- CLRB Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEFA14A Filing

Cellectar Biosciences (CLRB) DEFA14AAdditional proxy soliciting materials

Filed: 26 May 15, 12:00am

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ¨ | Definitive Proxy Statement |

| x | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to 240. 14a-12 |

CELLECTAR BIOSCIENCES, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. | |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |

| (1) | Title of each class of securities to which transaction applies: | |

| (2) | Aggregate number of securities to which transaction applies: | |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |

| (4) | Proposed maximum aggregate value of transaction: | |

| (5) | Total fee paid: | |

| ¨ | Fee paid previously with preliminary materials. | |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11 (a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |

| (1) | Amount previously paid: | |

| (2) | Form, Schedule or Registration Statement No.: | |

| (3) | Filing party: | |

| (4) | Date filed: | |

May 26, 2015

Dear Fellow Stockholders:

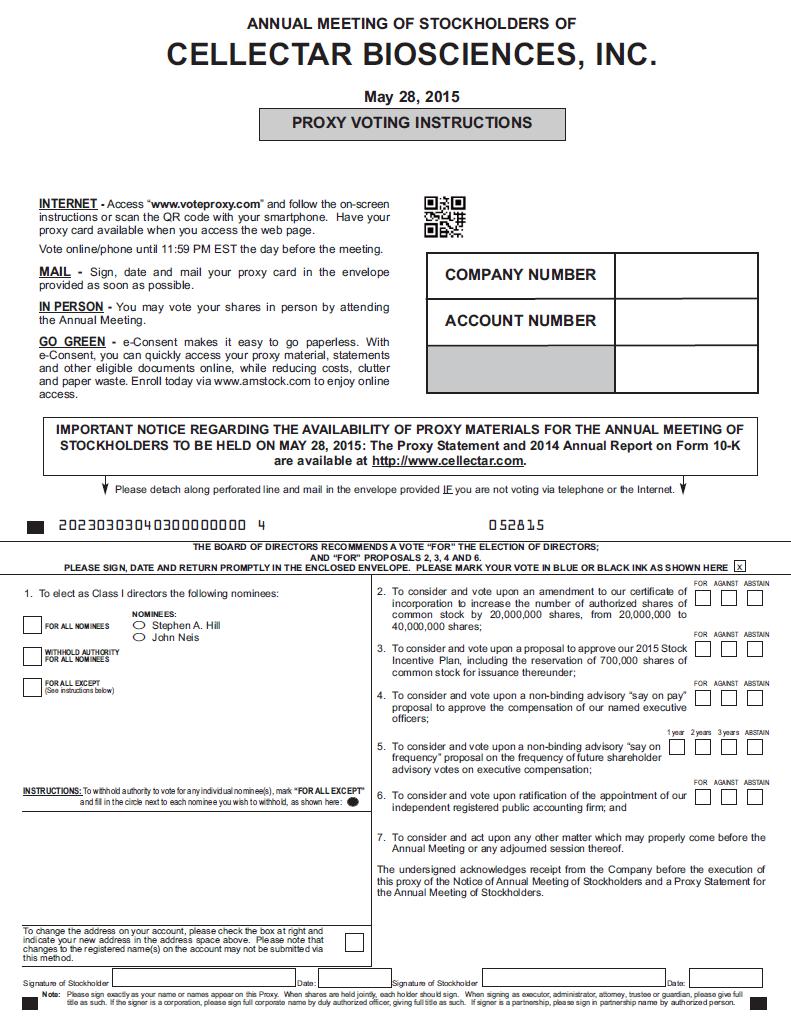

I am writing to inform you of a procedural change for our annual meeting of stockholders scheduled for May 28, 2015 at 10:00 A.M. at our offices in Madison, WI. While we are eager to convene this meeting and conduct the voting on those matters set forth in our proxy statement, recent events related to our financial reporting necessitated that an amendment to our annual report on Form 10-K be made reflecting a restatement of prior financial results. As this document is a critical part of our proxy materials, we want to be sure each of our stockholders has the opportunity to receive and review the current documents. Regrettably, this will result in a change to our annual meeting schedule this year.

To allow sufficient time for our stockholders to fully consider the information in our Form 10-K/A, including our restated financial results (available at http://www.cellectar.com), our Board of Directors intends to commence the 2015 Annual Meeting on May 28, 2015 and immediately adjourn the meeting to June 9, 2015 at 10:00 A.M. at our offices in Madison, WI.

Though the official business of the meeting, specifically the tabulation of stockholder voting, will be delayed until June 9, 2015, we recognize that many of you may have already made plans to attend the meeting in person on May 28. In recognition of this, our management team and members of the board of directors still plan to make themselves available and will host stockholders interested in visiting with management.

Stockholders of record may submit their votes for matters to be considered at the annual meeting until the polls are formally closed. Stockholders who have already voted in accordance with the instructions contained in the proxy statement and related materials do not need to submit new proxy cards or give new voting instructions unless they wish to change their votes. Stockholders who have not yet voted can still use the proxy cards and voting instruction forms previously provided to them or those included herewith. We encourage all stockholders to review the proxy statement and Annual Report on Form 10-K/A carefully before voting.

As reported in our Current Report on Form 8-K filed with the Securities and Exchange Commission (the “SEC”) on May 18, 2015, on May 14, 2015, the Audit Committee of our Board of Directors, together with management, concluded that our consolidated financial statements and other financial data as of and for the twelve months ended December 31, 2014 and the three and nine months ended September 30, 2014, as reported in our Annual Report on Form 10-K filed on March 24, 2015 and Quarterly Report on Form 10-Q filed on November 12, 2014, respectively, should not be relied upon because of the error discussed below.

On May 20, 2015, we filed Form 10-K/A to restate our consolidated financial statements and related footnote disclosures for the year ended December 31, 2014, and Form 10-Q/A to restate our condensed consolidated financial statements and related financial information for the three- and nine-month periods ended September 30, 2014. We also filed our Quarterly Report on Form 10-Q for the quarter ended March 31, 2015 on the same date. The restatements were the result of a misapplication in the guidance on accounting for warrants issued in August 2014. These restatements resulted in non-cash, non-operating financial statement corrections and had no impact on our current or previously reported cash position, operating expenses or total operating, investing or financing cash flows, as described in Note 1A to the consolidated financial statements included in the Form 10-K/A, which is excerpted below.

| Sincerely, | |

| Simon Pedder | |

| President and CEO |

NOTE 1A. RESTATEMENT OF PREVIOUSLY ISSUED CONSOLIDATED FINANCIAL STATEMENTS (Taken from Form 10-K/A filed May 20, 2015)

Overview

On August 20, 2014, Cellectar Biosciences, Inc. (“Cellectar Bio” or the “Company”) completed an underwritten public offering of 3,583,333 shares of its common stock and warrants to purchase 3,833,333 shares of its common stock at an exercise price of $4.68 per share, expiring on August 20, 2019 (the “August 2014 Underwritten Offering”). In conjunction with the August 2014 Underwritten Offering, all of the holders of the debentures issued in February 2014 elected to participate in the offering of common stock and warrants at the combined offering price of $3.76 per share. As a result, $4,000,000 principal amount of debentures and accrued interest of $172,435 was extinguished in exchange for 1,109,690 shares of the Company’s common stock and warrants to purchase 1,109,690 shares of common stock at $4.68 per share (the “August 2014 Debenture Tender and Exchange”). See Note 8 for further discussion of the August 2014 Underwritten Offering and the August 2014 Debenture Tender and Exchange (together the “August 2014 Offering”).

On May 14, 2015, the Audit Committee of the Company’s Board of Directors (the “Audit Committee”), in consultation with management, determined that due to a misapplication of the guidance on accounting for certain of its warrants issued in the August 2014 Offering, the Company’s previously issued financial statements for the periods ended September 30, 2014 and December 31, 2014 (the “Affected Periods) should no longer be relied upon. As a result, the Company has restated the financial statements for the Affected Periods. These restatements result in non-cash, non-operating financial statement corrections and have no impact on the Company’s current or previously reported cash position, operating expenses or total operating, investing or financing cash flows.

The warrants issued in the August 2014 Offering (the “August 2014 Warrants”) contain a cash settlement feature applicable in circumstances where there is no current prospectus to support the issuance of registered common stock and a warrant holder wishing to exercise the warrant requests gross settlement rather that the net settlement via cashless exercise provided for in the warrant. Based on Accounting Standards Codification 815, Derivatives and Hedging (“ASC 815”), warrant instruments that could potentially require net cash settlement in the absence of express language precluding such settlement and those which include “down-round provisions” should be initially classified as derivative liabilities at their estimated fair values, regardless of the likelihood that such instruments will ever be settled in cash. In periods subsequent to issuance, changes in the estimated fair value of the derivative instruments should be reported in the statement of operations.

Of the August 2014 Warrants, 4,943,023 contain the cash settlement feature. Previously classified as equity, these warrants have been reclassified as a derivative liability in the restated information. These warrants are listed on the NASDAQ Capital Market under the symbol CLRBW; therefore, the Company has established their fair value based upon the market value (see Note 3). The impact of the restatement on the consolidated balance sheet, statement of operations, changes in stockholders’ equity, and cash flows, as of and for the period ended December 31, 2014, is presented below.

| As of December 31, 2014 | ||||||||||||

| As Previously Reported | Adjustment | As Restated | ||||||||||

| Consolidated Balance Sheet Data: | ||||||||||||

| Derivative liability | $ | 1,128,499 | $ | 4,048,416 | $ | 5,176,915 | ||||||

| Total current liabilities | 2,184,590 | 4,048,416 | 6,233,006 | |||||||||

| Total liabilities | 2,673,567 | 4,048,416 | 6,721,983 | |||||||||

| Additional paid-in capital | 69,911,836 | (4,102,709 | ) | 65,809,127 | ||||||||

| Accumulated deficit | (59,165,963 | ) | 54,293 | (59,111,670 | ) | |||||||

| Total stockholders’ equity | 10,745,949 | (4,048,416 | ) | 6,697,533 | ||||||||

| Year Ended December 31, 2014 | ||||||||||||

| As Previously Reported | Adjustment | As Restated | ||||||||||

| Consolidated Statement of Operations Data: | ||||||||||||

| Gain on revaluation of derivative warrants | $ | 2,230,864 | $ | 54,293 | $ | 2,285,157 | ||||||

| Total other income, net | 1,784,550 | 54,293 | 1,838,843 | |||||||||

| Net loss | (8,106,395 | ) | 54,293 | (8,052,102 | ) | |||||||

| Basic and diluted net loss per common share | (1.77 | ) | 0.01 | (1.75 | ) | |||||||

| Year Ended December 31, 2014 | ||||||||||||

| As Previously Reported | Adjustment | As Restated | ||||||||||

| Consolidated Statement of Cash Flows Data: | ||||||||||||

| Net loss | (8,106,395 | ) | 54,293 | (8,052,102 | ) | |||||||

| Gain on revaluation of derivative warrants | (2,230,864 | ) | (54,293 | ) | (2,285,157 | ) | ||||||