Lehman Brothers 2007 Financial Services Conference September 11, 2007 Exhibit 99.1 |

2 FORWARD LOOKING STATEMENT The information contained in this presentation may include forward-looking statements which reflect Regions' current views with respect to future events and financial performance. The Private Securities Litigation Reform Act of 1995 ("the Act") provides a safe-harbor for forward-looking statements which are identified as such and are accompanied by the identification of important factors that could cause actual results to differ materially from the forward-looking statements. For these statements, we, together with our subsidiaries, unless the context implies otherwise, claim the protection afforded by the safe harbor in the Act. Forward-looking statements are not based on historical information, but rather are related to future operations, strategies, financial results, or other developments. Forward-looking statements are based on management's expectations as well as certain assumptions and estimates made by, and information available to, management at the time the statements are made. Those statements are based on general assumptions and are subject to various risks, uncertainties, and other factors that may cause actual results to differ materially from the views, beliefs, and projections expressed in such statements. These risks, uncertainties and other factors include, but are not limited to, those described below: Regions' ability to achieve the earnings expectations related to businesses that have been acquired, including its merger with AmSouth Bancorporation ("AmSouth"), which in turn depends on a variety of factors, including: Regions' ability to achieve the anticipated cost savings and revenue enhancements with respect to the acquired operations, or lower than expected revenues from continuing operations; the assimilation of the combined companies’ corporate cultures; the continued growth of the markets that the acquired entities serve, consistent with recent historical experience; difficulties related to the integration of the businesses, including integration of information systems and retention of key personnel. Regions' ability to expand into new markets and to maintain profit margins in the face of competitive pressures. Regions' ability to keep pace with technological changes. Regions' ability to develop competitive new products and services in a timely manner and the acceptance of such products and services by Regions' customers and potential customers. Regions' ability to effectively manage interest rate risk, market risk, credit risk, operational risk, legal risk, and regulatory and compliance risk. Regions' ability to manage fluctuations in the value of assets and liabilities and off-balance sheet exposure so as to maintain sufficient capital and liquidity to support Regions' business. The cost and other effects of material contingencies, including litigation contingencies. The effects of increased competition from both banks and non-banks. Further easing of restrictions on participants in the financial services industry, such as banks, securities brokers and dealers, investment companies and finance companies, may increase competitive pressures. Possible changes in interest rates may increase funding costs and reduce earning asset yields, thus reducing margins. Possible changes in general economic and business conditions in the United States in general and in the communities Regions serves in particular. Possible changes in the creditworthiness of customers and the possible impairment of collectibility of loans. The effects of geopolitical instability and risks such as terrorist attacks. Possible changes in trade, monetary and fiscal policies, laws, and regulations, and other activities of governments, agencies, and similar organizations, including changes in accounting standards, may have an adverse effect on business. Possible changes in consumer and business spending and saving habits could affect Regions' ability to increase assets and to attract deposits. The effects of weather and natural disasters such as hurricanes. The words "believe," "expect," "anticipate," "project," and similar expressions often signify forward-looking statements. You should not place undue reliance on any forward-looking statements. Any such statement speaks only as of the date the statement was made. Regions undertakes no obligation to update or revise any forward looking statements. |

3 Company Profile Company Profile Integration Update 2007 Initiatives 2Q07 Financial Performance Summary |

4 Regions is Among the Largest U.S. Banks Market Capitalization $23 billion 11th Assets $138 billion 10th Loans, net of unearned income $94 billion 9th Deposits $95 billion 8th Branches 1,911 7th ATMs 2,581 8th National Rank¹ 1 As of June 30, 2007. |

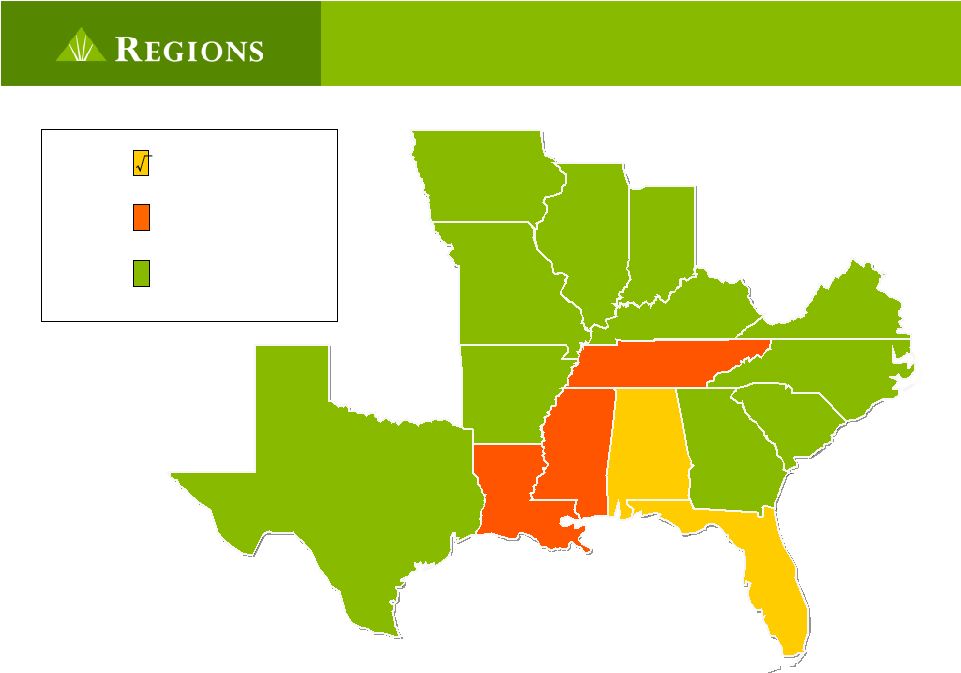

5 Franchise Footprint Source: SNL DataSource, adjusted for divestitures State Dep. ($B) Mkt. Share Rank AL $18.7 27% #1 FL 18.4 5 #4 TN 17.2 17 #2 LA 7.8 11 #3 MS 6.2 16 #1 GA 5.5 3 #6 AR 4.4 10 #1 TX 2.9 1 #19 IL 2.4 1 #22 MO 2.3 2 #7 IN 1.9 2 #10 Other 2.4 — — Regions Morgan Keegan Insurance |

6 Strong Local Market Share 10.9 Citigroup 14.9 SunTrust 15.1 National City 15.4 AmSouth 15.7 Regions (pre-merger) 17.8 US Bancorp 18.7 Fifth Third 18.8 Bank of America 19.2 JPMorgan Chase 20.3 Wachovia 20.4 Regions 21.3 BB&T 23.8% Wells Fargo Weighted Average Market Share¹ Top U.S. Banks Regions compares favorably in terms of local market share relative to other top 10 banking franchises 1 Deposit weighted by county. Excludes deposits from branches with > $10bn of deposits. Based on June 30, 2006 data. |

7 Fast Growing Footprint Projected Population Growth of Market Footprint (1) 6.7% National Average Source: SNL Financial. Data as of June 2006. Pro forma for completed/pending M&A. (1) Deposit weighted by MSA. |

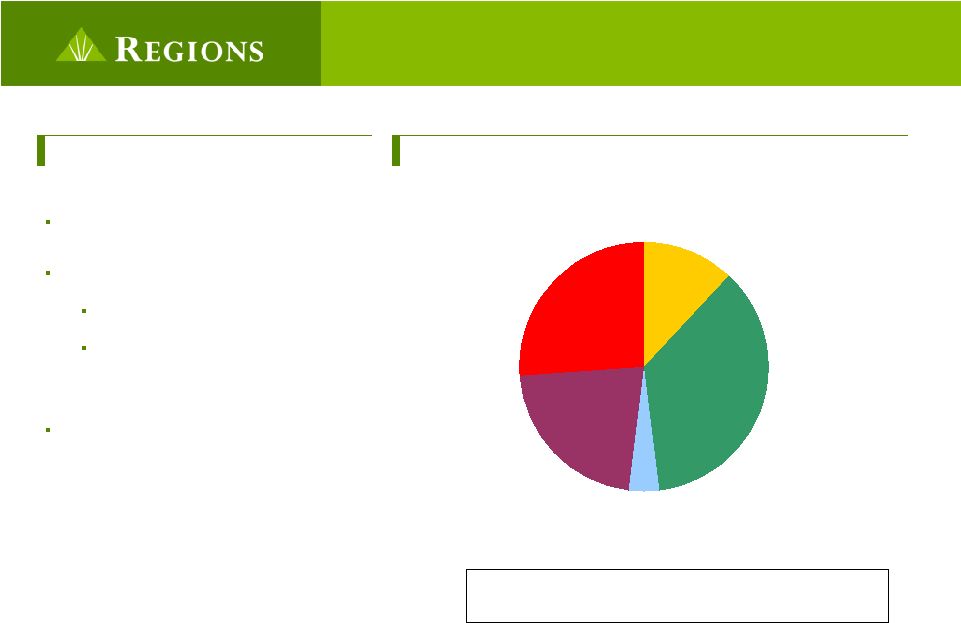

8 Morgan Keegan – Among the Largest Regional Full-Service Brokerage and Investment Banking Firms Revenue ($M) Pre-Tax Income ($M) Financial Performance 446 Office Locations Revenue Composition (2Q ’07) Profile Founded in 1969 Acquired by Regions in 2001 1,300 financial advisors 446 offices in 19 states 27,800 new accounts opened in 2Q ’07 $81 billion of customer assets $79 billion of trust assets #1 underwriter of long-term municipal bonds in the south central U.S. for 14 consecutive years #11 book-running manager in 2006 ($8.6 billion, 445 issues) $810 $1,029 $631 2005 2006 6/30/07 YTD $161 $239 $151 2005 2006 6/30/07 YTD Private Client 31% Fixed Income Capital Markets 19% Equity Capital Markets 8% Regions MK Trust 17% Asset Management 14% Other 11% |

9 Company Profile Integration Update Integration Update 2007 Initiatives 2Q07 Financial Performance Summary |

10 Key Integration Accomplishments Established Matrix Organizational Structure Completed Branch Divestitures Converted Brokerage, Mortgage, Payroll, Employee Benefits and Trust Systems Completed Alabama and Florida Branch Conversions Branch Consolidations Well Underway Exceeding Original Cost Saves |

11 Integration Timeline Combined Product Set & Incentives Complete Sale of Divested Branches 1Q07 2Q07 3Q07 4Q07 1Q08 2Q08 Brokerage Conversion Mortgage Origination & Servicing Conversion Trust Conversion Achieve $500 MM Annual Run-rate in Cost Saves Event Two Branch Conversion and Consolidations Event Three Branch Conversion and Consolidations Event One Branch Conversion and Consolidations Pre-conversion Branch Consolidations |

12 Event 1 July 13, 2007 (633 branches) Event 2 October 26, 2007 (563 branches) Event 3 December 7, 2007 (590 branches) FL AL GA MS LA TX AR MO IA IL IN KY TN NC VA SC |

13 Branch Consolidations 46 Tennessee 1 Missouri 2 Georgia 12 Mississippi 17 Louisiana 32 Alabama 34 Florida 15 branches consolidated pre-conversion in Arkansas, Florida, Missouri and Tennessee Significant source of cost saves Total of 159 branches consolidated Event 1 Event 2 Event 3 |

14 Net Cost Saves $0 $100 $200 $300 $400 $500 2008E 2007E 4Q06 $7 MM Estimated $250 MM Estimated $500 MM Full run-rate achieved by 2Q 2008 $135 MM through 2Q07 Exceeding Original Cost Saves |

15 Measuring the Customer Experience Measurement Plans Gallup Organization, Greenwich Organization and Customer Surveys Trend Identification Tracking over 100 operational metrics |

16 Company Profile Integration Update 2007 Initiatives 2007 Initiatives 2Q07 Financial Performance Summary |

17 De Novo Branching 2007 De Novo Branches Florida 32 Alabama 3 Tennessee 5 Other 10 Total 50 |

18 Consumer checking household growth of 2% Retain a minimum of 85% of the consumer checking households New customer cross-sell ratio of 4.5 services per household Grow private banking households by 10% Consumer Services Initiatives for 2007 |

19 Treasury Management Commercial and Industrial/ Middle Market Community Banking Corporate Banking Commercial Real Estate Business Banking Business Services |

20 Summary of Key Initiatives Leverage New Capabilities and Credit Limits Fully Develop Morgan Keegan Partnership Drive Improvements in Sales Process Deepen Cross-Sell with Existing Clients Improve Associate and Client Retention Enhance Productivity |

21 Company Profile Integration Update 2007 Initiatives 2Q07 Financial 2Q07 Financial Performance Performance Summary |

22 Good fee-based revenue growth Lower net interest income and margin compression driven largely by divestitures Above-plan merger cost saves; good expense containment Disciplined balance sheet/capital management Credit costs remain low Excellent merger integration progress, including successful Alabama/Florida branches conversion Solid Financial Performance |

23 Financial Performance $ 0.69 EPS – diluted* 0.23 % Net Charge-Off Ratio Asset Quality 0.62 % Nonperforming Assets as a % of Loans 1.19 % Allowance for Credit Losses as a % of Loans 24.79 % Return on Avg. Tangible Equity* 1.43 % Return on Avg. Assets* 57.44 % Operating Efficiency 3.82 % Net Interest Margin Profitability 2Q07 * Excluding discontinued operations and merger related charges. For a reconciliation of these amounts to GAAP financial measures and a statement of why management believes these measures provide useful information to investors, see Regions’ 10-Q for the period ended June 30, 2007. 2Q07 Financial Summary |

24 Credit Quality Trends 0.45 % 0.62 % 0.20 % 0.23 % 0.00% 0.20% 0.40% 0.60% 0.80% 1.00% 1.20% 4Q06 1Q07 2Q07 0.40 % 0.27 % NPAs/Loans and OREO Net Charge-Offs/Average Loans 1.11 % 1.11 % 0.99 % Delinquent Loans (>30 days) |

25 Diversified Loan Portfolio Note: Loan Portfolio per Call Report Schedule RC-C. June 30, 2007. Loan Portfolio Total Loan Portfolio as of 6/30/07 ($MM) = $94,014 Commercial/Leasing, 23% Multifamily, 1% Other Commercial Real Estate, 9% Alt A, 3% Indirect, 4% 1-4 Family Construction, 5% Land and Other Construction, 13% Residential First Mortgage, 16% Owner Occupied Real Estate , 8% Other Consumer, 2% Home Equity, 16% |

26 Commercial Real Estate CRE Portfolio by Product CRE Portfolio Characteristics CRE portfolio is diversified by product, loan size, and by geography CRE portfolio is very granular with the average note size under $500 thousand This average note size is reflective of real estate in our Community Banks Loans are generally underwritten based on the individual borrower's financial strength and consequently provide a different risk profile than larger CRE loans Top 5 MSA concentrations are Atlanta, Miami, Nashville, Tampa, and Birmingham, all of which are under 10% Note: Commercial Real Estate by Product per June 30, 2007 Call Report Schedule RC-C. Owner Occupied Commercial Real Estate is based on the credit strength of the operating company (borrower) and does not depend on the real estate for repayment 1-4 Family Construction, 12% Land and Other Construction, 36% Multifamily, 4% Owner Occupied Real Estate, 22% Other Commercial Real Estate, 26% |

27 Consumer Real Estate Portfolio Average Loan Size = $114 thousand 71% are first lien position Weighted Average LTV FICO Total Portfolio 71% 733 Alt A 72% 733 Negligible subprime exposure (0.1 %) No negative amortizing mortgages No Option Adjustable Rate Mortgages EquiFirst sold 1Q2007 Remaining Loan Portfolio 65% Home Equity 16% Alt A 3% Residential First Mortgage 16% Note: as of June 30, 2007. |

28 Strong Capital Position Tangible Equity / Tangible Assets Source: SNL DataSource, Tangible Equity/Tangible Assets as of June 30, 2007. 5.5% Median |

29 Company Profile Integration Update 2007 Initiatives 2Q07 Financial Performance Summary Summary |

30 Current Banking Environment Interest Rates Disciplined balance sheet management Large branch network in high growth areas provides strong engine for low cost deposit growth Concerns Our Response |

31 Current Banking Environment Interest Rates Credit Quality Disciplined balance sheet management Large branch network in high growth areas provides strong engine for low cost deposit growth Loan portfolio well diversified by size, product type and geography Strengthened underwriting and approval processes Comprehensive credit servicing reviews Concerns Our Response |

32 Current Banking Environment Interest Rates Credit Quality Economy Disciplined balance sheet management Large branch network in high growth areas provides strong engine for low cost deposit growth Fast growing Southeastern footprint High market density in footprint Customer retention programs Household growth Comprehensive product set Revenue diversity – Morgan Keegan Exceeding original cost saves Concerns Our Response Loan portfolio well diversified by size, product type and geography Strengthened underwriting and approval processes Comprehensive credit servicing reviews |

* * * * * * * * * * * * * * * * |