Exhibit 99.1 BancAnalysts Association of Boston Conference November 3, 2022

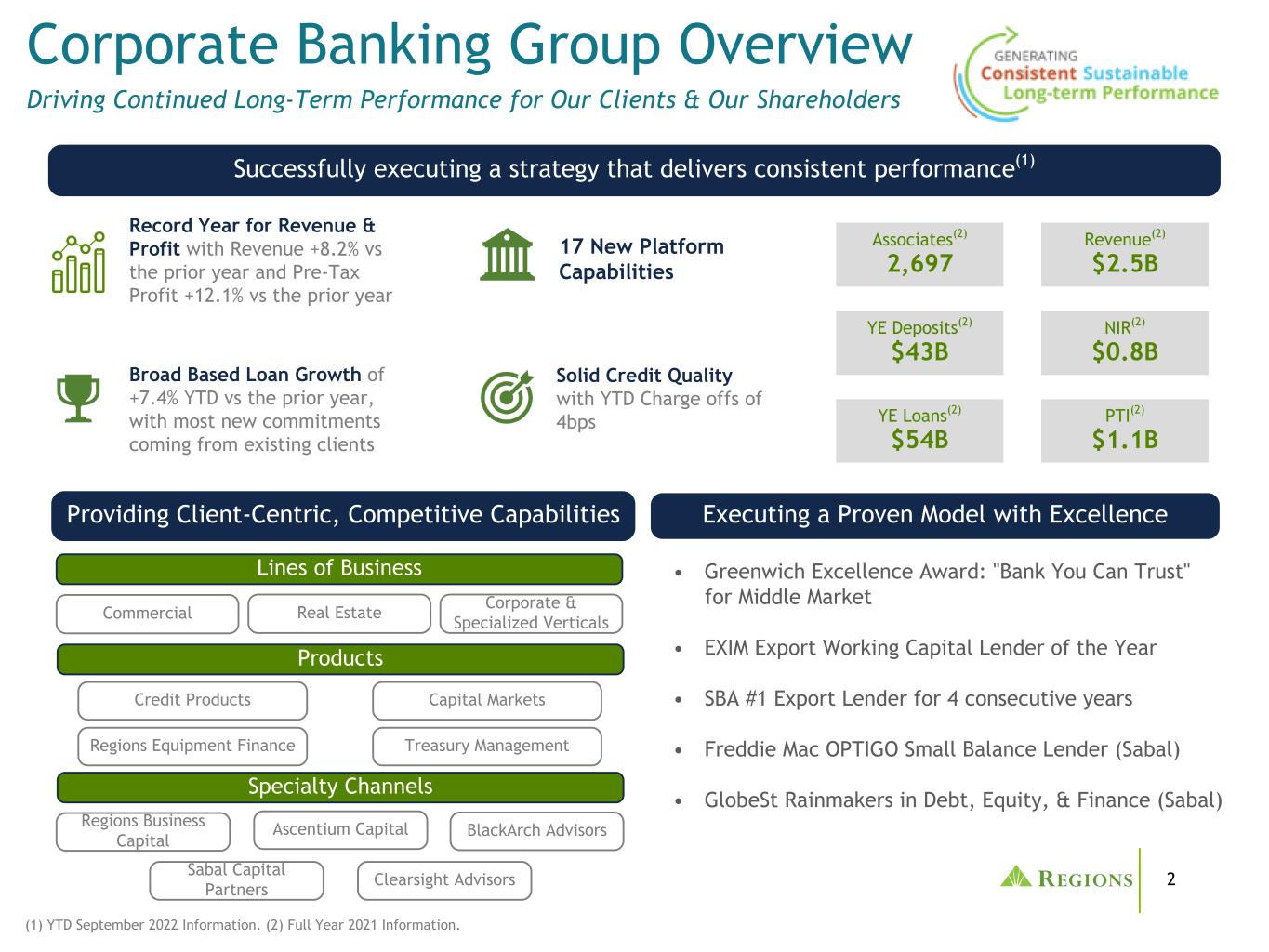

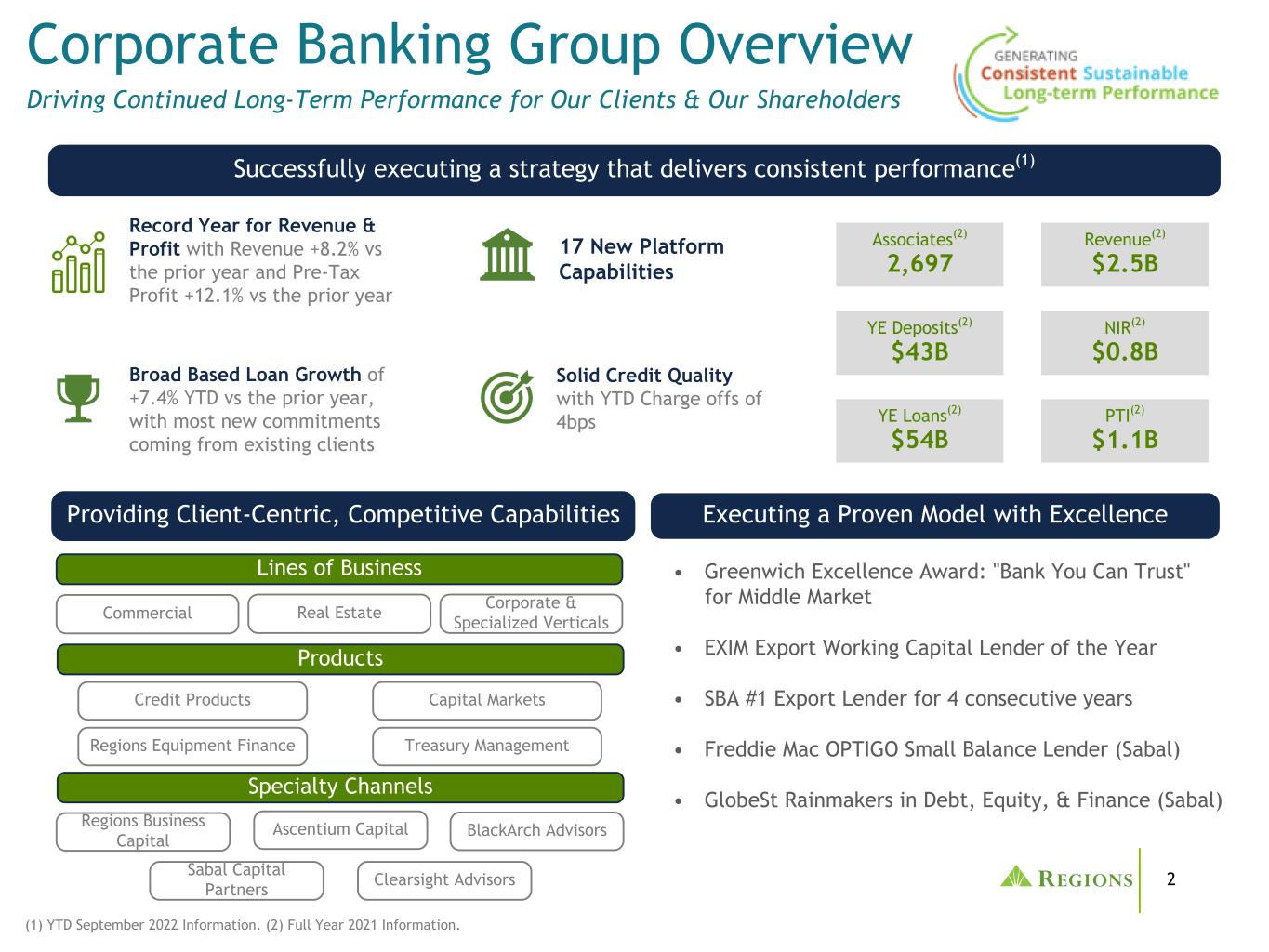

2 Providing Client-Centric, Competitive Capabilities Delivering from a Position of Strength & Stability(1) Executing a Proven Model with Excellence Corporate Banking Group Overview Driving Continued Long-Term Performance for Our Clients & Our Shareholders Solid Credit Quality with YTD Charge offs of 4bps Record Year for Revenue & Profit with Revenue +8.2% vs the prior year and Pre-Tax Profit +12.1% vs the prior year 17 New Platform Capabilities Broad Based Loan Growth of +7.4% YTD vs the prior year, with most new commitments coming from existing clients • Greenwich Excellence Award: "Bank You Can Trust" for Middle Market • EXIM Export Working Capital Lender of the Year • SBA #1 Export Lender for 4 consecutive years • Freddie Mac OPTIGO Small Balance Lender (Sabal) • GlobeSt Rainmakers in Debt, Equity, & Finance (Sabal) Associates(2) 2,697 YE Loans(2) $54B YE Deposits(2) $43B Revenue(2) $2.5B PTI(2) $1.1B NIR(2) $0.8B (1) YTD September 2022 Information. (2) Full Year 2021 Information. Successfully executing a strategy that delivers consistent performance(1) Lines of Business Commercial Corporate & Specialized Verticals Products Real Estate Credit Products Capital Markets Treasury Management Regions Equipment Finance Specialty Channels Regions Business Capital Ascentium Capital BlackArch Advisors Sabal Capital Partners Clearsight Advisors

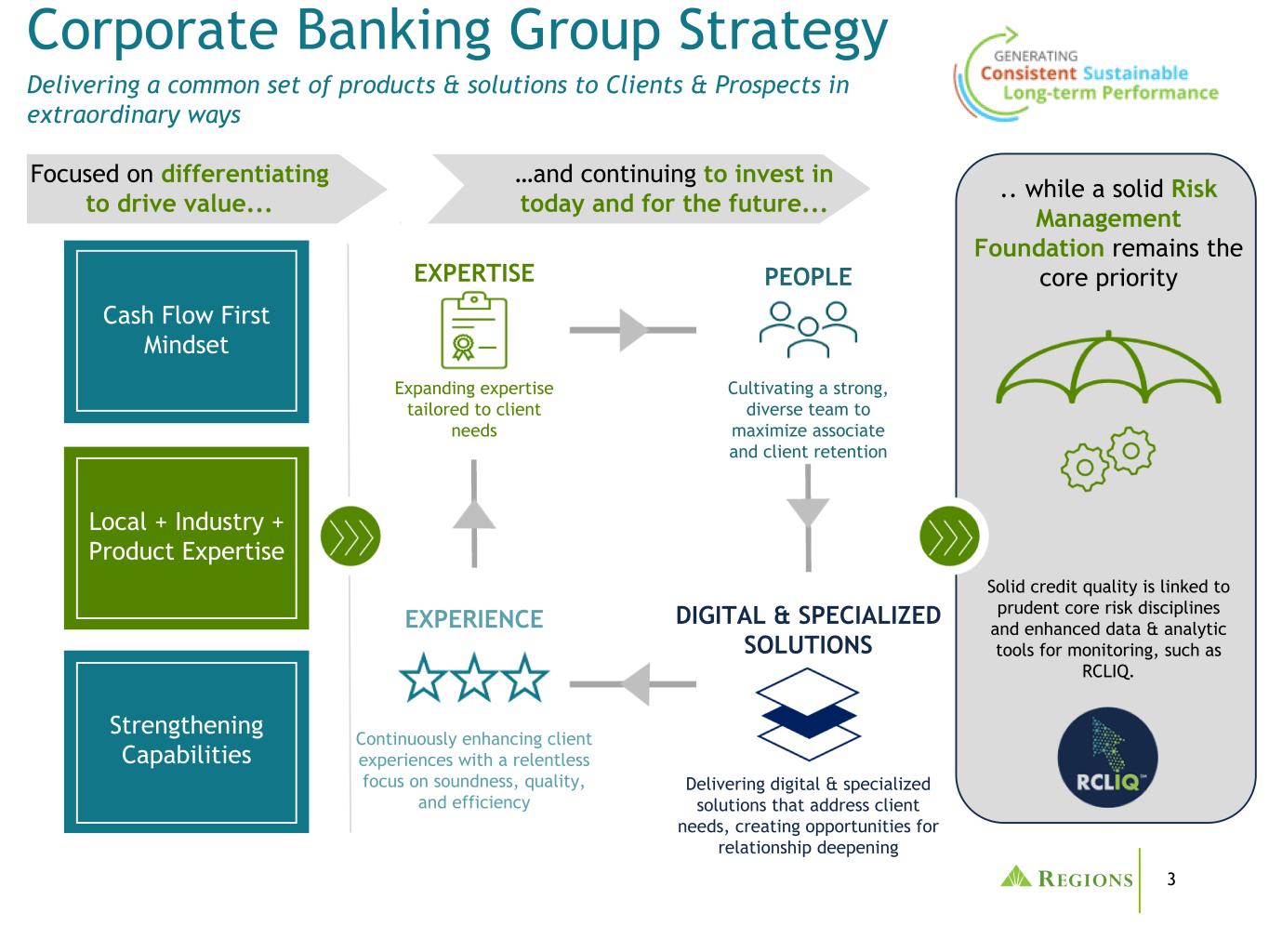

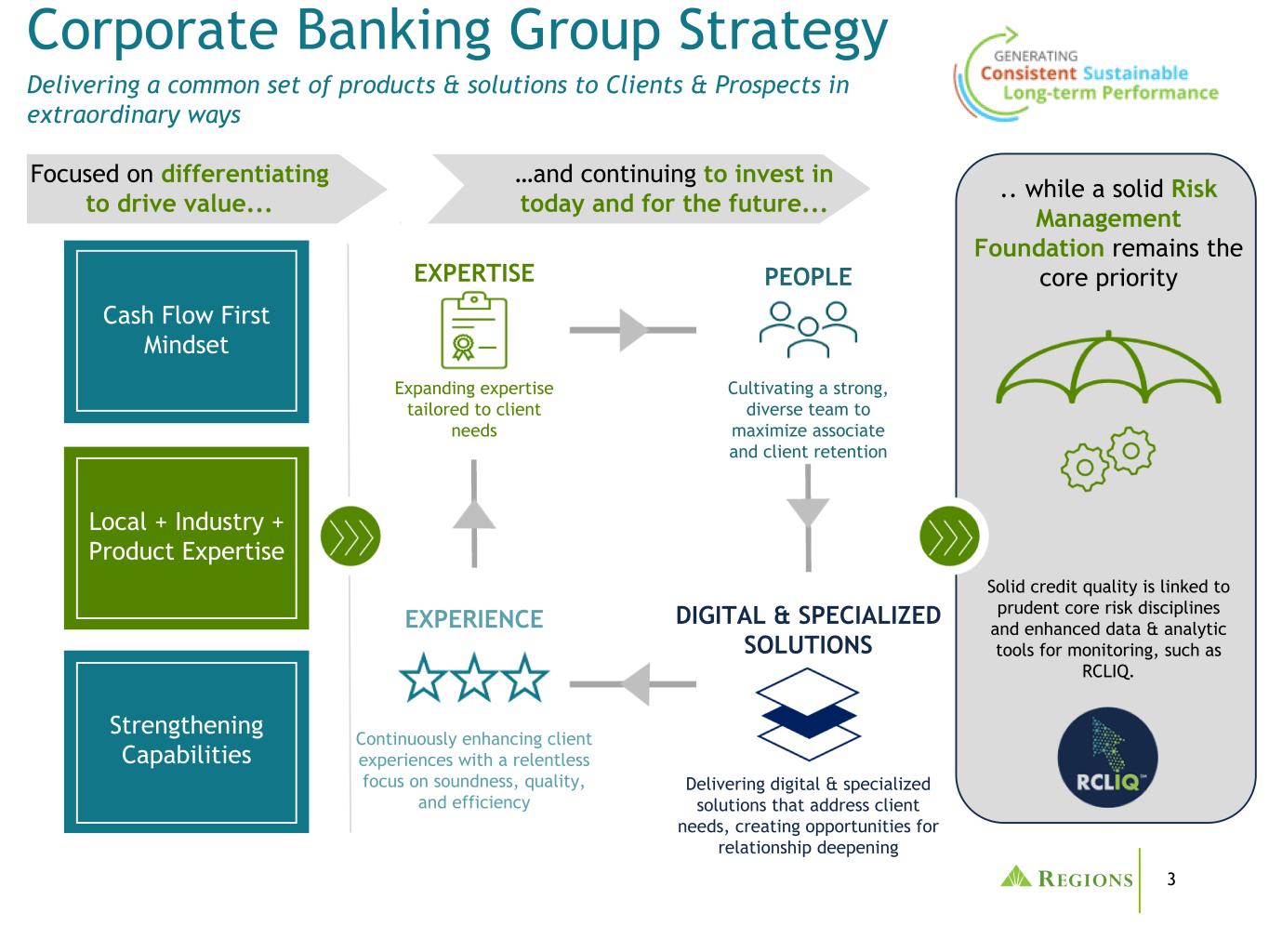

3 Corporate Banking Group Strategy Delivering a common set of products & solutions to Clients & Prospects in extraordinary ways Cash Flow First Mindset Focused on differentiating to drive value... Local + Industry + Product Expertise Strengthening Capabilities Expanding expertise tailored to client needs Continuously enhancing client experiences with a relentless focus on soundness, quality, and efficiency Delivering digital & specialized solutions that address client needs, creating opportunities for relationship deepening Cultivating a strong, diverse team to maximize associate and client retention EXPERIENCE EXPERTISE PEOPLE DIGITAL & SPECIALIZED SOLUTIONS .. while a solid Risk Management Foundation remains the core priority Solid credit quality is linked to prudent core risk disciplines and enhanced data & analytic tools for monitoring, such as RCLIQ. …and continuing to invest in today and for the future...

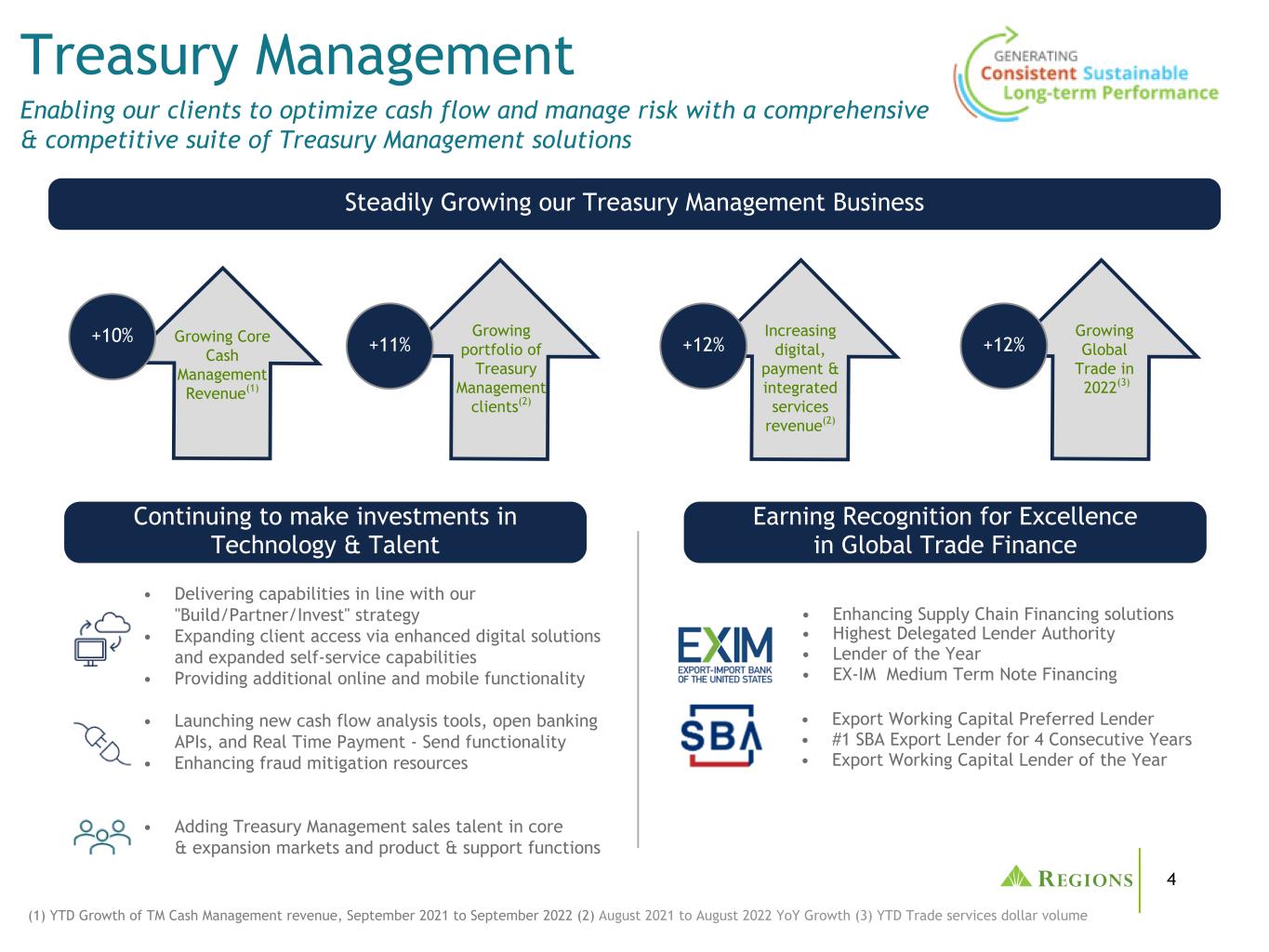

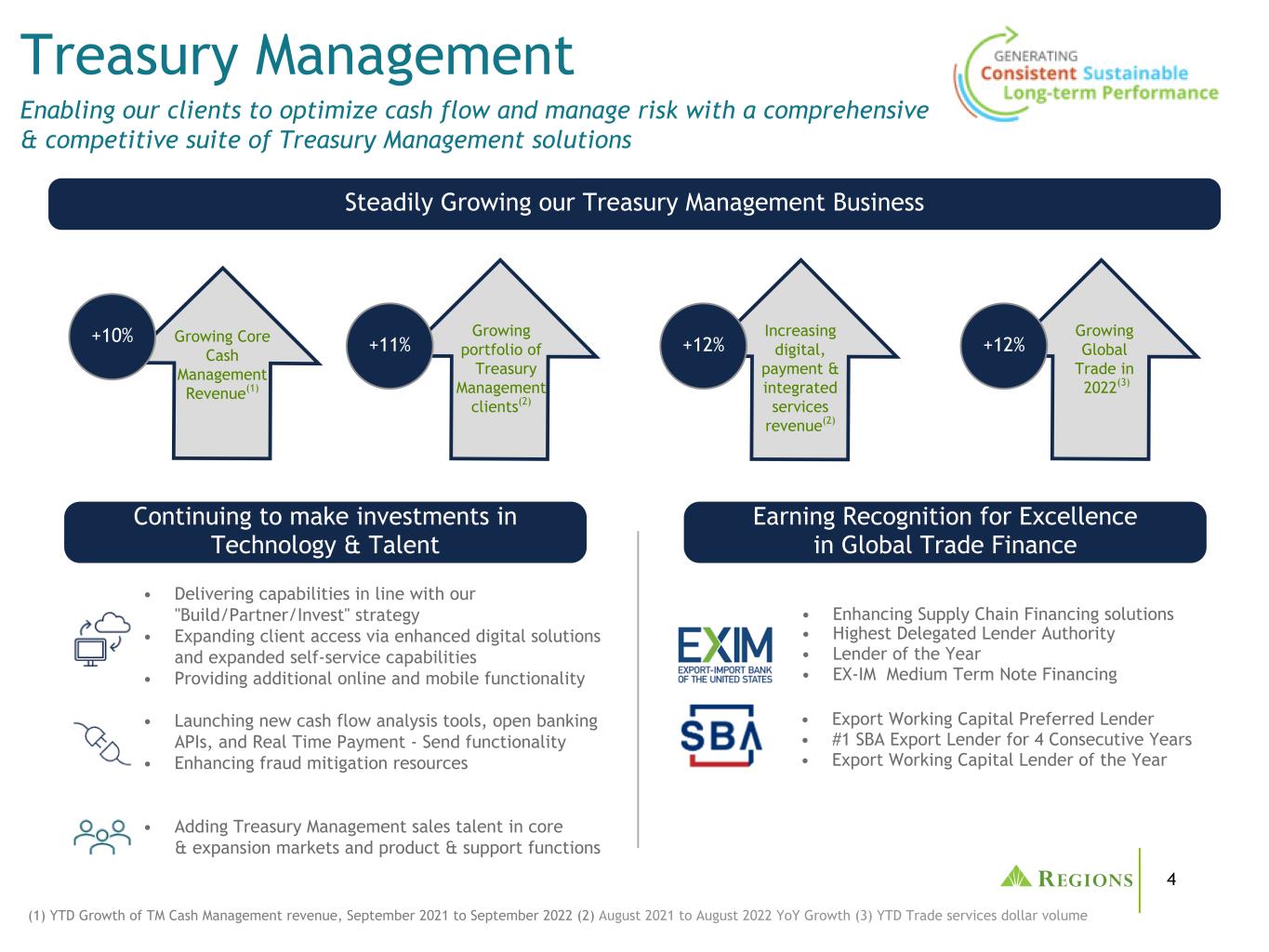

4 Treasury Management Enabling our clients to optimize cash flow and manage risk with a comprehensive & competitive suite of Treasury Management solutions • Export Working Capital Preferred Lender • #1 SBA Export Lender for 4 Consecutive Years • Export Working Capital Lender of the Year • Highest Delegated Lender Authority • Lender of the Year • EX-IM Medium Term Note Financing (1) YTD Growth of TM Cash Management revenue, September 2021 to September 2022 (2) August 2021 to August 2022 YoY Growth (3) YTD Trade services dollar volume • Delivering capabilities in line with our "Build/Partner/Invest" strategy • Expanding client access via enhanced digital solutions and expanded self-service capabilities • Providing additional online and mobile functionality • Launching new cash flow analysis tools, open banking APIs, and Real Time Payment - Send functionality • Enhancing fraud mitigation resources • Adding Treasury Management sales talent in core & expansion markets and product & support functions • Enhancing Supply Chain Financing solutions +11% +12% +12% Growing portfolio of Treasury Management clients(2) Increasing digital, payment & integrated services revenue(2) Growing Global Trade in 2022(3) +10% Growing Core Cash Management Revenue(1) Steadily Growing our Treasury Management Business Continuing to make investments in Technology & Talent Earning Recognition for Excellence in Global Trade Finance

5 Capital Markets Overview Growing products and services that our clients' value Capital markets is an umbrella over capital raising, risk management, and advisory services. Capital Markets Product Solutions Financial Risk Management Regions Financial Risk Management Group offers advice, strategies, and solutions to Regions’ clients to assist in managing their exposures to changes in interest rates, commodity prices, and currency rates • Interest Rate Derivatives • Commodity Derivatives • Foreign Exchange Debt & Capital Capital Markets has consistently invested in expanding capital raising capabilities to provide expansive product solutions for customers Advisory Services Regions Advisory team has strong track record of growth in sell-side and buy-side engagements by providing long-term, relationship focused advisory solutions • Mergers & Acquisitions • Debt/Capital Structure • Real Estate ◦ Loan origination & distribution ▪ Fannie Mae ▪ Freddie Mac ▪ HUD ▪ CMBS ◦ Real Estate loan syndications ◦ Low-income housing tax credit distribution • Debt & Capital ◦ Loan Syndication ◦ Sponsor coverage ◦ Loan sales & trading ◦ Public and private capital raising • Structured Products ◦ Asset backed loan warehousing & fixed income underwriting ◦ Private equity subscription lines Client Coverage Areas • Corporate Banking • Commercial Banking • Commercial Real Estate • Specialized Industries • Wealth Management Teaming with our client coverage areas is key to deliver product solutions:

6 Capital Markets Growth $73 $104 $152 $161 $202 $178 $275 $331 $363 2014 2015 2016 2017 2018 2019 2020 2021 2022E Capital Markets has added new capabilities to provide solutions for CBG client needs while diversifying revenue; Result has been a CAGR of >20% Capital Markets Fee Income & Key Product Additions(1,2,3) (1) Prior to 2018, Capital Markets Fee income was labeled as "Capital Markets Fee Income and Other". (2) Decline in 2019 revenue was due to market conditions impacting M&A, Derivatives and CVA/DVA. (3) 2022 Capital Markets Fee Income estimate based on 9/30/2022 YTD actuals and midpoint of 4Q 2022 guidance of $80-$90M. ($ in millions) >20% CAGR Began to rebuild Capital Markets capabilities in 2014 after its 2012 sale of Morgan Keegan Launched Regions Securities • Dedicated Investment Grade Corporate Fixed Income underwriting staff Real Estate Capital Markets • Fannie Mae DUS multi- family capability BlackArch Partners • Sponsor to Sponsor M&A Advisory First Sterling • Low-income housing tax credit distribution Sponsor Coverage • Dedicated PE Sponsor Coverage and generalist M&A advisory staff Debt Capital Markets • Dedicated Institutional Term Loan sales and trading staff Sabal Capital Partners • Small-balance agency multi-family and CMBS Clearsight Advisors • Tech enabled Business services M&A Advisory • Debt/Capital structure advisory Real Estate Capital Markets • Freddie Mac conventional agency multi-family capability Equity Capital Markets • Dedicated Primary and Secondary offering EMC underwriting team. Debt Capital Markets • Dedicated High-Yield Corporate Fixed Income underwriting staff

7 Appendix

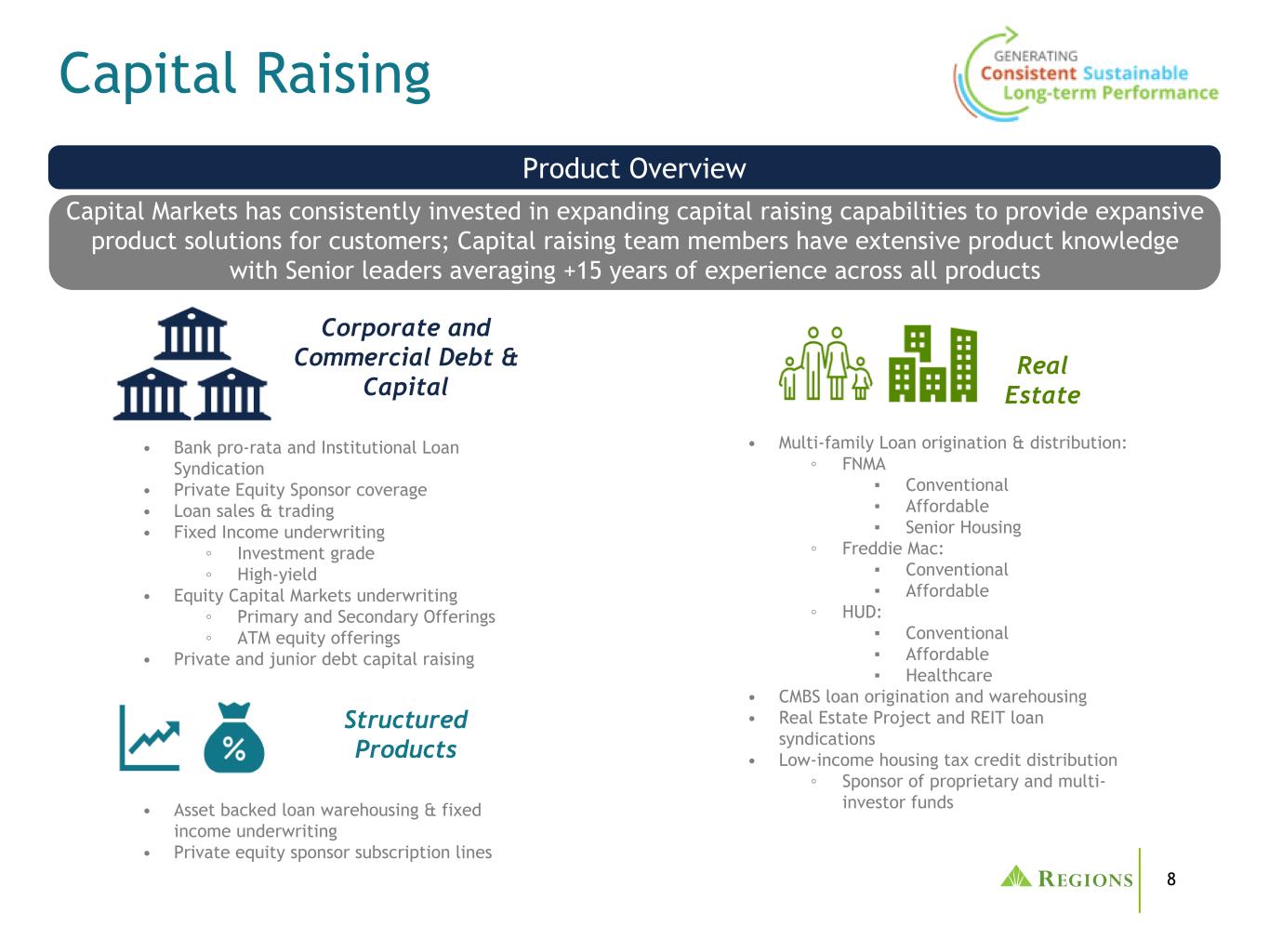

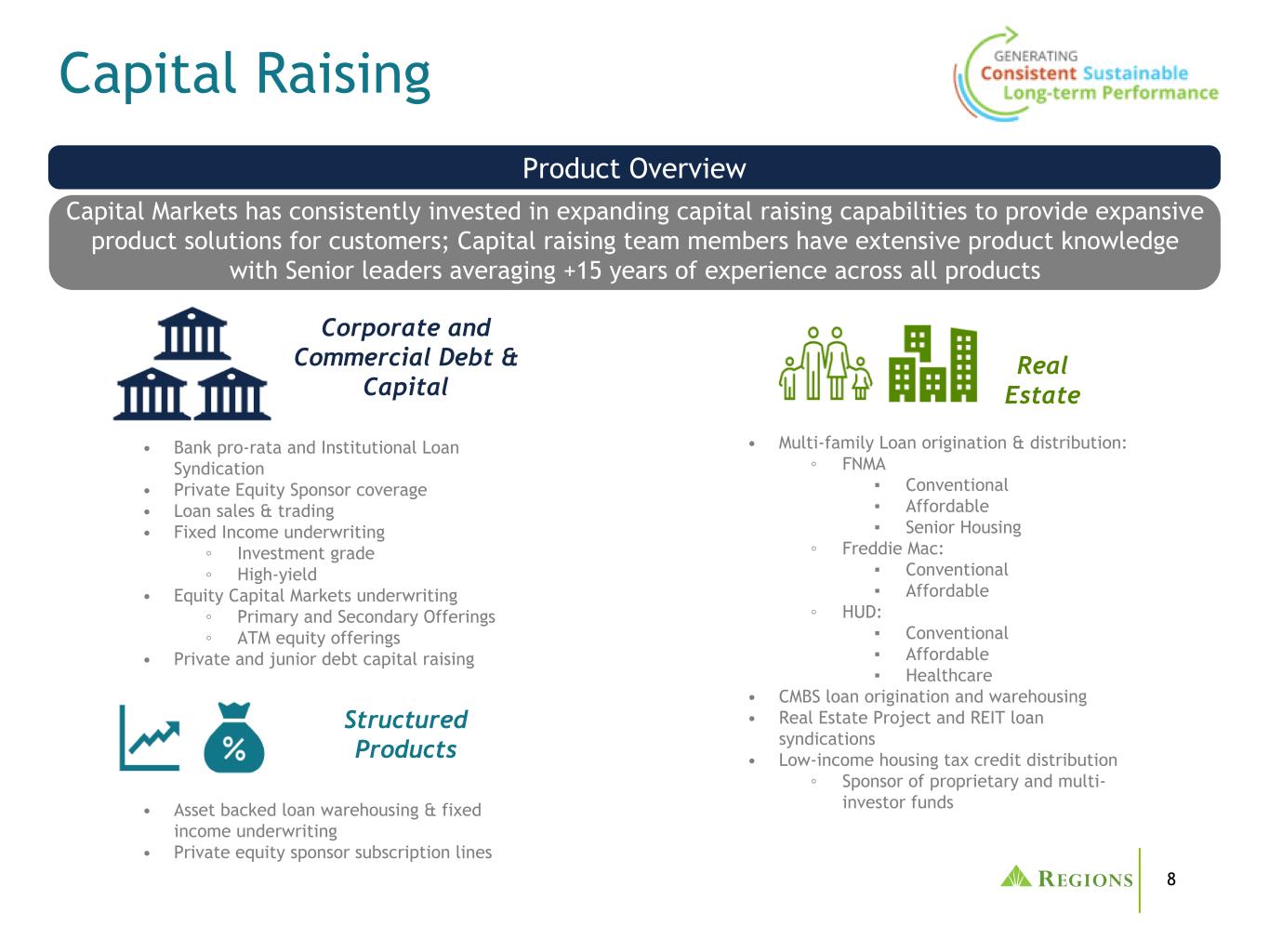

8 Capital Raising • Asset backed loan warehousing & fixed income underwriting • Private equity sponsor subscription lines Corporate and Commercial Debt & Capital • Multi-family Loan origination & distribution: ◦ FNMA ▪ Conventional ▪ Affordable ▪ Senior Housing ◦ Freddie Mac: ▪ Conventional ▪ Affordable ◦ HUD: ▪ Conventional ▪ Affordable ▪ Healthcare • CMBS loan origination and warehousing • Real Estate Project and REIT loan syndications • Low-income housing tax credit distribution ◦ Sponsor of proprietary and multi- investor funds • Bank pro-rata and Institutional Loan Syndication • Private Equity Sponsor coverage • Loan sales & trading • Fixed Income underwriting ◦ Investment grade ◦ High-yield • Equity Capital Markets underwriting ◦ Primary and Secondary Offerings ◦ ATM equity offerings • Private and junior debt capital raising Structured Products Real Estate Capital Markets has consistently invested in expanding capital raising capabilities to provide expansive product solutions for customers; Capital raising team members have extensive product knowledge with Senior leaders averaging +15 years of experience across all products Product Overview

9 Advisory Services Product Overview • Advisory Focus: ◦ Sell-side M&A ◦ Buy-side M&A ◦ Private Capital Raising • Transaction Focus: ◦ Founder/family-owned businesses ◦ Generalists primarily working directly with bank clients • Strategy Focus: ◦ Generalist coverage of Commercial & Corporate Bank ◦ Sourcing filter for BlackArch and Clearsight sector opportunities • Regions Advisory team has strong track record of growth in sell-side and buy-side engagements by providing long-term, relationship focused advisory solutions • Senior professionals throughout the advisory businesses average over 25 years of experience • Average deal size across all businesses: $50 - $250 million with approximately 60% private equity and 40% corporate/ entrepreneur-owned clients • The three distinct advisory practice areas complement each other from a sector focus perspective and cross reference opportunities Regions Corporate Advisory BlackArch Partners Clearsight Advisors • Advisory Focus: ◦ Sell-side M&A • Transaction Focus: ◦ Private Equity-owned ◦ Sponsor-to-sponsor trades • Sector Focus: ◦ Aerospace, Defense, & Government Services ◦ Distribution ◦ Building Products & Infrastructure ◦ Business & Industrial Services ◦ Diversified Industrials ◦ Consumer & Retail ◦ Healthcare • Advisory Focus: ◦ Sell-side M&A ◦ Buy-side M&A ◦ Capital Raising Advisory ◦ Financial Advisory & Consulting • Transaction Focus: ◦ Primarily founder/family-owned businesses ◦ Exclusive focus on technology- related opportunities • Sector Focus: ◦ Software ◦ Data & Analytics ◦ Technology-enabled Business Services

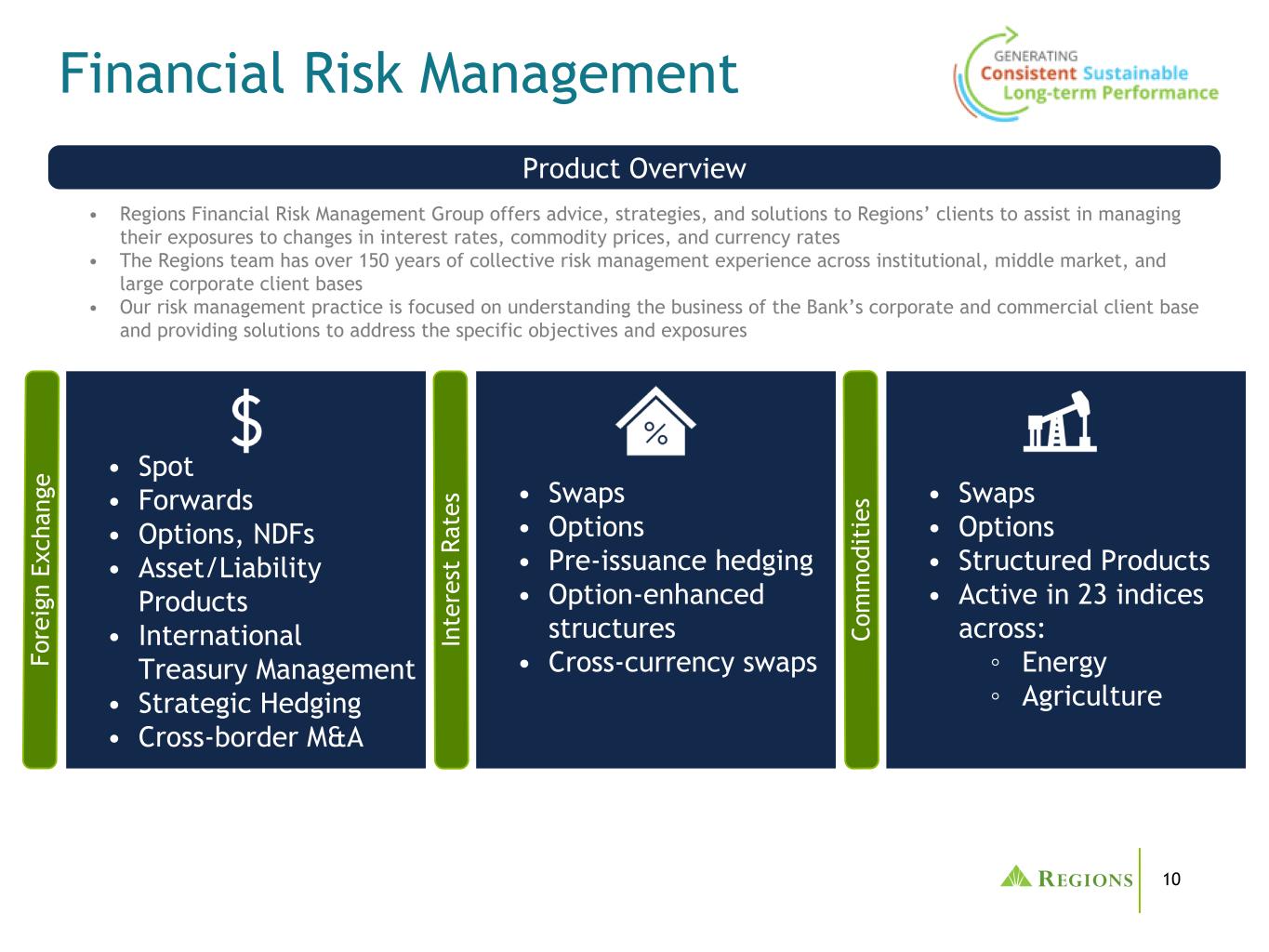

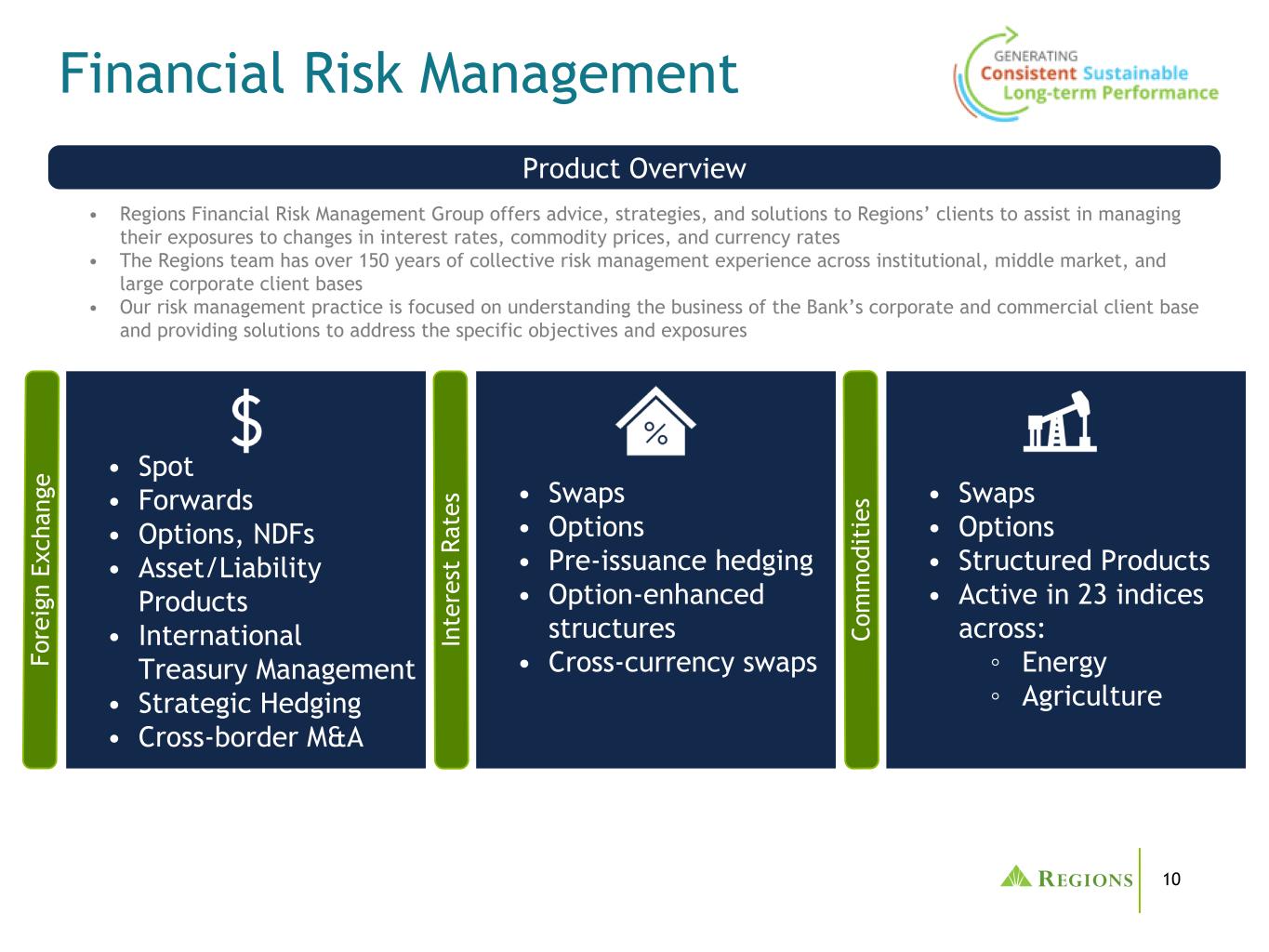

10 Financial Risk Management • Spot • Forwards • Options, NDFs • Asset/Liability Products • International Treasury Management • Strategic Hedging • Cross-border M&A • Regions Financial Risk Management Group offers advice, strategies, and solutions to Regions’ clients to assist in managing their exposures to changes in interest rates, commodity prices, and currency rates • The Regions team has over 150 years of collective risk management experience across institutional, middle market, and large corporate client bases • Our risk management practice is focused on understanding the business of the Bank’s corporate and commercial client base and providing solutions to address the specific objectives and exposures Fo re ig n Ex ch an ge In te re st R at es • Swaps • Options • Pre-issuance hedging • Option-enhanced structures • Cross-currency swaps • Swaps • Options • Structured Products • Active in 23 indices across: ◦ Energy ◦ Agriculture Co m m od it ie s Product Overview

11 Forward-Looking Statements This presentation may include forward-looking statements as defined in the Private Securities Litigation Reform Act of 1995. Forward-looking statements are not based on historical information, but rather are related to future operations, strategies, financial results or other developments. Forward-looking statements are based on management’s current expectations as well as certain assumptions and estimates made by, and information available to, management at the time the statements are made. Those statements are based on general assumptions and are subject to various risks, and because they also relate to the future they are likewise subject to inherent uncertainties and other factors that may cause actual results to differ materially from the views, beliefs and projections expressed in such statements. Therefore, we caution you against relying on any of these forward-looking statements. These risks, uncertainties and other factors include, but are not limited to, those described below: • Current and future economic and market conditions in the United States generally or in the communities we serve (in particular the Southeastern United States), including the effects of possible declines in property values, increases in unemployment rates, financial market disruptions and potential reductions of economic growth, which may adversely affect our lending and other businesses and our financial results and conditions. • Possible changes in trade, monetary and fiscal policies of, and other activities undertaken by, governments, agencies, central banks and similar organizations, which could have a material adverse effect on our earnings. • Possible changes in market interest rates or capital markets could adversely affect our revenue and expense, the value of assets and obligations, and the availability and cost of capital and liquidity. • The impact of pandemics, including the ongoing COVID-19 pandemic, on our businesses, operations, and financial results and conditions. The duration and severity of any pandemic, including the COVID-19 pandemic, could disrupt the global economy, adversely affect our capital and liquidity position, impair the ability of borrowers to repay outstanding loans and increase our allowance for credit losses, impair collateral values, and result in lost revenue or additional expenses. • Any impairment of our goodwill or other intangibles, any repricing of assets, or any adjustment of valuation allowances on our deferred tax assets due to changes in tax law, adverse changes in the economic environment, declining operations of the reporting unit or other factors. • The effect of new tax legislation and/or interpretation of existing tax law, which may impact our earnings, capital ratios, and our ability to return capital to shareholders. • Possible changes in the creditworthiness of customers and the possible impairment of the collectability of loans and leases, including operating leases. • Changes in the speed of loan prepayments, loan origination and sale volumes, charge-offs, credit loss provisions or actual credit losses where our allowance for credit losses may not be adequate to cover our eventual losses. • Possible acceleration of prepayments on mortgage-backed securities due to low interest rates, and the related acceleration of premium amortization on those securities. • Loss of customer checking and savings account deposits as customers pursue other, higher-yield investments, which could increase our funding costs. • Possible changes in consumer and business spending and saving habits and the related effect on our ability to increase assets and to attract deposits, which could adversely affect our net income. • Our ability to effectively compete with other traditional and non-traditional financial services companies, including fintechs, some of whom possess greater financial resources than we do or are subject to different regulatory standards than we are. • Our inability to develop and gain acceptance from current and prospective customers for new products and services and the enhancement of existing products and services to meet customers’ needs and respond to emerging technological trends in a timely manner could have a negative impact on our revenue. • Our inability to keep pace with technological changes, including those related to the offering of digital banking and financial services, could result in losing business to competitors. • Changes in laws and regulations affecting our businesses, including legislation and regulations relating to bank products and services, as well as changes in the enforcement and interpretation of such laws and regulations by applicable governmental and self-regulatory agencies, including as a result of the changes in U.S. presidential administration, control of the U.S. Congress, and changes in personnel at the bank regulatory agencies, which could require us to change certain business practices, increase compliance risk, reduce our revenue, impose additional costs on us, or otherwise negatively affect our businesses. • Our capital actions, including dividend payments, common stock repurchases, or redemptions of preferred stock, must not cause us to fall below minimum capital ratio requirements, with applicable buffers taken into account, and must comply with other requirements and restrictions under law or imposed by our regulators, which may impact our ability to return capital to shareholders. Forward-looking statements

12 • Our ability to comply with stress testing and capital planning requirements (as part of the CCAR process or otherwise) may continue to require a significant investment of our managerial resources due to the importance of such tests and requirements. • Our ability to comply with applicable capital and liquidity requirements (including, among other things, the Basel III capital standards), including our ability to generate capital internally or raise capital on favorable terms, and if we fail to meet requirements, our financial condition and market perceptions of us could be negatively impacted. • The effects of any developments, changes or actions relating to any litigation or regulatory proceedings brought against us or any of our subsidiaries. • The costs, including possibly incurring fines, penalties, or other negative effects (including reputational harm) of any adverse judicial, administrative, or arbitral rulings or proceedings, regulatory enforcement actions, or other legal actions to which we or any of our subsidiaries are a party, and which may adversely affect our results. • Our ability to manage fluctuations in the value of assets and liabilities and off-balance sheet exposure so as to maintain sufficient capital and liquidity to support our businesses. • Our ability to execute on our strategic and operational plans, including our ability to fully realize the financial and nonfinancial benefits relating to our strategic initiatives. • The risks and uncertainties related to our acquisition or divestiture of businesses, including our recently completed acquisitions of EnerBank, Sabal, and Clearsight, and risks related to such acquisitions, including that the expected synergies, cost savings and other financial or other benefits may not be realized within the expected timeframes, or might be less than projected; difficulties in integrating the businesses; and the inability of Regions to effectively cross-sell products following these acquisitions. • The success of our marketing efforts in attracting and retaining customers. • Our ability to recruit and retain talented and experienced personnel to assist in the development, management and operation of our products and services may be affected by changes in laws and regulations in effect from time to time. • Fraud or misconduct by our customers, employees or business partners. • Any inaccurate or incomplete information provided to us by our customers or counterparties. • Inability of our framework to manage risks associated with our businesses, such as credit risk and operational risk, including third-party vendors and other service providers, which could, among other things, result in a breach of operating or security systems as a result of a cyber attack or similar act or failure to deliver our services effectively. • Dependence on key suppliers or vendors to obtain equipment and other supplies for our businesses on acceptable terms. • The inability of our internal controls and procedures to prevent, detect or mitigate any material errors or fraudulent acts. • The effects of geopolitical instability, including wars, conflicts, civil unrest, and terrorist attacks and the potential impact, directly or indirectly, on our businesses. • The effects of man-made and natural disasters, including fires, floods, droughts, tornadoes, hurricanes, and environmental damage (specifically in the Southeastern United States), which may negatively affect our operations and/or our loan portfolios and increase our cost of conducting business. The severity and frequency of future earthquakes, fires, hurricanes, tornadoes, droughts, floods and other weather-related events are difficult to predict and may be exacerbated by global climate change. • Changes in commodity market prices and conditions could adversely affect the cash flows of our borrowers operating in industries that are impacted by changes in commodity prices (including businesses indirectly impacted by commodities prices such as businesses that transport commodities or manufacture equipment used in the production of commodities), which could impair their ability to service any loans outstanding to them and/or reduce demand for loans in those industries. • Our ability to identify and address cyber-security risks such as data security breaches, malware, ransomware, “denial of service” attacks, “hacking” and identity theft, including account take-overs, a failure of which could disrupt our businesses and result in the disclosure of and/or misuse or misappropriation of confidential or proprietary information, disruption or damage to our systems, increased costs, losses, or adverse effects to our reputation. • Our ability to achieve our expense management initiatives. Forward-looking statements (continued)

13 • Market replacement of LIBOR and the related effect on our LIBOR-based financial products and contracts, including, but not limited to, derivative products, debt obligations, deposits, investments, and loans. • Possible downgrades in our credit ratings or outlook could, among other negative impacts, increase the costs of funding from capital markets. • The effects of problems encountered by other financial institutions that adversely affect us or the banking industry generally could require us to change certain business practices, reduce our revenue, impose additional costs on us, or otherwise negatively affect our businesses. • The effects of the failure of any component of our business infrastructure provided by a third party could disrupt our businesses, result in the disclosure of and/or misuse of confidential information or proprietary information, increase our costs, negatively affect our reputation, and cause losses. • Our ability to receive dividends from our subsidiaries, in particular Regions Bank, could affect our liquidity and ability to pay dividends to shareholders. • Changes in accounting policies or procedures as may be required by the FASB or other regulatory agencies could materially affect our financial statements and how we report those results, and expectations and preliminary analyses relating to how such changes will affect our financial results could prove incorrect. • Fluctuations in the price of our common stock and inability to complete stock repurchases in the time frame and/or on the terms anticipated. • The effects of anti-takeover and exclusive forum laws and provision in our certificate of incorporation and bylaws. • The effects of any damage to our reputation resulting from developments related to any of the items identified above. • Other risks identified from time to time in reports that we file with the SEC. The foregoing list of factors is not exhaustive. For discussion of these and other factors that may cause actual results to differ from expectations, look under the captions “Forward-Looking Statements” and “Risk Factors” of Regions’ Annual Report on Form 10-K for the year ended December 31, 2021 and the “Risk Factors” of Regions’ Quarterly Reports on Form 10-Q for the subsequent quarters of 2022, as filed with the SEC. Forward-looking statements are subject to the risk that the actual effects may differ, possibly materially, from what is reflected in those forward-looking statements due to factors and future developments that are uncertain, unpredictable and in many cases beyond our control, including the scope and duration of the COVID-19 pandemic (including the impact of additional variants and resurgences), the effectiveness, availability and acceptance of any vaccines or therapies, and the direct and indirect impact of the COVID-19 pandemic on our customers, third parties and us. The words “future,” “anticipates,” “assumes,” “intends,” “plans,” “seeks,” “believes,” “predicts,” “potential,” “objectives,” “estimates,” “expects,” “targets,” “projects,” “outlook,” “forecast,” “would,” “will,” “may,” “might,” “could,” “should,” “can,” and similar terms and expressions often signify forward-looking statements. You should not place undue reliance on any forward-looking statements, which speak only as of the date made. Factors or events that could cause our actual results to differ may emerge from time to time, and it is not possible to predict all of them. We assume no obligation and do not intend to update or revise any forward-looking statements that are made from time to time, either as a result of future developments, new information or otherwise, except as may be required by law. Regions’ Investor Relations contact is Dana Nolan at (205) 264-7040; Regions’ Media contact is Jeremy King at (205) 264-4551. Forward-looking statements (continued)

14 ®