Exhibit 99.2

March 2024 Corporate Presentation OTCQB: ZDPY www. ZonedProperties .com The Cannabis Friendly Landlord

2 Safe Harbor Statement This presentation contains forward - looking statements . All statements other than statements of historical facts included in this press release are forward - looking statements . In some cases, forward - looking statements can be identified by words such as "believe," "expect," "anticipate," "plan," "potential," "continue" or similar expressions . Such forward - looking statements include risks and uncertainties, and there are important factors that could cause actual results to differ materially from those expressed or implied by such forward - looking statements . These factors, risks and uncertainties are discussed in the Company's filings with the Securities and Exchange Commission . Investors should not place any undue reliance on forward - looking statements since they involve known and unknown, uncertainties and other factors which are, in some cases, beyond the Company's control which could, and likely will, materially affect actual results, levels of activity, performance or achievements . Any forward - looking statement reflects the Company's current views with respect to future events and is subject to these and other risks, uncertainties and assumptions relating to operations, results of operations, growth strategy and liquidity . The Company assumes no obligation to publicly update or revise these forward - looking statements for any reason, or to update the reasons actual results could differ materially from those anticipated in these forward - looking statements, even if new information becomes available in the future . COVID - 19 Statement In March 2020 , the World Health Organization declared COVID - 19 a global pandemic and recommended containment and mitigation measures worldwide . The Company is monitoring this closely, and although operations have not been materially affected by the COVID - 19 outbreak to date, the ultimate duration and severity of the outbreak and its impact on the economic environment and our business is uncertain . Currently, all of the properties in the Company’s portfolio are open to its Significant Tenants and will remain open pursuant to state and local government requirements . The Company did not experience in 2020 or 2021 and does not foresee in 2022 , any material changes to its operations from COVID - 19 . The Company’s tenants are continuing to generate revenue at these properties, and they have continued to make rental payments in full and on time and we believe the tenants’ liquidity position is sufficient to cover its expected rental obligations . Accordingly, while the Company does not anticipate an impact on its operations, it cannot estimate the duration of the pandemic and potential impact on its business if the properties must close or if the tenants are otherwise unable or unwilling to make rental payments . In addition, a severe or prolonged economic downturn could result in a variety of risks to the Company’s business, including weakened demand for its properties and a decreased ability to raise additional capital when needed on acceptable terms, if at all . Forward Looking Statements

Company Overview

Our MISSION To acquire value - add Retail Dispensary Properties for best - in - class Cannabis Operators . Our VISION Our VALUES To Own a Portfolio of Premier Dispensary Properties approved and operating in every Local Community. Sophistication , Safety , Sustainability , Stewardship Our Motto The Cannabis Friendly Landlord Company Philosophy 4

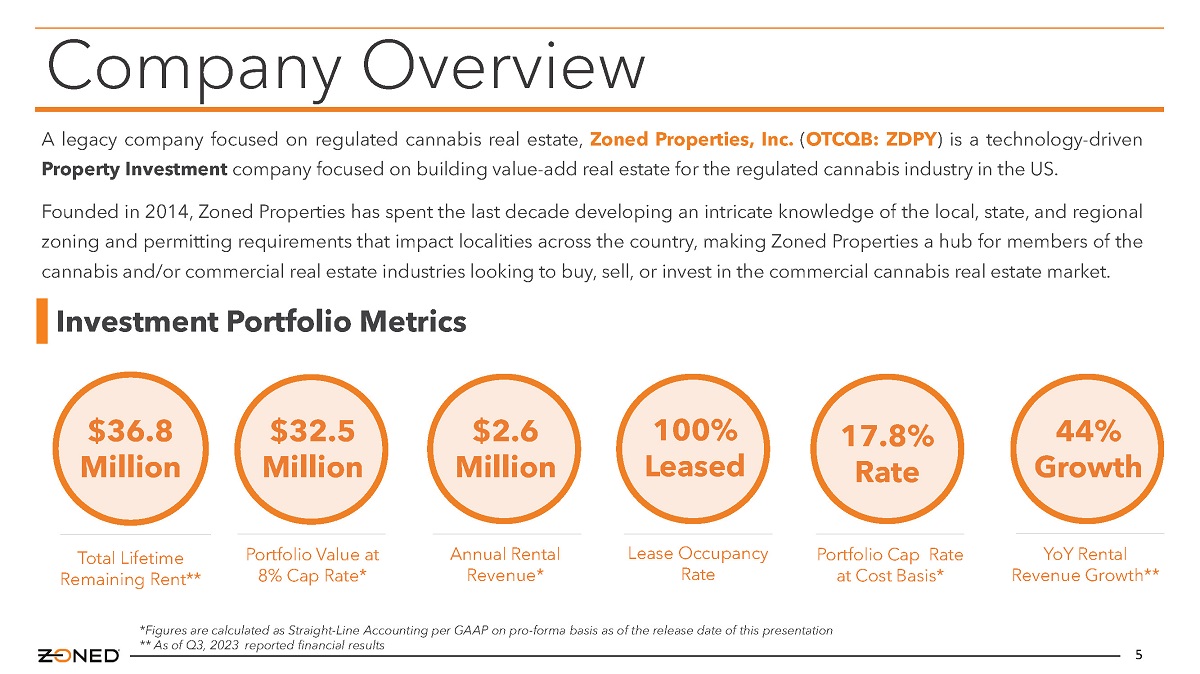

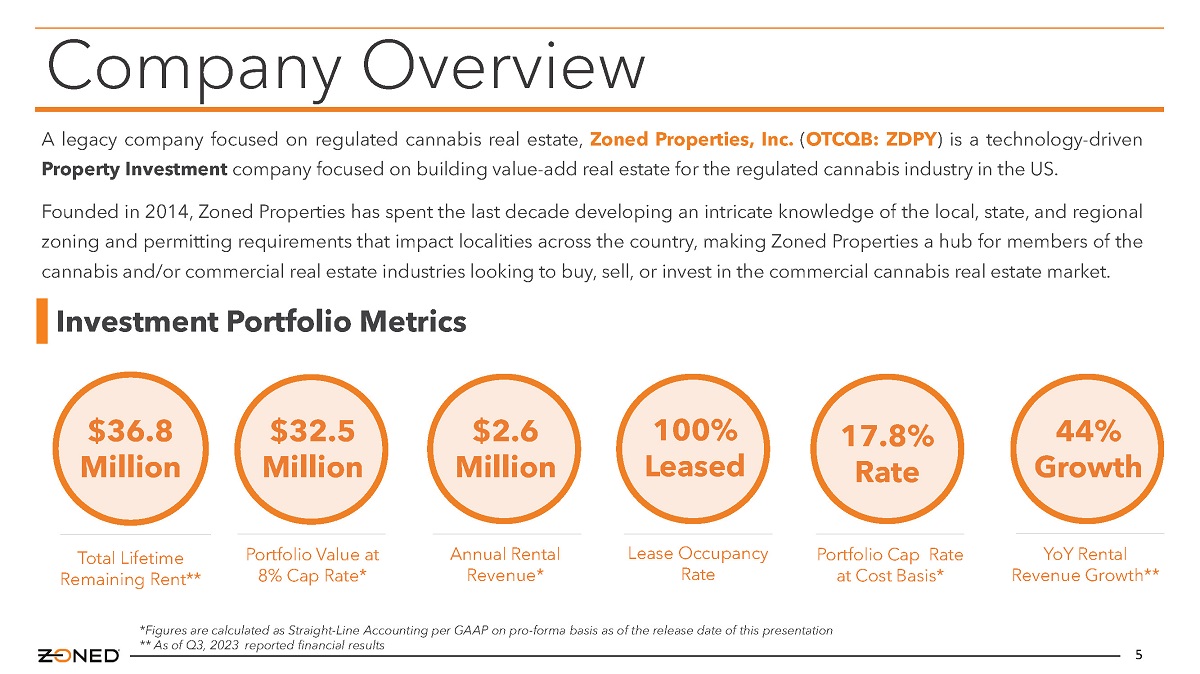

5 A legacy company focused on regulated cannabis real estate, Zoned Properties, Inc . ( OTCQB : ZDPY ) is a technology - driven Property Investment company focused on building value - add real estate for the regulated cannabis industry in the US . Founded in 2014 , Zoned Properties has spent the last decade developing an intricate knowledge of the local, state, and regional zoning and permitting requirements that impact localities across the country, making Zoned Properties a hub for members of the cannabis and/or commercial real estate industries looking to buy, sell, or invest in the commercial cannabis real estate market . Company Overview Lease Occupancy Rate 100% Leased Portfolio Cap Rate at Cost Basis* 17.8% Rate Portfolio Value at 8% Cap Rate* Annual Rental Revenue* $2.6 Million YoY Rental Revenue Growth** 44% Growth $32.5 Million Total Lifetime Remaining Rent** $36.8 Million Investment Portfolio Metrics *Figures are calculated as Straight - Line Accounting per GAAP on pro - forma basis as of the release date of this presentation ** As of Q3, 2023 reported financial results

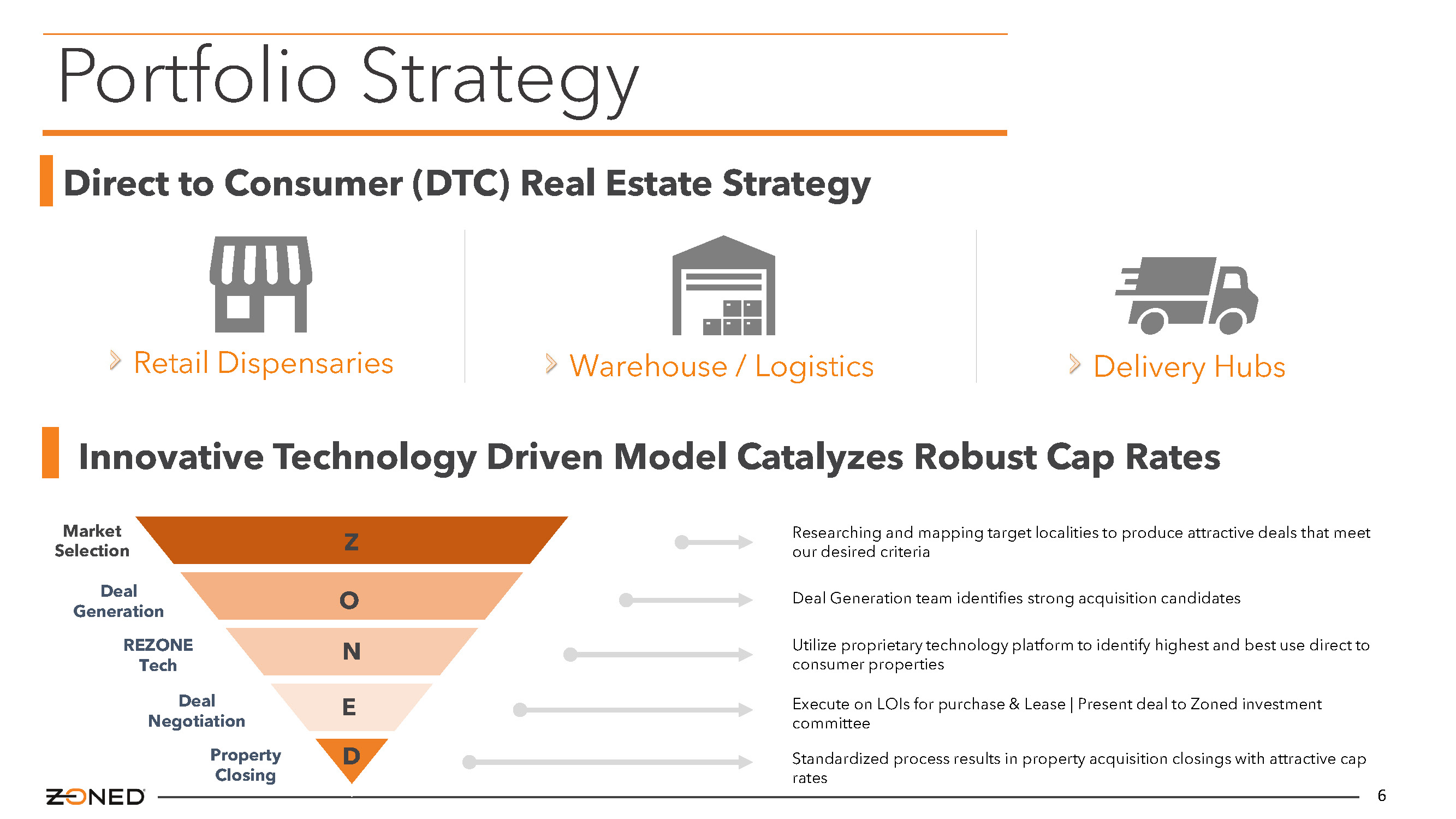

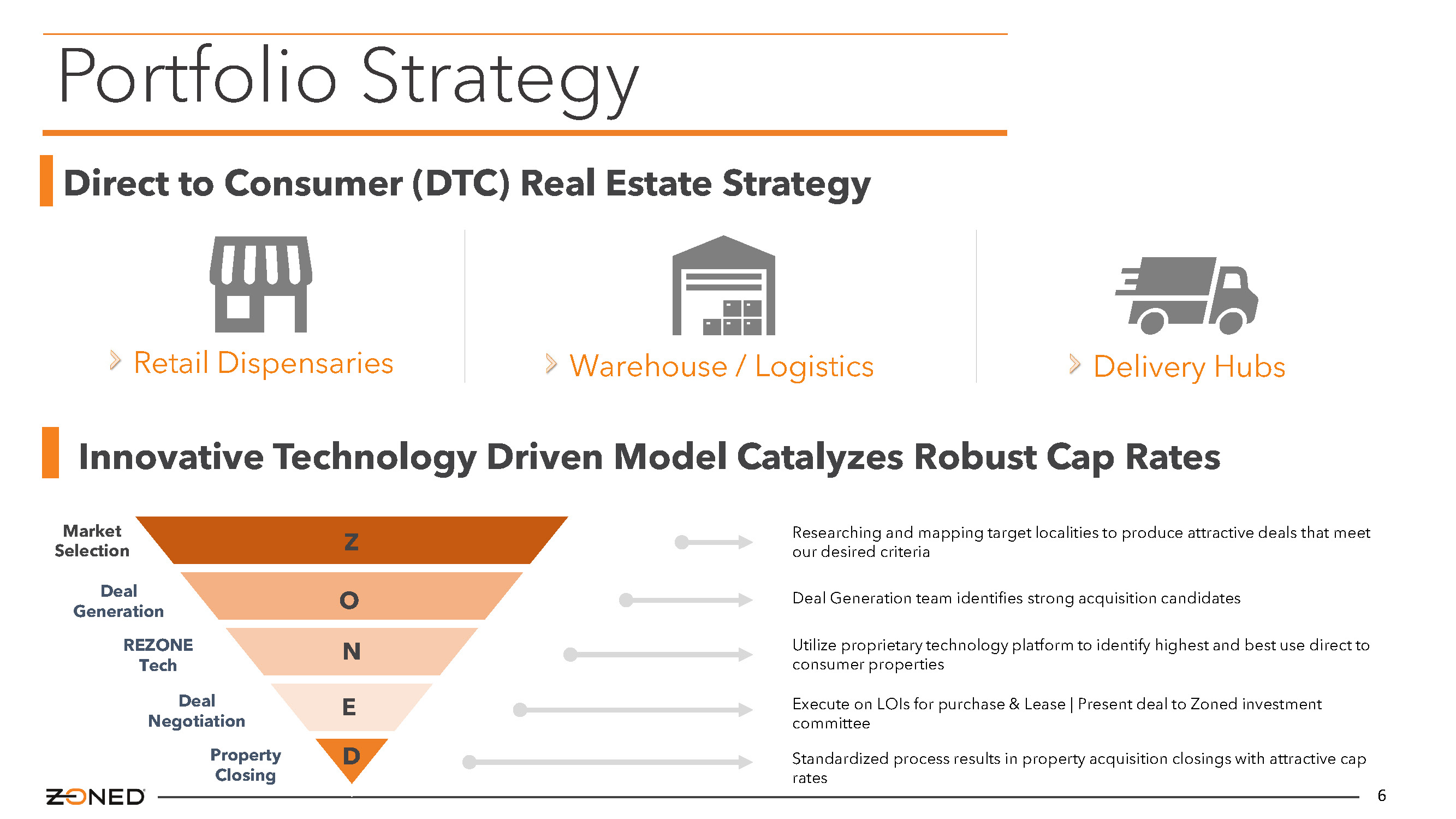

6 Direct to Consumer (DTC) Real Estate Strategy Warehouse / Logistics Delivery Hubs Retail Dispensaries Portfolio Strategy Z O N E D Market Selection Deal Generation REZONE Tech Deal Negotiation Property Closing Deal Generation team identifies strong acquisition candidates Researching and mapping target localities to produce attractive deals that meet our desired criteria Execute on LOIs for purchase & Lease | Present deal to Zoned investment committee Utilize proprietary technology platform to identify highest and best use direct to consumer properties Standardized process results in property acquisition closings with attractive cap rates Innovative Technology Driven Model Catalyzes Robust Cap Rates

Marketplace Relationships 7

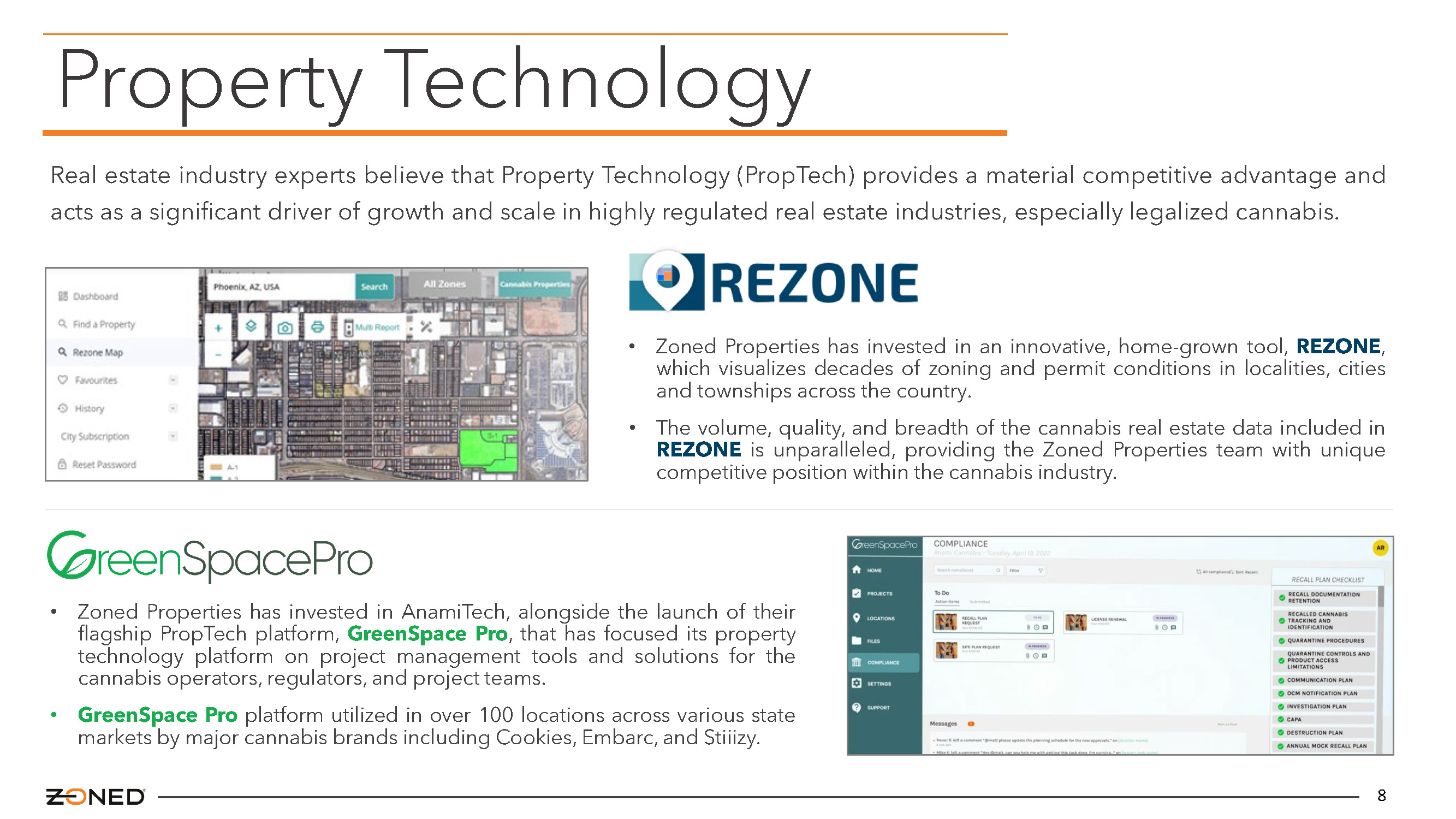

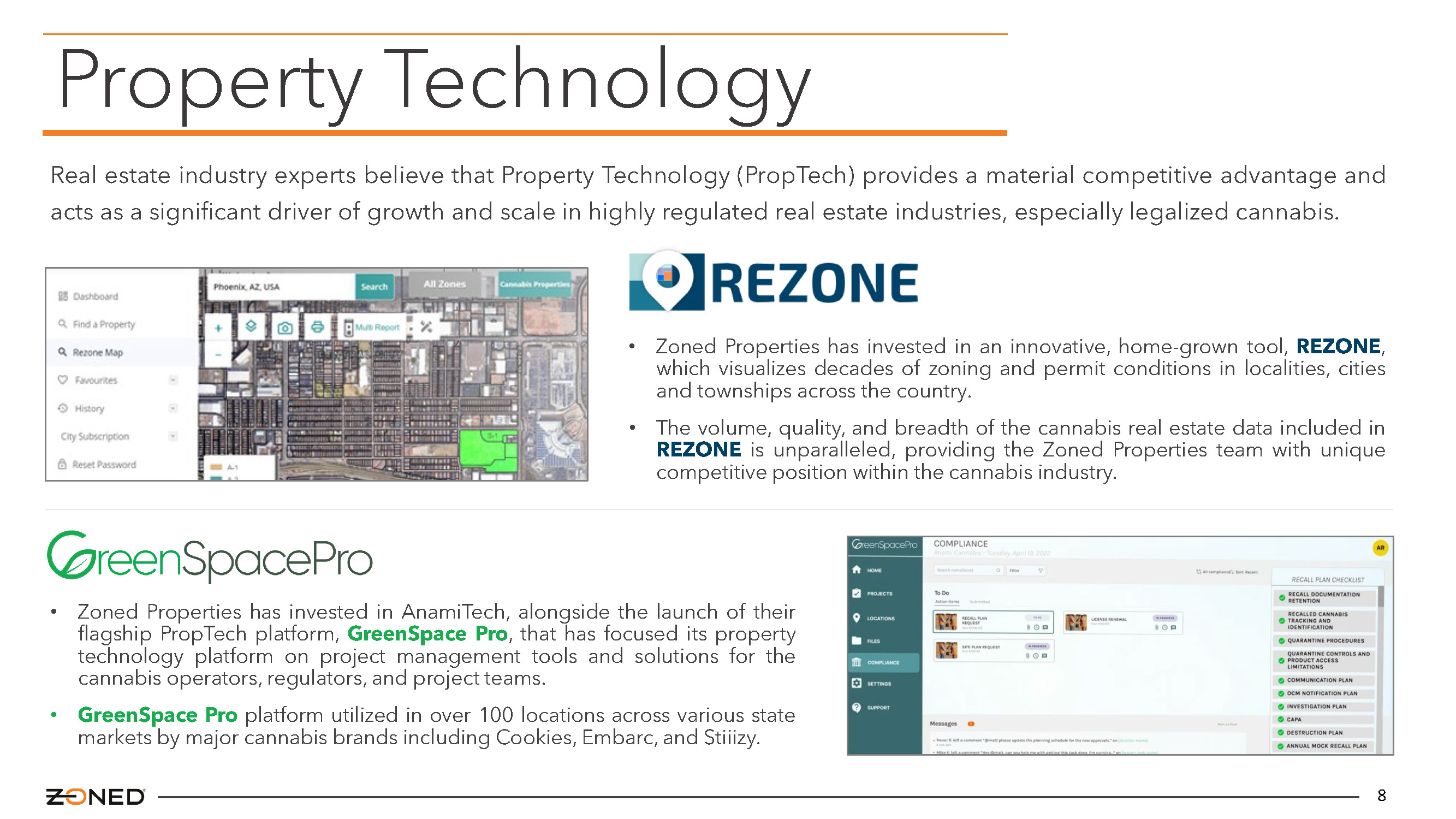

8 Property Technology • Zoned Properties has invested in an innovative, home - grown tool, REZONE , which visualizes decades of zoning and permit conditions in localities, cities and townships across the country . • The volume, quality, and breadth of the cannabis real estate data included in REZONE is unparalleled, providing the Zoned Properties team with unique competitive position within the cannabis industry . • Zoned Properties has invested in AnamiTech, alongside the launch of their flagship PropTech platform, GreenSpace Pro , that has focused its property technology platform on project management tools and solutions for the cannabis operators, regulators, and project teams . • GreenSpace Pro platform utilized in over 100 locations across various state markets by major cannabis brands including Cookies, Embarc, and Stiiizy . Real estate industry experts believe that Property Technology (PropTech) provides a material competitive advantage and acts as a significant driver of growth and scale in highly regulated real estate industries, especially legalized cannabis .

9 Development Project for future dispensary property located in Chicago, Illinois . The Investment Property was acquired for approximately $1.6 Million , including a commitment from the tenant's operating partner of up to $1 million for renovation and construction improvements. Justice Cannabis Co.'s BLOC Dispensaries under a long - term, absolute - net lease agreement, which will produce an approximate 16.5% Cap Rate when straight - lined over the 15 - year term of the lease agreement. The lease includes 3% annual increases in base rent over the life of the lease term, yielding approximately $265,000 in annual base rental revenue when straight - lined over the life of the lease term. Justice Cannabis Co. (formerly known as Justice Grown), has been a steady force in the U.S. cannabis industry for over 7 years. Project Highlights Recent Transaction Spotlight

Market Landscape

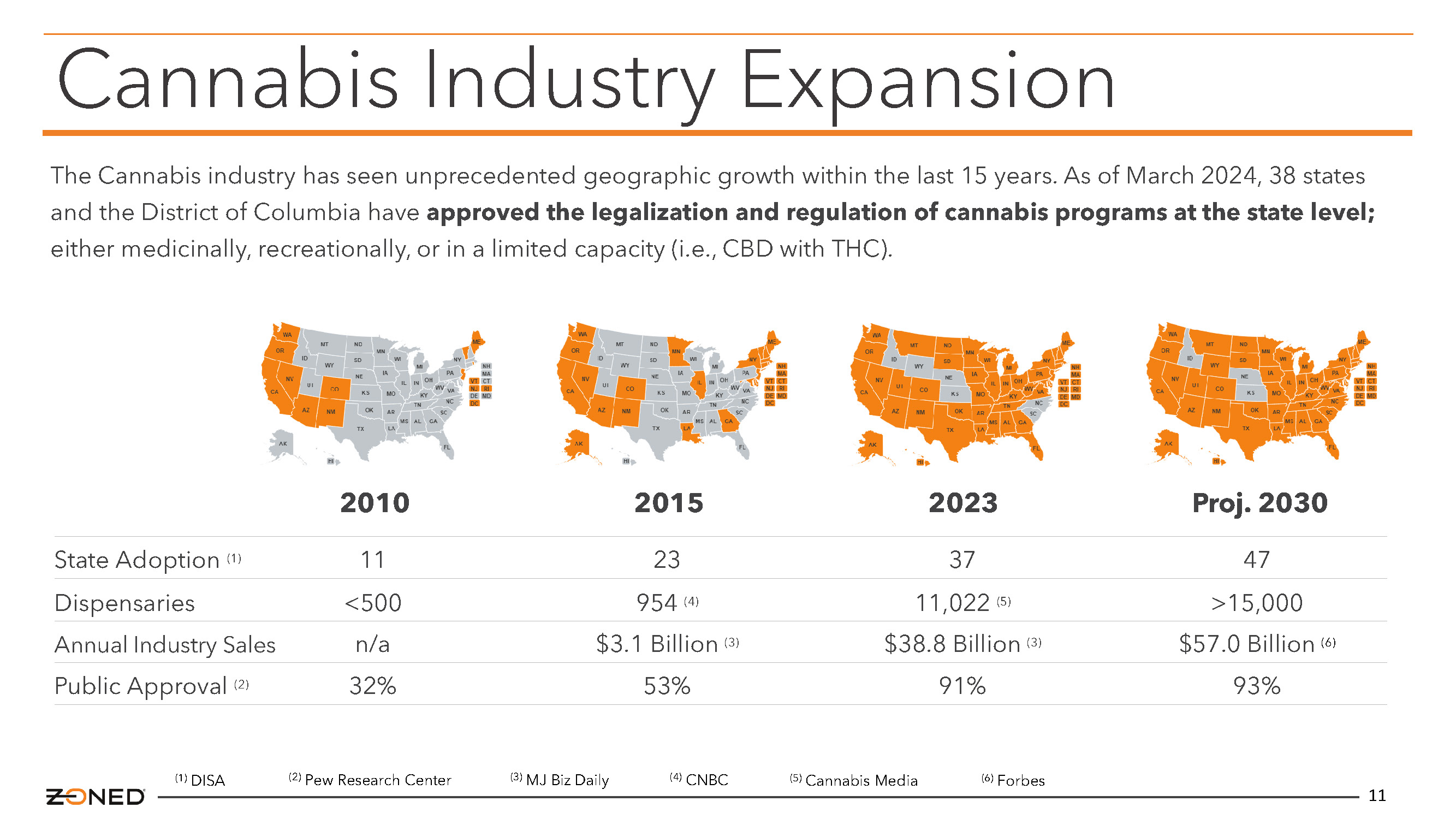

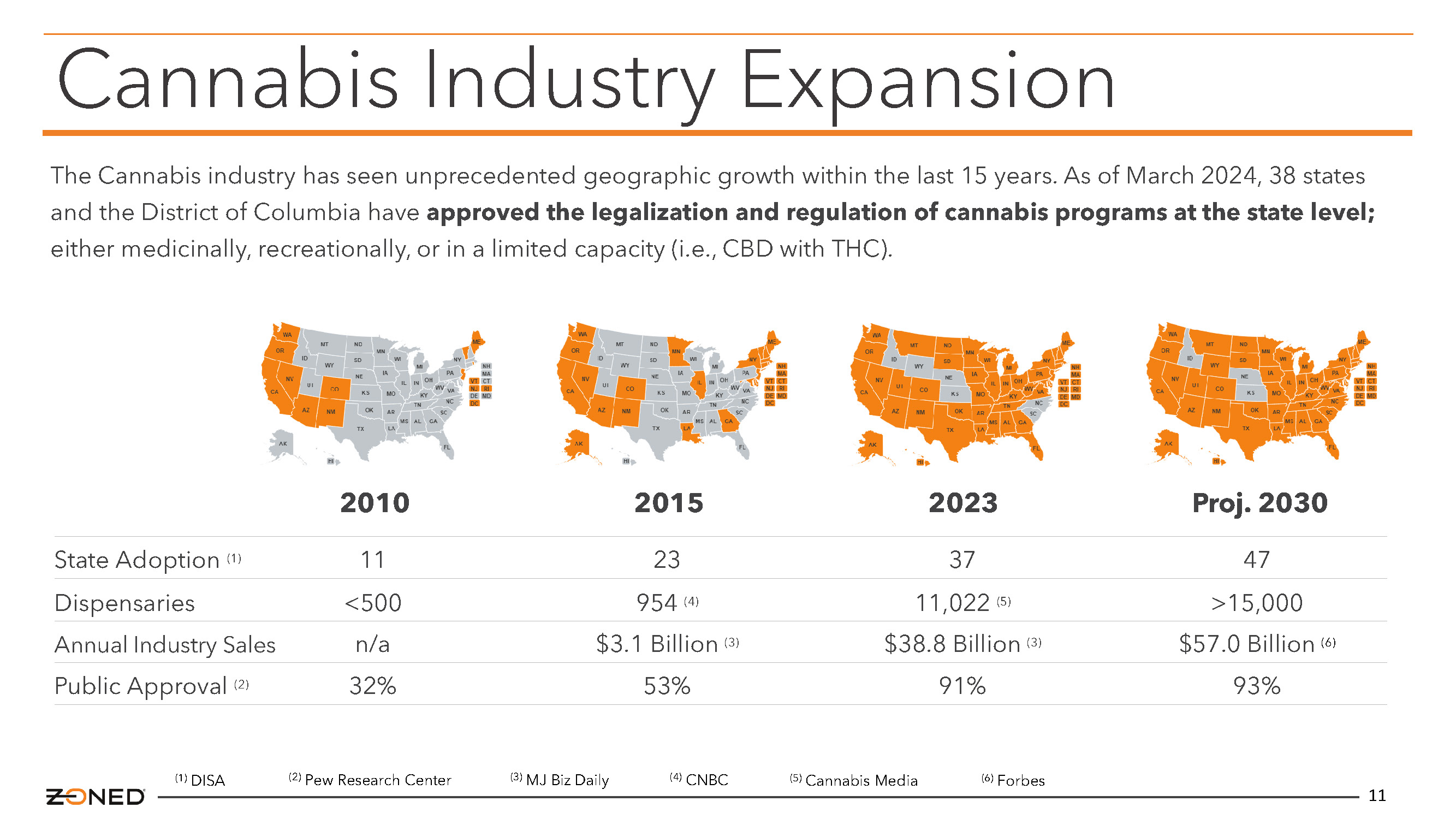

11 The Cannabis industry has seen unprecedented geographic growth within the last 15 years. As of March 2024, 38 states and the District of Columbia have approved the legalization and regulation of cannabis programs at the state level; either medicinally, recreationally, or in a limited capacity (i.e., CBD with THC). Cannabis Industry Expansion State Adoption (1) Dispensaries Annual Industry Sales Public Approval (2) 11 <500 n/a 32% 23 954 (4) $3.1 Billion (3) 53% 37 11,022 (5) $38.8 Billion (3) 91% 47 >15,000 $57.0 Billion (6) 93% 2010 2015 2023 Proj. 2030 (1) DISA (2) Pew Research Center (3) MJ Biz Daily (4) CNBC (5) Cannabis Media (6) Forbes

Executive Management

Executive Management 13 Mr . McLaren has a strong professional background in the social, economic, and environmental development of complex business organizations . Over his professional career, he has successfully implemented large - scale projects for corporate and community organizations . Mr . McLaren has been certified as a Licensed REALTOR, Green Roof Professional, LEED Green Associate, and is an active Forbes Contributor as part of the Forbes Real Estate Council . Prior to his role at Zoned Properties, McLaren worked as a Sustainability Consultant for Waste Management where he led the strategic development and operational implementation of zero - waste programs for Higher Education clients . Sustainable development has been a life - long passion for McLaren, who strives to create a global impact by forging a strong foundation for principles of sustainability in emerging industries . Mr . Blackwell has served as our Chief Operating Officer since July 1 , 2021 , and as our President since July 1 , 2022 . Prior to his appointment to these positions and since September 2020 , Mr . Blackwell served as our Director of Business Development . From December 2018 until June 2021 , Mr . Blackwell also served as President of Daily Jam Holdings LLC . From January 2016 to December 2018 , he served as Vice President of Due North Holdings LLC . Prior to joining the Company, Mr . Blackwell developed domestic and international markets for Kahala Brands, a global franchise organization with more than 3 , 000 retail locations in over a dozen countries . He also led emerging brand and portfolio operations for several private equity groups investing in the restaurant franchise space . Mr . Blackwell earned his B . A . in Finance from Fort Lewis College . Berekk Blackwell | President & Chief Operating Officer Bryan McLaren, MBA | Chairman of the Board, Chief Executive Officer, & Chief Financial Officer

Capital Structure

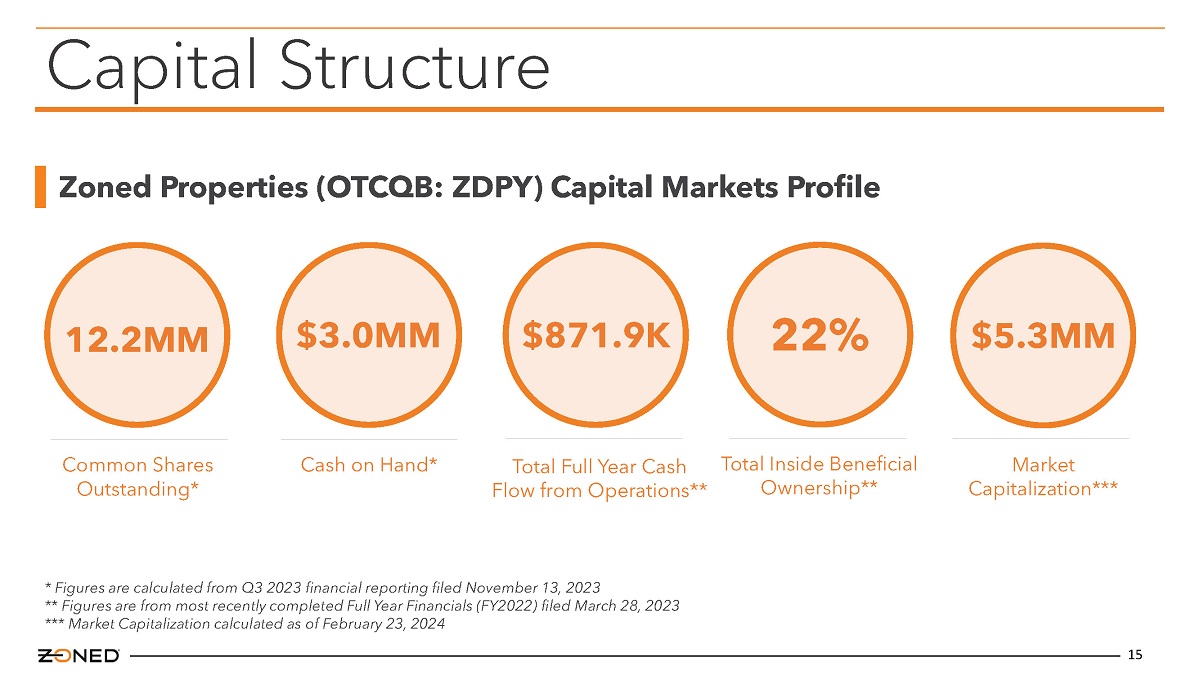

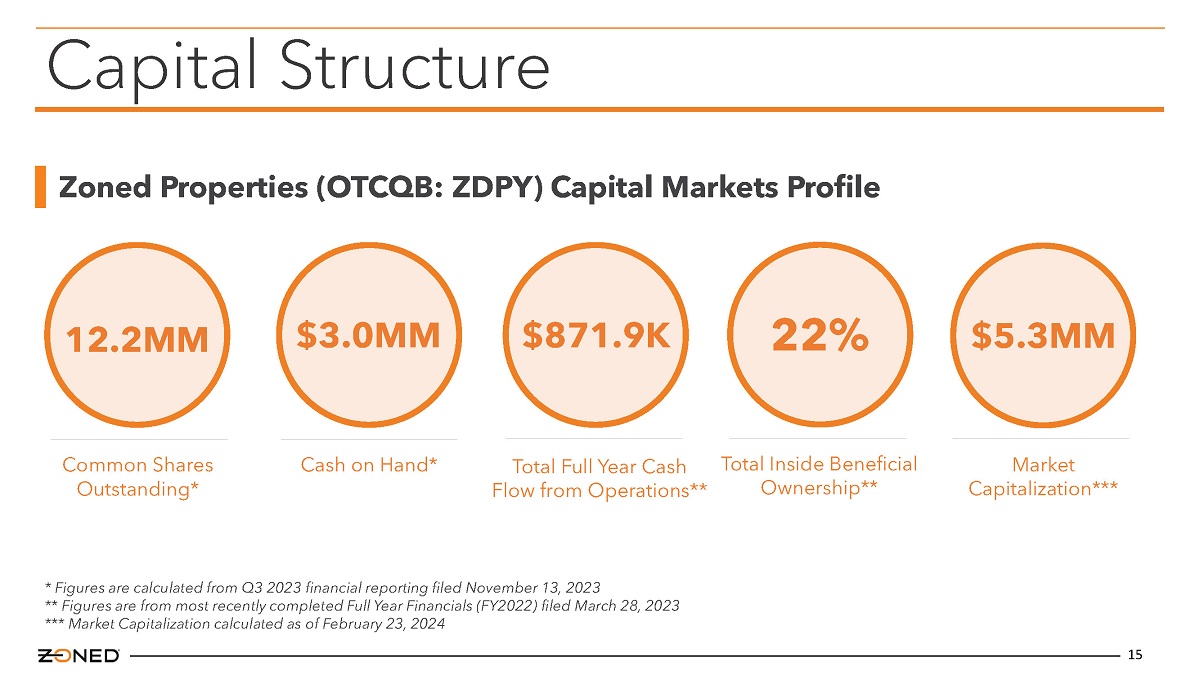

15 Capital Structure Common Shares Outstanding* Cash on Hand* 12.2MM $3.0MM Market Capitalization*** $5.3MM Total Full Year Cash Flow from Operations** $871.9K Total Inside Beneficial Ownership** 22% Zoned Properties (OTCQB: ZDPY) Capital Markets Profile * Figures are calculated from Q3 2023 financial reporting filed November 13, 2023 ** Figures are from most recently completed Full Year Financials (FY2022) filed March 28, 2023 *** Market Capitalization calculated as of February 23, 2024

Investment Thesis

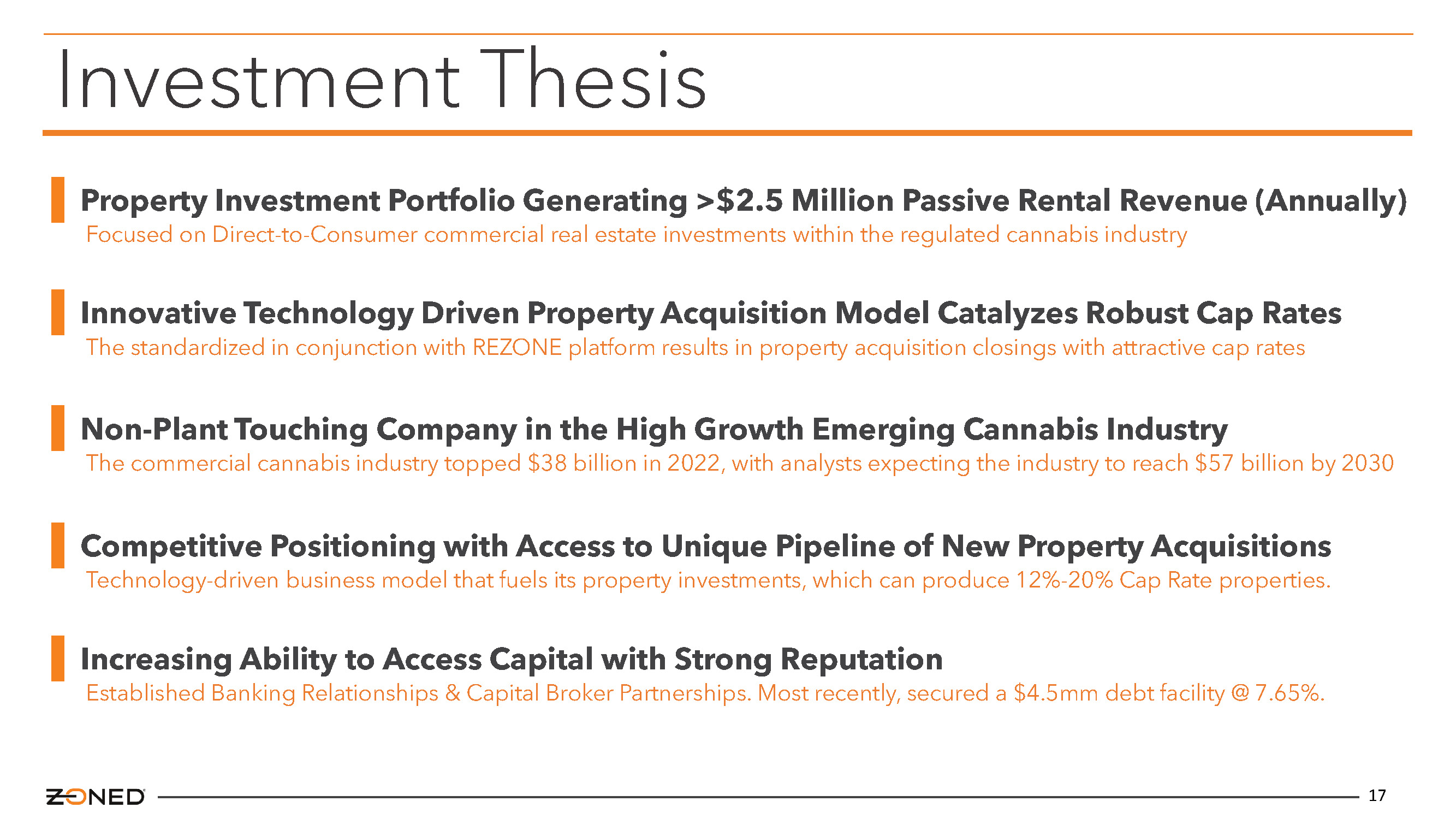

17 Property Investment Portfolio Generating >$2.5 Million Passive Rental Revenue (Annually) Focused on Direct - to - Consumer commercial real estate investments within the regulated cannabis industry Competitive Positioning with Access to Unique Pipeline of New Property Acquisitions Technology - driven business model that fuels its property investments, which can produce 12% - 20% Cap Rate properties. Non - Plant Touching Company in the High Growth Emerging Cannabis Industry The commercial cannabis industry topped $38 billion in 2022, with analysts expecting the industry to reach $57 billion by 203 0 Innovative Technology Driven Property Acquisition Model Catalyzes Robust Cap Rates The standardized in conjunction with REZONE platform results in property acquisition closings with attractive cap rates Increasing Ability to Access Capital with Strong Reputation Established Banking Relationships & Capital Broker Partnerships. Most recently, secured a $4.5mm debt facility @ 7.65%. Investment Thesis

Company Contact Information 18 Bryan McLaren Chairman, CEO, & CFO Zoned Properties, Inc. | Scottsdale, AZ www.ZonedProperties.com Tel 480.351.8193 | Investors@ZonedProperties.com