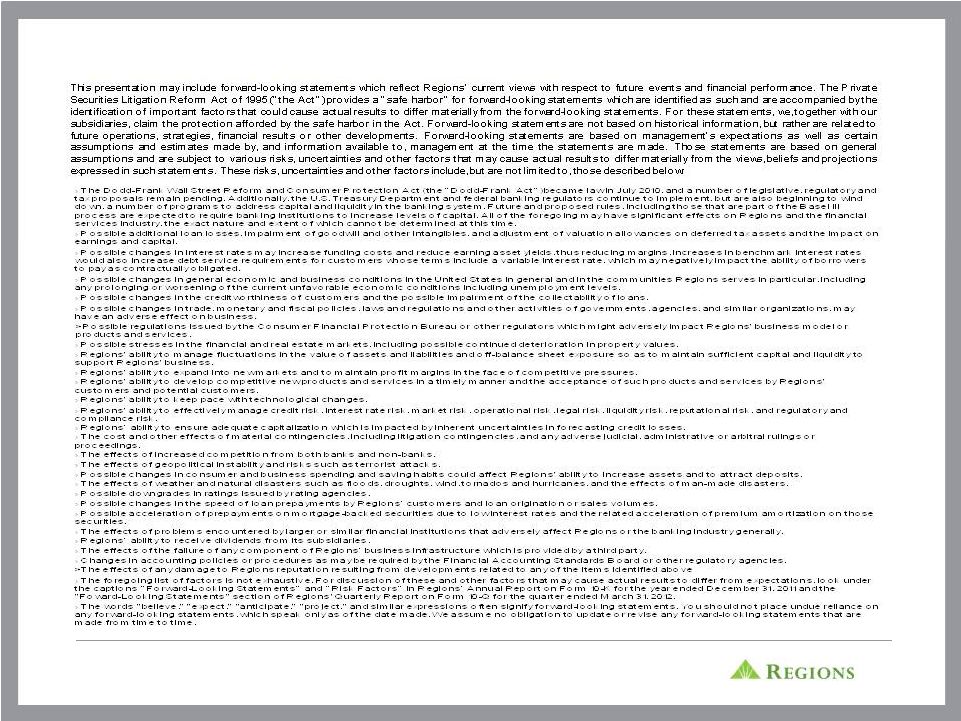

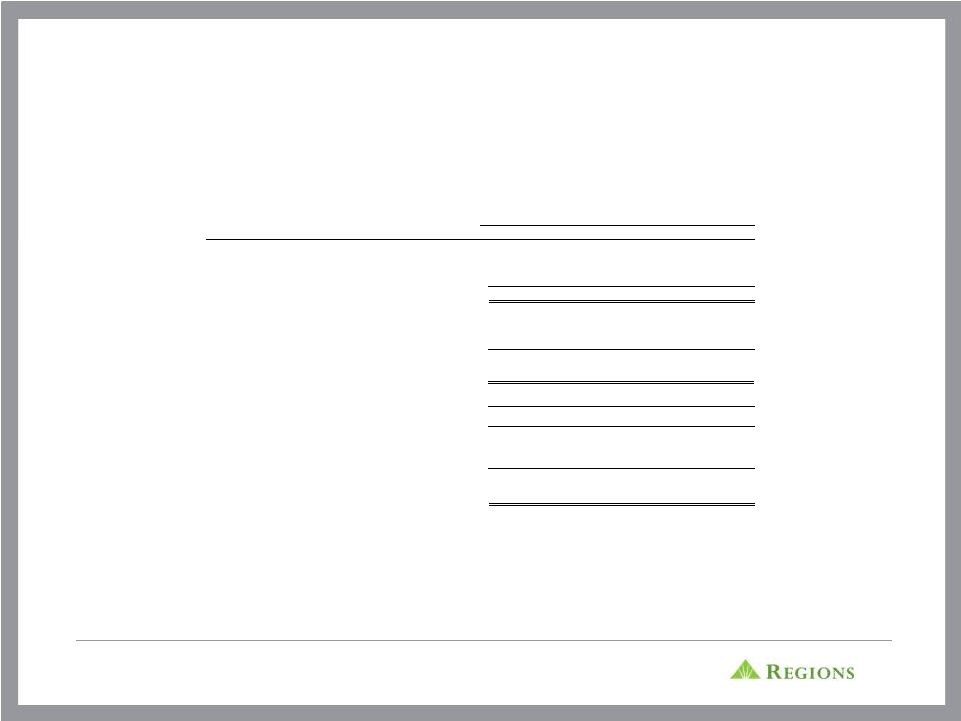

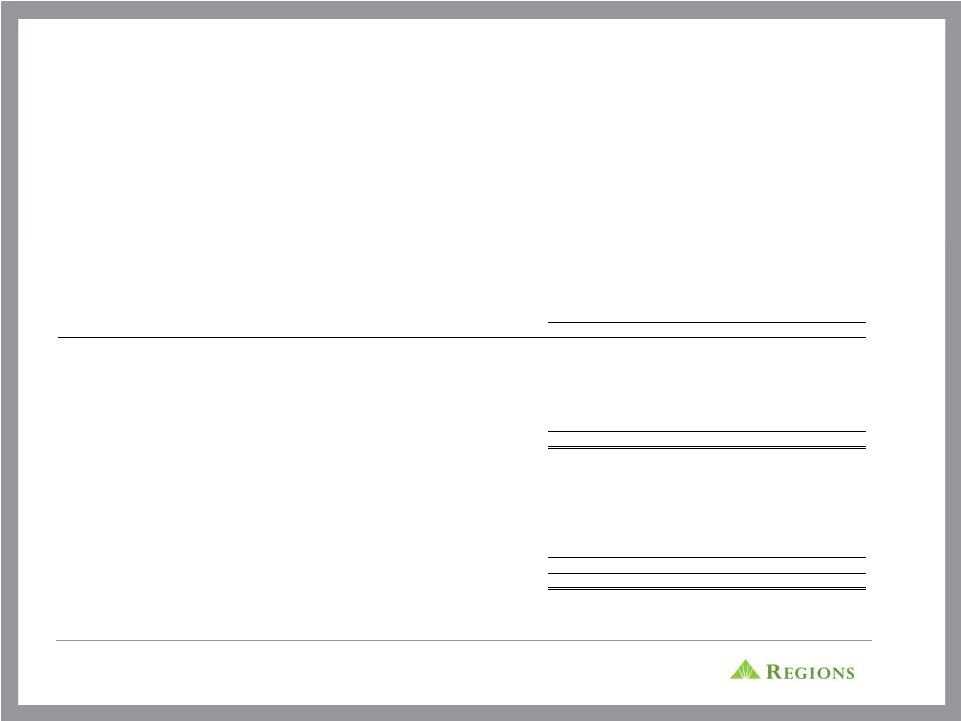

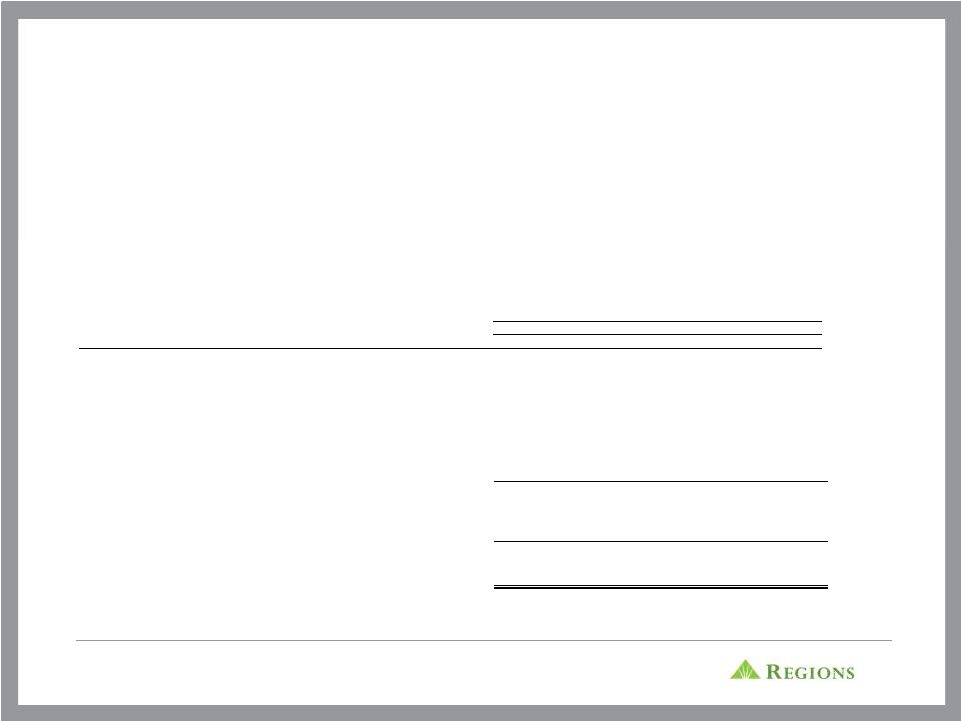

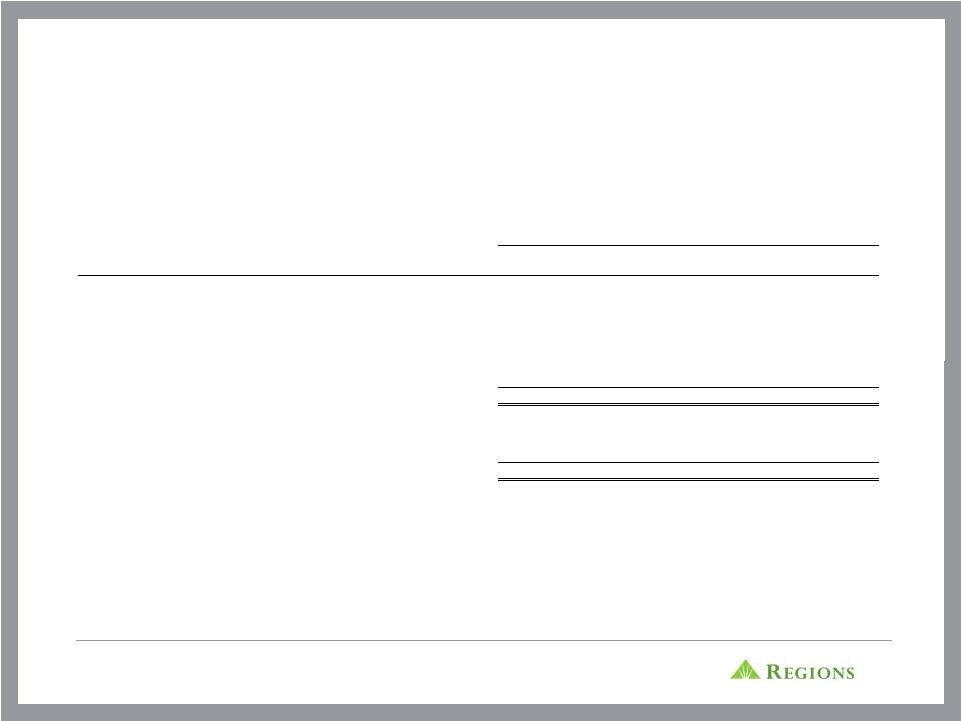

13 NON-GAAP RECONCILIATION: NET INCOME / (LOSS) AND EARNINGS PER SHARE (1) There are no preferred shares allocable to discontinued operations. (2) In the second quarter of 2010, Regions recorded a $200 million charge to account for a probable, reasonably estimable loss related to a pending settlement of regulatory matters. At that time, Regions assumed that the entire charge would be non-deductible for income tax purposes. $75 million of the regulatory charge relates to continuing operations. The settlement was finalized during the second quarter of 2011. At the time of settlement, Regions had better information related to tax implications. Approximately $125 million of the settlement charge will be deductible for federal income tax purposes. Accordingly, during the second quarter of 2011, Regions adjusted federal income taxes to account for the impact of the deduction. The adjustment reduced Regions' provision for income taxes by approximately $44 million for the second quarter of 2011, of which approximately $17 million relates to continuing operations. . ` (1) ($ amounts in millions, except per share data) 06/30/12 03/31/12 12/31/11 9/30/11 6/30/11 Net income (loss) available to common shareholders (GAAP) 284 $ 145 $ (602) $ 101 $ 55 $ Preferred dividends and accretion (GAAP) 71 54 54 54 54 Income (loss) from discontinued operations, net of tax (GAAP) 4 (40) (467) 14 30 Income (loss) from continuing operations (GAAP) A 351 $ 239 $ (81) $ 141 $ 79 $ B 284 $ 145 $ (602) $ 101 $ 55 $ Goodwill impairment, net of tax - - 731 - - Regulatory charge and related tax benefit - - - - (44) C 284 $ 145 $ 129 $ 101 $ 11 $ B 284 $ 145 $ (602) $ 101 $ 55 $ 4 (40) (467) 14 30 D 280 185 (135) 87 25 - - 253 - - - - - - (17) E 280 $ 185 $ 118 $ 87 $ 8 $ F 1,418 1,283 1,259 1,261 1,260 A/F 0.25 $ 0.19 $ (0.06) $ 0.11 $ 0.06 $ B/F 0.20 $ 0.11 $ (0.48) $ 0.08 $ 0.04 $ ` D/F 0.20 $ 0.14 $ (0.11) $ 0.07 $ �� 0.02 $ E/F 0.20 $ 0.14 $ 0.09 $ 0.07 $ 0.01 $ Earnings per common share from continuing operations, excluding goodwill impairment and regulatory charge and related tax benefit - diluted (non-GAAP) Income from continuing operations available to common shareholders, excluding goodwill impairment and regulatory charge and related tax benefit (non-GAAP) Weighted-average diluted shares Earnings (loss) per common share -diluted (GAAP) Earnings (loss) per common share from continuing operations - diluted (GAAP) Earnings (loss) per common share from continuing operations, excluding preferred dividends and accretion -diluted (non- GAAP) Regulatory charge and related tax benefit from continuing operations (2) As of and for Quarter Ended Net income (loss) available to common shareholders (GAAP) Income available to common shareholders, excluding goodwill impairment and regulatory charge and related tax benefit (non- GAAP) Net income (loss) available to common shareholders (GAAP) Income (loss) from discontinued operations, net of tax (GAAP) Income (loss) from continuing operations available to common shareholders (GAAP) Goodwill impairment from continuing operations (non- deductible) The table below presents earnings (loss) per share from continuing operations, excluding preferred dividends and accretion (non-GAAP). The table also presents computations of earnings (loss) and certain other financial measures, excluding goodwill impairment and regulatory charge and related tax benefit (non-GAAP) all recorded in 2011. The preferred dividends and accretion, goodwill impairment charge, and the regulatory charge and related tax benefit are included in financial results presented in accordance with generally accepted accounting principles (GAAP). Regions believes that the exclusion of the preferred dividends and accretion, goodwill impairment and the regulatory charge and related tax benefit in expressing earnings (loss) and certain other financial measures, including "earnings (loss) per common share, excluding preferred dividends and accretion" and "earnings (loss) per common share, excluding goodwill impairment and regulatory charge and related tax benefit" provides a meaningful base for period- to-period comparisons, which management believes will assist investors in analyzing the operating results of the Company and predicting future performance. These non-GAAP financial measures are also used by management to assess the performance of Regions' business because management does not consider the preferred dividends and accretion, goodwill impairment and regulatory charge and related tax benefit to be relevant to ongoing operating results. Management and the Board of Directors utilize these non-GAAP financial measures for the following purposes: preparation of Regions' operating budgets; monthly financial performance reporting; monthly close-out reporting of consolidated results (management only); and presentations to investors of Company performance. Regions believes that presenting these non-GAAP financial measures will permit investors to assess the performance of the Company on the same basis as that applied by management and the Board of Directors. Non-GAAP financial measures have inherent limitations, are not required to be uniformly applied and are not audited. Although these non-GAAP financial measures are frequently used by stakeholders in the evaluation of a company, they have limitations as analytical tools, and should not be considered in isolation, or as a substitute for analyses of results as reported under GAAP. In particular, a measure of earnings that excludes the preferred dividends and accretion, goodwill impairment charge, and the regulatory charge and related tax benefit does not represent the amount that effectively accrues directly to stockholders (i.e. the preferred dividends and accretion, goodwill impairment charge, and the regulatory charge are reductions in earnings and stockholders' equity). |