Operating Officer and a member of its managing board since its formation in 1999.

Director Compensation

Each of the Company’s independent directors (Messrs. Arendell, Bagnell, Delson, DiNubile and Holtz) is paid a monthly retainer of $1,000 and a fee of $1,000 for each Board meeting attended. The chairman of a committee receives an additional monthly retainer of $500 and other committee members receive an additional monthly retainer of $250. In addition, each of the independent directors annually receives deferred units, representing a right to receive shares of the Company’s common stock over a four-year vesting period, in an amount equal to $15,000 divided by the price per share of the Company’s common stock at the time of the award.

Mr. J. Cohen received $50,000 in fiscal 2005 for his service as Vice Chairman of the Company’s Board of Directors. In fiscal 2005, Mr. J. Cohen also received a grant of options to acquire 200,000 shares of common stock at an exercise price of $38.21 per share, which options vested immediately, and a grant of 12,500 phantom units under the Atlas Pipeline Long-Term Incentive Plan which, upon vesting, entitles Mr. J. Cohen to receive 12,500 common units. The phantom units vest over a four-year period at the rate of 25% per year.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934 requires the Company’s officers, directors, and persons who own more than ten percent of a registered class of the Company’s equity securities to file reports of ownership and changes in ownership with the Securities and Exchange Commission and to furnish the Company with copies of all such reports.

Based solely on its review of the reports received by it, or written representations from certain reporting persons that no filings were required for those persons, the Company believes that, during fiscal year 2005, its officers, directors and greater than ten percent stockholders complied with all applicable filing requirements.

6

Compensation Committee Interlocks and Insider Participation

The compensation committee of the Board during fiscal 2005 consisted of Messrs. Delson, DiNubile and Holtz. None of such persons was an officer or employee, or former officer or employee, of the Company or any of its subsidiaries during fiscal 2005. No executive officer of the Company was a director or executive officer of any entity of which any member of the compensation committee was a director or executive officer during fiscal year 2005.

Information Concerning the Board of Directors and Certain Committees

The Board held four meetings during fiscal 2005. Each of the directors attended at least 75% of the meetings of the Board and all meetings of the committees on which the director served during fiscal 2005. The Board currently consists of seven members, five of whom are independent directors as defined by Nasdaq National Market standards. The five independent directors are Messrs. Arendell, Bagnell, Delson, DiNubile and Holtz.

Standing committees of the Board of Directors are the audit committee, the compensation committee and the nominating and governance committee.

Audit Committee. The principal functions of the audit committee are to assist the Board of Directors in monitoring the integrity of the Company’s financial statements, the independent auditor’s qualifications and independence, the performance of the Company’s independent auditors and the Company’s compliance with legal and regulatory requirements. The audit committee has the sole authority to retain and terminate the Company’s independent auditors and to approve the compensation paid to the independent auditors. The audit committee held three meetings during fiscal 2005. The audit committee is also responsible for overseeing the Company’s internal audit function. The audit committee is comprised solely of independent directors, consisting of Messrs. Arrendell, Bagnell and Delson, with Mr. Arrendell acting as the chairman. The Board has determined that Mr. Delson is an audit committee financial expert. The Company’s Board of Directors previously adopted a written charter for the audit committee, a current copy of which is available on the Company’s web site at www.atlasamerica.com.

Compensation Committee. The principal functions of the compensation committee are to administer the Company’s employee benefit plans (including incentive plans), annually evaluate salary grades and ranges, establish guidelines concerning average compensation increases, establish performance criteria for and evaluate the performance of the Company’s chief executive officer and approve compensation of all officers and directors. The compensation committee held seven meetings during fiscal 2005. The compensation committee is comprised solely of independent directors, consisting of Messrs. Delson, DiNubile and Holtz, with Mr. Delson acting as the chairman.

Nominating and Governance Committee. The principal functions of the nominating and governance committee are to recommend persons to be selected by the Board as nominees for election as directors, recommend persons to be elected to fill any vacancies on the Board, consider and recommend to the Board qualifications for the office of director and policies concerning the term of office of directors and the composition of the Board and consider and recommend to the Board other actions relating to corporate governance. The nominating and governance committee held no meetings during fiscal 2005 but held a meeting in 2006 to consider the two nominees. The nominating and governance committee is comprised solely of independent directors, consisting of Messrs. Bagnell, DiNubile and Holtz, with Mr. Holtz acting as the chairman.

The nominating and governance committee has adopted a charter with respect to its nominating function, a current copy of which is available on the Company’s web site at www.atlasamerica.com. The committee will consider nominees recommended by security holders for the 2007 annual meeting of stockholders if submitted in writing to the Secretary of the Company in accordance with the Company’s bylaws and rules promulgated by the Securities and Exchange Commission. See “Stockholder Proposals” for information concerning nominations by stockholders.

7

The Board has also established a process for stockholders to send communications to it. Any stockholder of the Company who wishes to send a communication to the Board should mail such communication to the Secretary of the Company at its Moon Township address stated herein. Beneficial owners shall include in their communication a good faith representation that they are beneficial owners of the Company’s common stock. The Secretary of the Company will promptly forward to the Chairman of the Board any and all such stockholder communications.

The Company does not have a formal policy regarding Board member attendance at its annual meeting of stockholders. Because a regularly scheduled meeting of the Board will occur on the date of the Meeting, the Company anticipates that all of its Board members will attend the Meeting.

Report of the Audit Committee

The audit committee has approved the following report:

In connection with its function to oversee and monitor the financial reporting process of the Company, the audit committee has done the following:

| • | reviewed and discussed the Company’s audited financial statements for the fiscal year ended September 30, 2005 with the Company’s management; |

| | |

| • | discussed with the Company’s independent auditors those matters which are required to be discussed by SAS 61 (Codification of Statements on Auditing Standards, AU Sec. 380); and |

| | |

| • | received the written disclosures and the letter from the Company’s independent auditors required by Independence Standards Board Standard No. 1 (Independence Discussion with Audit Committees) and discussed with the independent auditors their independence. |

Based on the foregoing, the audit committee recommended to the Board that the audited financial statements be included in the Company’s annual report on Form 10-K for the fiscal year ended September 30, 2005.

Carlton M. Arendell, Chairman

William R. Bagnell

Donald W. Delson

Audit Fees

The aggregate fees billed by the Company’s independent auditors, Grant Thornton LLP, for professional services rendered for the audit of the Company’s annual financial statements for the fiscal year ended September 30, 2005, and for the reviews of the financial statements included in its quarterly reports on Form 10-Q and for services that are normally provided by the independent auditors in connection with statutory or regulatory filings or engagements during such fiscal year were $888,000. The aggregate fees billed by Grant Thornton for professional services rendered since the Company’s initial public offering for the audit of the Company’s annual financial statements for the fiscal year ended September 30, 2004 were $276,000.

8

Audit-Related Fees

The aggregate fees billed by Grant Thornton LLP for audit-related services were $2,000 for the fiscal year ended September 30, 2005, and $135,200 for the fiscal year ended September 30, 2004, which were primarily related to services rendered in connection with the Company’s initial public offering.

Tax Fees

Grant Thornton LLP billed no fees for tax services rendered to the Company for either of the fiscal years ended September 30, 2005 and September 30, 2004.

All Other Fees

Grant Thornton LLP billed no fees for other services rendered to the Company for either of the fiscal years ended September 30, 2005 and September 30, 2004.

Audit Committee Pre-Approval Policies and Procedures

The audit committee, on at least an annual basis, reviews audit and non-audit services performed by Grant Thornton LLP as well as the fees charged by Grant Thornton LLP for such services. The Company’s policy is that all audit and non-audit services must be pre-approved by the audit committee. All of such services and fees were pre-approved during fiscal 2005.

Other Matters

Upon the recommendation of the audit committee, approved by the Board of Directors, Grant Thornton LLP served as the Company’s independent auditors during fiscal year 2005.The audit committee anticipates that Grant Thornton LLP will be re-appointed as the Company’s independent auditors for fiscal year 2006. The Company does not anticipate that a representative of Grant Thornton LLP will be present at the Meeting.

Executive Officer Compensation

The following table sets forth certain information concerning the compensation paid or accrued during each of the last two fiscal years for our Chief Executive Officer and each of our four other most highly compensated executive officers whose aggregate salary and bonus exceeded $100,000. We were a privately held company until May 10, 2004.

9

Summary Compensation Table

| | | | | | | | Long-Term Compensation | | | | |

| | | | | |

|

| | | | |

| | | | | Annual Compensation | | | Awards | | | | |

| | | |

| |

|

| | | | |

| Name and Principal Position | | Fiscal

Year | | Salar | | | Bonus (1) | | | Restricted

Stock

Awards(2) | | | Securities

Underlying

Options | | | All Other

Compen−

sation (3) | |

| |

| |

| | |

| | |

| | |

| | |

| |

| Edward E. Cohen(4) | | 2005 | | $ 546,154 | | | $ 800,000 | | | $ 2,345 | | | 300,000 | | | $ 1,134,200 | |

| Chairman, Chief Executive | | 2004 | | 401,000 | | | 385,000 | | | 209,924 | | | 0 | | | 995,441 | |

| Officer and President | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

Freddie M. Kotek

Executive Vice President | | 2005

2004 | | $ 303,846

267,500 | | | $ 300,000

250,000 | | | $ 2,345

51,564 | | | 40,000

0 | | | $ 48,660

6,500 | |

| | | | | | | | | | | | | | | | | | |

Frank P. Carolas

Executive Vice President | | 2005

2004 | | $ 225,962

192,500 | | | $ 125,000

75,000 | | | $ 2,345

5,798 | | | 30,000

0 | | | $ 0

81,357 | |

| | | | | | | | | | | | | | | | | | |

Jeffrey C. Simmons

Executive Vice President | | 2005

2004 | | $ 225,962

192,500 | | | $ 125,000

75,000 | | | $ 2,345

102,083 | | | 30,000

0 | | | $ 0

81,357 | |

| | | | | | | | | | | | | | | | | | |

Michael L. Staines

Executive Vice President | | 2005

2004 | | $ 225,962

195,500 | | | $ 125,000

65,000 | | | $ 2,345

99,026 | | | 5,000

0 | | | $ 194,640

298,000 | |

| | |

| (1) | Bonuses in any fiscal year are generally based upon the Company’s performance in the prior fiscal year and the individual’s contribution to that performance. From time to time, the Company may award bonuses in a fiscal year reflecting an individual’s performance during that fiscal year. |

| | |

| (2) | Amounts in 2005 reflect allocations of shares to employee accounts under the Company’s Employee Stock Ownership Plan (“Atlas ESOP”). Amounts in 2004 reflect allocations of shares to employee accounts under the ESOP of the Company’s former majority stockholder, RAI (“Resource ESOP”), to reconcile shares held to shares which should have been allocated to those accounts in prior years. Share allocations under the Atlas ESOP have been valued at the closing price of the Company’s common stock at the end of its fiscal year and share allocations under the Resource ESOP were valued at the closing price of RAI’s common stock at the end of RAI’s fiscal year. As of September 30, 2005, Messrs. E. Cohen, Kotek, Carolas, Simmons and Staines were fully vested. |

| | |

| (3) | Reflects matching payments RAI made under its 401(k) Plan in 2004 and grants in 2005 and 2004 of phantom units under the Atlas Pipeline Long-Term Incentive Plan, valued at the closing price of common units on the respective dates of grants. The amounts set forth for Mr. E. Cohen in fiscal 2005 and 2004 also include $161,000 and $59,500, respectively, of accrued obligations under a Supplemental Employment Retirement Plan established by the Company in May 2004 in connection with an employment agreement with Mr. E. Cohen. The phantom unit grants under the Atlas Pipeline Long-Term Incentive Plan entitle the recipient, upon vesting, to receive one common unit or its then fair market value in cash and include distribution equivalent rights. The number of phantom units held and the value of those phantom units, valued at the closing market price of Atlas Pipeline Partner, L.P.’s common units on September 30, 2005, are: Mr. E. Cohen – 45,000 phantom units ($2,198,250); Mr. Kotek – 1,000 phantom units ($48,850); Mr. Carolas – 2,000 phantom units ($97,700); Mr. Simmons – 2,000 phantom units ($97,700); and Mr. Staines – 12,000 phantom units ($586,200). |

| | |

| (4) | Until the completion of the Company’s initial public offering in May 2004, it did not directly compensate Mr. E. Cohen. Rather, RAI allocated his compensation between activities on behalf of the Company and activities on behalf of RAI based upon an estimate of the time spent by Mr. E. Cohen on activities for the Company and for RAI, and the Company reimbursed RAI for the compensation allocated to it. RAI also similarly allocated compensation for Messrs. E. Cohen, Carolas, Simmons and Staines to Atlas Pipeline Partners, L.P. |

10

Option/SARS Grants and Exercises in Last Fiscal Year and Fiscal Year-End Option Values

The following table provides additional information about the stock options shown in the “Securities Underlying Options” column of the preceding Summary Compensation Table, which were granted in fiscal 2005 to the named executive officers. The Company did not grant any stock appreciation rights to the named executive officers in fiscal 2005.

Option Grants in Fiscal Year 2005

| Name | | | Number of Securities

Underlying

Options Granted (1) | | | Percent of Total Options Granted to Employees in

Fiscal 2005 | | | Exercise Price ($/Share) | | | Expiration Date | | | Potential Realizable Value

at Stock Price

Appreciation for

Option Term (2) | |

| | |

| | |

| |

|

| |

|

| |

|

|

|

|

| |

| | | | | | | | | | | | | | | | @5% | | | @10% | |

| | | | | | | | | | | | | | |

|

| |

|

| |

| Edward E. Cohen | | | 300,000 | | | 38.6% | | $ | 38.21 | | | 07/01/2015 | | $ | 7,209,019 | | $ | 18,269,070 | |

| Freddie M. Kotek | | | 40,000 | | | 5.1% | | $ | 38.21 | | | 07/01/2015 | | | 961,203 | | | 2,435,876 | |

| Frank P. Carolas | | | 30,000 | | | 3.9% | | $ | 38.21 | | | 07/01/2015 | | | 720,902 | | | 1,826,907 | |

| Jeffrey C. Simmons | | | 30,000 | | | 3.9% | | $ | 38.21 | | | 07/01/2015 | | | 720,902 | | | 1,826,907 | |

| Michael L. Staines | | | 5,000 | | | 0.6% | | $ | 38.21 | | | 07/01/2015 | | | 120,150 | | | 304,484 | |

| | |

| (1) | All options listed in this table were granted on July 1, 2005 under the Company’s Stock Incentive Plan. The options granted to Mr. E. Cohen vested immediately. The options granted to Messrs. Kotek, Carolas, Simmons and Staines vest 25% per year commencing on July 1, 2006. |

| | |

| (2) | These assumed rates of appreciation are provided in order to comply with requirements of the Securities and Exchange Commission, and do not represent the Company’s estimate or projection as to the actual rate of appreciation of its common stock. The actual value of the options will depend on the performance of the Company’s common stock, which may be greater or less than the amounts shown. |

The following table sets forth the number of unexercised options and their value on September 30, 2005, held by the named executive officers. No options were exercised and no stock appreciation rights were exercised or held by the named executive officers in fiscal 2005.

Aggregated Option Exercises In Last Fiscal Year

And Fiscal Year-End Option Values

| Name | | | Shares

Acquired

On Exercise | | | Value

Realized | | | Number of

Securities Underlying

Unexercised Options at

FY-End Exercisable/Unexercisable | | | Value of Unexercised

In-the-Money Options at

FY-End Exercisable/Unexercisable (1) | |

| | |

| |

|

| | |

| | |

| |

| Edward E. Cohen | | | — | | | — | | | 300,000/0 | | | $3,192,000/$0 | |

| Freddie M. Kotek | | | — | | | — | | | 0/40,000 | | | $0/$425,600 | |

| Frank P. Carolas | | | — | | | — | | | 0/30,000 | | | $0/$319,200 | |

| Jeffrey C. Simmons | | | — | | | — | | | 0/30,000 | | | $0/$319,200 | |

| Michael L. Staines | | | — | | | — | | | 0/5,000 | | | $0/$53,200 | |

| | |

| (1) | Value is calculated by subtracting the total exercise price from the fair market value of the securities underlying the options at September 30, 2005. |

11

Employment Agreement

The Company has an employment agreement with Edward E. Cohen, who currently serves as its Chairman, Chief Executive Officer and President. The agreement requires him to devote such time to the Company as is reasonably necessary to the fulfillment of his duties, although it permits him to invest and participate in outside business endeavors. The agreement provides for initial base compensation of $350,000 per year, which may be increased by the compensation committee based upon its evaluation of Mr. Cohen’s performance. Mr. Cohen is eligible to receive incentive bonuses and stock option grants and to participate in all employee benefit plans in effect during his period of employment. The agreement has a term of three years and, until notice to the contrary, the term is automatically extended so that on any day on which the agreement is in effect it has a then-current three-year term.

The agreement provides for a Supplemental Executive Retirement Plan, or SERP, pursuant to which Mr. Cohen will receive an annual retirement benefit equal to the product of:

| | | | |

| | | • | his base salary as of the time Mr. Cohen’s employment with the Company ceases, multiplied by |

| | | | |

| | | • | the number of years (or portions thereof) which Mr. Cohen is employed by the Company. |

The maximum benefit under the SERP is limited to 65% of his final base salary. The benefit is guaranteed to his estate for 10 years if he should die before receiving 10 years’ of SERP benefits. If there is a change of control and his employment with the Company is terminated, or if the Company terminates his employment without cause, then the SERP benefit will be the greater of the accrued benefit pursuant to the above formula, or 35% of his final base salary.

The agreement provides the following regarding termination and termination benefits:

| | | • | upon termination of employment due to death, Mr. Cohen’s estate will receive an amount equal to his final base salary multiplied by the number of years (or portion thereof) that he shall have worked for the Company (but not to be greater than three years’ base salary or less than one year’s base salary); |

| | | | |

| | | • | the Company may terminate Mr. Cohen’s employment if he is disabled for 180 days consecutive days during any 12-month period. If his employment is terminated due to disability, he will receive his base salary and benefits for three years, and such three year period will be deemed a portion of his employment term for purposes of accruing SERP benefits; |

| | | | |

| | | • | the Company may terminate his employment without cause upon 30 days’ written notice or upon a change of control after providing at least 30 days’ written notice. Mr. Cohen may terminate his employment for good reason or upon a change in control. Good reason is defined as a reduction in Mr. Cohen’s base pay, a demotion, a material reduction in his duties, relocation, his failure to be elected to the Board or a material breach of the agreement by the Company. If employment is terminated by the Company without cause, by Mr. Cohen for good reason or by either party in connection with a change of control, he will be entitled to any amounts then owed to him plus either: |

| | | | | |

| | | | − | severance benefits under the Company’s then current severance policy, if any, or; |

| | | | | |

| | | | − | if Mr. Cohen signs a release, 36 months of continuedhealth insurance coverage and a lump sum payment equal to three years of his average compensation (which the Company defines as the average of the three highest years of total compensation that he shall have earned under the agreement, or if the agreement is less than three years old, the highest total compensation in any year or portion thereof); |

12

| | | | |

| | | • | Mr. Cohen may terminate the agreement without cause with 60 days notice to us, and if he does so after January 1, 2006, and signs a release, he will receive a severance benefit equal to one-half of one year’s base salary then in effect; and |

| | | | |

| | | • | the Company may terminate Mr. Cohen’s employment for cause (defined as a felony conviction or conviction of a crime involving fraud, embezzlement or moral turpitude, intentional and continual failure to perform his material duties after notice, or violation of confidentiality obligations) in which case he will receive only accrued amounts then owed to him. |

In the event that any amounts payable to Mr. Cohen upon termination become subject to any excise tax imposed under Section 4999 of the Internal Revenue Code, the Company must pay him an additional sum such that the net amounts retained by him, after payment of excise, income and withholding taxes, equals the termination amounts payable prior to reduction by any excise tax, unless Mr. Cohen’s employment terminates because of his death or disability.

Certain Relationships and Related Party Transactions

In the ordinary course of its business operations, the Company has ongoing relationships with several related entities and persons:

Relationship with Company Sponsored Partnerships. The Company conducts certain activities through, and a substantial portion of its revenues are attributable to, energy limited partnerships (“Partnerships”). A subsidiary of the Company serves as general partner of the Partnerships and assumes customary rights and obligations for the Partnerships. As the general partner, the Company’s subsidiary is liable for certain Partnership liabilities, unless exculpated under partnership agreements, and can be liable to limited partners if the Company breaches its responsibilities with respect to the operations of the Partnerships. The Company is entitled to receive management fees, reimbursement for administrative costs incurred, and to share in the Partnerships’ revenue, and costs and expenses pursuant to the respective Partnership agreements.

Relationship with Resource America, Inc. In May 2004, the Company completed an initial public offering of 2,645,000 shares of its common stock at a price of $15.50 per common share. The net proceeds of the offering of $37.0 million, after deducting underwriting discounts and costs, were distributed to the Company’s then parent, RAI (NASDAQ: REXI) in the form of a non-taxable dividend. As part of the Company’s spin-off from RAI completed on June 30, 2005, the Company entered into a transition services agreement. Pursuant thereto, the Company reimburses RAI for certain costs and expenses it continues to incur on the Company’s behalf, primarily payroll and rent. For fiscal 2005, these costs totaled $602,000. Certain operating expenditures totaling $111,000 that remain to be settled between the Company and RAI are reflected in the Company’s consolidated balance sheets as advances from affiliate. Mr. E. Cohen is the Chairman of the Board of RAI, and Mr. J. Cohen is its Chief Executive Officer, President and a director of RAI.

Resource America, Inc.’s relationship with Anthem Securities (a wholly- owned subsidiary of the Company). Anthem Securities is a wholly-owned subsidiary of the Company and a registered broker-dealer which serves as the dealer-manager of investment programs sponsored by RAI’s real estate and equipment finance segments. Some of the personnel performing services for Anthem have been on RAI’s payroll, and Anthem reimburses RAI for the allocable costs of such personnel. During fiscal 2005, Anthem reimbursed RAI $653,000 for such costs. In addition, RAI has agreed to cover some of the operating costs for Anthem’s office of supervisory jurisdiction, principally licensing fees and costs. In fiscal 2005, RAI paid $270,000 toward such operating costs.

13

Relationship with Retirement Trust. Upon his retirement, Mr. E. Cohen is entitled to receive payments from a Supplemental Employment Retirement Plan (“SERP”). See “Employment Agreement.”

Relationship with Ledgewood. Until April 1996, Mr. E. Cohen was of counsel to Ledgewood, a Philadelphia law firm. Mr. E. Cohen receives certain debt service payments from Ledgewood related to the termination of his affiliation with Ledgewood and its redemption of his interest. The Company paid Ledgewood $440,300 during fiscal 2005 for legal services rendered.

Relationship with Friedman, Billings, Ramsey & Co. Until March 2005, Matthew A. Jones, the Company’s Chief Financial Officer, was a Managing Director of Friedman, Billings, Ramsey & Co., Inc., which acted an underwriter in connection with the Company’s initial public officering in May 2004, receiving underwriting discounts and commissions and expense reimbursement of $1,852,544. In addition, FBR acted as an underwriter of the April and July 2004 public offerings of Atlas Pipeline Partners, L.P., receiving underwriting discounts and commissions of $1,339,528 and $427,200, respectively, and FBR provided advisory services to Atlas Pipeline Partners, L.P. in connection with its acquisition of ETC Oklahoma Pipeline, Ltd. in April 2005, receiving total compensation of $767,205 (including expense reimbursements).

Performance Graph

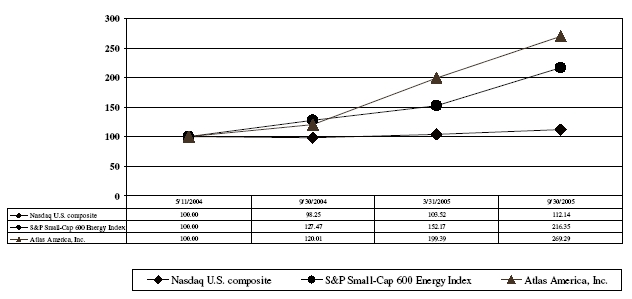

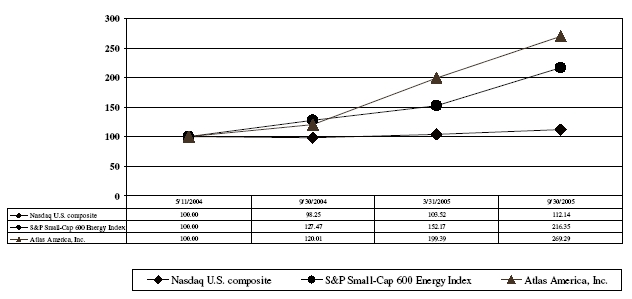

The following graph compares the cumulative total stockholder return on the Company’s common stock with the cumulative total return of two other stock market indices: the Nasdaq United States Composite and the S&P Small-Cap 600 Energy Index.

Comparison Cumulative Total Return Since IPO*

| * | Total return since the Company’s initial public offering. Assumes $100 was invested on May 11, 2004 in the Company’s common stock or in the indicated index and that cash dividends were reinvested as received. |

14

Compensation Committee Report on Executive Compensation

The compensation committee of the Board of Directors is responsible for setting and administering compensation programs for the Company’s executives.

The Company’s compensation philosophy and objectives are driven by the desire to:

| • | compensate and reward executives for their contribution to the historical success of the Company; and |

| | |

| • | provide suitable compensation packages to attract, motivate and retain talented executives. |

The executive compensation program is designed to reward performance that is directly relevant to the Company’s short-term and long-term success and goals and, as such, has three components: base salary, annual bonuses, and long term incentives.

Base Salary

Base salaries for executive officers are determined in part by pay practices in unaffiliated companies and the compensation committee’s assessment of individual performance relative to responsibilities and objectives for each executive. Base salaries are not intended to compensate individuals for extraordinary performance or for above average Company performance.

Bonus Plan

Executives are eligible to receive annual bonuses, which are generally based on the Company’s overall performance during the preceding year and the individual’s contribution to that performance. The Company does not have a defined bonus pool and the amount of any bonus payment is at the discretion of the compensation committee. No formula performance measures were utilized in establishing the amount of the bonus awards; however, the committee considers individual contribution to the overall performance of the Company and performance relative to expectations.

Long Term Incentives

General. Long term incentives are designed to focus executives on the long term goals and performance of the Company and to provide a reward directly tied to stockholder return: the performance of the Company’s common stock. The particular plans are intended to encourage the participants to strive to achieve the long term success of the Company and to remain with the Company in order to fully benefit from the plans.

Stock Options. Stock options are issued periodically to key employees at an exercise price of no less than the then current market price of the Company’s common stock, have a life up to ten (10) years and typically vest to the executive at a rate not exceeding twenty-five percent (25%) of the amount awarded on each anniversary of their issuance. Allocation of available options is at the discretion of the compensation committee and is determined by potential contribution to, or impact upon, the overall performance of the Company by the executive.

Employee Stock Ownership Plan. In 2005, the Company established the Atlas America, Inc. Employee Stock Ownership Plan for the benefit of all qualified employees. All employees, including executive officers, are allocated shares from an available pool in proportion to their relative compensation.While the allocations from this plan are determined solely by a predetermined and required formula in accordance with ERISA, the intent was, and remains, to reward all employees, including executives, based on the long term success of the Company as measured by the stockholder return.

15

Savings Plan. The Company’s 401(k) Plan offers eligible employees the opportunity to make long-term investments on a regular basis through salary contributions, which are supplemented by matching Company contributions. During fiscal year 2005, the Company matched employee contributions 50% up to 10% of their deferral in their choice of offered mutual funds and/or Company common stock. While participation in this plan is at the discretion of the qualified employee, the intent again was, and remains, to reward all employees, including executives, based on the long term success of the Company as measured by the returns to stockholders.

Chief Executive Officer Compensation

Edward E. Cohen has served as the Company’s Chairman of the Board, Chief Executive Officer and President since 2000. Applying the considerations noted below, for fiscal year 2005, the committee maintained Mr. E. Cohen’s base salary at the rate of $600,000 and paid Mr. E. Cohen a bonus of $800,000 based on his performance during fiscal year 2004. The compensation and the bonus awarded to Mr. E. Cohen is allocated between the work that he performs for the Company and for Atlas Pipeline Partners, L.P.

In evaluating the performance and setting the total compensation package for Mr. E. Cohen for fiscal year 2005, including the bonus compensation paid in January 2005 for performance during the 2004 fiscal year, the committee took note of the significant growth in the Company’s net income ($21.2 million at September 30, 2004 compared to $13.9 million at September 30, 2003), the Company’s revenues ($180.1 million at September 30, 2004 compared to $105.7 at September 30, 2003), the PV-10 estimate of Company owned proved energy reserves ($320.4 million at September 30, 2004 compared to $191.4 million at September 30, 2003) and the PV-10 value of energy assets under management ($457.1 million at September 30, 2004 compared to $273.5 million at September 30, 2003).

This report has been provided by the compensation committee of the Board of Directors of Atlas America, Inc.

Donald W. Delson, Chairman

Dennis A. Holtz

Nicholas A. DiNubile

OTHER MATTERS

As of the date of this proxy statement, the Board does not intend to present and has not been informed that any other person intends to present any other matters for action at the Meeting. However, if other matters do properly come before the Meeting, it is the intention of the persons named as proxies to vote upon them in accordance with their best judgment.

Except as hereinabove stated, all shares represented by valid proxies received will be voted in accordance with the provisions of the proxy.

ANNUAL REPORT AND REPORT ON FORM 10-K

The Company’s 2005 Annual Report to Stockholders including the financial statements and management’s discussion and analysis of financial condition and results of operations for the year ended September 30, 2005, is being sent to stockholders of record as of March 3, 2006 with this proxy statement. Stockholders of record as of March 3, 2006, and beneficial owners of the Company’s common stock on that date, may obtain from the Company, without charge, a copy of the Company’s most recent Annual Report on Form 10-K filed with the Securities and Exchange Commission, exclusive of the exhibits thereto, by a request therefor in writing. Such requests should be directed to the Company, at its Moon Township address stated herein, and to the attention of the Secretary. Beneficial owners shall include in their written requests a good faith representation that they were beneficial owners of the Company’s common stock on March 3, 2006.

16

STOCKHOLDER PROPOSALS

Rule 14a-8 of the Securities Exchange Act of 1934 establishes the eligibility requirements and the procedures that must be followed for a stockholder’s proposal to be included in a public company’s proxy materials. Under the rule, proposals submitted for inclusion in the Company’s 2006 proxy materials must be received by Atlas America, Inc. at 311 Rouser Road, Moon Township, Pennsylvania 15108, Attention: Secretary, on or before the close of business on November 21, 2006. Proposals must comply with all the requirements of Rule 14a-8.

A stockholder who wishes to present a matter for action at the Company’s 2006 annual meeting, but chooses not to do so under Rule 14a-8, must deliver to the Secretary of the Company on or before December 21, 2006, a notice containing the information required by the advance notice and other provisions of the Company’s bylaws. A copy of the bylaws may be obtained by directing a written request to Atlas America, Inc., 311 Rouser Road, Moon Township, Pennsylvania 15108, Attention: Secretary.

17

ATLAS AMERICA, INC.

PROXY

THIS PROXY IS SOLICITED ON BEHALF OF

THE BOARD OF DIRECTORS OF ATLAS AMERICA, INC.

The undersigned hereby constitutes and appoints Edward E. Cohen and Matthew A. Jones, or either of them, as and for his proxies, each with the power to appoint such proxy’s substitute, and hereby authorizes them, or either of them, to vote all of the shares of common stock of Atlas America, Inc. held of record by the undersigned on March 3, 2006 at the Annual Meeting of Stockholders of Atlas America, Inc. to be held Wednesday, April 26, 2006 and at any and all adjournments thereof as follows:

| | | | |  I plan to attend the meeting I plan to attend the meeting |

1. ELECTION OF CLASS I DIRECTORS: The nominees for Class I directors are William R. Bagnell and Nicholas A. DiNubile.

FOR ALL NOMINEES FOR ALL NOMINEES | |  WITHHOLD AUTHORITY WITHHOLD AUTHORITY

FOR ALL NOMINEES | |  FOR ALL EXCEPT: FOR ALL EXCEPT:

__________________ |

2. IN THEIR DISCRETION, THE PROXIES ARE AUTHORIZED TO VOTE UPON SUCH OTHER BUSINESS AS MAY PROPERLY BE BROUGHT BEFORE THE MEETING OR ANY ADJOURNMENT THEREOF.

This proxy, when properly executed, will be voted in the manner specified above by the named proxies. If no direction is made, this proxy will be voted FOR all nominees listed. Please sign exactly as your name appears on this proxy card. When shares are held by joint tenants, both should sign. When signing as an attorney, executor, administrator, trustee, or guardian, please give full title as such. If a corporation, please sign in full corporate name by President or other authorized officer. If a partnership, please sign in partnership name by authorized person.

The undersigned hereby acknowledges receipt of the Atlas America, Inc. Annual Report to Stockholders, Notice of the Atlas America, Inc. Annual Meeting and the Proxy Statement relating thereto.

Dated: _______________, 2006

_______________________________

Signature of stockholder

_______________________________

Signature if held jointly

PLEASE MARK, SIGN, DATE AND RETURN THE PROXY CARD PROMPTLY USING THE ENCLOSED ENVELOPE.