Exhibit 99.1

Annual Information Form

Lake Shore Gold Corp.

For the year ended December 31, 2013

Dated as of March 18, 2014

Table of Contents

CAUTION REGARDING FORWARD-LOOKING STATEMENTS | 1 |

CORPORATE STRUCTURE | 2 |

NAME, ADDRESS AND INCORPORATION | 2 |

INTERCORPORATE RELATIONSHIPS | 2 |

GENERAL DEVELOPMENT OF THE BUSINESS | 3 |

THREE YEAR HISTORY | 3 |

DESCRIPTION OF BUSINESS | 5 |

GENERAL | 5 |

RISK FACTORS | 11 |

MINERAL PROJECTS | 20 |

DESCRIPTION OF CAPITAL STRUCTURE | 21 |

GENERAL DESCRIPTION OF CAPITAL STRUCTURE | 21 |

DIVIDEND POLICY | 22 |

MARKET FOR SECURITIES | 22 |

TRADING PRICE AND VOLUME | 22 |

DIRECTORS AND OFFICERS | 23 |

NAME, OCCUPATION AND SECURITY HOLDING | 23 |

CONFLICTS OF INTEREST | 29 |

AUDIT COMMITTEE | 29 |

CHARTER | 29 |

COMPOSITION OF THE AUDIT COMMITTEE | 29 |

RELEVANT EDUCATION AND EXPERIENCE OF AUDIT COMMITTEE | 29 |

AUDIT COMMITTEE OVERSIGHT | 30 |

PRE-APPROVAL POLICIES AND PROCEDURES | 30 |

SERVICE FEES PAID TO EXTERNAL AUDITORS | 30 |

LEGAL PROCEEDINGS | 30 |

INTEREST OF MANAGEMENT AND OTHERS IN MATERIAL TRANSACTIONS | 30 |

TRANSFER AGENTS AND REGISTRARS | 31 |

MATERIAL CONTRACTS | 31 |

INTERESTS OF EXPERTS | 31 |

ADDITIONAL INFORMATION | 32 |

GLOSSARY OF TERMS | 33 |

SCHEDULE A — AUDIT COMMITTEE CHARTER | A-1 |

SCHEDULE B — TIMMINS WEST MINE | B-1 |

SCHEDULE C — BELL CREEK COMPLEX | C-1 |

All information in this Annual Information Form (“AIF”) is as of December 31, 2013, unless otherwise indicated.

All information stated to be incorporated by reference in the AIF is filed on the SEDAR website (www.sedar.com).

CAUTION REGARDING FORWARD-LOOKING STATEMENTS

All statements, other than statements of historical fact, contained or incorporated by reference in this AIF including, but not limited to, any information as to the future financial or operating performance of Lake Shore Gold Corp., constitute “forward-looking information” or “forward-looking statements” within the meaning of certain securities laws, including the provisions of the Securities Act (Ontario) and the provisions for “safe harbour” under the United States Private Securities Litigation Reform Act of 1995, and are based on expectations, estimates and projections as of the date of this AIF or, in the case of documents incorporated by reference herein, as of the date of such documents. Forward-looking statements are included for the purpose of providing information about management’s expectations and plans relating to the future. All of the forward-looking statements made in this AIF are qualified by these cautionary statements and those made in our other filings with the securities regulators of Canada and the Securities Exchange Commission (the “SEC”).

Other than as specifically required by law, the Corporation does not intend, and does not assume any obligation, to explain any material difference between subsequent actual events and such forward-looking statements, or to update any forward-looking statement to reflect events or circumstances after the date on which such statement is made or to reflect the occurrence of unanticipated events, whether as a result of new information, future events or results or otherwise. These forward-looking statements represent management’s best judgment based on facts and assumptions that management considers reasonable, including that: there are no significant disruptions affecting operations, whether due to labour disruptions, supply disruptions, power disruptions, damage to equipment or otherwise; permitting, development, operations, expansion and acquisitions at the Timmins Gold Complex continue on a basis consistent with the Corporation’s current expectations; permitting, development and operations at the Bell Creek Complex continue on a basis consistent with the Corporation’s current expectations; the exchange rate between the Canadian dollar and the U.S. dollar stays approximately consistent with current levels; certain price assumptions for gold hold true; prices for fuel, electricity and other key supplies remains consistent with current levels; production and cost of sales forecasts meet expectations; the accuracy of the Corporation’s current mineral reserve and mineral resource estimates hold true; and labour and materials costs increase on a basis consistent with the Corporation’s current expectations. The Corporation makes no representation that reasonable business people in possession of the same information would reach the same conclusions.

Forward-looking statements include, but are not limited to, possible events, statements with respect to possible events, statements with respect to the future price of gold and other metals, the estimation of mineral resources and reserves, the realization of mineral reserve and resource estimates, the timing and amount of estimated future production, costs of production, expected capital expenditures, costs and timing of the development of new deposits, success of exploration and development activities, permitting time lines, currency fluctuations, requirements for additional capital, government regulation of exploration and mining operations, environmental risks, unanticipated reclamation expenses, title disputes or claims, completion of acquisitions and their potential impact on the Corporation and its operations, limitations on insurance coverage and the timing and possible outcome of pending litigation. In certain cases, forward-looking statements can be identified by the use of words such as “plans”, “expects” or “does not expect”, “is expected”, “budget”, “scheduled”, “estimates”, “forecasts”, “intends”, “anticipates” or “does not anticipate”, or “believes”, or variations of such words and phrases or statements that certain actions, events or results “may”, “could”, “would”, “might” or “will be taken”, “occur” or “be achieved”.

1

Forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Corporation to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. As well as those factors discussed in the section entitled “Risk Factors” in this AIF, known and unknown risks which could cause actual results to differ materially from projections in forward-looking statements include, among others: fluctuations in the currency markets; fluctuations in the spot and forward price of gold or certain other commodities (such as diesel fuel and electricity); changes in interest rates; changes in national and local government legislation, taxation, controls, regulations and political or economic developments in Canada or other countries in which the Corporation may carry on business in the future; business opportunities that may be presented to, or pursued by, the Corporation; the Corporation’s ability to integrate acquisitions successfully; operating or technical difficulties in connection with mining or development activities; employee relations; the speculative nature of gold exploration and development, including the risks of obtaining necessary licenses and permits; diminishing quantities or grades of reserves; and contests over title to properties, particularly title to undeveloped properties. In addition, there are risks and hazards associated with the business of gold exploration, development and mining, including environmental hazards, industrial accidents, unusual or unexpected formations, pressures, cave-ins, flooding and gold bullion losses (and the risk of inadequate insurance, or the inability to obtain insurance, to cover these risks).

Although the Corporation has attempted to identify important factors (which it believes are reasonable) that could cause actual actions, events or results to differ materially from those described in forward-looking statements, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. There can be no assurance that forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements.

CORPORATE STRUCTURE

Name, Address and Incorporation

Lake Shore Gold Corp. (referred to in this AIF as “Lake Shore Gold” or the “Corporation”) was continued under the Canada Business Corporations Act (the “Act”) on July 18, 2008. On November 6, 2009, Lake Shore Gold acquired all of the issued and outstanding shares of West Timmins Mining Inc. (“WTM”) pursuant to a business combination agreement and subsequently, on January 1, 2012, Lake Shore Gold amalgamated under the Act with WTM.

The Corporation’s corporate head office and principal place of business is Suite 2000, 181 University Avenue, Toronto Ontario, M5H 3M7. The Corporation also has offices at 1515 Government Road, Timmins, Ontario. The Corporation is a reporting issuer in all Provinces in Canada, and a foreign private issuer as defined in Rule 3b-4 under the Securities Exchange Act of 1934 (the “Exchange Act”) in the United States eligible to file disclosure documents pursuant to the multi-jurisdictional disclosure system of the Exchange Act (“MJDS”) adopted by the SEC.

Intercorporate Relationships

Lake Shore Gold has no material subsidiaries.

2

GENERAL DEVELOPMENT OF THE BUSINESS

Three Year History

During the past three years, the Corporation has conducted mining and mineral production, development and exploration activities in Ontario and Québec, with the focus being its Timmins West Complex and Bell Creek Complex, both in Timmins, Ontario. The principal product and source of cash flow for Lake Shore Gold is the mining and sale of gold.

Events that influenced the general development of the business over the past three years are described below.

2011

· Lake Shore Gold declared commercial production at its Timmins Deposit, with a mining rate of 1,500 tonnes per day.

· Lake Shore Gold finalized a US$50 million, three-year corporate revolving credit facility with UniCredit Bank AG.

· Lake Shore Gold published resource estimates at its Marlhill and Vogel deposits increasing total resources at the Bell Creek Complex by 2,614,000 tonnes of both open pit and underground resources at a combined average grade of 2.17 gpt Au for 182,400 contained ounces in the indicated category and 1,459,000 tonnes at 3.60 gpt for 168,800 contained ounces in the inferred category.

· Lake Shore Gold acquired the Fenn-Gib project, located approximately 60 kilometres east of its Bell Creek Complex, from Barrick Gold Corporation, and subsequently published an open-pit resource estimate including 40.8 million tonnes grading 0.99 gpt for a total of 1.30 million contained Au ounces in the indicated category and 24.5 million tonnes at 0.95 gpt for a total of 0.75 million ounces in the inferred category. Lake Shore Gold issued approximately 14.9 million shares to acquire the Fenn-Gib project.

· Lake Shore Gold’s common shares commenced trading on the NYSE MKT stock exchange on August 1, 2011.

· As a result of operational experience and updated information from drilling, the Corporation determined that mineralization at the Timmins Deposit was broader and at a lower grade than previously believed, and revised its plans for mining the mineralization to reflect the nature of the mineralization.

· The Corporation initiated a plan to expand the milling capacity of its Bell Creek Mill to 3,000 tonnes per day.

· Lake Shore Gold entered into an option agreement with Revolution Resources Corp. (“Revolution”) relating to the Corporation’s Mexican property portfolio, allowing Revolution the opportunity to earn an interest of up to 60% of the portfolio by incurring expenditures of $35 million on the properties and issuing stock to Lake Shore Gold, with the possibility of earning up to 100% by paying certain amounts to Lake Shore Gold based on discovery success and achieving certain other milestones. Revolution issued 5,713,740 common shares to Lake Shore Gold upon signing the agreement.

· Lake Shore Gold published resource estimates at its Thunder Creek Deposit, including an indicated resource of 2,877,000 tonnes at 5.64 gpt for 521,600 contained ounces of gold, and an inferred resource of 2,693,000 tonnes at 5.89 gpt for 510,000 contained ounces of gold.

3

· Lake Shore Gold produced 83,585 ounces of gold from all mineral deposits for the full year 2011.

2012

· Lake Shore Gold declared commercial production at the Bell Creek Mine and at the Thunder Creek Deposit of the Timmins West Mine (the Timmins Deposit, also part of the Timmins West Mine went in to commercial production as of January 1 2011).

· Lake Shore Gold entered into transactions with Franco-Nevada Corporation (“FNV”) pursuant to which FNV paid Lake Shore Gold US$35 million for a 2.25% net smelter returns royalty on mineral production from the Timmins West Complex, and $15 million for 10,050,591 common shares of the Corporation.

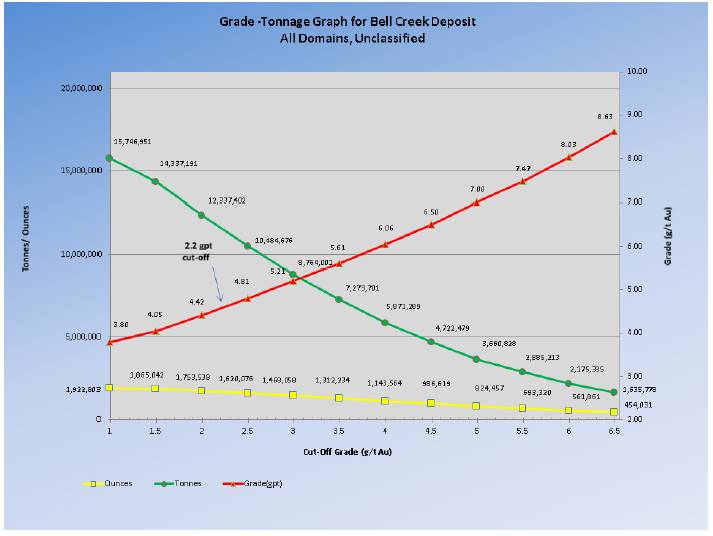

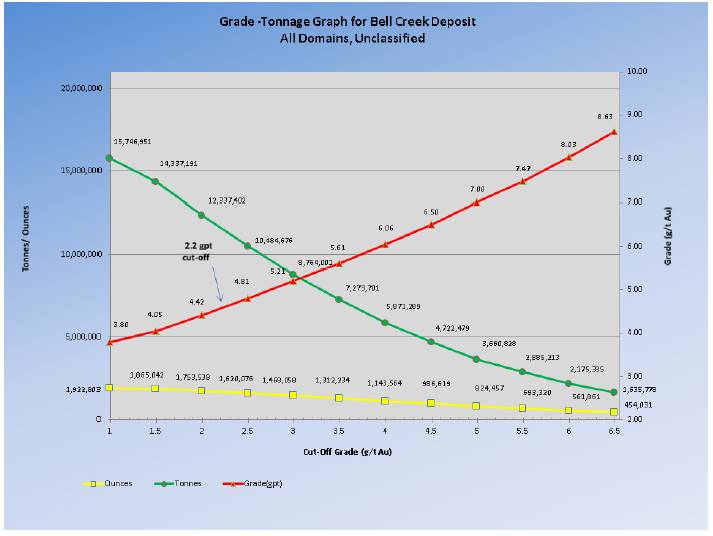

· Lake Shore Gold issued an updated resource estimate for its Bell Creek Mine with measured and indicated resources of 4,249,451 tonnes at a grade of 4.73 gpt for 646,431 ounces of gold, and inferred resources of 6,088,506 tonnes at a grade of 4.87 gpt for 953,845 ounces of gold (using a 2.2 gpt cut-off grade).

· Lake Shore Gold issued updated resource and reserve estimates for the Timmins West Mine, comprising both the Timmins Deposit and Thunder Creek Deposit. The Corporation estimated probable reserves of 4,922,180 tonnes grading 5.21 gpt for 823,848 ounces of gold, indicated resources (inclusive of reserves) totaling 5,826,000 tonnes grading 5.99 gpt for 1,122,500 ounces of gold, and inferred resources of 4,272,000 tonnes grading 5.76 gpt for 791,500 ounces of gold.

· Lake Shore Gold issued updated resource estimates for the Gold River Trend project, comprising East Deposit and West Deposit, both of which are located approximately 4.0 kilometres south of the producing Timmins West Mine shaft, with indicated resources of 690,000 tonnes grading 5.29 gpt for 117,400 ounces of gold, and inferred resources of 5,273,000 tonnes at an average grade of 6.06 gpt for 1,027,800 ounces of gold.

· Lake Shore Gold entered into an agreement with Sprott Resource Lending Partnership (“Sprott”) for a credit facility (the “Facility”) totaling up to $70 million. The Facility involves two components, a $35 million gold loan (the “Gold Loan”) maturing on May 31, 2015 and a standby line of credit (the “Standby Line”) for an additional $35 million. Only the Gold Loan portion was drawn in 2012.

· Lake Shore Gold issued $103.5 million principal amount of 6.25% convertible senior unsecured debentures maturing on September 30, 2017, the net proceeds of which were used to repay and extinguish the US$50 million revolving facility with UniCredit Bank AG and for general corporate purposes.

· Lake Shore Gold completed the first stage of its mill expansion, achieving a processing capacity of 2,500 tonnes per day, representing an increase of 25% from the previous capacity of 2,000 tonnes per day.

· Lake Shore Gold produced 85,782 ounces of gold in 2012 (719,298 tonnes @ 3.9 grams per tonne).

2013

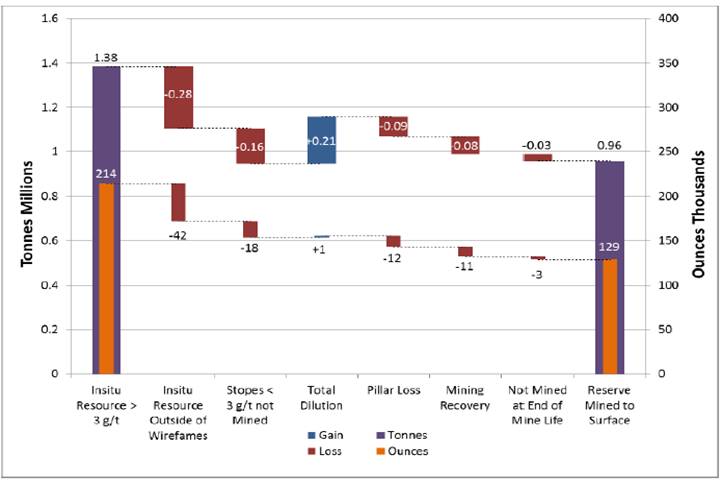

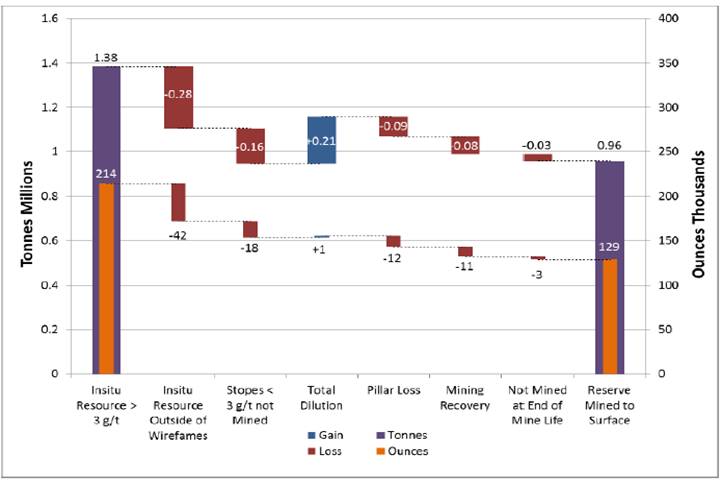

· Lake Shore Gold announced an updated reserve estimate at Timmins West Mine of 4,811,000 tonnes at an average grade of 5.2 grams per tonne for 798,000 ounces of gold. The Corporation also announced an initial reserve estimate for Bell Creek Mine of 960,000 tonnes at an average grade of 4.2 gram per tonne for 129,000 ounces of gold. Lake Shore Gold announced updated resource estimates (inclusive of reserves) including: measured and indicated resources at Timmins West Mine of 5,978,000 tonnes at an average grade of 5.5 grams per tonne for

4

1,061,000 ounces of gold, and at Bell Creek Mine of 4,685,000 tonnes at 4.7 gram per tonne for 710,000 ounces of gold; inferred resources of 3,549,000 tonnes at 5.4 grams per tonne at Timmins West Mine and 6,080,000 tonnes at 4.6 grams per tonne at Bell Creek Mine.

· Lake Shore Gold entered into a revised agreement with Revolution Resources Corp. to sell to Revolution 100% of the Corporation’s Mexican property portfolio, subject to certain net smelter returns royalties retained by Lake Shore Gold, for 20,000,000 common shares of Revolution, issuable on closing, and, on or before December 31, 2017, CDN$5,000,000 in cash or common shares valued at the greater of $0.20 and a five day volume weighted average trading price.

· Lake Shore Gold drew down the $35 million Standby Line under the Facility with Sprott Resource Lending Partnership.

· Lake Shore Gold completed the second stage of its mill expansion, achieving a processing capacity of over 3,000 tonnes per day, representing an increase of 50% from operating levels in 2011 prior to commencing the expansion.

· Lake Shore Gold amended the terms of the Facility with Sprott in order to extend the maturity of the Standby Line to November 30, 2016 (prior to the amendment the Standby Line was due in full on January 1, 2015), payable in 18 equal monthly payments of outstanding principal plus accrued interest starting on June 30, 2015. The Corporation also elected to repay $5 million of the Standby Line, reducing the principal balance to $30 million.

· Lake Shore Gold produced 134,600 ounces of gold in 2013 from processing 952,700 tonnes at an average grade of 4.6 grams per tonne.

DESCRIPTION OF BUSINESS

General

Lake Shore Gold is a gold mining company that is in production and pursuing rapid growth through the successful exploration, development and operation of three wholly owned, multi-million ounce gold complexes in the Timmins Gold Camp. Lake Shore Gold is in commercial production at both the Timmins West and Bell Creek mines, with material being delivered for processing to the Bell Creek Mill, with an operating capacity of over 3,000 tonnes per day. In addition to current operations, properties such as Fenn-Gib, 144, Gold River Trend, Marlhill, Vogel and Schumacher provide the Corporation with significant potential for future development projects and additional discoveries in Timmins in support of future growth. Lake Shore Gold also owns extensive land positions throughout other parts of the Abitibi Greenstone belt in Northern Ontario and Quebec, which provide attractive longer-term exploration potential.

Principal Properties

1. Timmins West Complex

The Corporation’s Timmins West Complex covers an area of approximately 130 square kilometers and hosts the Corporation’s operating Timmins West Mine, exploration-stage projects at the Gold River Trend and 144, and a large area of highly prospective ground. All mineral production from the Timmins West Complex is subject to a 2.25% net smelter returns royalty in favour of Franco-Nevada Corporation (“FNV”).

5

a. Timmins West Mine

The Timmins West Mine comprises the Timmins Deposit, which has been in commercial production since January 1, 2011, and the Thunder Creek Deposit, which was placed into commercial production on January 1, 2012. Lake Shore Gold originally optioned a 50% interest in the Timmins Deposit property from Holmer Gold Mines Limited (“Holmer”) and later consolidated ownership of the Timmins Deposit property in 2004 through a business combination with Holmer. The Timmins Deposit property consists of a contiguous block of 23 claims (12 leased claims, which are grouped into two 21-year leases and 11 individual patented claims) covering approximately 395 hectares. All 23 claims cover both mining and surface rights. The Thunder Creek property is a 54-claim unit package adjacent to and southwest of the Timmins Deposit property. The Thunder Creek property was also originally held through a joint venture following the exercise of an option, and in November 2009 Lake Shore Gold completed a business combination with West Timmins Mining Inc. (“WTM”) consolidating ownership of the Thunder Creek property.

In March 2012, Franco-Nevada Corporation paid the Company $35 million for a 2.25% NSR royalty on the sale of minerals from the Timmins West Mine (and surrounding areas). In addition, there are several other royalties applicable to various land areas comprising the Timmins West Mine. Only one of these royalties, a 1% NSR royalty related to Thunder Creek, involves areas of known mineralization.

A total of 107,151 ounces of gold was produced at Timmins West Mine in 2013, which resulted from processing 747,491 tonnes with an average head grade of 4.63 grams of gold per tonne at a recovery rate of 96.26%.

Among the work completed at the Timmins West Mine in 2013 were 10,700 metres of total mine capital and operating development. At Timmins Deposit, the ramp approached the 870 Level with level development advancing on the 750, 770, 790, 810, 830 and 850 levels. The ramp in the lower mine at Thunder Creek advanced upwards to the 590 Level and down to the 765 Level with level development focused mainly on the 765, 730, 695, 660, 625 and 590 levels. Other components of the Company’s 2013 capital program at Timmins West Mine included establishment of an underground paste fill distribution system, completion of a diamond drill drift on the 790 Level of Timmins Deposit, commissioning of a ventilation system from the 730 to 870 levels at Timmins Deposit and completion of a waste pass at Thunder Creek from 730 Level to surface.

A total of 64,000 metres of in-mine drilling was completed in 2013. Drilling during the year was focused between the 790 and 830 levels at the Timmins Deposit and between the 660 and 765 levels at Thunder Creek. Drilling at the Timmins Deposit was completed mainly with two drill rigs and targeted the downward extension of the UM5 and FW zones between the 790 and 830 levels, which contained key mining blocks for the second half of 2013 and beyond. Drilling at Thunder Creek was completed with two drill rigs and targeted new stoping blocks in the Prophyry and Rusk zones near the 765 and 660 levels.

b. Gold River Trend

The Gold River Trend is an east-west trending mineralized deformation and alteration zone, traced for over 3 kilometres, located on the south side of the Timmins West sedimentary basin. The Gold River Trend is interpreted as a branch fault from the Destor Porcupine Fault. The Gold River Trend varies from 50 to 200 metres in width and is dominated by strongly sheared and hydrothermally altered sedimentary and volcanic rocks which have been intruded by lenses of porphyry. Work to date indicates that at least 15 different zones of gold mineralization exist with potential for being defined as narrow high grade or wide bulk resources. In most cases the mineralization is closely associated with pyrite-arsenopyrite-ankerite-quartz veins.

In February 2012, the Corporation published a resource estimate for the Gold River Trend property that includes an indicated resource of 690,000 tonnes at 5.29 gpt for 117,400 contained ounces of gold, and an inferred resource of 5,273,000 tonnes at 6.06 gpt for 1,027,800 contained ounces of gold. The

6

resources are contained within two deposits, the East Deposit and West Deposit and lie within approximately 4.0 kilometres of the Timmins West Mine shaft.

In addition to the royalty in favour of FNV, certain claims along the Gold River Trend are subject to net smelter returns royalties ranging from 2% to 5%.

c. 144 Property

The 144 Property consists of 34 staked claims covering approximately 4.0 kilometres of the same volcanic/ultramafic intrusive/sedimentary contacts found at the Timmins West Mine. Drilling at 144 has intersected multiple zones of gold mineralization located along a 1.2 kilometre stretch of the contact and associated with porphyritic intrusions similar to those which host some of the broadest and highest grade intercepts from the Thunder Creek Deposit. Given the shallow nature of the drilling and that the grades and widths of mineralization increased with depth, the potential to expand the known mineralization within the initial 1.2 kilometre area, as well as to the north and along strike, is considered excellent.

In addition to the royalty in favour of FNV, certain claims in the 144 land package are subject to net smelter returns royalties ranging from 2% to 5%.

2. Bell Creek Complex

The Bell Creek Complex is an area of approximately 32 square kilometers that includes the Bell Creek Mine and Mill, together with the contiguous Marlhill, Vogel and Schumacher properties, as well as numerous other projects at various stages of exploration.

a. Bell Creek Mine

The Bell Creek Mine comprises 3 crown mining leases and 5 freehold patents. Mineral production from the Mine is subject to a 2% net smelter returns royalty in favour of Goldcorp.

In May 2009, the Company commenced an advanced exploration program at Bell Creek Mine mainly focused on de-watering and rehabilitating the existing Bell Creek shaft and workings and collaring a surface ramp at Bell Creek to connect to the underground mine workings. Commercial production was declared at the Bell Creek Mine as of January 1, 2012.

During the year ended December 31, 2013, a total of 27,413 ounces of gold was produced (205,203 tonnes with an average grade of 4.41 grams of gold per tonne at a recovery rate of 94.14%). Production in 2013 was primarily in the North A Deep and Hanging Wall zones between the 505 and 625 levels with sill development to the 685 Level.

During the year, 6,320 metres of capital and operating development were completed, including advancing the ramp from surface to the 715 Level and advancing level development mainly on the 625, 640, 655, 670 and 685 levels.

A total of approximately 7,860 metres of in-mine drilling was completed at the Bell Creek Mine during 2013.

b. Bell Creek Mill

The Bell Creek mill is a conventional gold mill circuit, involving crushing and grinding, gravity and leaching, followed by a “Carbon-In-Pulp” (“CIP”) process for gold recovery. The mill also includes associated buildings and surface infrastructure, offices and an approved tailings area. The facility had been placed on care and maintenance in 2002. At the beginning of 2009, the mill had been refurbished with an initial capacity of 800 tonnes per day and was subsequently refurbished to a capacity of 1,500 tonnes per day near the end of the third quarter of that year. Since then the Mill has been expanded several times: in 2010 to a capacity of 2,000 tonnes per day; in 2012 to 2,500 tonnes per day; and in 2013 to 3,000 tonnes per day.

7

c. Vogel/Schumacher

The Vogel/Schumacher properties cover approximately 1.6 kilometres between Goldcorp Inc.’s high-grade Hoyle Pond Mine and Lake Shore Gold’s Bell Creek Mine. Gold mineralization at Vogel/Schumacher is hosted by a sequence of variably altered and veined steeply south dipping mafic volcanics. The alteration and veining occurs in two main forms either steeply dipping zones at the contact with ultramafic volcanics or as flat vein systems within the mafic volcanics.

Gold mineralization occurs in eight zones which are associated with quartz veining, pyrite mineralization and ankerite/albite/sericite alteration. Mineralized/altered zones vary from less than a metre to in excess of 20m in width. Gold values are associated with the quartz veining, the mineralized alteration envelopes about the veins and intervals of increased pyrite content. Modelling and resource estimation shows the presence of both a broad lower grade resource that could be suitable for an open pit and a narrower style of mineralization that would be more amenable to underground mining.

In May 2011, Lake Shore Gold published an estimate of both open pit and underground resources for the Vogel/Schumacher deposit that included an indicated mineral resource of 2.2 million tonnes at an average grade of 1.75 gpt containing 125,000 ounces of gold, and inferred mineral resources of 1.5 million tonnes grading 3.60 gpt containing 168,800 ounces of gold. The deposit remains open down-dip.

Both Vogel and Schumacher are subject to royalties on mineral production of up to 3% of net smelter returns.

d. Marlhill

The Marlhill property is located north-east of the Bell Creek Mine and is a former producing mine. In May 2011, Lake Shore Gold released an estimate for the Marlhill property of indicated resources of 395,000 tonnes at an average grade of 4.52 gpt for 57,400 contained ounces of gold. The resources are at shallow depths, mainly above the 360 metre level. All resources at Marlhill were estimated assuming an underground mining scenario. The resource estimate was for the M1 vein only and was prepared using historical drill information. Lake Shore Gold has completed only limited drilling at Marlhill.

Previous diamond drilling programs conducted by former operators at Marlhill have been successful in tracing the M1 vein, the primary vein identified and mined previously, to a strike length of 500 metres to 600 metres and to a vertical depth of 400 metres to 500 metres from surface. The current resource for the Marlhill deposit, incorporating the M1 vein only, extends to an approximate depth of 360 metres, while historic mining extended to a depth of only 150 metres. Based on work to date, neither the depth extent of the M1 Zone at Marlhill nor the extent along strike has been defined. The mineralization at Marlhill is located within 700 – 800 metres of the Bell Creek Mine, making it readily accessible using the Bell Creek Mine infrastructure.

Any mineral production from the Marlhill property is subject to a 2% net smelter returns royalty in favour of Goldcorp.

3. Fenn-Gib

The Fenn-Gib Project is located approximately 60 kilometres east of Timmins and 20 kilometres east of Matheson. The Project consists of 171 mining claims, patents and leases covering approximately 29 square kilometres. Geologically, Fenn-Gib lies along the east extension of the Destor Porcupine Fault Zone (“DPFZ”) and Pipestone Fault Zone (“PFZ”), near a major change in trend from southeasterly to east–west which is interpreted as a major dilatent zone. Associated with the interpreted dilatent zone are a number of syenitic intrusions and a major east-west trending Arrow fault. Fenn-Gib overlies a southeast trending contact between mafic volcanic (Kidd Munroe Assemblage) and sedimentary rocks (Hoyle Group) which follows the trend of the PFZ and has been intruded by a series of mafic to syenitic intrusions. A portion of the land position being acquired lies approximately four kilometres to the south of the main Fenn-Gib Project and covers 6 kilometres of strike length along the DPFZ. This land position, called Guibord Main, contains a mixture of mafic to ultramafic volcanics, which have also been intruded

8

by syenite. This geologic setting has some strong similarities to the geology found west of Timmins where Lake Shore Gold is in commercial production at its Timmins West Mine.

In November 2011, Lake Shore Gold published a resource estimate for the Fenn-Gib project that included an indicated resource of 40.8 million tonnes grading 0.99 gpt for a total of 1.30 million contained ounces of gold, and an inferred resource of 24.5 million tonnes at 0.95 gpt for a total of 0.75 million contained ounces of gold. Most of the resources are in the Main Zone, which is located in the northern portion of the Fenn-Gib property. Mineralization in the Main Zone consists of broad disseminated mineralization surrounding a distinct flexure of the PFZ and mafic volcanic-sedimentary contact where it has been intruded by mafic and syenitic intrusive rocks. The most common style of gold mineralization consists of quartz-carbonate veins, stringers and breccias hosted within intensely altered volcanic rocks and syenitic intrusions with lesser amounts being associated with fine crystalline pyrite in altered sediments and volcanic rocks.

Certain claims in the Fenn-Gib land package are subject to net smelter returns royalties ranging from 2% to 3%.

Production

Lake Shore Gold generates revenue through the extraction and sale of gold from underground mineral deposits at the Timmins West Mine. Commercial gold sales during 2013 totalled 135,550 ounces at an average price per ounce of US$1,377, for gold revenues of US$186.7 million. Commercial gold sales during 2012 totalled 79,742 ounces at an average price per ounce of US$1,666, for gold revenues of US$133 million. All gold sales were to arm’s length institutional purchasers.

At the Timmins West Mine, a production shaft is the primary access to the underground workings and is used to transfer ore and waste to surface. The shaft, sunk in close proximity to the Timmins Deposit, penetrates to 710 meters below surface. The 5.5m concrete lined shaft includes two 12 tonne capacity skip compartments, a service cage compartment, and a service compartment for piping and electrical services.

There is a 5.0 metre wide by 5.0 metre high ramp that extends from surface at the Timmins Deposit to the 290 metre level. In the lower part of the Timmins Deposit, a ramp from 480 metre level currently approaches the 870 metre level. Two connections exist between the Timmins and Thunder Creek deposits: a haulage ramp from the shaft at the 200 metre level at the Timmins Deposit connects to the Thunder Creek Deposit at the 300 metre level; and a haulage ramp extending from the 650 metre level at the Timmins Deposit connects to the Thunder Creek Deposit at the 730 metre level. At the Thunder Creek Deposit, a ramp extends from the 280 metre level to the 395 metre level. In the lower part of Thunder Creek a ramp from the 590 metre level extends to the 765 metre level.

Broken ore and waste rock at Timmins West Mine are hauled primarily to separate ore and waste dumps/rockbreaker arrangements near the shaft at 650L. Broken material is dumped onto grizzlies and sized through 0.35 metre by 0.35 metre grizzly openings with stationary hydraulic rockbreakers. The product is then gravity fed into the loading pocket and loaded into 12 tonnes skips for hoisting to surface.

At the Bell Creek Mine the primary access to the underground workings is via an existing portal and main ramp from surface. The main ramp is 5.0 metre wide by 5.0 metre high and currently extends to the 715L. There is an existing 6.3 metre by 2.6 metre rectangular, three-compartment timbered shaft. The shaft is 290 metres deep. A main shaft station exists at the 240L. The headframe and hoisting facilities remain in place, but are currently not being used. Material at Bell Creek Mine is drawn out by scoop trams and trucked to surface up the ramp.

Sale of Gold

There is a worldwide gold market into which Lake Shore Gold sells gold. As a result, the Corporation will not be dependent on a particular purchaser for its sales of gold, and the Corporation is not required to

9

undertake any marketing efforts in order to sell its gold, provided that it is selling the gold at the prevailing market price. The Corporation produces gold doré bars at its Bell Creek Mill. Because doré is an alloy consisting primarily of gold but also containing silver and other metals, doré bars are sent to refiners to produce bullion that meets the required market standard of 99.99% pure gold. All gold doré produced by the Bell Creek Mill is shipped to Johnson Matthey Ltd. for processing at its refinery in Brampton, Ontario, Canada. Lake Shore Gold actively manages sales by soliciting offers from arm’s length institutional purchasers for a specified number of ounces of gold (and any silver byproduct resulting from the refining process). Ownership of the refined gold and any silver is generally transferred to the purchaser at the refinery, but from time to time Lake Shore Gold may transfer ownership of the doré directly to a purchaser when it leaves the mill. Lake Shore Gold does not currently undertake any hedging activity.

Specialized Skill and Knowledge

The skill and knowledge required to develop a producing mine includes experience in exploration, development, construction, mine operations, metallurgical processing and environmental compliance. Lake Shore Gold employs a number of technical personnel with relevant experience, education and professional designations, and constantly evaluates the need for additional employees with particular expertise. In addition, from time to time, as necessary, Lake Shore Gold engages professionals in geological, metallurgical, engineering, environmental and other relevant disciplines as consultants. Lake Shore Gold endeavours to maintain attractive remuneration and compensation packages in order to attract and retain personnel with the necessary qualifications, skills and experience, and to date has been able to meet the Corporation’s staffing requirements.

Competitive Conditions

The mining industry is intensely competitive and Lake Shore Gold must compete in all aspects of its operations with other mining companies, including many large established mining companies having substantial capabilities and greater financial and technical resources than Lake Shore Gold. As a result, Lake Shore Gold may be at a disadvantage with respect to the acquisition and development of mining properties. Lake Shore Gold also competes with other mining companies for qualified employees, and may not be able to offer the same level of compensation as other mining companies. Significant growth in the mining industry over the past several years has increased the demand for experienced miners and qualified technical personnel. If the Corporation were unable to attract and retain appropriate personnel, it could delay the development and exploitation of the Corporation’s assets, and other plans.

Components

Lake Shore Gold sources machinery, parts and services from local businesses wherever possible, but also procures components from large national and multinational suppliers to the mining industry. The Corporation orders mine inventory items, mill components, consumables, and other items that are necessary for continued operation in advance to ensure delivery when needed to avoid production or development delays. Both the Bell Creek Mine and Timmins West Mine are located near the City of Timmins, with ready access to both sites by provincial highways. The City of Timmins also has an airport through which smaller cargo is regularly transported.

Cycles

The gold mining and exploration business is highly dependent on the price of gold, which is set by market forces and factors beyond the cost of production and has historically been volatile. Since the Corporation does not have control over the selling price of its production, a decrease in the market price of gold will negatively affect the Corporation’s revenues.

Environmental Protection

Lake Shore Gold’s mining and milling operations are regulated by licenses issued by the Province of Ontario allowing the Corporation to: (i) draw fresh water from local rivers; (ii) store waste material and

10

tailings from mining and milling operations in containment ponds built and maintained by the Corporation; (iii) discharge treated water to local waterways; and (iv) release emissions into the air. The activities governed by these licences are important to the regular mining activities of the Corporation, and the loss of a licence or the failure to obtain new licences when required could delay or stop the Corporation’s activities or plans. The terms of Lake Shore Gold’s licences are similar to those of other mining companies operating near the Corporation’s properties, and do not place Lake Shore Gold at a competitive disadvantage compared to other mining companies.

Environmental monitoring data is maintained, and environmental incidents and accidents are reported and addressed immediately. The cost of regular compliance with environmental controls is not significant, but a significant accident resulting in the discharge of contaminants to the environment could result in significant clean up costs and penalties, which would have a material effect on the Corporation’s financial position.

Lake Shore Gold continuously strives to improve its environmental performance, and will spend approximately $9 million this year on capital improvements related to water management. In addition, there are known future environmental obligations relating to mine reclamation and closure activities. These activities are site specific and are governed by the Closure Plans filed with the Ontario Ministry of Northern Development and Mines. Lake Shore Gold has already provided for the estimated costs of closure of approximately $5.2 million by posting letters of credit with the Ministry of Northern Development and Mines.

Employees

Lake Shore Gold had 433 employees at the end of 2013.

Social and Environmental Policies

Lake Shore Gold is committed to the long-term well-being of the communities in which it operates. Lake Shore Gold is sensitive to concerns regarding the activities carried on by mining companies and works with communities and organizations to alleviate those concerns. Lake Shore Gold regularly consults with local First Nation communities in respect of its projects, and has entered into an Impact and Benefits Agreement in respect of the Timmins West Complex that provides for education and training of First Nations’ members, employment opportunities, environmental care, and collaborative business opportunities. Lake Shore Gold is working on implementing a similar arrangement with First Nations in respect of the Bell Creek Complex.

Risk Factors

The following is a brief description of those distinctive or special characteristics of Lake Shore Gold’s operations and industry, which may have a material impact on, or constitute risk factors in respect of, Lake Shore Gold’s financial performance, business and operations.

Dependence on Timmins West Mine and Bell Creek Mill

Lake Shore Gold’s operations at the Timmins West Mine will account for the majority of the Corporation’s production for the foreseeable future, all of which will be processed at the Bell Creek Mill. Any adverse condition affecting mining or milling conditions at the Timmins West Mine or the Bell Creek Mill could be expected to have a material adverse effect on the Corporation’s financial performance and results of operations. The Corporation also anticipates using revenue generated by its operations at the Timmins West Mine in the future to finance a substantial portion of the exploration and capital expenditures required at its development projects. Unless the Corporation can successfully bring into production other mineral projects on its existing properties, or otherwise acquire gold-producing assets, the Corporation will be dependent on the Timmins West Mine for the majority of its gold production and revenues. Further, there can be no assurance that the Corporation’s current exploration and development programs at its

11

properties will result in any new economically viable mining operations or yield new mineral resources to replace and expand current mineral resources.

Uncertainty of Production Estimates

The Corporation’s gold production may fall below estimated levels if, during the course of mining, unfavourable ground conditions or seismic activity are encountered, mineral grades are lower than expected, the physical or metallurgical characteristics of the minerals are less amenable than expected to mining or treatment, or dilution increases. In addition, production may be unexpectedly reduced as a result of mining accidents such as cave-ins, rock falls, rock bursts or flooding, or as a result of other operational difficulties. Accordingly, there can be no assurance that the Corporation will achieve current or future production estimates.

Mineral Exploration, Development and Production Activities Inherently Risky

The business of mineral exploration and extraction involves a high degree of risk. Few properties that are explored are ultimately developed into production and there is a risk that none of the Corporation’s properties, other than the Timmins West Mine and Bell Creek Mine, will ultimately be developed into mines. Among the many uncertainties inherent in any gold exploration and development program are the location of economic orebodies, the development of appropriate metallurgical processes, the receipt of necessary governmental permits and the construction of mining and processing facilities. Substantial expenditures are required to pursue such exploration and development activities. Other risks involved in extraction operations and the conduct of exploration programs include unusual or unexpected formations, formation pressures, seismic activity, fires, power outages, labour disruptions, flooding, explosions, rock bursts, cave-ins, landslides, variations in grade, deposit size, density and other geological problems, hydrological conditions, metallurgical and other processing problems, mechanical equipment performance problems, the unavailability of materials and equipment including fuel, unanticipated transportation costs, unanticipated regulatory changes, unanticipated or significant changes in the costs of supplies including, but not limited to, fuel, and adverse weather conditions and other conditions involved in the drilling and removal of material, any of which could result in increased costs, damage to, or destruction of, mines and other producing facilities, damage to life or property, environmental damage and possible legal liability. Although Lake Shore Gold carries liability insurance with respect to its mineral exploration operations, Lake Shore Gold may become subject to liability for damage to life and property, environmental damage, cave-ins or hazards against which it cannot insure or against which it may elect not to insure.

Assuming discovery of an economic orebody, depending on the type of mining operation involved, several years may elapse from the initial phases of drilling until commercial operations are commenced and during such time the economic feasibility of production may change. Accordingly, there can be no assurance that the Corporation’s current or future exploration and development programs will result in any new economically viable mining operations or yield new mineral reserves.

Uncertainty of Mineral Resources and Reserves

The figures for mineral resources and reserves stated in this AIF, or in the documents incorporated by reference, are estimates and no assurance can be given that the anticipated tonnages and grades will be achieved or that the indicated level of recovery of gold will be realized. Market price fluctuations of gold, in addition to increased production costs or reduced recovery rates may render resources uneconomic. Moreover, short-term operating factors relating to the mineral deposits, such as the need for orderly development of the deposits or the processing of new or different grades of ore, may cause any mining operation to be unprofitable in any particular accounting period.

Until mineral reserves or mineral resources are actually mined and processed, mineral resource and mineral reserve grades must be considered as estimates only. In addition, mineral reserves and mineral resources may vary depending on, among other things, metal prices and currency exchange rates. Any material change in mineral reserves, mineral resources, grade or dilution may affect the economic viability of the properties. In addition, there can be no assurance that gold recoveries or other metal recoveries in

12

small scale laboratory tests will be duplicated in larger scale tests under on-site conditions or during production.

The Corporation’s mineral projects, other than the Timmins West Mine and Bell Creek Mine, which are in commercial production, are in the exploration stage. Until mineral resources on these exploration properties are categorized as mineral reserves, the known mineralization at these projects is not determined to be economic. The Corporation’s ability to put its exploration properties into production will be dependent upon the results of further drilling and evaluation. There is no certainty that expenditures made in the exploration of the Corporation’s mineral properties will result in the identification of commercially recoverable quantities of ore or that mineral reserves will be mined or processed profitably. Greater assurance may require completion of comprehensive feasibility studies and, possibly, further associated exploration and other work that concludes a potential mine at each of these projects is likely to be economic.

Risk of Flooding

In previous years, Lake Shore Gold has experienced significant water flows onto its properties as a result of the spring thaw in Timmins. Once on the Corporation’s properties, this water must be treated as any other water which the Corporation seeks to discharge from its properties and must meet environmental standards. This means that the Corporation is required to store and potentially treat the water, and to limit discharge to the approved limits under the Corporation’s permits. If the amount of such water flowing onto the properties exceeds the capacity of the Corporation’s storage ponds, the Corporation may be required to store water in underground areas of its mines, limiting its ability to operate in those areas. Production and capital development could be delayed if the Corporation cannot operate in necessary areas as a result of such flooding, which could cause the Corporation to miss production targets and to lose revenue. The Corporation may also incur additional costs as a result of such flooding, both in dealing with the excess water and in remediating any damage resulting from flooding. Lake Shore Gold plans to spend approximately $9 million in 2014 to improve its water management infrastructure.

Risk of Project Delay

There are significant risks that the commencement and completion of construction of a mine on any of the Corporation’s properties could be delayed due to circumstances beyond the Corporation’s control. Such risks include delays in obtaining environmental and construction authorizations and permits, delays in finalizing all necessary detailed engineering and construction contracts, as well as unforeseen difficulties encountered during the construction process.

The Corporation May Not Meet Key Production and Other Cost Estimates

A decrease in the amount and a change in the timing of the production outlook for the Corporation will directly impact the amount and timing of the Corporation’s cash flow from operations. The actual impact of such a decrease on the Corporation’s cash flow from operations would depend on the timing of any changes in production and on actual prices and costs. Any change in the amount or timing of these projected cash flows that would occur due to production shortfall, changes in prices or costs, labour disruptions, or reduced availability of required equipment or suppliers may require that the Corporation seek additional financing to fund operational or capital expenditures.

Global Financial Condition

Global financial conditions in recent years have been characterized by weakness and uncertainty, and access to public financing has been negatively impacted by disruptions in the credit and capital markets. These factors may impact the ability of the Corporation to obtain equity or debt financing in the future on terms favourable to the Corporation. Additionally, these factors, as well as other related factors, may cause decreases in asset values that are deemed to be significant or prolonged, which may result in impairment losses. If such increased levels of volatility and market turmoil continue, the Corporation’s

13

operations could be adversely impacted and the trading price of its common shares may be adversely affected.

Fluctuation of Mineral Prices

The success of the Timmins West Mine, Bell Creek Mine, and the Corporation’s other properties will be primarily dependent on the future price of gold. Gold prices are subject to significant fluctuation and are affected by a number of factors which are beyond the control of the Corporation. Such factors include, but are not limited to, interest rates, exchange rates, inflation or deflation, fluctuation in the value of the United States dollar and foreign currencies, global and regional supply and demand, and the political and economic conditions of major gold-producing countries throughout the world. The price of gold has fluctuated widely in recent years, and future serious price declines could cause continued development of, and commercial production from, the Corporation’s properties to be impracticable or uneconomic. Depending on the price of gold, projected cash flow from planned mining operations may not be sufficient and the Corporation could be forced to discontinue development and may lose its interest in, or may be forced to sell, some of its properties. Future production from the Corporation’s mining properties is dependent on gold prices that are adequate to make these properties economically viable. Lake Shore Gold does not currently engage in any hedging activity and is fully exposed to changes in the gold price, but may in the future enter into hedging arrangements with respect to its gold-denominated obligations under the Gold Loan with Sprott.

Furthermore, recalculating reserve and resource estimates and life-of-mine plans using significantly lower gold prices could result in material write-downs of the Corporation’s investment in mining properties and increased amortization, reclamation and closure charges. In addition to adversely affecting the Corporation’s mineral resource and reserve estimates and its financial condition, declining metal prices can impact operations by requiring a reassessment of the feasibility of a particular project. Such reassessment may be the result of a management decision or may be required under financing arrangements related to a particular project. Even if the project is ultimately determined to be economically viable, the need to conduct such a reassessment may cause substantial delays or may interrupt operations until the reassessment can be completed.

Currency Fluctuations

Currency fluctuations may affect the costs the Corporation incurs in its operations and may affect the Corporation’s operating results and cash flows. Gold is sold throughout the world based principally on the U.S. dollar price, but the Corporation’s operating and capital expenses are incurred in Canadian dollars. The appreciation of the Canadian dollar against the U.S. dollar can reduce the Corporation’s revenues relative to the costs at the Corporation’s operations, making such operations less profitable. Lake Shore Gold does not engage in any hedging activity and is fully exposed to changes in exchange rates.

Fluctuations in External Factors Affecting Costs

The Corporation’s production costs are dependent on a number of factors, including refining charges, production royalties based on the price of gold, and the cost of inputs used in mining operations, including equipment, labour (including contractors), steel, chemical reagents and energy. All of these factors are beyond the Corporation’s control. If the Corporation’s total production costs per ounce of gold rise above the market price of gold and remain so for any sustained period, the Corporation may experience losses and may curtail or suspend some or all of its exploration, development and mining activities.

History of Net Losses; Uncertainty of Additional Financing

Prior to January 1, 2011, the Corporation had not recorded any revenues from operations nor had the Corporation operated in commercial production on any property. Despite the commencement of commercial production at the Timmins Deposit on January 1, 2011, and at Thunder Creek and Bell Creek Mine on January 1, 2012, there can be no assurance that significant losses will not continue to occur or

14

that the Corporation will be profitable in the future. There is no assurance that Lake Shore Gold’s operations will ever provide a return on investment in the future. The Corporation has not paid dividends in the past and has no current plans to pay dividends in the future.

The Corporation’s operating expenses and capital expenditures may increase with mining activities at Timmins West Mine and Bell Creek Mine, and advancing exploration, development and commercial production of other properties in which the Corporation has an interest. The Corporation may continue to incur losses unless and until such time as it generates sufficient revenues from commercial production to fund all of its continuing operations. The development of the Corporation’s properties may require the commitment of substantial resources.

The Corporation may require additional financing from external sources in order to fund future capital and operating costs. There can be no assurance that such financing will be available to the Corporation or, if it is, that it will be offered on acceptable terms. If additional financing is raised through the issuance of equity or convertible debt securities of the Corporation, the interests of shareholders in the net assets of the Corporation may be diluted. Any failure of the Corporation to obtain required financing on acceptable terms could have a material adverse effect on the Corporation’s financial condition, results of operations and liquidity and require the Corporation to cancel or postpone planned capital investments.

Limitations under Credit Facility

The Corporation’s secured credit facility limits, among other things, the Corporation’s ability to permit the creation of certain liens, make investments, dispose of the Corporation’s assets or, in certain circumstances, pay dividends. In addition, the credit facility limits the Corporation’s ability to incur additional indebtedness and requires the Corporation to maintain specified financial ratios and meet financial condition covenants. Events beyond the Corporation’s control, including changes in general economic and business conditions, may affect the Corporation’s ability to satisfy these covenants, which could result in a default under one or both of the credit facilities or the notes. If an event of default under the credit facility occurs, the lenders could elect to declare all principal amounts outstanding thereunder at such time, together with accrued interest, to be immediately due. An event of default under the credit facility may also give rise to an event of default under existing and future debt agreements and, in such event, the Corporation may not have sufficient funds to repay amounts owing under such agreements.

Risks Relating to Statutory and Regulatory Compliance

The current and future operations of Lake Shore Gold, including exploration, development activities and commercial production are and will be governed by laws and regulations governing mineral claims acquisition, prospecting, development, mining, production, exports, taxes, labour standards, occupational health, waste disposal, toxic substances, land use, environmental protection, mine safety and other matters. Companies engaged in exploration activities and in the development and operation of mines and related facilities generally experience increased costs and delays in production and other schedules as a result of the need to comply with applicable laws, regulations and permits. Lake Shore Gold has received all necessary permits for the mining operations and the exploration and development work it is presently conducting, but there can be no assurance that all permits, if any, which Lake Shore Gold may require for future exploration, construction of mining facilities and conduct of mining operations will be obtainable on reasonable terms or on a timely basis, or that such laws and regulations would not have an adverse effect on any project which Lake Shore Gold may undertake.

Failure to comply with applicable laws, regulations and permits may result in enforcement actions thereunder, including the forfeiture of claims, orders issued by regulatory or judicial authorities requiring operations to cease or be curtailed, and may include corrective measures requiring capital expenditures, installation of additional equipment or costly remedial actions. Lake Shore Gold may be required to compensate those suffering loss or damage by reason of its mineral exploration activities and may have civil or criminal fines or penalties imposed for violations of such laws, regulations and permits. Lake Shore Gold is not currently covered by any form of environmental liability insurance. See “Insurance Risk” below.

15

Existing and possible future laws, regulations and permits governing operations and activities of exploration and development companies, or more stringent implementation thereof, could have a material adverse impact on Lake Shore Gold and cause increases in capital expenditures or require abandonment of, or delays in, exploration.

Uncertainty in Executing, Managing and Integrating Acquisitions

The Corporation occasionally evaluates opportunities to acquire shares or assets of other mining businesses. Such acquisitions may be significant in size, may change the scale of the Corporation’s business and may expose the Corporation to new geographic, political, operating, financial or geological risks. The Corporation’s success in its acquisition activities depends on its ability to identify suitable acquisition candidates, acquire them on acceptable terms and integrate their operations successfully with those of the Corporation. Any acquisition would be accompanied by risks, such as the difficulty of assimilating the operations and personnel of any acquired businesses; the potential disruption of the Corporation’s ongoing business; the inability of management to maximize the financial and strategic position of the Corporation through the successful integration of acquired assets and businesses; the maintenance of uniform standards, controls, procedures and policies; the impairment of relationships with employees, customers and contractors as a result of any integration of new management personnel; and the potential unknown liabilities associated with acquired assets and businesses. In addition, the Corporation may need additional capital to finance an acquisition. Debt financing related to any acquisition may expose the Corporation to the risks related to increased leverage, while equity financing may cause existing shareholders to suffer dilution.

Possible Loss of Interests in Exploration Properties; Possible Failure to Obtain Mining Licenses

Terms under which Lake Shore Gold acquired or may acquire interests in certain properties provide that Lake Shore Gold must over certain time periods expend certain minimum amounts on the exploration of the properties, make payments, or contribute its share of ongoing expenditures. If Lake Shore Gold fails to make such payments or expenditures in a timely fashion, Lake Shore Gold may lose its interest in those properties. Further, with respect to any exploration property, Lake Shore Gold may not be able to obtain the necessary licenses or permits to conduct mining operations on the properties, and thus would realize no benefit from its exploration activities on such properties.

Lake Shore Gold has Limited Mineral Reserves

Mineral resources are inventories of mineralization that under realistically assumed and justifiable technical and economic conditions might become economically extractable. Mineral reserves are those parts of mineral resources which, after the application of all mining factors, result in an estimated tonnage and grade which is the basis of an economically viable project after taking account of all relevant processing, metallurgical, economic, marketing, legal, environment, socio-economic and government factors. Additional work is required before Lake Shore Gold can demonstrate whether mineral resources may be economically viable and if any of its properties other than the Timmins West Complex and the Bell Creek Complex have a body of commercially viable ore. Exploration for minerals is a speculative venture necessarily involving substantial risk. If the expenditures Lake Shore Gold makes on its properties do not result in discoveries of mineralization that can be economically recovered, the value of exploration and acquisition expenditures may be lost and the value of Lake Shore Gold stock will be negatively impacted.

The Corporation has not prepared feasibility studies for either the Timmins West Mine or the Bell Creek Mine. Feasibility studies typically serve as the basis for a production decision, demonstrating with a higher degree of certainty that extraction is reasonably justified (economically mineable). The decision to proceed without these comprehensive studies of the mineral projects carries significant risks as a result of the lower level of confidence of the information used, which could lead to either or both higher production costs and lower production levels. If the Corporation is unable to realize sufficient profit from its gold mining operations to support the costs of sustaining the Corporation, the Corporation would incur losses and any investment in the Corporation could be negatively affected.

16

Title Risks

The acquisition of title to mineral properties is a very detailed and time-consuming process. Title to, and the area of, the mineral property may be disputed. There is no guarantee that such title will not be challenged or impaired. There may be challenges to the title of the properties in which the Corporation has an interest, which, if successful, could result in the loss or reduction of the Corporation’s interest in the properties.

Although title to its material properties has been reviewed by or on behalf of Lake Shore Gold, no assurances can be given that there are no title defects affecting the properties. Title insurance generally is not available for mining claims in Canada and Lake Shore Gold’s ability to ensure that it has obtained secure claim to individual mineral properties may be severely constrained. Lake Shore Gold has not conducted surveys of all of the claims in which it holds direct or indirect interests, therefore, the precise area and location of such claims may be in doubt. The properties may be subject to prior unregistered liens, agreements, transfers or claims including native land claims, and title may be affected by, among other things, undetected defects. In addition, Lake Shore Gold may be unable to conduct work on the properties as permitted or to enforce its rights with respect to its properties.

Obligations and Potential Liabilities with Respect to Acquired Properties

Under agreements for the acquisition of existing and future properties, Lake Shore Gold has assumed or may assume liabilities relating to the mineral properties, surface buildings, mill and tailings, past, present and future. While Lake Shore Gold conducts due diligence with a view to determining, among other things, what these obligations and liabilities may be, there is no assurance that Lake Shore Gold has been or will be able to determine accurately the existence or extent or potential cost of any such obligations and liabilities. Failure to determine adequately or at all the existence or extent or potential cost of any such obligations and liabilities could, in the future, have a material adverse impact on Lake Shore Gold’s profitability, business prospects, results of operations and financial condition.

Environmental Risks

Mining operations have inherent risks and liabilities associated with pollution of the environment and the disposal of waste products occurring as a result of mineral exploration and production. Laws and regulations involving the protection and remediation of the environment and the governmental policies for implementation of such laws and regulations are constantly changing and are generally becoming more restrictive. Lake Shore Gold cannot give any assurance that, notwithstanding its precautions, breaches of environmental laws (even if inadvertent) or environmental pollution will not materially and adversely affect its financial condition and its results from operations.

Previous mining operations may have caused environmental damage at certain of Lake Shore Gold’s properties. It may be difficult or impossible to assess the extent to which such damage was caused by Lake Shore Gold or by the activities of previous operators, in which case, any indemnities and exemptions from liability may be ineffective.

There is no assurance that future changes in environmental regulation, if any, will not adversely affect the Corporation’s operations. Environmental hazards may exist on the properties on which the Corporation holds interests which are unknown to the Corporation at present and which have been caused by previous or existing owners or operators of the properties. Reclamation costs are uncertain and planned expenditures may differ from the actual expenditures required.

Risks Associated with Joint Venture Agreements

Lake Shore Gold’s interests in various of its properties may, in certain circumstances, become subject to the risks normally associated with the conduct of joint ventures. In the event that any of Lake Shore Gold’s properties become subject to a joint venture, the existence or occurrence of one or more of the

17

following circumstances and events could have a material adverse impact on Lake Shore Gold’s profitability or the viability of its interests held through joint ventures, which could have a material adverse impact on Lake Shore Gold’s business prospects, results of operations and financial condition: (i) disagreements with joint venture partners on how to conduct exploration; (ii) inability of joint venture partners to meet their obligations to the joint venture or third parties; and (iii) disputes or litigation between joint venture partners regarding budgets, development activities, reporting requirements and other joint venture matters.

Third Party Reliance

Lake Shore Gold’s rights to acquire an interest in certain resource properties may have been granted by third parties who themselves held only a lease or an option to acquire such properties. If such persons fail to fulfill their obligations, Lake Shore Gold could lose such interest in the properties and may have no meaningful recourse, as it may not have any direct contractual arrangements with the underlying property holders.

Insurance Risk

The Corporation’s business is subject to a number of risks and hazards generally, including adverse environmental conditions, industrial accidents, labour disputes or slowdowns, unusual or unexpected geological conditions, ground or stope failures, cave-ins, changes in the regulatory environment or laws, and natural phenomena such as inclement weather conditions, forest fires, floods and earthquakes. Such occurrences could result in damage to mineral properties or production facilities, personal injury or death, environmental damage to the Corporation’s properties or the properties of others, delays in development or mining, monetary losses and possible legal liability.

Although the Corporation maintains insurance to protect against certain risks in such amounts as it considers reasonable, its insurance will not cover all potential risks associated with its operations. The Corporation may also be unable to maintain insurance to cover these risks at economically feasible premiums. Insurance coverage may not continue to be available or may not be adequate to cover any resulting liability. Moreover, insurance against risks such as environmental pollution or other hazards as a result of exploration and production is not generally available to the Corporation or to other companies in the mining industry on acceptable terms. The Corporation might also become subject to liability for pollution or other hazards which may not be insured against or which the Corporation may elect not to insure against because of premium costs or other reasons. Losses from these events may cause the Corporation to incur significant costs that could have a material adverse effect upon its financial performance and results of operations.

Competition

The Corporation’s business is intensely competitive, and the Corporation competes with other mining companies, many of which have greater resources and experience. Competition in the precious metals mining industry is primarily for: (i) mineral rich properties which can be developed and produced economically; (ii) the technical expertise to find, develop, and produce from such properties; (iii) the labour to operate the properties; and (iv) the capital for financing development of such properties. Many competitors not only explore for and mine precious metals, but conduct refining and marketing operations on a world-wide basis and some of these companies have much greater financial and technical resources than the Corporation. Such competition may result in the Corporation being unable to acquire desired properties, recruit or retain qualified employees or acquire the capital necessary to fund its operations and develop its properties. The Corporation’s inability to compete with other mining companies could have a material adverse effect on the Corporation’s results of operations.

18

Dependence on Key Management and Employees

The success of the operations and activities of Lake Shore Gold is dependent to a significant extent on the efforts and abilities of its management, key employees and outside contractors. Relationships between the Corporation and its employees may be affected by changes in the scheme of labour relations that may be introduced by relevant government authorities in the jurisdictions that the Corporation operates. Changes in applicable legislation or in the relationship between the Corporation and its employees or contractors may have a material adverse effect on the Corporation’s business, results of operations and financial condition. The Corporation’s ability to manage its operating, development, exploration and financing activities will depend in large part on the efforts of key management personnel. The loss of the services of one or more of these individuals could adversely affect Lake Shore Gold’s profitability, results of operations and financial condition. The Corporation faces significant competition for qualified personnel and there can be no assurance that the Corporation will be able to attract and retain such personnel. The Corporation does not hold key person insurance on any of these individuals.

Volatility of Market Price of Securities

The trading price of the Corporation’s common shares has been and may continue to be subject to large fluctuations which may result in losses to investors. The trading price of the Corporation’s common shares may increase or decrease in response to a number of events and factors, including:

· changes in the market price of gold;

· current events affecting the economic situation in Canada, the United States and elsewhere;

· trends in the mining industry and the markets in which the Corporation operates;

· changes in financial estimates and recommendations by securities analysts;

· acquisitions and financings;

· quarterly variations in operating results;

· the Corporation’s inability to achieve its guidance or meet expectations of market participants;

· the operating and share price performance of other companies that investors may deem comparable; and

· purchases or sales of blocks of the Corporation’s common shares.

Wide price swings are currently common in the markets on which the Corporation’s securities trade. This volatility may adversely affect the prices of the Corporation’s common shares regardless of the Corporation’s operating performance. As well, there can be no assurance that an active market for the securities of the Corporation will be sustained.

Impairment of Assets.

In accordance with IFRS, Lake Shore Gold capitalizes certain expenditures and advances relating to its mineral projects. From time to time the carrying amounts of mining properties and plant and equipment are reviewed for impairment if events or changes in circumstances indicate that the carrying value may not be recoverable. If there are indicators of impairment, an exercise is undertaken to determine whether the carrying values are in excess of their recoverable amount. Such review is undertaken on an asset by asset basis, except where such assets do not generate cash flows independent of other assets, and then the review is undertaken at the cash generating unit level.

Events that could, in some circumstances, lead to an impairment include, but are not limited to, shutting down a facility or operation, reevaluation of the economic or operating parameters of an existing operation, abandoning a development project, the denial of a permit, or the Corporation’s market capitalization being less than the carrying amounts of its mining properties and plant equipment.

The assessment requires the use of estimates and assumptions such as, but not limited to, long-term commodity prices, foreign exchange rates, discount rates, future capital requirements, resource

19

estimates, exploration potential and operating performance as well as the definition of cash generating units. It is possible that that the actual fair value could be significantly different from those assumptions, and changes in the assumptions will affect the recoverable amount of the mining interests. In the absence of any mitigating valuation factors, the Corporation’s failure to achieve its valuation assumptions or declines in the fair values of its cash generating units or other assets may, over time, result in impairment charges.

If Lake Shore Gold determines that an asset is impaired, the Corporation will charge against earnings any difference between (i) the carrying amount of the assets and (ii) the estimated fair value less cost to sell of those assets. Any such charges could have a material adverse effect on Lake Shore Gold’s results of operations.

Conflicts of Interest