Exhibit 99.3 2nd Quarter Earnings Conference Call July 20, 2018

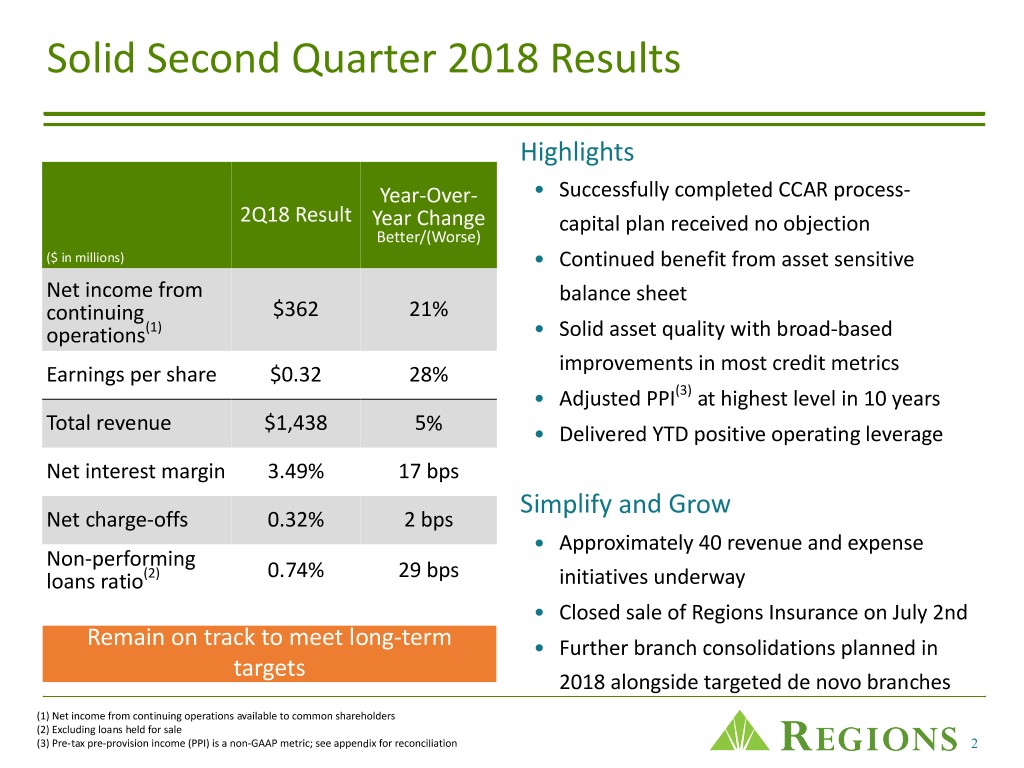

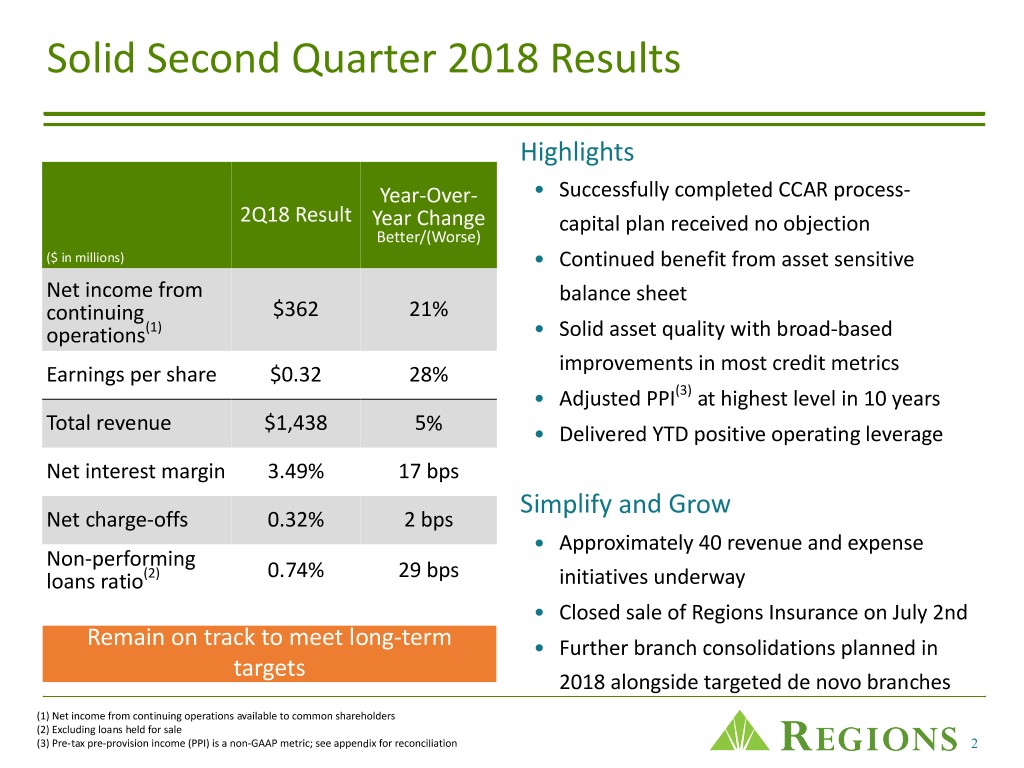

Solid Second Quarter 2018 Results Highlights Year-Over- • Successfully completed CCAR process- 2Q18 Result Year Change capital plan received no objection Better/(Worse) ($ in millions) • Continued benefit from asset sensitive Net income from balance sheet continuing $362 21% operations(1) • Solid asset quality with broad-based improvements in most credit metrics Earnings per share $0.32 28% • Adjusted PPI(3) at highest level in 10 years Total revenue $1,438 5% • Delivered YTD positive operating leverage Net interest margin 3.49% 17 bps Simplify and Grow Net charge-offs 0.32% 2 bps • Approximately 40 revenue and expense Non-performing loans ratio(2) 0.74% 29 bps initiatives underway • Closed sale of Regions Insurance on July 2nd Remain on track to meet long-term • Further branch consolidations planned in targets 2018 alongside targeted de novo branches (1) Net income from continuing operations available to common shareholders (2) Excluding loans held for sale (3) Pre-tax pre-provision income (PPI) is a non-GAAP metric; see appendix for reconciliation 2

Managing for long-term performance Opportunities to drive growth and efficiencies Asset Sensitivity Capital Return Significant funding advantage Capital sufficient for organic driven by low-cost deposit growth, strategic opportunities, & base; accretive fixed-rate robust shareholder returns reinvestments Stable Asset Quality Revenue Growth & Broad-based credit metric Efficiency Opportunities improvements; sound risk Identify and execute additional management practices combined opportunities to increase revenues with recently completed de- and reduce expenses through risking activities have us positioned well for the next credit cycle 3

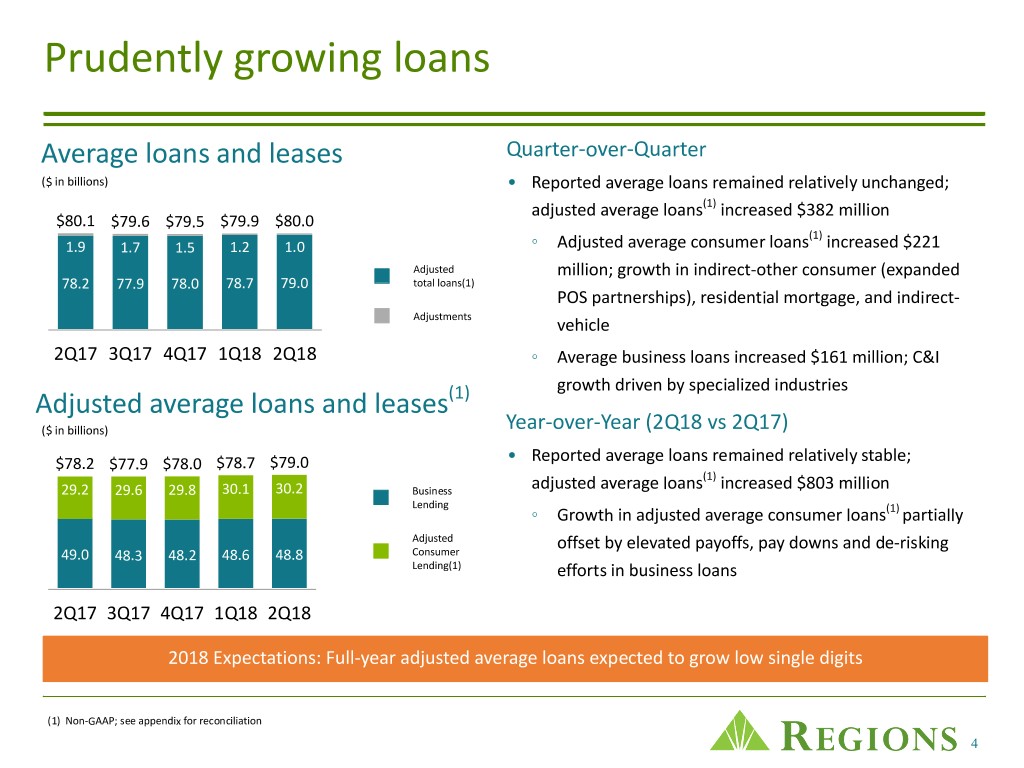

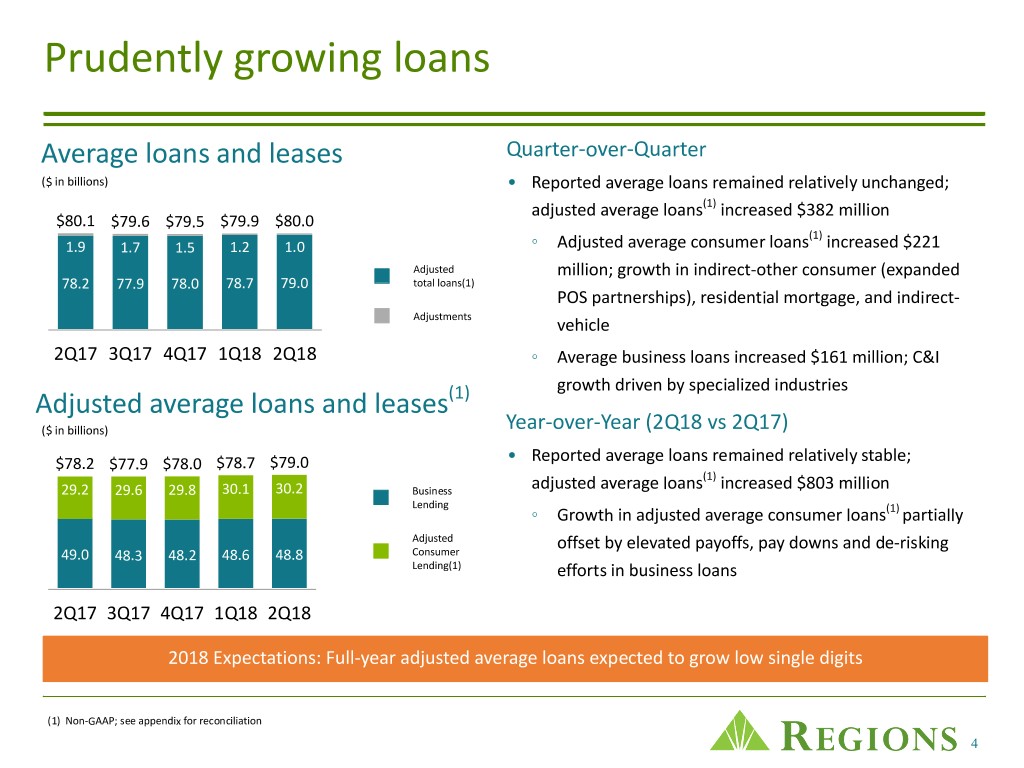

Prudently growing loans Average loans and leases Quarter-over-Quarter ($ in billions) • Reported average loans remained relatively unchanged; adjusted average loans(1) increased $382 million $80.1 $79.6 $79.5 $79.9 $80.0 (1) 1.9 1.7 1.5 1.2 1.0 ◦ Adjusted average consumer loans increased $221 Adjusted million; growth in indirect-other consumer (expanded 78.2 77.9 78.0 78.7 79.0 total loans(1) POS partnerships), residential mortgage, and indirect- Adjustments vehicle 2Q17 3Q17 4Q17 1Q18 2Q18 ◦ Average business loans increased $161 million; C&I growth driven by specialized industries Adjusted average loans and leases(1) ($ in billions) Year-over-Year (2Q18 vs 2Q17) $78.2 $77.9 $78.0 $78.7 $79.0 • Reported average loans remained relatively stable; (1) 29.2 29.6 29.8 30.1 30.2 Business adjusted average loans increased $803 million Lending ◦ Growth in adjusted average consumer loans(1) partially Adjusted offset by elevated payoffs, pay downs and de-risking 49.0 48.3 48.2 48.6 48.8 Consumer Lending(1) efforts in business loans 2Q17 3Q17 4Q17 1Q18 2Q18 2018 Expectations: Full-year adjusted average loans expected to grow low single digits (1) Non-GAAP; see appendix for reconciliation 4

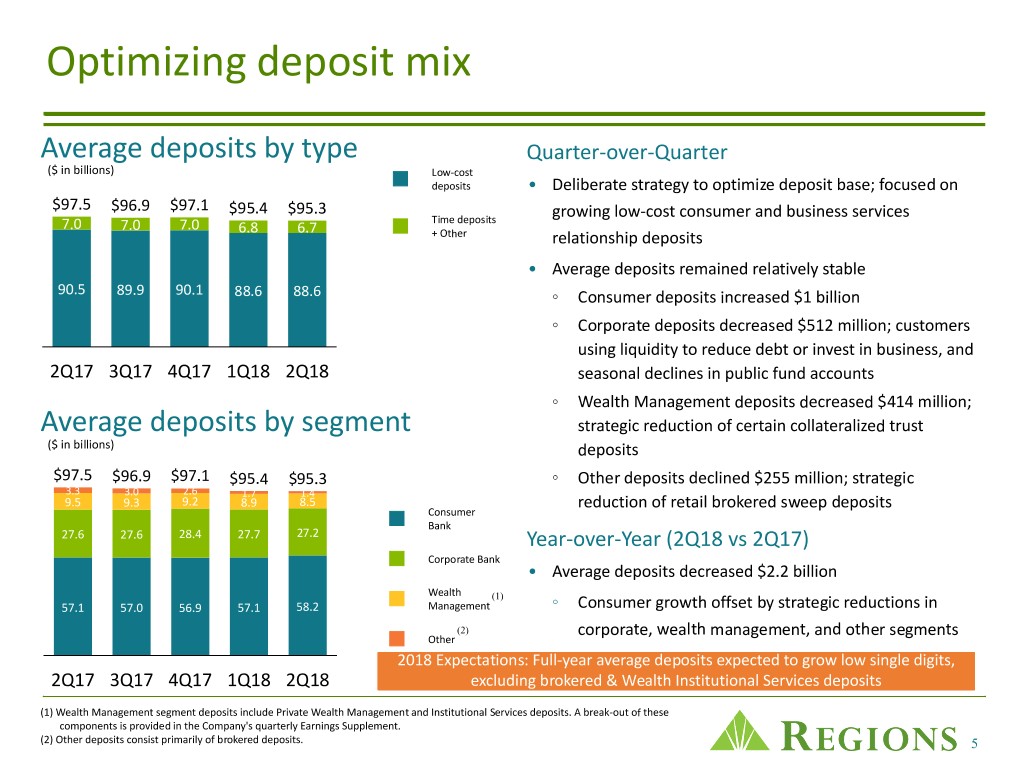

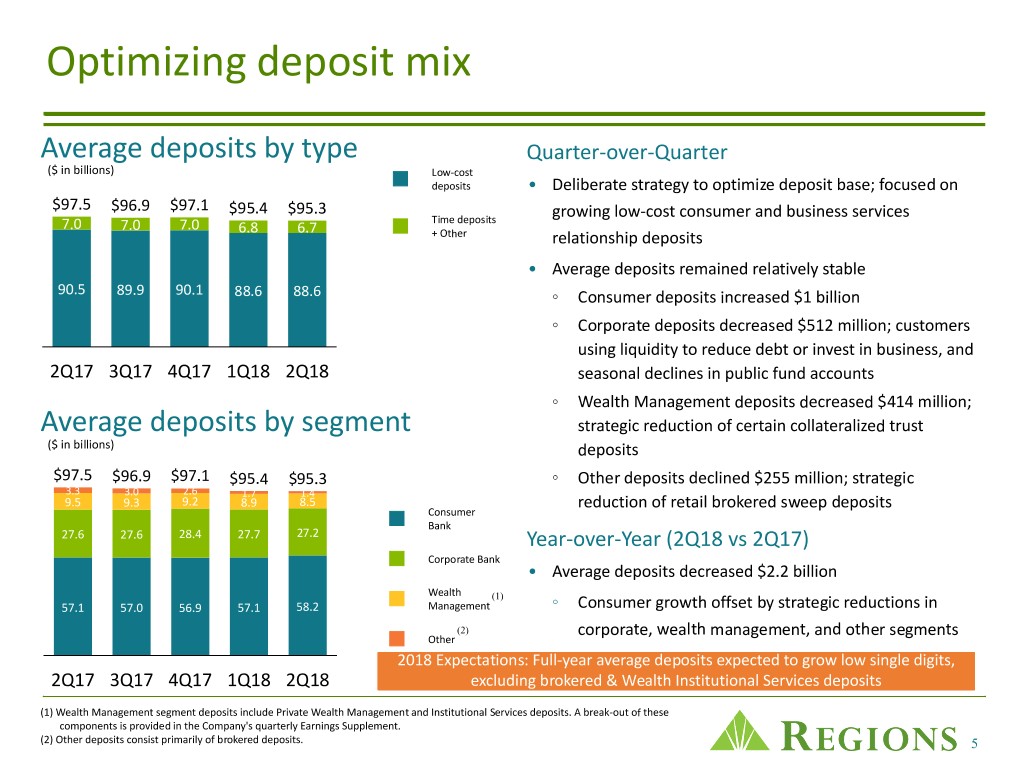

Optimizing deposit mix Average deposits by type Quarter-over-Quarter ($ in billions) Low-cost deposits • Deliberate strategy to optimize deposit base; focused on $97.5 $96.9 $97.1 $95.4 $95.3 Time deposits growing low-cost consumer and business services 7.0 7.0 7.0 6.8 6.7 + Other relationship deposits • Average deposits remained relatively stable 90.5 89.9 90.1 88.6 88.6 ◦ Consumer deposits increased $1 billion ◦ Corporate deposits decreased $512 million; customers using liquidity to reduce debt or invest in business, and 2Q17 3Q17 4Q17 1Q18 2Q18 seasonal declines in public fund accounts ◦ Wealth Management deposits decreased $414 million; Average deposits by segment strategic reduction of certain collateralized trust ($ in billions) deposits $97.5 $96.9 $97.1 $95.4 $95.3 ◦ Other deposits declined $255 million; strategic 3.3 3.0 2.6 1.7 1.4 9.5 9.3 9.2 8.9 8.5 reduction of retail brokered sweep deposits Consumer Bank 27.6 27.6 28.4 27.7 27.2 Year-over-Year (2Q18 vs 2Q17) Corporate Bank • Average deposits decreased $2.2 billion Wealth (1) 57.1 57.0 56.9 57.1 58.2 Management ◦ Consumer growth offset by strategic reductions in (2) corporate, wealth management, and other segments Other 2018 Expectations: Full-year average deposits expected to grow low single digits, 2Q17 3Q17 4Q17 1Q18 2Q18 excluding brokered & Wealth Institutional Services deposits (1) Wealth Management segment deposits include Private Wealth Management and Institutional Services deposits. A break-out of these components is provided in the Company's quarterly Earnings Supplement. (2) Other deposits consist primarily of brokered deposits. 5

Deposit advantage Deposits by Customer Type(1) Non-Interest Bearing Deposits Interest Bearing Deposits (Retail vs. Business) by Customer Type(1) by Customer Type(1) 2Q18, ($ in billions) ($ in billions) ($ in billions) Private Institutional $37 $37 $61 Wealth* Services* $36 $35 $36 $60 $60 $60 $59 $1 $8 16 15 14 14 13 17 18 18 16 16 Corporate Consumer Segment $27 Segment 45 45 46 46 46 $58 19 19 19 19 20 Other 2Q17 3Q17 4Q17 1Q18 2Q18 2Q17 3Q17 4Q17 1Q18 2Q18 Segment $1 • Retail deposits represent 69% of total deposits; Business • Approximately 50% of consumer low-cost deposit dollars have deposits represent 31% of total deposits been customers for over 10 years • 38% of total average 2Q18 deposits are non-interest bearing • 93% of consumer checking households include a high quality deposits primary checking account(2) • Total deposit cost 24 bps, interest-bearing cost 38 bps • Over 55% of consumer checking customers utilize multiple channels and 75% of all interactions are digital • Total cumulative deposit beta (since 3Q15) of 14%; consumer retail beta 1%; commercial beta 44% • Active mobile banking customers increased 12% YoY and active mobile deposit customers more than doubled * Private Wealth Management and Institutional Services deposits are combined into the Wealth Management Segment. (1) Average balances (2) High quality and primary account estimates are based on multiple individual account behaviors and activities (e.g., balances 6 and transaction levels).

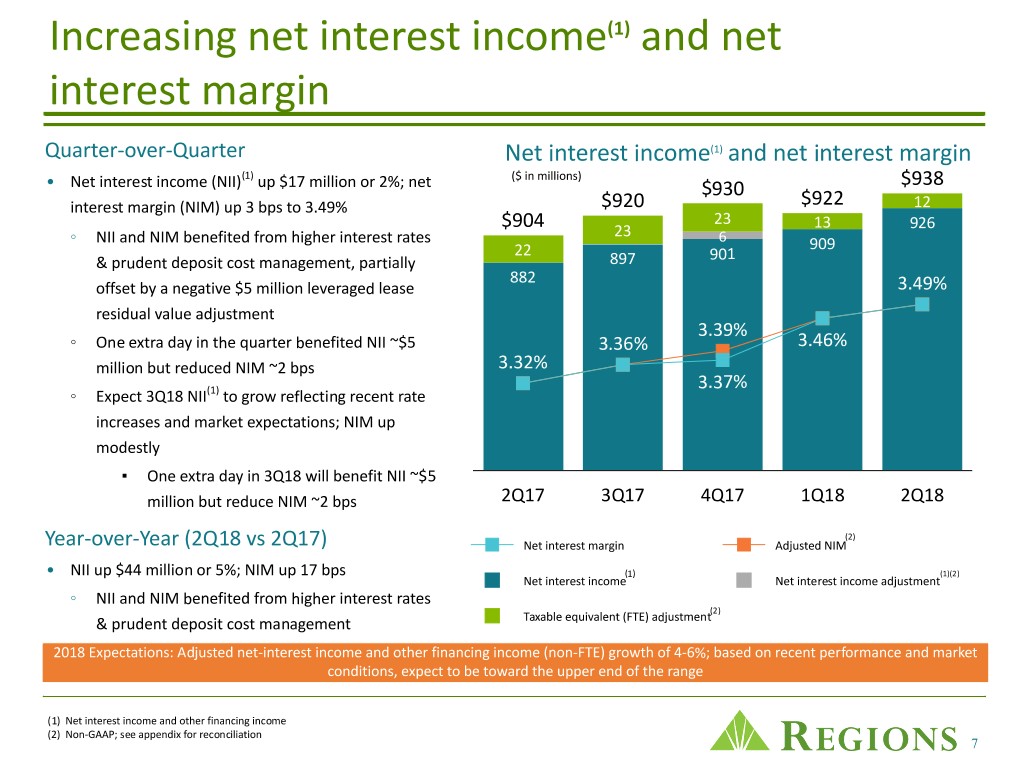

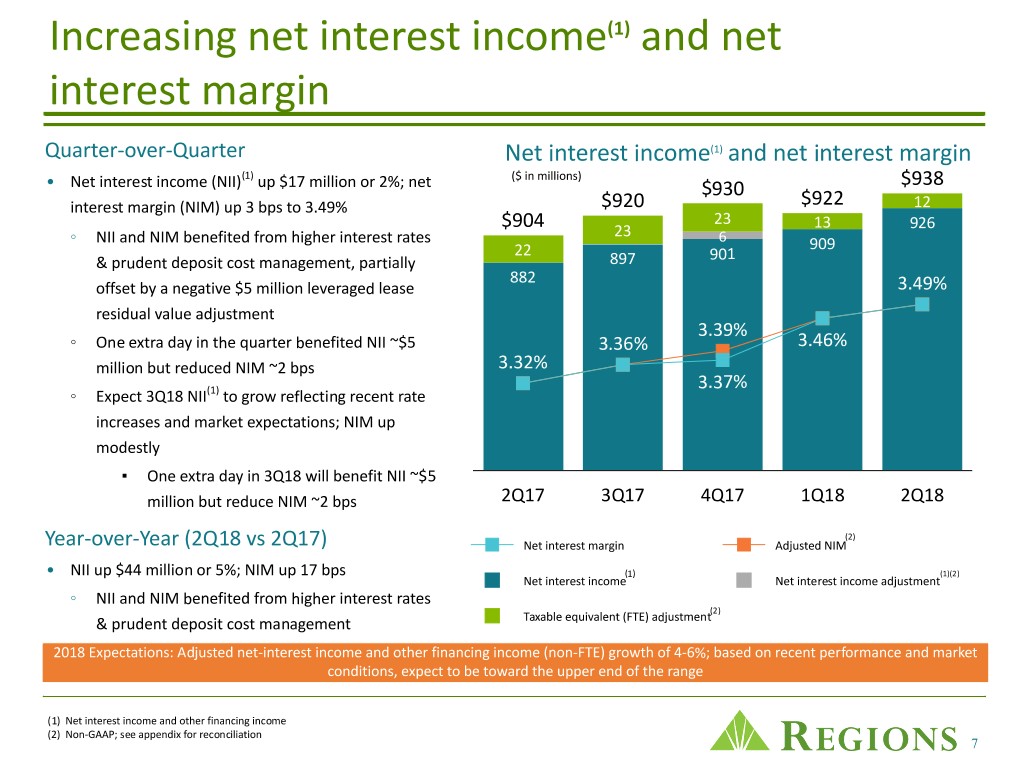

Increasing net interest income(1) and net interest margin Quarter-over-Quarter Net interest income(1) and net interest margin (1) ($ in millions) • Net interest income (NII) up $17 million or 2%; net $930 $938 interest margin (NIM) up 3 bps to 3.49% $920 $922 12 23 13 $904 23 926 ◦ NII and NIM benefited from higher interest rates 6 909 22 901 & prudent deposit cost management, partially 897 882 offset by a negative $5 million leveraged lease 3.49% residual value adjustment 3.39% ◦ One extra day in the quarter benefited NII ~$5 3.36% 3.46% million but reduced NIM ~2 bps 3.32% 3.37% ◦ Expect 3Q18 NII(1) to grow reflecting recent rate increases and market expectations; NIM up modestly ▪ One extra day in 3Q18 will benefit NII ~$5 million but reduce NIM ~2 bps 2Q17 3Q17 4Q17 1Q18 2Q18 (2) Year-over-Year (2Q18 vs 2Q17) Net interest margin Adjusted NIM • NII up $44 million or 5%; NIM up 17 bps (1) (1)(2) Net interest income Net interest income adjustment ◦ NII and NIM benefited from higher interest rates (2) & prudent deposit cost management Taxable equivalent (FTE) adjustment 2018 Expectations: Adjusted net-interest income and other financing income (non-FTE) growth of 4-6%; based on recent performance and market conditions, expect to be toward the upper end of the range (1) Net interest income and other financing income (2) Non-GAAP; see appendix for reconciliation 7

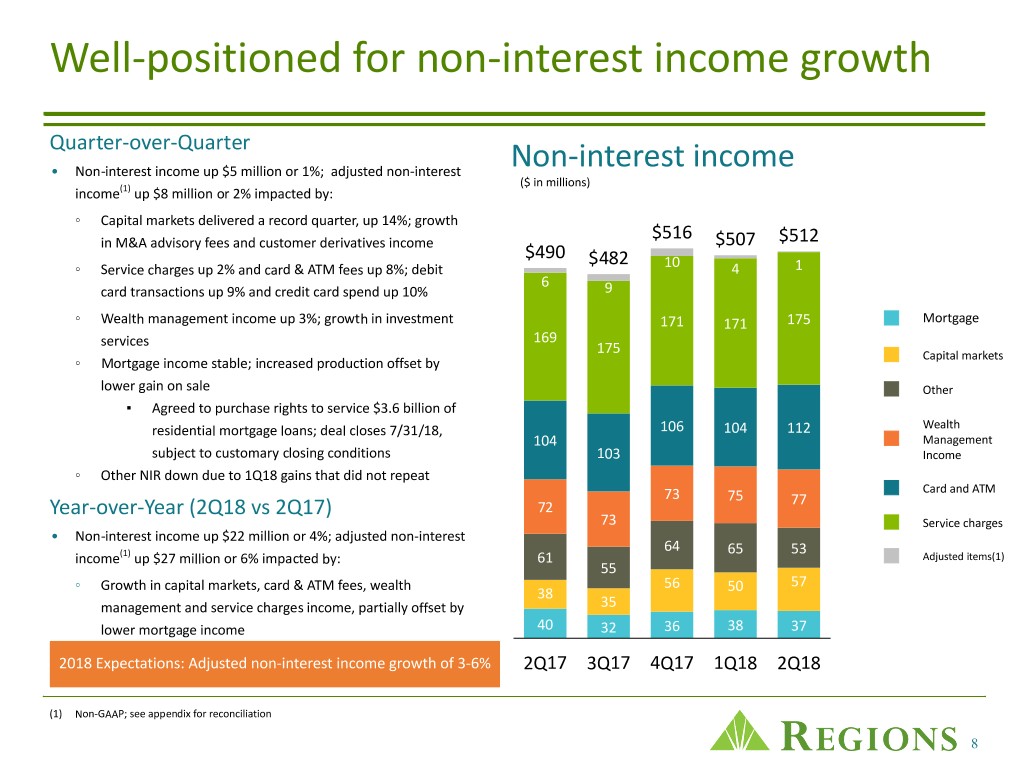

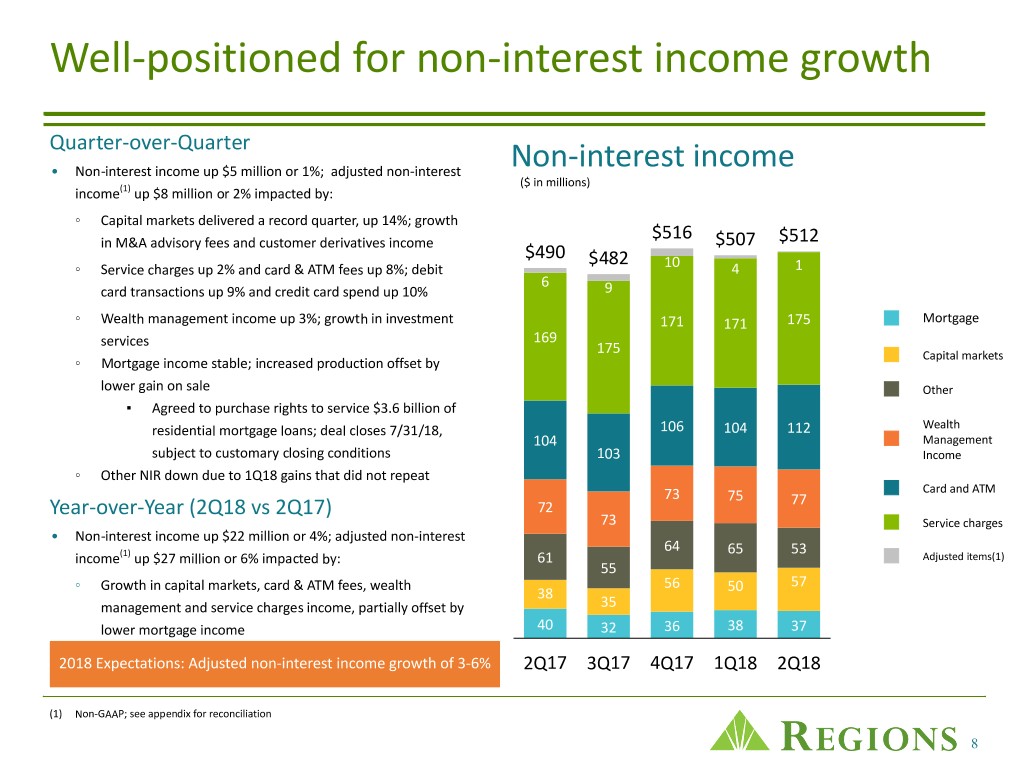

Well-positioned for non-interest income growth Quarter-over-Quarter • Non-interest income up $5 million or 1%; adjusted non-interest Non-interest income ($ in millions) income(1) up $8 million or 2% impacted by: ◦ Capital markets delivered a record quarter, up 14%; growth $516 in M&A advisory fees and customer derivatives income $507 $512 $490 $482 ◦ Service charges up 2% and card & ATM fees up 8%; debit 10 4 1 6 card transactions up 9% and credit card spend up 10% 9 ◦ Wealth management income up 3%; growth in investment 171 171 175 Mortgage services 169 175 Capital markets ◦ Mortgage income stable; increased production offset by lower gain on sale Other ▪ Agreed to purchase rights to service $3.6 billion of residential mortgage loans; deal closes 7/31/18, 106 104 112 Wealth 104 Management subject to customary closing conditions 103 Income ◦ Other NIR down due to 1Q18 gains that did not repeat Card and ATM 73 75 77 Year-over-Year (2Q18 vs 2Q17) 72 73 Service charges • Non-interest income up $22 million or 4%; adjusted non-interest 64 65 53 income(1) up $27 million or 6% impacted by: 61 Adjusted items(1) 55 ◦ Growth in capital markets, card & ATM fees, wealth 56 57 38 50 management and service charges income, partially offset by 35 lower mortgage income 40 32 36 38 37 2018 Expectations: Adjusted non-interest income growth of 3-6% 2Q17 3Q17 4Q17 1Q18 2Q18 (1) Non-GAAP; see appendix for reconciliation 8

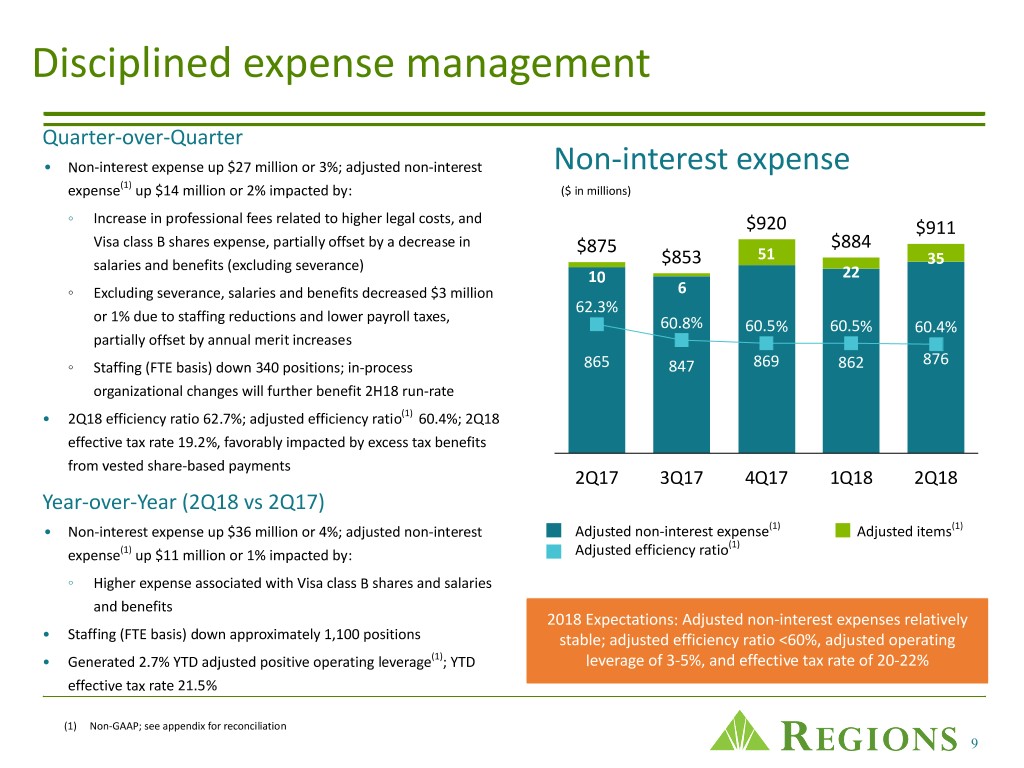

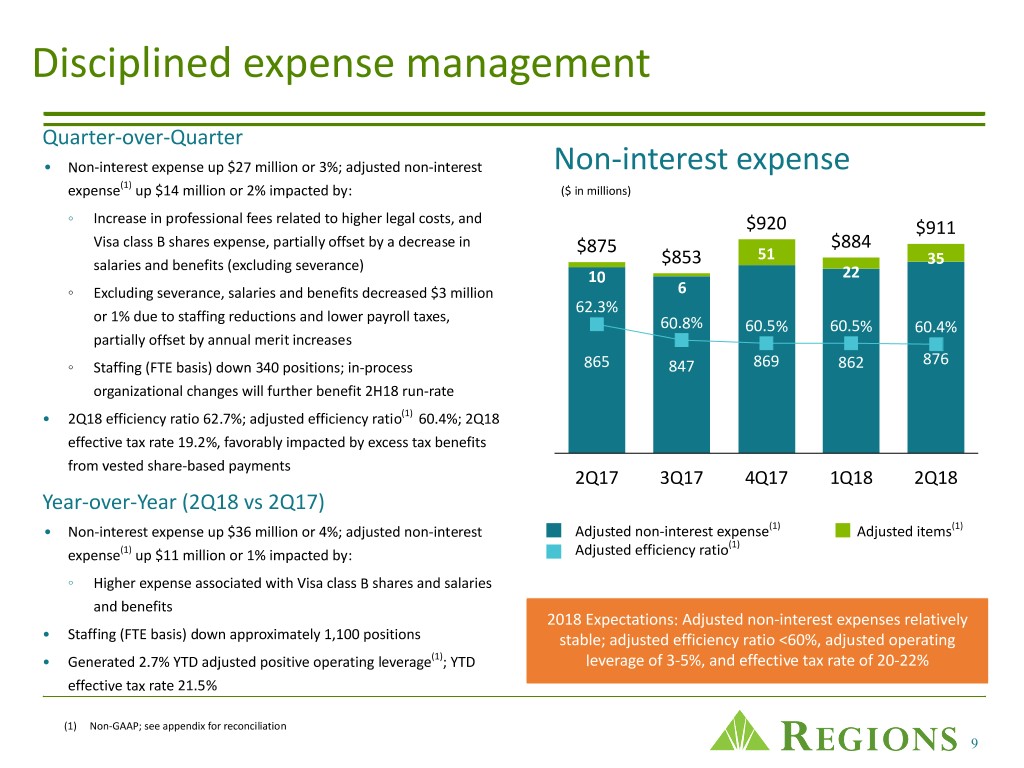

Disciplined expense management Quarter-over-Quarter • Non-interest expense up $27 million or 3%; adjusted non-interest Non-interest expense expense(1) up $14 million or 2% impacted by: ($ in millions) ◦ Increase in professional fees related to higher legal costs, and $920 $911 Visa class B shares expense, partially offset by a decrease in $884 $875 51 salaries and benefits (excluding severance) $853 35 10 22 ◦ Excluding severance, salaries and benefits decreased $3 million 6 62.3% or 1% due to staffing reductions and lower payroll taxes, 60.8% 60.5% 60.5% 60.4% partially offset by annual merit increases 876 ◦ Staffing (FTE basis) down 340 positions; in-process 865 847 869 862 organizational changes will further benefit 2H18 run-rate • 2Q18 efficiency ratio 62.7%; adjusted efficiency ratio(1) 60.4%; 2Q18 effective tax rate 19.2%, favorably impacted by excess tax benefits from vested share-based payments 2Q17 3Q17 4Q17 1Q18 2Q18 Year-over-Year (2Q18 vs 2Q17) • Non-interest expense up $36 million or 4%; adjusted non-interest Adjusted non-interest expense(1) Adjusted items(1) (1) expense(1) up $11 million or 1% impacted by: Adjusted efficiency ratio ◦ Higher expense associated with Visa class B shares and salaries and benefits 2018 Expectations: Adjusted non-interest expenses relatively • Staffing (FTE basis) down approximately 1,100 positions stable; adjusted efficiency ratio <60%, adjusted operating • Generated 2.7% YTD adjusted positive operating leverage(1); YTD leverage of 3-5%, and effective tax rate of 20-22% effective tax rate 21.5% (1) Non-GAAP; see appendix for reconciliation 9

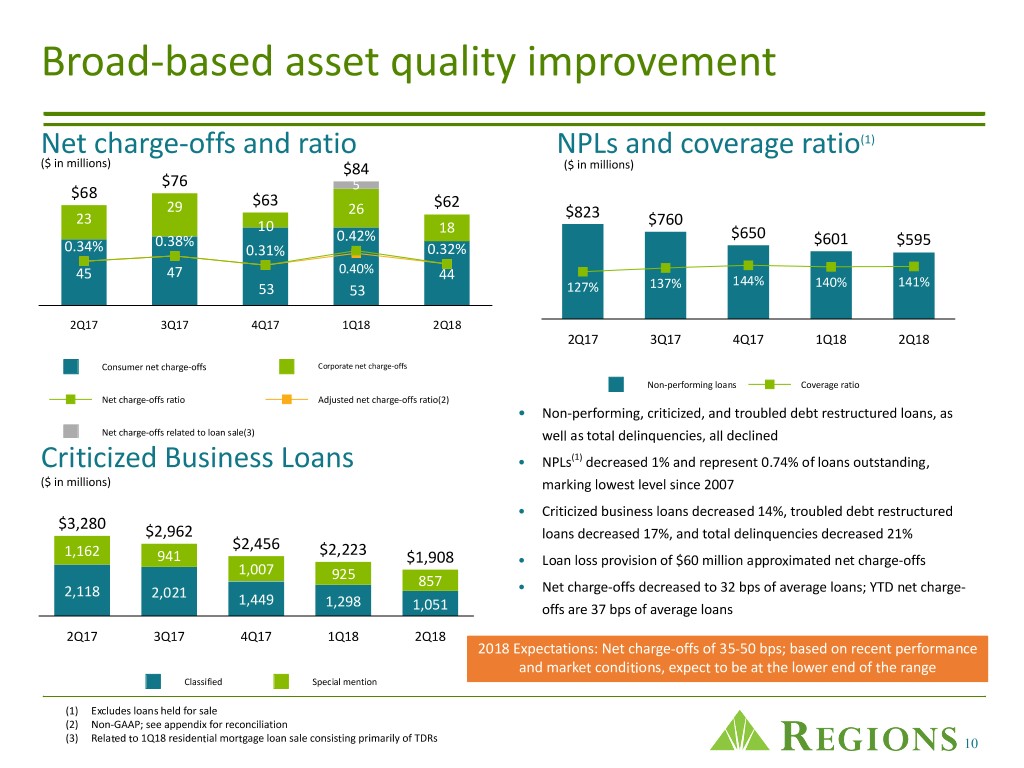

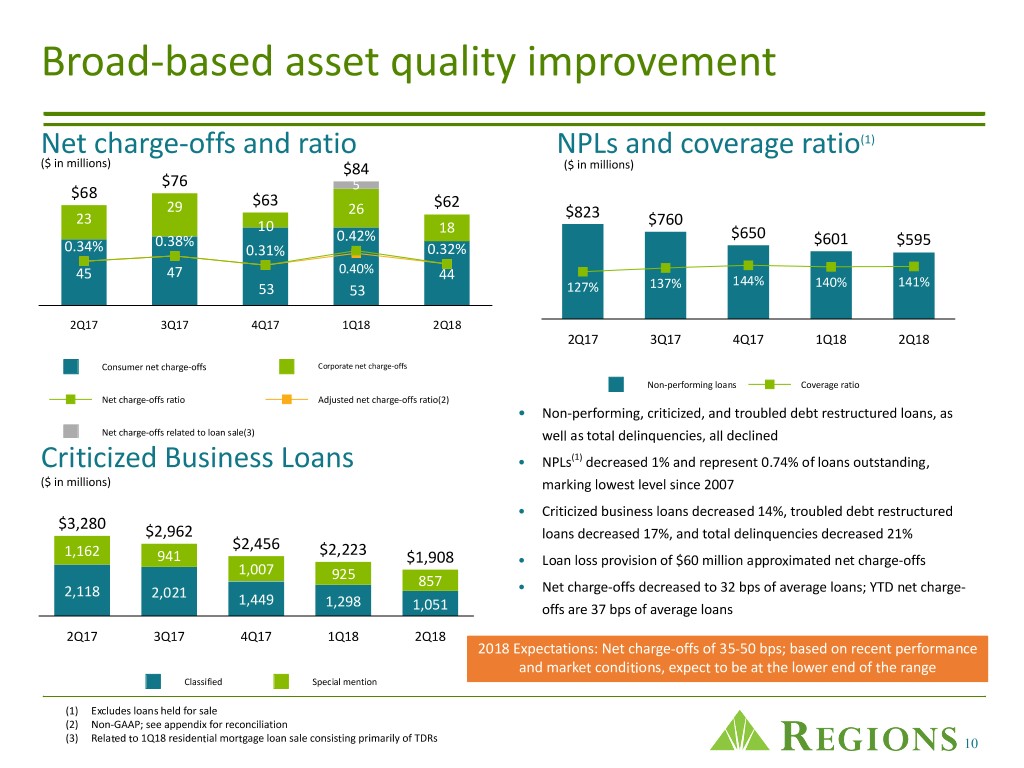

Broad-based asset quality improvement Net charge-offs and ratio NPLs and coverage ratio(1) ($ in millions) $84 ($ in millions) $76 5 $68 $63 29 26 $62 23 $823 10 18 $760 0.38% 0.42% $650 $601 $595 0.34% 0.31% 0.32% 45 47 0.40% 44 144% 140% 141% 53 53 127% 137% 2Q17 3Q17 4Q17 1Q18 2Q18 2Q17 3Q17 4Q17 1Q18 2Q18 Consumer net charge-offs Corporate net charge-offs Non-performing loans Coverage ratio Net charge-offs ratio Adjusted net charge-offs ratio(2) • Non-performing, criticized, and troubled debt restructured loans, as Net charge-offs related to loan sale(3) well as total delinquencies, all declined Criticized Business Loans • NPLs(1) decreased 1% and represent 0.74% of loans outstanding, ($ in millions) marking lowest level since 2007 • Criticized business loans decreased 14%, troubled debt restructured $3,280 $2,962 loans decreased 17%, and total delinquencies decreased 21% 1,162 $2,456 $2,223 941 $1,908 • Loan loss provision of $60 million approximated net charge-offs 1,007 925 857 2,118 • Net charge-offs decreased to 32 bps of average loans; YTD net charge- 2,021 1,449 1,298 1,051 offs are 37 bps of average loans 2Q17 3Q17 4Q17 1Q18 2Q18 2018 Expectations: Net charge-offs of 35-50 bps; based on recent performance and market conditions, expect to be at the lower end of the range Classified Special mention (1) Excludes loans held for sale (2) Non-GAAP; see appendix for reconciliation (3) Related to 1Q18 residential mortgage loan sale consisting primarily of TDRs 10

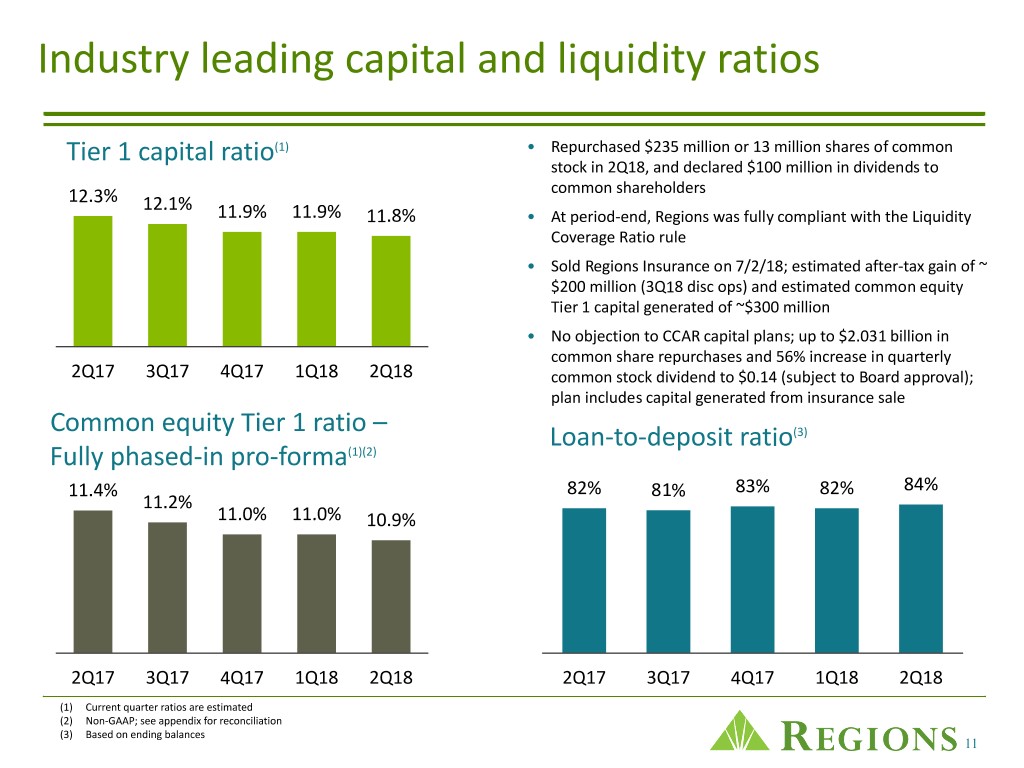

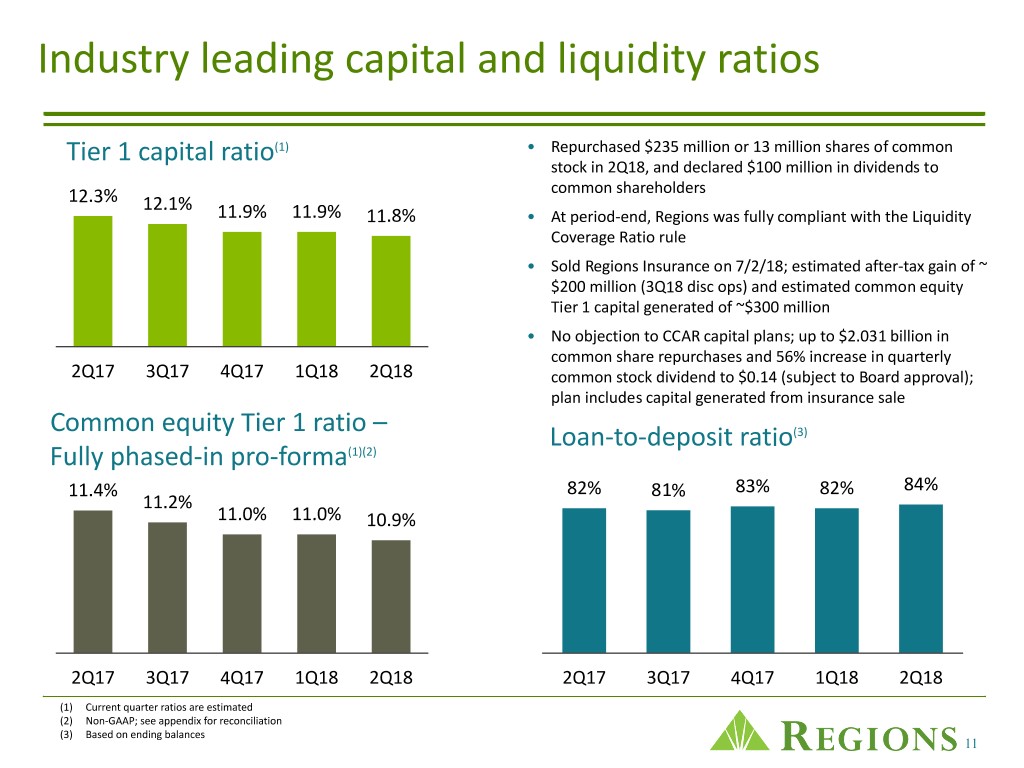

Industry leading capital and liquidity ratios Tier 1 capital ratio(1) • Repurchased $235 million or 13 million shares of common stock in 2Q18, and declared $100 million in dividends to common shareholders 12.3% 12.1% 11.9% 11.9% 11.8% • At period-end, Regions was fully compliant with the Liquidity Coverage Ratio rule • Sold Regions Insurance on 7/2/18; estimated after-tax gain of ~ $200 million (3Q18 disc ops) and estimated common equity Tier 1 capital generated of ~$300 million • No objection to CCAR capital plans; up to $2.031 billion in common share repurchases and 56% increase in quarterly 2Q17 3Q17 4Q17 1Q18 2Q18 common stock dividend to $0.14 (subject to Board approval); plan includes capital generated from insurance sale Common equity Tier 1 ratio – Loan-to-deposit ratio(3) Fully phased-in pro-forma(1)(2) 11.4% 82% 81% 83% 82% 84% 11.2% 11.0% 11.0% 10.9% 2Q17 3Q17 4Q17 1Q18 2Q18 2Q17 3Q17 4Q17 1Q18 2Q18 (1) Current quarter ratios are estimated (2) Non-GAAP; see appendix for reconciliation (3) Based on ending balances 11

2018 expectations • Adjusted ROATCE of 14 to 16%(1)(2) • Full-year adjusted average loans are expected to grow in the low single digits(1) • Full-year average deposits are expected to grow in the low single digits, excluding brokered and Wealth Institutional Services deposits(3) • Adjusted operating leverage of approximately 3% - 5%(1) – Adjusted net interest income and other financing income growth (non-FTE) of 4% - 6%(1); based on recent performance and market conditions, expect to be toward the upper end of the range – Adjusted non-interest income growth of 3% - 6%(1) – Adjusted non-interest expenses relatively stable(1) – Adjusted efficiency ratio < 60%(1) • Effective income tax rate of 20-22% • Net charge-offs of 35-50 bps; based on recent performance and market conditions, expect to be at the lower end of the range (1) The reconciliation with respect to forward-looking non-GAAP measures is expected to be consistent with actual non-GAAP reconciliations included in attached appendix or previous filings with the SEC. (2) This long-term target was updated to reflect the impact of corporate income tax reform. (3) Private Wealth Management and Institutional Services deposits are combined into the Wealth Management Segment. Total Other segment deposits consist primarily of brokered deposits. A break-out of these components are provided in the Company's quarterly Earnings Supplement. 12

Appendix 13

Selected items impacting earnings Adjusted Items Quarter Ended • Incurred $34 million in severance and ($ amounts in millions, except per share data) 6/30/2018 3/31/2018 6/30/2017 $1 million in branch consolidation Pre-tax adjusted items: expenses related to Simplify and Grow Branch consolidation, property and equipment charges $ (1) $ (3) $ (7) initiative Salaries and benefits related to severance charges (34) (15) (3) Expenses associated with residential mortgage loan sale — (4) — Selected Items(2) Securities gains (losses), net 1 — 1 Leveraged lease termination gains — 4 — • Incurred $5 million of net impairment Net provision benefit from residential mortgage loan sale — 16 — charges reducing the value of certain Gain on sale of affordable housing residential mortgage loans — — 5 operating lease assets (1) Diluted EPS impact $ (0.02) $ — $ — • Lower than anticipated losses Pre-tax additional selected items(2): associated with 2017 hurricanes Operating lease impairment charges $ (5) $ (4) $ (7) resulted in a reduction to the company's Reduction of hurricane-related allowance for loan losses 10 30 — hurricane-specific allowance for loan Visa Class B shares expense (10) (2) (1) losses of $10 million Pension settlement charge — — (10) • Incurred $10 million of expense associated with Visa class B shares sold in a prior year (1) Based on income taxes at a 25% incremental rate beginning in 2018, and 38.5% for all prior periods. (2) Items represent an outsized or unusual impact to the quarter or quarterly trends, but are not considered non-GAAP adjustments. 14

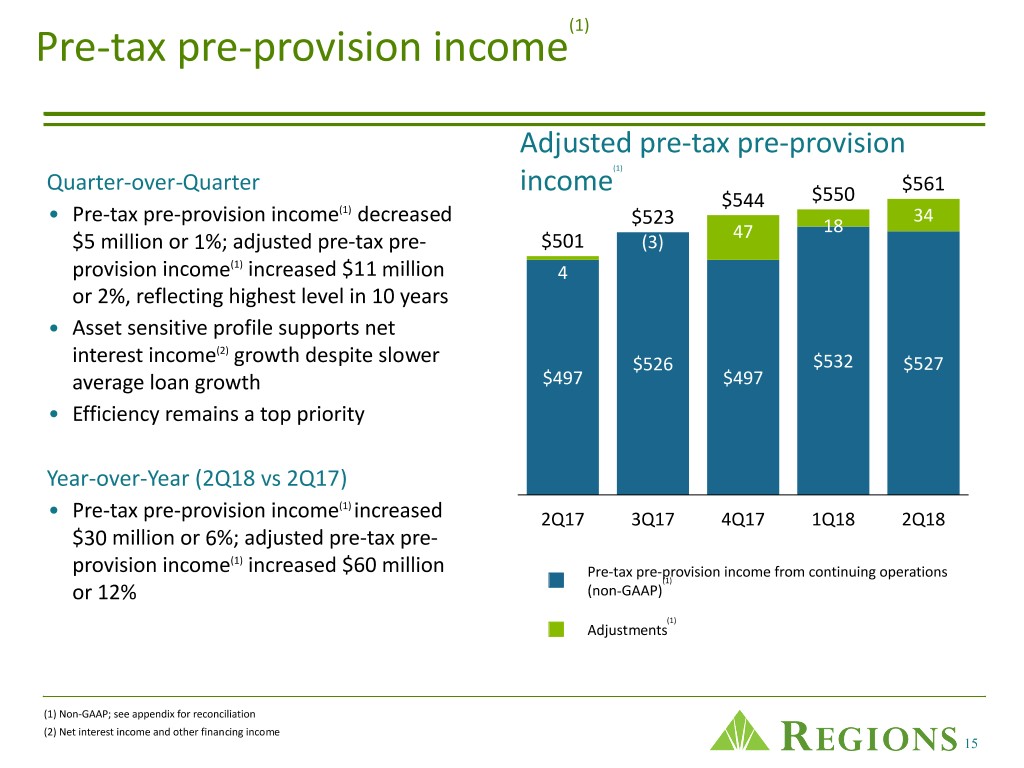

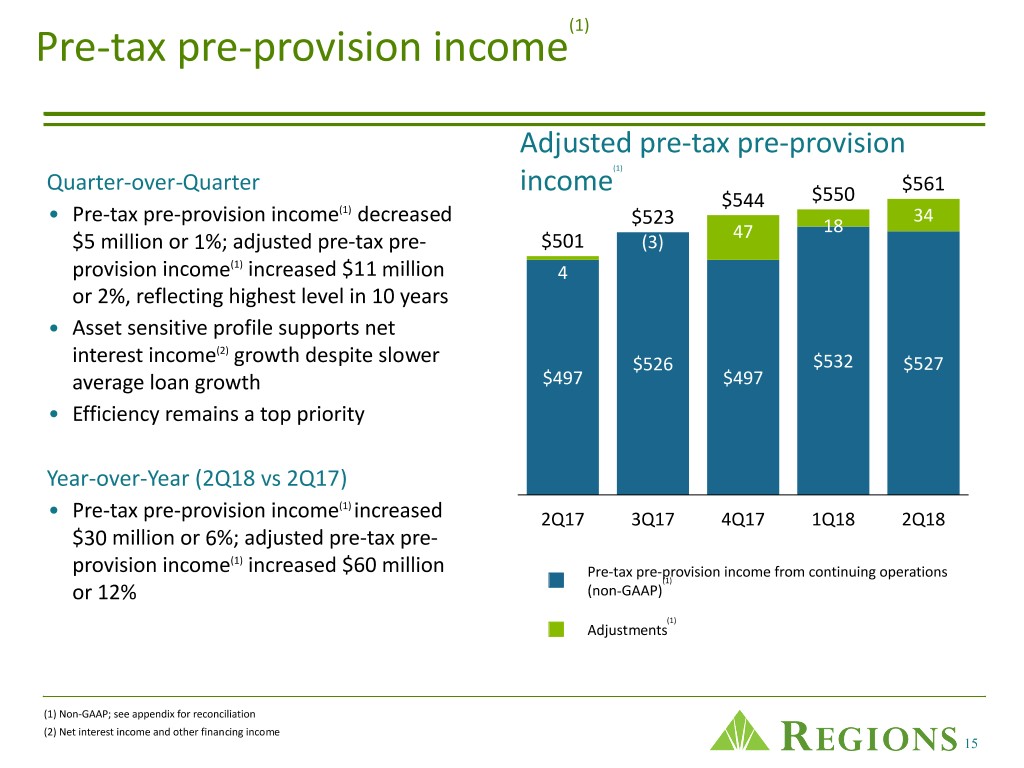

(1) Pre-tax pre-provision income Adjusted pre-tax pre-provision (1) Quarter-over-Quarter income $550 $561 $544 • Pre-tax pre-provision income(1) decreased $523 34 47 18 $5 million or 1%; adjusted pre-tax pre- $501 (3) provision income(1) increased $11 million 4 or 2%, reflecting highest level in 10 years • Asset sensitive profile supports net (2) interest income growth despite slower $526 $532 $527 average loan growth $497 $497 • Efficiency remains a top priority Year-over-Year (2Q18 vs 2Q17) (1) • Pre-tax pre-provision income increased 2Q17 3Q17 4Q17 1Q18 2Q18 $30 million or 6%; adjusted pre-tax pre- (1) provision income increased $60 million Pre-tax pre-provision income from continuing operations (1) or 12% (non-GAAP) (1) Adjustments (1) Non-GAAP; see appendix for reconciliation (2) Net interest income and other financing income 15

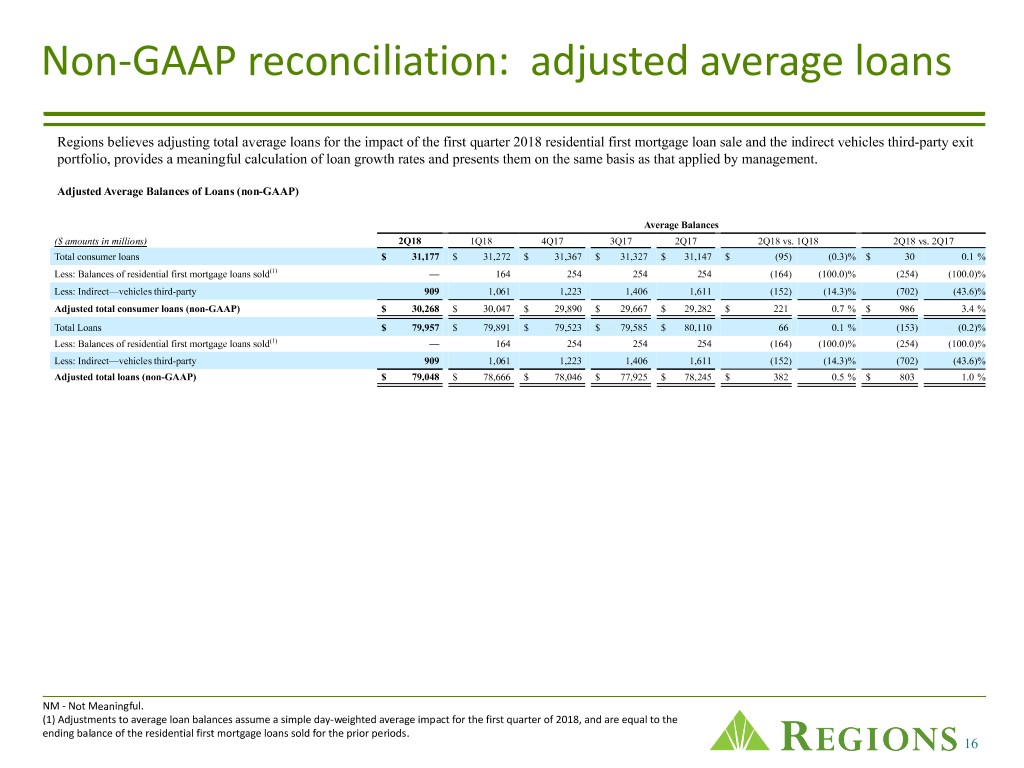

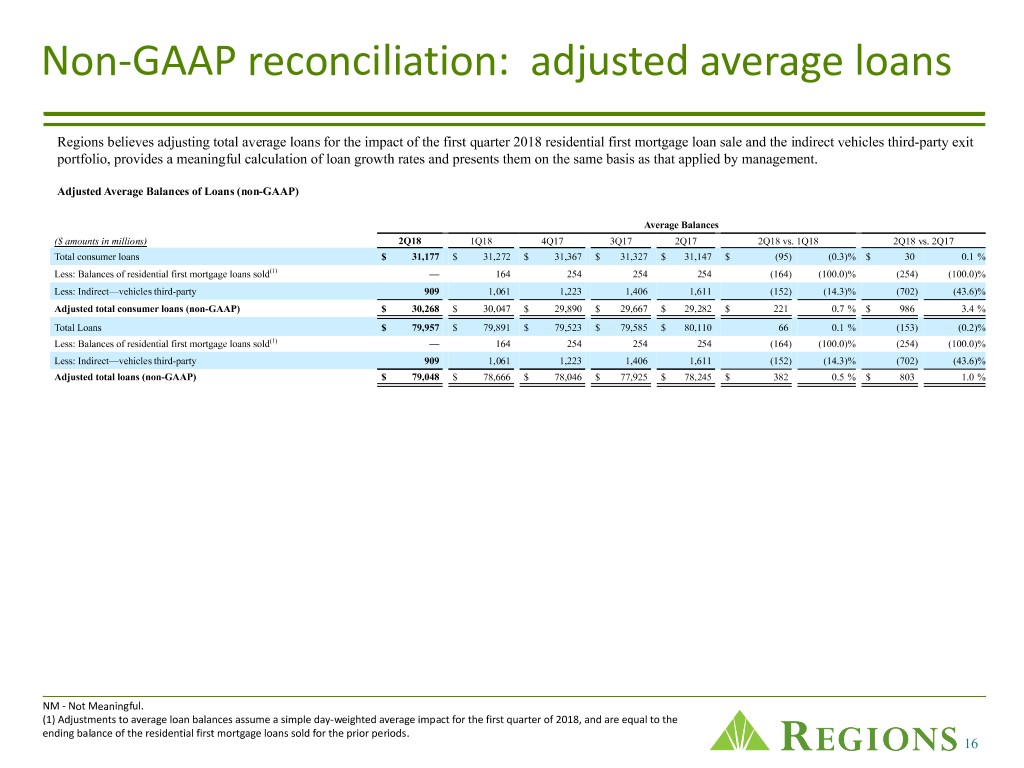

Non-GAAP reconciliation: adjusted average loans Regions believes adjusting total average loans for the impact of the first quarter 2018 residential first mortgage loan sale and the indirect vehicles third-party exit portfolio, provides a meaningful calculation of loan growth rates and presents them on the same basis as that applied by management. Adjusted Average Balances of Loans (non-GAAP) Average Balances ($ amounts in millions) 2Q18 1Q18 4Q17 3Q17 2Q17 2Q18 vs. 1Q18 2Q18 vs. 2Q17 Total consumer loans $ 31,177 $ 31,272 $ 31,367 $ 31,327 $ 31,147 $ (95) (0.3)% $ 30 0.1 % Less: Balances of residential first mortgage loans sold(1) — 164 254 254 254 (164) (100.0)% (254) (100.0)% Less: Indirect—vehicles third-party 909 1,061 1,223 1,406 1,611 (152) (14.3)% (702) (43.6)% Adjusted total consumer loans (non-GAAP) $ 30,268 $ 30,047 $ 29,890 $ 29,667 $ 29,282 $ 221 0.7 % $ 986 3.4 % Total Loans $ 79,957 $ 79,891 $ 79,523 $ 79,585 $ 80,110 66 0.1 % (153) (0.2)% Less: Balances of residential first mortgage loans sold(1) — 164 254 254 254 (164) (100.0)% (254) (100.0)% Less: Indirect—vehicles third-party 909 1,061 1,223 1,406 1,611 (152) (14.3)% (702) (43.6)% Adjusted total loans (non-GAAP) $ 79,048 $ 78,666 $ 78,046 $ 77,925 $ 78,245 $ 382 0.5 % $ 803 1.0 % NM - Not Meaningful. (1) Adjustments to average loan balances assume a simple day-weighted average impact for the first quarter of 2018, and are equal to the ending balance of the residential first mortgage loans sold for the prior periods. 16

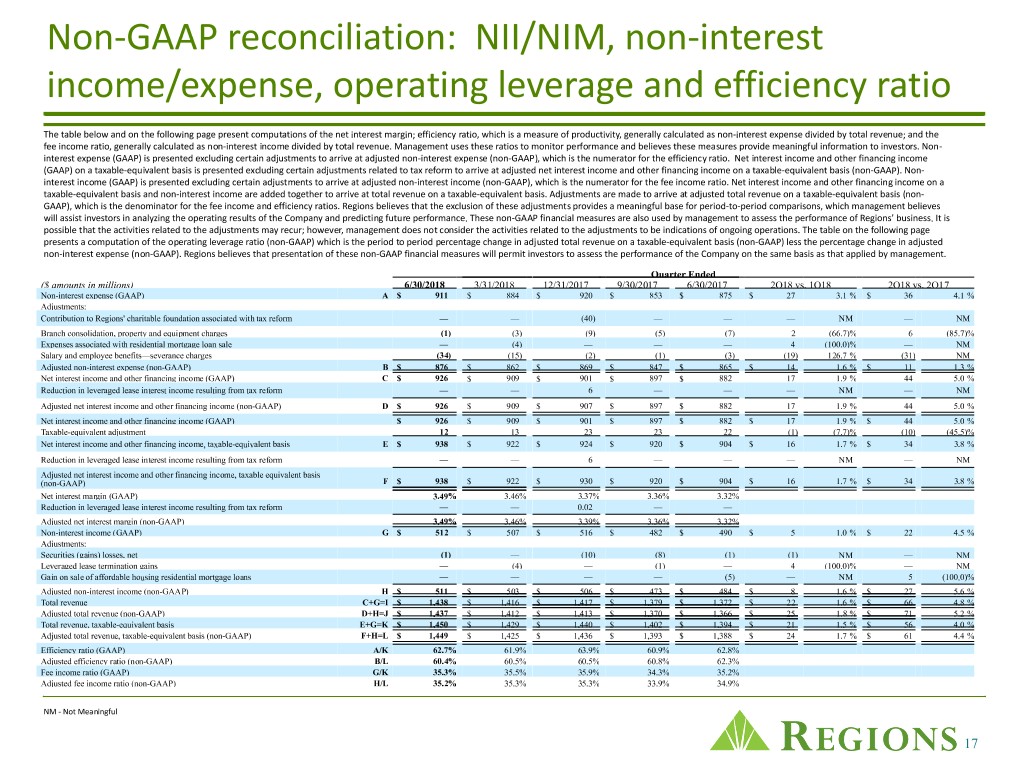

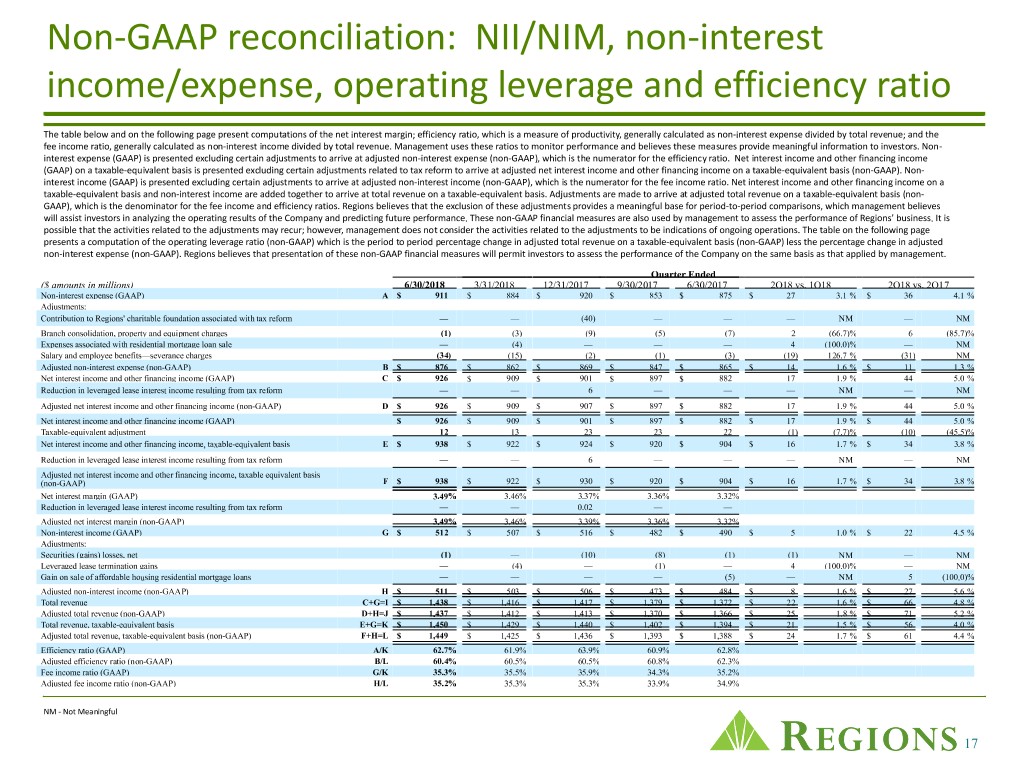

Non-GAAP reconciliation: NII/NIM, non-interest income/expense, operating leverage and efficiency ratio The table below and on the following page present computations of the net interest margin; efficiency ratio, which is a measure of productivity, generally calculated as non-interest expense divided by total revenue; and the fee income ratio, generally calculated as non-interest income divided by total revenue. Management uses these ratios to monitor performance and believes these measures provide meaningful information to investors. Non- interest expense (GAAP) is presented excluding certain adjustments to arrive at adjusted non-interest expense (non-GAAP), which is the numerator for the efficiency ratio. Net interest income and other financing income (GAAP) on a taxable-equivalent basis is presented excluding certain adjustments related to tax reform to arrive at adjusted net interest income and other financing income on a taxable-equivalent basis (non-GAAP). Non- interest income (GAAP) is presented excluding certain adjustments to arrive at adjusted non-interest income (non-GAAP), which is the numerator for the fee income ratio. Net interest income and other financing income on a taxable-equivalent basis and non-interest income are added together to arrive at total revenue on a taxable-equivalent basis. Adjustments are made to arrive at adjusted total revenue on a taxable-equivalent basis (non- GAAP), which is the denominator for the fee income and efficiency ratios. Regions believes that the exclusion of these adjustments provides a meaningful base for period-to-period comparisons, which management believes will assist investors in analyzing the operating results of the Company and predicting future performance. These non-GAAP financial measures are also used by management to assess the performance of Regions’ business. It is possible that the activities related to the adjustments may recur; however, management does not consider the activities related to the adjustments to be indications of ongoing operations. The table on the following page presents a computation of the operating leverage ratio (non-GAAP) which is the period to period percentage change in adjusted total revenue on a taxable-equivalent basis (non-GAAP) less the percentage change in adjusted non-interest expense (non-GAAP). Regions believes that presentation of these non-GAAP financial measures will permit investors to assess the performance of the Company on the same basis as that applied by management. Quarter Ended ($ amounts in millions) 6/30/2018 3/31/2018 12/31/2017 9/30/2017 6/30/2017 2Q18 vs. 1Q18 2Q18 vs. 2Q17 Non-interest expense (GAAP) A $ 911 $ 884 $ 920 $ 853 $ 875 $ 27 3.1 % $ 36 4.1 % Adjustments: Contribution to Regions' charitable foundation associated with tax reform — — (40) — — — NM — NM Branch consolidation, property and equipment charges (1) (3) (9) (5) (7) 2 (66.7)% 6 (85.7)% Expenses associated with residential mortgage loan sale — (4) — — — 4 (100.0)% — NM Salary and employee benefits—severance charges (34) (15) (2) (1) (3) (19) 126.7 % (31) NM Adjusted non-interest expense (non-GAAP) B $ 876 $ 862 $ 869 $ 847 $ 865 $ 14 1.6 % $ 11 1.3 % Net interest income and other financing income (GAAP) C $ 926 $ 909 $ 901 $ 897 $ 882 17 1.9 % 44 5.0 % Reduction in leveraged lease interest income resulting from tax reform — — 6 — — — NM — NM Adjusted net interest income and other financing income (non-GAAP) D $ 926 $ 909 $ 907 $ 897 $ 882 17 1.9 % 44 5.0 % Net interest income and other financing income (GAAP) $ 926 $ 909 $ 901 $ 897 $ 882 $ 17 1.9 % $ 44 5.0 % Taxable-equivalent adjustment 12 13 23 23 22 (1) (7.7)% (10) (45.5)% Net interest income and other financing income, taxable-equivalent basis E $ 938 $ 922 $ 924 $ 920 $ 904 $ 16 1.7 % $ 34 3.8 % Reduction in leveraged lease interest income resulting from tax reform — — 6 — — — NM — NM Adjusted net interest income and other financing income, taxable equivalent basis (non-GAAP) F $ 938 $ 922 $ 930 $ 920 $ 904 $ 16 1.7 % $ 34 3.8 % Net interest margin (GAAP) 3.49% 3.46% 3.37% 3.36% 3.32% Reduction in leveraged lease interest income resulting from tax reform — — 0.02 — — Adjusted net interest margin (non-GAAP) 3.49% 3.46% 3.39% 3.36% 3.32% Non-interest income (GAAP) G $ 512 $ 507 $ 516 $ 482 $ 490 $ 5 1.0 % $ 22 4.5 % Adjustments: Securities (gains) losses, net (1) — (10) (8) (1) (1) NM — NM Leveraged lease termination gains — (4) — (1) — 4 (100.0)% — NM Gain on sale of affordable housing residential mortgage loans — — — — (5) — NM 5 (100.0)% Adjusted non-interest income (non-GAAP) H $ 511 $ 503 $ 506 $ 473 $ 484 $ 8 1.6 % $ 27 5.6 % Total revenue C+G=I $ 1,438 $ 1,416 $ 1,417 $ 1,379 $ 1,372 $ 22 1.6 % $ 66 4.8 % Adjusted total revenue (non-GAAP) D+H=J $ 1,437 $ 1,412 $ 1,413 $ 1,370 $ 1,366 $ 25 1.8 % $ 71 5.2 % Total revenue, taxable-equivalent basis E+G=K $ 1,450 $ 1,429 $ 1,440 $ 1,402 $ 1,394 $ 21 1.5 % $ 56 4.0 % Adjusted total revenue, taxable-equivalent basis (non-GAAP) F+H=L $ 1,449 $ 1,425 $ 1,436 $ 1,393 $ 1,388 $ 24 1.7 % $ 61 4.4 % Efficiency ratio (GAAP) A/K 62.7% 61.9% 63.9% 60.9% 62.8% Adjusted efficiency ratio (non-GAAP) B/L 60.4% 60.5% 60.5% 60.8% 62.3% Fee income ratio (GAAP) G/K 35.3% 35.5% 35.9% 34.3% 35.2% Adjusted fee income ratio (non-GAAP) H/L 35.2% 35.3% 35.3% 33.9% 34.9% NM - Not Meaningful 17

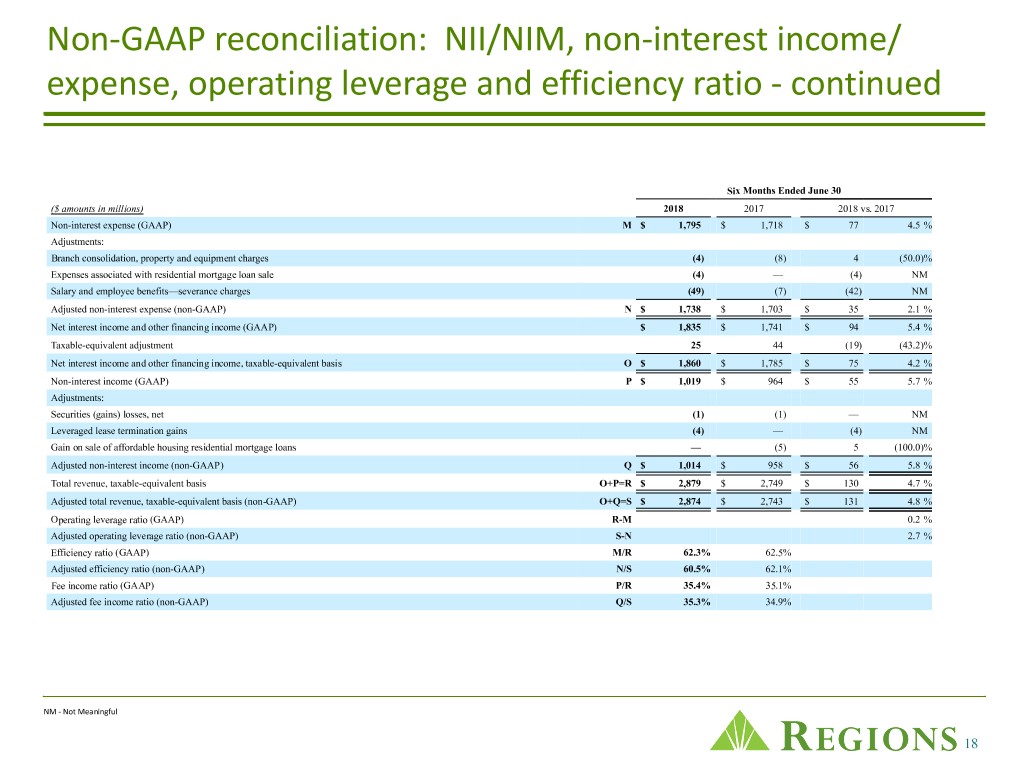

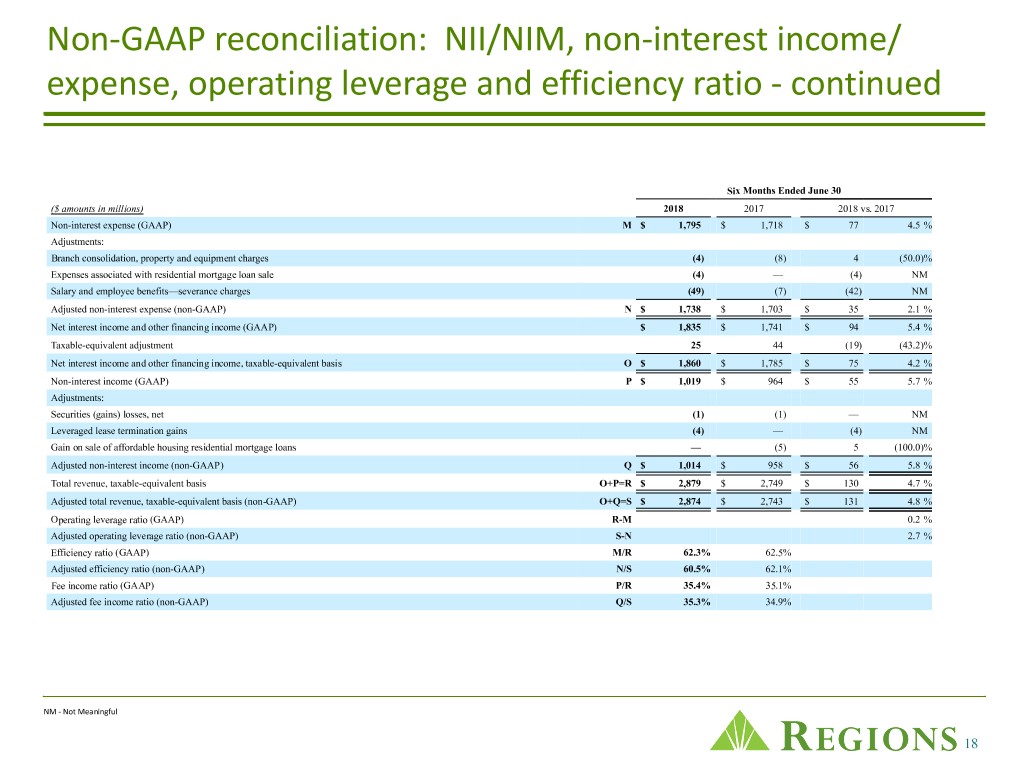

Non-GAAP reconciliation: NII/NIM, non-interest income/ expense, operating leverage and efficiency ratio - continued Six Months Ended June 30 ($ amounts in millions) 2018 2017 2018 vs. 2017 Non-interest expense (GAAP) M $ 1,795 $ 1,718 $ 77 4.5 % Adjustments: Branch consolidation, property and equipment charges (4) (8) 4 (50.0)% Expenses associated with residential mortgage loan sale (4) — (4) NM Salary and employee benefits—severance charges (49) (7) (42) NM Adjusted non-interest expense (non-GAAP) N $ 1,738 $ 1,703 $ 35 2.1 % Net interest income and other financing income (GAAP) $ 1,835 $ 1,741 $ 94 5.4 % Taxable-equivalent adjustment 25 44 (19) (43.2)% Net interest income and other financing income, taxable-equivalent basis O $ 1,860 $ 1,785 $ 75 4.2 % Non-interest income (GAAP) P $ 1,019 $ 964 $ 55 5.7 % Adjustments: Securities (gains) losses, net (1) (1) — NM Leveraged lease termination gains (4) — (4) NM Gain on sale of affordable housing residential mortgage loans — (5) 5 (100.0)% Adjusted non-interest income (non-GAAP) Q $ 1,014 $ 958 $ 56 5.8 % Total revenue, taxable-equivalent basis O+P=R $ 2,879 $ 2,749 $ 130 4.7 % Adjusted total revenue, taxable-equivalent basis (non-GAAP) O+Q=S $ 2,874 $ 2,743 $ 131 4.8 % Operating leverage ratio (GAAP) R-M 0.2 % Adjusted operating leverage ratio (non-GAAP) S-N 2.7 % Efficiency ratio (GAAP) M/R 62.3% 62.5% Adjusted efficiency ratio (non-GAAP) N/S 60.5% 62.1% Fee income ratio (GAAP) P/R 35.4% 35.1% Adjusted fee income ratio (non-GAAP) Q/S 35.3% 34.9% NM - Not Meaningful 18

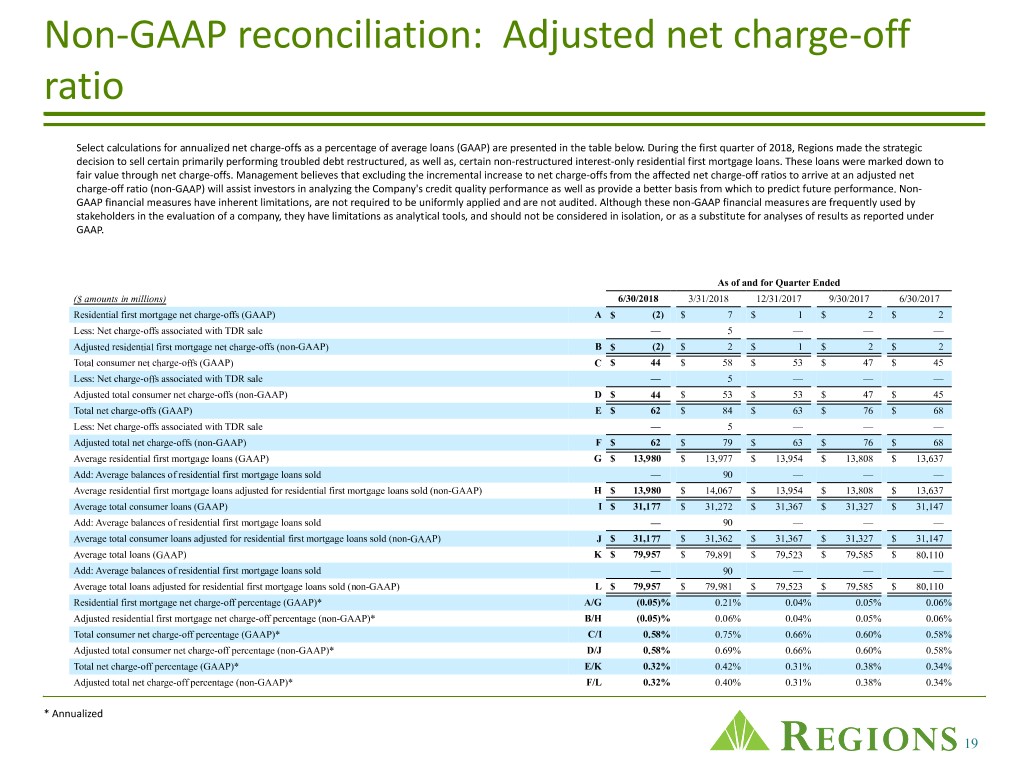

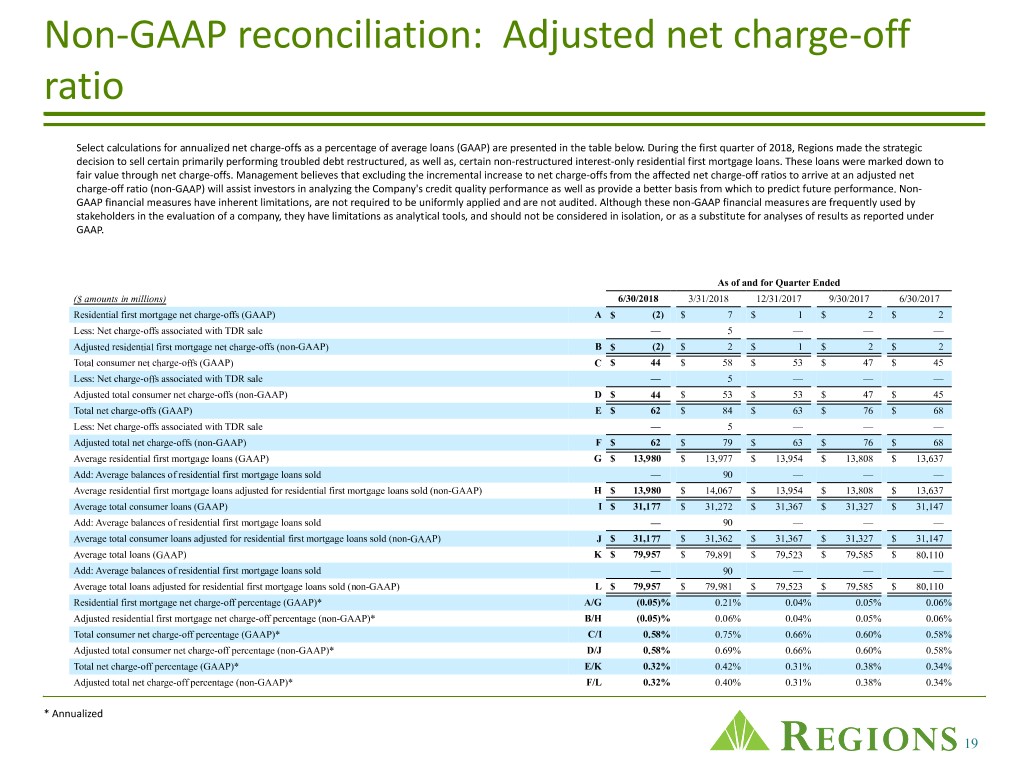

Non-GAAP reconciliation: Adjusted net charge-off ratio Select calculations for annualized net charge-offs as a percentage of average loans (GAAP) are presented in the table below. During the first quarter of 2018, Regions made the strategic decision to sell certain primarily performing troubled debt restructured, as well as, certain non-restructured interest-only residential first mortgage loans. These loans were marked down to fair value through net charge-offs. Management believes that excluding the incremental increase to net charge-offs from the affected net charge-off ratios to arrive at an adjusted net charge-off ratio (non-GAAP) will assist investors in analyzing the Company's credit quality performance as well as provide a better basis from which to predict future performance. Non- GAAP financial measures have inherent limitations, are not required to be uniformly applied and are not audited. Although these non-GAAP financial measures are frequently used by stakeholders in the evaluation of a company, they have limitations as analytical tools, and should not be considered in isolation, or as a substitute for analyses of results as reported under GAAP. As of and for Quarter Ended ($ amounts in millions) 6/30/2018 3/31/2018 12/31/2017 9/30/2017 6/30/2017 Residential first mortgage net charge-offs (GAAP) A $ (2) $ 7 $ 1 $ 2 $ 2 Less: Net charge-offs associated with TDR sale — 5 — — — Adjusted residential first mortgage net charge-offs (non-GAAP) B $ (2) $ 2 $ 1 $ 2 $ 2 Total consumer net charge-offs (GAAP) C $ 44 $ 58 $ 53 $ 47 $ 45 Less: Net charge-offs associated with TDR sale — 5 — — — Adjusted total consumer net charge-offs (non-GAAP) D $ 44 $ 53 $ 53 $ 47 $ 45 Total net charge-offs (GAAP) E $ 62 $ 84 $ 63 $ 76 $ 68 Less: Net charge-offs associated with TDR sale — 5 — — — Adjusted total net charge-offs (non-GAAP) F $ 62 $ 79 $ 63 $ 76 $ 68 Average residential first mortgage loans (GAAP) G $ 13,980 $ 13,977 $ 13,954 $ 13,808 $ 13,637 Add: Average balances of residential first mortgage loans sold — 90 — — — Average residential first mortgage loans adjusted for residential first mortgage loans sold (non-GAAP) H $ 13,980 $ 14,067 $ 13,954 $ 13,808 $ 13,637 Average total consumer loans (GAAP) I $ 31,177 $ 31,272 $ 31,367 $ 31,327 $ 31,147 Add: Average balances of residential first mortgage loans sold — 90 — — — Average total consumer loans adjusted for residential first mortgage loans sold (non-GAAP) J $ 31,177 $ 31,362 $ 31,367 $ 31,327 $ 31,147 Average total loans (GAAP) K $ 79,957 $ 79,891 $ 79,523 $ 79,585 $ 80,110 Add: Average balances of residential first mortgage loans sold — 90 — — — Average total loans adjusted for residential first mortgage loans sold (non-GAAP) L $ 79,957 $ 79,981 $ 79,523 $ 79,585 $ 80,110 Residential first mortgage net charge-off percentage (GAAP)* A/G (0.05)% 0.21% 0.04% 0.05% 0.06% Adjusted residential first mortgage net charge-off percentage (non-GAAP)* B/H (0.05)% 0.06% 0.04% 0.05% 0.06% Total consumer net charge-off percentage (GAAP)* C/I 0.58% 0.75% 0.66% 0.60% 0.58% Adjusted total consumer net charge-off percentage (non-GAAP)* D/J 0.58% 0.69% 0.66% 0.60% 0.58% Total net charge-off percentage (GAAP)* E/K 0.32% 0.42% 0.31% 0.38% 0.34% Adjusted total net charge-off percentage (non-GAAP)* F/L 0.32% 0.40% 0.31% 0.38% 0.34% * Annualized 19

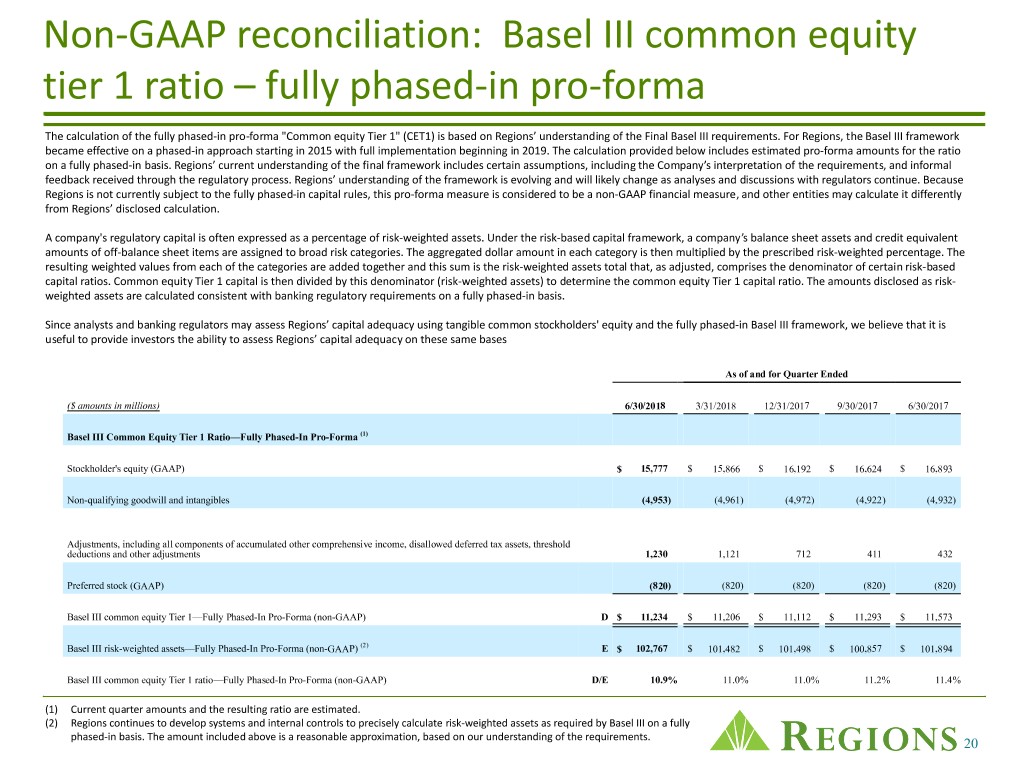

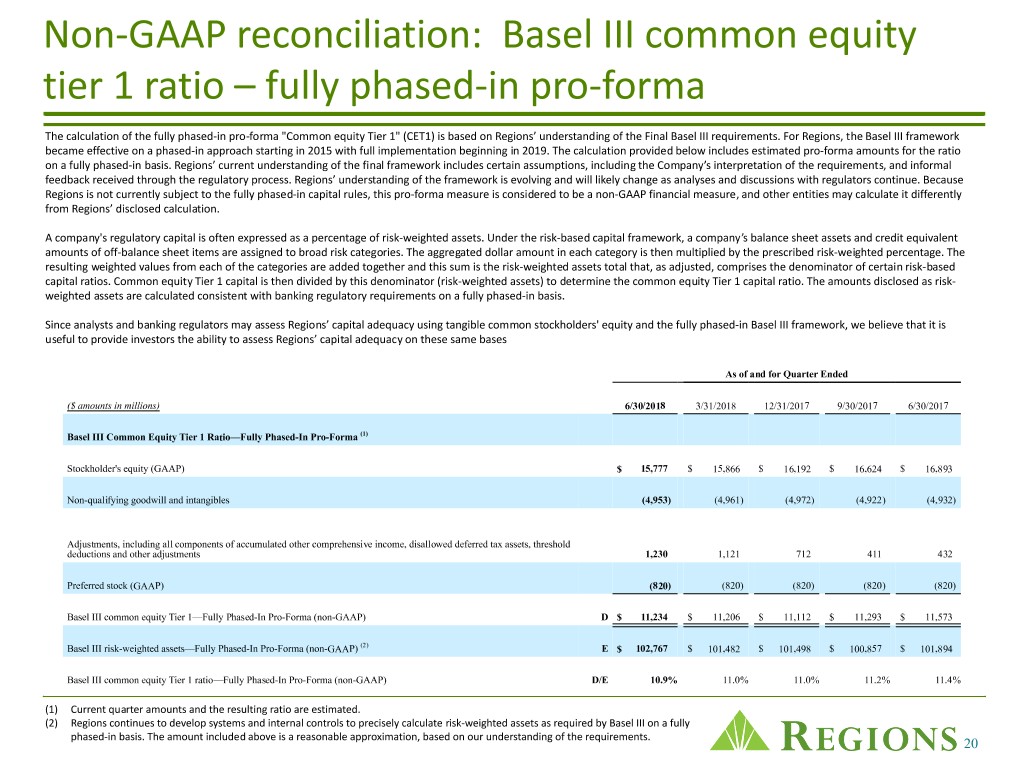

Non-GAAP reconciliation: Basel III common equity tier 1 ratio – fully phased-in pro-forma The calculation of the fully phased-in pro-forma "Common equity Tier 1" (CET1) is based on Regions’ understanding of the Final Basel III requirements. For Regions, the Basel III framework became effective on a phased-in approach starting in 2015 with full implementation beginning in 2019. The calculation provided below includes estimated pro-forma amounts for the ratio on a fully phased-in basis. Regions’ current understanding of the final framework includes certain assumptions, including the Company’s interpretation of the requirements, and informal feedback received through the regulatory process. Regions’ understanding of the framework is evolving and will likely change as analyses and discussions with regulators continue. Because Regions is not currently subject to the fully phased-in capital rules, this pro-forma measure is considered to be a non-GAAP financial measure, and other entities may calculate it differently from Regions’ disclosed calculation. A company's regulatory capital is often expressed as a percentage of risk-weighted assets. Under the risk-based capital framework, a company’s balance sheet assets and credit equivalent amounts of off-balance sheet items are assigned to broad risk categories. The aggregated dollar amount in each category is then multiplied by the prescribed risk-weighted percentage. The resulting weighted values from each of the categories are added together and this sum is the risk-weighted assets total that, as adjusted, comprises the denominator of certain risk-based capital ratios. Common equity Tier 1 capital is then divided by this denominator (risk-weighted assets) to determine the common equity Tier 1 capital ratio. The amounts disclosed as risk- weighted assets are calculated consistent with banking regulatory requirements on a fully phased-in basis. Since analysts and banking regulators may assess Regions’ capital adequacy using tangible common stockholders' equity and the fully phased-in Basel III framework, we believe that it is useful to provide investors the ability to assess Regions’ capital adequacy on these same bases As of and for Quarter Ended ($ amounts in millions) 6/30/2018 3/31/2018 12/31/2017 9/30/2017 6/30/2017 Basel III Common Equity Tier 1 Ratio—Fully Phased-In Pro-Forma (1) Stockholder's equity (GAAP) $ 15,777 $ 15,866 $ 16,192 $ 16,624 $ 16,893 Non-qualifying goodwill and intangibles (4,953) (4,961) (4,972) (4,922) (4,932) Adjustments, including all components of accumulated other comprehensive income, disallowed deferred tax assets, threshold deductions and other adjustments 1,230 1,121 712 411 432 Preferred stock (GAAP) (820) (820) (820) (820) (820) Basel III common equity Tier 1—Fully Phased-In Pro-Forma (non-GAAP) D $ 11,234 $ 11,206 $ 11,112 $ 11,293 $ 11,573 Basel III risk-weighted assets—Fully Phased-In Pro-Forma (non-GAAP) (2) E $ 102,767 $ 101,482 $ 101,498 $ 100,857 $ 101,894 Basel III common equity Tier 1 ratio—Fully Phased-In Pro-Forma (non-GAAP) D/E 10.9% 11.0% 11.0% 11.2% 11.4% (1) Current quarter amounts and the resulting ratio are estimated. (2) Regions continues to develop systems and internal controls to precisely calculate risk-weighted assets as required by Basel III on a fully phased-in basis. The amount included above is a reasonable approximation, based on our understanding of the requirements. 20

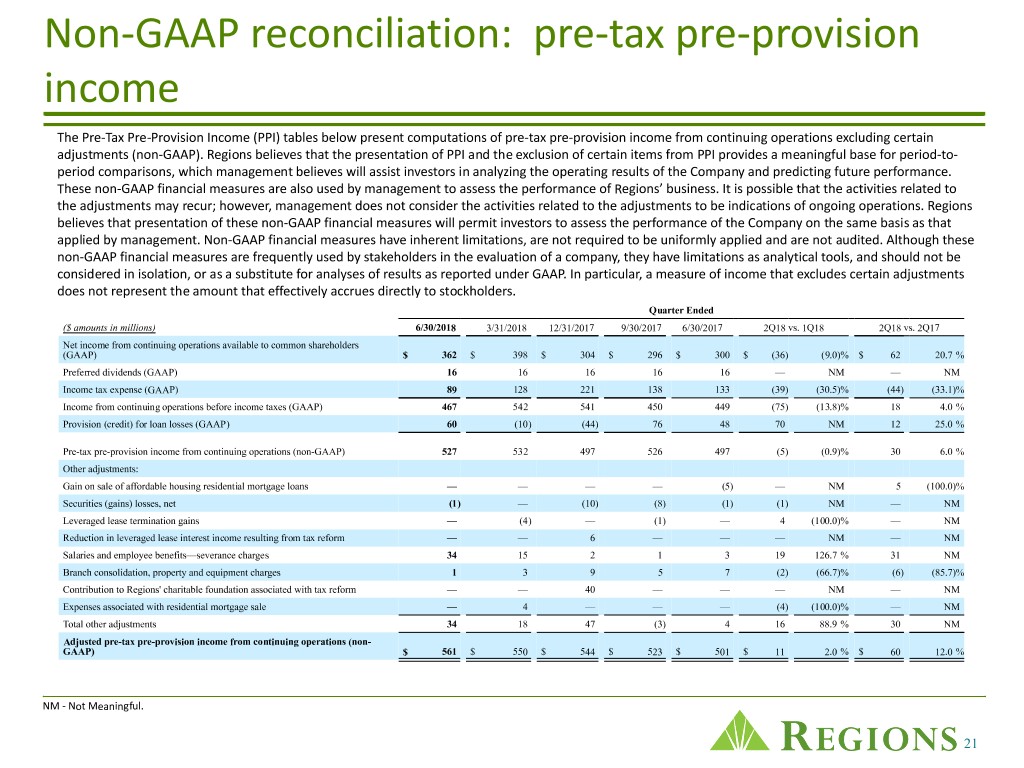

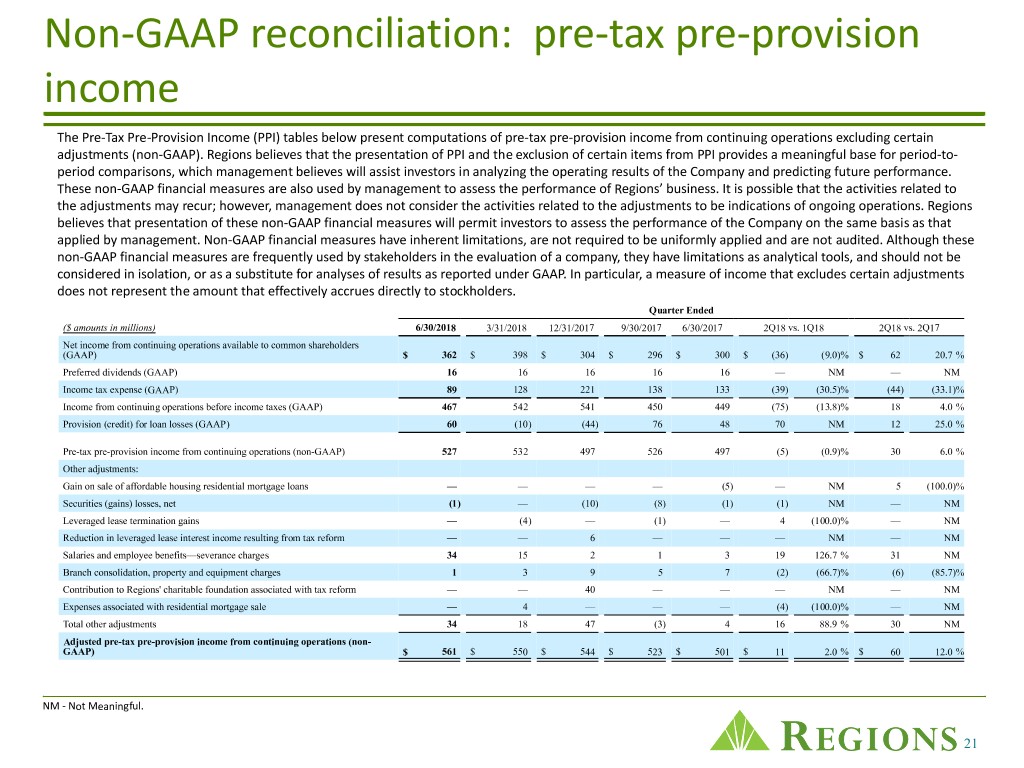

Non-GAAP reconciliation: pre-tax pre-provision income The Pre-Tax Pre-Provision Income (PPI) tables below present computations of pre-tax pre-provision income from continuing operations excluding certain adjustments (non-GAAP). Regions believes that the presentation of PPI and the exclusion of certain items from PPI provides a meaningful base for period-to- period comparisons, which management believes will assist investors in analyzing the operating results of the Company and predicting future performance. These non-GAAP financial measures are also used by management to assess the performance of Regions’ business. It is possible that the activities related to the adjustments may recur; however, management does not consider the activities related to the adjustments to be indications of ongoing operations. Regions believes that presentation of these non-GAAP financial measures will permit investors to assess the performance of the Company on the same basis as that applied by management. Non-GAAP financial measures have inherent limitations, are not required to be uniformly applied and are not audited. Although these non-GAAP financial measures are frequently used by stakeholders in the evaluation of a company, they have limitations as analytical tools, and should not be considered in isolation, or as a substitute for analyses of results as reported under GAAP. In particular, a measure of income that excludes certain adjustments does not represent the amount that effectively accrues directly to stockholders. Quarter Ended ($ amounts in millions) 6/30/2018 3/31/2018 12/31/2017 9/30/2017 6/30/2017 2Q18 vs. 1Q18 2Q18 vs. 2Q17 Net income from continuing operations available to common shareholders (GAAP) $ 362 $ 398 $ 304 $ 296 $ 300 $ (36) (9.0)% $ 62 20.7 % Preferred dividends (GAAP) 16 16 16 16 16 — NM — NM Income tax expense (GAAP) 89 128 221 138 133 (39) (30.5)% (44) (33.1)% Income from continuing operations before income taxes (GAAP) 467 542 541 450 449 (75) (13.8)% 18 4.0 % Provision (credit) for loan losses (GAAP) 60 (10) (44) 76 48 70 NM 12 25.0 % Pre-tax pre-provision income from continuing operations (non-GAAP) 527 532 497 526 497 (5) (0.9)% 30 6.0 % Other adjustments: Gain on sale of affordable housing residential mortgage loans — — — — (5) — NM 5 (100.0)% Securities (gains) losses, net (1) — (10) (8) (1) (1) NM — NM Leveraged lease termination gains — (4) — (1) — 4 (100.0)% — NM Reduction in leveraged lease interest income resulting from tax reform — — 6 — — — NM — NM Salaries and employee benefits—severance charges 34 15 2 1 3 19 126.7 % 31 NM Branch consolidation, property and equipment charges 1 3 9 5 7 (2) (66.7)% (6) (85.7)% Contribution to Regions' charitable foundation associated with tax reform — — 40 — — — NM — NM Expenses associated with residential mortgage sale — 4 — — — (4) (100.0)% — NM Total other adjustments 34 18 47 (3) 4 16 88.9 % 30 NM Adjusted pre-tax pre-provision income from continuing operations (non- GAAP) $ 561 $ 550 $ 544 $ 523 $ 501 $ 11 2.0 % $ 60 12.0 % NM - Not Meaningful. 21

Forward-looking statements Forward-Looking Statements This release may include forward-looking statements as defined in the Private Securities Litigation Reform Act of 1995, which reflect Regions’ current views with respect to future events and financial performance. Forward-looking statements are not based on historical information, but rather are related to future operations, strategies, financial results or other developments. Forward-looking statements are based on management’s expectations as well as certain assumptions and estimates made by, and information available to, management at the time the statements are made. Those statements are based on general assumptions and are subject to various risks, uncertainties and other factors that may cause actual results to differ materially from the views, beliefs and projections expressed in such statements. These risks, uncertainties and other factors include, but are not limited to, those described below: • Current and future economic and market conditions in the United States generally or in the communities we serve, including the effects of possible declines in property values, increases in unemployment rates and potential reductions of economic growth, which may adversely affect our lending and other businesses and our financial results and conditions. • Possible changes in trade, monetary and fiscal policies of, and other activities undertaken by, governments, agencies, central banks and similar organizations, which could have a material adverse effect on our earnings. • The effects of a possible downgrade in the U.S. government’s sovereign credit rating or outlook, which could result in risks to us and general economic conditions that we are not able to predict. • Possible changes in market interest rates or capital markets could adversely affect our revenue and expense, the value of assets and obligations, and the availability and cost of capital and liquidity. • Any impairment of our goodwill or other intangibles, any repricing of assets, or any adjustment of valuation allowances on our deferred tax assets due to changes in law, adverse changes in the economic environment, declining operations of the reporting unit or other factors. • The effect of changes in tax laws, including the effect of Tax Reform and any future interpretations of or amendments to Tax Reform, which may impact our earnings, capital ratios and our ability to return capital to shareholders. • Possible changes in the creditworthiness of customers and the possible impairment of the collectability of loans and leases, including operating leases. • Changes in the speed of loan prepayments, loan origination and sale volumes, charge-offs, loan loss provisions or actual loan losses where our allowance for loan losses may not be adequate to cover our eventual losses. • Possible acceleration of prepayments on mortgage-backed securities due to low interest rates, and the related acceleration of premium amortization on those securities. • Loss of customer checking and savings account deposits as customers pursue other, higher-yield investments, which could increase our funding costs. • Possible changes in consumer and business spending and saving habits and the related effect on our ability to increase assets and to attract deposits, which could adversely affect our net income. • Our ability to effectively compete with other traditional and non-traditional financial services companies, some of whom possess greater financial resources than we do or are subject to different regulatory standards than we are. • Our inability to develop and gain acceptance from current and prospective customers for new products and services and the enhancement of existing products and services to meet customers’ needs and respond to emerging technological trends in a timely manner could have a negative impact on our revenue. • Our inability to keep pace with technological changes could result in losing business to competitors. • Changes in laws and regulations affecting our businesses, including legislation and regulations relating to bank products and services, as well as changes in the enforcement and interpretation of such laws and regulations by applicable governmental and self-regulatory agencies, which could require us to change certain business practices, increase compliance risk, reduce our revenue, impose additional costs on us, or otherwise negatively affect our businesses. • Our ability to obtain a regulatory non-objection (as part of the CCAR process or otherwise) to take certain capital actions, including paying dividends and any plans to increase common stock dividends, repurchase common stock under current or future programs, or redeem preferred stock or other regulatory capital instruments, may impact our ability to return capital to stockholders and market perceptions of us. • Our ability to comply with stress testing and capital planning requirements (as part of the CCAR process or otherwise) may continue to require a significant investment of our managerial resources due to the importance and intensity of such tests and requirements. • Our ability to comply with applicable capital and liquidity requirements (including, among other things, the Basel III capital standards and the LCR rule), including our ability to generate capital internally or raise capital on favorable terms, and if we fail to meet requirements, our financial condition could be negatively impacted. • The effects of any developments, changes or actions relating to any litigation or regulatory proceedings brought against us or any of our subsidiaries. • The costs, including possibly incurring fines, penalties, or other negative effects (including reputational harm) of any adverse judicial, administrative, or arbitral rulings or proceedings, regulatory enforcement actions, or other legal actions to which we or any of our subsidiaries are a party, and which may adversely affect our results. • Our ability to manage fluctuations in the value of assets and liabilities and off-balance sheet exposure so as to maintain sufficient capital and liquidity to support our business. 22

Forward-looking statements (continued) • Our ability to execute on our strategic and operational plans, including our ability to fully realize the financial and non-financial benefits relating to our strategic initiatives. • The risks and uncertainties related to our acquisition or divestiture of businesses. • The success of our marketing efforts in attracting and retaining customers. • Our ability to recruit and retain talented and experienced personnel to assist in the development, management and operation of our products and services may be affected by changes in laws and regulations in effect from time to time. • Fraud or misconduct by our customers, employees or business partners. • Any inaccurate or incomplete information provided to us by our customers or counterparties. • Inability of our framework to manage risks associated with our business such as credit risk and operational risk, including third-party vendors and other service providers, which could, among other things, result in a breach of operating or security systems as a result of a cyber attack or similar act or failure to deliver our services effectively. • Dependence on key suppliers or vendors to obtain equipment and other supplies for our business on acceptable terms. • The inability of our internal controls and procedures to prevent, detect or mitigate any material errors or fraudulent acts. • The effects of geopolitical instability, including wars, conflicts and terrorist attacks and the potential impact, directly or indirectly, on our businesses. • The effects of man-made and natural disasters, including fires, floods, droughts, tornadoes, hurricanes, and environmental damage, which may negatively affect our operations and/or our loan portfolios and increase our cost of conducting business. • Changes in commodity market prices and conditions could adversely affect the cash flows of our borrowers operating in industries that are impacted by changes in commodity prices (including businesses indirectly impacted by commodities prices such as businesses that transport commodities or manufacture equipment used in the production of commodities), which could impair their ability to service any loans outstanding to them and/or reduce demand for loans in those industries. • Our ability to identify and address cyber-security risks such as data security breaches, malware, “denial of service” attacks, “hacking” and identity theft, a failure of which could disrupt our business and result in the disclosure of and/or misuse or misappropriation of confidential or proprietary information, disruption or damage to our systems, increased costs, losses, or adverse effects to our reputation. • Our ability to realize our adjusted efficiency ratio target as part of our expense management initiatives. • Possible downgrades in our credit ratings or outlook could increase the costs of funding from capital markets. • The effects of problems encountered by other financial institutions that adversely affect us or the banking industry generally could require us to change certain business practices, reduce our revenue, impose additional costs on us, or otherwise negatively affect our businesses. • The effects of the failure of any component of our business infrastructure provided by a third party could disrupt our businesses, result in the disclosure of and/or misuse of confidential information or proprietary information, increase our costs, negatively affect our reputation, and cause losses. • Our ability to receive dividends from our subsidiaries could affect our liquidity and ability to pay dividends to stockholders. • Changes in accounting policies or procedures as may be required by the FASB or other regulatory agencies could materially affect how we report our financial results. • Other risks identified from time to time in reports that we file with the SEC. • Fluctuations in the price of our common stock and inability to complete stock repurchases in the time frame and/or on the terms anticipated. • The effects of any damage to our reputation resulting from developments related to any of the items identified above. The foregoing list of factors is not exhaustive. For discussion of these and other factors that may cause actual results to differ from expectations, look under the captions “Forward-Looking Statements” and “Risk Factors” of Regions’ Annual Report on Form 10- K for the year ended December 31, 2017 as filed with the SEC. The words "future," “anticipates,” "assumes," “intends,” “plans,” “seeks,” “believes,” "predicts," "potential," "objectives," “estimates,” “expects,” “targets,” “projects,” “outlook,” “forecast,” "would," “will,” “may,” “could,” “should,” “can,” and similar expressions often signify forward-looking statements. You should not place undue reliance on any forward-looking statements, which speak only as of the date made. We assume no obligation and do not intend to update or revise any forward-looking statements that are made from time to time. Regions’ Investor Relations contact is Dana Nolan at (205) 264-7040; Regions’ Media contact is Evelyn Mitchell at (205) 264-4551. 23

® 24