UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

Schedule 14A Information

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box:

| | |

| x | | Preliminary Proxy Statement |

| |

| ¨ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

| ¨ | | Definitive Proxy Statement |

| |

| ¨ | | Definitive Additional Materials |

| |

| ¨ | | Soliciting Material Pursuant to §240.14a-12 |

WellCare Health Plans, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| | | | |

| |

| x | | No fee required. |

| |

| ¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | |

| | (1) | | Title of each class of securities to which transaction applies: |

| | (2) | | Aggregate number of securities to which transaction applies: |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | | Proposed maximum aggregate value of transaction: |

| | (5) | | Total fee paid: |

| |

| ¨ | | Fee paid previously with preliminary materials. |

| |

| ¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | |

| | (1) | | Amount Previously Paid: |

| | (2) | | Form, Schedule or Registration Statement No.: |

| | (3) | | Filing Party: |

| | (4) | | Date Filed: |

8735 Henderson Road Ÿ Tampa, Florida 33634 Ÿ (813) 290-6200 Ÿ www.wellcare.com

April , 2014

Dear Stockholder:

On behalf of the Board of Directors and the management team, it is my pleasure to invite you to attend the 2014 Annual Meeting of Stockholders of WellCare Health Plans, Inc.

As shown in the enclosed Notice of 2014 Annual Meeting of Stockholders, the Annual Meeting will be held at 10:00 a.m., Eastern Time, Wednesday, May 28, 2014, at the Renaissance Centre building at our corporate headquarters, 8745 Henderson Road, Tampa, Florida 33634. At the Annual Meeting, we will be acting on the matters listed in the accompanying Notice. If you require special assistance at the Annual Meeting because of a disability, please contact Lisa Iglesias, our Secretary, at(813) 206-1393.

We hope you will be able to attend our Annual Meeting. However, whether or not you are personally present, it is important that your shares be represented at this meeting to assure the presence of a quorum. Whether or not you plan to attend the Annual Meeting, you are urged to date, sign and mail the enclosed proxy card in the envelope provided or to vote on the Internet or by telephone. If you attend the Annual Meeting, you may vote in person, even if you have previously voted. However, if you hold your shares in a brokerage account, or “street name,” you will need to provide a proxy from the institution that holds your shares reflecting stock ownership as of the record date to be able to vote by ballot at the Annual Meeting.

Thank you for your support.

Sincerely,

David J. Gallitano

Chairman of the Board and Chief Executive Officer

—IMPORTANT—

WHETHER OR NOT YOU PLAN TO ATTEND THE ANNUAL MEETING, PLEASE SIGN, DATE AND RETURN THE ENCLOSED PROXY CARD AS PROMPTLY AS POSSIBLE IN THE ENCLOSED POSTAGE PAID ENVELOPE OR VOTE ON THE INTERNET OR BY TELEPHONE. IF YOU ATTEND THE ANNUAL MEETING AND PROVIDE APPROPRIATE DOCUMENTATION, YOU MAY WITHDRAW YOUR PROXY AND VOTE IN PERSON. THANK YOU FOR VOTING PROMPTLY.

WELLCARE HEALTH PLANS, INC.

Notice of 2014 Annual Meeting of Stockholders

| | |

| TIME AND DATE | | 10:00 a.m., Eastern Time, May 28, 2014. |

| |

| PLACE | | 8745 Henderson Road Renaissance Centre Tampa, Florida 33634 |

| |

| PURPOSE | | 1. To elect ten directors to hold office until the 2015 Annual Meeting of Stockholders or until their successors are duly elected and qualified; 2. To approve a proposed amendment to the WellCare Health Plans, Inc. certificate of incorporation to include a forum selection clause; 3. To ratify the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2014; 4. To cast a non-binding advisory vote on the compensation of the Company’s named executive officers contained in the accompanying proxy statement; and 5. To transact such other business as may properly come before the Annual Meeting or at any convening or reconvening of the Annual Meeting following a postponement or adjournment of the Annual Meeting. |

| |

| | The Board recommends that stockholders voteFOR all director nominees in Proposal 1 andFOR Proposals 2, 3 and 4, as outlined in the accompanying proxy statement. |

| |

| RECORD DATE | | March 31, 2014. |

| |

| PROXY VOTING | | It is important that you vote your shares. You can vote your shares by completing and returning the proxy card sent to you or by voting on the Internet or by telephone. Please refer to your proxy card or Notice of Internet Availability of Proxy Materials to determine if there are other voting options available to you. You can revoke a proxy at any time prior to its exercise at the Annual Meeting by following the instructions in the accompanying proxy statement. |

| |

| WEBCAST | | A live webcast of the 2014 Annual Meeting of Stockholders will be provided through the Company’s website atwww.wellcare.com. SelectInvestors, then select the icon for the 2014 Annual Meeting and follow the instructions provided. Additionally, the recorded webcast will be available on the Investor Relations website for a period of 30 days following the 2014 Annual Meeting of Stockholders. |

On or about April , 2014, we mailed to our stockholders either (1) a copy of our proxy statement, a proxy card and an Annual Report or (2) a Notice of Internet Availability of Proxy Materials (“Availability Notice”), which indicates how to access the proxy materials on the Internet. We believe furnishing proxy materials to our stockholders on the Internet provides our stockholders with the information they need while lowering the costs of delivery and reducing the environmental impact of the distribution process.

| | | | |

| | | | BY ORDER OF THE BOARD OF DIRECTORS |

| | |

| | | |  |

| Tampa, Florida | | | | Lisa G. Iglesias |

| April , 2014 | | | | Senior Vice President, General Counsel and Secretary |

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE 2014 ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON MAY 28, 2014:

The accompanying proxy statement and the 2013 Annual Report on Form 10-K are available atwww.proxyvote.com.

Please have the 12-digit control number on your Availability Notice available to access these documents.

TABLE OF CONTENTS

|

| PROXY STATEMENT HIGHLIGHTS |

This summary is provided for your convenience. Please read our entire proxy statement and 2013 annual report before determining how to vote.

|

HOW TO VOTE IN PERSON AT THE ANNUAL MEETING Beneficial stockholders - Most stockholders of WellCare Health Plans, Inc. (“WellCare,” the “Company,” “we,” “us” or “our”) are “beneficial owners”, also known as “street name” holders, which means a bank, broker or other institution holds shares on their behalf. If this is how you hold your shares, you will need to get a legal proxy from the institution holding your shares to vote in person at the Annual Meeting. You will also need to provide proper identification at the Annual Meeting. Registered stockholders – A few of our stockholders are registered directly with our transfer agent, Computershare, as holders of WellCare stock. As the stockholder of record, a registered stockholder can vote in person at the Annual Meeting without a legal proxy from an institution. You will need to provide proper identification at the Annual Meeting You can also vote via the internet, by phone or by mail. See “How do I cast my vote?” below for additional information on how to vote. |

Record Date & Meeting Date

The record date for the Annual Meeting is March 31, 2014. Owners of the Company’s common stock at the close of business on the record date are entitled to receive notice of the Annual Meeting and to vote at the meeting, which will be held at 10:00 a.m., Eastern Time, May 28, 2014. The meeting will be at our headquarters located at 8745 Henderson Road, Tampa, Florida.

Proposals and Vote Recommendations

At the Annual Meeting stockholders will consider the following proposals:

| | | | |

Proposal | | Vote recommendation of the Board | | See Page |

| Election of 10 directors | | FOR all nominees | | 10 |

Approval of an amendment to the Company’s certificate of incorporation to include a forum selection clause | | FOR | | 18 |

Ratification of the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for the current fiscal year | | FOR | | 21 |

Advisory vote on the compensation of the Company’s named executive officers (“Say-on-Pay” vote) | | FOR | | 23 |

The stockholders will also vote to transact any other business that may properly come before the Annual Meeting.

Directors

The table below shows summary information regarding WellCare’s current directors, each of which is a nominee for director at the Annual Meeting. More information regarding our directors is included under “Proposal 1: Election of Directors” in this proxy statement.

| | | | | | |

| Name | | Age | | Director

Since | | Current Committees |

David J. Gallitano Chairman and Chief Executive Officer, WellCare Health Plans, Inc. | | 66 | | 2009 | | • None |

1

| | | | | | |

| Name | | Age | | Director

Since | | Current Committees |

Richard C. Breon President and Chief Executive Officer, Spectrum Health System | | 63 | | 2013 | | • Health Care Quality and Access • Regulatory Compliance |

Carol J. Burt Principal, Burt Hilliard Investments | | 56 | | 2010 | | • Audit and Finance • Compensation (chair) • Nominating and Corporate Governance |

Roel C. Campos Partner, Locke Lord LLP | | 65 | | 2013 | | • Health Care Quality and Access • Regulatory Compliance |

D. Robert Graham Chair, Board of Oversight of the Bob Graham Center for Public Service | | 77 | | 2007 | | • Health Care Quality and Access • Regulatory Compliance |

Kevin F. Hickey Principal, HES Advisors | | 62 | | 2002 | | • Compensation • Health Care Quality and Access |

Christian P. Michalik Managing Director, Kinderhook Industries | | 45 | | 2002 | | • Audit and Finance • Nominating and Corporate Governance (chair) |

Glenn D. Steele, Jr., M.D. President and Chief Executive Officer, Geisinger Health System | | 69 | | 2009 | | • Compensation • Nominating and Corporate Governance • Health Care Quality and Access (chair) |

William L. Trubeck Former Executive Vice President and Chief Financial Officer, H&R Block, Inc. | | 67 | | 2010 | | • Audit and Finance • Regulatory Compliance (chair) |

Paul E. Weaver Former Vice Chairman, PricewaterhouseCoopers, LLP | | 68 | | 2010 | | • Audit and Finance (chair) • Compensation |

Corporate Governance Highlights

| | |

• Nine of our 10 directors are independent (with the exception being Mr. Gallitano, who is serving as our Chief Executive Officer until a new Chief Executive Officer is appointed and therefore currently is not independent) • Directors are elected by majority vote in uncontested elections • Annual election of all directors (no staggered board) • Independent Compensation Committee that engages an independent compensation consultant | | • Code of Conduct and Business Ethics applicable to directors, executives and other associates • Stock ownership guidelines for directors and executives • Disclosure on our website of political giving policy and amounts given • Simple majority vote to approve a merger • No “poison pill” (stockholders’ rights plan) |

Leadership Structure. Our Corporate Governance Guidelines provide that the positions of Chair and Chief Executive Officer are to be held by different individuals unless the Company’s Board of Directors (the “Board”) affirmatively determines that it is in our best interests for the positions to be held by a single individual. Currently, the Board is conducting a search for a new Chief Executive Officer. Our Chairman, David Gallitano, has been appointed as Chief Executive Officer until a new Chief Executive Officer is appointed. Mr. Gallitano has affirmatively removed himself from consideration for the permanent position of Chief Executive Officer and the Board intends that the positions of Chair and Chief Executive Officer be separated again, as soon as the new Chief Executive Officer commences employment with us. During this interim period, the Board has appointed Christian Michalik to serve as an independent Lead Director.

2

Meetings and Attendance. The Board met 11 times in 2013. During 2013, all directors attended at least 86% of the aggregate number of meetings of the Board and all committees on which the director served held during the period in which the director served. All directors who were members of the Board at the time of our 2013 Annual Meeting of Stockholders attended the 2013 Annual Meeting.

Committees. Each of our committees is comprised solely of independent directors. The names of the committees, their primary areas of responsibility, and the number of times they met during 2013 are as follows:

| | | | |

Committee | | Primary Responsibilities | | # of Meetings in 2013 |

| Audit and Finance | | • Oversees financial reporting and other financial matters • Oversees compliance with legal and regulatory requirements • Oversees the performance of our internal audit function | | 11 |

| Compensation | | • Oversees and guides our compensation and benefit programs • Reviews and approves compensation and significant terms of employment of CEO and other executive officers • Reviews and advises the Board regarding equity plans and director compensation | | 12 |

| Health Care Quality and Access | | • Oversees our strategies and activities relating to health care quality and access • Collaborates with the Compensation Committee regarding quality related performance measures for incentive compensation | | 4 |

Nominating and Corporate Governance | | • Reviews Board composition and recommends director nominees • Reviews and recommends revisions to our Corporate Governance Guidelines • Reviews and makes recommendations regarding committee composition, chairs, lead director and similar matters | | 7 |

| Regulatory Compliance | | • Provides detailed and focused oversight of our compliance with laws, rules and regulations • Oversees and makes recommendations regarding our Code of Conduct and Business Ethics • Oversees compliance with our Corporate Integrity Agreement | | 4 |

More detailed information regarding our corporate governance is included under “Corporate Governance” in this proxy statement.

Amendment to Certificate of Incorporation

The Board is recommending that stockholders approve an amendment to the Company’s Amended and Restated Certificate of Incorporation to provide that, with certain exceptions, the Court of Chancery of the State of Delaware be the exclusive forum for the following legal actions involving the Company:

| | • | | actions asserting a claim of breach of a fiduciary duty owed by any director, officer, employee or other agent of WellCare to it or its stockholders, |

| | • | | actions asserting a claim arising pursuant to any provision of the Delaware General Corporate Law, the Company’s certificate of incorporation or bylaws, and |

| | • | | actions asserting a claim governed by the internal affairs doctrine. |

3

This amendment is intended to assist the Company in avoiding multiple lawsuits in multiple jurisdictions regarding the same matter. The ability to require such claims to be brought in a single forum will help to assure consistent consideration of the issues, the application of a relatively known body of case law and level of expertise, and should promote efficiency and cost-savings in the resolution of such claims.

Please see “Proposal 2: Approval of an Amendment to the Certificate of Incorporation” for the text of the proposed amendment as well as more complete information about the proposed amendment.

Independent Registered Public Accounting Firm

The Audit and Finance Committee has appointed the firm of Deloitte & Touche LLP (“Deloitte”) as our independent registered public accounting firm for the fiscal year ending December 31, 2014. The Board is seeking stockholder ratification of the appointment.

The fees we paid to Deloitte in 2013 are set forth below:

| | | | |

Audit Fees | | $ | 2,842,150 | |

All Other Fees | | $ | 0 | |

All of the 2013 fees described above were pre-approved by the Audit and Finance Committee in accordance with our Audit and Non-Audit Services Pre-Approval Policy.

Please see “Proposal 3: Ratification of the Appointment of Independent Registered Public Accounting Firm” for more information regarding this proposal.

Executive Compensation

At our 2013 Annual Meeting of Stockholders, more than 98% of the votes cast in the advisory vote were in favor of our named executive officer compensation as disclosed in our 2013 proxy statement. The Compensation Committee did not make any substantive changes to our executive officer compensation program in 2013.

In 2013, our “named executive officers” were:

| | • | | David J. Gallitano, Chairman of the Board and Chief Executive Officer; |

| | • | | Alec Cunningham, former Chief Executive Officer; |

| | • | | Thomas L. Tran, Senior Vice President and Chief Financial Officer; |

| | • | | Lisa G. Iglesias, Senior Vice President, General Counsel and Secretary; |

| | • | | Blair W. Todt, Senior Vice President, Chief Strategy and Development Officer; |

| | • | | Lawrence D. Anderson, Senior Vice President and Chief Human Resources Officer; |

| | • | | Daniel R. Paquin, former President, National Health Plans; and |

| | • | | Walter W. Cooper, former Chief Administrative Officer. |

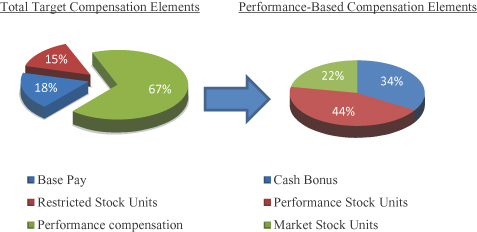

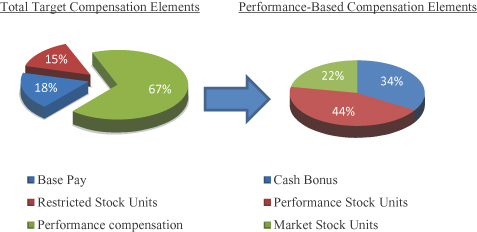

A substantial percentage of the compensation we pay our named executive officers consists of performance-based compensation. Our Compensation Committee grants performance-based incentive awards under a pay-for-performance compensation program with pre-established short-term and long-term incentive goals designed to align individuals’ rewards with Company performance, including tangible financial results and the achievement of heath care quality goals. The Compensation Committee also uses benchmarking in connection with assessing and reviewing compensation for our executive officers to help ensure the Company remains competitive relative to its peers with respect to attracting and retaining qualified executives.

| | Ø | 2013 short-term incentive program: Adjusted EPS (as calculated in accordance with the 2013 short-term incentive program) was $4.98 compared to a target of $5.00. With respect to our named executive officers, bonuses under this program were paid at 98% of target for Ms. Iglesias, Mr. Todt and Mr. Anderson. |

4

| | Ø | 2010 - 2013 long-term incentive program: The Company was ranked 34% above median in terms of return on equity and 37% above median in terms of operating margin. The Company achieved accreditation for all targeted health plans during the period. Although the Company improved its Medicare STAR scores and HEDIS scores, its performance was below the targets set for these goals. With respect to our named executive officers, bonuses under this program were paid at 115% of target for Mr. Tran, Ms. Iglesias, Mr. Todt and Mr. Anderson. |

The Compensation Committee has retained Frederic W. Cook & Co. Inc. (“Cook & Co.”) as its independent compensation consultant since June 2011. Cook & Co. does not perform any additional services for us. The Compensation Committee believes that Cook & Co. has been independent and does not have any conflicts of interest during its service as independent compensation consultant to the Compensation Committee.

Please see “Executive Compensation” for more complete information regarding our compensation philosophy, our executive compensation program and the amounts paid to our named executive officers.

Important Deadlines Relating to 2015 Annual Meeting

In order for a stockholder proposal to be presented at the 2015 Annual Meeting of Stockholders it must be received by WellCare within the timeframes set forth below:

| | |

| | | Must be received by WellCare |

| Stockholder proposal included in proxy statement | | No later than December ___, 2014 |

| Stockholder proposal not included in proxy statement | | Between January 28, 2015 and February 27, 2015 |

5

|

Commonly Asked Questions and Answers About the Annual Meeting |

| 1. | Why am I receiving these materials? |

These materials are being sent to you on behalf of our Board of Directors (the “Board of Directors” or the “Board”). You are receiving these materials because you are a stockholder of WellCare that is entitled to receive notice of the 2014 Annual Meeting of Stockholders (“Annual Meeting”) and to vote on matters that are properly presented at the Annual Meeting.

| 2. | What is the purpose of the Annual Meeting? |

Our stockholders meet annually to elect directors and to make decisions about other matters that are presented at the Annual Meeting. In addition, management will report on the performance of the Company and respond to questions from stockholders.

If you designate another person to vote your shares, that other person is called a proxy. If you designate someone as your proxy in a written document, that document is also called a proxy or a proxy card. If you complete the enclosed proxy card to give us your proxy, you will have designated Thomas Tran, the Company’s Chief Financial Officer, and Lisa Iglesias, the Company’s Secretary, or such other individuals as the Board may later designate, as your proxies to vote your shares as directed.

| 4. | What is the purpose of this proxy statement? |

This proxy statement provides information regarding matters to be voted on by stockholders at the Annual Meeting and other information regarding the governance of the Company.

| 5. | Where is the Annual Meeting? |

The Annual Meeting will be held at 10:00 a.m., Eastern Time, May 28, 2014, in the Renaissance Centre building at WellCare’s corporate headquarters, 8745 Henderson Road, Tampa, Florida 33634. Signs will be posted to direct stockholders to the meeting room in the

Renaissance Centre, as well as to parking which will be available by the building located at 8735 Henderson Road or in Garage A.

| 6. | What does it mean if I receive more than one package of proxy materials? |

This means that you have multiple accounts holding WellCare shares. These may include: accounts with our transfer agent, Computershare Trust Company, N.A. (“Computershare”); accounts holding shares that you have acquired under the Company’s stock plans; and accounts with a broker, bank or other holder of record. Please vote all proxy cards and voting instruction forms that you receive with each package of proxy materials to ensure that all of your shares are voted.

| 7. | Why did I receive a one-page notice in the mail regarding the Internet availability of proxy materials instead of a full set of printed proxy materials? |

Under rules adopted by the U.S. Securities and Exchange Commission (the “SEC”), we provide access to our proxy materials on the Internet. Accordingly, we are sending a Notice of Internet Availability of Proxy Materials (the “Availability Notice”) to some of our stockholders. If you received an Availability Notice by mail, you will not receive a printed copy of the proxy materialsunless you request one. The Availability Notice will tell you how to access and review the proxy materials on the Internet atwww.proxyvote.com. The Availability Notice also tells you how to access your proxy card to vote on the Internet. If you received an Availability Notice by mail and would like to receive a printed copy of our proxy materials, please follow the instructions on the Availability Notice.

| 8. | What is the record date and what does it mean? |

The record date for the Annual Meeting is March 31, 2014. Holders of the Company’s common stock at the close of business on the record date are entitled to receive notice of the Annual Meeting and to vote at the meeting.

6

| 9. | Is there a minimum number of shares that must be represented in person or by proxy to hold the Annual Meeting? |

Yes. A quorum is the minimum number of shares that must be present to conduct business at the Annual Meeting. The quorum requirement is the number of shares that represent a majority of the outstanding shares of the Company as of the record date. Shares necessary to meet the quorum requirement may be present in person or represented by proxy. There were shares of our common stock issued and outstanding on the record date. Therefore, at least shares of our common stock must be present in person or represented by proxy at the Annual Meeting to satisfy the quorum requirement.

Your shares will be counted to determine whether there is a quorum if you submit a valid proxy card or voting instruction form, give proper instructions over the telephone or on the Internet, or attend the Annual Meeting in person. Pursuant to Delaware law, proxies received but marked as abstentions and broker non-votes (which are discussed in Question 16 below) are counted as present for purposes of determining a quorum.

| 10. | Who can vote on matters that will be presented at the Annual Meeting? |

You can vote if you were a stockholder of the Company at the close of business on the record date of March 31, 2014.

| 11. | What is the difference between a registered stockholder and a beneficial owner? |

Many WellCare stockholders hold their shares through a stockbroker, bank or other nominee rather than directly in their own names. As summarized below, there are some distinctions between shares held of record and those owned beneficially.

| | • | | Registered stockholder: If your shares are registered directly in your name with the Company’s transfer agent, Computershare, you are considered, with respect to those shares, the “stockholder of record” or a |

| | | “registered stockholder,” and these proxy materials are being sent directly to you by the Company. As the stockholder of record, you have the right to grant your voting proxy directly to the Company or to vote in person at the Annual Meeting. |

| | • | | Beneficial owner: If your shares are held in a stock brokerage account or by a bank, trustee or other nominee, you are considered the “beneficial owner” of those shares held in street name, and these proxy materials are being forwarded to you by your broker, bank or other holder of record who is considered, with respect to those shares, the stockholder of record. As the beneficial owner you have the right to direct your broker, bank or other holder of record on how to vote your shares and you are invited to attend the Annual Meeting. Your broker, bank, trustee or nominee is obligated to provide you with a voting instruction form for you to use. |

| 12. | How many votes am I entitled to per share? |

Each share of common stock outstanding on the record date is entitled to one vote on each matter properly presented at the Annual Meeting. Stockholders do not have a right to cumulate their votes for directors.

| 13. | Who will count the vote? |

Broadridge Investor Communication Solutions, Inc. (“Broadridge”) was appointed by our Board of Directors to tabulate the vote and act as Inspector of Election. Information about Broadridge is available atwww.broadridge.com.

| 14. | How do I cast my vote? |

Registered stockholders: There are four ways you can cast your vote:

| | • | | Vote on the Internet at www.proxyvote.com using the control number provided to you; |

| | • | | Vote by telephone at 1-800-690-6903 using the control number provided to you; |

7

| | • | | Complete and properly sign, date and return a proxy card in the postage paid envelope provided. If voting by mail, please allow sufficient time for the postal service to deliver your proxy card before the Annual Meeting; or |

| | • | | Attend the Annual Meeting and deliver your completed proxy card or complete a ballot in person. |

Beneficial owners:Your proxy materials should include a voting instruction form from the institution holding your shares. There are up to four ways you can cast your vote:

| | • | | Vote on the Internet at www.proxyvote.com using the control number provided to you by the institution holding your shares; |

| | • | | Vote by telephone using the telephone number and the control number provided to you (note: the availability of telephone voting will depend upon the institution’s voting processes); |

| | • | | Complete and properly sign, date and return a voting instruction form from the institution holding your shares; or |

| | • | | Obtain alegal proxy from the institution holding your shares to vote in person at the Annual Meeting. |

Please contact the institution holding your shares for additional information.

| 15. | What is the voting requirement to approve each of the proposals? How do abstentions and broker non-votes affect the vote outcome? |

Proposal 1: Directors will be elected by a majority of votes cast, which means a majority of the votes actually cast “for” or “against” this particular proposal, whether in person or by proxy.

Proposal 2: Proposal 2 will pass if approved by the affirmative vote of a majority of our common stock outstanding.

Proposals 3 and 4: Proposals 3 and 4 will pass with the votes of a majority of the voting power present or represented by proxy. The voting power present or represented by proxy means the shares present in person or represented by proxy at the Annual Meeting and entitled to vote on the proposal.

A broker non-vote (a broker non-vote is explained in the answer to Question 16) on a proposal is considered a share not entitled to vote on that proposal and is not a vote cast. Accordingly, a broker non-vote will have the effect of a negative vote on Proposal 2 and no effect on the vote outcome of any of the other proposals.

Abstentions are considered shares entitled to vote on a proposal but are not considered as having been cast “for” or “against” a proposal. Therefore, abstentions will have no effect on Proposal 1; for all other proposals, abstentions have the same effect as an “against” vote.

Discretionary voting by brokers will be permitted by the New York Stock Exchange (“NYSE”) only in connection with Proposal 3. Discretionary voting is explained in the answer to Question 16.

| 16. | What if I return my proxy card or voting instruction form but do not provide voting instructions? |

Registered stockholders: If you are a registered stockholder and you return your signed proxy card, your shares will be voted as you designate on the proxy card. If you do not return your voted proxy card, vote by phone or the Internet, or if you submit your proxy card with an unclear voting designation, your shares will not be voted. If you return your signed proxy card and do not provide a voting designation, your shares will be votedFOR the election of all director nominees listed in Proposal 1;FOR Proposals 2, 3 and 4; and in the discretion of the proxy holders as to any other matters that arise at the Annual Meeting.

Beneficial owners: In limited instances, your shares may be voted if they are held in the name of a broker, bank or other intermediary, even if

8

you do not provide the holder with voting instructions. This is called “discretionary voting.” Brokerage firms and banks generally have the authority, under NYSE rules, to vote shares on certain “routine” matters for which their customers do not provide voting instructions. Of the four proposals scheduled to be presented at the Annual Meeting, only Proposal 3: Ratification of the Appointment of Independent Registered Public Accounting Firm, is considered a routine matter under the NYSE’s rules. Proposals 1, 2 and 4, and any other matter that may be presented at the Annual Meeting, are not considered routine. When a proposal is not a routine matter and the institution holding the shares has not received voting instructions from the beneficial owner of the shares with respect to that proposal, the institution cannot vote the shares on that proposal. This is called a “broker non-vote.” In tabulating the voting result for any particular proposal, shares represented at the Annual Meeting that constitute broker non-votes will not be included in vote totals. As a result, they will have the same effect as a negative vote on Proposal 2 and no effect on the outcome of any other vote.

| 17. | Can I change my mind after I submit my proxy? |

Yes, if you vote by proxy, you may revoke that proxy at any time before it is voted at the Annual Meeting.

You may do this by:

| | • | | voting again on the Internet or by telephone prior to the Annual Meeting; |

| | • | | signing another proxy card with a later date and mailing it for receipt prior to the Annual Meeting; or |

| | • | | attending the Annual Meeting in person and delivering your proxy or casting a ballot. |

If you are a beneficial owner of our stock you must obtain a legal proxy from the institution holding your shares to vote in person at the Annual Meeting.

| 18. | Where can I find the voting results of the Annual Meeting? |

We intend to announce preliminary voting results at the Annual Meeting and publish voting results on a Current Report on Form 8-K within four business days after the conclusion of the Annual Meeting. The Form 8-K will be accessible at the SEC’s website atwww.sec.gov or on our website atwww.wellcare.com. In addition, we will also post voting results online atwww.wellcare.com /stockholdermeeting.

| 19. | Who will bear the costs of this proxy solicitation? |

This proxy solicitation is being sent on behalf of our Board of Directors and the Company will bear the cost of this proxy solicitation, including reimbursing banks and brokers for reasonable expenses of sending out proxy materials to beneficial owners.

| 20. | What if I have additional questions that are not addressed here? |

You may call Investor Relations at (813) 206-3916, e-mail Investor Relations at investorrelations@wellcare.com or call the Office of the Secretary at (813) 206-1393.

9

|

| Proposals to be Voted on at the Annual Meeting |

Proposal 1: Election of Directors

Ten individuals have been nominated for election at the 2014 Annual Meeting of Stockholders, each to hold office until the 2015 Annual Meeting or until a successor has been duly elected and qualified. All of the nominees listed below are currently directors of the Company and all but Richard C. Breon were elected at the 2013 Annual Meeting of Stockholders. Mr. Breon was appointed to the Board of Directors in September 2013.

Unless otherwise directed, the holders of proxies intend to vote all proxiesFOR the election of all the director nominees listed below. If any nominee becomes unavailable for any reason, or if a vacancy should occur before the election, the holders of proxies may vote for the election of such other person as may be recommended by the Board of Directors. In accordance with our bylaws, directors must receive a majority of the votes cast on this proposal to be elected.

Qualifications

The Board evaluates each director candidate on his or her individual merits and values many different types of contributions. However, the Board considers the following to be key attributes for Company directors:

Leadership / Executive Experience: The Board believes experience in executive and other leadership roles is valuable to the Company in connection with setting goals and strategy. This type of expertise includes experience with strategic transactions, enterprise risk management, other public companies, restructuring and leadership. This expertise is important to help the Company optimize its operations and in connection with the evaluation of potential acquisitions and other strategic transactions. Directors with leadership experience also help us prioritize and anticipate challenges before we encounter them. Directors with this type of

experience are particularly valuable as we pursue our strategic priorities ofdelivering prudent, profitable growthandachieving service excellence.

Financial Expertise: The Board believes financial expertise is vital for the Board to perform its oversight responsibilities. Financial management experience and expertise with accounting and control processes are examples of financial expertise. Directors with financial expertise are able to review the Company’s financial statements and business plans critically and can offer valuable guidance in connection with our financing activities. Directors with this type of expertise are particularly valuable as we pursue our strategic priority ofoptimizing financial performance.

Industry Experience: Our industry is complex and rapidly evolving. Industry experience includes expertise with health care operations, health care technology, insurance and other experience. Directors with industry experience help the Company to stay abreast with industry best practices and innovations and help us to benchmark our practices against those of our competitors. Directors with this type of experience are particularly valuable as we pursue our strategic priorities ofimproving health care quality and accessandachieving service excellence.

Government / Regulatory Expertise: As a company that specializes in offering health care plans to government programs, we are highly regulated at both the state and the federal level. Directors with government, compliance and regulatory expertise help us to identify risks and have valuable insight as we evaluate new government programs and the regulatory landscape in which we operate. Directors with this type of experience are particularly valuable as we pursue our strategic priorities ofdelivering prudent, profitable growth andachieving service excellence.

The Board of Directors recommends a voteFOR each nominee.

Information as of March 31, 2014 related to each of the nominees for director is set forth on the following pages:

10

| | |

| | Principal Qualifications: Leadership / Executive Experience & Industry Experience • President and Chief Executive Officer, Spectrum Health System • Former President and Chief Executive Officer, Mission Health System, Inc. • Former President and Chief Executive Officer, Mercy Hospital Tenure:Mr. Breon has served as a director of WellCare since 2013. Age:63 |

Experience: Since August 2000, Mr. Breon has been the President and Chief Executive Officer of Spectrum Health System, a non-profit managed care health care organization based in West Michigan. Prior to that, he served as President and Chief Executive Officer of Mission Health System, Inc./St. Mary’s Medical Center in Evansville, Indiana, from 1995 to August 2000. Prior to that, Mr. Breon served as President and Chief Executive Officer of Mercy Hospital in Iowa City, Iowa, from 1989 to 1995. Mr. Breon serves on the West Michigan Regional Air Alliance, a non-profit promoting commercial air travel in West Michigan. Mr. Breon also serves as the Vice Chair for The Right Place, Inc., a regional non-profit economic development organization.

| | |

| Education: | | • Master of Arts in Hospital and Health Administration, the University of Iowa |

| | • Bachelor of Science, Iowa State University |

| | |

| | Principal Qualifications: Leadership / Executive Experience • Former Senior Vice President, Corporate Finance and Development, WellPoint, Inc. Financial Expertise & Industry Experience • Former Senior Vice President, Corporate Finance and Development, WellPoint, Inc. • Former Senior Vice President, Finance and Treasury, American Medical Response, Inc. • Former Managing Director and head of the Healthcare Investment Banking Group of Chase Securities (now JP Morgan Chase) Tenure: Ms. Burt has served as a director of WellCare since 2010. Age: 56 |

Experience: Ms. Burt, principal of Burt Hilliard Investments since January 2008, is a private investor with more than 30 years of experience in operations, strategy, corporate finance and investment banking. Ms. Burt has served as an operating partner and a member of the operating council of Consonance Capital Partners, a New York-based private equity firm focused on the health care industry, since January 2013. Ms. Burt was formerly an executive of WellPoint, Inc., where she served from 1997 to 2007, most recently as WellPoint’s Senior Vice President, Corporate Finance and Development. In her time at WellPoint, Ms. Burt was responsible for, among other things, corporate strategy, mergers and acquisitions, finance, treasury and real estate management. In addition, WellPoint’s financial services and international insurance business units reported to her. Before joining WellPoint, Ms. Burt was

11

Senior Vice President and Treasurer of American Medical Response and spent 16 years with Chase Securities (now JP Morgan) most recently as founder and head of the Health Care Investment Banking Group.

| | |

| Education: | | • Bachelor of Business Administration, the University of Houston |

Other Public Company Boards: Since 2011, Ms. Burt has served as a director of Envision Healthcare Holdings, Inc., a company focused on outsourced facility-based physician and health care transportation services, where she serves on the audit, finance and nominating and governance committees. Since 2013, she has also served as a director of ResMed Inc., a developer, manufacturer and distributor of medical equipment for treating, diagnosing, and managing sleep-disordered breathing and other respiratory disorders. From 2011 until 2013 she served as a director of Vanguard Health Systems, Inc., an operator of integrated health care delivery networks, where she served on the audit and compliance committee and in 1997 she served on the board of Transitional Hospitals Corporation, an operator of acute care and psychiatric hospitals, where she served on the audit, compensation and government relations committees.

| | |

| | Principal Qualifications: Government / Regulatory Expertise • Partner, Locke Lord LLP (practice focuses on securities regulation, corporate governance and securities enforcement) • Former member, Presidential Intelligence Advisory Board • Former Commissioner, U.S. Securities and Exchange Commission (“SEC”) • Former federal prosecutor Financial Expertise • Member, Advisory Board for the Public Company Accounting Oversight Board • Has advised accounting clients • As a former SEC Commissioner, has evaluated and judged accounting matters for possible enforcement actions by the SEC Tenure: Mr. Campos has served as a director of WellCare since 2013. Age: 65 |

Experience: Mr. Campos is a partner with the law firm of Locke Lord LLP, which he joined in April 2011. He practices in the areas of securities regulation, corporate governance and securities enforcement. He had previously been a partner in the law firm of Cooley LLP from September 2007 to April 2011. Prior to that, he received a presidential appointment and served as a Commissioner of the SEC from 2002 to 2007. Prior to serving with the SEC, Mr. Campos was a founding partner of a Houston-based radio broadcaster. Earlier in his career, he practiced corporate law and later served as a federal prosecutor in Los Angeles, California. He is a trustee for the Managed Portfolio Series, an open-end mutual fund registered with the SEC under the Investment Company Act of 1940. He is also a director of Paulson International Ltd., a privately-held, Cayman-based hedge fund and a director of a private registered broker-dealer, Liquidnet Holdings, Inc. From 2009 – 2013, Mr. Campos served with the current Secretary of Defense, Charles Hagel, and other national intelligence experts on the Presidential Intelligence Advisory Board. Mr. Campos also serves on the Advisory Board for the Public Company Accounting Oversight Board and serves on various non-profit boards.

| | |

| Education: | | • Juris Doctorate, Harvard Law School • Master of Science in Business Administration, the University of California, Los Angeles • Bachelor of Science, United States Air Force Academy |

Other Public Company Boards: Mr. Campos has been a director of Regional Management Corp., a NYSE- listed specialty consumer finance company, since March 2012.

12

| | |

| | Principal Qualifications: Leadership / Executive Experience • Chief Executive Officer, WellCare Health Plans, Inc. • Former Chief Executive Officer, APW, Ltd. • Former Chief Executive Officer, Columbia National, Inc. • Former Executive Vice President, PaineWebber Incorporated (head of Principal Transactions Group) Financial Expertise • Former Chief Executive Officer, APW, Ltd. (restructuring) Tenure: Mr. Gallitano has served as a director of WellCare since 2009 and as our Chairman since May 2013. Since November 2013 he has also served as our Chief Executive Officer. Age: 66 |

Experience: Since November 2013, Mr. Gallitano has served as our Chief Executive Officer. Mr. Gallitano has been President of Tucker Advisors, Inc., a private investment and consulting firm, since 2002. Mr. Gallitano was the Chairman and Chief Executive Officer of APW, Ltd., a manufacturer of specialized industrial products and provider of related services, from 2003 to 2005 and Chairman and Chief Executive Officer of Columbia National, Inc., a residential and commercial real estate financing company, from 1993 until 2002. Mr. Gallitano was an Executive Vice President at PaineWebber Incorporated, a NYSE-listed brokerage firm, where he headed the Principal Transactions Group, from 1986 through 1993. Mr. Gallitano also served as President and Chief Executive Officer of the General Electric Mortgage Capital Corporation from 1984 through 1986.

| | |

| Education: | | • Master of Business Administration, the University of Chicago |

| | • Bachelor of Business Administration, the George Washington University |

Other Public Company Boards: Mr. Gallitano currently serves on the board of directors of The Hanover Insurance Group, Inc., a provider of insurance products, where he is chair of the nominating and corporate governance committee and has served on the compensation committee and the audit committee. Mr. Gallitano previously served as a director, chair of the audit committee, chair of the compensation committee and a member of the nominating committee for Wild Oats Corporation, a natural and organic foods retailer, from 2004 to 2007.

| | |

| | Principal Qualifications: Government / Regulatory Expertise • Former United States Senator • Former Governor, the State of Florida • Former member, Financial Crisis Inquiry Commission • Former member, Central Intelligence Advisory Board • Former Co-Chair, National Commission on the BP Deepwater Horizon Oil Spill and Offshore Drilling • Former Chairman, Commission on the Prevention of Weapons of Mass Destruction Tenure: Senator Graham has served as a director of WellCare since 2007. Age: 77 |

13

Experience: Since his retirement from the United States Senate in 2005, Senator Graham has been Chair of the Board of Oversight of the Bob Graham Center for Public Service, a political and civic leadership center at the University of Florida. Among his other duties, Senator Graham was appointed by the President of the United States to serve as co-chair of the National Commission on the BP Deepwater Horizon Oil Spill and Offshore Drilling from its inception in May 2010 until its report was published in January 2011. He also served on the Financial Crisis Inquiry Commission which concluded its operations in February 2011. Senator Graham also served as the Chairman of the Commission on the Prevention of Weapons of Mass Destruction Proliferation and Terrorism, which published its report in the fall of 2008, and he continues the work of the Commission by serving as co-chairman of the WMD Center, a non-profit research organization. From September 2009 to February 2012, he served as a member of the Central Intelligence Agency External Advisory Board. From September 2005 until June 2006, Senator Graham served a one-year term as a senior Fellow at Harvard University’s John F. Kennedy School of Government. From January 1987 to January 2005, he served in the United States Senate. From January 1979 to January 1987, Senator Graham was the Governor of the State of Florida. Senator Graham served as an executive of the Graham Companies prior to his election as Governor of Florida and now is a member of the board of directors. The Graham Companies is a family of corporate entities engages in dairy, beef cattle and pecan production in Florida and Georgia and real estate development and management in Miami Lakes, Florida.

| | |

| Education: | | • Bachelor of Laws, Harvard Law School |

| | • Bachelor of Arts, the University of Florida |

| | |

| | Principal Qualifications: Leadership / Executive Experience & Industry Experience • Former President, D2Hawkeye, Inc. • Founder and former Chairman, IntelliClaim, Inc. • Former Executive Vice President, Operations and Technology, Oxford Health Plans, Inc. Other Industry Experience • Principal, HES Advisors • Founder and former Chairman, IntelliClaim, Inc. • Former director, Healthaxis, Inc. Tenure: Mr. Hickey has served as a director of WellCare since 2002. Age: 62 |

Experience: Since January 1983, Mr. Hickey has served as Principal of HES Advisors, a strategic advisory firm serving the health care, health care technology and life sciences industries, where he also serves as a director. From January 2006 to December 2007, Mr. Hickey served as President of D2Hawkeye, Inc. (now VeriskHealth). From January 2008 to March 2012, Mr. Hickey served as Senior Advisor to Verisk Analytics, Inc., a company specializing in health care predictive analytics. Mr. Hickey previously served as a director of DiagnosisOne, a privately-held health care technology company, from 2011 to 2012. Mr. Hickey previously served as a director of Healthaxis Inc., a public health care technology company, from 2000 to 2007. He was also Founder and Chairman of IntelliClaim, Inc., a privately-held health care technology company, from 1999 until 2005, when it was acquired by McKesson, Inc.

| | |

| Education: | | • Juris Doctorate, Loyola College of Law |

| | • Master of Health Services Administration, the University of Michigan • Bachelor of Arts, Harvard College |

14

| | |

| | Principal Qualifications: Financial Expertise • Managing Director, Kinderhook Industries • Served on numerous audit committees Industry Experience • Managing Director, Kinderhook Industries (numerous health care company investments) • Chairman, Clinical Research Advantage, Inc. • Chairman, E4 Health Care, Inc. • Chairman, Global Health Inc. Tenure: Mr. Michalik has served as a director of WellCare since 2002. Age: 45 |

Experience: Since July 2004, Mr. Michalik has served as Managing Director of Kinderhook Industries, a private equity investment firm. Mr. Michalik has significant investment experience in the health care sector and currently is Chairman of several specialized health care service companies, including Clinical Research Advantage, Inc., E4 Health Care, Inc. and Global Health Inc.

| | |

| Education: | | • Master of Business Administration, Harvard Business School |

| | • Bachelor of Arts, Yale College |

| | |

| Glenn D. Steele, Jr., M.D. |

| | |

| | Principal Qualifications: Leadership / Executive Experience & Industry Experience • President and Chief Executive Officer, Geisinger Health System • Former President and Chief Executive Officer, Deaconess Professional Practice Group Other Industry Experience • Former practicing surgeon • Former Dean, Pritzker School of Medicine Tenure:Dr. Steele has served as a director of WellCare since 2009. Age:69 |

Experience: Dr. Steele is the President and Chief Executive Officer of Geisinger Health System, a physician-led health care system serving multiple regions of Pennsylvania, a position he has held since 2001.

| | |

| Education: | | • Docent, Lund University • Doctor of Medicine, New York University School of Medicine • Bachelor of Arts, Harvard College |

Other Public Company Boards: Dr. Steele serves on the board of directors of Weis Markets, Inc., a supermarket chain, where he currently serves on the audit and compensation committees. He also serves on the board of directors of Cepheid, a molecular diagnostics company that develops, manufactures and markets molecular systems and tests. He also serves as a member of Cepheid’s compensation committee.

15

| | |

| | Principal Qualifications: Leadership / Executive Experience & Financial Expertise • Former Executive Vice President and Chief Financial Officer, H&R Block, Inc. • Former Executive Vice President and Chief Financial Officer, Waste Management, Inc. • Former Senior Vice President and Chief Financial Officer, International Multifoods, Inc. Tenure:Mr. Trubeck has served as a director of WellCare since 2010. Age:67 |

Experience: From March 2011 until July 2011, Mr. Trubeck served as Interim Executive Vice President and Chief Financial Officer of YRC Worldwide, Inc., a freight, shipping and trucking services company. He was formerly Executive Vice President and Chief Financial Officer of H&R Block, Inc., a tax services provider, from 2004 to 2007. Mr. Trubeck has served as a director of EQ Holdings, Inc., a privately-held industrial waste management company since 2010. Mr. Trubeck has served as a director of Custom Ecology, Inc., a privately-held industrial and hazardous waste transporter company since 2012.

| | |

| Education: | | • Master of Business Administration, University of Connecticut |

| | • Bachelor of Arts, Monmouth College |

Other Public Company Boards: Mr. Trubeck served as a director of YRC Worldwide, Inc. from 1994 until July 2011 and was chair of the audit/ethics committee. He also previously served as a director of Dynegy, Inc., a wholesale power, capacity and ancillary services company, from April 2003 to June 2011 and also served as a member of the compensation and human resources committee and as chair of the audit and compliance committee. Mr. Trubeck previously served as a director of Ceridian Corp. from 2006 to 2007, where he also served as a member of the audit committee.

| | |

| | Principal Qualifications: Leadership / Executive Experience & Financial Expertise • Former Vice Chairman, PricewaterhouseCoopers, LLP • Former Chairman, Global Technology and Infocomm, PricewaterhouseCoopers, LLP Tenure:Mr. Weaver has served as a director of WellCare since 2010. Age:68 |

Experience: Mr. Weaver is a former executive of PricewaterhouseCoopers, LLP. Mr. Weaver served PricewaterhouseCoopers, LLP from 1972 until 2006, including as its Vice Chairman from 1994 to 1999 and as Chairman of its Global Technology and Infocomm practice from 1999 to 2006. The Board has found Mr. Weaver’s extensive financial background and financial reporting expertise, his service as an audit partner at a multinational professional services firm and his financial leadership roles on other boards on which he has served, to be of particular value to the Board.

16

| | |

| Education: | | • Master of Business Administration, University of Michigan |

| | • Bachelor of Science, Elizabethtown College |

Other Public Company Boards: Mr. Weaver has served as a director of AMN Healthcare Services, Inc., a NYSE-listed health care staffing and management services company, since 2006 and currently serves as the chair of AMN’s audit committee and as a member of its executive committee. Since 2010, Mr. Weaver has also served as a director of Unisys Corporation, an information technology consulting company, where he also serves as chair of the audit committee and as a member of the compensation committee. Mr. Weaver previously served as a director and member of the audit committee and the corporate governance and nominating committee of Gateway, Inc., a retail computer company, from 2006 until 2007 and as a director of Idearc Media Corp., now known as Dex Media, Inc., a media advisory company, from 2006 until 2010, where he also served as chair of the audit committee and a member of the compensation committee.

17

Proposal 2: Approval of an Amendment to the Certificate of Incorporation to Include a Forum Selection Clause

Our board of directors has adopted a resolution approving and recommending to the stockholders for their approval a proposal to add a new Article X of the Company’s Amended and Restated Certificate of Incorporation to provide that, with certain exceptions, a court in the State of Delaware be the exclusive forum for certain legal actions (the “Article X Amendment”).

The form of the Article X Amendment is as follows:

“The following is hereby added as Article X of the Amended and Restated Certificate of Incorporation of the Corporation:

ARTICLE X

EXCLUSIVE FORUM SELECTION

Unless the Corporation consents in writing to the selection of an alternative forum, to the fullest extent permitted by law, the sole and exclusive forum for (i) any derivative action or proceeding brought on behalf of the Corporation, (ii) any action asserting a claim of breach of a fiduciary duty owed by any director, officer, employee or other agent of the Corporation to the Corporation or the Corporation’s stockholders, (iii) any action asserting a claim arising pursuant to any provision of the DGCL, the Company’s Certificate of Incorporation or bylaws, or (iv) any action asserting a claim governed by the internal affairs doctrine shall be the Court of Chancery of the State of Delaware (or, if the Court of Chancery does not have jurisdiction, another state court located within the State of Delaware or, if no state court located within the State of Delaware has jurisdiction, the federal district court of the District of Delaware). The Court of Chancery of the State of Delaware (or, if the Court of Chancery does not have jurisdiction, another state court located within the State of Delaware or, if no state court located within the State of Delaware has jurisdiction, the federal district court of the District of Delaware) shall have the fullest authority allowed by law to issue an anti-suit injunction to enforce this forum selection clause and to preclude suit in any other forum. Any person who, or entity that, purchases or otherwise acquires an interest in stock of the Corporation will be

deemed (i) to have notice of, and agree to comply with, the provisions of this Article X, and (ii) to consent to the personal jurisdiction of the Court of Chancery of the State of Delaware (or if the Court of Chancery does not have jurisdiction, another court of the State of Delaware, or if no court of the State of Delaware has jurisdiction, the federal district court for the District of Delaware) in any proceeding brought to enjoin any action by that person or entity that is inconsistent with the exclusive jurisdiction provided for in this Article X.

If any provision contained in this Article X is held to be invalid, illegal or unenforceable as applied to any person or entity or circumstance for any reason whatsoever, then, to the fullest extent permitted by law, the validity, legality and enforceability of such provisions in any other circumstance and of the remaining provisions of this Article X (including, without limitation, each portion of any sentence of the new Article containing any such provision held to be invalid, illegal or unenforceable that is not itself held to be invalid, illegal or unenforceable) and the application of such provision to other persons or entities and circumstances shall not in any way be affected or impaired thereby.”

Summary

If this proposal is approved, a stockholder bringing a claim subject to Article X will be required to bring that claim in the Court of Chancery in the State of Delaware. If the Court of Chancery does not have jurisdiction for the claim, then the claim must be brought in another state court in the State of Delaware. If no state court located within the State of Delaware has jurisdiction, then the claim must be brought in the federal district court in the District of Delaware.

In addition, the stockholder bringing a claim subject to Article X may be required by that provision to bring other related claims in the Court of Chancery (or a state or federal court in the State of Delaware if the Court of Chancery does not have jurisdiction), even if such other related claims do not fall within one of the enumerated categories set forth in

18

clauses (i) through (iv) in Article X. However, any such other related claim will not have to be brought in the Court of Chancery (or such other Delaware court) if:

| | • | | exclusive jurisdiction with respect to such claim is vested in a court or forum other than the Court of Chancery (or such other Delaware court in which the original claim is being adjudicated); or |

| | • | | the Court of Chancery (or such other Delaware court in which the original claim is being adjudicated) does not have subject matter jurisdiction with respect to such claim. |

The Company may decide that it is in the best interests of the Company and its stockholders to bring an action in a forum other than the Court of Chancery (or a state or federal court in the State of Delaware if the Court of Chancery does not have jurisdiction), and it may consent in writing to the selection of an alternative forum.

The proposal provides that the applicable Delaware court will have the fullest authority allowed by law to issue an anti-suit injunction to enforce this provision. In addition, any person who acquires an interest in the stock of the Company will be deemed to have notice of this provision and consent to personal jurisdiction in the applicable Delaware court.

Article X would not apply to claims brought against the Company except for those enumerated in Article X.

Background and Reasons for the Proposed Amendment

This amendment is intended to assist the Company in avoiding multiple lawsuits in multiple jurisdictions regarding the same matter. The ability to require such claims to be brought in a single forum will help to assure consistent consideration of the issues, the application of a relatively known body of case law and level of expertise, and should promote efficiency and cost-savings in the resolution of such claims. The Board of Directors believes that Delaware courts are best suited to address disputes involving such matters given that the Company is incorporated in Delaware, Delaware law generally applies to such matters and

the Delaware courts have a reputation for expertise in corporate law matters. Delaware offers a specialized Court of Chancery to address corporate law matters, with streamlined procedures and processes which help provide relatively quick decisions. This accelerated schedule can minimize the time, cost and uncertainty of litigation for all parties. The Court of Chancery has developed considerable expertise with respect to corporate law issues, as well as a substantial and influential body of case law construing Delaware’s corporate law and long-standing precedent regarding corporate governance. This provides stockholders and the Company with more predictability regarding the outcome of intra-corporate disputes. In the event the Court of Chancery does not have jurisdiction, the other state courts or federal district court located in Delaware would be the most appropriate forums because these courts have more expertise on matters of Delaware law compared to other jurisdictions.

In addition, this amendment would promote judicial fairness and avoid conflicting results, as well as make the Company’s defense of applicable claims less disruptive and more economically feasible, principally by avoiding duplicative discovery.

For these reasons, the Board of Directors believes that providing for Delaware as the exclusive forum for the types of disputes described above is in the best interests of the Company and its stockholders. At the same time, the Board believes that the Company should retain the ability to consent to an alternative forum on a case-by-case basis where the Company determines that its interests and those of its stockholders are best served by permitting such a dispute to proceed in a forum other than in Delaware.

The Company has been through the recent experience of being named a party in two class action complaints in the United States District Court for the Middle District of Florida and six stockholder derivative actions, four of which were filed in the United States District Court for the Middle District of Florida and two of which were filed in Circuit Court for Hillsborough County, Florida. In addition, severalqui tam complaints were filed against us, one in the state court for Leon County, Florida, a federalqui tam action in the District of Connecticut and three additionalqui tam actions in federal court in Florida. All of these actions arose out of the same set of circumstances and alleged that the Company had

19

materially misstated its reported financial condition by, among other things, purportedly incorrectly reporting expenditures under certain community health behavioral contracts and the Florida Healthy Kids programs. As a result of the lawsuits, and investigations by the United States Attorney’s Office for the Middle District of Florida, the Civil Division of the United States Department of Justice, the Civil Division of the United States Attorney’s Office for the District of Connecticut, we entered into settlement agreements for aggregate principal amount in cash and bonds of $337.5 million. Our total expenses related to these matters have exceeded$700.9 million since October 2007. The exclusive forum selection amendment to our certificate of incorporation would have potentially required the derivative securities lawsuits to each be filed in the Court of Chancery in Delaware. The Company has been materially harmed by the expense of managing multiple lawsuits by multiple parties in multiple jurisdictions regarding the same set of facts.

The Board is aware that certain proxy advisors and institutional holders will not generally support an exclusive forum clause unless the company proposing it can show it already has suffered material harm as a result of multiple stockholder suits filed in different jurisdictions regarding the same matter. As stated above, we believe the Company has suffered material harm as a result of the multiple stockholder suits filed in different jurisdictions regarding the same matter. For the reasons set forth above, we believe that Delaware courts are best suited to address such issues.

As a Company we support the interests of our stockholders. This is one of the reasons we maintain

strong governance practices, many of which are described in this proxy statement, including a highly independent board, a lead independent director, and the absence of a “poison pill.” The Board believes that minimizing duplicative litigation through the adoption of Article X to the Company’s certificate of incorporation will help the Company retain more of its resources for its operations, which ultimately benefits its stockholders. In light of these governance practices and for the reasons set forth above, the board believes that it is more prudent to take preventive measures before the Company and most of its stockholders are harmed by the increasing practice of the plaintiffs’ bar to rush to file their own claims in their favorite jurisdictions, which may not be familiar with Delaware law.

The exclusive forum provision in Article X provides that it will not be enforceable to the extent it is held to be invalid, illegal or unenforceable. State courts in which applicable claims are asserted in contravention of Article X must be willing to enforce its terms. It cannot be assured that all state courts will determine such an exclusive forum provision to be enforceable or will be willing to force the transfer of such proceedings to the Delaware courts.

If approved by our stockholders, the amendment will be effective upon filing with the Secretary of State of the State of Delaware, which we intend to do promptly after stockholder approval is obtained.

Votes Required

The affirmative vote of the majority of our common stock outstanding is required for the approval of this proposed amendment of WellCare’s certificate of incorporation.

The Board of Directors recommends a voteFOR this proposal.

20

Proposal 3: Ratification of the Appointment of Independent Registered Public Accounting Firm

The Audit and Finance Committee has appointed Deloitte as our independent registered public accounting firm for the fiscal year ending December 31, 2014. Deloitte has served as the Company’s independent registered public accounting firm since prior to its initial public offering, including for the fiscal year ended December 31, 2013. As a matter of good corporate governance to provide stockholders a venue to express their views on this matter, the Board has decided to seek stockholder ratification of Deloitte’s appointment. If the stockholders do not ratify the appointment of

Deloitte, the Audit and Finance Committee will reconsider the appointment of the independent registered public accounting firm but may still retain Deloitte. We anticipate that a representative of Deloitte will be present at the Annual Meeting to respond to questions and to make such statements as he or she may desire.

The affirmative vote of the holders of a majority of the shares present in person or represented by proxy and entitled to vote on this proposal at the Annual Meeting is required to approve this proposal.

The Board of Directors recommends a voteFOR this proposal.

Audit, Audit-Related, Tax and Other Fees. The following table summarizes professional fees billed by Deloitte for the years ended December 31, 2013 and 2012.

| | | | | | | | |

| | | 2013 | | | 2012 | |

Audit Fees(1) | | $ | 2,842,150 | | | $ | 2,507,300 | |

Audit-related Fees | | | — | | | | — | |

Tax Fees | | | — | | | | — | |

All Other Fees(2) | | | — | | | $ | 77,309 | |

| (1) | The audit services billed by Deloitte in 2013 and 2012 include services rendered for the audits of our annual consolidated financial statements and the effectiveness of internal control over financial reporting and the review of the interim financial statements included in our quarterly reports on Form 10-Q. This amount also includes fees billed for services normally provided by an independent auditor in connection with subsidiary audits, statutory requirements, review of our registration statements on Form S-8 and S-3, regulatory filings and similar engagements. |

| (2) | All other fees consist of fees for other permissible work performed by Deloitte that is not included within the above category descriptions. Fees incurred during 2012 were related to diligence conducted by Deloitte in connection with our acquisitions. |

Audit and Non-Audit Services Pre-Approval Policy

The Audit and Finance Committee has adopted an Audit and Non-Audit Services Pre-Approval Policy that is designed to assure that the services performed for us by our independent registered public accounting firm do not impair its independence from the Company. This policy sets forth guidelines and procedures the Audit and Finance Committee must follow when retaining an independent registered public accounting firm to perform audit, audit-related, tax and other services. The policy provides detailed descriptions of the types of services that may

be provided under these four categories and also sets forth a list of services that our independent registered public accounting firm may not perform for us.

Prior to engagement, the Audit and Finance Committee pre-approves the services and fees of the independent registered public accounting firm within each of the above categories. During the year, it may become necessary to engage the independent registered public accounting firm for additional services not previously contemplated as part of the engagement. In those instances, the Audit and Non-Audit Services Pre-Approval Policy requires that the

21

Audit and Finance Committee specifically approve the services prior to the independent registered public accounting firm’s commencement of those additional services. Under the Audit and Non-Audit Services Pre-Approval Policy, the Audit and Finance Committee has delegated the ability to pre-approve audit and non-audit services to the Audit and Finance Committee chairperson, provided the chairperson

reports any pre-approval decision to the Audit and Finance Committee at its next scheduled meeting. The policy does not provide for ade minimis exception to the pre-approval requirements. Accordingly, all of the 2013 and 2012 fees described above were pre-approved by the Audit and Finance Committee in accordance with the Audit and Non-Audit Services Pre-Approval Policy.

22

Proposal 4: Advisory Vote on Compensation of the Company’s Named Executive Officers

The stockholders have the opportunity at the Annual Meeting to cast a non-binding advisory vote on the compensation of the Company’s named executive officers contained in this proxy statement (“Say-on-Pay” vote) through the following resolution:

“RESOLVED, that the compensation paid to the Company’s named executive officers, as disclosed pursuant to Item 402 of Regulation S-K, including the Compensation Discussion and Analysis, compensation tables and narrative discussion disclosed in the Company’s 2014 Proxy Statement, is hereby APPROVED.”

While this advisory vote on executive compensation is non-binding, the Board and the Compensation Committee value the opinions that stockholders express in their votes and in any additional dialogue

and will take into account the outcome of the vote when considering future executive compensation decisions for named executive officers. Stockholders who want to communicate with our Board should refer to“Communication with Directors” in this proxy statement for additional information.

The affirmative vote of the holders of a majority of the shares present in person or represented by proxy and entitled to vote on this proposal at the Annual Meeting is required to approve this proposal.

At the 2011 Annual Meeting of Stockholders held on May 25, 2011, stockholders indicated that they prefer an annual Say-on-Pay vote. Therefore, stockholders will next have an opportunity to vote on a Say-on-Pay proposal at the 2015 Annual Meeting of Stockholders.

The Board of Directors recommends a voteFOR this proposal.

Other Matters

The Board of Directors knows of no other matters that will be presented at the Annual Meeting. However, if any other matters are properly presented at the Annual Meeting or any convening or reconvening of the Annual Meeting upon an

adjournment or postponement of the Annual Meeting, it is the intention of the persons named as proxies to vote in accordance with their best judgment.

23

Corporate Governance Guidelines

The Board has developed and adopted Corporate Governance Guidelines to promote the functioning of the Board and its committees. Among other things, the Corporate Governance Guidelines set forth criteria regarding Board member selection and qualification, establishment of committees and committee composition, executive sessions, management succession and director compensation. They also set forth certain rights of the Board, such as the power of the Board and each of its committees to engage independent legal, financial and other advisors as they may deem necessary without the approval of any officer of the Company. The guidelines also address the Board’s expectations of each director in furtherance of the Board’s primary responsibility of overseeing the business and affairs of the Company. In particular, the guidelines address meeting attendance and participation, other directorships and new director orientation. The guidelines also contain the Board’s Majority Vote

Policy, which requires a director to tender a conditional resignation in the event he or she fails to receive a majority of the votes cast in an uncontested election or a plurality of the votes cast in a contested election. Each of the Company’s current directors has executed a director resignation letter in the form attached to the Corporate Governance Guidelines, which will serve as a tender of resignation if the director fails to receive the required vote in an election, subject to acceptance by our Board. The Corporate Governance Guidelines also require that the Board conduct an annual performance evaluation to determine whether it and its committees are functioning effectively. The Corporate Governance Guidelines are available on our website atwww.wellcare.com. Alternatively, any stockholder may request a printed copy of our Corporate Governance Guidelines by contacting us as described in the section entitled “Requests for Additional Information” below.

Director Independence