FILED BY CENTENE CORPORATION

PURSUANT TO RULE 425 UNDER THE SECURITIES ACT OF 1933

AND DEEMED FILED PURSUANT TO RULE 14a-12

UNDER THE SECURITIES EXCHANGE ACT OF 1934

SUBJECT COMPANY: WELLCARE HEALTH PLANS, INC.

COMMISSION FILE NO. 001-32209

On December 13, 2019, Centene Corporation held an investor day. The following are excerpts from the investor day presentation in connection with Centene’s proposed acquisition of WellCare Health Plans, Inc.

Cautionary Statement on Forward-Looking Statements All statements, other than statements of current or historical fact, contained in this communication are forward-looking statements. Centene (the Company, our, or we) intends such forward-looking statements to be covered by the safe-harbor provisions for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995, and we are including this statement for purposes of complying with these safe-harbor provisions. Without limiting the foregoing, forward-looking statements often use words such as and other similar words or expressions (and the negative thereof). In particular, these statements include, without limitation, statements about future operating or financial performance, market opportunity, growth strategy, competition, expected activities in completed and future acquisitions (including statements about the impact of the proposed acquisition of WellCare Health Plans, Inc., referred to as WellCare, by Centene, which is referred to as the WellCare Transaction, recent acquisition, which is referred to as the Fidelis Care Acquisition, of substantially all the assets of New York State Catholic Health Plan, Inc., d/b/a Fidelis Care New York, which is referred to as Fidelis Care, and investments and the adequacy of available cash resources. These forward-looking statements reflect current views with respect to future events and are based on numerous assumptions and assessments made by Centene, in light of experience and perception of historical trends, current conditions, business strategies, operating environments, future developments and other factors Centene believes appropriate. By their nature, forward-looking statements involve known and unknown risks and uncertainties and are subject to change because they relate to events and depend on circumstances that will occur in the future, including economic, regulatory, competitive and other factors that may cause or its actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by these forward-looking statements. These statements are not guarantees of future performance and are subject to risks, uncertainties and assumptions. All forward-looking statements included in this communication are based on information available to Centene on the date of this communication. Except as may be otherwise required by law, Centene undertakes no obligation, and expressly disclaims, any obligation to update or revise the forward-looking statements included in this communication, whether as a result of new information, future events or otherwise, after the date of this communication. You should not place undue reliance on any forward-looking statements, as actual results may differ materially from projections, estimates or other forward-looking statements due to a variety of important factors, variables and events, including but not limited to: the risk that regulatory or other approvals required for the WellCare Transaction may be delayed or not obtained or are obtained subject to conditions that are not anticipated that could require the exertion of time and resources or otherwise have an adverse effect on Centene; the possibility that certain conditions to the consummation of the WellCare Transaction will not be satisfied or completed on a timely basis and, accordingly, the WellCare Transaction may not be consummated on a timely basis or at all; uncertainty as to the expected financial performance of the combined company following completion of the WellCare Transaction; the possibility that the expected synergies and value creation from the WellCare Transaction will not be realized, or will not be realized within the expected time period; the exertion of time and resources, and other expenses incurred and business changes required, in connection with any regulatory, governmental or third party consents or approvals for the WellCare Transaction; the risk that unexpected costs will be incurred in connection with the completion and/or integration of the WellCare Transaction or that the integration of WellCare will be more difficult or time consuming than expected; the risk that potential litigation in connection with the WellCare Transaction may affect the timing or occurrence of the WellCare Transaction, cause it not to close at all, or result in significant costs of defense, indemnification and liability; unexpected costs, charges or expenses resulting from the WellCare Transaction; the possibility that competing offers will be made to acquire WellCare; the inability to retain key personnel; disruption from the announcement, pendency and/or completion of the WellCare Transaction, including potential adverse reactions or changes to business relationships with customers, employees, suppliers or regulators, making it more difficult to maintain business and operational relationships; the risk that, following the WellCare Transaction, the combined company may not be able to effectively manage its expanded operations; ability to accurately predict and effectively manage health benefits and other operating expenses and reserves; competition; membership and revenue declines or unexpected trends; changes in healthcare practices, new technologies, and advances in medicine; increased healthcare costs; changes in economic, political or market conditions; changes in federal or state laws or regulations, including changes with respect to income tax reform or government healthcare programs as well as changes with respect to the Patient Protection and Affordable Care Act and the Health Care and Education Affordability Reconciliation Act, collectively referred to as the Affordable Care Act (ACA) and any regulations enacted thereunder that may result from changing political conditions or judicial actions, including the ultimate outcome of the District Court decision in v. United States of regarding the constitutionality of the ACA; rate cuts or other payment reductions or delays by governmental payors and other risks and uncertainties affecting government businesses; ability to adequately price products on federally facilitated and state-based Health Insurance Marketplaces; tax matters; disasters or major epidemics; the outcome of legal and regulatory proceedings; changes in expected contract start dates; provider, state, federal and other contract changes and timing of regulatory approval of contracts; the expiration, suspension, or termination of contracts with federal or state governments (including but not limited to Medicaid, Medicare, TRICARE or other customers); the difficulty of predicting the timing or outcome of pending or future litigation or government investigations; challenges to contract awards; cyber-attacks or other privacy or data security incidents; the possibility that the expected synergies and value creation from acquired businesses, including, without limitation, the Fidelis Care Acquisition, will not be realized, or will not be realized within the expected time period; the exertion of time and resources, and other expenses incurred and business changes required in connection with complying with the undertakings in connection with any regulatory, governmental or third party consents or approvals for acquisitions; disruption caused by significant completed and pending acquisitions, including, among others, the Fidelis Care Acquisition, making it more difficult to maintain business and operational relationships; the risk that unexpected costs will be incurred in connection with the completion and/or integration of acquisition transactions; changes in expected closing dates, estimated purchase price and accretion for acquisitions; the risk that acquired businesses, including Fidelis Care, will not be integrated successfully; the risk that Centene may not be able to effectively manage its operations as they have expanded as a result of the Fidelis Care Acquisition; restrictions and limitations in connection with indebtedness; ability to maintain or achieve improvement in the Centers for Medicare and Medicaid Services star ratings and maintain or achieve improvement in other quality scores in each case that can impact revenue and future growth; availability of debt and equity financing, on terms that are favorable to Centene; inflation; foreign currency fluctuations; and the risk that the unaudited pro forma condensed combined financial information included or incorporated by reference in this communication may not be reflective of the operating results and financial condition of the combined company following the completion of the WellCare Transaction. This list of important factors is not intended to be exhaustive. Centene discusses certain of these matters more fully, as well as certain other factors that may affect business operations, financial condition and results of operations, in filings with the Securities and Exchange Commission (SEC), including Annual Report on Form 10-K, Quarterly Reports on Form 10- Q and Current Reports on Form 8-K. Due to these important factors and risks, Centene cannot give assurances with respect to future performance, including, without limitation, ability to maintain adequate premium levels or ability to control its future medical and selling, general and administrative costs. We expressly qualify in their entirety all forward-looking statements attributable to us or any person acting on our behalf, as applicable, by the cautionary statements contained or referred to in this communication. 2020 FINANCIAL GUIDANCE 3

M&A Growth Continue to demonstrate our ability to acquire and successfully integrate both large and small scale acquisitions 2020 FINANCIAL GUIDANCE 17

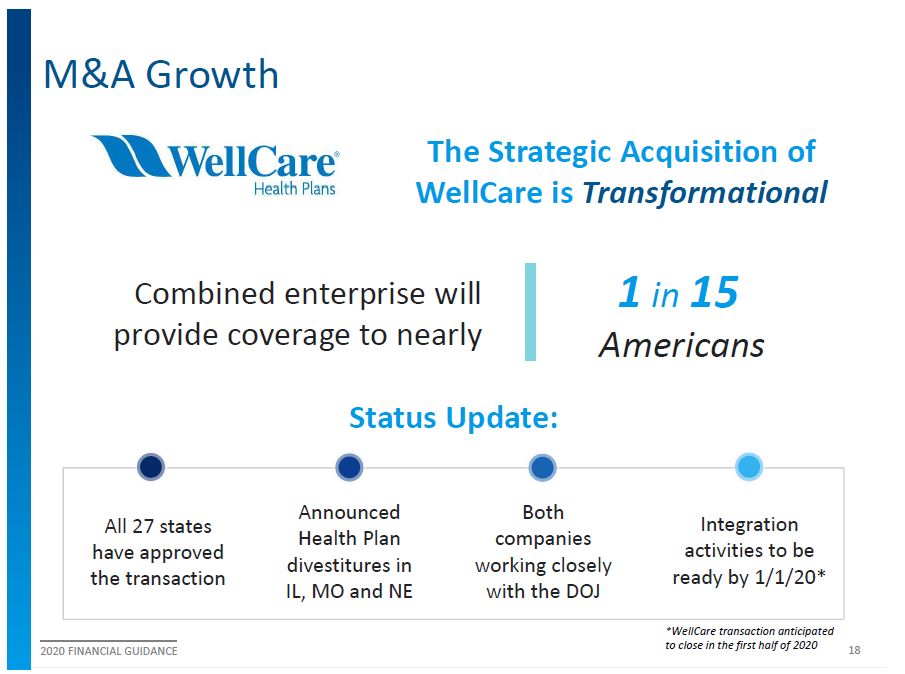

M&A Growth The Strategic Acquisition of WellCare is Transformational Combined enterprise will provide coverage to nearly 1 in 15 Americans All 27 states have approved the transaction Announced Health Plan divestitures in IL, MO and NE Both companies working closely with the DOJ Integration activities to be ready by 1/1/20* *WellCare transaction anticipated to close in the first half of 2020 Status Update: 2020 FINANCIAL GUIDANCE 18

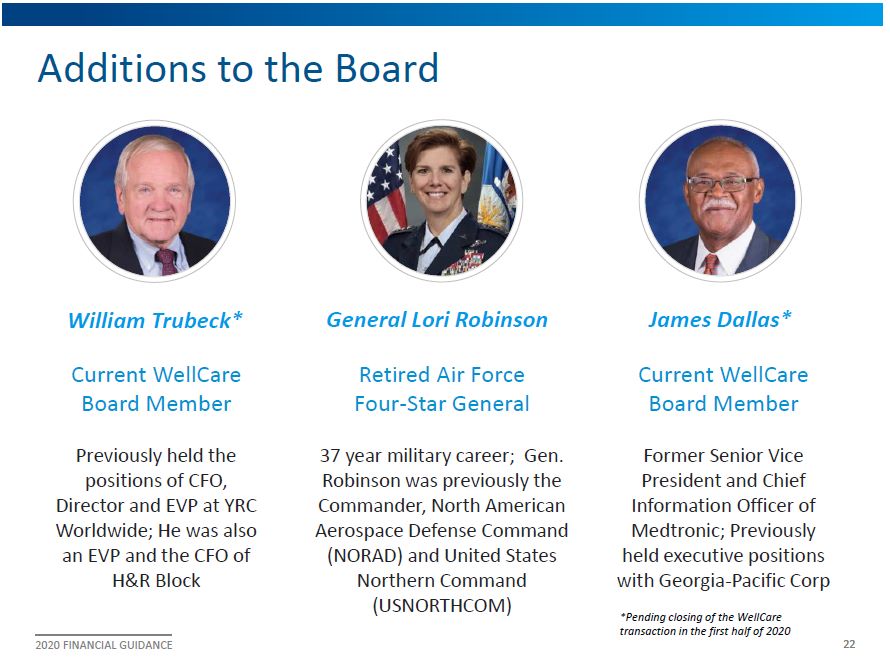

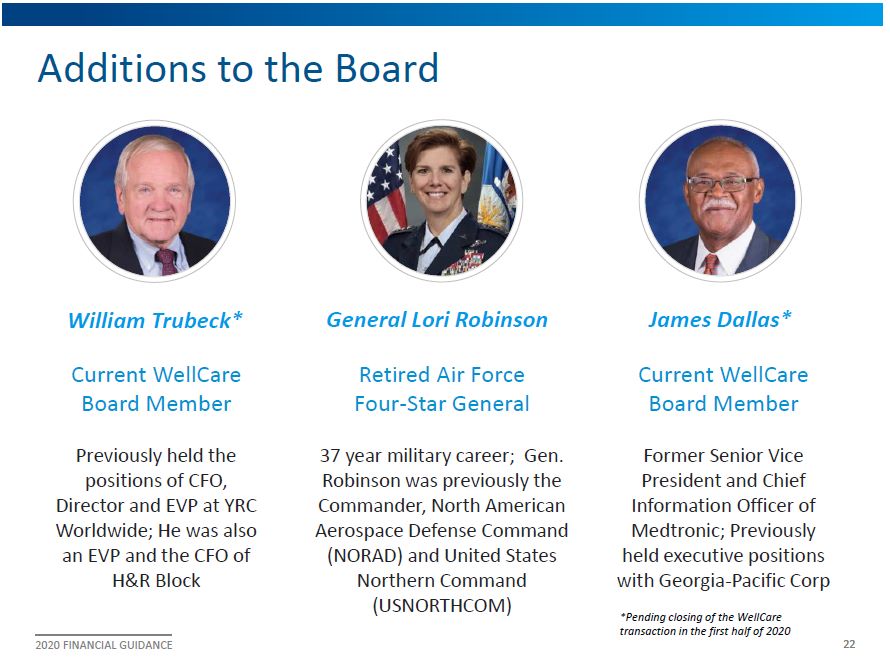

Additions to the Board Retired Air Force Four-Star General 37 year military career; Gen. Robinson was previously the Commander, North American Aerospace Defense Command (NORAD) and United States Northern Command (USNORTHCOM) William Trubeck* General Lori Robinson James Dallas* Current WellCare Board Member Previously held the positions of CFO, Director and EVP at YRC Worldwide; He was also an EVP and the CFO of H&R Block Current WellCare Board Member Former Senior Vice President and Chief Information Officer of Medtronic; Previously held executive positions with Georgia-Pacific Corp *Pending closing of the WellCare transaction in the first half of 2020 2020 FINANCIAL GUIDANCE 22

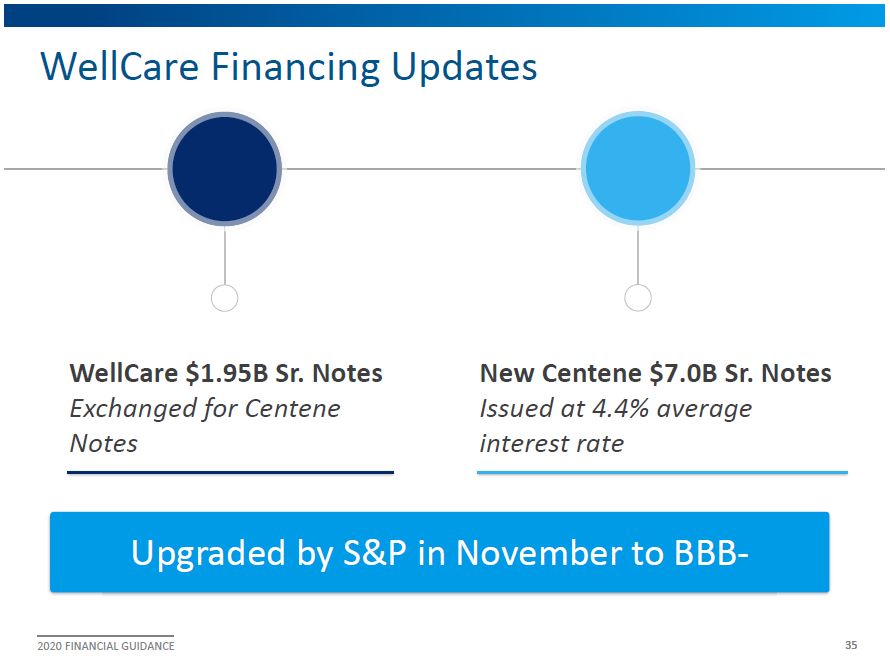

WellCare Financing Updates WellCare $1.95B Sr. Notes Exchanged for Centene Notes New Centene $7.0B Sr. Notes Issued at 4.4% average interest rate Upgraded by S&P in November to BBB 2020 FINANCIAL GUIDANCE 35

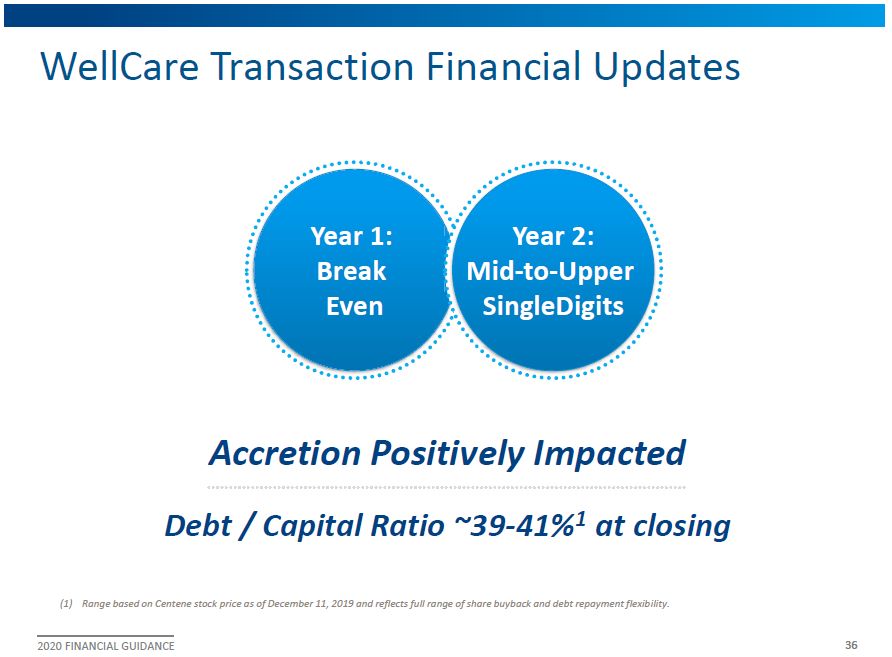

WellCare Transaction Financial Updates Year 1: Break Even Year 2: Mid-to-Upper SingleDigits Accretion Positively Impacted Debt / Capital Ratio ~39-41%1 at closing Year 1: Break Even Year 2: Mid-to-Upper SingleDigits (1) Range based on Centene stock price as of December 11, 2019 and reflects full range of share buyback and debt repayment flexibility. 2020 FINANCIAL GUIDANCE 36

2020 Strategy Continued Margin Expansion Successful WellCare Integration Focused Revenue Growth 2020 FINANCIAL GUIDANCE 37 2020

WellCare Integration Update Lisa Brubaker SVP, Quality and Risk Adjustment 2020 FINANCIAL GUIDANCE 93

Our Promise Deliver Fair Treatment to Our Providers Ensure Continuity of Care for Our Members Minimize Complications for Our States and CMS 2020 FINANCIAL GUIDANCE 94

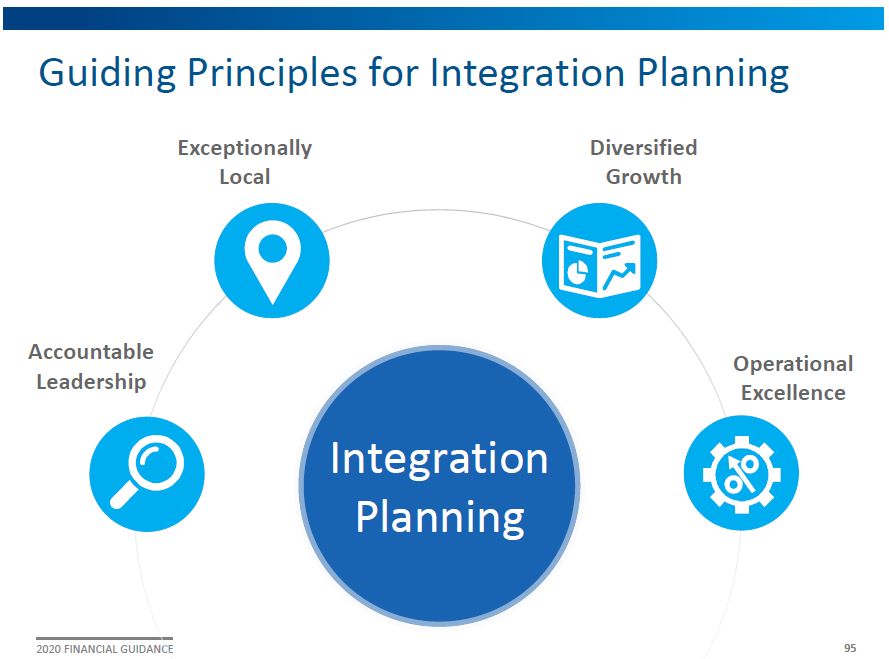

Guiding Principles for Integration Planning Exceptionally Local Operational Excellence Diversified Growth Accountable Leadership Integration Planning 2020 FINANCIAL GUIDANCE 95

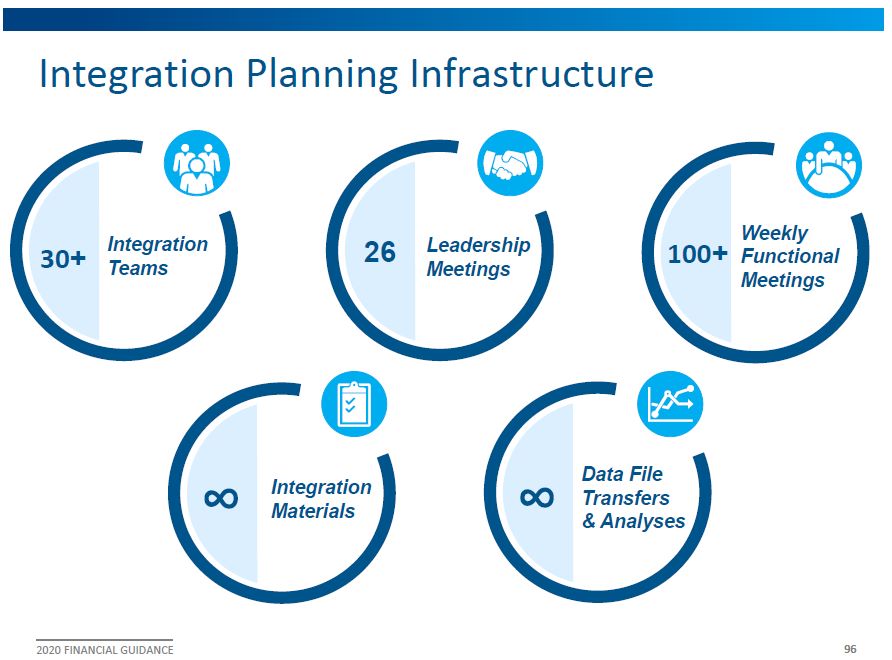

Integration Planning Infrastructure Leadership Meetings 30+ Integration 26 Teams Integration Materials Weekly Functional Meetings 100+ Data File Transfers & Analyses 2020 FINANCIAL GUIDANCE 96

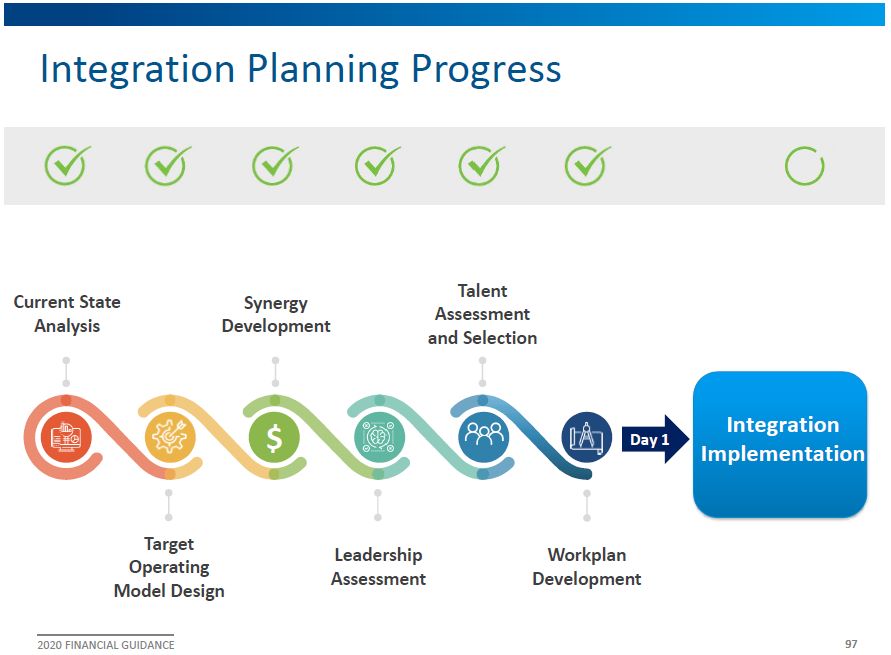

Integration Planning Progress $ Day 1 Synergy Development Talent Assessment and Selection Workplan Development Target Operating Model Design Leadership Assessment Current State Analysis Integration Implementation 2020 FINANCIAL GUIDANCE 97

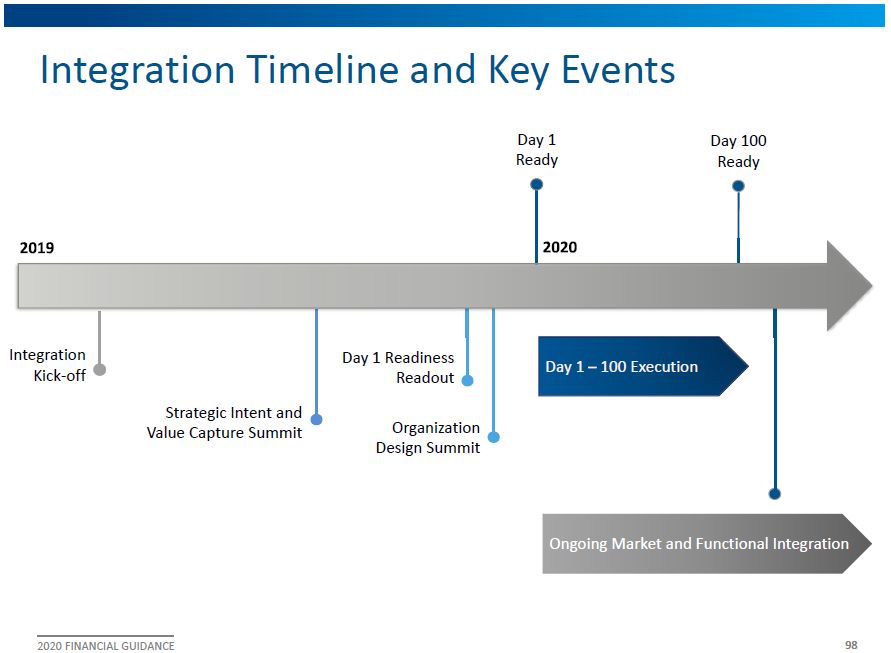

Integration Timeline and Key Events Day 1 100 Execution Integration Kick-off 2020 Strategic Intent and Value Capture Summit Day 1 Ready Day 100 Ready Organization Design Summit Day 1 Readiness Readout Ongoing Market and Functional Integration 2019 2020 FINANCIAL GUIDANCE 98

Growth and Diversification: M&A ~$51.4 Billion In Total Revenue 2009-2019 *WellCare transaction pending regulatory approval *Includes pro forma 2019 revenue from WellCare 20N2C0E FINANCIAL GUIDANCE 105

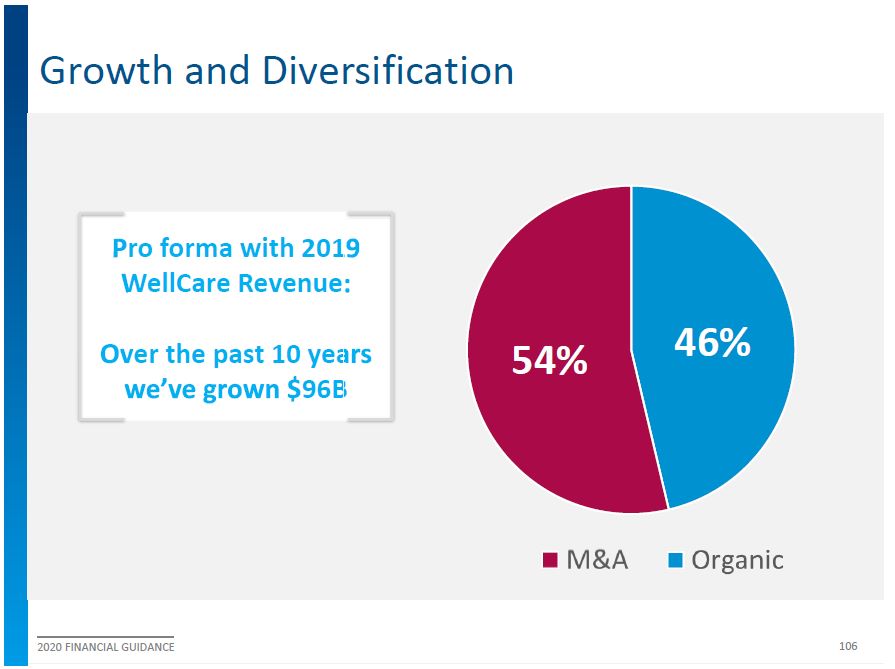

Growth and Diversification Pro forma with 2019 WellCare Revenue: Over the past 10 years 96B 54% 46% 2020 FINANCIAL GUIDANCE 106

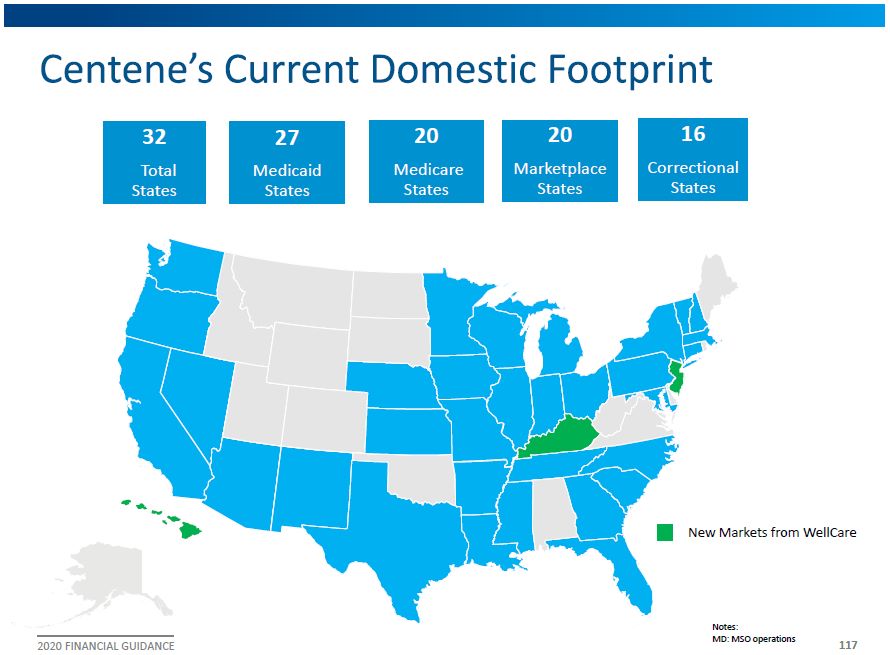

32 Total States 27 Medicaid States 20 Medicare States 20 Marketplace States 16 Correctional States New Markets from WellCare Notes: MD: MSO operations 2020 FINANCIAL GUIDANCE 117

Important Additional Information and Where to Find It

In connection with the WellCare Transaction, on May 23, 2019, Centene filed with the SEC the Registration Statement, which included a prospectus with respect to the shares of Centene’s common stock to be issued in the WellCare Transaction and a joint proxy statement for Centene’s and WellCare’s respective stockholders (the “Joint Proxy Statement”). The SEC declared the Registration Statement effective on May 23, 2019, and the Joint Proxy Statement was first mailed to stockholders of Centene and WellCare on or about May 24, 2019. Each of Centene and WellCare may file other documents regarding the WellCare Transaction with the SEC. This communication is not a substitute for the Registration Statement, the Joint Proxy Statement or any other document that Centene or WellCare may send to their respective stockholders in connection with the WellCare Transaction. INVESTORS AND SECURITY HOLDERS OF CENTENE AND WELLCARE ARE URGED TO READ THE REGISTRATION STATEMENT, THE JOINT PROXY STATEMENT AND ANY OTHER RELEVANT DOCUMENTS (INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO) FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION ABOUT CENTENE, WELLCARE, THE WELLCARE TRANSACTION AND RELATED MATTERS. Investors and security holders of Centene and WellCare are able to obtain free copies of the Registration Statement, the Joint Proxy Statement and other documents (including any amendments or supplements thereto) containing important information about Centene and WellCare through the website maintained by the SEC at www.sec.gov. Centene and WellCare make available free of charge at www.centene.com and www.ir.wellcare.com, respectively, copies of materials they file with, or furnish to, the SEC.

No Offer or Solicitation

This communication is for informational purposes only and does not constitute, or form a part of, an offer to sell or the solicitation of an offer to sell or an offer to buy or the solicitation of an offer to buy any securities, and there shall be no sale of securities, in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended, and otherwise in accordance with applicable law.