NOTICE OF ANNUAL AND SPECIAL MEETING OF SHAREHOLDERS

TO BE HELD ON MAY 2, 2019

AND

INFORMATION CIRCULAR - PROXY STATEMENT

DATED MARCH 14, 2019

|

| | | | |

These materials are important and require your immediate attention. If you have questions or require assistance with voting your shares, you may contact Baytex's proxy solicitation agent:

Laurel Hill Advisory Group North American Toll-Free Number: 1-877-452-7184 Collect Calls Outside North America: 1-416-304-0211 Email: assistance@laurelhill.com

|

YOUR VOTE IS IMPORTANT. PLEASE VOTE YOUR PROXY TODAY.

LETTER TO SHAREHOLDERS

March 14, 2019

Dear Fellow Shareholders:

On behalf of the Board of Directors, I am pleased to invite you to our 2019 annual and special meeting of shareholders. It will be held at 3:00 p.m. (Calgary time) on Thursday, May 2, 2019 at the Calgary Petroleum Club.

This past year has been transformational as Baytex executed a strategic combination with Raging River Exploration Inc. We have now repositioned our company as a top-tier North American oil producer with a strengthened balance sheet and an impressive suite of high quality assets. As part of this combination, I was pleased to take on the role of Chairman and, as a result, this will mark my first shareholder meeting as Chairman of Baytex.

The Board of Directors is committed to delivering returns to shareholders, paying particular attention to value creation and board governance - areas that are fundamental to Baytex’s sustainability and future success. With this in mind, as you review our information circular, I would like to highlight some of our practices and some of the notable changes we have made this year.

BOARD STRUCTURE AND GOVERNANCE

Board refreshment:

| |

| • | reduced the number of director nominees to eight (we currently have ten directors) |

| |

| • | appointment of a new Lead Independent Director, new chair of the Human Resources and Compensation Committee and new chair of the Nominating and Governance Committee |

| |

| • | we have no "over-boarded" directors |

| |

| • | board refreshment changes were a result of a post-merger board self evaluation process |

Independent structure:

| |

| ▪ | all of our committees, including committee chairs, are comprised entirely of independent directors |

| |

| ▪ | appointed a Lead Independent Director |

| |

| ▪ | board and board committee meetings include in camera sessions |

Diversity:

| |

| ▪ | Trudy Curran has been appointed chair of our Nominating and Governance Committee |

| |

| ▪ | one female director nominee |

| |

| ▪ | we have also established a written target of 20% for the representation of women on our board by year-end 2020 |

In connection with the changes to our Board, both Ray Chan and Gary Bugeaud decided to not stand for election as directors this year. I would like to thank Ray for his 20 plus years of service to Baytex, Gary for his 15 year involvement with Raging River and my predecessor companies and both of them for their efforts in bringing about the combination of Baytex and Raging River.

COMPENSATION

At our 2018 annual meeting, 75.38% of voting shareholders voted in favour of accepting our approach to executive compensation. We want to do better. Given the foregoing, some of the changes and decisions we made in 2018 regarding compensation are highlighted below.

Compensation Policy and Program changes:

| |

| ▪ | adopted a clawback policy for executive officers |

| |

| • | for 2019, revised the performance factors used to: |

| |

| ◦ | establish our annual bonus pool |

| |

| ◦ | determine the multiplier for our performance share awards |

| |

| ◦ | assess our President and CEO |

| |

| ▪ | changed how the multiplier is calculated for our performance share awards to create greater alignment between shareholder returns and the multiplier applied to our performance awards |

| |

| • | amended our share award incentive plan to: |

| |

| ◦ | make share awards subject to a double trigger in the event of a change of control |

| |

| ◦ | extended the vesting of our share awards to 1/3 per year (instead of 1/6 every six months) |

Compensation Decisions:

| |

| ▪ | used our discretion to deem the Raging River merger to not be a change of control under our Share Award Incentive Plan and, as a result, did not vest our outstanding share awards |

| |

| ▪ | used our discretion to reduce the corporate performance factor score used to determine the annual bonus pool (to 85% from 120%) |

| |

| ▪ | for the fourth consecutive year held Named Executive Officer salaries flat |

•continued to drive our cost structure lower

| |

| ◦ | per unit G&A costs improved to $1.56/boe in 2018, as compared to $1.85/boe in 2017 |

| |

| ◦ | executive team was reduced from 21 (Baytex and Raging River combined) at year-end 2017, to 14 following the merger and then 11 by year-end 2018 |

| |

| ◦ | employee headcount reduced from 289 (Baytex and Raging River combined) at year-end 2017 to 242 by year-end 2018 |

| |

| • | reduced Chairman of the Board annual retainer from $260,000 to $125,000 and the value of the annual director share award grants from $150,000 per year to $125,000 |

LOOKING AHEAD

The Raging River combination has repositioned our business, with a strengthened balance sheet and tremendous assets, we are set up for success. We have significantly refreshed our board and made improvements to our compensation programs, but we are not done. We will continue to review our programs and make changes that we think will further our primary goal - shareholder returns.

If you wish to provide input on our governance and compensation practices, we would welcome your feedback. You can contact us by writing to Baytex Energy, 2800, 520 3rd Avenue S.W., Calgary, Alberta, T2P 0R3, by email at investor@baytexenergy.com or by telephone at 1-800-524-5521.

Your vote is important. Please take some time to read the attached management proxy circular before you decide how to vote your shares.

Sincerely,

Neil J. Roszell

Chairman of the Board

TABLE OF CONTENTS

|

| |

| Solicitation of Proxies | |

| Advice to Beneficial Holders of Common Shares | |

| Notice-and-Access | |

| Revocability of Proxy | |

| Persons Making the Solicitation | |

| Exercise of Discretion by Proxy | |

| Voting Shares and Principal Holders Thereof | |

| Quorum for Meeting | |

| Approval Requirements | |

| Matters to be Acted Upon at the Meeting | |

| Election of Directors | |

| Appointment of Auditors | |

| Advisory Vote on Executive Compensation | |

| Approval of Unallocated Awards under the Share Award Incentive Plan | |

| Director Compensation | |

| Compensation Discussion and Analysis | |

| How We Compensate Our Executives | |

| How We Measure Performance | |

| 2018 Compensation Decisions | |

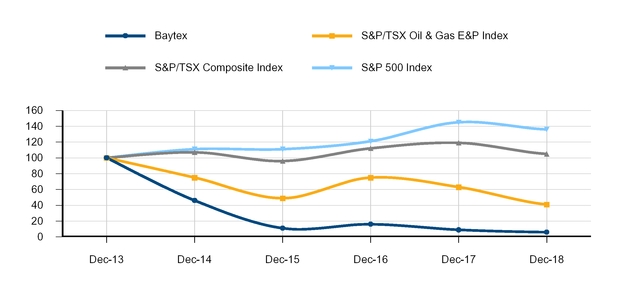

| Performance Graph | |

| Supplemental Information about our Compensation Programs | |

| Executive Compensation | |

| Securities Authorized for Issuance Under Equity Compensation Plans | |

| Equity Ownership | |

| Ownership Guidelines | |

| Statement of Corporate Governance Practices | |

| Interest of Informed Persons in Material Transactions | |

| Interest of Certain Persons and Companies in Matters to be Acted Upon | |

| Additional Information | |

| Other Matters | |

| | |

| Schedule A - Board of Directors – Mandate and Terms of Reference | |

| Schedule B - Legacy Long Term Incentive Plans | |

| Schedule C - Advisory Statements | |

NOTICE OF MEETING OF SHAREHOLDERS

|

| | | | | |

| MEETING INFORMATION | | | AGENDA |

| Date: | Thursday May 2, 2019 | | | 1. To receive and consider our consolidated financial statements for the year ended December 31, 2018, together with the report of the auditors. |

| | | | |

| Time: | 3:00 p.m. | | | 2. Elect eight (8) directors. |

| | (Calgary time) | | | 3. Appoint the auditors and authorize the directors to fix their remuneration. |

| | | | |

| Place: | Devonian Room | | | 4. Consider a non-binding advisory resolution to accept our approach to executive compensation. |

| | Calgary Petroleum Club | | |

| | 319 - 5th Avenue SW | | | 5. Consider a resolution to approve the unallocated awards under our Share Award Incentive Plan. |

| | Calgary, Alberta | | |

| | | | | 6. Transact such other business as may properly be brought before the meeting or any adjournment thereof. |

| | | | |

The specific details of the matters proposed to be put before the meeting (including the full text of the resolutions) are set forth in the information circular - proxy statement accompanying this notice.

If you are unable to attend the meeting in person, we request that you complete, date and sign the form of proxy and return it by mail, hand delivery, or fax to our transfer agent, Computershare Trust Company of Canada, as follows:

|

| | | |

| | BENEFICIAL SHAREHOLDERS | | REGISTERD SHAREHOLDERS |

| | Shares held with a broker, bank or other intermediary | | Shares held in own name and represented by a physical certificate |

| INTERNET | www.proxyvote.com | | www.investorvote.com |

| TELEPHONE OR FAX | Call or fax to the number(s) listed on your voting instruction form | | Phone: 1-866-732-8683 Fax: 1-866-249-7775 |

| MAIL | Return the voting instruction form in the enclosed postage paid envelope | | Return the form of proxy in the enclosed postage paid envelope |

A vote submitted via the internet must be received by 3:00 p.m. (Calgary time) on April 30, 2019 or at least 48 hours prior to the time of any adjournment of the meeting. See the information circular - proxy statement for further instructions on internet voting.

In order to be valid and acted upon at the meeting, forms of proxy must be returned to the aforesaid address or fax number not less than 48 hours before the time for holding the meeting or any adjournment thereof. Registered shareholders may also vote via the internet at https://investorvote.com/.

Only shareholders of record at the close of business on March 14, 2019 will be entitled to vote at the meeting, unless that shareholder has transferred any shares subsequent to that date and the transferee shareholder, not later than ten days before the meeting, establishes ownership of the shares and demands that the transferee's name be included on the list of shareholders entitled to vote at the meeting.

DATED at Calgary, Alberta, this 14th day of March, 2019.

By order of the Board of Directors

Sincerely,

Edward D. Lafehr

President and Chief Executive Officer

BAYTEX ENERGY CORP.

Information Circular - Proxy Statement

for the Annual and Special Meeting to be held on Thursday, May 2, 2019

SOLICITATION OF PROXIES

This information circular - proxy statement is furnished in connection with the solicitation of proxies for use at the annual and special meeting of the shareholders of Baytex Energy Corp. to be held at 3:00 p.m. (Calgary time) on Thursday, May 2, 2019 in the Devonian Room of the Calgary Petroleum Club, 319 - 5th Avenue S.W., Calgary, Alberta and at any adjournment thereof. In this information circular - proxy statement, references to "Baytex", "we", "us", "our" and the "Corporation" refer to Baytex Energy Corp., references to "Baytex Energy" refer to our wholly-owned subsidiary, Baytex Energy Ltd.

Forms of proxy must be deposited with Computershare Trust Company of Canada by mail or courier at 8th Floor, 100 University Avenue, Toronto, Ontario, M5J 2Y1, Attention: Proxy Department or by fax to 1-866-249-7775 (outside North America to 1-416-263-9524) not less than 48 hours before the time for holding the meeting or any adjournment thereof. Registered shareholders may also vote via the internet at www.investorvote.com/. Shareholders will be prompted to enter the control number which is located on the form of proxy. A vote submitted via the internet must be received by 3:00 p.m. (Calgary time) on April 30, 2019 or at least 48 hours prior to the time of any adjournment of the meeting. The website may also be used to appoint a proxy holder to attend and vote at the meeting on the shareholder's behalf and to convey a shareholder's voting instructions.

Only shareholders of record at the close of business on March 14, 2019 will be entitled to vote at the meeting, unless that shareholder has transferred any shares subsequent to that date and the transferee shareholder, not later than ten days before the meeting, establishes ownership of the shares and demands that the transferee's name be included on the list of shareholders entitled to vote at the meeting.

The instrument appointing a proxy must be in writing and must be executed by you or your attorney authorized in writing or, if you are a corporation, under your corporate seal or by a duly authorized officer or attorney of the corporation.

The persons named in the enclosed form of proxy are our officers. As a shareholder you have the right to appoint a person, who need not be a shareholder, to represent you at the meeting. To exercise this right you should insert the name of the desired representative in the blank space provided on the form of proxy and strike out the other names or submit another appropriate proxy.

ADVICE TO BENEFICIAL HOLDERS OF COMMON SHARES

The information set forth in this section is of significant importance to you if you do not hold your common shares in your own name. Only proxies deposited by shareholders whose names appear on our records as the registered holders of common shares can be recognized and acted upon at the meeting. If common shares are listed in your account statement provided by your broker, then in almost all cases those common shares will not be registered in your name on our records. Such common shares will likely be registered under the name of your broker or an agent of that broker. In Canada, the vast majority of such shares are registered under the name of CDS & Co., the registration name for CDS Clearing and Depository Services Inc., which acts as nominee for many Canadian brokerage firms. Common shares held by your broker or their nominee can only be voted upon your instructions. Without specific instructions, your broker or their nominee is prohibited from voting your shares.

Applicable regulatory policy requires your broker to seek voting instructions from you in advance of the meeting. Every broker has its own mailing procedures and provides its own return instructions, which you should carefully follow in order to ensure that your shares are voted at the meeting. Often, the form of proxy supplied by your broker is identical to the form of proxy provided to registered shareholders. However, its

purpose is limited to instructing the registered shareholder how to vote on your behalf. The majority of brokers now delegate responsibility for obtaining instructions from clients to Broadridge Financial Solutions Inc. ("Broadridge") who mails a scannable voting instruction form in lieu of the form of proxy. You are asked to complete and return the voting instruction form to them by mail or facsimile. Alternatively, you can use their website www.proxyvote.com or call their toll-free telephone number to instruct them how to vote your shares. They then tabulate the results of all instructions received and provide appropriate instructions respecting the voting of shares to be represented at the meeting. Baytex may utilize the Broadridge QuickVoteTM service to assist shareholders with voting their shares. Those shareholders who have not objected to Baytex knowing who they are (non-objecting beneficial owners) may be contacted by Laurel Hill Advisory Group ("Laurel Hill") to conveniently obtain a vote directly over the phone. If you receive a voting instruction form from a mailing/tabulating agent, it cannot be used as a proxy to vote shares directly at the meeting as it must be returned to the mailing/tabulating agent well in advance of the meeting in order to have the shares voted.

NOTICE-AND-ACCESS

We have elected to use the "notice-and-access" provisions under National Instrument 54-101 "Communications with Beneficial Owners of Securities of a Reporting Issuer" (the "Notice-and-Access Provisions") for the meeting in respect of mailings to beneficial holders of our common shares (i.e., a shareholder who holds their shares in the name of a broker or an agent) and registered holders of our common shares (i.e., a shareholder whose name appears on our records as a holder of common shares). The Notice-and-Access Provisions are a set of rules developed by the Canadian Securities Administrators that reduce the volume of materials which are mailed to shareholders by allowing a reporting issuer to post an information circular in respect of a meeting of its shareholders and related materials on-line.

We have also elected to use procedures known as 'stratification' in relation to our use of the Notice-and-Access Provisions. Stratification occurs when a reporting issuer using the Notice-and-Access Provisions provides a paper copy of an information circular and, if applicable, a paper copy of financial statements and related management's discussion and analysis ("Financial Information"), to some shareholders together with a notice of a meeting of its shareholders. A paper copy of the notice of meeting, this information circular – proxy statement, and a form of proxy or voting instruction form will be mailed to those shareholders who have previously requested to receive paper copies of these materials. Furthermore, a paper copy of the Financial Information in respect of our most recently completed financial year was mailed to those registered and beneficial holders of our common shares who previously requested to receive such information.

We intend to pay for intermediaries to deliver proxy-related materials to objecting beneficial owners of our common shares.

REVOCABILITY OF PROXY

Only a registered shareholder may revoke their proxy at any time prior to a vote. If you or the person you give your proxy attends personally at the meeting, you or such person may revoke the proxy and vote in person. In addition to revocation in any other manner permitted by law, a proxy may be revoked by an instrument in writing executed by you or your attorney authorized in writing or, if you are a corporation, under your corporate seal or by a duly authorized officer or attorney of the corporation. To be effective the instrument in writing must be deposited either at our head office at any time up to and including the last business day before the day of the meeting, or any adjournment thereof, at which the proxy is to be used, or with the chairman of the meeting on the day of the meeting, or any adjournment thereof.

Beneficial holders who wish to change their vote must, in sufficient time in advance of the meeting, arrange for their respective intermediaries to change their vote and, if necessary, revoke their proxy in accordance with the revocation procedures set out above.

PERSONS MAKING THE SOLICITATION

This solicitation is made on behalf of our management. We will bear the costs incurred in the preparation and mailing of the form of proxy, notice of meeting and this information circular - proxy statement. In addition to mailing forms of proxy, proxies may be solicited by personal interviews, or by other means of communication, by our directors, officers and employees who will not be remunerated therefor.

We have also retained Laurel Hill to assist us with corporate governance advisory services and communicating with shareholders. In connection with these services, Laurel Hill is expected to receive a fee of $32,500, plus out-of-pocket expenses. We will bear all costs of this solicitation. We have arranged for intermediaries to forward the meeting materials to beneficial owners of the common shares held of record by those intermediaries and we may reimburse the intermediaries for their reasonable fees and disbursements in that regard.

EXERCISE OF DISCRETION BY PROXY

The common shares represented by proxy in favour of management nominees will be voted on any poll at the meeting. Where you specify a choice with respect to any matter to be acted upon, the shares will be voted on any poll in accordance with the specification so made. If you do not provide instructions, your shares will be voted in favour of the matters to be acted upon as set out herein. The persons appointed under the form of proxy which we have furnished are conferred with discretionary authority with respect to amendments or variations of those matters specified in the form of proxy and notice of meeting and with respect to any other matters which may properly be brought before the meeting or any adjournment thereof. At the time of printing this information circular - proxy statement, we know of no such amendment, variation or other matter.

VOTING SHARES AND PRINCIPAL HOLDERS THEREOF

We are authorized to issue an unlimited number of common shares without nominal or par value. As at March 14, 2019 there were 555,872,167 common shares issued and outstanding. As a holder of common shares you are entitled to one vote for each share you own.

As at March 14, 2019, our nominee directors and officers, as a group, beneficially owned, or controlled or directed, directly or indirectly, 12,823,072 common shares, representing approximately 2.3% of the issued and outstanding common shares (and the votes entitled to be cast at the meeting). To the knowledge of our directors and officers, as at March 14, 2019, no person or company beneficially owned, or controlled or directed, directly or indirectly, common shares entitled to more than 10% of the votes which may be cast at the meeting.

QUORUM FOR MEETING

At the meeting, a quorum shall consist of two or more persons either present in person or represented by proxy and representing in the aggregate not less than twenty-five percent (25%) of the outstanding common shares. If a quorum is not present at the opening of the meeting, the shareholders present may adjourn the meeting to a fixed time and place but may not transact any other business.

APPROVAL REQUIREMENTS

All matters to be considered at the meeting are ordinary resolutions requiring approval by more than fifty percent (50%) of the votes cast in respect of the resolution by or on behalf of shareholders present.

MATTERS TO BE ACTED UPON AT THE MEETING

Election of Directors

The by-laws of Baytex provide that the number of directors shall be fixed from time to time by the shareholders or the board of directors (the "Board"). The Board has fixed the number of directors at eight. The eight nominees proposed for election as directors of Baytex are as follows:

|

| | |

| Mark R. Bly | Edward D. LaFehr | David L. Pearce |

| Trudy M. Curran | Gregory K. Melchin | Neil J. Roszell |

| Naveen Dargan | Kevin D. Olson | |

Unless otherwise directed, it is the intention of management to vote proxies in favour of these eight (8) nominees. In the event that a vacancy among such nominees occurs because of death or for any other reason prior to the meeting, the proxy shall not be voted with respect to such vacancy.

Voting for the election of directors will be conducted on an individual, and not slate, basis. Management of Baytex recommends that shareholders vote FOR the election of each of these nominees. The persons named in the enclosed form of proxy intend to vote FOR the election of each of these nominees unless the shareholder specifies that the authority to do so is withheld.

Majority Voting

The Board has adopted a policy stipulating that if the votes in favour of the election of a director nominee at a shareholders' meeting represent less than a majority of the common shares voted and withheld, the nominee will submit his or her resignation promptly after the meeting for the Board's consideration. In determining whether the resignation should be accepted, the Board will consider all factors that it deems relevant, including, without limitation, the composition of the Board, the voting results and whether acceptance of the resignation is in the best interests of Baytex. Absent extraordinary circumstances, the Board will accept the resignation. The Board's decision to accept or reject the resignation will be announced by way of press release within 90 days of the date of the shareholders' meeting. The policy does not apply in circumstances involving contested director elections.

Advance Notice By-Law

We have adopted an advance notice by-law ("By-Law No. 2") which was ratified by shareholders at the 2014 annual and special meeting of shareholders. By-Law No. 2 provides that advance notice must be given to Baytex in circumstances where nominations of persons for election to the Board are made by shareholders other than pursuant to: (a) a "proposal" made in accordance with the Business Corporations Act (Alberta); or (b) a requisition of a meeting made pursuant to the Business Corporations Act (Alberta). It also stipulates a deadline by which shareholders must notify Baytex of their intention to nominate directors and sets out the information that shareholders must provide regarding each director nominee and the nominating shareholder in order for the advance notice requirement to be met. These requirements are intended to provide all shareholders with the opportunity to evaluate and review the proposed candidates and vote in an informed and timely manner regarding said nominees. No person nominated by a shareholder will be eligible for election as a director of Baytex unless nominated in accordance with the provisions of By-Law No. 2. As of the date of this information circular - proxy statement, we have not received any nominations via the advance notice mechanism.

Proposed Directors

For each person proposed to be nominated for election as a director of Baytex, the following table sets forth their name, place of residence, age (at December 31, 2018), the year in which they became a director, a brief biography, their membership on committees of the Board, their attendance at Board and committee meetings during 2018, the number and value of common shares and other securities beneficially owned, controlled or directed (directly or indirectly) by them and the votes for and withheld for their election at the last annual meeting of shareholders. This information is based partly on our records and partly on information received by us from the nominees.

|

| | | | | | | | |

| | Neil J. Roszell | Non-Independent | Age 51 | Calgary, Alberta, Canada | Director Since 2018 |

| | | Mr. Roszell was appointed Chairman of the Board of Baytex on August 22, 2018. He is a professional engineer with 25 years of industry experience. Mr. Roszell was the Executive Chairman and Chief Executive Officer of Raging River Exploration Inc. ("Raging River") from June 2017 until August 2018 and Raging River’s President and Chief Executive Officer from incorporation in 2012. Mr. Roszell was the President and Chief Executive Officer of Wild Stream Exploration Inc. from October 2009 until March 2012, the President and Chief Executive Officer of Wild River Resources Ltd. from February 2007 until July 2009, the President and Chief Operating Officer of Prairie Schooner Energy Ltd. from August 2004 until September 2006 and the Vice President, Engineering of Great Northern Exploration Ltd. from September 2001 to June 2004. He received a Bachelor of Applied Science degree in Engineering from the University of Regina in 1991. |

| | 2018 Voting Results | Board / Committee Membership | Meetings Attended | Total Attendance |

| | n/a

n/a

n/a | for

withheld

votes cast | n/a

n/a

n/a | Board (Chair) | 4/4 | 100% |

| | Mr. Roszell is not a member of any Board committees, however, he is usually invited by the Chair of each Board committee to attend the meetings of such committee. |

| |

| | Baytex Securities held as at (1) | Common Shares | Performance Awards | Restricted Awards | Total Value ($) |

| | Amount

(#) | Value

($) | Amount

(#) | Value

($) | Amount

(#) | Value

($) |

| | Mar. 14, 2019 | 10,265,609 | 23,713,557 | - | - | 56,155 | 129,718 | 23,843,275 |

| | Other public company boards |

| | None |

|

| | | | | | | |

| Mark. R. Bly | Lead Independent | Age 59 | Incline Village, NV, U.S.A. | Director Since 2017 |

| Mr. Bly was appointed Lead Independent Director on March 5, 2019 after having been appointed to the Board in 2017. Mr. Bly is an independent businessman with over 35 years of experience in the oil and gas industry, primarily with BP, a global producer of oil and gas. At BP, Mr. Bly held various senior leadership roles in its domestic and international operations, including leading the North American onshore unit, Group Vice President for approximately 25% of BP's global production, and Executive Vice President of Group Safety and Operational Risk. Since retiring from BP in 2013, Mr. Bly has worked with private oil and gas production and service companies serving as an executive, board member and advisor. Mr. Bly holds a Master of Science degree in structural engineering from the University of California, Berkeley and a Bachelor of Science degree in civil engineering from the University of California, Davis.

|

| 2018 Voting Results | Board / Committee Membership | Meetings Attended | Total Attendance |

| 96.64% | for | 52,099,407 | Board | 10/10 | 100% |

| 3.36% | withheld | 1,812,965 | Reserves Committee | 1/1 |

| 100% | votes cast | 53,912,372 | Audit Committee | 1/1 |

| Baytex Securities held as at | Common Shares | Performance Awards | Restricted Awards | Total Value ($) |

Amount (#) | Value ($) | Amount (#) | Value

($) | Amount (#) | Value

($) |

| Mar. 14, 2019 | 137,029 | 316,537 | - | - | 71,151 | 164,359 | 480,896 |

| Mar. 1, 2018 | 30,000 | 93,600 | - | - | 35,971 | 112,230 | 205,830 |

| Other public company boards |

| Vista Oil & Gas S.A.B. de C.V. | | |

|

|

| | | | | | | |

| Trudy M. Curran | Independent | Age 56 | Calgary, Alberta, Canada | Director Since 2016 |

| Ms. Curran is a retired businesswoman with experience in executive compensation, mergers and acquisitions, financing and governance. She is currently serving as interim managing director of Riversdale Resources Ltd., a public Australian incorporated coal development company. She served as an officer of Canadian Oil Sands Limited from September 2002 to the time of its sale in February 2016. As Senior Vice President, General Counsel & Corporate Secretary of Canadian Oil Sands Limited, she was responsible for legal, human resources and administration and a member of the executive team focused on strategy and risk management. From 2003 to 2016, she was a director of Syncrude Canada Ltd. where she served as chair of the Human Resources and Compensation Committee and as a member of the Pension Committee. She serves on the Executive Committee of the Calgary chapter of the Institute of Corporate Directors and is a member of the Alberta Securities Commission and serves on its Human Resources and Compensation Committee. Ms. Curran holds a Bachelor of Arts degree in English and a Bachelor of Laws degree (both with distinction) from the University of Saskatchewan and the ICD.D designation from the Institute of Corporate Directors. |

| 2018 Voting Results | Board / Committee Membership | Meetings Attended | Total Attendance |

96.56%

3.44%

100% | for

withheld

votes cast | 52,056,705

1,855,667

53,912,372 | Board | 10/10 | 100% |

| Human Resources and Compensation Committee | 4/4 |

| Nominating and Governance Committee | 1/1 |

| Audit Committee | 4/4 |

| Reserves Committee | 1/1 |

| Baytex Securities held as at | Common Shares | Performance Awards | Restricted Awards | Total Value ($) |

Amount

(#) | Value

($) | Amount

(#) | Value

($) | Amount

(#) | Value

($) |

| Mar. 14, 2019 | 62,220 | 143,728 | 1,126 | 2,601 | 79,865 | 184,488 | 330,817 |

| Mar. 1, 2018 | 30,911 | 96,442 | 3,378 | 10,539 | 53,678 | 167,475 | 274,457 |

| Mar. 1, 2017 | 24,252 | 118,107 | 5,630 | 27,418 | 26,702 | 130,039 | 275,564 |

| Other public company boards |

| Riversdale Resources Ltd. | | | |

|

| | | | | | | |

| Naveen Dargan | Independent | Age 61 | Calgary, Alberta, Canada | Director Since 2003 |

| Mr. Dargan has been an independent businessman since June 2003. Prior thereto, he worked for over 20 years in the investment banking business, finishing his career as Senior Managing Director and Head of Energy Investment Banking at Raymond James Ltd. Since 2003, Mr. Dargan has served on various boards for companies in the Energy Industry, Energy Services Industry and one Philanthropic Organization. Mr. Dargan holds a Bachelor of Arts (Honours) degree in Mathematics and Economics from Queen’s University, a Master of Business Administration degree from the Schulich School of Business and a Chartered Business Valuator designation. |

| 2018 Voting Results | Board / Committee Membership | Meetings Attended | Total Attendance |

94.80%

5.20%

100% | for

withheld

votes cast | 51,108,872

2,803,500

53,912,372 | Board | 10/10 | 100% |

| Audit Committee | 5/5 |

| Reserves Committee | 1/1 |

| Compensation Committee | 2/2 |

| Baytex Securities held as at | Common Shares | Performance Awards | Restricted Awards | Total Value ($) |

Amount

(#) | Value

($) | Amount

(#) | Value

($) | Amount

(#) | Value

($) |

| Mar. 14, 2019 | 444,574 | 1,026,966 | - | - | 79,582 | 183,834 | 1,210,800 |

| Mar. 1, 2018 | 418,150 | 1,304,628 | 10,474 | 32,679 | 55,453 | 173,013 | 1,510,320 |

| Mar. 1, 2017 | 404,473 | 1,969,784 | 22,044 | 107,354 | 30,808 | 150,035 | 2,227,173 |

| Other public company boards |

| None |

|

| | | | | | | | | |

| | Edward D. LaFehr | President & Chief Executive Officer | Age 59 | Calgary, Alberta, Canada | Director Since 2017 |

| | | Mr. LaFehr joined Baytex as President on July 18, 2016 and was appointed Chief Executive Officer on May 4, 2017. Mr. LaFehr has nearly 35 years of experience in the oil and gas industry working with Amoco, BP, Talisman and the Abu Dhabi National Energy Company ("TAQA") in various geographies. Before joining Baytex, Mr. LaFehr was President of TAQA’s North American oil and gas business which led to his subsequent role as Chief Operating Officer of TAQA, globally. Prior to this, he served as Senior Vice President for Talisman Energy. Mr. LaFehr has a long track record of success in the oil and gas industry leading organizations, growing assets and joint ventures, and driving capital and cost efficiencies. On March 12, 2019 he was appointed as a director of TransGlobe Energy Corporation, an exploration and production company headquartered in Calgary, whose activities are concentrated in Egypt. Mr. LaFehr holds Masters degrees in geophysics and mineral economics from Stanford University and the Colorado School of Mines, respectively. |

| | 2018 Voting Results | Board / Committee Membership | Meetings Attended | Total Attendance |

| | 96.78%

3.22%

100% | for

withheld

votes cast | 52,174,357

1,738,015

53,912,372 | Board | 10/10 | 100% |

| | Mr. LaFehr is not a member of any Board committees, however, he is usually invited by the Chair of each Board committee to attend the meetings of such committee. | | |

| |

| |

| | Baytex Securities held as at | Common Shares | Performance Awards | Restricted Awards | Total Value ($) |

| | Amount

(#) | Value

($) | Amount

(#) | Value

($) | Amount

(#) | Value

($) |

| | Mar. 14, 2019 | 464,444 | 1,072,866 |

| 859,875 | 1,986,311 | 214,969 | 496,578 | 3,555,755 |

| | Mar. 1, 2018 | 198,883 | 620,515 |

| 606,666 | 1,892,798 | 151,666 | 473,198 | 2,986,511 |

| | Mar. 1, 2017 | 58,006 | 282,489 |

| 366,667 | 1,785,668 | 91,667 | 446,418 | 2,514,576 |

| | Other public company boards |

| | TransGlobe Energy Corporation |

|

| | | | | | | |

| Gregory K. Melchin | Independent | Age 65 | Calgary, Alberta, Canada | Director Since 2008 |

| Mr. Melchin is currently the Chairperson of the Board of Directors of ENMAX Corporation, a municipally-owned utility. Mr. Melchin was a member of the Legislative Assembly of Alberta from March 1997 to March 2008. Among his various assignments with the Government of Alberta, he was Minister of Energy, Minister of Seniors and Community Supports and Minister of Revenue. Prior to being elected to the Legislative Assembly of Alberta, he served in various management positions for 20 years in the Calgary business community. Mr. Melchin holds a Bachelor of Science degree (major in accounting), a Fellow Chartered Accountant designation from the Institute of Chartered Accountants of Alberta and the ICD.D designation from the Institute of Corporate Directors. |

| 2018 Voting Results | Board / Committee Membership | Meetings Attended | Total Attendance |

96.00%

4.00%

100% | for

withheld

votes cast | 51,757,811

2,154,561

53,912,372 | Board | 10/10 | 100% |

| Audit Committee | 5/5 |

| Nominating and Governance Committee | 1/1 |

| Reserves Committee | 1/1 |

| Baytex Securities held as at | Common Shares | Performance Awards | Restricted Awards | Total Value ($) |

Amount

(#) | Value

($) | Amount

(#) | Value

($) | Amount

(#) | Value

($) |

| Mar. 14, 2019 | 109,501 | 252,947 | - | - | 79,582 | 183,834 | 436,781 |

| Mar. 1, 2018 | 83,077 | 259,200 | 10,474 | 32,679 | 55,453 | 173,013 | 464,892 |

| Mar. 1, 2017 | 59,979 | 292,098 | 22,044 | 107,354 | 30,808 | 150,035 | 549,487 |

| Other public company boards |

| Total Energy Services Inc. and ENMAX Corporation |

|

| | | | | | | |

| Kevin D. Olson | Independent | Age 50 | Calgary, Alberta, Canada | Director Since 2018 |

| Mr. Olson was appointed to the Board on August 22, 2018. He has 25 years of experience in energy investing, investment banking and the Canadian upstream energy industry. He is currently the President & Portfolio Manager of a private investment firm. Mr. Olson was a director of Raging River from March 2012 to August 2018. Prior thereto, Mr. Olson was President and Portfolio Manager of EnergyX Equity Inc. from 2001 to 2011. Mr. Olson was Vice President, Corporate Development of Northrock Resources Ltd. from 2000 to 2001. From 1993 to 2000 Mr. Olson worked with FirstEnergy Capital Corp. as Vice-President, Corporate Development. He currently serves on Gear Energy Ltd.’s board and had previously served on several Canadian public and private energy and energy service company boards. Mr. Olson holds a Bachelor of Commerce degree (with distinction) majoring in finance and accounting from the University of Calgary. |

| 2018 Voting Results | Board / Committee Membership | Meetings Attended | Total Attendance |

n/a

n/a

n/a | for

withheld

votes cast | n/a

n/a

n/a | Board | 4/4 | 100% |

| Audit Committee | 1/1 |

| Human Resources and Compensation Committee | 2/2 |

| Baytex Securities held as at | Common Shares | Performance Awards | Restricted Awards | Total Value ($) |

Amount

(#) | Value

($) | Amount

(#) | Value

($) | Amount

(#) | Value

($) |

| Mar. 14, 2019 | 1,626,530 | 3,757,284 | - | - | 56,155 | 129,718 | 3,887,002 |

| Other public company boards |

| Gear Energy Ltd. |

|

| | | | | | | |

| David L. Pearce | Independent | Age 65 | Calgary, Alberta, Canada | Director Since 2018 |

| Mr. Pearce was appointed to the Board on August 22, 2018. Mr. Pearce has been working with the Private Equity Energy firm Azimuth Capital Management since July 2014 as Deputy Managing Partner. He was an Operating Partner with the Azimuth predecessor KERN Partners from November 2008 to July 2014. Mr. Pearce was a director of Raging River Exploration Inc. from March 2012 to August 2018. He was with Northrock Resources Ltd. from June 1999 to January 2008 where he held several senior officer positions and most recently was the President and Chief Executive Officer. Prior thereto Mr. Pearce worked in various Management roles at Fletcher Challenge Canada, Amoco Canada and Dome Petroleum. He has a Bachelor of Science in Mechanical Engineering (Honors) from the University of Manitoba.

|

| 2018 Voting Results | Board / Committee Membership | Meetings Attended | Total Attendance |

n/a

n/a

n/a | for

withheld

votes cast | n/a

n/a

n/a | Board | 4/4 | 100% |

| Reserves Committee | - |

| Nominating and Governance Committee | 1/1 |

| Baytex Securities held as at | Common Shares | Performance Awards | Restricted Awards | Total Value ($) |

Amount

(#) | Value

($) | Amount

(#) | Value

($) | Amount

(#) | Value

($) |

| Mar. 14, 2019 | 177,609 | 410,277 | - | - | 56,155 | 129,718 | 539,995 |

| Other public company boards |

| None |

Notes:

| |

| (1) | Does not include 278,800 options to acquire common shares held by Mr. Roszell with a weighted average exercise price of $7.03 (after adjusting the quantity of awards outstanding based on the exchange ratio under the merger with Raging River) previously granted under former Raging River option plans which were assumed by us following the merger with Raging River. See "Schedule B - Legacy Long Term Incentive Plans". |

| |

| (2) | The value of the common shares was calculated by multiplying the number of common shares by the closing price of the common shares on the Toronto Stock Exchange (the "TSX") on March 14, 2019 ($2.31), March 1, 2018 ($3.12) and March 1, 2017 ($4.87). |

| |

| (3) | The value of the performance awards and the restricted awards was calculated by multiplying the number of awards by the closing price of the common shares on the TSX on March 14, 2019, March 1, 2018 and March 1, 2017. For performance awards, a payout multiplier of 1x was assumed. In addition, the calculation does not include dividend equivalents that may accumulate on the underlying grants. |

| |

| (4) | Committee membership as at December 31, 2018. See "Statement of Corporate Governance Practices" for current committee memberships. |

As at March 14, 2019, our director nominees, as a group, beneficially owned, or controlled or directed, directly or indirectly, 12,823,072 common shares, which, based on the closing price on the common shares on the TSX on March 14, 2019 ($2.31) had a value of $29,621,296 See "Equity Ownership".

Experience and Background of Directors

The following table outlines the experience and background of, but not necessarily the technical expertise of, our proposed directors based on information provided by such individuals.

|

| | | | | | | | | |

| ENTERPRISE AND EXPERIENCE | | | | | | | |

| | Bly | Curran | Dargan | LaFehr | Melchin | Olson | Pearce | Roszell | Total (of 8) |

| Enterprise Management | ü | ü | ü | ü | ü | | ü | ü | 7 |

| Business Development | ü | ü | ü | ü | ü | ü | ü | ü | 8 |

| Financial Literacy | ü | ü | ü | ü | ü | ü | ü

| ü

| 8 |

| Corporate Governance | ü

| ü | ü | ü | ü | ü | ü | ü | 8 |

| Change Management | ü

| ü | ü | ü | | ü | ü | ü | 7 |

| Operations | ü

| ü | | ü | ü | ü | ü | ü | 7 |

| HS&E Management | ü

| ü | | ü | ü | | ü | ü | 6 |

| Financial Experience | | ü | ü | ü | ü | ü | ü | ü | 7 |

| Non-Canadian Resource Experience | ü | | | ü | | | ü | | 3 |

| Human Resources | ü | ü | ü | ü | ü | ü | ü | ü | 8 |

| Reserves Evaluation | ü | | | ü | | ü | ü | ü | 5 |

| Risk Evaluation | ü | ü | ü | ü | ü | ü | ü | ü | 8 |

| BOARD COMPOSITION | | | | | | | |

| Age | 59 | 56 | 61 | 59 | 65 | 50 | 65 | 51 | Average 58 years |

| Board Tenure | 2 | 3 | 16 | 2 | 11 | New | New | New | Average 4.5 years |

| Gender Male | ü | | ü | ü | ü | ü | ü | ü | 7 (87.5%) |

| Female | | ü | | | | | | | 1 (12.5%) |

| Independence* | ü | ü | ü | P | ü | ü | ü | C | 6 (75%) |

| | | | | | | | | | |

| * P = President and Chief Executive Officer; C = Chairman | | | | | |

Notes:

| |

| (1) | Enterprise Management – senior executive experience leading an organization or major business line. |

| |

| (2) | Business Development – experience identifying value creation opportunities. |

| |

| (3) | Financial Literacy – ability to critically read and analyze financial statements. |

| |

| (4) | Corporate Governance – understanding of the requirements of good corporate governance usually gained through experience as a senior executive or a board member of a public organization. |

| |

| (5) | Change Management – experience leading a major organizational change or managing a significant merger or acquisition. |

| |

| (6) | Operations – experience with oil and gas operations. |

| |

| (7) | HS&E Management – understanding of the regulatory environment surrounding health, safety and environmental matters in the oil and gas industry. |

| |

| (8) | Financial Experience – experience in financial accounting and reporting and corporate finance. |

| |

| (9) | Non-Canadian Resource Experience – experience in a multi-national organization providing an understanding of the challenges faced in a different cultural, political or regulatory environment. |

| |

| (10) | Human Resources – management or executive experience with responsibility for human resources. |

| |

| (11) | Reserves Evaluation – experience with or executive responsibility for oil and gas reserves evaluation. |

| |

| (12) | Risk Evaluation – experience in evaluating and managing the variety of risks faced by an organization. |

Additional Disclosure Relating to Proposed Directors

To the knowledge of our directors and executive officers, none of our proposed directors is, as of the date hereof, or was within ten years before the date hereof, a director, chief executive officer or chief financial officer of any company (including us), that was subject to a cease trade order (including a management cease trade order), an order similar to a cease trade order or an order that denied the relevant company access to any exemption under securities legislation, in each case that was in effect for a period of more than 30 consecutive days (collectively, an "Order"), that was issued while that person was acting in the capacity as director, chief executive officer or chief financial officer or was subject to an Order that was issued after that person ceased to be a director, chief executive officer or chief financial officer and which resulted from an event that occurred while that person was acting in the capacity as director, chief executive officer or chief financial officer.

Other than as disclosed below, none of our proposed directors is, as of the date hereof, or has been within the ten years before the date hereof, a director or executive officer of any company (including us) that, while that person was acting in that capacity, or within a year of that person ceasing to act in that capacity, became bankrupt, made a proposal under any legislation relating to bankruptcy or insolvency or was subject to or instituted any proceedings, arrangement or compromise with creditors or had a receiver, receiver-manager or trustee appointed to hold its assets or has, within the ten years before the date hereof, become bankrupt, made a proposal under any legislation relating to bankruptcy or insolvency, or become subject to or instituted any proceedings, arrangement or compromise with creditors, or had a receiver, receiver-manager or trustee appointed to hold the assets of the director, executive officer or shareholder.

Mr. Dargan, a director of Baytex, was formerly a director of Tervita Corporation (a private environmental solutions company). Tervita made a proposal under the Canada Business Corporations Act on September 14, 2016 and a voluntary filing under Chapter 15 of the United States Bankruptcy Code on October 20, 2016, which resulted in a plan of arrangement under the Canada Business Corporations Act. Mr. Dargan resigned as a director of Tervita on December 13, 2016.

In addition, none of our proposed directors has been subject to any penalties or sanctions imposed by a court relating to securities legislation or by a securities regulatory authority or has entered into a settlement agreement with a securities regulatory authority, or any other penalties or sanctions imposed by a court or regulatory body that would likely be considered important to a reasonable investor in making investment decisions.

Appointment of Auditors

Management is soliciting proxies, in the accompanying form of proxy, in favour of the appointment of the firm of KPMG LLP, Chartered Professional Accountants, as our auditors, to hold office until the next annual meeting of shareholders or until their successors are appointed and to authorize the directors to fix their remuneration. KPMG LLP have acted as the auditors of Baytex since June 2016.

The following table provides information about the fees billed to us and our subsidiaries for professional services rendered by our external auditors during fiscal 2018 and 2017:

|

| | | | | |

| | Aggregate fees billed ($000s) |

| | 2018 |

| | 2017 |

|

| Audit Fees | 973 |

| | 723 |

|

| Audit-Related Fees | 199 |

| | 11 |

|

| Tax Fees | 30 |

| | - |

|

| All Other Fees | - |

| | 5 |

|

| | 1,202 |

| | 739 |

|

Audit Fees: Audit fees consist of fees for the audit of our annual financial statements or services that are normally provided in connection with statutory and regulatory filings or engagements. In addition to the fees for annual audits of financial statements and review of quarterly financial statements, services in this category for fiscal 2018 and 2017 also include amounts for audit work performed in relation to the requirements of Section 404 of the Sarbanes-Oxley Act of 2002 relating to internal control over financial reporting.

Audit-Related Fees: Audit-related fees consist of fees for assurance and related services that are reasonably related to the performance of the audit or review of our financial statements and are not reported as Audit Fees. For fiscal 2018, audit-related fees included fees associated with securities filings for the strategic combination with Raging River.

Tax Fees: Tax fees include fees for tax compliance, tax advice and tax planning. For fiscal 2018, tax fees included fees associated with a transfer pricing study related to our US operations.

All Other Fees: All other fees include fees for services other than Audit Fee, Audit-Related Fees and Tax Fees.

Advisory Vote on Executive Compensation

As part of Baytex's commitment to corporate governance, the Board provides shareholders an opportunity to provide feedback on our approach to executive compensation by way of a non-binding advisory vote. The Board believes that it is essential for the shareholders to be well informed of Baytex's approach to executive compensation and considers this advisory vote to be an important part of the ongoing process of engagement between the shareholders and the Board.

At last year's annual meeting, the results of the advisory vote on our approach to executive compensation were 75.38% (40.6 million shares) in favour and 24.62% (13.27 million shares) against. Due, in part to the result of this vote, we made several changes to our compensation program. Many of these changes are highlighted in the "Letter to Shareholders" at the front of this information circular - proxy statement and a detailed discussion of our executive compensation program is provided in the "Compensation Discussion and Analysis" section of this information circular - proxy statement.

The underlying principle for compensation throughout Baytex is "pay-for-performance". We believe that this philosophy achieves the goal of attracting and retaining excellent employees and executive officers, while rewarding the demonstrated behaviours that reinforce our values and help us to deliver on our corporate objectives.

At the meeting, shareholders will have an opportunity to vote on our approach to executive compensation through consideration of the following advisory resolution:

"Resolved, on an advisory basis and not to diminish the role and responsibilities of the Board, that the shareholders accept the approach to executive compensation disclosed in the Information Circular - Proxy Statement of Baytex Energy Corp. dated March 14, 2019."

As this is an advisory vote, the results will not be binding upon the Board. However, the Board will consider the outcome of the vote as part of its ongoing review of executive compensation.

The Board unanimously recommends that shareholders vote FOR the advisory vote on executive compensation. It is the intention of the persons named in the enclosed form of proxy, if named as proxy and not expressly directed to the contrary in the form of proxy, to vote those proxies FOR the advisory vote on executive compensation.

Approval of Unallocated Share Awards under the Share Award Incentive Plan

Background

Our primary long-term incentive plan is a "full-value" award plan (the "Share Award Incentive Plan"), which permits the granting of restricted awards and performance awards (collectively, "Share Awards") to the directors, officers, employees and other service providers of Baytex and its subsidiaries (collectively, "Service Providers").

The Share Award Incentive Plan was originally approved by the unitholders of Baytex Energy Trust (our predecessor) on December 9, 2010 and came into effect on January 1, 2011. At the annual and special meeting of shareholders held on June 1, 2016, the shareholders approved the unallocated share awards under the Share Award Incentive Plan for an additional three-year period. For a complete description of the Share Award Incentive Plan, see "Executive Compensation - Share Award Incentive Plan".

The Share Award Incentive Plan reserves for issuance a maximum of 3.8% of the outstanding common shares (on a non-diluted basis) at the relevant time. Common shares issuable pursuant to the Legacy Plans (as defined below) are not included in this number. This type of plan is referred to as a "reloading plan" under the rules of the TSX.

Pursuant to the merger with Raging River, we became the successor to Raging River under Raging River's 2012 Option Plan and Raging River's 2016 Option Plan (collectively, the "Raging River Option Plans") and Raging River's award plan (the "Raging River Award Plan" and, together with the Raging River Option Plans, the "Legacy Plans"). Although no new grants will be made under the Legacy Plans, holders of options and share awards granted under the Legacy Plans are entitled to receive our common shares on the exercise of such options and settlement of such awards in such number and, in the case of options, at such exercise prices, as to reflect the exchange ratio under the merger with Raging River. In the case of performance based awards, the performance multiplier was fixed at 1x. See "Schedule B - Legacy Long Term Incentive Plans" for further information with respect to these plans.

As of March 14, 2019, there were 5,358,559 restricted awards and 5,383,048 performance awards, issued under the Share Award Incentive Plan, outstanding, representing 1.93% of the issued and outstanding common shares on that date, leaving approximately 10,381,535 common shares (representing 1.87% of the issued and outstanding common shares on that date) reserved and available for issuance pursuant to Share Awards that may be granted in the future (this calculation does not include dividend equivalents that may accumulate on the underlying grants and assumes a payout multiplier of 1x for the performance awards).

A copy of the Share Award Incentive Plan is accessible on the SEDAR website at www.sedar.com (filed on January 28, 2019 under the filing category "Other security holders documents").

Approval of Unallocated Share Awards

When Share Awards have been granted, common shares reserved for issuance under an outstanding Share Award are referred to as allocated awards. Additional common shares that may be issued pursuant to Share Awards that have not yet been granted are referred to as unallocated awards.

Pursuant to the rules of the TSX, all unallocated awards under "reloading plans" must be approved by an issuer's directors and equity security holders every three years. As a result, shareholders will be asked at

the meeting to pass an ordinary resolution to approve all unallocated Share Awards under the Share Award Incentive Plan.

Recommendation of the Board

The Share Award Incentive Plan is an important component of the compensation program at Baytex. In order to attract and retain qualified staff in a competitive marketplace, it is imperative that Baytex have a long-term incentive plan, such as the Share Award Incentive Plan.

The Share Award Incentive Plan also aligns the interests of Service Providers with shareholders as it provides an incentive for these Service Providers to maximize total shareholder return. A portion of the Share Awards granted to Service Providers is in the form of performance awards. The portion of performance awards increases at higher levels of responsibility reaching 80% for our President and Chief Executive Officer. The performance awards, through the payout multiplier, provide a link between the achievement of pre-determined goals set by the Board (50% of which are tied to total shareholder return) and the level of payout received. The Board believes that the pay for performance orientation of the performance awards is aligned with shareholder interests.

If the resolution to approve all unallocated Share Awards under the Share Award Incentive Plan is passed at the meeting, we will be required to seek this approval from the shareholders again in three years time.

If the shareholders do not approve the resolution, (i) all unallocated Share Awards outstanding as of May 2, 2019 will be cancelled and we will not be permitted to grant further Share Awards under the Share Award Incentive Plan until such time as the required shareholder approval has been obtained, (ii) all Share Awards that have been allocated and granted as of May 2, 2019 will continue unaffected in accordance with their current terms, and (iii) we will have to consider alternative forms of long-term incentive plans in order to attract and retain qualified personnel.

The Board has determined that the continuation of the Share Award Incentive Plan is in the best interests of Baytex and its shareholders and unanimously recommends that shareholders vote in favour of the resolution outlined below.

Approval Requirements

At the meeting, shareholders will be asked to consider and, if thought fit, to pass an ordinary resolution in the form set forth below to approve the unallocated Share Awards under the Share Award Incentive Plan:

BE IT RESOLVED AS AN ORDINARY RESOLUTION OF THE SHAREHOLDERS OF BAYTEX ENERGY CORP. THAT:

| |

| 1. | All unallocated share awards to acquire common shares of Baytex Energy Corp. under its Share Award Incentive Plan are hereby approved and authorized until May 2, 2022; and |

| |

| 2. | Any director or officer of Baytex Energy Corp. is authorized and directed to do all such things and execute all such documents and instruments as may be necessary or desirable to give effect to the foregoing resolution. |

In order to be passed, the above ordinary resolution must be approved by a majority of the aggregate votes cast by shareholders at the meeting. It is the intention of the persons named in the enclosed form of proxy, if named as proxy and not expressly directed to the contrary in the form of proxy, to vote those proxies in favour of the above resolution.

DIRECTOR COMPENSATION

General

The Human Resources and Compensation Committee of the Board (the "HRC Committee") is responsible for the development and implementation of a compensation plan for directors who are not also officers of Baytex. Officers of Baytex who are also directors are not paid any compensation for acting as a director. In addition, no performance awards have been granted to a non-executive director since December 2016 when the Board established a policy of only granting restricted awards to non-executive directors.

The main objectives of our directors' compensation plan are: (a) to attract and retain the services of the most qualified individuals; (b) to compensate the directors in a manner that is commensurate with the risks and responsibilities assumed in Board and committee membership and at a level that approximates the median compensation paid to directors of an industry-specific peer group; and (c) to align the interests of directors with our shareholders. To meet and maintain these objectives, the HRC Committee annually performs a review of the directors' compensation plan, which includes surveying the compensation paid to directors of an industry-specific peer group (see "Compensation Discussion and Analysis – How We Compensate Our Executives – Competitive Factors" for a listing of the peer group members). The HRC Committee recommends any changes to the compensation plan to the Board for consideration and, if deemed appropriate, approval.

The following table sets forth the principal elements of the compensation plan for directors (who are not also officers) for the 2018 year and at present. In addition, directors were reimbursed for any expenses incurred to attend a board or committee meeting.

|

| | |

| Compensation Element | Amount ($) |

| 2018 | Current |

Chairman of the Board Retainer – Annual (1) | 260,000 | 125,000 |

| Board Retainer – Annual | 40,000 | 40,000 |

Grant of Share Awards – Annual (2) | 150,000 | 125,000 |

Lead Independent Director Retainer – Annual (3) | 25,000 | 15,000 |

| Committee Chair Retainers – Annual: | | |

Audit (4) | 25,000 | 15,000 |

| Human Resources and Compensation | 8,000 | 8,000 |

| Nominating and Governance | 8,000 | 8,000 |

| Reserves | 8,000 | 8,000 |

Audit Committee Member Retainer – Annual (5) | 10,000 | 7,500 |

Meeting Attendance Fee (6) | 1,500 | 1,500 |

| Travel Fee – for travel outside of home province/state (for more than four hours round trip) to attend a meeting | 1,500 | 1,500 |

Notes:

| |

| (1) | Prior to August 22, 2018, the Chairman of the Board Retainer - Annual was $260,000, after August 22, 2018 it was reduced to $125,000. |

| |

| (2) | Reduced to $125,000 for 2019. Those directors who were appointed to the Board as of August 22, 2018, received a pro-rated grant. Share awards granted to directors in 2018 and 2019 were restricted share awards. |

| |

| (3) | Reduced to $15,000 effective as of March 5, 2019. |

| |

| (4) | Reduced to $15,000 effective as of March 5, 2019. |

| |

| (5) | Reduced to $7,500 effective as of March 5, 2019. |

| |

| (6) | The Chairman of the Board did not receive the meeting attendance fee prior to August 22, 2018. |

2019 Update

|

|

| As a result of our review of the director's compensation plan this year, the Board approved a reduction in the Chairman of the Board annual retainer from $260,000 to $125,000 and a reduction in the value of the restricted share awards granted to our directors in 2019 from $150,000 to $125,000. In addition, on March 5, 2019, the retainer paid to our Lead Independent Director was reduced from $25,000 to $15,000, the Chair of the Audit committee retainer was reduced from $25,000 to $15,000 and the Audit committee member retainer was reduced from $10,000 to $7,500. |

The following table sets forth the cash retainers and fees that were paid to each of the directors (who are not also officers) during the year ended December 31, 2018. Directors' fees are paid on a quarterly basis. |

| | | | | | | | | |

| DIRECTOR NOMINEES |

| | Board Retainer ($) | Lead Independent Director Retainer ($) | Committee Chair Retainer ($) | Audit Committee Member Retainer ($) | Meeting Attendance and Travel Fees ($) | Total Fees Earned ($) |

Mark R. Bly (1) | 40,000 | - | - |

| 2,500 |

| 33,060 |

| 75,560 |

| Trudy M. Curran | 40,000 | - | - |

| 7,500 |

| 30,000 |

| 77,500 |

| Naveen Dargan | 40,000 | - | - |

| 25,000 |

| 27,000 |

| 92,000 |

| Gregory K. Melchin | 40,000 | - | 4,489 |

| 10,000 |

| 25,500 |

| 79,989 |

Kevin D. Olson (2) | 14,333 | - | - |

| 3,575 |

| 10,500 |

| 28,408 |

David L. Pearce (2) | 14,333 | - | - |

| - |

| 7,500 |

| 21,833 |

Neil J. Roszell (2)(3) | 44,792 | - | - |

| - |

| 10,500 |

| 55,292 |

| | | | | | | |

| PAST/RETIRING DIRECTORS |

James L. Bowzer (1)(4) | 25,778 | - | - |

| - |

| 15,060 |

| 40,838 |

John A. Brussa (5) | 10,000 | - | 1,333 |

| - |

| 3,000 |

| 14,333 |

Gary R. Bugeaud (2)(6) | 14,333 | - | 2,867 |

| - |

| 10,500 |

| 27,700 |

Raymond T. Chan (6)(7) | 177,556 | 8,958 | 2,867 |

| - |

| 9,000 |

| 198,381 |

Edward Chwyl (4) | 25,778 | - | 5,156 |

| - |

| 12,000 |

| 42,934 |

R.E.T. (Rusty) Goepel (5) | 10,000 | - | - |

| - |

| 1,500 |

| 11,500 |

Mary Ellen Peters (1)(4) | 25,778 | - | - |

| 6,425 |

| 22,560 |

| 54,763 |

Dale O. Shwed (4) | 25,778 | - | 5,156 |

| - |

| 10,500 |

| 41,434 |

Notes:

| |

| (1) | As of August 22, 2018, Mr. Bly was appointed as a director of our indirect, wholly owned, subsidiary, Baytex Energy USA, Inc. Prior to August 22, 2018, Mr. Bowzer and Ms. Peters served as directors of this subsidiary. In this capacity they are paid meeting attendance fees of US $1,200 per meeting. This fee has been converted to Canadian dollars using an exchange rate of 1.30 CAD/US. Each of them attended one meeting in 2018. |

| |

| (2) | Appointed as Director on August 22, 2018. Fees for 2018 were pro-rated based on the portion of 2018 served as a Director. |

| |

| (3) | Mr. Roszell was appointed Chairman of the Board on August 22, 2018. His annual retainer for 2018 is based on the portion of 2018 served as Chairman of the Board. |

| |

| (4) | Retired August 22, 2018. Annual fees were pro-rated based on the portion of 2018 served as a Director. |

| |

| (5) | Retired May 4, 2018. Annual fees were pro-rated based on the portion of 2018 served as a Director. |

| |

| (6) | Mr. Bugeaud and Mr. Chan are not standing for re-election to the Board in 2019. |

| |

| (7) | Mr. Chan served as Chairman of the Board to August 22, 2018 and as Lead Independent Director thereafter. Fees in 2018 are pro-rated based on the portion of 2018 served as Chairman and the portion served as Lead Independent Director. |

Long-Term Incentive Compensation

We have a full-value award plan pursuant to which restricted awards and performance awards may be granted to the directors, officers, employees and other service providers of Baytex and its subsidiaries. The Share Award Incentive Plan contains the following restrictions on director participation: (1) the number of common shares issuable pursuant to the Share Award Incentive Plan to directors (who are not also officers), in aggregate, will be limited to a maximum of 0.25% of the issued and outstanding common shares; and (2) the value of all share awards granted to any one director (who is not also an officer) during a calendar year, as calculated on the date of grant, cannot exceed $150,000. For further information, see "Executive Compensation – Share Award Incentive Plan".

On December 16, 2017, the HRC Committee approved the issuance of 35,971 restricted awards to Mr. Bly, Mr. Bowzer, Mr. Chan, Mr. Chwyl, Ms. Curran, Mr. Dargan, Mr. Melchin, Ms. Peters and Mr. Shwed. These awards were granted on January 18, 2018 with an issue date schedule of one-sixth on the six month anniversary of the grant date and a further one-sixth every six months thereafter (with the last issuance to occur 36 months following the grant date). Upon their appointment to the Board, Mr. Olson, Mr. Bugeaud, Mr. Pearce and Mr. Roszell were each granted13,478 restricted awards. These awards were granted on August 22, 2018 with an issue date schedule of one-third in January 2019 and one-sixth every six months thereafter. Edward D. LaFehr is our President and Chief Executive Officer and in accordance with our policy, is not granted additional compensation to serve as a director.

The following table shows the number of common shares issuable to directors (who are not also officers) pursuant to the Share Award Incentive Plan as at December 31, 2018:

|

| | |

| | Common Shares issuable as at December 31, 2018 |

| | # | % (1) |

Share Award Incentive Plan (2) | | |

| Restricted Awards | 258,576 | |

Performance Awards (3) | 16,790 | |

Total (4) | 275,366 | 0.0496 |

Notes:

| |

| (1) | Represents the number of common shares issuable as a percentage of the issued and outstanding common shares as at December 31, 2018. |

| |

| (2) | The number of common shares issuable pursuant to the Share Award Incentive Plan does not include dividend equivalents on the underlying awards and assumes a payout multiplier of 1x for the performance awards. If the payout multiplier was 2x, the total number of common shares would increase to 292,156, which represents 0.0527% of the issued and outstanding common shares as at December 31, 2018. |

| |

| (3) | In December 2016 Baytex adopted a policy of not granting performance awards to non-officer directors. |

| |

| (4) | Does not include 278,800 options to acquire common shares (after adjusting the quantity of awards outstanding based on the exchange ratio under the merger with Raging River) with a weighted average exercise price of $7.03 held by Neil Roszell previously granted under the Legacy Plans. See "Schedule B - Legacy Long Term Incentive Plans". |

Summary Compensation Table

The following table sets forth the total compensation paid by us to our directors (who are not also officers) for the year ended December 31, 2018. |

| | | | | | | |

| DIRECTOR NOMINEES |

| | Fees earned ($) | Share-based awards (1) ($) | All other compensation ($) | Total ($) |

| Mark R. Bly | 75,560 |

| 150,000 |

| - | 225,560 |

|

| Trudy M. Curran | 77,500 |

| 150,000 |

| - | 227,500 |

|

| Naveen Dargan | 92,000 |

| 150,000 |

| - | 242,000 |

|

| Gregory K. Melchin | 79,989 |

| 150,000 |

| - | 229,989 |

|

Kevin D. Olson (2) | 28,408 |

| 50,000 |

| - | 78,408 |

|

David L. Pearce (2) | 21,833 |

| 50,000 |

| - | 71,833 |

|

Neil J. Roszell (2)(3) | 55,292 |

| 50,000 |

| - | 105,292 |

|

| | | | | |

| PAST/RETIRING DIRECTORS |

James L. Bowzer (4) | 40,838 |

| 150,000 |

| - | 190,838 |

|

John A. Brussa (5) | 14,333 |

| - | - | 14,333 |

|

Gary R. Bugeaud (2)(6) | 27,700 |

| 50,000 |

| - | 77,700 |

|

Raymond T. Chan (6)(7) | 198,381 |

| 150,000 |

| - | 348,381 |

|

Edward Chwyl (4) | 42,933 |

| 150,000 |

| - | 192,933 |

|

R.E.T. (Rusty) Goepel (5) | 11,500 |

| - | - | 11,500 |

|

Mary Ellen Peters (4) | 54,763 |

| 150,000 |

| - | 204,763 |

|

Dale O. Shwed (4) | 41,433 |

| 150,000 |

| - | 191,433 |

|

Notes:

| |

| (1) | This column shows the total compensation value that was awarded as restricted awards. The actual value realized pursuant to such restricted awards may be greater or less than the indicated value. For additional information regarding the valuation methodology, see "Executive Compensation – Share Award Valuation" below. |

| |

| (2) | Appointed as Director on August 22, 2018. Fees for 2018 were pro-rated based on the portion of 2018 served as a Director. |

| |

| (3) | Mr. Roszell was appointed Chairman of the Board on August 22, 2018. His annual retainer for 2018 is based on the portion of 2018 served as Chairman of the Board. |

| |

| (4) | Retired August 22, 2018. Annual fees were pro-rated based on the portion of 2018 served as a Director. |

| |

| (5) | Retired May 4, 2018. Annual fees were pro-rated based on the portion of 2018 served as a Director. |

| |

| (6) | Mr. Bugeaud and Mr. Chan are not standing for re-election to the Board in 2019. |

| |

| (7) | Mr. Chan served as Chairman of the Board to August 22, 2018 and as Lead Independent Director thereafter. Fees in 2018 are pro-rated based on the portion of 2018 served as Chairman and the portion served as Lead Independent Director. |

Share-based Awards

The following table sets forth for each director (who is not also an officer) all share-based awards outstanding as at December 31, 2018 and the value of share-based awards that vested during the year ended December 31, 2018.

|

| | | | | |

| | Number of shares or units of shares that have not vested (#) | Market or payout value of share-based awards that have not vested (1) ($) | Market or payout value of vested share-based awards not paid out or distributed ($) | Value of share-based awards that vested during the year (2) ($) |

| Mark R. Bly | 29,676 nil | RA PA | 72,242 | - | 26,378 |

Gary R. Bugeaud (3) | 13,478 nil | RA PA | 32,482 | - | - |

Raymond T. Chan (3) | 43,834 4,846 | RA PA | 117,319 | - | 123,239 |

| Trudy M. Curran | 43,186 2,252 | RA PA | 109,506 | - | 74,577 |

| Naveen Dargan | 43,835 4,848 | RA PA | 117,319 | - | 123,239 |

| Gregory K. Melchin | 43,835 4,848 | RA PA | 117,319 | - | 123,239 |

Kevin D. Olson (4) | 13,478 nil | RA PA | 32,482 | - | - |

David L. Pearce (4) | 13,478 nil | RA PA | 32,482 | - | - |

Neil J. Roszell (4) | 13,478 nil | RA PA | 32,482 | - | - |

Notes:

| |

| (1) | Calculated by multiplying the number of restricted awards (RA) and performance awards (PA) by the closing price of the common shares on the TSX on December 31, 2018 ($2.41). For performance awards, a payout multiplier of 1x is assumed. The calculated value does not include the value of dividend equivalents on the underlying awards. |

| |

| (2) | Calculated by multiplying the number of common shares received upon the conversion of the performance awards and the restricted awards by the weighted average trading price of the common shares on the TSX for the five trading days preceding the issue date. |

| |

| (3) | Mr. Bugeaud and Mr. Chan are not standing for re-election in 2019. |

| |

| (4) | Does not include 278,800 options to acquire common shares with a weighted average exercise price of $7.03 held by Mr. Roszell. |

COMPENSATION DISCUSSION AND ANALYSIS

Introduction

The HRC Committee is responsible for reviewing matters relating to human resource policies and compensation programs for Baytex and its subsidiaries. The HRC Committee has established the following objectives for the compensation program: to award compensation that is commensurate with performance; to align the interests of management with the shareholders; and to attract and retain highly capable individuals.

The HRC Committee has been delegated authority by the Board to establish the total compensation for all of the officers of Baytex's subsidiaries in the context of the general and administrative expense budget which is approved by the Board. The HRC Committee meets at least annually with the President and Chief Executive Officer to review other employees' salaries but direct approval of those salaries is provided by the Board annually through the approval of the general and administrative expense budget.

The HRC Committee believes that long term shareholder value is enhanced by compensation based upon corporate performance achievements. Through the plans described below, a significant portion of the compensation for all employees, including officers, is based on corporate performance, as well as industry-competitive pay practices.

Compensation Program Changes

As noted in the letter from our Chairman, in 2018 we received a 75.38% vote in favour of accepting our approach to executive compensation and we want to do better. Although we did not conduct a shareholder outreach effort on this specific topic in 2018, we were actively engaged in shareholder engagement throughout the year. See "Statement of Corporate Governance Practices - Shareholder Engagement" for further details.

In order to evaluate our current compensation programs we conducted a review of the compensation practices of our peers and the policies and guidance published by Institutional Shareholder Services and Glass Lewis. These efforts informed the evaluation of our compensation programs. As a result we:

| |