Exhibit 99.2

Investor Presentation November 2019 | OTCQB: ZDPY A brand new EMERGING INDUSTRY “We are building for an industry that does not yet exist. It’s our responsibility to make sure it gets done right.” - Bryan McLaren OTCQB: ZDPY I November 2019 877 - 360 - 8839 | @ZonedProperties

FORWARD - LOOKING STATEMENTS This presentation release contains forward - looking statements within the meaning of Section 27 A of the Securities Act of 1933 , as amended, and Section 21 E of the Securities Exchange Act of 1934 , as amended . Readers are cautioned not to place undue reliance on these forward - looking statements . Actual results may differ materially from those indicated by these forward - looking statements as a result of risks and uncertainties impacting the Company's business including, increased competition ; the ability of the Company to expand its operations through either acquisitions or internal growth, to attract and retain qualified professionals, and to expand commercial relationships ; general economic conditions ; and other risks detailed from time to time in the Company's filings with the Securities and Exchange Commission . 877 - 360 - 8839 | @ZonedProperties OTCQB: ZDPY I November 2019

ZONED PROPERTIES ® , INC. Our MISSION Providing Real Estate & Sustainability Services for the Regulated Cannabis Industry, positioning the company for property acquisitions and revenue growth. Our VISION Our VALUES To be recognized for setting the standard of sustainable development in emerging industries, including the Regulated Cannabis Industry. Sophistication, Safety, Sustainability, Stewardship 877 - 360 - 8839 | @ZonedProperties OTCQB: ZDPY I November 2019

COMPANY ORGANIZATION (Real Estate Assets & NNN Leasing Revenue) *Future Charitable Organization (Advisory Services Revenue) 877 - 360 - 8839 | @ZonedProperties TM OTCQB: ZDPY I November 2019

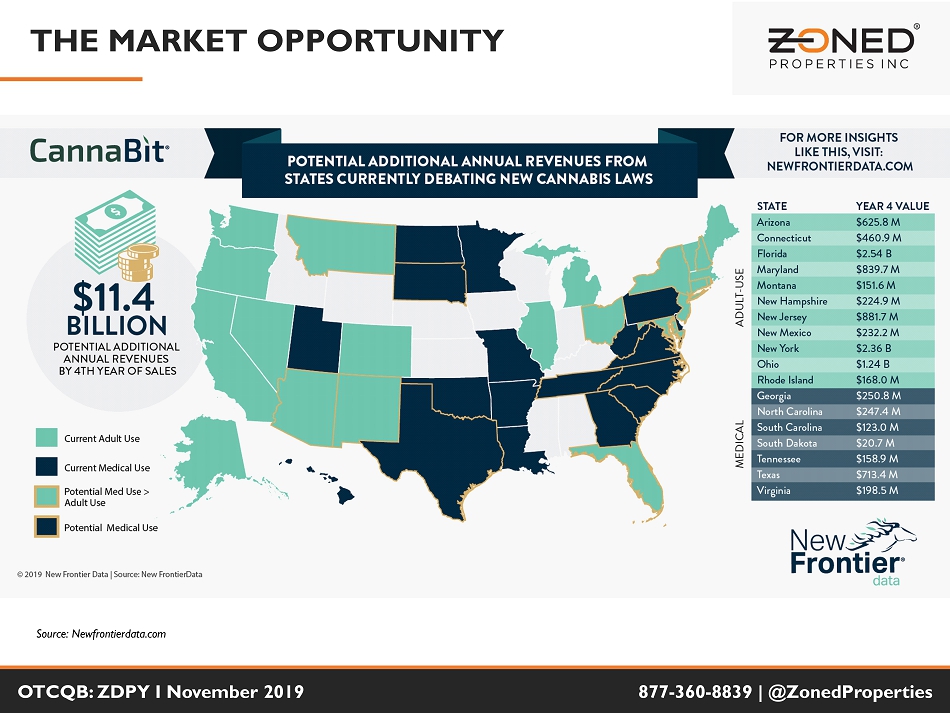

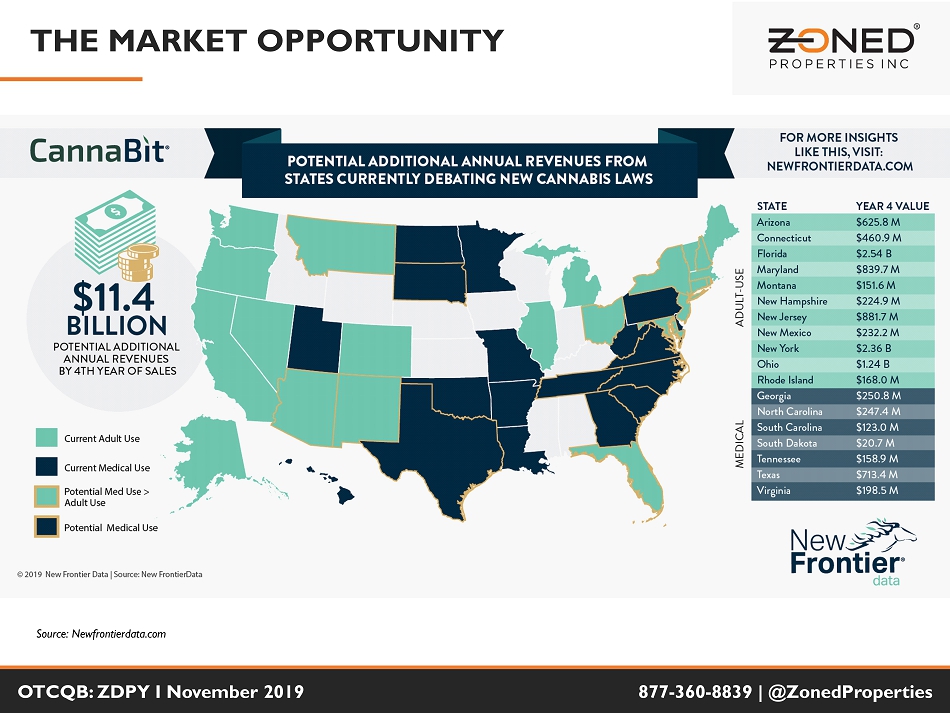

Source: Newfrontierdata.com THE MARKET OPPORTUNITY 877 - 360 - 8839 | @ZonedProperties OTCQB: ZDPY I November 2019

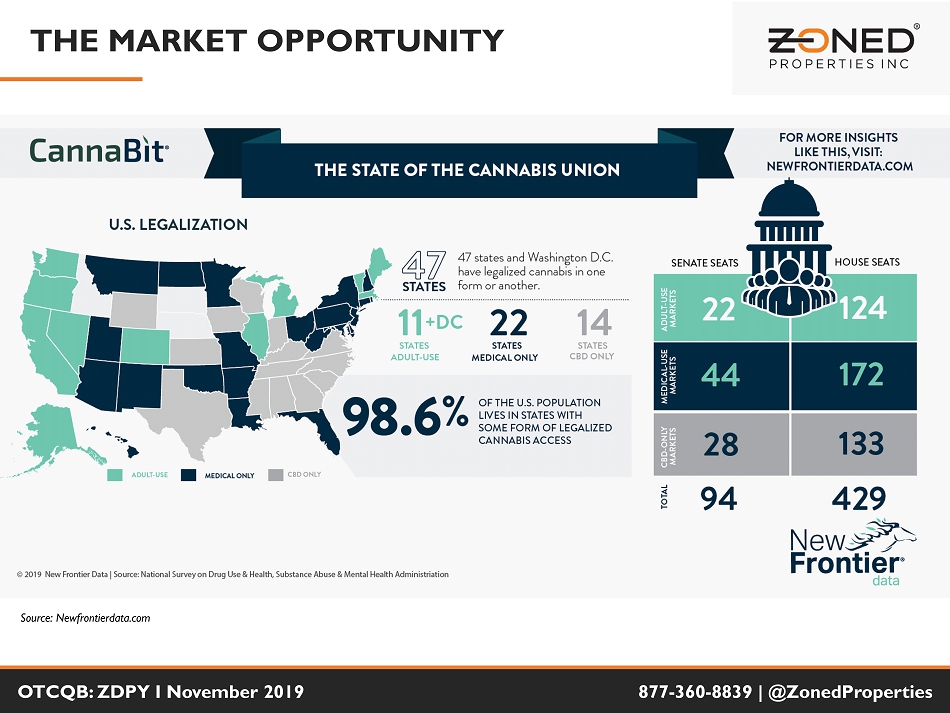

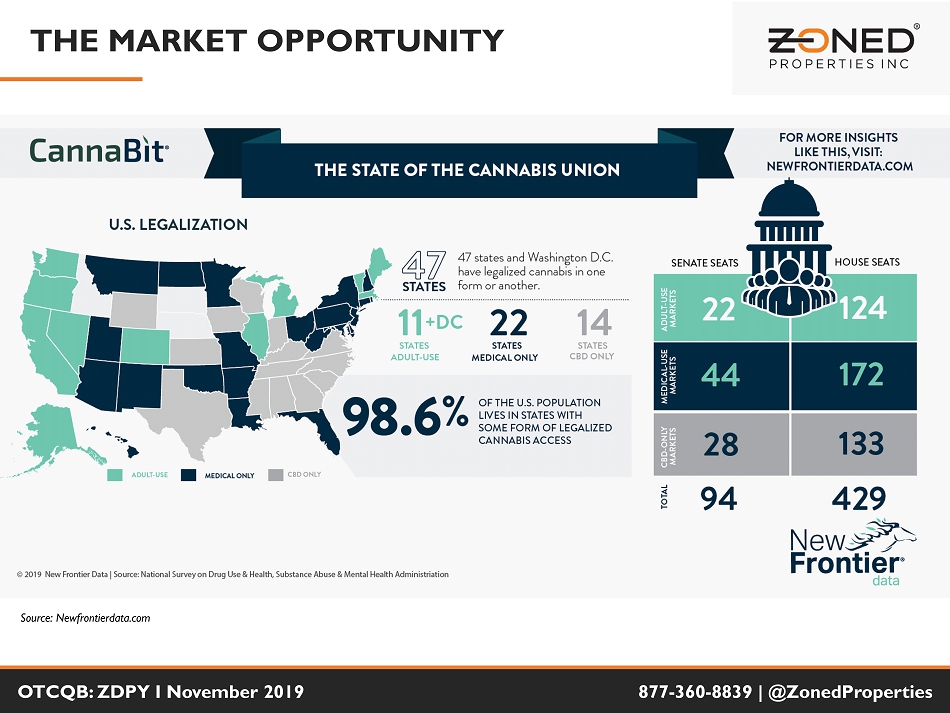

THE MARKET OPPORTUNITY Source: Newfrontierdata.com 877 - 360 - 8839 | @ZonedProperties OTCQB: ZDPY I November 2019

Source: Newfrontierdata.com THE MARKET OPPORTUNITY 877 - 360 - 8839 | @ZonedProperties OTCQB: ZDPY I November 2019

THE MARKET CHALLENGE Regulated Cannabis Industry Market Challenge Properly predicting the risk and success of a regulated operator, which will in turn affect the potential value of the operating property. How can a Real Estate Company, Fund, or Investor effectively identify properties with successful operators for acquisition targets and sale - leaseback opportunities? 877 - 360 - 8839 | @ZonedProperties OTCQB: ZDPY I November 2019

OUR MARKET APPROACH Sale - Leaseback Opportunities Sustainability Services Real Estate Services Research Services Zoned Advisory Services provides Real Estate & Sustainability Services to Regulated Cannabis Clients in order to mitigate the risk of externally targeting properties for sale - leaseback opportunities. 877 - 360 - 8839 | @ZonedProperties OTCQB: ZDPY I November 2019

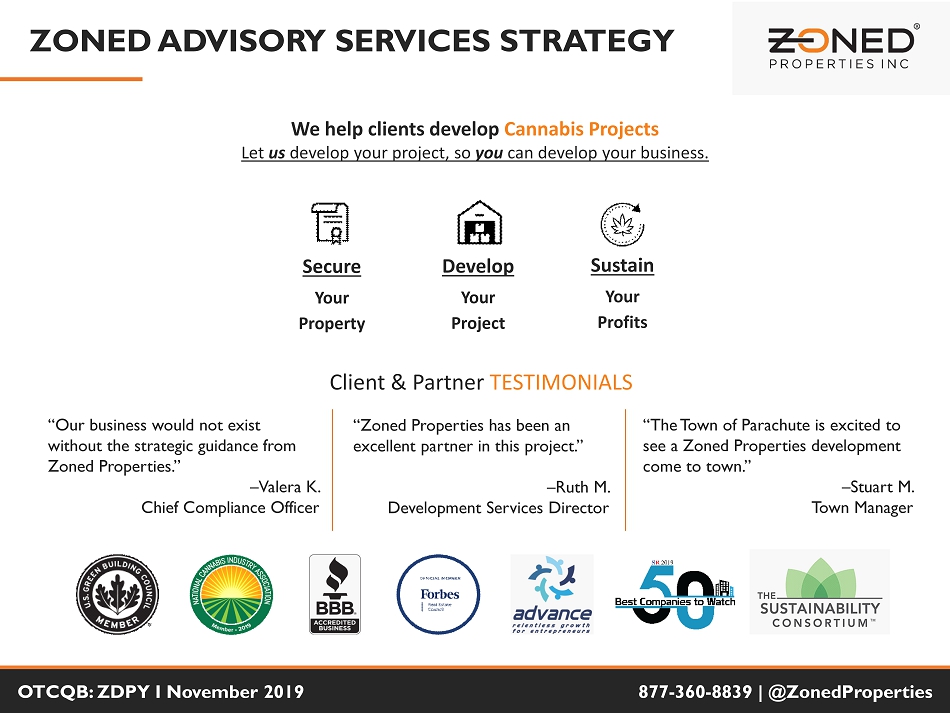

ZONED ADVISORY SERVICES STRATEGY Client & Partner TESTIMONIALS “Our business would not exist without the strategic guidance from Zoned Properties.” – Valera K. Chief Compliance Officer “Zoned Properties has been an excellent partner in this project.” – Ruth M. Development Services Director “The Town of Parachute is excited to see a Zoned Properties development come to town.” – Stuart M. Town Manager We help clients develop Cannabis Projects Let us develop your project, so you can develop your business. Secure Your Property Develop Your Project Sustain Your Profits 877 - 360 - 8839 | @ZonedProperties OTCQB: ZDPY I November 2019

ZONED SALE - LEASEBACK STRATEGY Zoned Advisory Services & Real Estate Teams can generate new revenue while vetting future acquisition targets, feeding our pipeline for property acquisitions and revenue growth. Services Revenue Real Estate Services Services Revenue Sustainability Services Commission Revenue REALTOR® Transactions Active Asset Growth Sale Leaseback Acquisitions Passive Revenue Growth Triple - Net NNN Lease Revenue Client Services Revenue to Support Company Expenses & Growth Portfolio Revenue to Support Shareholder Value 1. Project Research Services • Real Estate Services • Sustainability Services 2. Project Advisory Services • Real Estate Services • Sustainability Services 3. Cannabis Real Estate Team • Commercial Transactions • Buyer/Seller Introductions 4. Property Sale - Leasebacks • With Engaged Advisory Clients • For Successful Operators 5. Property Portfolio Growth • Balance Sheet Asset Ownership • Triple - Net (NNN) Leasing Revenue 877 - 360 - 8839 | @ZonedProperties OTCQB: ZDPY I November 2019

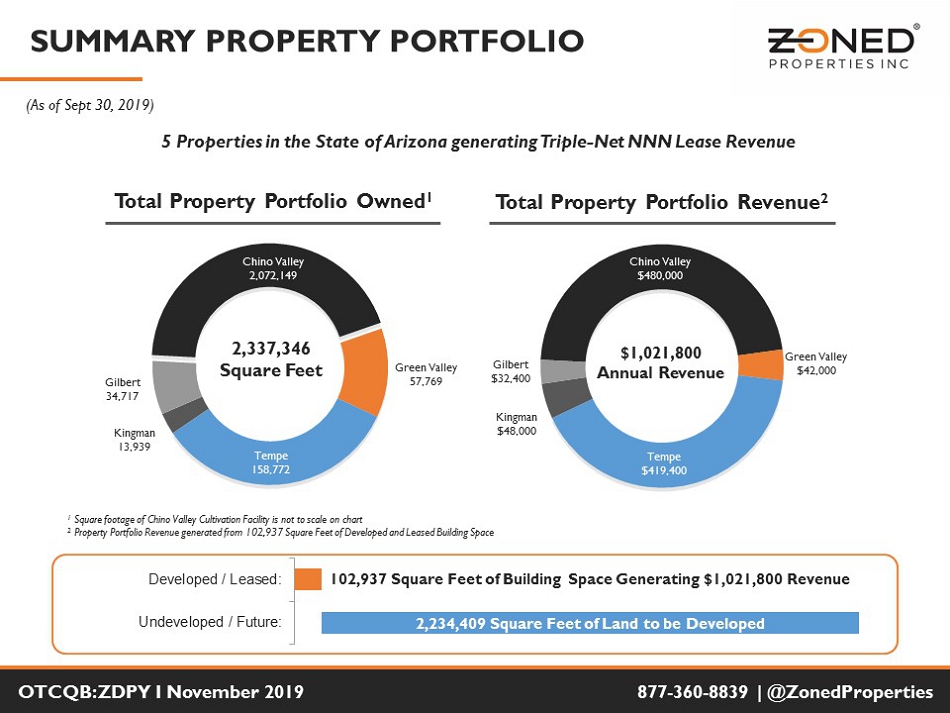

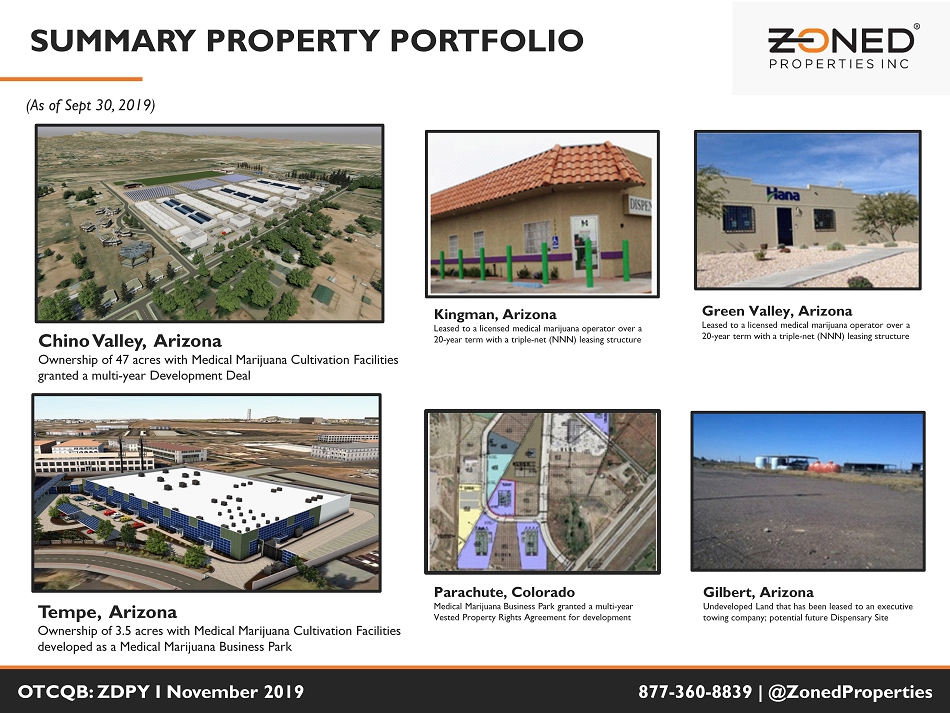

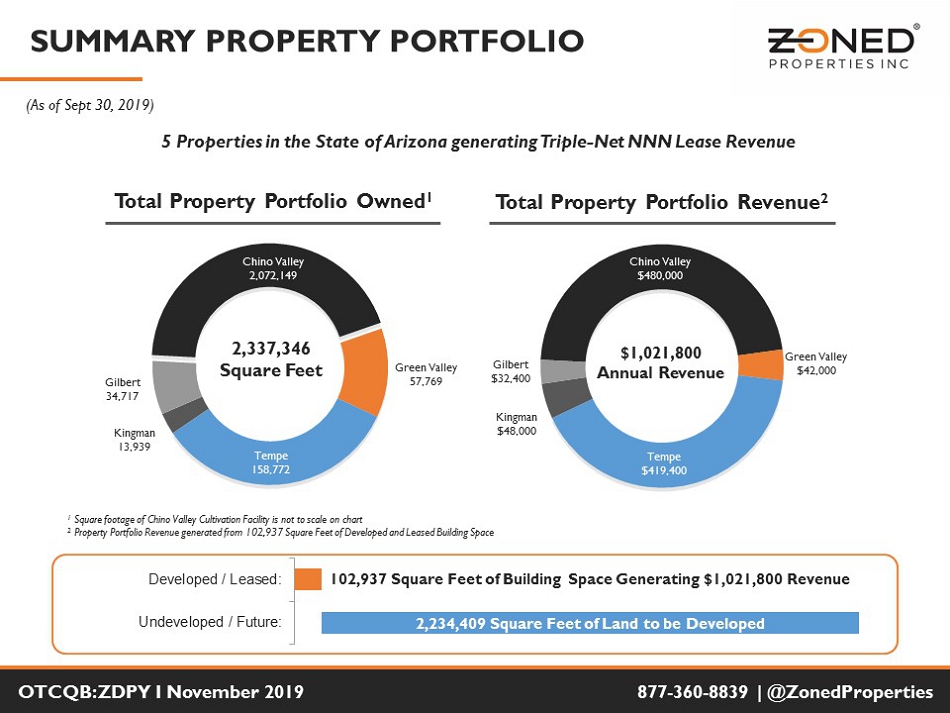

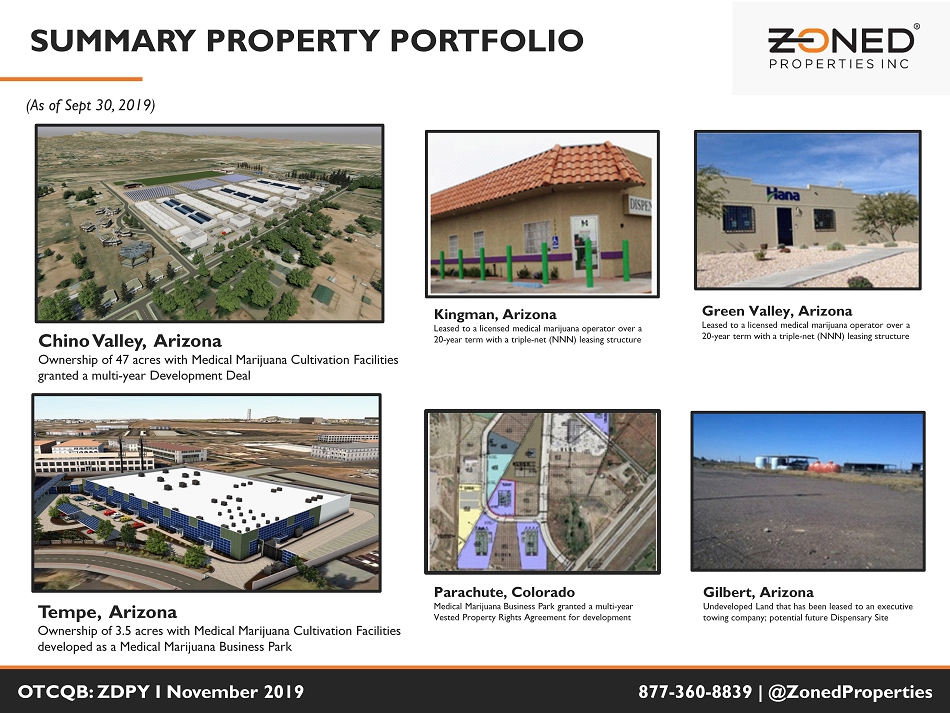

(As of Sept 30, 2019) SUMMARY PROPERTY PORTFOLIO 5 Properties in the State of Arizona generating Triple - Net NNN Lease Revenue 102,937 Square Feet of Building Space Generating $1,021,800 Revenue 2,234,409 Square Feet of Land to … Undeveloped / Future: Developed / Leased: Chino Valley 2,072,149 Green Valley 57,769 Tempe 158,772 Kingman 13,939 Gilbert 34,717 2,337,346 Square Feet Total Property Portfolio Owned 1 Total Property Portfolio Revenue 2 1 Square footage of Chino Valley Cultivation Facility is not to scale on chart 2 Property Portfolio Revenue generated from 102,937 Square Feet of Developed and Leased Building Space Chino Valley $480,000 Green Valley $42,000 Tempe $419,400 Kingman $48,000 Gilbert $32,400 $1,021,800 Annual Revenue 877 - 360 - 8839 | @ZonedProperties OTCQB: ZDPY I November 2019

SUMMARY PROPERTY PORTFOLIO Chino Valley, Arizona Ownership of 47 acres with Medical Marijuana Cultivation Facilities granted a multi - year Development Deal Tempe, Arizona Ownership of 3.5 acres with Medical Marijuana Cultivation Facilities developed as a Medical Marijuana Business Park Kingman, Arizona Leased to a licensed medical marijuana operator over a 20 - year term with a triple - net (NNN) leasing structure Green Valley, Arizona Leased to a licensed medical marijuana operator over a 20 - year term with a triple - net (NNN) leasing structure Parachute, Colorado Medical Marijuana Business Park granted a multi - year Vested Property Rights Agreement for development Gilbert, Arizona Undeveloped Land that has been leased to an executive towing company; potential future Dispensary Site 877 - 360 - 8839 | @ZonedProperties OTCQB: ZDPY I November 2019 (As of Sept 30, 2019)

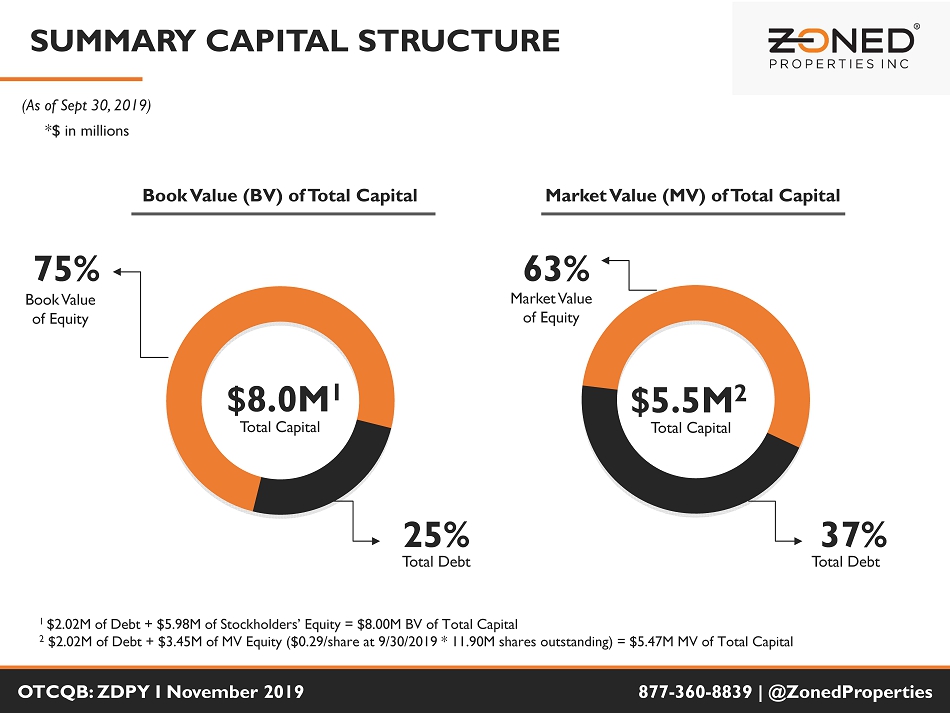

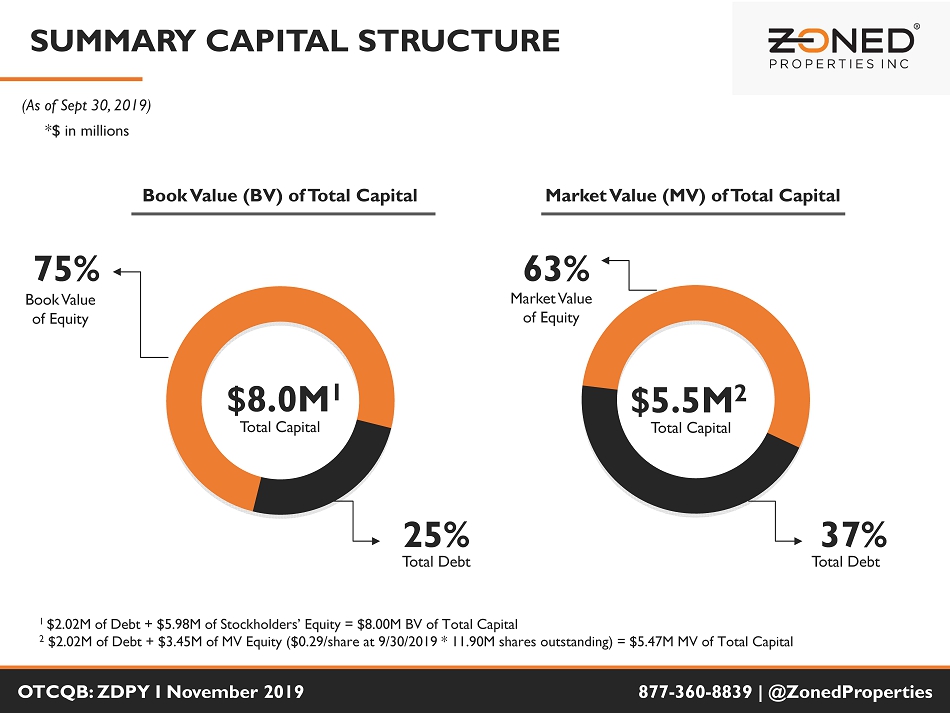

SUMMARY CAPITAL STRUCTURE Book Value (BV) of Total Capital Market Value (MV) of Total Capital 1 $2.02M of Debt + $5.98M of Stockholders’ Equity = $8.00M BV of Total Capital 2 $2.02M of Debt + $3.45M of MV Equity ($0.29/share at 9/30/2019 * 11.90M shares outstanding) = $5.47M MV of Total Capital Total Capital Total Capital Book Value of Equity Total Debt Market Value of Equity Total Debt 63% 37% 75% 25% $8.0M 1 $5.5M 2 (As of Sept 30, 2019) *$ in millions 877 - 360 - 8839 | @ZonedProperties OTCQB: ZDPY I November 2019

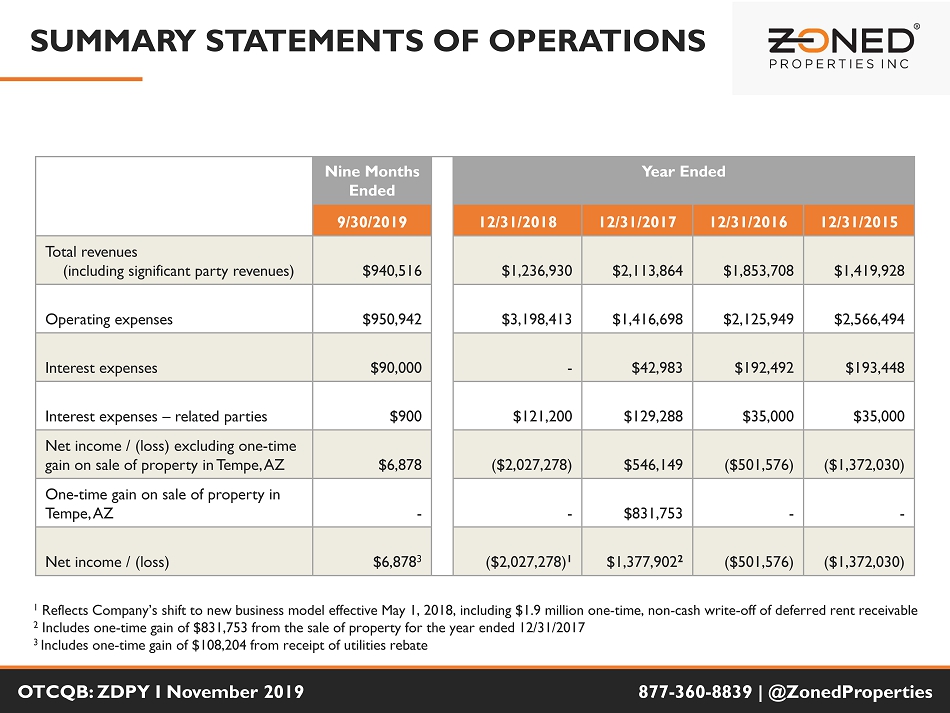

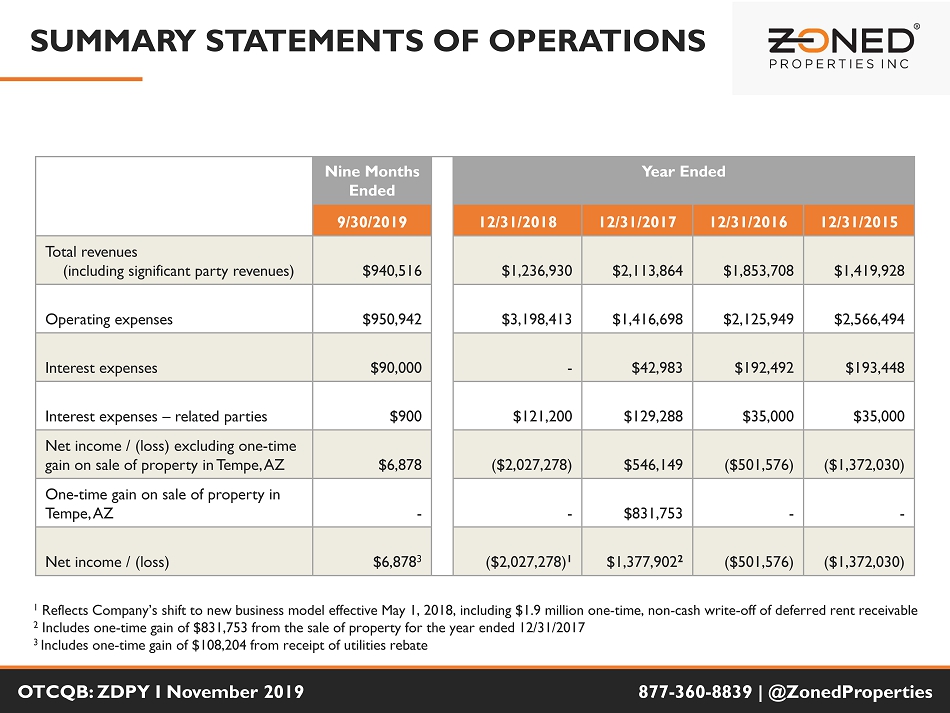

SUMMARY STATEMENTS OF OPERATIONS Nine Months Ended Year Ended 9/30/2019 12/31/2018 12/31/2017 12/31/2016 12/31/2015 Total revenues (including significant party revenues) $940,516 $1,236,930 $2,113,864 $1,853,708 $1,419,928 Operating expenses $950,942 $3,198,413 $1,416,698 $2,125,949 $2,566,494 Interest expenses $90,000 - $42,983 $192,492 $193,448 Interest expenses – related parties $900 $121,200 $129,288 $35,000 $35,000 Net income / (loss) excluding one - time gain on sale of property in Tempe, AZ $6,878 ($2,027,278) $546,149 ($501,576) ($1,372,030) One - time gain on sale of property in Tempe, AZ - - $831,753 - - Net income / (loss) $6,878 3 ($2,027,278) 1 $1,377,902 2 ($501,576) ($1,372,030) 1 Reflects Company’s shift to new business model effective May 1, 2018, including $1.9 million one - time, non - cash write - off of de ferred rent receivable 2 Includes one - time gain of $831,753 from the sale of property for the year ended 12/31/2017 3 Includes one - time gain of $108,204 from receipt of utilities rebate 877 - 360 - 8839 | @ZonedProperties OTCQB: ZDPY I November 2019

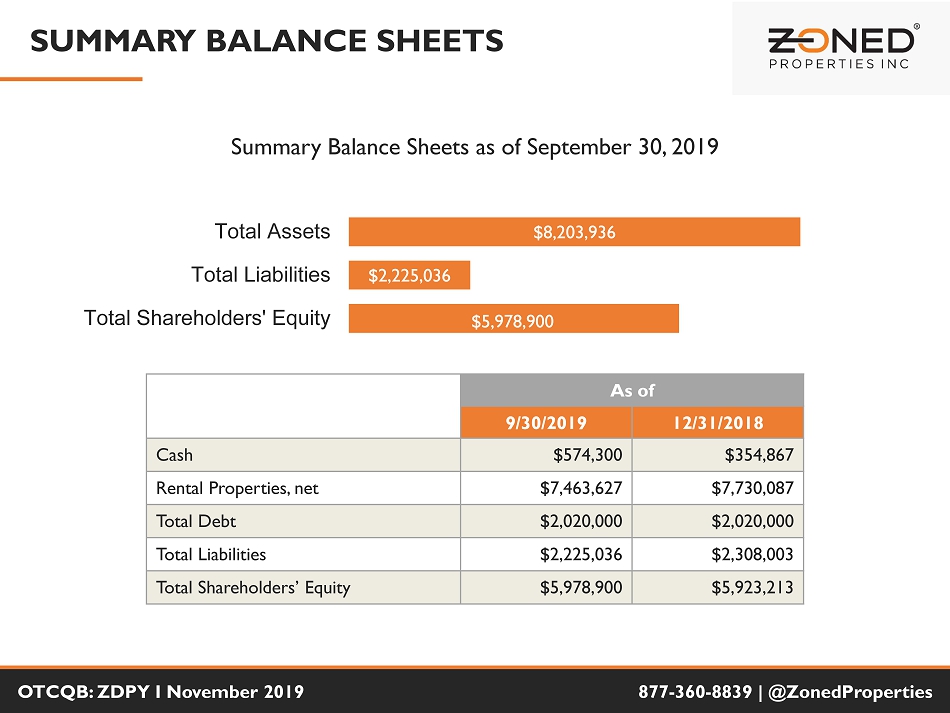

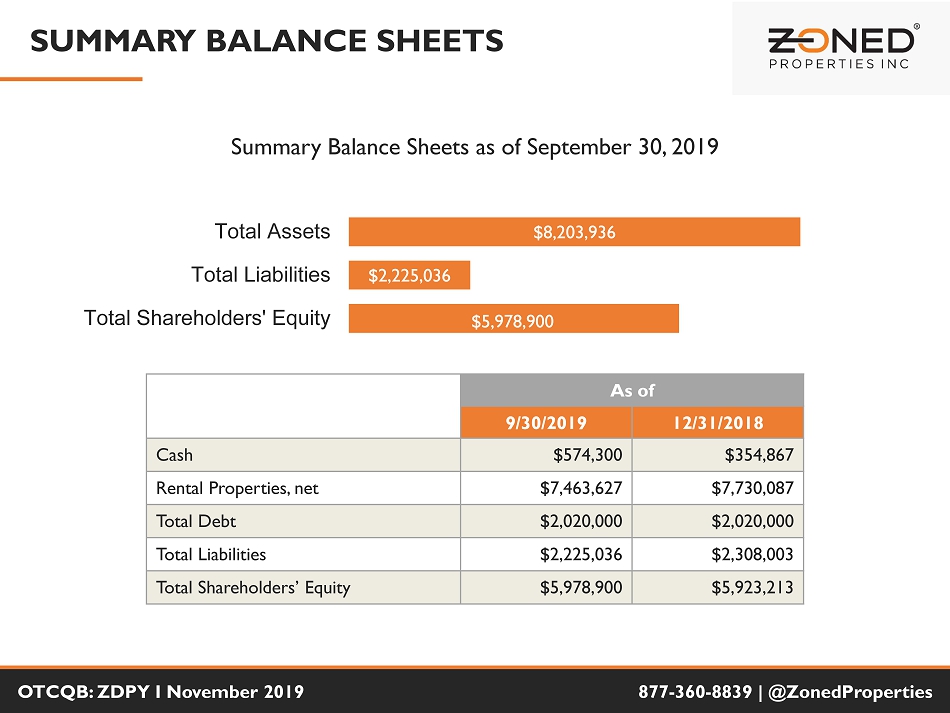

SUMMARY BALANCE SHEETS As of 9/30/2019 12/31/2018 Cash $574,300 $354,867 Rental Properties, net $7,463,627 $7,730,087 Total Debt $2,020,000 $2,020,000 Total Liabilities $2,225,036 $2,308,003 Total Shareholders’ Equity $5,978,900 $5,923,213 $5,978,900 $2,225,036 $8,203,936 Total Shareholders' Equity Total Liabilities Total Assets Summary Balance Sheets as of September 30, 2019 877 - 360 - 8839 | @ZonedProperties OTCQB: ZDPY I November 2019

INDUSTRY LEADERSHIP Executive Councils & Memberships 877 - 360 - 8839 | @ZonedProperties OTCQB: ZDPY I November 2019

David Honaman Independent Director BUSINESS LEADERSHIP Bryan McLaren, MBA Chief Executive Officer & Chief Financial Officer Management Board of Directors Bryan McLaren Chairman Alex McLaren Director Art Friedman Independent Director Derek Overstreet Independent Director John Kester III, PHD Director of Sustainability Services 877 - 360 - 8839 | @ZonedProperties OTCQB: ZDPY I November 2019

ZONED PROPERTIES ® , INC. TIGHT CAPITAL STRUCTURE 11,901,548 COMMON SHARES (As of September 30, 2019) 2 MILLION SQ. FT. OF PROPERTY OWNERSHIP ( No Toxic Debt) MULTI - STATE EXPERIENCE & PROVEN SUCCESS EXECUTIVE MEMBERSHIPS FORBES, USGBC, NCIA, BBB COMMUNITY FOCUSED REGULATED CANNABIS CO. OVER 5 - YEARS AS PUBLIC COMPANY IN REGULATED CANNABIS CASH FLOW POSITIVE FROM OPERATIONS TRIPLE - NET (NNN) PASSIVE REVENUE STREAM 877 - 360 - 8839 | @ZonedProperties OTCQB: ZDPY I November 2019

FOR MORE INFORMATION COMPANY CONTACT Bryan McLaren ; Chairman, CEO & CFO Zoned Properties, Inc. | Scottsdale, AZ www.ZonedProperties.com | Tel 877.360.8839 | Bryan@ZonedProperties.com 877 - 360 - 8839 | @ZonedProperties OTCQB: ZDPY I November 2019

20