Marcellus Joint Venture with Reliance Industries April 2010 Atlas Energy, Inc. Exhibit 99.3 |

Disclaimer 1 Cautionary Note Regarding Forward-Looking Statements This document contains forward-looking statements that involve a number of assumptions, risks and uncertainties that could cause actual results to differ materially from those contained in the forward-looking statements. Atlas Energy, Inc. cautions readers that any forward-looking information is not a guarantee of future performance. Such forward-looking statements include, but are not limited to, statements about future financial and operating results, resource potential, the Company’s plans, objectives, expectations and intentions and other statements that are not historical facts. Risks, assumptions and uncertainties that could cause actual results to materially differ from the forward-looking statements include, but are not limited to, those associated with general economic and business conditions; changes in commodity price; changes in the costs and results of drilling operations; uncertainties about estimates; the Company’s level of indebtedness; changes in government environmental policies and other environmental risks; the availability of drilling equipment and the timing of production; tax consequences of business transactions; and other risks, assumptions and uncertainties detailed from time to time in the Company’s reports filed with the U.S. Securities and Exchange Commission (the “SEC”). Forward-looking statements speak only as of the date hereof, and the Company assumes no obligation to update such statements, except as may be required by applicable law. The SEC requires natural gas and oil companies, in filings made with the SEC, to disclose proved reserves, which are those quantities of natural gas and oil that by analysis of geo-science and engineering data can be estimated with reasonable certainty to be economically producible from a given date forward, from known reservoirs, and under existing economic conditions, operating methods, and government regulations. For filings reporting year-end 2009 reserves, the SEC permits the optional disclosure of probable and possible reserves. The Company has elected not to report probable and possible reserves in its filings with the SEC. In this press release the estimate of “incremental net recoverable reserves” describes the Company’s internal estimates of volumes of natural gas that are not classified as proved reserves but are potentially recoverable through exploratory drilling or additional drilling or recovery techniques. This may be a broader description of potentially recoverable volumes than probable and possible reserves, as defined by SEC regulations. Estimates of unproved resources are by their nature more speculative than estimates of proved resources and, accordingly, are subject to substantially greater risk of actually being realized by the Company. The Company believes that its estimates of unproved resources are reasonable, but such estimates have of reserves and resource potential; inability to obtain capital needed for operations; the not been reviewed by independent engineers. Estimates of unproven resources may change significantly as development provides additional data and actual quantities that are ultimately recovered may differ substantially from prior estimates. |

JV Transaction Overview 2 • Atlas to sell 40% undivided working interest in approximately 300,000 net Marcellus Shale acres to an affiliate of Reliance Industries Limited (“Reliance”) for $1.7 billion (1) – $340 million in cash upfront – $1.36 billion drilling carry; Reliance to fund 75% of Atlas' share of well costs until drilling carry has been fully utilized – Drilling carry period of 5.5 years; extending to 7.5 yr under certain conditions – Transaction expected to close before end of April 2010 • Creation of an Area of Mutual Interest (AMI) for future acreage acquisitions – Atlas will be sole leasing agent • Atlas will be operator of joint interests in AMI – Reliance has right in the future to operate certain project areas outside of Atlas’s core area of Greene, Washington, Fayette and Westmoreland counties. • Reliance has a Right of First Offer (“ROFO”) to acquire acreage from Atlas in certain counties – ROFO price is $8,000 per net acre on a present value basis (using a discount rate of 10%) (1) Subject to normal pre and post closing purchase price adjustments |

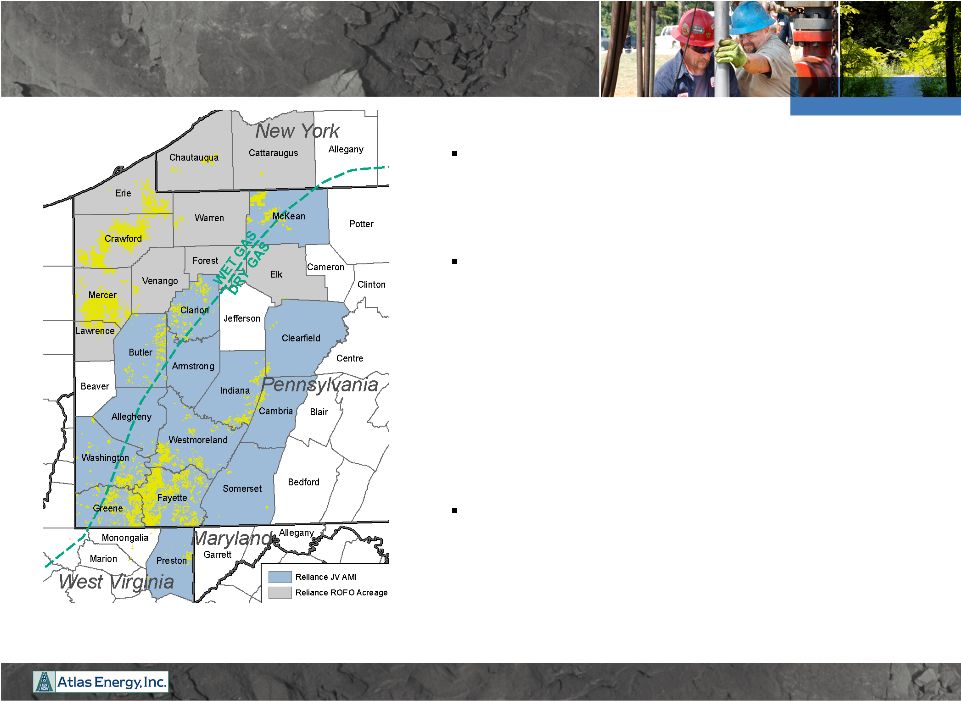

Overview of Marcellus Joint Venture AMI 3 High quality existing acreage position in AMI – Approximately 300,000 net acres – Majority of acreage located in delineated, dry gas window of southwestern Pennsylvania Results suggest existing acreage in AMI has over 13 Tcfe of potential reserves from Marcellus Shale – Approx. 3,150 horizontal locations identified – Recent Atlas wells turned into line were assigned EURs averaging 5.6 Bcf – The Joint Venture expects to complete 45 horizontal wells in 2010, over 100 wells in 2011 and ramping to 300 wells by 2013 and beyond – Atlas’ recent results indicate shallower than expected decline rates Laurel Mountain Midstream, LLC will provide Joint Venture with mid-stream services – Ongoing build out of header system will ensure that Joint Venture gas will get to market (1) Otsego and Delaware County, NY are not displayed on this map but included in the ROFO acreage. (1) |

Transaction Rationale 4 • Enables substantial expansion of ATLS’ development of its Marcellus Shale assets – Joint venture intends to drill over 1,000 horizontal Marcellus Shale wells in next 5 years • Upfront portion of consideration will de-lever balance sheet and increase liquidity – Pro forma net debt to EBITDA of 1.6x – Zero pro forma revolver borrowings of with existing borrowing base of $575 million • Drilling carry will significantly reduce Atlas’s capital expenditures – Finding and development costs could fall to $0.20/mcfe or lower, after taking into account the Drilling Carry. • Tax efficient structure • Aligns Atlas with global partner focused on expansion in the Marcellus Shale – Reliance is a Fortune Global 500 company fully integrated across the energy value chain – Reliance has demonstrated track record of excellence in large scale E&P development – Joint venture partners focused on additional acreage acquisitions and expanding operations – Reliance has right to operate certain project areas, which will create additional development capability for the joint venture – Reliance Right of First Offer creates potential benchmark for value of > $2 billion for remaining Marcellus acreage not included in AMI |

5 A Global Enterprise Focused on a Growing E&P Business • India’s Largest Private Sector Enterprise – 3% of India’s GDP – Current market cap of $78.3 billion – LTM 12/31/2009 EBITDA of ~USD $5.8 billion – 61% of FY2009 revenues generated outside of India • One of world’s leading natural gas producers – 8.3 Tcfe of Proved Reserves (94% gas; 60% PDP) – Total daily production of approximately 3 Bcfe/d – Growth in E&P is focus of the company’s strategy • A world leader in crude refining and petrochemicals – Largest single refining complex in the world – Aggregate refining capacity of 1.24 million barrels per day – Largest polyester manufacturer in the world – Leading producer of polymers, chemicals and fiber intermediaries |

Atlas poised to become a large scale producer in the Marcellus Shale 6 Premier Land Position People Gathering System to Move Large Volumes Take-Away Capacity to Premium Markets Water Treatment and Reuse Capacity Access to Equipment and Services Capital to Fund Growth The Reliance joint venture provides Atlas the capital necessary to develop the Marcellus Shale on a large scale |

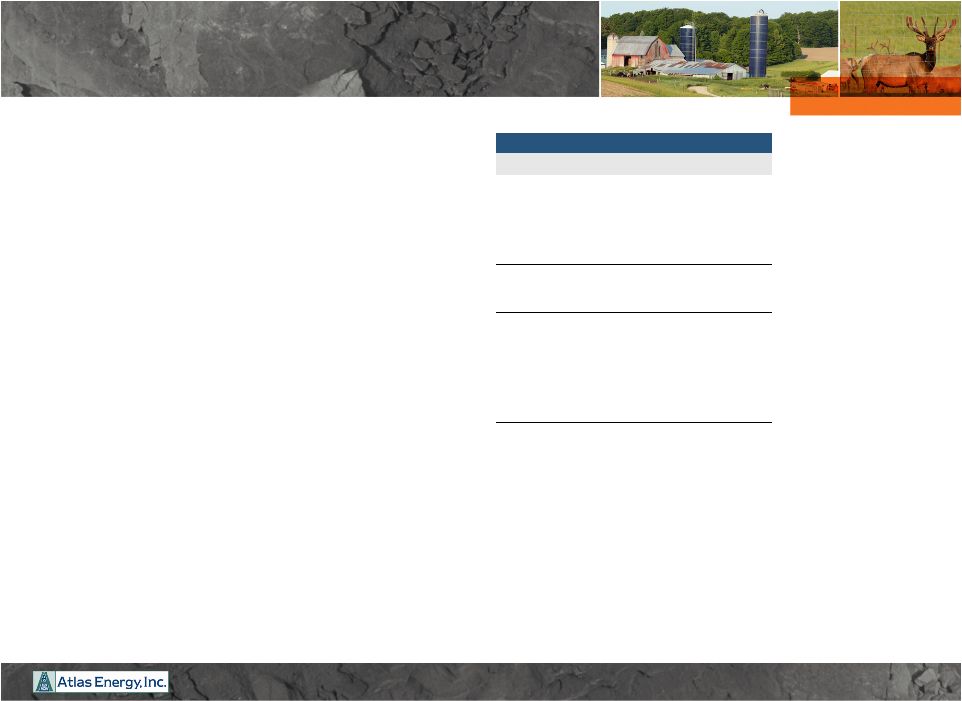

ATLS Pro Forma Capitalization and Liquidity 7 12/31/2009 Actual Pro Forma Cash 20.6 $ 150.6 $ Revolver 184.0 - 10.750% Senior Notes 400.0 400.0 12.125% Senior Notes 200.0 200.0 Total Debt 784.0 $ 600.0 $ Equity 1,703.5 1,703.5 Total Capitalization 2,487.5 $ 2,303.5 $ Equity / Total Capitalization 68.5% 74.0% Revolver Borrowing Base 575.0 575.0 Less: Drawn Portion of Revolver (184.0) - Plus: Cash 20.6 150.6 Total Liquidity 411.6 $ 725.6 $ LTM E&P EBITDA 279.3 $ 279.3 $ Net Debt 763.4 449.4 Proved Reserves (Bcfe) 1,020.0 PDP reserves (Bcfe) 535.0 Net Debt / LTM E&P EBITDA 2.7x 1.6x Net Debt / Proved reserves 0.75 $ 0.44 $ Net Debt / PDP reserves 1.43 $ 0.84 $ |

8 Reconciliation of Non-GAAP Measures Full Year Ended Full Year Ended December 31, December 31, 2009 2008 Reconciliation of net income to non-GAAP measures Net Income (71,986) (6,158) Atlas Pipeline and Atlas Pipeline Holdings net (income) loss (1,417) 55,077 Depreciation, Depletion and Amortization 108,290 95,427 Asset Impairment 156,359 - Interest Expense 64,866 56,191 Non-cash stock compensation expense 8,304 10,971 Income tax benefit (49,069) (5,021) Income attributable to ATN non-controlling interests 18,086 76,475 Non-recurring merger costs 8,113 - Non-cash net loss on sale of assets 6,435 32 Adjustment to reflect cash impact of derivatives 31,333 12,431 E&P Operations Adjusted EBITDA 279,314 295,425 |