Exhibit 99.3 4th Quarter Earnings Conference Call January 20, 2023

2 2022 overview Continue to generate consistent, sustainable long-term performance (1) Non-GAAP, see appendix for reconciliation. (2) Peer banks include: CFG, CMA, FHN, FITB, HBAN, HWC, KEY, MTB, SNV, PNC, TFC, USB, and ZION. Key Performance Metrics 4Q22 FY22 Reported Adjusted(1) Reported Adjusted(1) Net Income Available to Common Shareholders $660M $2.1B Diluted Earnings Per Share $0.70 $2.28 Total Revenue $2.0B $2.0B $7.2B $7.2B Non-Interest Expense $1.0B $1.0B $4.1B $3.9B Pre-Tax Pre-Provision Income(1) $984M $939M $3.1B $3.3B Efficiency Ratio 50.5% 51.6% 56.0% 53.9% Net-Charge Offs 0.29% 0.29% 0.29% 0.22% Highlights • Both reported and adjusted FY PPI(1) represent highest level on record • 4Q NII grew to a record $1.4B • Reported 4Q NIM increased 46 bps to 3.99%, highest level in last 15 years • Implemented additional OD policy enhancements benefiting customers • Asset sensitive profile supports strong QoQ margin expansion • Produced robust YTD average Commercial and Consumer loan growth • Continued focus on disciplined capital allocation and risk-adjusted returns • Top quartile returns on ROATCE and 1 & 3 year TSR(2)

3 (1) October 2022 vs 2021. (2) Quality Relationships defined as having a cumulative $500K in loans, deposits and IM&T accounts, revenue per Quality Relationship measured over TTM, Nov '22 vs Dec '21. (3) Retention of IM&T revenue vs baseline. Investments in our businesses Investments in talent, technology and strategic acquisitions continue to pay off CORPORATE CONSUMER WEALTH Mobile users increased 5.7% YoY Growth in revenue per quality relationship(2) of 14.5% Sabal closed +$730M loans in 2022, FNMA small balance origination volume doubled Better use of data contributing to strong PWM retention rate(3) of 93% Industry leading Customer Satisfaction and primacy levels 40% of all PWM Clients have a Wealth Plan, allowing us to help them focus on their unique goals Ascentium Capital experienced record 2022 loan production, up 25% YoY Completed $13B UPB MSRs bulk purchases & continue to purchase MSRs on a flow basis Upgraded mortgage contact relationship management platform EnerBank generating high quality loans; synergy work ongoing Investment Services average monthly revenue up 17%, over PY Strong Client Satisfaction and Associate Engagement scores Record 2022 non- interest income reflecting growth of 9.2% vs PY Treasury Management client base grew 11.5% YoY(1); 2022 Revenue grew 10% achieving new record Significantly improved closing time on home equity productsMigrated iTreasury to modern platform & launched Real-Time Payment send capabilities Top talent acquisition in key areas: SBA, Franchise, New Markets Tax Credits & Equip. Finance Enhanced origination productivity: BUILT, Blooma, & nCino; Continued expansion of Regions Client IQ (RCLIQ)

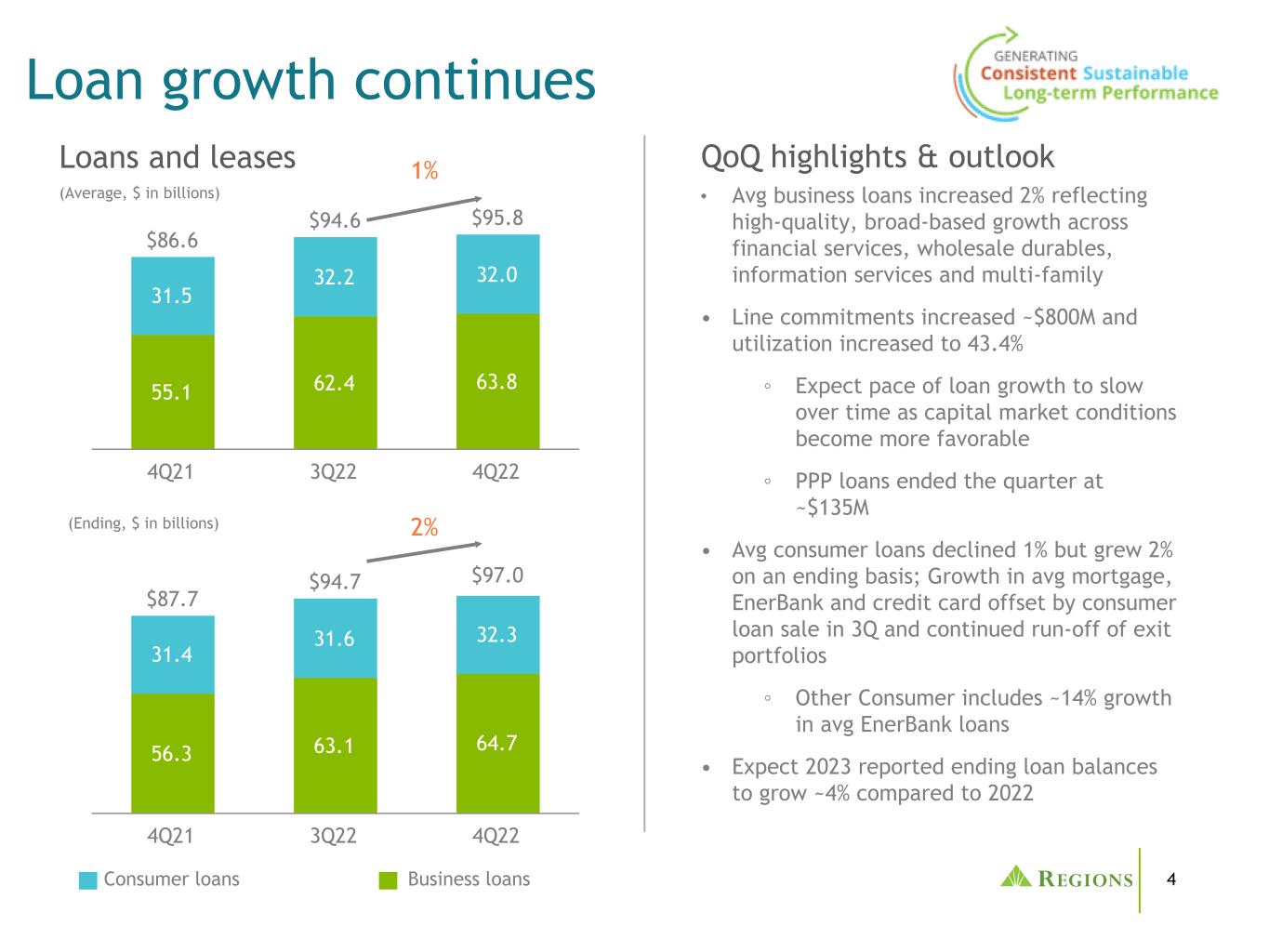

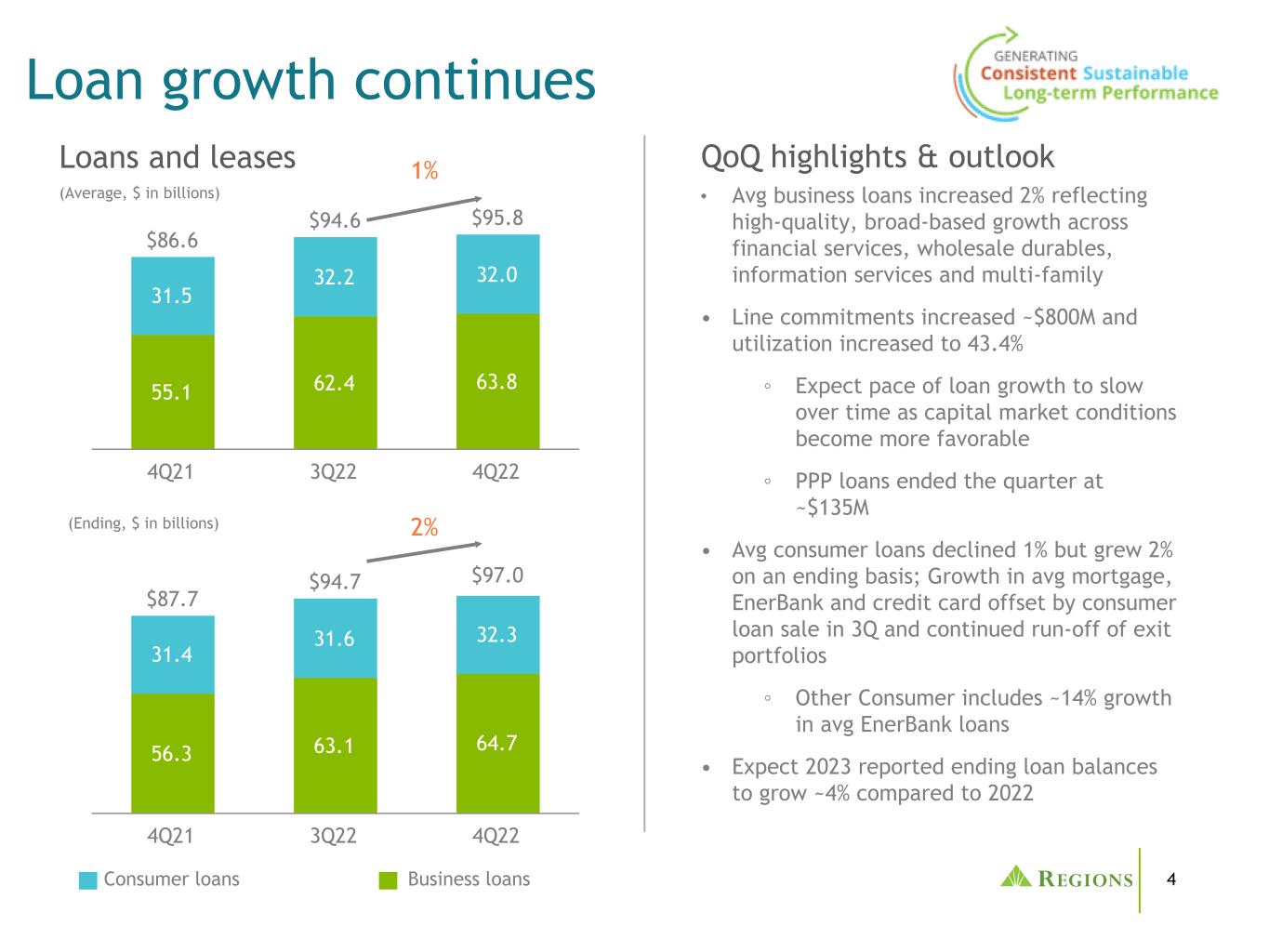

4 • Avg business loans increased 2% reflecting high-quality, broad-based growth across financial services, wholesale durables, information services and multi-family • Line commitments increased ~$800M and utilization increased to 43.4% ◦ Expect pace of loan growth to slow over time as capital market conditions become more favorable ◦ PPP loans ended the quarter at ~$135M • Avg consumer loans declined 1% but grew 2% on an ending basis; Growth in avg mortgage, EnerBank and credit card offset by consumer loan sale in 3Q and continued run-off of exit portfolios ◦ Other Consumer includes ~14% growth in avg EnerBank loans • Expect 2023 reported ending loan balances to grow ~4% compared to 2022 Loan growth continues $87.7 $94.7 $97.0 56.3 63.1 64.7 31.4 31.6 32.3 4Q21 3Q22 4Q22 (Ending, $ in billions) $86.6 $94.6 $95.8 55.1 62.4 63.8 31.5 32.2 32.0 4Q21 3Q22 4Q22 Loans and leases (Average, $ in billions) Business loansConsumer loans 1% 2% QoQ highlights & outlook

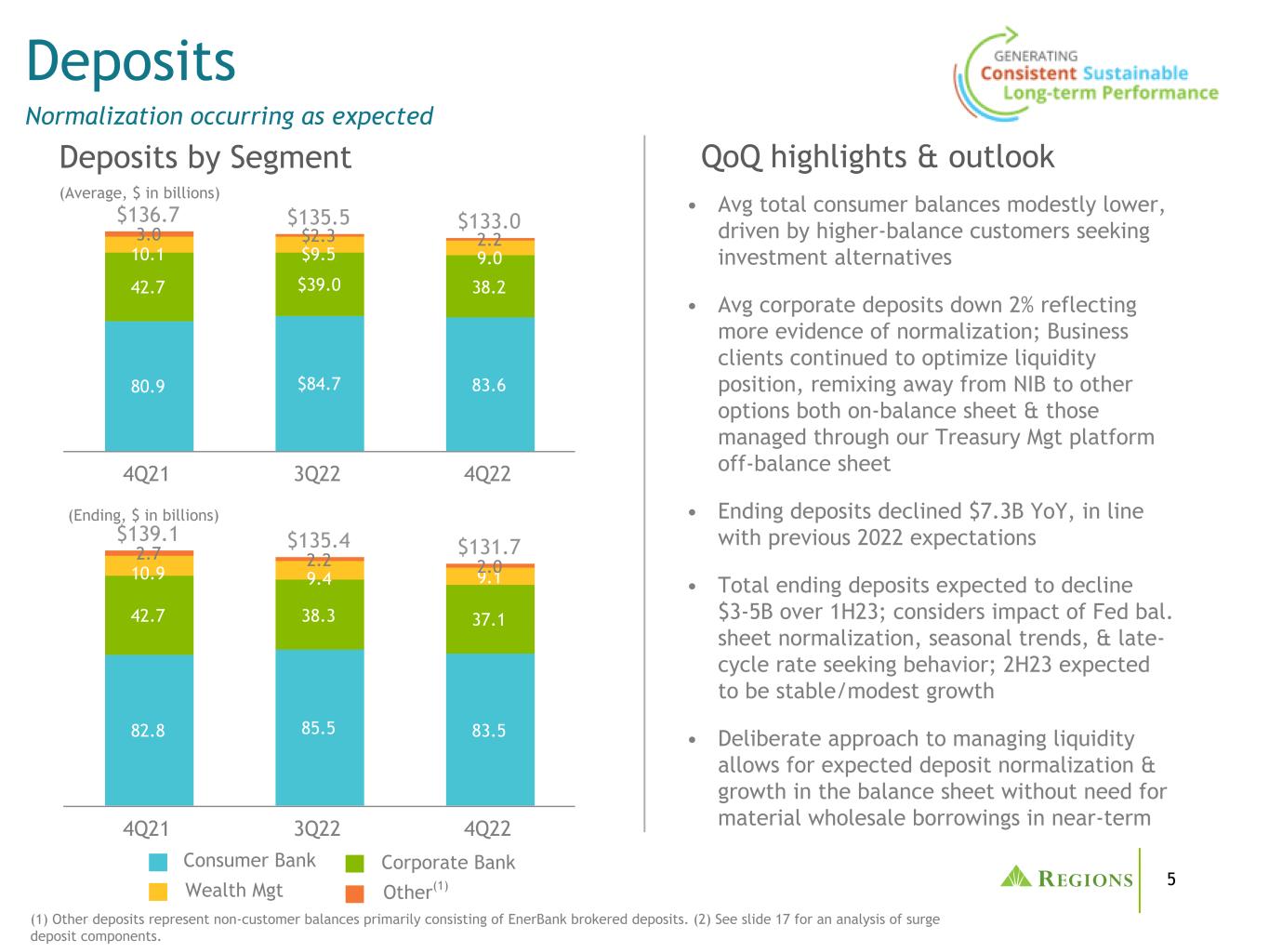

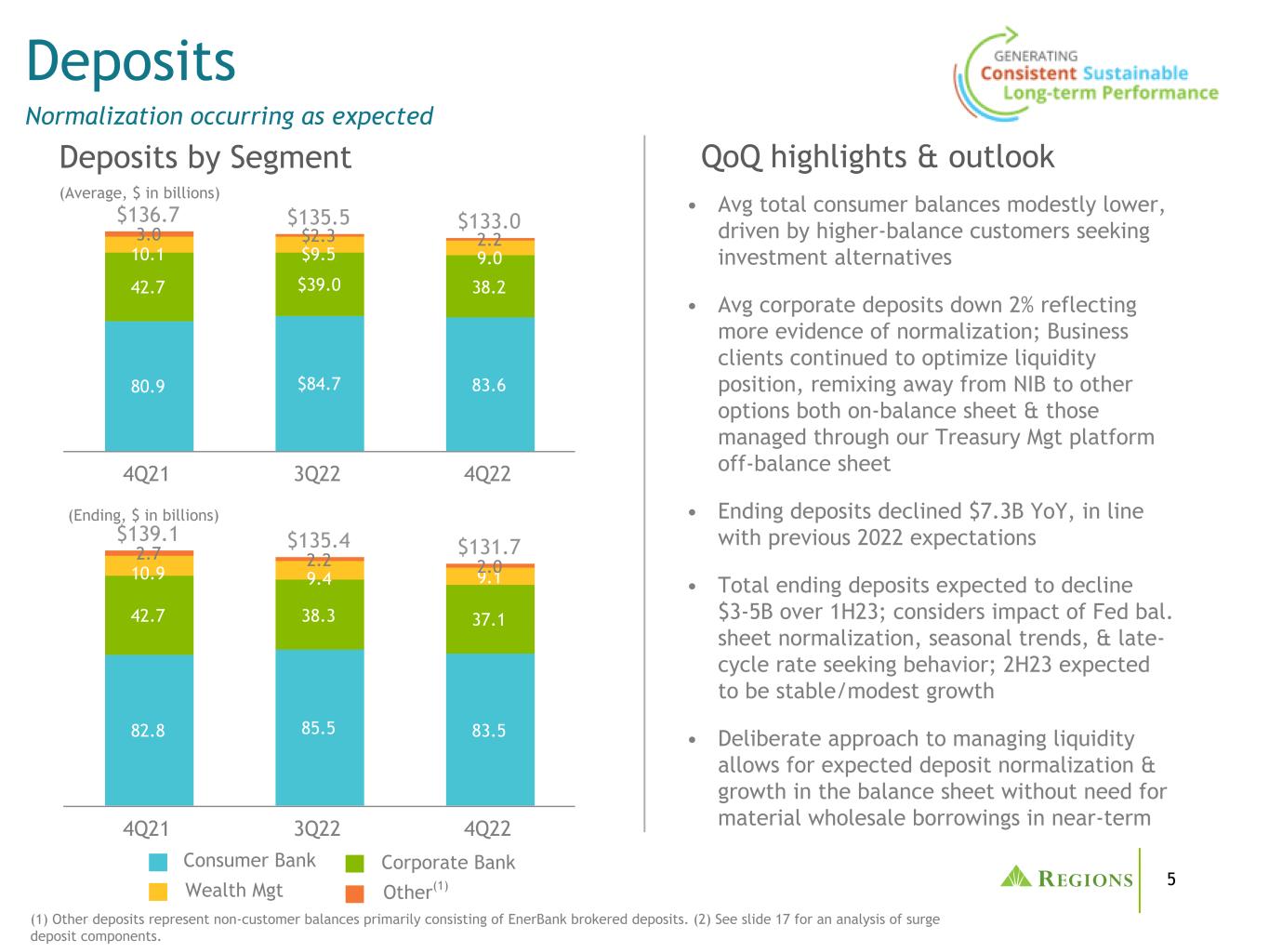

5 $139.1 $135.4 $131.7 82.8 85.5 83.5 42.7 38.3 37.1 10.9 9.4 9.1 2.7 2.2 2.0 4Q21 3Q22 4Q22 $136.7 $135.5 $133.0 80.9 $84.7 83.6 42.7 $39.0 38.2 10.1 $9.5 9.0 3.0 $2.3 2.2 4Q21 3Q22 4Q22 Deposits Normalization occurring as expected (1) Other deposits represent non-customer balances primarily consisting of EnerBank brokered deposits. (2) See slide 17 for an analysis of surge deposit components. Wealth Mgt Other(1) Consumer Bank Corporate Bank QoQ highlights & outlook • Avg total consumer balances modestly lower, driven by higher-balance customers seeking investment alternatives • Avg corporate deposits down 2% reflecting more evidence of normalization; Business clients continued to optimize liquidity position, remixing away from NIB to other options both on-balance sheet & those managed through our Treasury Mgt platform off-balance sheet • Ending deposits declined $7.3B YoY, in line with previous 2022 expectations • Total ending deposits expected to decline $3-5B over 1H23; considers impact of Fed bal. sheet normalization, seasonal trends, & late- cycle rate seeking behavior; 2H23 expected to be stable/modest growth • Deliberate approach to managing liquidity allows for expected deposit normalization & growth in the balance sheet without need for material wholesale borrowings in near-term (Ending, $ in billions) Deposits by Segment (Average, $ in billions)

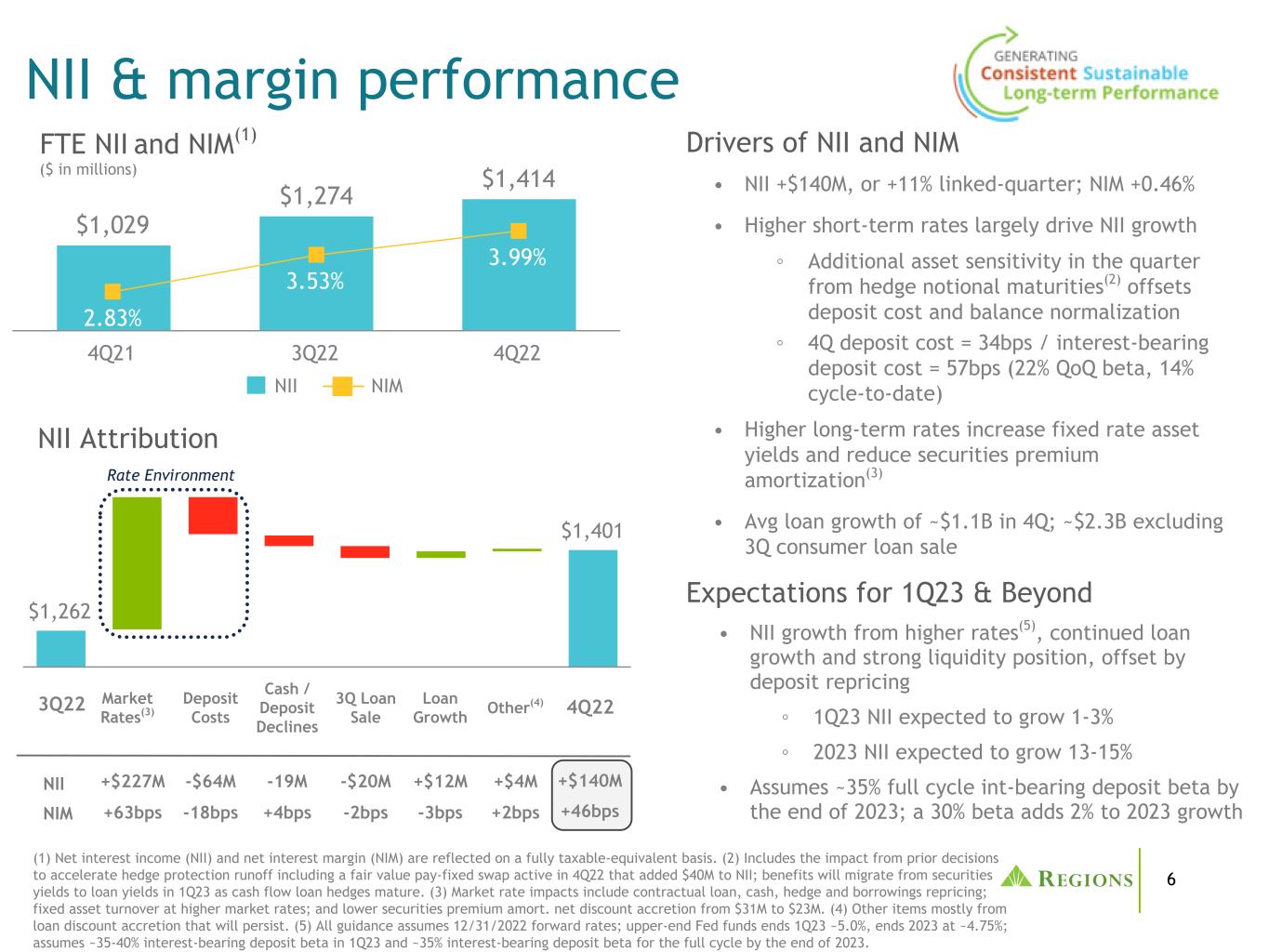

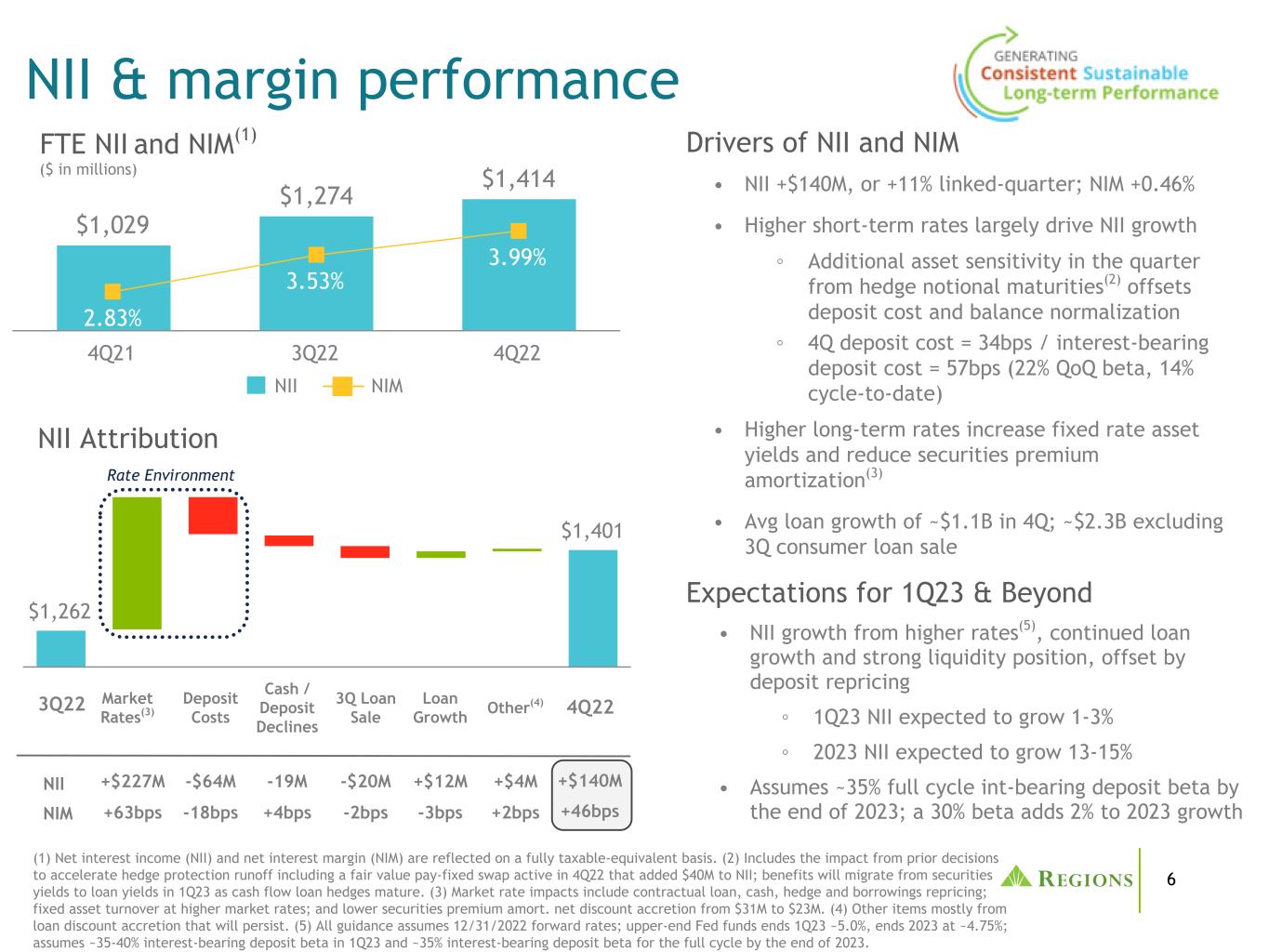

6 • NII +$140M, or +11% linked-quarter; NIM +0.46% • Higher short-term rates largely drive NII growth ◦ Additional asset sensitivity in the quarter from hedge notional maturities(2) offsets deposit cost and balance normalization ◦ 4Q deposit cost = 34bps / interest-bearing deposit cost = 57bps (22% QoQ beta, 14% cycle-to-date) • Higher long-term rates increase fixed rate asset yields and reduce securities premium amortization(3) • Avg loan growth of ~$1.1B in 4Q; ~$2.3B excluding 3Q consumer loan sale Market Rates(3) (1) Net interest income (NII) and net interest margin (NIM) are reflected on a fully taxable-equivalent basis. (2) Includes the impact from prior decisions to accelerate hedge protection runoff including a fair value pay-fixed swap active in 4Q22 that added $40M to NII; benefits will migrate from securities yields to loan yields in 1Q23 as cash flow loan hedges mature. (3) Market rate impacts include contractual loan, cash, hedge and borrowings repricing; fixed asset turnover at higher market rates; and lower securities premium amort. net discount accretion from $31M to $23M. (4) Other items mostly from loan discount accretion that will persist. (5) All guidance assumes 12/31/2022 forward rates; upper-end Fed funds ends 1Q23 ~5.0%, ends 2023 at ~4.75%; assumes ~35-40% interest-bearing deposit beta in 1Q23 and ~35% interest-bearing deposit beta for the full cycle by the end of 2023. $1,262 $1,401 NII Attribution Drivers of NII and NIM 4Q22 3Q22 -18bps -3bps +2bps+63bps -$64M +$12M +$4M+$227MNII NIM NII & margin performance Other(4) -19M +4bps Rate Environment $1,029 $1,274 $1,414 2.83% 3.53% 3.99% 4Q21 3Q22 4Q22 Expectations for 1Q23 & Beyond • NII growth from higher rates(5), continued loan growth and strong liquidity position, offset by deposit repricing ◦ 1Q23 NII expected to grow 1-3% ◦ 2023 NII expected to grow 13-15% • Assumes ~35% full cycle int-bearing deposit beta by the end of 2023; a 30% beta adds 2% to 2023 growth NII FTE NII and NIM(1) ($ in millions) NIM Deposit Costs Cash / Deposit Declines 3Q Loan Sale Loan Growth -$20M -2bps +$140M +46bps

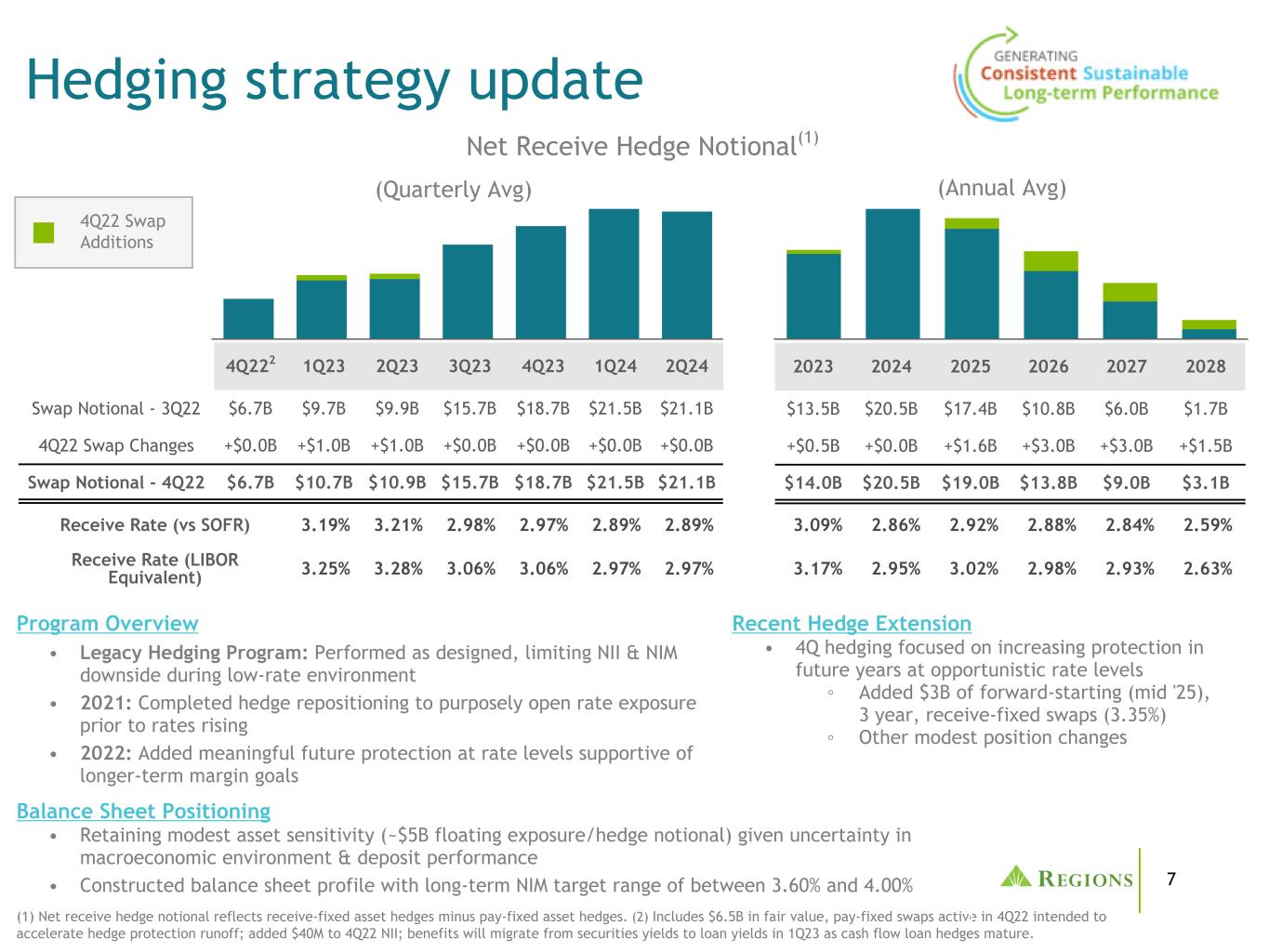

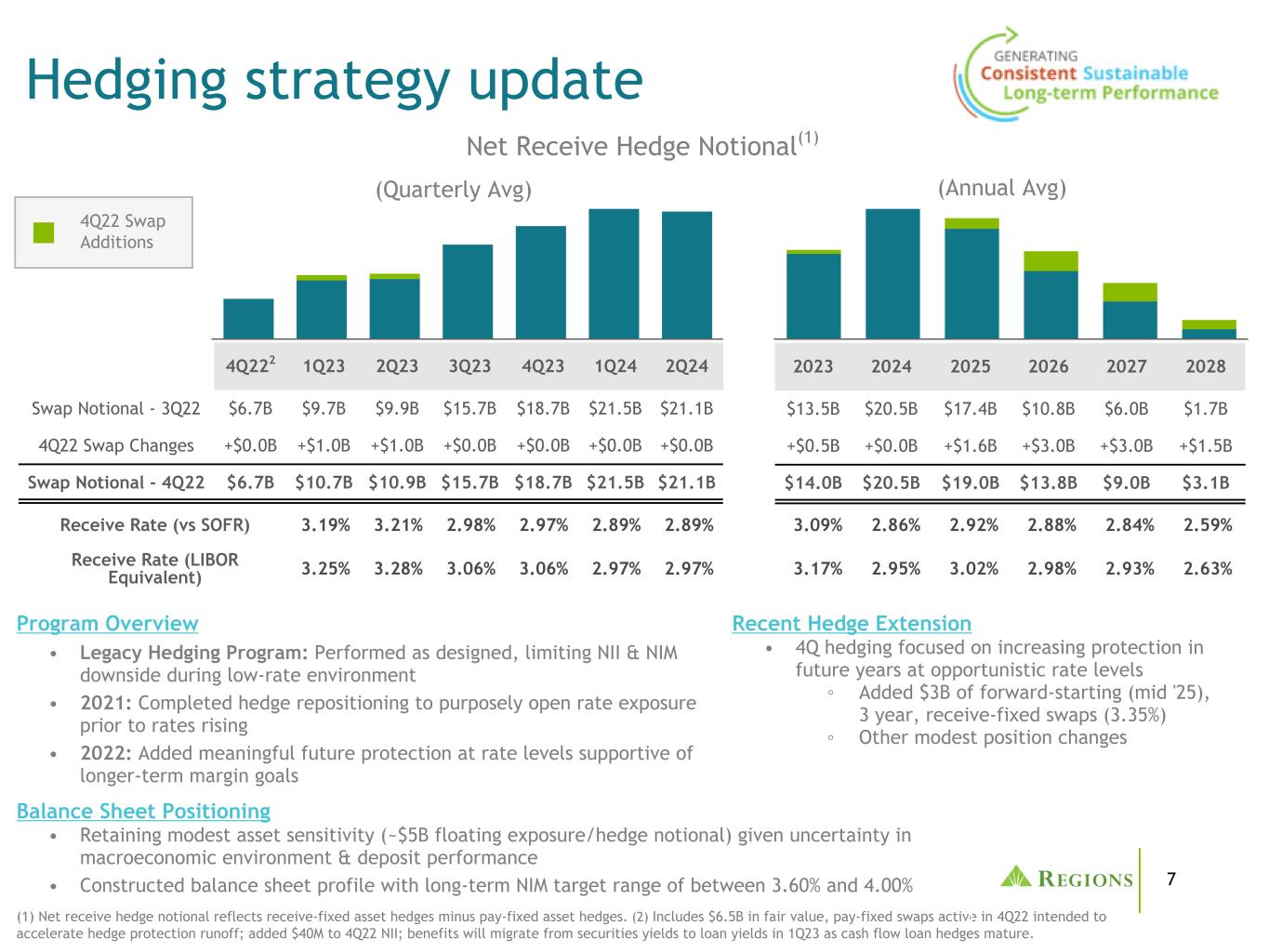

7 1 2 3 4 5 6 7 Program Overview • Legacy Hedging Program: Performed as designed, limiting NII & NIM downside during low-rate environment • 2021: Completed hedge repositioning to purposely open rate exposure prior to rates rising • 2022: Added meaningful future protection at rate levels supportive of longer-term margin goals Net Receive Hedge Notional(1) (1) Net receive hedge notional reflects receive-fixed asset hedges minus pay-fixed asset hedges. (2) Includes $6.5B in fair value, pay-fixed swaps active in 4Q22 intended to accelerate hedge protection runoff; added $40M to 4Q22 NII; benefits will migrate from securities yields to loan yields in 1Q23 as cash flow loan hedges mature. Hedging strategy update (Quarterly Avg) 1 2 3 4 5 62023 2024 2025 2026 2027 2028 $13.5B $20.5B $17.4B $10.8B $6.0B $1.7B +$0.5B +$0.0B +$1.6B +$3.0B +$3.0B +$1.5B $14.0B $20.5B $19.0B $13.8B $9.0B $3.1B 3.09% 2.86% 2.92% 2.88% 2.84% 2.59% 3.17% 2.95% 3.02% 2.98% 2.93% 2.63% (Annual Avg) Recent Hedge Extension • 4Q hedging focused on increasing protection in future years at opportunistic rate levels ◦ Added $3B of forward-starting (mid '25), 3 year, receive-fixed swaps (3.35%) ◦ Other modest position changes 4Q222 1Q23 2Q23 3Q23 4Q23 1Q24 2Q24 Swap Notional - 3Q22 $6.7B $9.7B $9.9B $15.7B $18.7B $21.5B $21.1B 4Q22 Swap Changes +$0.0B +$1.0B +$1.0B +$0.0B +$0.0B +$0.0B +$0.0B Swap Notional - 4Q22 $6.7B $10.7B $10.9B $15.7B $18.7B $21.5B $21.1B 4Q22 Swap Additions Receive Rate (vs SOFR) 3.19% 3.21% 2.98% 2.97% 2.89% 2.89% Receive Rate (LIBOR Equivalent) 3.25% 3.28% 3.06% 3.06% 2.97% 2.97% Balance Sheet Positioning • Retaining modest asset sensitivity (~$5B floating exposure/hedge notional) given uncertainty in macroeconomic environment & deposit performance • Constructed balance sheet profile with long-term NIM target range of between 3.60% and 4.00%

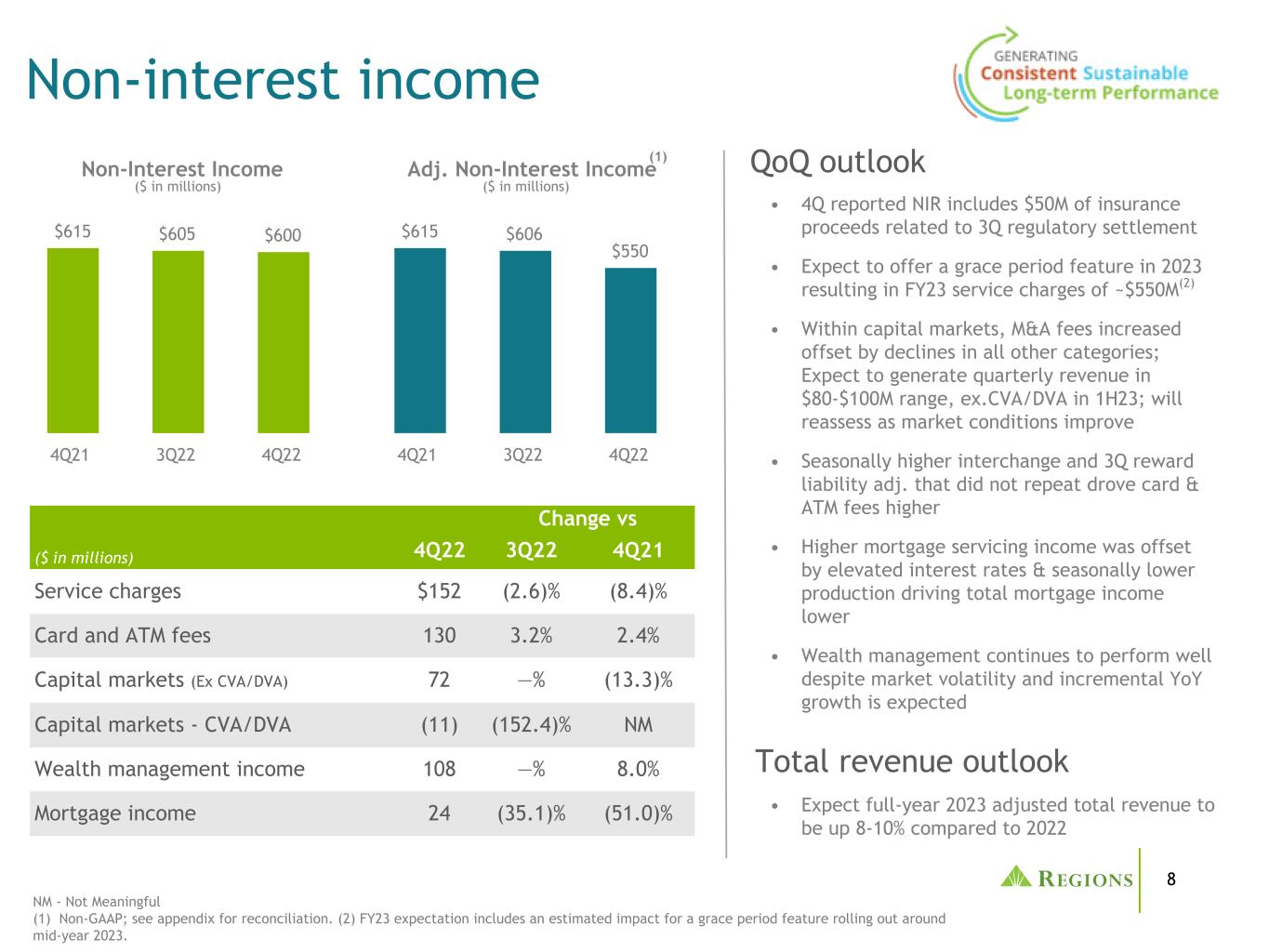

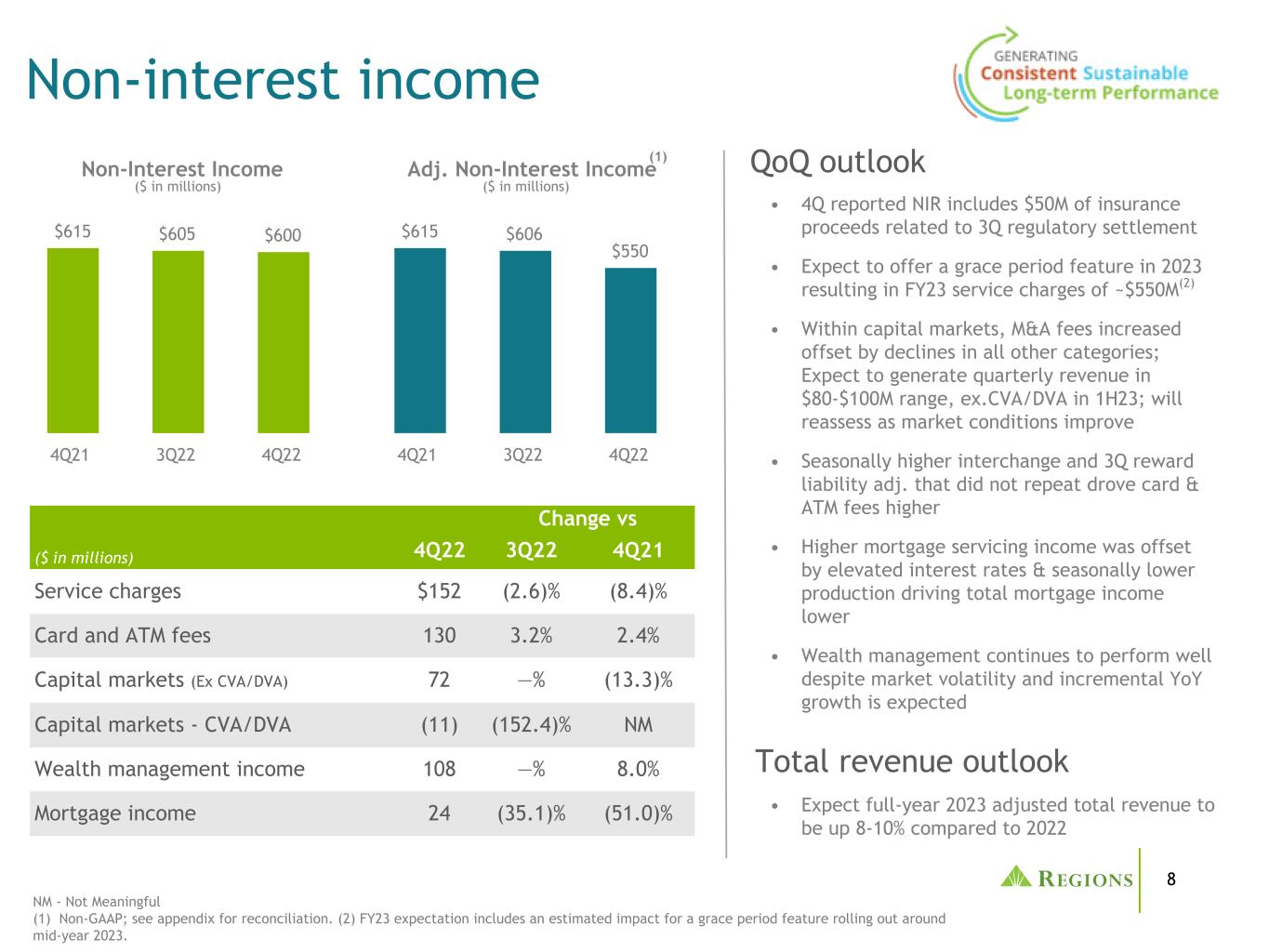

8 Adj. Non-Interest Income $615 $606 $550 4Q21 3Q22 4Q22 Change vs ($ in millions) 4Q22 3Q22 4Q21 Service charges $152 (2.6)% (8.4)% Card and ATM fees 130 3.2% 2.4% Capital markets (Ex CVA/DVA) 72 —% (13.3)% Capital markets - CVA/DVA (11) (152.4)% NM Wealth management income 108 —% 8.0% Mortgage income 24 (35.1)% (51.0)% Non-interest income NM - Not Meaningful (1) Non-GAAP; see appendix for reconciliation. (2) FY23 expectation includes an estimated impact for a grace period feature rolling out around mid-year 2023. • Expect full-year 2023 adjusted total revenue to be up 8-10% compared to 2022 QoQ outlook Total revenue outlook • 4Q reported NIR includes $50M of insurance proceeds related to 3Q regulatory settlement • Expect to offer a grace period feature in 2023 resulting in FY23 service charges of ~$550M(2) • Within capital markets, M&A fees increased offset by declines in all other categories; Expect to generate quarterly revenue in $80-$100M range, ex.CVA/DVA in 1H23; will reassess as market conditions improve • Seasonally higher interchange and 3Q reward liability adj. that did not repeat drove card & ATM fees higher • Higher mortgage servicing income was offset by elevated interest rates & seasonally lower production driving total mortgage income lower • Wealth management continues to perform well despite market volatility and incremental YoY growth is expected Non-Interest Income $615 $605 $600 4Q21 3Q22 4Q22 ($ in millions) ($ in millions) (1)

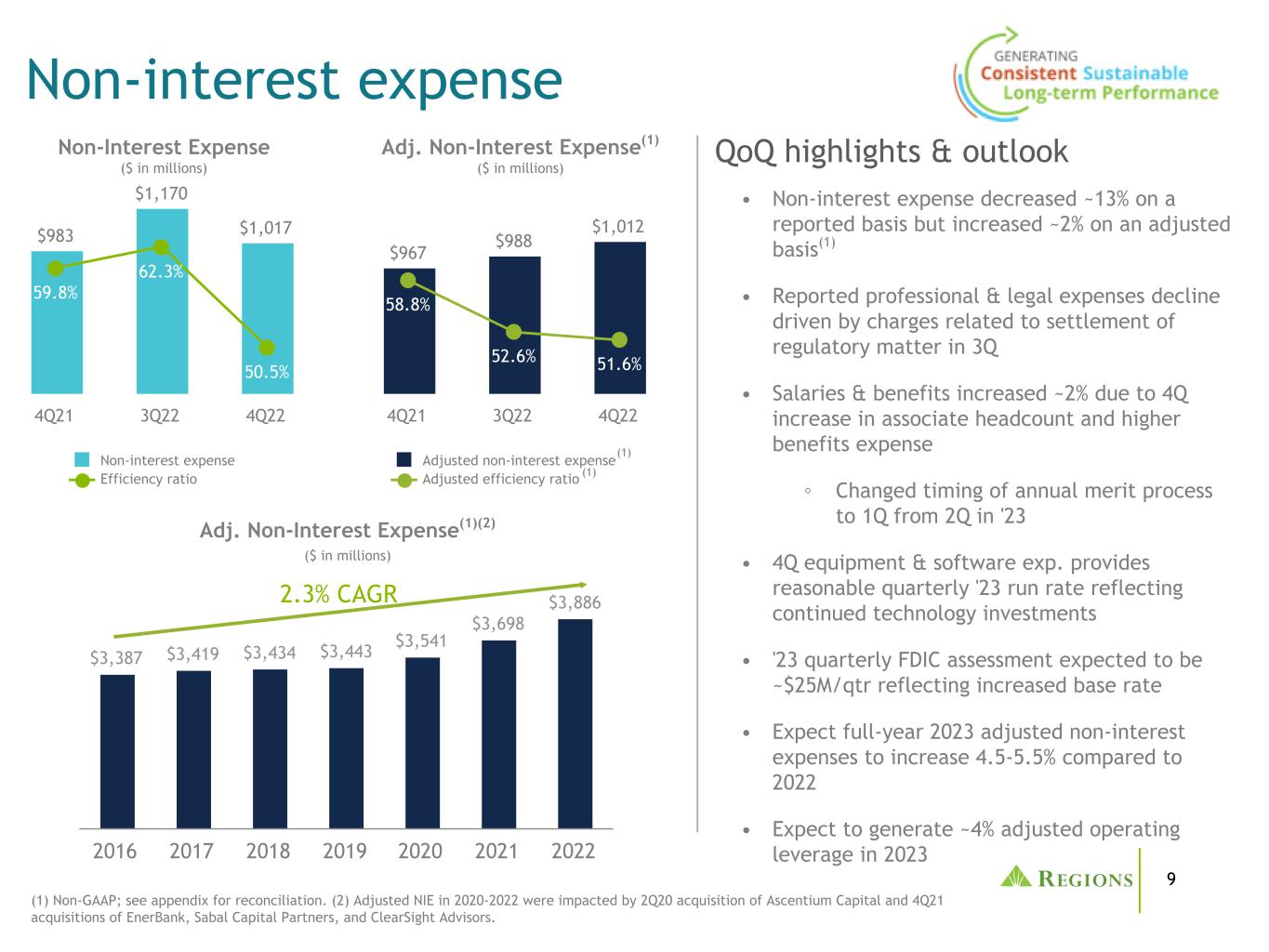

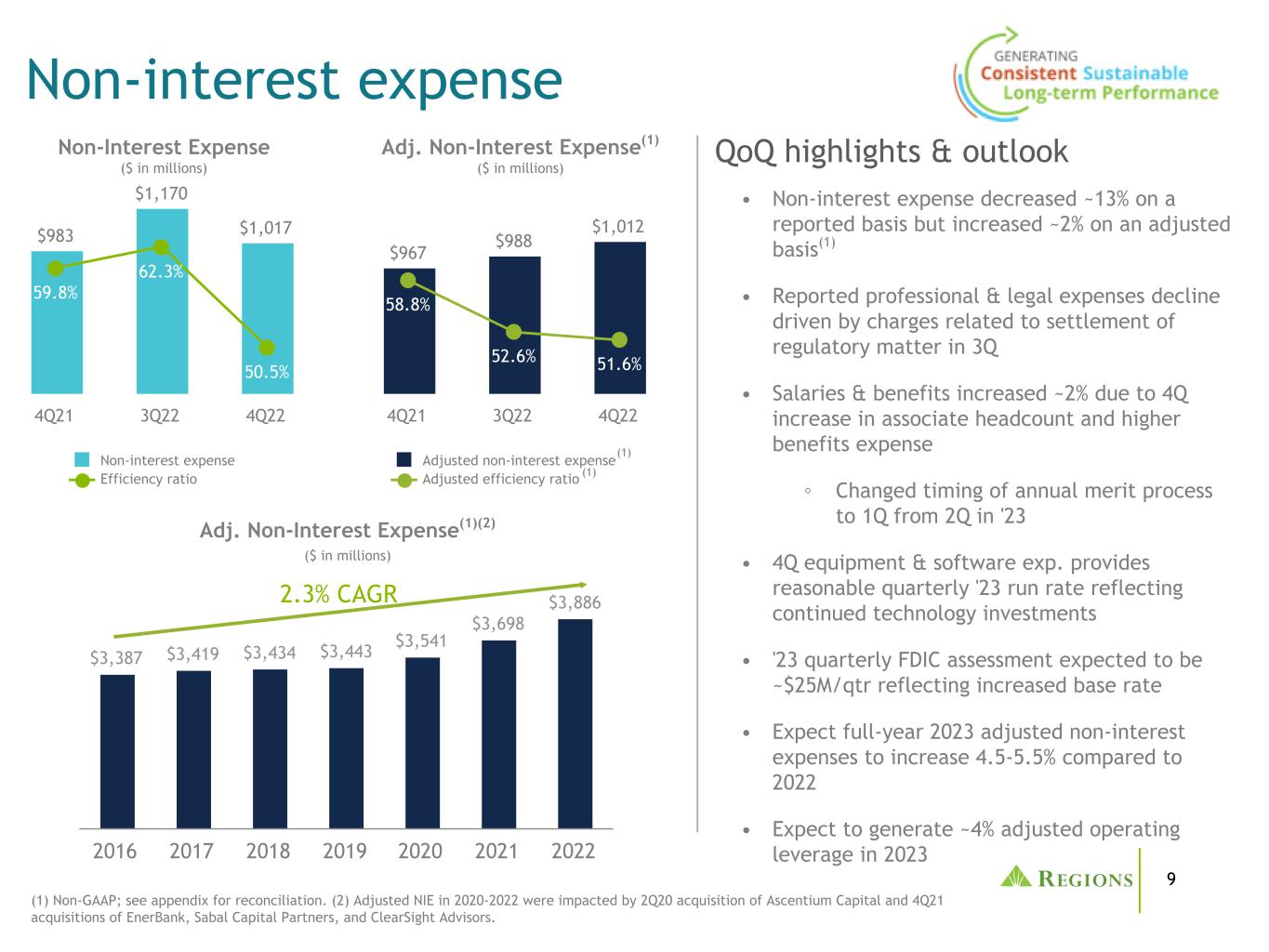

9 $983 $1,170 $1,017 59.8% 62.3% 50.5% Non-interest expense Efficiency ratio 4Q21 3Q22 4Q22 • Non-interest expense decreased ~13% on a reported basis but increased ~2% on an adjusted basis(1) • Reported professional & legal expenses decline driven by charges related to settlement of regulatory matter in 3Q • Salaries & benefits increased ~2% due to 4Q increase in associate headcount and higher benefits expense ◦ Changed timing of annual merit process to 1Q from 2Q in '23 • 4Q equipment & software exp. provides reasonable quarterly '23 run rate reflecting continued technology investments • '23 quarterly FDIC assessment expected to be ~$25M/qtr reflecting increased base rate • Expect full-year 2023 adjusted non-interest expenses to increase 4.5-5.5% compared to 2022 • Expect to generate ~4% adjusted operating leverage in 2023 $967 $988 $1,012 58.8% 52.6% 51.6% Adjusted non-interest expense Adjusted efficiency ratio 4Q21 3Q22 4Q22 $3,387 $3,419 $3,434 $3,443 $3,541 $3,698 $3,886 2016 2017 2018 2019 2020 2021 2022 Non-interest expense QoQ highlights & outlookAdj. Non-Interest Expense(1) ($ in millions) 2.3% CAGR (1) (1) Non-GAAP; see appendix for reconciliation. (2) Adjusted NIE in 2020-2022 were impacted by 2Q20 acquisition of Ascentium Capital and 4Q21 acquisitions of EnerBank, Sabal Capital Partners, and ClearSight Advisors. (1) Non-Interest Expense ($ in millions) Adj. Non-Interest Expense(1)(2) ($ in millions)

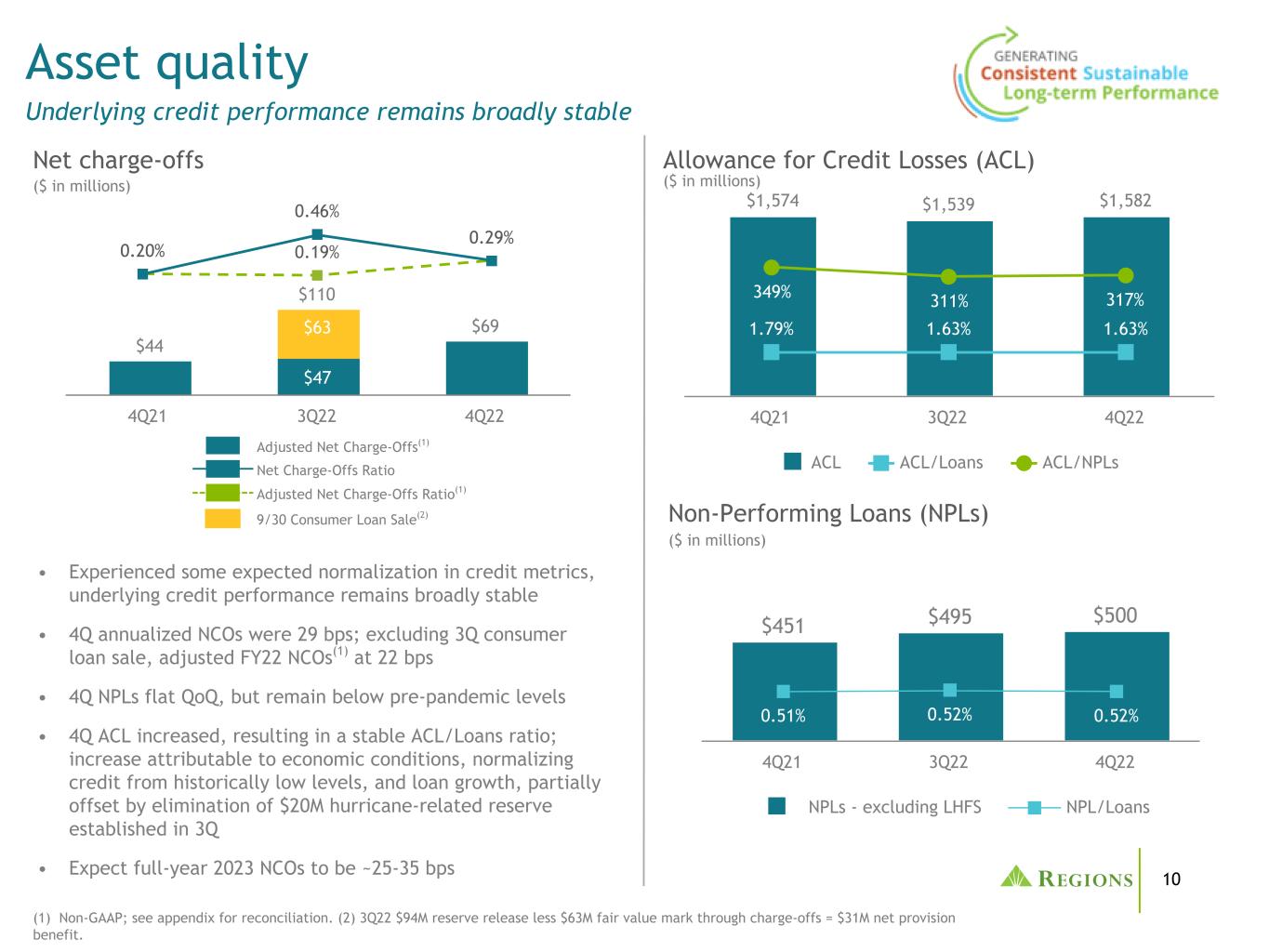

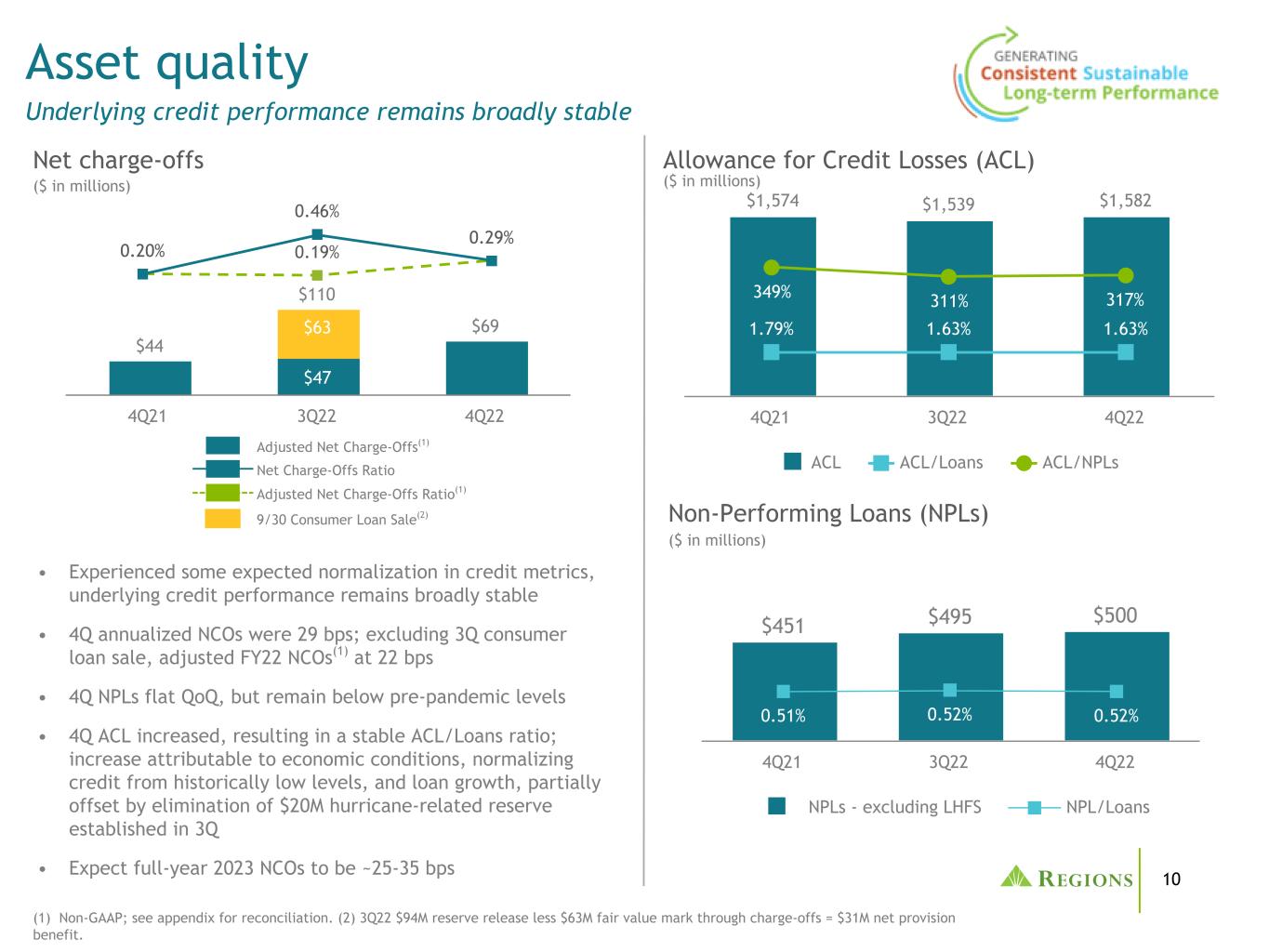

10 • Experienced some expected normalization in credit metrics, underlying credit performance remains broadly stable • 4Q annualized NCOs were 29 bps; excluding 3Q consumer loan sale, adjusted FY22 NCOs(1) at 22 bps • 4Q NPLs flat QoQ, but remain below pre-pandemic levels • 4Q ACL increased, resulting in a stable ACL/Loans ratio; increase attributable to economic conditions, normalizing credit from historically low levels, and loan growth, partially offset by elimination of $20M hurricane-related reserve established in 3Q • Expect full-year 2023 NCOs to be ~25-35 bps Non-Performing Loans (NPLs) Asset quality Underlying credit performance remains broadly stable ($ in millions) ($ in millions) Allowance for Credit Losses (ACL) $1,574 $1,539 $1,582 1.79% 1.63% 1.63% 349% 311% 317% ACL ACL/Loans ACL/NPLs 4Q21 3Q22 4Q22 $44 $110 $69 $47 $63 4Q21 3Q22 4Q22 0.20% 0.19% 0.29% 0.46% (1) Non-GAAP; see appendix for reconciliation. (2) 3Q22 $94M reserve release less $63M fair value mark through charge-offs = $31M net provision benefit. $451 $495 $500 0.51% 0.52% 0.52% NPLs - excluding LHFS NPL/Loans 4Q21 3Q22 4Q22 Net charge-offs ($ in millions) Adjusted Net Charge-Offs(1) 9/30 Consumer Loan Sale(2) Net Charge-Offs Ratio Adjusted Net Charge-Offs Ratio(1)

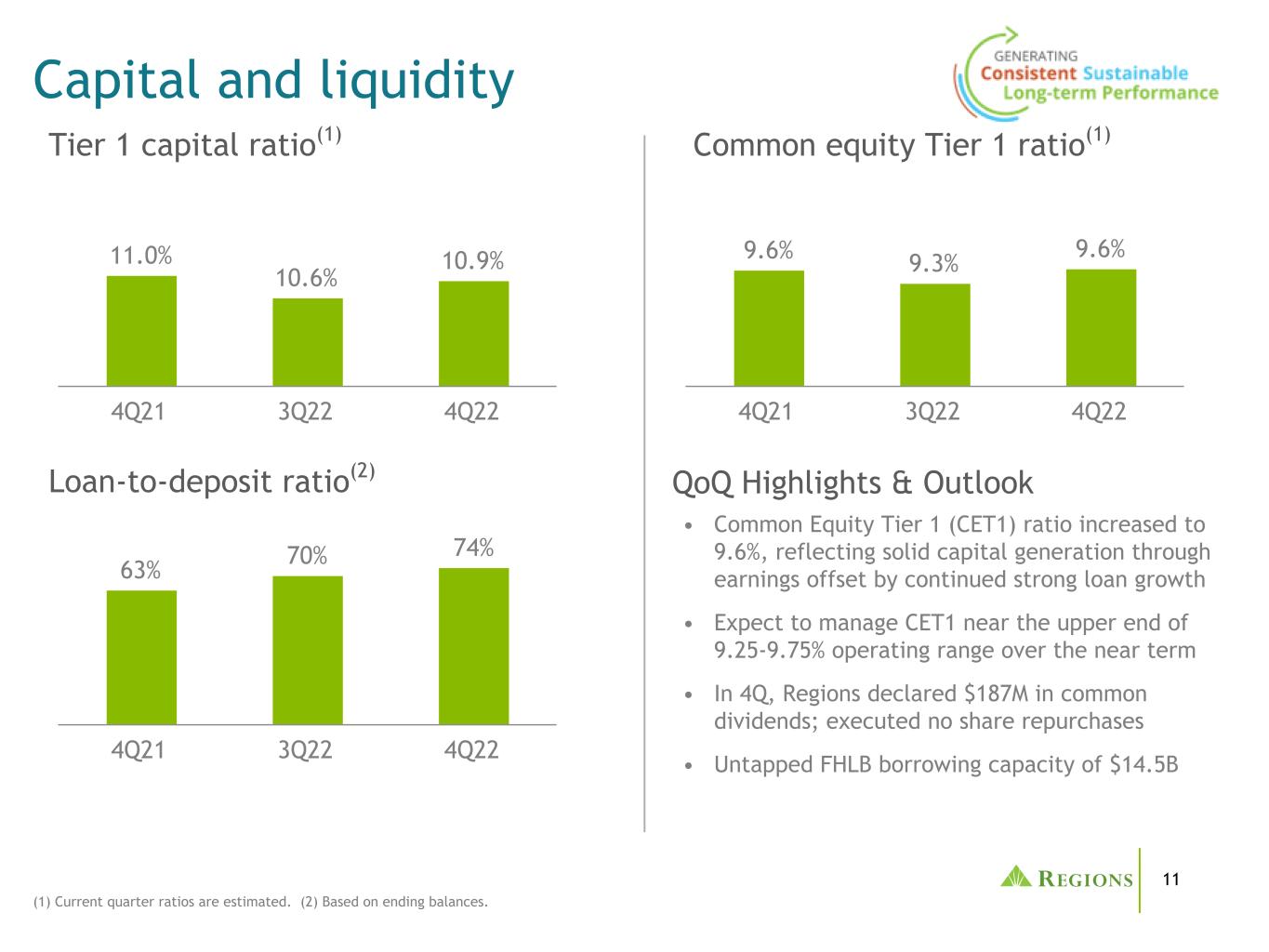

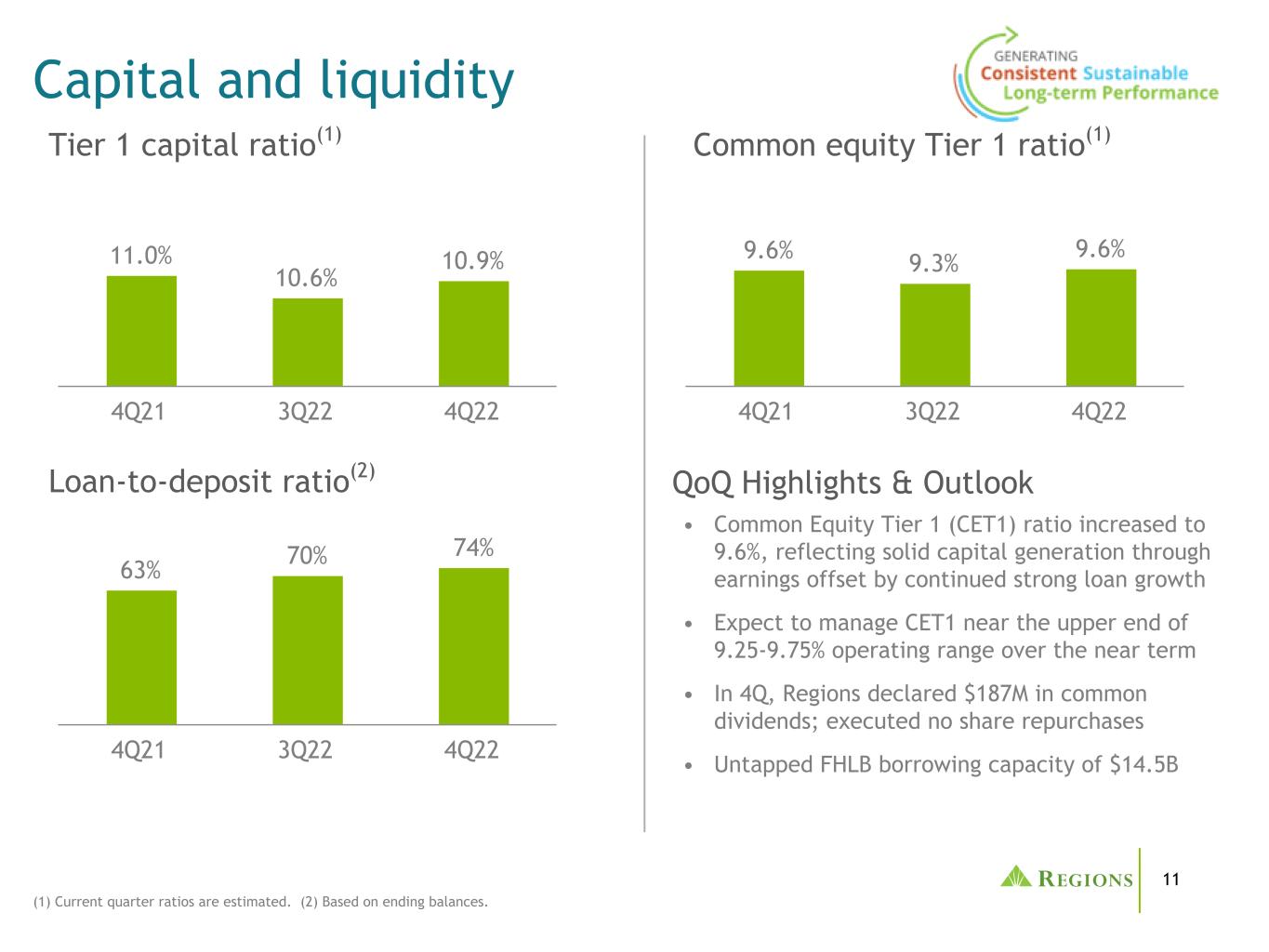

11 9.6% 9.3% 9.6% 4Q21 3Q22 4Q22 • Common Equity Tier 1 (CET1) ratio increased to 9.6%, reflecting solid capital generation through earnings offset by continued strong loan growth • Expect to manage CET1 near the upper end of 9.25-9.75% operating range over the near term • In 4Q, Regions declared $187M in common dividends; executed no share repurchases • Untapped FHLB borrowing capacity of $14.5B QoQ Highlights & Outlook Capital and liquidity (1) Current quarter ratios are estimated. (2) Based on ending balances. 11.0% 10.6% 10.9% 4Q21 3Q22 4Q22 Tier 1 capital ratio(1) Loan-to-deposit ratio(2) 63% 70% 74% 4Q21 3Q22 4Q22 Common equity Tier 1 ratio(1)

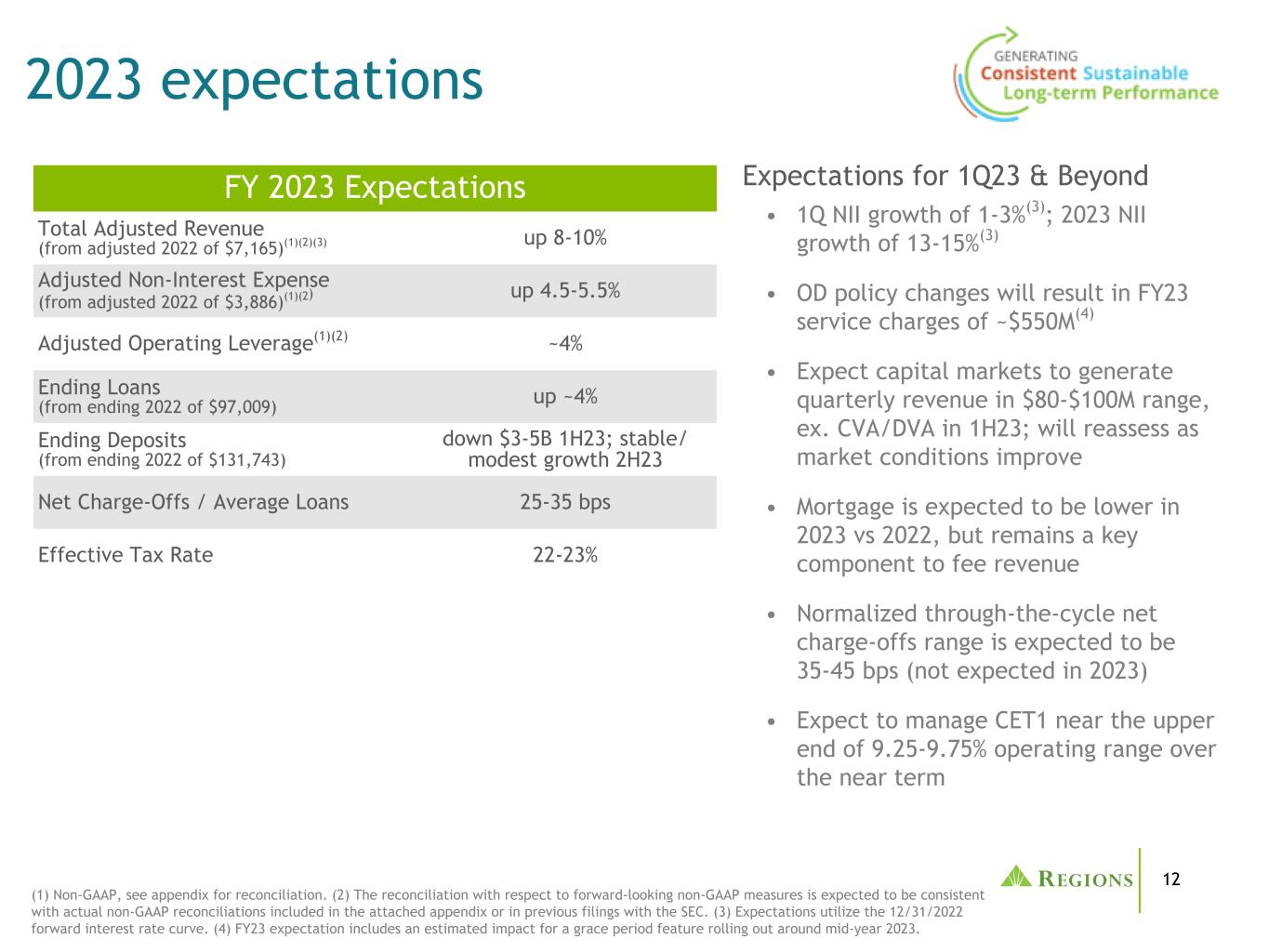

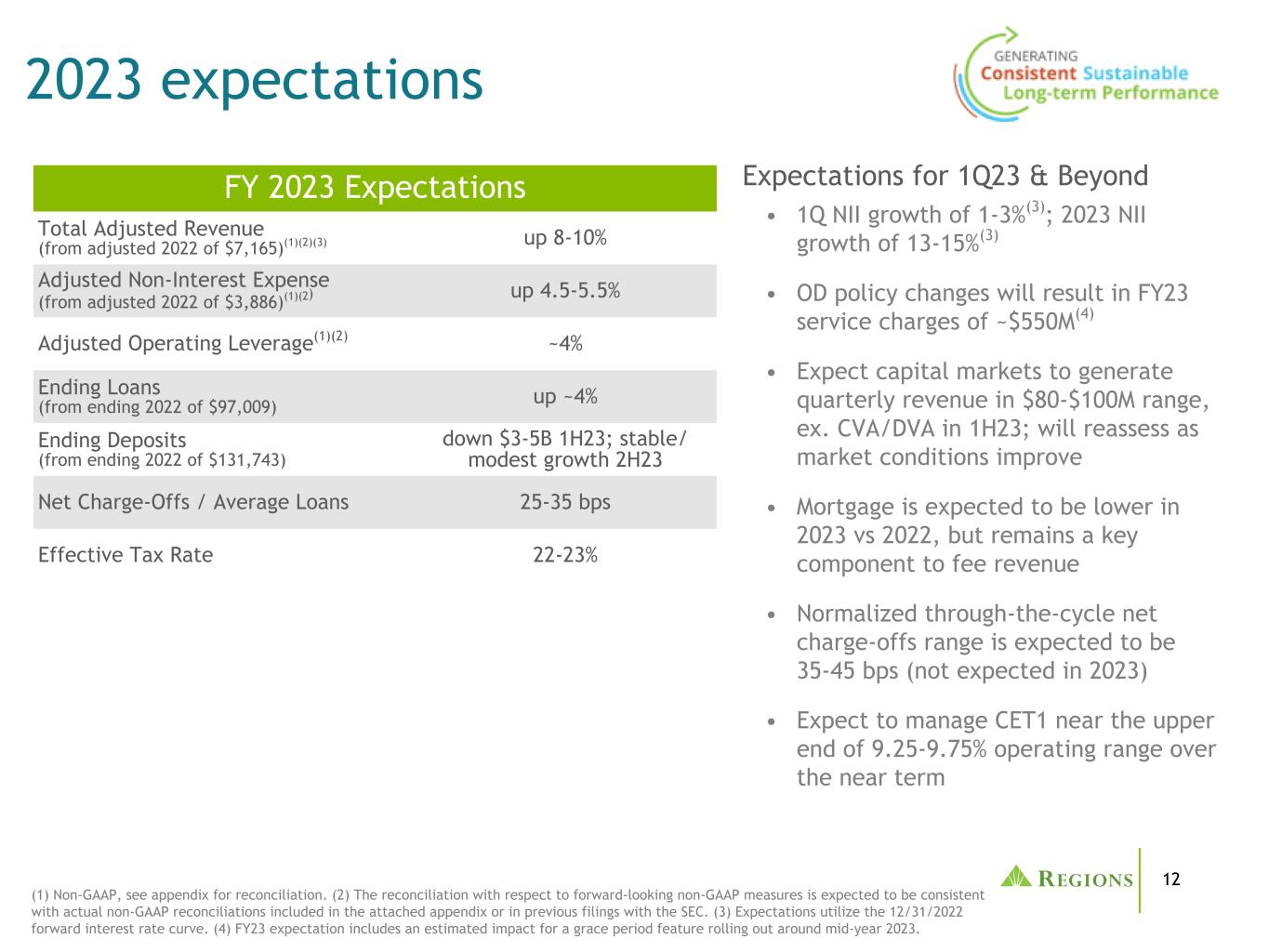

12 2023 expectations (1) Non-GAAP, see appendix for reconciliation. (2) The reconciliation with respect to forward-looking non-GAAP measures is expected to be consistent with actual non-GAAP reconciliations included in the attached appendix or in previous filings with the SEC. (3) Expectations utilize the 12/31/2022 forward interest rate curve. (4) FY23 expectation includes an estimated impact for a grace period feature rolling out around mid-year 2023. FY 2023 Expectations Total Adjusted Revenue (from adjusted 2022 of $7,165)(1)(2)(3) up 8-10% Adjusted Non-Interest Expense (from adjusted 2022 of $3,886)(1)(2) up 4.5-5.5% Adjusted Operating Leverage(1)(2) ~4% Ending Loans (from ending 2022 of $97,009) up ~4% Ending Deposits (from ending 2022 of $131,743) down $3-5B 1H23; stable/ modest growth 2H23 Net Charge-Offs / Average Loans 25-35 bps Effective Tax Rate 22-23% Expectations for 1Q23 & Beyond • 1Q NII growth of 1-3%(3); 2023 NII growth of 13-15%(3) • OD policy changes will result in FY23 service charges of ~$550M(4) • Expect capital markets to generate quarterly revenue in $80-$100M range, ex. CVA/DVA in 1H23; will reassess as market conditions improve • Mortgage is expected to be lower in 2023 vs 2022, but remains a key component to fee revenue • Normalized through-the-cycle net charge-offs range is expected to be 35-45 bps (not expected in 2023) • Expect to manage CET1 near the upper end of 9.25-9.75% operating range over the near term

13 Appendix

14 Selected items impact Fourth quarter 2022 highlights (1) Non-GAAP, see appendix for reconciliation. (2) Based on income taxes at an approximate 25% incremental rate. 3Q22 regulatory settlement included a $50M civil monetary penalty that is not tax deductible. (3) Items impacting results or trends during the period, but are not considered non-GAAP adjustments. These items generally include market-related measures, impacts of new accounting guidance, or event driven actions. (4) 3Q22 net provision benefit of $31M includes a reserve release of $94M offset by a $63M fair value mark through charge-offs. (5) CECL provision in excess of charge-offs excludes the 3Q22 $31M net provision benefit from the sale of unsecured consumer loans and the $20M provision for hurricane-related allowance for loan losses recorded in 3Q22 and released in 4Q22. NM - Not Meaningful ($ amounts in millions, except per share data) 4Q22 QoQ Change YoY Change Net interest income $ 1,401 11.0% 37.5% Provision for (benefit from) credit losses 112 (17.0)% 1.8% Non-interest income 600 (0.8)% (2.4)% Non-interest expense 1,017 (13.1)% 3.5% Income before income taxes 872 55.2% 61.2% Income tax expense 187 40.6% 81.6% Net income 685 59.7% 56.4% Preferred dividends 25 —% 4.2% Net income available to common shareholders $ 660 63.4% 59.4% Diluted EPS $ 0.70 62.8% 62.8% Summary of fourth quarter results (amounts in millions, except per share data) 4Q22 FY 2022 Pre-tax adjusted items(1): Branch consolidation, property and equipment charges $ (5) $ (3) Professional, legal and regulatory expenses — (179) Insurance proceeds 50 50 Securities gains (losses), net — 1 Leveraged lease termination gains — (1) Net provision benefit from sale of unsecured consumer loans(4) — 31 Total pre-tax adjusted items(1) $ 45 $ (101) Diluted EPS impact(2) $ 0.03 $ (0.09) Additional selected items(3): CECL provision (in excess of) less than net charge-offs(5) $ (62) $ (38) Hurricane-related reserve release 20 — Capital markets income - CVA/DVA (11) 36 Residential MSR net hedge performance (6) 2 PPP loan interest/fee income 1 24 Pension settlement charges (6) (6) GNMA re-securitization gain — 12

15 2.04 2.27 2.40 4Q20 4Q21 4Q22 1.79 2.66 3.44 4Q20 4Q21 4Q22149 158 161 4Q20 4Q21 4Q22 2.89 3.18 3.28 4Q20 4Q21 4Q22 20.0% 21.5% 22.3% 33.3% 33.0% 33.0% 46.7% 45.5% 44.7% 4Q20 4Q21 4Q22 64.5 75.8 68.0 53.2 66.2 55.3 11.3 9.6 12.7 Deposits Lending 4Q20 4Q21 4Q22 67% 69% 71% 33% 31% 29% 4Q20 4Q21 4Q22 Growth in digital Mobile Banking Log-Ins (Millions) Customer Transactions(2)(3) Deposit Transactions by Channel +13% Active Users (Millions) Digital Sales (Accounts in Thousands)(1) Digital Banking Digital Non-Digital Mobile ATMBranch (1) Digital sales represent deposit accounts opened and loans booked. Temporary disruption in Digital Deposit Account Opening process in early November resulted in decreases in 4Q22 Digital Deposits sales. (2) Digital transactions represent online and mobile only; Non-digital transactions represent branches, contact centers and ATMs. (3) Transactions represent Consumer customer deposits, transfers, mobile deposits, fee refunds, withdrawals, payments, official checks, bill payments, and Western Union. Excludes ACH and Debit Card purchases/refunds. (4) Includes cross-channel sales capabilities through digital banker dashboard applications launched across our footprint at the end of 2Q21. +93% +8% 21% 22% 22% 76% 76% 76% 3% 2% 2% 4Q20 4Q21 4Q22 Digital BranchContact Center Consumer Checking Sales by Channel(4) Mobile Banking Mobile App Rating Zelle Transactions (Millions)Sales and TransactionsDigital Usage 5.5% +17%

16 Deposit mix and outlook Trends & Outlook Consumer & Wealth • New Customers & Customers with Low Betas in 2019: Customers who had low deposit betas in the 2019 rate cycle (effective annual rate <20bps)(3) and new customers since 2019 have exhibited very stable behavior thus far • Other 2019 Customers: Customers who were relatively more rate sensitive in the prior rate cycle declined modestly in 2022 in response to rapidly rising rates • The large low-sensitive deposit base will likely continue to support advantageous balance and overall rate sensitivity in this cycle • New Relationships & Relationships with Low Betas in 2019: Relationships with annual rate <20bps & new relationships since 2019. This cohort represents the majority of portfolio balances • Other 2019 Relationships: As expected, more rate sensitive customers are normalizing excess and seeking higher rate at a modest pace • Some additional normalization and rate seeking has been expected, but Regions' large proportion of non-interest will foster relative stability through the cycle 12/31/2022 Deposits(1)(2) (Ending, $ in billions) (1) Excludes Wealth Non-Retail deposits (Institutional Trust) of $0.9B and Other segment deposits of $2.0B. (2) Percentage estimates based on mixture at Nov 30 applied to Dec 31 balances. (3) Effective annual rates computed at the end of the 2019 up-rate cycle. 38%62% 80% 20% $37.1B $91.7B Other 2019 Relationships New Relationships & Relationships with Low Betas in 2019 Commercial/Corporate Other 2019 Customers New Customers & Customers with Low Betas in 2019

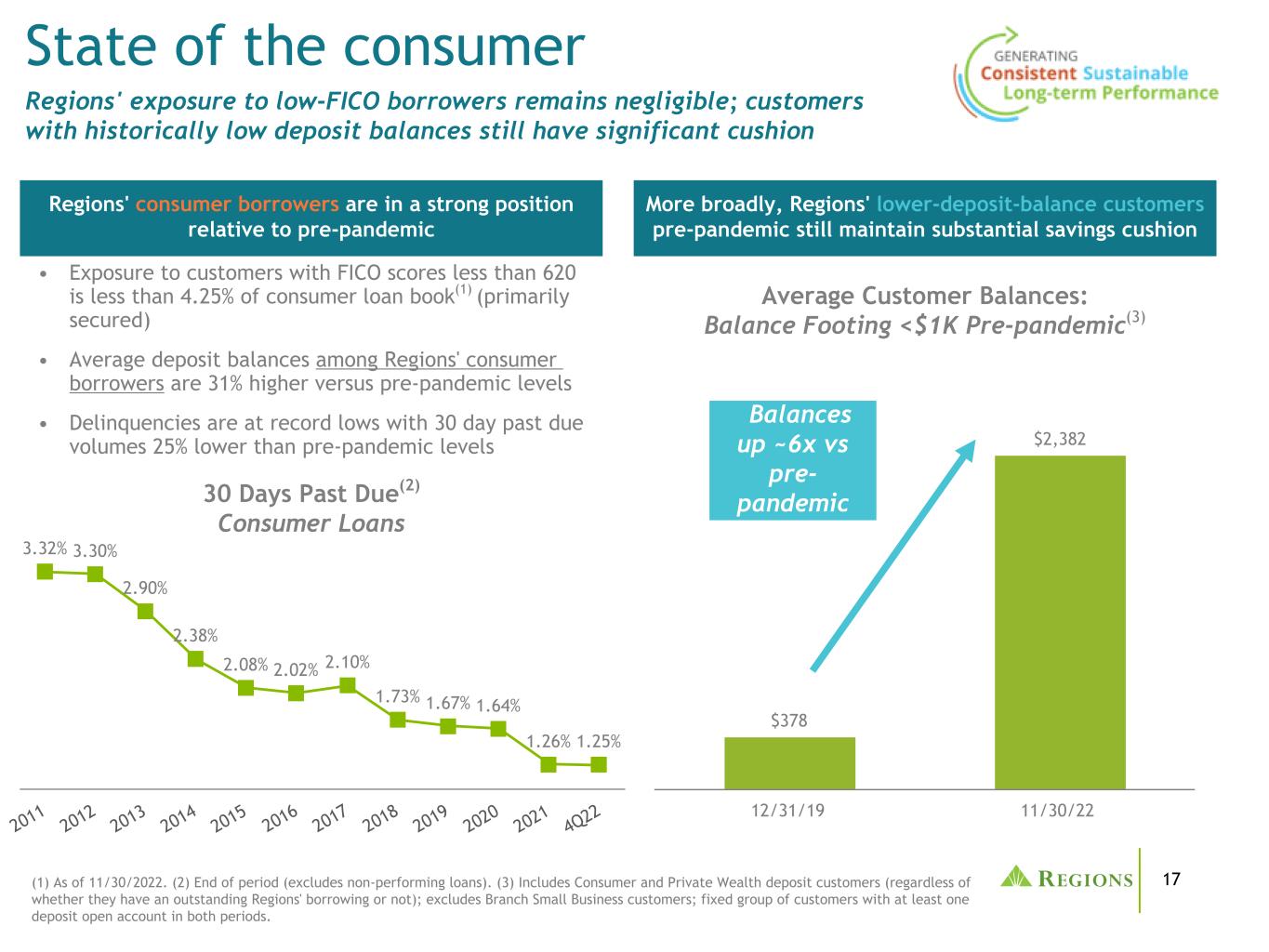

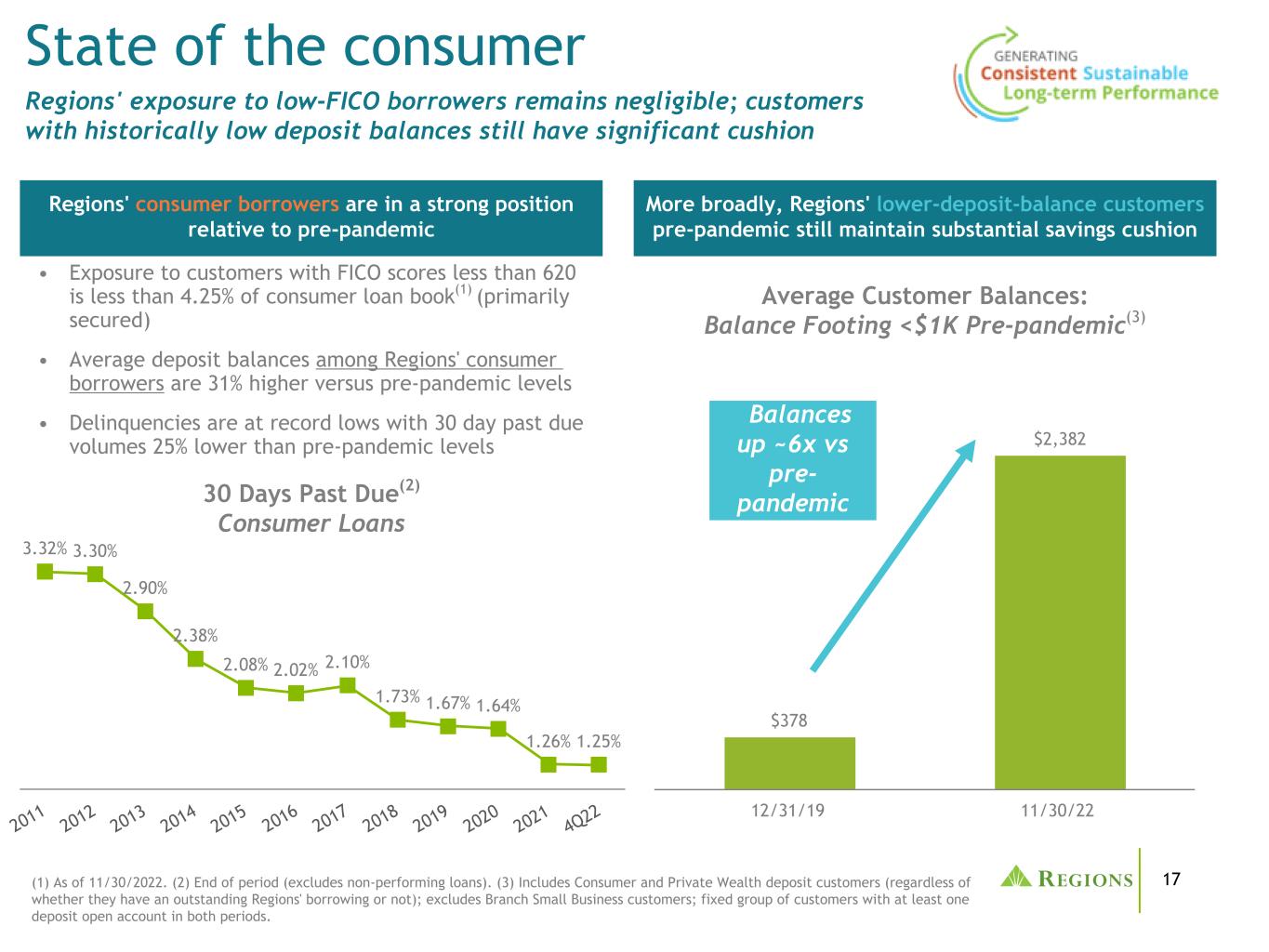

17 State of the consumer Regions' exposure to low-FICO borrowers remains negligible; customers with historically low deposit balances still have significant cushion Retail Deposits Business/ Other Deposits Retail Deposits Regions' consumer borrowers are in a strong position relative to pre-pandemic $378 $2,382 12/31/19 11/30/22 Balances up ~6x vs pre- pandemic • Exposure to customers with FICO scores less than 620 is less than 4.25% of consumer loan book(1) (primarily secured) • Average deposit balances among Regions' consumer borrowers are 31% higher versus pre-pandemic levels • Delinquencies are at record lows with 30 day past due volumes 25% lower than pre-pandemic levels Average Customer Balances: Balance Footing <$1K Pre-pandemic(3) More broadly, Regions' lower-deposit-balance customers pre-pandemic still maintain substantial savings cushion 3.32% 3.30% 2.90% 2.38% 2.08% 2.02% 2.10% 1.73% 1.67% 1.64% 1.26% 1.25% 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 4Q22 (1) As of 11/30/2022. (2) End of period (excludes non-performing loans). (3) Includes Consumer and Private Wealth deposit customers (regardless of whether they have an outstanding Regions' borrowing or not); excludes Branch Small Business customers; fixed group of customers with at least one deposit open account in both periods. 30 Days Past Due(2) Consumer Loans

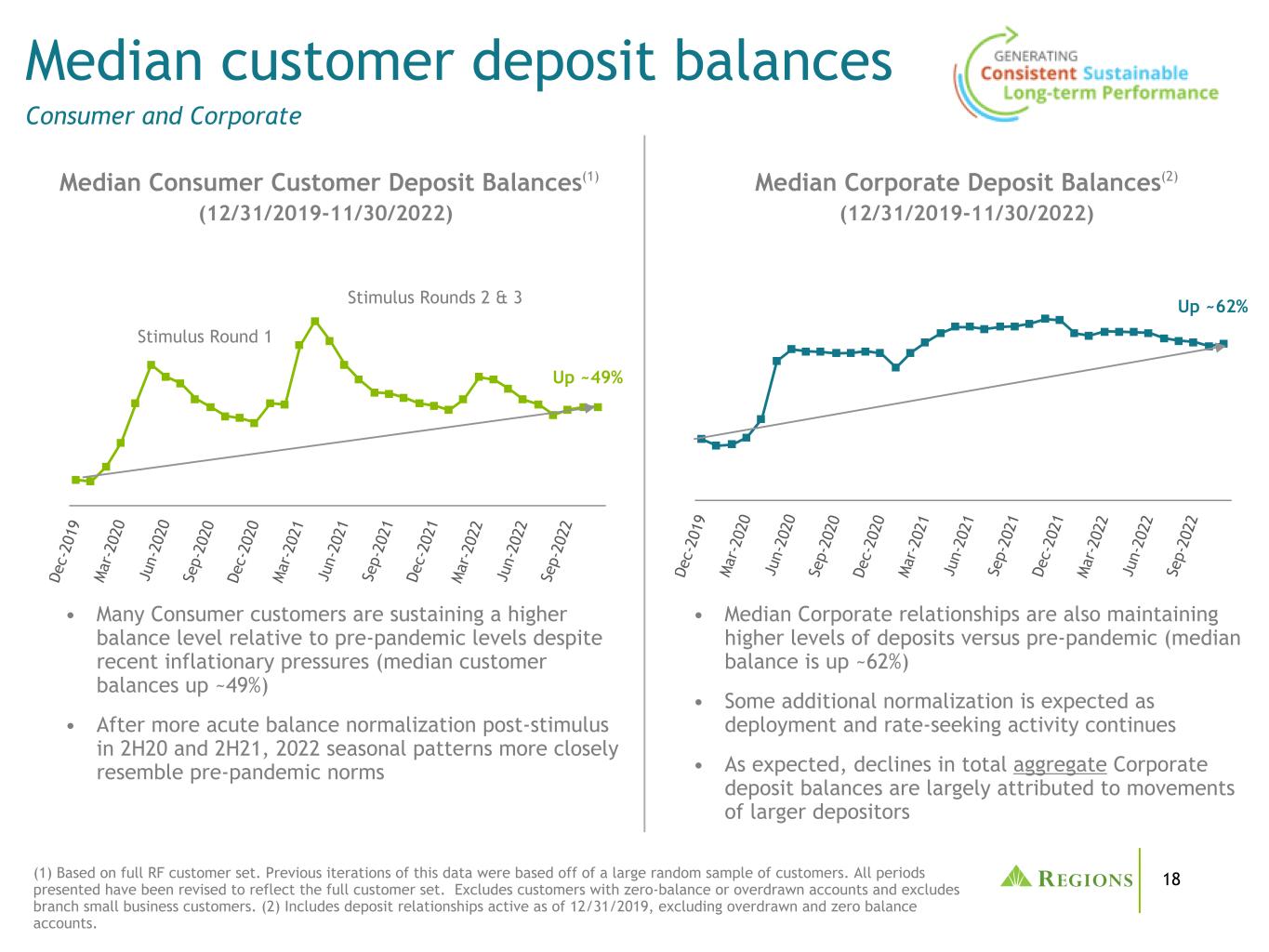

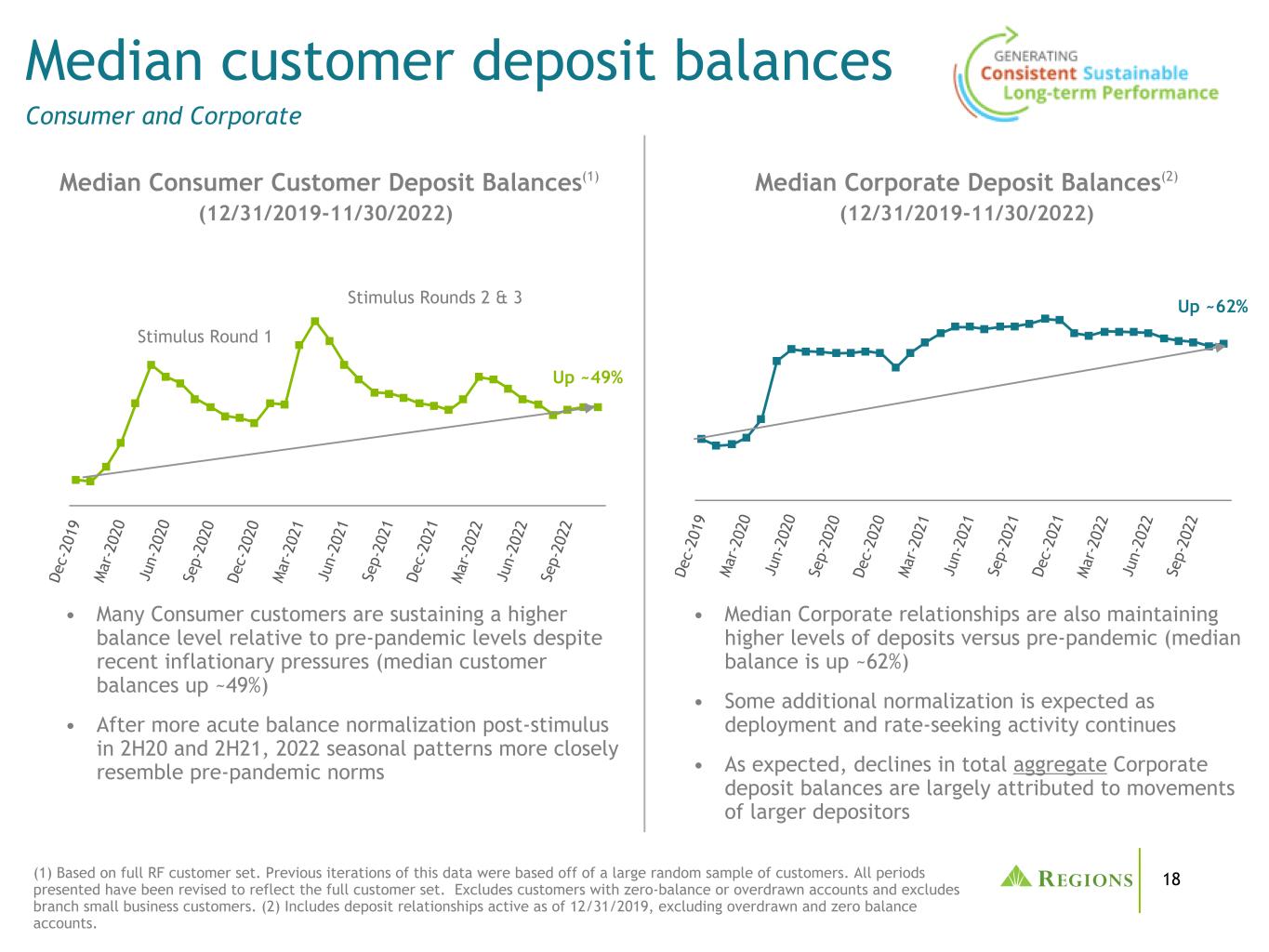

18 Median customer deposit balances Consumer and Corporate Retail Deposits De c- 20 19 M ar -2 02 0 Ju n- 20 20 Se p- 20 20 De c- 20 20 M ar -2 02 1 Ju n- 20 21 Se p- 20 21 De c- 20 21 M ar -2 02 2 Ju n- 20 22 Se p- 20 22 (1) Based on full RF customer set. Previous iterations of this data were based off of a large random sample of customers. All periods presented have been revised to reflect the full customer set. Excludes customers with zero-balance or overdrawn accounts and excludes branch small business customers. (2) Includes deposit relationships active as of 12/31/2019, excluding overdrawn and zero balance accounts. Median Consumer Customer Deposit Balances(1) (12/31/2019-11/30/2022) • Many Consumer customers are sustaining a higher balance level relative to pre-pandemic levels despite recent inflationary pressures (median customer balances up ~49%) • After more acute balance normalization post-stimulus in 2H20 and 2H21, 2022 seasonal patterns more closely resemble pre-pandemic norms Median Corporate Deposit Balances(2) (12/31/2019-11/30/2022) • Median Corporate relationships are also maintaining higher levels of deposits versus pre-pandemic (median balance is up ~62%) • Some additional normalization is expected as deployment and rate-seeking activity continues • As expected, declines in total aggregate Corporate deposit balances are largely attributed to movements of larger depositors Up ~49% De c- 20 19 M ar -2 02 0 Ju n- 20 20 Se p- 20 20 De c- 20 20 M ar -2 02 1 Ju n- 20 21 Se p- 20 21 De c- 20 21 M ar -2 02 2 Ju n- 20 22 Se p- 20 22 Up ~62%Stimulus Rounds 2 & 3 Stimulus Round 1

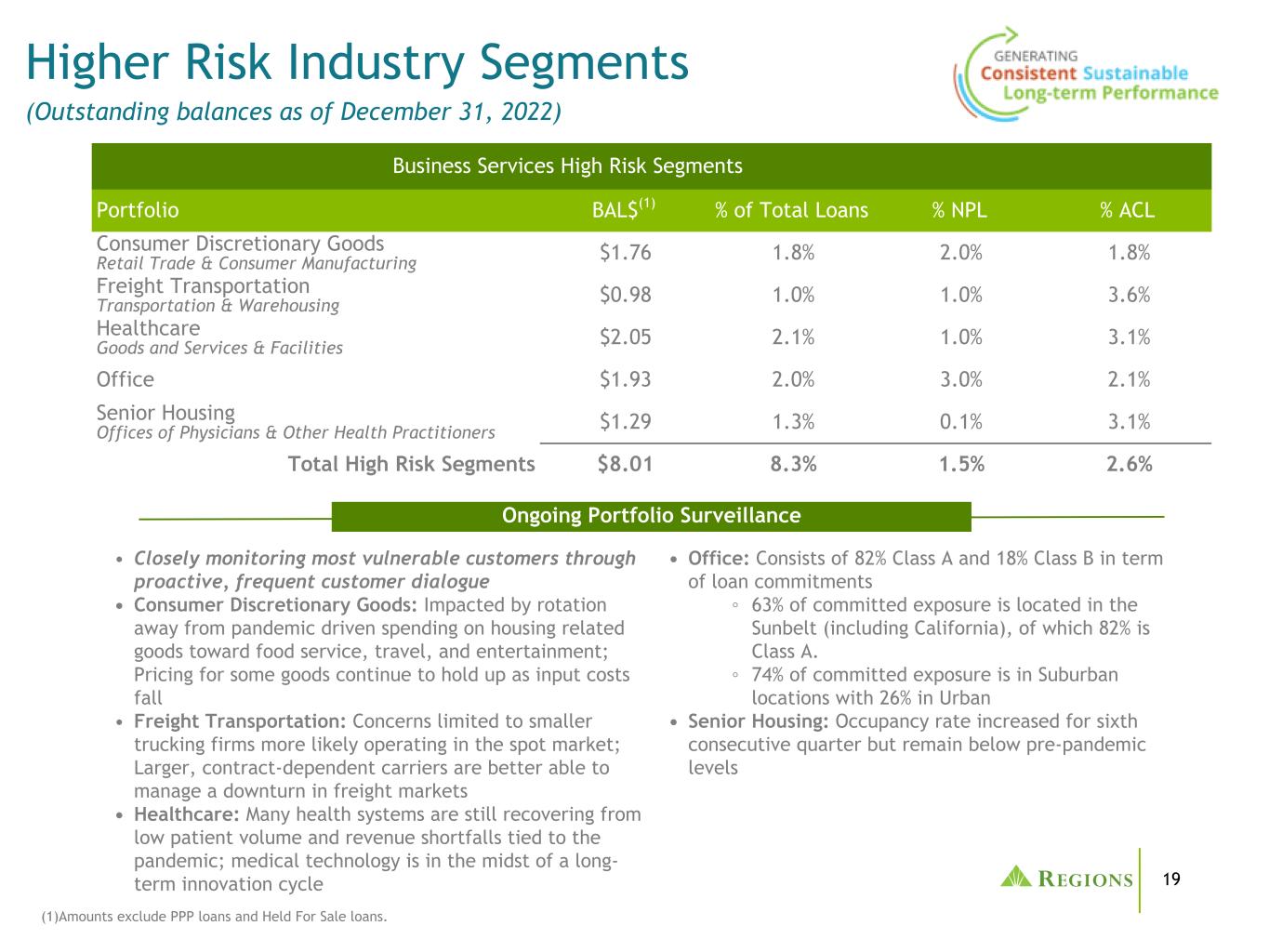

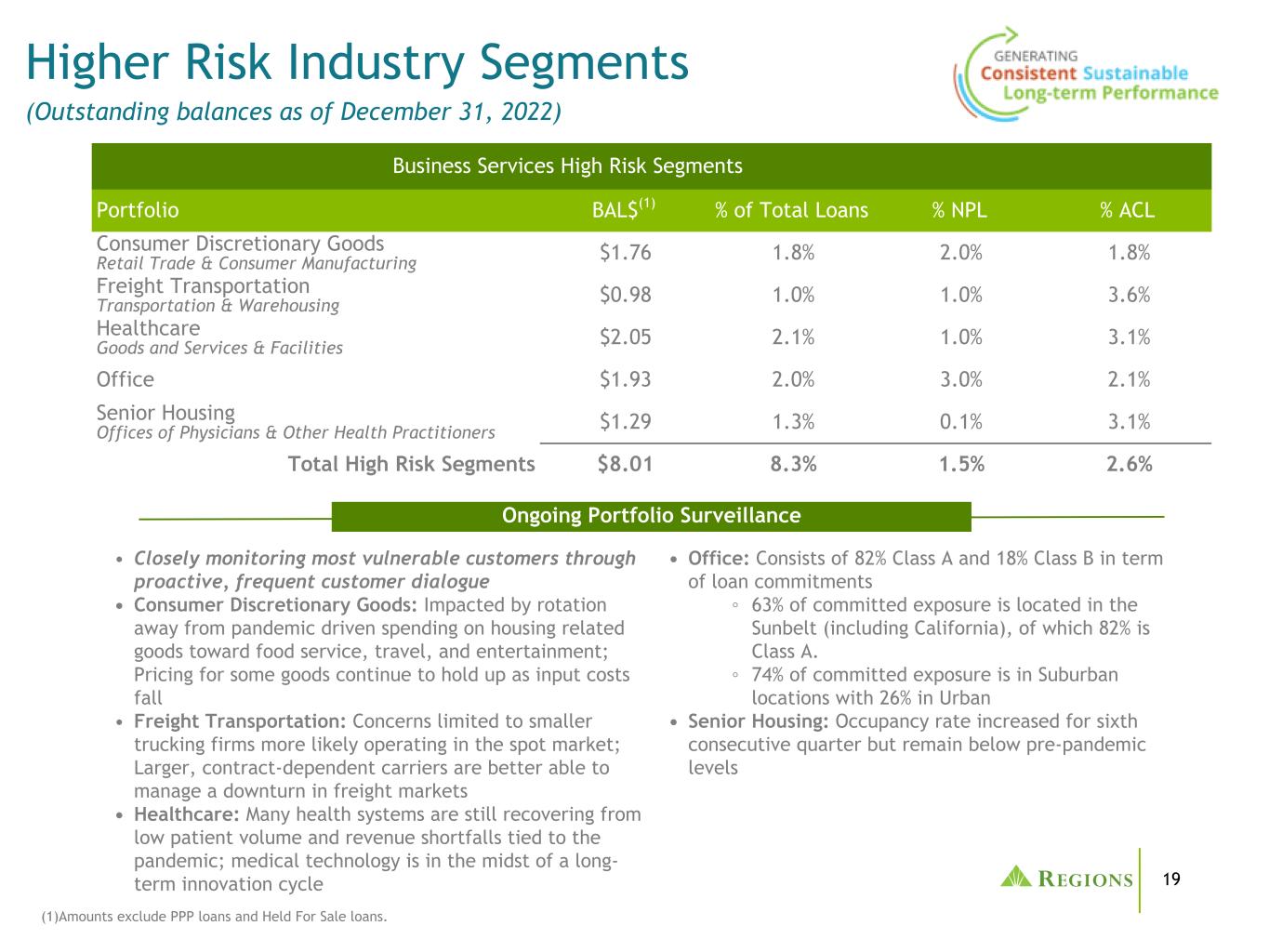

19 Higher Risk Industry Segments (Outstanding balances as of December 31, 2022) (1)Amounts exclude PPP loans and Held For Sale loans. Business Services High Risk Segments Portfolio BAL$(1) % of Total Loans % NPL % ACL Consumer Discretionary Goods Retail Trade & Consumer Manufacturing $1.76 1.8% 2.0% 1.8% Freight Transportation Transportation & Warehousing $0.98 1.0% 1.0% 3.6% Healthcare Goods and Services & Facilities $2.05 2.1% 1.0% 3.1% Office $1.93 2.0% 3.0% 2.1% Senior Housing Offices of Physicians & Other Health Practitioners $1.29 1.3% 0.1% 3.1% Total High Risk Segments $8.01 8.3% 1.5% 2.6% • Closely monitoring most vulnerable customers through proactive, frequent customer dialogue • Consumer Discretionary Goods: Impacted by rotation away from pandemic driven spending on housing related goods toward food service, travel, and entertainment; Pricing for some goods continue to hold up as input costs fall • Freight Transportation: Concerns limited to smaller trucking firms more likely operating in the spot market; Larger, contract-dependent carriers are better able to manage a downturn in freight markets • Healthcare: Many health systems are still recovering from low patient volume and revenue shortfalls tied to the pandemic; medical technology is in the midst of a long- term innovation cycle Ongoing Portfolio Surveillance • Office: Consists of 82% Class A and 18% Class B in term of loan commitments ◦ 63% of committed exposure is located in the Sunbelt (including California), of which 82% is Class A. ◦ 74% of committed exposure is in Suburban locations with 26% in Urban • Senior Housing: Occupancy rate increased for sixth consecutive quarter but remain below pre-pandemic levels

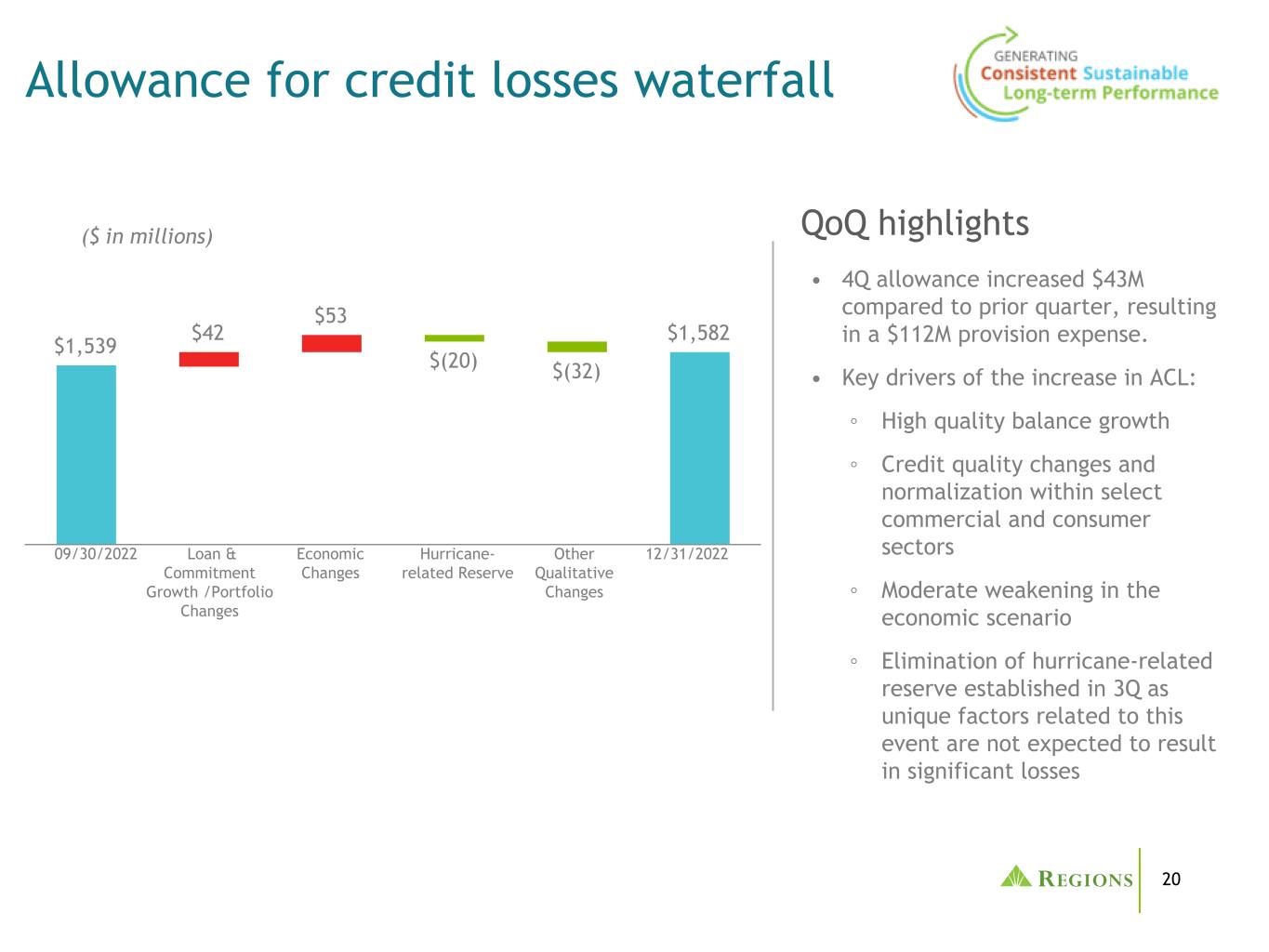

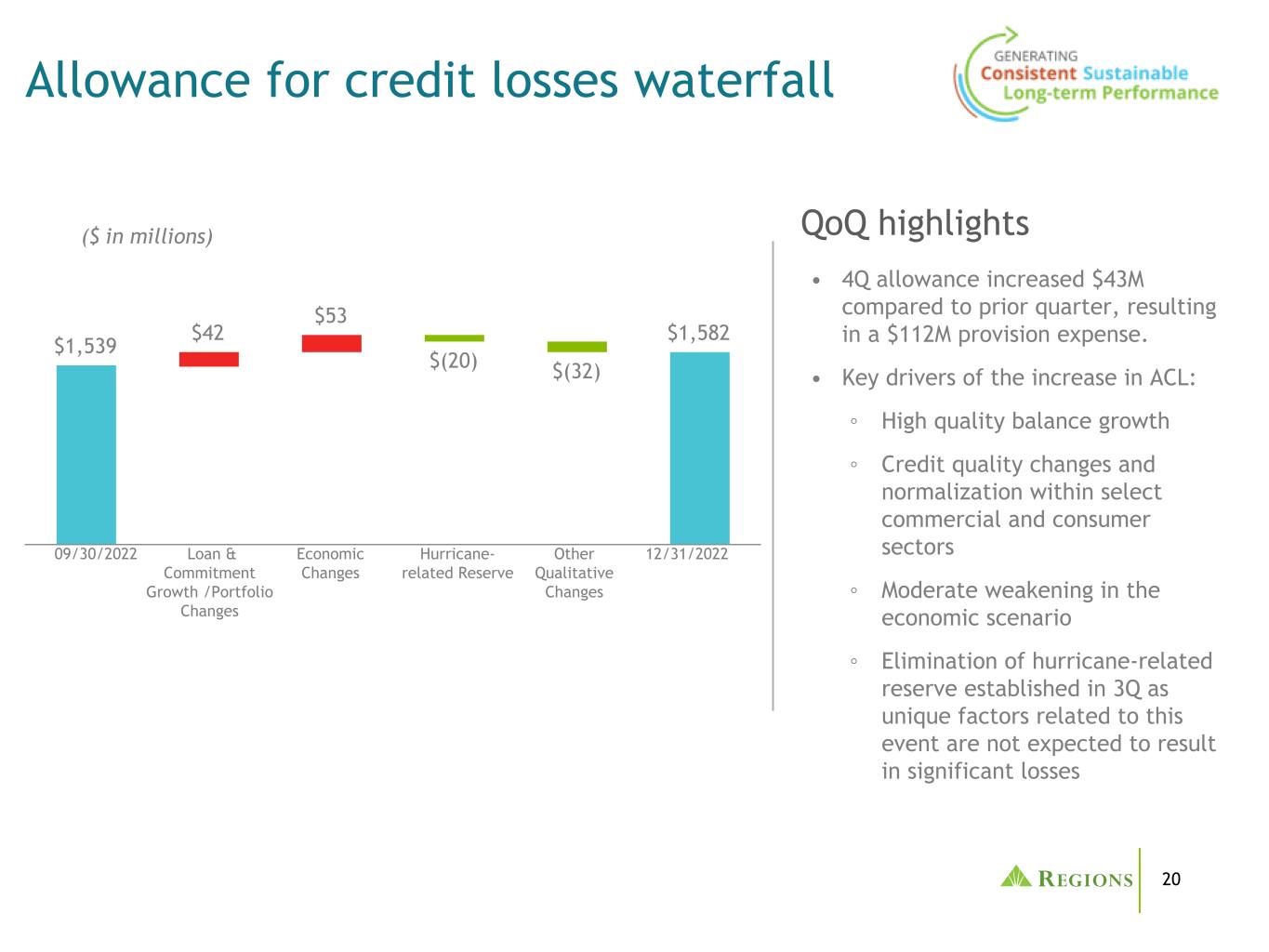

20 Economic Changes $1,539 $42 $53 $(20) $(32) $1,582 Allowance for credit losses waterfall 12/31/2022 • 4Q allowance increased $43M compared to prior quarter, resulting in a $112M provision expense. • Key drivers of the increase in ACL: ◦ High quality balance growth ◦ Credit quality changes and normalization within select commercial and consumer sectors ◦ Moderate weakening in the economic scenario ◦ Elimination of hurricane-related reserve established in 3Q as unique factors related to this event are not expected to result in significant losses QoQ highlights($ in millions) 09/30/2022 Loan & Commitment Growth /Portfolio Changes Other Qualitative Changes Hurricane- related Reserve

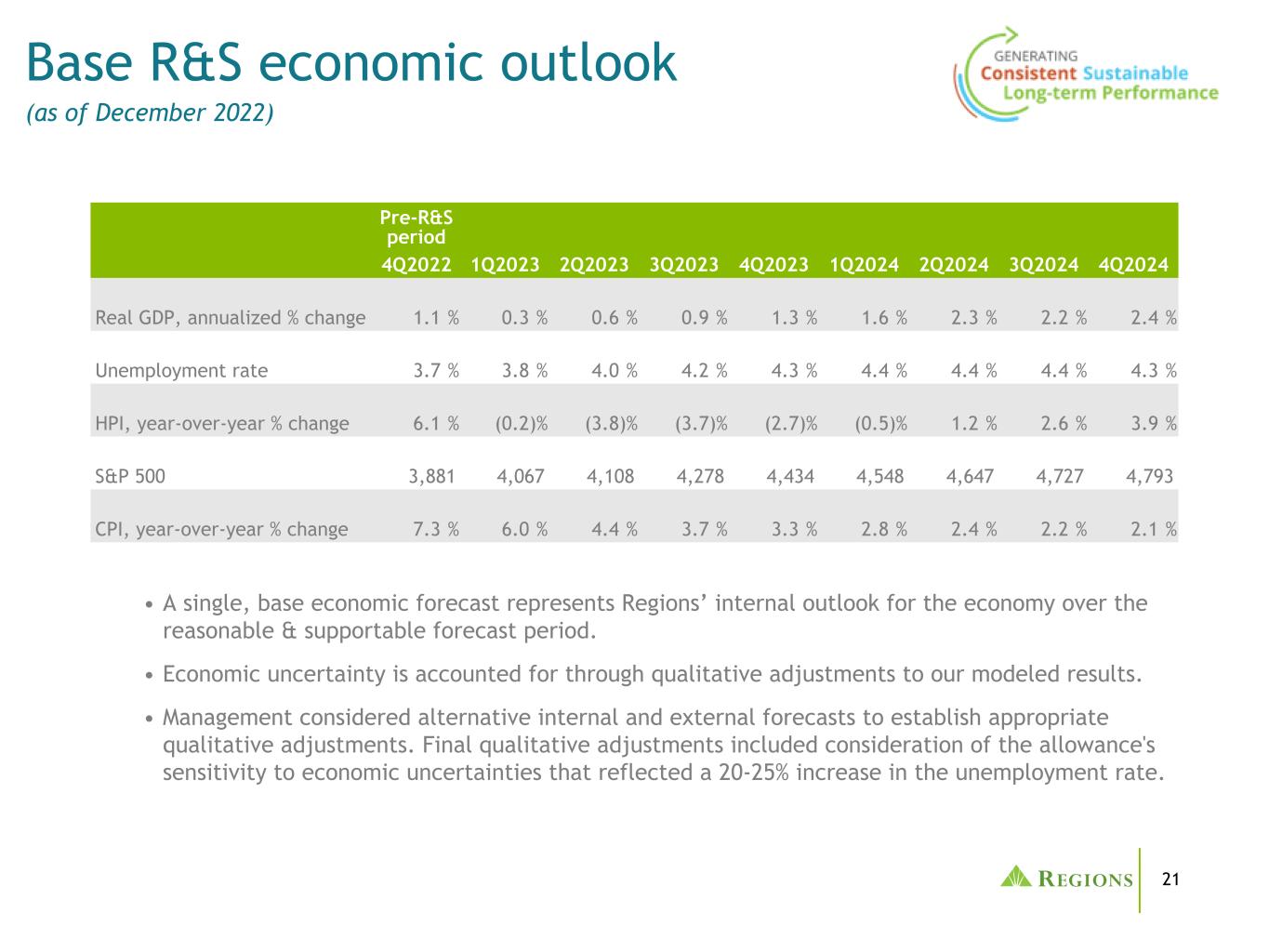

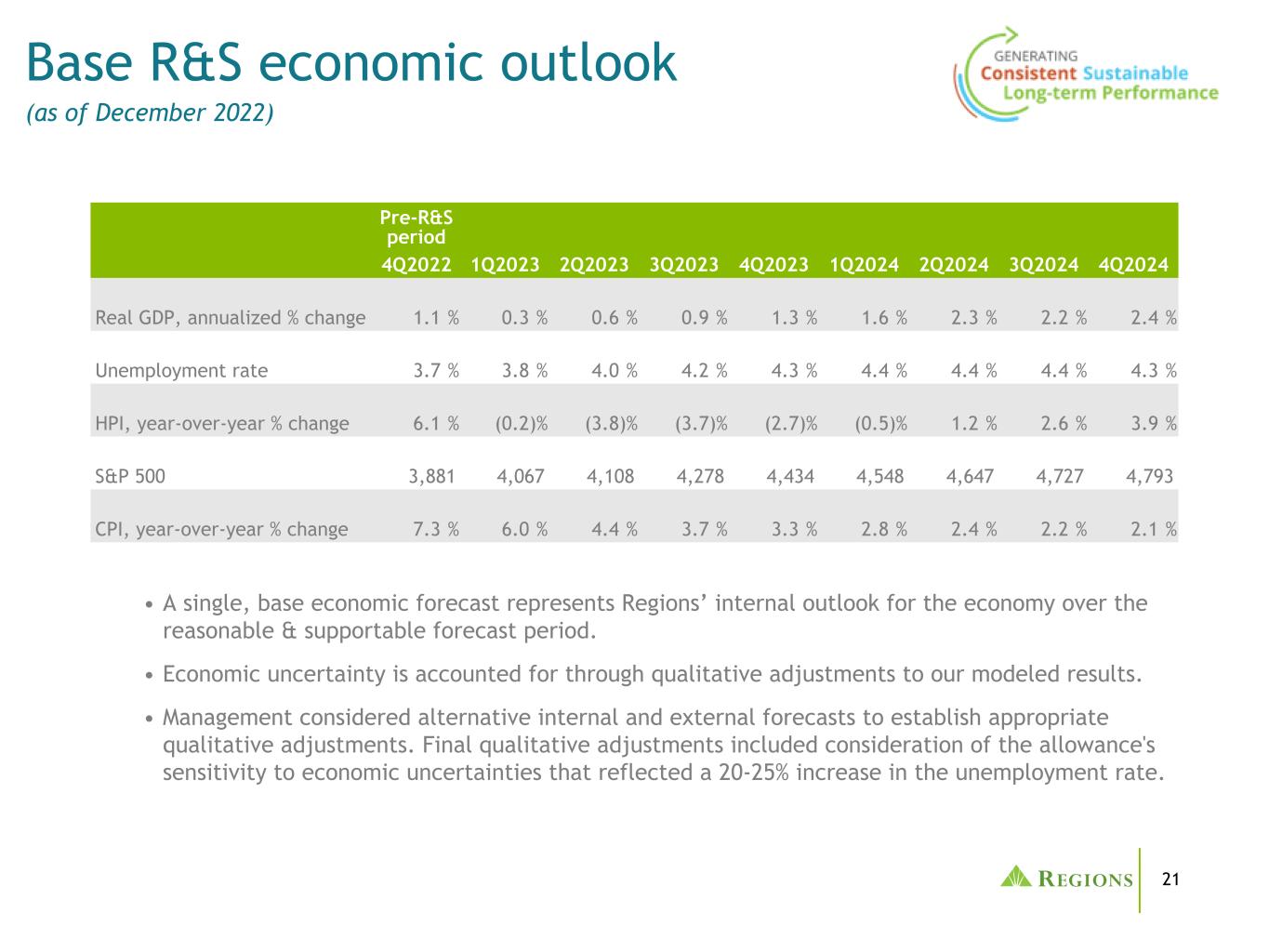

21 Pre-R&S period 4Q2022 1Q2023 2Q2023 3Q2023 4Q2023 1Q2024 2Q2024 3Q2024 4Q2024 Real GDP, annualized % change 1.1 % 0.3 % 0.6 % 0.9 % 1.3 % 1.6 % 2.3 % 2.2 % 2.4 % Unemployment rate 3.7 % 3.8 % 4.0 % 4.2 % 4.3 % 4.4 % 4.4 % 4.4 % 4.3 % HPI, year-over-year % change 6.1 % (0.2) % (3.8) % (3.7) % (2.7) % (0.5) % 1.2 % 2.6 % 3.9 % S&P 500 3,881 4,067 4,108 4,278 4,434 4,548 4,647 4,727 4,793 CPI, year-over-year % change 7.3 % 6.0 % 4.4 % 3.7 % 3.3 % 2.8 % 2.4 % 2.2 % 2.1 % Base R&S economic outlook (as of December 2022) • A single, base economic forecast represents Regions’ internal outlook for the economy over the reasonable & supportable forecast period. • Economic uncertainty is accounted for through qualitative adjustments to our modeled results. • Management considered alternative internal and external forecasts to establish appropriate qualitative adjustments. Final qualitative adjustments included consideration of the allowance's sensitivity to economic uncertainties that reflected a 20-25% increase in the unemployment rate.

22 As of 12/31/2022 As of 12/31/2021 (in millions) Loan Balance ACL ACL/Loans Loan Balance ACL ACL/Loans C&I $50,905 $628 1.23 % $43,758 $613 1.40 % CRE-OO mortgage 5,103 102 2.00 % 5,287 118 2.23 % CRE-OO construction 298 7 2.29 % 264 9 3.53 % Total commercial $56,306 $737 1.31 % $49,309 $740 1.50 % IRE mortgage 6,393 114 1.78 % 5,441 77 1.41 % IRE construction 1,986 28 1.38 % 1,586 10 0.61 % Total IRE $8,379 $142 1.69 % $7,027 $87 1.23 % Residential first mortgage 18,810 124 0.66 % 17,512 122 0.70 % Home equity lines 3,510 77 2.18 % 3,744 83 2.23 % Home equity loans 2,489 29 1.17 % 2,510 28 1.13 % Consumer credit card 1,248 134 10.75 % 1,184 120 10.15 % Other consumer- exit portfolios 570 39 6.80 % 1,071 64 6.00 % Other consumer 5,697 300 5.28 % 5,427 330 6.07 % Total consumer $32,324 $703 2.18 % $31,448 $747 2.38 % Total $97,009 $1,582 1.63 % $87,784 $1,574 1.79 % Allowance allocation

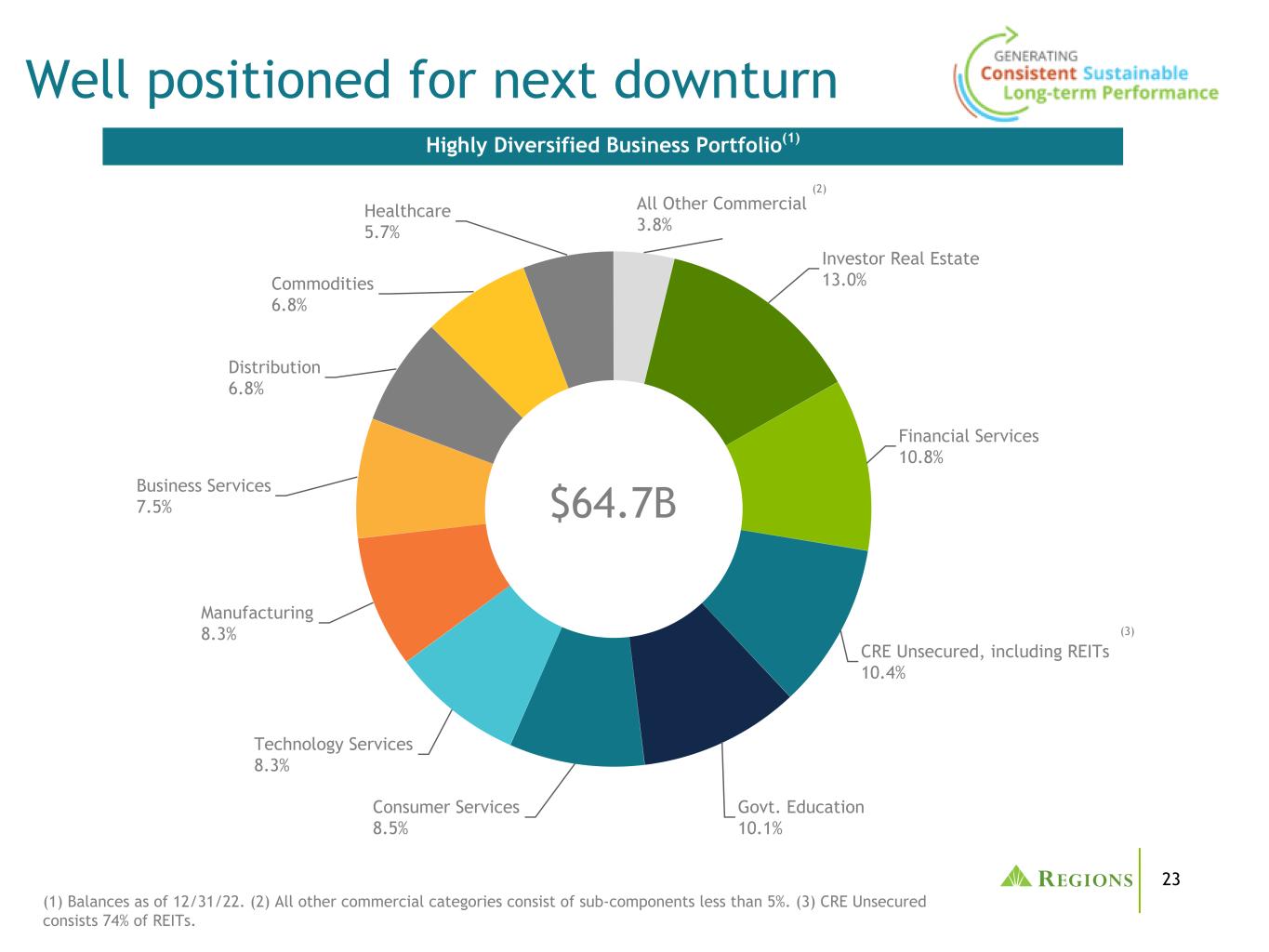

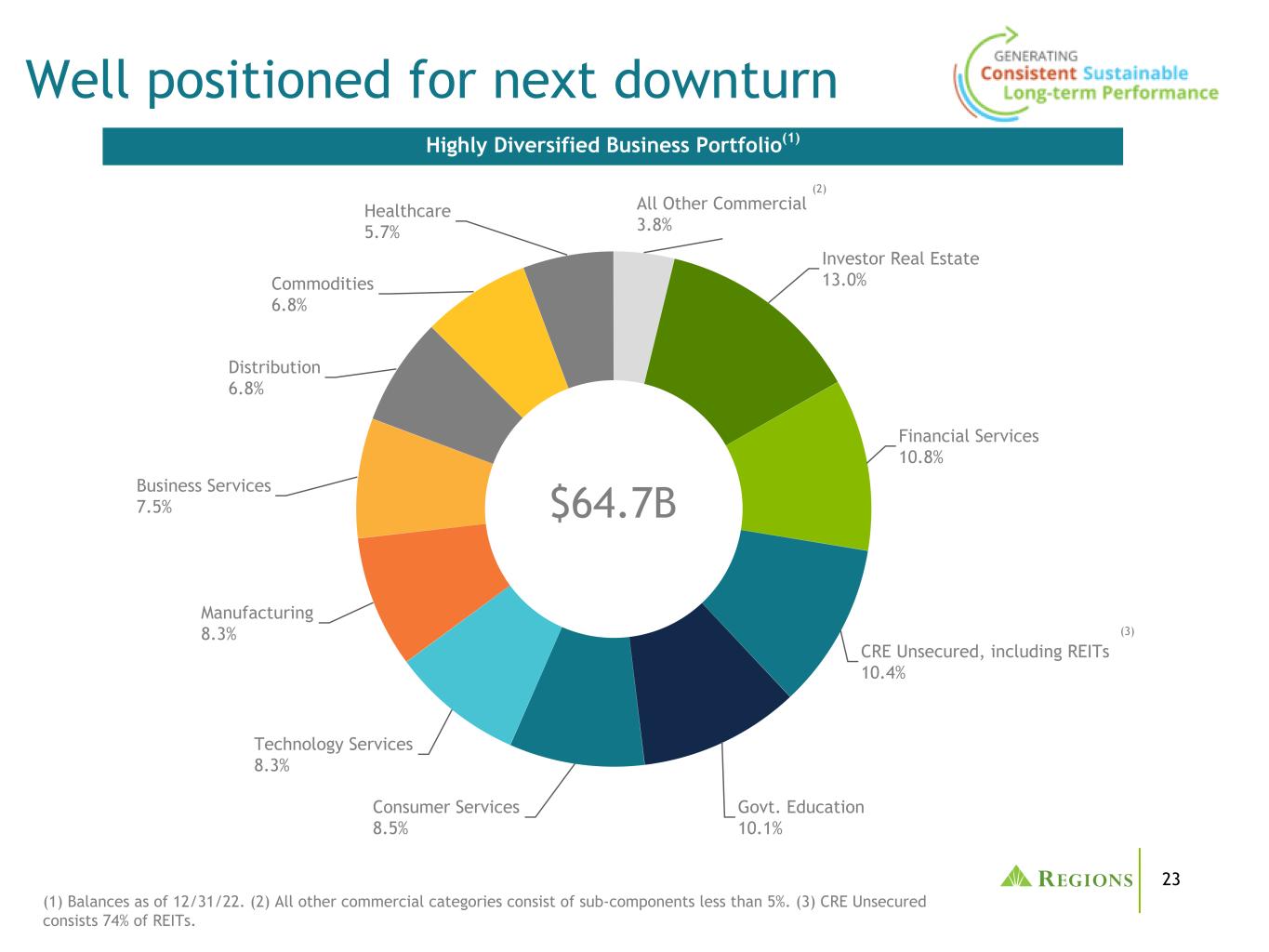

23 All Other Commercial 3.8% Investor Real Estate 13.0% Financial Services 10.8% CRE Unsecured, including REITs 10.4% Govt. Education 10.1% Consumer Services 8.5% Technology Services 8.3% Manufacturing 8.3% Business Services 7.5% Distribution 6.8% Commodities 6.8% Healthcare 5.7% Well positioned for next downturn $64.7B Highly Diversified Business Portfolio(1) (1) Balances as of 12/31/22. (2) All other commercial categories consist of sub-components less than 5%. (3) CRE Unsecured consists 74% of REITs. (2) (3)

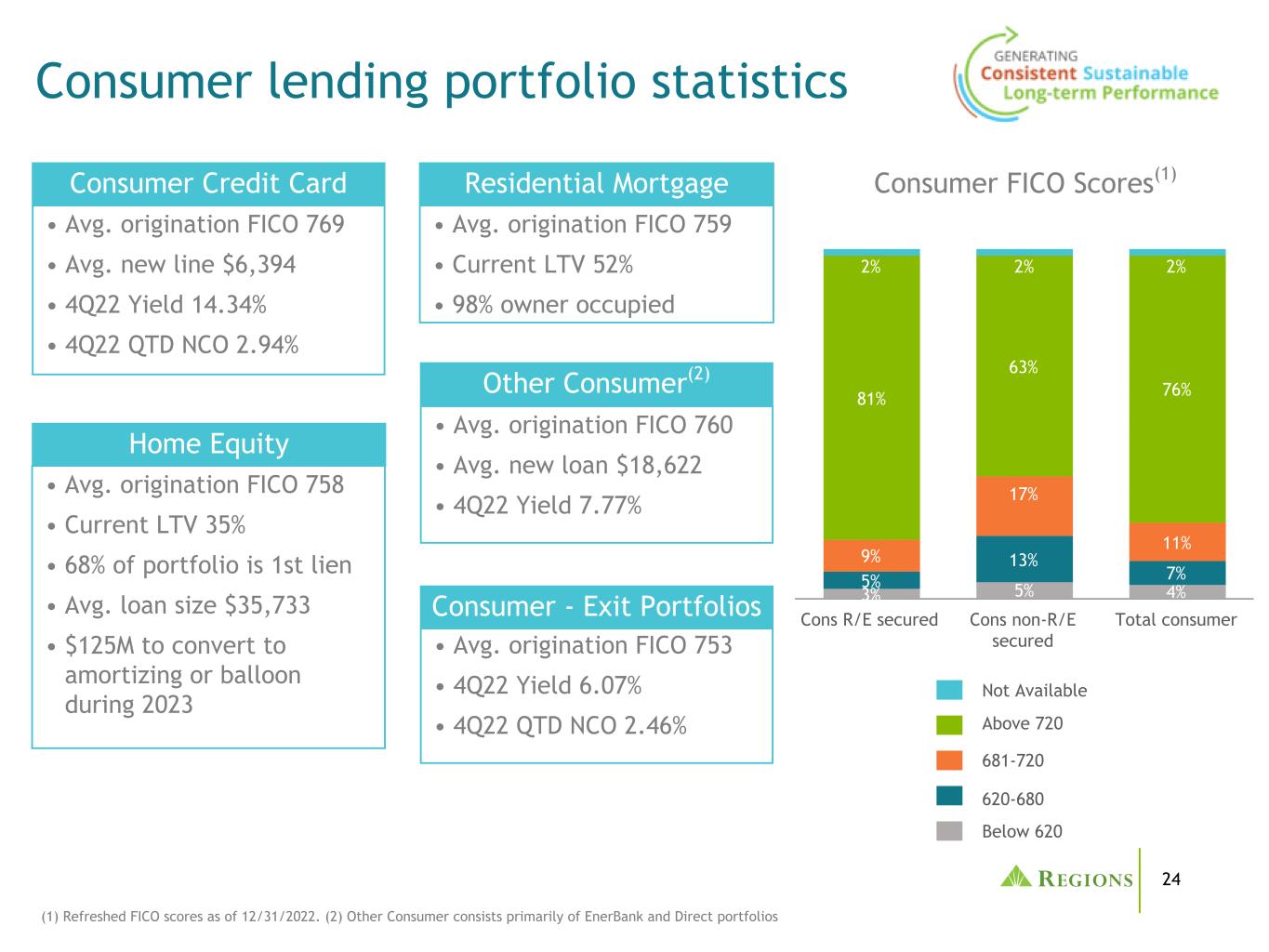

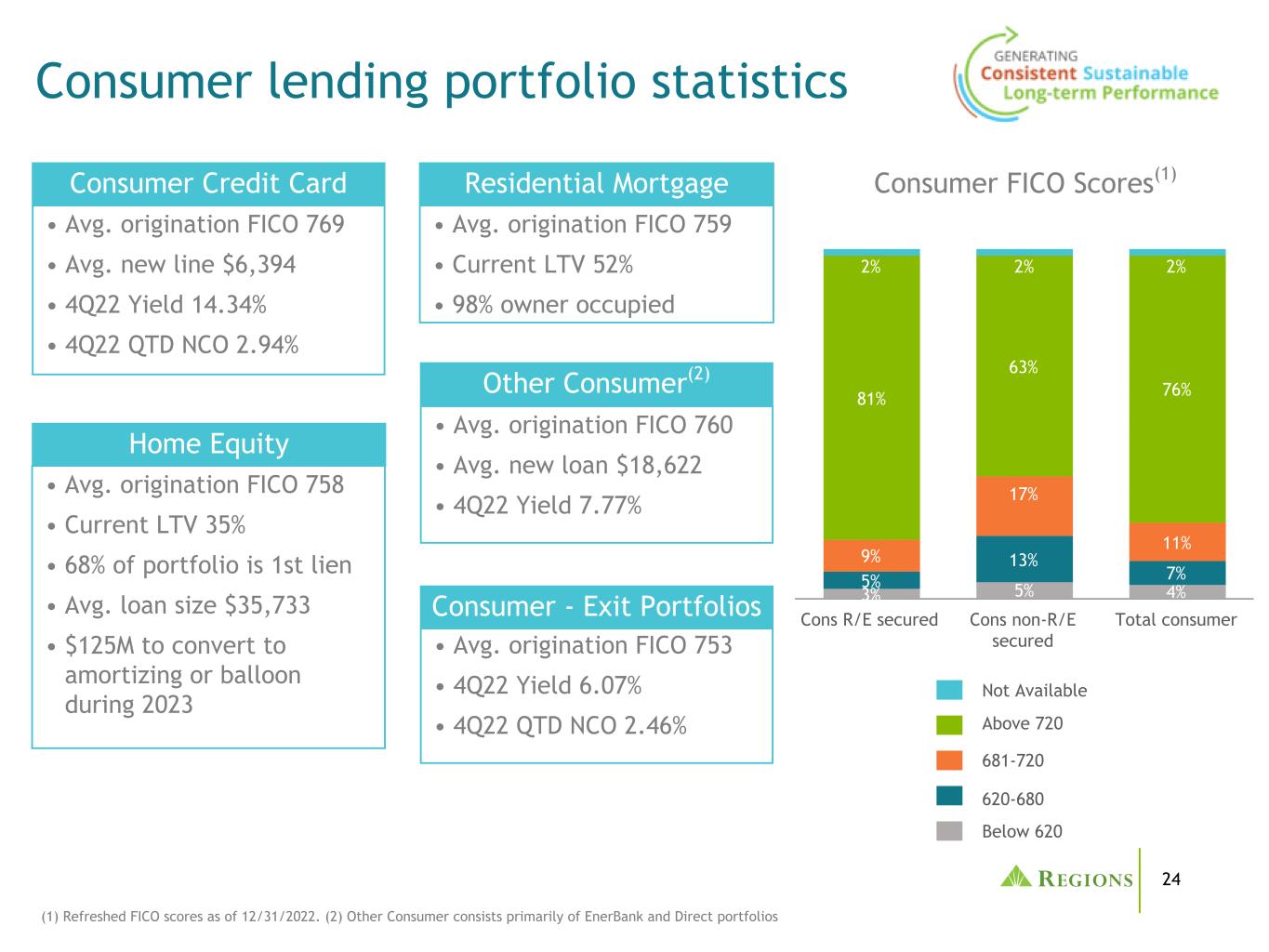

24 Consumer lending portfolio statistics • Avg. origination FICO 759 • Current LTV 52% • 98% owner occupied • Avg. origination FICO 758 • Current LTV 35% • 68% of portfolio is 1st lien • Avg. loan size $35,733 • $125M to convert to amortizing or balloon during 2023 • Avg. origination FICO 760 • Avg. new loan $18,622 • 4Q22 Yield 7.77% • Avg. origination FICO 753 • 4Q22 Yield 6.07% • 4Q22 QTD NCO 2.46% • Avg. origination FICO 769 • Avg. new line $6,394 • 4Q22 Yield 14.34% • 4Q22 QTD NCO 2.94% 3% 5% 4%5% 13% 7% 9% 17% 11% 81% 63% 76% 2% 2% 2% Cons R/E secured Cons non-R/E secured Total consumer Not Available Above 720 620-680 Below 620 681-720 Consumer FICO Scores(1) (1) Refreshed FICO scores as of 12/31/2022. (2) Other Consumer consists primarily of EnerBank and Direct portfolios Residential Mortgage Consumer - Exit Portfolios Consumer Credit Card Home Equity Other Consumer(2)

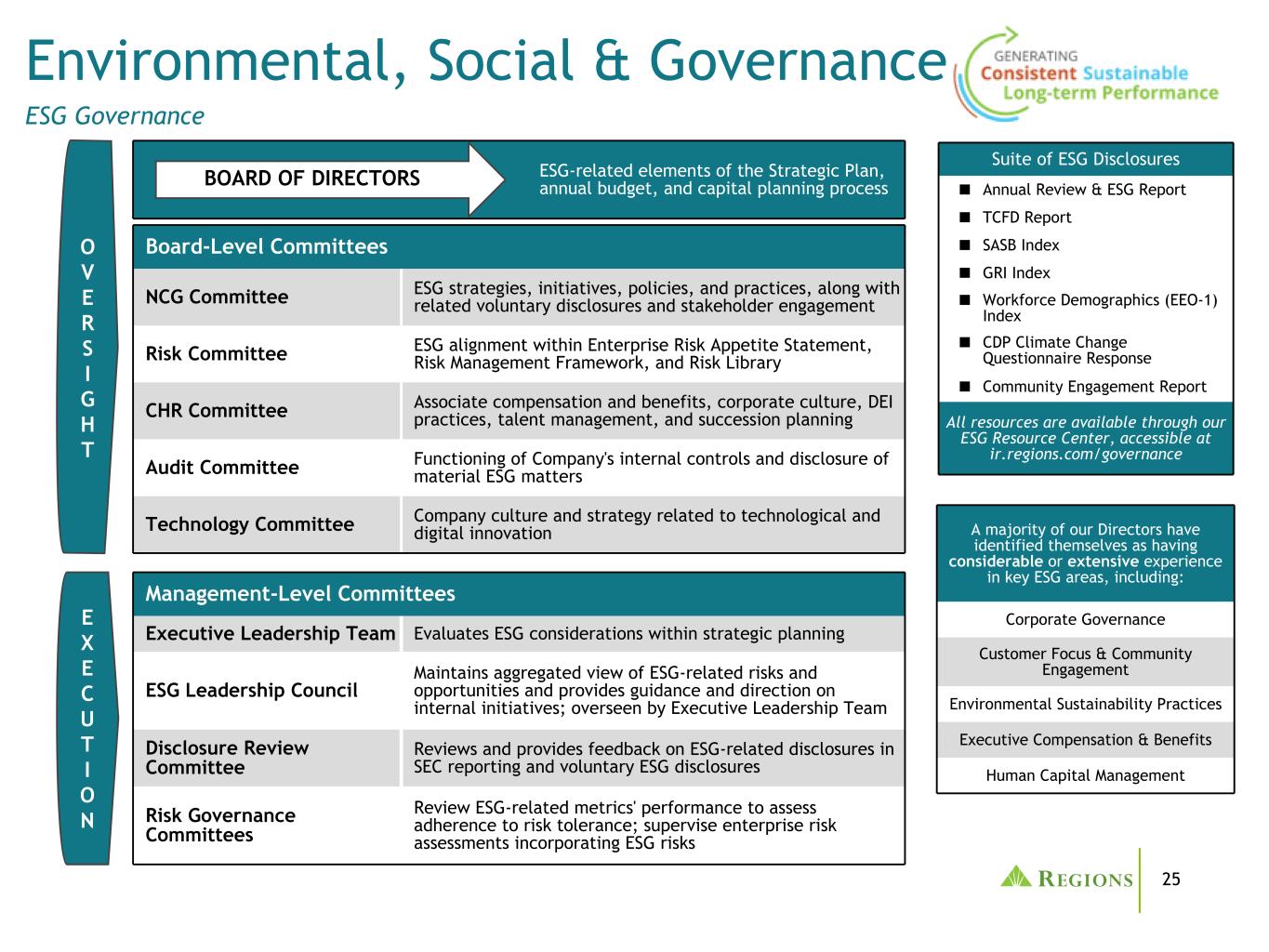

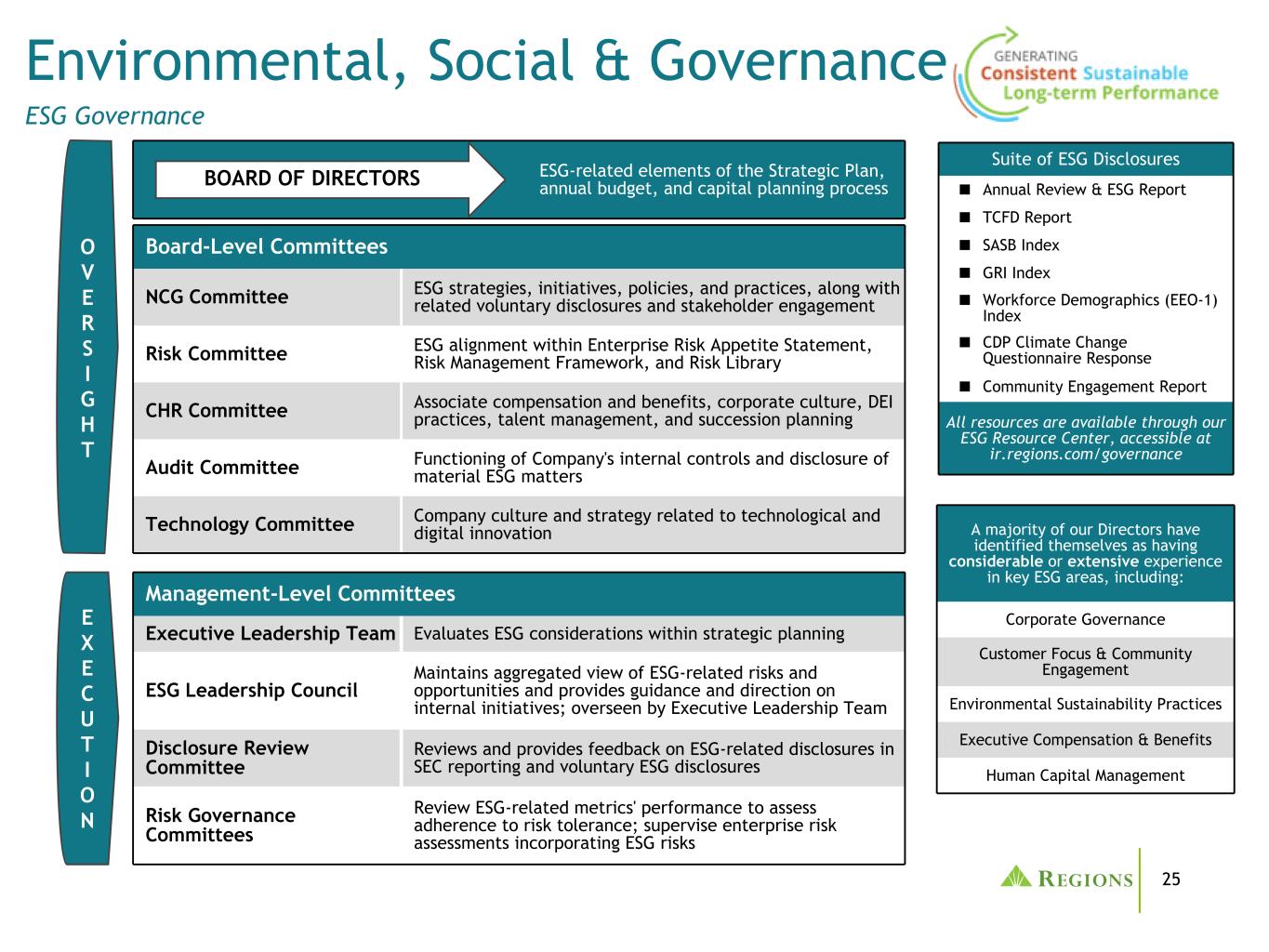

25 Environmental, Social & Governance ESG Governance ESG-related elements of the Strategic Plan, annual budget, and capital planning processBOARD OF DIRECTORS Board-Level Committees NCG Committee ESG strategies, initiatives, policies, and practices, along with related voluntary disclosures and stakeholder engagement Risk Committee ESG alignment within Enterprise Risk Appetite Statement, Risk Management Framework, and Risk Library CHR Committee Associate compensation and benefits, corporate culture, DEI practices, talent management, and succession planning Audit Committee Functioning of Company's internal controls and disclosure of material ESG matters Technology Committee Company culture and strategy related to technological and digital innovation Management-Level Committees Executive Leadership Team Evaluates ESG considerations within strategic planning ESG Leadership Council Maintains aggregated view of ESG-related risks and opportunities and provides guidance and direction on internal initiatives; overseen by Executive Leadership Team Disclosure Review Committee Reviews and provides feedback on ESG-related disclosures in SEC reporting and voluntary ESG disclosures Risk Governance Committees Review ESG-related metrics' performance to assess adherence to risk tolerance; supervise enterprise risk assessments incorporating ESG risks O V E R S I G H T E X E C U T I O N A majority of our Directors have identified themselves as having considerable or extensive experience in key ESG areas, including: Corporate Governance Customer Focus & Community Engagement Environmental Sustainability Practices Executive Compensation & Benefits Human Capital Management Suite of ESG Disclosures ■ Annual Review & ESG Report ■ TCFD Report ■ SASB Index ■ GRI Index ■ Workforce Demographics (EEO-1) Index ■ CDP Climate Change Questionnaire Response ■ Community Engagement Report All resources are available through our ESG Resource Center, accessible at ir.regions.com/governance

26 Promoting financial inclusivity Pursuing environmental sustainability Maintaining accountability for our ESG progress ▪ Further integrated ESG into our enterprise-wide strategic planning and risk management processes ▪ Formed a new Technology Committee of the Board of Directors to provide oversight of technology and innovation initiatives, including multi-year Regions 2.0 project ▪ Onboarded 3 new independent Directors with extensive leadership experience, understanding of our footprint, and technology and cybersecurity knowledge ▪ Enhanced ESG considerations within our credit policy ▪ Introduced Regions Now CheckingSM to suite of Regions Now Banking® products ▪ Facilitated associate-led financial wellness workshops through Regions Next Step® program ▪ Built out additional resources devoted to community and fair lending ▪ Enabled customers to complete financial health plans through Regions GreenprintTM ▪ Surpassed 2023 target to reduce energy usage by 30%(1) ▪ Reduced operational greenhouse gas emissions as part of 50% reduction target for 2030(2) ▪ Established cross-functional project operating model to measure Scope 3 portfolio emissions ▪ Engaged internal stakeholders to develop and socialize organizational definition of sustainable finance ▪ Nurtured inclusivity with "Bring Your Whole Self to Work" philosophy ▪ Devoted resources to empowering associates' career and leadership development ▪ Provided philanthropic and community giving through Regions Bank and the Regions Foundation ▪ Invested in new debt and equity commitments through the Regions Community Development Corporation Fostering diversity, equity, and inclusion Maturing our governance around ESG risks and opportunities ▪ Coordinated simultaneous publication of our 2021 Annual Review & ESG Report and 2021 TCFD Report ▪ Merged disclosures aligned with SASB, GRI, and EEO-1 reporting frameworks into ESG Report ▪ Leveraged internal reporting expertise to continue evolving our ESG data governance Environmental, Social & Governance Creating Shared Value Through Commitments and Initiatives (1) Against 2015 baseline. (2) Against 2019 baseline.

27 Management uses pre-tax pre-provision income (non-GAAP) and adjusted pre-tax pre-provision income (non-GAAP), as well as the adjusted efficiency ratio (non-GAAP) and the adjusted fee income ratio (non-GAAP) to monitor performance and believes these measures provide meaningful information to investors. Non-interest expense (GAAP) is presented excluding certain adjustments to arrive at adjusted non-interest expense (non-GAAP), which is the numerator for the efficiency ratio. Non-interest income (GAAP) is presented excluding certain adjustments to arrive at adjusted non-interest income (non-GAAP), which is the numerator for the fee income ratio. Adjusted non-interest income (non-GAAP) and adjusted non-interest expense (non- GAAP) are used to determine adjusted pre-tax pre-provision income (non-GAAP). Net interest income (GAAP) on a taxable-equivalent basis and non-interest income are added together to arrive at total revenue on a taxable-equivalent basis. Adjustments are made to arrive at adjusted total revenue on a taxable-equivalent basis (non-GAAP), which is the denominator for the fee income and efficiency ratios. Net loan charge-offs (GAAP) are presented excluding adjustments to arrive at adjusted net loan-charge offs (non-GAAP). Adjusted net loan charge-offs as a percentage of average loans (non-GAAP) are calculated as adjusted net loan charge-offs (non-GAAP) divided by average loans (GAAP) and annualized. Regions believes that the exclusion of these adjustments provides a meaningful base for period-to-period comparisons, which management believes will assist investors in analyzing the operating results of the Company and predicting future performance. These non-GAAP financial measures are also used by management to assess the performance of Regions’ business. It is possible that the activities related to the adjustments may recur; however, management does not consider the activities related to the adjustments to be indications of ongoing operations. Regions believes that presentation of these non-GAAP financial measures will permit investors to assess the performance of the Company on the same basis as that applied by management. Tangible common stockholders’ equity and return on average tangible common shareholders' equity (ROATCE) ratios have become a focus of some investors and management believes they may assist investors in analyzing the capital position of the Company absent the effects of intangible assets and preferred stock. Analysts and banking regulators have assessed Regions’ capital adequacy using the tangible common stockholders’ equity measure. Because tangible common stockholders’ equity and ROATCE are not formally defined by GAAP or prescribed in any amount by federal banking regulations they are currently considered to be non-GAAP financial measures and other entities may calculate them differently than Regions’ disclosed calculations. Adjustments to shareholders' equity include intangible assets and related deferred taxes and preferred stock. Additionally, adjustments to ROATCE include accumulated other comprehensive income. Since analysts and banking regulators may assess Regions’ capital adequacy using tangible common stockholders’ equity, management believes that it is useful to provide investors the ability to assess Regions’ capital adequacy on this same basis. Non-GAAP financial measures have inherent limitations, are not required to be uniformly applied and are not audited. Although these non-GAAP financial measures are frequently used by stakeholders in the evaluation of a company, they have limitations as analytical tools, and should not be considered in isolation, or as a substitute for analyses of results as reported under GAAP. In particular, a measure of earnings that excludes selected items does not represent the amount that effectively accrues directly to stockholders. Management and the Board of Directors utilize non-GAAP measures as follows: • Preparation of Regions' operating budgets • Monthly financial performance reporting • Monthly close-out reporting of consolidated results (management only) • Presentation to investors of company performance • Metrics for incentive compensation Non-GAAP information

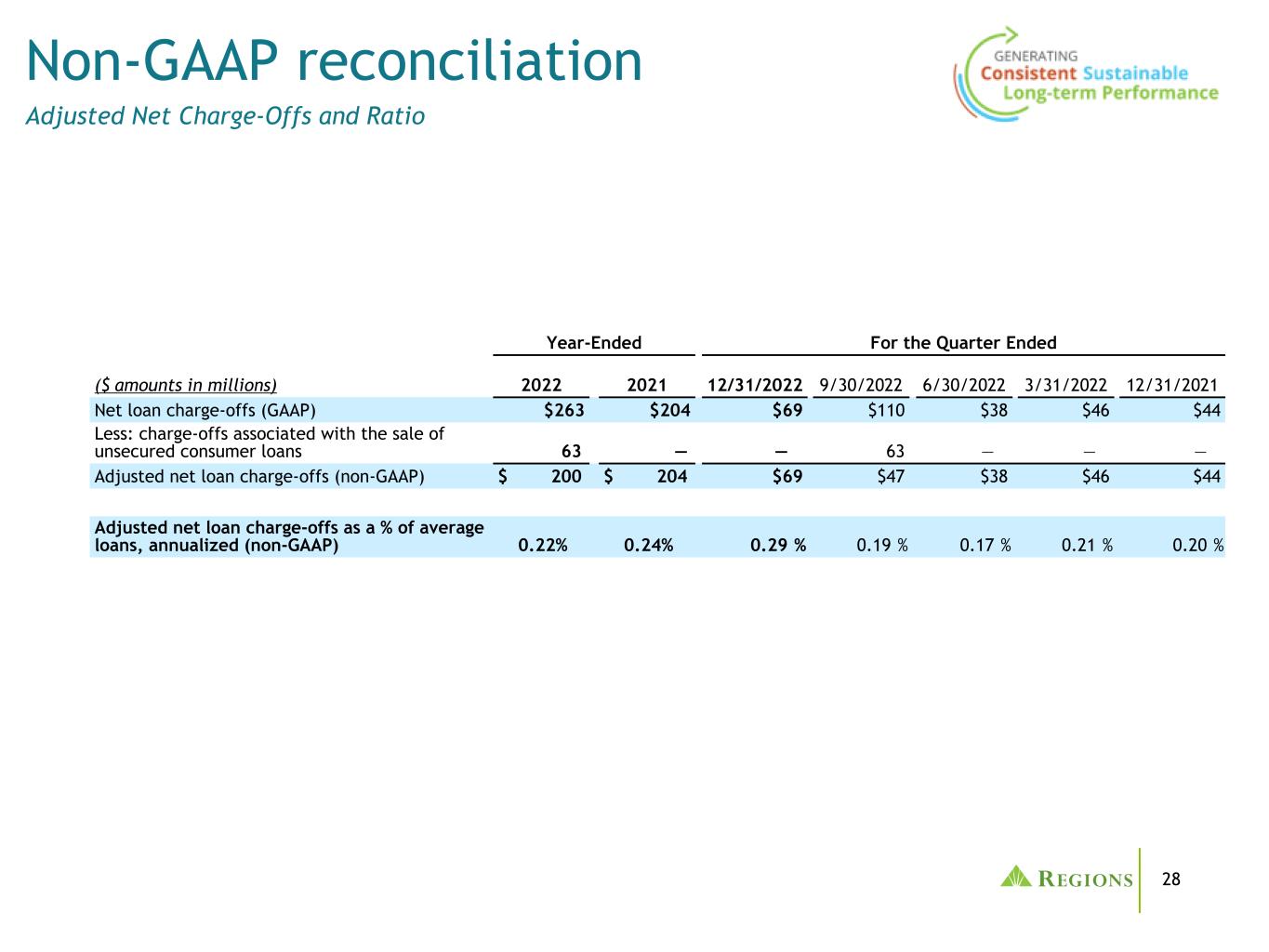

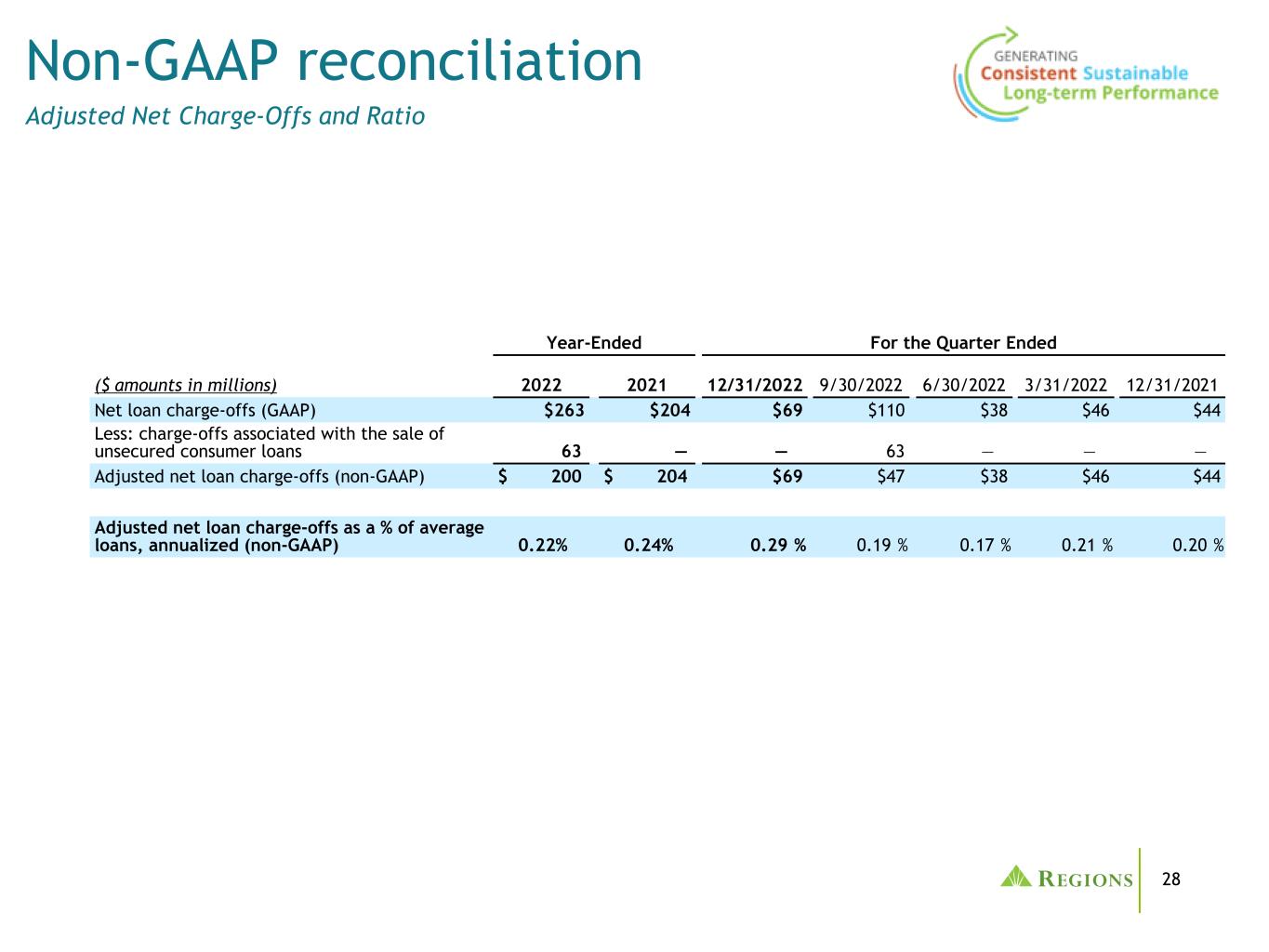

28 Non-GAAP reconciliation Adjusted Net Charge-Offs and Ratio Year-Ended For the Quarter Ended ($ amounts in millions) 2022 2021 12/31/2022 9/30/2022 6/30/2022 3/31/2022 12/31/2021 Net loan charge-offs (GAAP) $263 $204 $69 $110 $38 $46 $44 Less: charge-offs associated with the sale of unsecured consumer loans 63 — — 63 — — — Adjusted net loan charge-offs (non-GAAP) $ 200 $ 204 $69 $47 $38 $46 $44 Adjusted net loan charge-offs as a % of average loans, annualized (non-GAAP) 0.22% 0.24% 0.29 % 0.19 % 0.17 % 0.21 % 0.20 %

29 Non-GAAP reconciliation Non-interest expense Twelve Months Ended December 31 ($ amounts in millions) 2022 2021 2020 2019 2018 2017 2016 Non-interest expense (GAAP) $ 4,068 $ 3,747 $ 3,643 $ 3,489 $ 3,570 $ 3,491 $ 3,483 Adjustments: Contribution to Regions Financial Corporation foundation — (3) (10) — (60) (40) — Professional, legal and regulatory expenses (179) (15) (7) — — — (3) Branch consolidation, property and equipment charges (3) (5) (31) (25) (11) (22) (58) Expenses associated with residential mortgage loan sale — — — — (4) — — Loss on early extinguishment of debt — (20) (22) (16) — — (14) Salary and employee benefits—severance charges — (6) (31) (5) (61) (10) (21) Acquisition expense — — (1) — — — — Adjusted non-interest expense (non-GAAP) $ 3,886 $ 3,698 $ 3,541 $ 3,443 $ 3,434 $ 3,419 $ 3,387

30 Non-GAAP reconciliation Pre-tax pre-provision income (PPI) Year Ended Quarter Ended ($ amounts in millions) 2022 12/31/2022 9/30/2022 6/30/2022 3/31/2022 12/31/2021 4Q22 vs. 3Q22 4Q22 vs. 4Q21 Net income available to common shareholders (GAAP) $ 2,146 $ 660 $ 404 $ 558 $ 524 $ 414 $ 256 63.4 % $ 246 59.4 % Preferred dividends (GAAP) 99 25 25 25 24 24 — — % 1 4.2 % Income tax expense (GAAP) 631 187 133 157 154 103 54 40.6 % 84 81.6 % Income before income taxes (GAAP) 2,876 872 562 740 702 541 310 55.2 % 331 61.2 % Provision for (benefit from) credit losses (GAAP) 271 112 135 60 (36) 110 (23) (17.0) % 2 1.8 % Pre-tax pre-provision income (non-GAAP) 3,147 984 697 800 666 651 287 41.2 % 333 51.2 % Other adjustments: Securities (gains) losses, net 1 — 1 — — — (1) (100.0) % — NM Leveraged lease termination gains, net (1) — — — (1) — — NM — NM Insurance proceeds (50) (50) — — — — (50) NM (50) NM Salaries and employee benefits—severance charges — — — — — 1 — NM (1) (100.0) % Branch consolidation, property and equipment charges 3 5 3 (6) 1 — 2 66.7 % 5 NM Professional, legal and regulatory expenses 179 — 179 — — 15 (179) (100.0) % (15) (100.0) % Total other adjustments 132 (45) 183 (6) — 16 (228) (124.6) % (61) (381.3) % Adjusted pre-tax pre-provision income (non-GAAP) $ 3,279 $ 939 $ 880 $ 794 $ 666 $ 667 $ 59 6.7 % $ 272 40.8 % NM - Not Meaningful

31 Non-GAAP reconciliation NII, non-interest income/expense, and efficiency ratio NM - Not Meaningful Quarter Ended ($ amounts in millions) 12/31/2022 9/30/2022 6/30/2022 3/31/2022 12/31/2021 4Q22 vs. 3Q22 4Q22 vs. 4Q21 Non-interest expense (GAAP) A $ 1,017 $ 1,170 $ 948 $ 933 $ 983 $ (153) (13.1) % $ 34 3.5 % Adjustments: Branch consolidation, property and equipment charges (5) (3) 6 (1) — (2) (66.7) % (5) NM Salary and employee benefits—severance charges — — — — (1) — NM 1 100.0 % Professional, legal and regulatory expenses — (179) — — (15) 179 100.0 % 15 100.0 % Adjusted non-interest expense (non-GAAP) B $ 1,012 $ 988 $ 954 $ 932 $ 967 $ 24 2.4 % $ 45 4.7 % Net interest income (GAAP) C $ 1,401 $ 1,262 $ 1,108 $ 1,015 $ 1,019 $ 139 11.0 % $ 382 37.5 % Taxable-equivalent adjustment 13 12 11 11 10 1 8.3 % 3 30.0 % Net interest income, taxable-equivalent basis D $ 1,414 $ 1,274 $ 1,119 $ 1,026 $ 1,029 $ 140 11.0 % $ 385 37.4 % Non-interest income (GAAP) E 600 605 640 584 615 (5) (0.8) % (15) (2.4) % Adjustments: Securities (gains) losses, net — 1 — — — (1) (100.0) % — NM Leveraged lease termination gains — — — (1) — — NM — NM Insurance Proceeds (50) — — — — (50) NM (50) NM Adjusted non-interest income (non-GAAP) F $ 550 $ 606 $ 640 $ 583 $ 615 (56) (9.2) % $ (65) (10.6) % Total revenue C+E=G $ 2,001 $ 1,867 $ 1,748 $ 1,599 $ 1,634 $ 134 7.2 % $ 367 22.5 % Adjusted total revenue (non-GAAP) C+F=H $ 1,951 $ 1,868 $ 1,748 $ 1,598 $ 1,634 $ 83 4.4 % $ 317 19.4 % Total revenue, taxable-equivalent basis D+E=I $ 2,014 $ 1,879 $ 1,759 $ 1,610 $ 1,644 $ 135 7.2 % $ 370 22.5 % Adjusted total revenue, taxable-equivalent basis (non-GAAP) D+F=J $ 1,964 $ 1,880 $ 1,759 $ 1,609 $ 1,644 $ 84 4.5 % $ 320 19.5 % Efficiency ratio (GAAP) A/I 50.5 % 62.3 % 53.9 % 57.9 % 59.8 % Adjusted efficiency ratio (non-GAAP) B/J 51.6 % 52.6 % 54.2 % 57.9 % 58.8 % Fee income ratio (GAAP) E/I 29.8 % 32.2 % 36.4 % 36.3 % 37.4 % Adjusted fee income ratio (non-GAAP) F/J 28.0 % 32.2 % 36.4 % 36.2 % 37.4 %

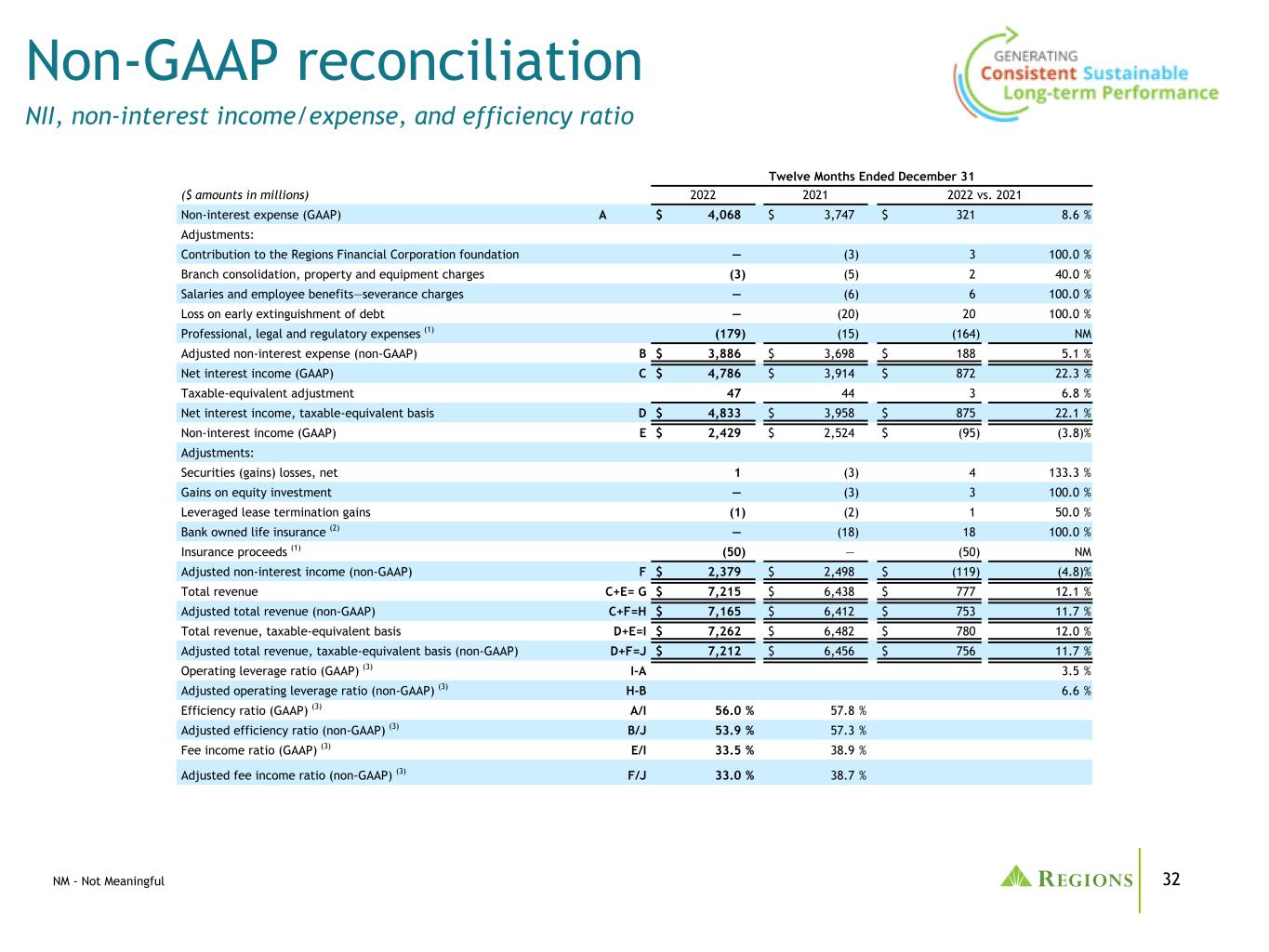

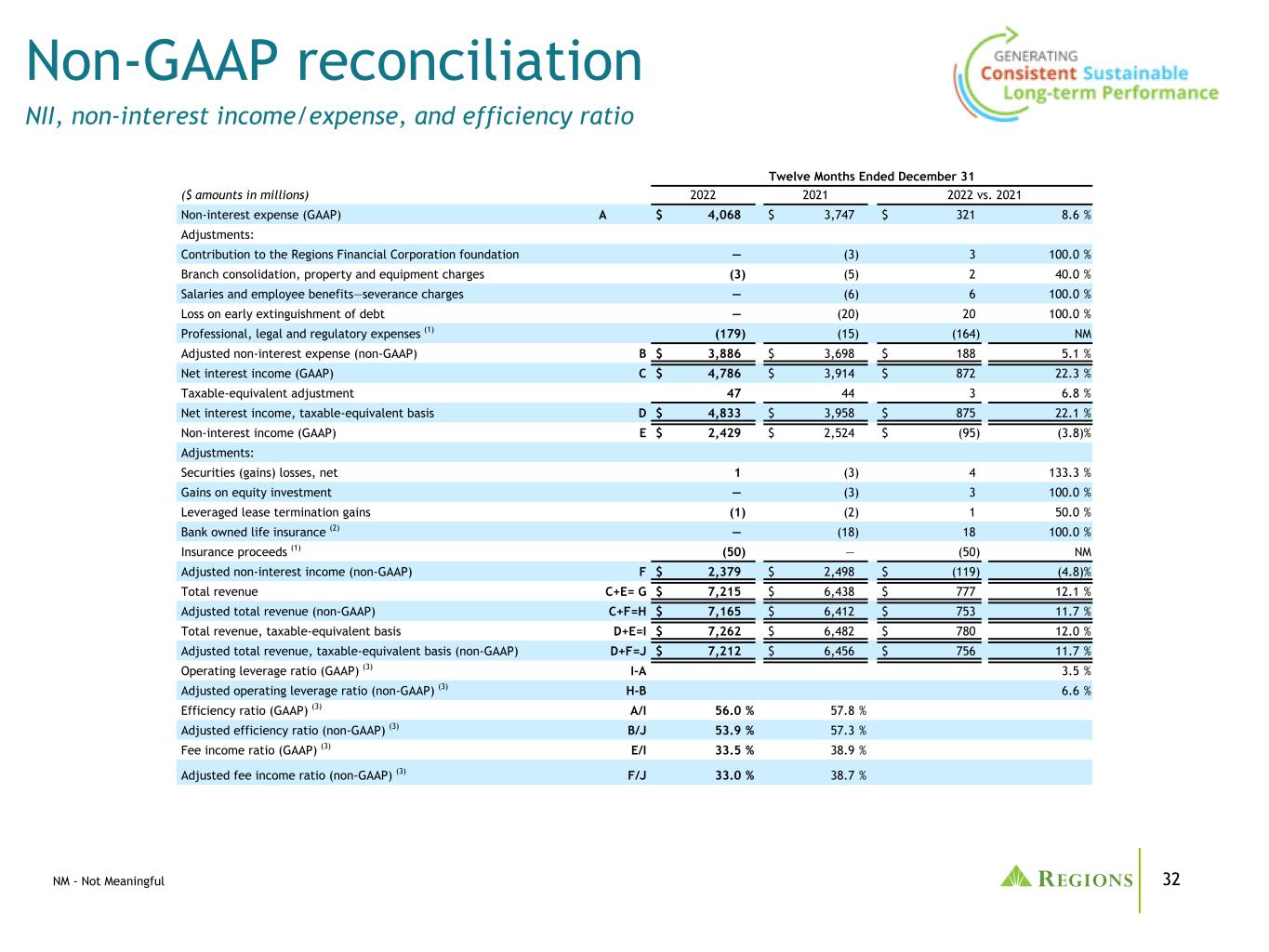

32 Non-GAAP reconciliation NII, non-interest income/expense, and efficiency ratio NM - Not Meaningful Twelve Months Ended December 31 ($ amounts in millions) 2022 2021 2022 vs. 2021 Non-interest expense (GAAP) A $ 4,068 $ 3,747 $ 321 8.6 % Adjustments: Contribution to the Regions Financial Corporation foundation — (3) 3 100.0 % Branch consolidation, property and equipment charges (3) (5) 2 40.0 % Salaries and employee benefits—severance charges — (6) 6 100.0 % Loss on early extinguishment of debt — (20) 20 100.0 % Professional, legal and regulatory expenses (1) (179) (15) (164) NM Adjusted non-interest expense (non-GAAP) B $ 3,886 $ 3,698 $ 188 5.1 % Net interest income (GAAP) C $ 4,786 $ 3,914 $ 872 22.3 % Taxable-equivalent adjustment 47 44 3 6.8 % Net interest income, taxable-equivalent basis D $ 4,833 $ 3,958 $ 875 22.1 % Non-interest income (GAAP) E $ 2,429 $ 2,524 $ (95) (3.8) % Adjustments: Securities (gains) losses, net 1 (3) 4 133.3 % Gains on equity investment — (3) 3 100.0 % Leveraged lease termination gains (1) (2) 1 50.0 % Bank owned life insurance (2) — (18) 18 100.0 % Insurance proceeds (1) (50) — (50) NM Adjusted non-interest income (non-GAAP) F $ 2,379 $ 2,498 $ (119) (4.8) % Total revenue C+E= G $ 7,215 $ 6,438 $ 777 12.1 % Adjusted total revenue (non-GAAP) C+F=H $ 7,165 $ 6,412 $ 753 11.7 % Total revenue, taxable-equivalent basis D+E=I $ 7,262 $ 6,482 $ 780 12.0 % Adjusted total revenue, taxable-equivalent basis (non-GAAP) D+F=J $ 7,212 $ 6,456 $ 756 11.7 % Operating leverage ratio (GAAP) (3) I-A 3.5 % Adjusted operating leverage ratio (non-GAAP) (3) H-B 6.6 % Efficiency ratio (GAAP) (3) A/I 56.0 % 57.8 % Adjusted efficiency ratio (non-GAAP) (3) B/J 53.9 % 57.3 % Fee income ratio (GAAP) (3) E/I 33.5 % 38.9 % Adjusted fee income ratio (non-GAAP) (3) F/J 33.0 % 38.7 %

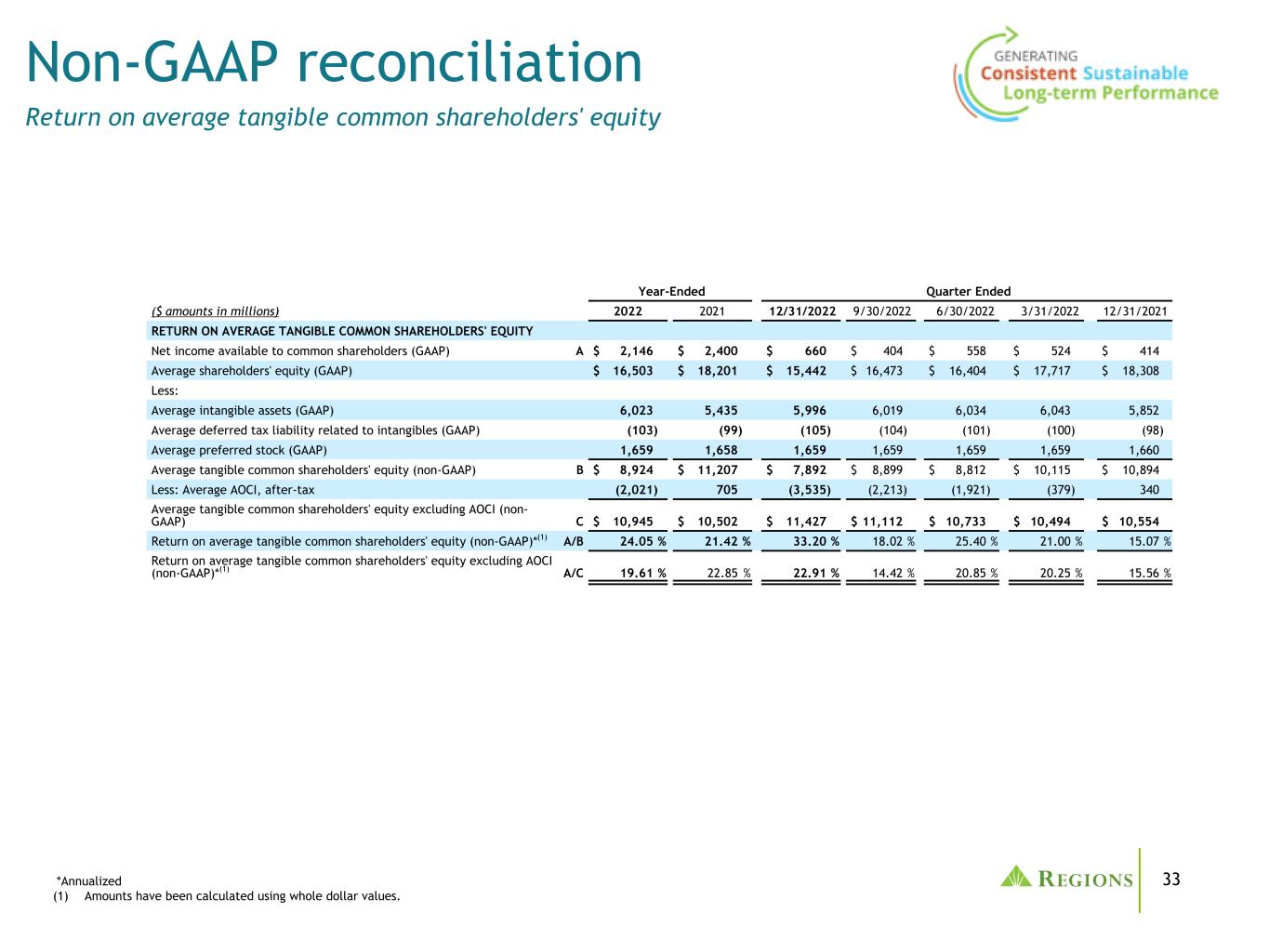

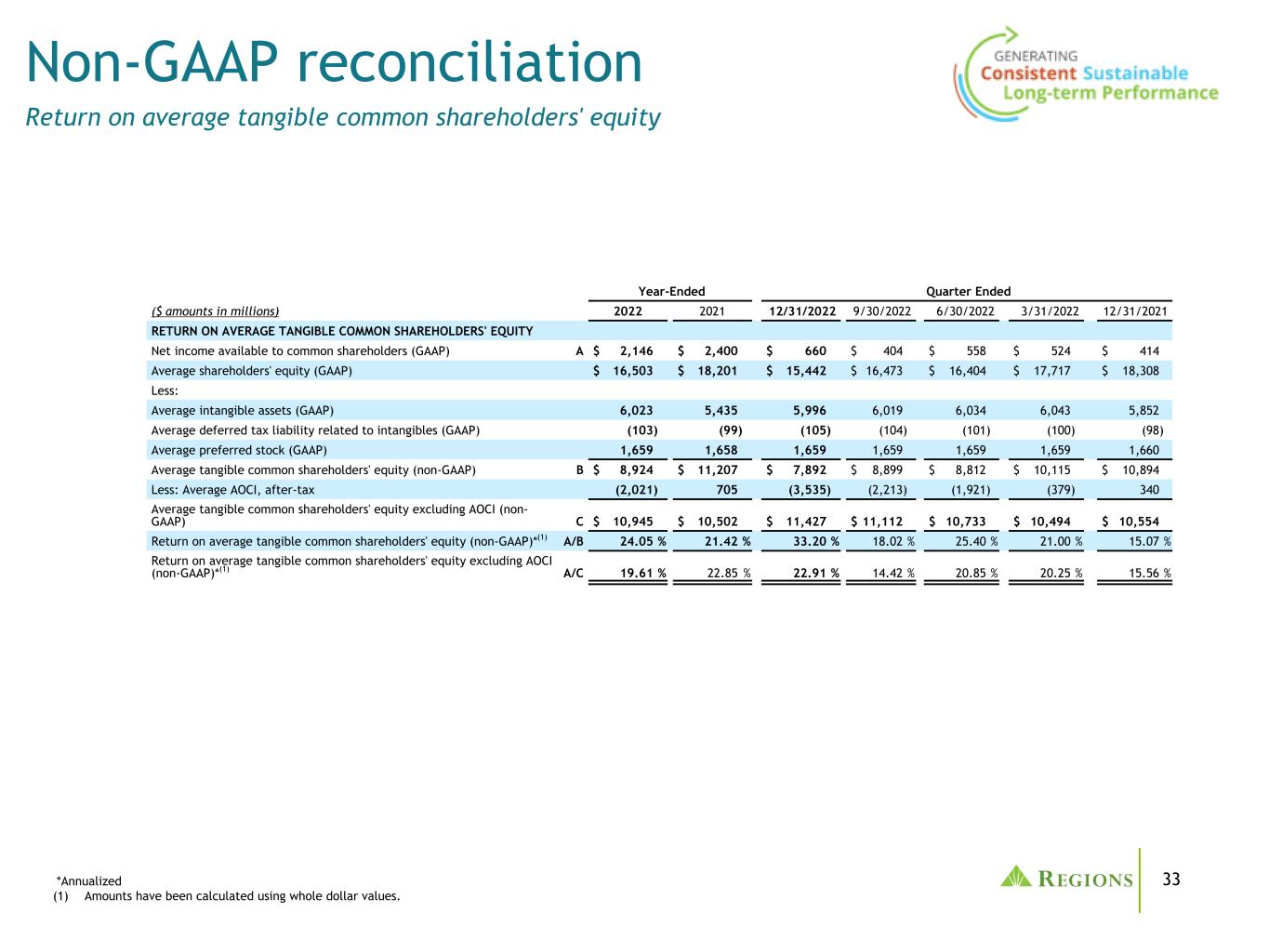

33 Year-Ended Quarter Ended ($ amounts in millions) 2022 2021 12/31/2022 9/30/2022 6/30/2022 3/31/2022 12/31/2021 RETURN ON AVERAGE TANGIBLE COMMON SHAREHOLDERS' EQUITY Net income available to common shareholders (GAAP) A $ 2,146 $ 2,400 $ 660 $ 404 $ 558 $ 524 $ 414 Average shareholders' equity (GAAP) $ 16,503 $ 18,201 $ 15,442 $ 16,473 $ 16,404 $ 17,717 $ 18,308 Less: Average intangible assets (GAAP) 6,023 5,435 5,996 6,019 6,034 6,043 5,852 Average deferred tax liability related to intangibles (GAAP) (103) (99) (105) (104) (101) (100) (98) Average preferred stock (GAAP) 1,659 1,658 1,659 1,659 1,659 1,659 1,660 Average tangible common shareholders' equity (non-GAAP) B $ 8,924 $ 11,207 $ 7,892 $ 8,899 $ 8,812 $ 10,115 $ 10,894 Less: Average AOCI, after-tax (2,021) 705 (3,535) (2,213) (1,921) (379) 340 Average tangible common shareholders' equity excluding AOCI (non- GAAP) C $ 10,945 $ 10,502 $ 11,427 $ 11,112 $ 10,733 $ 10,494 $ 10,554 Return on average tangible common shareholders' equity (non-GAAP)*(1) A/B 24.05 % 21.42 % 33.20 % 18.02 % 25.40 % 21.00 % 15.07 % Return on average tangible common shareholders' equity excluding AOCI (non-GAAP)*(1) A/C 19.61 % 22.85 % 22.91 % 14.42 % 20.85 % 20.25 % 15.56 % Non-GAAP reconciliation Return on average tangible common shareholders' equity *Annualized (1) Amounts have been calculated using whole dollar values.

34 Forward-Looking Statements This presentation may include forward-looking statements as defined in the Private Securities Litigation Reform Act of 1995. The words “future,” “anticipates,” “assumes,” “intends,” “plans,” “seeks,” “believes,” “predicts,” “potential,” “objectives,” “estimates,” “expects,” “targets,” “projects,” “outlook,” “forecast,” “would,” “will,” “may,” “might,” “could,” “should,” “can,” and similar terms and expressions often signify forward-looking statements. Forward-looking statements are subject to the risk that the actual effects may differ, possibly materially, from what is reflected in those forward-looking statements due to factors and future developments that are uncertain, unpredictable and in many cases beyond our control. Forward-looking statements are not based on historical information, but rather are related to future operations, strategies, financial results or other developments. Forward-looking statements are based on management’s current expectations as well as certain assumptions and estimates made by, and information available to, management at the time the statements are made. Those statements are based on general assumptions and are subject to various risks, and because they also relate to the future they are likewise subject to inherent uncertainties and other factors that may cause actual results to differ materially from the views, beliefs and projections expressed in such statements. Therefore, we caution you against relying on any of these forward-looking statements. These risks, uncertainties and other factors include, but are not limited to, those described below: • Current and future economic and market conditions in the United States generally or in the communities we serve (in particular the Southeastern United States), including the effects of possible declines in property values, increases in interest rates and unemployment rates, inflation, financial market disruptions and potential reductions of economic growth, which may adversely affect our lending and other businesses and our financial results and conditions. • Possible changes in trade, monetary and fiscal policies of, and other activities undertaken by, governments, agencies, central banks and similar organizations, which could have a material adverse effect on our businesses and our financial results and conditions. • Changes in market interest rates or capital markets could adversely affect our revenue and expense, the value of assets and obligations, and the availability and cost of capital and liquidity. • The impact of pandemics, including the ongoing COVID-19 pandemic, on our businesses, operations, and financial results and conditions. The duration and severity of any pandemic, including the COVID-19 pandemic, could disrupt the global economy, adversely affect our capital and liquidity position, impair the ability of borrowers to repay outstanding loans and increase our allowance for credit losses, impair collateral values, and result in lost revenue or additional expenses. • Any impairment of our goodwill or other intangibles, any repricing of assets, or any adjustment of valuation allowances on our deferred tax assets due to changes in tax law, adverse changes in the economic environment, declining operations of the reporting unit or other factors. • The effect of new tax legislation and/or interpretation of existing tax law, which may impact our earnings, capital ratios, and our ability to return capital to shareholders. • Possible changes in the creditworthiness of customers and the possible impairment of the collectability of loans and leases, including operating leases. • Volatility and uncertainty related to inflation and the effects of inflation, which may lead to increased costs for businesses and consumers and potentially contribute to poor business and economic conditions generally. • Changes in the speed of loan prepayments, loan origination and sale volumes, charge-offs, credit loss provisions or actual credit losses where our allowance for credit losses may not be adequate to cover our eventual losses. • Possible acceleration of prepayments on mortgage-backed securities due to low interest rates, and the related acceleration of premium amortization on those securities. • Loss of customer checking and savings account deposits as customers pursue other, higher-yield investments, which could increase our funding costs. • Possible changes in consumer and business spending and saving habits and the related effect on our ability to increase assets and to attract deposits, which could adversely affect our net income. • Our ability to effectively compete with other traditional and non-traditional financial services companies, including fintechs, some of whom possess greater financial resources than we do or are subject to different regulatory standards than we are. • Our inability to develop and gain acceptance from current and prospective customers for new products and services and the enhancement of existing products and services to meet customers’ needs and respond to emerging technological trends in a timely manner could have a negative impact on our revenue. • Our inability to keep pace with technological changes, including those related to the offering of digital banking and financial services, could result in losing business to competitors. • Changes in laws and regulations affecting our businesses, including legislation and regulations relating to bank products and services, as well as changes in the enforcement and interpretation of such laws and regulations by applicable governmental and self-regulatory agencies, including as a result of the changes in U.S. presidential administration, control of the U.S. Congress, and changes in personnel at the bank regulatory agencies, which could require us to change certain business practices, increase compliance risk, reduce our revenue, impose additional costs on us, or otherwise negatively affect our businesses. • Our capital actions, including dividend payments, common stock repurchases, or redemptions of preferred stock, must not cause us to fall below minimum capital ratio requirements, with applicable buffers taken into account, and must comply with other requirements and restrictions under law or imposed by our regulators, which may impact our ability to return capital to shareholders. Forward-looking statements

35 • Our ability to comply with stress testing and capital planning requirements (as part of the CCAR process or otherwise) may continue to require a significant investment of our managerial resources due to the importance of such tests and requirements. • Our ability to comply with applicable capital and liquidity requirements (including, among other things, the Basel III capital standards), including our ability to generate capital internally or raise capital on favorable terms, and if we fail to meet requirements, our financial condition and market perceptions of us could be negatively impacted. • The effects of any developments, changes or actions relating to any litigation or regulatory proceedings brought against us or any of our subsidiaries. • The costs, including possibly incurring fines, penalties, or other negative effects (including reputational harm) of any adverse judicial, administrative, or arbitral rulings or proceedings, regulatory enforcement actions, or other legal actions to which we or any of our subsidiaries are a party, and which may adversely affect our results. • Our ability to manage fluctuations in the value of assets and liabilities and off-balance sheet exposure so as to maintain sufficient capital and liquidity to support our businesses. • Our ability to execute on our strategic and operational plans, including our ability to fully realize the financial and nonfinancial benefits relating to our strategic initiatives. • The risks and uncertainties related to our acquisition or divestiture of businesses and risks related to such acquisitions, including that the expected synergies, cost savings and other financial or other benefits may not be realized within expected timeframes, or might be less than projected; and difficulties in integrating acquired businesses. • The success of our marketing efforts in attracting and retaining customers. • Our ability to recruit and retain talented and experienced personnel to assist in the development, management and operation of our products and services may be affected by changes in laws and regulations in effect from time to time. • Fraud or misconduct by our customers, employees or business partners. • Any inaccurate or incomplete information provided to us by our customers or counterparties. • Inability of our framework to manage risks associated with our businesses, such as credit risk and operational risk, including third-party vendors and other service providers, which could, among other things, result in a breach of operating or security systems as a result of a cyber attack or similar act or failure to deliver our services effectively. • Our ability to identify and address operational risks associated with the introduction of or changes to products, services, or delivery platforms. • Dependence on key suppliers or vendors to obtain equipment and other supplies for our businesses on acceptable terms. • The inability of our internal controls and procedures to prevent, detect or mitigate any material errors or fraudulent acts. • The effects of geopolitical instability, including wars, conflicts, civil unrest, and terrorist attacks and the potential impact, directly or indirectly, on our businesses. • The effects of man-made and natural disasters, including fires, floods, droughts, tornadoes, hurricanes, and environmental damage (specifically in the Southeastern United States), which may negatively affect our operations and/or our loan portfolios and increase our cost of conducting business. The severity and frequency of future earthquakes, fires, hurricanes, tornadoes, droughts, floods and other weather-related events are difficult to predict and may be exacerbated by global climate change. • Changes in commodity market prices and conditions could adversely affect the cash flows of our borrowers operating in industries that are impacted by changes in commodity prices (including businesses indirectly impacted by commodities prices such as businesses that transport commodities or manufacture equipment used in the production of commodities), which could impair their ability to service any loans outstanding to them and/or reduce demand for loans in those industries. • Our ability to identify and address cyber-security risks such as data security breaches, malware, ransomware, “denial of service” attacks, “hacking” and identity theft, including account take-overs, a failure of which could disrupt our businesses and result in the disclosure of and/or misuse or misappropriation of confidential or proprietary information, disruption or damage to our systems, increased costs, losses, or adverse effects to our reputation. • Our ability to achieve our expense management initiatives. Forward-looking statements (continued)

36 • Market replacement of LIBOR and the related effect on our LIBOR-based financial products and contracts, including, but not limited to, derivative products, debt obligations, deposits, investments, and loans. • Possible downgrades in our credit ratings or outlook could, among other negative impacts, increase the costs of funding from capital markets. • The effects of problems encountered by other financial institutions that adversely affect us or the banking industry generally could require us to change certain business practices, reduce our revenue, impose additional costs on us, or otherwise negatively affect our businesses. • The effects of the failure of any component of our business infrastructure provided by a third party could disrupt our businesses, result in the disclosure of and/or misuse of confidential information or proprietary information, increase our costs, negatively affect our reputation, and cause losses. • Our ability to receive dividends from our subsidiaries, in particular Regions Bank, could affect our liquidity and ability to pay dividends to shareholders. • Changes in accounting policies or procedures as may be required by the FASB or other regulatory agencies could materially affect our financial statements and how we report those results, and expectations and preliminary analyses relating to how such changes will affect our financial results could prove incorrect. • Fluctuations in the price of our common stock and inability to complete stock repurchases in the time frame and/or on the terms anticipated. • The effects of anti-takeover laws and exclusive forum provision in our certificate of incorporation and bylaws. • The effects of any damage to our reputation resulting from developments related to any of the items identified above. • Other risks identified from time to time in reports that we file with the SEC. The foregoing list of factors is not exhaustive. For discussion of these and other factors that may cause actual results to differ from expectations, look under the captions “Forward-Looking Statements” and “Risk Factors” of Regions’ Annual Report on Form 10-K for the year ended December 31, 2021 and the “Risk Factors” of Regions’ Quarterly Reports on Form 10-Q for the subsequent quarters of 2022, as filed with the SEC. You should not place undue reliance on any forward-looking statements, which speak only as of the date made. Factors or events that could cause our actual results to differ may emerge from time to time, and it is not possible to predict all of them. We assume no obligation and do not intend to update or revise any forward-looking statements that are made from time to time, either as a result of future developments, new information or otherwise, except as may be required by law. Regions’ Investor Relations contact is Dana Nolan at (205) 264-7040; Regions’ Media contact is Jeremy King at (205) 264-4551. Forward-looking statements (continued)

37 ®