Use these links to rapidly review the document

TABLE OF CONTENTS

EXHIBIT 99.1

ANNUAL INFORMATION FORM

2011

MARCH 15, 2012

TABLE OF CONTENTS

| | |

| | Page |

|---|

SELECTED TERMS | | 1 |

ABBREVIATIONS | | 3 |

CONVERSIONS | | 3 |

CONVENTIONS | | 4 |

SPECIAL NOTES TO READER | | 4 |

BAYTEX ENERGY CORP. | | 8 |

GENERAL DEVELOPMENT OF OUR BUSINESS | | 9 |

RISK FACTORS | | 10 |

DESCRIPTION OF OUR BUSINESS AND OPERATIONS | | 27 |

DIRECTORS AND OFFICERS | | 62 |

AUDIT COMMITTEE INFORMATION | | 68 |

DESCRIPTION OF CAPITAL STRUCTURE | | 70 |

DIVIDENDS | | 72 |

MARKET FOR SECURITIES | | 75 |

RATINGS | | 76 |

LEGAL PROCEEDINGS AND REGULATORY ACTIONS | | 77 |

INTEREST OF INSIDERS AND OTHERS IN MATERIAL TRANSACTIONS | | 77 |

AUDITORS, TRANSFER AGENT AND REGISTRAR | | 77 |

INTERESTS OF EXPERTS | | 77 |

MATERIAL CONTRACTS | | 78 |

INDUSTRY CONDITIONS | | 78 |

ADDITIONAL INFORMATION | | 90 |

| | |

APPENDICES: |

APPENDIX A | | REPORT OF MANAGEMENT AND DIRECTORS ON OIL AND GAS DISCLOSURE |

APPENDIX B | | REPORT ON RESERVES DATA BY INDEPENDENT QUALIFIED RESERVES EVALUATOR |

APPENDIX C | | AUDIT COMMITTEE MANDATE AND TERMS OF REFERENCE |

SELECTED TERMS

Capitalized terms in this Annual Information Form have the meanings set forth below:

Entities

Baytex or theCorporation means Baytex Energy Corp., a corporation incorporated under the ABCA.

Baytex Commercial Trusts mean, collectively, Baytex Commercial Trust 1, Baytex Commercial Trust 2, Baytex Commercial Trust 3, Baytex Commercial Trust 4, Baytex Commercial Trust 5, Baytex Commercial Trust 6 and Baytex Commercial Trust 7.

Baytex Energy means Baytex Energy Ltd., a corporation amalgamated under the ABCA.

Baytex Partnership means Baytex Energy Partnership, a general partnership, the partners of which are Baytex Energy, Baytex Holdings Limited Partnership and Baytex Oil & Gas Ltd.

Baytex USA means Baytex Energy USA Ltd.

Board of Directors means the board of directors of Baytex.

NYMEX means the New York Mercantile Exchange, a commodity futures exchange.

OPEC means the Organization of the Petroleum Exporting Countries.

Operating Entities means our subsidiaries that are actively involved in the acquisition, production, processing, transportation and marketing of crude oil, natural gas liquids and natural gas, being Baytex Energy, Baytex Partnership and Baytex USA, each a direct or indirect wholly-owned subsidiary of us, and "Operating Subsidiary" means any one of them, as applicable.

SEC means the United States Securities and Exchange Commission.

Shareholders mean the holders from time to time of Common Shares.

subsidiary has the meaning ascribed thereto in theSecurities Act (Ontario) and, for greater certainty, includes all corporations, partnerships and trusts owned, controlled or directed, directly or indirectly, by us.

Trust means Baytex Energy Trust, a trust created under the laws of the Province of Alberta on July 24, 2003 pursuant to the Trust Indenture and which was dissolved into the Corporation on January 1, 2011 in connection with the Corporate Conversion.

we,us andour means Baytex and all its subsidiaries on a consolidated basis unless the context requires otherwise.

Independent Engineering

COGE Handbook means the Canadian Oil and Gas Evaluation Handbook.

NI 51-101 means National Instrument 51-101 "Standards of Disclosure for Oil and Natural Gas Activities" of the Canadian Securities Administrators.

Sproule means Sproule Associates Limited, independent petroleum consultants of Calgary, Alberta.

Sproule Report means the report prepared by Sproule dated March 7, 2012 entitled "Evaluation of the P&NG Reserves of Baytex Energy Corp. (As of December 31, 2011)".

Securities and Other Terms

2016 Debentures means our $150 million 9.15% series A senior unsecured debentures due August 26, 2016 and issued pursuant to the Debenture Indenture.

2021 Debentures means our US$150 million 6.75% series B senior unsecured debentures due February 17, 2021 and issued pursuant to the Debenture Indenture.

ABCA means theBusiness Corporations Act (Alberta), R.S.A. 2000, c. B-9, as amended, including the regulations promulgated thereunder.

Canadian GAAP means generally accepted accounting principles in Canada.

Common Shares means the common shares of Baytex.

Corporate Conversion means the internal reorganization of the Trust and certain of its subsidiaries which resulted in the conversion of the legal structure of the Trust from a trust to a corporation effective December 31, 2010 pursuant to a plan of arrangement under the ABCA.

Credit Facilities means, collectively, the $40 million extendible operating loan facility that Baytex Energy has with a chartered bank and the $660 million extendible syndicated loan facility that Baytex Energy has with a syndicate of chartered banks, each of which constitute a revolving credit facility for a three-year term (to June 14, 2014), which is extendible annually for a 1, 2 or 3 year period (subject to a maximum three-year term at any time).

Debenture Indenture means the amended and restated trust indenture among us, as issuer, Baytex Energy, Baytex Oil & Gas Ltd., Baytex Partnership, Baytex Marketing Ltd. and Baytex USA, as guarantors, and Valiant Trust Company, as indenture trustee, dated January 1, 2011, which is an amendment and restatement of a trust indenture dated August 26, 2009, as supplemented by a supplemental indenture dated February 17, 2011.

Debentures means, collectively, the 2016 Debentures and the 2021 Debentures.

Notes mean the unsecured subordinated promissory notes issued by Baytex Energy and certain other Operating Entities to us.

Tax Act means theIncome Tax Act (Canada), R.S.C. 1985, c. 1 (5th Supp.), as amended, including the regulations promulgated thereunder, as amended from time to time.

Trust Indenture means the third amended and restated trust indenture between Valiant Trust Company, and Baytex Energy dated May 20, 2008, as amended by a supplemental indenture dated December 31, 2010.

Trust Unit orUnit means a unit issued by the Trust, each unit representing an equal undivided beneficial interest in the Trust's assets.

2

ABBREVIATIONS

| | | | | | |

Oil and Natural Gas Liquids | | Natural Gas |

|---|

bbl | | barrel | | Mcf | | thousand cubic feet |

Mbbl | | thousand barrels | | MMcf | | million cubic feet |

MMbbl | | million barrels | | Bcf | | billion cubic feet |

NGL | | natural gas liquids | | Mcf/d | | thousand cubic feet per day |

bbl/d | | barrels per day | | MMcf/d | | million cubic feet per day |

| | | | m3 | | cubic metres |

| | | | MMbtu | | million British Thermal Units |

| | | | GJ | | gigajoule |

| | |

Other | |

|

|---|

| BOE or boe | | barrel of oil equivalent, using the conversion factor of 6 Mcf of natural gas being equivalent to one bbl of oil.BOEs may be misleading, particularly if used in isolation. A BOE conversion ratio of 6 Mcf: 1 bbl is based on an energy equivalency conversion method primarily applicable at the burner tip and does not represent a value equivalency at the wellhead. |

| Mboe | | thousand barrels of oil equivalent. |

| MMboe | | million barrels of oil equivalent. |

| boe/d | | barrels of oil equivalent per day. |

| WTI | | West Texas Intermediate. |

| API | | the measure of the density or gravity of liquid petroleum products derived from a specific gravity. |

| $ Million | | means millions of dollars. |

| $000s | | means thousands of dollars. |

CONVERSIONS

The following table sets forth certain conversions between Standard Imperial Units and the International System of Units (or metric units).

| | | | | | |

To Convert From | | To | | Multiply By | |

|---|

| Mcf | | Cubic metres | | | 28.174 | |

| Cubic metres | | Cubic feet | | | 35.494 | |

| Bbl | | Cubic metres | | | 0.159 | |

| Cubic metres | | Bbl | | | 6.293 | |

| Feet | | Metres | | | 0.305 | |

| Metres | | Feet | | | 3.281 | |

| Miles | | Kilometres | | | 1.609 | |

| Kilometres | | Miles | | | 0.621 | |

| Acres | | Hectares | | | 0.405 | |

| Hectares | | Acres | | | 2.471 | |

| Gigajoules | | MMbtu | | | 0.948 | |

3

CONVENTIONS

Certain terms used herein are defined in NI 51-101 and, unless the context otherwise requires, shall have the same meanings in this Annual Information Form as in NI 51-101. Unless otherwise indicated, references in this Annual Information Form to "$" or "dollars" are to Canadian dollars and references to "US$" are to United States dollars. All financial information contained in this Annual Information Form has been presented in Canadian dollars in accordance with Canadian GAAP. Words importing the singular number only include the plural, and vice versa, and words importing any gender include all genders. All operational information contained in this Annual Information Form relates to our consolidated operations unless the context otherwise requires.

SPECIAL NOTES TO READER

Forward-Looking Statements

In the interest of providing our Shareholders and potential investors with information about us, including management's assessment of our future plans and operations, certain statements in this Annual Information Form are "forward-looking statements" within the meaning of theUnited States Private Securities Litigation Reform Act of 1995 and "forward-looking information" within the meaning of applicable Canadian securities legislation (collectively, "forward-looking statements"). In some cases, forward-looking statements can be identified by terminology such as "anticipate", "believe", "continue", "could", "estimate", "expect", "forecast", "intend", "may", "objective", "ongoing", "outlook", "potential", "project", "plan", "should", "target", "would", "will" or similar words suggesting future outcomes, events or performance. The forward-looking statements contained in this Annual Information Form speak only as of the date hereof and are expressly qualified by this cautionary statement.

Specifically, this Annual Information Form contains forward-looking statements relating to: our business strategies, plans and objectives; the portion of our funds from operations to be allocated to our capital program; our ability to maintain production levels by investing approximately two-thirds of our internally generated funds from operations; our ability to grow our reserve base and add to production levels through exploration and development activities complemented by strategic acquisitions; our petroleum and natural gas reserves, including the quantum thereof and the present value of the future net revenue to be derived therefrom; the contingent resource estimates for our oil resource plays at Seal, northeast Alberta, North Dakota, Redwater and Kerrobert/Whiteside, including the quantum thereof and the present value of the future net revenue to be derived therefrom; development plans for our properties, including number of potential drilling locations, number of wells to be drilled in 2012, initial production rates from new wells and recovery factors; our light oil resource play at Kerrobert, including the development potential of the Viking formation; our steam-assisted gravity drainage project at Kerrobert, including resource potential of our undeveloped land, initial production rates from new wells and the number of potential drilling locations; our heavy oil resource play at Peace River, including the resource potential of our undeveloped land, initial production rates from new wells, the ability to recover incremental reserves using waterflood and cyclic steam recovery methods, our assessment of our cyclic steam stimulation pilot projects and the timing of commencing development of a 15-well thermal module; our light oil resource play in North Dakota, including our assessment of the number of wells to be drilled, initial production rates from new wells and average recoveries per well; our ability to utilize our tax pools to reduce our taxable income; our working interest production volume for 2012; the existence, operation and strategy of our risk management program; our dividend policy and level; funding sources for development capital expenditures and dividend payments; and the impact of existing and proposed governmental and environmental regulation. Cash dividends on our common shares are paid at the discretion of our Board of Directors and can fluctuate. In establishing the level of cash dividends, the Board of Directors considers all factors that it deems relevant, including, without limitation, the outlook for commodity prices, our

4

operational execution, the amount of funds from operations and capital expenditures and our prevailing financial circumstances at the time.

In addition, there are forward looking statements in this Annual Information Form under the heading "Description of Our Business and Operations — Statement of Reserves Data and Other Oil and Gas Information" (as to our reserves and future net revenues from our reserves, pricing and inflation rates, future development costs, the development of our proved undeveloped reserves and probable undeveloped reserves, future development costs, contingent resources, reclamation and abandonment obligations, tax horizon, exploration and development activities and production estimates). Information and statements relating to reserves and resources are deemed to be forward-looking statements, as they involve implied assessment, based on certain estimates and assumptions, that the reserves and resources described exist in quantities predicted or estimated, and that the reserves and resources can be profitably produced in the future.

These forward-looking statements are based on certain key assumptions regarding, among other things: petroleum and natural gas prices and pricing differentials between light, medium and heavy gravity crude oils; well production rates and reserve volumes; our ability to add production and reserves through our exploration and development activities; capital expenditure levels; the receipt, in a timely manner, of regulatory and other required approvals; the availability and cost of labour and other industry services; the amount of future cash dividends that we intend to pay; interest and foreign exchange rates; and the continuance of existing and, in certain circumstances, proposed tax and royalty regimes. Readers are cautioned that such assumptions, although considered reasonable by Baytex at the time of preparation, may prove to be incorrect.

Actual results achieved during the forecast period will vary from the information provided herein as a result of numerous known and unknown risks and uncertainties and other factors. Such factors include, but are not limited to: declines in oil and natural gas prices; variations in interest rates and foreign exchange rates; risks associated with our hedging activities; uncertainties in the credit markets may restrict the availability of credit or increase the cost of borrowing; refinancing risk for existing debt and debt service costs; access to external sources of capital; third party credit risk; a downgrade of our credit ratings; risks associated with the exploitation of our properties and our ability to acquire reserves; increases in operating costs; changes in government regulations that affect the oil and gas industry; risks relating to hydraulic fracturing; changes in income tax or other laws or government incentive programs; uncertainties associated with estimating petroleum and natural gas reserves; risks associated with acquiring, developing and exploring for oil and natural gas and other aspects of our operations; risks associated with properties operated by third parties; risks associated with delays in business operations; risks associated with the marketing of our petroleum and natural gas production; risks related to the accessibility, availability, proximity and capacity of gathering, processing and pipeline systems; risks associated with large projects or expansion of our activities; risks related to heavy oil projects; expansion of our operations; the failure to realize anticipated benefits of acquisitions and dispositions or to manage growth; changes in climate change laws and other environmental, health and safety regulations; competition in the oil and gas industry for, among other things, acquisitions of reserves, undeveloped lands, skilled personnel and drilling and related equipment; the activities of our Operating Entities and their key personnel; depletion of our reserves; risks associated with securing and maintaining title to our properties; seasonal weather patterns; our permitted investments; risks associated with the ownership of our securities, including the discretionary nature of dividend payments and changes in market-based factors; risks for United States and other non-resident shareholders, including the ability to enforce civil remedies, differing practices for reporting reserves and production, additional taxation applicable to non-residents and foreign exchange risk; and other factors, many of which are beyond the control of Baytex.

Readers are cautioned that the foregoing list of risk factors is not exhaustive. New risk factors emerge from time to time, and it is not possible for management to predict all of such factors and to assess in

5

advance the impact of each such factor on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements. Readers should also carefully consider the matters discussed under the heading "Risk Factors" in this Annual Information Form.

There is no representation by Baytex that actual results achieved during the forecast period will be the same in whole or in part as those forecast and Baytex does not undertake any obligation to update publicly or to revise any of the included forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required by applicable securities law. The forward-looking statements contained in this Annual Information Form are expressly qualified by this cautionary statement.

Contingent Resource

This Annual Information Form contains estimates as of December 31, 2011 of the volumes of, and the net present value of the future net revenue from, the "contingent resource" for four of our oil resource plays: the Bluesky in the Seal area of Alberta; the Bakken/Three Forks in North Dakota; the Viking in southeast Alberta; and the Lloydminster area of Alberta. These estimates were prepared by independent qualified reserves evaluators.

"Contingent resource" is not, and should not be confused with, petroleum and natural gas reserves. "Contingent resource" is defined in the Canadian Oil and Gas Evaluation Handbook as: "those quantities of petroleum estimated, as of a given date, to be potentially recoverable from known accumulations using established technology or technology under development, but which are not currently considered to be commercially recoverable due to one or more contingencies. Contingencies may include factors such as economic, legal, environmental, political and regulatory matters or a lack of markets. It is also appropriate to classify as contingent resource the estimated discovered recoverable quantities associated with a project in the early evaluation stage."

A range of contingent resource estimates (low, best and high) were prepared by the independent qualified reserves evaluators. A low estimate (C1) is considered to be a conservative estimate of the quantity of the resource that will actually be recovered. It is likely that the actual remaining quantities recovered will exceed the low estimate. Those resources at the low end of the estimate range have the highest degree of certainty (a 90% confidence level) that the actual quantities recovered will be equal or exceed the estimate. A best estimate (C2) is considered to be the best estimate of the quantity of the resource that will actually be recovered. It is equally likely that the actual remaining quantities recovered will be greater or less than the best estimate. Those resources that fall within the best estimate have a 50% confidence level that the actual quantities recovered will be equal or exceed the estimate. A high estimate (C3) is considered to be an optimistic estimate of the quantity of the resource that will actually be recovered. It is unlikely that the actual remaining quantities of resource recovered will meet or exceed the high estimate. Those resources at the high end of the estimate range have a lower degree of certainty (a 10% confidence level) that the actual quantities recovered will equal or exceed the estimate.

The primary contingencies which currently prevent the classification of the contingent resource as reserves consist of: preparation of firm development plans, including determination of the specific scope and timing of the project; project sanction; access to capital markets; stakeholder and regulatory approvals; access to required services and field development infrastructure; oil prices; demonstration of economic viability; future drilling program and testing results; further reservoir delineation and studies; facility design work; limitations to development based on adverse topography or other surface restrictions; and the uncertainty regarding marketing and transportation of petroleum from development areas.

6

There is no certainty that it will be commercially viable to produce any portion of the contingent resource or that we will produce any portion of the volumes currently classified as contingent resource. The estimates of contingent resource involve implied assessment, based on certain estimates and assumptions, that the resource described exists in the quantities predicted or estimated and that the resource can be profitably produced in the future. The net present value of the future net revenue from the contingent resource does not necessarily represent the fair market value of the contingent resource.

The recovery and resource estimates provided herein are estimates only. Actual contingent resource (and any volumes that may be reclassified as reserves) and future production from such contingent resource may be greater than or less than the estimates provided herein.

Description of Funds from Operations

This Annual Information Form contains references to funds from operations, which does not have any standardized meaning prescribed by Canadian GAAP. We define funds from operations as cash flow from operating activities adjusted for financing costs, changes in non-cash operating working capital and other operating items. We believe that this measure assists in providing a more complete understanding of certain aspects of our results of operations and financial performance, including our ability to generate the cash flow necessary to fund future dividends to shareholders and capital investments. However, funds from operations should not be construed as an alternative to traditional performance measures determined in accordance with Canadian GAAP, such as cash flow from operating activities and net income.

For a reconciliation of funds from operations to cash flow from operating activities, see our "Management's Discussion and Analysis of the operating and financial results" which is accessible on the SEDAR website atwww.sedar.com.

New York Stock Exchange

As a Canadian issuer listed on the New York Stock Exchange (the "NYSE"), we are not required to comply with most of the NYSE's corporate governance rules and listing standards and instead may comply with domestic corporate governance requirements. The NYSE requires that as a foreign private issuer we disclose any significant ways in which our corporate governance practices differ from those followed by U.S. domestic issuers. We have reviewed the NYSE corporate governance and listing standards applicable to U.S. domestic issuers and confirm that our corporate governance practices do not differ significantly from such standards.

Access to Documents

Any document referred to in this Annual Information and described as being accessible on the SEDAR website atwww.sedar.com (including those documents referred to as being incorporated by reference in this Annual Information Form) may be obtained free of charge from us at Suite 2800, Centennial Place, East Tower, 520 - 3rd Avenue S.W., Calgary, Alberta, Canada, T2P 0R3.

7

BAYTEX ENERGY CORP.

General

We were incorporated on October 22, 2010 pursuant to the provisions of the ABCA, as an indirect wholly-owned subsidiary of the Trust, for the sole purpose of participating in a plan of arrangement under the ABCA to effect the conversion of the legal structure of the Trust from a trust to a corporation. The Corporate Conversion was implemented as a result of changes to laws regarding the taxation of trusts in Canada that took effect on January 1, 2011.

Pursuant to the Corporate Conversion: (i) on December 31, 2010, holders of Trust Units exchanged their Trust Units for Common Shares on a one-for-one basis; and (ii) on January 1, 2011, the Trust was dissolved and terminated, with the Corporation being the successor to the Trust.

Our head and principal office is located at Suite 2800, Centennial Place, East Tower, 520 - 3rd Avenue S.W., Calgary, Alberta, Canada, T2P 0R3. Our registered office is located at 1400, 350 - 7th Avenue S.W., Calgary, Alberta, Canada, T2P 3N9.

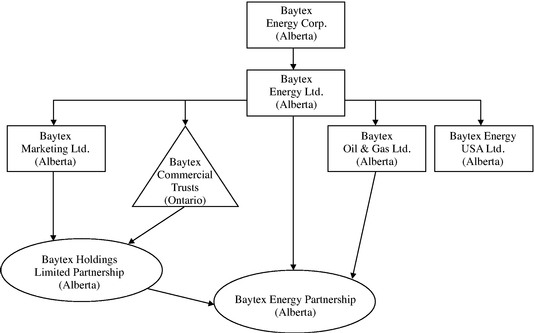

Inter-Corporate Relationships

The following table provides the name, the percentage of voting securities owned by us and the jurisdiction of incorporation, continuance, formation or organization of our subsidiaries either, direct and indirect, as at the date hereof.

| | | | | |

| | Percentage of voting securities

(directly or indirectly) | | Jurisdiction of

Incorporation/

Formation |

|---|

Baytex Energy Ltd. | | | 100% | | Alberta |

Baytex Marketing Ltd. | | | 100% | | Alberta |

Baytex Commercial Trusts | | | 100% | | Ontario |

Baytex Oil & Gas Ltd. | | | 100% | | Alberta |

Baytex Energy USA Ltd. | | | 100% | | Colorado |

Baytex Holdings Limited Partnership | | | 100% | | Alberta |

Baytex Energy Partnership | | | 100% | | Alberta |

8

Our Organizational Structure

The following diagram describes the inter-corporate relationships among us and our material subsidiaries.

GENERAL DEVELOPMENT OF OUR BUSINESS

History and Development

In this section, references to "we", "us" and "our" for events occurring prior to January 1, 2011 refer to the Trust and its subsidiaries on a consolidated basis, unless the context requires otherwise.

On April 14, 2009, we completed a public offering of 7,935,000 Trust Units at a price of $14.50 per Trust Unit for gross proceeds of $115,057,500. The net proceeds of the offering were used to repay outstanding bank indebtedness.

On July 30, 2009, we completed the acquisition of predominantly heavy oil assets located in the Kerrobert and Coleville areas of southwest Saskatchewan, plus certain natural gas assets located in the Ferrier area of west central Alberta effective May 1, 2009. Aggregate cash consideration for the acquisition was $86.2 million, net of adjustments such as net operating income for the interim period from May 1, 2009 to July 30, 2009 and prepaid items. The acquired assets were producing approximately 3,000 boe/d (72% heavy oil and 28% natural gas) at the time of the acquisition. The acquired assets included approximately 47,700 net acres of developed land and 63,300 net acres of undeveloped land in close proximity to our existing assets in the Lloydminster area.

On August 26, 2009, we completed a public offering of $150 million principal amount of 9.15% series A senior unsecured debentures due August 26, 2016. The net proceeds of the offering along with funds drawn on the Credit Facilities were used to fund the redemption effective September 25, 2009 of the following senior subordinated notes of Baytex Energy: 9.625% notes due July 15, 2010 (principal amount US$179.7 million) and 10.5% notes due February 15, 2011 (principal amount US$0.2 million).

In November, 2009, we reached an agreement with our joint venture partner in the Bakken/Three Forks light oil resource play in the Williston Basin in northwest North Dakota to pre-pay the remaining deferred acquisition payments. The original participation agreement with the joint venture partner called for deferred acquisition payments totalling approximately US$36 million to be made prior to the

9

spud date of each of the remaining 24 earning wells, occurring more or less rateably until approximately January 2011. On December 15, 2009, we paid our joint venture partner US$33.2 million to complete the remaining deferred acquisition payments and to earn the right to operate a portion of the joint project area effective at the beginning of 2010.

On May 26, 2010, we completed the acquisition of a private company with heavy oil assets in the Lloydminster area of southwest Saskatchewan for aggregate net cash consideration of $40.9 million. The acquired assets were producing approximately 900 bbl/d of heavy oil at the time of the acquisition. The acquired assets included approximately 32,100 net acres of undeveloped land in close proximity to our existing assets in the Lloydminster area.

On September 30, 2010, we closed the sale of our 50% interest in the lands and wells comprising phase one of an in-situ combustion project located in the Kerrobert area of southwest Saskatchewan for $18 million and a gross overriding royalty on the divested lands. We retained our 50% interest in the area of mutual interest surrounding the phase one lands. Our other Kerrobert interests, including our 100% working interest in our steam-assisted gravity drainage project, were unaffected by the sale.

On December 31, 2010 / January 1, 2011, the Corporate Conversion was completed which resulted in holders of Trust Units exchanging their Trust Units for Common Shares on a one-for-one basis and the dissolution and termination of the Trust, with the Corporation being the successor to the Trust.

On February 3, 2011, we completed the acquisition of heavy oil assets located in the Reno area of northern Alberta and the Lloydminster area of western Saskatchewan. The total consideration for the acquisition of $159.3 million (net of adjustments) was funded by drawing on our revolving credit facilities.

On February 17, 2011, we completed a private placement of US$150 million principal amount of 6.75% series B senior unsecured debentures due February 17, 2021. The net proceeds of the offering were used to repay existing indebtedness under the credit facilities and for general corporate purposes.

On August 9, 2011, we completed the acquisition of natural gas assets located in the Brewster area of west central Alberta. The total consideration for the acquisition of $22.4 million (net of adjustments) was funded by drawing on our revolving credit facilities.

In the fourth quarter of 2011, we completed two dispositions of primarily undeveloped lands for $47.4 million. In the Kaybob South area of west central Alberta, we sold six sections of leasehold, including five sections with Duvernay rights, for $11.1 million. In the Dodsland area in southwest Saskatchewan, we sold 32,600 net acres of leasehold in the "halo" of the field for $36.3 million.

Significant Acquisitions

During the year ended December 31, 2011, we did not complete any acquisitions for which disclosure was required under Part 8 of National Instrument 51-102.

RISK FACTORS

You should carefully consider the following risk factors, as well as the other information contained in this Annual Information Form and our other public filings before making an investment decision. If any of the risks described below materialize, our business, financial condition or results of operations could be materially and adversely affected. Additional risks and uncertainties not currently known to us that we currently view as immaterial may also materially and adversely affect our business, financial condition or results of operations. Residents of the United States and other non-residents of Canada should have additional regard to the risk factors under the heading "— Certain Risks for United States and other non-resident Shareholders".

10

The information set forth below contains "forward-looking statements", which are qualified by the information contained in the section of this Annual Information Form entitled "Special Notes to Reader — Forward-Looking Statements".

Risks Relating to Our Business and Operations

Oil and natural gas prices are volatile. Declines in oil and natural gas prices will adversely affect our financial condition

Our revenues, operating results, profitability and future rate of growth depend primarily upon the prices we receive for the oil and natural gas that we sell. Prices also affect the amount of cash flow available for capital expenditures and dividends to Shareholders and our ability to borrow money or raise additional capital.

The extreme volatility of oil and natural gas prices over the past few years has affected the monthly distributions per Trust Unit paid by our predecessor, which reached a high of $0.25 for June to November 2008, before being reduced to $0.18 for December 2008 and January 2009 and $0.12 for February to November 2009. With the recovery in oil and natural gas prices, monthly distributions per Trust Unit were increased to $0.18 in December 2009 and to $0.20 in December 2010. Continuing strength in oil prices in 2011 allowed us to increase monthly dividends per Common Share to $0.22 in December 2011. Declines in oil and natural gas prices may result in declines in, or the elimination of, dividends to Shareholders.

Historically, oil and natural gas prices have been volatile and they are likely to continue to be volatile. Oil and natural gas prices are determined by economic factors and in the case of oil prices, political factors and a variety of additional factors beyond our control. These factors include economic conditions in the United States and Canada and worldwide including ongoing credit and liquidity concerns, the actions of OPEC, sanctions imposed on certain oil producing nations by other countries, governmental regulation, political instability or armed-conflict in the Middle East and other oil producing regions, weather conditions including weather-related disruptions to the North American natural gas supply, the foreign supply of oil and natural gas, risks of supply disruption, the level of consumer demand, the price of foreign imports and the availability of alternative fuel sources. Any substantial and extended decline in the price of oil and natural gas would have an adverse effect on the carrying value of our proved and probable reserves, net asset value, borrowing capacity, revenues, profitability and funds from operations and ultimately on our financial condition and may, therefore, affect the amount of dividends that we pay to our Shareholders.

Our financial performance also depends on revenues from the sale of commodities which differ in quality and location from underlying commodity prices quoted on financial exchanges. Of particular importance are the price differentials between our light/medium oil and heavy oil (in particular the light/heavy differential) and quoted market prices. Not only are these discounts influenced by regional supply and demand factors, they are also influenced by other factors such as transportation costs, capacity and interruptions, refining demand, the availability and cost of diluents used to blend and transport product and the quality of the oil produced, all of which are beyond our control.

The economics of producing from some wells may change as a result of lower commodity prices, which could result in reduced production of oil or natural gas and a reduction in the volumes of our reserves. We might also elect not to produce from certain wells at lower prices. Volatile oil and natural gas prices also make it difficult to estimate the value of producing properties for acquisitions and often cause disruption in the market for oil and natural gas producing properties, as buyers and sellers have difficulty agreeing on such value. Price volatility also makes it difficult to budget for and project the return on acquisitions and development and exploitation projects.

11

Variations in interest rates and foreign exchange rates could adversely affect our financial condition

There is a risk that the interest rates will increase given the current historical low level of interest rates. An increase in interest rates could result in a significant increase in the amount we pay to service debt and could have an adverse impact on our financial condition, results of operations and future growth, potentially resulting in a decrease in dividends to Shareholders and/or the market price of the Common Shares.

World oil prices are quoted in United States dollars and the price received by Canadian producers is therefore affected by the Canada/U.S. foreign exchange rate that may fluctuate over time. A material increase in the value of the Canadian dollar may negatively impact our production revenue and our ability to maintain dividends to Shareholders in the future. Future Canada/U.S. foreign exchange rates could also impact the future value of our reserves as determined by our independent evaluator.

A decline in the value of the Canadian dollar relative to the United States dollar provides a competitive advantage to United States companies in acquiring Canadian oil and gas properties and may make it more difficult for us to replace reserves through acquisitions.

Our hedging activities may negatively impact our income and our financial condition

We may manage the risk associated with changes in commodity prices by entering into petroleum or natural gas price hedges. If we hedge our commodity price exposure, we may forego some of the benefits we would otherwise experience if commodity prices were to increase. For more information in relation to our commodity hedging program, see "Statement of Reserves Data and Other Oil and Natural Gas Information — Other Oil and Gas Information — Forward Contracts". We may initiate certain hedges to attempt to mitigate the risk of the Canadian dollar appreciating against the U.S. dollar. An increase in the Canada/U.S. foreign exchange rate will impact future dividends and the future value of our reserves as determined by independent evaluators. These hedging activities could expose us to losses and to credit risk associated with counterparties with which we contract.

Uncertainty in the credit markets may restrict the availability or increase the cost of borrowing required for future development and acquisitions

Our future success depends in part on our ability to access capital markets and obtain financing on reasonable terms. Our ability to do so is dependent on a number of factors, many of which are beyond our control, including our credit ratings, interest rates, the structured and commercial financial markets and perceptions of us and the oil and natural gas exploration and production industry generally.

Uncertainty in domestic and international credit markets and other financial systems could materially affect our ability to access sufficient capital for our capital expenditures and acquisitions on reasonable terms, or at all, and, as a result, may have a material adverse effect on our ability to execute our business strategy and on our financial condition. There can be no assurance that financing will be available or sufficient to meet these requirements or for other corporate purposes or, if financing is available, that it will be on terms appropriate and acceptable to us. Should the lack of financing and uncertainty in the capital markets adversely impact our ability to refinance debt, additional equity may be issued resulting in a dilutive effect on current and future Shareholders.

Our bank credit facilities will need to be renewed prior to June 14, 2014 and failure to renew, in whole or in part, or higher interest charges will adversely affect our financial condition

Our existing Credit Facilities and any replacement credit facilities may not provide sufficient liquidity. The amounts available under our existing Credit Facilities may not be sufficient for future operations, or we may not be able to obtain additional financing on economic terms attractive to us, if at all. We currently have Credit Facilities in the amount of $700 million. In the event that the Credit Facilities are

12

not extended before June 14, 2014, indebtedness under the Credit Facilities will be repayable on June 14, 2014. The interest charged on the Credit Facilities is calculated based on a sliding scale ratio of our debt to EBITDA ratio. Repayment of all outstanding amounts under the Credit Facilities may be demanded on relatively short notice if an event of default occurs, which is continuing. If this occurs, we may need to obtain alternate financing. Any failure to obtain suitable replacement financing may have a material adverse effect on our business, and dividends to Shareholders may be materially reduced. There is also a risk that the Credit Facilities will not be renewed for the same amount or on the same terms.

As at December 31, 2011, our outstanding indebtedness included $150 million of 2016 Debentures which mature on August 26, 2016 and US$150 million of 2021 Debentures which mature on February 17, 2021. We intend to fund these debt maturities with our existing Credit Facilities. In the event we are unable to refinance our debt obligations, it may impact our ability to fund our ongoing operations and to pay dividends.

We are required to comply with covenants under the Credit Facilities and the Debentures. In the event that we do not comply with these covenants, our access to capital could be restricted or repayment could be required on an accelerated basis by our lenders, and the ability to pay dividends to our Shareholders may be restricted. The lenders under the Credit Facilities have security over substantially all of our assets. If we become unable to pay our debt service charges or otherwise commit an event of default, such as breach of our financial covenants, the lenders under the Credit Facilities may foreclose on or sell our working interests in our properties.

Amounts paid in respect of interest and principal on debt may reduce dividends to Shareholders. Variations in interest rates and scheduled principal repayments could result in significant changes in the amount required to be applied to debt service before payment of dividends. Certain covenants in the agreements with our lenders under the Credit Facilities and the holders of the Debentures may also limit dividends. Although we believe the Credit Facilities will be sufficient for our immediate requirements, there can be no assurance that the amount will be adequate for our future financial obligations including our future capital expenditure program, or that we will be able to obtain additional funds.

From time to time we may enter into transactions which may be financed in whole or in part with debt. The level of our indebtedness from time to time could impair our ability to obtain additional financing on a timely basis to take advantage of business opportunities that may arise.

We have been historically reliant on external sources of capital, borrowings and equity sales and, if unavailable, our financial condition will be adversely affected

As future capital expenditures will be financed out of funds from operations, borrowings and possible future equity sales, our ability to do so is dependent on, among other factors, the overall state of capital markets and investor appetite for investments in the energy industry and our securities in particular.

To the extent that external sources of capital become limited or unavailable or available on onerous terms, our ability to make capital investments and maintain or expand existing assets and reserves may be impaired, and our assets, liabilities, business, financial condition, results of operations and dividends to Shareholders may be materially and adversely affected as a result.

Shareholders may suffer dilution in connection with future issuances of Common Shares. One of our objectives is to continually add to our reserves through acquisitions and through development. Our success is, in part, dependent on our ability to raise capital from time to time by selling additional Common Shares. Shareholders will suffer dilution as a result of these offerings if, for example, the cash flow, production or reserves from the acquired assets do not reflect the additional number of Common

13

Shares issued to acquire those assets. Shareholders may also suffer dilution in connection with future issuances of Common Shares to complete acquisitions.

If funds from operations are lower than expected or capital costs for these projects exceed current estimates, or if we incur major unanticipated expenses related to development or maintenance of our existing properties, we may be required to seek additional capital to maintain our capital expenditures at planned levels. Failure to obtain any financing necessary for our capital expenditure plans may result in a delay in development of, or production from, our properties resulting in a decrease in the amount of funds from operations received by us and, therefore, may reduce dividends to Shareholders.

Failure of third parties to meet their contractual obligations to us may have a material adverse affect on our financial condition

We are exposed to third party credit risk through our contractual arrangements with our current or future joint venture partners, third party operators, marketers of our petroleum and natural gas production, hedge counterparties and other parties. In the event such parties fail to meet their contractual obligations to us, such failures may have a material adverse effect on our business, financial condition, results of operations and prospects. In addition, poor credit conditions in the industry and of joint venture partners may impact a joint venture partner's willingness to participate in our ongoing capital program, potentially delaying the program and the results of such program until we find a suitable alternative partner.

A downgrade our credit rating could increase our cost of capital and limit our access to capital, suppliers or counterparties.

Rating agencies regularly evaluate us, basing their ratings of our long-term and short-term debt on a number of factors. This includes our financial strength as well as factors not entirely within our control, including conditions affecting the oil and gas industry generally and the wider state of the economy. There can be no assurance that one or more of our credit ratings will not be downgraded.

Our borrowing costs and ability to raise funds are directly impacted by our credit ratings. Credit ratings may be important to suppliers or counterparties when they seek to engage in certain transactions, including transactions involving over-the-counter derivatives. A credit-rating downgrade could potentially impair our ability to enter into arrangements with suppliers or counterparties, to engage in certain transactions, and could limit our access to private and public credit markets and increase the costs of borrowing under our existing credit facilities. A downgrade could also limit our access to short-term debt markets, increase the cost of borrowing in the short-term and long-term debt markets, and trigger collateralization requirements related to physical and financial derivative liabilities with certain marketing counterparties and pipeline and midstream service providers.

In connection with certain over-the-counter derivatives contracts and other trading agreements, we could be required to provide additional collateral or to terminate transactions with certain counterparties in the event of a downgrade of our credit rating. The occurrence of any of the foregoing could adversely affect our ability to execute portions of our business strategy, including hedging, and could have a material adverse effect on our liquidity and capital position.

Our ability to add to our petroleum and natural gas reserves is highly dependent on our success in exploiting existing properties and acquiring additional reserves

Our long-term commercial success depends on our ability to find, acquire, develop and commercially produce petroleum and natural gas reserves. Future oil and natural gas exploration may involve unprofitable efforts, not only from unsuccessful wells, but also from wells that are productive but do not produce sufficient petroleum substances to return a profit after drilling, completion (including hydraulic fracturing), operating and other costs. Completion of a well does not assure a profit on the

14

investment or recovery of drilling, completion, operating and other costs. Drilling hazards or environmental damage could greatly increase the cost of operations, and various field operating conditions may adversely affect the production from successful wells. These conditions include delays in obtaining governmental approvals or consents, shut-ins of connected wells resulting from extreme weather conditions, insufficient storage or transportation capacity or other geological and mechanical conditions. While diligent well supervision and effective maintenance operations can contribute to maximizing production rates over time, production delays and declines from normal field operating conditions cannot be eliminated and can be expected to adversely affect revenue and cash flow levels to varying degrees. New wells we drill or participate in may not become productive and we may not recover all or any portion of our investment in wells we drill or participate in. The cost of drilling, completing and operating a well is often uncertain, and cost factors can adversely affect the economics of a project.

There is no assurance we will be successful in developing additional reserves or acquiring additional reserves on terms that meet our investment objectives. Without these reserves additions, our reserves will deplete and as a consequence, either production from, or the average reserves life of, our properties will decline, which will result in a reduction in the value of Common Shares and in a reduction in funds from operations available for dividends to Shareholders.

Increases in operating costs could adversely affect our business, financial condition and results of operations

Higher operating costs for our underlying properties will directly decrease the amount of funds from operations received by us and, therefore, may reduce dividends to Shareholders. Labour costs, electricity, gas processing, well servicing and chemicals are examples of types of operating costs that are susceptible to material fluctuation. There is no assurance that further commercial quantities of petroleum and natural gas will be discovered or acquired by us.

Changes in government regulations that affect the oil and gas industry, or failing to comply with such regulations, could adversely affect us

The oil and gas industry in Canada and the United States is subject to federal, provincial, state and municipal legislation and regulation governing such matters as land tenure, prices, royalties, production rates, environmental protection controls, the exportation of crude oil, natural gas and other products, as well as other matters. See "Industry Conditions".

The industry is also subject to regulation by governments in such matters as the awarding or acquisition of exploration and production rights, oil sands or other interests, the imposition of specific drilling obligations, environmental protection controls, control over the development and abandonment of fields and mine sites (including restrictions on production) and possibly expropriation or cancellation of contract rights. We also rely on fresh water, which is obtained under government licenses to provide domestic and utility water for certain of our operations. There can be no assurance that the licenses to withdraw water will not be rescinded or that additional conditions will not be added to these licenses.

Government regulations may change from time to time in response to economic or political conditions. The exercise of discretion by governmental authorities under existing regulations, the implementation of new regulations or the modification of existing regulations affecting the oil and gas industry could reduce demand for crude oil and natural gas, increase our costs, or delay or restrict our operations, all of which would have a material adverse impact on us. In addition, failure to comply with government regulations may result in the suspension or termination of operations and subject us to liabilities and administrative, civil and criminal penalties. Compliance costs can be significant.

15

Hydraulic fracturing is subject to certain risks

Hydraulic fracturing involves the injection of water, sand and small amounts of additives under pressure into rock formations to stimulate hydrocarbon (natural gas and oil) production. The use of hydraulic fracturing is being used to produce commercial quantities of natural gas and oil from reservoirs that were previously unproductive. We use hydraulic fracturing in our operations. With the increase in the use of fracture stimulations in horizontal wells there is increased communication between the oil and natural gas industry and a wider variety of stakeholders regarding the responsible use of this technology as it relates to the environment. This increased attention to fracture stimulations may result in increased regulation or changes of law which may make the conduct of our business more expensive or prevent us from conducting our business as currently conducted. Any new laws, regulation or permitting requirements regarding hydraulic fracturing could lead to operational delay or increased operating costs or third party or governmental claims, and could increase our costs of compliance and doing business as well as delay the development of oil and natural gas resources from shale formations which are not commercial without the use of hydraulic fracturing. Restrictions on hydraulic fracturing could also reduce the amount of oil and natural gas that we are ultimately able to produce from our reserves.

Income tax laws or other laws or government incentive programs or regulations relating to our industry may in the future be changed or interpreted in a manner that adversely affects us and our Shareholders

Income tax laws, other laws or government incentive programs relating to the oil and gas industry, such as resource allowance, may in the future be changed or interpreted in a manner that adversely affects us and our Shareholders. Tax authorities having jurisdiction over us or our Shareholders may disagree with the manner in which we calculate our income for tax purposes or could change their administrative practices to our detriment or the detriment of our Shareholders.

The oil and gas industry is subject to extensive controls and regulations governing its operations (including land tenure, exploration, development, production, refining, transportation, and marketing) imposed by legislation enacted by various levels of government and with respect to pricing and taxation of oil and natural gas by agreements among the governments of Canada, Alberta, British Columbia, Saskatchewan, the United States, North Dakota and Wyoming, all of which should be carefully considered by investors in the oil and gas industry. All of such controls, regulations and legislation are subject to revocation, amendment or administrative change, some of which have historically been material and in some cases materially adverse and there can be no assurance that there will not be further revocation, amendment or administrative change which will be materially adverse to our assets, reserves, financial condition or results of operations or prospects and our ability to maintain dividends to Shareholders.

We cannot assure you that income tax laws and government incentive programs relating to the oil and gas industry generally will not change in a manner that adversely affects the market price of the Common Shares.

There are numerous uncertainties inherent in estimating quantities of recoverable petroleum and natural gas reserves, including many factors beyond our control

In general, estimates of economically recoverable petroleum and natural gas reserves and resources and the future net revenues therefrom are based upon a number of variable factors and assumptions, such as historical production from the properties, production rates, ultimate reserve recovery, timing and amount of capital expenditures, marketability of petroleum and natural gas, royalty rates, the assumed effects of regulation by governmental agencies and future operating costs, all of which may vary materially from actual results. All such estimates are based on professional judgment and classifications of reserves, which, by their nature have a high degree of subjectivity. For those reasons, estimates of

16

the economically recoverable petroleum and natural gas reserves or estimates of resources attributable to any particular group of properties, classification of such reserves based on risk of recovery and estimates of future net revenues associated with reserves prepared by different engineers, or by the same engineers at different times, may vary.

The reserves and recovery information contained in the Sproule Report is only an estimate and the actual production and ultimate reserves from the properties may be greater or less than the estimates prepared by Sproule and such variations could be material. The Sproule Report has been prepared using certain commodity price assumptions which are described in the notes to the reserves tables. If we realize lower prices for crude oil, natural gas liquids and natural gas and they are substituted for the price assumptions utilized in the Sproule Report, the present value of estimated future net revenues for our reserves and our net asset value would be reduced and the reduction could be significant. The estimates in the Sproule Report are based in part on the timing and success of activities we intend to undertake in future years. The reserves and estimated cash flows to be derived therefrom contained in the Sproule Report will be reduced, in future years, to the extent that such activities do not achieve the level of success assumed in the Sproule Report.

Estimates of proved and probable reserves include undeveloped reserves that are expected to be recovered from new wells on undrilled acreage or from existing wells where a relatively major expenditure is still required before such wells begin production. Reserves may be recognized when plans are in place to make the required investments to convert these undeveloped reserves to producing. Circumstances such as a sustained decline in commodity prices or poorer than expected results from initial activities could cause a change in the investment or development plans which could result in a material change in our reserves estimates.

Estimates of proved undeveloped reserves are sometimes based upon volumetric calculations and upon analogy to similar types of reserves rather than actual production history. Recovery factors and drainage areas were estimated by experience and analogy to similar producing pools. Estimates based on these methods are generally less reliable than those based on actual production history. Subsequent evaluation of the same reserves based upon production history and production practices will result in variations in the estimated reserves and such variations could have a material and adverse impact on our business and financial condition.

The contingent resource volumes included in this Annual Information Form are estimates only. The same uncertainties inherent in estimating quantities of reserves apply to estimating quantities of contingent resource. In addition, there are contingencies that prevent contingent resource from being classified as reserves. There is no certainty that it will be commercially viable to produce any portion of the contingent resource. Actual results may vary significantly from these estimates and such variances could be material.

Acquiring, developing and exploring for oil and natural gas involves many operating risks, which even a combination of experience, knowledge and careful evaluation may not be able to overcome. We have not insured and cannot fully insure against all risks related to our operations

Our business involves many operating risks related to the acquiring, developing and exploring for oil and natural gas. These risks include, but are not limited to, encountering unexpected formations or pressures, premature declines of reservoirs, blow-outs, craterings, equipment failures and other accidents, sour gas releases and spills, uncontrollable flows of oil, natural gas or well fluids, the invasion of water into producing formations, adverse weather conditions, pollution, other environmental hazards, fires, spills and delays in payments between parties caused by operation or economic matters which could result in substantial damage to oil and natural gas wells, production facilities, other property and the environment, personal injuries, loss of life and other hazards, all of which could result in liability. These risks will increase as we undertake more exploratory activity. Drilling hazards or environmental

17

damage could greatly increase the cost of operations, and various field operating conditions may adversely affect the production from successful wells. These conditions include delays in obtaining governmental approvals or consents, the shut-in of connected wells resulting from extreme weather conditions, insufficient storage or transportation capacity or other geological and mechanical conditions.

Although we maintain insurance in accordance with customary industry practice, we are not fully insured against all of these risks nor are all such risks insurable and in certain circumstances we may elect not to obtain insurance to deal with specific risks due to the high premiums associated with such insurance or other reasons. In addition, the nature of these risks is such that liabilities could exceed policy limits, in which event we could incur significant costs that could have a material adverse effect upon our financial condition.

Exploration and development risks arise due to the uncertain results of searching for and producing petroleum and natural gas using imperfect scientific methods. Losses resulting from the occurrence of any of these risks may have a material adverse effect on our business, financial condition, results of operations, prospects and our ability to maintain dividends to Shareholders.

The operation of a portion of our properties is largely dependent on the ability of third party operators, and harm to their business could cause delays and additional expenses in our receiving revenues

The continuing production from a property, and to some extent the marketing of production, is dependent upon the ability of the operators of our properties. Our return on assets operated by others depends upon a number of factors that may be outside of our control, including the timing and amount of capital expenditures, the operator's expertise and financial resources, the approval of other participants, the selection of technology and risk management practices. If, in situations where we are not the operator, the operator fails to perform these functions properly or becomes insolvent, revenues may be reduced. Revenues from production generally flow through the operator and, where we are not the operator, there is a risk of delay and additional expense in receiving such revenues.

In addition to the usual delays in payment by purchasers of oil and natural gas to the operators of the properties, and by the operator to our Operating Entities, payments between any of such parties may also be delayed by restrictions imposed by lenders, delays in the sale or delivery of products, delays in the connection of wells to a gathering system, blowouts or other accidents, recovery by the operator of expenses incurred in the operation of properties or the establishment by the operator of reserves for such expenses.

The operation of wells located on properties not operated by us is generally governed by operating agreements which typically require the operator to conduct operations in a good and workman-like manner. Operating agreements generally provide, however, that the operator will have no liability to the other non-operating working interest owners for losses sustained or liabilities incurred, except such as may result from gross negligence or wilful misconduct. In addition, third-party operators are generally not fiduciaries with respect to us or our Shareholders. As owner of working interests in properties not operated by us, we will generally have a cause of action for damages arising from a breach of the operator's duty. Although not established by definitive legal precedent, it is unlikely that our Shareholders would be entitled to bring suit against third party operators to enforce the terms of the operating agreements. Therefore, our Shareholders will be dependent upon us, as owner of the working interest, to enforce such rights.

18

Delays in business operations could adversely affect our income and financial condition

Delays in business operations could adversely affect our income and financial condition and may affect our ability to pay dividends to Shareholders and the market price of our Common Shares. In addition to the usual delays in payment by purchasers of oil and natural gas to the operators of our properties, and the delays of those operators in remitting payment to us, payments between any of these parties may also be delayed by:

- •

- restrictions imposed by lenders;

- •

- accounting delays;

- •

- delays in the sale or delivery of products;

- •

- delays in the connection of wells to a gathering system;

- •

- restrictions due to limited pipeline or processing capacity;

- •

- operational problems affecting pipelines and facilities;

- •

- blowouts or other accidents;

- •

- adjustments for prior periods;

- •

- recovery by the operator of expenses incurred in the operation of the properties; or

- •

- the establishment by the operator of reserves for these expenses.

Any of these delays could reduce the amount of cash available to pay dividends to Shareholders in a given period and expose us to additional third party credit risks.

The marketability of petroleum and natural gas that may be acquired or discovered by us will be affected by numerous factors beyond our control

These factors include demand for petroleum and natural gas, market fluctuations, the availability, proximity and capacity of oil and natural gas pipelines and processing and storage facilities and government regulations, including regulations relating to environmental protection, royalties, allowable production, pricing, taxes, importing and exporting of oil and natural gas and political events throughout the world that cause disruptions in the supply of oil. Any particular event could result in a material decline in prices and therefore result in a reduction of our net production revenue. The availability of markets is beyond our control.

In addition, our oil and natural gas properties, wells and facilities could be subject to a terrorist attack. If any of our properties, wells or facilities are the subject of terrorist attack it could have a material adverse effect on our financial condition. We do not have insurance to protect against the risk from terrorism.

The amount of oil and natural gas that we can produce and sell is subject to the accessibility, availability, proximity and capacity of gathering, processing and pipeline systems

We deliver our products through gathering, processing and pipeline systems some of which we do not own. Access to the pipeline capacity for the transport of crude oil into the United States has become inadequate for the amount of Canadian production being exported to the United States and has recently resulted in significantly lower amounts being realized by Canadian producers compared with the WTI price for crude oil. The lack of access to capacity in any of the gathering, processing and pipeline systems, and in particular the processing facilities, could result in our inability to realize the full economic potential of our production or in a reduction of the price offered for our production. Any significant change in market factors or other conditions affecting these infrastructure systems and

19

facilities, as well as any delays in constructing new infrastructure systems and facilities could harm our business and, in turn, our financial condition.

Certain pipeline leaks in 2011have gained media and other stakeholder attention and may result in additional regulation or changes in law which could impede the conduct of our business or make our operations more expensive.

A portion our production may, from time to time, be processed through facilities owned by third parties and which we do not have control of. From time to time these facilities may discontinue or decrease operations either as a result of normal servicing requirements or as a result of unexpected events. A discontinuance or decrease of operations could materially adversely affect our ability to process our production and to deliver the same for sale.

We may participate in larger projects and may have more concentrated risk in certain areas of our operations

We manage a variety of small and large projects in the conduct of our business. Project delays may impact expected revenues from operations. Significant project cost over-runs could make a project uneconomic. Our ability to execute projects and market oil and natural gas depends upon numerous factors beyond our control, including:

- •

- the availability of processing capacity;

- •

- the availability and proximity of pipeline capacity;

- •

- the availability of storage capacity;

- •

- the availability of, and the ability to acquire, water supplies needed for drilling and hydraulic fracturing, or our ability to dispose of water used or removed from strata at a reasonable cost and within applicable environmental regulations;

- •

- the supply of and demand for oil and natural gas;

- •

- the availability of alternative fuel sources;

- •

- the effects of inclement weather;

- •

- the availability of drilling and related equipment;

- •

- unexpected cost increases;

- •

- accidental events;

- •

- currency fluctuations;

- •

- changes in regulations;

- •

- the availability and productivity of skilled labour; and

- •

- the regulation of the oil and gas industry by various levels of government and governmental agencies.

Because of these factors, we could be unable to execute projects on time, on budget or at all, and may not be able to effectively market the oil and natural gas that we produce.

Our heavy oil projects face additional risks compared to conventional oil and gas production

Some of our heavy oil projects are capital intensive projects which rely on specialized production technologies. Certain current technologies for the recovery of heavy oil, such as cyclic steam stimulation and steam-assisted gravity drainage, are energy intensive, requiring significant consumption of natural gas and other fuels in the production of steam that is used in the recovery process. The amount of steam required in the production process varies and therefore impacts costs. The performance of the

20

reservoir can also affect the timing and levels of production using new technologies. A large increase in recovery costs could cause certain projects that rely on cyclic steam stimulation, steam-assisted gravity drainage or other new technologies to become uneconomical, which could have a negative effect on our financial condition. There are risks associated with growth and other capital projects that rely largely or partly on new technologies and the incorporation of such technologies into new or existing operations. The success of projects incorporating new technologies cannot be assured.

The operating costs of our heavy oil projects have the potential to vary considerably throughout the operating period and will be significant components of the cost of production of any petroleum products produced. Project economics and our overall earnings may be reduced if increases in operating costs are incurred. Factors which could affect operating costs include, without limitation: labor costs; the cost of catalyst and chemicals; the cost of natural gas and electricity; power outages; produced sand causing issues of erosion, hot spots and corrosion; reliability of and maintenance cost of facilities; and the cost to transport sales products and the cost to dispose of certain by-products.

We only operate in western Canada and the United States and expansion outside of these areas may increase our risk exposure

Our operations and expertise are currently primarily focused on oil and gas production and development in western Canada and the United States. In the future, we may acquire oil and gas properties outside of these geographic areas. In addition, we could acquire other energy related assets, such as oil and natural gas processing plants or pipelines, or an interest in an oil sands project. Expansion of our activities into new areas may present new additional risks or alternatively, significantly increase the exposure to one or more of the present risk factors which may adversely affect our business, financial condition or results of operations.

We may not be able to realize the anticipated benefits of acquisitions and dispositions or to manage growth

We make acquisitions and dispositions of businesses and assets in the ordinary course of our business. Achieving the benefits of acquisitions depends in part on successfully consolidating functions and integrating operations and procedures in a timely and efficient manner as well as our ability to realize the anticipated growth opportunities and synergies from combining the acquired businesses and operations with our operations. There is no assurance that we will be able to continue to complete acquisitions or dispositions of oil and natural gas properties which realize all the synergistic benefits.

We periodically dispose of non-core assets so that management can focus its efforts and resources more efficiently. Depending on the state of the market for such non-core assets, certain of our non-core assets, if disposed of, could be expected to realize less than their carrying value on our financial statements.

The price we pay for the purchase of any material properties is based on several criteria, including engineering and economic assessments made by independent engineers modified to reflect our technical and economic views. These assessments include a series of assumptions regarding such factors as recoverability and marketability of petroleum and natural gas, future prices of petroleum and natural gas, future operating costs, future capital expenditures and royalties and other government levies which will be imposed over the producing life of the reserves. Many of these factors are subject to change and are beyond our control. All such assessments involve a measure of geologic and engineering uncertainty which could result in lower than anticipated production and reserves. Consequently, the reserves acquired may be less than expected, which could adversely impact cash flow from operating activities and dividends to Shareholders.

We may be subject to growth-related risks including capacity constraints and pressure on our internal systems and controls. Our ability to manage growth effectively will require us to continue to implement and improve our operational and financial systems and to expand, train and manage our employee

21

base. Our inability to deal with this growth could have a material adverse effect on our business, financial condition, results of operations and prospects.

Climate change laws and related environmental, health and safety regulation may impose restrictions or costs on our business which may adversely affect our financial condition and our ability to maintain dividends