Exhibit 99.2

Investor Presentation May 2016 OTCQX: ZDPY

Investor Presentation This presentation release contains forward - looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Readers are cautioned not to place undue reliance on these forward - looking statements. Actual results may differ materially from those indicated by these forward - looking statements as a result of risks and uncertainties impacting the Company's business including, increased competition; the ability of the Company to expand its operations through either acquisitions or internal growth, to attract and retain qualified professionals, and to expand commercial relationships; general economic conditions; and other risks detailed from time to time in the Company's filings with the Securities and Exchange Commission. Forward - looking Statements OTCQX: ZDPY 2 May 2016

Investor Presentation Investment Highlights • Real estate holding / development company with high, premium rent per square foot ($32 - $40 per square foot) , investment grade leases, average lease term of 15 years and a significant backlog of development projects and potential tenants in the licensed medical marijuana industry • Uniquely positioned to benefit from growth in the medical and adult use marijuana sector while minimizing exposure to risk • Solid balance sheet with $9.2M 1 in assets and $3.4M 1 in liabilities at March 31, 2016 • Experienced management team • Tight capital structure with 17.1 million fully diluted shares outstanding, 24% insider ownership, no warrants, 1.3 million options and 200,000 shares issuable upon conversion of convertible debt OTCQX: ZDPY 3 May 2016 1 - Unaudited

Investor Presentation Setting the Standard in Property Development OTCQX: ZDPY 4 • Identifying • Developing • Leasing • Sophistication • Safety • Sustainability May 2016 OTCQX: ZDPY

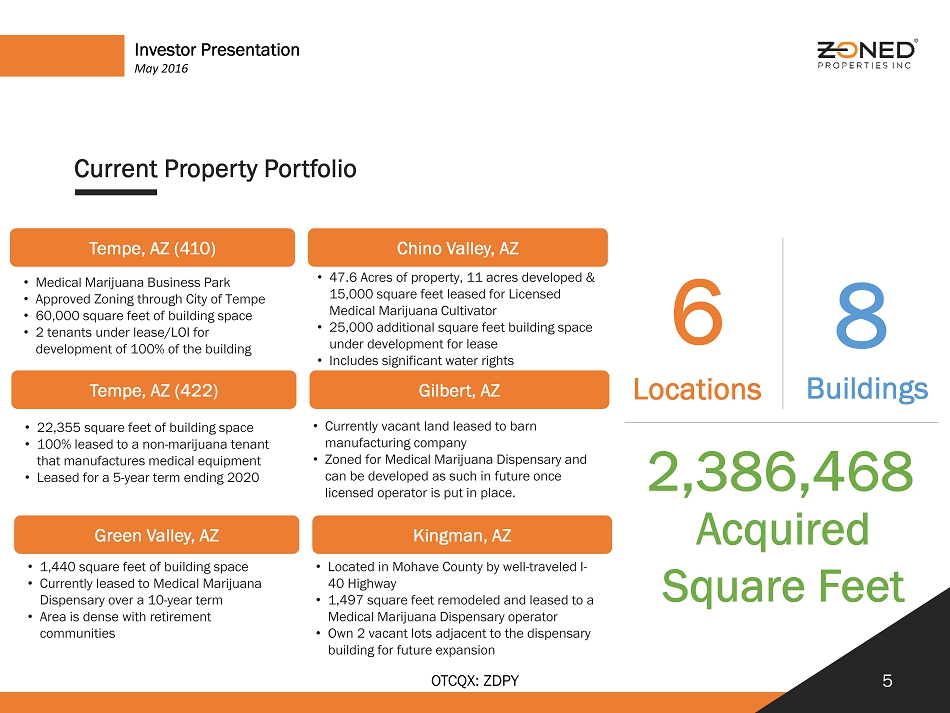

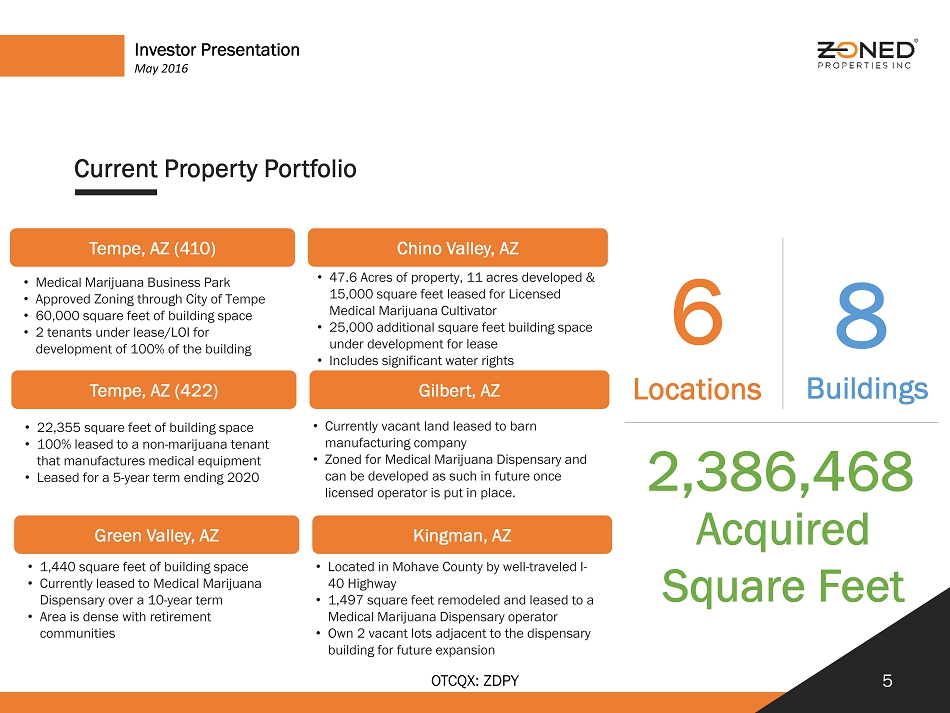

OTCQX: ZDPY 5 Investor Presentation Current Property Portfolio • Medical Marijuana Business Park • Approved Zoning through City of Tempe • 60,000 square feet of building space • 2 tenants under lease/LOI for development of 100% of the building • 47.6 Acres of property, 11 acres developed & 15,000 square feet leased for Licensed Medical Marijuana Cultivator • 25,000 additional square feet building space under development for lease • Includes significant water rights 2,386,468 Acquired Square Feet 6 Locations 8 Buildings Tempe, AZ (410) Gilbert, AZ Tempe, AZ (422) Chino Valley, AZ • 22,355 square feet of building space • 100% leased to a non - marijuana tenant that manufactures medical equipment • Leased for a 5 - year term ending 2020 • Currently vacant land leased to barn manufacturing company • Zoned for Medical Marijuana Dispensary and can be developed as such in future once licensed operator is put in place. 5 Kingman, AZ Green Valley, AZ • 1,440 square feet of building space • Currently leased to Medical Marijuana Dispensary over a 10 - year term • Area is dense with retirement communities • Located in Mohave County by well - traveled I - 40 Highway • 1,497 square feet remodeled and leased to a Medical Marijuana Dispensary operator • Own 2 vacant lots adjacent to the dispensary building for future expansion May 2016

Investor Presentation Licensed Marijuana Property Portfolio 101,736 Rentable Square Feet 4 Locations 7 Buildings OTCQX: ZDPY 6 • Medical Marijuana Business Park • Approved zoning through City of Tempe • 60,000 square feet of building space • 2 tenants under lease/LOI for development of 100% of the building • 47.6 acres of property, 11 acres developed & 15,000 square feet leased for Licensed Medical Marijuana Cultivator • 25,000 additional square feet building space under development for lease • Includes significant water rights Tempe, AZ (410) Chino Valley, AZ Kingman, AZ Green Valley, AZ • 1,440 square feet of building space • Currently leased to Medical Marijuana Dispensary over a 10 - year term • Area is dense with retirement communities • Located in Mohave County by well - traveled I - 40 Highway • 1,497 square feet remodeled and leased to a Medical Marijuana Dispensary operator • Own 2 vacant lots adjacent to the dispensary building for future expansion May 2016

OTCQX: ZDPY 7 Investor Presentation Property Development Projects Focused on the Licensed Marijuana Industry 141,736 Rentable Square Feet 3 Locations 4 Buildings Parachute, CO • 35 acres potential development for vested property rights agreement with Town of Parachute, CO • Medical Marijuana Development • Adult Use Marijuana Capabilities • Located Directly off I - 70 Highway 7 • Medical Marijuana Business Park • Approved zoning City of Tempe • 60,000 square feet of space • 2 tenants under lease/LOI for development of 100% of building • $1,920,000 potential annual rental revenue from development • 47.6 acres of property, 11 acres developed & 15,000 square feet leased for Licensed Medical Marijuana Cultivator • 25,000 additional square feet building space under development for lease • Includes significant water rights Tempe, AZ (410) Chino Valley, AZ May 2016

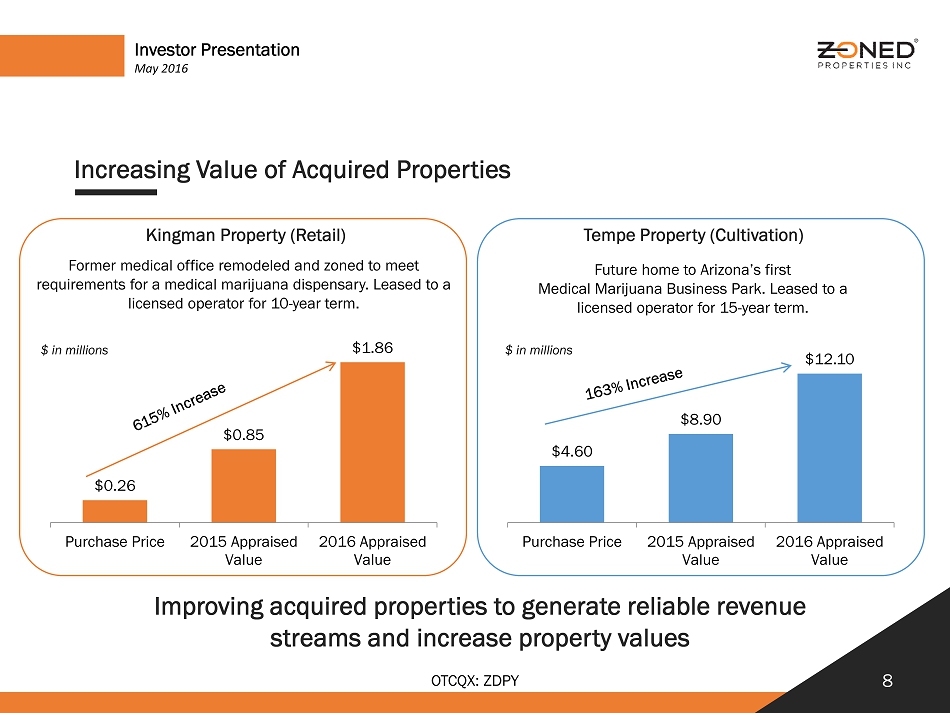

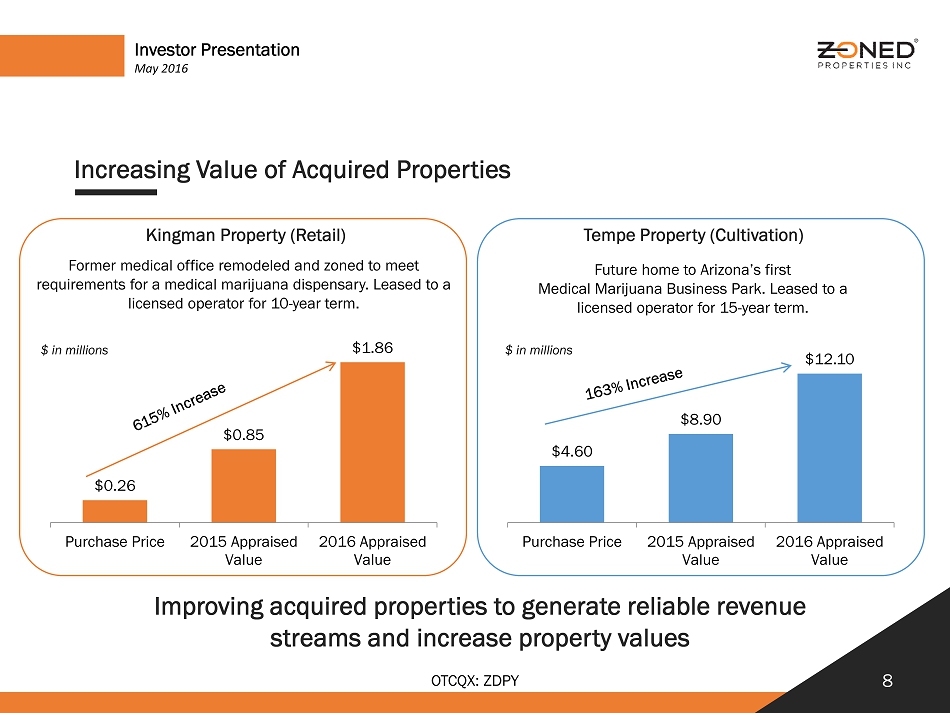

$0.26 $0.85 $1.86 Purchase Price 2015 Appraised Value 2016 Appraised Value $ in millions Investor Presentation Increasing Value of Acquired Properties OTCQX: ZDPY 8 Tempe Property (Cultivation) Kingman Property (Retail) Improving acquired properties to generate reliable revenue streams and increase property values Former medical office remodeled and zoned to meet requirements for a medical marijuana dispensary. Leased to a licensed operator for 10 - year term. Future home to Arizona’s first Medical Marijuana Business Park. Leased to a licensed operator for 15 - year term. $4.60 $8.90 $12.10 Purchase Price 2015 Appraised Value 2016 Appraised Value $ in millions May 2016

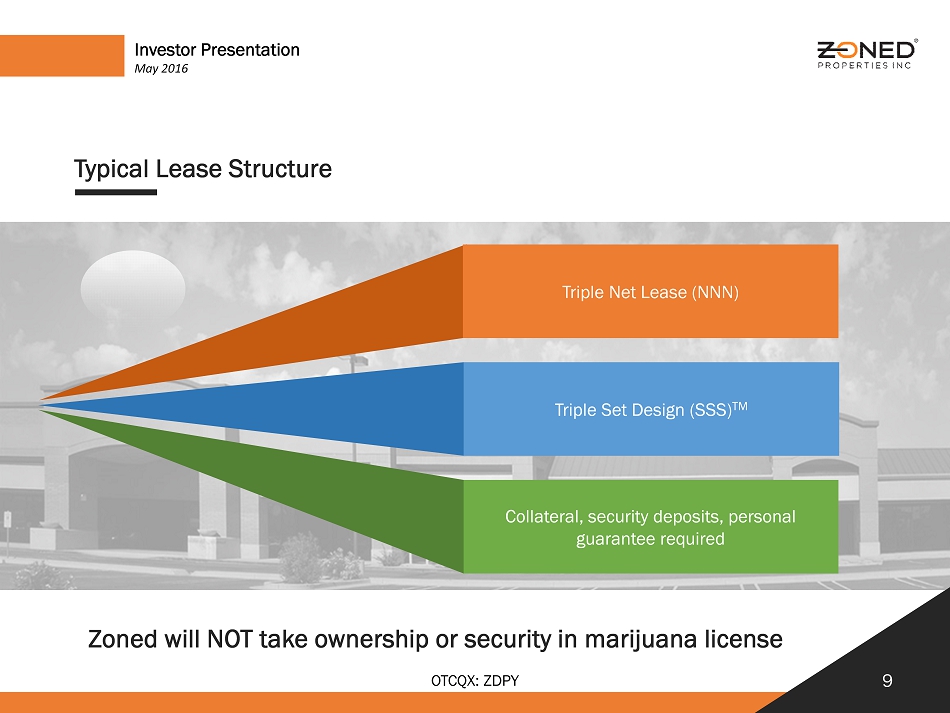

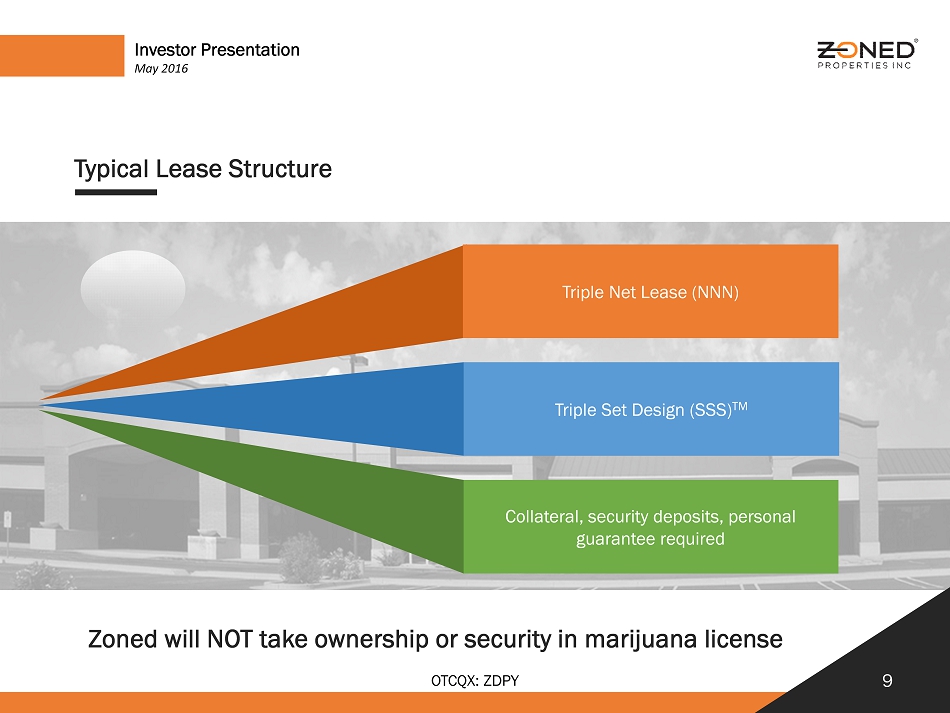

Investor Presentation Typical Lease Structure Triple Net Lease (NNN) Collateral, security deposits, personal guarantee required Triple Set Design (SSS) TM OTCQX: ZDPY 9 Zoned will NOT take ownership or security in marijuana license May 2016

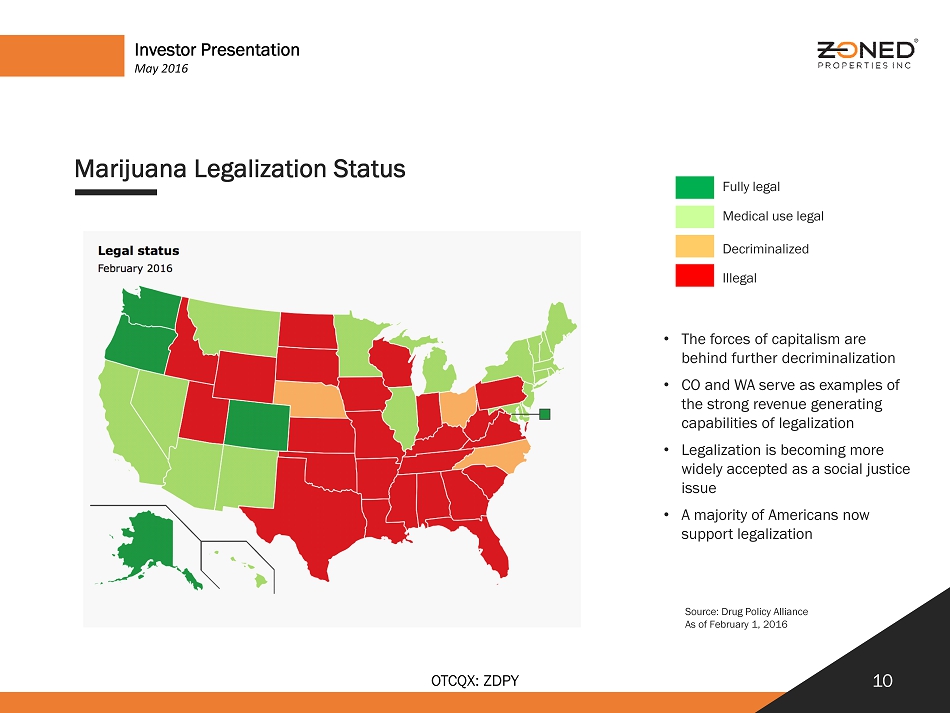

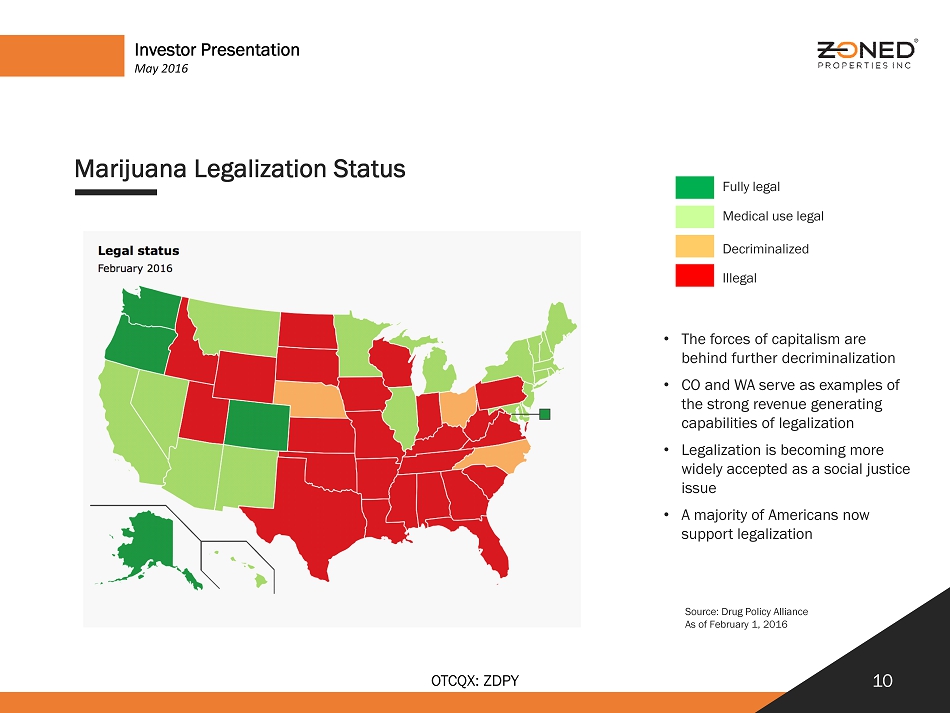

• The forces of capitalism are behind further decriminalization • CO and WA serve as examples of the strong revenue generating capabilities of legalization • Legalization is becoming more widely accepted as a social justice issue • A majority of Americans now support legalization Investor Presentation Marijuana Legalization Status Source: Drug Policy Alliance As of February 1, 2016 Illegal Decriminalized Fully legal Medical use legal OTCQX: ZDPY 10 May 2016

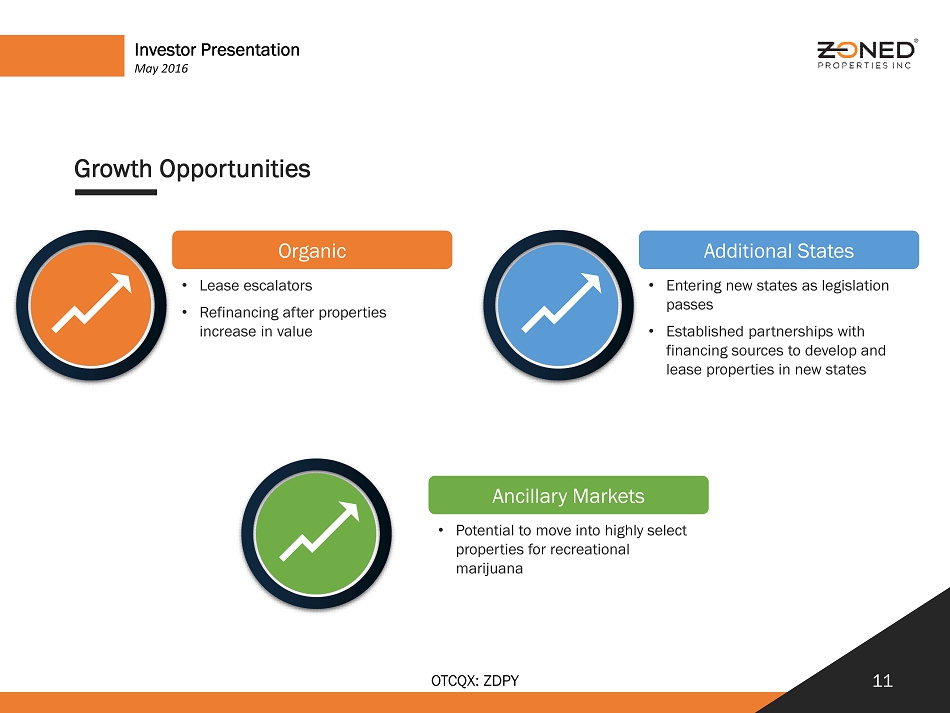

Investor Presentation Growth Opportunities Additional States • Entering new states as legislation passes • Established partnerships with financing sources to develop and lease properties in new states OTCQX: ZDPY 11 Ancillary Markets • Potential to move into highly select properties for recreational marijuana Organic • Lease escalators • Refinancing after properties increase in value May 2016

Investor Presentation Industry Relationships OTCQX: ZDPY 12 Financing Construction Design Insurance May 2016

Investor Presentation Zoned Real Estate Services & Consulting OTCQX: ZDPY We work with property owners to fully understand their real estate development needs; utilizing emerging industry expertise to complete the identification, development, and leasing of sophisticated, safe, and sustainable properties. 13 May 2016

Investor Presentation Development of Buildings & Utilities OTCQX: ZDPY 14 Collaborative design and development elicits exceptional returns on an investment portfolio. The process requires sophisticated implementation of large - scale utilities including water and power. May 2016

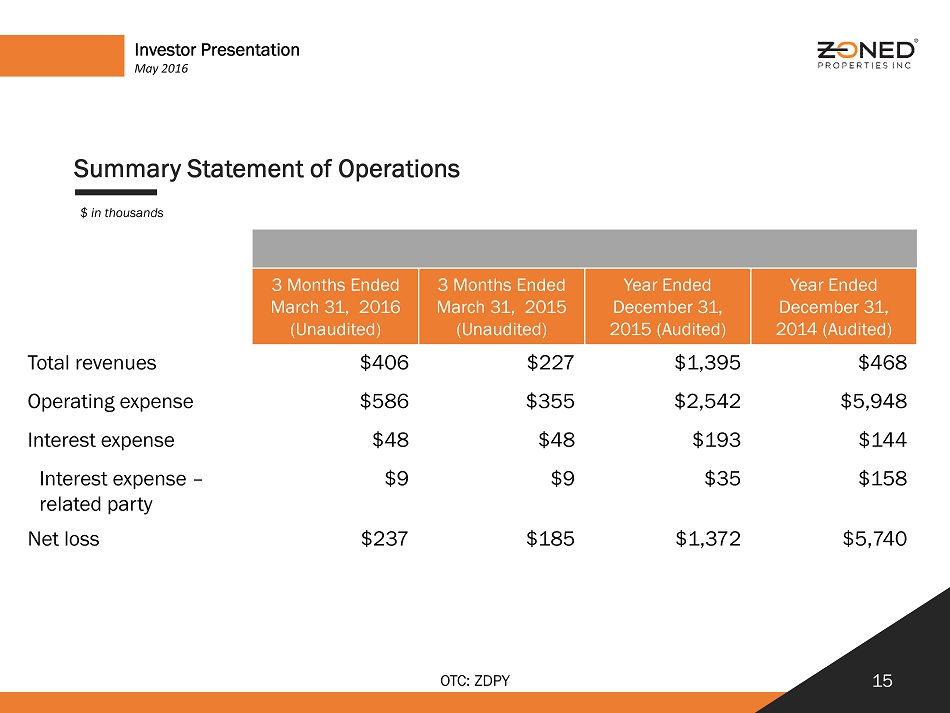

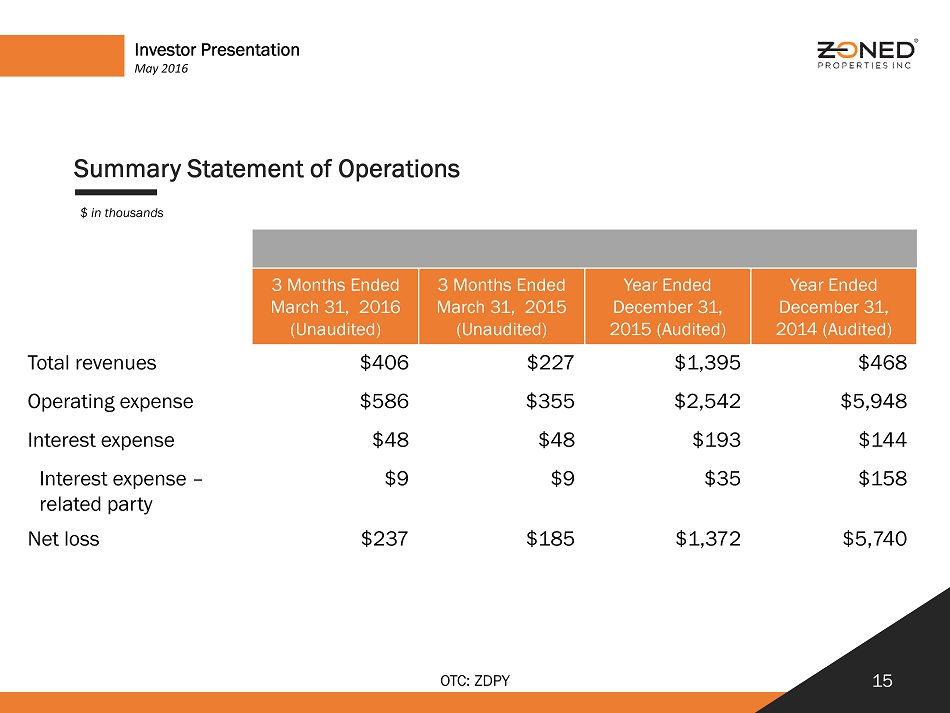

Investor Presentation Summary Statement of Operations 3 Months Ended March 31, 2016 (Unaudited) 3 Months Ended March 31, 2015 (Unaudited) Year Ended December 31, 2015 (Audited) Year Ended December 31, 2014 (Audited) Total revenues $406 $227 $1,395 $468 Operating expense $586 $355 $2,542 $5,948 Interest expense $48 $48 $193 $144 Interest expense – related party $9 $9 $35 $158 Net loss $237 $185 $1,372 $5,740 OTC: ZDPY 15 $ in thousands May 2016

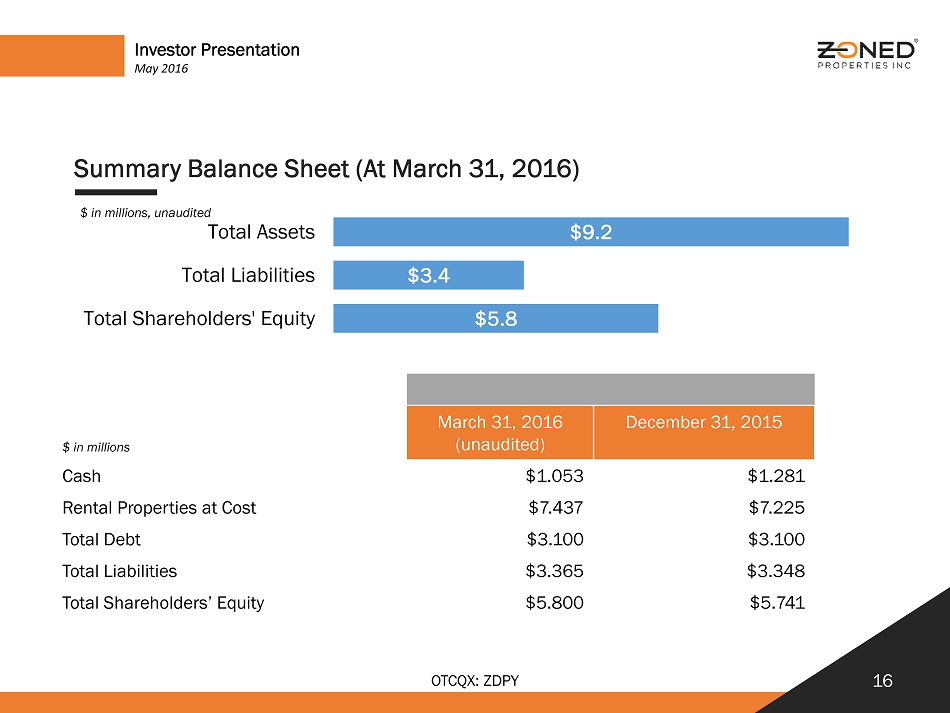

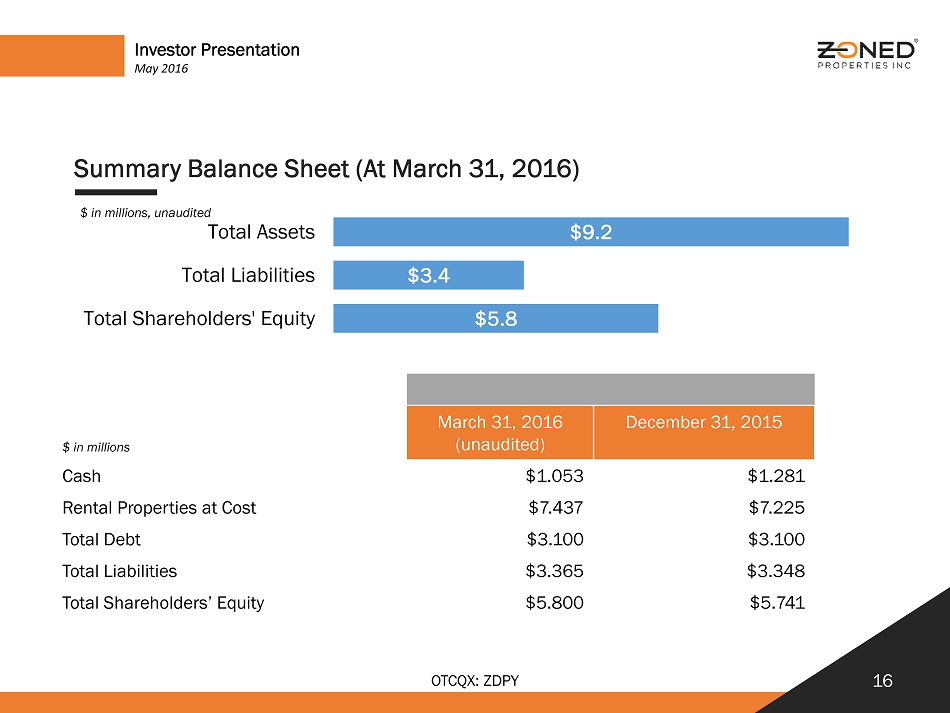

Investor Presentation Summary Balance Sheet (At March 31, 2016) March 31, 2016 (unaudited) December 31, 2015 Cash $1.053 $1.281 Rental Properties at Cost $7.437 $7.225 Total Debt $3.100 $3.100 Total Liabilities $3.365 $3.348 Total Shareholders’ Equity $5.800 $5.741 $5.8 $3.4 $9.2 Total Shareholders' Equity Total Liabilities Total Assets OTCQX: ZDPY 16 $ in millions, unaudited $ in millions May 2016

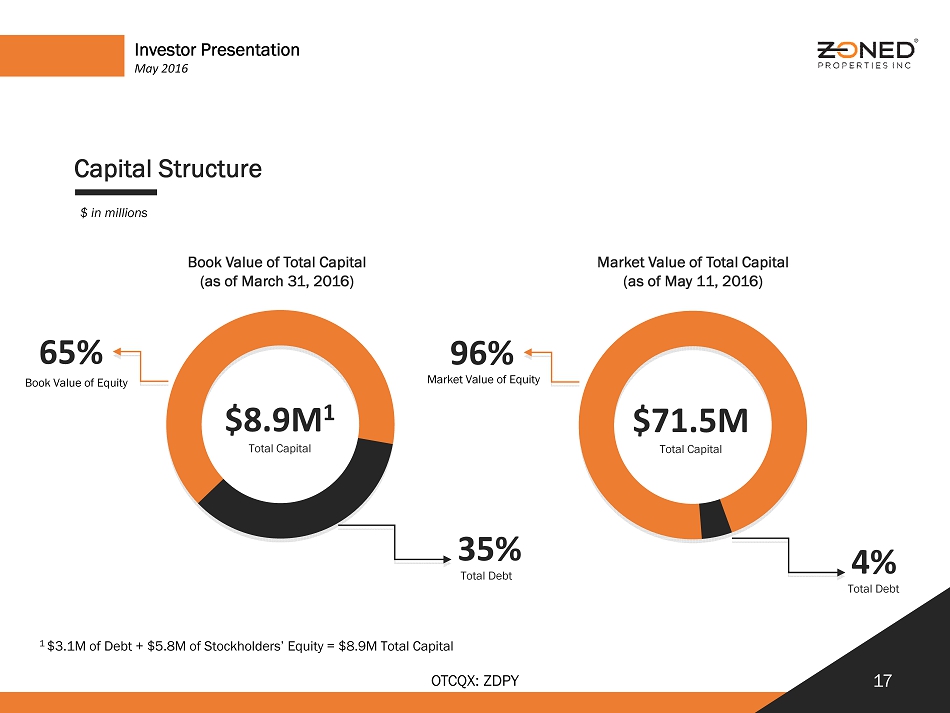

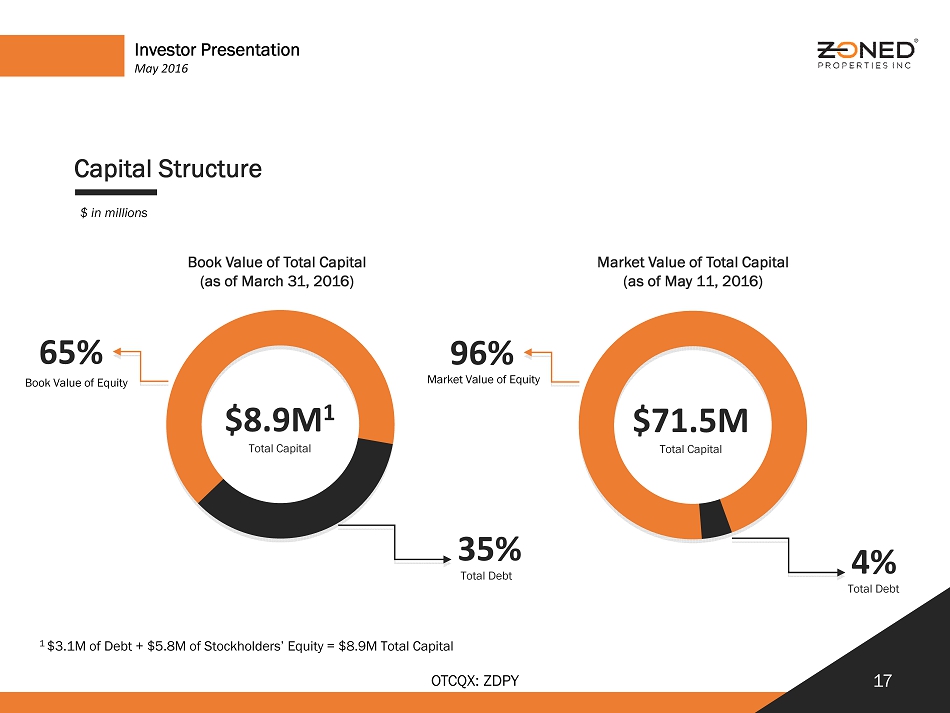

Investor Presentation Capital Structure Book Value of Total Capital (as of March 31, 2016) $8.9M 1 Total Capital 65% Book Value of Equity 35% Total Debt $71.5M Total Capital 96% Market Value of Equity 4% Total Debt Market Value of Total Capital (as of May 11, 2016) OTCQX: ZDPY 17 $ in millions 1 $3.1M of Debt + $5.8M of Stockholders’ Equity = $8.9M Total Capital May 2016

Investor Presentation Executive Leadership OTCQX: ZDPY 18 Bryan McLaren President & Chief Executive Officer Adam Wasserman Chief Financial Officer Management Board of Directors Bryan McLaren Chairman Alex McLaren Director Art Friedman Director Irvin Rosenfeld Director May 2016

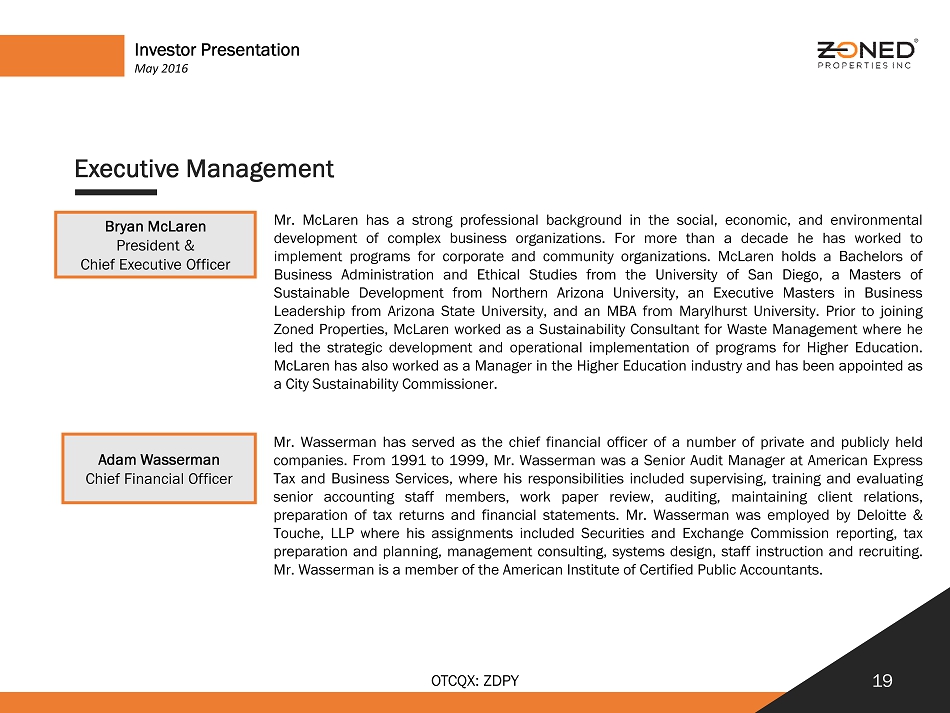

Investor Presentation Executive Management OTCQX: ZDPY 19 Bryan McLaren President & Chief Executive Officer Mr . McLaren has a strong professional background in the social, economic, and environmental development of complex business organizations . For more than a decade he has worked to implement programs for corporate and community organizations . McLaren holds a Bachelors of Business Administration and Ethical Studies from the University of San Diego, a Masters of Sustainable Development from Northern Arizona University, an Executive Masters in Business Leadership from Arizona State University, and an MBA from Marylhurst University . Prior to joining Zoned Properties, McLaren worked as a Sustainability Consultant for Waste Management where he led the strategic development and operational implementation of programs for Higher Education . McLaren has also worked as a Manager in the Higher Education industry and has been appointed as a City Sustainability Commissioner . Adam Wasserman Chief Financial Officer Mr . Wasserman has served as the chief financial officer of a number of private and publicly held companies . From 1991 to 1999 , Mr . Wasserman was a Senior Audit Manager at American Express Tax and Business Services, where his responsibilities included supervising, training and evaluating senior accounting staff members, work paper review, auditing, maintaining client relations, preparation of tax returns and financial statements . Mr . Wasserman was employed by Deloitte & Touche , LLP where his assignments included Securities and Exchange Commission reporting, tax preparation and planning, management consulting, systems design, staff instruction and recruiting . Mr . Wasserman is a member of the American Institute of Certified Public Accountants . May 2016

Investor Presentation Investment Highlights • Real estate holding / development company with high, premium rent per square foot ($32 - $40 per square foot) , investment grade leases, average lease term of 15 years and a significant backlog of development projects and potential tenants in the licensed medical marijuana industry • Uniquely positioned to benefit from growth in the medical and adult use marijuana sector while minimizing exposure to risk • Solid balance sheet with $9.2M 1 in assets and $3.4M 1 in liabilities at March 31, 2016 • Experienced management team • Tight capital structure with 17.1 million fully diluted shares outstanding, 24% insider ownership, no warrants, 1.3 million options and 200,000 shares issuable upon conversion of convertible debt OTCQX: ZDPY 20 May 2016 1 - Unaudited

Investor Presentation For More Information OTCQX: ZDPY 21 Company Contact Bryan McLaren , Chairman & CEO Zoned Properties, Inc., Scottsdale, AZ Tel 877.360.8839 | www.zonedproperties.com Investor Relations Brett Maas , Managing Partner Hayden IR Tel 646.536.7331 | www.haydenir.com May 2016