Exhibit 99.2

FINANCIAL SUPPLEMENT TO THIRD QUARTER 2009 EARNINGS RELEASE

FINANCIAL SUPPLEMENT TO THIRD QUARTER 2009 EARNINGS RELEASE

Summary

Quarterly loss of $0.37 per diluted share reflects continued efforts to improve the risk profile of the balance sheet and a charge related to branch consolidation

| | • | | Significant third quarter drivers include: $1,025 million loan loss provision ($345 million above net charge-offs); net interest margin expanded 11 bps to 2.73%; 2 percent increase in average low-cost deposits, including a $701 million rise in non-interest bearing deposits; Results included a $41 million charge related to consolidating 121 branches |

| | • | | Pre-provision net revenue adversely impacted by higher other real estate owned, legal and professional expenses |

Focus on growing customer relationships, resulting in continued deposit growth

| | • | | Opened a record 270,000 new retail and business deposit checking accounts during the third quarter - a 29% increase versus the same period last year; New account openings YTD totaled 762,000, placing Regions on pace to meet its goal of 1 million new checking accounts in 2009 |

| | • | | Average customer deposits grew 1% linked quarter, up $10.2 billion or 12% year-over-year |

| | • | | Continued success in growing average non-interest bearing deposits, up 3% linked-quarter; 19% year-over-year |

| | • | | Strong customer satisfaction: JD Power & Associates ranked Regions the most improved retail bank as well as highest in customer satisfaction among primary mortgage servicing companies |

Net interest margin expansion driven by strong low-cost deposit growth as well as enhanced risk-adjusted loan and deposit pricing

| | • | | Net interest margin expanded 11 bps to 2.73%, reflecting continued low-cost deposit growth, especially in non-interest bearing deposits which have increased for four consecutive quarters |

| | • | | Third quarter net interest income increased $14 million to $845 million, despite a lower earning asset base resulting from lower cash balances and a decline in loans |

| | • | | Loan spreads and deposit pricing continue to improve; asset sensitive balance sheet well positioned for eventual rising rate environment |

Solid non-interest income; continued focus on performance and efficiency

| | • | | Non-interest revenues essentially unchanged, excluding prior quarter’s gains related to a trust preferred exchange, Visa shares and other securities sales and leveraged lease terminations |

| | • | | Service charges income increased $12 million or 4% to $300 million, benefiting from a higher level of customer transactions and new account growth |

| | • | | Brokerage income declined $11 million or 4% to $252 million, driven by lower fees from investment banking and a decline in fixed income capital markets revenue |

| | • | | Mortgage income rose $12 million, or 19% linked quarter, primarily the result of favorable mortgage servicing rights and related hedge performance |

| | • | | Non-interest expense increased 1% linked quarter, however when excluding the second quarter’s securities impairment charge and FDIC special assessment, and the current quarter’s branch consolidation charges, non-interest expense increased 9% linked quarter |

| | • | | A $37 million increase in other real estate owned expense and a $48 million increase in legal and professional expenses are driving the increase in core expenses on a linked quarter basis |

| | • | | Salaries and benefits declined $8 million to $578 million, primarily due to headcount reductions, which have declined 6% since 4Q08, and lower brokerage-related incentive costs |

Provision for loan losses increased to $1,025 million, $345 million above net charge-offs; Allowance for credit losses increased to 2.90% of loans; gross in-migration of non-performing loans declined versus prior quarter

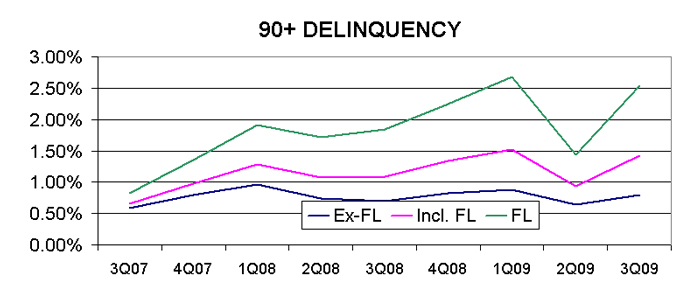

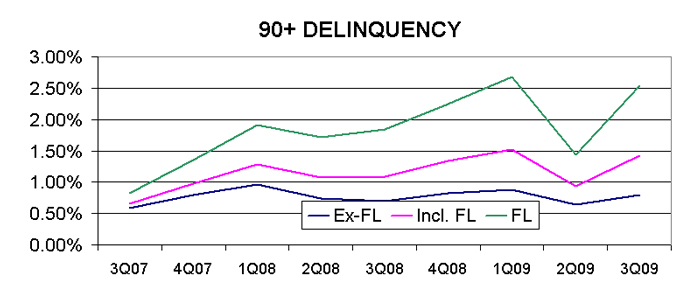

| | • | | Net charge-offs rose 80 bps to 2.86% of loans in the third quarter; driven by commercial real estate value-related writedowns and problem asset dispositions. Net charge-offs within the home equity portfolio declined versus the prior quarter, reflecting the benefits of Regions’ proactive customer assistance program. |

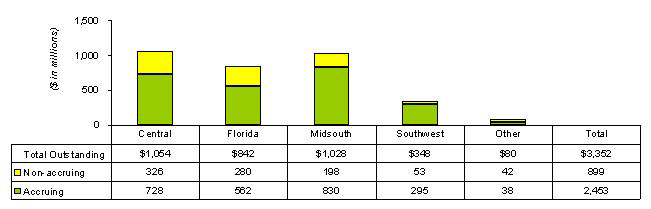

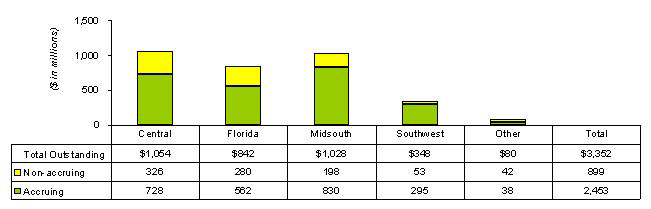

| | • | | Non-performing loans increased $598 million in the third quarter to $3.2 billion; inflows were driven primarily by homebuilder loans and loans secured by income-producing properties, such as multi-family and retail |

| | • | | Allowance coverage ratio (ALL/NPL, excluding loans held for sale) at 0.82x as of September 30, 2009, as compared to 0.85x at June 30, 2009 |

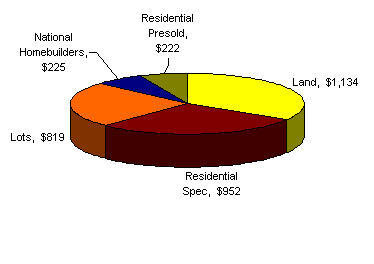

Continued focus on improving the risk profile of the balance sheet

| | • | | Residential homebuilder portfolio exposure declined another $434 million; total exposure down 53% since the beginning of 2008 |

| | • | | Condominium portfolio continues to decline, down another $64 million to $647 million; less than 1 percent of overall loan portfolio |

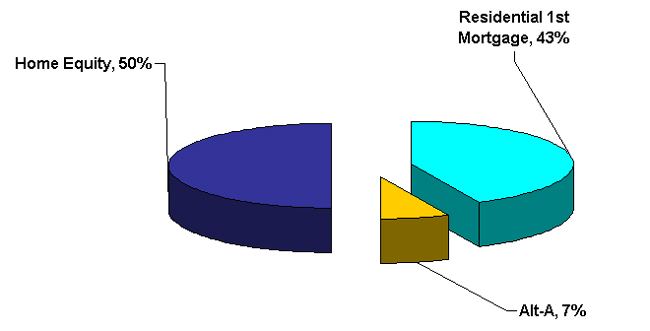

| | • | | Florida second lien home equity exposure declined $54 million to $3.6 billion; net charge-off rate declined 156 basis points versus the previous quarter to an annualized 6.33%. |

Capital position remains strong

| | • | | Tier 1 common ratio of 7.8% |

| | • | | Tier 1 capital ratio of 12.1% at September 30, 2009, $6.5 billion above “Well Capitalized” threshold |

FINANCIAL SUPPLEMENT TO

THIRD QUARTER 2009 EARNINGS RELEASE

PAGE 2

Regions Financial Corporation and Subsidiaries

Consolidated Balance Sheets

(Unaudited)

| | | | | | | | | | | | | | | | | | | | |

($ amounts in millions) | | 9/30/09 | | | 6/30/09 | | | 3/31/09 | | | 12/31/08 | | | 9/30/08 | |

Assets: | | | | | | | | | | | | | | | | | | | | |

Cash and due from banks | | $ | 2,101 | | | $ | 2,363 | | | $ | 2,429 | | | $ | 2,643 | | | $ | 2,986 | |

Interest-bearing deposits in other banks | | | 5,902 | | | | 2,846 | | | | 2,288 | | | | 7,540 | | | | 30 | |

Federal funds sold and securities purchased under agreements to resell | | | 366 | | | | 3,221 | | | | 418 | | | | 790 | | | | 542 | |

Trading account assets | | | 1,388 | | | | 1,109 | | | | 1,348 | | | | 1,050 | | | | 1,268 | |

Securities available for sale | | | 21,030 | | | | 19,681 | | | | 20,970 | | | | 18,850 | | | | 17,633 | |

Securities held to maturity | | | 39 | | | | 43 | | | | 45 | | | | 47 | | | | 50 | |

Loans held for sale | | | 1,470 | | | | 1,932 | | | | 1,956 | | | | 1,282 | | | | 1,054 | |

Loans, net of unearned income | | | 92,754 | | | | 96,149 | | | | 95,686 | | | | 97,419 | | | | 98,712 | |

Allowance for loan losses | | | (2,627 | ) | | | (2,282 | ) | | | (1,861 | ) | | | (1,826 | ) | | | (1,472 | ) |

| | | | | | | | | | | | | | | | | | | | |

Net loans | | | 90,127 | | | | 93,867 | | | | 93,825 | | | | 95,593 | | | | 97,240 | |

Other interest-earning assets | | | 839 | | | | 829 | | | | 849 | | | | 897 | | | | 587 | |

Premises and equipment, net | | | 2,694 | | | | 2,789 | | | | 2,808 | | | | 2,786 | | | | 2,730 | |

Interest receivable | | | 499 | | | | 501 | | | | 426 | | | | 458 | | | | 512 | |

Goodwill | | | 5,557 | | | | 5,556 | | | | 5,551 | | | | 5,548 | | | | 11,529 | |

Mortgage servicing rights (MSRs) | | | 216 | | | | 202 | | | | 161 | | | | 161 | | | | 263 | |

Other identifiable intangible assets | | | 535 | | | | 568 | | | | 603 | | | | 638 | | | | 675 | |

Other assets | | | 7,223 | | | | 7,304 | | | | 8,303 | | | | 7,965 | | | | 7,193 | |

| | | | | | | | | | | | | | | | | | | | |

Total Assets | | $ | 139,986 | | | $ | 142,811 | | | $ | 141,980 | | | $ | 146,248 | | | $ | 144,292 | |

| | | | | | | | | | | | | | | | | | | | |

Liabilities and Stockholders’ Equity: | | | | | | | | | | | | | | | | | | | | |

Deposits: | | | | | | | | | | | | | | | | | | | | |

Non-interest-bearing | | $ | 21,226 | | | $ | 20,995 | | | $ | 19,988 | | | $ | 18,457 | | | $ | 18,045 | |

Interest-bearing | | | 73,654 | | | | 73,731 | | | | 73,548 | | | | 72,447 | | | | 71,176 | |

| | | | | | | | | | | | | | | | | | | | |

Total deposits | | | 94,880 | | | | 94,726 | | | | 93,536 | | | | 90,904 | | | | 89,221 | |

Borrowed funds: | | | | | | | | | | | | | | | | | | | | |

Short-term borrowings: | | | | | | | | | | | | | | | | | | | | |

Federal funds purchased and securities sold under agreements to repurchase | | | 2,633 | | | | 2,265 | | | | 2,828 | | | | 3,143 | | | | 10,427 | |

Other short-term borrowings | | | 2,653 | | | | 4,927 | | | | 6,525 | | | | 12,679 | | | | 7,115 | |

| | | | | | | | | | | | | | | | | | | | |

Total short-term borrowings | | | 5,286 | | | | 7,192 | | | | 9,353 | | | | 15,822 | | | | 17,542 | |

Long-term borrowings | | | 18,093 | | | | 18,238 | | | | 18,762 | | | | 19,231 | | | | 14,168 | |

| | | | | | | | | | | | | | | | | | | | |

Total borrowed funds | | | 23,379 | | | | 25,430 | | | | 28,115 | | | | 35,053 | | | | 31,710 | |

Other liabilities | | | 3,235 | | | | 3,918 | | | | 3,512 | | | | 3,478 | | | | 3,656 | |

| | | | | | | | | | | | | | | | | | | | |

Total Liabilities | | | 121,494 | | | | 124,074 | | | | 125,163 | | | | 129,435 | | | | 124,587 | |

Stockholders’ equity: | | | | | | | | | | | | | | | | | | | | |

Preferred stock, Series A | | | 3,334 | | | | 3,325 | | | | 3,316 | | | | 3,307 | | | | — | |

Preferred stock, Series B | | | 278 | | | | 278 | | | | — | | | | — | | | | — | |

Common stock | | | 12 | | | | 12 | | | | 7 | | | | 7 | | | | 7 | |

Additional paid-in capital | | | 18,754 | | | | 18,740 | | | | 16,828 | | | | 16,815 | | | | 16,607 | |

Retained earnings (deficit) | | | (2,618 | ) | | | (2,169 | ) | | | (1,913 | ) | | | (1,869 | ) | | | 4,445 | |

Treasury stock, at cost | | | (1,411 | ) | | | (1,413 | ) | | | (1,415 | ) | | | (1,425 | ) | | | (1,424 | ) |

Accumulated other comprehensive income (loss), net | | | 143 | | | | (36 | ) | | | (6 | ) | | | (22 | ) | | | 70 | |

| | | | | | | | | | | | | | | | | | | | |

Total Stockholders’ Equity | | | 18,492 | | | | 18,737 | | | | 16,817 | | | | 16,813 | | | | 19,705 | |

| | | | | | | | | | | | | | | | | | | | |

Total Liabilities and Stockholders’ Equity | | $ | 139,986 | | | $ | 142,811 | | | $ | 141,980 | | | $ | 146,248 | | | $ | 144,292 | |

| | | | | | | | | | | | | | | | | | | | |

FINANCIAL SUPPLEMENT TO

THIRD QUARTER 2009 EARNINGS RELEASE

PAGE 3

Regions Financial Corporation and Subsidiaries

Consolidated Statements of Operations (1)

(Unaudited)

| | | | | | | | | | | | | | | | | | | |

| | | Quarter Ended | |

($ amounts in millions, except per share data) | | 9/30/09 | | | 6/30/09 | | | 3/31/09 | | 12/31/08 | | | 9/30/08 | |

Interest income on: | | | | | | | | | | | | | | | | | | | |

Loans, including fees | | $ | 1,047 | | | $ | 1,073 | | | $ | 1,098 | | $ | 1,328 | | | $ | 1,318 | |

Securities: | | | | | | | | | | | | | | | | | | | |

Taxable | | | 232 | | | | 239 | | | | 239 | | | 212 | | | | 208 | |

Tax-exempt | | | 6 | | | | 5 | | | | 7 | | | 9 | | | | 11 | |

| | | | | | | | | | | | | | | | | | | |

Total securities | | | 238 | | | | 244 | | | | 246 | | | 221 | | | | 219 | |

Loans held for sale | | | 12 | | | | 15 | | | | 16 | | | 8 | | | | 9 | |

Federal funds sold and securities purchased under agreements to resell | | | — | | | | 1 | | | | 1 | | | 2 | | | | 5 | |

Trading account assets | | | 10 | | | | 10 | | | | 12 | | | 11 | | | | 13 | |

Other interest-earning assets | | | 7 | | | | 8 | | | | 6 | | | 11 | | | | 5 | |

| | | | | | | | | | | | | | | | | | | |

Total interest income | | | 1,314 | | | | 1,351 | | | | 1,379 | | | 1,581 | | | | 1,569 | |

Interest expense on: | | | | | | | | | | | | | | | | | | | |

Deposits | | | 301 | | | | 330 | | | | 366 | | | 408 | | | | 391 | |

Short-term borrowings | | | 9 | | | | 16 | | | | 20 | | | 69 | | | | 102 | |

Long-term borrowings | | | 159 | | | | 174 | | | | 184 | | | 180 | | | | 154 | |

| | | | | | | | | | | | | | | | | | | |

Total interest expense | | | 469 | | | | 520 | | | | 570 | | | 657 | | | | 647 | |

| | | | | | | | | | | | | | | | | | | |

Net interest income | | | 845 | | | | 831 | | | | 809 | | | 924 | | | | 922 | |

Provision for loan losses | | | 1,025 | | | | 912 | | | | 425 | | | 1,150 | | | | 417 | |

| | | | | | | | | | | | | | | | | | | |

Net interest income (loss) after provision for loan losses | | | (180 | ) | | | (81 | ) | | | 384 | | | (226 | ) | | | 505 | |

Non-interest income: | | | | | | | | | | | | | | | | | | | |

Service charges on deposit accounts | | | 300 | | | | 288 | | | | 269 | | | 288 | | | | 294 | |

Brokerage, investment banking and capital markets | | | 252 | | | | 263 | | | | 217 | | | 241 | | | | 241 | |

Mortgage income | | | 76 | | | | 64 | | | | 73 | | | 34 | | | | 33 | |

Trust department income | | | 49 | | | | 48 | | | | 46 | | | 52 | | | | 66 | |

Securities gains, net | | | 4 | | | | 108 | | | | 53 | | | — | | | | — | |

Other | | | 91 | | | | 428 | | | | 408 | | | 87 | | | | 85 | |

| | | | | | | | | | | | | | | | | | | |

Total non-interest income | | | 772 | | | | 1,199 | | | | 1,066 | | | 702 | | | | 719 | |

Non-interest expense: | | | | | | | | | | | | | | | | | | | |

Salaries and employee benefits | | | 578 | | | | 586 | | | | 539 | | | 562 | | | | 552 | |

Net occupancy expense | | | 121 | | | | 112 | | | | 107 | | | 114 | | | | 110 | |

Furniture and equipment expense | | | 83 | | | | 78 | | | | 76 | | | 79 | | | | 88 | |

Impairment (recapture) of MSR’s | | | — | | | | — | | | | — | | | 99 | | | | 11 | |

Goodwill impairment | | | — | | | | — | | | | — | | | 6,000 | | | | — | |

Other-than-temporary impairments (2) | | | 3 | | | | 69 | | | | 3 | | | 13 | | | | 9 | |

Other | | | 458 | | | | 386 | | | | 333 | | | 406 | | | | 358 | |

| | | | | | | | | | | | | | | | | | | |

Total non-interest expense (3) | | | 1,243 | | | | 1,231 | | | | 1,058 | | | 7,273 | | | | 1,128 | |

| | | | | | | | | | | | | | | | | | | |

Income (loss) before income taxes from continuing operations | | | (651 | ) | | | (113 | ) | | | 392 | | | (6,797 | ) | | | 96 | |

Income taxes | | | (274 | ) | | | 75 | | | | 315 | | | (579 | ) | | | 6 | |

| | | | | | | | | | | | | | | | | | | |

Income (loss) from continuing operations | | | (377 | ) | | | (188 | ) | | | 77 | | | (6,218 | ) | | | 90 | |

Discontinued operations: | | | | | | | | | | | | | | | | | | | |

Loss from discontinued operations before income taxes | | | — | | | | — | | | | — | | | — | | | | (18 | ) |

Income tax benefit | | | — | | | | — | | | | — | | | — | | | | (7 | ) |

| | | | | | | | | | | | | | | | | | | |

Loss from discontinued operations, net of tax | | | — | | | | — | | | | — | | | — | | | | (11 | ) |

| | | | | | | | | | | | | | | | | | | |

Net income (loss) | | $ | (377 | ) | | $ | (188 | ) | | $ | 77 | | $ | (6,218 | ) | | $ | 79 | |

| | | | | | | | | | | | | | | | | | | |

Income (loss) from continuing operations available to common shareholders | | $ | (437 | ) | | $ | (244 | ) | | $ | 26 | | $ | (6,244 | ) | | $ | 90 | |

| | | | | | | | | | | | | | | | | | | |

Net income (loss) available to common shareholders | | $ | (437 | ) | | $ | (244 | ) | | $ | 26 | | $ | (6,244 | ) | | $ | 79 | |

| | | | | | | | | | | | | | | | | | | |

Weighted-average shares outstanding–during quarter: | | | | | | | | | | | | | | | | | | | |

Basic | | | 1,189 | | | | 876 | | | | 693 | | | 693 | | | | 696 | |

Diluted | | | 1,189 | | | | 876 | | | | 694 | | | 693 | | | | 696 | |

Actual shares outstanding–end of quarter | | | 1,188 | | | | 1,188 | | | | 695 | | | 691 | | | | 692 | |

Earnings (loss) per common share (4): | | | | | | | | | | | | | | | | | | | |

Basic | | $ | (0.37 | ) | | $ | (0.28 | ) | | $ | 0.04 | | $ | (9.01 | ) | | $ | 0.11 | |

Diluted | | $ | (0.37 | ) | | $ | (0.28 | ) | | $ | 0.04 | | $ | (9.01 | ) | | $ | 0.11 | |

Cash dividends declared per common share | | $ | 0.01 | | | $ | 0.01 | | | $ | 0.10 | | $ | 0.10 | | | $ | 0.10 | |

Taxable-equivalent net interest income from continuing operations | | $ | 853 | | | $ | 840 | | | $ | 817 | | $ | 933 | | | $ | 931 | |

| (1) | Certain amounts in the prior periods have been classified to reflect current period presentation |

| (2) | Includes $3 million and $260 million of gross charges, net of $0 and $191 million noncredit related portion recognized in other comprehensive income, in 3Q09 and 2Q09, respectively. |

| (3) | Merger-related charges total $25 million in 3Q08. See page 24 for additional detail. |

| (4) | Includes preferred stock dividends |

FINANCIAL SUPPLEMENT TO

THIRD QUARTER 2009 EARNINGS RELEASE

PAGE 4

Regions Financial Corporation and Subsidiaries

Consolidated Statements of Operations (1)

(Unaudited)

| | | | | | | | |

($ amounts in millions, except per share data) | | Nine Months Ended

September 30 | |

| | | 2009 | | | 2008 | |

Interest income on: | | | | | | | | |

Loans, including fees | | $ | 3,218 | | | $ | 4,222 | |

Securities: | | | | | | | | |

Taxable | | | 710 | | | | 616 | |

Tax-exempt | | | 18 | | | | 31 | |

| | | | | | | | |

Total securities | | | 728 | | | | 647 | |

Loans held for sale | | | 43 | | | | 27 | |

Federal funds sold and securities purchased under agreements to resell | | | 2 | | | | 16 | |

Trading account assets | | | 32 | | | | 52 | |

Other interest-earning assets | | | 21 | | | | 18 | |

| | | | | | | | |

Total interest income | | | 4,044 | | | | 4,982 | |

Interest expense on: | | | | | | | | |

Deposits | | | 997 | | | | 1,316 | |

Short-term borrowings | | | 45 | | | | 300 | |

Long-term borrowings | | | 517 | | | | 447 | |

| | | | | | | | |

Total interest expense | | | 1,559 | | | | 2,063 | |

| | | | | | | | |

Net interest income | | | 2,485 | | | | 2,919 | |

Provision for loan losses | | | 2,362 | | | | 907 | |

| | | | | | | | |

Net interest income after provision for loan losses | | | 123 | | | | 2,012 | |

Non-interest income: | | | | | | | | |

Service charges on deposit accounts | | | 857 | | | | 860 | |

Brokerage, investment banking and capital markets | | | 732 | | | | 786 | |

Mortgage income | | | 213 | | | | 104 | |

Trust department income | | | 143 | | | | 182 | |

Securities gains, net | | | 165 | | | | 92 | |

Other | | | 927 | | | | 347 | |

| | | | | | | | |

Total non-interest income | | | 3,037 | | | | 2,371 | |

Non-interest expense: | | | | | | | | |

Salaries and employee benefits | | | 1,703 | | | | 1,794 | |

Net occupancy expense | | | 340 | | | | 328 | |

Furniture and equipment expense | | | 237 | | | | 255 | |

Recapture of MSR’s | | | — | | | | (14 | ) |

Other-than-temporary impairments (2) | | | 75 | | | | 10 | |

Other | | | 1,177 | | | | 1,146 | |

| | | | | | | | |

Total non-interest expense (3) | | | 3,532 | | | | 3,519 | |

| | | | | | | | |

Income (loss) before income taxes from continuing operations | | | (372 | ) | | | 864 | |

Income taxes | | | 116 | | | | 231 | |

| | | | | | | | |

Income (loss) from continuing operations | | | (488 | ) | | | 633 | |

Discontinued operations: | | | | | | | | |

Loss from discontinued operations before income taxes | | | — | | | | (18 | ) |

Income tax benefit | | | — | | | | (7 | ) |

| | | | | | | | |

Loss from discontinued operations, net of tax | | | — | | | | (11 | ) |

| | | | | | | | |

Net income (loss) | | | ($488 | ) | | $ | 622 | |

| | | | | | | | |

Income (loss) from continuing operations available to common shareholders | | | ($655 | ) | | $ | 633 | |

| | | | | | | | |

Net income (loss) available to common shareholders | | | ($655 | ) | | $ | 622 | |

| | | | | | | | |

Weighted-average shares outstanding–year-to-date: | | | | | | | | |

Basic | | | 921 | | | | 696 | |

Diluted | | | 921 | | | | 696 | |

Actual shares outstanding–end of period | | | 1,188 | | | | 692 | |

Earnings (loss) per common share (4): | | | | | | | | |

Basic | | $ | (0.71 | ) | | $ | 0.89 | |

Diluted | | $ | (0.71 | ) | | $ | 0.89 | |

Cash dividends declared per common share | | $ | 0.12 | | | $ | 0.86 | |

Taxable equivalent net interest income from continuing operations | | $ | 2,510 | | | $ | 2,947 | |

| (1) | Certain amounts in the prior periods have been classified to reflect current period presentation |

| (2) | Includes $266 million of gross charges, net of $191 million noncredit related portion recognized in other comprehensive income, in 2009. |

| (3) | Merger-related charges total $201 million for the nine months ended September 30, 2008 . |

| (4) | Includes preferred stock dividends |

FINANCIAL SUPPLEMENT TO

THIRD QUARTER 2009 EARNINGS RELEASE

PAGE 5

Regions Financial Corporation and Subsidiaries

Consolidated Average Daily Balances and Yield/Rate Analysis (1)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Quarter Ended | |

| | | 9/30/09 | | | 6/30/09 | | | 3/31/09 | | | 12/31/08 | | | 9/30/08 | |

($ amounts in millions; yields on

taxable-equivalent basis) | | Average

Balance | | | Income/

Expense | | Yield/

Rate | | | Average

Balance | | | Income/

Expense | | Yield/

Rate | | | Average

Balance | | | Income/

Expense | | Yield/

Rate | | | Average

Balance | | | Income/

Expense | | Yield/

Rate | | | Average

Balance | | | Income/

Expense | | Yield/

Rate | |

Assets | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Interest-earning assets: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Federal funds sold and securities purchased under agreements to resell | | $ | 597 | | | $ | — | | 0.42 | % | | $ | 508 | | | $ | 1 | | 0.49 | % | | $ | 545 | | | $ | 1 | | 0.80 | % | | $ | 608 | | | $ | 2 | | 1.37 | % | | $ | 1,000 | | | $ | 5 | | 1.96 | % |

Trading account assets | | | 1,101 | | | | 10 | | 3.59 | % | | | 1,221 | | | | 11 | | 3.58 | % | | | 1,234 | | | | 13 | | 4.21 | % | | | 1,334 | | | | 12 | | 3.50 | % | | | 1,348 | | | | 14 | | 4.06 | % |

Securities: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Taxable | | | 19,177 | | | | 232 | | 4.79 | % | | | 19,453 | | | | 239 | | 4.92 | % | | | 19,160 | | | | 239 | | 5.06 | % | | | 17,081 | | | | 212 | | 4.92 | % | | | 16,962 | | | | 208 | | 4.88 | % |

Tax-exempt | | | 463 | | | | 8 | | 6.52 | % | | | 562 | | | | 8 | | 6.30 | % | | | 687 | | | | 11 | | 6.34 | % | | | 800 | | | | 14 | | 7.15 | % | | | 767 | | | | 16 | | 8.61 | % |

Loans held for sale | | | 1,522 | | | | 12 | | 3.25 | % | | | 1,790 | | | | 16 | | 3.41 | % | | | 1,819 | | | | 15 | | 3.45 | % | | | 823 | | | | 8 | | 4.17 | % | | | 563 | | | | 9 | | 6.02 | % |

Loans, net of unearned income (2) | | | 94,354 | | | | 1,053 | | 4.43 | % | | | 95,382 | | | | 1,077 | | 4.53 | % | | | 96,648 | | | | 1,102 | | 4.62 | % | | | 99,134 | | | | 1,331 | | 5.34 | % | | | 98,333 | | | | 1,321 | | 5.34 | % |

Other interest-earning assets | | | 6,841 | | | | 7 | | 0.40 | % | | | 9,700 | | | | 8 | | 0.36 | % | | | 5,599 | | | | 6 | | 0.40 | % | | | 5,604 | | | | 11 | | 0.78 | % | | | 582 | | | | 5 | | 3.37 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total interest-earning assets | | | 124,055 | | | $ | 1,322 | | 4.23 | % | | | 128,616 | | | $ | 1,360 | | 4.24 | % | | | 125,692 | | | $ | 1,387 | | 4.47 | % | | | 125,384 | | | $ | 1,590 | | 5.05 | % | | | 119,555 | | | $ | 1,578 | | 5.25 | % |

Allowance for loan losses | | | (2,393 | ) | | | | | | | | | (1,917 | ) | | | | | | | | | (1,868 | ) | | | | | | | | | (1,456 | ) | | | | | | | | | (1,491 | ) | | | | | | |

Cash and due from banks | | | 2,113 | | | | | | | | | | 2,269 | | | | | | | | | | 2,396 | | | | | | | | | | 2,499 | | | | | | | | | | 2,421 | | | | | | | |

Other non-earning assets | | | 16,530 | | | | | | | | | | 17,119 | | | | | | | | | | 17,343 | | | | | | | | | | 21,647 | | | | | | | | | | 22,756 | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | $ | 140,305 | | | | | | | | | $ | 146,087 | | | | | | | | | $ | 143,563 | | | | | | | | | $ | 148,074 | | | | | | | | | $ | 143,241 | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Liabilities and Stockholders’ Equity | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Interest-bearing liabilities: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Savings accounts | | $ | 4,038 | | | $ | 1 | | 0.13 | % | | $ | 4,029 | | | $ | 1 | | 0.11 | % | | $ | 3,804 | | | $ | 1 | | 0.12 | % | | $ | 3,691 | | | $ | 1 | | 0.12 | % | | $ | 3,774 | | | $ | 1 | | 0.11 | % |

Interest-bearing transaction accounts | | | 13,934 | | | | 10 | | 0.27 | % | | | 14,277 | | | | 11 | | 0.30 | % | | | 14,909 | | | | 10 | | 0.27 | % | | | 14,393 | | | | 20 | | 0.55 | % | | | 14,831 | | | | 28 | | 0.77 | % |

Money market accounts | | | 23,107 | | | | 35 | | 0.61 | % | | | 22,138 | | | | 43 | | 0.78 | % | | | 21,204 | | | | 67 | | 1.28 | % | | | 20,565 | | | | 93 | | 1.79 | % | | | 20,394 | | | | 81 | | 1.59 | % |

Time deposits | | | 32,584 | | | | 255 | | 3.10 | % | | | 33,442 | | | | 275 | | 3.30 | % | | | 32,894 | | | | 288 | | 3.55 | % | | | 31,849 | | | | 293 | | 3.65 | % | | | 30,168 | | | | 273 | | 3.60 | % |

Other | | | — | | | | — | | — | | | | 728 | | | | — | | 0.14 | % | | | 530 | | | | — | | 0.07 | % | | | 1,262 | | | | 1 | | 0.42 | % | | | 1,733 | | | | 8 | | 1.71 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total interest-bearing deposits | | | 73,663 | | | | 301 | | 1.62 | % | | | 74,614 | | | | 330 | | 1.78 | % | | | 73,341 | | | | 366 | | 2.02 | % | | | 71,760 | | | | 408 | | 2.26 | % | | | 70,900 | | | | 391 | | 2.20 | % |

Federal funds purchased and securities sold under agreements to repurchase | | | 2,649 | | | | 1 | | 0.11 | % | | | 3,734 | | | | 3 | | 0.33 | % | | | 3,199 | | | | 3 | | 0.41 | % | | | 4,458 | | | | 12 | | 1.08 | % | | | 9,906 | | | | 52 | | 2.07 | % |

Other short-term borrowings | | | 2,721 | | | | 8 | | 1.26 | % | | | 7,427 | | | | 13 | | 0.71 | % | | | 9,023 | | | | 17 | | 0.73 | % | | | 14,260 | | | | 57 | | 1.59 | % | | | 8,014 | | | | 50 | | 2.49 | % |

Long-term borrowings | | | 18,250 | | | | 159 | | 3.45 | % | | | 18,829 | | | | 174 | | 3.70 | % | | | 18,958 | | | | 184 | | 3.95 | % | | | 16,069 | | | | 180 | | 4.47 | % | | | 13,364 | | | | 154 | | 4.58 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total interest-bearing liabilities | | | 97,283 | | | $ | 469 | | 1.91 | % | | | 104,604 | | | $ | 520 | | 2.00 | % | | | 104,521 | | | $ | 570 | | 2.21 | % | | | 106,547 | | | $ | 657 | | 2.45 | % | | | 102,184 | | | $ | 647 | | 2.52 | % |

Net interest spread | | | | | | | | | 2.32 | % | | | | | | | | | 2.24 | % | | | | | | | | | 2.26 | % | | | | | | | | | 2.60 | % | | | | | | | | | 2.73 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Non-interest-bearing deposits | | | 21,122 | | | | | | | | | | 20,421 | | | | | | | | | | 18,896 | | | | | | | | | | 17,773 | | | | | | | | | | 17,691 | | | | | | | |

Other liabilities | | | 3,288 | | | | | | | | | | 3,567 | | | | | | | | | | 3,436 | | | | | | | | | | 3,344 | | | | | | | | | | 3,652 | | | | | | | |

Stockholders’ equity | | | 18,612 | | | | | | | | | | 17,495 | | | | | | | | | | 16,710 | | | | | | | | | | 20,410 | | | | | | | | | | 19,714 | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | $ | 140,305 | | | | | | | | | $ | 146,087 | | | | | | | | | $ | 143,563 | | | | | | | | | $ | 148,074 | | | | | | | | | $ | 143,241 | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net interest income/margin FTE basis | | | | | | $ | 853 | | 2.73 | % | | | | | | $ | 840 | | 2.62 | % | | | | | | $ | 817 | | 2.64 | % | | | | | | $ | 933 | | 2.96 | % | | | | | | $ | 931 | | 3.10 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (1) | Certain amounts in prior periods have been reclassified to reflect current period presentation |

| (2) | 3Q08 loan income includes a $43.1 million reduction for the impact of a leveraged lease tax settlement. The yield on loans adjusted to exclude the settlement would be 5.52% in 3Q08. |

FINANCIAL SUPPLEMENT TO

THIRD QUARTER 2009 EARNINGS RELEASE

PAGE 6

Regions Financial Corporation and Subsidiaries

Consolidated Average Daily Balances and Yield/Rate Analysis (1)

| | | | | | | | | | | | | | | | | | | | |

| | | Nine Months Ended September 30 | |

| | | 2009 | | | 2008 | |

($ amounts in millions; yields on taxable equivalent basis) | | Average

Balance | | | Revenue/

Expense | | Yield/

Rate | | | Average

Balance | | | Revenue/

Expense | | Yield/

Rate | |

Assets | | | | | | | | | | | | | | | | | | | | |

Interest-earning assets: | | | | | | | | | | | | | | | | | | | | |

Federal funds sold and securities purchased under agreements to resell | | $ | 550 | | | $ | 2 | | 0.57 | % | | $ | 955 | | | $ | 17 | | 2.31 | % |

Trading account assets | | | 1,185 | | | | 34 | | 3.80 | % | | | 1,520 | | | | 54 | | 4.75 | % |

Securities: | | | | | | | | | | | | | | | | | | | | |

Taxable securities | | | 19,263 | | | | 710 | | 4.92 | % | | | 16,835 | | | | 616 | | 4.89 | % |

Tax-exempt | | | 570 | | | | 27 | | 6.38 | % | | | 738 | | | | 47 | | 8.45 | % |

Loans held for sale | | | 1,709 | | | | 43 | | 3.37 | % | | | 611 | | | | 27 | | 5.93 | % |

Loans, net of unearned income | | | 95,453 | | | | 3,232 | | 4.53 | % | | | 97,087 | | | | 4,231 | | 5.82 | % |

Other earning assets | | | 7,385 | | | | 21 | | 0.38 | % | | | 620 | | | | 18 | | 3.89 | % |

| | | | | | | | | | | | | | | | | | | | |

Total interest-earning assets | | | 126,115 | | | | 4,069 | | 4.31 | % | | | 118,366 | | | | 5,010 | | 5.65 | % |

Allowance for loan losses | | | (2,061 | ) | | | | | | | | | (1,398 | ) | | | | | | |

Cash and due from banks | | | 2,258 | | | | | | | | | | 2,530 | | | | | | | |

Other non-earning assets | | | 16,995 | | | | | | | | | | 23,063 | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | $ | 143,307 | | | | | | | | | $ | 142,561 | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

Liabilities and Stockholders’ Equity | | | | | | | | | | | | | | | | | | | | |

Interest-bearing liabilities: | | | | | | | | | | | | | | | | | | | | |

Savings accounts | | $ | 3,958 | | | $ | 4 | | 0.12 | % | | $ | 3,761 | | | $ | 3 | | 0.12 | % |

Interest-bearing transaction accounts | | | 14,370 | | | | 30 | | 0.28 | % | | | 15,281 | | | | 107 | | 0.94 | % |

Money market accounts | | | 22,157 | | | | 145 | | 0.88 | % | | | 21,276 | | | | 280 | | 1.76 | % |

Time deposits | | | 32,972 | | | | 818 | | 3.32 | % | | | 29,892 | | | | 881 | | 3.94 | % |

Other | | | 417 | | | | — | | 0.11 | % | | | 2,347 | | | | 45 | | 2.55 | % |

| | | | | | | | | | | | | | | | | | | | |

Total interest-bearing deposits | | | 73,874 | | | | 997 | | 1.81 | % | | | 72,557 | | | | 1,316 | | 2.42 | % |

Federal funds purchased and securities sold under agreements to repurchase | | | 3,192 | | | | 7 | | 0.30 | % | | | 8,785 | | | | 159 | | 2.42 | % |

Other short-term borrowings | | | 6,368 | | | | 38 | | 0.80 | % | | | 6,839 | | | | 141 | | 2.76 | % |

Long-term borrowings | | | 18,676 | | | | 517 | | 3.70 | % | | | 12,650 | | | | 447 | | 4.72 | % |

| | | | | | | | | | | | | | | | | | | | |

Total interest-bearing liabilities | | | 102,110 | | | | 1,559 | | 2.04 | % | | | 100,831 | | | | 2,063 | | 2.73 | % |

Net interest spread | | | | | | | | | 2.27 | % | | | | | | | | | 2.92 | % |

| | | | | | | | | | | | | | | | | | | | |

Non-interest bearing deposits | | | 20,154 | | | | | | | | | | 17,702 | | | | | | | |

Other liabilities | | | 3,430 | | | | | | | | | | 4,248 | | | | | | | |

Stockholders’ equity | | | 17,613 | | | | | | | | | | 19,780 | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | $ | 143,307 | | | | | | | | | $ | 142,561 | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

Net interest income/margin FTE basis | | | | | | $ | 2,510 | | 2.66 | % | | | | | | $ | 2,947 | | 3.33 | % |

| | | | | | | | | | | | | | | | | | | | |

| (1) | Certain amounts in prior periods have been reclassified to reflect current period presentation |

FINANCIAL SUPPLEMENT TO

THIRD QUARTER 2009 EARNINGS RELEASE

PAGE 7

Regions Financial Corporation and Subsidiaries

Selected Ratios

| | | | | | | | | | | | | | | | | | | | |

| | | As of and for Quarter Ended | |

| | | 9/30/09 | | | 6/30/09 | | | 3/31/09 | | | 12/31/08 | | | 9/30/08 | |

Return on average assets* | | | (1.24 | %) | | | (0.67 | %) | | | 0.07 | % | | | NM | | | | 0.22 | % |

Return on average common equity* | | | (11.55 | %) | | | (6.96 | %) | | | 0.77 | % | | | NM | | | | 1.60 | % |

Return on average tangible common equity* (non-GAAP) | | | (19.48 | %) | | | (12.34 | %) | | | 1.43 | % | | | NM | | | | 4.20 | % |

Common equity per share | | $ | 12.53 | | | $ | 12.74 | | | $ | 19.43 | | | $ | 19.53 | | | $ | 28.48 | |

Tangible common book value per share (non-GAAP) | | $ | 7.40 | | | $ | 7.58 | | | $ | 10.57 | | | $ | 10.59 | | | $ | 10.84 | |

Stockholders’ equity to total assets | | | 13.21 | % | | | 13.12 | % | | | 11.84 | % | | | 11.50 | % | | | 13.66 | % |

Tangible common stockholders’ equity to tangible assets (non-GAAP) | | | 6.56 | % | | | 6.59 | % | | | 5.41 | % | | | 5.23 | % | | | 5.69 | % |

Tier 1 Common risk-based ratio (non-GAAP) (1) | | | 7.8 | % | | | 8.1 | % | | | 6.5 | % | | | 6.6 | % | | | 6.5 | % |

Tier 1 Capital (1) | | | 12.1 | % | | | 12.2 | % | | | 10.4 | % | | | 10.4 | % | | | 7.5 | % |

Total Risk-Based Capital (1) | | | 16.2 | % | | | 16.2 | % | | | 14.6 | % | | | 14.6 | % | | | 11.7 | % |

Allowance for credit losses as a percentage of loans, net of unearned income (2) | | | 2.90 | % | | | 2.43 | % | | | 2.02 | % | | | 1.95 | % | | | 1.57 | % |

Allowance for loan losses as a percentage of loans, net of unearned income | | | 2.83 | % | | | 2.37 | % | | | 1.94 | % | | | 1.87 | % | | | 1.49 | % |

Allowance for loan losses to non-performing loans | | | 0.82 | x | | | 0.87 | x | | | 1.13 | x | | | 1.74 | x | | | 1.02 | x |

Net interest margin (FTE) (3) | | | 2.73 | % | | | 2.62 | % | | | 2.64 | % | | | 2.96 | % | | | 3.10 | % |

Loans, net of unearned income, to total deposits | | | 97.76 | % | | | 101.50 | % | | | 102.30 | % | | | 107.17 | % | | | 110.64 | % |

Net charge-offs as a percentage of average loans* | | | 2.86 | % | | | 2.06 | % | | | 1.64 | % | | | 3.19 | % | | | 1.68 | % |

Non-performing assets (excluding loans 90 days past due) as a percentage of loans and other real estate | | | 4.40 | % | | | 3.55 | % | | | 2.43 | % | | | 1.76 | % | | | 1.79 | % |

Non-performing assets (excluding loans 90 days past due) as a percentage of loans and other real estate (4) | | | 3.99 | % | | | 3.17 | % | | | 2.02 | % | | | 1.33 | % | | | 1.66 | % |

Non-performing assets (including loans 90 days past due) as a percentage of loans and other real estate | | | 5.08 | % | | | 4.18 | % | | | 3.24 | % | | | 2.33 | % | | | 2.25 | % |

Non-performing assets (including loans 90 days past due) as a percentage of loans and other real estate (4) | | | 4.68 | % | | | 3.80 | % | | | 2.83 | % | | | 1.89 | % | | | 2.12 | % |

| (1) | Current quarter Tier 1 Common, Tier 1 and Total Risk-based Capital ratios are estimated |

| (2) | The allowance for credit losses reflects the allowance related to both loans on the balance sheet and exposure related to unfunded commitments and standby letters of credit |

| (3) | 3Q08 lower by 14 bps resulting from the impact of a leveraged lease tax settlement in the quarter |

| (4) | Excludes loans held for sale |

FINANCIAL SUPPLEMENT TO

THIRD QUARTER 2009 EARNINGS RELEASE

PAGE 8

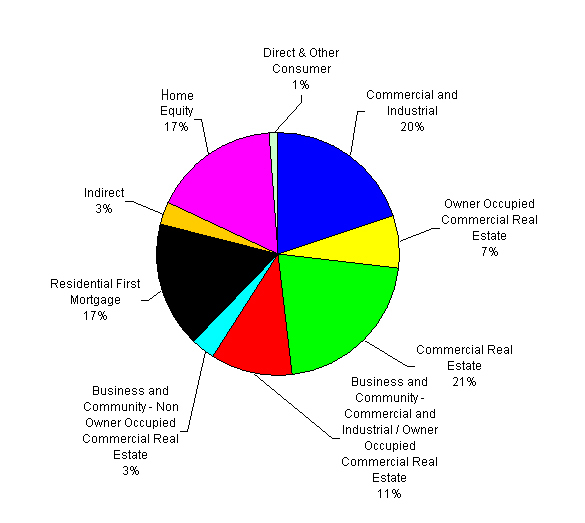

Loans (1)

Loan Portfolio - Period End Data

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

($ amounts in millions) | | 9/30/09 | | 6/30/09 | | 3/31/09 | | 12/31/08 | | 9/30/08 | | 9/30/09

vs. 6/30/09 | | | 9/30/09

vs. 9/30/08 | |

Commercial and industrial | | $ | 21,925 | | $ | 23,619 | | $ | 22,585 | | $ | 23,596 | | $ | 23,511 | | $ | (1,694 | ) | | -7.2 | % | | $ | (1,586 | ) | | -6.7 | % |

Commercial real estate - non-owner-occupied | | | 16,190 | | | 16,419 | | | 15,969 | | | 14,486 | | | 14,151 | | | (229 | ) | | -1.4 | % | | | 2,039 | | | 14.4 | % |

Commercial real estate - owner-occupied | | | 12,103 | | | 12,282 | | | 11,926 | | | 11,722 | | | 11,569 | | | (179 | ) | | -1.5 | % | | | 534 | | | 4.6 | % |

Construction - non-owner-occupied | | | 6,616 | | | 7,163 | | | 7,611 | | | 9,029 | | | 9,810 | | | (547 | ) | | -7.6 | % | | | (3,194 | ) | | -32.6 | % |

Construction - owner-occupied | | | 875 | | | 1,060 | | | 1,328 | | | 1,605 | | | 1,810 | | | (185 | ) | | -17.5 | % | | | (935 | ) | | -51.7 | % |

Residential first mortgage | | | 15,513 | | | 15,564 | | | 15,678 | | | 15,839 | | | 16,191 | | | (51 | ) | | -0.3 | % | | | (678 | ) | | -4.2 | % |

Home equity | | | 15,630 | | | 15,796 | | | 16,023 | | | 16,130 | | | 15,849 | | | (166 | ) | | -1.1 | % | | | (219 | ) | | -1.4 | % |

Indirect | | | 2,755 | | | 3,099 | | | 3,464 | | | 3,854 | | | 4,211 | | | (344 | ) | | -11.1 | % | | | (1,456 | ) | | -34.6 | % |

Other consumer | | | 1,147 | | | 1,147 | | | 1,102 | | | 1,158 | | | 1,610 | | | — | | | 0.0 | % | | | (463 | ) | | -28.8 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | $ | 92,754 | | $ | 96,149 | | $ | 95,686 | | $ | 97,419 | | $ | 98,712 | | $ | (3,395 | ) | | -3.5 | % | | $ | (5,958 | ) | | -6.0 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

|

| Loan Portfolio - Average Balances | |

| | | | | | | |

($ amounts in millions) | | 3Q09 | | 2Q09 | | 1Q09 | | 4Q08 | | 3Q08 | | 3Q09

vs. 2Q09 | | | 3Q09

vs. 3Q08 | |

Commercial and industrial | | $ | 22,443 | | $ | 22,707 | | $ | 23,095 | | $ | 24,122 | | $ | 22,916 | | $ | (264 | ) | | -1.2 | % | | $ | (473 | ) | | -2.1 | % |

Commercial real estate - non-owner-occupied | | | 16,470 | | | 16,081 | | | 15,215 | | | 14,313 | | | 13,836 | | | 389 | | | 2.4 | % | | | 2,634 | | | 19.0 | % |

Commercial real estate - owner-occupied | | | 12,188 | | | 11,983 | | | 11,773 | | | 11,574 | | | 11,371 | | | 205 | | | 1.7 | % | | | 817 | | | 7.2 | % |

Construction - non-owner-occupied | | | 7,010 | | | 7,474 | | | 8,420 | | | 9,802 | | | 9,837 | | | (464 | ) | | -6.2 | % | | | (2,827 | ) | | -28.7 | % |

Construction - owner-occupied | | | 944 | | | 1,198 | | | 1,524 | | | 1,782 | | | 2,205 | | | (254 | ) | | -21.2 | % | | | (1,261 | ) | | -57.2 | % |

Residential first mortgage | | | 15,508 | | | 15,593 | | | 15,708 | | | 16,005 | | | 16,304 | | | (85 | ) | | -0.5 | % | | | (796 | ) | | -4.9 | % |

Home equity | | | 15,714 | | | 15,940 | | | 16,115 | | | 16,036 | | | 15,659 | | | (226 | ) | | -1.4 | % | | | 55 | | | 0.4 | % |

Indirect | | | 2,923 | | | 3,276 | | | 3,660 | | | 4,043 | | | 4,214 | | | (353 | ) | | -10.8 | % | | | (1,291 | ) | | -30.6 | % |

Other consumer | | | 1,154 | | | 1,130 | | | 1,138 | | | 1,457 | | | 1,991 | | | 24 | | | 2.1 | % | | | (837 | ) | | -42.0 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | $ | 94,354 | | $ | 95,382 | | $ | 96,648 | | $ | 99,134 | | $ | 98,333 | | $ | (1,028 | ) | | -1.1 | % | | $ | (3,979 | ) | | -4.0 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (1) | Certain amounts in the prior periods have been reclassified to reflect current period presentation |

FINANCIAL SUPPLEMENT TO

THIRD QUARTER 2009 EARNINGS RELEASE

PAGE 9

Deposits (1)

Deposit Portfolio - Period End Data

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | 9/30/09 | | | 9/30/09 | |

($ amounts in millions) | | 9/30/09 | | 6/30/09 | | 3/31/09 | | 12/31/08 | | 9/30/08 | | vs. 6/30/09 | | | vs. 9/30/08 | |

Customer Deposits | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Interest-free deposits | | $ | 21,226 | | $ | 20,995 | | $ | 19,988 | | $ | 18,457 | | $ | 18,045 | | $ | 231 | | | 1.1 | % | | $ | 3,181 | | | 17.6 | % |

Interest-bearing checking | | | 13,688 | | | 14,140 | | | 14,800 | | | 15,022 | | | 14,616 | | | (452 | ) | | -3.2 | % | | | (928 | ) | | -6.3 | % |

Savings | | | 4,025 | | | 4,033 | | | 3,970 | | | 3,663 | | | 3,709 | | | (8 | ) | | -0.2 | % | | | 316 | | | 8.5 | % |

Money market - domestic | | | 22,327 | | | 21,571 | | | 19,969 | | | 19,471 | | | 17,098 | | | 756 | | | 3.5 | % | | | 5,229 | | | 30.6 | % |

Money market - foreign | | | 941 | | | 1,075 | | | 1,357 | | | 1,812 | | | 2,454 | | | (134 | ) | | -12.5 | % | | | (1,513 | ) | | -61.7 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Low-cost deposits | | | 62,207 | | | 61,814 | | | 60,084 | | | 58,425 | | | 55,922 | | | 393 | | | 0.6 | % | | | 6,285 | | | 11.2 | % |

Time deposits | | | 32,582 | | | 32,724 | | | 33,379 | | | 32,369 | | | 29,288 | | | (142 | ) | | -0.4 | % | | | 3,294 | | | 11.2 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total customer deposits | | | 94,789 | | | 94,538 | | | 93,463 | | | 90,794 | | | 85,210 | | | 251 | | | 0.3 | % | | | 9,579 | | | 11.2 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Corporate Treasury Deposits | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Time deposits | | | 91 | | | 188 | | | 73 | | | 110 | | | 1,123 | | | (97 | ) | | -51.6 | % | | | (1,032 | ) | | -91.9 | % |

Other | | | — | | | — | | | — | | | — | | | 2,888 | | | — | | | NM | | | | (2,888 | ) | | -100.0 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total corporate treasury deposits | | | 91 | | | 188 | | | 73 | | | 110 | | | 4,011 | | | (97 | ) | | -51.6 | % | | | (3,920 | ) | | -97.7 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total Deposits | | $ | 94,880 | | $ | 94,726 | | $ | 93,536 | | $ | 90,904 | | $ | 89,221 | | $ | 154 | | | 0.2 | % | | $ | 5,659 | | | 6.3 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

|

Deposit Portfolio - Average Balances | |

| | | | | | | | | | | | | 3Q09 | | | 3Q09 | |

($ amounts in millions) | | 3Q09 | | 2Q09 | | 1Q09 | | 4Q08 | | 3Q08 | | vs. 2Q09 | | | vs. 3Q08 | |

Customer Deposits | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Interest-free deposits | | $ | 21,122 | | $ | 20,421 | | $ | 18,896 | | $ | 17,773 | | $ | 17,691 | | $ | 701 | | | 3.4 | % | | $ | 3,431 | | | 19.4 | % |

Interest-bearing checking | | | 13,934 | | | 14,277 | | | 14,909 | | | 14,393 | | | 14,831 | | | (343 | ) | | -2.4 | % | | | (897 | ) | | -6.0 | % |

Savings | | | 4,038 | | | 4,029 | | | 3,804 | | | 3,691 | | | 3,774 | | | 9 | | | 0.2 | % | | | 264 | | | 7.0 | % |

Money market - domestic | | | 22,103 | | | 20,962 | | | 19,670 | | | 18,432 | | | 17,534 | | | 1,141 | | | 5.4 | % | | | 4,569 | | | 26.1 | % |

Money market - foreign | | | 1,004 | | | 1,176 | | | 1,534 | | | 2,133 | | | 2,860 | | | (172 | ) | | -14.6 | % | | | (1,856 | ) | | -64.9 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Low-cost deposits | | | 62,201 | | | 60,865 | | | 58,813 | | | 56,422 | | | 56,690 | | | 1,336 | | | 2.2 | % | | | 5,511 | | | 9.7 | % |

Time deposits | | | 32,481 | | | 33,221 | | | 32,814 | | | 31,442 | | | 27,770 | | | (740 | ) | | -2.2 | % | | | 4,711 | | | 17.0 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total customer deposits | | | 94,682 | | | 94,086 | | | 91,627 | | | 87,864 | | | 84,460 | | | 596 | | | 0.6 | % | | | 10,222 | | | 12.1 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Corporate Treasury Deposits | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Time deposits | | | 103 | | | 221 | | | 80 | | | 407 | | | 2,398 | | | (118 | ) | | -53.4 | % | | | (2,295 | ) | | -95.7 | % |

Other | | | — | | | 728 | | | 530 | | | 1,262 | | | 1,733 | | | (728 | ) | | -100.0 | % | | | (1,733 | ) | | -100.0 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total corporate treasury deposits | | | 103 | | | 949 | | | 610 | | | 1,669 | | | 4,131 | | | (846 | ) | | -89.1 | % | | | (4,028 | ) | | -97.5 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total Deposits | | $ | 94,785 | | $ | 95,035 | | $ | 92,237 | | $ | 89,533 | | $ | 88,591 | | $ | (250 | ) | | -0.3 | % | | $ | 6,194 | | | 7.0 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (1) | Certain amounts in the prior periods have been reclassified to reflect current period presentation |

FINANCIAL SUPPLEMENT TO

THIRD QUARTER 2009 EARNINGS RELEASE

PAGE 10

Pre-Tax Pre-Provision Net Revenue (“PPNR”) (2)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | 3Q09 | | | 3Q09 | |

($ amounts in millions) | | 3Q09 | | | 2Q09 | | | 1Q09 | | | 4Q08 | | | 3Q08 | | vs. 2Q09 | | | vs. 3Q08 | |

Net Interest Income | | $ | 845 | | | $ | 831 | | | $ | 809 | | | $ | 924 | | | $ | 922 | | | 14 | | | 1.7 | % | | $ | (77 | ) | | -8.4 | % |

Non-Interest Income | | | 772 | | | | 1,199 | | | | 1,066 | | | | 702 | | | | 719 | | | (427 | ) | | -35.6 | % | | | 53 | | | 7.4 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total Revenue | | | 1,617 | | | | 2,030 | | | | 1,875 | | | | 1,626 | | | | 1,641 | | | (413 | ) | | -20.3 | % | | | (24 | ) | | -1.5 | % |

Non-Interest Expense | | | 1,243 | | | | 1,231 | | | | 1,058 | | | | 7,273 | | | | 1,128 | | | 12 | | | 1.0 | % | | | 115 | | | 10.2 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Pre-tax Pre-provision Net Revenue | | $ | 374 | | | $ | 799 | | | $ | 817 | | | $ | (5,647 | ) | | $ | 513 | | | (425 | ) | | -53.2 | % | | | (139 | ) | | -27.1 | % |

Adjustments: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Securities gains, net | | | (4 | ) | | | (108 | ) | | | (53 | ) | | | — | | | | — | | | 104 | | | -96.3 | % | | | (4 | ) | | NM | |

Gain on sale of Visa shares | | | — | | | | (80 | ) | | | — | | | | — | | | | — | | | 80 | | | NM | | | | — | | | NM | |

Leveraged lease termination gains | | | (4 | ) | | | (189 | ) | | | (323 | ) | | | — | | | | — | | | 185 | | | -97.9 | % | | | (4 | ) | | NM | |

Gain on extinguishment of debt | | | — | | | | (61 | ) | | | — | | | | — | | | | — | | | 61 | | | NM | | | | — | | | NM | |

Impairment (recapture) of MSR’s | | | — | | | | — | | | | — | | | | 99 | | | | 11 | | | — | | | NM | | | | (11 | ) | | NM | |

FDIC special assessment | | | — | | | | 64 | | | | — | | | | — | | | | — | | | (64 | ) | | NM | | | | — | | | NM | |

Securities impairment, net | | | 3 | | | | 69 | | | | 3 | | | | 13 | | | | 9 | | | (66 | ) | | NM | | | | (6 | ) | | NM | |

Branch consolidation costs (1) | | | 41 | | | | — | | | | — | | | | — | | | | — | | | 41 | | | NM | | | | 41 | | | NM | |

Merger-related charges | | | — | | | | — | | | | — | | | | — | | | | 25 | | | — | | | NM | | | | (25 | ) | | NM | |

Goodwill impairment | | | — | | | | — | | | | — | | | | 6,000 | | | | — | | | — | | | NM | | | | — | | | NM | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total adjustments | | | 36 | | | | (305 | ) | | | (373 | ) | | | 6,112 | | | | 45 | | | 341 | | | -111.8 | % | | | (9 | ) | | NM | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Adjusted PPNR | | $ | 410 | | | $ | 494 | | | $ | 444 | | | $ | 465 | | | $ | 558 | | $ | (84 | ) | | -17.0 | % | | $ | (148 | ) | | -26.5 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (1) | Includes $9 million of net occupancy expense, $7 million of furniture and equipment expense and $25 million in valuation charges. |

| (2) | Certain amounts in the prior periods have been reclassified to reflect current period presentation |

FINANCIAL SUPPLEMENT TO

THIRD QUARTER 2009 EARNINGS RELEASE

PAGE 11

Non-Interest Income and Expense from Continuing Operations (1)

Non-Interest Income and Expense

Non-Interest Income

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | 3Q09 | | | 3Q09 | |

($ amounts in millions) | | 3Q09 | | 2Q09 | | 1Q09 | | 4Q08 | | 3Q08 | | vs. 2Q09 | | | vs. 3Q08 | |

Service charges on deposit accounts | | $ | 300 | | $ | 288 | | $ | 269 | | $ | 288 | | $ | 294 | | $ | 12 | | | 4.2 | % | | $ | 6 | | | 2.0 | % |

Brokerage, investment banking and capital markets | | | 252 | | | 263 | | | 217 | | | 241 | | | 241 | | | (11 | ) | | -4.2 | % | | | 11 | | | 4.6 | % |

Mortgage income | | | 76 | | | 64 | | | 73 | | | 34 | | | 33 | | | 12 | | | 18.8 | % | | | 43 | | | 130.3 | % |

Trust department income | | | 49 | | | 48 | | | 46 | | | 52 | | | 66 | | | 1 | | | 2.1 | % | | | (17 | ) | | -25.8 | % |

Securities gains, net | | | 4 | | | 108 | | | 53 | | | — | | | — | | | (104 | ) | | -96.3 | % | | | 4 | | | NM | |

Insurance income | | | 25 | | | 27 | | | 28 | | | 26 | | | 26 | | | (2 | ) | | -7.4 | % | | | (1 | ) | | -3.8 | % |

Leveraged lease termination gains | | | 4 | | | 189 | | | 323 | | | — | | | — | | | (185 | ) | | -97.9 | % | | | 4 | | | NM | |

Visa shares sale gain | | | — | | | 80 | | | — | | | — | | | — | | | (80 | ) | | NM | | | | — | | | NM | |

Gain on early extinguishment of debt | | | — | | | 61 | | | — | | | — | | | — | | | (61 | ) | | NM | | | | — | | | NM | |

Other | | | 62 | | | 71 | | | 57 | | | 61 | | | 59 | | | (9 | ) | | -12.7 | % | | | 3 | | | 5.1 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total non-interest income | | $ | 772 | | $ | 1,199 | | $ | 1,066 | | $ | 702 | | $ | 719 | | $ | (427 | ) | | -35.6 | % | | $ | 53 | | | 7.4 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | |

Non-Interest Expense (2) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | 3Q09 | | | 3Q09 | |

($ amounts in millions) | | 3Q09 | | 2Q09 | | 1Q09 | | 4Q08 | | 3Q08 | | vs. 2Q09 | | | vs. 3Q08 | |

Salaries and employee benefits | | $ | 578 | | $ | 586 | | $ | 539 | | $ | 562 | | $ | 527 | | $ | (8 | ) | | -1.4 | % | | $ | 51 | | | 9.7 | % |

Net occupancy expense | | | 121 | | | 112 | | | 107 | | | 114 | | | 110 | | | 9 | | | 8.0 | % | | | 11 | | | 10.0 | % |

Furniture and equipment expense | | | 83 | | | 78 | | | 76 | | | 79 | | | 88 | | | 5 | | | 6.4 | % | | | (5 | ) | | -5.7 | % |

Impairment (recapture) of MSR’s | | | — | | | — | | | — | | | 99 | | | 11 | | | — | | | NM | | | | (11 | ) | | NM | |

Professional fees | | | 98 | | | 50 | | | 53 | | | 74 | | | 52 | | | 48 | | | 96.0 | % | | | 46 | | | 88.5 | % |

Marketing expense | | | 20 | | | 20 | | | 17 | | | 21 | | | 23 | | | — | | | 0.0 | % | | | (3 | ) | | -13.0 | % |

Amortization of core deposit intangible | | | 30 | | | 30 | | | 31 | | | 32 | | | 33 | | | — | | | 0.0 | % | | | (3 | ) | | -9.1 | % |

Amortization of MSR’s | | | — | | | — | | | — | | | 16 | | | 13 | | | — | | | NM | | | | (13 | ) | | NM | |

Other real estate owned expense | | | 61 | | | 24 | | | 26 | | | 32 | | | 44 | | | 37 | | | 154.2 | % | | | 17 | | | 38.6 | % |

Other-than-temporary impairments, net | | | 3 | | | 69 | | | 3 | | | 13 | | | 9 | | | (66 | ) | | -95.7 | % | | | (6 | ) | | NM | |

FDIC premiums - special assessment | | | — | | | 64 | | | — | | | — | | | — | | | (64 | ) | | NM | | | | — | | | NM | |

FDIC premiums | | | 56 | | | 43 | | | 10 | | | 6 | | | 4 | | | 13 | | | 30.2 | % | | | 52 | | | NM | |

Valuation charges associated with branch consolidations | | | 25 | | | — | | | — | | | — | | | — | | | 25 | | | NM | | | | 25 | | | NM | |

Other | | | 168 | | | 155 | | | 196 | | | 225 | | | 189 | | | 13 | | | 8.4 | % | | | (21 | ) | | -11.1 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total non-interest expense, excluding merger and goodwill impairment charges | | | 1,243 | | | 1,231 | | | 1,058 | | | 1,273 | | | 1,103 | | | 12 | | | 1.0 | % | | | 140 | | | 12.7 | % |

Merger-related charges | | | — | | | — | | | — | | | — | | | 25 | | | — | | | NM | | | | (25 | ) | | -100.0 | % |

Goodwill impairment charge | | | — | | | — | | | — | | | 6,000 | | | — | | | — | | | NM | | | | — | | | NM | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total non-interest expense | | $ | 1,243 | | $ | 1,231 | | $ | 1,058 | | $ | 7,273 | | $ | 1,128 | | $ | 12 | | | 1.0 | % | | $ | 115 | | | 10.2 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (1) | Certain amounts in prior periods have been reclassified to reflect current period presentation |

| (2) | Individual expense categories are presented excluding merger-related charges and goodwill impairment, which are presented in separate line items in the above table |

| | • | | Non-interest revenues essentially unchanged, excluding prior quarter’s gains related to a trust preferred exchange, Visa shares and other securities sales and leveraged lease terminations |

| | • | | Service charges increased $12 million linked quarter, largely reflecting higher level of customer transactions and new account growth |

| | • | | Brokerage, investment banking and capital markets income declined $11 million or 4% linked quarter, primarily driven by lower fees from investment banking and fixed income capital markets |

| | • | | Mortgage income remained strong, increasing $12 million, or 19% linked quarter, benefiting from MSR and related hedge improvement |

| | • | | 2Q09 reflects both the sale of approximately $1.4 billion of agency debentures ($108 million gain) and the sale of Visa shares ($80 million gain). The proceeds from the sale of the agency debentures were reinvested in U.S. government agency mortgage-backed securities classified as available for sale, as part of Regions’ asset/liability management strategy. |

| | • | | 1Q09 securities gains reflect sale of approximately $656 million of U.S. Treasury securities with the proceeds reinvested in U.S. government agency mortgage-backed securities classified as available for sale, as part of Regions’ asset/liability management strategy |

| | • | | Leveraged lease termination gains reflect revenue recorded as a result of Regions unwinding certain leveraged lease transactions. These amounts totaled $4 million in 3Q09, $189 million in 2Q09 and $323 million in 1Q09; however these amounts were offset by $4 million, $196 million and $315 million in increased tax expense, respectively, resulting in a nominal impact to net income. |

| | • | | Non-interest expense increased 1% linked quarter, however when excluding the second quarter’s securities impairment charge and FDIC special assessment, and the current quarter’s branch consolidation charges, non-interest expense increased 9% linked quarter |

| | • | | Salaries and employee benefits declined $8 million linked quarter, primarily due to headcount reductions (declined 1,789 since 12/31/08), and lower brokerage-related incentive costs |

| | • | | Professional fees increased $48 million linked quarter reflecting higher legal costs. |

| | • | | Other real estate owned expense rose $37 million due to increasing property valuation adjustments and higher levels of foreclosed properties. |

| | • | | Current quarter’s $41 million branch consolidation charge includes $9 million of net occupancy expense, $7 million of furniture and equipment expense and $25 million in valuation charges. |

| | • | | 2Q09 non-interest expense was negatively impacted by higher FDIC insurance expenses, including a $64 million special assessment, and $69 million of securities valuation charges |

FINANCIAL SUPPLEMENT TO

THIRD QUARTER 2009 EARNINGS RELEASE

PAGE 12

Morgan Keegan

Morgan Keegan

Summary Income Statement (1)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | 3Q09 | | | 3Q09 | |

($ amounts in millions) | | 3Q09 | | 2Q09 | | 1Q09 | | 4Q08 | | 3Q08 | | vs. 2Q09 | | | vs. 3Q08 | |

Revenues: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Commissions | | $ | 53 | | $ | 48 | | $ | 49 | | $ | 56 | | $ | 61 | | $ | 5 | | | 10.4 | % | | $ | (8 | ) | | -13.1 | % |

Principal transactions | | | 116 | | | 122 | | | 94 | | | 98 | | | 46 | | | (6 | ) | | -4.9 | % | | | 70 | | | 152.2 | % |

Investment banking | | | 50 | | | 56 | | | 33 | | | 43 | | | 41 | | | (6 | ) | | -10.7 | % | | | 9 | | | 22.0 | % |

Interest | | | 17 | | | 19 | | | 22 | | | 29 | | | 37 | | | (2 | ) | | -10.5 | % | | | (20 | ) | | -54.1 | % |

Trust fees and services | | | 47 | | | 44 | | | 41 | | | 45 | | | 61 | | | 3 | | | 6.8 | % | | | (14 | ) | | -23.0 | % |

Investment advisory | | | 44 | | | 32 | | | 29 | | | 50 | | | 49 | | | 12 | | | 37.5 | % | | | (5 | ) | | -9.9 | % |

Other | | | 6 | | | 16 | | | 7 | | | 13 | | | 8 | | | (10 | ) | | -62.5 | % | | | (2 | ) | | -25.0 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total revenues | | | 333 | | | 337 | | | 275 | | | 334 | | | 303 | | | (4 | ) | | -1.2 | % | | | 30 | | | 10.0 | % |

Expenses: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Interest expense | | | 3 | | | 5 | | | 6 | | | 14 | | | 20 | | | (2 | ) | | -40.0 | % | | | (17 | ) | | -85.0 | % |

Non-interest expense | | | 284 | | | 285 | | | 248 | | | 277 | | | 234 | | | (1 | ) | | -0.4 | % | | | 50 | | | 21.4 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total expenses | | | 287 | | | 290 | | | 254 | | | 291 | | | 254 | | | (3 | ) | | -1.0 | % | | | 33 | | | 13.0 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Income before income taxes | | | 46 | | | 47 | | | 21 | | | 43 | | | 49 | | | (1 | ) | | -2.1 | % | | | (3 | ) | | -5.5 | % |

Income taxes | | | 17 | | | 17 | | | 8 | | | 15 | | | 18 | | | — | | | 0.0 | % | | | (1 | ) | | -5.6 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net income | | $ | 29 | | $ | 30 | | $ | 13 | | $ | 28 | | $ | 31 | | $ | (1 | ) | | -3.3 | % | | $ | (2 | ) | | -6.5 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Breakout of Revenue by Division

| | | | | | | | | | | | | | | | | | | | | | | | |

($ amounts in millions) | | Private

Client | | | Fixed-

Income

Capital

Markets | | | Equity

Capital

Markets | | | Regions

MK

Trust | | | Asset

Management | | | Interest

& Other | |

Three months ended September 30, 2009 | | | | | | | | | | | | | | | | | | | | | | | | |

$ amount of revenue | | $ | 83 | | | $ | 108 | | | $ | 22 | | | $ | 51 | | | $ | 45 | | | $ | 24 | |

% of gross revenue | | | 24.9 | % | | | 32.5 | % | | | 6.6 | % | | | 15.3 | % | | | 13.5 | % | | | 7.2 | % |

Three months ended June 30, 2009 | | | | | | | | | | | | | | | | | | | | | | | | |

$ amount of revenue | | $ | 78 | | | $ | 120 | | | $ | 26 | | | $ | 49 | | | $ | 43 | | | $ | 21 | |

% of gross revenue | | | 23.2 | % | | | 35.4 | % | | | 7.6 | % | | | 14.5 | % | | | 12.7 | % | | | 6.4 | % |

Nine months ended September 30, 2009 | | | | | | | | | | | | | | | | | | | | | | | | |

$ amount of revenue | | $ | 235 | | | $ | 333 | | | $ | 60 | | | $ | 148 | | | $ | 119 | | | $ | 50 | |

% of gross revenue | | | 24.9 | % | | | 35.2 | % | | | 6.3 | % | | | 15.7 | % | | | 12.6 | % | | | 5.3 | % |

Nine months ended September 30, 2008 | | | | | | | | | | | | | | | | | | | | | | | | |

$ amount of revenue | | $ | 258 | | | $ | 260 | | | $ | 105 | | | $ | 177 | | | $ | 131 | | | $ | 75 | |

% of gross revenue | | | 25.6 | % | | | 25.8 | % | | | 10.4 | % | | | 17.6 | % | | | 13.0 | % | | | 7.6 | % |

| (1) | Certain amounts in the prior periods have been reclassified to reflect current period presentation |

| | • | | Fixed-Income Capital Markets revenue, while down versus prior quarter, remained solid, driven by institutional customers’ demand for government, mortgage-backed and municipal securities |

| | • | | Private Client revenue increased 6% versus the previous quarter, reflecting incremental improvements in the equity markets as well as the addition of new financial advisors |

| | • | | Trust and Asset Management revenues improved as a result of strong equity markets, driving customer and trust assets up by 6% and 4%, respectively |

| | • | | New accounts openings continue to rise with the addition of 16,200 in the current quarter, bringing year-to-date gross new account additions to 64,500 |

FINANCIAL SUPPLEMENT TO

THIRD QUARTER 2009 EARNINGS RELEASE

PAGE 13

Credit Quality (1)

Credit Quality

| | | | | | | | | | | | | | | | | | | | |

| | | As of and for Quarter Ended | |

($ in millions) | | 9/30/09 | | | 6/30/09 | | | 3/31/09 | | | 12/31/08 | | | 9/30/08 | |

Allowance for credit losses (ACL) | | $ | 2,690 | | | $ | 2,335 | | | $ | 1,935 | | | $ | 1,900 | | | $ | 1,546 | |

Provision for loan losses | | | 1,025 | | | | 912 | | | | 425 | | | | 1,150 | | | | 417 | |

Provision for unfunded credit losses | | | 10 | | | | (21 | ) | | | — | | | | (1 | ) | | | 9 | |

Net loans charged-off:* | | | | | | | | | | | | | | | | | | | | |

Commercial and industrial | | | 137 | | | | 84 | | | | 58 | | | | 73 | | | | 51 | |

Commercial real estate - non-owner-occupied | | | 196 | | | | 90 | | | | 87 | | | | 245 | | | | 50 | |

Commercial real estate - owner-occupied | | | 17 | | | | 15 | | | | 12 | | | | 32 | | | | 9 | |

Construction - non-owner-occupied | | | 148 | | | | 111 | | | | 66 | | | | 301 | | | | 194 | |

Construction - owner-occupied | | | 2 | | | | 3 | | | | 4 | | | | 4 | | | | 5 | |

Residential first mortgage | | | 57 | | | | 51 | | | | 39 | | | | 41 | | | | 18 | |

Home equity | | | 94 | | | | 113 | | | | 95 | | | | 69 | | | | 63 | |

Indirect | | | 10 | | | | 11 | | | | 16 | | | | 15 | | | | 10 | |

Other consumer | | | 19 | | | | 13 | | | | 13 | | | | 16 | | | | 16 | |

| | | | | | | | | | | | | | | | | | | | |

Total | | $ | 680 | | | $ | 491 | | | $ | 390 | | | $ | 796 | | | $ | 416 | |

| | | | | | | | | | | | | | | | | | | | |

Net loan charge-offs as a % of average loans, annualized * | | | | | | | | | | | | | | | | | | | | |

Commercial and industrial | | | 2.43 | % | | | 1.49 | % | | | 1.02 | % | | | 1.20 | % | | | 0.89 | % |

Commercial real estate - non-owner-occupied | | | 4.74 | % | | | 2.23 | % | | | 2.30 | % | | | 6.80 | % | | | 1.45 | % |

Commercial real estate - owner-occupied | | | 0.55 | % | | | 0.51 | % | | | 0.42 | % | | | 1.10 | % | | | 0.31 | % |

Construction - non-owner-occupied | | | 8.40 | % | | | 5.94 | % | | | 3.18 | % | | | 12.20 | % | | | 7.83 | % |

Construction - owner-occupied | | | 0.88 | % | | | 1.00 | % | | | 1.06 | % | | | 0.89 | % | | | 0.90 | % |

Residential first mortgage | | | 1.45 | % | | | 1.31 | % | | | 1.02 | % | | | 1.05 | % | | | 0.45 | % |

Home equity | | | 2.37 | % | | | 2.85 | % | | | 2.38 | % | | | 1.72 | % | | | 1.59 | % |

Indirect | | | 1.46 | % | | | 1.31 | % | | | 1.74 | % | | | 1.43 | % | | | 0.96 | % |

Other consumer | | | 6.21 | % | | | 4.78 | % | | | 4.70 | % | | | 4.38 | % | | | 3.21 | % |

| | | | | | | | | | | | | | | | | | | | |

Total | | | 2.86 | % | | | 2.06 | % | | | 1.64 | % | | | 3.19 | % | | | 1.68 | % |

| | | | | | | | | | | | | | | | | | | | |

Non-accrual loans | | $ | 3,216 | | | $ | 2,618 | | | $ | 1,641 | | | $ | 1,052 | | | $ | 1,441 | |

Foreclosed properties | | | 503 | | | | 439 | | | | 294 | | | | 243 | | | | 201 | |

| | | | | | | | | | | | | | | | | | | | |

Non-performing assets, excluding loans held for sale | | $ | 3,719 | | | $ | 3,057 | | | $ | 1,935 | | | $ | 1,295 | | | $ | 1,642 | |

Non-performing loans held for sale | | | 380 | | | | 371 | | | | 393 | | | | 423 | | | | 129 | |

| | | | | | | | | | | | | | | | | | | | |

Non-performing assets (NPAs) | | $ | 4,099 | | | $ | 3,428 | | | $ | 2,328 | | | $ | 1,718 | | | $ | 1,771 | |

| | | | | | | | | | | | | | | | | | | | |

Loans past due > 90 days* | | $ | 643 | | | $ | 613 | | | $ | 782 | | | $ | 554 | | | $ | 457 | |

Restructured loans not included in categories above | | $ | 1,416 | | | $ | 1,178 | | | $ | 737 | | | $ | 455 | | | $ | 139 | |

Credit Ratios: | | | | | | | | | | | | | | | | | | | | |

ACL/Loans, net | | | 2.90 | % | | | 2.43 | % | | | 2.02 | % | | | 1.95 | % | | | 1.57 | % |

ALL/Loans, net | | | 2.83 | % | | | 2.37 | % | | | 1.94 | % | | | 1.87 | % | | | 1.49 | % |

NPAs (ex. 90+ past due)/Loans and foreclosed properties | | | 4.40 | % | | | 3.55 | % | | | 2.43 | % | | | 1.76 | % | | | 1.79 | % |

NPAs (ex. 90+ past due)/Loans and foreclosed properties - excludes loans held for sale | | | 3.99 | % | | | 3.17 | % | | | 2.02 | % | | | 1.33 | % | | | 1.66 | % |

NPAs (inc. 90+ past due)/Loans and foreclosed properties | | | 5.08 | % | | | 4.18 | % | | | 3.24 | % | | | 2.33 | % | | | 2.25 | % |

NPAs (inc. 90+ past due)/Loans and foreclosed properties - excludes loans held for sale | | | 4.68 | % | | | 3.80 | % | | | 2.83 | % | | | 1.89 | % | | | 2.12 | % |

| * | See pages 14-17 for loan portfolio (risk view) breakout |

Allowance for Credit Losses

| | | | | | | | |

($ amounts in millions) | | Nine Months Ended

September 30 | |

| | 2009 | | | 2008 | |

Balance at beginning of year | | $ | 1,900 | | | $ | 1,379 | |

Net loans charged-off | | | (1,561 | ) | | | (751 | ) |

Allowance allocated to sold loans | | | — | | | | (5 | ) |

Provision for loan losses | | | 2,362 | | | | 907 | |

Provision for unfunded credit commitments | | | (11 | ) | | | 16 | |

| | | | | | | | |

Balance at end of period | | $ | 2,690 | | | $ | 1,546 | |

| | | | | | | | |

Components: | | | | | | | | |

Allowance for loan losses | | $ | 2,627 | | | $ | 1,472 | |

Reserve for unfunded credit commitments | | | 63 | | | | 74 | |

| | | | | | | | |

Allowance for credit losses | | $ | 2,690 | | | $ | 1,546 | |

| | | | | | | | |

| (1) | Certain amounts in prior periods have been reclassified to reflect current period presentation |

FINANCIAL SUPPLEMENT TO

THIRD QUARTER 2009 EARNINGS RELEASE

PAGE 14

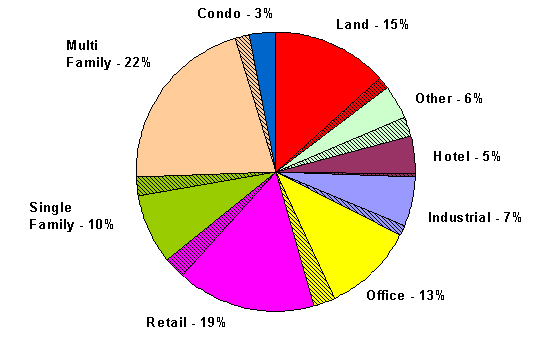

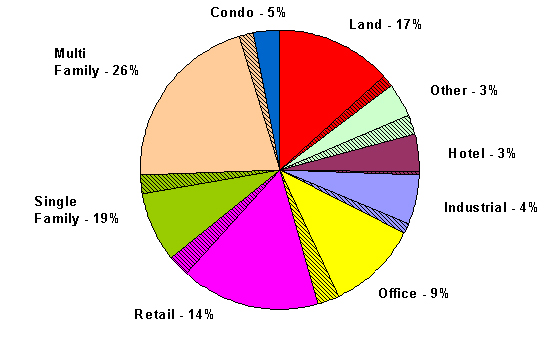

Loan Portfolio - Risk View

Total Loan Portfolio

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

($ in millions) | | Ending Balance | | % of Total Loans | |

| | 3Q09 | | 2Q09 | | 1Q09 | | 4Q08 | | 3Q08 | | 3Q09 | | | 2Q09 | | | 1Q09 | | | 4Q08 | | | 3Q08 | |

Commercial | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

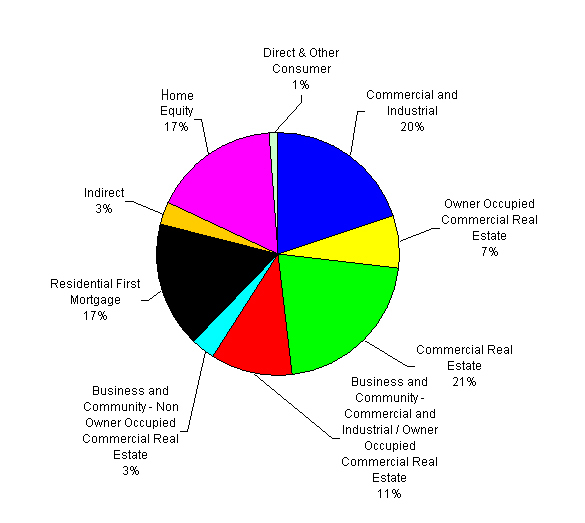

Commercial and Industrial/Leases | | $ | 18,442 | | $ | 20,003 | | $ | 18,853 | | $ | 19,581 | | $ | 19,221 | | 20 | % | | 21 | % | | 20 | % | | 20 | % | | 19 | % |

Commercial Real Estate - Owner-Occupied Mortgages | | | 5,461 | | | 5,573 | | | 5,147 | | | 4,780 | | | 4,646 | | 6 | % | | 6 | % | | 5 | % | | 5 | % | | 5 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total Commercial | | | 23,903 | | | 25,576 | | | 24,000 | | | 24,361 | | | 23,867 | | 26 | % | | 27 | % | | 25 | % | | 25 | % | | 24 | % |

Commercial Real Estate | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

CRE - Non-Owner-Occupied Mortgages | | | 13,030 | | | 13,034 | | | 12,425 | | | 10,732 | | | 10,306 | | 14 | % | | 14 | % | | 13 | % | | 11 | % | | 11 | % |

Non-Owner Occupied Construction | | | 6,472 | | | 6,961 | | | 7,316 | | | 8,624 | | | 9,325 | | 7 | % | | 7 | % | | 8 | % | | 9 | % | | 10 | % |

Owner Occupied Construction | | | 649 | | | 807 | | | 1,023 | | | 1,235 | | | 1,353 | | 1 | % | | 1 | % | | 1 | % | | 1 | % | | 1 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Construction | | | 7,121 | | | 7,768 | | | 8,339 | | | 9,859 | | | 10,678 | | 8 | % | | 8 | % | | 9 | % | | 10 | % | | 11 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total Commercial Real Estate | | | 20,151 | | | 20,802 | | | 20,765 | | | 20,591 | | | 20,984 | | 22 | % | | 22 | % | | 22 | % | | 21 | % | | 22 | % |

Business and Community Banking | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Commercial and Industrial | | | 3,483 | | | 3,616 | | | 3,732 | | | 4,015 | | | 4,290 | | 4 | % | | 4 | % | | 4 | % | | 4 | % | | 4 | % |

Commercial Real Estate - Owner-Occupied Mortgages | | | 6,642 | | | 6,709 | | | 6,779 | | | 6,942 | | | 6,923 | | 7 | % | | 7 | % | | 7 | % | | 7 | % | | 7 | % |

CRE - Non-Owner-Occupied Mortgages | | | 3,160 | | | 3,385 | | | 3,543 | | | 3,754 | | | 3,845 | | 3 | % | | 4 | % | | 4 | % | | 4 | % | | 4 | % |

Non-Owner Occupied Construction | | | 144 | | | 202 | | | 295 | | | 405 | | | 485 | | 0 | % | | 0 | % | | 0 | % | | 0 | % | | 0 | % |

Owner Occupied Construction | | | 225 | | | 253 | | | 305 | | | 370 | | | 457 | | 0 | % | | 0 | % | | 0 | % | | 0 | % | | 0 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Construction | | | 369 | | | 455 | | | 600 | | | 775 | | | 942 | | 0 | % | | 0 | % | | 1 | % | | 1 | % | | 1 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total Business and Community Banking | | | 13,654 | | | 14,165 | | | 14,654 | | | 15,486 | | | 16,000 | | 14 | % | | 15 | % | | 15 | % | | 16 | % | | 16 | % |

Residential First Mortgage | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

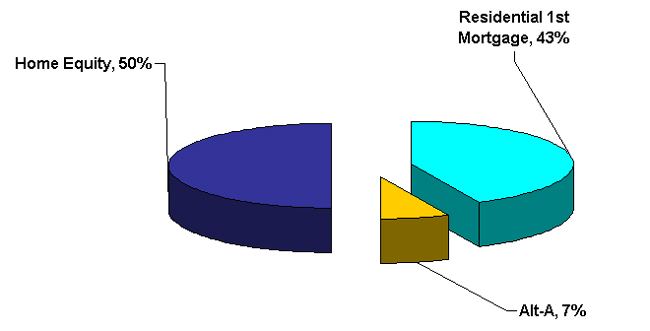

Alt-A | | | 2,284 | | | 2,359 | | | 2,451 | | | 2,549 | | | 2,615 | | 3 | % | | 2 | % | | 2 | % | | 2 | % | | 2 | % |

Residential First Mortgage | | | 13,229 | | | 13,205 | | | 13,227 | | | 13,290 | | | 13,576 | | 14 | % | | 14 | % | | 14 | % | | 14 | % | | 14 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total Residential First Mortgage | | | 15,513 | | | 15,564 | | | 15,678 | | | 15,839 | | | 16,191 | | 17 | % | | 16 | % | | 16 | % | | 16 | % | | 16 | % |

Consumer | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Home Equity Lending | | | 15,630 | | | 15,796 | | | 16,023 | | | 16,130 | | | 15,849 | | 17 | % | | 16 | % | | 17 | % | | 17 | % | | 16 | % |

Indirect Lending | | | 2,755 | | | 3,099 | | | 3,464 | | | 3,854 | | | 4,211 | | 3 | % | | 3 | % | | 4 | % | | 4 | % | | 4 | % |

Direct Lending | | | 797 | | | 786 | | | 783 | | | 826 | | | 873 | | 1 | % | | 1 | % | | 1 | % | | 1 | % | | 1 | % |

Other Consumer | | | 351 | | | 361 | | | 319 | | | 332 | | | 737 | | 0 | % | | 0 | % | | 0 | % | | 0 | % | | 1 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total Other Consumer | | | 19,533 | | | 20,042 | | | 20,590 | | | 21,142 | | | 21,670 | | 21 | % | | 20 | % | | 22 | % | | 22 | % | | 22 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total Loans | | $ | 92,754 | | $ | 96,149 | | $ | 95,686 | | $ | 97,419 | | $ | 98,712 | | 100 | % | | 100 | % | | 100 | % | | 100 | % | | 100 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

FINANCIAL SUPPLEMENT TO

THIRD QUARTER 2009 EARNINGS RELEASE

PAGE 15

Loan Portfolio - Risk View

Net Charge-offs

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

($ in millions) | | Net Charge-offs (1) | | % of Loans* (1) | |

| | 3Q09 | | 2Q09 | | 1Q09 | | 4Q08 | | 3Q08 | | 3Q09 | | | 2Q09 | | | 1Q09 | | | 4Q08 | | | 3Q08 | |

Commercial | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Commercial and Industrial/Leases | | $ | 87 | | $ | 46 | | $ | 27 | | $ | 43 | | $ | 28 | | 1.83 | % | | 0.97 | % | | 0.57 | % | | 0.86 | % | | 0.61 | % |

Commercial Real Estate - Owner-Occupied Mortgages | | | 15 | | | 14 | | | 10 | | | 26 | | | 8 | | 1.08 | % | | 1.06 | % | | 0.86 | % | | 2.21 | % | | 0.72 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total Commercial | | | 102 | | | 60 | | | 37 | | | 69 | | | 36 | | 1.66 | % | | 0.99 | % | | 0.63 | % | | 1.11 | % | | 0.63 | % |

Commercial Real Estate | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

CRE - Non-Owner-Occupied Mortgages | | | 193 | | | 88 | | | 83 | | | 241 | | | 49 | | 5.81 | % | | 2.80 | % | | 2.91 | % | | 9.14 | % | | 2.11 | % |

Non-Owner Occupied Construction | | | 147 | | | 110 | | | 66 | | | 300 | | | 189 | | 8.57 | % | | 6.08 | % | | 3.30 | % | | 12.77 | % | | 7.52 | % |

Owner Occupied Construction | | | 2 | | | 3 | | | 3 | | | 4 | | | 5 | | 1.10 | % | | 1.32 | % | | 1.08 | % | | 1.08 | % | | 1.06 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Construction | | | 149 | | | 113 | | | 69 | | | 304 | | | 194 | | 7.88 | % | | 5.54 | % | | 3.02 | % | | 11.30 | % | | 6.50 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total Commercial Real Estate | | | 342 | | | 201 | | | 152 | | | 545 | | | 243 | | 6.56 | % | | 3.88 | % | | 2.96 | % | | 10.23 | % | | 4.58 | % |

Business and Community Banking | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Commercial and Industrial | | | 49 | | | 38 | | | 31 | | | 30 | | | 23 | | 5.45 | % | | 4.16 | % | | 3.23 | % | | 2.84 | % | | 2.12 | % |

Commercial Real Estate - Owner-Occupied Mortgages | | | 2 | | | 1 | | | 2 | | | 6 | | | 1 | | 0.11 | % | | 0.08 | % | | 0.11 | % | | 0.36 | % | | 0.06 | % |

CRE - Non-Owner-Occupied Mortgages | | | 3 | | | 2 | | | 4 | | | 4 | | | 1 | | 0.40 | % | | 0.15 | % | | 0.39 | % | | 0.35 | % | | 0.15 | % |

Non-Owner Occupied Construction | | | 1 | | | 1 | | | — | | | 1 | | | 5 | | 1.48 | % | | 1.13 | % | | 0.45 | % | | 0.67 | % | | 2.76 | % |

Owner Occupied Construction | | | — | | | — | | | 1 | | | — | | | — | | 0.22 | % | | 0.55 | % | | 0.99 | % | | 0.34 | % | | 0.10 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Construction | | | 1 | | | 1 | | | 1 | | | 1 | | | 5 | | 0.77 | % | | 0.82 | % | | 0.72 | % | | 0.51 | % | | 1.38 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total Business and Community Banking | | | 55 | | | 42 | | | 38 | | | 41 | | | 30 | | 1.56 | % | | 1.16 | % | | 1.01 | % | | 1.02 | % | | 0.75 | % |

Residential First Mortgage | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Alt-A | | | 19 | | | 17 | | | 13 | | | 6 | | | 4 | | 3.27 | % | | 2.91 | % | | 2.20 | % | | 1.03 | % | | 0.60 | % |

Residential First Mortgage | | | 38 | | | 34 | | | 26 | | | 35 | | | 14 | | 1.13 | % | | 1.02 | % | | 0.80 | % | | 1.05 | % | | 0.42 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total Residential First Mortgage | | | 57 | | | 51 | | | 39 | | | 41 | | | 18 | | 1.45 | % | | 1.31 | % | | 1.02 | % | | 1.05 | % | | 0.45 | % |

Consumer | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Home Equity Lending | | | 94 | | | 113 | | | 95 | | | 69 | | | 63 | | 2.37 | % | | 2.85 | % | | 2.38 | % | | 1.72 | % | | 1.59 | % |

Indirect Lending | | | 11 | | | 11 | | | 16 | | | 15 | | | 10 | | 1.46 | % | | 1.31 | % | | 1.74 | % | | 1.43 | % | | 0.96 | % |

Direct Lending | | | 5 | | | 3 | | | 2 | | | 3 | | | 3 | | 2.47 | % | | 1.59 | % | | 1.14 | % | | 1.61 | % | | 1.33 | % |

Other Consumer | | | 14 | | | 10 | | | 11 | | | 13 | | | 13 | | 15.61 | % | | 12.00 | % | | 13.43 | % | | 8.24 | % | | 4.76 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total Other Consumer | | | 124 | | | 137 | | | 124 | | | 100 | | | 89 | | 2.49 | % | | 2.71 | % | | 2.40 | % | | 1.85 | % | | 1.62 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total Loans | | $ | 680 | | $ | 491 | | $ | 390 | | $ | 796 | | $ | 416 | | 2.86 | % | | 2.06 | % | | 1.64 | % | | 3.19 | % | | 1.68 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| * | Percentage of related loan category outstandings |

| (1) | Information prior to 4Q08 does not reflect reclassifications between various Commercial Real Estate and Business and Community Banking categories |

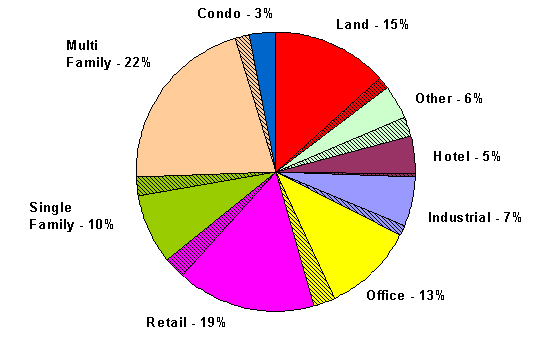

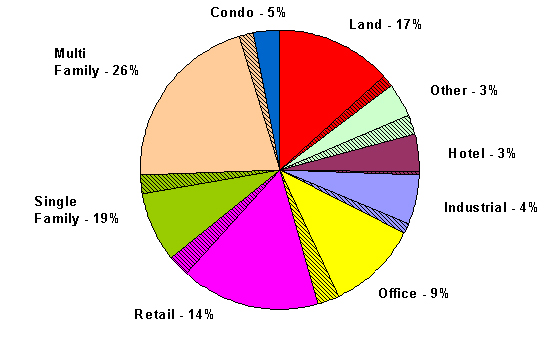

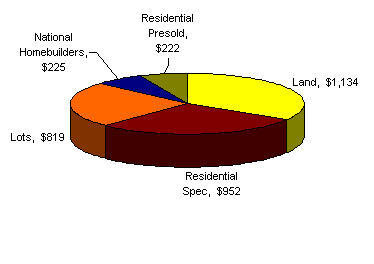

FINANCIAL SUPPLEMENT TO