1 1 Blackbaud, Inc. Adjusted Unaudited Historical Financial Information and Non-GAAP Financial Measures Reclassifications to the unaudited historical financial information In order to provide comparability between periods presented, certain previously reported historical financial information has been reclassified to conform to the presentation of the most recent reporting period. A summary of those prior period reclassifications is as follows: • "Our revenue from "subscriptions" and "maintenance" and a portion of our "services and other" have been combined within "recurring" revenue in the consolidated statements of comprehensive income. Similarly, "cost of subscriptions" and "cost of maintenance" and a portion of "cost of services and other" have been combined within "cost of recurring" in the consolidated statements of comprehensive income. • "Services and other" revenue has been renamed as "one-time services and other" and consists of revenue that did not meet the description of "recurring" revenue in the consolidated statements of comprehensive income. Exhibit 99.2

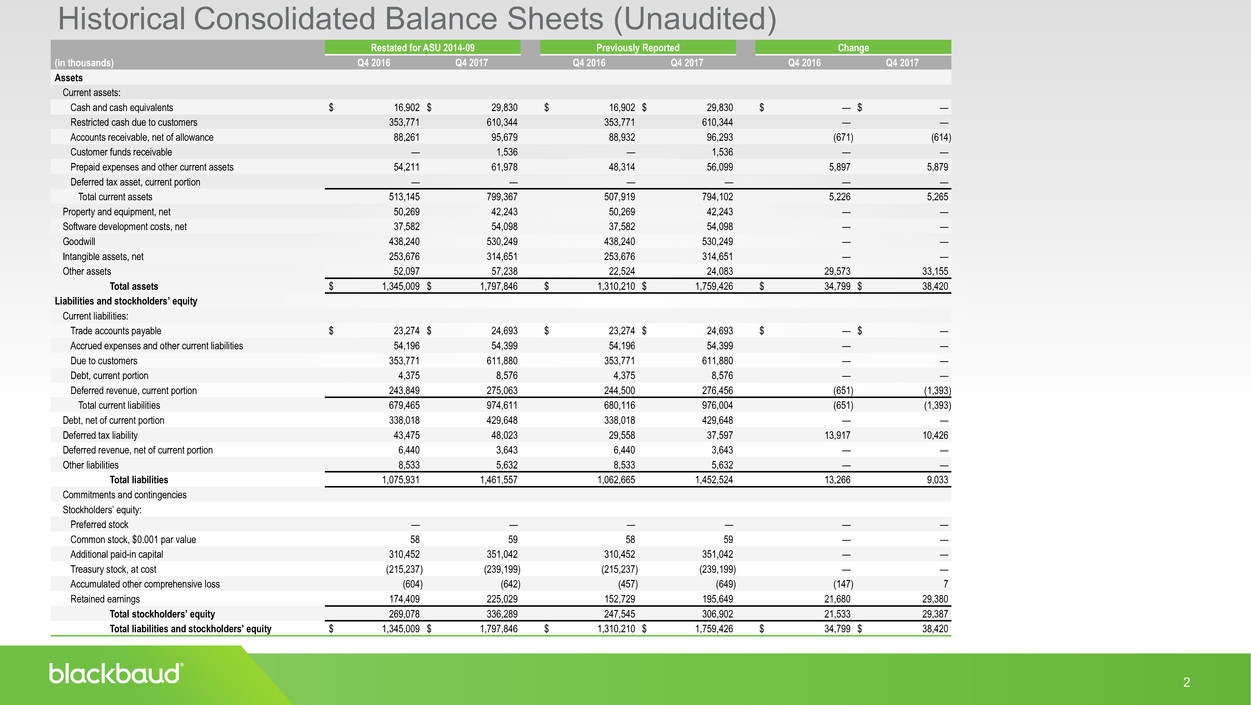

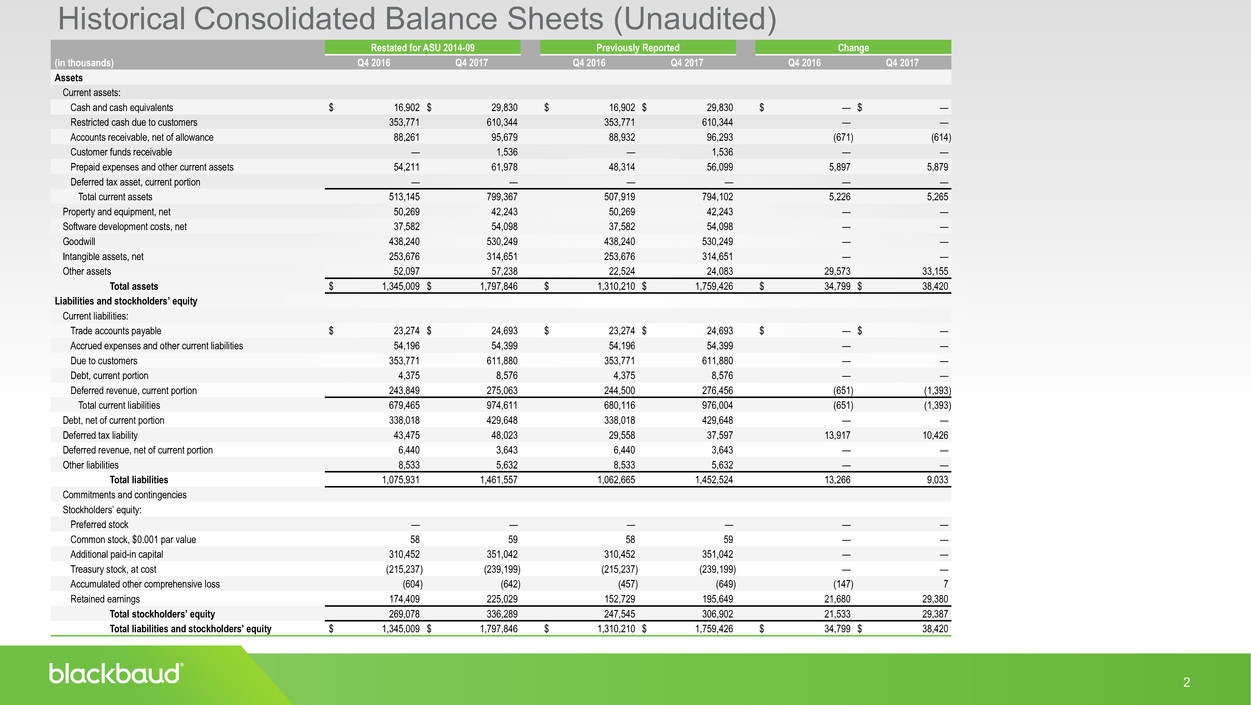

2 2 Historical Consolidated Balance Sheets (Unaudited) Restated for ASU 2014-09 Previously Reported Change (in thousands) Q4 2016 Q4 2017 Q4 2016 Q4 2017 Q4 2016 Q4 2017 Assets Current assets: Cash and cash equivalents $ 16,902 $ 29,830 $ 16,902 $ 29,830 $ — $ — Restricted cash due to customers 353,771 610,344 353,771 610,344 — — Accounts receivable, net of allowance 88,261 95,679 88,932 96,293 (671) (614) Customer funds receivable — 1,536 — 1,536 — — Prepaid expenses and other current assets 54,211 61,978 48,314 56,099 5,897 5,879 Deferred tax asset, current portion — — — — — — Total current assets 513,145 799,367 507,919 794,102 5,226 5,265 Property and equipment, net 50,269 42,243 50,269 42,243 — — Software development costs, net 37,582 54,098 37,582 54,098 — — Goodwill 438,240 530,249 438,240 530,249 — — Intangible assets, net 253,676 314,651 253,676 314,651 — — Other assets 52,097 57,238 22,524 24,083 29,573 33,155 Total assets $ 1,345,009 $ 1,797,846 $ 1,310,210 $ 1,759,426 $ 34,799 $ 38,420 Liabilities and stockholders’ equity Current liabilities: Trade accounts payable $ 23,274 $ 24,693 $ 23,274 $ 24,693 $ — $ — Accrued expenses and other current liabilities 54,196 54,399 54,196 54,399 — — Due to customers 353,771 611,880 353,771 611,880 — — Debt, current portion 4,375 8,576 4,375 8,576 — — Deferred revenue, current portion 243,849 275,063 244,500 276,456 (651) (1,393) Total current liabilities 679,465 974,611 680,116 976,004 (651) (1,393) Debt, net of current portion 338,018 429,648 338,018 429,648 — — Deferred tax liability 43,475 48,023 29,558 37,597 13,917 10,426 Deferred revenue, net of current portion 6,440 3,643 6,440 3,643 — — Other liabilities 8,533 5,632 8,533 5,632 — — Total liabilities 1,075,931 1,461,557 1,062,665 1,452,524 13,266 9,033 Commitments and contingencies Stockholders’ equity: Preferred stock — — — — — — Common stock, $0.001 par value 58 59 58 59 — — Additional paid-in capital 310,452 351,042 310,452 351,042 — — Treasury stock, at cost (215,237) (239,199) (215,237) (239,199) — — Accumulated other comprehensive loss (604) (642) (457) (649) (147) 7 Retained earnings 174,409 225,029 152,729 195,649 21,680 29,380 Total stockholders’ equity 269,078 336,289 247,545 306,902 21,533 29,387 Total liabilities and stockholders’ equity $ 1,345,009 $ 1,797,846 $ 1,310,210 $ 1,759,426 $ 34,799 $ 38,420

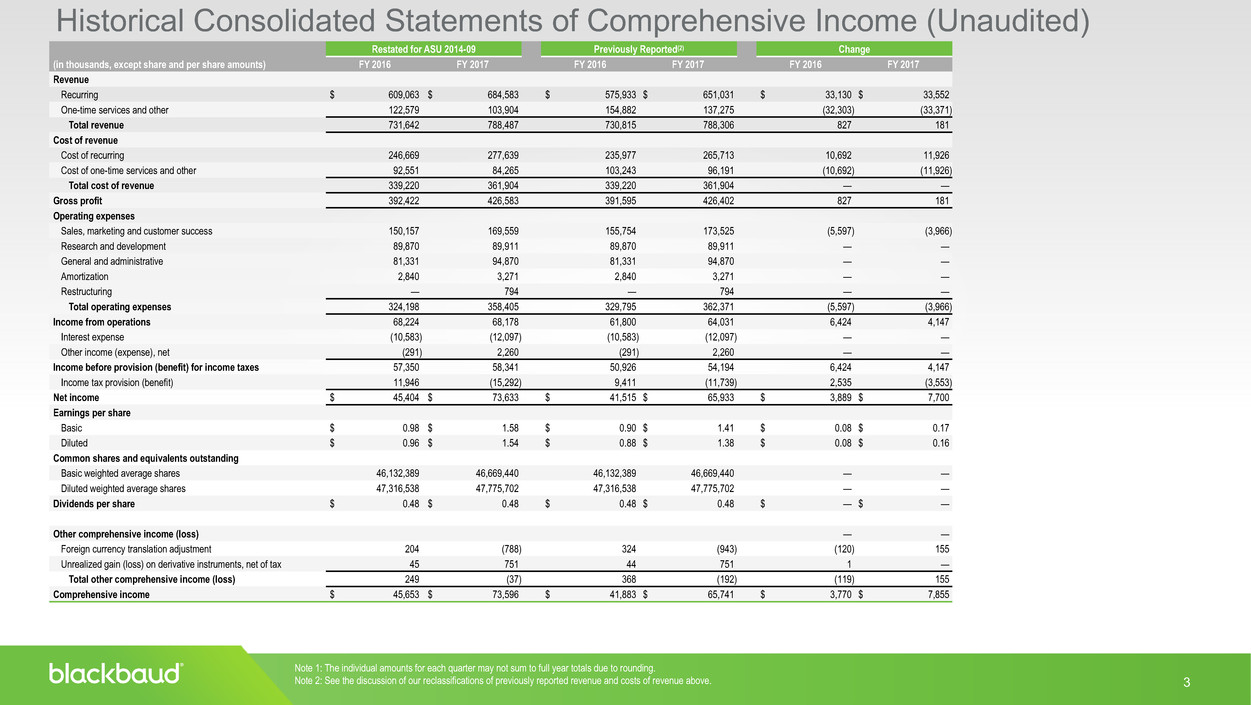

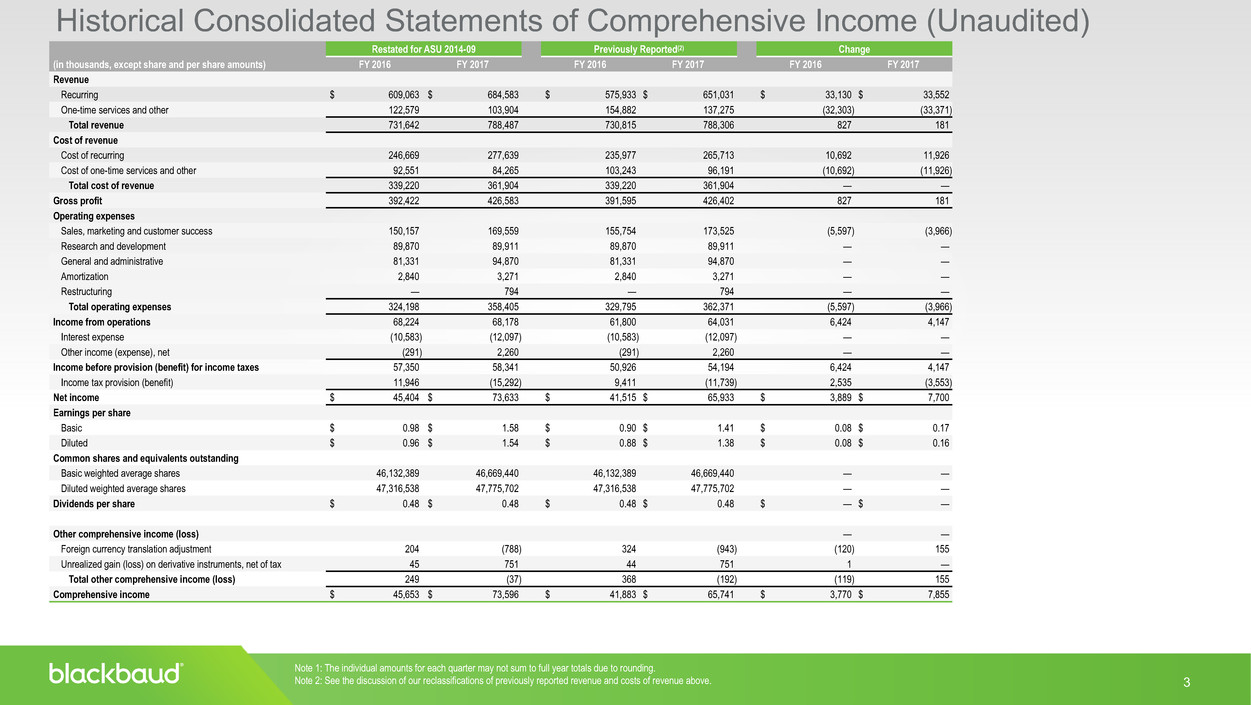

3 3 Historical Consolidated Statements of Comprehensive Income (Unaudited) Restated for ASU 2014-09 Previously Reported(2) Change (in thousands, except share and per share amounts) FY 2016 FY 2017 FY 2016 FY 2017 FY 2016 FY 2017 Revenue Recurring $ 609,063 $ 684,583 $ 575,933 $ 651,031 $ 33,130 $ 33,552 One-time services and other 122,579 103,904 154,882 137,275 (32,303) (33,371) Total revenue 731,642 788,487 730,815 788,306 827 181 Cost of revenue Cost of recurring 246,669 277,639 235,977 265,713 10,692 11,926 Cost of one-time services and other 92,551 84,265 103,243 96,191 (10,692) (11,926) Total cost of revenue 339,220 361,904 339,220 361,904 — — Gross profit 392,422 426,583 391,595 426,402 827 181 Operating expenses Sales, marketing and customer success 150,157 169,559 155,754 173,525 (5,597) (3,966) Research and development 89,870 89,911 89,870 89,911 — — General and administrative 81,331 94,870 81,331 94,870 — — Amortization 2,840 3,271 2,840 3,271 — — Restructuring — 794 — 794 — — Total operating expenses 324,198 358,405 329,795 362,371 (5,597) (3,966) Income from operations 68,224 68,178 61,800 64,031 6,424 4,147 Interest expense (10,583) (12,097) (10,583) (12,097) — — Other income (expense), net (291) 2,260 (291) 2,260 — — Income before provision (benefit) for income taxes 57,350 58,341 50,926 54,194 6,424 4,147 Income tax provision (benefit) 11,946 (15,292) 9,411 (11,739) 2,535 (3,553) Net income $ 45,404 $ 73,633 $ 41,515 $ 65,933 $ 3,889 $ 7,700 Earnings per share Basic $ 0.98 $ 1.58 $ 0.90 $ 1.41 $ 0.08 $ 0.17 Diluted $ 0.96 $ 1.54 $ 0.88 $ 1.38 $ 0.08 $ 0.16 Common shares and equivalents outstanding Basic weighted average shares 46,132,389 46,669,440 46,132,389 46,669,440 — — Diluted weighted average shares 47,316,538 47,775,702 47,316,538 47,775,702 — — Dividends per share $ 0.48 $ 0.48 $ 0.48 $ 0.48 $ — $ — Other comprehensive income (loss) — — Foreign currency translation adjustment 204 (788) 324 (943) (120) 155 Unrealized gain (loss) on derivative instruments, net of tax 45 751 44 751 1 — Total other comprehensive income (loss) 249 (37) 368 (192) (119) 155 Comprehensive income $ 45,653 $ 73,596 $ 41,883 $ 65,741 $ 3,770 $ 7,855 Note: The individual amounts for each quarter may not sum to full year totals due to rounding. Note 1: The individual amounts for each quarter may not sum to full year totals due to rounding. Note 2: See the discussion of our reclassifications of previously reported revenue and costs of revenue above.

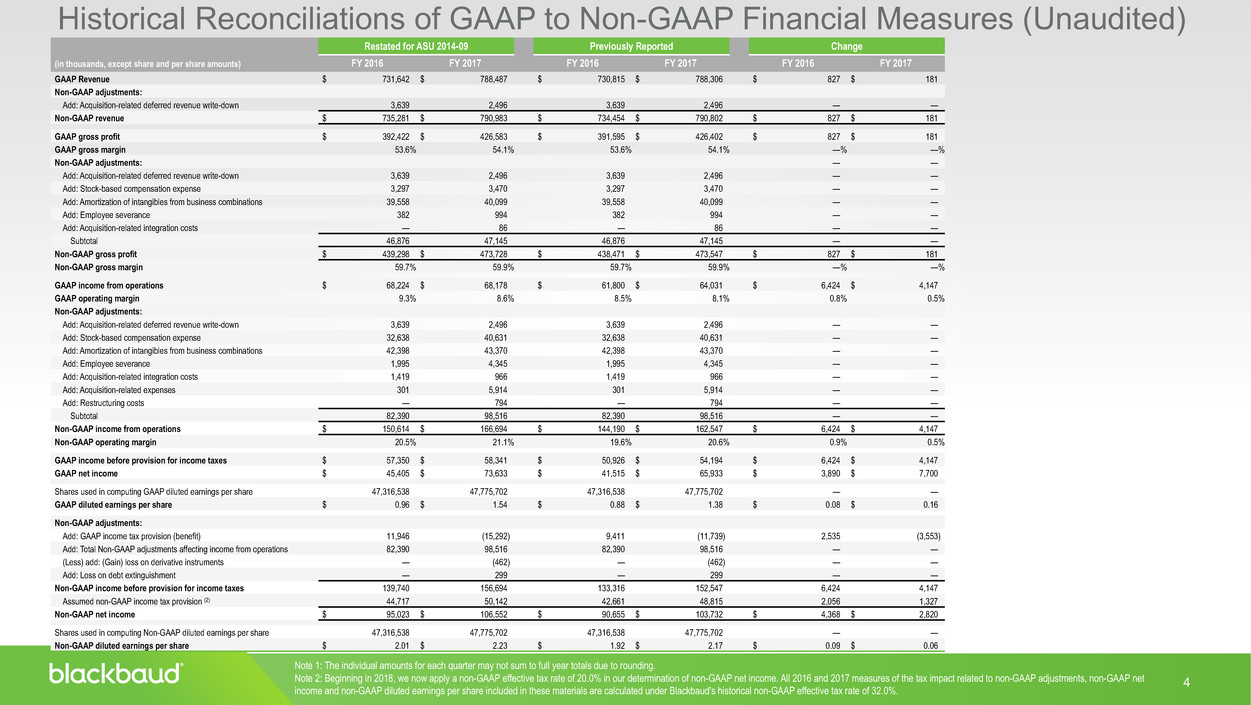

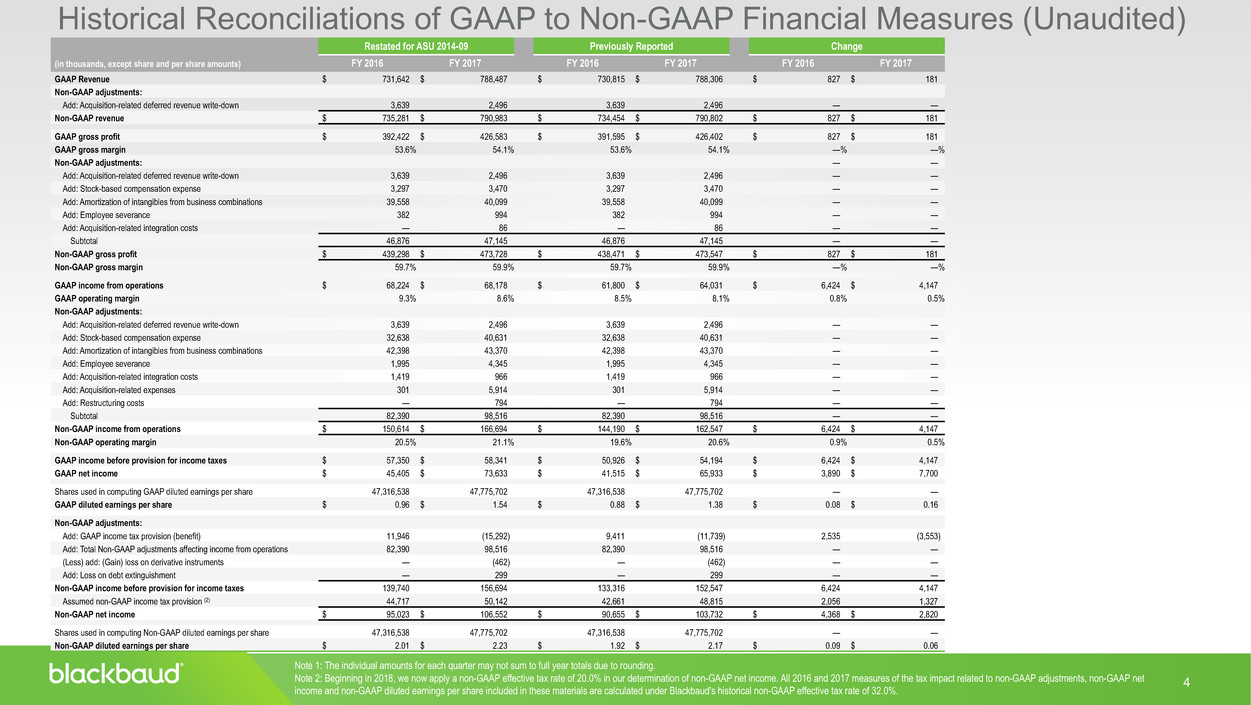

4 4 Historical Reconciliations of GAAP to Non-GAAP Financial Measures (Unaudited) Restated for ASU 2014-09 Previously Reported Change (in thousands, except share and per share amounts) FY 2016 FY 2017 FY 2016 FY 2017 FY 2016 FY 2017 GAAP Revenue $ 731,642 $ 788,487 $ 730,815 $ 788,306 $ 827 $ 181 Non-GAAP adjustments: Add: Acquisition-related deferred revenue write-down 3,639 2,496 3,639 2,496 — — Non-GAAP revenue $ 735,281 $ 790,983 $ 734,454 $ 790,802 $ 827 $ 181 GAAP gross profit $ 392,422 $ 426,583 $ 391,595 $ 426,402 $ 827 $ 181 GAAP gross margin 53.6% 54.1% 53.6% 54.1% —% —% Non-GAAP adjustments: — — Add: Acquisition-related deferred revenue write-down 3,639 2,496 3,639 2,496 — — Add: Stock-based compensation expense 3,297 3,470 3,297 3,470 — — Add: Amortization of intangibles from business combinations 39,558 40,099 39,558 40,099 — — Add: Employee severance 382 994 382 994 — — Add: Acquisition-related integration costs — 86 — 86 — — Subtotal 46,876 47,145 46,876 47,145 — — Non-GAAP gross profit $ 439,298 $ 473,728 $ 438,471 $ 473,547 $ 827 $ 181 Non-GAAP gross margin 59.7% 59.9% 59.7% 59.9% —% —% GAAP income from operations $ 68,224 $ 68,178 $ 61,800 $ 64,031 $ 6,424 $ 4,147 GAAP operating margin 9.3% 8.6% 8.5% 8.1% 0.8% 0.5% Non-GAAP adjustments: Add: Acquisition-related deferred revenue write-down 3,639 2,496 3,639 2,496 — — Add: Stock-based compensation expense 32,638 40,631 32,638 40,631 — — Add: Amortization of intangibles from business combinations 42,398 43,370 42,398 43,370 — — Add: Employee severance 1,995 4,345 1,995 4,345 — — Add: Acquisition-related integration costs 1,419 966 1,419 966 — — Add: Acquisition-related expenses 301 5,914 301 5,914 — — Add: Restructuring costs — 794 — 794 — — Subtotal 82,390 98,516 82,390 98,516 — — Non-GAAP income from operations $ 150,614 $ 166,694 $ 144,190 $ 162,547 $ 6,424 $ 4,147 Non-GAAP operating margin 20.5% 21.1% 19.6% 20.6% 0.9% 0.5% GAAP income before provision for income taxes $ 57,350 $ 58,341 $ 50,926 $ 54,194 $ 6,424 $ 4,147 GAAP net income $ 45,405 $ 73,633 $ 41,515 $ 65,933 $ 3,890 $ 7,700 Shares used in computing GAAP diluted earnings per share 47,316,538 47,775,702 47,316,538 47,775,702 — — GAAP diluted earnings per share $ 0.96 $ 1.54 $ 0.88 $ 1.38 $ 0.08 $ 0.16 Non-GAAP adjustments: Add: GAAP income tax provision (benefit) 11,946 (15,292) 9,411 (11,739) 2,535 (3,553) Add: Total Non-GAAP adjustments affecting income from operations 82,390 98,516 82,390 98,516 — — (Less) add: (Gain) loss on derivative instruments — (462) — (462) — — Add: Loss on debt extinguishment — 299 — 299 — — Non-GAAP income before provision for income taxes 139,740 156,694 133,316 152,547 6,424 4,147 Assumed non-GAAP income tax provision (2) 44,717 50,142 42,661 48,815 2,056 1,327 Non-GAAP net income $ 95,023 $ 106,552 $ 90,655 $ 103,732 $ 4,368 $ 2,820 Shares used in computing Non-GAAP diluted earnings per share 47,316,538 47,775,702 47,316,538 47,775,702 — — Non-GAAP diluted earnings per share $ 2.01 $ 2.23 $ 1.92 $ 2.17 $ 0.09 $ 0.06 Note 1: The individual amounts for each quarter may not sum to full year totals due to rounding. Note 2: Beginning in 2018, we now apply a non-GAAP effective tax rate of 20.0% in our determination of non-GAAP net income. All 2016 and 2017 measures of the tax impact related to non-GAAP adjustments, non-GAAP net income and non-GAAP diluted earnings per share included in these materials are calculated under Blackbaud's historical non-GAAP effective tax rate of 32.0%.

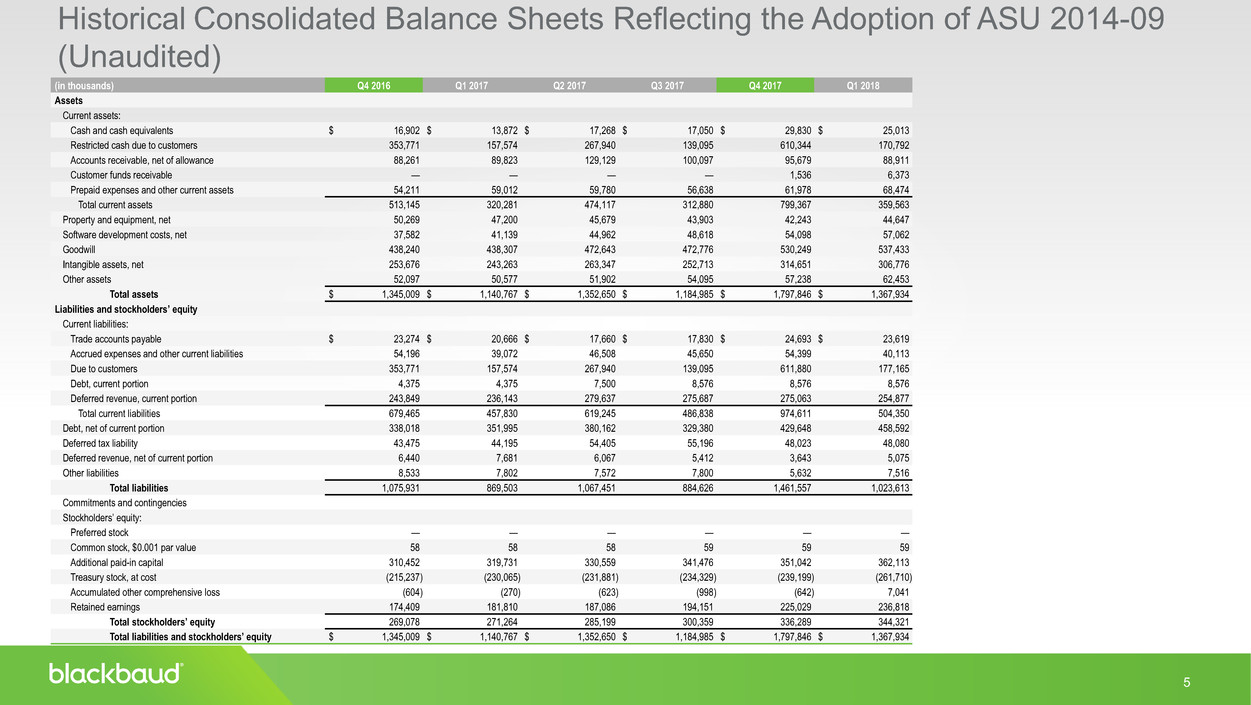

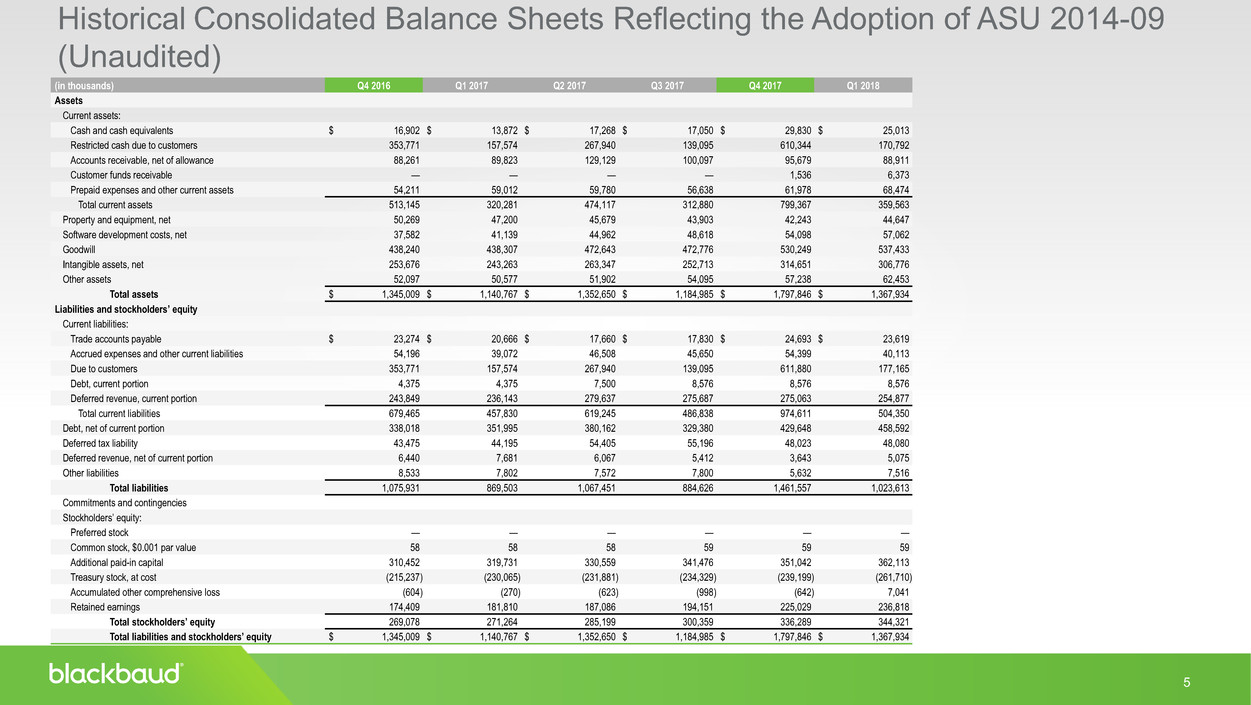

5 5 Historical Consolidated Balance Sheets Reflecting the Adoption of ASU 2014-09 (Unaudited) (in thousands) Q4 2016 Q1 2017 Q2 2017 Q3 2017 Q4 2017 Q1 2018 Assets Current assets: Cash and cash equivalents $ 16,902 $ 13,872 $ 17,268 $ 17,050 $ 29,830 $ 25,013 Restricted cash due to customers 353,771 157,574 267,940 139,095 610,344 170,792 Accounts receivable, net of allowance 88,261 89,823 129,129 100,097 95,679 88,911 Customer funds receivable — — — — 1,536 6,373 Prepaid expenses and other current assets 54,211 59,012 59,780 56,638 61,978 68,474 Total current assets 513,145 320,281 474,117 312,880 799,367 359,563 Property and equipment, net 50,269 47,200 45,679 43,903 42,243 44,647 Software development costs, net 37,582 41,139 44,962 48,618 54,098 57,062 Goodwill 438,240 438,307 472,643 472,776 530,249 537,433 Intangible assets, net 253,676 243,263 263,347 252,713 314,651 306,776 Other assets 52,097 50,577 51,902 54,095 57,238 62,453 Total assets $ 1,345,009 $ 1,140,767 $ 1,352,650 $ 1,184,985 $ 1,797,846 $ 1,367,934 Liabilities and stockholders’ equity Current liabilities: Trade accounts payable $ 23,274 $ 20,666 $ 17,660 $ 17,830 $ 24,693 $ 23,619 Accrued expenses and other current liabilities 54,196 39,072 46,508 45,650 54,399 40,113 Due to customers 353,771 157,574 267,940 139,095 611,880 177,165 Debt, current portion 4,375 4,375 7,500 8,576 8,576 8,576 Deferred revenue, current portion 243,849 236,143 279,637 275,687 275,063 254,877 Total current liabilities 679,465 457,830 619,245 486,838 974,611 504,350 Debt, net of current portion 338,018 351,995 380,162 329,380 429,648 458,592 Deferred tax liability 43,475 44,195 54,405 55,196 48,023 48,080 Deferred revenue, net of current portion 6,440 7,681 6,067 5,412 3,643 5,075 Other liabilities 8,533 7,802 7,572 7,800 5,632 7,516 Total liabilities 1,075,931 869,503 1,067,451 884,626 1,461,557 1,023,613 Commitments and contingencies Stockholders’ equity: Preferred stock — — — — — — Common stock, $0.001 par value 58 58 58 59 59 59 Additional paid-in capital 310,452 319,731 330,559 341,476 351,042 362,113 Treasury stock, at cost (215,237) (230,065) (231,881) (234,329) (239,199) (261,710) Accumulated other comprehensive loss (604) (270) (623) (998) (642) 7,041 Retained earnings 174,409 181,810 187,086 194,151 225,029 236,818 Total stockholders’ equity 269,078 271,264 285,199 300,359 336,289 344,321 Total liabilities and stockholders’ equity $ 1,345,009 $ 1,140,767 $ 1,352,650 $ 1,184,985 $ 1,797,846 $ 1,367,934

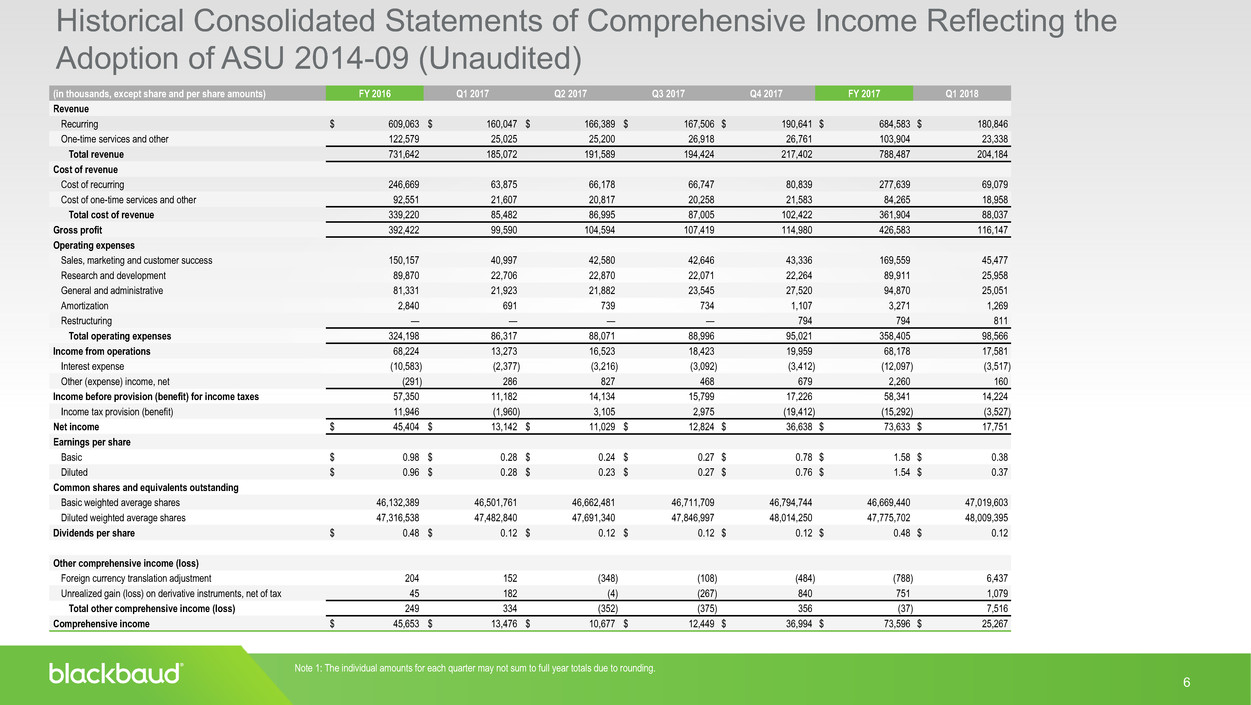

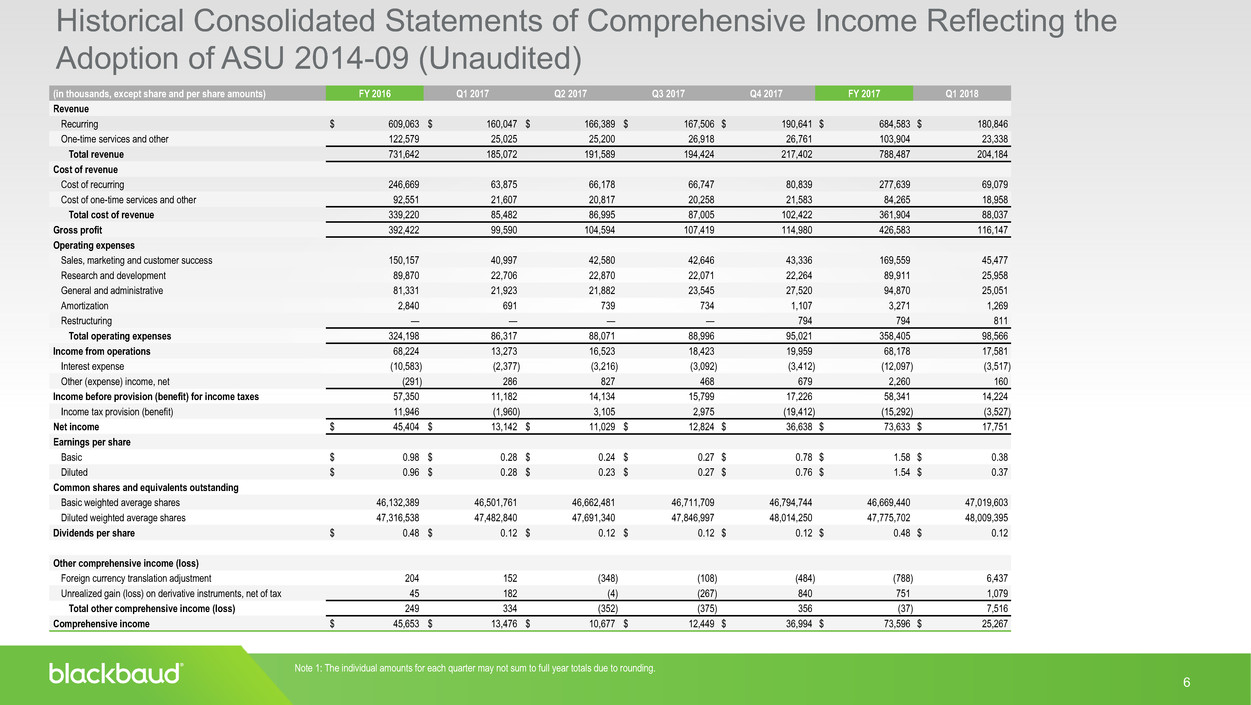

6 6 Historical Consolidated Statements of Comprehensive Income Reflecting the Adoption of ASU 2014-09 (Unaudited) (in thousands, except share and per share amounts) FY 2016 Q1 2017 Q2 2017 Q3 2017 Q4 2017 FY 2017 Q1 2018 Revenue Recurring $ 609,063 $ 160,047 $ 166,389 $ 167,506 $ 190,641 $ 684,583 $ 180,846 One-time services and other 122,579 25,025 25,200 26,918 26,761 103,904 23,338 Total revenue 731,642 185,072 191,589 194,424 217,402 788,487 204,184 Cost of revenue Cost of recurring 246,669 63,875 66,178 66,747 80,839 277,639 69,079 Cost of one-time services and other 92,551 21,607 20,817 20,258 21,583 84,265 18,958 Total cost of revenue 339,220 85,482 86,995 87,005 102,422 361,904 88,037 Gross profit 392,422 99,590 104,594 107,419 114,980 426,583 116,147 Operating expenses Sales, marketing and customer success 150,157 40,997 42,580 42,646 43,336 169,559 45,477 Research and development 89,870 22,706 22,870 22,071 22,264 89,911 25,958 General and administrative 81,331 21,923 21,882 23,545 27,520 94,870 25,051 Amortization 2,840 691 739 734 1,107 3,271 1,269 Restructuring — — — — 794 794 811 Total operating expenses 324,198 86,317 88,071 88,996 95,021 358,405 98,566 Income from operations 68,224 13,273 16,523 18,423 19,959 68,178 17,581 Interest expense (10,583) (2,377) (3,216) (3,092) (3,412) (12,097) (3,517) Other (expense) income, net (291) 286 827 468 679 2,260 160 Income before provision (benefit) for income taxes 57,350 11,182 14,134 15,799 17,226 58,341 14,224 Income tax provision (benefit) 11,946 (1,960) 3,105 2,975 (19,412) (15,292) (3,527) Net income $ 45,404 $ 13,142 $ 11,029 $ 12,824 $ 36,638 $ 73,633 $ 17,751 Earnings per share Basic $ 0.98 $ 0.28 $ 0.24 $ 0.27 $ 0.78 $ 1.58 $ 0.38 Diluted $ 0.96 $ 0.28 $ 0.23 $ 0.27 $ 0.76 $ 1.54 $ 0.37 Common shares and equivalents outstanding Basic weighted average shares 46,132,389 46,501,761 46,662,481 46,711,709 46,794,744 46,669,440 47,019,603 Diluted weighted average shares 47,316,538 47,482,840 47,691,340 47,846,997 48,014,250 47,775,702 48,009,395 Dividends per share $ 0.48 $ 0.12 $ 0.12 $ 0.12 $ 0.12 $ 0.48 $ 0.12 Other comprehensive income (loss) Foreign currency translation adjustment 204 152 (348) (108) (484) (788) 6,437 Unrealized gain (loss) on derivative instruments, net of tax 45 182 (4) (267) 840 751 1,079 Total other comprehensive income (loss) 249 334 (352) (375) 356 (37) 7,516 Comprehensive income $ 45,653 $ 13,476 $ 10,677 $ 12,449 $ 36,994 $ 73,596 $ 25,267 Note: The individual amounts for each quarter may not sum to full year totals due to rounding. Note 1: The individual amounts for each quarter may not sum to full year totals due to rounding.

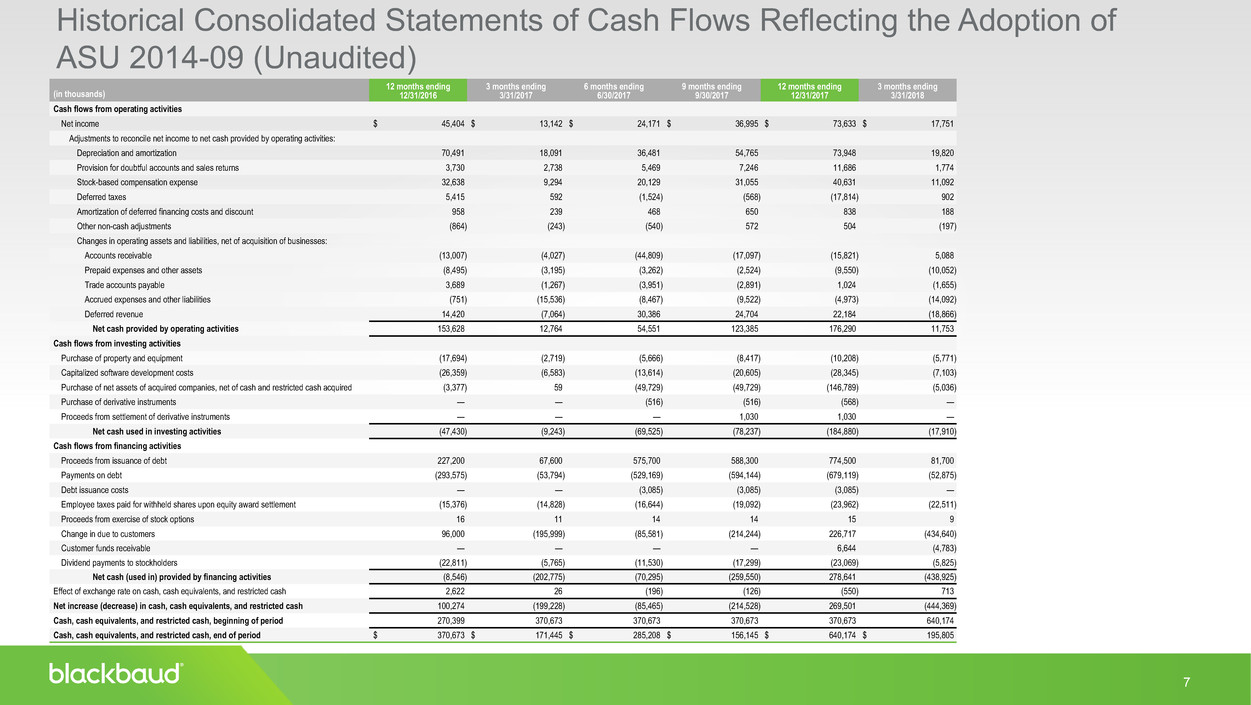

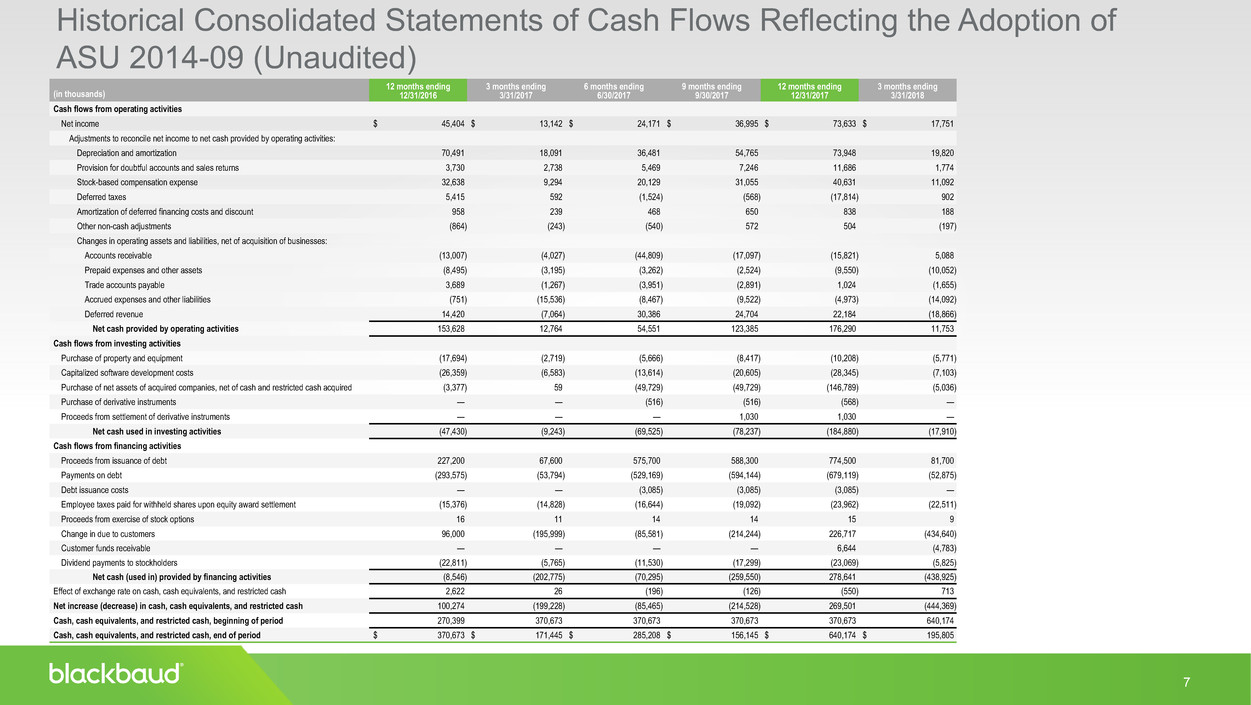

7 7 Historical Consolidated Statements of Cash Flows Reflecting the Adoption of ASU 2014-09 (Unaudited) (in thousands) 12 months ending 12/31/2016 3 months ending 3/31/2017 6 months ending 6/30/2017 9 months ending 9/30/2017 12 months ending 12/31/2017 3 months ending 3/31/2018 Cash flows from operating activities Net income $ 45,404 $ 13,142 $ 24,171 $ 36,995 $ 73,633 $ 17,751 Adjustments to reconcile net income to net cash provided by operating activities: Depreciation and amortization 70,491 18,091 36,481 54,765 73,948 19,820 Provision for doubtful accounts and sales returns 3,730 2,738 5,469 7,246 11,686 1,774 Stock-based compensation expense 32,638 9,294 20,129 31,055 40,631 11,092 Deferred taxes 5,415 592 (1,524) (568) (17,814) 902 Amortization of deferred financing costs and discount 958 239 468 650 838 188 Other non-cash adjustments (864) (243) (540) 572 504 (197) Changes in operating assets and liabilities, net of acquisition of businesses: Accounts receivable (13,007) (4,027) (44,809) (17,097) (15,821) 5,088 Prepaid expenses and other assets (8,495) (3,195) (3,262) (2,524) (9,550) (10,052) Trade accounts payable 3,689 (1,267) (3,951) (2,891) 1,024 (1,655) Accrued expenses and other liabilities (751) (15,536) (8,467) (9,522) (4,973) (14,092) Deferred revenue 14,420 (7,064) 30,386 24,704 22,184 (18,866) Net cash provided by operating activities 153,628 12,764 54,551 123,385 176,290 11,753 Cash flows from investing activities Purchase of property and equipment (17,694) (2,719) (5,666) (8,417) (10,208) (5,771) Capitalized software development costs (26,359) (6,583) (13,614) (20,605) (28,345) (7,103) Purchase of net assets of acquired companies, net of cash and restricted cash acquired (3,377) 59 (49,729) (49,729) (146,789) (5,036) Purchase of derivative instruments — — (516) (516) (568) — Proceeds from settlement of derivative instruments — — — 1,030 1,030 — Net cash used in investing activities (47,430) (9,243) (69,525) (78,237) (184,880) (17,910) Cash flows from financing activities Proceeds from issuance of debt 227,200 67,600 575,700 588,300 774,500 81,700 Payments on debt (293,575) (53,794) (529,169) (594,144) (679,119) (52,875) Debt issuance costs — — (3,085) (3,085) (3,085) — Employee taxes paid for withheld shares upon equity award settlement (15,376) (14,828) (16,644) (19,092) (23,962) (22,511) Proceeds from exercise of stock options 16 11 14 14 15 9 Change in due to customers 96,000 (195,999) (85,581) (214,244) 226,717 (434,640) Customer funds receivable — — — — 6,644 (4,783) Dividend payments to stockholders (22,811) (5,765) (11,530) (17,299) (23,069) (5,825) Net cash (used in) provided by financing activities (8,546) (202,775) (70,295) (259,550) 278,641 (438,925) Effect of exchange rate on cash, cash equivalents, and restricted cash 2,622 26 (196) (126) (550) 713 Net increase (decrease) in cash, cash equivalents, and restricted cash 100,274 (199,228) (85,465) (214,528) 269,501 (444,369) Cash, cash equivalents, and restricted cash, beginning of period 270,399 370,673 370,673 370,673 370,673 640,174 Cash, cash equivalents, and restricted cash, end of period $ 370,673 $ 171,445 $ 285,208 $ 156,145 $ 640,174 $ 195,805 Note: The year-to-date amounts may not sum to full year totals due to rounding.

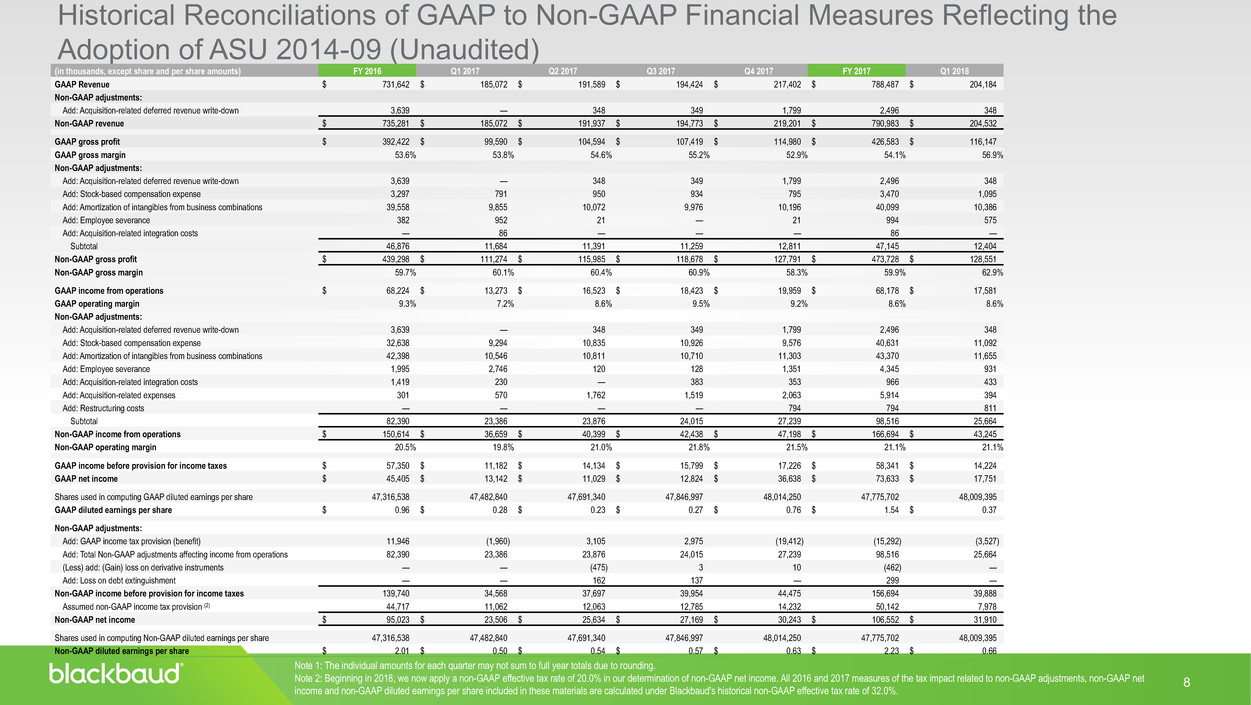

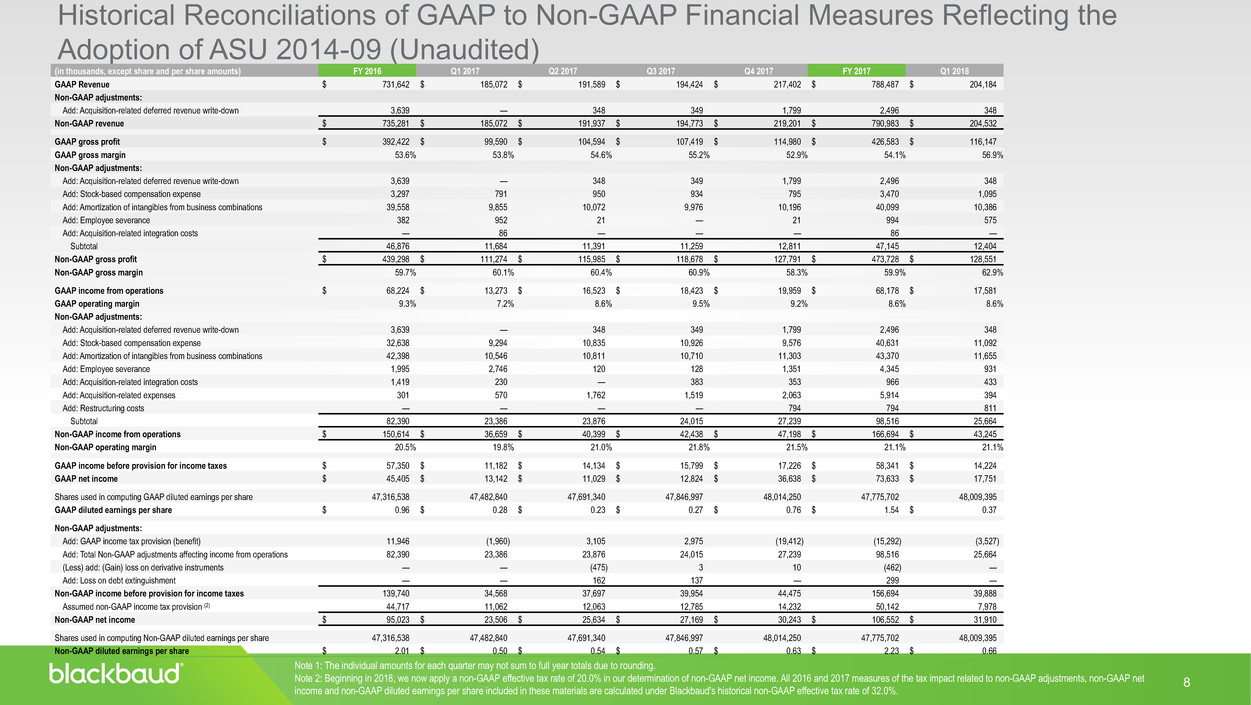

8 8 Historical Reconciliations of GAAP to Non-GAAP Financial Measures Reflecting the Adoption of ASU 2014-09 (Unaudited) (in thousands, except share and per share amounts) FY 2016 Q1 2017 Q2 2017 Q3 2017 Q4 2017 FY 2017 Q1 2018 GAAP Revenue $ 731,642 $ 185,072 $ 191,589 $ 194,424 $ 217,402 $ 788,487 $ 204,184 Non-GAAP adjustments: Add: Acquisition-related deferred revenue write-down 3,639 — 348 349 1,799 2,496 348 Non-GAAP revenue $ 735,281 $ 185,072 $ 191,937 $ 194,773 $ 219,201 $ 790,983 $ 204,532 GAAP gross profit $ 392,422 $ 99,590 $ 104,594 $ 107,419 $ 114,980 $ 426,583 $ 116,147 GAAP gross margin 53.6% 53.8% 54.6% 55.2% 52.9% 54.1% 56.9% Non-GAAP adjustments: Add: Acquisition-related deferred revenue write-down 3,639 — 348 349 1,799 2,496 348 Add: Stock-based compensation expense 3,297 791 950 934 795 3,470 1,095 Add: Amortization of intangibles from business combinations 39,558 9,855 10,072 9,976 10,196 40,099 10,386 Add: Employee severance 382 952 21 — 21 994 575 Add: Acquisition-related integration costs — 86 — — — 86 — Subtotal 46,876 11,684 11,391 11,259 12,811 47,145 12,404 Non-GAAP gross profit $ 439,298 $ 111,274 $ 115,985 $ 118,678 $ 127,791 $ 473,728 $ 128,551 Non-GAAP gross margin 59.7% 60.1% 60.4% 60.9% 58.3% 59.9% 62.9% GAAP income from operations $ 68,224 $ 13,273 $ 16,523 $ 18,423 $ 19,959 $ 68,178 $ 17,581 GAAP operating margin 9.3% 7.2% 8.6% 9.5% 9.2% 8.6% 8.6% Non-GAAP adjustments: Add: Acquisition-related deferred revenue write-down 3,639 — 348 349 1,799 2,496 348 Add: Stock-based compensation expense 32,638 9,294 10,835 10,926 9,576 40,631 11,092 Add: Amortization of intangibles from business combinations 42,398 10,546 10,811 10,710 11,303 43,370 11,655 Add: Employee severance 1,995 2,746 120 128 1,351 4,345 931 Add: Acquisition-related integration costs 1,419 230 — 383 353 966 433 Add: Acquisition-related expenses 301 570 1,762 1,519 2,063 5,914 394 Add: Restructuring costs — — — — 794 794 811 Subtotal 82,390 23,386 23,876 24,015 27,239 98,516 25,664 Non-GAAP income from operations $ 150,614 $ 36,659 $ 40,399 $ 42,438 $ 47,198 $ 166,694 $ 43,245 Non-GAAP operating margin 20.5% 19.8% 21.0% 21.8% 21.5% 21.1% 21.1% GAAP income before provision for income taxes $ 57,350 $ 11,182 $ 14,134 $ 15,799 $ 17,226 $ 58,341 $ 14,224 GAAP net income $ 45,405 $ 13,142 $ 11,029 $ 12,824 $ 36,638 $ 73,633 $ 17,751 Shares used in computing GAAP diluted earnings per share 47,316,538 47,482,840 47,691,340 47,846,997 48,014,250 47,775,702 48,009,395 GAAP diluted earnings per share $ 0.96 $ 0.28 $ 0.23 $ 0.27 $ 0.76 $ 1.54 $ 0.37 Non-GAAP adjustments: Add: GAAP income tax provision (benefit) 11,946 (1,960) 3,105 2,975 (19,412) (15,292) (3,527) Add: Total Non-GAAP adjustments affecting income from operations 82,390 23,386 23,876 24,015 27,239 98,516 25,664 (Less) add: (Gain) loss on derivative instruments — — (475) 3 10 (462) — Add: Loss on debt extinguishment — — 162 137 — 299 — Non-GAAP income before provision for income taxes 139,740 34,568 37,697 39,954 44,475 156,694 39,888 Assumed non-GAAP income tax provision (2) 44,717 11,062 12,063 12,785 14,232 50,142 7,978 Non-GAAP net income $ 95,023 $ 23,506 $ 25,634 $ 27,169 $ 30,243 $ 106,552 $ 31,910 Shares used in computing Non-GAAP diluted earnings per share 47,316,538 47,482,840 47,691,340 47,846,997 48,014,250 47,775,702 48,009,395 Non-GAAP diluted earnings per share $ 2.01 $ 0.50 $ 0.54 $ 0.57 $ 0.63 $ 2.23 $ 0.66 Note 1: The individual amounts for each quarter may not sum to full year totals due to rounding. Note 2: Beginning in 2018, we now apply a non-GAAP effective tax rate of 20.0% in our determination of non-GAAP net income. All 2016 and 2017 measures of the tax impact related to non-GAAP adjustments, non-GAAP net income and non-GAAP diluted earnings per share included in these materials are calculated under Blackbaud's historical non-GAAP effective tax rate of 32.0%.

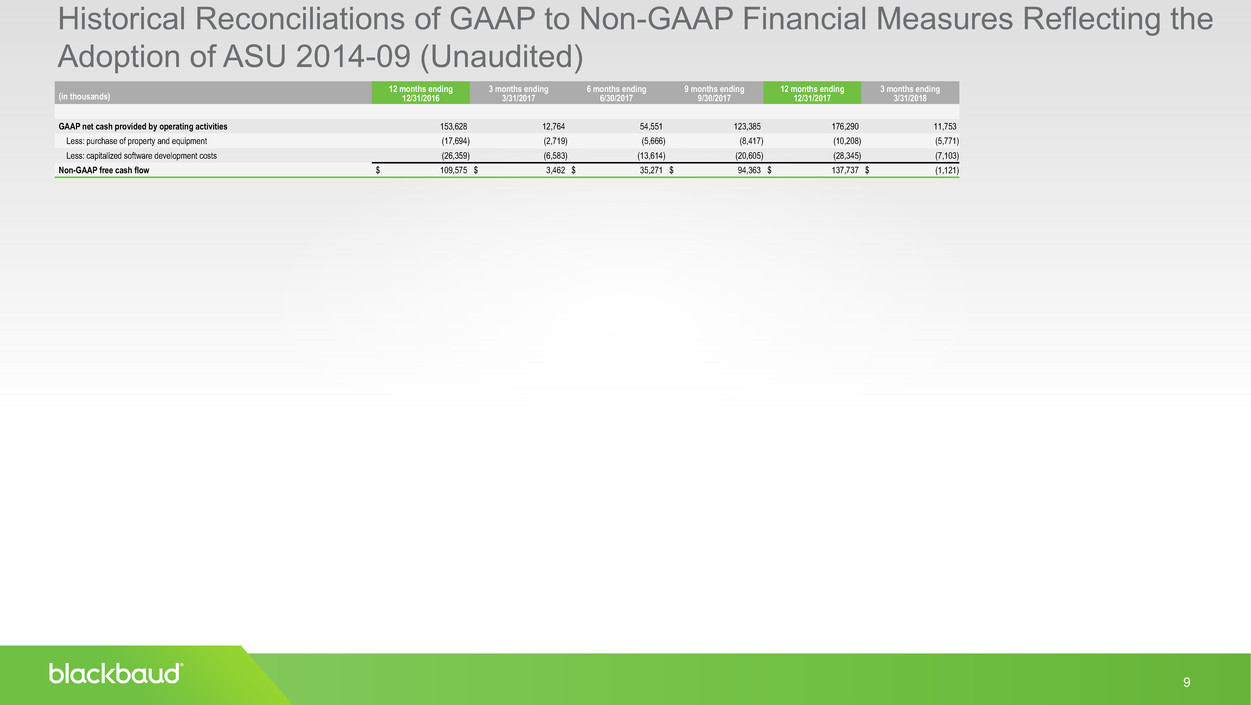

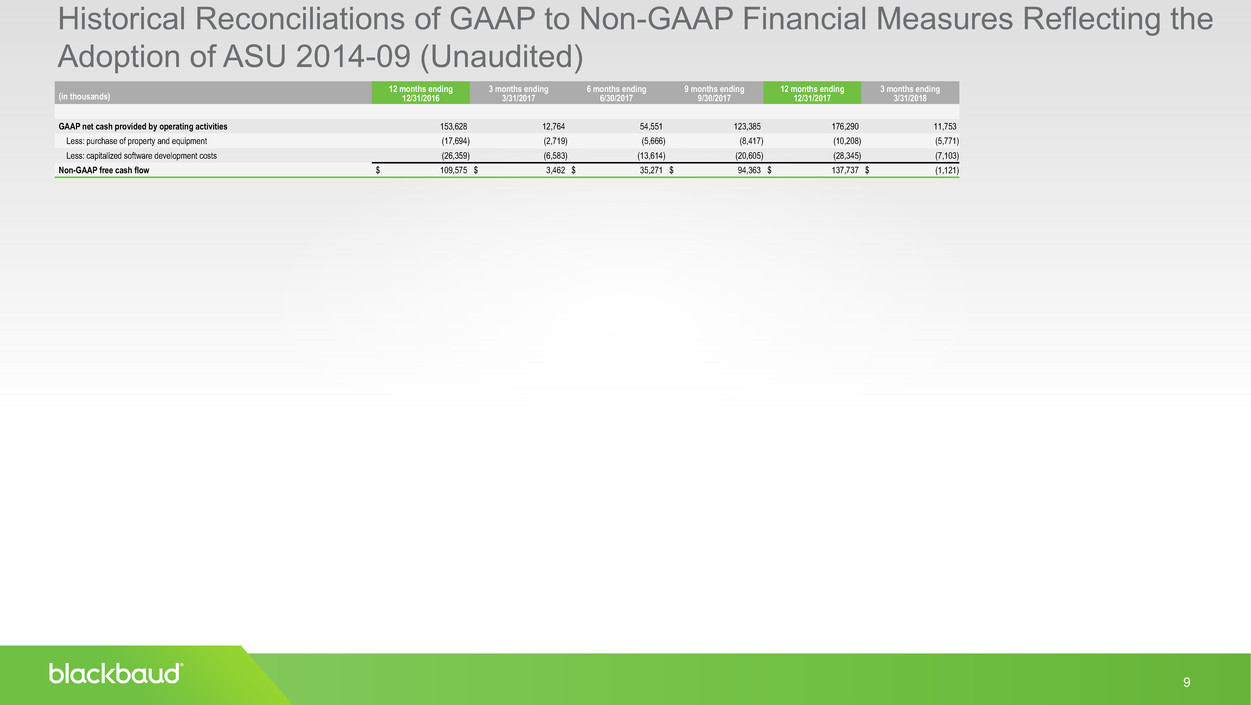

9 9 (in thousands) 12 months ending 12/31/2016 3 months ending 3/31/2017 6 months ending 6/30/2017 9 months ending 9/30/2017 12 months ending 12/31/2017 3 months ending 3/31/2018 GAAP net cash provided by operating activities 153,628 12,764 54,551 123,385 176,290 11,753 Less: purchase of property and equipment (17,694) (2,719) (5,666) (8,417) (10,208) (5,771) Less: capitalized software development costs (26,359) (6,583) (13,614) (20,605) (28,345) (7,103) Non-GAAP free cash flow $ 109,575 $ 3,462 $ 35,271 $ 94,363 $ 137,737 $ (1,121) Note: The year-to-date amounts may not sum to full year totals due to rounding. Historical Reconciliations of GAAP to Non-GAAP Financial Measures Reflecting the Adoption of ASU 2014-09 (Unaudited)