Exhibit 99.3 3rd Quarter Earnings Conference Call October 22, 2021

2 Third quarter 2021 overview (1) Non-GAAP, see appendix for reconciliation. Adjusted Pre-Tax Pre- Provision Income(1) Diluted Earnings Per Share Adjusted Total Revenue(1) Adjusted Non- Interest Expense(1) Net Income Available to Common Shareholders $693M $0.65 $1,611M $918M $624M • Adjusted pre-tax pre-provision income(1) increased 4% QoQ • Adjusted efficiency ratio(1) improved 30 bps QoQ to 56.6% • Generated YTD positive operating leverage • Net charge-offs ratio improved 9 bps QoQ to 0.14%, lowest level on record post the Company's 2006 MOE

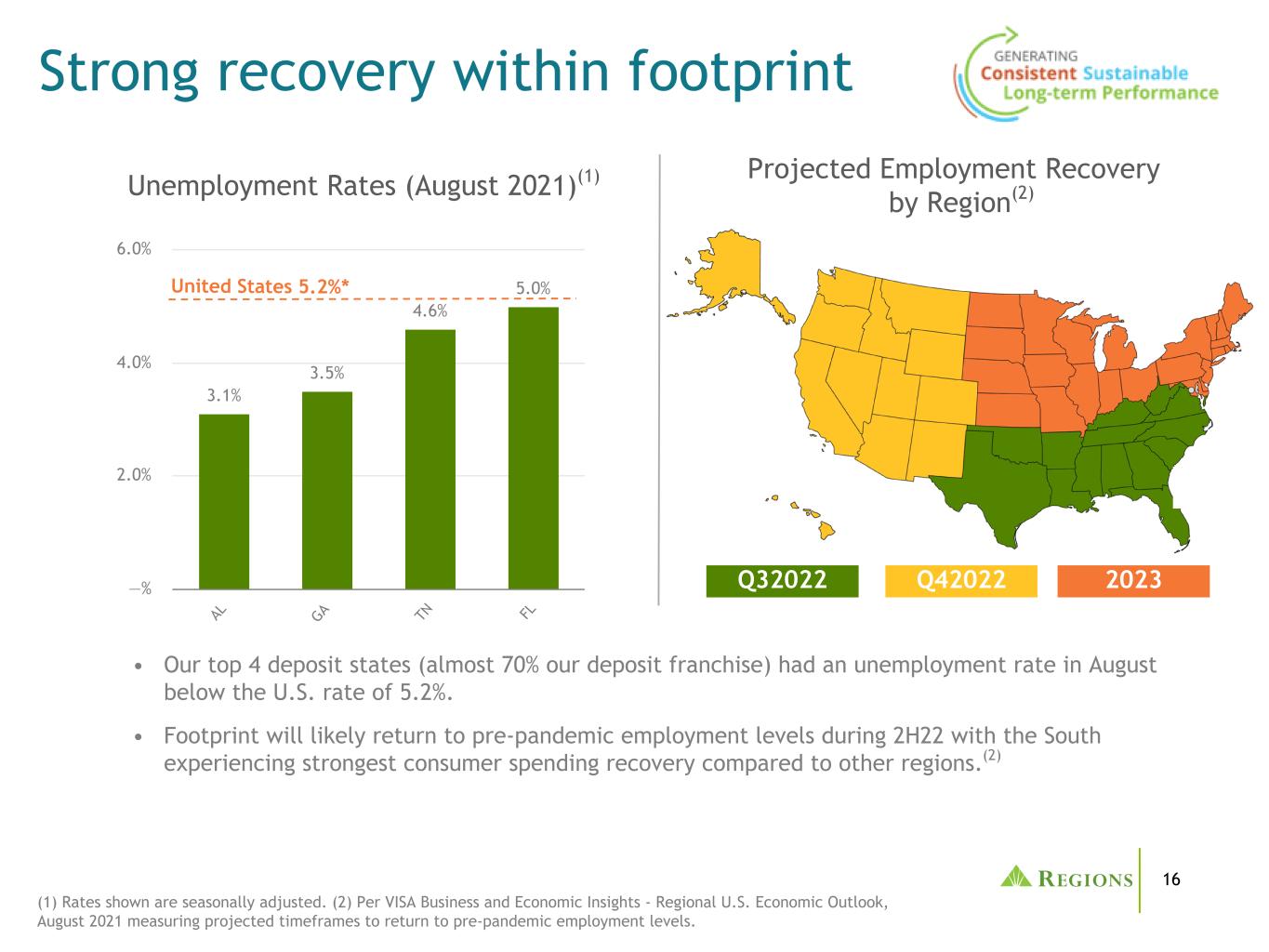

3 Strong foundation-positioned for growth Committed to continuous expansion of platforms and capabilities Innovating through digital investments and enhancing our customer experiences to generate shareholder return Online and mobile banking enhancements Omnichannel delivery-providing advice, guidance and personalized solutions through excellent customer service and technology Digitized sales within consumer bank-YTD digital sales up 38% Expanding E-signature capabilities Leveraging AI in contact centers; virtual banker will handle over 1M customer calls this year Digital investments generate return Increased Mortgage Loan Originator (MLO) headcount by ~150(1) Added ~80 client facing associates in growth markets across Wealth Mgt. and Corporate Bank(1) Consolidated ~215 branches while opening ~75 De Novos(1) Growing highly efficient business segments Strong & recovering markets Expanding capabilities with bolt-on acquisitions: Contact centers ~100% remote; reducing corporate retail space Sabal Capital Partners (pending) EnerBank (home improvement point-of-sale) Ascentium Capital (1) Since 2017. (2) Source: Bureau of Labor Statistics based on June unemployment data. (3) Source: S&P Global Market Intelligence (4) Source: U.S. Postal Service. (5) Source: CoStar as of June 2021 for hotel occupancy and 2Q21 vs. 2Q20 growth for apartment rents. (6) Per VISA Business and Economic Insights - Regional U.S. Economic Outlook, August 2021. Top 4 deposit states have unemployment rates below national average(2) ~60% of our top MSAs projected to grow faster than national average(3) 16 of top 25 markets with net migration inflows are within footprint(4) ~65% of top 25 MSAs with fastest YoY growth in apartment rents and >50% of top 25 MSAs with highest YoY hotel occupancy growth are within footprint(5) Southeast region expected to recover the fastest to pre- pandemic employment levels(6) YTD net new consumer account growth has exceeded the preceding 3 years combined ~6% YTD small bus. acct. growth; outpacing 2020's record growth

4 • Adjusted average and ending loans increased ~1% QoQ; positioning us well for continued momentum for loan growth in 4Q and beyond. • Commercial pipelines have surpassed pre-pandemic levels, production remains strong, and line of credit commitments increased $2B YTD • Average PPP loans decreased 45% QoQ to $2.1B, while ending PPP loans decreased 48% to $1.5B; includes $1.4B forgiveness in 3Q. • Through 3Q, ~76% of total PPP loans have been forgiven; expect 80-85% to be forgiven by year end. • Consumer loans reflected another strong quarter of mortgage portfolio production accompanied by modest growth in credit card. ◦ Continue to be impacted by run-off portfolios; expect run-off portfolios to have an average impact of ~$1.2B in FY21 and ~$700M in FY22. • Excluding 4Q benefit from EnerBank acquisition, expect 2021 adjusted average loans to be down low single digits compared to 2020; adjusted ending loans are expected to grow low single digits. Loan growth momentum (1) Non-GAAP, see appendix for reconciliation. $81.4 $79.6 $80.5 53.9 52.6 53.2 27.5 27.1 27.3 3Q20 2Q21 3Q21 (Ending, $ in billions) $82.3 $79.2 $79.8 55.0 52.3 52.7 27.3 26.9 27.1 3Q20 2Q21 3Q21 Adjusted loans and leases(1) (Average, $ in billions) Adj. business loans(1)Adj. consumer loans(1) QoQ highlights & outlook

5 $116.7 $131.1 $131.9 68.8 78.2 79.1 38.8 43.0 42.5 8.7 9.5 9.9 0.4 0.4 0.4 3Q20 2Q21 3Q21 Deposit growth continues (1) Other deposits represent non-customer balances primarily consisting of wholesale funding (for example, Eurodollar deposits, selected deposits and brokered time deposits). Average deposits by segment ($ in billions) Wealth Mgt Other(1) Consumer Bank Corporate Bank QoQ highlights & outlook • Pace of deposit growth has slowed, balances continued to increase to new record levels. • Average deposits QoQ growth primarily due to higher account balances and strong new account growth. ◦ YTD net new consumer acct. growth has exceeded acct. growth for the preceding 3 years combined. ◦ ~6% YTD net new small bus. acct. growth. • Based on analysis of deposit inflow characteristics, we currently believe ~30% of pandemic-related deposit increases can be used to support longer term growth through the rate cycle. Additional balances may persist, but likely more rate sensitive. • 4Q EnerBank acquisition will include CD funding that matures over time, and will benefit from Regions' funding advantage.

6 $1,000 $975 $976 3.13% 2.81% 2.76% 3.41% 3.31% 3.30% 3Q20 2Q21 3Q21 NII(1) Stable NII & margin NII and NIM(1) ($ in millions) (1) Net interest income (NII) and net interest margin (NIM) are reflected on a fully taxable-equivalent basis. (2) Non-GAAP; see appendix for reconciliation. NIM • In 3Q, deposit and cash balances remained elevated. • PPP and cash account for -54 bps NIM and +$34M NII within the quarter (-4 bps / -$12M QoQ) ◦ PPP loans account for +5 bps NIM and +$31M NII within the quarter (0 bps / -$12M QoQ) ◦ Excess cash accounts for -59 bps NIM and +$3M NII (-4 bps / $0M QoQ) • Total of ~$15.5B active balance sheet management (details on next slide) since pandemic began, balancing risk and return including a net reduction of debt balances of -$0.4B in 3Q21 ◦ -10 bps cumulative impact to adjusted NIM(2) from $5B post-pandemic securities additions NIM excl. PPP/Cash(2)

7 • Rate environment impacts offset through active balance sheet management ◦ Hedging benefit of $108M NII in 3Q(3) ◦ Lower deposit pricing; 3Q deposit cost = 4bps / interest-bearing deposit cost = 8bps ◦ Pandemic cash management includes ~$5B securities adds and ~$10.5B long-term debt calls/ maturities (incl. $1B holding company debt call offset by $0.6B issuance in 3Q21) • Outsized credit interest recovery • Adjusted loan growth in 3Q21 of +~$660M average and +~$830M ending (1) Core NII and adj. NIM excludes PPP and excess cash over $750M. Core NII and adjusted NIM are non-GAAP; see appendix for reconciliations. (2) Market rate impacts include contractual loan, cash, and borrowings repricing and fixed asset turnover at lower market rates. (3) Hedges mostly remain active; ~$1.6B total return, $574M NII accrual since beginning of 2020, $1.1B unrealized pre-tax gain, to be amortized into NII over the remaining life of hedges. (4) Non-GAAP, see appendix for reconciliation. $929 $942 Core(1) NII Attribution Drivers of Core(1) NII and NIM 3Q21 excl. PPP/cash 2Q21 excl. PPP/cash -2bps -1bps +1bps -1bps+1bps -$7M +$3M +$2M +$2M+$4M +$6M • Longer-term NII growth from organic and strategic asset growth; positioned to benefit from rising market rates ◦ Mid-3Q21, $5B receive-fixed swaps repositioned, shorten maturities from 2026 to late 2022, which locks in gains. Allow for more NII expansion when rates are projected to rise and incorporates the impact of EnerBank's fixed-rate loan portfolio. ◦ Cumulative hedge program value is ~$1.6B (realized and unrealized); ~75% has been realized or is locked-in from swap repositioning/terminations reflecting the dynamic management of hedging strategy. • Linked-quarter NII expected to grow 5-6% in 4Q21 ◦ Core(1) NII expected to be stable linked-quarter after adjusting for outsized credit interest recovery in 3Q21 ◦ Uncertain timing of PPP forgiveness to benefit NII/NIM - currently assume higher PPP NII in 4Q21 ◦ EnerBank acquisition to add approximately 5% to NII in 4Q21 • Excluding PPP/cash, adjusted NIM(1) expected to increase to ~3.40%, mostly from EnerBank Expectations for 4Q21 and Beyond NII NIM Days/ Other +2bps Loan bals/mix Cash mgmt. Market rates(2) Deposit pricing Offset ongoing impacts of reinvestment through balance sheet management strategies Loan hedges NII & margin - core drivers Credit recovery +$3M -1bps

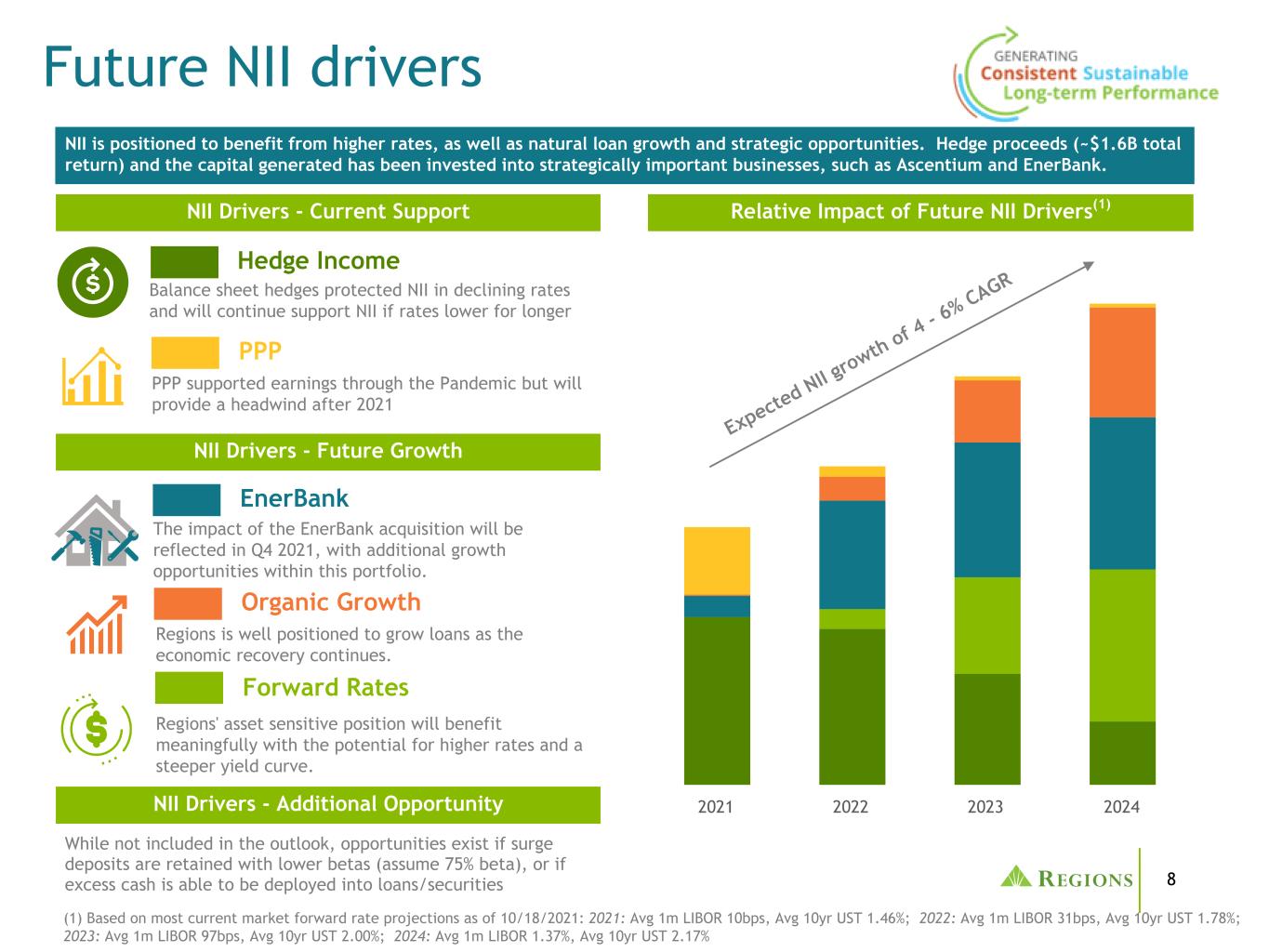

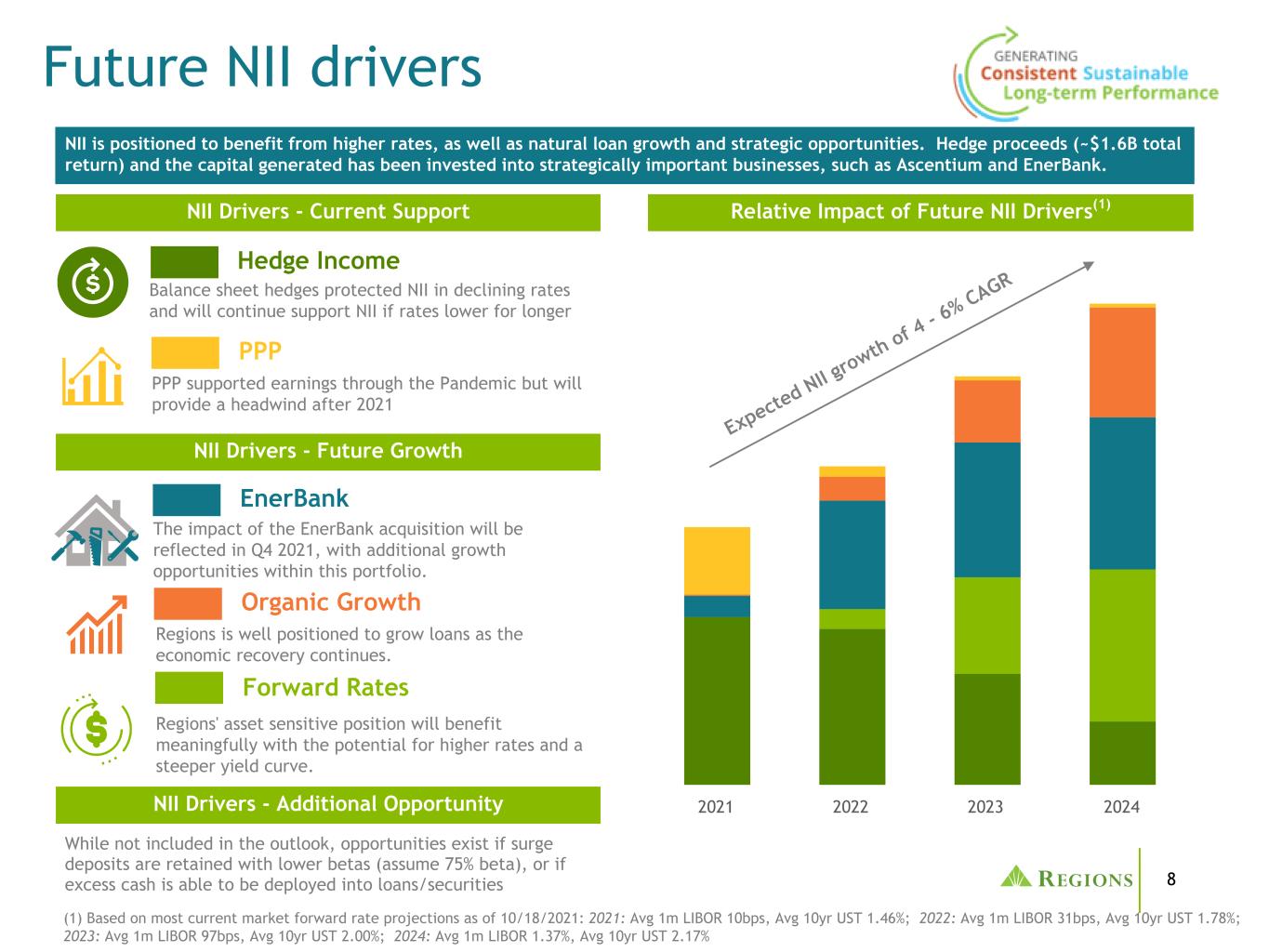

8 While not included in the outlook, opportunities exist if surge deposits are retained with lower betas (assume 75% beta), or if excess cash is able to be deployed into loans/securities NII is positioned to benefit from higher rates, as well as natural loan growth and strategic opportunities. Hedge proceeds (~$1.6B total return) and the capital generated has been invested into strategically important businesses, such as Ascentium and EnerBank. 2021 2022 2023 2024 NII Drivers - Current Support Relative Impact of Future NII Drivers(1) NII Drivers - Future Growth Expecte d NII g rowth of 4 - 6 % CAGR Hedge Income Forward Rates EnerBank PPP Organic Growth Balance sheet hedges protected NII in declining rates and will continue support NII if rates lower for longer Regions' asset sensitive position will benefit meaningfully with the potential for higher rates and a steeper yield curve. The impact of the EnerBank acquisition will be reflected in Q4 2021, with additional growth opportunities within this portfolio. PPP supported earnings through the Pandemic but will provide a headwind after 2021 Regions is well positioned to grow loans as the economic recovery continues. NII Drivers - Additional Opportunity (1) Based on most current market forward rate projections as of 10/18/2021: 2021: Avg 1m LIBOR 10bps, Avg 10yr UST 1.46%; 2022: Avg 1m LIBOR 31bps, Avg 10yr UST 1.78%; 2023: Avg 1m LIBOR 97bps, Avg 10yr UST 2.00%; 2024: Avg 1m LIBOR 1.37%, Avg 10yr UST 2.17% Future NII drivers

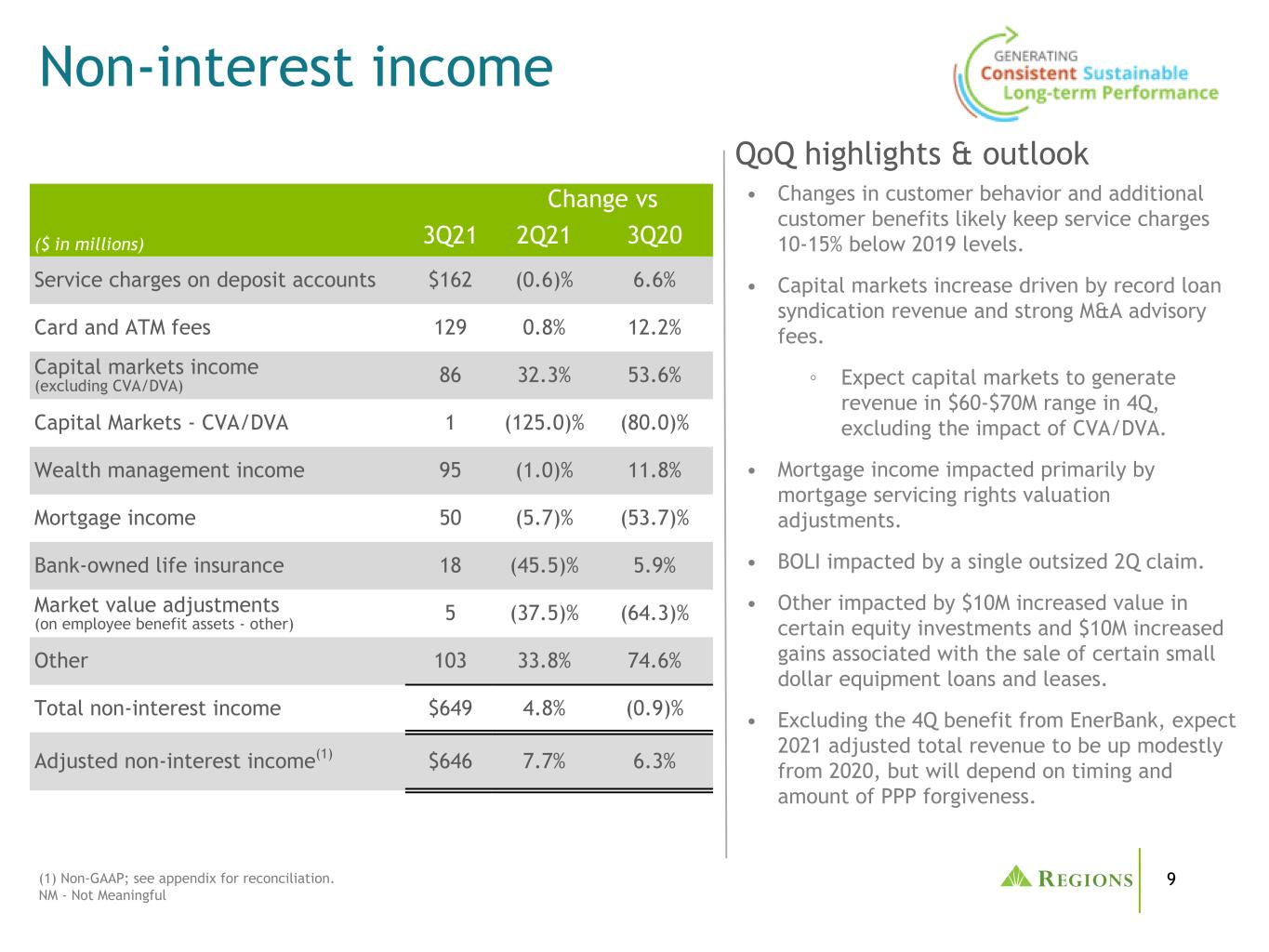

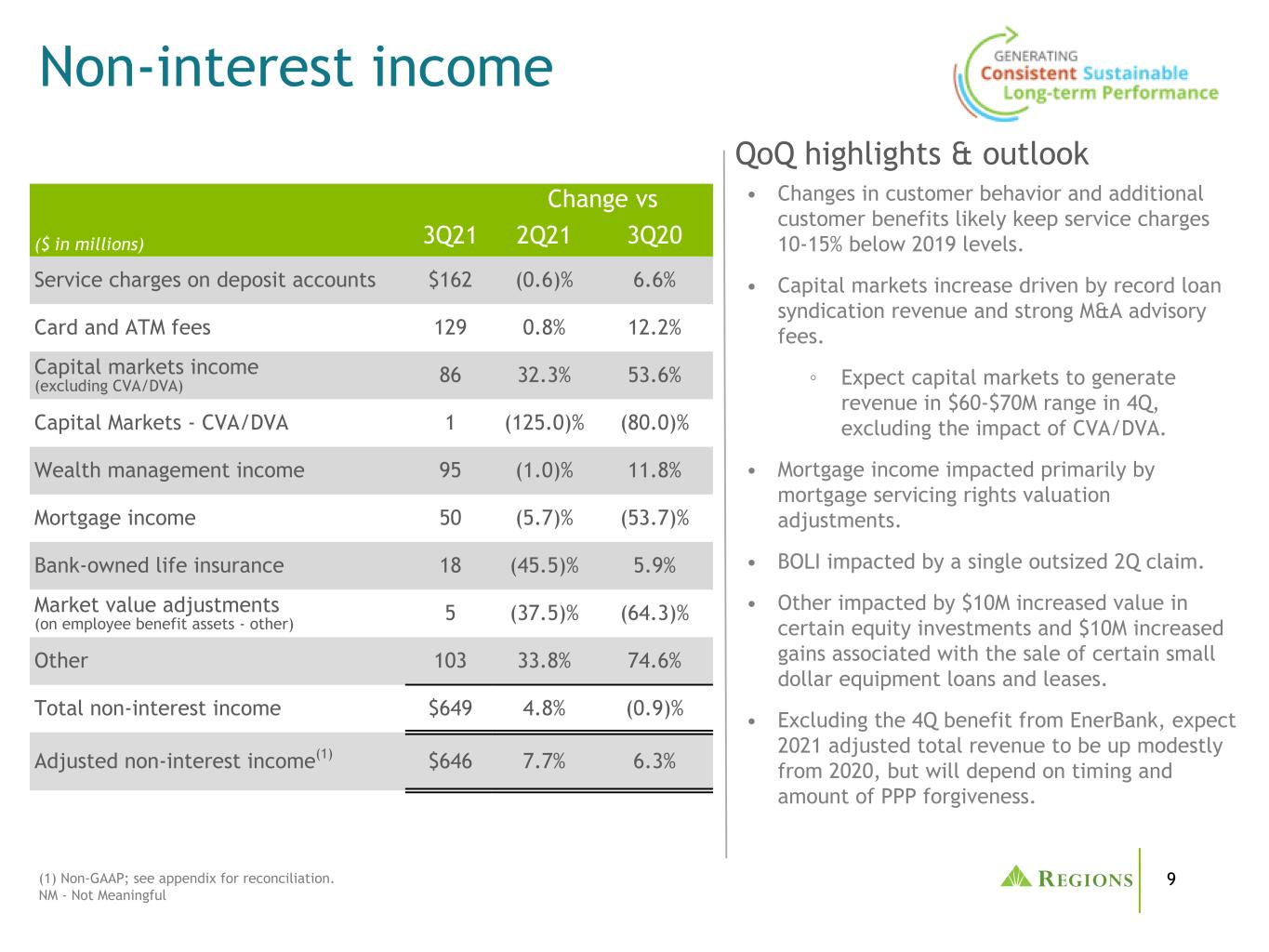

9 • Changes in customer behavior and additional customer benefits likely keep service charges 10-15% below 2019 levels. • Capital markets increase driven by record loan syndication revenue and strong M&A advisory fees. ◦ Expect capital markets to generate revenue in $60-$70M range in 4Q, excluding the impact of CVA/DVA. • Mortgage income impacted primarily by mortgage servicing rights valuation adjustments. • BOLI impacted by a single outsized 2Q claim. • Other impacted by $10M increased value in certain equity investments and $10M increased gains associated with the sale of certain small dollar equipment loans and leases. • Excluding the 4Q benefit from EnerBank, expect 2021 adjusted total revenue to be up modestly from 2020, but will depend on timing and amount of PPP forgiveness. Change vs ($ in millions) 3Q21 2Q21 3Q20 Service charges on deposit accounts $162 (0.6)% 6.6% Card and ATM fees 129 0.8% 12.2% Capital markets income (excluding CVA/DVA) 86 32.3% 53.6% Capital Markets - CVA/DVA 1 (125.0)% (80.0)% Wealth management income 95 (1.0)% 11.8% Mortgage income 50 (5.7)% (53.7)% Bank-owned life insurance 18 (45.5)% 5.9% Market value adjustments (on employee benefit assets - other) 5 (37.5)% (64.3)% Other 103 33.8% 74.6% Total non-interest income $649 4.8% (0.9)% Adjusted non-interest income(1) $646 7.7% 6.3% Non-interest income (1) Non-GAAP; see appendix for reconciliation. NM - Not Meaningful QoQ highlights & outlook

10 (1) Non-GAAP; see appendix for reconciliation. (2) 2020 adjusted non-interest expenses include ~$60M of expense associated with the Ascentium acquisition that closed 4/1/2020. $3,387 $3,419 $3,434 $3,443 $3,541 2016 2017 2018 2019 2020 Non-interest expense QoQ highlights & outlookAdjusted non-interest expense(1) ($ in millions) $889 $895 $918 55.3% 56.9% 56.6% Adjusted non-interest expense Adjusted efficiency ratio 3Q20 2Q21 3Q21 ~1% CAGR (1) (1) • Adjusted non-interest expenses increased 2% driven primarily by higher salary and benefits and professional and legal fees, offset by a decline in marketing expenses. ◦ Salaries and benefits increased 4% due to higher variable-based compensation associated with elevated fee income as well as 1 additional work day. ◦ Associate headcount increased 149 positions (majority within revenue producing businesses). ◦ Exceptionally strong performance is also contributing to higher incentive compensation. ◦ YTD associate headcount is down 2% and base salaries are down 1% • 3Q expenses include $8M from pension settlement charges. • Excluding $35M core run rate expenses from EnerBank, expect 2021 adjusted non-interest expenses to be up modestly from 2020. • We remain committed to generating adjusted positive operating leverage over time. (2)

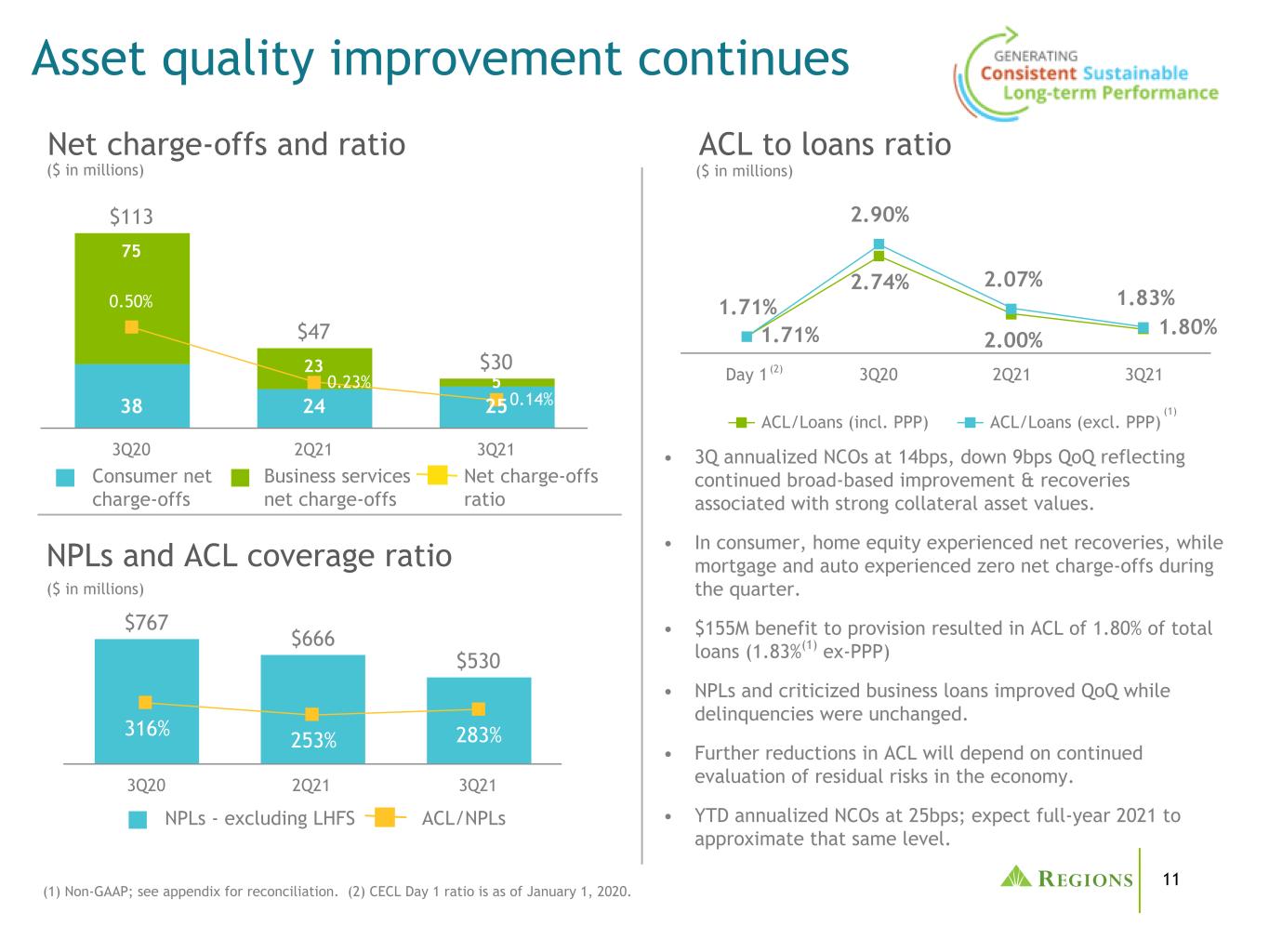

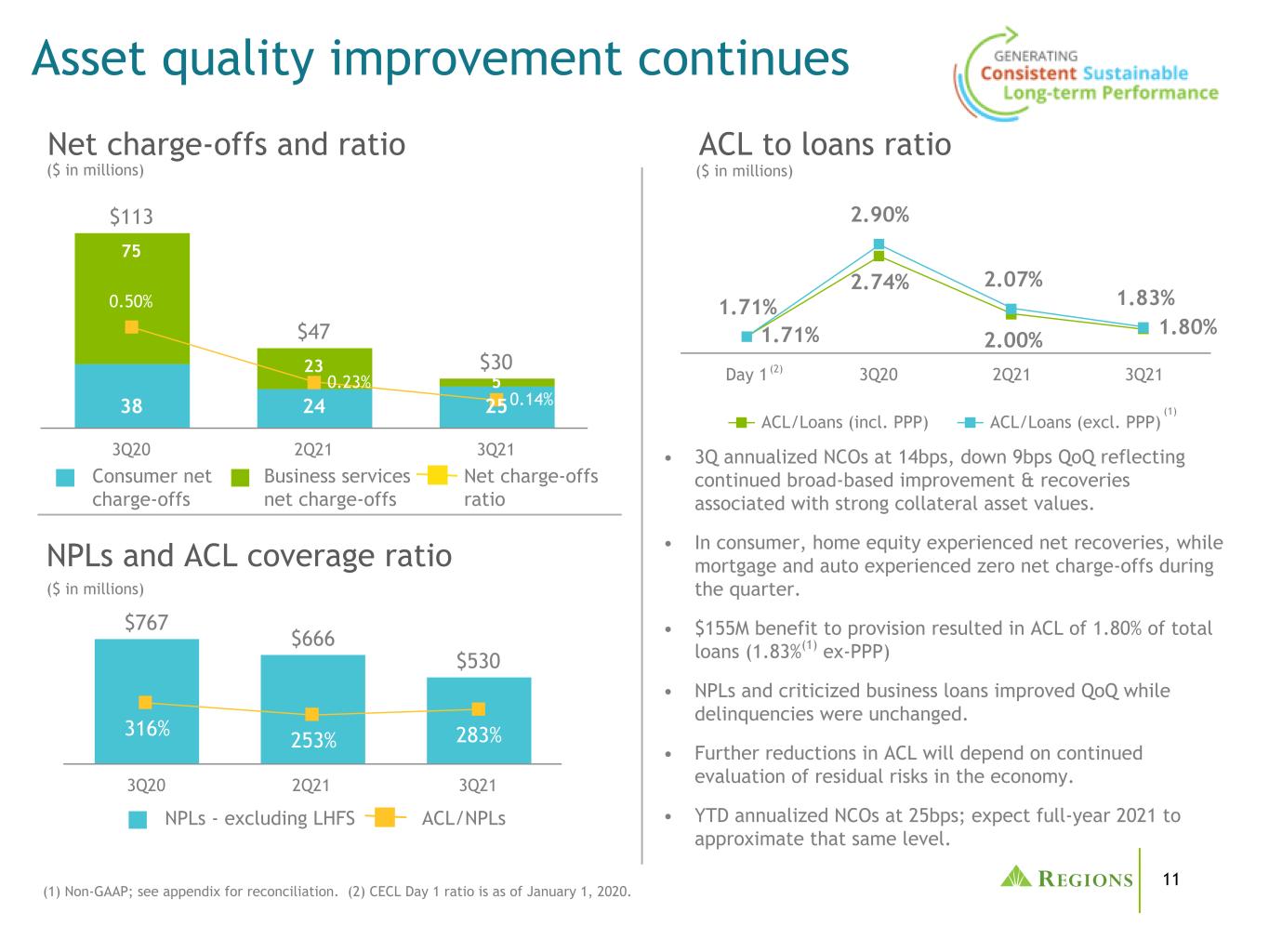

11 1.71% 2.74% 2.00% 1.80% 1.71% 2.90% 2.07% 1.83% ACL/Loans (incl. PPP) ACL/Loans (excl. PPP) Day 1 3Q20 2Q21 3Q21 $113 $47 $30 38 24 25 75 23 5 0.50% 0.23% 0.14% 3Q20 2Q21 3Q21 $767 $666 $530 316% 253% 283% 3Q20 2Q21 3Q21 NPLs and ACL coverage ratio Asset quality improvement continues ($ in millions) ($ in millions) ($ in millions) Net charge-offs and ratio NPLs - excluding LHFS ACL/NPLs Consumer net charge-offs Business services net charge-offs Net charge-offs ratio (1) Non-GAAP; see appendix for reconciliation. (2) CECL Day 1 ratio is as of January 1, 2020. • 3Q annualized NCOs at 14bps, down 9bps QoQ reflecting continued broad-based improvement & recoveries associated with strong collateral asset values. • In consumer, home equity experienced net recoveries, while mortgage and auto experienced zero net charge-offs during the quarter. • $155M benefit to provision resulted in ACL of 1.80% of total loans (1.83%(1) ex-PPP) • NPLs and criticized business loans improved QoQ while delinquencies were unchanged. • Further reductions in ACL will depend on continued evaluation of residual risks in the economy. • YTD annualized NCOs at 25bps; expect full-year 2021 to approximate that same level. ACL to loans ratio (2) (1)

12 9.3% 10.4% 10.8% 3Q20 2Q21 3Q21 • During 3Q, Regions declared $164M in common dividends. • Stress Capital Buffer requirement for 4Q21 through 3Q22 is 2.5%. • Common Equity Tier 1 (CET1) ratio increased 40 bps in 3Q to an estimated 10.8%. • Continue to prioritize capital utilization for organic growth and non-bank acquisitions like EnerBank and Sabal that propel future growth. • Temporarily paused share repurchases until after October 1st close of EnerBank (~$1B of capital). Anticipate being back in the market in 4Q21 and expect to manage CET1 to the mid-point of 9.25-9.75% operating range by year-end. QoQ Highlights & Outlook Capital and liquidity (1) Current quarter ratios are estimated. (2) Based on ending balances. 10.8% 11.9% 12.3% 3Q20 2Q21 3Q21 Tier 1 capital ratio(1) Loan-to-deposit ratio(2) 75% 64% 63% 3Q20 2Q21 3Q21 Common equity Tier 1 ratio(1)

13 2021 expectations (1) Non-GAAP, see appendix for reconciliation. (2) The reconciliation with respect to forward-looking non-GAAP measures is expected to be consistent with actual non-GAAP reconciliations included in the attached appendix or in previous filings with the SEC. (3) Adjusted ending and average 2020 loans were revised in 2Q21 to remove impact of $239M of C&I loans moved to HFS on 12/31/2020 and then moved back to HFI on 6/1/2021. Category FY 2021 Expectations Total Adjusted Revenue (from adjusted 2020 of $6,206)(1)(2) Up modestly (dependent on timing & amount of PPP forgiveness) Adjusted Non-Interest Expense (from adjusted 2020 of $3,541)(1)(2) Up modestly Adjusted Average Loans (from adjusted 2020 of $82,070)(1)(2)(3) Down low single digits Adjusted Ending Loans (from adjusted 2020 of $79,846)(1)(2)(3) Up low single digits Net charge-offs / average loans ~25bps Effective tax rate 22-23% • Impacts from 4Q EnerBank and Sabal acquisitions are not considered in these expectations. • Effective tax rate expectations do not include the impact of potential tax legislation.

14 Appendix

15 Selected items impact Third quarter 2021 highlights (1) Non-GAAP, see appendix for reconciliation. (2) Based on income taxes at an approximate 25% incremental rate. (3) Items impacting results or trends during the quarter, but are not considered non-GAAP adjustments. These items generally include market-related measures, impacts of new accounting guidance, or event driven actions. NM - Not Meaningful ($ amounts in millions, except per share data) 3Q21 QoQ Change YoY Change Net interest income $ 965 0.2% (2.3)% Provision for (benefit from) credit losses (155) (54.0)% (237.2)% Non-interest income 649 4.8% (0.9)% Non-interest expense 938 4.5% 4.7% Income before income taxes 831 (18.6)% 31.1% Income tax expense 180 (22.1)% 73.1% Net income 651 (17.6)% 22.8% Preferred dividends 27 (35.7)% (6.9)% Net income available to common shareholders $ 624 (16.6)% 24.6% Diluted EPS $ 0.65 (15.6)% 25.0% Summary of third quarter results (amounts in millions, except per share data) 3Q21 Pre-tax adjusted items(1): Loss on early extinguishment of debt $ (20) Securities gains (losses), net $ 1 Leveraged lease termination gains 2 Total pre-tax adjusted items(1) $ (17) Diluted EPS impact(2) $ (0.01) Additional selected items(3): CECL provision less than (in excess of) net charge-offs $ 185 Capital markets income - CVA/DVA 1 MSR net hedge performance (15) PPP loan interest/fee income 31 Pension settlement charges (8)

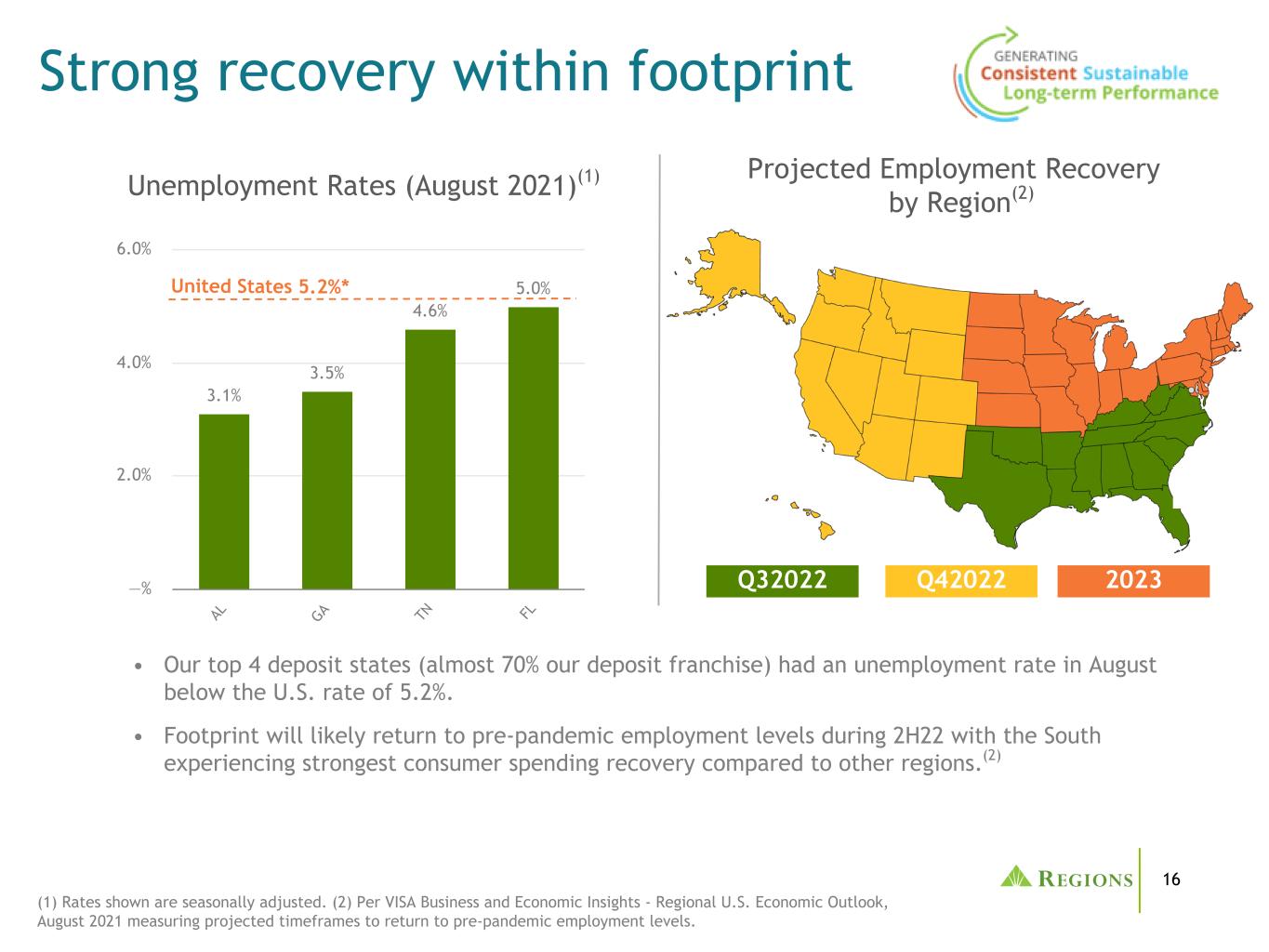

16 3.1% 3.5% 4.6% 5.0% AL GA TN FL —% 2.0% 4.0% 6.0% Unemployment Rates (August 2021)(1) Strong recovery within footprint United States 5.2%* (1) Rates shown are seasonally adjusted. (2) Per VISA Business and Economic Insights - Regional U.S. Economic Outlook, August 2021 measuring projected timeframes to return to pre-pandemic employment levels. • Our top 4 deposit states (almost 70% our deposit franchise) had an unemployment rate in August below the U.S. rate of 5.2%. • Footprint will likely return to pre-pandemic employment levels during 2H22 with the South experiencing strongest consumer spending recovery compared to other regions.(2) Q32022 Q42022 2023 Projected Employment Recovery by Region(2)

17 Making banking easier Providing transparency, simplicity and speed into how accounts work Improved Visibility and Transparency Expanded Alert Capabilities ◦ Balance alerts based on available balance ◦ Transaction alerts providing information in near real-time ◦ Automated email alerts for notification of overdraft as well as overdraft protection transfers ◦ Over 200,000 subscribers to the new alerts added as of September 30, 2021 Enhanced Views in Digital Channels ◦ Projected Available Balance that shows how much is expected to be available after nightly posting ◦ Clearer descriptions for pending transactions ◦ Addition of hold expiration dates ◦ New and refreshed hover box definitions for balances Intraday visibility of checks cleared ◦ Applies to personal Regions accounts Enhanced Product Features New Product - Regions Now Checking Simplified Transaction Posting Order ◦ Credits will continue to post first, consistent with prior practices ◦ Debits posted after credits, generally in the time order received Limiting Fees ◦ Lowered daily overdraft/non- sufficient fund fee caps for personal accounts ◦ Added daily overdraft/non- sufficient fund fee caps for small businesses accounts ◦ Reduced overdraft protection transfer fees Customer Education Tools ◦ Video series titled “Just a Minute” explaining how and when transactions are processed and tools to help manage finances ◦ Developed central hub on public facing Regions.com website providing information around changes ◦ Robust proactive customer and associate communication and training across channels around changes and enhancements New Checking Account Product – ◦ Product developed to standards and certified by Bank On ◦ No Overdraft, Non-sufficient Funds or Overdraft protection transfer fees ◦ Low monthly fee ◦ Regions Visa CheckCard with CashBack rewards ◦ Online & Mobile Banking with online bill pay ◦ Unlimited check writing capability ◦ Free LifeGreen Savings Account with savings bonus ◦ Product launched on September 30, 2021

18 0.67 1.57 2.40 3Q19 3Q20 3Q21 120 143 162 3Q19 3Q20 3Q21 2.7 2.8 3.1 3Q19 3Q20 3Q21 1.8 2.0 2.3 3Q19 3Q20 3Q21 13% 20% 21% 30% 33% 33% 57% 47% 46% 3Q19 3Q20 3Q21 60.2 73.0 83.0 49.3 63.4 71.3 7.4 2.8 4.1 3.5 6.8 7.6 3Q19 3Q20 3Q21 60% 66% 69% 40% 34% 31% 3Q19 3Q20 3Q21 Growth in digital Mobile Banking Log-Ins Customer Transactions Deposit Transactions by Channel 14% (Millions) (Millions) Active Digital Banking Users Active Mobile Banking Users (Millions) 23% Loans Digital Sales(1) (Accounts in Thousands) Deposits Credit Card Accounts Digital Non-Digital Mobile ATM Branch (1) Digital sales represents accounts opened. (2) Digital transactions represent online and mobile only; Non-digital transactions represent branches, contact centers and ATMs. (3) Transactions represent Consumer customer deposits, transfers, mobile deposits, fee refunds, withdrawals, payments, official checks, bill payments, and Western Union. Excludes ACH and Debit Card purchases/refunds.(4) Consumer Checking Omni-Channel sales capability was launched at the end of 1Q21 (2)(3) Zelle Transactions (Millions) 256% 34% 17% 22% 24% 83% 78% 72% —% —% 4% 3Q19 3Q20 3Q21 Digital Branch+Contact Center Omni-Channel Consumer Checking Sales by Channel(4)

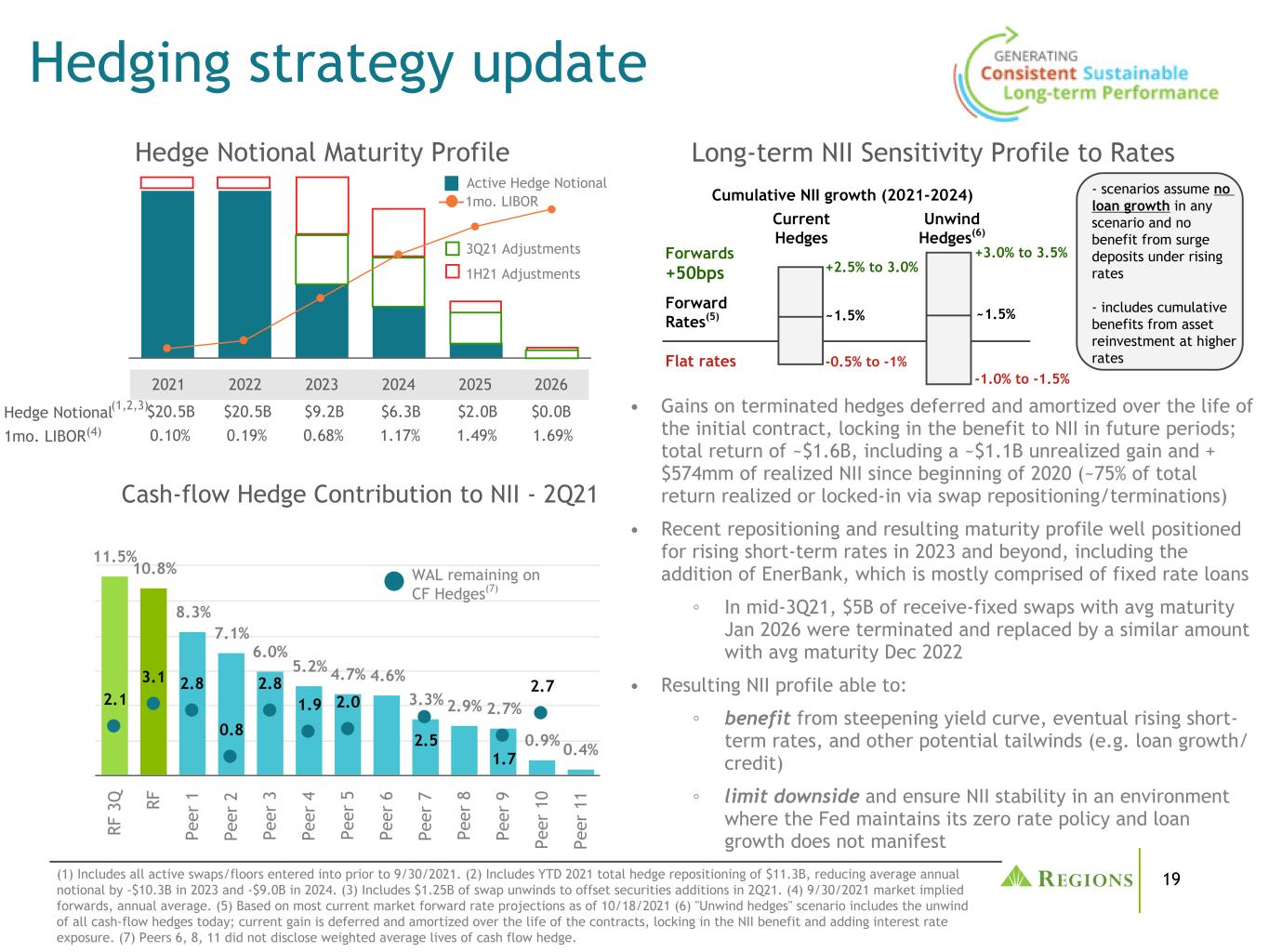

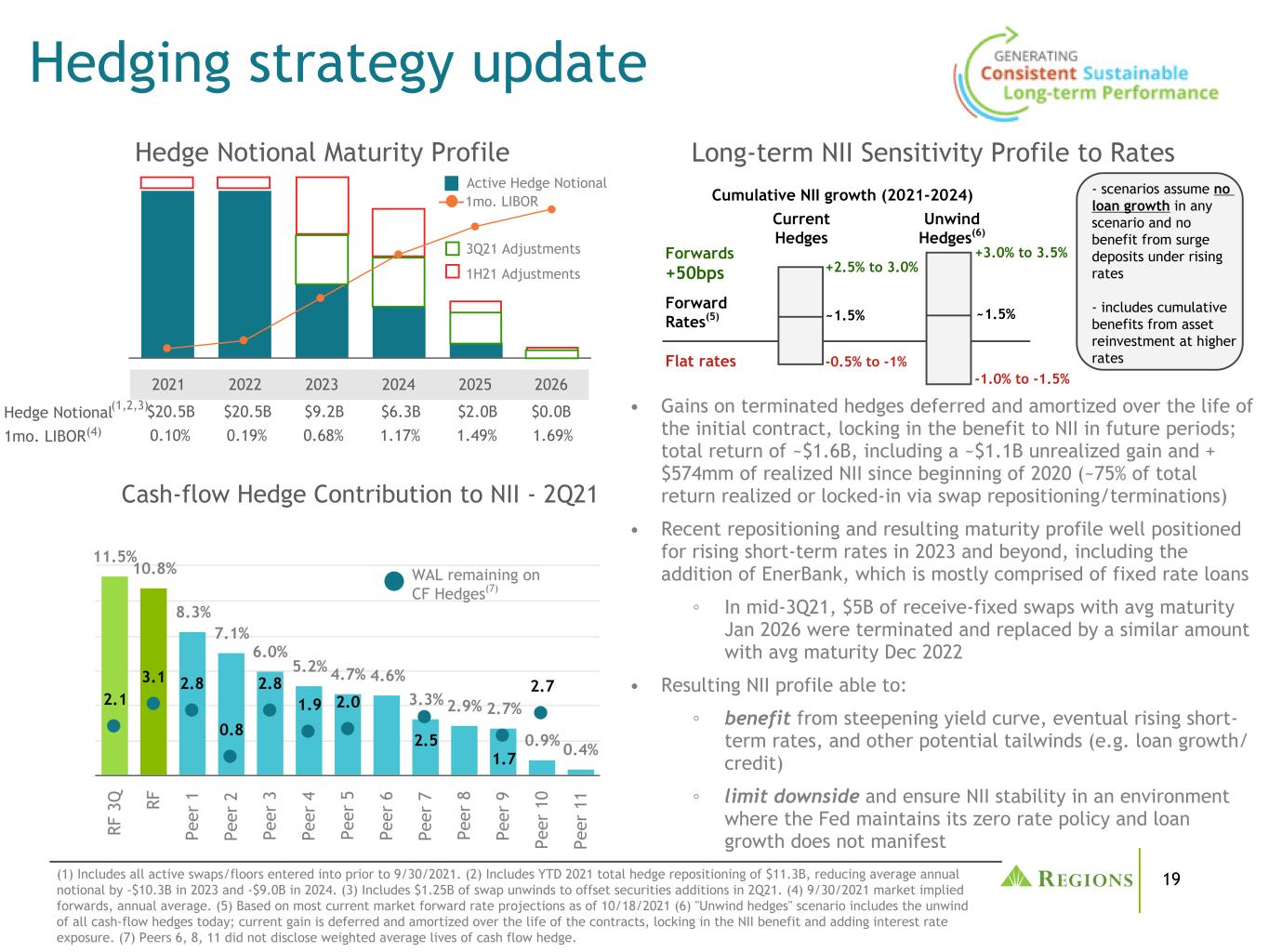

19 ~1.5% 11.5% 10.8% 8.3% 7.1% 6.0% 5.2% 4.7% 4.6% 3.3% 2.9% 2.7% 0.9% 0.4% 2.1 3.1 2.8 0.8 2.8 1.9 2.0 2.5 1.7 2.7 RF 3 Q RF Pe er 1 Pe er 2 Pe er 3 Pe er 4 Pe er 5 Pe er 6 Pe er 7 Pe er 8 Pe er 9 Pe er 1 0 Pe er 1 1 1 2 3 4 5 6 • Gains on terminated hedges deferred and amortized over the life of the initial contract, locking in the benefit to NII in future periods; total return of ~$1.6B, including a ~$1.1B unrealized gain and + $574mm of realized NII since beginning of 2020 (~75% of total return realized or locked-in via swap repositioning/terminations) • Recent repositioning and resulting maturity profile well positioned for rising short-term rates in 2023 and beyond, including the addition of EnerBank, which is mostly comprised of fixed rate loans ◦ In mid-3Q21, $5B of receive-fixed swaps with avg maturity Jan 2026 were terminated and replaced by a similar amount with avg maturity Dec 2022 • Resulting NII profile able to: ◦ benefit from steepening yield curve, eventual rising short- term rates, and other potential tailwinds (e.g. loan growth/ credit) ◦ limit downside and ensure NII stability in an environment where the Fed maintains its zero rate policy and loan growth does not manifest Long-term NII Sensitivity Profile to RatesHedge Notional Maturity Profile ~1.5% 2021 2022 2023 2024 2025 2026 Hedge Notional $20.5B $20.5B $9.2B $6.3B $2.0B $0.0B 1mo. LIBOR 0.10% 0.19% 0.68% 1.17% 1.49% 1.69% 1mo. LIBOR Active Hedge Notional Forward Rates(5) (1,2,3) 3Q21 Adjustments - scenarios assume no loan growth in any scenario and no benefit from surge deposits under rising rates - includes cumulative benefits from asset reinvestment at higher rates (4) Forwards +50bps Cumulative NII growth (2021-2024) Flat rates Current Hedges Unwind Hedges(6) +2.5% to 3.0% +3.0% to 3.5% -0.5% to -1% -1.0% to -1.5% 1H21 Adjustments (1) Includes all active swaps/floors entered into prior to 9/30/2021. (2) Includes YTD 2021 total hedge repositioning of $11.3B, reducing average annual notional by -$10.3B in 2023 and -$9.0B in 2024. (3) Includes $1.25B of swap unwinds to offset securities additions in 2Q21. (4) 9/30/2021 market implied forwards, annual average. (5) Based on most current market forward rate projections as of 10/18/2021 (6) "Unwind hedges" scenario includes the unwind of all cash-flow hedges today; current gain is deferred and amortized over the life of the contracts, locking in the NII benefit and adding interest rate exposure. (7) Peers 6, 8, 11 did not disclose weighted average lives of cash flow hedge. Hedging strategy update Cash-flow Hedge Contribution to NII - 2Q21 WAL remaining on CF Hedges(7)

20 Pe er 1 Pe er 2 Pe er 3 Pe er 4 Pe er 5 Pe er 6 Pe er 7 RF 2 Q 21 RF 3 Q 21 Pe er 8 Pe er 9 Pe er 1 0 Pe er 1 1 Pe er 1 2 Pe er 1 3 0% 20% Peer Median: 22% Ending Securities / Total Earning Assets (2Q21)(2) • Recent liquidity inflows represent an NII opportunity, with cash deployment dependent on: ◦ stability and rate-sensitivity of deposit inflows ◦ return levels on potential asset purchases ◦ demand for loan growth • Regions will take a conservative approach to cash deployment over time in consideration of risk/return profiles versus cash. • Deposit levels will likely continue to be supported by an accommodative Fed, but even if/when that reverses, deposit segment analysis indicates significant volume can be used to support investment and loan growth (see call out box) • Added $5B of securities since 3Q20 to support near- term earnings stability ◦ Mix of MBS, corporate bonds, and Treasury notes ◦ Purchases limit spread risk/duration and prepayment sensitivity ◦ $1.25B 2026 maturity swaps unwound to offset added asset duration ◦ Funding acquired with Enerbank will be advantageously replaced with organic funding as they mature (1) Includes Regular and Life Green Savings products that have shown predicable patterns through pre-pandemic cycles; understanding subject to change as the environment evolves. (2) Source: SNL Financial, SEC Reporting. ~$35B Ending Deposit Growth (Dec 2019 to Sep 2021) Balance sheet management Cash management update • Deposit growth broadly distributed across products, businesses, and industries • 67% of growth in NIB checking balances • Mix of growth by business: Consumer/Small Bus. 51%, Corporate 44%, Wealth 5% • Of total pandemic growth, approx. 30% arose within new Consumer/Small Bus. and Wealth relationships and product types which have been historically stable through rate cycles.(1)

21 • Strong improvement despite second lowest loan growth in peer group resulting from de-risking activities and focus on risk- adjusted returns. ◦ Capital recycling in C&I portfolio began in earnest in 2014 ◦ Improvement came without whole bank M&A • ROATCE improved 480 bps from 2014 to 2020 with rank improving from 10/15 to 5/14. • 180 bps above peer median in 2020 after being 90 bps below peer median in 2014. • Excluding Peer 1, Regions is the only bank with an ROATCE over 10% in 2014 to improve ~500 bps. (1) Source: S&P Global. (2) Normalized: NCOs used in place of provision expense; assumes 25% marginal tax rate. (3) Peer 1 had outsized gain related to M&A activity. (4) Banks who have grown via whole bank M&A. 16.8% 16.4% 15.2% 14.5% 14.3% 13.4% 12.5% 12.1% 10.8% 5.0%10.8% 20.5% 13.7% 14.7% 10.4% 6.4% 12.0% 9.7% 6.9% 6.6% 13.3% 12.1% 8.7% 11.1% Pe er 1 Pe er 2 Pe er 3 Pe er 4 RF Pe er 5 Pe er 6 Pe er 7 Pe er 8 Pe er 9 Pe er 10 Pe er 11 Pe er 12 Pe er 13 Strategy yielding strong ROATCE improvement 2020 ROATCE(1)(2) vs. 2014 ROATCE(2) Loan Growth CAGR (2014 - 2020) 2014: Peer Median 11.3% 2020: Peer Median 13.4% 19.9% 17.5% 11.4% 10.7% 9.8% 9.4% 6.8% 5.8% 4.1% 4.0% 3.8% 2.4% 1.7% Pe er 1 Pe er 4 Pe er 5 Pe er 7 Pe er 6 Pe er 13 Pe er 3 Pe er 8 Pe er 9 Pe er 2 Pe er 10 Pe er 11 RF Pe er 12 Peer Median 6.8% (4 ) (4 ) (4 ) (4 ) (4 ) (4 ) (4 ) (4 ) 5.0% (3 ) 26.3% 17.6% 12.1% 11.3%

22 ($ in millions) 2Q20 3Q20 4Q20 1Q21 2Q21 3Q21 Round 1-average $ 3,213 $ 4,558 $ 4,143 $ 3,171 $ 2,401 $ 814 Round 2-average — — — 627 1,500 1,324 Total-average $ 3,213 $ 4,558 $ 4,143 $ 3,798 $ 3,901 $ 2,138 NII(1) $ 18 $ 31 $ 54 $ 40 $ 43 $ 31 Round 1-ending $ 4,498 $ 4,594 $ 3,624 $ 2,974 $ 1,438 $ 416 Round 2-ending — — — 1,343 1,510 1,120 Total-ending $ 4,498 $ 4,594 $ 3,624 $ 4,317 $ 2,948 $ 1,536 Balance forgiven $ — $ — $ 970 $ 651 $ 1,655 $ 1,412 PPP loan details • Through 3Q21, approximately 73% of total estimated program fees have been recognized (~$64M in remaining unamortized fees) • Expect 80-85% of total $6.2B PPP loans to be forgiven by year-end 2021. (1) NII recognized during the period includes contractual loan yields, amortization of loan fees (including accelerated forgiveness) net of estimated funding costs.

23 10.4% 0.6% 0.1% (0.1)% (0.2)% 10.8% CET1 waterfall (1) Non-GAAP; see appendix for reconciliation. (2) Provision benefit includes the impact of CECL deferral. (3) Current quarter ratios are estimated and reflect rounding. 2Q21 CET1% Pre-tax pre- provision income(1) Common Dividend 3Q21 CET1%(3) Provision benefit(2) Tax & Other

24 Regions Preferred Par Value 3Q21 4Q21E Series B $500.0 $8.0 $8.0 Series C $500.0 $7.1 $7.1 Series D $350.0 $5.0 $5.0 Series E $400.0 $6.5 $4.5 Total $26.6 $24.6 Projected preferred stock expense ($ in millions) • The 3Q dividend for Series E includes a long first dividend period to include accrual since settlement on May 4, 2021. • The 4Q dividend reflects the expected quarterly run-rate.

25 Changes in Portfolio Risk & Balances $1,684 $(30) $(91) $(64) $1,499 Allowance for credit losses waterfall Changes in Economic Outlook & Adjustments Net Charge- Offs 9/30/2021 • 3Q ending allowance decreased $185M due to continued improvement in the economic outlook and expectations of improving credit performance in certain sectors / clients. • The benefits of the improving economic outlook were partially offset by a continued level of imprecision due to uncertainty regarding the timing of full economic recovery. QoQ highlights ($ in millions) 06/30/2021

26 Pre-R&S period 3Q2021 4Q2021 1Q2022 2Q2022 3Q2022 4Q2022 1Q2023 2Q2023 3Q2023 Real GDP, annualized % change 3.8 % 5.6 % 5.2 % 4.1 % 3.2 % 2.6 % 2.3 % 2.2 % 2.3 % Unemployment rate 5.2 % 4.8 % 4.6 % 4.4 % 4.2 % 4.1 % 4.0 % 3.9 % 3.8 % HPI, year-over-year % change 18.1 % 16.0 % 12.9 % 8.1 % 4.0 % 3.4 % 3.5 % 3.6 % 3.8 % S&P 500 4,450 4,557 4,600 4,630 4,657 4,693 4,726 4,764 4,805 Base R&S economic outlook (as of September 2021) • Economic forecasts represent Regions’ internal outlook for the economy over the reasonable & supportable forecast period. • Given improvements in the economic outlook, management considered alternative analytics to support qualitative additions to the modeled results to reflect continued risk and uncertainty in certain portfolios.

27 As of 9/30/2021 As of 12/31/20 (in millions) Loan Balance ACL ACL/Loans Loan Balance ACL ACL/Loans C&I $41,748 647 1.55 % $42,870 $1,027 2.40 % CRE-OO mortgage 5,446 128 2.35 % 5,405 242 4.47 % CRE-OO construction 252 9 3.64 % 300 24 7.98 % Total commercial $47,446 $784 1.65 % $48,575 $1,293 2.66 % IRE mortgage 5,608 86 1.53 % 5,394 167 3.10 % IRE construction 1,704 11 0.65 % 1,869 30 1.58 % Total IRE $7,312 $97 1.32 % $7,263 $197 2.71 % Residential first mortgage 17,347 129 0.74 % 16,575 155 0.94 % Home equity lines 3,875 92 2.37 % 4,539 122 2.69 % Home equity loans 2,556 30 1.17 % 2,713 33 1.23 % Indirect-vehicles 500 4 0.78 % 934 19 2.04 % Indirect-other consumer 2,123 177 8.33 % 2,431 241 9.92 % Consumer credit card 1,136 123 10.84 % 1,213 161 13.30 % Other consumer 975 63 6.48 % 1,023 72 7.01 % Total consumer $28,512 $618 2.17 % $29,428 $803 2.73 % Total $83,270 $1,499 1.80 % $85,266 $2,293 2.69 % Government guaranteed PPP loans 1,536 2 0.15 % 3,624 1 — Total, excluding PPP loans(1) $81,734 $1,497 1.83 % $81,642 $2,292 2.81 % Allowance allocation (1) Non-GAAP; see appendix for reconciliation. Note - All PPP loans are included in C&I. Excluding PPP loans from that category would increase the ACL ratio for C&I loans to 1.60%.

28 • Proactive, frequent customer dialogue • Closely monitoring most vulnerable customers • Monitoring ratings migration • Quarter over quarter balances declined $0.19B Bottom up review informs and narrows COVID-19 high-risk industry sectors (as of September 30, 2021) C&I Portfolio BAL$(1) % of BAL$ Utilization Rate(2) % Criticized Energy – Oil & Gas Extraction, Oilfield Services, Coal $0.93b 1.1% 48% 22% Consumer Services & Travel – Amusement, Arts and Recreation, Charter Bus Industry, Taxi & Limousine Service $0.56b 0.7% 76% 8% Retail (non-essential) – Clothing, Miscellaneous Store Retailers $0.20b 0.2% 45% 2% Restaurants – Full Service $0.53b 0.6% 69% 32% Total C&I high-risk industry sectors $2.22b 2.7% 57% 19% CRE related exposures including unsecured C&I BAL$(1) % of BAL$ Utilization Rate(2) % Criticized IRE Hotels – Full service, limited service, extended stay $0.30b 0.4% 95% 95% Total CRE-related high-risk industry sectors $0.30b 0.4% 95% 95% Total $2.52b (1) Amounts exclude PPP Loans, Operating Leases and Held For Sale exposure. (2) Borrowing Base Adjusted Commitments, excludes PPP, Operating Leases and Loans Held For Sale. Ongoing Portfolio Surveillance

29 Ascentium Capital Acquisition exceeding expectations Company Overview • Ascentium Capital was the largest independent equipment finance lender in the U.S. • Partners with ~4,000 vendors to finance essential-use equipment for small business customers. • Strong risk management culture and data driven framework resulting in solid credit performance throughout economic cycles. • Provides diversification with strength across multiple industries and geographies. Integration Updates Ascentium Financial Performance(1) • Ascentium Capital has contributed just over 10% of the Corporate Banking Group's YTD total revenue. • Loan production increased 3% QoQ and 9% YoY. • Recoveries remain historically high; delinquencies and NCOs remain below pre-pandemic levels. Acquisition closed April 1, 2020, and integration with Regions' systems, policies and people is now complete. Ascentium provided payment relief to as much as 30% of its customers at the peak of the pandemic; currently no customers remain on a relief plan. Transportation & Warehousing 31% Healthcare 13% Restaurant, Accommodation & Lodging 11% Real Estate - Services, Construction 8% Administrative, Support 8% Retail Trade 8% Manufacturing 7% All Other 14% Industry Diversification(1) Ascentium focus on portfolio growth in areas of core strength. Cross-sell of products between Ascentium & Regions customers has begun. Differentiated technology platform and processes, delivering same day credit decisions and funding. (1) Ascentium loan balances were ~$2.1B at 9/30/2021.

30 • Headquartered in Salt Lake City, UT, EnerBank originates prime and super-prime home improvement point-of-sale loans through a national network of contractors • A top 5 originator in the home improvement point-of- sale space, one of the fastest growing segments in consumer lending • Experienced and tenured management team with nearly 20-year track record operating in a regulated bank environment Overview Top Home Improvement Projects Financed Portfolio Overview Roofing & Siding Windows & Doors Notable Company / Transaction Metrics (as of Sept. 30, 2021) Contractor Network 10,500+ Loan Balances(2)(3) ~$3.1B Average Customer FICO ~760 Average Annual Net Losses ~1.0%-1.5% Gross Loan Effective Yield(4) ~9% Yield of acquired loans after marking to fair value(4) ~6-7% Outstanding Non-Transaction Deposits(2) ~$2.7B Deposit Cost(5) ~40bps Efficiency Ratio <40% Estimated Recurring Quarterly Expenses(6) ~$35MM Day 2 CECL Double Count, After Tax ~$85MM-$115MM Pools HVAC ~55% of LTM originations in Regions retail footprint (1) LTM as of September 30, 2021. (2) Balances are preliminary and still subject to the finalization of fair value marks and purchase accounting adjustments (PAA). (3) Loan weighted average life (WAL) of ~3 years. (4) On average, 6-7% of the loan yield is paid by the consumer, 2-3% is paid by the contractor; contractor discount of acquired loans are recognized at purchase as part of fair value mark; new originations will yield ~9%. (5) Adjusted for estimated PAAs; WAL of deposits is ~2 years; Regions will replace EnerBank's funding base over time. (6) Including $5MM-$7MM amortization of intangibles. LTM Originations Heat Map(1) Solar EnerBank acquisition Closed: October 1, 2021

31 Agency Licenses Sabal Capital Partners acquisition Continues build-out of Regions' fee-based businesses Company Overview & Regions' Strategic Rationale • Announced October 4, 2021; expected close 4Q21 • Sabal Capital Partners is a market leader in the origination of small-balance agency loans. • Top originator of Fannie Mae and Freddie Mac small- balance commercial real estate (CRE) loans with a growing presence in non-agency commercial mortgage- backed securities loan origination. • Sabal will further expand Regions' real estate capital markets capabilities established since 2014, which today contributes just over 20% of total YTD capital markets revenue. Business Lines Agency Lending(1) Non-Agency Lending(2) Servicing • Sabal expands Regions’ agency (Fannie/Freddie) CRE lending product suite and provides Regions the opportunity to become a top 5 bank agency producer. • Sabal’s platform provides Regions off-balance sheet solutions for small-balance commercial real estate loans and further supports Regions' existing clients and markets. Post acquisition, loans will be sourced through Sabal’s current platform and primarily within Regions’ core markets. • Sabal’s vertically integrated platform will provide Regions the opportunity to in-source servicing on our current large-ticket agency production. Multi-Family Freddie Mac / Fannie Mae CMBS: Multi- Family, Office, Industrial, Retail, Storage ~$5B UPB of servicing book(2) Regions Sabal Freddie Mac SBL Fannie Mae Small Loan HUD Freddie Mac CME Fannie Mae DUS Ginnie Mae Fannie Mae/ Freddie Mac Affordable (1) Expected average holding periods on the company's balance sheet ~20 days. (2) Expected average holding periods on the company's balance sheet ~50-60 days for CMBS. (2) As of 08/31/21

32 ESG - Recognitions and resources MSCI State Street Global Advisors S&P Global Sustainalytics AA ESG Rating 63 R-Factor Score S&P 500 ESG Index Low-Risk ESG Risk Rating Human Rights Campaign JUST Capital JUST Capital Disability Equality Index FTSE Russell 100 Score in 2021 Corporate Equality Index 2021 JUST 100 Top 100 Companies Supporting Healthy Families and Communities 2021 Best Place To Work FTSE4Good Index Series Suite of ESG Disclosures • Annual Review & ESG Report • TCFD Report • GRI Content Index • CDP Climate Change Questionnaire Response • SASB Disclosure • Community Engagement Report All resources available through our ESG Resource Center accessible at ir.regions.com/governance

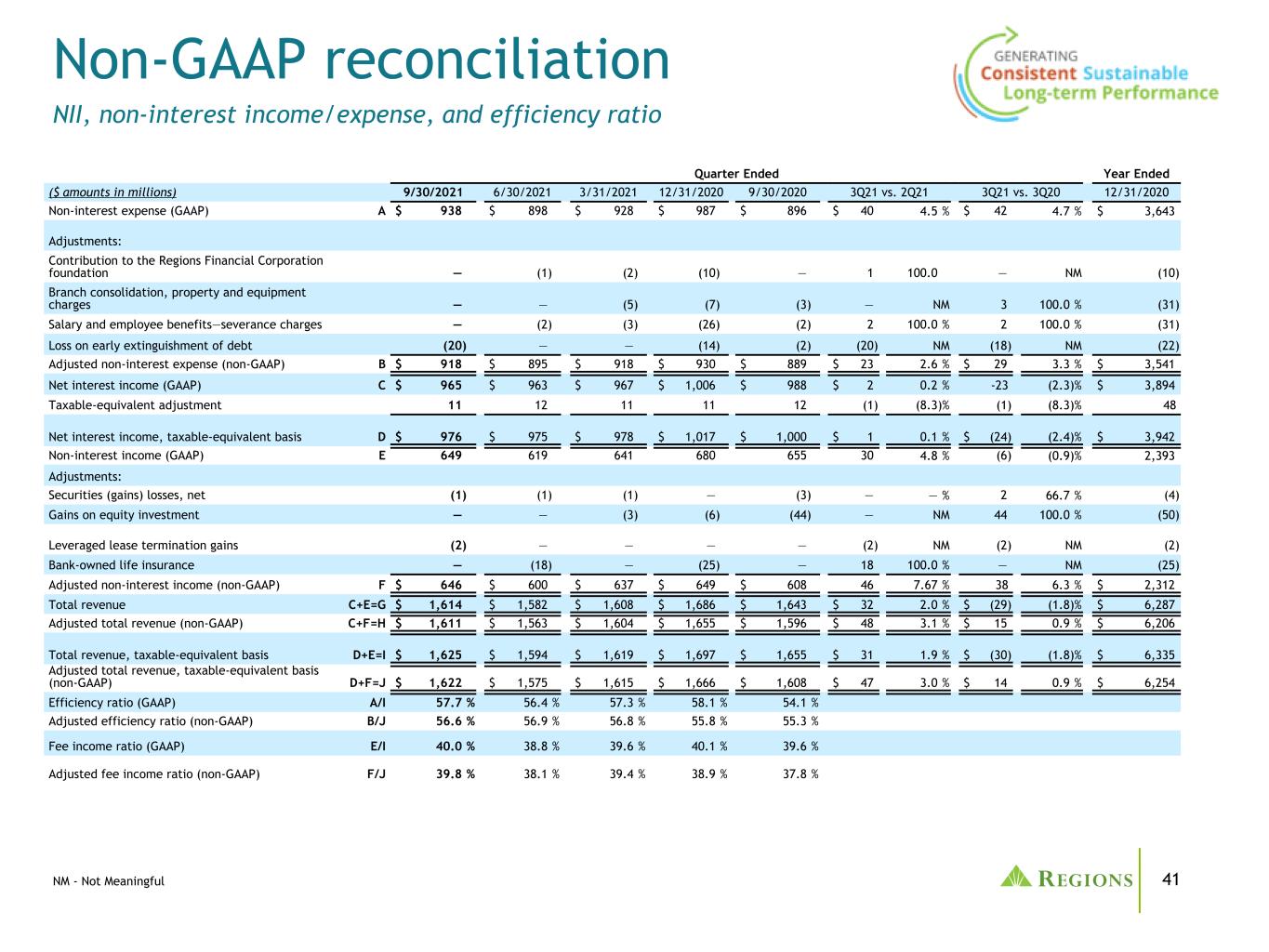

33 Management uses pre-tax pre-provision income (non-GAAP) and adjusted pre-tax pre-provision income (non-GAAP), as well as the adjusted efficiency ratio (non-GAAP) and the adjusted fee income ratio (non-GAAP) to monitor performance and believes these measures provide meaningful information to investors. Non-interest expense (GAAP) is presented excluding certain adjustments to arrive at adjusted non-interest expense (non-GAAP), which is the numerator for the efficiency ratio. Non-interest income (GAAP) is presented excluding certain adjustments to arrive at adjusted non-interest income (non-GAAP), which is the numerator for the fee income ratio. Adjusted non-interest income (non-GAAP) and adjusted non-interest expense (non- GAAP) are used to determine adjusted pre-tax pre-provision income (non-GAAP). Net interest income (GAAP) on a taxable-equivalent basis and non-interest income are added together to arrive at total revenue on a taxable-equivalent basis. Adjustments are made to arrive at adjusted total revenue on a taxable-equivalent basis (non-GAAP), which is the denominator for the fee income and efficiency ratios. Regions believes that the exclusion of these adjustments provides a meaningful base for period-to-period comparisons, which management believes will assist investors in analyzing the operating results of the Company and predicting future performance. These non-GAAP financial measures are also used by management to assess the performance of Regions’ business. It is possible that the activities related to the adjustments may recur; however, management does not consider the activities related to the adjustments to be indications of ongoing operations. Regions believes that presentation of these non-GAAP financial measures will permit investors to assess the performance of the Company on the same basis as that applied by management. The allowance for credit losses (ACL) as a percentage of total loans is an important ratio, especially during periods of economic stress. Management believes this ratio provides investors with meaningful additional information about credit loss allowance levels when the impact of SBA's Paycheck Protection Program loans, which are fully backed by the U.S. government, and any related allowance are excluded from total loans and total allowance which are the denominator and numerator, respectively, used in the ACL ratio. This adjusted ACL ratio represents a non-GAAP financial measure. Tangible common stockholders’ equity ratios have become a focus of some investors and management believes they may assist investors in analyzing the capital position of the Company absent the effects of intangible assets and preferred stock. Analysts and banking regulators have assessed Regions’ capital adequacy using the tangible common stockholders’ equity measure. Because tangible common stockholders’ equity is not formally defined by GAAP or prescribed in any amount by federal banking regulations it is currently considered to be a non- GAAP financial measure and other entities may calculate it differently than Regions’ disclosed calculations. Since analysts and banking regulators may assess Regions’ capital adequacy using tangible common stockholders’ equity, management believes that it is useful to provide investors the ability to assess Regions’ capital adequacy on this same basis. Non-GAAP financial measures have inherent limitations, are not required to be uniformly applied and are not audited. Although these non-GAAP financial measures are frequently used by stakeholders in the evaluation of a company, they have limitations as analytical tools, and should not be considered in isolation, or as a substitute for analyses of results as reported under GAAP. In particular, a measure of earnings that excludes selected items does not represent the amount that effectively accrues directly to stockholders. Management and the Board of Directors utilize non-GAAP measures as follows: • Preparation of Regions' operating budgets • Monthly financial performance reporting • Monthly close-out reporting of consolidated results (management only) • Presentation to investors of company performance • Metrics for incentive compensation Non-GAAP information

34 Non-GAAP reconciliation Core net interest income and adjusted net interest margin Quarter-ended 9/30/2021 6/30/2021 Net interest income (FTE) (GAAP) $ 976 $ 975 Impact of SBA PPP loans (31) (43) Impact of excess cash (3) (3) Core net interest income (FTE) (non-GAAP) $ 942 $ 929 Net interest margin (FTE) (GAAP) 2.76 % 2.81 % Impact of SBA PPP loans (0.05) % (0.05) % Impact of excess cash 0.59 % 0.55 % Adjusted net interest margin (FTE) (non-GAAP) 3.30 % 3.31 % NM - Not Meaningful

35 Non-GAAP reconciliation Adjusted average loans Average Balances ($ amounts in millions) 3Q21 2Q21 1Q21 4Q20 3Q20 3Q21 vs. 2Q21 3Q21 vs. 3Q20 Commercial and industrial $ 41,892 $ 43,140 $ 42,816 $ 43,889 $ 46,405 $ (1,248) (2.9) % $ (4,513) (9.7) % Add: Commercial loans held for sale reclassified to the portfolio — 138 231 3 — (138) (100.0) % — NM Less: SBA PPP Loans 2,138 3,901 3,798 4,143 4,558 (1,763) (45.2) % (2,420) (53.1) % Adjusted commercial and industrial loans (non-GAAP) $ 39,754 $ 39,377 $ 39,249 $ 39,749 $ 41,847 $ 377 1.0 % $ (2,093) (5.0) % Total commercial loans $ 47,574 $ 48,774 $ 48,494 $ 49,597 $ 52,221 $ (1,200) (2.5) % $ (4,647) (8.9) % Add: Commercial loans held for sale reclassified to the portfolio — 138 231 3 — (138) (100.0) % — NM Less: SBA PPP Loans 2,138 3,901 3,798 4,143 4,558 (1,763) (45.2) % (2,420) (53.1) % Adjusted total commercial loans (non-GAAP) $ 45,436 $ 45,011 $ 44,927 $ 45,457 $ 47,663 $ 425 0.9 % $ (2,227) (4.7) % Total business loans $ 54,885 $ 56,056 $ 55,716 $ 57,045 $ 59,519 $ (1,171) (2.1) % $ (4,634) (7.8) % Add: Commercial loans held for sale reclassified to the portfolio — 138 231 3 — (138) (100.0) % — NM Less: SBA PPP Loans 2,138 3,901 3,798 4,143 4,558 (1,763) (45.2) % (2,420) (53.1) % Adjusted total business loans (non-GAAP) $ 52,747 $ 52,293 $ 52,149 $ 52,905 $ 54,961 $ 454 0.9 % $ (2,214) (4.0) % Total consumer loans $ 28,465 $ 28,495 $ 29,039 $ 29,619 $ 29,851 $ (30) (0.1) % $ (1,386) (4.6) % Less: Indirect—other consumer exit portfolio 806 909 1,034 1,164 1,318 (103) (11.3) % (512) (38.8) % Less: Indirect—vehicles 557 690 850 1,023 1,223 (133) (19.3) % (666) (54.5) % Adjusted total consumer loans (non-GAAP) $ 27,102 $ 26,896 $ 27,155 $ 27,432 $ 27,310 $ 206 0.8 % $ (208) (0.8) % Total loans $ 83,350 $ 84,551 $ 84,755 $ 86,664 $ 89,370 $ (1,201) (1.4) % $ (6,020) (6.7) % Add: Commercial loans held for sale reclassified to the portfolio — 138 231 3 — (138) (100.0) % — NM Less: SBA PPP Loans 2,138 3,901 3,798 4,143 4,558 (1,763) (45.2) % (2,420) (53.1) % Less: Indirect—other consumer exit portfolio 806 909 1,034 1,164 1,318 (103) (11.3) % (512) (38.8) % Less: Indirect—vehicles 557 690 850 1,023 1,223 (133) (19.3) % (666) (54.5) % Adjusted total loans (non-GAAP) $ 79,849 $ 79,189 $ 79,304 $ 80,337 $ 82,271 $ 660 0.8 % $ (2,422) (2.9) % NM - Not Meaningful

36 Non-GAAP reconciliation Adjusted full year average loans Average Balance Twelve Months Ended ($ amounts in millions) December 31, 2020 Total Loans $ 87,813 Add: Commercial loans held for sale reclassified to the portfolio 1 Less: SBA PPP Loans 2,986 Less: Indirect—other consumer exit portfolio 1,417 Less: Indirect—vehicles 1,341 Adjusted total loans (non-GAAP) $ 82,070 NM - Not Meaningful

37 Non-GAAP reconciliation Adjusted ending loans As of 9/30/2021 9/30/2021 ($ amounts in millions) 9/30/2021 6/30/2021 3/31/2021 12/31/2020 9/30/2020 vs. 6/30/2021 vs. 9/30/2020 Commercial and industrial $ 41,748 $ 42,628 $ 43,241 $ 42,870 $ 45,199 $ (880) (2.1) % $ (3,451) (7.6) % Add: Commercial loans held for sale reclassified to the portfolio — — 210 239 — — NM — NM Less: SBA PPP Loans 1,536 2,948 4,317 3,624 4,594 (1,412) (47.9) % (3,058) (66.6) % Adjusted commercial and industrial loans (non-GAAP) $ 40,212 $ 39,680 $ 39,134 $ 39,485 $ 40,605 $ 532 1.3 % $ (393) (1.0) % Total commercial loans $ 47,446 $ 48,254 $ 48,869 $ 48,575 $ 50,955 $ (808) (1.7) % $ (3,509) (6.9) % Add: Commercial loans held for sale reclassified to the portfolio — — 210 239 — — NM — NM Less: SBA PPP Loans 1,536 2,948 4,317 3,624 4,594 (1,412) (47.9) % (3,058) (66.6) % Adjusted total commercial loans (non-GAAP) $ 45,910 $ 45,306 $ 44,762 $ 45,190 $ 46,361 $ 604 1.3 % $ (451) (1.0) % Total business loans $ 54,758 $ 55,502 $ 56,091 $ 55,838 $ 58,537 $ (744) (1.3) % $ (3,779) (6.5) % Add: Commercial loans held for sale reclassified to the portfolio — — 210 239 — — NM — NM Less: SBA PPP Loans 1,536 2,948 4,317 3,624 4,594 (1,412) (47.9) % (3,058) (66.6) % Adjusted total business loans (non-GAAP) $ 53,222 $ 52,554 $ 51,984 $ 52,453 $ 53,943 $ 668 1.3 % $ (721) (1.3) % Total consumer loans $ 28,512 $ 28,572 $ 28,664 $ 29,428 $ 29,822 $ (60) (0.2) % $ (1,310) (4.4) % Less: Indirect—other consumer exit portfolio 760 858 971 1,101 1,240 (98) (11.4) % (480) (38.7) % Less: Indirect—vehicles 500 621 768 934 1,120 (121) (19.5) % (620) (55.4) % Adjusted total consumer loans (non-GAAP) $ 27,252 $ 27,093 $ 26,925 $ 27,393 $ 27,462 $ 159 0.6 % $ (210) (0.8) % Total loans $ 83,270 $ 84,074 $ 84,755 $ 85,266 $ 88,359 $ (804) (1.0) % $ (5,089) (5.8) % Add: Commercial loans held for sale reclassified to the portfolio — — 210 239 — — NM — NM Less: SBA PPP Loans 1,536 2,948 4,317 3,624 4,594 (1,412) (47.9) % (3,058) (66.6) % Less: Indirect—other consumer exit portfolio 760 858 971 1,101 1,240 (98) (11.4) % (480) (38.7) % Less: Indirect—vehicles 500 621 768 934 1,120 (121) (19.5) % (620) (55.4) % Adjusted ending total loans (non-GAAP) $ 80,474 $ 79,647 $ 78,909 $ 79,846 $ 81,405 $ 827 1.0 % $ (931) (1.1) % NM - Not Meaningful

38 Non-GAAP reconciliation Non-interest expense Year Ended December 31 ($ amounts in millions) 2020 2019 2018 2017 2016 Non-interest expense (GAAP) $ 3,643 $ 3,489 $ 3,570 $ 3,491 $ 3,483 Adjustments: Contribution to Regions Financial Corporation foundation (10) — (60) (40) — Professional, legal and regulatory expenses (7) — — — (3) Branch consolidation, property and equipment charges (31) (25) (11) (22) (58) Expenses associated with residential mortgage loan sale — — (4) — — Loss on early extinguishment of debt (22) (16) — — (14) Salary and employee benefits—severance charges (31) (5) (61) (10) (21) Acquisition Expense (1) — — — — Adjusted non-interest expense (non-GAAP) $ 3,541 $ 3,443 $ 3,434 $ 3,419 $ 3,387

39 Non-GAAP reconciliation ACL/Loans excluding PPP As of ($ amounts in millions) 9/30/2021 6/30/2021 3/31/2021 12/31/2020 9/30/2020 Total Loans $ 83,270 $ 84,074 $ 84,755 $ 85,266 $ 88,359 Less: SBA PPP Loans 1,536 2,948 4,317 3,624 4,594 Loans excluding PPP, net (non- GAAP) $ 81,734 $ 81,126 $ 80,438 $ 81,642 $ 83,765 ACL at period end $ 1,499 $ 1,684 $ 2,068 $ 2,293 $ 2,425 Less: SBA PPP Loans' ACL $ 2 $ 3 $ 3 $ 1 $ — ACL excluding PPP Loans' ACL (non-GAAP) $ 1,497 $ 1,681 $ 2,065 $ 2,292 $ 2,425 ACL/Loans excluding PPP, net (non-GAAP) 1.83 % 2.07 % 2.57 % 2.81 % 2.90 %

40 Non-GAAP reconciliation Pre-tax pre-provision income (PPI) Quarter Ended ($ amounts in millions) 9/30/2021 6/30/2021 3/31/2021 12/31/2020 9/30/2020 3Q21 vs. 2Q21 3Q21 vs. 3Q20 Net income (loss) available to common shareholders (GAAP) $ 624 $ 748 $ 614 $ 588 $ 501 $ (124) (16.6) % $ 123 24.6 % Preferred dividends and other (GAAP)(1) 27 42 28 28 29 (15) (35.7) % (2) (6.9) % Income tax expense (benefit) (GAAP) 180 231 180 121 104 (51) (22.1) % 76 73.1 % Income (loss) before income taxes (GAAP) 831 1,021 822 737 634 (190) (18.6) % 197 31.1 % Provision for (benefit from) credit losses (GAAP) (155) (337) (142) (38) 113 182 54.0 % (268) (237.2) % Pre-tax pre-provision income (non-GAAP) 676 684 680 699 747 (8) (1.2) % (71) (9.5) % Other adjustments: Securities (gains) losses, net (1) (1) (1) — (3) — — % 2 66.7 % Gains on equity investment — — (3) (6) (44) — NM 44 100.0 % Leveraged lease termination gains, net (2) — — — — (2) NM (2) NM Bank-owned life insurance — (18) — (25) — 18 100.0 % — NM Salaries and employee benefits—severance charges — 2 3 26 2 (2) (100.0) % (2) (100.0) % Branch consolidation, property and equipment charges — — 5 7 3 — NM (3) (100.0) % Contribution to the Regions Financial Corporation foundation — 1 2 10 — (1) (100.0) % — NM Loss on early extinguishment of debt 20 — — 14 2 20 NM 18 NM Total other adjustments 17 (16) 6 26 (40) 33 206.3 % 57 142.5 % Adjusted pre-tax pre-provision income (non-GAAP) $ 693 $ 668 $ 686 $ 725 $ 707 $ 25 3.7 % $ (14) (2.0) % NM - Not Meaningful NM - Not Meaningful (1) The second quarter 2021 amount includes $13 million of Series A preferred stock issuance costs, which reduced net income available to common shareholders when the shares were redeemed during the second quarter of 2021. Management does not consider this $13 million to be indicative of the company's performance and believes excluding it will assist investors in analyzing its results and in predicting future performance.

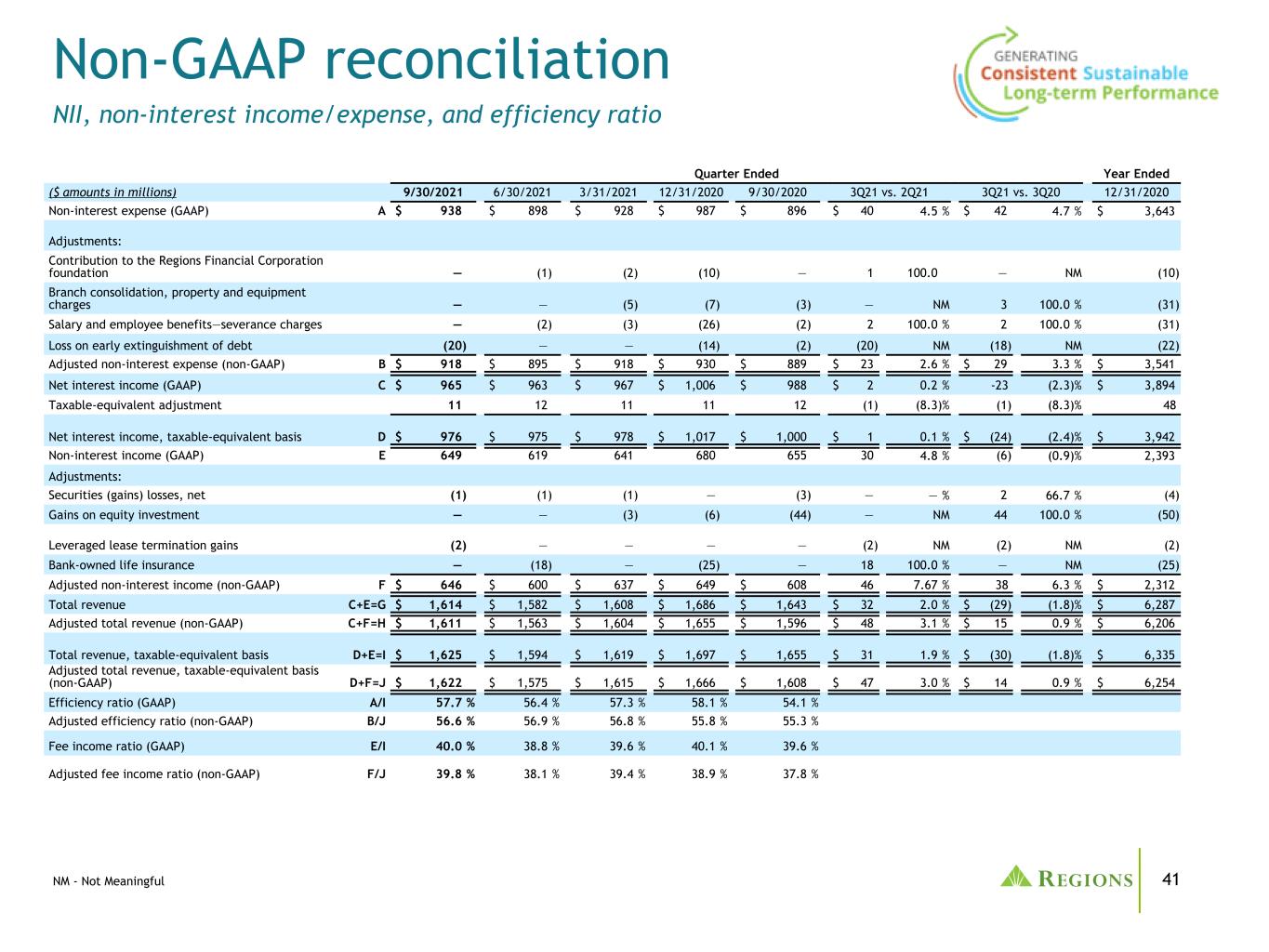

41 Non-GAAP reconciliation NII, non-interest income/expense, and efficiency ratio NM - Not Meaningful Quarter Ended Year Ended ($ amounts in millions) 9/30/2021 6/30/2021 3/31/2021 12/31/2020 9/30/2020 3Q21 vs. 2Q21 3Q21 vs. 3Q20 12/31/2020 Non-interest expense (GAAP) A $ 938 $ 898 $ 928 $ 987 $ 896 $ 40 4.5 % $ 42 4.7 % $ 3,643 Adjustments: Contribution to the Regions Financial Corporation foundation — (1) (2) (10) — 1 100.0 — NM (10) Branch consolidation, property and equipment charges — — (5) (7) (3) — NM 3 100.0 % (31) Salary and employee benefits—severance charges — (2) (3) (26) (2) 2 100.0 % 2 100.0 % (31) Loss on early extinguishment of debt (20) — — (14) (2) (20) NM (18) NM (22) Adjusted non-interest expense (non-GAAP) B $ 918 $ 895 $ 918 $ 930 $ 889 $ 23 2.6 % $ 29 3.3 % $ 3,541 Net interest income (GAAP) C $ 965 $ 963 $ 967 $ 1,006 $ 988 $ 2 0.2 % -23 (2.3) % $ 3,894 Taxable-equivalent adjustment 11 12 11 11 12 (1) (8.3) % (1) (8.3) % 48 Net interest income, taxable-equivalent basis D $ 976 $ 975 $ 978 $ 1,017 $ 1,000 $ 1 0.1 % $ (24) (2.4) % $ 3,942 Non-interest income (GAAP) E 649 619 641 680 655 30 4.8 % (6) (0.9) % 2,393 Adjustments: Securities (gains) losses, net (1) (1) (1) — (3) — — % 2 66.7 % (4) Gains on equity investment — — (3) (6) (44) — NM 44 100.0 % (50) Leveraged lease termination gains (2) — — — — (2) NM (2) NM (2) Bank-owned life insurance — (18) — (25) — 18 100.0 % — NM (25) Adjusted non-interest income (non-GAAP) F $ 646 $ 600 $ 637 $ 649 $ 608 46 7.67 % 38 6.3 % $ 2,312 Total revenue C+E=G $ 1,614 $ 1,582 $ 1,608 $ 1,686 $ 1,643 $ 32 2.0 % $ (29) (1.8) % $ 6,287 Adjusted total revenue (non-GAAP) C+F=H $ 1,611 $ 1,563 $ 1,604 $ 1,655 $ 1,596 $ 48 3.1 % $ 15 0.9 % $ 6,206 Total revenue, taxable-equivalent basis D+E=I $ 1,625 $ 1,594 $ 1,619 $ 1,697 $ 1,655 $ 31 1.9 % $ (30) (1.8) % $ 6,335 Adjusted total revenue, taxable-equivalent basis (non-GAAP) D+F=J $ 1,622 $ 1,575 $ 1,615 $ 1,666 $ 1,608 $ 47 3.0 % $ 14 0.9 % $ 6,254 Efficiency ratio (GAAP) A/I 57.7 % 56.4 % 57.3 % 58.1 % 54.1 % Adjusted efficiency ratio (non-GAAP) B/J 56.6 % 56.9 % 56.8 % 55.8 % 55.3 % Fee income ratio (GAAP) E/I 40.0 % 38.8 % 39.6 % 40.1 % 39.6 % Adjusted fee income ratio (non-GAAP) F/J 39.8 % 38.1 % 39.4 % 38.9 % 37.8 %

42 Forward-Looking Statements This presentation may include forward-looking statements as defined in the Private Securities Litigation Reform Act of 1995. Forward-looking statements are not based on historical information, but rather are related to future operations, strategies, financial results or other developments. Forward-looking statements are based on management’s current expectations as well as certain assumptions and estimates made by, and information available to, management at the time the statements are made. Those statements are based on general assumptions and are subject to various risks, and because they also relate to the future they are likewise subject to inherent uncertainties and other factors that may cause actual results to differ materially from the views, beliefs and projections expressed in such statements. Therefore, we caution you against relying on any of these forward-looking statements. These risks, uncertainties and other factors include, but are not limited to, those described below: • Current and future economic and market conditions in the United States generally or in the communities we serve (in particular the Southeastern United States), including the effects of possible declines in property values, increases in unemployment rates, financial market disruptions and potential reductions of economic growth, which may adversely affect our lending and other businesses and our financial results and conditions. • Possible changes in trade, monetary and fiscal policies of, and other activities undertaken by, governments, agencies, central banks and similar organizations, which could have a material adverse effect on our earnings. • Possible changes in market interest rates or capital markets could adversely affect our revenue and expense, the value of assets and obligations, and the availability and cost of capital and liquidity. • The impact of pandemics, including the ongoing COVID-19 pandemic, on our businesses, operations, and financial results and conditions. The duration and severity of the ongoing COVID-19 pandemic, which has disrupted the global economy, has and could continue to adversely affect our capital and liquidity position, impair the ability of borrowers to repay outstanding loans and increase our allowance for credit losses, impair collateral values, and result in lost revenue or additional expenses. The pandemic could also result in goodwill impairment charges and the impairment of other financial and nonfinancial assets, and increase our cost of capital. • Any impairment of our goodwill or other intangibles, any repricing of assets, or any adjustment of valuation allowances on our deferred tax assets due to changes in tax law, adverse changes in the economic environment, declining operations of the reporting unit or other factors. • The effect of new tax legislation and/or interpretation of existing tax law, which may impact our earnings, capital ratios, and our ability to return capital to shareholders. • Possible changes in the creditworthiness of customers and the possible impairment of the collectability of loans and leases, including operating leases. • Changes in the speed of loan prepayments, loan origination and sale volumes, charge-offs, credit loss provisions or actual credit losses where our allowance for credit losses may not be adequate to cover our eventual losses. • Possible acceleration of prepayments on mortgage-backed securities due to low interest rates, and the related acceleration of premium amortization on those securities. • Loss of customer checking and savings account deposits as customers pursue other, higher-yield investments, which could increase our funding costs. • Possible changes in consumer and business spending and saving habits and the related effect on our ability to increase assets and to attract deposits, which could adversely affect our net income. • Our ability to effectively compete with other traditional and non-traditional financial services companies, including fintechs, some of whom possess greater financial resources than we do or are subject to different regulatory standards than we are. • Our inability to develop and gain acceptance from current and prospective customers for new products and services and the enhancement of existing products and services to meet customers’ needs and respond to emerging technological trends in a timely manner could have a negative impact on our revenue. • Our inability to keep pace with technological changes, including those related to the offering of digital banking and financial services, could result in losing business to competitors. • Changes in laws and regulations affecting our businesses, including legislation and regulations relating to bank products and services, as well as changes in the enforcement and interpretation of such laws and regulations by applicable governmental and self-regulatory agencies, including as a result of the recent change in U.S. presidential administration and control of the U.S. Congress, which could require us to change certain business practices, increase compliance risk, reduce our revenue, impose additional costs on us, or otherwise negatively affect our businesses. • Our capital actions, including dividend payments, common stock repurchases, or redemptions of preferred stock or other regulatory capital instruments, must not cause us to fall below minimum capital ratio requirements, with applicable buffers taken into account, and must comply with other requirements and restrictions under law or imposed by our regulators, which may impact our ability to return capital to shareholders. Forward-looking statements

43 • Our ability to comply with stress testing and capital planning requirements (as part of the CCAR process or otherwise) may continue to require a significant investment of our managerial resources due to the importance of such tests and requirements. • Our ability to comply with applicable capital and liquidity requirements (including, among other things, the Basel III capital standards), including our ability to generate capital internally or raise capital on favorable terms, and if we fail to meet requirements, our financial condition and market perceptions of us could be negatively impacted. • The effects of any developments, changes or actions relating to any litigation or regulatory proceedings brought against us or any of our subsidiaries. • The costs, including possibly incurring fines, penalties, or other negative effects (including reputational harm) of any adverse judicial, administrative, or arbitral rulings or proceedings, regulatory enforcement actions, or other legal actions to which we or any of our subsidiaries are a party, and which may adversely affect our results. • Our ability to manage fluctuations in the value of assets and liabilities and off-balance sheet exposure so as to maintain sufficient capital and liquidity to support our businesses. • Our ability to execute on our strategic and operational plans, including our ability to fully realize the financial and nonfinancial benefits relating to our strategic initiatives. • The risks and uncertainties related to our acquisition or divestiture of businesses, including our recently completed acquisition of EnerBank and risks related to such acquisition, including that the expected synergies, cost savings and other financial or other benefits may not be realized within the expected timeframes, or might be less than projected; difficulties in integrating the business; and the inability of Regions to effectively cross-sell products to EnerBank’s customers; as well as our pending acquisition of Sabal and risks related to such acquisition, including delays in closing the transaction; that the expected synergies, cost savings, and other financial or other benefits of the transaction might not be realized within the expected timeframes, or might be less than projected; and difficulties in integrating Sabal’s business. • The success of our marketing efforts in attracting and retaining customers. • Our ability to recruit and retain talented and experienced personnel to assist in the development, management and operation of our products and services may be affected by changes in laws and regulations in effect from time to time. • Fraud or misconduct by our customers, employees or business partners. • Any inaccurate or incomplete information provided to us by our customers or counterparties. • Inability of our framework to manage risks associated with our businesses, such as credit risk and operational risk, including third-party vendors and other service providers, which could, among other things, result in a breach of operating or security systems as a result of a cyber attack or similar act or failure to deliver our services effectively. • Dependence on key suppliers or vendors to obtain equipment and other supplies for our businesses on acceptable terms. • The inability of our internal controls and procedures to prevent, detect or mitigate any material errors or fraudulent acts. • The effects of geopolitical instability, including wars, conflicts, civil unrest, and terrorist attacks and the potential impact, directly or indirectly, on our businesses. • The effects of man-made and natural disasters, including fires, floods, droughts, tornadoes, hurricanes, and environmental damage (specifically in the Southeastern United States), which may negatively affect our operations and/or our loan portfolios and increase our cost of conducting business. The severity and impact of future earthquakes, fires, hurricanes, tornadoes, droughts, floods and other weather-related events are difficult to predict and may be exacerbated by global climate change. • Changes in commodity market prices and conditions could adversely affect the cash flows of our borrowers operating in industries that are impacted by changes in commodity prices (including businesses indirectly impacted by commodities prices such as businesses that transport commodities or manufacture equipment used in the production of commodities), which could impair their ability to service any loans outstanding to them and/or reduce demand for loans in those industries. • Our ability to identify and address cyber-security risks such as data security breaches, malware, ransomware, “denial of service” attacks, “hacking” and identity theft, including account take-overs, a failure of which could disrupt our businesses and result in the disclosure of and/or misuse or misappropriation of confidential or proprietary information, disruption or damage to our systems, increased costs, losses, or adverse effects to our reputation. • Our ability to achieve our expense management initiatives. Forward-looking statements (continued)

44 • Market replacement of LIBOR and the related effect on our LIBOR-based financial products and contracts, including, but not limited to, derivative products, debt obligations, deposits, investments, and loans. • Possible downgrades in our credit ratings or outlook could, among other negative impacts, increase the costs of funding from capital markets. • The effects of a possible downgrade in the U.S. government’s sovereign credit rating or outlook, which could result in risks to us and general economic conditions that we are not able to predict. • The effects of problems encountered by other financial institutions that adversely affect us or the banking industry generally could require us to change certain business practices, reduce our revenue, impose additional costs on us, or otherwise negatively affect our businesses. • The effects of the failure of any component of our business infrastructure provided by a third party could disrupt our businesses, result in the disclosure of and/or misuse of confidential information or proprietary information, increase our costs, negatively affect our reputation, and cause losses. • Our ability to receive dividends from our subsidiaries, in particular Regions Bank, could affect our liquidity and ability to pay dividends to shareholders. • Changes in accounting policies or procedures as may be required by the FASB or other regulatory agencies could materially affect our financial statements and how we report those results, and expectations and preliminary analyses relating to how such changes will affect our financial results could prove incorrect. • Other risks identified from time to time in reports that we file with the SEC. • Fluctuations in the price of our common stock and inability to complete stock repurchases in the time frame and/or on the terms anticipated. • The effects of any damage to our reputation resulting from developments related to any of the items identified above. The foregoing list of factors is not exhaustive. For discussion of these and other factors that may cause actual results to differ from expectations, look under the captions “Forward-Looking Statements” and “Risk Factors” of Regions’ Annual Report on Form 10-K for the year ended December 31, 2020 and the "Risk Factors" of Regions' Quarterly Report on Form 10-Q for the quarter ended June 30, 2021 as filed with the SEC. Further, statements about the potential effects of the COVID-19 pandemic on our businesses, operations, and financial results and conditions may constitute forward-looking statements and are subject to the risk that the actual effects may differ, possibly materially, from what is reflected in those forward-looking statements due to factors and future developments that are uncertain, unpredictable and in many cases beyond our control, including the scope and duration of the pandemic (including any resurgences), actions taken by governmental authorities in response to the pandemic and their success, the effectiveness and acceptance of any vaccines, and the direct and indirect impact of the pandemic on our customers, third parties and us. The words “future,” “anticipates,” “assumes,” “intends,” “plans,” “seeks,” “believes,” “predicts,” “potential,” “objectives,” “estimates,” “expects,” “targets,” “projects,” “outlook,” “forecast,” “would,” “will,” “may,” “might,” “could,” “should,” “can,” and similar terms and expressions often signify forward-looking statements. You should not place undue reliance on any forward-looking statements, which speak only as of the date made. Factors or events that could cause our actual results to differ may emerge from time to time, and it is not possible to predict all of them. We assume no obligation and do not intend to update or revise any forward-looking statements that are made from time to time, either as a result of future developments, new information or otherwise, except as may be required by law. Regions’ Investor Relations contact is Dana Nolan at (205) 264-7040; Regions’ Media contact is Jeremy King at (205) 264-4551. Forward-looking statements (continued)

45 ®