Exhibit 10.10

EXECUTION VERSION

LEASE AGREEMENT

BYANDBETWEEN

WESTCORE JAY, LLC,

A DELAWARELIMITEDLIABILITYCOMPANY

AS LANDLORD

AND

AMBARELLA CORPORATION,

A DELAWARECORPORATION

AS TENANT

RELATINGTOTHELEASINGOFCERTAINPREMISESLOCATEDAT:

3101 JAY STREET

SANTA CLARA, CALIFORNIA

TABLE OF CONTENTS

| | | | | | |

| | | | | Page | |

| | |

1. | | PREMISES; COMMON AREAS; PROJECT | | | 1 | |

| | |

2. | | THE TERM; LEASE COMMENCEMENT DATE; EARLY ACCESS | | | 1 | |

| | |

3. | | RENT | | | 3 | |

| | |

4. | | SECURITY DEPOSIT | | | 3 | |

| | |

5. | | INITIAL IMPROVEMENTS; CONDITIONOFTHE PREMISES | | | 3 | |

| | |

6. | | ADDITIONAL RENT | | | 4 | |

| | |

7. | | UTILITIESAND SERVICES | | | 8 | |

| | |

8. | | LATE CHARGES | | | 9 | |

| | |

9. | | USEOF PREMISES | | | 9 | |

| | |

10. | | ALTERATIONS;AND SURRENDEROF PREMISES | | | 11 | |

| | |

11. | | REPAIRSAND MAINTENANCE | | | 12 | |

| | |

12. | | INSURANCE | | | 14 | |

| | |

13. | | INDEMNITY; LIMITATIONOF LIABILITYAND WAIVEROF CLAIMS | | | 15 | |

| | |

14. | | ASSIGNMENTAND SUBLEASING | | | 16 | |

| | |

15. | | SUBORDINATION | | | 19 | |

| | |

16. | | RIGHTOF ENTRY | | | 19 | |

| | |

17. | | ESTOPPEL CERTIFICATE | | | 20 | |

| | |

18. | | TENANT’S DEFAULT | | | 20 | |

| | |

19. | | REMEDIESFOR TENANT’S DEFAULT | | | 21 | |

| | |

20. | | HOLDING OVER | | | 22 | |

| | |

21. | | LANDLORD’S DEFAULT | | | 23 | |

| | |

22. | | PARKING | | | 23 | |

| | |

23. | | TRANSFEROF LANDLORD’S INTEREST | | | 23 | |

| | |

24. | | WAIVER | | | 23 | |

| | |

25. | | CASUALTY DAMAGE | | | 24 | |

| | |

26. | | CONDEMNATION | | | 25 | |

| | |

27. | | ENVIRONMENTAL MATTERS; HAZARDOUS MATERIALS | | | 26 | |

| | |

28. | | FINANCIAL STATEMENTS | | | 28 | |

| | |

29. | | GENERAL PROVISIONS | | | 28 | |

| | |

30. | | SIGNS | | | 31 | |

| | |

31. | | MORTGAGEE PROTECTION | | | 31 | |

| | |

32. | | WARRANTIESOF TENANT | | | 31 | |

| | |

33. | | BROKERAGE COMMISSION | | | 32 | |

i

TABLE OF CONTENTS

(continued)

| | | | | | |

| | | | | Page | |

| | |

34. | | QUIET ENJOYMENT | | | 32 | |

| | |

35. | | EFFECTIVENESS CONDITIONS | | | 32 | |

| | |

36. | | RIDER 1 | | | RIDER 1 – PAGE 1 | |

| | |

37. | | OPTIONTO RENEW | | | RIDER 1 – PAGE 1 | |

| | |

38. | | LICENSE RIGHTS; SIGNAGE | | | RIDER 1 – PAGE 2 | |

ii

Lease Agreement

(NNN)

THIS LEASE AGREEMENT (this “Lease”) is made as of the Lease Date by and between Landlord and Tenant. This Lease consists of (i) the Basic Lease Information set forth in Part I, (ii) the Terms and Conditions set forth in Part II and (iii) the Attachments. The Basic Lease Information, the Terms and Conditions and the Attachments shall be construed as a single instrument.

PART I

Basic Lease Information

| | |

| Basic Lease Information: | | In the event of any conflict between the terms and conditions set forth in this basic lease information (collectively, the “Basic Lease Information”) and any other provision of this Lease, such other provision shall control. |

| |

| “Lease Date”: | | February 22, 2013 |

| |

| “Landlord”: | | WESTCORE JAY, LLC, a Delaware limited liability company |

| |

| Landlord’s Address For Notices: | | WESTCORE JAY, LLC c/o Dividend Capital Diversified Property Fund Inc. 518 17th Street, Suite 1700 Denver, Colorado 80202 Attn: Asset Management |

| |

| | With a copy to: |

| |

| | Westcore Jay, LLC c/o Dividend Capital Diversified Property Fund Inc. 518 17th Street, Suite 1700 Denver, Colorado 80202 Attn: General Counsel |

| |

| “Landlord’s Address For Rent”: | | Westcore Jay, LLC PO Box 83249 Chicago, IL 60691-0249 |

| |

| | or such other place as Landlord may, from time to time, designate in writing. |

| |

| “Tenant”: | | Ambarella Corporation, a Delaware corporation |

| |

| Tenant’s Address for Notices Before Lease Commencement Date: | | Ambarella Corporation 2975 San Ysidro Way Santa Clara, CA 95051 Attn: Chief Financial Officer |

| | With a copy to: |

| |

| | Wilson Sonsini Goodrich & Rosati 650 Page Mill Road |

| | Palo Alto, CA 94304-1050 Attn: Real Estate Department/SPR |

Basic Lease Information – Page 1

| | |

| |

| Tenant’s Address for Notices After Lease Commencement Date | | Ambarella Corporation 3101 Jay Street, Suite 110, Santa Clara, California 95054 Attn: Chief Financial Officer |

| |

| | With a copy to: |

| |

| | Wilson Sonsini Goodrich & Rosati 650 Page Mill Road Palo Alto, CA 94304-1050 Attn: Real Estate Department/SPR |

| |

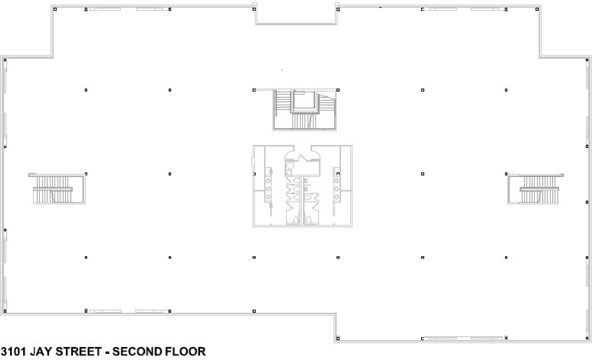

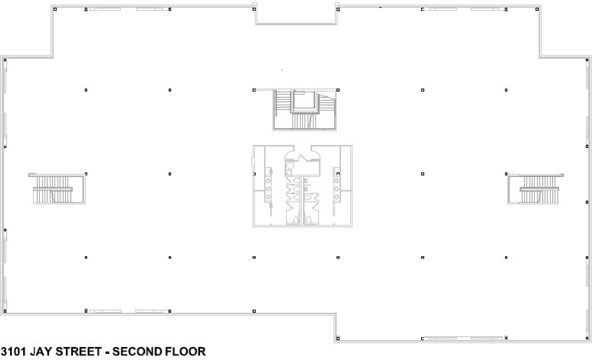

| “Premises”: | | Approximately 35,347 rentable square feet located on the first (1st) and second (2nd) floors of the Building with a street address of 3101 Jay Street, Suites 110 and 210, Santa Clara, California, as shown onExhibit A. |

| |

| “Building”: | | The building currently (i) consisting of approximately 47,015 rentable square feet, and (ii) having an address of 3101 Jay Street, Santa Clara, California. |

| |

| “Park” | | The business park currently (i) consisting of three (3) buildings that, in aggregate, consist of approximately 142,552 rentable square feet, and (ii) having addresses of 3101, 3131 and 3151 Jay Street, Santa Clara, California. |

| |

| “Term”: | | The period commencing on the date (the “Lease Commencement Date”) that is the later of (i) March 23, 2013, or (ii) or the date that the Premises are Ready for Occupancy (as defined in the Work Letter attached to the Lease asExhibit B) and Landlord has delivered possession of the Premises to Tenant in the required condition, and expiring on the last day of the 59th calendar month after the Lease Commencement Date. The Lease Commencement Date is subject to adjustment in accordance withSection 2.2 of this Lease. The Premises are estimated to be Ready for Occupancy on April 30, 2013 (the “Estimated Completion Date”). |

| |

| Base Rent (¶3): | | Tenant shall pay Landlord base rent for the Term (“Base Rent”) as follows: |

| | | | | | | | |

| Months of the Term | | Approximate

Rate/SF/Month | | | Monthly Base Rent | |

| 01 – 09** | | $ | 1.65 | ** | | $ | 44,550.00 | ** |

| 10 – 12 | | $ | 1.65 | | | $ | 58,322.55 | |

| 13 – 24 | | $ | 1.70 | | | $ | 60,089.90 | |

| 25 – 36 | | $ | 1.75 | | | $ | 61,857.25 | |

| 37 – 48 | | $ | 1.80 | | | $ | 63,624.60 | |

| 49 – 60 | | $ | 1.85 | | | $ | 65,391.95 | |

| ** | Notwithstanding the actual size of the Premises, Base Rent and Additional Rent during this period (the “Reduced Rent Period”) shall be calculated as if the Premises consisted of 27,000 rentable square feet. |

Basic Lease Information – Page 2

| | | | |

| | |

| “Tenant’s Share”: | | Of Operating Expenses (¶6.1): | | 75.18% of the Building; 24.80% of the Project; |

| | Of Tax Expenses (¶6.2): | | 75.18% of the Building; 24.80% of the Project; |

| | Of Common Area Utility Costs (¶7.2): | | 75.18% of the Building; 24.80% of the Project; |

| | Of Utility Expenses (¶7.1): | | 75.18% of the Building; 24.80% of the Project; |

| |

| | provided,however, that, during the Reduced Rent Period, (i) Tenant’s Share shall be calculated as if the Premises consisted of 27,000 rentable square feet, (ii) Tenant’s Share of the Building shall be 57.43%, and (iii) Tenant’s Share of the Project shall be 18.94%. |

| | |

| Advance Rent (¶3): | | $44,550.00 | | |

| | |

| Security Deposit (¶4): | | $58,322.55 | | |

| |

| Permitted Uses (¶9): | | General office and research and development, and any other related use to the extent permitted by the City of Santa Clara and all agencies and governmental authorities having jurisdiction thereof. |

| |

| Parking Spaces: | | 128 non-exclusive and unassigned spaces. |

| |

| Broker (¶33): | | Cornish & Carey Commercial Newmark Knight Frank, for Tenant Colliers International, for Landlord |

| |

| Attachments: | | The riders, exhibits and schedules set forth below shall be deemed to be a part of this Lease and are hereby incorporated herein (collectively, “Attachments”): |

| | | | |

| | Rider No. 1 | | Additional Provisions |

| | Exhibit A | | Depiction of the Premises |

| | Exhibit B | | Work Letter |

| | Exhibit C | | Rules and Regulations |

| | Exhibit D | | Intentionally Omitted |

| | Exhibit E | | Tenant’s Initial Hazardous Materials Disclosure Certificate |

| | Exhibit F | | Change of Commencement Date - Example |

| | Exhibit G | | Sign Criteria |

| | Exhibit H | | Tenant’s Approved Signage |

[Part II follows]

Basic Lease Information – Page 3

PART II

TERMS AND CONDITIONS

1.PREMISES; COMMON AREAS; PROJECT.

1.1 The Premises. Landlord leases the Premises to Tenant upon the terms and conditions contained herein. For purposes of this Lease, (i) as of the Lease Date, the rentable square footage area of the Premises, the Building and the Park shall be deemed to be the number of rentable square feet as set forth in the Basic Lease Information, (ii) the rentable square footage of the Premises reflects the square footage of a proportionate share of certain areas used in common by all occupants of the Building and/or the Park (by way of example only, but without limitation, corridors, common restrooms, an electrical room or telephone room, etc.), and (iii) the number of rentable square feet of any of the Building and the Park may subsequently change after the Lease Date commensurate with any physical modifications to any of the foregoing by Landlord, and, in such event, Tenant’s Share shall accordingly change.

1.2 The Common Areas. During the Term, Tenant shall have, as appurtenant to the Premises, non-exclusive rights to use in common with others entitled thereto, subject to the terms and conditions of this Lease, (i) all areas of the Park made available by Landlord from time to time for the general common use or benefit of the tenants of the Park, and their employees and invitees, or the public, as such areas may exist and may be changed from time to time (collectively, the “Common Areas”), and (ii) common walkways necessary for access to the Building, and no other appurtenant rights or easements. If the Premises include less than the entire rentable area of any floor, the Common Areas shall include the common toilets and other common facilities of such floor. The Common Areas shall be at all times subject to the exclusive control and management of Landlord, and Landlord shall have the right at any time and from time to time to establish, modify and enforce reasonable rules and regulations with respect to all the Common Areas. Landlord shall have the right (a) to change at any time and from time to time the area, level, location and arrangement of the Common Areas and/or (b) to close all or any portion of the Common Areas to such extent as may, in Landlord’s reasonable judgment, be legally sufficient to prevent a public dedication thereof or the accrual of any rights therein to any person or the public, provided, however, the same do not unreasonably interfere with Tenant’s use of or access to the Premises or Tenant’s parking rights. To the extent the Common Areas include parking areas, such reference shall in no way be construed as giving Tenant any rights or privileges in connection with such parking areas unless such rights or privileges are expressly set forth herein. All expenses incurred by Landlord in the maintenance and operation of the Common Areas shall be permitted Operating Expenses (as defined below).

1.3 The Project. The term “Project” means and collectively refers to the Building, the Common Areas and the Park, together with the land and real property upon which they are located.

2.THE TERM; LEASE COMMENCEMENT DATE; EARLY ACCESS.

2.1 The Term. The term of this Lease shall be for the Term set forth in the Basic Lease Information, unless sooner extended or terminated pursuant to this Lease. The word “Term” includes any valid extension or renewal of the term of this Lease.

2.2 Lease Commencement Date. It is anticipated that the Premises shall be Ready for Occupancy (as defined inExhibit B) on the Estimated Completion Date set forth in the Basic Lease Information;provided,however, Landlord shall have no responsibility or liability if the Premises are not Ready for Occupancy by the Estimated Completion Date and the postponement of the Lease Commencement Date and the commencement of Tenant’s obligation to pay Rent shall be in full settlement of all Claims (as defined inSection 13 below) which Tenant may otherwise have by reason of the Premises not being Ready for Occupancy by the Estimated Completion Date. If the Lease

1

Commencement Date occurs on a day other than the first day of a calendar month, then the Lease Commencement Date, and the beginning of the Term, shall be further delayed until the first day of the following month, but Tenant shall take occupancy of the Premises subject to the terms of this Lease and shall pay proportionate Rent based on the monthly Rent payable for the first (1st) month of the Term. If the Premises are not Ready for Occupancy on the Estimated Completion Date (or the later date contemplated herein) as a result of Tenant Delays (as defined inExhibit B), then the Lease Commencement Date shall be the date the Premises would have been Ready for Occupancy after the Estimated Completion Date but for Tenant Delays as reasonably determined by Landlord’s architect, and the Term and all of Tenant’s obligations hereunder will be measured from that date. Notwithstanding anything in this Lease to the contrary, Landlord shall deliver possession of the Premises to Tenant in good, vacant, broom clean condition, with all building systems, including mechanical, electrical, and plumbing, and fixtures, in good working order and the roof in good condition and repair, and in material compliance with all laws. Notwithstanding anything in this Lease to the contrary, if the Lease Commencement Date has not occurred for any reason on or before June 30, 2013 (the “Outside Completion Date”), then the date Tenant is otherwise obliged to commence payment of rent shall be delayed by one day for each day that the Lease Commencement Date is delayed beyond the Outside Completion Date;provided,however, that the Outside Completion Date shall be extended on a day-for-day basis for each day of Tenant Delays and Force Majeure (as defined below);provided,further,however, that in no event shall Force Majeure events extend, in aggregate, the Outside Completion Date by more than thirty (30) days. “Force Majeure” means the occurrence of any event (other than financial inability) which prevents or delays the performance by Landlord or Tenant of any obligation imposed upon it hereunder (other than payment of Rent) and the prevention or cessation of which event is beyond the reasonable control of the obligor.

2.3 Commencement Date Memorandum. Following the occurrence of the Lease Commencement Date, the parties shall execute a written amendment to this Lease substantially in the form ofExhibit F attached hereto (the “Commencement Date Memorandum”). Tenant shall execute and return the Commencement Date Memorandum to Landlord within fifteen (15) days after Tenant’s receipt thereof. The failure by either party, or both parties, to execute the Commencement Date Memorandum shall not affect the rights or obligations of either party hereunder. The Commencement Date Memorandum, when so executed and delivered, shall be deemed to be a part of this Lease.

2.4 Early Access. Subject to the terms and conditions of thisSection 2.4, Tenant shall have the right to enter and occupy the Premises from and after the date that is twenty-one (21) days prior to the Lease Commencement Date, as reasonably estimated by Landlord (the “Early Access Date”), solely for purposes of installing Tenant’s computer systems, telephone equipment, cabling, furniture, fixtures and special equipment, and to “fix-up” the Premises for Tenant’s intended use (but not to operate Tenant’s business), and such early entry for such purposes shall not trigger the Lease Commencement Date. Tenant agrees that (i) any such early entry by Tenant shall be at Tenant’s sole risk, (ii) Tenant shall not unreasonably interfere with Landlord or other tenants in the Building, and (iii) all terms, provisions and conditions of this Lease shall apply (except for the payment of Base Rent and Additional Rent), including, but not limited to, (a) Tenant’s obligation to provide Landlord with evidence of liability insurance coverage pursuant toSections 10 and12 below, and (b) Tenant’s indemnity obligations pursuant toSection 13 below;provided,however, Landlord shall not be obligated to deliver possession of the Premises to Tenant until Landlord has received from Tenant insurance certificates as required underSections 10 and12 below. If Landlord chooses not to deliver possession of the Premises to Tenant because Landlord has not received the required insurance certificates, the Lease Commencement Date shall not be affected or delayed thereby. Notwithstanding anything in thisSection 2.4 to the contrary, if, as of the Early Access Date, Landlord reasonably determines that Tenant’s early access to the Premises will unreasonably interfere with the completion of the Initial Improvements, then (1) Landlord may limit or otherwise restrict Tenant’s early access rights, and (2) Tenant shall not, in connection with any early access, interfere with the completion of the Initial Improvements.

2

3.RENT. On the date that Tenant executes this Lease, Tenant shall deliver to Landlord the original executed Lease, the Advance Rent (which shall be applied against Rent payable for the first month(s) Tenant is required to pay Rent), the Security Deposit, and all insurance certificates required to be delivered underSections 10 and12 of this Lease. Tenant agrees to pay Landlord without prior notice or demand, abatement, offset, deduction or claim, in advance at Landlord’s Address for Rent, on the Lease Commencement Date and thereafter on the first (1st) day of each month throughout the Term (i) Base Rent and (ii) as Additional Rent (as defined below), Tenant’s Share of Operating Expenses, Tax Expenses, Common Area Utility Costs, and Utility Expenses. The term “Rent” means, collectively, Base Rent, Additional Rent and all other amounts due to Landlord pursuant to this Lease. If any rental payment date (including the Lease Commencement Date) falls on a day of the month other than the first day of such month or if any rental payment is for a period which is shorter than one (1) month, then the rental for any such fractional month shall be a proportionate amount of a full calendar month’s rental based on the proportion that the number of days in such fractional month bears to the number of days in the calendar month during which the fractional month occurs. All other payments or adjustments required to be made under the terms of this Lease that require proration on a time basis shall be prorated in the same manner. Any prorated Rent for the first (1st) calendar month of the Term shall be paid on the Lease Commencement Date, and any prorated Rent for the final calendar month of the Term shall be paid on the first day of the calendar month in which the date of expiration or termination occurs.

4.SECURITY DEPOSIT. Simultaneously with Tenant’s execution and delivery of this Lease, Tenant shall deliver to Landlord, as a Security Deposit for the faithful performance by Tenant of its obligations under this Lease, the amount specified in the Basic Lease Information. If Tenant is in default hereunder beyond applicable notice and cure periods, Landlord may, but without obligation to do so, use all or any portion of the Security Deposit to cure the default or to compensate Landlord for all damages sustained by Landlord in connection therewith. Tenant shall, immediately on demand, pay to Landlord a sum equal to the portion of the Security Deposit so applied or used to replenish the amount of the Security Deposit held to increase such deposit to the amount initially deposited with Landlord. At the expiration or earlier termination of this Lease, within the time period(s) prescribed by California Civil Code Section 1950.7 (or any successor law), Landlord shall return the Security Deposit to Tenant, less such amounts as are reasonably necessary, as determined by Landlord, to remedy Tenant’s default(s) hereunder or to otherwise restore the Premises to the condition required pursuant to this Lease. Landlord shall not be required to segregate the Security Deposit from other funds, and, unless required by law, interest shall not be paid on the Security Deposit. Tenant shall not have any use of, or right of offset against, the Security Deposit. Tenant hereby waives (i) California Civil Code Section 1950.7 (or any successor law) and any and all other laws, rules and regulations applicable to security deposits in the commercial context with respect to the uses for which a security deposit may be applied (“Security Deposit Laws”), and (ii) any and all rights, duties and obligations either party may now or, in the future, will have relating to or arising from the Security Deposit Laws. Notwithstanding anything to the contrary contained herein, the Security Deposit may be retained and applied by Landlord (a) to offset Rent which is unpaid either before or after termination of this Lease, and (b) against other damages suffered by Landlord before or after termination of this Lease.

5.INITIAL IMPROVEMENTS; CONDITIONOFTHE PREMISES.

5.1 Initial Improvements. Landlord agrees to cause the Premises to be completed in accordance with the Work Letter attached to this Lease asExhibit B (the “Work Letter”). The real property improvements to be performed by Landlord pursuant to the Work Letter are referred to herein, collectively, as the “Initial Improvements”. The Initial Improvements shall include only those improvements within the interior portions of the Premises that are depicted on the Construction Drawings (as defined in the Work Letter).

5.2 Condition of the Premises. Subject to the terms of this Lease and Tenant’s rights hereunder, Tenant acknowledges that it has had the opportunity to inspect the Premises prior to the

3

execution of this Lease and agrees (i) to accept the Premises on the Lease Commencement Date (and by taking possession of the Premises Tenant shall be deemed to have accepted the Premises) as then being suitable for Tenant’s intended use and in good operating order, condition and repair in its then existing “AS IS” condition, except as otherwise set forth in this Lease, including with respect to Landlord’s delivery obligations and obligations underExhibit B and (ii) that, except as otherwise provided herein, neither Landlord nor any of Landlord’s agents, representatives or employees has made any representations as to the suitability, fitness or condition of the Premises or the Project for the conduct of Tenant’s business or for any other purpose, including without limitation, any storage incidental thereto.

6.ADDITIONAL RENT. Landlord and Tenant intend that this Lease be a “triple net lease.” Except as otherwise set forth herein, the costs and expenses described in thisSection 6 and all other sums, charges, costs and expenses specified in this Lease other than Base Rent are to be paid by Tenant to Landlord as additional rent (collectively, “Additional Rent”).

6.1 Operating Expenses.

6.1.1 Definition of Operating Expenses. Tenant shall pay to Landlord, as Additional Rent, Tenant’s Share or all Operating Expenses. The term “Operating Expenses” means the total amounts paid or payable by Landlord in connection with the ownership, management, maintenance, repair and operation of the Premises and the Project. Operating Expenses may include, but are not limited to, Landlord’s cost of: (i) costs of maintenance and non-structural repairs to any part of the interior or exterior of the Building (and its systems and equipment) and any part of the Common Areas, including, without limitation, costs under maintenance contracts and repairs and replacements of equipment used in connection with such maintenance and repair work; (ii) annual insurance premium(s) for any and all insurance Landlord elects to obtain, including without limitation, “causes of loss – special form” coverage, earthquake and flood for the Project, rental value insurance and subject toSections 6.1.2(v) and25 below, any reasonable deductible; (iii) (a) modifications and/or new improvements to any portion of the Project occasioned by any rules, laws or regulations, but only to the extent first made effective subsequent to the Lease Date; (b) reasonably necessary replacement improvements to any portion of the Project after the Lease Date if repair is no longer cost-effective; and (c) new improvements to the Project that are intended to reduce Operating Expenses or improve life-safety conditions, all of the foregoing as reasonably determined by Landlord (provided,however, if such costs are of a capital nature, then such costs or allocable portions thereof shall be amortized on a straight-line basis over the estimated useful life of the capital item, as reasonably determined by Landlord, together with reasonable interest on the unamortized balance); (iv) the management and administration of the Premises, including, without limitation, a property management fee (which in no event shall exceed three percent (3%) of the gross revenues of the Project), accounting, auditing, billing, postage, salaries and benefits for employees, whether located on the Project or off-site, payroll taxes and legal and accounting costs and all fees, licenses and permits related to the ownership, operation and management of the Premises; (v) preventative maintenance and repair contracts including, but not limited to, contracts for elevator systems (if any), heating, ventilation and air conditioning systems and lifts for disabled persons; (vi) security and fire protection services for any portion of the Premises, if and to the extent, in Landlord’s sole discretion, such services are provided; (vii) the creation and modification of any licenses, easements or other similar undertakings with respect to the Project; (viii) supplies, materials, equipment, rental equipment and other similar items used in the operation and/or maintenance of the Project; (ix) any and all levies, charges, fees and/or assessments payable to any applicable owner’s association or similar body; (x) any barrier removal work or other required improvements, alterations or work to any other portion of the Project generally required under the ADA (as defined below) (the “ADA Work”) (provided,however, if such ADA Work is required under the ADA due to Tenant’s particular use of the Premises, then the cost of such ADA Work required within the Premises shall be borne solely by Tenant and shall not be included as part of Operating Expenses; and (xi) the repairs and maintenance items set forth inSection 11.2 below (except to the extent excluded inSection 6.1.2 below).

4

6.1.2 Operating Expense Exclusions. The term “Operating Expenses” shall not include: (i) costs incurred in renovating, improving or decorating vacant space or space for other tenants within the Project; (ii) legal and auditing fees (other than those fees reasonably incurred in connection with the maintenance and operation of the Project), leasing commissions, advertising expenses, and other costs incurred in connection with the leasing of the Project; (iii) depreciation of the Building or any other improvements situated within the Building; (iv) any items for which Landlord is actually reimbursed; (v) costs of repairs or other work necessitated by casualty (excluding any commercially reasonable deductibles, provided that in no event shall Tenant’s Share of any such deductible exceed $25,000 in any one instance with respect to an earthquake and $10,000 in any one instance with respect to any other casualty) and/or costs of repair or other work necessitated by the exercise of the right of eminent domain (such costs of repairs or other work shall be paid by the parties in accordance with the provisions ofSections 25 and26, below); (vi) other than any interest charges for capital improvements referred to inSection 6.1.1(iii) above, any interest or payments on any financing for the Building or the Project, interest and penalties incurred as a result of Landlord’s late payment of any invoice (provided that Tenant pays Tenant’s Share of Operating Expenses and Tax Expenses to Landlord when due as set forth herein), and any bad debt loss, rent loss or reserves for same; (vii) costs associated with Hazardous Materials (defined below) present in, on or about any portion of the Project, unless such costs and expenses are the responsibility of Tenant as provided inSection 27 below, in which event such costs and expenses shall be paid solely by Tenant in accordance withSection 27 below; (viii) Landlord’s cost for the repairs and maintenance items set forth inSection 11.3 below; (ix) overhead and profit increment paid to Landlord or to subsidiaries or affiliates of Landlord for goods and/or services in the Premises to the extent the same exceeds the costs of such by unaffiliated third parties on a competitive basis; or any costs included in Operating Expenses representing an amount paid to any entity related to Landlord which is in excess of the amount which would have been paid in the absence of such relationship; (x) any payments under a ground lease or master lease; (xi) capital expenditures not expressly allowed pursuant toSection 6.1.1(iii) above; (xii) Landlord’s general corporate overhead and general and administrative expenses; (xiii) costs arising from Landlord’s negligence; (xiv) costs incurred in connection with the sale or transfer of the Building or any other portion of the Project, including, without limitation, transfer taxes, recording fees, title insurance premiums, appraisal costs and escrow fees; (xv) costs occasioned by the violation of any law by Landlord, any other occupant of the Project, or their respective agents, employees or contractors; (xvi) costs to correct any construction defect in the Project; (xvii) costs incurred in connection with disputes with any other occupant of the Project and costs arising from the violation by Landlord or any other occupant of the Project of the terms and conditions of any lease or other agreement; (xviii) increases in insurance costs caused by the activities of another occupant of the Project; (xix) interest, charges and fees incurred on debt; (xx) expense reserves; (xxi) wages, compensation, and labor burden for any employee not stationed on the Project on a full-time basis (unless the same are equitably allocated); or (xxii) costs for services not provided to Tenant under this Lease or of a nature that are payable directly by Tenant. Notwithstanding the foregoing in this Article 6, Tenant shall not be required to pay any Operating Expenses or Tax Expenses otherwise due hereunder if Landlord first notifies Tenant of such Operating Expenses or Tax Expenses in a statement received by Tenant more than twenty-four (24) months after such Operating Expenses or Tax Expenses are incurred.

6.2 Tax Expenses. Tenant shall pay to Landlord, as Additional Rent, Tenant’s Share or all Tax Expenses (as defined below) applicable to the Project. Prior to delinquency, Tenant shall pay any and all taxes and assessments levied upon Tenant’s Property (defined below inSection 10) located or installed in or about the Premises by, or on behalf of Tenant. To the extent any such taxes or assessments are not separately assessed or billed to Tenant, then Tenant shall pay the amount thereof as invoiced by Landlord. Tenant shall also reimburse and pay Landlord, as Additional Rent, within thirty (30) days after demand therefor, one hundred percent (100%) of (i) any increase in real property taxes attributable to the Initial Improvements, any and all Alterations (defined below inSection 10), fixtures, equipment or other improvements of any kind whatsoever placed in, on or about the Project for the benefit of, at the request of, or by Tenant, and (ii) taxes and assessments levied or assessed upon or with respect to the possession, operation, use or occupancy by Tenant of the Premises. “Tax

5

Expenses” means, without limitation, any form of tax and assessment (general, special, supplemental, ordinary or extraordinary), commercial rental tax, payments under any improvement bond or bonds, license fees, license tax, business license fee, rental tax, transaction tax or levy imposed by any authority having the direct or indirect power of tax (including any governmental, school, agricultural, lighting or other improvement district) as against any legal or equitable interest of Landlord in the Premises or any other tax, fee, or excise, however described, including, but not limited to, any tax imposed in substitution (partially or totally) of any tax previously included within the definition of Tax Expenses and any cost and/or fee (including without limit attorneys’ and appraisers’ fees and court costs) incurred by Landlord in calculating, contesting or negotiating any such taxes or assessments. “Tax Expenses” shall not include (a) any franchise, estate, inheritance, net income, or excess profits tax imposed upon Landlord, (b) any penalty or fee imposed solely as a result of Landlord’s failure to pay Tax Expenses when due, (c) any items included as or specifically excluded from Operating Expenses, (d) any taxes in excess of the amount which would be payable if such tax or assessment expense were paid in installments over the longest permitted term, (e) any fees attributable to gift, transfer, or state taxes, or (f) any taxes resulting from the improvement of any of the Project for the sole use of other occupants.

6.3 Adjustments and Allocations.

6.3.1 If the Building and/or other office buildings located in the Project are not 100% occupied during all or a portion of any calendar year, Landlord shall make an appropriate adjustment to the variable components of Operating Expenses for such year or applicable portion thereof, employing sound accounting and management principles, to determine the amount of Operating Expenses that would have been paid had such buildings been 100% occupied; and the amount so determined shall be deemed to have been the amount of Operating Expenses for such year, or applicable portion thereof.

6.3.2 The parties acknowledge that the Building is, or may in the future be a, part of a multi-building project, and that the costs and expenses incurred in connection with the Project (i.e., the Operating Expenses and the Tax Expenses) are determined annually for the Project as a whole but then allocated by Landlord among (i) the tenants of the Building, and (ii) if and when other buildings are constructed on the Project and are in operation, the tenants of such other buildings, for purposes of determining such tenants’ shares of Operating Expenses and Tax Expenses. In making such allocation of Operating Expenses and Tax Expenses for purposes of determining Tenant’s Share of Operating Expenses and Tenant’s Share of Tax Expenses, Operating Expenses and Tax Expenses shall be allocated as follows: the portion of Operating Expenses and Tax Expenses allocated to the tenants of the Building shall consist of (A) all Operating Expenses and Tax Expenses attributable solely to the Building and (B) an equitable portion of the Operating Expenses and Tax Expenses attributable to the Project as a whole and not attributable solely to the Building or to any other buildings of the Project. Additionally, Landlord shall have the right, from time to time, to equitably allocate some or all of the Operating Expenses among different tenants and/or different buildings of the Project (the “cost pools”). Such cost pools may include, but shall not be limited to, a building or buildings in the Project.

6.4 Payment of Expenses. Landlord shall estimate Tenant’s Share of Operating Expenses and Tax Expenses for the calendar year in which the Lease commences. Commencing on the Lease Commencement Date, one-twelfth (1/12th) of this estimated amount shall be paid by Tenant to Landlord, as Additional Rent, and thereafter on the first (1st) day of each month throughout the remaining months of such calendar year. Thereafter, Landlord may estimate such expenses for each calendar year during the Term of this Lease and Tenant shall pay one-twelfth (1/12th) of such estimated amount as Additional Rent on the first (1st) day of each month throughout the Term. Tenant’s obligation to pay Tenant’s Share Operating Expenses and Tax Expenses shall survive the expiration or earlier termination of this Lease. Landlord estimates that Operating Expenses and Tax Expenses for calendar year 2013 are currently expected to be $.39 per month per rentable square foot of the Premises; provided, however, that such Operating Expenses and Tax Expenses are subject to adjustment in accordance with the terms and conditions of this Lease.

6

6.5 Annual Reconciliation. By June 30th of each calendar year, Landlord shall furnish Tenant with an accounting of actual and accrued Operating Expenses and Tax Expenses (the “Expense Statement”);provided,however, that failure by Landlord to give the Expense Statement by such date shall not constitute a waiver by Landlord of its right to collect any underpayment by Tenant. Within thirty (30) days of Landlord’s delivery of the Expense Statement, Tenant shall pay to Landlord the amount of any underpayment. Landlord shall credit the amount of any overpayment by Tenant toward the next estimated monthly installment(s) falling due, or if the Term of the Lease has expired, refund the amount of overpayment to Tenant as soon as possible thereafter. If the Term of this Lease expires or terminates prior to the annual reconciliation of expenses, Landlord shall have the right to reasonably estimate Tenant’s Share of such expenses and to deduct any underpayments from Tenant’s Security Deposit, and shall thereafter reconcile the year’s Operating Expenses and Tax Expenses as provided above. Failure by Landlord to accurately estimate such expenses shall not constitute a waiver of Landlord’s right to collect any underpayment at any time during the Term or after the expiration or earlier termination of this Lease.

6.6 Audit. Landlord shall maintain books and records showing Operating Expenses and Tax Expenses in accordance with sound accounting and management practices, consistently applied. Subject to the terms and conditions of thisSection 6.6, Tenant or its representative (which representative shall be a certified public accountant licensed to do business in the State of California and whose primary business is certified public accounting or a member of Tenant’s finance department) shall have the right, for a period of ninety (90) days following the date upon which the Expense Statement is delivered to Tenant, to examine and audit (each, an “Audit”) Landlord’s books and records with respect to the items in such Expense Statement during normal business hours, upon written notice, delivered at least five (5) business days in advance. If Tenant does not object in writing to the Expense Statement within ninety (90) days after Landlord’s delivery thereof, specifying the nature of the item in dispute and the reasons therefor, then the Expense Statement shall be considered final and accepted by Tenant. Any amount due to Landlord as shown on the Expense Statement, whether or not disputed by Tenant as provided herein shall be paid by Tenant when due as provided above, without prejudice to any such written exception. Each Audit must be performed (i) at the location(s) where Landlord’s books and records are maintained, (ii) during normal business hours and (iii) in a manner that will not unreasonably interfere with Landlord’s business activities. Unless Landlord, in good faith, disputes the results of such Audit, an appropriate adjustment shall be made between Landlord and Tenant to reflect any overpayment of Operating Expenses and Tax Expenses for the calendar year in question within thirty (30) days. Tenant agrees to pay the cost of any Audit;provided,however, that if the Audit reveals that Landlord’s determination of the total Operating Expenses and Tax Expenses for the Project that was used as the basis of the relevant Expense Statement was in error in Landlord’s favor by more than five percent (5%), then Landlord agrees to pay the actual, out-of-pocket costs of such Audit incurred by Tenant (which costs must be determined on a reasonable hourly basis, and not a percentage or contingent fee basis). Tenant’s rights under thisSection 6.6 are subject to the following additional conditions:

(a) There is no event of default under this Lease then in existence, which Tenant has failed to after notice and the expiration of applicable cure periods;

(b) Each Audit shall be prepared by a member of Tenant’s finance department an independent certified public accounting firm of recognized national or regional standing using Generally Accepted Auditing Standards;

(c) Each Audit shall commence within ten (10) days after Landlord makes Landlord’s books and records available to Tenant’s auditor and shall conclude within thirty (30) days after commencement;

(d) Tenant and its accounting firm shall treat any Audit in a confidential manner and shall each execute a commercially reasonable confidentiality agreement for Landlord’s benefit prior to commencing the Audit;

7

(e) The accounting firm’s audit report shall, at no charge to Landlord, be submitted in draft form for Landlord’s review and comment before the final approved audit report is delivered to Landlord, and any reasonable comments by Landlord shall be incorporated into the final audit report; and

(f) At the conclusion of any Audit, Tenant and its employees, auditors and agents shall return all copies of supporting documentation made in connection with such Audit.

7.UTILITIESAND SERVICES. Tenant shall pay the cost of all (i) water, sewer use, sewer discharge fees and sewer connection fees, gas, electricity, telephone, telecommunications, cabling and other utilities billed or metered separately to the Premises, and (ii) refuse pickup and janitorial service to the Premises. Upon Landlord’s request, Tenant shall deliver to Landlord copies of all bills for utilities supplied to the Premises for the past twelve (12) month period within thirty (30) days of Landlord’s request. Notwithstanding anything in this Lease to the contrary, Landlord shall, subject to the terms of this Lease, as Utility Expenses, and in accordance with standards determined by Landlord from time to time for the Project, provide the following services (collectively, “Landlord’s Services”):

(a) furnish reasonable heating, ventilation, and air conditioning required for the comfortable occupancy and operation of the Premises during all hours of Tenant’s operation and at such other times as Tenant may reasonably request;

(b) furnish water, gas, light, power, electricity, telephone, trash pick-up and sewer services and utilities to the Premises and the Project.

7.2 Utility Expenses. Tenant shall pay to Landlord, as Additional Rent, Tenant’s Share of any utility fees, use charges, or similar services provided to Tenant at the Premises that are not billed or metered separately to Tenant (collectively, “Utility Expenses”). If Landlord reasonably determines that Tenant’s Share of Utility Expenses is not commensurate with Tenant’s use of such services, Tenant shall pay to Landlord, as Additional Rent, the amount which is attributable to Tenant’s use of the utilities or similar services, as reasonably estimated by and determined by Landlord (based upon factors such as size of the Premises and intensity of use of utilities by Tenant), such that Tenant shall pay the portion of such charges reasonably consistent with Tenant’s use of such utilities and similar services. Tenant shall also pay, as Additional Rent, Tenant’s Share of any assessments, charges and fees included within any tax bill for the Park, including without limitation, entitlement fees, allocation unit fees and sewer use fees, which amount Landlord may require to be paid monthly in the same manner as provided for Utility Expenses above and subject to reconciliation in the same manner as set forth inSection 6.5 above.

7.3 Common Area Utility Costs. Tenant shall pay to Landlord, as Additional Rent, Tenant’s Share of any Common Area utility fees, charges and expenses (collectively, “Common Area Utility Costs”). Tenant shall pay to Landlord one-twelfth (1/12th) of the estimated amount of Tenant’s Share of the Common Area Utility Costs on the Lease Commencement Date and thereafter on the first (1st) day of each month throughout the Term. Any reconciliation of Tenant’s Share of Common Area Utility Costs shall be substantially in the same manner as set forth inSection 6.5 above.

7.4 Miscellaneous. Tenant acknowledges that the Premises or other portions of the Project may become subject to the rationing of utility services or restrictions on utility use as required by a public utility company, governmental agency or other similar entity having jurisdiction thereof. Tenant agrees that its tenancy and occupancy hereunder shall be subject to such rationing restrictions as may be imposed upon Landlord, Tenant, the Premises, or other portions of the Project, and Tenant shall in no event be excused or relieved from any covenant or obligation to be kept or performed by Tenant by reason of any such rationing or restrictions.

7.5 Interruption of Services. The failure by Landlord to any extent to furnish, or the interruption or the termination of, Landlord’s Services, in whole or in part, resulting from adherence to Laws, wear, use, repairs, improvements, alterations or any other causes beyond Landlord’s reasonable control shall not render Landlord liable in any respect nor be construed as an actual or constructive

8

eviction of Tenant, nor give rise to an abatement of Rent, nor relieve Tenant from the obligation to fulfill any covenant or agreement hereof. Notwithstanding anything in thisSection 7.5 to the contrary, if (a) the Premises, or a material portion of the Premises, is made untenantable for a period in excess of five (5) business days after written notice to Landlord as a result of an interruption of essential utility services, such as electricity, telephone/telecommunication service, fire protection or water, that is a result of Landlord’s negligence or willful misconduct or is otherwise within Landlord’s reasonable control and (b) Tenant is unable to, and does not, conduct its normal business operations in all or any material portion of the Premises as a result thereof, then Tenant shall be entitled to receive an abatement of Base Rent payable hereunder during the period beginning after the fifth (5th) business day of the service failure and ending on the day the service has been restored;provided,however, that (i) the foregoing conditional abatement of Base Rent shall not apply if the interruption of such utility service is a result of Tenant’s (or Tenant’s Responsible Parties’) negligence, willful misconduct or breach of this Lease and (ii) such abatement shall be in proportion to the portion of the Premises which Tenant is unable to use. In no event, however, shall Landlord be liable to Tenant for any loss or damage, direct or indirect, special or consequential, including loss of business, arising out of or in connection with the failure of any such utility services. The foregoing provisions regarding interruption of utility services shall not apply in case of damage to or destruction of the Premises, which shall be governed bySection 25 of this Lease

8.LATE CHARGES. The sums and charges set forth in thisSection 8 shall be Additional Rent. Tenant acknowledges that late payment (the second (2nd) day of each month or any time thereafter) of Rent and all other sums due hereunder, will cause Landlord to incur costs not contemplated by this Lease. Such costs may include, without limitation, processing and accounting charges, and late charges that may be imposed on Landlord by the terms of any note secured by any encumbrance against the Premises, and late charges and penalties due to the late payment of real property taxes on the Premises. Therefore, if any installment of Rent or any other sum payable by Tenant is not received by Landlord when due, Tenant shall promptly pay to Landlord a late charge, as liquidated damages, in an amount equal to five percent (5%) of such delinquent amount plus interest thereon at ten percent (10%) per annum for as long as such sum remains unpaid. If Tenant delivers to Landlord two (2) checks for which there are not sufficient funds, Landlord may require Tenant to replace such check with a cashier’s check for the amount of such check and all other charges payable hereunder. The parties agree that this late charge and the other charges referenced above represent a fair and reasonable estimate of the costs that Landlord will incur by reason of such late payment by Tenant, excluding attorneys’ fees and costs. Acceptance of any late charge or other charges shall not constitute a waiver by Landlord of Tenant’s default with respect to the delinquent amount, nor prevent Landlord from exercising any of the other rights and remedies available to Landlord for any other default of Tenant under this Lease. Notwithstanding anything to the contrary contained herein, Tenant shall be entitled to notice and a five (5) business day grace period before the imposition of the first late charge in any calendar year.

9.USEOF PREMISES.

9.1 Compliance with Laws, Recorded Matters, and Rules and Regulations. The Premises shall be used solely for the permitted uses specified in the Basic Lease Information and for no other uses without Landlord’s prior written consent. Landlord’s consent shall not be unreasonably withheld or delayed so long as the proposed change in use (i) does not involve the use of Hazardous Materials other than as expressly permitted under the provisions ofSection 27 below, (ii) does not require any additional parking spaces, and (iii) is compatible and consistent with the other uses then being made in the Project, as reasonably determined by Landlord. The use of the Premises by Tenant and its licensees and subtenants, and each of their respective agents, contractors, employees, customers, invitees, and representatives (collectively, “Tenant’s Responsible Parties”) shall be subject to, and at all times in compliance with, (a) any and all applicable laws, rules, codes, ordinances, statutes, orders and regulations as same exist from time to time throughout the Term (collectively, “Laws”), including without limitation, the requirements of the Americans with Disabilities Act, a federal law codified at 42 U.S.C. 12101 et seq., including, but not limited to Title III thereof, all regulations and guidelines related

9

thereto and all requirements of Title 24 of the State of California (collectively, the “ADA”), (b) any and all instruments, licenses, restrictions, easements or similar instruments, conveyances or encumbrances which are at any time required to be made by or given by Landlord relating to the initial development of the Project and/or the construction, from time to time, of any additional improvements in the Project, including without limitation, the Initial Improvements (collectively, “Development Documents”), (c) any and all documents, easements, covenants, conditions and restrictions, and similar instruments, together with any and all amendments and supplements thereto made, from time to time, each of which has been or hereafter is recorded in any official or public records with respect to the Premises or any other portion of the Project (collectively, “Recorded Matters”), including, without limitation, that certain Declaration of Covenants, Conditions and Restrictions for San Tomas Industrial Park dated June 5, 1969 (a copy of which has been provided to Tenant), and (d) any and all rules and regulations set forth inExhibit C attached hereto and any other reasonable rules and regulations now or hereafter promulgated by Landlord, and any rules, restrictions, (collectively, “Rules and Regulations”). Landlord reserves to itself the right, from time to time, to grant, without the consent of Tenant, such easements, rights and dedications that Landlord deems reasonably necessary, and to cause the recordation of parcel or subdivision maps and/or restrictions, so long as such easements, rights, dedications, maps and restrictions, as applicable, do not materially and adversely interfere with Tenant’s use of or access to the Premises or Tenant’s parking rights, its operations in the Premises or increase the cost to Tenant under this Lease. Tenant agrees to sign promptly any documents reasonably requested by Landlord to effectuate any such easements, rights, dedications, maps or restrictions. Tenant agrees to, and does hereby, assume full and complete responsibility (x) to ensure that the Premises, including without limitation, any Alterations, are in compliance with all applicable Laws throughout the Term and (y) for the payment of all costs, fees and expenses associated with any modifications, improvements or other Alterations to the Premises occasioned by the enactment of, or changes to, any Laws arising from Tenant’s particular use of the Premises or Alterations or other improvements made to the Premises regardless of when such Laws became effective;provided,however, notwithstanding anything in this Lease to the contrary, Tenant shall not be obligated to make improvements to the Premises or the Building to comply with Laws or insurance requirements unless such improvements are made necessary by reason of Alterations made by Tenant or by Tenant’s unique use of the Premises (as distinguished from general occupancy). Tenant shall have no right to initiate, submit an application for, or otherwise request, any land use approvals or entitlements with respect to the Premises nor any other portion of the Project. Notwithstanding anything in this Lease to the contrary, Tenant shall not be required to comply with any new Rule and Regulations unless the same applies non-discriminatorily to all occupants of the Project, does not unreasonably interfere with Tenant’s use of the Premises or Tenant’s parking rights and does not materially increase the obligations or decrease the rights of Tenant under this Lease.

9.2 Prohibition on Use. Tenant shall not use the Premises or permit anything to be done in or about the Premises nor keep or bring anything therein which will cause a cancellation of any insurance policy. No auctions may be conducted in, on or about any portion of the Project without Landlord’s prior written consent thereto (which may be withheld in Landlord’s sole and absolute discretion). Tenant shall not do or permit anything to be done in or about the Premises or any other portion of the Project which will obstruct or interfere with the rights of Landlord. The Premises shall not be used for any unlawful purpose. Tenant shall not cause, maintain or permit any private or public nuisance in, on or about any portion of the Project, including, but not limited to, any offensive odors, noises, fumes or vibrations. Tenant shall not damage or deface or otherwise commit or suffer to be committed any waste in, upon or about the Project. Tenant shall not place or store, nor permit any other of its employees or agents to place or store, any property, equipment, materials, supplies or personal property outside of the Premises. Tenant shall not permit any animals, including, but not limited to, any household pets, to be brought or kept in or about the Premises. Tenant shall place no loads upon the floors, walls, or ceilings in excess of the maximum designed load permitted by the applicable Uniform Building Code or which may damage the Building or outside areas within the Premises.

10

9.3 Access. Notwithstanding anything in this Lease to the contrary, Landlord shall provide access to the Premises, 24 hours a day, seven days a week, subject to the terms of this Lease and to such reasonable regulations as Landlord prescribes from time-to-time for security purposes.

10.ALTERATIONS;AND SURRENDEROF PREMISES.

10.1 Alterations. Tenant shall be permitted to make, at its sole cost and expense, non-structural alterations and additions to the interior of the Premises without obtaining Landlord’s prior written consent, provided said alterations do not adversely affect the Building systems, are not visible from the exterior of the Building, are in compliance with all Laws and the requirements for Alterations set forth below (other than Landlord’s consent) and the cost of such alterations does not exceed Twenty Thousand Dollars ($20,000.00) per project (the “Permitted Improvements”). Tenant, however, shall first notify Landlord of such Permitted Improvements so that Landlord may post a Notice of Non-Responsibility on the Premises. Except for the Initial Improvements and the Permitted Improvements, Tenant shall neither install any signs, fixtures, or improvements, nor make or permit any other alterations or additions (individually, an “Alteration”, and collectively, “Alterations”) to the Premises without the prior written consent of Landlord, which consent shall not be unreasonably withheld so long as any such Alteration does not adversely affect the Building systems, structural integrity or structural components of the Premises. If any such Alteration is expressly permitted by Landlord, Tenant shall deliver at least ten (10) days prior written notice to Landlord, from the date Tenant commences construction, sufficient to enable Landlord to post and record a Notice of Non-Responsibility. Tenant shall obtain all permits or other governmental approvals prior to commencing any work and deliver a copy of same to Landlord. All Alterations shall be (i) at Tenant’s sole cost and expense in accordance with plans and specifications which have been previously submitted to and approved in writing by Landlord, and shall be installed by a licensed, insured (and bondable, at Landlord’s option) contractor (reasonably approved by Landlord) in compliance with all applicable Laws, Development Documents, Recorded Matters, and Rules and Regulations and (ii) performed in a good and workmanlike manner and so as not to obstruct access to any portion of the Project or any business of Landlord or any other tenant. Landlord’s approval of any plans, specifications or working drawings for Tenant’s Alterations shall neither create nor impose any responsibility or liability on the part of Landlord for their completeness, design sufficiency, or compliance with any Laws. As Additional Rent, Tenant shall reimburse Landlord, within ten (10) days after demand, for the reasonable and actual out-of-pocket legal, engineering, architectural, planning and other expenses incurred by Landlord in connection with Tenant’s Alterations. If Tenant makes any Alterations, Tenant shall carry “Builder’s All Risk” insurance, in an amount approved by Landlord and such other insurance as Landlord may require. All such Alterations shall be insured by Tenant in accordance withSection 12 of this Lease immediately upon completion. Tenant shall keep the Premises free from any liens arising out of any work performed, materials furnished or obligations incurred by or on behalf of Tenant. Tenant shall, prior to commencing any Alterations, (a) cause its contractor(s) and/or major subcontractor(s) to provide insurance as reasonably required by Landlord, and (b) provide such reasonable assurances to Landlord (including without limitation, waivers of lien, and, if such Alterations are expected to exceed $100,000.00, surety company performance bonds), as Landlord shall require to assure payment of the costs thereof to protect Landlord and the Premises from and against any mechanic’s, materialmen’s or other liens. Upon completion of any Permitted Improvements or any Alterations, Tenant agrees to cause a Notice of Completion to be recorded in the office of the Recorder of the County in which the Premises are located in accordance with Section 3093 of the Civil Code of the State of California or any successor statute, and if drawings are required for such Permitted Improvements or Alterations, Tenant shall deliver to the Landlord a reproducible copy of the “as built” drawings of all Permitted Improvements and all Alterations. Notwithstanding anything in this Lease to the contrary, Tenant’s Property shall at all times be and remain Tenant’s property. Except for Alterations which cannot be removed without structural injury to the Premises, at any time Tenant may remove Tenant’s Property from the Premises, provided that Tenant repairs all damage caused by such removal. Landlord shall have no lien or other interest in any item of Tenant’s Property. Landlord shall have no right to require Tenant to remove any Alterations unless it notifies Tenant at the time it consents to such alteration that it shall require such alteration to be removed.

11

10.2 Surrender of Premises. At the expiration of the Term or earlier termination of this Lease, Tenant shall surrender the Premises to Landlord (i) in the same condition and repair as received (damage by acts of God, casualty, normal wear and tear, condemnation, Hazardous Materials (other than those released or emitted by Tenant), Alterations or other interior improvements which it is permitted to surrender at the termination of this Lease and repairs that Tenant is not responsible for under this Lease, excepted), and (ii) in accordance withSection 27 hereof. Normal wear and tear shall not include any damage or deterioration that would have been prevented by proper maintenance by Tenant, or Tenant otherwise performing all of its obligations under this Lease. On or before the expiration or earlier termination of this Lease, Tenant shall remove (a) all of Tenant’s Property (defined below) and Tenant’s signage from the Premises, and (b) any Alterations made without Landlord’s consent and any other Alterations that Landlord may, by notice to Tenant given at the time it approves the Alterations require Tenant (at Tenant’s expense) to remove, and Tenant shall repair any damage caused by all of such removal activities. “Tenant’s Property” means all equipment, trade fixtures, computer wiring and cabling, furnishings, inventories, goods and personal property of Tenant. Any of Tenant’s Property not so removed by Tenant as required herein shall be deemed abandoned and may be stored, removed, and disposed of by Landlord at Tenant’s expense, and Tenant waives all claims against Landlord for any damages resulting from Landlord’s retention and disposition of such property;provided,however, Tenant shall remain liable to Landlord for all costs incurred in storing and disposing of such abandoned property of Tenant. Notwithstanding anything to the contrary contained herein, on or before the expiration of the Term or any earlier termination of this Lease, Tenant shall, at Tenant’s sole cost and expense and in compliance with the National Electric Code and other applicable laws, remove all electronic, fiber, phone and data cabling and related equipment that has been installed by or for the exclusive benefit of Tenant in or around the Premises (collectively, the “Cabling”);provided,however, Tenant shall not remove the Cabling if Tenant receives a written notice from Landlord at least thirty (30) days prior to the expiration of the Lease authorizing all or any portion of the Cabling to remain in place, in which event the Cabling or portion thereof authorized by Landlord remain at the Premises shall be surrendered with the Premises upon expiration or earlier termination of this Lease. All Alterations except those which Landlord requires Tenant to remove, shall remain in the Premises as the property of Landlord. If the Premises are not surrendered at the expiration of the Term or earlier termination of this Lease, Tenant shall continue to be responsible for the payment of Rent (as the same may be increased pursuant toSection 20 below) until the Premises are so surrendered. Tenant shall indemnify, defend and hold the Indemnitees (as defined below) harmless from and against any and all Claims (x) arising from any delay by Tenant in so surrendering the Premises including, without limitation, any Claims made against Landlord by any succeeding tenant or prospective tenant founded on or resulting from such delay, and (y) suffered by Landlord due to lost opportunities to lease any portion of the Premises to any such succeeding tenant or prospective tenant.

11.REPAIRSAND MAINTENANCE.

11.1 Tenant’s Repairs and Maintenance Obligations. Except for those portions of the Building to be maintained by Landlord, as provided inSections 11.2 and11.3 below (collectively, “Landlord Repair Obligations”), Tenant shall, at its sole cost and expense, keep and maintain all parts of the Premises and such portions of the Building as are within the exclusive control of Tenant in good, clean and safe condition and repair, promptly making all necessary repairs and replacements, whether ordinary or extraordinary, with materials and workmanship of the same character, kind and quality as the original thereof, all of the foregoing in accordance with the applicable provisions ofSection 10 hereof, and to the reasonable satisfaction of Landlord, including, but not limited to, repairing any damage (and replacing any property so damaged) caused by Tenant or any of Tenant’s Responsible Parties, and restoring the Premises to the condition existing prior to the occurrence of such damage. Without limiting any of the foregoing, Tenant shall be solely responsible for promptly maintaining (a) all mechanical

12

systems, heating, ventilation and air conditioning systems exclusively serving the Premises, unless maintained by Landlord, (b) all plumbing work and fixtures exclusively serving the Premises, (c) electrical wiring systems, fixtures and equipment exclusively serving the Premises, (d) all interior lighting (including, without limitation, light bulbs and/or ballasts) and exterior lighting exclusively serving the Premises or adjacent to the Premises, (e) all glass, windows, window frames, window casements, interior and exterior doors, door frames and door closers within the Premises, (f) all roll-up doors, ramps and dock equipment within the Premises, including without limitation, dock bumpers, dock plates, dock seals, dock levelers and dock lights, (g) all tenant signage, (h) sprinkler systems, fire protection systems and security systems inside and exclusively serving the Premises, except to the extent maintained by Landlord, and (i) all partitions, fixtures, equipment, interior painting, interior walls and floors, and floor coverings of the Premises and every part thereof. Any such work shall be performed by licensed, insured and bondable contractors and subcontractors reasonably approved by Landlord. Additionally, Tenant shall be solely responsible for the performance of the regular removal of trash and debris from the Premises.

11.2 Maintenance by Landlord. Subject to Tenant’s reimbursement obligations underSection 6, Landlord shall repair and maintain the following items: fire protection and life safety systems and services; the roof and roof coverings (provided that Tenant installs no additional air conditioning or other equipment on the roof that damages the roof coverings, in which event Tenant shall pay all costs relating to the presence of such additional equipment); the plumbing, electrical, and mechanical systems serving the Building (excluding the plumbing, mechanical and electrical systems inside and exclusively serving the Premises); exterior painting of the Building; repairs to the Premises that could be considered capital under generally accepted accounting principles; and the Common Areas, including the parking areas, pavement, sprinkler systems, sidewalks, driveways, curbs, and lighting systems in the Common Areas. If Landlord elects to perform any repair or restoration work required to be performed by Tenant underSection 11.4, Tenant shall reimburse Landlord upon demand for all costs and expenses incurred by Landlord in connection therewith. Tenant shall promptly report, in writing, to Landlord any defective condition known to it which Landlord is required to repair.

11.3 Landlord’s Repairs and Maintenance Obligations. Subject to the provisions ofSections 11.1,25 and26, and except for repairs rendered necessary by the intentional or negligent acts or omissions of Tenant or any of Tenant’s Responsible Parties that are not covered by the waiver inSection 12.5, Landlord shall, at Landlord’s sole cost and expense, keep in good repair and replace as necessary (a) the structural elements of the Building, including, without limitation, the structural portions of the floors, foundations and exterior perimeter walls of the Building (inclusive of glass and exterior doors), and (b) the roof of the Building (including the roof membrane), and (c) any repair, maintenance or improvements (i) necessitated by the acts or omissions of Landlord or any other occupant of the Building, or their respective agents, employees or contractors, or (ii) for which Landlord has a right of reimbursement from others.

11.4 Tenant’s Failure to Perform Repairs and Maintenance Obligations. If Tenant refuses or neglects to repair and maintain the Premises and the other areas properly as required herein and to the reasonable satisfaction of Landlord, (i) Landlord may, but without obligation to do so, at any time after reasonable advance notice to Tenant, make such repairs or maintenance without Landlord having any liability to Tenant for any loss or damage that may accrue to Tenant’s Property or to Tenant’s business by reason thereof, except to the extent any damage is caused by the willful misconduct or gross negligence of Landlord or its authorized agents and representatives and (ii) Tenant shall pay to Landlord, as Additional Rent, Landlord’s costs and expenses incurred therefor. Tenant’s obligations under thisSection 11 shall survive the expiration of the Term or earlier termination thereof. Tenant hereby waives any right to repair at the expense of Landlord under any applicable Laws now or hereafter in effect.

13

12.INSURANCE.

12.1 Types of Insurance. Tenant shall maintain in full force and effect at all times during the Term, at Tenant’s sole cost and expense, for the protection of Tenant and Landlord, as their interests may appear, policies of insurance issued by carriers reasonably acceptable to Landlord and its lender which afford the following coverages: (i) worker’s compensation and employer’s liability, as required by law; (ii) commercial general liability insurance (occurrence form) providing coverage against any and all claims for bodily injury and property damage occurring in, on or about the Premises arising out of Tenant’s and Tenant’s Responsible Parties’ use or occupancy of the Premises and such insurance shall (a) include coverage for blanket contractual liability, fire damage, premises, personal injury, completed operations and products liability, and (b) have a combined single limit of not less than Two Million Dollars ($2,000,000) per occurrence with a Three Million Dollar ($3,000,000) aggregate limit and excess/umbrella insurance in the amount of Five Million Dollars ($5,000,000); (iii) comprehensive automobile liability insurance with a combined single limit of at least $1,000,000 per occurrence for claims arising out of any owned, non-owned or hired automobiles used in the conduct of Tenant’s business; (iv) “causes of loss – special form” property insurance, including without limitation, sprinkler leakage, covering damage to or loss of any of Tenant’s Property and any Alterations located in, on or about the Premises (but not the Initial Improvements, which shall be insured by Landlord), together with, if the property of any of Tenant’s invitees, vendors or customers is to be kept in the Premises, warehouser’s legal liability or bailee customers insurance for the full replacement cost of the property belonging to such parties and located in the Premises (which insurance shall be written on a replacement cost basis (without deduction for depreciation) in an amount equal to one hundred percent (100%) of the full replacement value of the aggregate of the items referred to in this clause (iv)); and (v) such other insurance or higher limits of liability as is then customarily required for Comparable Building (as defined below) or as may be reasonably required by any of Landlord’s lenders and is required of all similarly situated tenants in the Project if permitted under such tenant’s leases. “Comparable Buildings” means commercial buildings located in Santa Clara, California or the surrounding metropolitan area that are comparable to the Building in quantity, size, type and quality.

12.2 Insurance Policies. Insurance required to be maintained by Tenant shall be written by companies (i) licensed to do business in the State of California, (ii) domiciled in the United States of America, and (iii) having a “General Policyholders Rating” of at least A-:VII (or such higher rating as may be required by a lender having a lien on the Premises) as set forth in the most current issue of “A.M. Best’s Rating Guides.” Any deductible amounts under any of the insurance policies required hereunder shall not exceed Twenty-Five Thousand Dollars ($25,000). Tenant shall deliver to Landlord certificates of insurance and true and complete copies of any and all endorsements required herein for all insurance required to be maintained by Tenant hereunder at the time of execution of this Lease by Tenant. Tenant shall, at least five (5) days prior to expiration of each policy, furnish Landlord with certificates of renewal or “binders” thereof. Each certificate shall expressly provide that such policies shall not be cancelable or otherwise subject to material modification except after thirty (30) days prior written notice to the parties named as additional insureds as required in this Lease (except for cancellation for nonpayment of premium, in which event cancellation shall not take effect until at least ten (10) days’ notice has been given to Landlord). Tenant shall have the right to provide insurance coverage which it is obligated to carry pursuant to the terms of this Lease under a blanket insurance policy, provided such blanket policy expressly affords coverage for the Premises and Landlord as required by this Lease.

12.3 Additional Insureds and Coverage. Each of Landlord, Landlord’s property management company or agent, and Landlord’s lender(s) having a lien against the Premises shall be named as additional insureds or loss payees (as applicable) under all of the policies required inSection 12.1(ii) and, with respect to any Alterations, inSection 12.1(iv) hereof. All such policies shall provide for severability of interest. All insurance to be maintained by Tenant shall, except for workers’ compensation and employer’s liability insurance, be endorsed to state that it is primary, without right of contribution from insurance maintained by Landlord, and shall be in excess of coverage which Landlord may have and shall be unaffected by any insurance or self-insurance Landlord may have regardless of whether any other insurance names Landlord as an insured or whether such insurance stands primary or secondary.

14

Any umbrella/excess liability policy (which shall be in “following form”) shall provide that if the underlying aggregate is exhausted, the excess coverage will drop down as primary insurance. The limits of insurance maintained by Tenant shall not limit Tenant’s liability under this Lease. It is the parties’ intention that the insurance to be procured and maintained by Tenant as required herein shall provide coverage for any and all damage or injury arising from or related to Tenant’s operations of its business and/or Tenant’s or Tenant’s Responsible Parties’ use of the Premises and any of the areas within the Premises.

12.4 Failure of Tenant to Purchase and Maintain Insurance. If Tenant fails to obtain and maintain the insurance required herein throughout the Term, Landlord may, but without obligation to do so, after notice to Tenant, purchase the necessary insurance and pay the premiums therefor. If Landlord so elects to purchase such insurance, Tenant shall promptly pay to Landlord as Additional Rent, the amount so paid by Landlord, upon Landlord’s demand therefor. In addition, Landlord may recover from Tenant and Tenant agrees to pay, as Additional Rent, any and all Claims which Landlord may incur due to Tenant’s failure to obtain and maintain such insurance.

12.5 Waiver of Subrogation. Notwithstanding any provision of this Lease to the contrary (including, without limitation,Section 13.2 below), Landlord and Tenant mutually waive their respective rights of recovery against each other for any loss of, or damage to, either parties’ property to the extent that such loss or damage is caused by or results from a risk which is actually insured by an insurance policy in effect or required to be in effect at the time of such loss or damage (or, in the case of damage to Landlord’s property, would normally have been covered but for Landlord’s election not to maintain a policy of all-risk or special form coverage for the full replacement value of such property), without regard to the negligence or willful misconduct of the entity so released. Each party shall obtain any special endorsements, if required by its insurer, whereby the insurer waives its rights of subrogation against the other party. This provision is intended to waive fully, and for the benefit of the parties hereto, any rights and/or claims which might give rise to a right of subrogation in favor of any insurance carrier. All of Landlord’s and Tenant’s repair and indemnity obligations under this Lease shall be subject to the waiver contained in this paragraph.

13.INDEMNITY; LIMITATIONOF LIABILITYAND WAIVEROF CLAIMS.