Exhibit 99.3 3rd Quarter Earnings Conference Call October 21, 2022

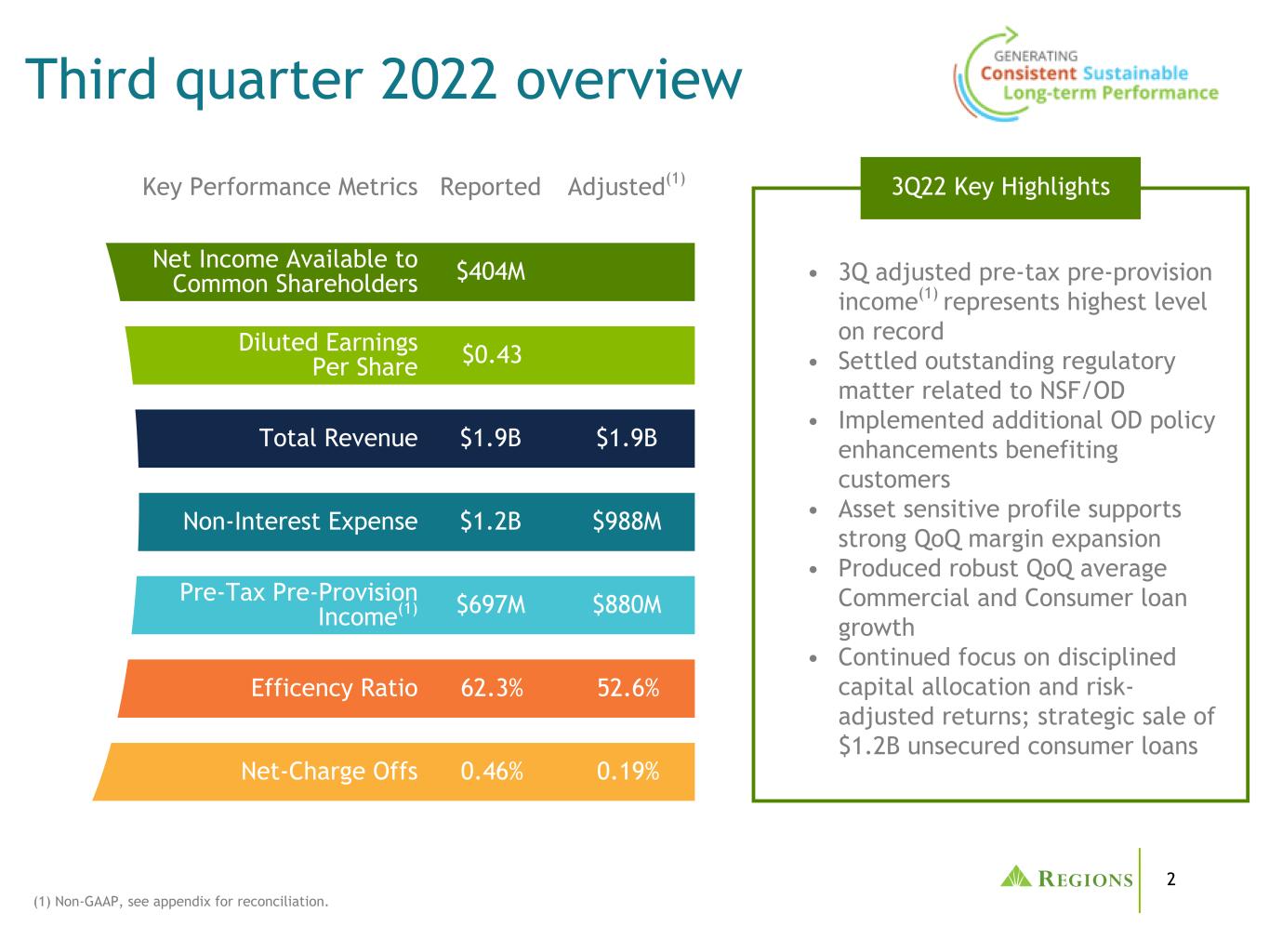

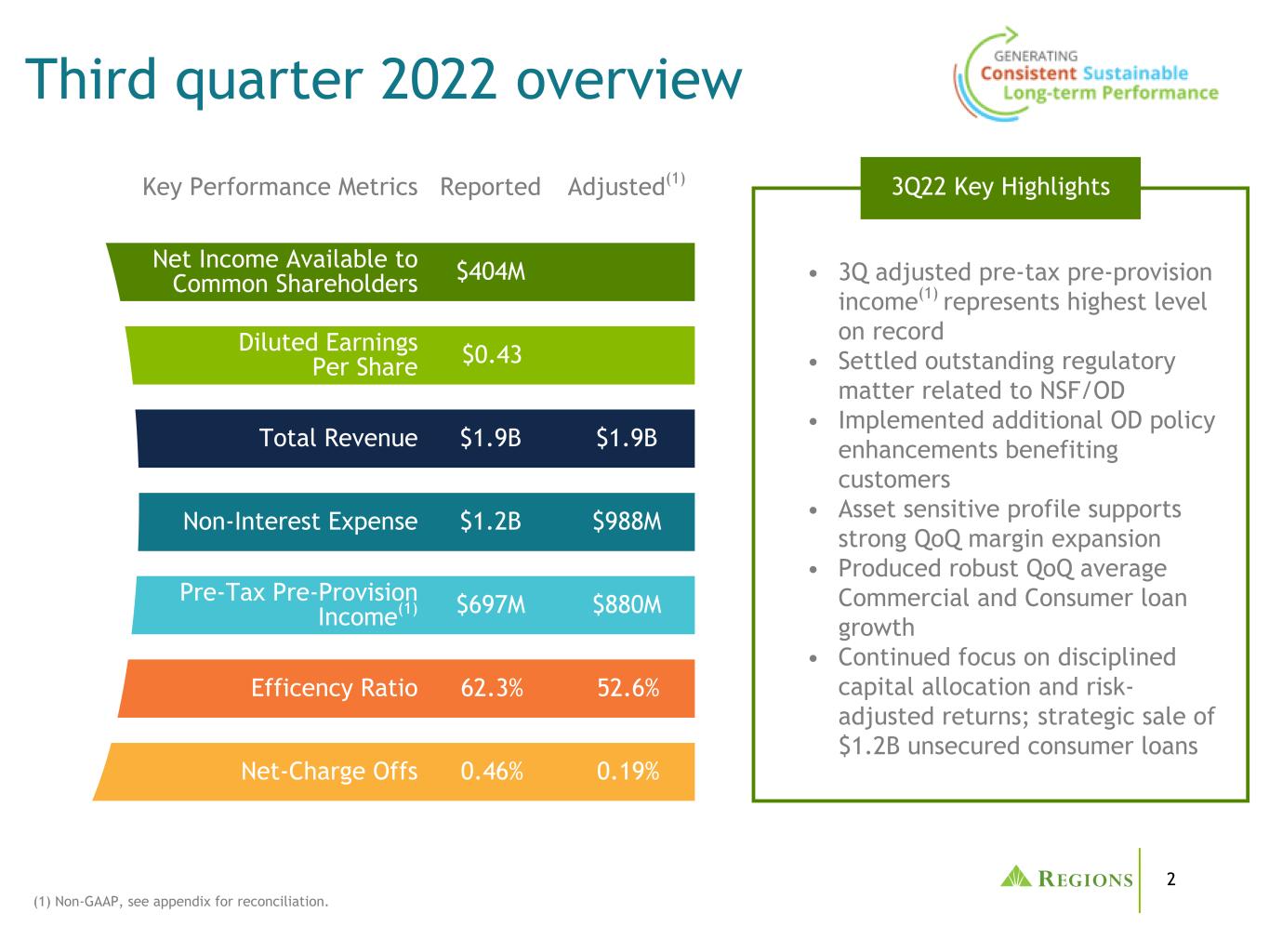

2 Third quarter 2022 overview (1) Non-GAAP, see appendix for reconciliation. Key Performance Metrics Reported Adjusted(1) Net Income Available to Common Shareholders $404M Diluted Earnings Per Share $0.43 Total Revenue $1.9B $1.9B Non-Interest Expense $1.2B $988M Pre-Tax Pre-Provision Income(1) $697M $880M Efficency Ratio 62.3% 52.6% Net-Charge Offs 0.46% 0.19% 3Q22 Key Highlights • 3Q adjusted pre-tax pre-provision income(1) represents highest level on record • Settled outstanding regulatory matter related to NSF/OD • Implemented additional OD policy enhancements benefiting customers • Asset sensitive profile supports strong QoQ margin expansion • Produced robust QoQ average Commercial and Consumer loan growth • Continued focus on disciplined capital allocation and risk- adjusted returns; strategic sale of $1.2B unsecured consumer loans

3 (1) August 2022 vs 2021. (2) Represents penetration of Corporate Banking Group segment. (3) Includes relationships/accounts for Private Wealth Management, Institutional Services and Investment Services, Jul vs Dec. (4) Quality Relationships defined as having a cumulative $500K in loans, deposits and IM&T accounts, revenue per Quality Relationship measured over TTM, Jul vs Dec. (5) Retention of IM&T revenue vs baseline. Investments in our businesses Increased number of Treasury Management clients 11.7% YoY(1); penetration rate improved 70bps(1)(2) Clearsight on track to meet FY expectations CORPORATE CONSUMER WEALTH We are investing in talent, technology, and strategic acquisitions; the investments we are making across all three of our businesses are paying off. Mobile users increased 6.5% YoY Growth in total relationships(3) of 5% and revenue per quality relationship(4) of 10% Sabal closed $593M in Loans YTD; anticipate increasing FY volume by 2% in challenging market conditions Better use of data contributing to strong PWM retention rate(5) of 93%Significantly improved closing time on home equity products Clients with Wealth Plans entrust us with 25% more assets Ascentium production up 27% YTD; pipelines remain strong Completed YTD bulk purchases of MSR totaling $13B UPB & continue to purchase MSR on a flow basis Upgraded mortgage contact relationship management platform EnerBank acquisition performing as expected generating high quality loans; synergy work ongoing Investment Services average monthly revenue up 14%, over PY Strong Client Satisfaction and Associate Engagement scores YTD non-interest income growth of 9%

4 • Avg business loans growth was broad-based across all businesses and industries; driven mostly by existing clients. Commitments increased $4.4B and utilization decreased to 43.1%. ◦ Expect pace of loan growth to slow over time as capital market conditions become more favorable. ◦ PPP loans ended the quarter at $177M. • Avg consumer loans grew 3% but declined 1% on an ending basis. Growth in avg mortgage, credit card & other consumer offset declines in other categories. ◦ Other Consumer reflects the sale of $1.2B of unsecured loans on 9/30. ◦ Other Consumer includes ~14% growth in avg EnerBank loans. • Expect full-year 2022 reported avg loan balances to grow ~9% compared to 2021. Loan growth continues $83.3 $93.5 $94.7 54.8 61.6 63.1 28.5 31.9 31.6 3Q21 2Q22 3Q22 (Ending, $ in billions) $83.4 $90.8 $94.6 54.9 59.5 62.4 28.5 31.3 32.2 3Q21 2Q22 3Q22 Loans and leases (Average, $ in billions) Business loansConsumer loans 4% 1% QoQ highlights & outlook • Expect PPP loans to reduce average loans by ~$2.4B in FY22; Expect consumer exit portfolios to reduce average loans by ~$700M in FY22.

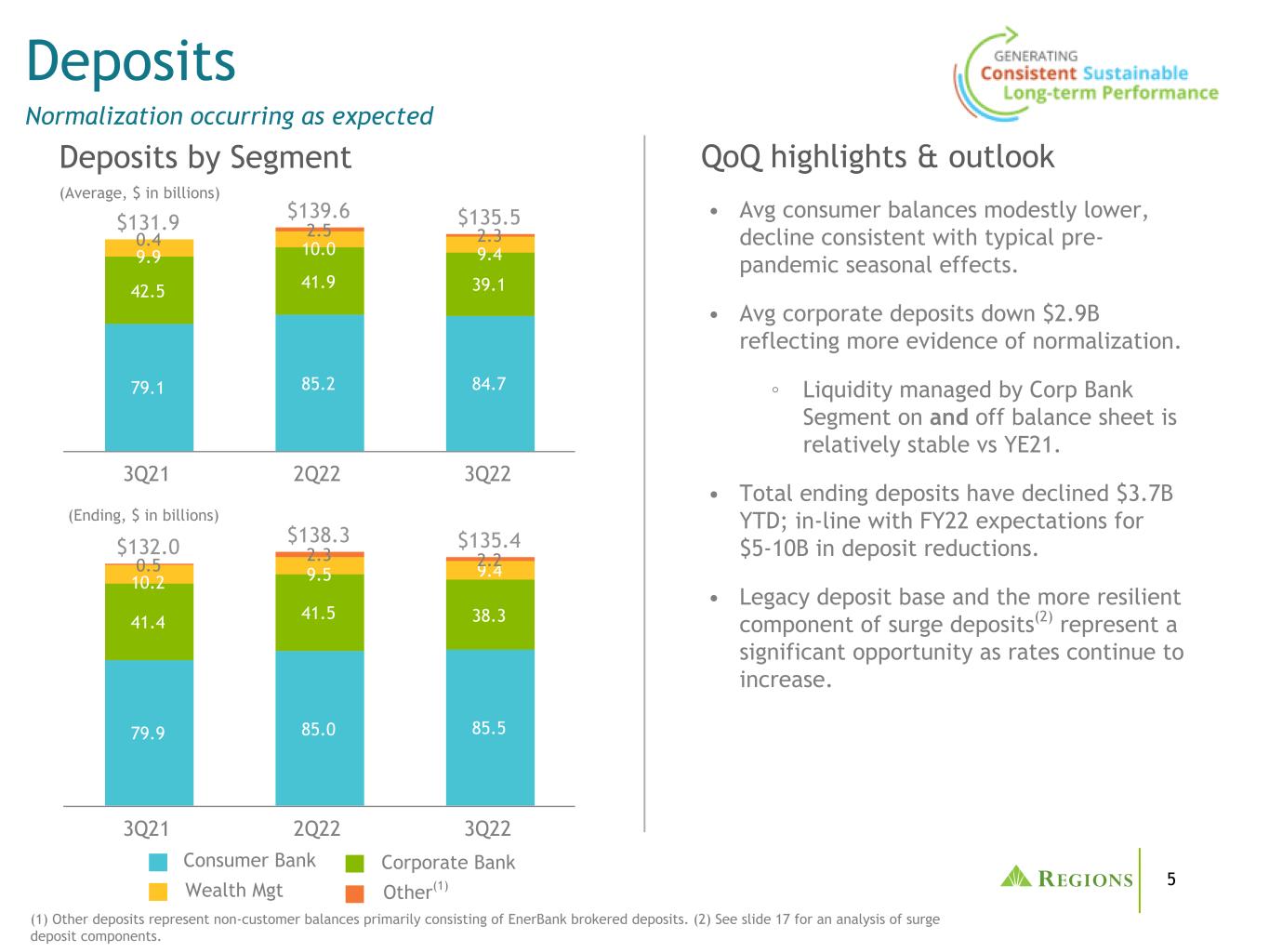

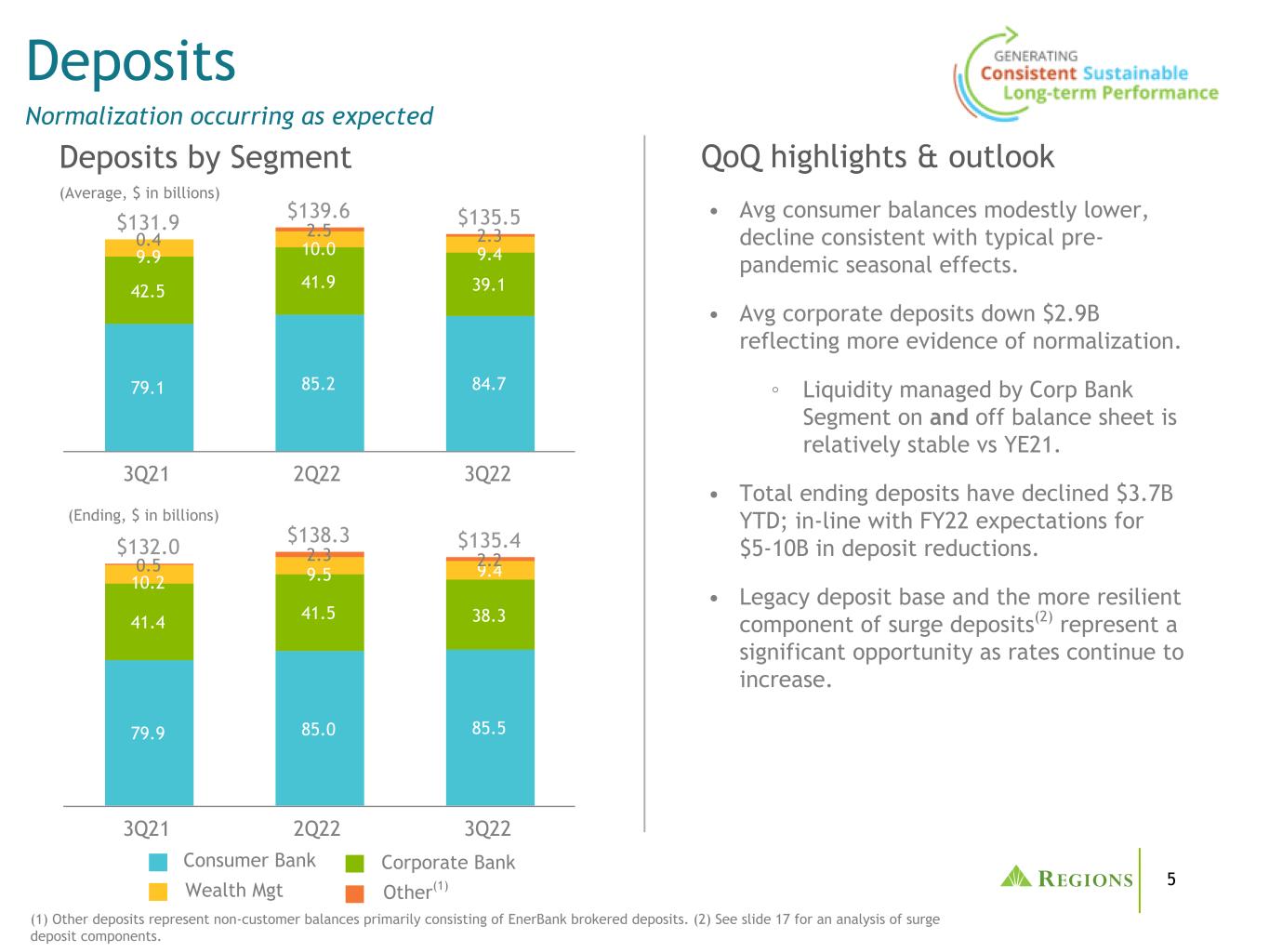

5 $132.0 $138.3 $135.4 79.9 85.0 85.5 41.4 41.5 38.3 10.2 9.5 9.40.5 2.3 2.2 3Q21 2Q22 3Q22 $131.9 $139.6 $135.5 79.1 85.2 84.7 42.5 41.9 39.1 9.9 10.0 9.4 0.4 2.5 2.3 3Q21 2Q22 3Q22 Deposits Normalization occurring as expected (1) Other deposits represent non-customer balances primarily consisting of EnerBank brokered deposits. (2) See slide 17 for an analysis of surge deposit components. Wealth Mgt Other(1) Consumer Bank Corporate Bank QoQ highlights & outlook • Avg consumer balances modestly lower, decline consistent with typical pre- pandemic seasonal effects. • Avg corporate deposits down $2.9B reflecting more evidence of normalization. ◦ Liquidity managed by Corp Bank Segment on and off balance sheet is relatively stable vs YE21. • Total ending deposits have declined $3.7B YTD; in-line with FY22 expectations for $5-10B in deposit reductions. • Legacy deposit base and the more resilient component of surge deposits(2) represent a significant opportunity as rates continue to increase. (Ending, $ in billions) Deposits by Segment (Average, $ in billions)

6 $976 $1,119 $1,274 2.76% 3.06% 3.53% 3.30% 3.44% 3.68% 3Q21 2Q22 3Q22 NII NII & margin performance NII and NIM(1) ($ in millions) (1) Net interest income (NII) and net interest margin (NIM) are reflected on a fully taxable-equivalent basis. (2) Non-GAAP; see appendix for reconciliation. NIM • In 3Q, deposit and cash balances remain elevated; expect normalization to continue at a modest pace; reported NIM and NIM excl. PPP/Cash expected to converge in 4Q • PPP and cash account for -15 bps NIM and $73M NII within the quarter (+23 bps / +$25M QoQ) ◦ PPP loans account for +1 bps NIM and $4M NII within the quarter (0 bps / -$4M QoQ) ◦ Excess cash accounts for -16 bps NIM and $69M NII (+23 bps / +$29M QoQ) • 10% average cash-to-earning asset ratio positioned well/provides flexibility in navigating a rising rate environment ◦ No near-term expectation to need more costly wholesale funding sources NIM excl. PPP/Cash(2)

7 • NII increased +$154M, or +14% linked-quarter • Higher short-term rates largely drive NII growth ◦ Hand-off from hedging benefit to contractual loan and cash repricing ◦ Deposit costs so far slow to react; 3Q deposit cost = 15 bps / interest-bearing deposit cost = 25 bps (11% QoQ beta) • Higher long-term rates increase fixed rate asset yields and reduce securities premium amortization(1) • Avg loans grew ~$3.9B in 3Q; Avg securities grew ~$670M from PQ hedging activity • Positive other items mostly from 1 additional day and loan yield adjustments Cash/Dep Normalization Market Rates(1) (1) Market rate impacts include contractual loan, cash, hedge and borrowings repricing; fixed asset turnover at higher market rates; and lower securities premium amort. net discount accretion from $35M to $31M. (2) Other items include 1 additional day, a small positive adjustment to loan yields, better loan fees, and less favorable credit interest recoveries. (3) All guidance assumes 9/30/2022 forward rates; ~75bps hike in Nov., between 25 and 50bps in Dec., Fed Funds ends 2022 between 4.25% and 4.5% $1,108 $1,262 NII Attribution Drivers of NII and NIM 3Q22 2Q22 -8bps 0bps +14bps+46bps -$30M +$13M -$15M+$163M Expectations for 4Q22 & Beyond NII NIM Contractual balance sheet and hedge repricing outpaced deposit cost increases Positioned well for continued market rate increases NII & margin - core drivers Other(2)Deposit Costs Asset Balances +$23M -5bps • NII expected to grow approximately 7-9% in 4Q(3) ◦ Asset growth: Near-term environment conducive for continued loan growth, albeit at a slower pace; No additional securities purchases included in guidance ◦ Market rates: Meaningful short and long-term rate leverage; lower net hedge notional adds rate exposure in 4Q ◦ Other: 9/30 consumer loan sale reduces loan balances by ~$1.2B and 4Q NII growth by ~1.5% • Longer-term NII growth from organic and strategic asset growth, and higher rates; 2022 NII growth expected to be +20-22%; excl. PPP +23-25%; expect 4Q22 NII to be ~33-35% higher than 1Q22(3) Rate Environment

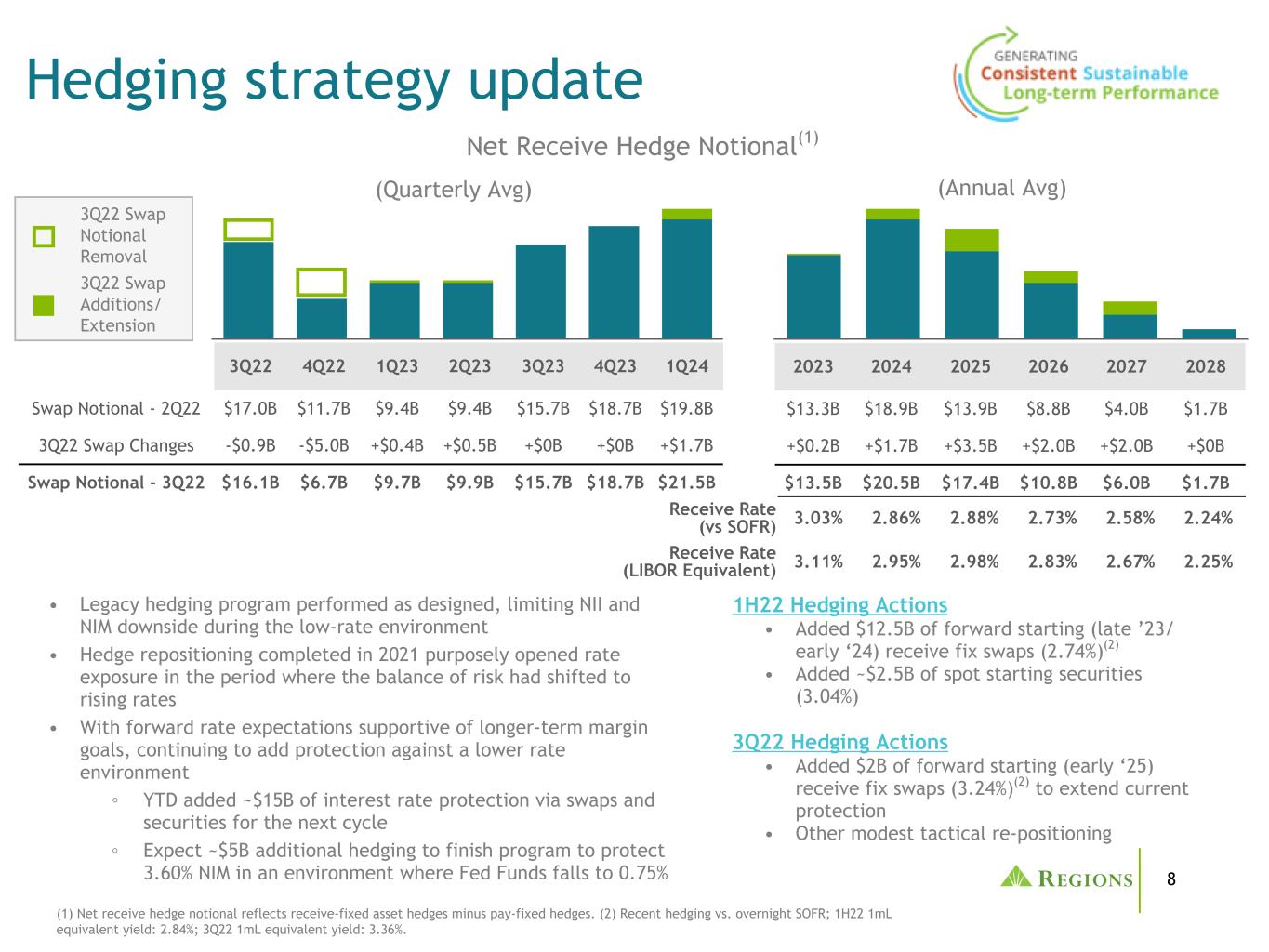

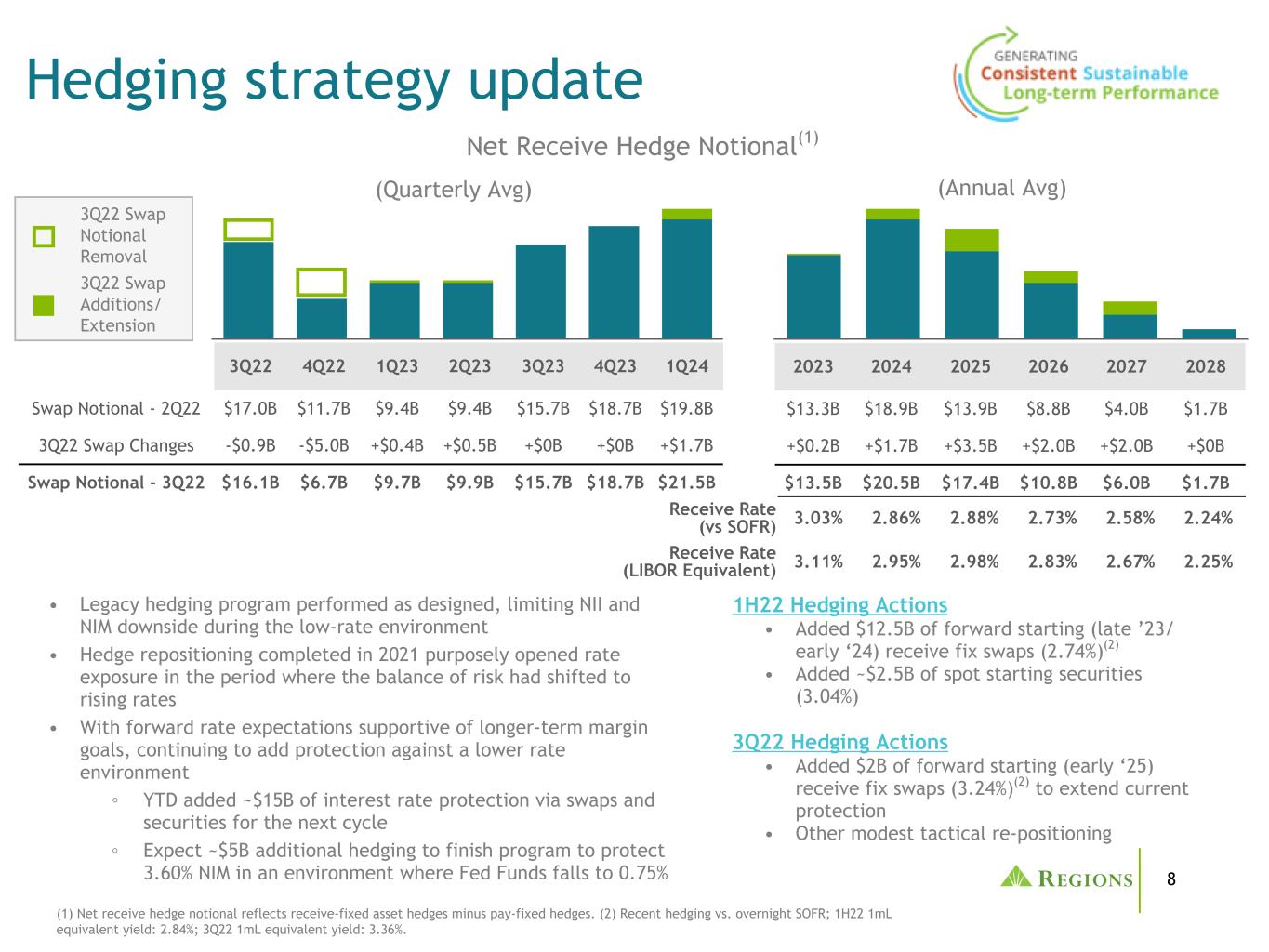

8 1 2 3 4 5 6 7 • Legacy hedging program performed as designed, limiting NII and NIM downside during the low-rate environment • Hedge repositioning completed in 2021 purposely opened rate exposure in the period where the balance of risk had shifted to rising rates • With forward rate expectations supportive of longer-term margin goals, continuing to add protection against a lower rate environment ◦ YTD added ~$15B of interest rate protection via swaps and securities for the next cycle ◦ Expect ~$5B additional hedging to finish program to protect 3.60% NIM in an environment where Fed Funds falls to 0.75% Net Receive Hedge Notional(1) (1) Net receive hedge notional reflects receive-fixed asset hedges minus pay-fixed hedges. (2) Recent hedging vs. overnight SOFR; 1H22 1mL equivalent yield: 2.84%; 3Q22 1mL equivalent yield: 3.36%. Hedging strategy update (Quarterly Avg) 1 2 3 4 5 62023 2024 2025 2026 2027 2028 $13.3B $18.9B $13.9B $8.8B $4.0B $1.7B +$0.2B +$1.7B +$3.5B +$2.0B +$2.0B +$0B $13.5B $20.5B $17.4B $10.8B $6.0B $1.7B Receive Rate (vs SOFR) 3.03% 2.86% 2.88% 2.73% 2.58% 2.24% Receive Rate (LIBOR Equivalent) 3.11% 2.95% 2.98% 2.83% 2.67% 2.25% (Annual Avg) 1H22 Hedging Actions • Added $12.5B of forward starting (late ’23/ early ‘24) receive fix swaps (2.74%)(2) • Added ~$2.5B of spot starting securities (3.04%) 3Q22 Hedging Actions • Added $2B of forward starting (early ‘25) receive fix swaps (3.24%)(2) to extend current protection • Other modest tactical re-positioning 3Q22 4Q22 1Q23 2Q23 3Q23 4Q23 1Q24 Swap Notional - 2Q22 $17.0B $11.7B $9.4B $9.4B $15.7B $18.7B $19.8B 3Q22 Swap Changes -$0.9B -$5.0B +$0.4B +$0.5B +$0B +$0B +$1.7B Swap Notional - 3Q22 $16.1B $6.7B $9.7B $9.9B $15.7B $18.7B $21.5B 3Q22 Swap Additions/ Extension 3Q22 Swap Notional Removal

9 Adj. Non-Interest Income $646 $640 $606 3Q21 2Q22 3Q22 Change vs ($ in millions) 3Q22 2Q22 3Q21 Service charges $156 (5.5)% (3.7)% Card and ATM fees 126 (5.3)% (2.3)% Capital markets (Ex CVA/DVA) 72 (21.7)% (16.3)% Capital Markets - CVA/DVA 21 5.0% NM Wealth management income 108 5.9% 13.7% Mortgage income 37 (21.3)% (26.0)% Non-interest income NM - Not Meaningful (1) Non-GAAP; see appendix for reconciliation. • Expect full-year 2022 adjusted total revenue to be up 11-12% compared to 2021. QoQ outlook Total revenue outlook • As of 9/30 all 2022 announced OD policy enhancements completed; expected to result in FY22 service charges of ~$630M. Expect to implement grace feature in 2023 resulting in FY23 service charges of ~$550M • Capital markets negatively impacted by delay of M&A deals and higher rates in real estate capital markets; 4Q revenue expected in $80-$90M range (ex.CVA/ DVA) • Mortgage impacted by elevated interest rates and seasonally lower production, partially offset by higher servicing. • Wealth management continues to perform well despite market volatility and incremental YoY growth is expected. Non-Interest Income $649 $640 $605 3Q21 2Q22 3Q22 ($ in millions) ($ in millions) (1)

10 $938 $948 $1,170 57.7% 53.9% 62.3% Non-interest expense Efficiency ratio 3Q21 2Q22 3Q22 • Non-interest expense increased ~23% on a reported basis and ~4% on an adjusted basis(1). ◦ Salaries and benefits increased ~3% due to higher base salaries along with one additional day in quarter; Offset by lower variable-based compensation and payroll taxes ◦ Professional & Legal expenses reflect the resolution of a previously announced regulatory matter; partial insurance reimbursement expected in 4Q • Expect full-year 2022 adjusted non-interest expenses to increase 4.5-5.5% compared to 2021. • Expect to generate 6% adjusted operating leverage in 2022. $918 $954 $988 56.6% 54.2% 52.6% Adjusted non-interest expense Adjusted efficiency ratio 3Q21 2Q22 3Q22 $3,387 $3,419 $3,434 $3,443 $3,541 $3,698 2016 2017 2018 2019 2020 2021 Non-interest expense QoQ highlights & outlookAdj. Non-Interest Expense(1) ($ in millions) 1.8% CAGR (3) (4) (2) (1) (2) (1) Non-GAAP; see appendix for reconciliation. (2) Includes the incremental increase of core operating expenses associated with the EnerBank, Sabal Capital Partners, and ClearSight Advisors acquisitions closed during 4Q21. (3) 2020 adjusted NIE includes expenses associated with the Ascentium acquisition that closed 4/1/2020. (4) 2021 adjusted NIE includes expenses associated with 3 additional months for Ascentium, as well as the 4Q21 EnerBank, Sabal Capital Partners, and Clearsight Advisors acquisitions. (1) Non-Interest Expense (2) (2) ($ in millions) Adj. Non-Interest Expense(1) ($ in millions)

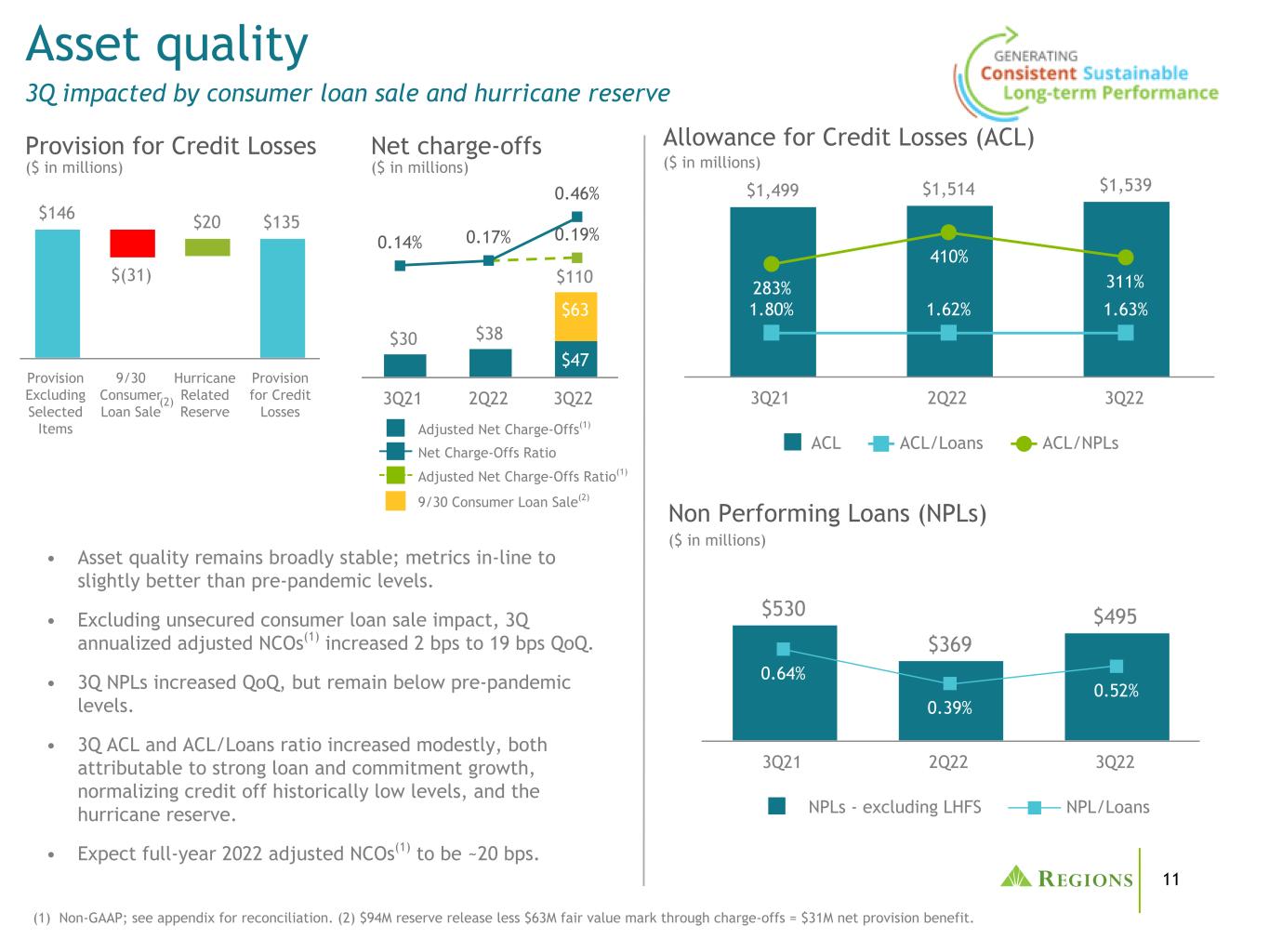

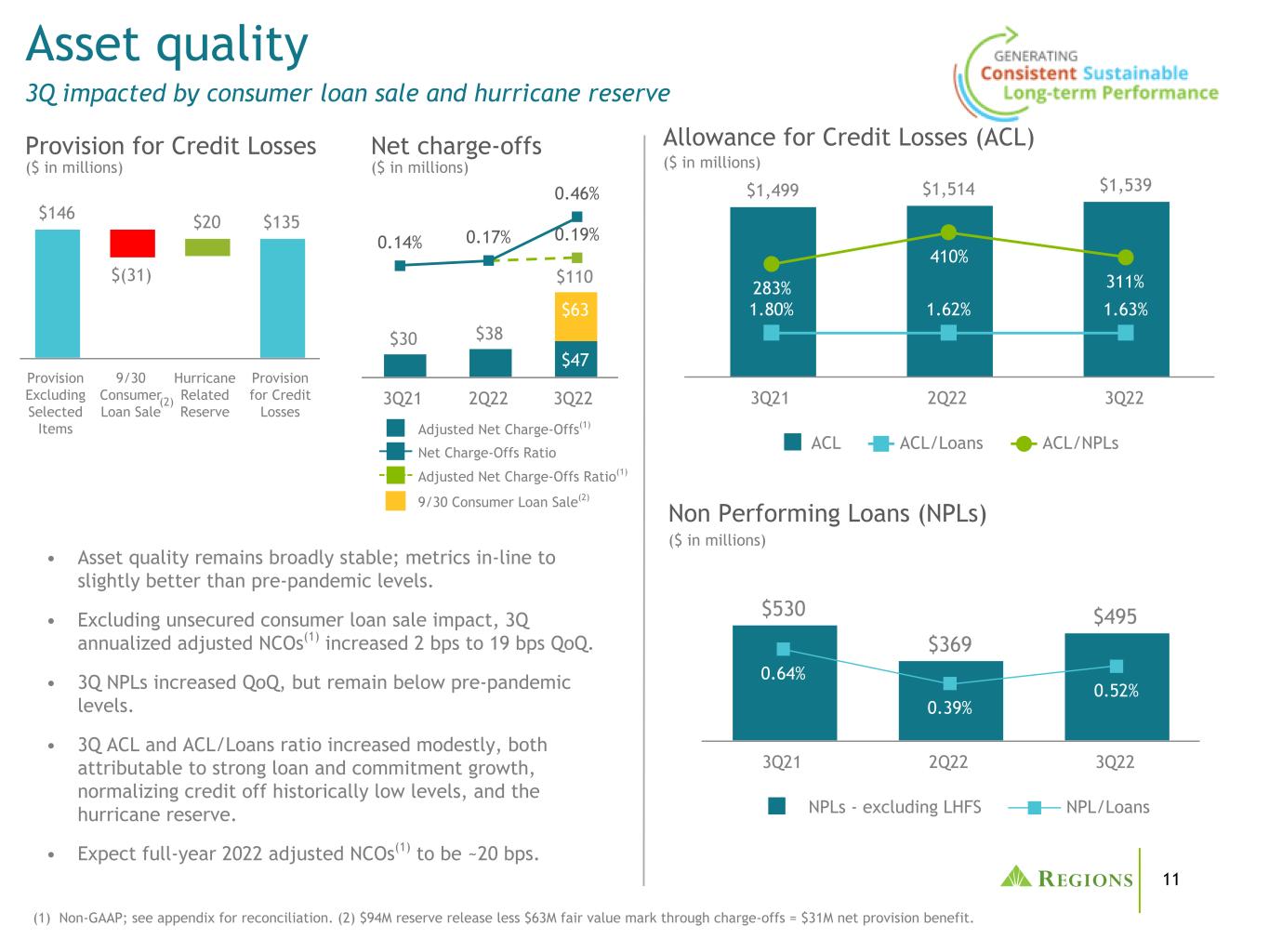

11 • Asset quality remains broadly stable; metrics in-line to slightly better than pre-pandemic levels. • Excluding unsecured consumer loan sale impact, 3Q annualized adjusted NCOs(1) increased 2 bps to 19 bps QoQ. • 3Q NPLs increased QoQ, but remain below pre-pandemic levels. • 3Q ACL and ACL/Loans ratio increased modestly, both attributable to strong loan and commitment growth, normalizing credit off historically low levels, and the hurricane reserve. • Expect full-year 2022 adjusted NCOs(1) to be ~20 bps. Non Performing Loans (NPLs) Asset quality 3Q impacted by consumer loan sale and hurricane reserve ($ in millions) ($ in millions) Allowance for Credit Losses (ACL) $1,499 $1,514 $1,539 1.80% 1.62% 1.63% 283% 410% 311% ACL ACL/Loans ACL/NPLs 3Q21 2Q22 3Q22 $30 $38 $110 $47 $63 3Q21 2Q22 3Q22 0.17% 0.19%0.14% 0.46% Adjusted Net Charge-Offs(1) 9/30 Consumer Loan Sale(2) Net Charge-Offs Ratio Adjusted Net Charge-Offs Ratio(1) (1) Non-GAAP; see appendix for reconciliation. (2) $94M reserve release less $63M fair value mark through charge-offs = $31M net provision benefit. $530 $369 $495 0.64% 0.39% 0.52% NPLs - excluding LHFS NPL/Loans 3Q21 2Q22 3Q22 Net charge-offsProvision for Credit Losses ($ in millions) ($ in millions) $146 $(31) $20 $135 Provision Excluding Selected Items 9/30 Consumer Loan Sale Hurricane Related Reserve Provision for Credit Losses (2)

12 10.8% 9.2% 9.3% 3Q21 2Q22 3Q22 • Common Equity Tier 1 (CET1) ratio increased to 9.3%, reflecting solid capital generation through earnings offset by continued strong loan growth. • Expect to manage to CET1 near the mid-to- upper end of 9.25-9.75% operating range over time. • In 3Q, Regions declared $187M in common dividends; executed no share repurchases. QoQ Highlights & Outlook Capital and liquidity (1) Current quarter ratios are estimated. (2) Based on ending balances. 12.3% 10.6% 10.6% 2Q21 1Q22 3Q22 Tier 1 capital ratio(1) Loan-to-deposit ratio(2) 63% 68% 70% 3Q21 2Q22 3Q22 Common equity Tier 1 ratio(1)

13 2022 expectations (1) Non-GAAP, see appendix for reconciliation. (2) The reconciliation with respect to forward-looking non-GAAP measures is expected to be consistent with actual non-GAAP reconciliations included in the attached appendix or in previous filings with the SEC. (3) Expectations utilize the 9/30/2022 forward interest rate curve. (4) FY23 expectation includes an estimated impact for a grace period feature rolling out sometime in 2023. Category FY 2022 Expectations Total Adjusted Revenue (from adjusted 2021 of $6,412)(1)(2)(3) up 11-12% Adjusted Non-Interest Expense (from adjusted 2021 of $3,698)(1)(2) up 4.5-5.5% Adjusted operating leverage(1)(2) ~6% Average Loans (from average 2021 of $84,802)(1)(2) up ~9% Adjusted net charge-offs / average loans(1)(2) ~20 bps Effective tax rate 22-23% Expectations for 4Q22 & Beyond • 4Q NII expected to grow 7-9%(3); 2022 NII growth expected to be +20-22%(3), excl. PPP +23-25%(3); expect 4Q22 NII to be ~33-35% higher than 1Q22(3) • Total ending deposits declining in-line with FY22 expectations for down $5-10B. • OD policy changes will result in FY22 service charges of ~$630M and FY23 service charges of ~$550M.(4) • Expect 4Q capital markets to generate quarterly revenue in the $80-$90M range, ex.CVA/DVA. • Mortgage is expected to be lower in 2022 vs 2021, but remains a key component to fee revenue. • Expect to manage to CET1 near the mid-to- upper end of 9.25-9.75% operating range over time.

14 Appendix

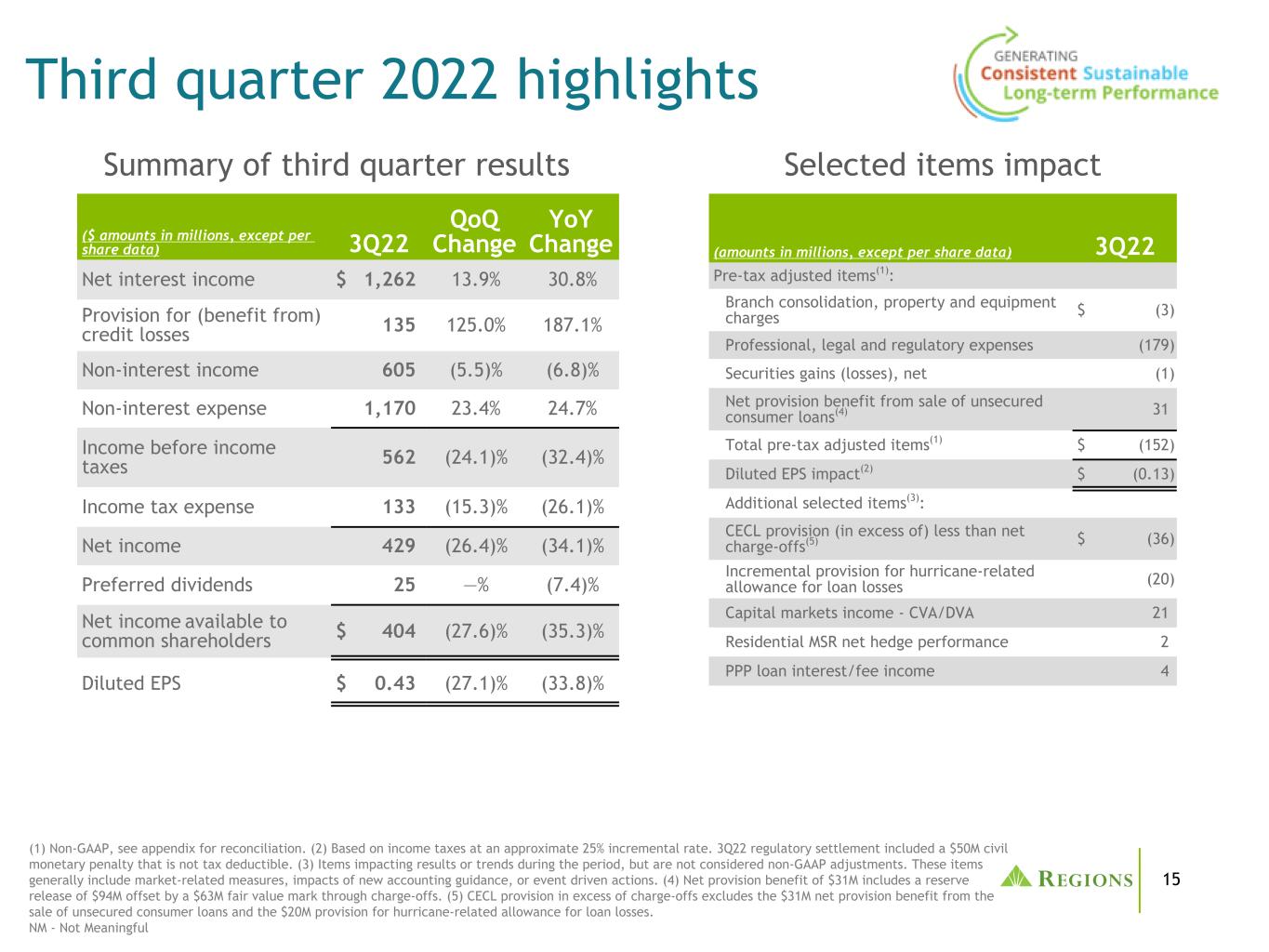

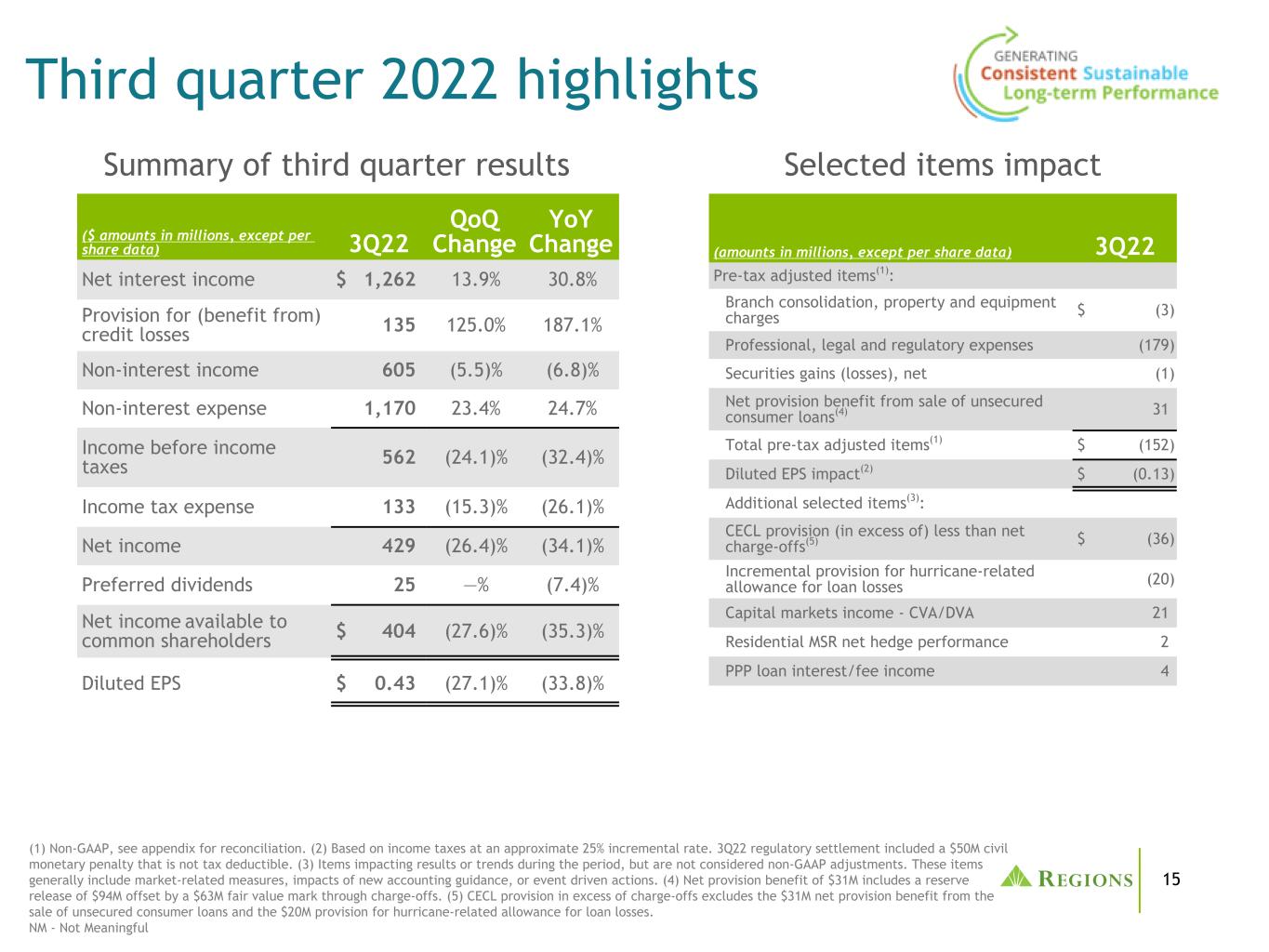

15 Selected items impact Third quarter 2022 highlights (1) Non-GAAP, see appendix for reconciliation. (2) Based on income taxes at an approximate 25% incremental rate. 3Q22 regulatory settlement included a $50M civil monetary penalty that is not tax deductible. (3) Items impacting results or trends during the period, but are not considered non-GAAP adjustments. These items generally include market-related measures, impacts of new accounting guidance, or event driven actions. (4) Net provision benefit of $31M includes a reserve release of $94M offset by a $63M fair value mark through charge-offs. (5) CECL provision in excess of charge-offs excludes the $31M net provision benefit from the sale of unsecured consumer loans and the $20M provision for hurricane-related allowance for loan losses. NM - Not Meaningful ($ amounts in millions, except per share data) 3Q22 QoQ Change YoY Change Net interest income $ 1,262 13.9% 30.8% Provision for (benefit from) credit losses 135 125.0% 187.1% Non-interest income 605 (5.5)% (6.8)% Non-interest expense 1,170 23.4% 24.7% Income before income taxes 562 (24.1)% (32.4)% Income tax expense 133 (15.3)% (26.1)% Net income 429 (26.4)% (34.1)% Preferred dividends 25 —% (7.4)% Net income available to common shareholders $ 404 (27.6)% (35.3)% Diluted EPS $ 0.43 (27.1)% (33.8)% Summary of third quarter results (amounts in millions, except per share data) 3Q22 Pre-tax adjusted items(1): Branch consolidation, property and equipment charges $ (3) Professional, legal and regulatory expenses (179) Securities gains (losses), net (1) Net provision benefit from sale of unsecured consumer loans(4) 31 Total pre-tax adjusted items(1) $ (152) Diluted EPS impact(2) $ (0.13) Additional selected items(3): CECL provision (in excess of) less than net charge-offs(5) $ (36) Incremental provision for hurricane-related allowance for loan losses (20) Capital markets income - CVA/DVA 21 Residential MSR net hedge performance 2 PPP loan interest/fee income 4

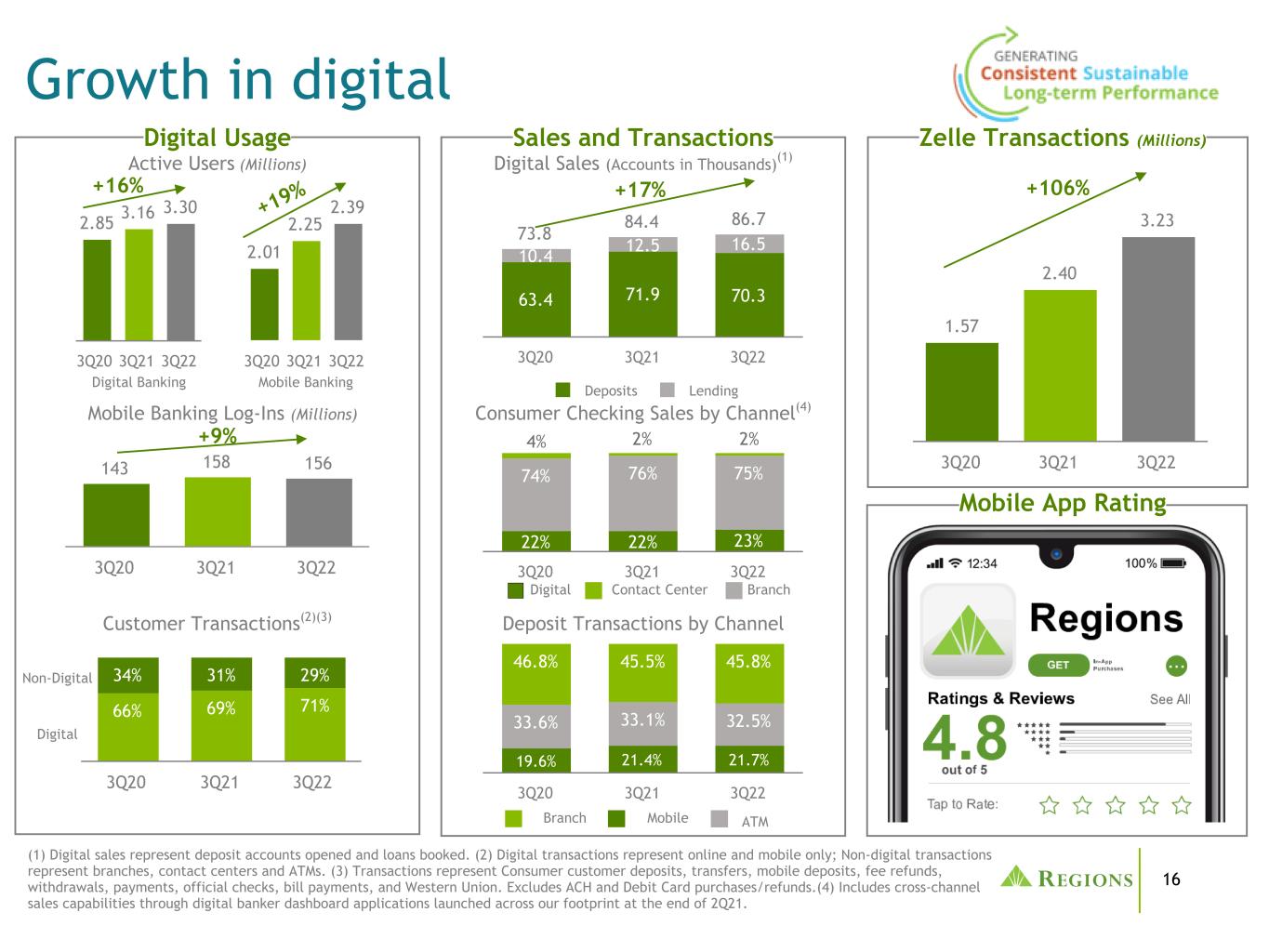

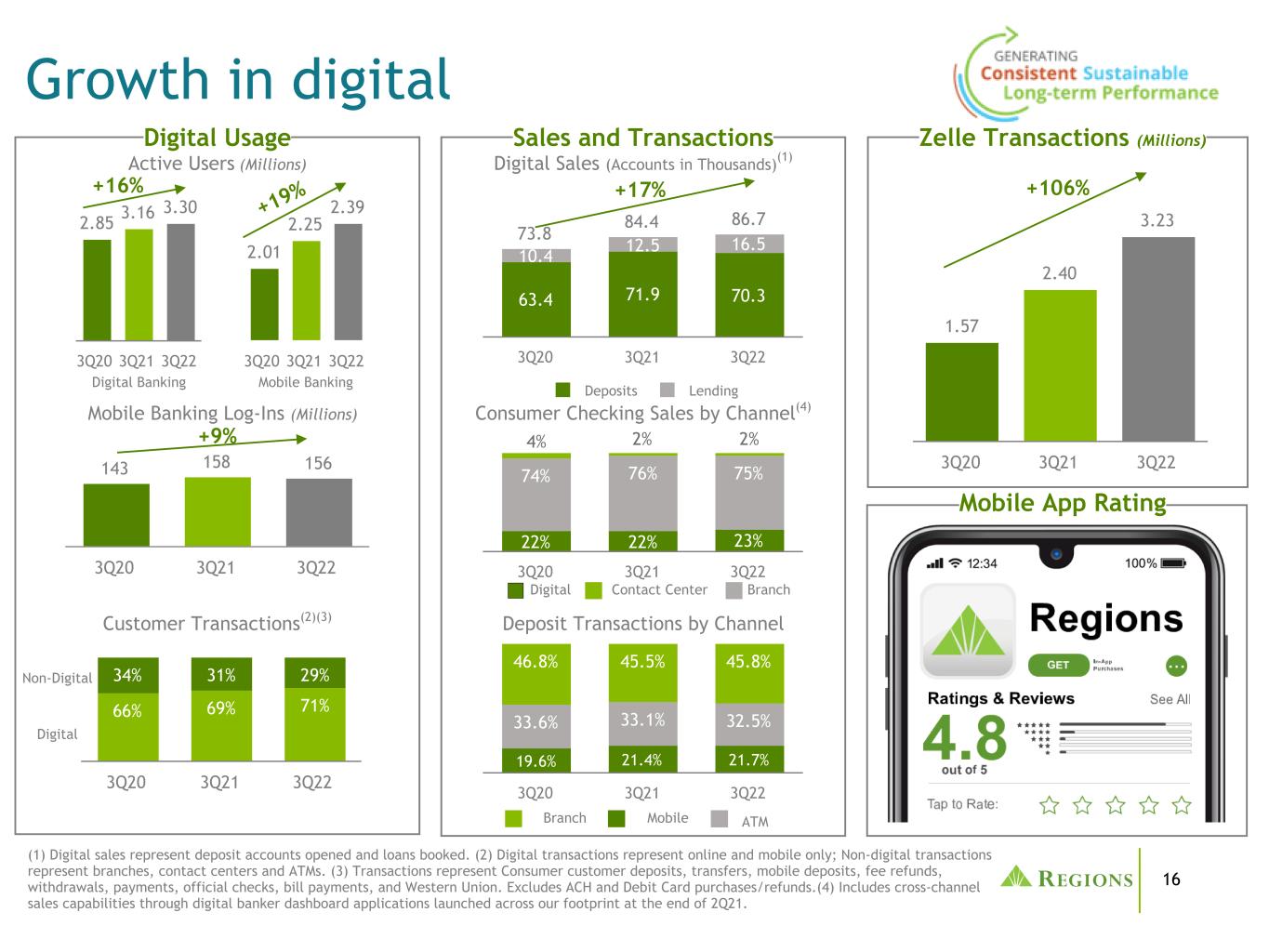

16 2.01 2.25 2.39 3Q20 3Q21 3Q22 1.57 2.40 3.23 3Q20 3Q21 3Q22143 158 156 3Q20 3Q21 3Q22 2.85 3.16 3.30 3Q20 3Q21 3Q22 19.6% 21.4% 21.7% 33.6% 33.1% 32.5% 46.8% 45.5% 45.8% 3Q20 3Q21 3Q22 73.8 84.4 86.7 63.4 71.9 70.3 10.4 12.5 16.5 Deposits Lending 3Q20 3Q21 3Q22 66% 69% 71% 34% 31% 29% 3Q20 3Q21 3Q22 Growth in digital Mobile Banking Log-Ins (Millions) Customer Transactions(2)(3) Deposit Transactions by Channel +16% Active Users (Millions) Digital Sales (Accounts in Thousands)(1) Digital Banking Digital Non-Digital Mobile ATMBranch (1) Digital sales represent deposit accounts opened and loans booked. (2) Digital transactions represent online and mobile only; Non-digital transactions represent branches, contact centers and ATMs. (3) Transactions represent Consumer customer deposits, transfers, mobile deposits, fee refunds, withdrawals, payments, official checks, bill payments, and Western Union. Excludes ACH and Debit Card purchases/refunds.(4) Includes cross-channel sales capabilities through digital banker dashboard applications launched across our footprint at the end of 2Q21. +106% +9% 22% 22% 23% 74% 76% 75% 4% 2% 2% 3Q20 3Q21 3Q22 Digital BranchContact Center Consumer Checking Sales by Channel(4) Mobile Banking Mobile App Rating Zelle Transactions (Millions)Sales and TransactionsDigital Usage +17% +19%

17 • Comprised of new consumer customers, consumer customers who did not receive stimulus and growth in historically stable products such as savings. • ~$15B, representing ~41% of growth since 12/31/2019. Balances roughly stable in 3Q22. • Considerable growth in consumer balances that had low betas in 2016-2019 cycle. Expect similar behavior to pre-pandemic portfolio, with a 30% through the cycle beta. $97 $15 $13 $9 $134 12/31/2019 Deposits Most-Stable, Low-Beta Growth Mid-Stable, Mid-Beta Growth Least Stable, Higher-Beta Growth 9/30/2022 Deposits $— $50 $100 $150 Mostly-Stable, Low-Beta - $0 Deposit surge and beta • Comprised mostly of small business accounts, stimulus-receiving customers(2), & wealth clients • ~$13B, representing ~35% of growth since 12/31/2019. Balances roughly stable in 3Q22. • Expected beta of 40-60% • Comprised largely of Corporate/Commercial clients. As expected, declines in total aggregate Corporate deposit balances largely attributable to movements of larger depositors. Some additional normalization is expected as deployment and rate-seeking activity continues. • ~$9B, representing ~24% of growth since 12/31/2019. Balances declined ~$3B in 3Q22. • Expected beta of 80-100% Low-beta deposits have grown considerably and remain relatively stable. Other pandemic era increases (approx. 2/3) are assumed to have a ~70% beta. Cash liquidity levels at ~$14B provide ample room to support cost-effective growth. Mostly-Stable, Low-Beta Surge: Mid-Stable, Mid-Beta Surge: Least-Stable, Higher-Beta (1) $ In Billions. Figures exclude EnerBank acquired deposits and are ending deposit balances. (2) Received via Direct Deposit Pandemic-Related Deposit Growth Adds to Low-Cost, Stable Funding Base(1) Business/ Other Deposits Business/ Other Deposits Retail Deposits Retail Deposits

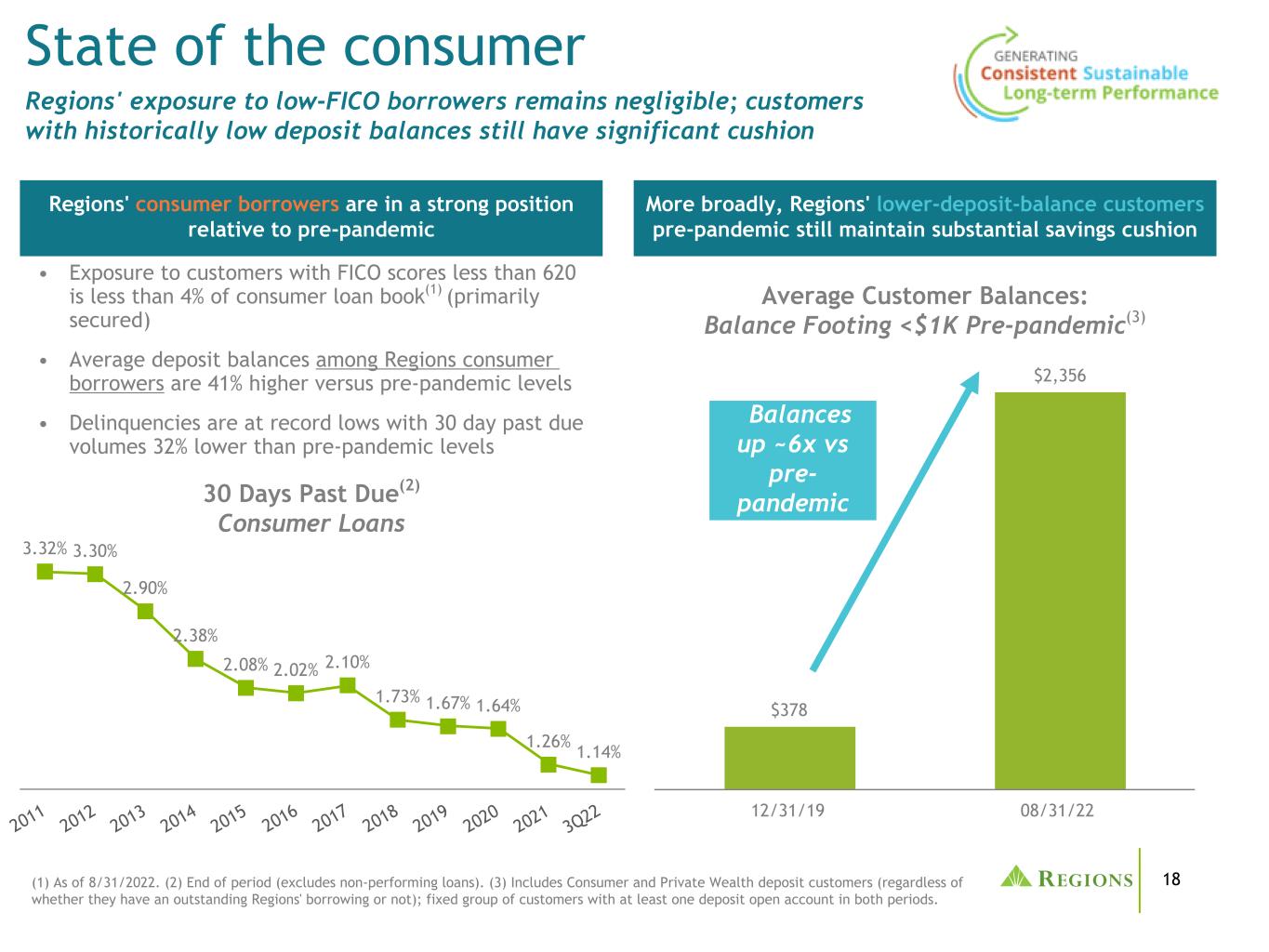

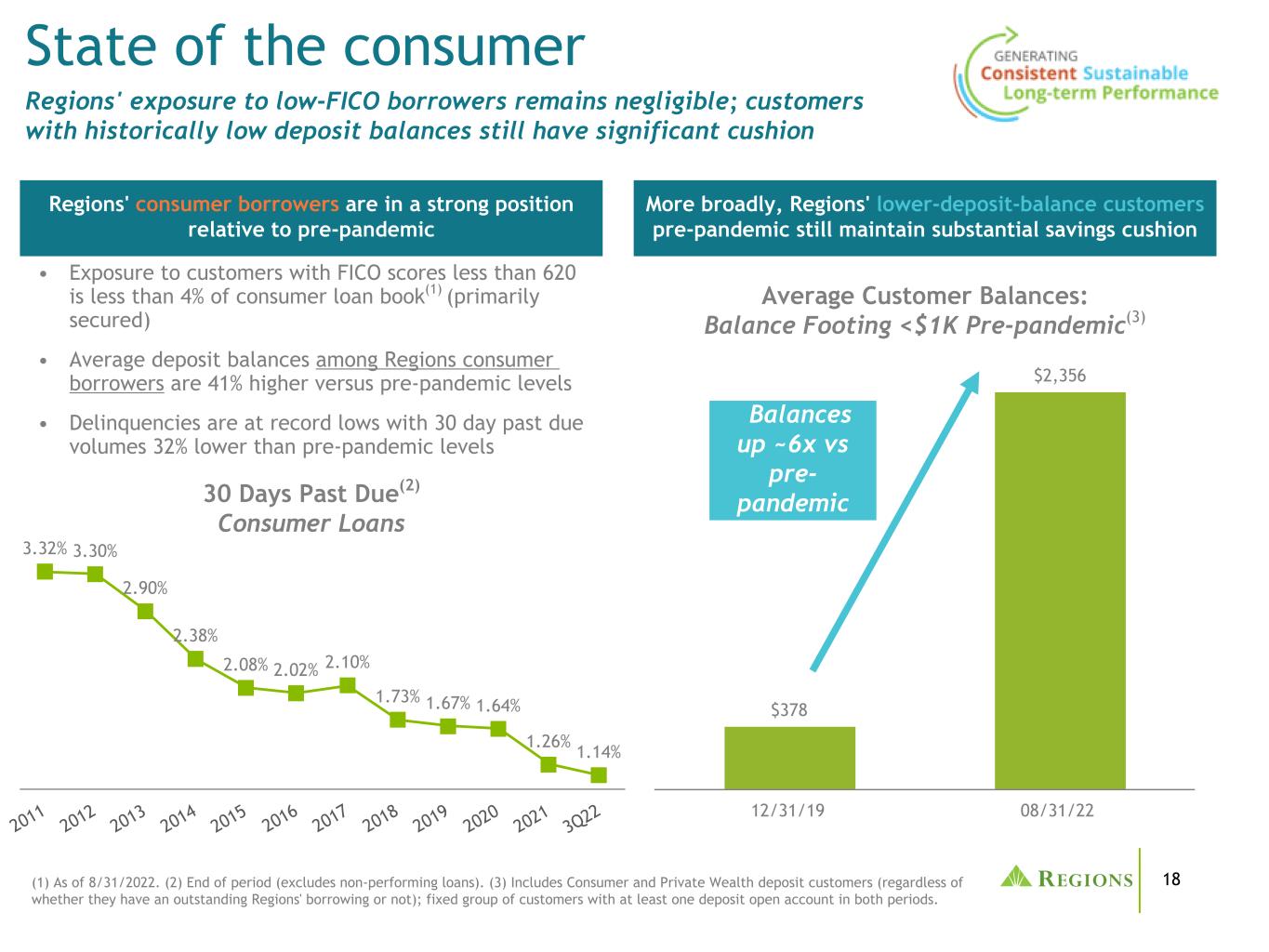

18 State of the consumer Regions' exposure to low-FICO borrowers remains negligible; customers with historically low deposit balances still have significant cushion Retail Deposits Business/ Other Deposits Retail Deposits Regions' consumer borrowers are in a strong position relative to pre-pandemic $378 $2,356 12/31/19 08/31/22 Balances up ~6x vs pre- pandemic • Exposure to customers with FICO scores less than 620 is less than 4% of consumer loan book(1) (primarily secured) • Average deposit balances among Regions consumer borrowers are 41% higher versus pre-pandemic levels • Delinquencies are at record lows with 30 day past due volumes 32% lower than pre-pandemic levels Average Customer Balances: Balance Footing <$1K Pre-pandemic(3) More broadly, Regions' lower-deposit-balance customers pre-pandemic still maintain substantial savings cushion 3.32% 3.30% 2.90% 2.38% 2.08% 2.02% 2.10% 1.73% 1.67% 1.64% 1.26% 1.14% 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 3Q22 (1) As of 8/31/2022. (2) End of period (excludes non-performing loans). (3) Includes Consumer and Private Wealth deposit customers (regardless of whether they have an outstanding Regions' borrowing or not); fixed group of customers with at least one deposit open account in both periods. 30 Days Past Due(2) Consumer Loans

19 Median customer deposit balances Consumer and Corporate Retail Deposits De c- 20 19 M ar -2 02 0 Ju n- 20 20 Se p- 20 20 De c- 20 20 M ar -2 02 1 Ju n- 20 21 Se p- 20 21 De c- 20 21 M ar -2 02 2 Ju n- 20 22 Se p- 20 22 (1) Based on large random sample of customers. Excludes customers with zero-balance or overdrawn accounts. (2) Includes deposit relationships active as of 12/31/2019, excluding overdrawn and zero balance accounts. Median Consumer Customer Deposit Balances(1) (12/31/2019-9/30/2022) • Many Consumer customers are sustaining a higher balance level relative to pre-pandemic levels despite recent inflationary pressures (median customer balances up roughly 44%) • After more acute balance normalization post-stimulus in 2H20 and 2H21, 2022 seasonal patterns are closer to pre-pandemic norms Median Corporate Deposit Balances(2) (12/31/2019-8/31/2022) • Median Corporate customers are also maintaining higher levels of deposits versus pre-pandemic (median customer balance is up roughly 63%) • Some additional normalization is expected as deployment and rate-seeking activity continues • As expected, declines in total aggregate Corporate deposit balances are largely attributed to movements of larger depositors Up 44% De c- 20 19 M ar -2 02 0 Ju n- 20 20 Se p- 20 20 De c- 20 20 M ar -2 02 1 Ju n- 20 21 Se p- 20 21 De c- 20 21 M ar -2 02 2 Ju n- 20 22 Up 63%Stimulus Round 2 Stimulus Round 1

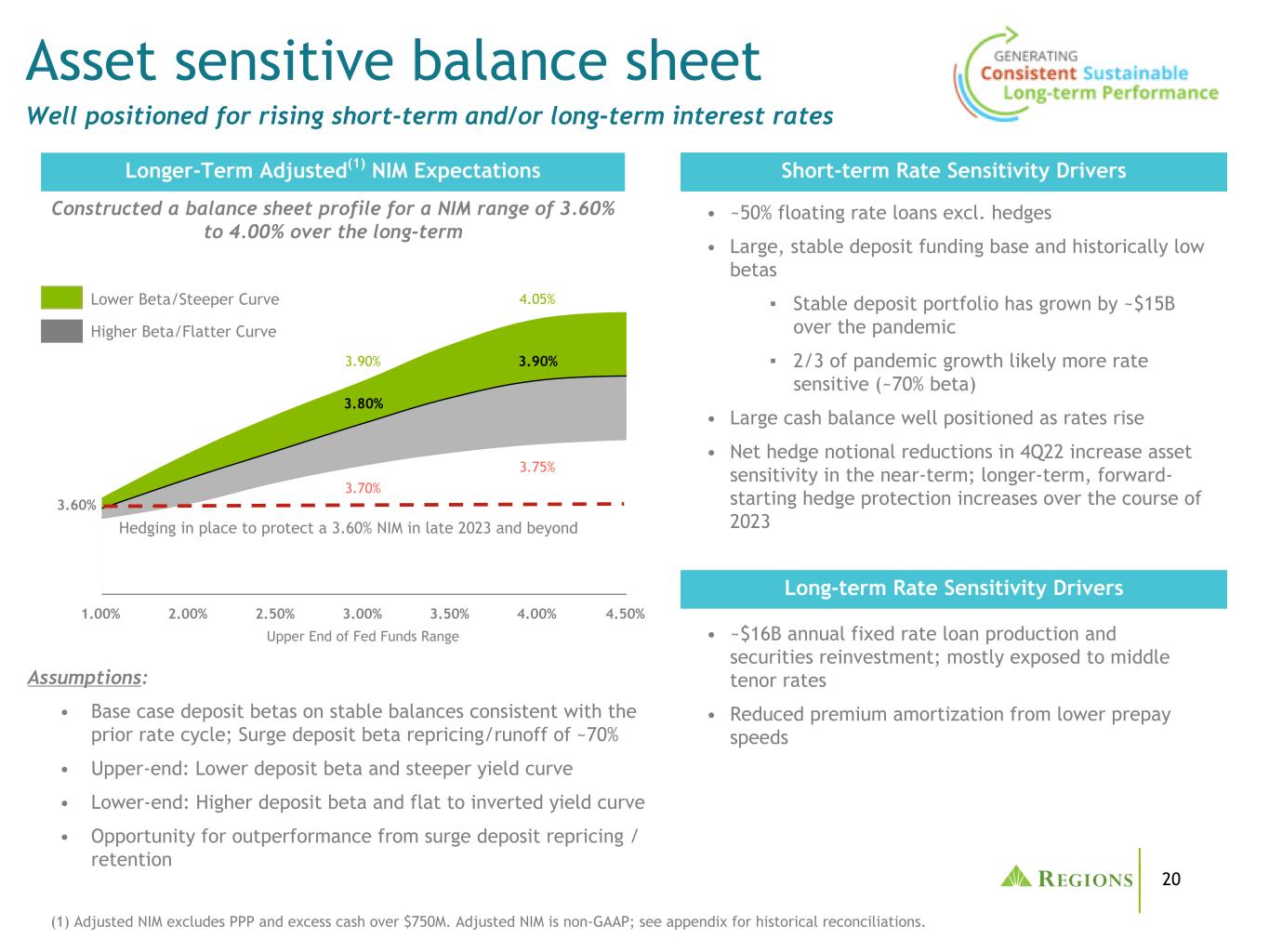

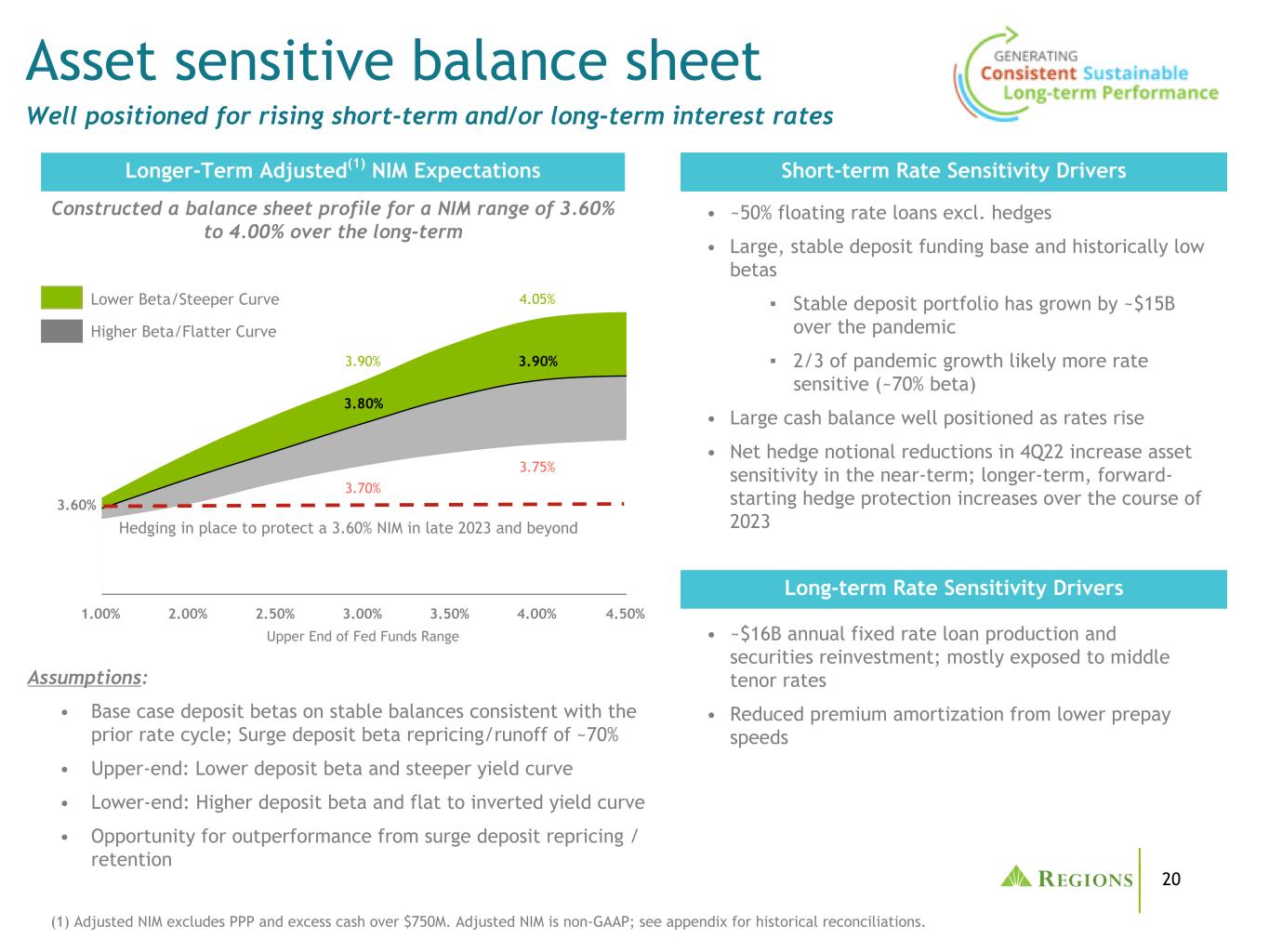

20 Upper End of Fed Funds Range 3.90% 4.05% 3.80% 3.90% 3.70% 3.75% 1.00% 2.00% 2.50% 3.00% 3.50% 4.00% 4.50% (1) Adjusted NIM excludes PPP and excess cash over $750M. Adjusted NIM is non-GAAP; see appendix for historical reconciliations. • ~$16B annual fixed rate loan production and securities reinvestment; mostly exposed to middle tenor rates • Reduced premium amortization from lower prepay speeds Asset sensitive balance sheet Well positioned for rising short-term and/or long-term interest rates Short-term Rate Sensitivity Drivers • ~50% floating rate loans excl. hedges • Large, stable deposit funding base and historically low betas ▪ Stable deposit portfolio has grown by ~$15B over the pandemic ▪ 2/3 of pandemic growth likely more rate sensitive (~70% beta) • Large cash balance well positioned as rates rise • Net hedge notional reductions in 4Q22 increase asset sensitivity in the near-term; longer-term, forward- starting hedge protection increases over the course of 2023 Long-term Rate Sensitivity Drivers Longer-Term Adjusted(1) NIM Expectations Assumptions: • Base case deposit betas on stable balances consistent with the prior rate cycle; Surge deposit beta repricing/runoff of ~70% • Upper-end: Lower deposit beta and steeper yield curve • Lower-end: Higher deposit beta and flat to inverted yield curve • Opportunity for outperformance from surge deposit repricing / retention Constructed a balance sheet profile for a NIM range of 3.60% to 4.00% over the long-term Lower Beta/Steeper Curve Higher Beta/Flatter Curve 3.60% Hedging in place to protect a 3.60% NIM in late 2023 and beyond

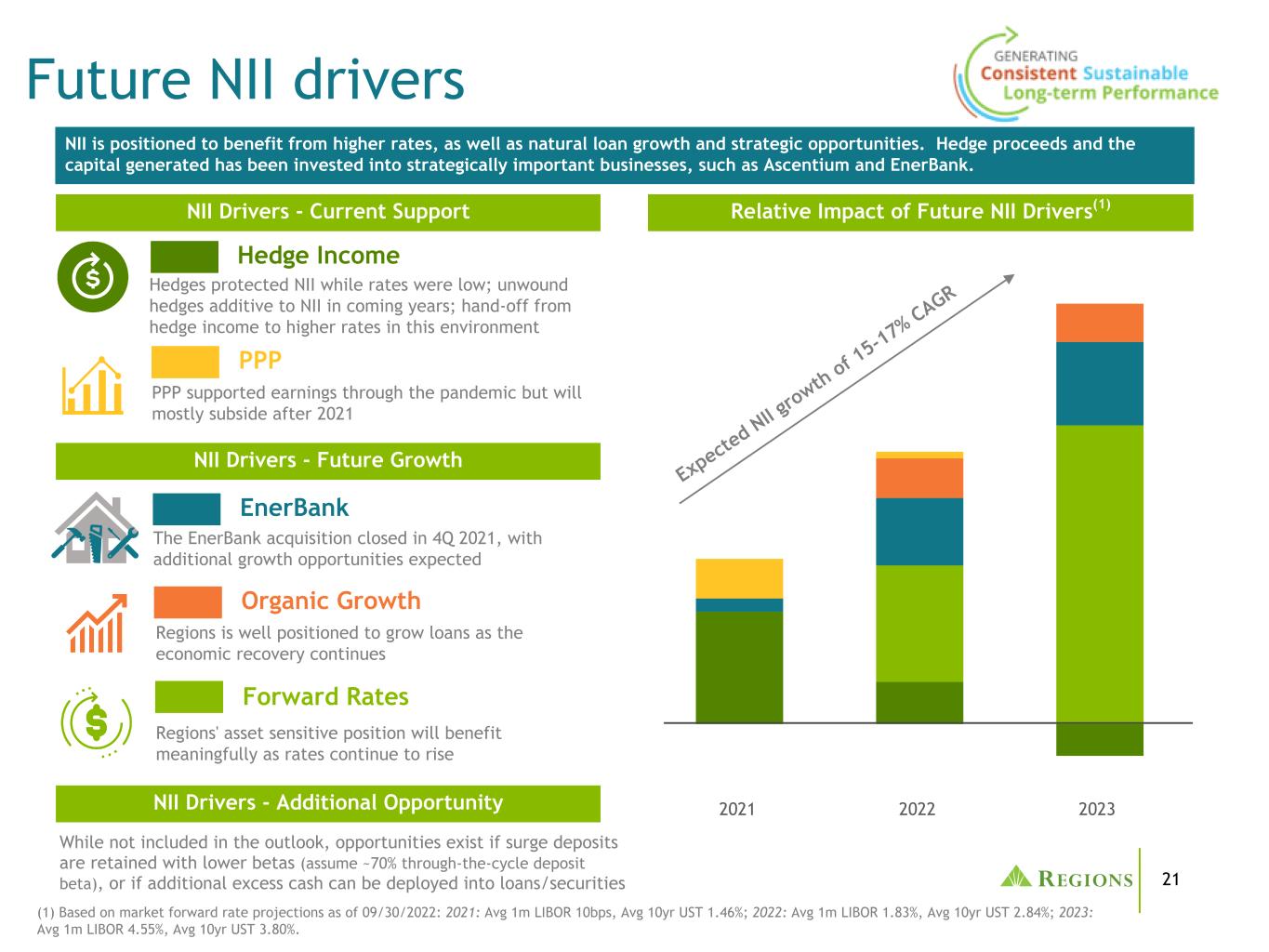

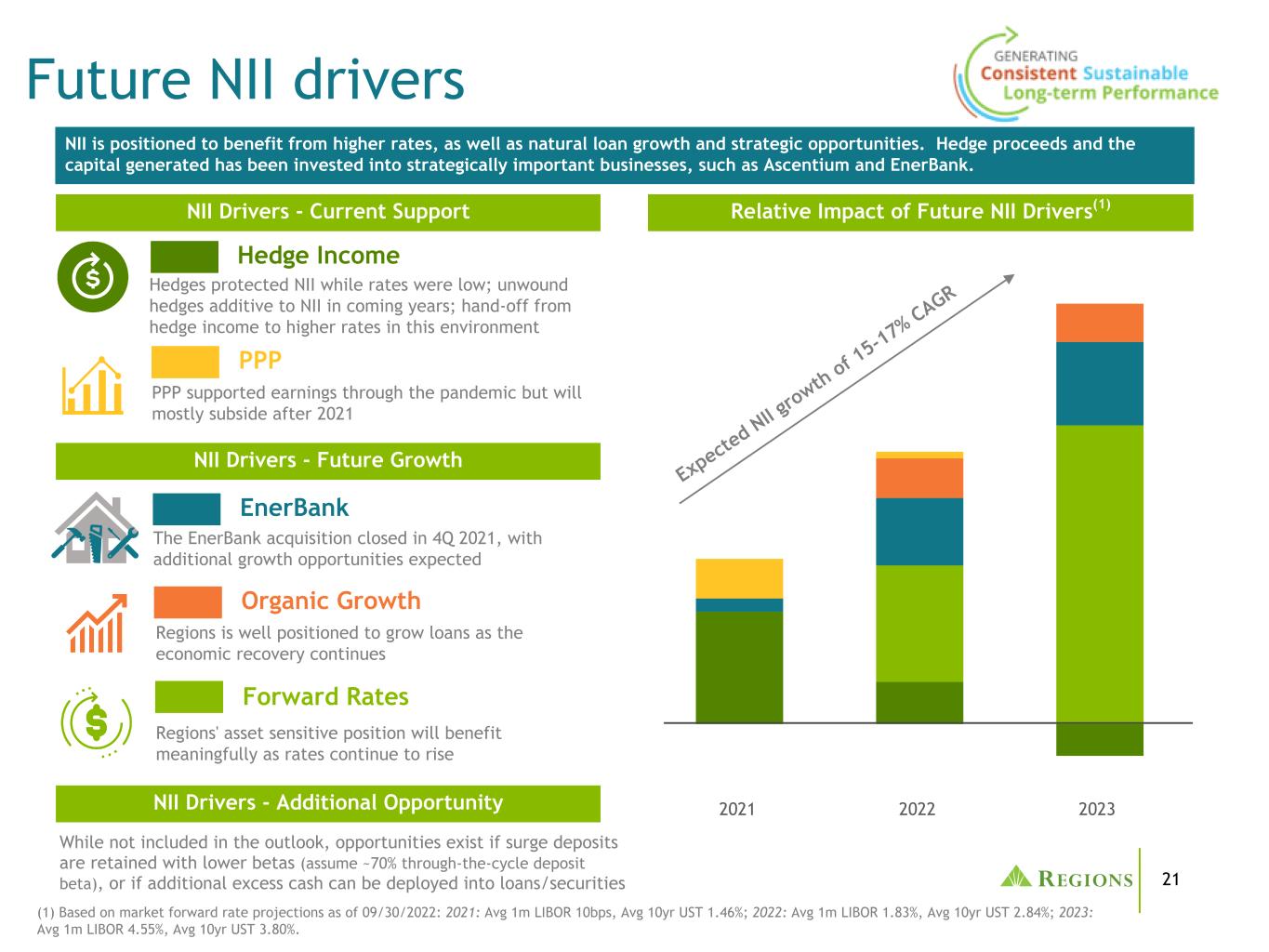

21 Hedges protected NII while rates were low; unwound hedges additive to NII in coming years; hand-off from hedge income to higher rates in this environment While not included in the outlook, opportunities exist if surge deposits are retained with lower betas (assume ~70% through-the-cycle deposit beta), or if additional excess cash can be deployed into loans/securities NII is positioned to benefit from higher rates, as well as natural loan growth and strategic opportunities. Hedge proceeds and the capital generated has been invested into strategically important businesses, such as Ascentium and EnerBank. 2021 2022 2023 NII Drivers - Current Support Relative Impact of Future NII Drivers(1) NII Drivers - Future Growth Expecte d NII g rowth of 1 5-17% CAGR Hedge Income Forward Rates EnerBank PPP Organic Growth Regions' asset sensitive position will benefit meaningfully as rates continue to rise The EnerBank acquisition closed in 4Q 2021, with additional growth opportunities expected PPP supported earnings through the pandemic but will mostly subside after 2021 Regions is well positioned to grow loans as the economic recovery continues NII Drivers - Additional Opportunity (1) Based on market forward rate projections as of 09/30/2022: 2021: Avg 1m LIBOR 10bps, Avg 10yr UST 1.46%; 2022: Avg 1m LIBOR 1.83%, Avg 10yr UST 2.84%; 2023: Avg 1m LIBOR 4.55%, Avg 10yr UST 3.80%. Future NII drivers

22 Economic / Qualitative & Hurricane Reserve(1) $1,514 $79 $40 $(94) $1,539 Allowance for credit losses waterfall 09/30/2022 • 3Q allowance increased $25M compared to prior quarter, resulting in a $135M provision expense. • Key drivers of the increase in ACL: ◦ Significant growth in commitments in both core Business (primarily from existing customers) and EnerBank ◦ Credit quality changes and normalization within select commercial sectors ◦ Heightened macroeconomic uncertainties ◦ Potential losses associated with Hurricane Ian QoQ highlights($ in millions) 06/30/2022 Loan & Commitment Growth / Portfolio Changes Unsecured Consumer Loan Sale (1) Includes an incremental provision for estimated hurricane-related loan losses of $20 million.

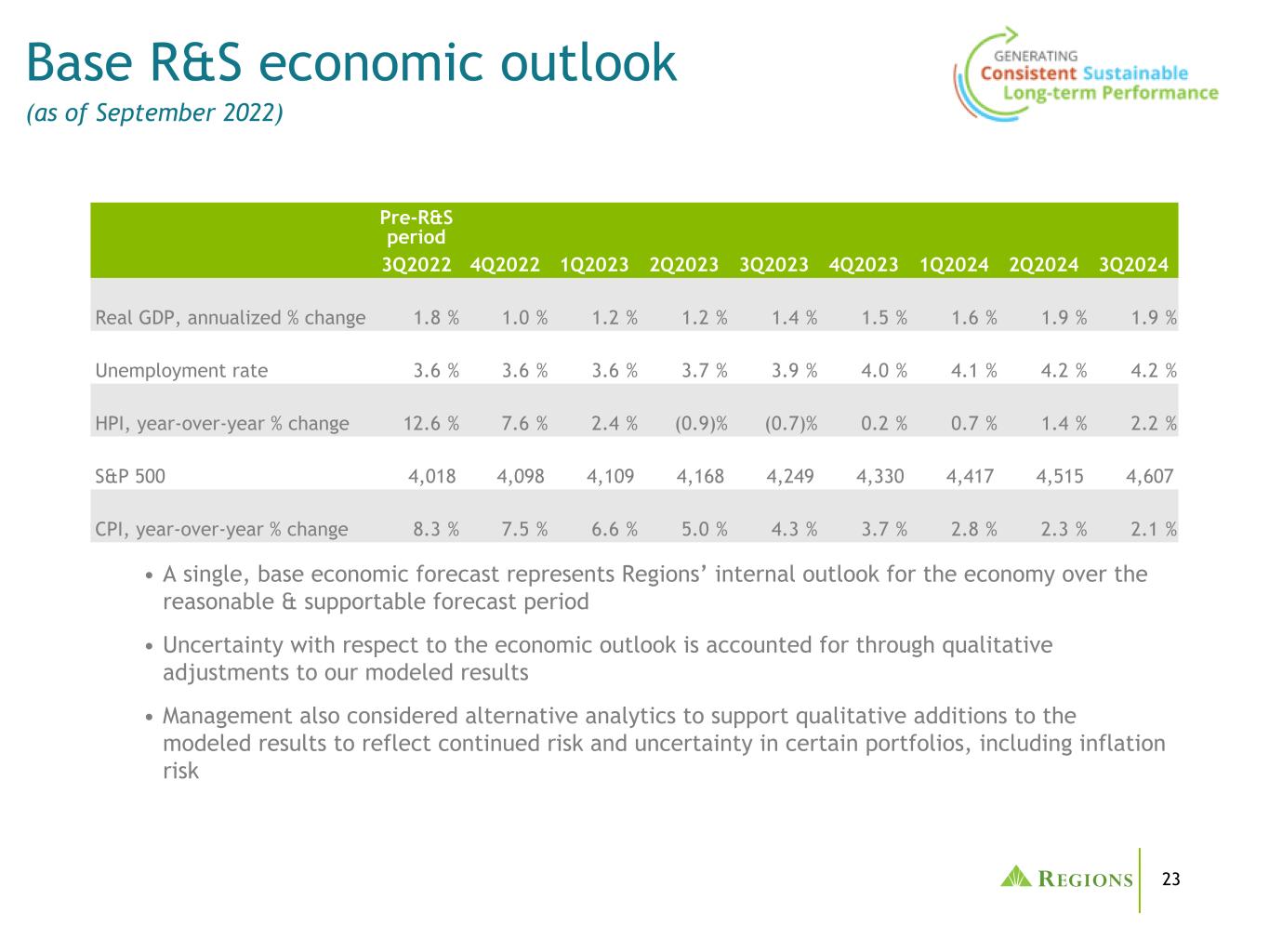

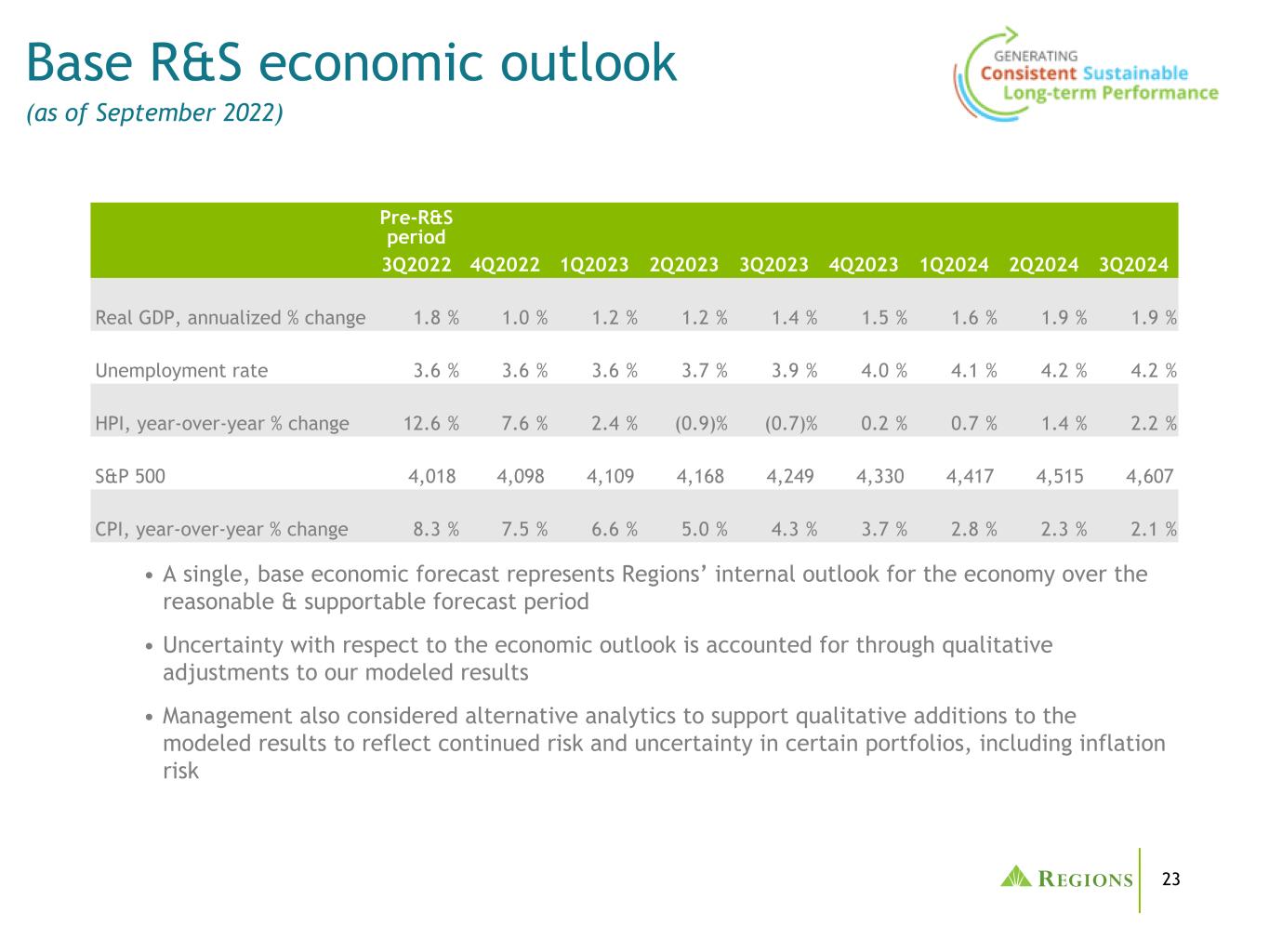

23 Pre-R&S period 3Q2022 4Q2022 1Q2023 2Q2023 3Q2023 4Q2023 1Q2024 2Q2024 3Q2024 Real GDP, annualized % change 1.8 % 1.0 % 1.2 % 1.2 % 1.4 % 1.5 % 1.6 % 1.9 % 1.9 % Unemployment rate 3.6 % 3.6 % 3.6 % 3.7 % 3.9 % 4.0 % 4.1 % 4.2 % 4.2 % HPI, year-over-year % change 12.6 % 7.6 % 2.4 % (0.9) % (0.7) % 0.2 % 0.7 % 1.4 % 2.2 % S&P 500 4,018 4,098 4,109 4,168 4,249 4,330 4,417 4,515 4,607 CPI, year-over-year % change 8.3 % 7.5 % 6.6 % 5.0 % 4.3 % 3.7 % 2.8 % 2.3 % 2.1 % Base R&S economic outlook (as of September 2022) • A single, base economic forecast represents Regions’ internal outlook for the economy over the reasonable & supportable forecast period • Uncertainty with respect to the economic outlook is accounted for through qualitative adjustments to our modeled results • Management also considered alternative analytics to support qualitative additions to the modeled results to reflect continued risk and uncertainty in certain portfolios, including inflation risk

24 As of 9/30/2022 As of 12/31/2021 (in millions) Loan Balance ACL ACL/Loans Loan Balance ACL ACL/Loans C&I $49,591 622 1.25 % $43,758 $613 1.40 % CRE-OO mortgage 5,167 107 2.08 % 5,287 118 2.23 % CRE-OO construction 282 6 2.30 % 264 9 3.53 % Total commercial $55,040 $735 1.34 % $49,309 $740 1.50 % IRE mortgage 6,295 98 1.56 % 5,441 77 1.41 % IRE construction 1,824 18 0.98 % 1,586 10 0.61 % Total IRE $8,119 $116 1.43 % $7,027 $87 1.23 % Residential first mortgage 18,399 123 0.67 % 17,512 122 0.70 % Home equity lines 3,521 73 2.08 % 3,744 83 2.23 % Home equity loans 2,515 27 1.09 % 2,510 28 1.13 % Consumer credit card 1,186 130 10.94 % 1,184 120 10.15 % Other consumer- exit portfolios 662 43 6.45 % 1,071 64 6.00 % Other consumer 5,269 292 5.53 % 5,427 330 6.07 % Total consumer $31,552 $688 2.18 % $31,448 $747 2.38 % Total $94,711 $1,539 1.63 % $87,784 $1,574 1.79 % Allowance allocation

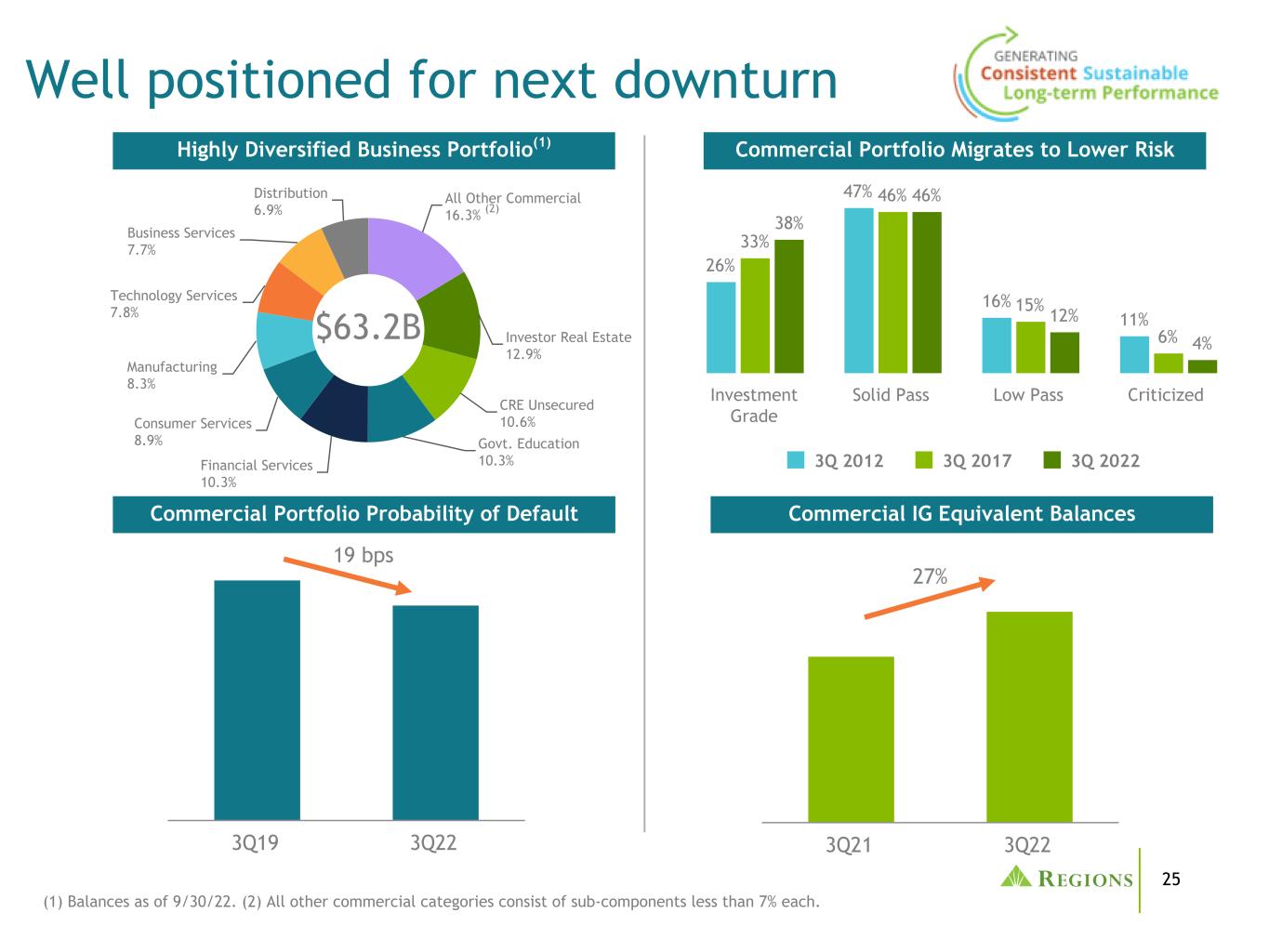

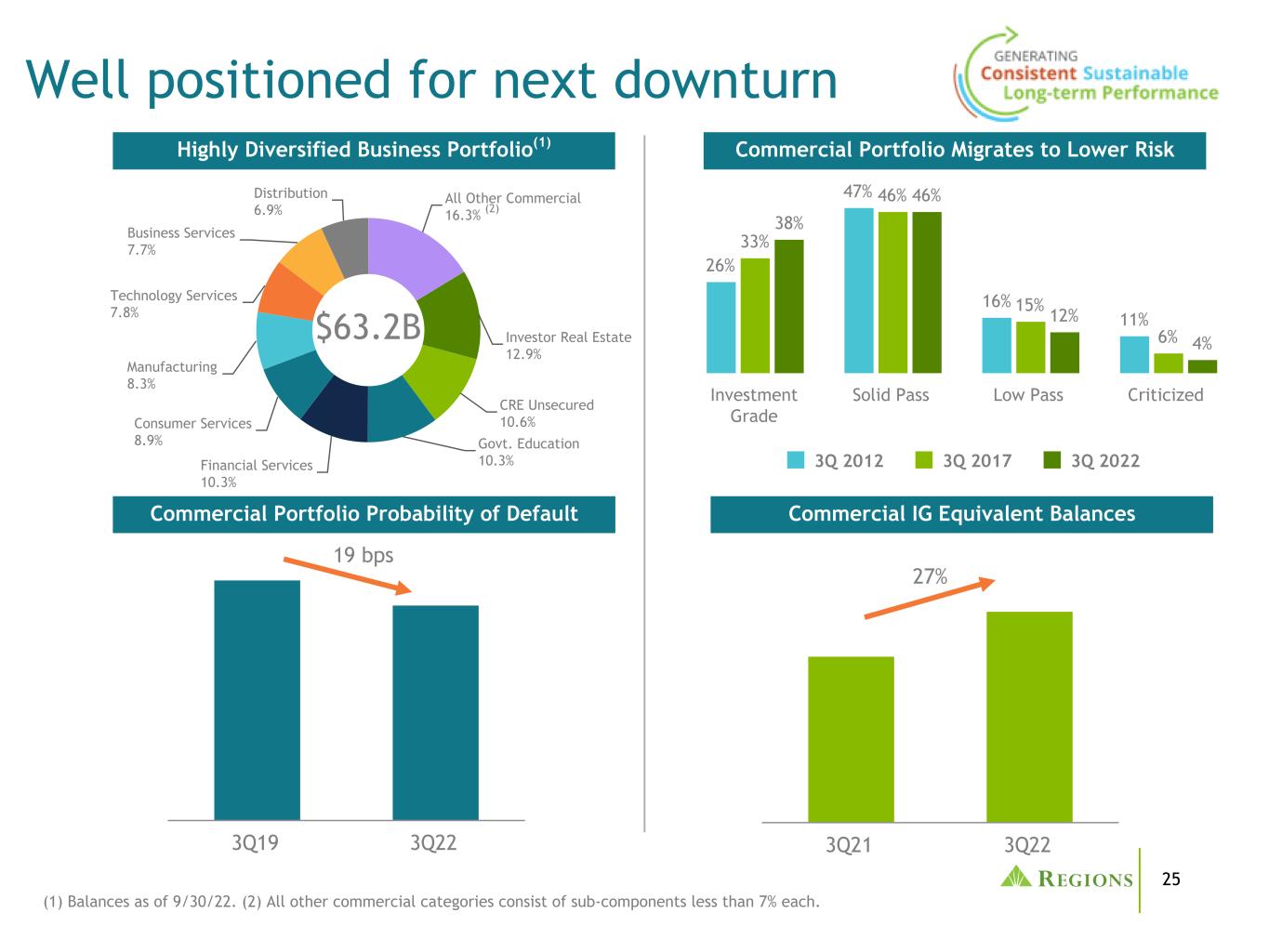

25 3Q21 3Q223Q19 3Q22 Commercial Portfolio Migrates to Lower Risk 19 bps Commercial Portfolio Probability of Default All Other Commercial 16.3% Investor Real Estate 12.9% CRE Unsecured 10.6% Govt. Education 10.3%Financial Services 10.3% Consumer Services 8.9% Manufacturing 8.3% Technology Services 7.8% Business Services 7.7% Distribution 6.9% Well positioned for next downturn $63.2B 27% Commercial IG Equivalent Balances Highly Diversified Business Portfolio(1) 26% 47% 16% 11% 33% 46% 15% 6% 38% 46% 12% 4% 3Q 2012 3Q 2017 3Q 2022 Investment Grade Solid Pass Low Pass Criticized (1) Balances as of 9/30/22. (2) All other commercial categories consist of sub-components less than 7% each. (2)

26 Consumer lending portfolio statistics • Avg. origination FICO 757 • Current LTV 51% • 98% owner occupied • Avg. origination FICO 748 • Current LTV 34% • 71% of portfolio is 1st lien • Avg. loan size $35,788 • $33M to convert to amortizing or balloon during 2022 • Avg. origination FICO 765 • Avg. new loan $24,246 • 3Q22 Yield 8.03% • Avg. origination FICO 752 • 3Q22 Yield 5.72% • 3Q22 QTD NCO 2.13% • Avg. origination FICO 776 • Avg. new line $6,367 • 3Q22 Yield 13.79% • 3Q22 QTD NCO 2.39% 3% 5% 4%5% 12% 7% 9% 17% 10% 81% 63% 77% 2% 3% 2% Cons R/E secured Cons non-R/E secured Total consumer Not Available Above 720 620-680 Below 620 681-720 Consumer FICO Scores(1) (1) Refreshed FICO scores as of 9/30/2022. (2) Other Consumer consists primarily of EnerBank and Direct portfolios Residential Mortgage Consumer - Exit Portfolios Consumer Credit Card Home Equity Other Consumer(2)

27 Environmental, Social & Governance ESG Governance ESG-related elements of the Strategic Plan, annual budget, and capital planning processBOARD OF DIRECTORS Board-Level Committees NCG Committee ESG strategies, initiatives, policies, and practices, along with related voluntary disclosures and stakeholder engagement Risk Committee ESG alignment within Enterprise Risk Appetite Statement, Risk Management Framework, and Risk Library CHR Committee Associate compensation and benefits, corporate culture, DEI practices, talent management, and succession planning Audit Committee Functioning of Company's internal controls and disclosure of material ESG matters Technology Committee Company culture and strategy related to technological and digital innovation Management-Level Committees Executive Leadership Team Evaluates ESG considerations within strategic planning ESG Leadership Council Maintains aggregated view of ESG-related risks and opportunities and provides guidance and direction on internal initiatives; overseen by Executive Leadership Team Disclosure Review Committee Reviews and provides feedback on ESG-related disclosures in SEC reporting and voluntary ESG disclosures Risk Governance Committees Review ESG-related metrics' performance to assess adherence to risk tolerance; supervise enterprise risk assessments incorporating ESG risks O V E R S I G H T E X E C U T I O N A majority of our Directors have identified themselves as having considerable or extensive experience in key ESG areas, including: Corporate Governance Customer Focus & Community Engagement Environmental Sustainability Practices Executive Compensation & Benefits Human Capital Management Suite of ESG Disclosures ■ Annual Review & ESG Report ■ TCFD Report ■ SASB Index ■ GRI Index ■ Workforce Demographics (EEO-1) Index ■ CDP Climate Change Questionnaire Response ■ Community Engagement Report All resources are available through our ESG Resource Center, accessible at ir.regions.com/governance

28 Promoting financial inclusivity Pursuing environmental sustainability Maintaining accountability for our ESG progress ▪ Further integrated ESG into our enterprise-wide strategic planning and risk management processes ▪ Formed a new Technology Committee of the Board of Directors to provide oversight of technology and innovation initiatives, including multi-year Regions 2.0 project ▪ Onboarded 3 new independent Directors with extensive leadership experience, understanding of our footprint, and technology and cybersecurity knowledge ▪ Enhanced ESG considerations within our credit policy ▪ Introduced Regions Now CheckingSM to suite of Regions Now Banking® products ▪ Facilitated 124,000 associate-led financial wellness workshops through Regions Next Step® program ▪ Built out additional resources devoted to community and fair lending ▪ Enabled more than 1 million customers to complete financial health plans through Regions GreenprintTM ▪ Surpassed 2023 target to reduce energy usage by 30%(1) ▪ Achieved 33% reduction in operational greenhouse gas emissions as part of 50% reduction target for 2030(2) ▪ Established cross-functional project operating model to measure Scope 3 portfolio emissions ▪ Engaged internal stakeholders to develop and socialize organizational definition of sustainable finance ▪ Nurtured inclusive corporate culture with "Bring Your Whole Self to Work" philosophy ▪ Devoted resources to empowering associates' career and leadership development ▪ Provided $23M in philanthropic and community giving(3) ▪ Invested $33M in new debt and equity commitments(4) Fostering diversity, equity, and inclusion Maturing our governance around ESG risks and opportunities ▪ Coordinated simultaneous publication of our 2021 Annual Review & ESG Report and 2021 TCFD Report ▪ Merged disclosures aligned with SASB, GRI, and EEO-1 reporting frameworks into ESG Report ▪ Leveraged internal reporting expertise to continue evolving our ESG data governance Environmental, Social & Governance 2021 Highlights (1) Against 2015 baseline. (2) Against 2019 baseline. (3) Includes $17M of contributions and sponsorships from Regions Bank and $6M in grants by the Regions FoundationTM. (4) Through Regions Community Development Corporation.

29 Management uses pre-tax pre-provision income (non-GAAP) and adjusted pre-tax pre-provision income (non-GAAP), as well as the adjusted efficiency ratio (non-GAAP) and the adjusted fee income ratio (non-GAAP) to monitor performance and believes these measures provide meaningful information to investors. Non-interest expense (GAAP) is presented excluding certain adjustments to arrive at adjusted non-interest expense (non-GAAP), which is the numerator for the efficiency ratio. Non-interest income (GAAP) is presented excluding certain adjustments to arrive at adjusted non-interest income (non-GAAP), which is the numerator for the fee income ratio. Adjusted non-interest income (non-GAAP) and adjusted non-interest expense (non- GAAP) are used to determine adjusted pre-tax pre-provision income (non-GAAP). Net interest income (GAAP) on a taxable-equivalent basis and non-interest income are added together to arrive at total revenue on a taxable-equivalent basis. Adjustments are made to arrive at adjusted total revenue on a taxable-equivalent basis (non-GAAP), which is the denominator for the fee income and efficiency ratios. Net loan charge-offs (GAAP) are presented excluding adjustments to arrive at adjusted net loan-charge offs (non-GAAP). Adjusted net loan charge-offs as a percentage of average loans (non-GAAP) are calculated as adjusted net loan charge-offs (non-GAAP) divided by average loans (GAAP) and annualized. Regions believes that the exclusion of these adjustments provides a meaningful base for period-to-period comparisons, which management believes will assist investors in analyzing the operating results of the Company and predicting future performance. These non-GAAP financial measures are also used by management to assess the performance of Regions’ business. It is possible that the activities related to the adjustments may recur; however, management does not consider the activities related to the adjustments to be indications of ongoing operations. Regions believes that presentation of these non-GAAP financial measures will permit investors to assess the performance of the Company on the same basis as that applied by management. Tangible common stockholders’ equity ratios have become a focus of some investors and management believes they may assist investors in analyzing the capital position of the Company absent the effects of intangible assets and preferred stock. Analysts and banking regulators have assessed Regions’ capital adequacy using the tangible common stockholders’ equity measure. Because tangible common stockholders’ equity is not formally defined by GAAP or prescribed in any amount by federal banking regulations it is currently considered to be a non- GAAP financial measure and other entities may calculate it differently than Regions’ disclosed calculations. Since analysts and banking regulators may assess Regions’ capital adequacy using tangible common stockholders’ equity, management believes that it is useful to provide investors the ability to assess Regions’ capital adequacy on this same basis. Non-GAAP financial measures have inherent limitations, are not required to be uniformly applied and are not audited. Although these non-GAAP financial measures are frequently used by stakeholders in the evaluation of a company, they have limitations as analytical tools, and should not be considered in isolation, or as a substitute for analyses of results as reported under GAAP. In particular, a measure of earnings that excludes selected items does not represent the amount that effectively accrues directly to stockholders. Management and the Board of Directors utilize non-GAAP measures as follows: • Preparation of Regions' operating budgets • Monthly financial performance reporting • Monthly close-out reporting of consolidated results (management only) • Presentation to investors of company performance • Metrics for incentive compensation Non-GAAP information

30 Non-GAAP reconciliation Core net interest income and adjusted net interest margin Quarter-ended 9/30/2022 6/30/2022 3/31/2022 12/31/2021 9/30/2021 Net interest margin (FTE) (GAAP) 3.53 % 3.06 % 2.85 % 2.83 % 2.76 % Impact of SBA PPP loans (0.01) % (0.01) % (0.02) % (0.09) % (0.05) % Impact of excess cash 0.16 % 0.39 % 0.60 % 0.60 % 0.59 % Adjusted net interest margin (FTE) (non-GAAP) 3.68 % 3.44 % 3.43 % 3.34 % 3.30 %

31 Non-GAAP reconciliation Adjusted Net Charge-Offs and Ratio For the Quarter Ended ($ amounts in millions) 9/30/2022 6/30/2022 3/31/2022 12/31/2021 9/30/2021 Net loan charge-offs (GAAP) $110 $38 $46 $44 $30 Less: charge-offs associated with the sale of unsecured consumer loans 63 — — — — Adjusted net loan charge-offs (non-GAAP) 47 38 46 44 30 Adjusted net loan charge-offs as a % of average loans, annualized (non-GAAP) 0.19 % 0.17 % 0.21 % 0.20 % 0.14 %

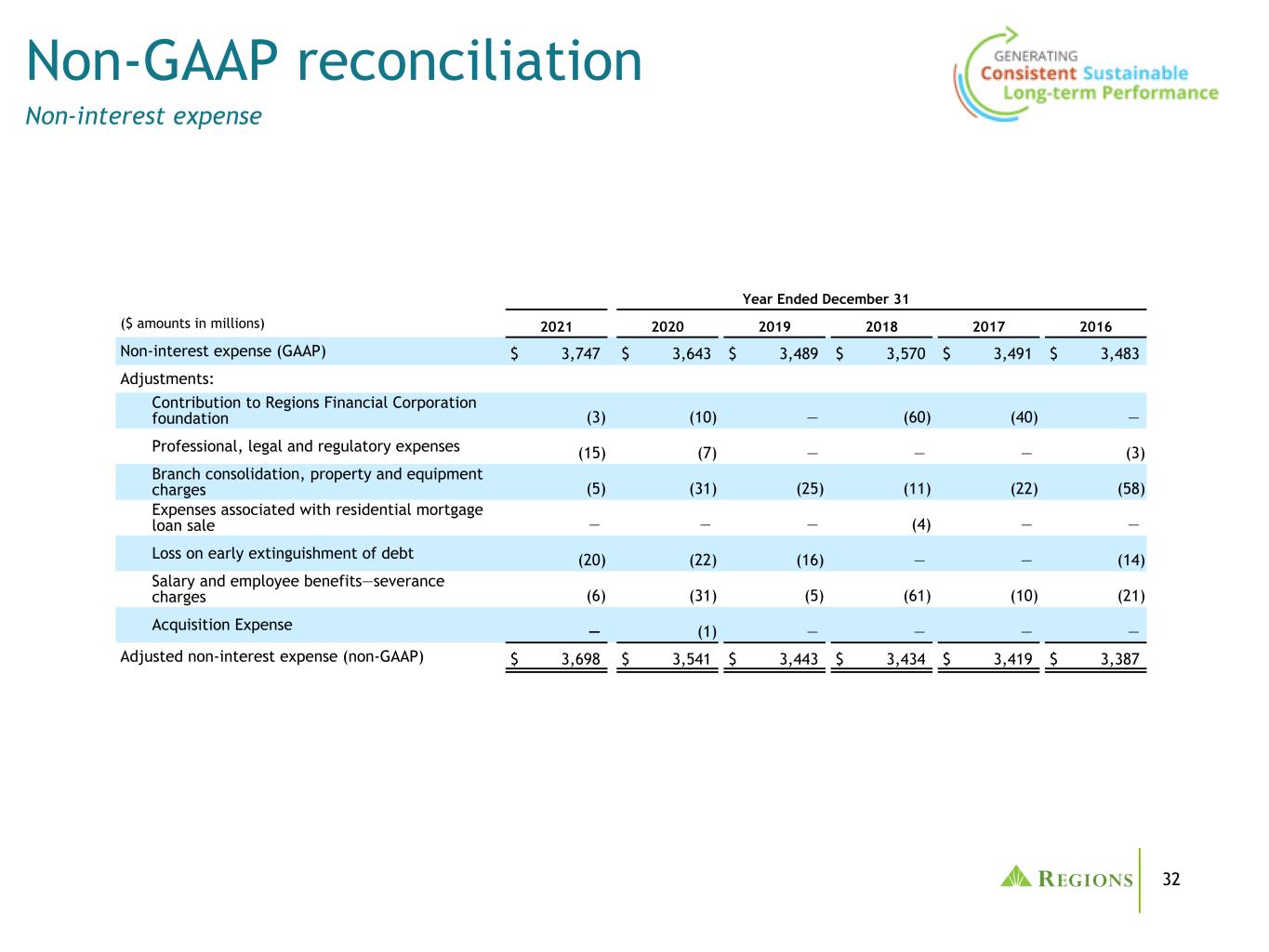

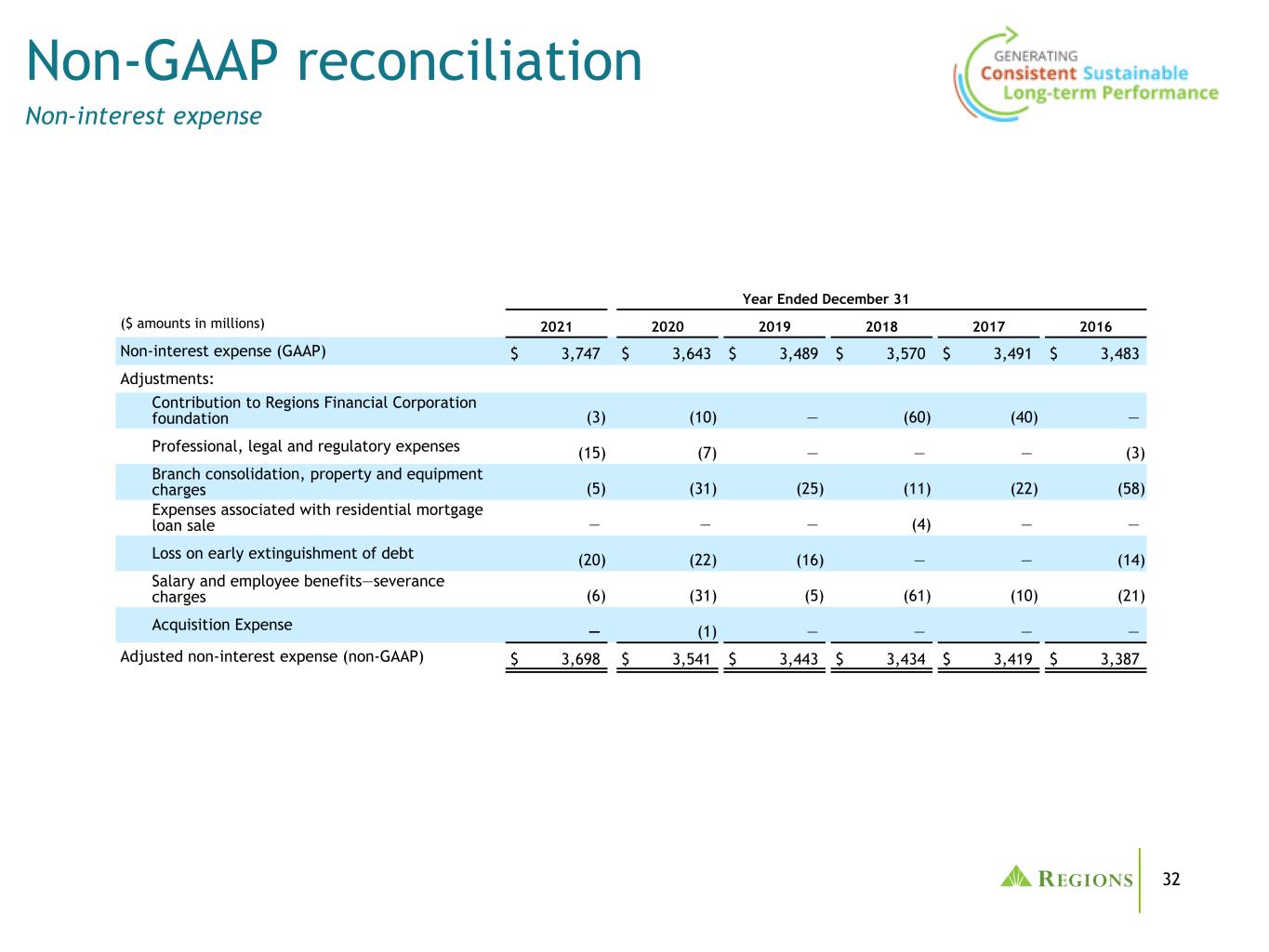

32 Non-GAAP reconciliation Non-interest expense Year Ended December 31 ($ amounts in millions) 2021 2020 2019 2018 2017 2016 Non-interest expense (GAAP) $ 3,747 $ 3,643 $ 3,489 $ 3,570 $ 3,491 $ 3,483 Adjustments: Contribution to Regions Financial Corporation foundation (3) (10) — (60) (40) — Professional, legal and regulatory expenses (15) (7) — — — (3) Branch consolidation, property and equipment charges (5) (31) (25) (11) (22) (58) Expenses associated with residential mortgage loan sale — — — (4) — — Loss on early extinguishment of debt (20) (22) (16) — — (14) Salary and employee benefits—severance charges (6) (31) (5) (61) (10) (21) Acquisition Expense — (1) — — — — Adjusted non-interest expense (non-GAAP) $ 3,698 $ 3,541 $ 3,443 $ 3,434 $ 3,419 $ 3,387

33 Non-GAAP reconciliation Pre-tax pre-provision income (PPI) Quarter Ended ($ amounts in millions) 9/30/2022 6/30/2022 3/31/2022 12/31/2021 9/30/2021 3Q22 vs. 2Q22 3Q22 vs. 3Q21 Net income (loss) available to common shareholders (GAAP) $ 404 $ 558 $ 524 $ 414 $ 624 $ (154) (27.6) % $ (220) (35.3) % Preferred dividends and other (GAAP) 25 25 24 24 27 — — % (2) (7.4) % Income tax expense (benefit) (GAAP) 133 157 154 103 180 (24) (15.3) % (47) (26.1) % Income (loss) before income taxes (GAAP) 562 740 702 541 831 (178) (24.1) % (269) (32.4) % Provision for (benefit from) credit losses (GAAP) 135 60 (36) 110 (155) 75 125.0 % 290 187.1 % Pre-tax pre-provision income (non-GAAP) 697 800 666 651 676 (103) (12.9) % 21 3.1 % Other adjustments: Securities (gains) losses, net 1 — — — (1) 1 NM 2 200.0 % Leveraged lease termination gains, net — — (1) — (2) — NM 2 100.0 % Salaries and employee benefits—severance charges — — — 1 — — NM — NM Branch consolidation, property and equipment charges 3 (6) 1 — — 9 150.0 % 3 NM Loss on early extinguishment of debt — — — — 20 — NM (20) (100.0) % Professional, legal and regulatory expenses 179 — 0 15 — 179 NM 179 NM Total other adjustments 183 (6) — 16 17 189 NM 166 NM Adjusted pre-tax pre-provision income (non-GAAP) $ 880 $ 794 $ 666 $ 667 $ 693 $ 86 10.8 % $ 187 27.0 % NM - Not Meaningful

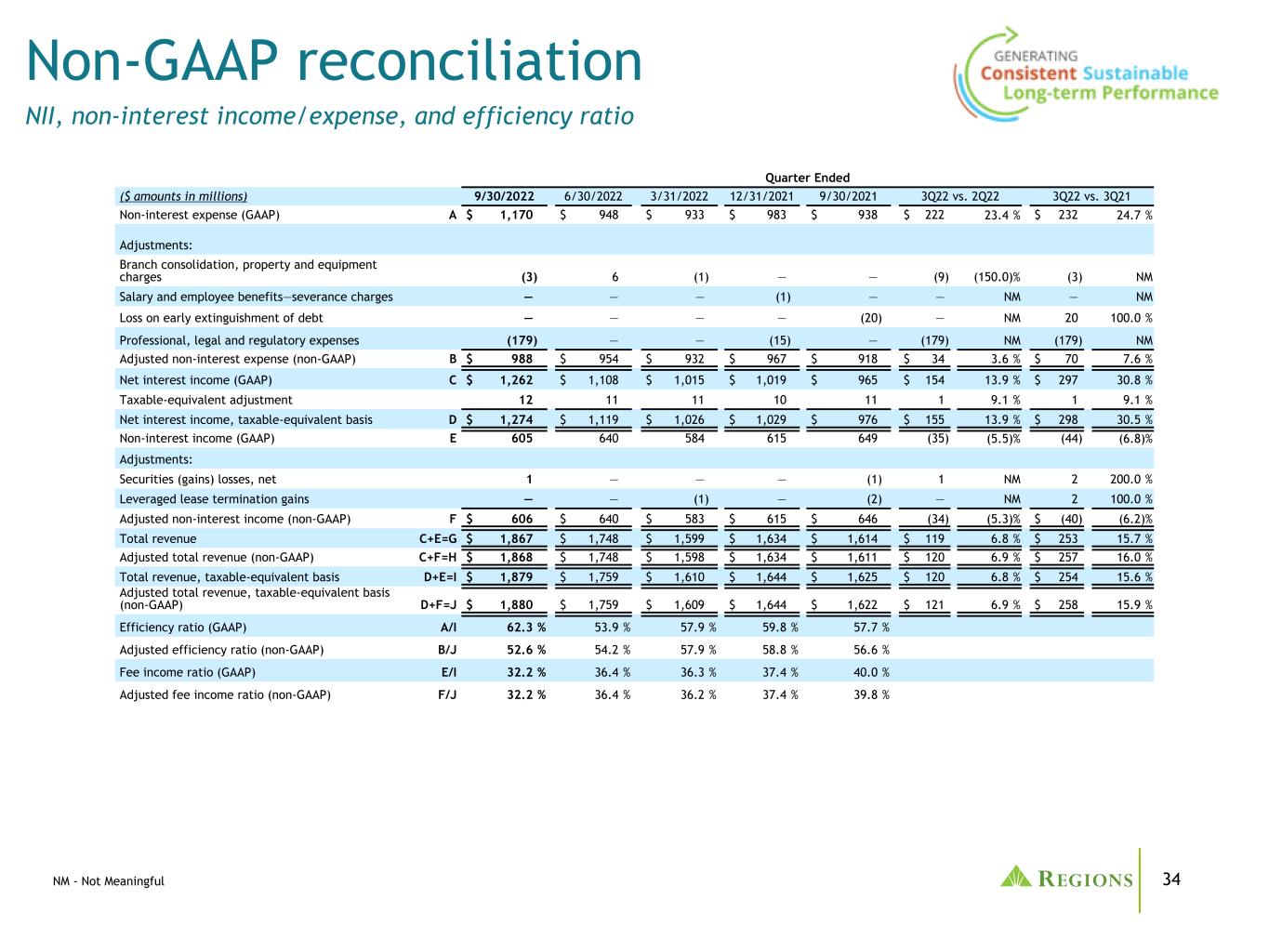

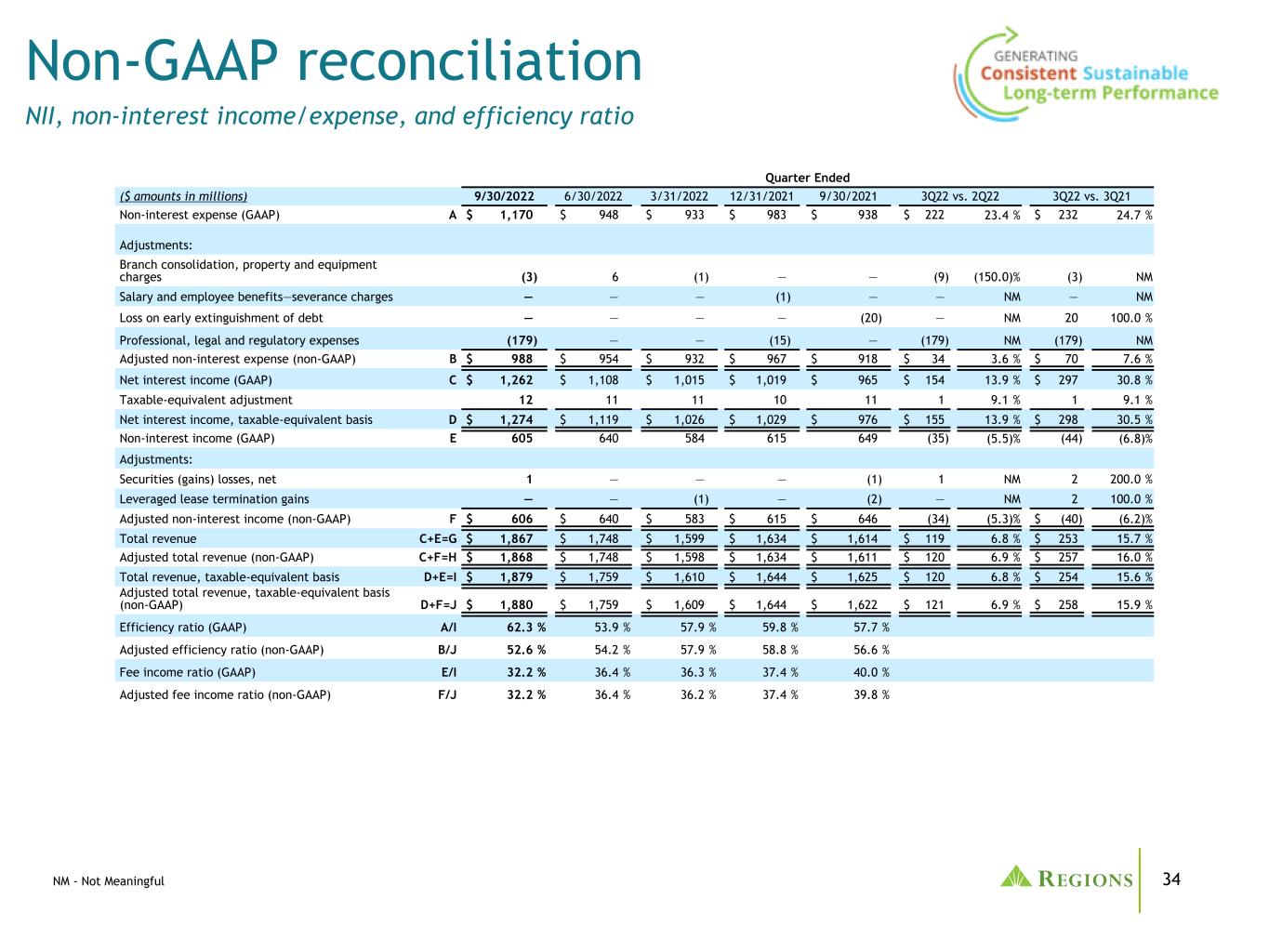

34 Non-GAAP reconciliation NII, non-interest income/expense, and efficiency ratio NM - Not Meaningful Quarter Ended ($ amounts in millions) 9/30/2022 6/30/2022 3/31/2022 12/31/2021 9/30/2021 3Q22 vs. 2Q22 3Q22 vs. 3Q21 Non-interest expense (GAAP) A $ 1,170 $ 948 $ 933 $ 983 $ 938 $ 222 23.4 % $ 232 24.7 % Adjustments: Branch consolidation, property and equipment charges (3) 6 (1) — — (9) (150.0) % (3) NM Salary and employee benefits—severance charges — — — (1) — — NM — NM Loss on early extinguishment of debt — — — — (20) — NM 20 100.0 % Professional, legal and regulatory expenses (179) — — (15) — (179) NM (179) NM Adjusted non-interest expense (non-GAAP) B $ 988 $ 954 $ 932 $ 967 $ 918 $ 34 3.6 % $ 70 7.6 % Net interest income (GAAP) C $ 1,262 $ 1,108 $ 1,015 $ 1,019 $ 965 $ 154 13.9 % $ 297 30.8 % Taxable-equivalent adjustment 12 11 11 10 11 1 9.1 % 1 9.1 % Net interest income, taxable-equivalent basis D $ 1,274 $ 1,119 $ 1,026 $ 1,029 $ 976 $ 155 13.9 % $ 298 30.5 % Non-interest income (GAAP) E 605 640 584 615 649 (35) (5.5) % (44) (6.8) % Adjustments: Securities (gains) losses, net 1 — — — (1) 1 NM 2 200.0 % Leveraged lease termination gains — — (1) — (2) — NM 2 100.0 % Adjusted non-interest income (non-GAAP) F $ 606 $ 640 $ 583 $ 615 $ 646 (34) (5.3) % $ (40) (6.2) % Total revenue C+E=G $ 1,867 $ 1,748 $ 1,599 $ 1,634 $ 1,614 $ 119 6.8 % $ 253 15.7 % Adjusted total revenue (non-GAAP) C+F=H $ 1,868 $ 1,748 $ 1,598 $ 1,634 $ 1,611 $ 120 6.9 % $ 257 16.0 % Total revenue, taxable-equivalent basis D+E=I $ 1,879 $ 1,759 $ 1,610 $ 1,644 $ 1,625 $ 120 6.8 % $ 254 15.6 % Adjusted total revenue, taxable-equivalent basis (non-GAAP) D+F=J $ 1,880 $ 1,759 $ 1,609 $ 1,644 $ 1,622 $ 121 6.9 % $ 258 15.9 % Efficiency ratio (GAAP) A/I 62.3 % 53.9 % 57.9 % 59.8 % 57.7 % Adjusted efficiency ratio (non-GAAP) B/J 52.6 % 54.2 % 57.9 % 58.8 % 56.6 % Fee income ratio (GAAP) E/I 32.2 % 36.4 % 36.3 % 37.4 % 40.0 % Adjusted fee income ratio (non-GAAP) F/J 32.2 % 36.4 % 36.2 % 37.4 % 39.8 %

35 Forward-Looking Statements This presentation may include forward-looking statements as defined in the Private Securities Litigation Reform Act of 1995. Forward-looking statements are not based on historical information, but rather are related to future operations, strategies, financial results or other developments. Forward-looking statements are based on management’s current expectations as well as certain assumptions and estimates made by, and information available to, management at the time the statements are made. Those statements are based on general assumptions and are subject to various risks, and because they also relate to the future they are likewise subject to inherent uncertainties and other factors that may cause actual results to differ materially from the views, beliefs and projections expressed in such statements. Therefore, we caution you against relying on any of these forward-looking statements. These risks, uncertainties and other factors include, but are not limited to, those described below: • Current and future economic and market conditions in the United States generally or in the communities we serve (in particular the Southeastern United States), including the effects of possible declines in property values, increases in unemployment rates, financial market disruptions and potential reductions of economic growth, which may adversely affect our lending and other businesses and our financial results and conditions. • Possible changes in trade, monetary and fiscal policies of, and other activities undertaken by, governments, agencies, central banks and similar organizations, which could have a material adverse effect on our earnings. • Possible changes in market interest rates or capital markets could adversely affect our revenue and expense, the value of assets and obligations, and the availability and cost of capital and liquidity. • The impact of pandemics, including the ongoing COVID-19 pandemic, on our businesses, operations, and financial results and conditions. The duration and severity of any pandemic, including the COVID-19 pandemic, could disrupt the global economy, adversely affect our capital and liquidity position, impair the ability of borrowers to repay outstanding loans and increase our allowance for credit losses, impair collateral values, and result in lost revenue or additional expenses. • Any impairment of our goodwill or other intangibles, any repricing of assets, or any adjustment of valuation allowances on our deferred tax assets due to changes in tax law, adverse changes in the economic environment, declining operations of the reporting unit or other factors. • The effect of new tax legislation and/or interpretation of existing tax law, which may impact our earnings, capital ratios, and our ability to return capital to shareholders. • Possible changes in the creditworthiness of customers and the possible impairment of the collectability of loans and leases, including operating leases. • Changes in the speed of loan prepayments, loan origination and sale volumes, charge-offs, credit loss provisions or actual credit losses where our allowance for credit losses may not be adequate to cover our eventual losses. • Possible acceleration of prepayments on mortgage-backed securities due to low interest rates, and the related acceleration of premium amortization on those securities. • Loss of customer checking and savings account deposits as customers pursue other, higher-yield investments, which could increase our funding costs. • Possible changes in consumer and business spending and saving habits and the related effect on our ability to increase assets and to attract deposits, which could adversely affect our net income. • Our ability to effectively compete with other traditional and non-traditional financial services companies, including fintechs, some of whom possess greater financial resources than we do or are subject to different regulatory standards than we are. • Our inability to develop and gain acceptance from current and prospective customers for new products and services and the enhancement of existing products and services to meet customers’ needs and respond to emerging technological trends in a timely manner could have a negative impact on our revenue. • Our inability to keep pace with technological changes, including those related to the offering of digital banking and financial services, could result in losing business to competitors. • Changes in laws and regulations affecting our businesses, including legislation and regulations relating to bank products and services, as well as changes in the enforcement and interpretation of such laws and regulations by applicable governmental and self-regulatory agencies, including as a result of the changes in U.S. presidential administration, control of the U.S. Congress, and changes in personnel at the bank regulatory agencies, which could require us to change certain business practices, increase compliance risk, reduce our revenue, impose additional costs on us, or otherwise negatively affect our businesses. • Our capital actions, including dividend payments, common stock repurchases, or redemptions of preferred stock, must not cause us to fall below minimum capital ratio requirements, with applicable buffers taken into account, and must comply with other requirements and restrictions under law or imposed by our regulators, which may impact our ability to return capital to shareholders. Forward-looking statements

36 • Our ability to comply with stress testing and capital planning requirements (as part of the CCAR process or otherwise) may continue to require a significant investment of our managerial resources due to the importance of such tests and requirements. • Our ability to comply with applicable capital and liquidity requirements (including, among other things, the Basel III capital standards), including our ability to generate capital internally or raise capital on favorable terms, and if we fail to meet requirements, our financial condition and market perceptions of us could be negatively impacted. • The effects of any developments, changes or actions relating to any litigation or regulatory proceedings brought against us or any of our subsidiaries. • The costs, including possibly incurring fines, penalties, or other negative effects (including reputational harm) of any adverse judicial, administrative, or arbitral rulings or proceedings, regulatory enforcement actions, or other legal actions to which we or any of our subsidiaries are a party, and which may adversely affect our results. • Our ability to manage fluctuations in the value of assets and liabilities and off-balance sheet exposure so as to maintain sufficient capital and liquidity to support our businesses. • Our ability to execute on our strategic and operational plans, including our ability to fully realize the financial and nonfinancial benefits relating to our strategic initiatives. • The risks and uncertainties related to our acquisition or divestiture of businesses, including our recently completed acquisitions of EnerBank, Sabal, and Clearsight, and risks related to such acquisitions, including that the expected synergies, cost savings and other financial or other benefits may not be realized within the expected timeframes, or might be less than projected; difficulties in integrating the businesses; and the inability of Regions to effectively cross-sell products following these acquisitions. • The success of our marketing efforts in attracting and retaining customers. • Our ability to recruit and retain talented and experienced personnel to assist in the development, management and operation of our products and services may be affected by changes in laws and regulations in effect from time to time. • Fraud or misconduct by our customers, employees or business partners. • Any inaccurate or incomplete information provided to us by our customers or counterparties. • Inability of our framework to manage risks associated with our businesses, such as credit risk and operational risk, including third-party vendors and other service providers, which could, among other things, result in a breach of operating or security systems as a result of a cyber attack or similar act or failure to deliver our services effectively. • Dependence on key suppliers or vendors to obtain equipment and other supplies for our businesses on acceptable terms. • The inability of our internal controls and procedures to prevent, detect or mitigate any material errors or fraudulent acts. • The effects of geopolitical instability, including wars, conflicts, civil unrest, and terrorist attacks and the potential impact, directly or indirectly, on our businesses. • The effects of man-made and natural disasters, including fires, floods, droughts, tornadoes, hurricanes, and environmental damage (specifically in the Southeastern United States), which may negatively affect our operations and/or our loan portfolios and increase our cost of conducting business. The severity and frequency of future earthquakes, fires, hurricanes, tornadoes, droughts, floods and other weather-related events are difficult to predict and may be exacerbated by global climate change. • Changes in commodity market prices and conditions could adversely affect the cash flows of our borrowers operating in industries that are impacted by changes in commodity prices (including businesses indirectly impacted by commodities prices such as businesses that transport commodities or manufacture equipment used in the production of commodities), which could impair their ability to service any loans outstanding to them and/or reduce demand for loans in those industries. • Our ability to identify and address cyber-security risks such as data security breaches, malware, ransomware, “denial of service” attacks, “hacking” and identity theft, including account take-overs, a failure of which could disrupt our businesses and result in the disclosure of and/or misuse or misappropriation of confidential or proprietary information, disruption or damage to our systems, increased costs, losses, or adverse effects to our reputation. • Our ability to achieve our expense management initiatives. Forward-looking statements (continued)

37 • Market replacement of LIBOR and the related effect on our LIBOR-based financial products and contracts, including, but not limited to, derivative products, debt obligations, deposits, investments, and loans. • Possible downgrades in our credit ratings or outlook could, among other negative impacts, increase the costs of funding from capital markets. • The effects of problems encountered by other financial institutions that adversely affect us or the banking industry generally could require us to change certain business practices, reduce our revenue, impose additional costs on us, or otherwise negatively affect our businesses. • The effects of the failure of any component of our business infrastructure provided by a third party could disrupt our businesses, result in the disclosure of and/or misuse of confidential information or proprietary information, increase our costs, negatively affect our reputation, and cause losses. • Our ability to receive dividends from our subsidiaries, in particular Regions Bank, could affect our liquidity and ability to pay dividends to shareholders. • Changes in accounting policies or procedures as may be required by the FASB or other regulatory agencies could materially affect our financial statements and how we report those results, and expectations and preliminary analyses relating to how such changes will affect our financial results could prove incorrect. • Fluctuations in the price of our common stock and inability to complete stock repurchases in the time frame and/or on the terms anticipated. • The effects of anti-takeover and exclusive forum laws and provision in our certificate of incorporation and bylaws. • The effects of any damage to our reputation resulting from developments related to any of the items identified above. • Other risks identified from time to time in reports that we file with the SEC. The foregoing list of factors is not exhaustive. For discussion of these and other factors that may cause actual results to differ from expectations, look under the captions “Forward-Looking Statements” and “Risk Factors” of Regions’ Annual Report on Form 10-K for the year ended December 31, 2021 and the "Risk Factors" of Regions' Quarterly Report on Form 10-Q for the quarter ended June 30, 2022, as filed with the SEC. Forward-looking statements are subject to the risk that the actual effects may differ, possibly materially, from what is reflected in those forward-looking statements due to factors and future developments that are uncertain, unpredictable and in many cases beyond our control, including the scope and duration of the COVID-19 pandemic (including the impact of additional variants and resurgences), the effectiveness, availability and acceptance of any vaccines or therapies, and the direct and indirect impact of the COVID-19 pandemic on our customers, third parties and us. The words “future,” “anticipates,” “assumes,” “intends,” “plans,” “seeks,” “believes,” “predicts,” “potential,” “objectives,” “estimates,” “expects,” “targets,” “projects,” “outlook,” “forecast,” “would,” “will,” “may,” “might,” “could,” “should,” “can,” and similar terms and expressions often signify forward-looking statements. You should not place undue reliance on any forward-looking statements, which speak only as of the date made. Factors or events that could cause our actual results to differ may emerge from time to time, and it is not possible to predict all of them. We assume no obligation and do not intend to update or revise any forward-looking statements that are made from time to time, either as a result of future developments, new information or otherwise, except as may be required by law. Regions’ Investor Relations contact is Dana Nolan at (205) 264-7040; Regions’ Media contact is Jeremy King at (205) 264-4551. Forward-looking statements (continued)

38 ®