Exhibit 99.1

ANNUAL INFORMATION FORM

2013

MARCH 25, 2014

TABLE OF CONTENTS

|

| | |

| | Page |

|

| 1 |

|

| 3 |

|

| 3 |

|

| 4 |

|

| 4 |

|

| 8 |

|

| 9 |

|

| 11 |

|

| 21 |

|

| 50 |

|

| 56 |

|

| 57 |

|

| 60 |

|

| 62 |

|

| 63 |

|

| 64 |

|

| 64 |

|

| 64 |

|

| 65 |

|

| 65 |

|

| 65 |

|

| 77 |

|

APPENDICES:

| |

| APPENDIX A | REPORT OF MANAGEMENT AND DIRECTORS ON OIL AND GAS DISCLOSURE |

| |

| APPENDIX B | REPORT ON RESERVES DATA BY INDEPENDENT QUALIFIED RESERVES EVALUATOR |

APPENDIX C AUDIT COMMITTEE MANDATE AND TERMS OF REFERENCE

SELECTED TERMS

Capitalized terms in this Annual Information Form have the meanings set forth below:

Entities

Baytex or the Corporation means Baytex Energy Corp., a corporation incorporated under the ABCA.

Baytex Commercial Trusts mean, collectively, Baytex Commercial Trust 1, Baytex Commercial Trust 2, Baytex Commercial Trust 3, Baytex Commercial Trust 4, Baytex Commercial Trust 5, Baytex Commercial Trust 6 and Baytex Commercial Trust 7.

Baytex Energy means Baytex Energy Ltd., a corporation amalgamated under the ABCA.

Baytex Partnership means Baytex Energy Partnership, a general partnership, the partners of which are Baytex Energy and Baytex Holdings Limited Partnership.

Baytex USA means Baytex Energy USA Ltd.

Board of Directors means the board of directors of Baytex.

NYMEX means the New York Mercantile Exchange, a commodity futures exchange.

OPEC means the Organization of the Petroleum Exporting Countries.

Operating Entities means our subsidiaries that are actively involved in the acquisition, production, processing, transportation and marketing of crude oil, natural gas liquids and natural gas, being Baytex Energy, Baytex Partnership and Baytex USA, each a direct or indirect wholly-owned subsidiary of us, and Operating Entity means any one of them, as applicable.

SEC means the United States Securities and Exchange Commission.

Shareholders mean the holders from time to time of Common Shares.

subsidiary has the meaning ascribed thereto in the Securities Act (Ontario) and, for greater certainty, includes all corporations, partnerships and trusts owned, controlled or directed, directly or indirectly, by us.

Trust means Baytex Energy Trust, a trust created under the laws of the Province of Alberta on July 24, 2003 pursuant to the Trust Indenture and which was dissolved into the Corporation on January 1, 2011 in connection with the Corporate Conversion.

we, us and our means Baytex and all its subsidiaries on a consolidated basis unless the context requires otherwise.

Independent Engineering

COGE Handbook means the Canadian Oil and Gas Evaluation Handbook.

NI 51-101 means National Instrument 51-101 "Standards of Disclosure for Oil and Natural Gas Activities" of the Canadian Securities Administrators.

Sproule means Sproule Associates Limited, independent petroleum consultants of Calgary, Alberta.

Sproule Report means the report prepared by Sproule dated February 28, 2014 entitled "Evaluation of the P&NG Reserves of Baytex Energy Corp. (As of December 31, 2013)".

Securities and Other Terms

2021 Debentures means our US$150 million 6.75% series B senior unsecured debentures due February 17, 2021 and issued pursuant to the Debenture Indenture.

2022 Debentures means our $300 million 6.625% series C senior unsecured debentures due July 19, 2022 and issued pursuant to the Debenture Indenture.

ABCA means the Business Corporations Act (Alberta), R.S.A. 2000, c. B-9, as amended, including the regulations promulgated thereunder.

Canadian GAAP means generally accepted accounting principles in Canada, which is consistent with International Financial Reporting Standards as issued by the International Accounting Standards Board.

Common Shares means the common shares of Baytex.

Corporate Conversion means the internal reorganization of the Trust and certain of its subsidiaries which resulted in the conversion of the legal structure of the Trust from a trust to a corporation effective December 31, 2010 pursuant to a plan of arrangement under the ABCA.

Credit Facilities means, collectively, the $40 million extendible operating loan facility that Baytex Energy has with a chartered bank and the $810 million extendible syndicated loan facility that Baytex Energy has with a syndicate of chartered banks, each of which constitute a revolving credit facility that is extendible annually for a 1, 2, 3 or 4 year period (subject to a maximum four-year term at any time). Unless extended, the Credit Facilities will mature on June 14, 2017.

Debenture Indenture means the amended and restated trust indenture among us, as issuer, Baytex Energy, Baytex Partnership, Baytex Marketing Ltd., Baytex USA, the Baytex Commercial Trusts and Baytex Finance Company Ltd., as guarantors, and Valiant Trust Company, as indenture trustee, dated January 1, 2011, as supplemented by supplemental indentures dated February 17, 2011, February 18, 2011, July 19, 2012 and December 19, 2012.

Debentures means, collectively, the 2021 Debentures and the 2022 Debentures.

Notes mean the unsecured subordinated promissory notes issued by Baytex Energy and certain other Operating Entities to us.

SAGD means steam-assisted gravity drainage.

Tax Act means the Income Tax Act (Canada), R.S.C. 1985, c. 1 (5th Supp.), as amended, including the regulations promulgated thereunder, as amended from time to time.

Trust Indenture means the third amended and restated trust indenture between Valiant Trust Company, and Baytex Energy dated May 20, 2008, as amended by a supplemental indenture dated December 31, 2010.

Trust Unit or Unit means a unit issued by the Trust, each unit representing an equal undivided beneficial interest in the Trust's assets.

ABBREVIATIONS

|

| | | | |

| Oil and Natural Gas Liquids | Natural Gas |

| | | | |

| bbl | barrel | Mcf | thousand cubic feet |

| Mbbl | thousand barrels | MMcf | million cubic feet |

| MMbbl | million barrels | Bcf | billion cubic feet |

| NGL | natural gas liquids | Mcf/d | thousand cubic feet per day |

| bbl/d | barrels per day | MMcf/d | million cubic feet per day |

| | | m3 | cubic metres |

| | | MMbtu | million British Thermal Units |

| | | GJ | gigajoule |

| | | | |

| Other | |

| AECO | the natural gas storage facility located at Suffield, Alberta |

| BOE or boe | barrel of oil equivalent, using the conversion factor of 6 Mcf of natural gas being equivalent to one bbl of oil. BOEs may be misleading, particularly if used in isolation. A BOE conversion ratio of 6 Mcf: 1 bbl is based on an energy equivalency conversion method primarily applicable at the burner tip and does not represent a value equivalency at the wellhead. |

| Mboe | thousand barrels of oil equivalent |

| MMboe | million barrels of oil equivalent |

| boe/d | barrels of oil equivalent per day |

| WTI | West Texas Intermediate |

| API | the measure of the density or gravity of liquid petroleum products derived from a specific gravity |

| $ Million | millions of dollars |

| $000s | thousands of dollars |

CONVERSIONS

The following table sets forth certain conversions between Standard Imperial Units and the International System of Units (or metric units).

|

| | |

| To Convert From | To | Multiply By |

| | | |

| Mcf | Cubic metres | 28.174 |

| Cubic metres | Cubic feet | 35.494 |

| Bbl | Cubic metres | 0.159 |

| Cubic metres | Bbl | 6.293 |

| Feet | Metres | 0.305 |

| Metres | Feet | 3.281 |

| Miles | Kilometres | 1.609 |

| Kilometres | Miles | 0.621 |

| Acres | Hectares | 0.405 |

| Hectares | Acres | 2.471 |

| Gigajoules | MMbtu | 0.948 |

CONVENTIONS

Certain terms used herein are defined in NI 51-101 and, unless the context otherwise requires, shall have the same meanings in this Annual Information Form as in NI 51-101. Unless otherwise indicated, references in this Annual Information Form to "$" or "dollars" are to Canadian dollars and references to "US$" are to United States dollars. All financial information contained in this Annual Information Form has been presented in Canadian dollars in accordance with Canadian GAAP. Words importing the singular number only include the plural, and vice versa, and words importing any gender include all genders. All operational information contained in this Annual Information Form relates to our consolidated operations unless the context otherwise requires.

SPECIAL NOTES TO READER

Forward-Looking Statements

In the interest of providing our Shareholders and potential investors with information about us, including management's assessment of our future plans and operations, certain statements in this Annual Information Form are "forward-looking statements" within the meaning of the United States Private Securities Litigation Reform Act of 1995 and "forward-looking information" within the meaning of applicable Canadian securities legislation (collectively, "forward-looking statements"). In some cases, forward-looking statements can be identified by terminology such as "anticipate", "believe", "continue", "could", "estimate", "expect", "forecast", "intend", "may", "objective", "ongoing", "outlook", "potential", "project", "plan", "should", "target", "would", "will" or similar words suggesting future outcomes, events or performance. The forward-looking statements contained in this Annual Information Form speak only as of the date hereof and are expressly qualified by this cautionary statement.

Specifically, this Annual Information Form contains forward-looking statements relating to, but not limited to: our business strategies, plans and objectives; the portion of our funds from operations to be allocated to our capital program; our ability to maintain production levels by investing approximately two-thirds of our internally generated funds from operations; our ability to grow our reserve base and add to production levels through exploration and development activities complemented by strategic acquisitions; the anticipated benefits from the acquisition (the "Acquisition") of Aurora Oil & Gas Limited ("Aurora"), including our belief that the Acquisition will be an excellent fit with our business model and will provide shareholders with exposure to low-risk, repeatable, high-return projects with capital efficiencies; our expectation that the Aurora assets have infrastructure in place to provide low-risk annual production and that such assets will provide material production, long-term growth and high quality reserves with upside potential; our expectations regarding the effect of well downspacing, improving completion techniques and new development targets on the reserves potential of the Aurora assets; the timing of completion of the Acquisition; our plan to establish new revolving credit facilities and a term loan for us and a borrowing base facility for Aurora's U.S. subsidiary following closing of the Acquisition; payment of the purchase price for the Acquisition, including the use of proceeds from the subscription receipt financing and our plan to draw on the new revolving credit facilities and term loan; our petroleum and natural gas reserves, including the volume thereof and the present value of the future net revenue to be derived therefrom; the estimates of contingent resources for our oil resource plays at Peace River, northeast Alberta, North Dakota and the Gemini SAGD project, including the volume thereof; development plans for our properties, including number of potential drilling locations, number of wells to be drilled in 2014, initial production rates from new wells and recovery factors; the development potential of our oil sands leases at Angling Lake (Cold Lake) for both primary (cold) and thermal recovery methods; our plans for a SAGD project at Gemini (Angling Lake (Cold Lake)), including the timing of initial production from the pilot project; our plan to expand the waterflood at Carruthers in 2014; our SAGD project at Kerrobert, including the number of potential well pair and infill well drilling locations and well costs; our plan for a commercial waterflood project at Tangleflags; our heavy oil resource play at Peace River, including the resource potential of our undeveloped land, initial production rates from new wells under primary recovery methods and the ability to recover incremental reserves using waterflood and polymer flood recovery methods; our thermal operations at Cliffdale, including our assessment of the production and steam-oil ratio performance of Pad 1, the timing of commencing steam injection at Pad 2 and plans to expand the program and build a central processing facility; our light oil resource play in North Dakota, including our assessment of the number of wells to be drilled, initial production rates from new wells and average recoveries per well; our plan to drill a well in the Weston and Niobrara Counties of

Wyoming and the estimated cost thereof; our expectation regarding the payment of cash income taxes prior to 2015; our working interest production volume for 2014; the existence, operation and strategy of our risk management program; our dividend policy and level; funding sources for development capital expenditures and dividend payments; and the impact of existing and proposed governmental and environmental regulation. Cash dividends on our Common Shares are paid at the discretion of our Board of Directors and can fluctuate. In establishing the level of cash dividends, the Board of Directors considers all factors that it deems relevant, including, without limitation, the outlook for commodity prices, our operational execution, the amount of funds from operations and capital expenditures and our prevailing financial circumstances at the time.

In addition, there are forward looking statements in this Annual Information Form under the heading "Description of Our Business and Operations – Statement of Reserves Data and Other Oil and Gas Information" (as to our reserves and future net revenues from our reserves, pricing and inflation rates, future development costs, the development of our proved undeveloped reserves and probable undeveloped reserves, future development costs, contingent resources, reclamation and abandonment obligations, tax horizon, exploration and development activities and production estimates). Information and statements relating to reserves and resources are deemed to be forward-looking statements, as they involve implied assessment, based on certain estimates and assumptions, that the reserves and resources described exist in quantities predicted or estimated, and that the reserves and resources can be profitably produced in the future.

These forward-looking statements are based on certain key assumptions regarding, among other things: the receipt of regulatory, court and shareholder approvals for the Acquisition; our ability to execute and realize on the anticipated benefits of the acquisition of Aurora; petroleum and natural gas prices and pricing differentials between light, medium and heavy gravity crude oils; well production rates and reserve volumes; our ability to add production and reserves through our exploration and development activities; capital expenditure levels; the receipt, in a timely manner, of regulatory and other required approvals for our operating activities; the availability and cost of labour and other industry services; the amount of future cash dividends that we intend to pay; interest and foreign exchange rates; the continuance of existing and, in certain circumstances, proposed tax and royalty regimes; our ability to develop our crude oil and natural gas properties in the manner currently contemplated; and current industry conditions, laws and regulations continuing in effect (or, where changes are proposed, such changes being adopted as anticipated). Readers are cautioned that such assumptions, although considered reasonable by us at the time of preparation, may prove to be incorrect.

Actual results achieved during the forecast period will vary from the information provided herein as a result of numerous known and unknown risks and uncertainties and other factors. Such factors include, but are not limited to: the acquisition of Aurora may not be completed on the terms contemplated or at all; failure to realize the anticipated benefits of the acquisition of Aurora; closing of the acquisition of Aurora could be delayed or not completed if we are unable to obtain the necessary regulatory, court and shareholder approvals for the Acquisition or any other approvals required for completion or, unless waived, some other condition to closing is not satisfied; failure to put in place a borrowing base facility for Aurora's U.S. subsidiary following completion of the Acquisition; declines in oil and natural gas prices; risks related to the accessibility, availability, proximity and capacity of gathering, processing and pipeline systems; variations in interest rates and foreign exchange rates; risks associated with our hedging activities; uncertainties in the credit markets may restrict the availability of credit or increase the cost of borrowing; refinancing risk for existing debt and debt service costs; a downgrade of our credit ratings; the cost of developing and operating our assets; risks associated with the exploitation of our properties and our ability to acquire reserves; changes in government regulations that affect the oil and gas industry; changes in income tax or other laws or government incentive programs; uncertainties associated with estimating petroleum and natural gas reserves; risks associated with acquiring, developing and exploring for oil and natural gas and other aspects of our operations; risks associated with large projects or expansion of our activities; risks related to heavy oil projects; changes in environmental, health and safety regulations; the implementation of strategies for reducing greenhouse gases; depletion of our reserves; risks associated with the ownership of our securities, including the discretionary nature of dividend payments and changes in market-based factors; risks for United States and other non-resident shareholders, including the ability to enforce civil remedies, differing practices for reporting reserves and production, additional taxation applicable to non-residents and foreign exchange risk; and other factors, many of which are beyond our control.

Readers are cautioned that the foregoing list of risk factors is not exhaustive. New risk factors emerge from time to time, and it is not possible for management to predict all of such factors and to assess in advance the impact of each

such factor on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements. Readers should also carefully consider the matters discussed under the heading "Risk Factors" in this Annual Information Form.

The above summary of assumptions and risks related to forward-looking information in this Annual Information Form has been provided in order to provide Shareholders and potential investors with a more complete perspective on our current and future operations (if the acquisition of Aurora is completed) and such information may not be appropriate for other purposes. There is no representation by us that actual results achieved during the forecast period will be the same in whole or in part as those forecast and we do not undertake any obligation to update publicly or to revise any of the included forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required by applicable securities law. The forward‑looking statements contained in this Annual Information Form are expressly qualified by this cautionary statement.

Contingent Resources

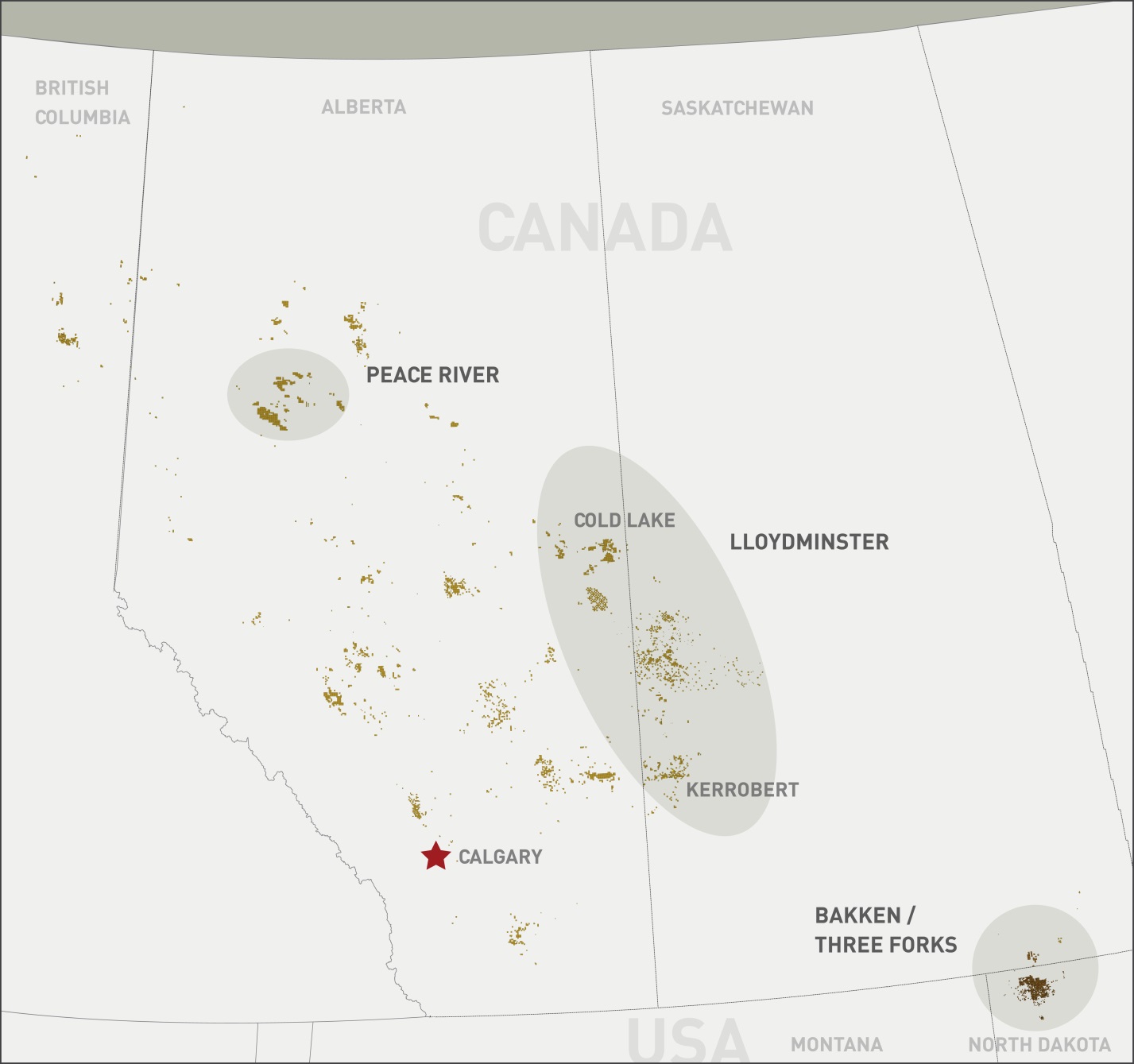

This Annual Information Form contains estimates of the volumes of the "contingent resources" for our oil resource plays in the Bluesky in the Peace River area of Alberta, the Mannville group in northeast Alberta and the Bakken/Three Forks in North Dakota as of December 31, 2013 and for the Gemini SAGD project in Cold Lake, Alberta, as of December 31, 2012. These estimates were prepared by independent qualified reserves evaluators.

"Contingent resources" are not, and should not be confused with, petroleum and natural gas reserves. "Contingent resources" are defined in the COGE Handbook as: "those quantities of petroleum estimated, as of a given date, to be potentially recoverable from known accumulations using established technology or technology under development, but which are not currently considered to be commercially recoverable due to one or more contingencies. Contingencies may include factors such as economic, legal, environmental, political and regulatory matters or a lack of markets. It is also appropriate to classify as contingent resources the estimated discovered recoverable quantities associated with a project in the early evaluation stage."

The outstanding contingencies applicable to our disclosed contingent resources do not include economic contingencies. Economic contingent resources are those resources that are currently economically recoverable based on specific forecasts of commodity prices and costs. The assigned contingent resources are categorized as economically recoverable based on economics completed at year-end 2012.

A range of contingent resources estimates (low, best and high) were prepared by the independent qualified reserves evaluators. A low estimate (C1) is considered to be a conservative estimate of the quantity of the resource that will actually be recovered. It is likely that the actual remaining quantities recovered will exceed the low estimate. Those resources in the low estimate have the highest degree of certainty (a 90% confidence level) that the actual quantities recovered will equal or exceed the estimate. A best estimate (C2) is considered to be the best estimate of the quantity of the resource that will actually be recovered. It is equally likely that the actual remaining quantities recovered will be greater or less than the best estimate. Those resources in the best estimate have a 50% confidence level that the actual quantities recovered will equal or exceed the estimate. A high estimate (C3) is considered to be an optimistic estimate of the quantity of the resource that will actually be recovered. It is unlikely that the actual remaining quantities of resource recovered will equal or exceed the high estimate. Those resources in the high estimate have a lower degree of certainty (a 10% confidence level) that the actual quantities recovered will equal or exceed the estimate.

The primary contingencies which currently prevent the classification of the contingent resources as reserves consist of: preparation of firm development plans, including determination of the specific scope and timing of the project; project sanction; stakeholder and regulatory approvals; access to required services and field development infrastructure; oil prices and price differentials between light, medium and heavy gravity crude oils; future drilling program and testing results; further reservoir delineation and studies; facility design work; limitations to development based on adverse topography or other surface restrictions; and the uncertainty regarding marketing and transportation of petroleum from development areas.

There is no certainty that it will be commercially viable to produce any portion of the contingent resources or that we will produce any portion of the volumes currently classified as contingent resources. The estimates of contingent resources involve implied assessment, based on certain estimates and assumptions, that the resources described exists in the quantities predicted or estimated and that the resources can be profitably produced in the future.

The recovery and resource estimates provided herein are estimates only. Actual contingent resources (and any volumes that may be reclassified as reserves) and future production from such contingent resources may be greater than or less than the estimates provided herein.

Description of Funds from Operations

This Annual Information Form contains references to funds from operations, which does not have any standardized meaning prescribed by Canadian GAAP and may not be comparable to similar measures used by other companies. We define funds from operations as cash flow from operating activities adjusted for financing costs, changes in non-cash operating working capital and other operating items. We believe that this measure assists in providing a more complete understanding of certain aspects of our results of operations and financial performance, including our ability to generate the cash flow necessary to fund future dividends to shareholders and capital investments. However, funds from operations should not be construed as an alternative to traditional performance measures determined in accordance with Canadian GAAP, such as cash flow from operating activities and net income.

For a reconciliation of funds from operations to cash flow from operating activities, see our "Management's Discussion and Analysis of operating and financial results for the year ended December 31, 2013" which is accessible on the SEDAR website at www.sedar.com.

New York Stock Exchange

As a Canadian foreign private issuer listed on the New York Stock Exchange (the "NYSE"), we are not required to comply with most of the NYSE's corporate governance rules and listing standards and instead may comply with domestic corporate governance requirements. The NYSE requires that we disclose any significant ways in which our corporate governance practices differ from those followed by U.S. domestic issuers. We have reviewed the NYSE corporate governance and listing standards applicable to U.S. domestic issuers and confirm that our corporate governance practices do not differ from such standards in any significant way.

Access to Documents

Any document referred to in this Annual Information Form and described as being accessible on the SEDAR website at www.sedar.com (including those documents referred to as being incorporated by reference in this Annual Information Form) may be obtained free of charge from us at Suite 2800, Centennial Place, East Tower, 520 - 3rd Avenue S.W., Calgary, Alberta, Canada, T2P 0R3.

BAYTEX ENERGY CORP.

General

We were incorporated on October 22, 2010 pursuant to the provisions of the ABCA, as an indirect wholly-owned subsidiary of the Trust, for the sole purpose of participating in a plan of arrangement under the ABCA to effect the conversion of the legal structure of the Trust from a trust to a corporation. The Corporate Conversion was implemented as a result of changes to laws regarding the taxation of trusts in Canada that took effect on January 1, 2011.

Pursuant to the Corporate Conversion: (i) on December 31, 2010, holders of Trust Units exchanged their Trust Units for Common Shares on a one-for-one basis; and (ii) on January 1, 2011, the Trust was dissolved and terminated, with the Corporation being the successor to the Trust.

Our head and principal office is located at Suite 2800, Centennial Place, East Tower, 520 – 3rd Avenue S.W., Calgary, Alberta, Canada, T2P 0R3. Our registered office is located at 2400, 525 – 8th Avenue S.W., Calgary, Alberta, Canada, T2P 1G1.

Inter-Corporate Relationships

The following table provides the name, the percentage of voting securities owned by us and the jurisdiction of incorporation, continuance, formation or organization of our subsidiaries either, direct and indirect, as at the date hereof.

|

| | |

| | Percentage of voting securities (directly or indirectly) | Jurisdiction of Incorporation/ Formation |

| Baytex Energy Ltd. | 100% | Alberta |

| Baytex Marketing Ltd. | 100% | Alberta |

| Baytex Commercial Trusts | 100% | Ontario |

| Baytex Energy USA Ltd. | 100% | Colorado |

| Baytex Holdings Limited Partnership | 100% | Alberta |

| Baytex Energy Partnership | 100% | Alberta |

Our Organizational Structure

The following diagram describes the inter-corporate relationships among us and our material subsidiaries.

GENERAL DEVELOPMENT OF OUR BUSINESS

History and Development

In this section, references to "we", "us" and "our" for events occurring prior to January 1, 2011 refer to the Trust and its subsidiaries on a consolidated basis, unless the context requires otherwise.

On December 31, 2010 / January 1, 2011, the Corporate Conversion was completed which resulted in holders of Trust Units exchanging their Trust Units for Common Shares on a one-for-one basis and the dissolution and termination of the Trust, with the Corporation being the successor to the Trust.

On February 3, 2011, we completed the acquisition of heavy oil assets located in the Reno area of northern Alberta and the Lloydminster area of western Saskatchewan. The total consideration for the acquisition of $159.3 million (net of adjustments) was funded by drawing on our Credit Facilities.

On February 17, 2011, we completed a private placement of US$150 million principal amount of 6.75% series B senior unsecured debentures due February 17, 2021. The net proceeds of the offering were used to repay existing indebtedness under the Credit Facilities and for general corporate purposes.

On August 9, 2011, we completed the acquisition of natural gas assets located in the Brewster area of west central Alberta. The total consideration for the acquisition of $22.4 million (net of adjustments) was funded by drawing on our revolving credit facilities.

In the fourth quarter of 2011, we completed two dispositions of primarily undeveloped lands for $47.4 million. In the Kaybob South area of west central Alberta, we sold six sections of leasehold, including five sections with Duvernay rights, for $11.1 million. In the Dodsland area in southwest Saskatchewan, we sold 32,600 net acres of leasehold in the "halo" of the field for $36.3 million.

On May 22, 2012, we completed the sale of our non-operated interests in North Dakota for US$312 million (net of adjustments). The disposed assets included approximately 950 boe/d of Bakken light oil production and 149,700 (50,400 net) acres of land, of which approximately 24% was developed.

On July 19, 2012, we completed a public offering of $300 million principal amount of 6.625% series C senior unsecured debentures due July 19, 2022. The net proceeds of the offering were used to repay existing indebtedness under the Credit Facilities and to fund the redemption effective August 26, 2012 of our 9.15% series A senior unsecured debentures due August 26, 2016 (principal amount $150 million).

On October 3, 2012, we acquired a 100% working interest in 46 sections of undeveloped oil sands leases in the Angling Lake (Cold Lake) area of Northern Alberta. The lands are proximal to our existing Cold Lake heavy oil assets and are prospective for both cold and thermal development. Regulatory approval has been obtained for the construction and operation of a two-stage bitumen recovery scheme using steam-assisted gravity drainage on approximately 2.5 sections of the acquired lands. The total consideration for the acquisition of $120 million was funded by drawing on our Credit Facilities.

On January 31, 2013, we completed the sale of our Viking land rights in the Kerrobert area of southwest Saskatchewan for $42.0 million. The disposed assets included approximately 100 boe/d of production, 22,000 net acres of land and 1.5 million boe of proved plus probable reserves (4% proved developed producing) as at December 31, 2012.

On February 6, 2014, we entered an agreement to acquire all of the ordinary shares of Aurora Oil & Gas Ltd. ("Aurora") for A$4.10 (Australian dollars) per share by way of a scheme of arrangement under Part 5.1 of the Corporations Act 2001 (Australia) (the "Arrangement"). The total purchase price for Aurora is estimated at $2.6 billion (including the assumption of approximately $0.7 billion of indebtedness). Aurora's primary asset is 22,200 net contiguous acres in the Sugarkane Field located in South Texas in the core of the liquids-rich Eagle Ford shale. Aurora's fourth quarter 2013 gross production was 24,678 boe/d (82% liquids) of predominantly light, high-quality crude oil. The Sugarkane Field has been largely delineated with infrastructure in place which is expected to facilitate low-risk future annual production growth. In addition, these assets have significant future reserves upside potential from well downspacing, improving completion techniques and new development targets in additional zones.

The Arrangement is subject to a number of customary closing conditions, including the receipt of required regulatory approvals and court approvals, as well as the approval of the shareholders of Aurora. Regulatory approvals include approval of the Australian Foreign Investment Review Board and the applicable approvals required under the Hart-Scott-Rodino Antitrust Improvements Act of 1976 (the "HSR"), as amended. On March 4, 2014, we received approval from the Federal Trade Commission with respect to the HSR. The Arrangement must be approved by: (i) at least 75% of the votes cast by Aurora shareholders; and (ii) by a majority, in number, of the Aurora shareholders who cast votes. The Arrangement is expected to close in the first half of June 2014.

To finance the acquisition of Aurora, we completed a subscription receipt financing and entered into a commitment letter with a Canadian chartered bank to establish new credit facilities, as described in more detail below.

On February 6, 2014, we entered into an agreement, on a "bought-deal" basis, with a syndicate of underwriters for an offering of 33,420,000 subscription receipts ("Subscription Receipts") at a price of $38.90 per Subscription Receipt with each Subscription Receipt entitling the holder thereof to receive, on closing of the Arrangement, one Common Share for aggregate gross proceeds of approximately $1.3 billion. We granted the underwriters an over-allotment option to purchase, on the same terms, up to an additional 5,013,000 Subscription Receipts. At the closing of the offering on February 24, 2014, we issued 38,433,000 Subscription Receipts for aggregate gross proceeds of approximately $1.5 billion, which have been placed in escrow.

On February 6, 2014, we entered into a commitment letter with a Canadian chartered bank for the provision of new revolving credit facilities in the amount of $1.0 billion (to replace the Credit Facilities of Baytex Energy), new non-revolving facilities consisting of a $200 million two-year facility and a $1.3 billion equity bridge loan and a new borrowing base facility in the amount of US$300 million for a U.S. subsidiary of Aurora (to be established upon closing

of the Arrangement as a replacement for an existing facility). As a result of the completion of the Subscription Receipt financing, the $1.3 billion equity bridge loan is no longer available.

Significant Acquisitions

During the year ended December 31, 2013, we did not complete any acquisitions for which disclosure was required under Part 8 of National Instrument 51-102.

RISK FACTORS

You should carefully consider the following risk factors, as well as the other information contained in this Annual Information Form and our other public filings before making an investment decision. If any of the risks described below materialize, our business, reputation, financial condition, results of operations and cash flow could be materially and adversely affected, which may reduce or restrict our ability to pay dividends to Shareholders and may materially affect the market price of our securities. Additional risks and uncertainties not currently known to us that we currently view as immaterial may also materially and adversely affect us. Residents of the United States and other non-residents of Canada should have additional regard to the risk factors under the heading "- Certain Risks for United States and other non-resident Shareholders".

The information set forth below contains forward-looking statements, which are qualified by the information contained in the section of this Annual Information Form entitled "Special Notes to Reader – Forward-Looking Statements".

Risks Relating to Our Business and Operations

Oil and natural gas prices are volatile; declines in oil and natural gas prices will adversely affect us

Our financial condition is substantially dependent on, and highly sensitive to the prevailing prices of crude oil and natural gas. Significant declines in crude oil or natural gas prices could have a material adverse effect on our operations and financial condition and the value and amount of our reserves.

Prices for crude oil and natural gas fluctuate in response to changes in the supply of, and demand for, crude oil and natural gas, market uncertainty and a variety of additional factors beyond our control. Crude oil prices are primarily determined by international supply and demand. Factors which affect crude oil prices include the actions of the Organization of Petroleum Exporting Countries, the condition of the Canadian, United States, European and Asian economies, government regulation, political stability in the Middle East and elsewhere, the foreign supply of crude oil, the price of foreign imports, the ability to secure adequate transportation for products, the availability of alternate fuel sources and weather conditions. Natural gas prices realized by us are affected primarily in North America by supply and demand, weather conditions, industrial demand, prices of alternate sources of energy and developments related to the market for liquefied natural gas. All of these factors are beyond our control and can result in a high degree of price volatility. Fluctuations in currency exchange rates further compound this volatility when the commodity prices, which are generally set in U.S. dollars, are stated in Canadian dollars.

Our financial performance also depends on revenues from the sale of commodities which differ in quality and location from underlying commodity prices quoted on financial exchanges. Of particular importance are the price differentials between our light/medium oil and heavy oil (in particular the light/heavy differential) and quoted market prices. Not only are these discounts influenced by regional supply and demand factors, they are also influenced by other factors such as transportation costs, capacity and interruptions, refining demand, the availability and cost of diluents used to blend and transport product and the quality of the oil produced, all of which are beyond our control. The supply of Canadian crude oil with demand from the refinery complex and access to those markets through various transportation outlets is currently finely balanced and, therefore, very sensitive to pipeline and refinery outages, which contributes to this volatility.

Fluctuations in the price of commodities and associated price differentials may impact the value of our assets, our ability to maintain our business and to fund growth projects. Prolonged periods of commodity price volatility may also

negatively impact our ability to meet guidance targets and meet all of our financial obligations as they come due. Any substantial or extended decline in these commodity prices may result in a delay or cancellation of existing or future drilling, development or construction programs, or curtailment in production at some properties, result in unutilized long-term transportation commitments and a reduction in the volumes of our reserves.

We conduct assessments of the carrying value of our assets in accordance with Canadian GAAP. If crude oil and natural gas forecast prices decline, the carrying value of property, plant and equipment could be subject to downward revisions, and net earnings could be adversely affected.

The amount of oil and natural gas that we can produce and sell is subject to the accessibility, availability, proximity and capacity of gathering, processing and pipeline systems

We deliver our products through gathering, processing and pipeline systems, some of which we do not own. The lack of access to capacity in any of the gathering, processing and pipeline systems, and in particular the processing facilities, could result in our inability to realize the full economic potential of our production or in a reduction of the price offered for our production. Any significant change in market factors or other conditions affecting these infrastructure systems and facilities, as well as any delays in constructing new infrastructure systems and facilities, could harm our business and, in turn, our financial condition.

Our production is primarily transported through various pipelines and by rail. Access to the pipeline capacity for the transport of crude oil into the United States has become inadequate for the amount of Canadian production being exported to the United States and has recently resulted in significantly lower prices being realized by Canadian producers compared with the WTI price for crude oil. Although pipeline expansions are ongoing, the lack of firm pipeline capacity continues to affect the oil and natural gas industry and limit the ability to produce and to market oil and natural gas production. In addition, the pro-rationing of capacity on inter-provincial pipeline systems also continues to affect the ability to export oil and natural gas. There can be no certainty that investments in pipelines which would result in extra long-term take-away capacity will be made by applicable third party pipeline providers or that the application will receive the required regulatory approval. There is also no certainty that short-term operational constraints on the pipeline system, arising from pipeline interruption and/or increased supply of crude oil, will not occur. There is also no certainty that crude-by-rail transportation and other alternative types of transportation for our production will be sufficient to address any gaps caused by operational constraints on the pipeline system. In addition, our crude-by-rail shipments may be impacted by service delays, inclement weather or derailment and could adversely impact our crude oil sales volumes or the price received for our product. Our product or railcars may be involved in a derailment or incident that results in legal liability or reputational harm. In addition, if new regulation is introduced, including but not limited to the potential amendment of the safety standards for tank cars used to transport crude oil, it could adversely affect our ability to ship crude oil by rail or the economics associated with rail transportation.

A portion of our production may, from time to time, be processed through facilities owned by third parties and which we do not have control of. From time to time these facilities may discontinue or decrease operations either as a result of normal servicing requirements or as a result of unexpected events. A discontinuance or decrease of operations could materially adversely affect our ability to process our production and to deliver the same for sale.

Variations in interest rates and foreign exchange rates could adversely affect our financial condition

There is a risk that the interest rates will increase given the current historical low level of interest rates. An increase in interest rates could result in a significant increase in the amount we pay to service debt and could have an adverse affect on our financial condition, results of operations and future growth, potentially resulting in a decrease in dividends to Shareholders and/or the market price of the Common Shares.

World oil prices are quoted in United States dollars and the price received by Canadian producers is therefore affected by the Canada/U.S. foreign exchange rate that may fluctuate over time. A material increase in the value of the Canadian dollar may negatively impact our revenues and our ability to maintain dividends to Shareholders in the future. Future Canada/U.S. foreign exchange rates could also impact the future value of our reserves as determined by our independent evaluator.

A decline in the value of the Canadian dollar relative to the United States dollar provides a competitive advantage to United States companies in acquiring Canadian oil and gas properties and may make it more difficult for us to replace reserves through acquisitions.

Our hedging activities may negatively impact our income and our financial condition

In response to fluctuations in commodity prices, foreign exchange and interest rates, we may utilize various derivative financial instruments and physical sales contracts to manage our exposure under a defined hedging program. We also use derivative instruments in various operational markets to optimize our supply or production chain. The terms of these arrangements may limit the benefit to us of favourable changes in these factors and may also result in royalties being paid on a reference price which is higher than the hedged price. We may also suffer financial loss due to hedging arrangements if we are unable to produce oil or natural gas to fulfill our delivery obligations. There is also increased exposure to counterparty credit risk. For more information in relation to our commodity hedging program, see "Description of Our Business and Operations - Statement of Reserves Data and Other Oil and Natural Gas Information – Other Oil and Gas Information – Forward Contracts".

Uncertainty in the credit markets may restrict the availability or increase the cost of borrowing required for future development and acquisitions

The future development of our business may be dependent on our ability to obtain additional capital including, but not limited to, debt and equity financing. Unpredictable financial markets and the associated credit impacts may impede our ability to secure and maintain cost effective financing and limit our ability to achieve timely access to capital markets on acceptable terms and conditions. If external sources of capital become limited or unavailable, our ability to make capital investments, continue our business plan, meet all of our financial obligations as they come due and maintain existing properties may be impaired. Should the lack of financing and uncertainty in the capital markets adversely impact our ability to refinance debt, additional equity may be issued resulting in a dilutive effect on current and future Shareholders.

Our ability to obtain additional capital is dependent on, among other things, interest in investments in the energy industry in general and interest in our securities in particular and our ability to maintain our credit ratings. If we are unable to maintain our indebtedness and financial ratios at levels acceptable to our credit rating agencies, or should our business prospects deteriorate, our credit ratings could be downgraded, which would adversely affect the value of our outstanding securities and existing debt and our ability to obtain new financing and may increase our borrowing costs.

Our bank credit facilities will need to be renewed prior to June 14, 2017 and failure to renew, in whole or in part, or higher interest charges will adversely affect our financial condition

Our existing Credit Facilities and any replacement credit facilities may not provide sufficient liquidity. The amounts available under our existing Credit Facilities may not be sufficient for future operations, or we may not be able to obtain additional financing on economic terms attractive to us, if at all. We currently have Credit Facilities in the amount of $850 million. In the event that the Credit Facilities are not extended before June 14, 2017, indebtedness under the Credit Facilities will be repayable on June 14, 2017. The interest charged on the Credit Facilities is calculated based on a sliding scale ratio of our debt to earnings ratio. Repayment of all outstanding amounts under the Credit Facilities may be demanded on relatively short notice if an event of default occurs, which is continuing. If this occurs, we may need to obtain alternate financing. Any failure to obtain suitable replacement financing may have a material adverse affect on our business, and dividends to Shareholders may be materially reduced. There is also a risk that the Credit Facilities will not be renewed for the same amount or on the same terms.

As at December 31, 2013, our outstanding indebtedness included US$150 million of 2021 Debentures which mature on February 17, 2021 and $300 million of 2022 Debentures which mature on July 19, 2022. We intend to fund these debt maturities with our existing Credit Facilities. In the event we are unable to refinance our debt obligations, it may impact our ability to fund our ongoing operations and to pay dividends.

We are required to comply with covenants under the Credit Facilities and the Debentures. In the event that we do not comply with these covenants, our access to capital could be restricted or repayment could be required on an accelerated basis by our lenders, and the ability to pay dividends to our Shareholders may be restricted. The lenders under the Credit Facilities have security over substantially all of our assets. If we become unable to pay our debt service charges or otherwise commit an event of default, such as breach of the financial covenants specified in the Credit Facilities, the lenders under the Credit Facilities may foreclose on or sell our working interests in our properties.

Amounts paid in respect of interest and principal on debt may reduce dividends to Shareholders. Variations in interest rates and scheduled principal repayments could result in significant changes in the amount required to be applied to debt service before payment of dividends. Certain covenants in the agreements with our lenders under the Credit Facilities and the holders of the Debentures may also limit dividends. Although we believe the Credit Facilities will be sufficient for our immediate requirements, there can be no assurance that the amount will be adequate for our future financial obligations, including our future capital expenditure program, or that we will be able to obtain additional funds.

From time to time we may enter into transactions which may be financed in whole or in part with debt. The level of our indebtedness from time to time could impair our ability to obtain additional financing on a timely basis to take advantage of business opportunities that may arise.

Our financial performance is significantly affected by the cost of developing and operating our assets.

Our development and operating costs are affected by a number of factors including, but not limited to: inflationary price pressure, scheduling delays, failure to maintain quality construction standards, and supply chain disruptions, including access to skilled labour. Natural gas, electricity, water, diluent, chemicals, supplies, reclamation, abandonment and labour costs are examples of operating and other costs that are susceptible to significant fluctuation.

Our ability to add to our oil and natural gas reserves is highly dependent on our success in exploiting existing properties and acquiring additional reserves

Our long-term commercial success depends on our ability to find, acquire, develop and commercially produce oil and natural gas reserves. Future oil and natural gas exploration may involve unprofitable efforts, not only from unsuccessful wells, but also from wells that are productive but do not produce sufficient petroleum substances to return a profit. Completion of a well does not assure a profit on the investment. Drilling hazards or environmental damage could greatly increase the cost of operations, and various field operating conditions may adversely affect the production from successful wells. These conditions include delays in obtaining governmental approvals or consents, shut-ins of connected wells resulting from extreme weather conditions, insufficient storage or transportation capacity or other geological and mechanical conditions. While diligent well supervision and effective maintenance operations can contribute to maximizing production rates over time, production delays and declines from normal field operating conditions cannot be eliminated and can be expected to adversely affect revenue and cash flow levels to varying degrees. New wells we drill or participate in may not become productive and we may not recover all or any portion of our investment in wells we drill or participate in.

Changes in government regulations that affect the oil and gas industry, or failing to comply with such regulations, could adversely affect us

The oil and gas industry is subject to extensive controls and regulations governing its operations (including land tenure, exploration, development, production, refining, transportation, and marketing) imposed by legislation enacted by various levels of government and with respect to pricing and taxation of oil and natural gas by agreements among the governments of Canada, Alberta, British Columbia, Saskatchewan, the United States, North Dakota and Wyoming, all of which should be carefully considered by investors in the oil and gas industry. See "Industry Conditions". All of such controls, regulations and legislation are subject to revocation, amendment or administrative change, some of which have historically been material and in some cases materially adverse and there can be no assurance that there will not be further revocation, amendment or administrative change which will be materially adverse to our assets, reserves, financial condition or results of operations or prospects and our ability to maintain dividends to Shareholders.

The oil and gas industry is also subject to regulation by governments in such matters as the awarding or acquisition of exploration and production rights, oil sands or other interests, the imposition of specific drilling obligations, environmental protection controls, control over the development and abandonment of fields (including restrictions on production) and possibly expropriation or cancellation of contract rights.

We rely on fresh water, which is obtained under government licenses to provide domestic and utility water for certain of our operations. There can be no assurance that the licenses to withdraw water will not be rescinded or that additional conditions will not be added to these licenses. There can be no assurance that we will not have to pay a fee for the use of water in the future or that any such fees will be reasonable. In addition, new projects or the expansion of existing projects may be dependent on securing licenses for additional water withdrawal, and there can be no assurance that these licenses will be granted on terms favourable to us, or at all, or that such additional water will in fact be available to divert under such licenses.

We use hydraulic fracturing in our operations. With the increase in the use of fracture stimulations in horizontal wells there is increased communication between the oil and natural gas industry and a wider variety of stakeholders regarding the responsible use of this technology as it relates to the environment. This increased attention to fracture stimulations may result in increased regulation or changes of law which may make the conduct of our business more expensive or prevent us from conducting our business as currently conducted. Any new laws, regulation or permitting requirements regarding hydraulic fracturing could lead to operational delay or increased operating costs or third party or governmental claims, and could increase our costs of compliance and doing business as well as delay the development of oil and natural gas resources from shale formations which are not commercial without the use of hydraulic fracturing. Restrictions on hydraulic fracturing could also reduce the amount of oil and natural gas that we are ultimately able to produce from our reserves.

Other government regulations may change from time to time in response to economic or political conditions. The exercise of discretion by governmental authorities under existing regulations, the implementation of new regulations or the modification of existing regulations affecting the oil and gas industry could reduce demand for crude oil and natural gas, increase our costs, or delay or restrict our operations, all of which would have a material adverse affect on us. In addition, failure to comply with government regulations may result in the suspension or termination of operations and subject us to liabilities and administrative, civil and criminal penalties. Compliance costs can be significant.

Income tax laws or other laws or government incentive programs or regulations relating to our industry may in the future be changed or interpreted in a manner that adversely affects us and our Shareholders

We file all required income tax returns and believe that we are in full compliance with the applicable tax legislation. However, such returns are subject to reassessment by the applicable taxation authority. In the event of a successful reassessment of us, whether by re-characterization of exploration and development expenditures or otherwise, such reassessment may have an impact on current and future taxes payable.

Income tax laws, other laws or government incentive programs relating to the oil and gas industry, such as resource allowance, may in the future be changed or interpreted in a manner that adversely affects us and our Shareholders. Tax authorities having jurisdiction over us or our Shareholders may disagree with the manner in which we calculate our income for tax purposes or could change their administrative practices to our detriment or the detriment of our Shareholders.

We cannot assure you that income tax laws and government incentive programs relating to the oil and gas industry generally will not change in a manner that adversely affects the market price of the Common Shares.

There are numerous uncertainties inherent in estimating quantities of recoverable oil and natural gas reserves, including many factors beyond our control

The reserves estimates included in this Annual Information Form are estimates only. There are numerous uncertainties inherent in estimating quantities of reserves, including many factors beyond our control. In general, estimates of economically recoverable oil and natural gas reserves and the future net revenues therefrom are based upon a number of factors and assumptions made as of the date on which the reserves estimates were determined, such as geological and engineering estimates which have inherent uncertainties, the assumed effects of regulation by governmental agencies, historical production from the properties, initial production rates, production decline rates, the availability, proximity and capacity of oil and gas gathering systems, pipelines and processing facilities and estimates of future commodity prices and capital costs, all of which may vary considerably from actual results.

All such estimates are, to some degree, uncertain and classifications of reserves are only attempts to define the degree of uncertainty involved. For these reasons, estimates of the economically recoverable oil and natural gas reserves attributable to any particular group of properties, the classification of such reserves based on risk of recovery and estimates of future net revenues expected therefrom, prepared by different engineers or by the same engineers at different times, may vary substantially. Our actual production, revenues, royalties, taxes and development, abandonment and operating expenditures with respect to our reserves will likely vary from such estimates, and such variances could be material.

Estimates of reserves that may be developed and produced in the future are often based upon volumetric calculations and upon analogy to similar types of reserves, rather than upon actual production history. Subsequent evaluation of the same reserves based upon production history will result in variations in the previously estimated reserves.

If we fail to acquire, develop or find additional crude oil and natural gas reserves, our reserves and production will decline materially from their current levels and therefore our business, financial condition, results of operations and cash flows are highly dependent upon successfully producing current reserves and acquiring, discovering or developing additional reserves.

The contingent resources volumes included in this Annual Information Form are estimates only. The same uncertainties inherent in estimating quantities of reserves apply to estimating quantities of contingent resources. In addition, there are contingencies that prevent contingent resources from being classified as reserves. There is no certainty that it will be commercially viable to produce any portion of the contingent resources. Actual results may vary significantly from these estimates and such variances could be material.

Acquiring, developing and exploring for oil and natural gas involves many hazards. We have not insured and cannot fully insure against all risks related to our operations

Our crude oil and natural gas operations are subject to all of the risks normally incidental to: (i) the storing, transporting, processing, refining and marketing of crude oil, natural gas and other related products; (ii) drilling and completion of crude oil and natural gas wells; and (iii) the operation and development of crude oil and natural gas properties, including, but not limited to: encountering unexpected formations or pressures; premature declines of reservoir pressure or productivity; blowouts; fires; explosions; equipment failures and other accidents; gaseous leaks; uncontrollable flows of crude oil, natural gas or well fluids; migration of harmful substances; oil spills; corrosion; adverse weather conditions; pollution; acts of vandalism and terrorism; and other environmental risks.

Although we maintain insurance in accordance with customary industry practice, we are not fully insured against all of these risks nor are all such risks insurable and in certain circumstances we may elect not to obtain insurance to deal with specific risks due to the high premiums associated with such insurance or other reasons. In addition, the nature of these risks is such that liabilities could exceed policy limits, in which event we could incur significant costs that could have a material adverse effect on our business, financial condition, results of operations, prospects and our ability to maintain dividends to Shareholders.

We are subject to a number of additional business risks which could adversely affect our income and financial condition

Our business involves many operating risks related to acquiring, developing and exploring for oil and natural gas which even a combination of experience, knowledge and careful evaluation may not be able to overcome. Our operational risks include, but are not limited to: operational and safety considerations; pipeline transportation and interruptions; reservoir performance and technical challenges; partner risks; competition; technology; land claims; our ability to hire and retain necessary skilled personnel; the availability of drilling and related equipment; information systems; seasonality and access restrictions; timing and success of integrating the business and operations of acquired assets and companies; phased growth execution; risk of litigation, regulatory issues, increases in government taxes and changes to royalty or mineral/severance tax regimes; and risk to our reputation resulting from operational activities that may cause personal injury, property damage or environmental damage.

We may participate in larger projects and may have more concentrated risk in certain areas of our operations

We have a variety of exploration, development and construction projects underway at any given time. Project delays may result in delayed revenue receipts and cost overruns may result in projects being uneconomic. Our ability to complete projects is dependent on general business and market conditions as well as other factors beyond our control, including the availability of skilled labour and manpower, the availability and proximity of pipeline capacity and rail terminals, weather, environmental and regulatory matters, ability to access lands, availability of drilling and other equipment and supplies, and availability of processing capacity.

Our heavy oil projects face additional risks compared to conventional oil and gas production

Some of our heavy oil projects are capital intensive projects which rely on specialized production technologies. Certain current technologies for the recovery of heavy oil, such as cyclic steam stimulation and steam-assisted gravity drainage, are energy intensive, requiring significant consumption of natural gas and other fuels in the production of steam that is used in the recovery process. The amount of steam required in the production process varies and therefore impacts costs. The performance of the reservoir can also affect the timing and levels of production using new technologies. A large increase in recovery costs could cause certain projects that rely on cyclic steam stimulation, steam-assisted gravity drainage or other new technologies to become uneconomic, which could have an adverse affect on our financial condition. There are risks associated with growth and other capital projects that rely largely or partly on new technologies and the incorporation of such technologies into new or existing operations. The success of projects incorporating new technologies cannot be assured.

The operating costs of our heavy oil projects have the potential to vary considerably throughout the operating period and will be significant components of the cost of production of any petroleum products produced. Project economics and our overall earnings may be reduced if increases in operating costs are incurred. Factors which could affect operating costs include, without limitation: labor costs; the cost of catalyst and chemicals; the cost of natural gas and electricity; power outages; produced sand causing issues of erosion, hot spots and corrosion; reliability of and maintenance cost of facilities; the cost to transport sales products; and the cost to dispose of certain by-products.

The oil and gas industry is highly regulated and changes in environmental, health and safety regulations may impose restrictions or costs on our business which may adversely affect our financial condition and our ability to maintain dividends

All phases of our operations are subject to environmental, health and safety regulation pursuant to a variety of Canadian, U.S. and other federal, provincial, territorial, state and municipal laws and regulations (collectively, "environmental regulations"). Environmental regulations require that wells, facility sites, refineries and other properties associated with our operations be constructed, operated, maintained, abandoned and reclaimed to the satisfaction of applicable regulatory authorities. In addition, certain types of operations, including exploration and development projects and changes to certain existing projects, may require the submission and approval of environmental impact assessments or permit applications. Environmental regulations impose, among other things, restrictions, liabilities and obligations in connection with the generation, handling, use, storage, transportation, treatment and disposal of hazardous substances

and waste and in connection with spills, releases and emissions of various substances to the environment. It also imposes restrictions, liabilities and obligations in connection with the management of fresh or potable water sources that are being used, or whose use is contemplated, in connection with oil and gas operations. Alberta, Saskatchewan and British Columbia have developed liability management programs designed to prevent taxpayers from incurring costs associated with suspension, abandonment, remediation and reclamation of wells, facilities and pipelines in the event that a licensee or permit holder becomes defunct. These programs generally involve an assessment of the ratio of a licensee's deemed assets to deemed liabilities. If a licensee's deemed liabilities exceed its deemed assets, a security deposit is required. Changes of the ratio of our deemed assets to deemed liabilities or changes to the requirements of liability management programs may result in significant increases to the security that must be posted.

Compliance with environmental regulations can require significant expenditures, including expenditures for clean-up costs and damages arising out of contaminated properties and failure to comply with environmental regulations may result in the imposition of fines or issuance of clean up orders in respect of us or our properties, some of which may be material. We may also be exposed to civil liability for environmental matters or for the conduct of third parties, including private parties commencing actions and new theories of liability, regardless of negligence or fault. Although it is not expected that the costs of complying with environmental regulations will have a material adverse affect on our financial condition or results of operations, no assurance can be made that the costs of complying with environmental regulations in the future will not have such an effect. The implementation of new regulations or the modification of existing regulations affecting the oil and gas industry generally could reduce demand for crude oil and natural gas, result in stricter standards and enforcement, larger fines and liability, and increased capital expenditures and operating costs, which could have a material adverse affect on our financial condition or results of operations and prospects. See "Industry Conditions – Environmental Regulation".

Development of the Alberta oil sands has received considerable attention in recent public commentary on the subjects of environmental impact, climate change and greenhouse gas emissions. Despite the fact that much of the focus is on bitumen mining operations and not in-situ production, public concerns about greenhouse gas emissions and water and land use practices in oil sands developments may, directly or indirectly, impair the profitability of our current oil sands projects, and the viability of future oil sands projects, by creating significant regulatory uncertainty leading to uncertain economic modeling of current and future projects and delays relating to the sanctioning of future projects. Negative consequences which could arise as a result of changes to the current regulatory environment include, but are not limited to, extraordinary environmental and emissions regulation of current and future projects by governmental authorities, which could result in changes to facility design and operating requirements, thereby potentially increasing the cost of construction, operation and abandonment. In addition, legislation or policies that limit the purchase of crude oil or bitumen produced from the oil sands may be adopted in domestic and/or foreign jurisdictions, which, in turn, may limit the world market for this crude oil and reduce its price.

In addition to regulatory requirements pertaining to the production, marketing and sale of oil and natural gas mentioned above, our business and financial condition could be influenced by federal legislation affecting, in particular, foreign investment, through legislation such as the Competition Act (Canada) and the Investment Canada Act (Canada).

The implementation of strategies for reducing greenhouse gases may impose restrictions or costs on our business which may adversely affect our financial condition and our ability to maintain dividends

Our exploration and production facilities and other operations and activities emit greenhouse gases which may require us to comply with greenhouse gas emissions legislation that is enacted in jurisdictions where we have operations. Climate change policy is evolving at regional, national and international levels, and political and economic events may significantly affect the scope and timing of climate change measures that are ultimately put in place. As a signatory to the United Nations Framework Convention on Climate Change (the "UNFCCC") and a participant to the Copenhagen Agreement (a non-binding agreement created by the UNFCCC), the Government of Canada announced on January 29, 2010 that it will seek a 17% reduction in greenhouse gas emissions from 2005 levels by 2020. These greenhouse gas emission reduction targets are not binding, however.

Some of our significant facilities may ultimately be subject to future regional, provincial, state and/or federal climate change regulations to manage greenhouse gas emissions. The direct or indirect costs of compliance with these regulations

may have a material adverse effect on our business, financial condition, results of operations and prospects. Given the evolving nature of the debate related to climate change and the control of greenhouse gases and resulting requirements, it is not possible to predict either the nature of those requirements or the impact on us and our operations and financial condition.

Although we provide for the necessary amounts in our annual capital budget to fund our currently estimated environmental and reclamation obligations, there can be no assurance that we will be able to satisfy our actual future environmental and reclamation obligations from such funds. For more information on the evolution and status of climate change and related environmental legislation, see "Industry Conditions – Climate Change Regulation".

Our oil and natural gas reserves are a depleting resource and decline as such reserves are produced

Our future oil and natural gas reserves and production, and therefore our funds from operations, will be highly dependent on our success in exploiting our reserves base and acquiring additional reserves. Without reserves additions through exploration, acquisition or development activities, our reserves and production may decline over time as reserves are produced. The business of exploring for, developing or acquiring reserves is capital intensive.

There is no assurance we will be successful in developing additional reserves or acquiring additional reserves on terms that meet our investment objectives. Without these reserves additions, our reserves will deplete and as a consequence, either production from, or the average reserves life of, our properties will decline, which will result in a reduction in the value of Common Shares and in a reduction in funds from operations available for dividends to Shareholders.

We also distribute a significant proportion of our funds from operations to Shareholders rather than reinvesting in reserves additions. Accordingly, if external sources of capital become limited or unavailable on commercially reasonable terms, our ability to make the necessary capital investments to maintain or expand our oil and natural gas reserves may be impaired. In addition, we may be unable to find and develop or acquire additional reserves to replace our crude oil and natural gas production at acceptable costs.

Risks Relating to Ownership of our Securities

Our Board of Directors has discretion in the payment of dividends and may choose not to maintain dividends in certain circumstances

The amount of future cash dividends, if any, will be subject to the discretion of our Board of Directors and may vary depending on a variety of factors and conditions existing from time to time, including fluctuations in commodity prices, production levels, capital expenditure requirements, debt service requirements, operating costs, royalty burdens, foreign exchange rates and the satisfaction of the liquidity and solvency tests imposed by the ABCA for the declaration and payment of dividends. Depending on these and various other factors, many of which will be beyond the control of our Board of Directors and management team, we will change our dividend policy from time to time and, as a result, future cash dividends could be reduced or suspended entirely. The market value of our Common Shares may deteriorate if we reduce or suspend the amount of the cash dividends that we pay in the future and such deterioration may be material. Furthermore, the future treatment of dividends for tax purposes will be subject to the nature and composition of our dividends and potential legislative and regulatory changes.

Dividends may be reduced during periods of lower funds from operations, which result from lower commodity prices and the decision by us to finance capital expenditures using funds from operations. A reduction in dividends could also negatively affect the market price of the Common Shares.

Production and development costs incurred with respect to properties, including power costs and the costs of injection fluids associated with tertiary recovery operations, reduce the income that we receive and, consequently, the amounts we can distribute to our Shareholders.

The timing and amount of capital expenditures will directly affect the amount of income available to pay dividends to our Shareholders. Dividends may be reduced, or even eliminated, at times when significant capital or other expenditures

are planned. To the extent that external sources of capital, including the issuance of additional Common Shares, become limited or unavailable, our ability to make the necessary capital investments to maintain or expand oil and natural gas reserves and to invest in assets, as the case may be, will be impaired. To the extent that we are required to use funds from operations to finance capital expenditures or property acquisitions, the cash we receive will be reduced, resulting in reductions to the amount of cash we are able to distribute to our Shareholders. A reduction in the amount of cash distributed to Shareholders may negatively affect the market price of the Common Shares.