Regions Financial (RF) 8-KRegulation FD Disclosure

Filed: 5 Nov 09, 12:00am

BancAnalysts Association of Boston, Inc. November 5, 2009 Exhibit 99.1 * * * |

Forward Looking Statements The information contained in this presentation may include forward-looking statements which reflect Regions' current views with respect to future events and financial performance. The Private Securities Litigation Reform Act of 1995 (the “Act”) provides a “safe harbor” for forward-looking statements which are identified as such and are accompanied by the identification of important factors that could cause actual results to differ materially from the forward-looking statements. For these statements, we, together with our subsidiaries, claim the protection afforded by the safe harbor in the Act. Forward-looking statements are not based on historical information, but rather are related to future operations, strategies, financial results or other developments. Forward-looking statements are based on management’s expectations as well as certain assumptions and estimates made by, and information available to, management at the time the statements are made. Those statements are based on general assumptions and are subject to various risks, uncertainties and other factors that may cause actual results to differ materially from the views, beliefs and projections expressed in such statements. These risks, uncertainties and other factors include, but are not limited to, those described below: › In October 2008 Congress enacted and the President signed into law the Emergency Economic Stabilization Act of 2008, and on February 17, 2009 the American Recovery and Reinvestment Act of 2009 was signed into law. Additionally, the Department of the U.S. Treasury and federal banking regulators are implementing a number of programs to address capital and liquidity issues in the banking system, and may announce additional programs in the future, all of which may have significant effects on Regions and the financial services industry, the exact nature and extent of which cannot be determined at this time. › The impact of compensation and other restrictions imposed under the Troubled Asset Relief Program (“TARP”) until Regions is able to repay the outstanding preferred stock issued under the TARP. › Possible additional loan losses, impairment of goodwill and other intangibles and valuation allowances on deferred tax assets and the impact on earnings and capital. › Possible changes in interest rates may affect funding costs and reduce earning asset yields, thus reducing margins. › Possible changes in general economic and business conditions in the United States in general and in the communities Regions serves in particular. › Possible changes in the creditworthiness of customers and the possible impairment of the collectability of loans. › Possible changes in trade, monetary and fiscal policies, laws and regulations, and other activities of governments, agencies, and similar organizations, including changes in accounting standards, may have an adverse effect on business. › The current stresses in the financial and real estate markets, including possible continued deterioration in property values. › Regions' ability to manage fluctuations in the value of assets and liabilities and off-balance sheet exposure so as to maintain sufficient capital and liquidity to support Regions' business. › Regions' ability to achieve the earnings expectations related to businesses that have been acquired or that may be acquired in the future. › Regions' ability to expand into new markets and to maintain profit margins in the face of competitive pressures. › Regions' ability to develop competitive new products and services in a timely manner and the acceptance of such products and services by Regions' customers and potential customers. › Regions' ability to keep pace with technological changes. › Regions' ability to effectively manage credit risk, interest rate risk, market risk, operational risk, legal risk, liquidity risk, and regulatory and compliance risk. › The cost and other effects of material contingencies, including litigation contingencies. › The effects of increased competition from both banks and non-banks. › The effects of geopolitical instability and risks such as terrorist attacks. › Possible changes in consumer and business spending and saving habits could affect Regions' ability to increase assets and to attract deposits. › The effects of weather and natural disasters such as droughts and hurricanes. The foregoing list of factors is not exhaustive; for discussion of these and other risks that may cause actual results to differ from expectations, please look under the captions “Forward-Looking Statements” and “Risk Factors” in Regions’ Annual Report on Form 10-K for the year ended December 31, 2008 and Forms 10-Q for the quarters ended March 31, 2009 (as amended) June 30, 2009 and September 30, 2009, as on file with the Securities and Exchange Commission. The words "believe," "expect," "anticipate," "project," and similar expressions often signify forward-looking statements. You should not place undue reliance on any forward-looking statements, which speak only as of the date made. We assume no obligation to update or revise any forward-looking statements that are made from time to time. |

Strong Fundamentals Overshadowed by Credit Quality Issues › “Top Quartile” customer satisfaction › Improving and growing customer relationships › Geographically diversified franchise with strong and improving share in core markets › Solid capital position › Improving earnings power › Actively improving the risk profile of the balance sheet * * * * * * * * * * * * * |

Actively Improving Risk Profile › Risk management actions › Reducing the highest risk portfolios › Improvements in credit process post-merger › Conservative approach of early loss recognition to reduce future credit pressure * * * * * * * * * * |

Risk Management Actions › Sold Equifirst (subprime originations) in 1Q 2007 › Moratoriums on higher risk asset classes (Land and Lots, Condominiums, Retail CRE, etc.) › Aggressively reducing high risk Commercial Real Estate exposure › Sold or moved to held for sale $2.4 bn of problem assets › In late 2007, implemented a comprehensive Customer Assistance Program to manage home equity exposures › Improvements in credit process * * * * * * * * * * * * |

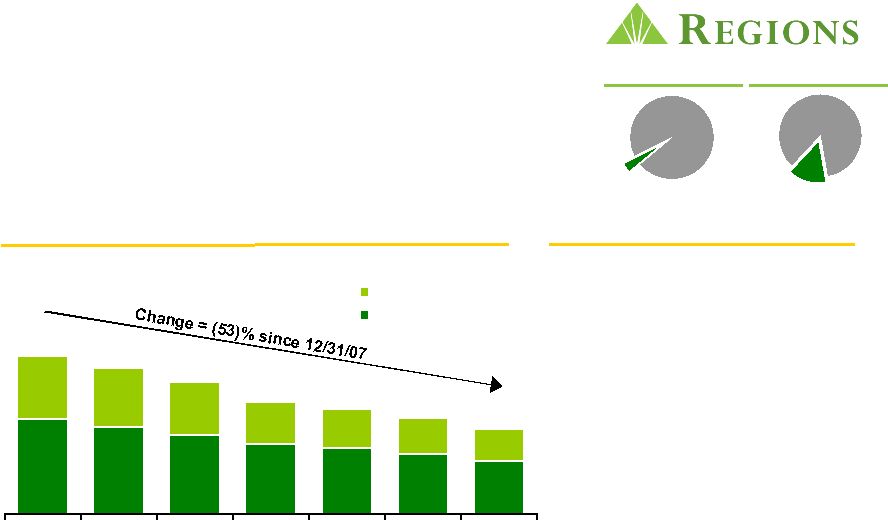

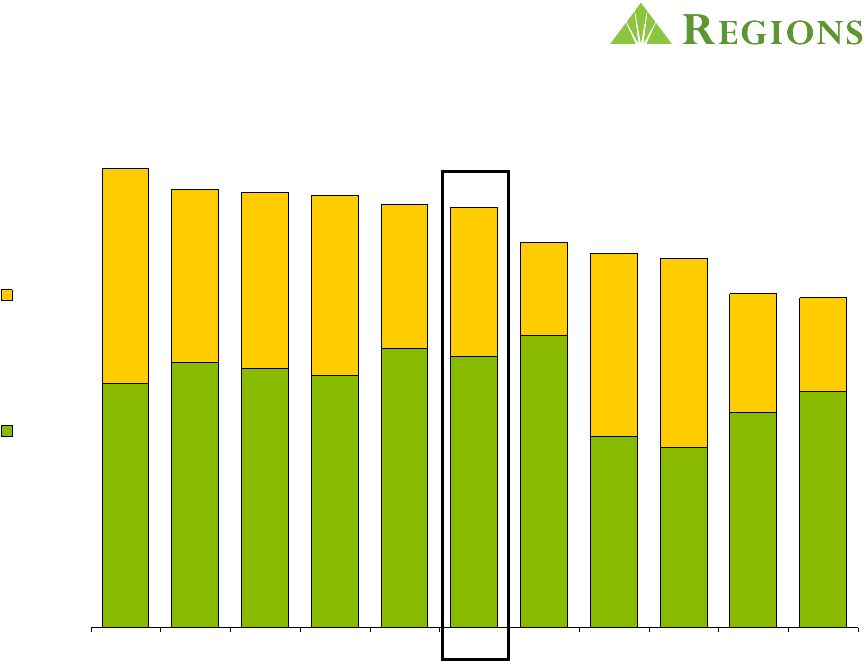

Homebuilder $3.4bn / 3.6% of Total Portfolio; 14.6% of NOO-CRE % of Total Portfolio % of Total CRE NOO 3.6% Continue to Reduce Exposure ($mm) 14.6% › Reduced exposure by 53% since 12/31/07 › Transferred 68 Real Estate bankers to workout positions › Frequent contact with borrowers › Closely tracking collateral values › Starting to see more short- sale activity indicating values are beginning to stabilize Observations 1Q08 2Q08 3Q08 4Q08 1Q09 2Q09 3Q09 FL / N. GA Remaining Portfolio $4,402 $5,202 $5,758 $6,231 $4,148 $3,786 $3,352 * * * * * * * * * * * |

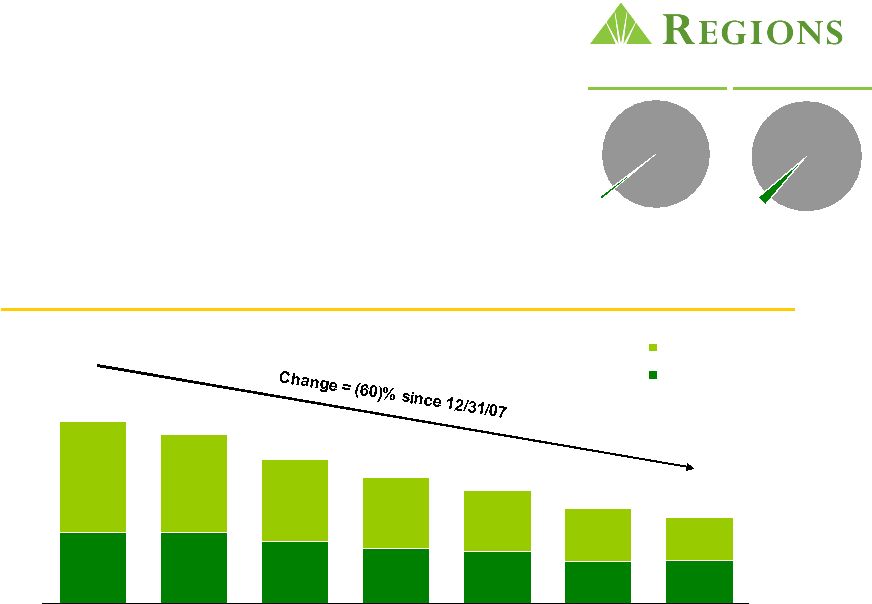

Condominium $647mm / 0.7% of Total Portfolio % of Total Portfolio % of Total CRE NOO Effectively Reducing Exposure ($mm) › Minimal exposure remaining › 50% of portfolio is in Florida 0.7% 2.8% 1Q08 2Q08 3Q08 4Q08 1Q09 2Q09 3Q09 Florida Remaining Portfolio $ 1,367 $ 1,266 $ 1,082 $ 946 $ 850 $ 711 $ 647 * * * * * * * * * * * * * |

Multi-Family and Retail Including Business and Community $9.4bn / 10% of Total Portfolio › More subject to workout and restructure and subsequent return to accrual status › Well-diversified by type and geography % of Total Portfolio % of Total CRE NOO By Geography Observations $0 $500 $1,000 $1,500 Multi-Family Retail Note: Central includes: AL, GA, SC; Midsouth includes: IL, IN, IA, KY, MO, NC, VA, TN; Southwest includes: AR, LA, MS, TX $ Millions 10.2% 41.3% * * * * * * * * * * * * * |

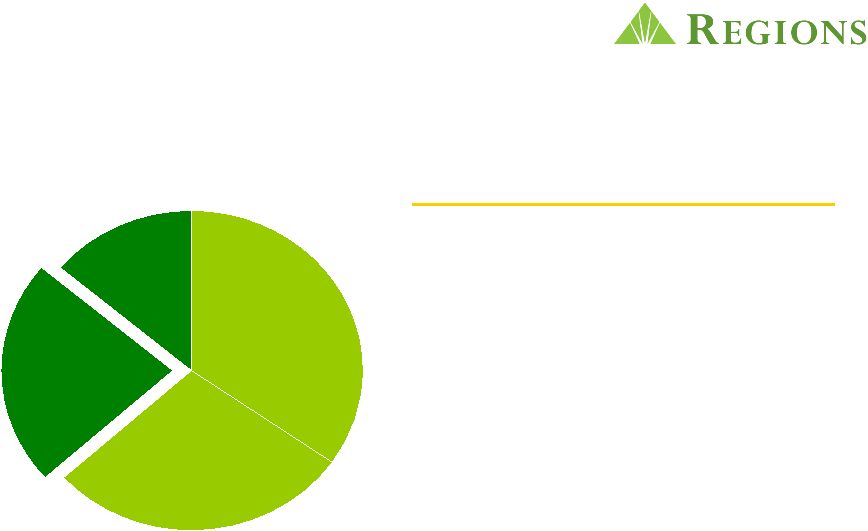

Home Equity - $15.6bn / 17% of Total Loans Most Stressed Portion is Florida 2 nd Liens - 3.8% of Total Loans Entire Home Equity Portfolio: › Branch originated, in-footprint balances › Active monitoring and management of lines › Home equity charge-offs declined $19 million linked quarter › Weighted average FICO of 738 › 42% in 1 st lien position › Average loan size of $75 thousand Florida 2 nd Lien Portion: › Florida 2 nd Lien 3Q09 charge-offs of 6.33% vs. 1.20% for remainder of portfolio › Florida 2 nd lien concentration (23%) primary driver of recent Home Equity performance Observations Other States 1 st Lien 28% Other States 2 nd Lien 35% Florida 1 st Lien 14% Florida 2 nd Lien 23% * * * * * * * * * * * |

Problem Asset Dispositions ($ in millions) 1Q 2009 2Q 2009 3Q 2009 2009 YTD OREO $ 57 $ 65 $ 111 $ 233 Problem Loan Sales 24 15 170 209 Held for Sale 56 67 72 195 Total Sales $ 137 $ 147 $ 353 $ 637 Held for Sale Balance $ 393 $ 371 $ 380 $ 380 * * * * * * * * * |

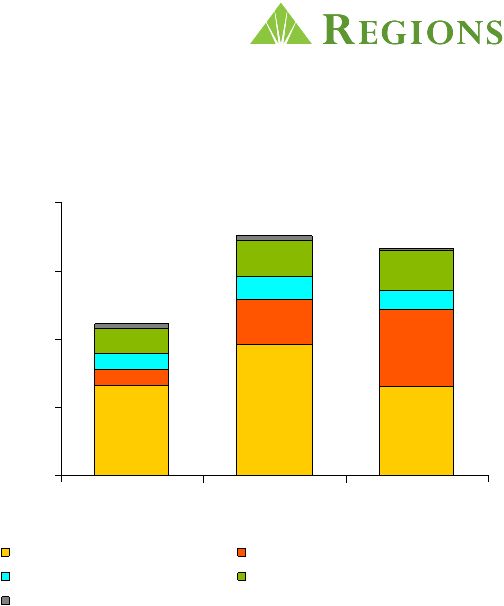

$1,116 $1,758 $1,667 › Income producing CRE, principally Multi-Family and Retail, continued to increase while the combined Homebuilder and Condo migration declined › 51% of Total CRE non- performing loans are in Florida and Georgia, our two primary markets of concern Gross NPA Migration Lower than Prior Quarter $0 $500 $1,000 $1,500 $2,000 1Q09 2Q09 3Q09 Homebuilder, Condo and Other Income Producing CRE Business and Community Commercial Consumer $ Millions * * * * * * * * * * |

Appropriate Reserve Coverage Total Loan Balances NPL Balances Allowance Total Loans NPLs Specific Analysis Loans (loans over $2.5 million) 2,039 2,039 404 19.8% 0.20x All Other Loans 90,715 1,177 2,223 2.5% 1.89x Total 92,754 3,216 2,627 2.8% 0.82x ALLL as % of * * * * * * * * * |

After three quarters, over $1 billion favorable to SCAP Stress Case scenario * PPNR adjusted for Q2 capital raise activities 1. Regions PPNR – Q309 YTD 2. SCAP assumptions straight-lined; PPNR includes $0.4 billion overage from 1Q09 (in millions) RF 1 SCAP 2 Difference B/(W) Net Charge-offs (1,561) $ (3,450) $ 1,889 $ Provision Over Charge-offs (801) - (801) Total Loan Loss Provision (2,362) (3,450) 1,088 PPNR* 1,741 1,638 103 Pre-tax (621) $ (1,812) $ 1,191 $ * * * * * * * * * * * * * * |

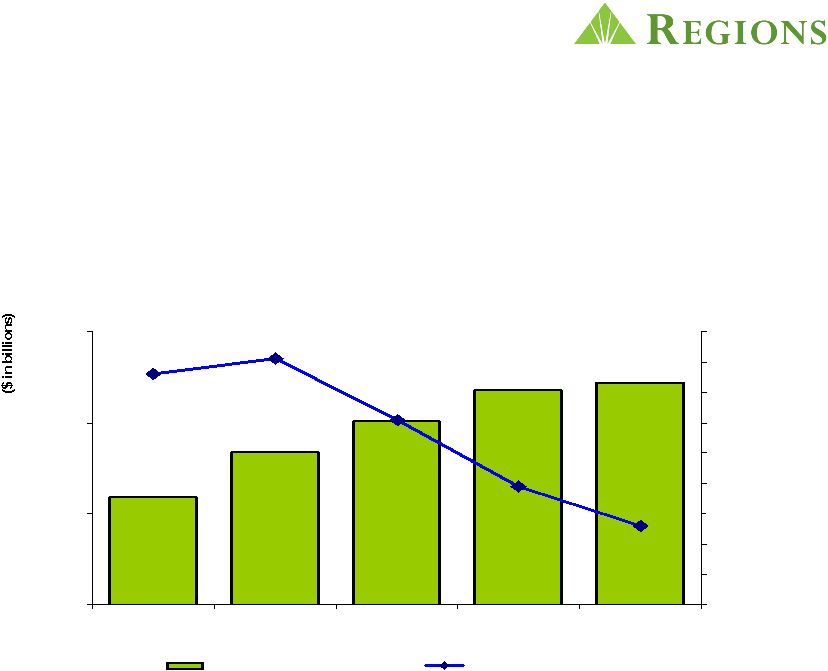

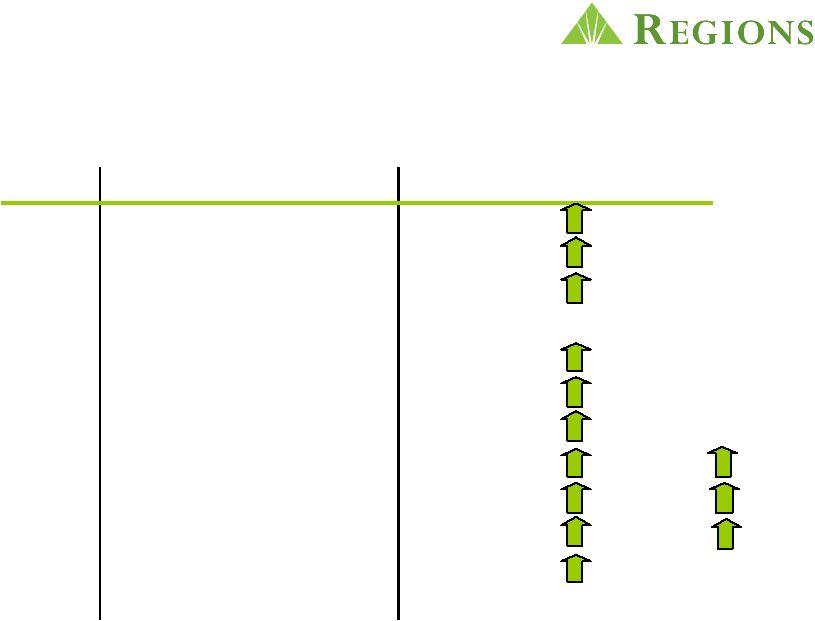

Net Charge-Offs Below Fed Stress Test Level - Cumulative $ millions $9.2B $5.9B $3.4B Does not include Provision over Net Charge-Offs 0 200 400 600 800 1,000 1,200 1,400 1Q09 2Q09 3Q09 4Q09 1Q10 2Q10 3Q10 4Q10 Regulators - Stress Net Charge-Offs Regions - Base Net Charge-Offs Regions - Stress Net Charge-Offs Regions - Actual Net Charge-Offs * * * * * * * * * * * * * |

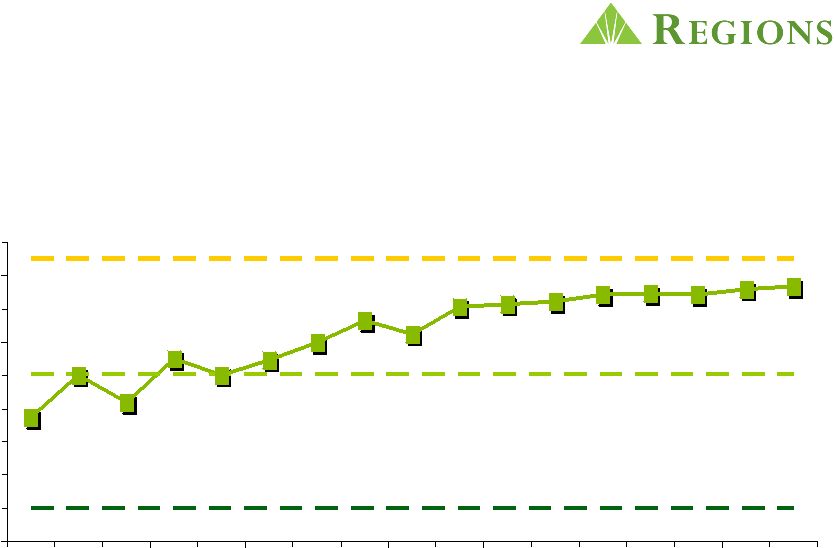

Growing Customer Relationships Loyalty drives the bottom line Loyalty Score 48 50 52 54 56 58 60 62 64 66 May- 08 J J A S O N D J F M A M J J A Sep- 09 Gallup’s 75th Percentile Gallup’s 50th Percentile Regions Percent Highly Loyal Gallup’s 90th Percentile * * * * * * * * * * * * * |

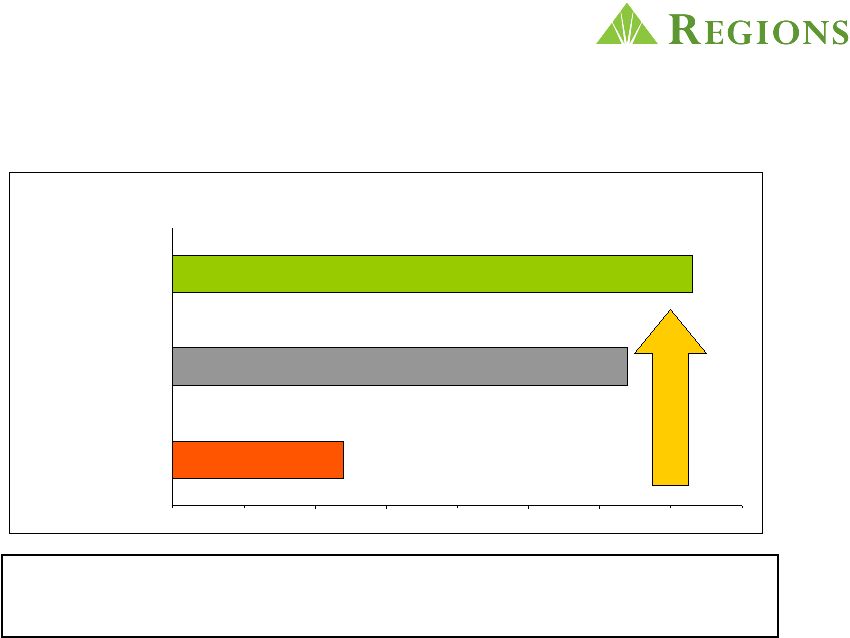

Added Emphasis on Customer Experience Has Led to Dramatic Performance Improvements J.D. Power 2009 Retail Bank Study Results 670 680 690 700 710 720 730 740 750 Regions 2008 Industry Average Regions 2009 We passed 29 banks in 1 year #1 in customer satisfaction among the 27 largest mortgage servicing companies – J.D. Power and Associates * * * * * * * * * * * * * |

On The “Road to One Million” Total New Checking Account Production 0 20,000 40,000 60,000 80,000 100,000 Jan Feb Mar Apr May Jun Jul Aug Sep 2008 2009 Up 29% Year Over Year Record Checking Sales * * * * * * * * * * * * * |

Strong Account Growth and High Customer Retention Lead to Rising Low-Cost Deposits $50.0 $55.0 $60.0 $65.0 Q3 '08 Q4 '08 Q1 '09 Q2 '09 Q3 '09 1.00 1.10 1.20 1.30 1.40 1.50 1.60 1.70 1.80 1.90 Low-Cost Deposits Total Deposit Costs › Opened a record 270,000 new retail and business checking accounts in 3Q09 up 29% versus 3Q08; 762,000 new accounts YTD; On the road to 1 MM new accounts in 2009 › Retention remains better than industry norms and at historical highs › Steadily increasing low-cost deposits * * * * * * * * * * * * * * |

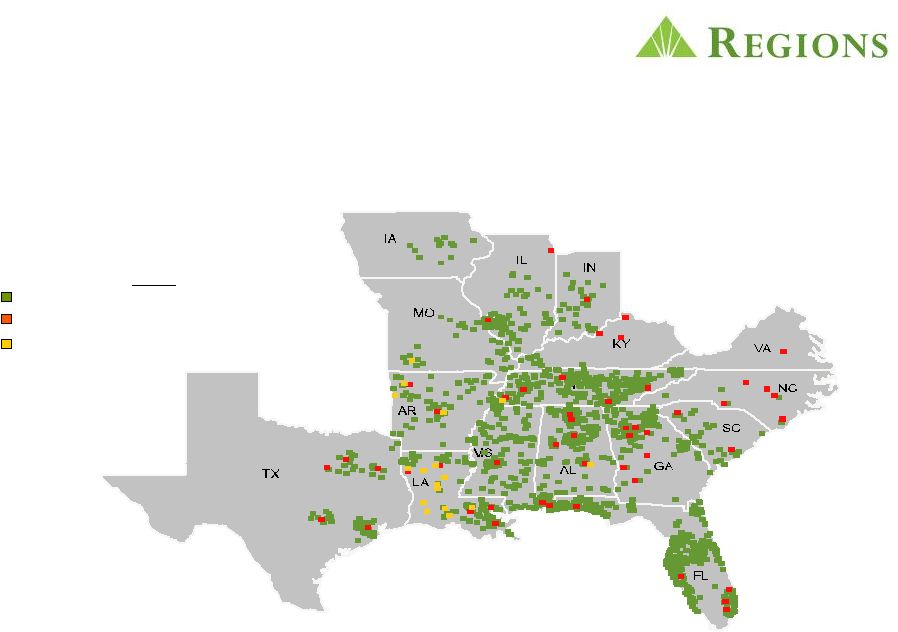

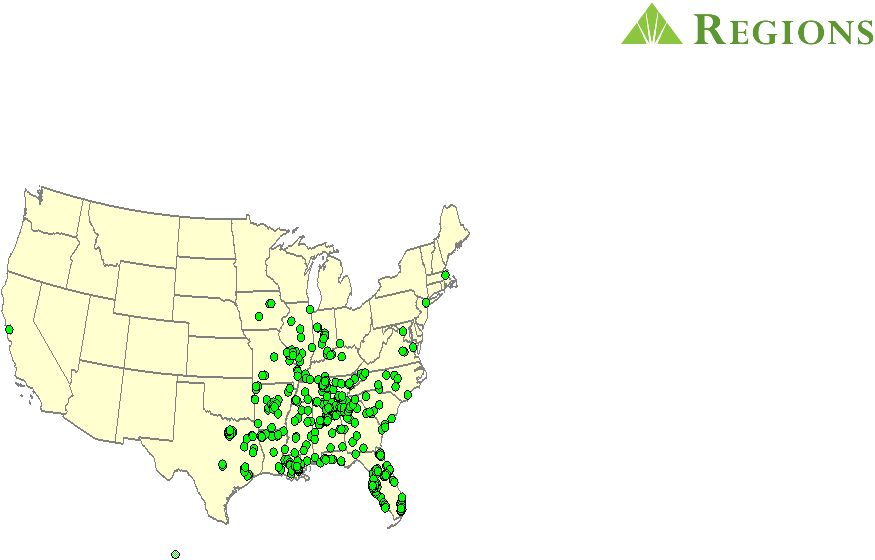

Diversified Southeastern Franchise › Strategically important position across a number of Southeastern markets Regions Morgan Keegan Insurance Offices 1,895 339 31 |

Morgan Keegan - Leading Regional Retail Brokerage, Investment Banking and Financial Services Company Morgan Keegan Highlights › 1,276 Financial Advisors › 339 Offices in 19 States › $75 billion of customer assets › $69 billion of trust assets › $69 million assets per financial advisor › $3.6 billion of new brokerage assets added this year › Revenues of $1.3 billion in 2008; $945 million 3Q09 YTD Morgan Keegan Branches * * * * * * * * * * * * * |

Strong and Improving Market Share Note: Based on June 30, 2009 FDIC data per SNL.. Adjusted for brokered deposits in MS and GA. State Dep. ($B) Rank AL 18.9 20 % 23 % 1 FL 17.4 19 4 4 TN 17.3 18 16 1 LA 7.3 8 9 3 MS 7.0 7 16 1 GA 6.4 7 4 6 AR 4.6 5 9 2 TX 3.7 4 1 16 IL 2.7 3 1 24 MO 2.5 3 2 9 IN 2.4 3 3 9 Other 3.5 4 - - % of Total Mkt. Share * * * * * * * * * * * * * |

7.03 7.63 7.45 7.25 8.02 7.80 8.40 5.50 5.18 6.20 6.80 9.50 9.60 10.63 10.80 11.10 12.10 12.18 12.46 12.55 12.61 13.23 RF Tier 1 T1C Regions’ Capital Levels Strong and Comparable to Peers Peers include: BAC, BBT, CMA, FITB, KEY, MI, PNC, STI, USB, WFC; Estimated capital ratios as of September 30, 2009 * * * * * * * * * * * * * * |

Improving Earnings Power › Disciplined Approach to Net Interest Income and Margin Improvement › Non-interest Revenue Initiatives › Focus on Improving Efficiency and Effectiveness * * * * * * * * * * |

Improved Margin and Net Interest Income 0.00 0.50 1.00 1.50 2.00 2.50 3.00 3.50 Q3 '08 Q4 '08 Q1 '09 Q2 '09 Q3 '09 Net Interest Margin Deposit Costs › Continued non-interest bearing deposit growth benefiting margin › Loan and deposit pricing improvements having a positive influence › Asset sensitive balance sheet well positioned for eventual rising rate environment * * * * * * * * * * * * |

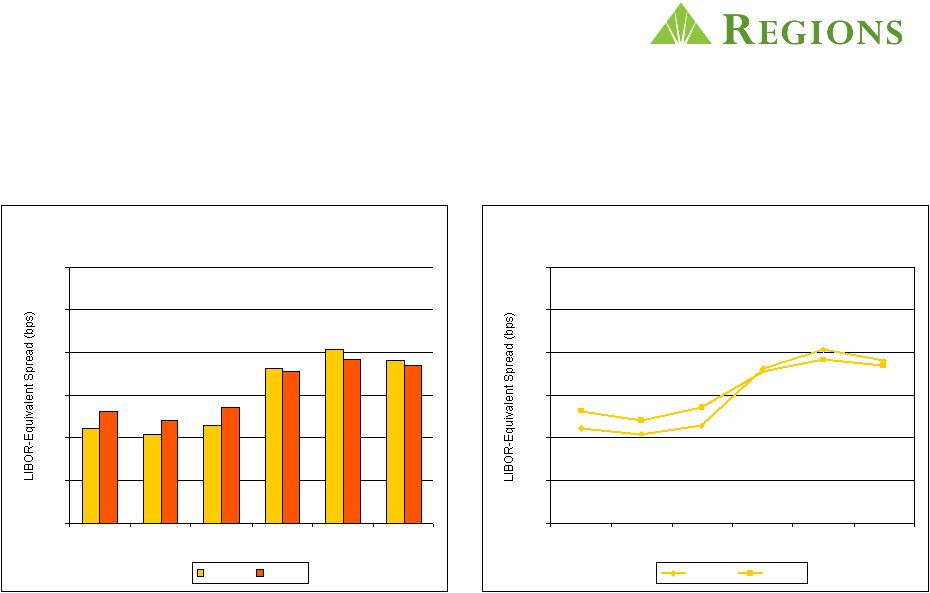

Risk Adjusted Going on Spreads 1 for New and Renewed Loans Source: Standard & Poor’s Regions vs. Market (1) Prime spreads were converted to the LIBOR-equivalent using an assumed differential of 275 bps. Spreads are weighted by outstandings. Going on Spreads do not include the impact of Fees or rate floors. Regions is now outperforming its peers in Loan Pricing. C&I, CRE, BB & CB LOBs 100 150 200 250 300 350 400 Q1 '08 Q2 '08 Q3 '08 Q4 '08 Q1 '09 Q2 '09 Regions Market C&I, CRE, BB & CB LOBs 100 150 200 250 300 350 400 Q1 '08 Q2 '08 Q3 '08 Q4 '08 Q1 '09 Q2 '09 Regions Market |

Non-interest Revenue Initiatives › Morgan Keegan › Checkcard / Merchant › Mortgage › Treasury Management › Capital Markets * * * * * * * * * * * |

Focus on Improving Efficiency and Effectiveness › Staffing › Occupancy › Branch Consolidation › Legal Fees › Telecom › Discretionary Spending * * * * * * * * * * * * |

Strong Fundamentals Overshadowed by Credit Quality Issues › Actively improving the risk profile of the balance sheet › “Top Quartile” customer satisfaction › Improving and growing customer relationships › Geographically diversified franchise with strong and improving share in core markets › Solid capital position › Improving earnings power * * * * * * * * * * * * * |

* * * * * * * * **************************************************************************************** **************************************************************************************** **************************************************************************************** |