Exhibit 99.2

Investor Presentation May 2022 | OTCQB: ZDPY Site Identification Advisory Commercial Brokerage Investment Portfolio Property Technology ® OTCQB: ZDPY I May 2022 1 877 - 360 - 8839 | @ZonedProperties

FORWARD - LOOKING STATEMENTS OTCQB: ZDPY I May 2022 2 877 - 360 - 8839 | @ZonedProperties Safe Harbor Statement This presentation contains forward - looking statements . All statements other than statements of historical facts included in this press release are forward - looking statements . In some cases, forward - looking statements can be identified by words such as "believe," "expect," "anticipate," "plan," "potential," "continue" or similar expressions . Such forward - looking statements include risks and uncertainties, and there are important factors that could cause actual results to differ materially from those expressed or implied by such forward - looking statements . These factors, risks and uncertainties are discussed in the Company's filings with the Securities and Exchange Commission . Investors should not place any undue reliance on forward - looking statements since they involve known and unknown, uncertainties and other factors which are, in some cases, beyond the Company's control which could, and likely will, materially affect actual results, levels of activity, performance or achievements . Any forward - looking statement reflects the Company's current views with respect to future events and is subject to these and other risks, uncertainties and assumptions relating to operations, results of operations, growth strategy and liquidity . The Company assumes no obligation to publicly update or revise these forward - looking statements for any reason, or to update the reasons actual results could differ materially from those anticipated in these forward - looking statements, even if new information becomes available in the future . COVID - 19 Statement In March 2020 , the World Health Organization declared COVID - 19 a global pandemic and recommended containment and mitigation measures worldwide . The Company is monitoring this closely, and although operations have not been materially affected by the COVID - 19 outbreak to date, the ultimate duration and severity of the outbreak and its impact on the economic environment and our business is uncertain . Currently, all of the properties in the Company’s portfolio are open to its Significant Tenants and will remain open pursuant to state and local government requirements . The Company did not experience in 2020 or 2021 and does not foresee in 2022 , any material changes to its operations from COVID - 19 . The Company’s tenants are continuing to generate revenue at these properties, and they have continued to make rental payments in full and on time and we believe the tenants’ liquidity position is sufficient to cover its expected rental obligations . Accordingly, while the Company does not anticipate an impact on its operations, it cannot estimate the duration of the pandemic and potential impact on its business if the properties must close or if the tenants are otherwise unable or unwilling to make rental payments . In addition, a severe or prolonged economic downturn could result in a variety of risks to the Company’s business, including weakened demand for its properties and a decreased ability to raise additional capital when needed on acceptable terms, if at all .

ZONED PROPERTIES, INC. (OTCQB: ZDPY) Our MISSION To provide a full - spectrum of Real Estate Services for the Regulated Cannabis Industry , positioning the Company for Real Estate Investments & Revenue Growth . Our VISION Our VALUES Integrating Legacy Cannabis into Modern Communities through Real Estate Development Projects. OTCQB: ZDPY I May 2022 3 877 - 360 - 8839 | @ZonedProperties Sophistication , Safety , Sustainability , Stewardship

Zoned Properties ® (OTCQB: ZDPY) is positioning to deploy Real Estate Capital focused on Highly Regulated Industries that have Major Barriers to Entry and Premium Return Profiles , with a best - in - class team to help Mitigate Risks . Scalable growth opportunity with Public Company Up - side 12.2 Million Shares Outstanding | 6+ Years as Public Company: Audited & SEC Reporting $2 Million non - toxic Debt (Maturity 2030) Real Estate Portfolio cash - flowing $ 1.83 Million Annually through 2040 Triple - Net (NNN) Investment - Grade Leases ZONED PROPERTIES, INC. (OTCQB: ZDPY) OTCQB: ZDPY I May 2022 4 877 - 360 - 8839 | @ZonedProperties

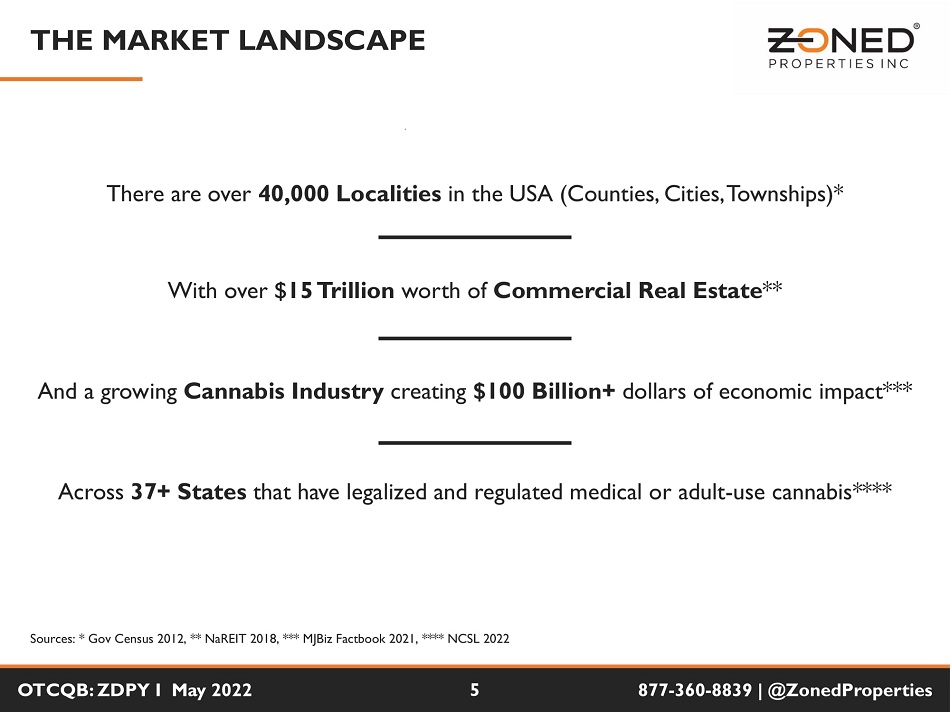

THE MARKET LANDSCAPE There are over 40,000 Localities in the USA (Counties, Cities,Townships)* With over $ 15 Trillion worth of Commercial Real Estate ** Sources: * Gov Census 2012, ** NaREIT 2018, *** MJBiz Factbook 2021, **** NCSL 2022 And a growing Cannabis Industry creating $100 Billion+ dollars of economic impact*** Across 37+ States that have legalized and regulated medical or adult - use cannabis**** OTCQB: ZDPY I May 2022 5 877 - 360 - 8839 | @ZonedProperties

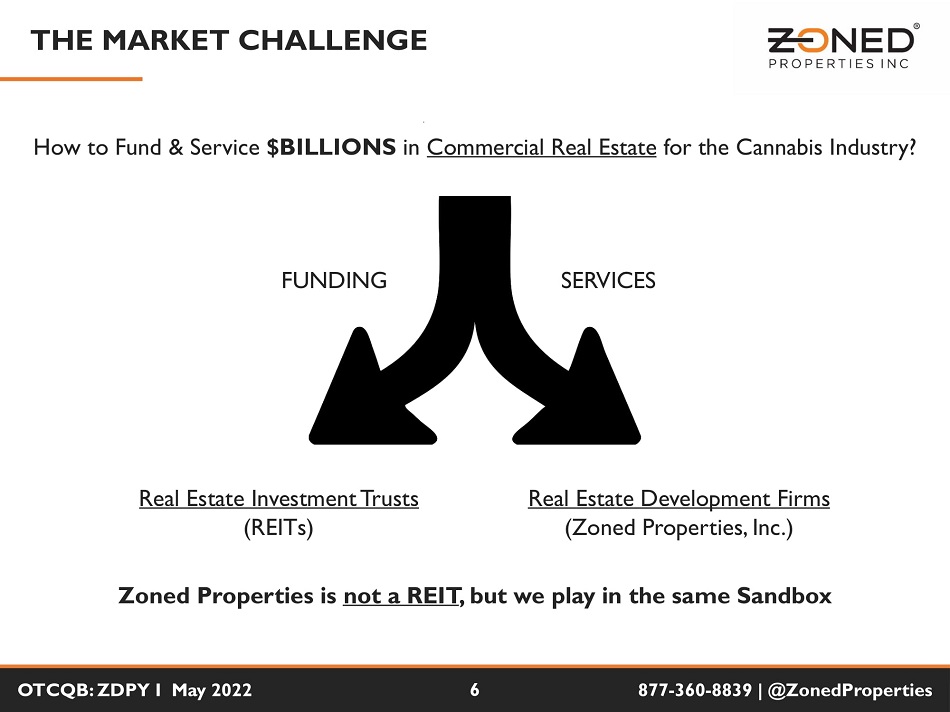

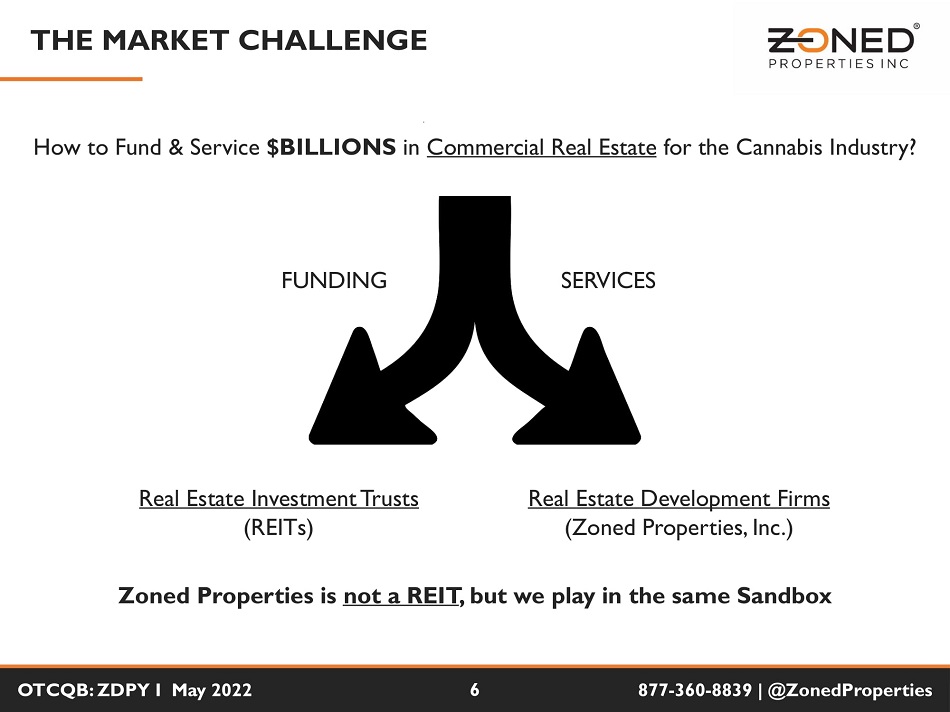

THE MARKET CHALLENGE How to Fund & Service $BILLIONS in Commercial Real Estate for the Cannabis Industry? Real Estate Investment Trusts (REITs) Real Estate Development Firms (Zoned Properties, Inc.) Zoned Properties is not a REIT , but we play in the same Sandbox FUNDING SERVICES OTCQB: ZDPY I May 2022 6 877 - 360 - 8839 | @ZonedProperties

THE MARKET OPPORTUNITY There are estimated to be 7,500+ Retail Dispensaries in the U.S. as of 2022 There are estimated to be 15,000+ Retail Dispensaries in the U.S. by 2025 With an average of $2 Million in Real Estate Capital needed per Project Site ~60% of these projects will need 3 rd Party Real Estate Capital ~95% of these projects will need 3 rd Party Real Estate Services & Expertise Zoned Properties is positioned to capture Market Share by leveraging our full - spectrum of integrated commercial real estate development services. OTCQB: ZDPY I May 2022 7 877 - 360 - 8839 | @ZonedProperties

THE ZONED PROPERTIES SOLUTION The best - in - class team at Zoned Properties are experts in cannabis real estate services. We have been sharpening our National Services and Property Investment process to fuel a strong Pipeline for investment portfolio acquisitions and growth Zoned Properties can go where others won’t or can’t, leveraging our full - spectrum of Real Estate Services to build a strong property Investment Portfolio Property Technology powering Real Estate Services fueling our Investment Portfolio Site Identification Advisory Commercial Brokerage Investment Portfolio Property Technology OTCQB: ZDPY I May 2022 8 877 - 360 - 8839 | @ZonedProperties

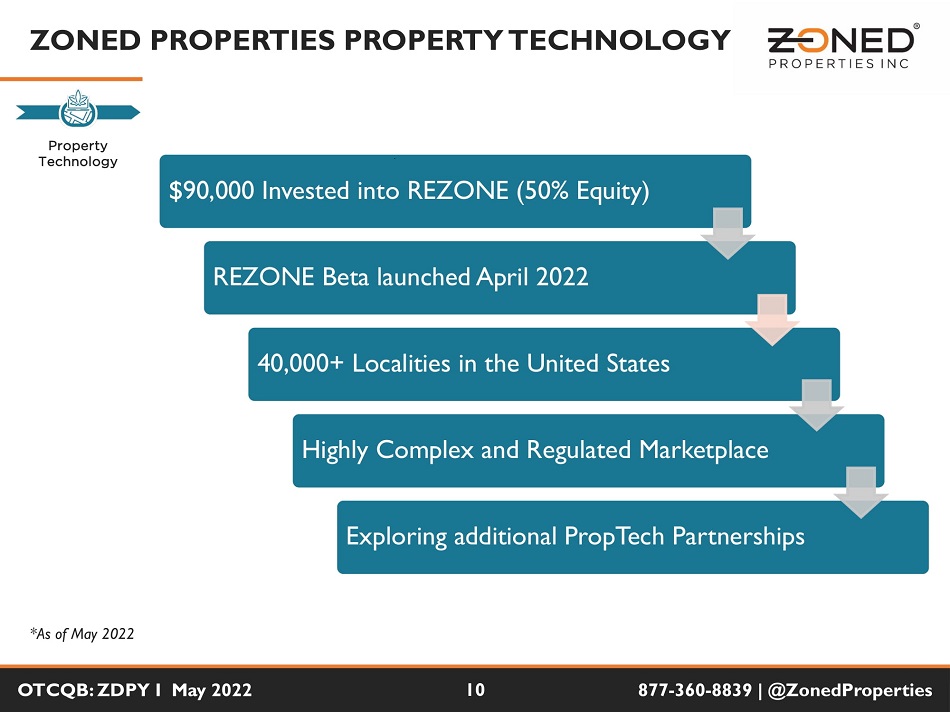

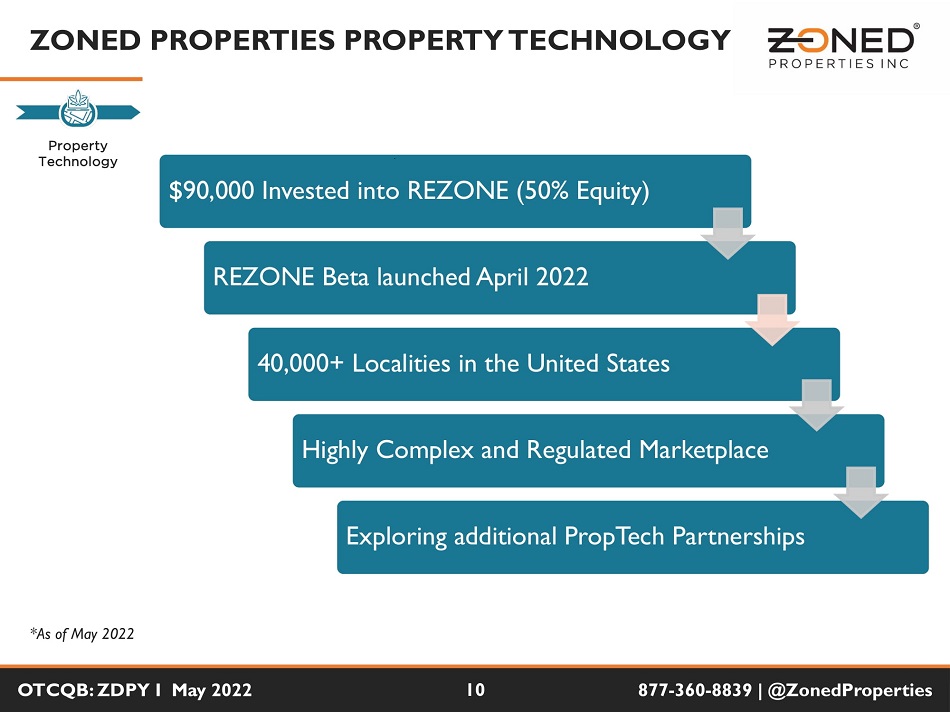

ZONED PROPERTIES PROPTECH SERVICES • We believe Property Technology (“PropTech”) will become a significant driver of growth in highly regulated real estate marketplaces, especially the regulated cannabis industry . • Zoned Properties has partnered with Zoneomics & invested $ 90 , 000 to launch our zoning and mapping platform, REZONE , which aims to leverage our real estate expertise through a scalable property technology platform . • Through our capital investment, Zoned Properties holds a 50 % equity stake in REZONE along with our partner, Zoneomics . Property Technology OTCQB: ZDPY I May 2022 9 877 - 360 - 8839 | @ZonedProperties

ZONED PROPERTIES PROPERTY TECHNOLOGY Property Technology $90,000 Invested into REZONE (50% Equity) REZONE Beta launched April 2022 40,000+ Localities in the United States Highly Complex and Regulated Marketplace Exploring additional PropTech Partnerships *As of May 2022 OTCQB: ZDPY I May 2022 10 877 - 360 - 8839 | @ZonedProperties

ZONED PROPERTIES ADVISORY SERVICES We help clients develop Cannabis Projects Let us develop your project, so you can develop your business. Site Identification Advisory • Identifying and developing qualified real estate for regulated cannabis can be extremely challenging . Sifting through municipal zoning code, endless review of local mapping overlays, measuring distances from sensitive uses, and all to risk having a property owner deny the use . The list goes on . • At Zoned Properties, we leverage our best - in - class network and years of experience specializing in cannabis real estate with proven processes and a proprietary tech stack that saves our clients time and money . OTCQB: ZDPY I May 2022 11 877 - 360 - 8839 | @ZonedProperties

ZONED PROPERTIES ADVISORY SERVICES $400,000+ Advisory Revenues* 100+ Cannabis Zoned Properties Identified* 50+ Advisory Client Project Engagements* 10+ State Cannabis Market Experience* National Cannabis Advisory Network Site Identification Advisory *Cumulative Advisory Metrics since inception as May 2022 OTCQB: ZDPY I May 2022 12 877 - 360 - 8839 | @ZonedProperties

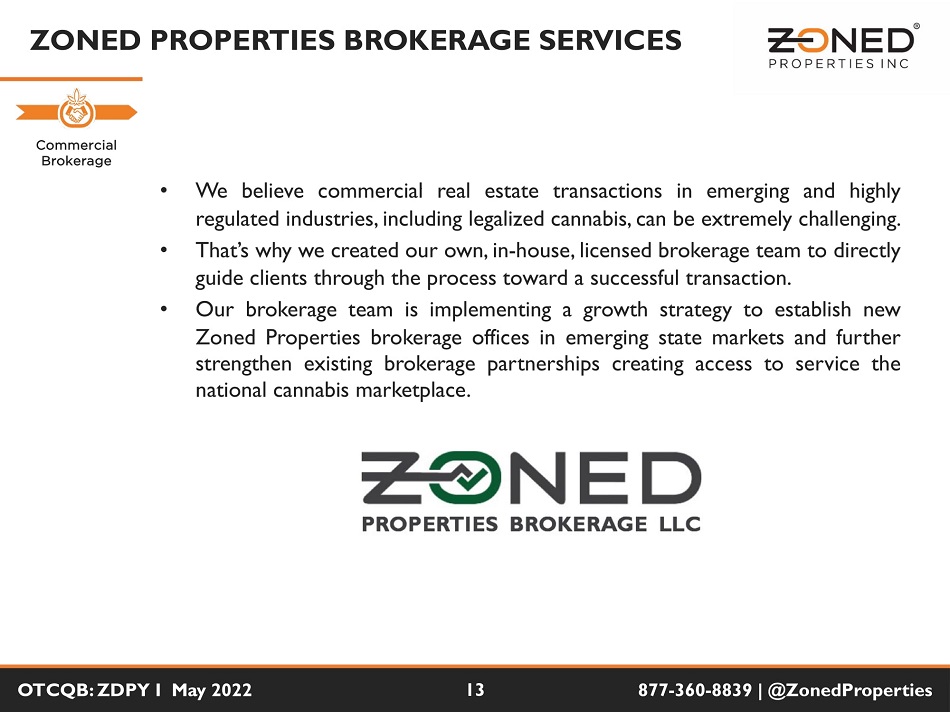

ZONED PROPERTIES BROKERAGE SERVICES Commercial Brokerage • We believe commercial real estate transactions in emerging and highly regulated industries, including legalized cannabis, can be extremely challenging . • That’s why we created our own, in - house, licensed brokerage team to directly guide clients through the process toward a successful transaction . • Our brokerage team is implementing a growth strategy to establish new Zoned Properties brokerage offices in emerging state markets and further strengthen existing brokerage partnerships creating access to service the national cannabis marketplace . OTCQB: ZDPY I May 2022 13 877 - 360 - 8839 | @ZonedProperties

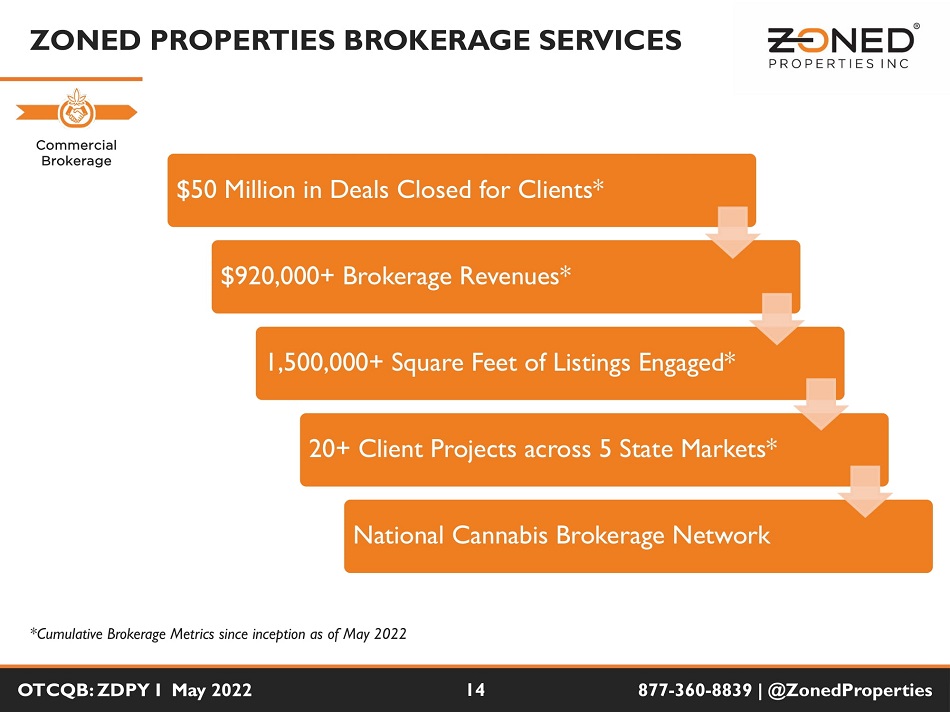

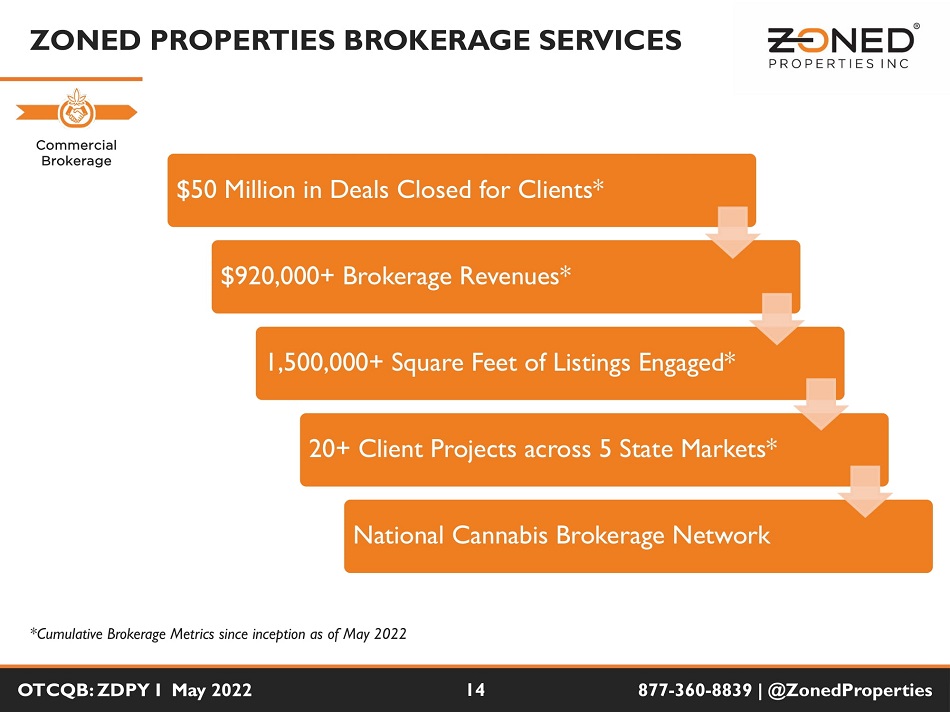

ZONED PROPERTIES BROKERAGE SERVICES $50 Million in Deals Closed for Clients* $920,000+ Brokerage Revenues* 1,500,000+ Square Feet of Listings Engaged* 20+ Client Projects across 5 State Markets* National Cannabis Brokerage Network Commercial Brokerage *Cumulative Brokerage Metrics since inception as of May 2022 OTCQB: ZDPY I May 2022 14 877 - 360 - 8839 | @ZonedProperties

ZONED PROPERTIES INVESTMENT PORTFOLIO • We believe Cannabis Sites and Franchise Organizations are strong drivers of value for real estate development and investment opportunities . • As part of the commercial real estate strategy at Zoned Properties, we have partnered with & provided $ 200 , 000 of investment capital to a national cannabis retail franchisor, Open Dør Dispensaries, leveraging our real estate services across a multi - state platform . • Zoned Properties can benefit directly and indirectly from our partnership with Open Dør Dispensaries . As an investor, the Company receives a percentage of initial franchise fees and renewal fees, and as the commercial real estate partner, the Zoned Properties is positioned to provide real estate services and property investments for franchise real estate locations . Investment Portfolio OTCQB: ZDPY I May 2022 15 877 - 360 - 8839 | @ZonedProperties

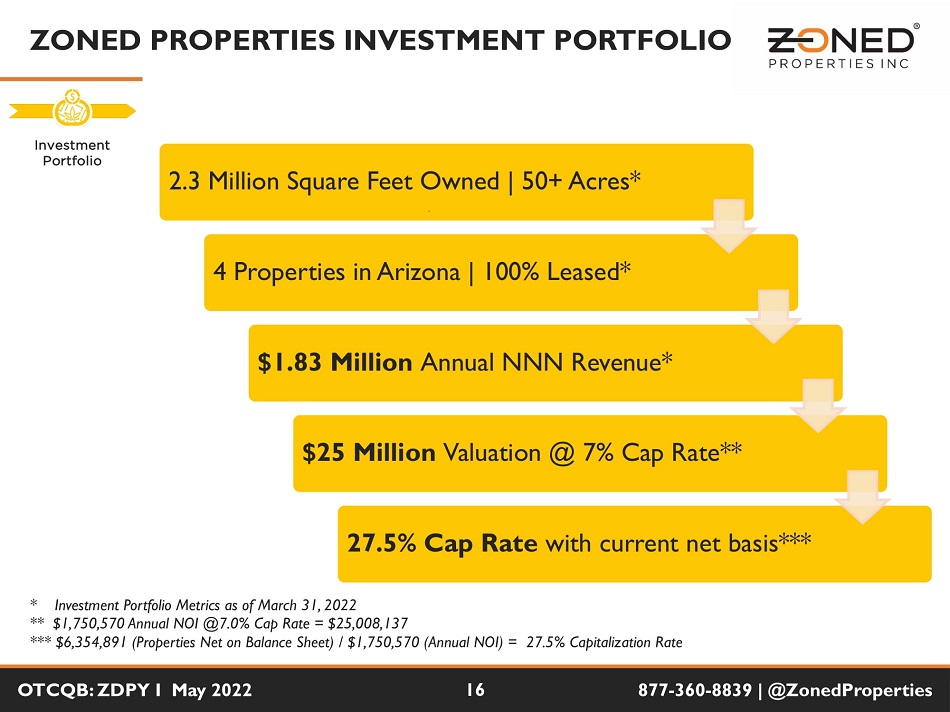

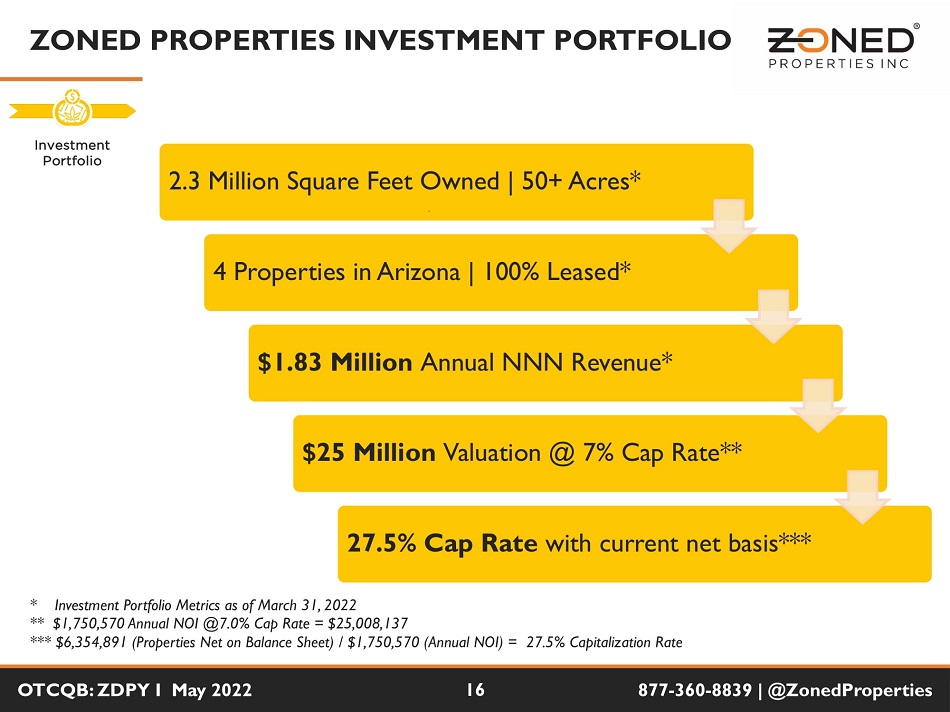

ZONED PROPERTIES INVESTMENT PORTFOLIO 2.3 Million Square Feet Owned | 50+ Acres* 4 Properties in Arizona | 100% Leased* $1.83 Million Annual NNN Revenue* $25 Million Valuation @ 7% Cap Rate** 27.5% Cap Rate with current net basis*** * Investment Portfolio Metrics as of March 31, 2022 ** $1,750,570 Annual NOI @7.0% Cap Rate = $25,008,137 *** $6,354,891 (Properties Net on Balance Sheet) / $1,750,570 (Annual NOI) = 27.5% Capitalization Rate Investment Portfolio OTCQB: ZDPY I May 2022 16 877 - 360 - 8839 | @ZonedProperties

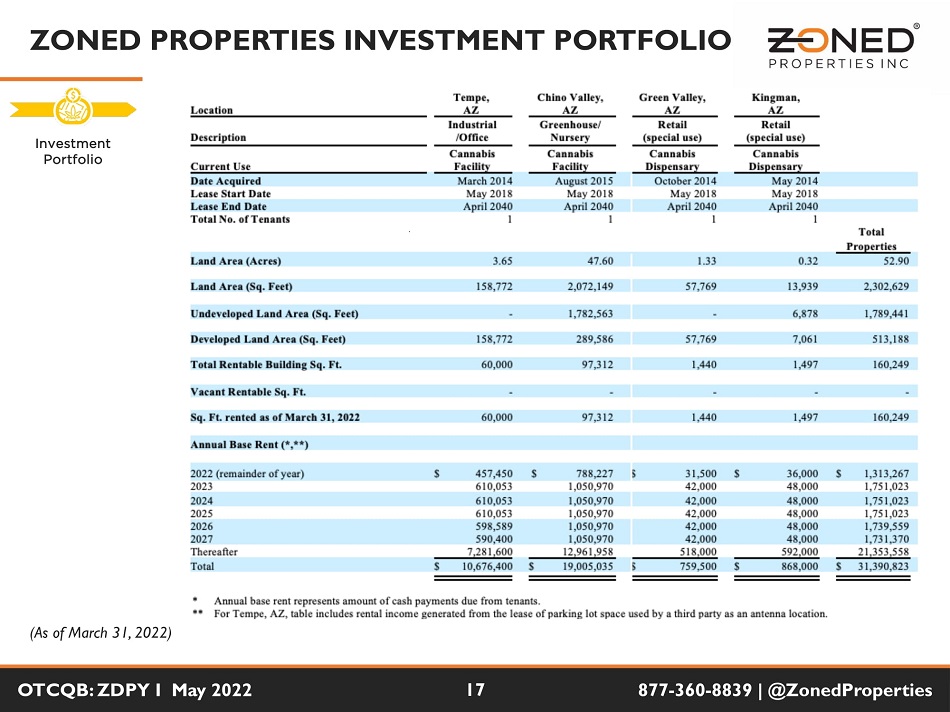

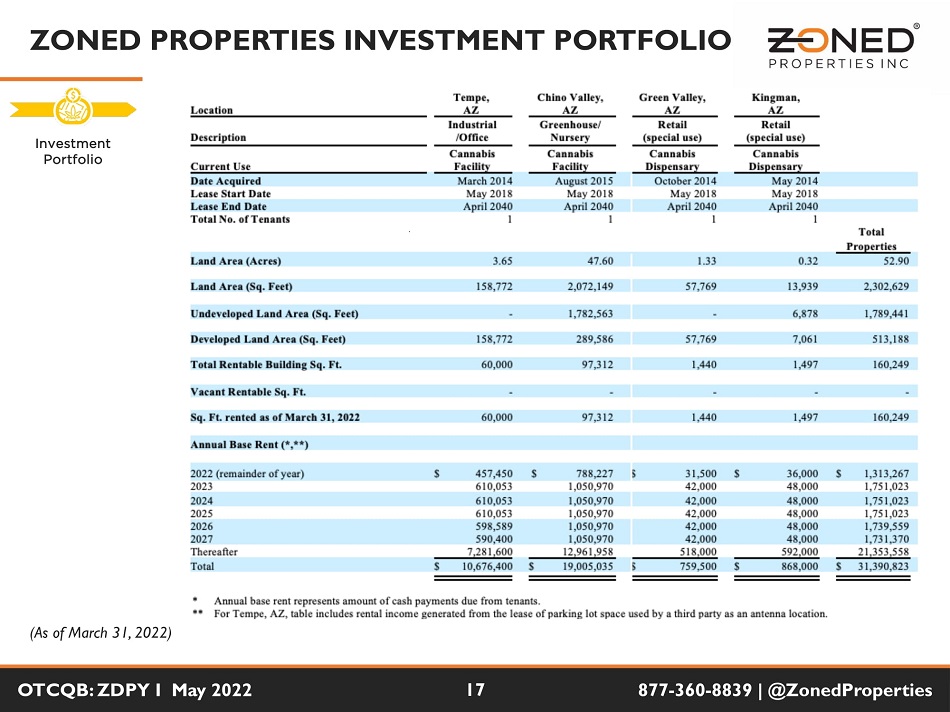

ZONED PROPERTIES INVESTMENT PORTFOLIO Investment Portfolio (As of March 31, 2022) OTCQB: ZDPY I May 2022 17 877 - 360 - 8839 | @ZonedProperties

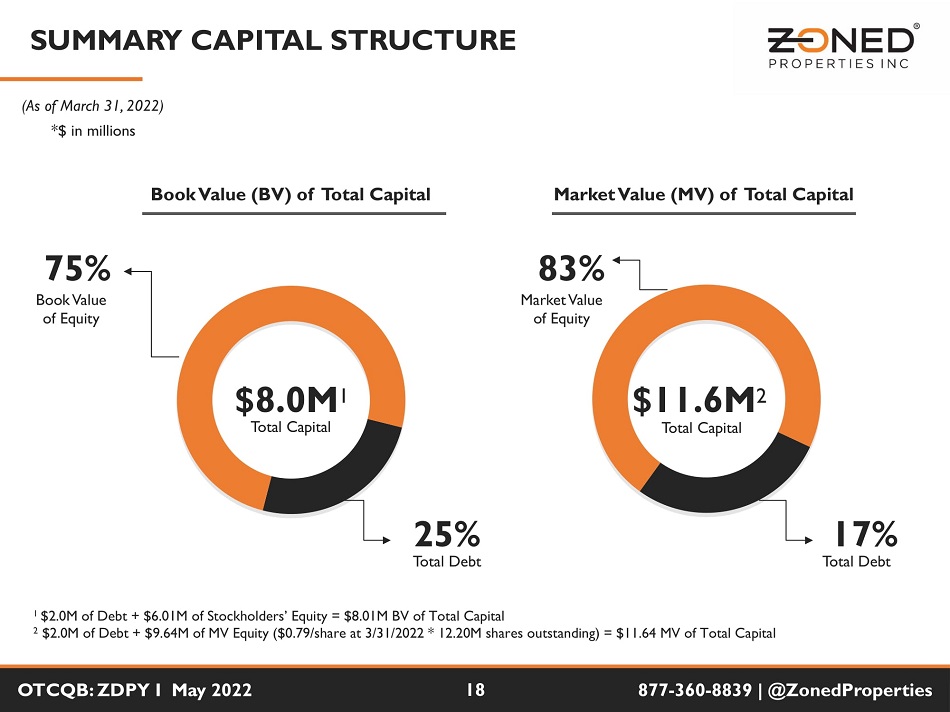

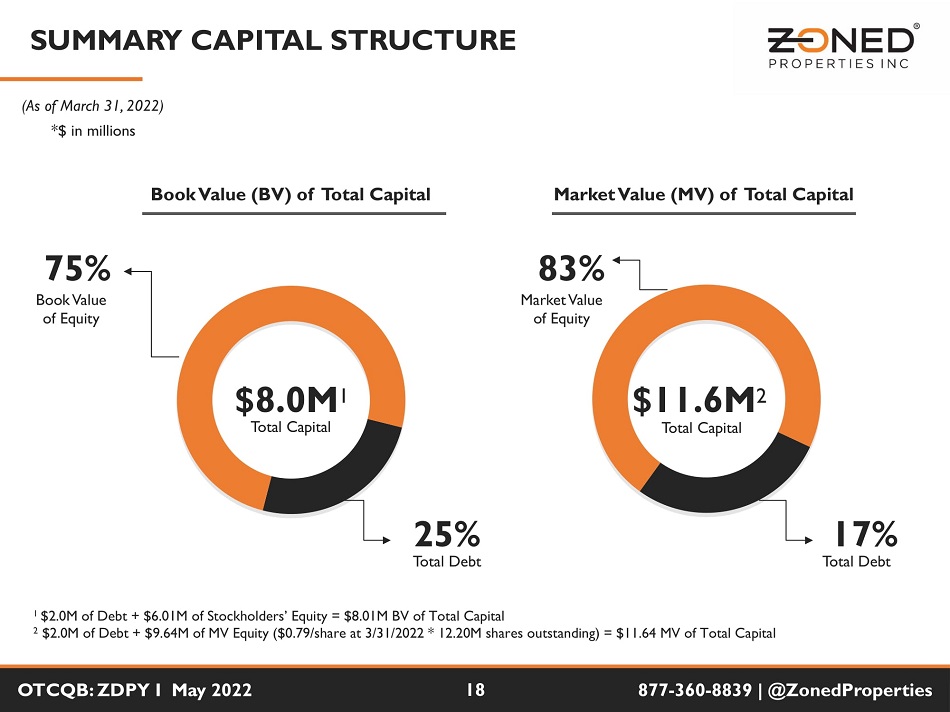

SUMMARY CAPITAL STRUCTURE Book Value (BV) of Total Capital Market Value (MV) of Total Capital 1 $2.0M of Debt + $6.01M of Stockholders’ Equity = $8.01M BV of Total Capital 2 $2.0M of Debt + $9.64M of MV Equity ($0.79/share at 3/31/2022 * 12.20M shares outstanding) = $11.64 MV of Total Capital $8.0M 1 Total Capital 75% Book Value of Equity 25% Total Debt 83% Market Value of Equity $11.6M 2 Total Capital 17% Total Debt (As of March 31, 2022) *$ in millions OTCQB: ZDPY I May 2022 18 877 - 360 - 8839 | @ZonedProperties

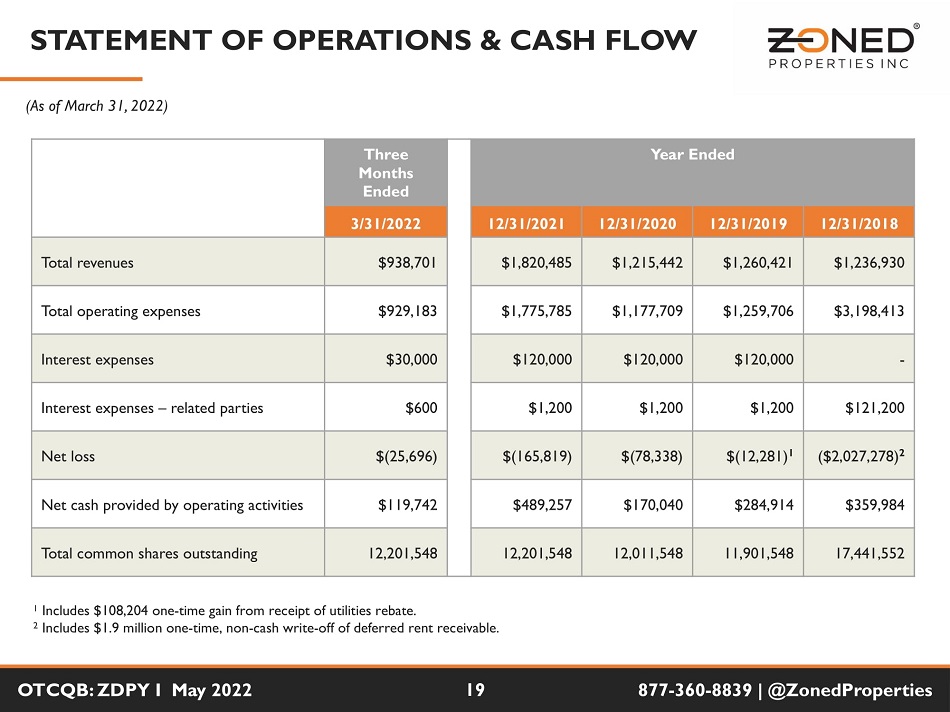

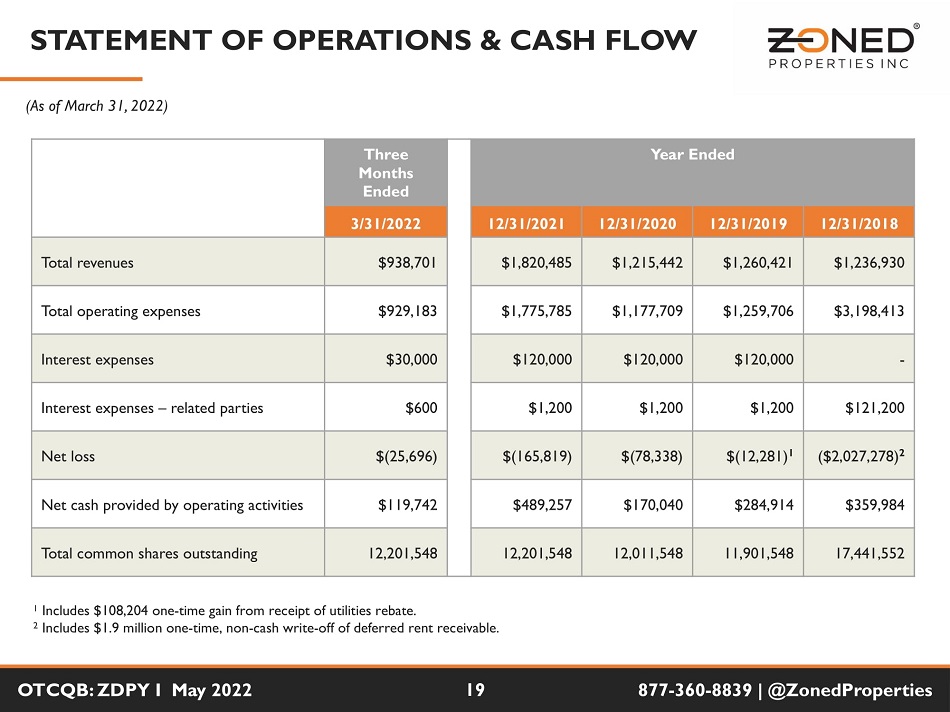

STATEMENT OF OPERATIONS & CASH FLOW OTCQB: ZDPY I May 2022 19 877 - 360 - 8839 | @ZonedProperties Three Months Ended Year Ended 3/31/2022 12/31/2021 12/31/2020 12/31/2019 12/31/2018 Total revenues $938,701 $1,820,485 $1,215,442 $1,260,421 $1,236,930 Total operating expenses $929,183 $1,775,785 $1,177,709 $1,259,706 $3,198,413 Interest expenses $30,000 $120,000 $120,000 $120,000 - Interest expenses – related parties $600 $1,200 $1,200 $1,200 $121,200 Net loss $(25,696) $(165,819) $(78,338) $(12,281) 1 ($2,027,278) 2 Net cash provided by operating activities $119,742 $489,257 $170,040 $284,914 $359,984 Total common shares outstanding 12,201,548 12,201,548 12,011,548 11,901,548 17,441,552 1 Includes $108,204 one - time gain from receipt of utilities rebate. 2 Includes $1.9 million one - time, non - cash write - off of deferred rent receivable. (As of March 31, 2022)

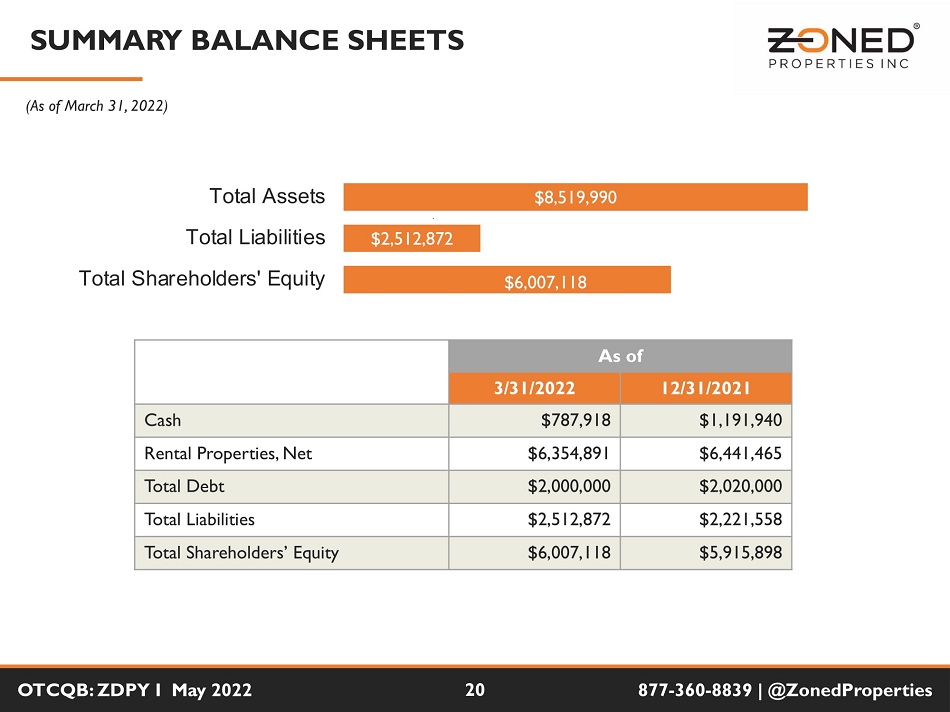

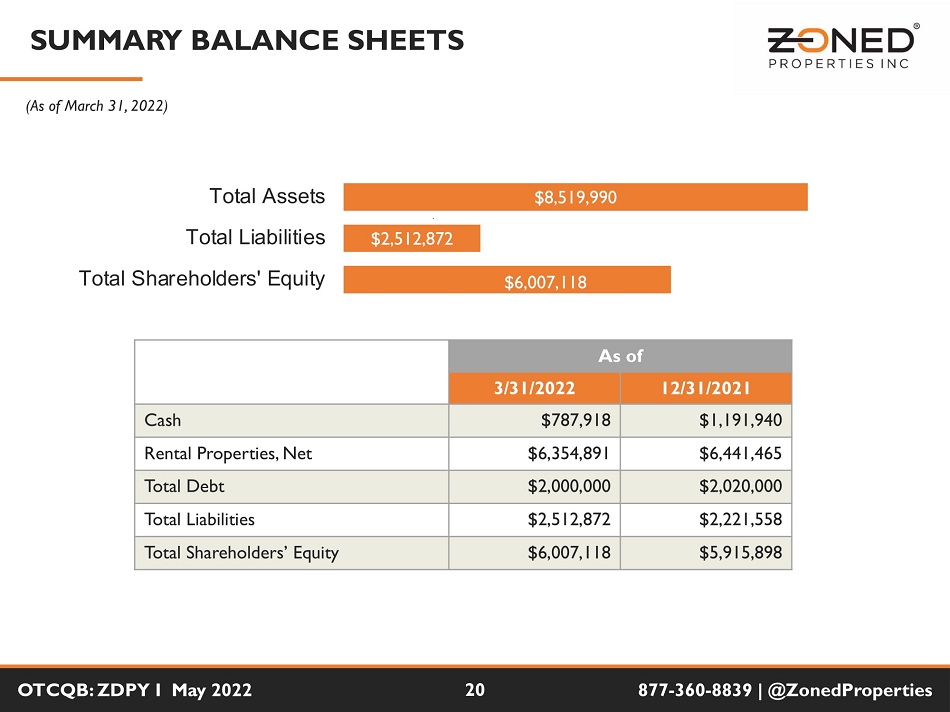

SUMMARY BALANCE SHEETS OTCQB: ZDPY I May 2022 20 877 - 360 - 8839 | @ZonedProperties As of 3/31/2022 12/31/2021 Cash $787,918 $1,191,940 Rental Properties, Net $6,354,891 $6,441,465 Total Debt $2,000,000 $2,020,000 Total Liabilities $2,512,872 $2,221,558 Total Shareholders’ Equity $6,007,118 $5,915,898 Total Assets $8,519,990 Total Liabilities $2,512,872 Total Shareholders' Equity $6,007,118 (As of March 31, 2022)

INDUSTRY LEADERSHIP Executive Councils & Memberships A Highly Regulated & EMERGING INDUSTRY “We are building for an industry that does not yet exist. It’s our responsibility to make sure it gets done right.” - Bryan McLaren OTCQB: ZDPY I May 2022 21 877 - 360 - 8839 | @ZonedProperties

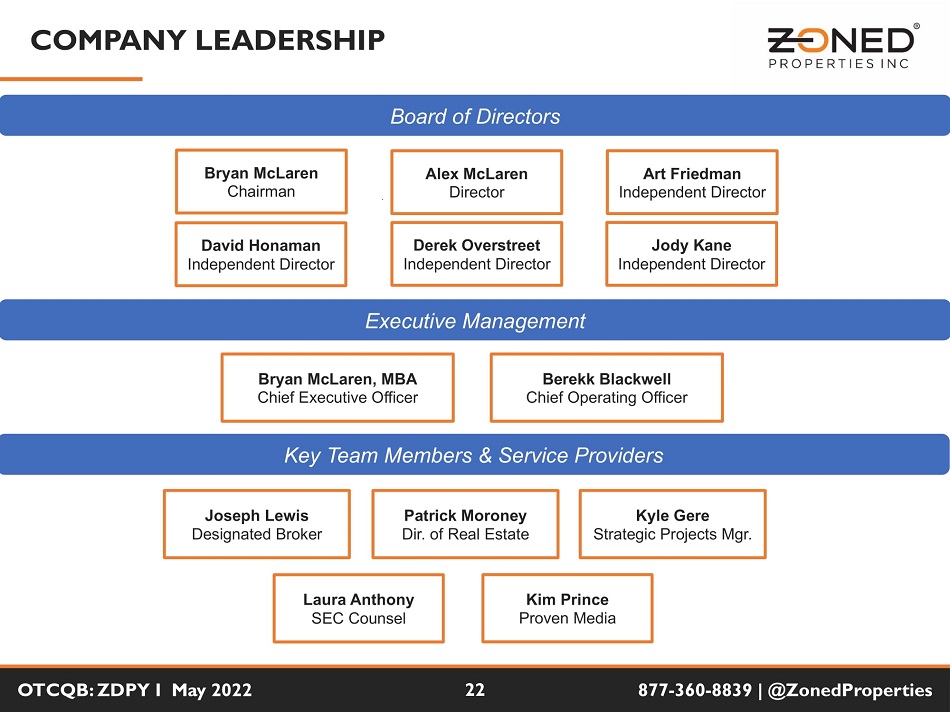

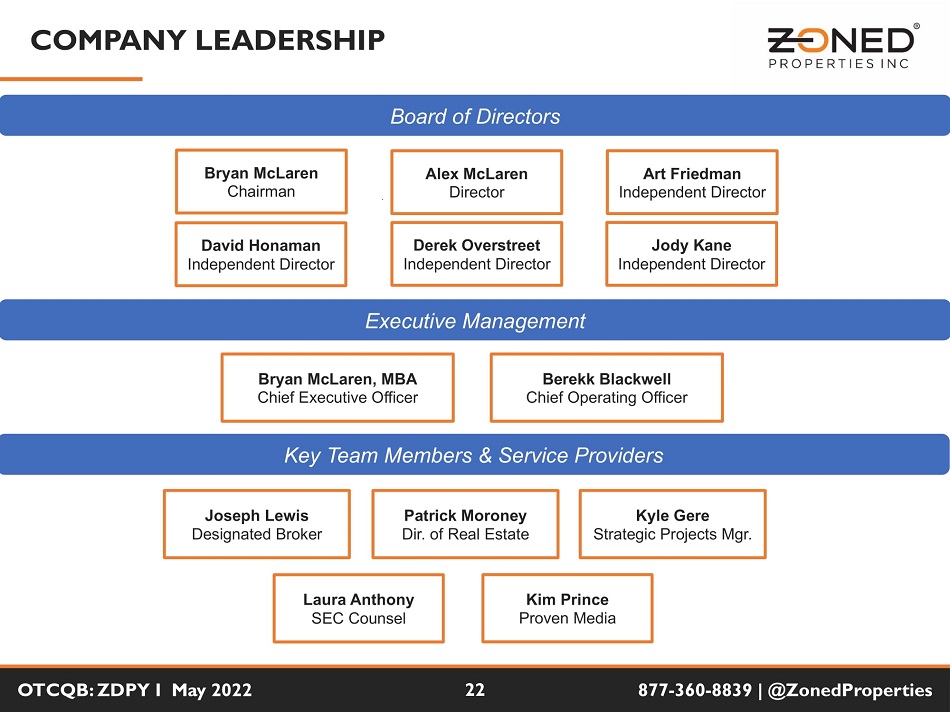

David Honaman Independent Director COMPANY LEADERSHIP Executive Management Board of Directors Bryan McLaren Chairman Alex McLaren Director Art Friedman Independent Director Derek Overstreet Independent Director Bryan McLaren, MBA Chief Executive Officer Berekk Blackwell Chief Operating Officer Jody Kane Independent Director Key Team Members & Service Providers OTCQB: ZDPY I May 2022 22 877 - 360 - 8839 | @ZonedProperties Joseph Lewis Designated Broker Patrick Moroney Dir. of Real Estate Kyle Gere Strategic Projects Mgr. Laura Anthony SEC Counsel Kim Prince Proven Media

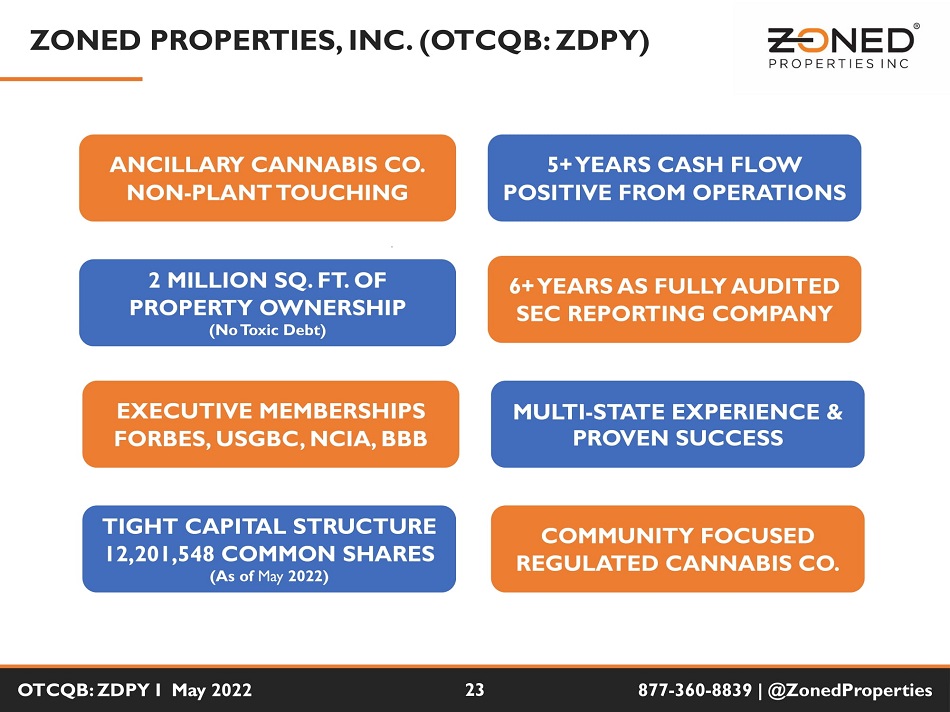

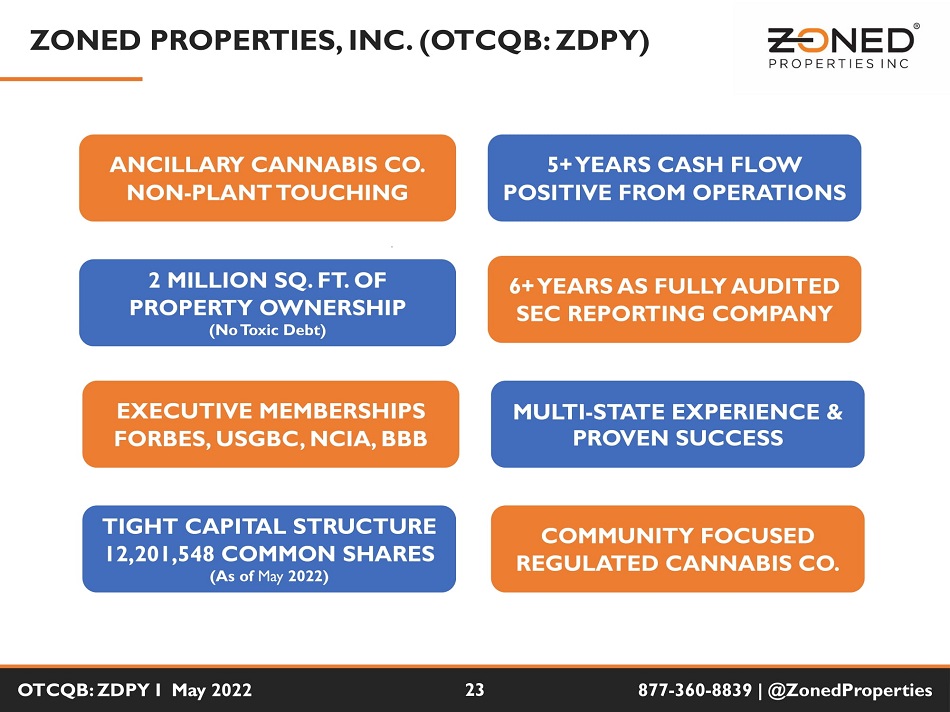

ANCILLARY CANNABIS CO. NON - PLANT TOUCHING 2 MILLION SQ. FT. OF PROPERTY OWNERSHIP (No Toxic Debt) EXECUTIVE MEMBERSHIPS FORBES, USGBC, NCIA, BBB TIGHT CAPITAL STRUCTURE 12,201,548 COMMON SHARES (As of May 2022) COMMUNITY FOCUSED REGULATED CANNABIS CO. 5+ YEARS CASH FLOW POSITIVE FROM OPERATIONS 6+ YEARS AS FULLY AUDITED SEC REPORTING COMPANY MULTI - STATE EXPERIENCE & PROVEN SUCCESS OTCQB: ZDPY I May 2022 23 877 - 360 - 8839 | @ZonedProperties ZONED PROPERTIES, INC. (OTCQB: ZDPY)

COMPANY CONTACT INFORMATION OTCQB: ZDPY I May 2022 24 877 - 360 - 8839 | @ZonedProperties COMPANY CONTACT Bryan McLaren ; Chairman & CEO Zoned Properties, Inc. | Scottsdale, AZ www.ZonedProperties.com | Tel 877.360.8839 | Bryan@ZonedProperties.com