| Item 2. | Management’s Discussion and Analysis of Financial Condition and Results of Operations |

You should read the following discussion and analysis of our financial condition and results of operations together with the consolidated financial statements and related notes that are included elsewhere in this Quarterly Report on Form 10-Q and our 2021 Form 10-K. This discussion contains forward-looking statements based upon current plans, expectations and beliefs that involve risks and uncertainties. Our actual results may differ materially from those anticipated in these forward-looking statements as a result of various factors, including, but not limited to, those discussed in the section entitled “Risk Factors” and elsewhere in this Quarterly Report on Form 10-Q. In preparing this MD&A, we presume that readers have access to and have read the MD&A in our 2021 Form 10-K, pursuant to Instruction 2 to paragraph of Item 303 of Regulation S-K. Unless stated otherwise, references in this Quarterly Report on Form 10-Q to “us,” “we,” “our,” or our “Company” and similar terms refer to Rocket Pharmaceuticals, Inc.

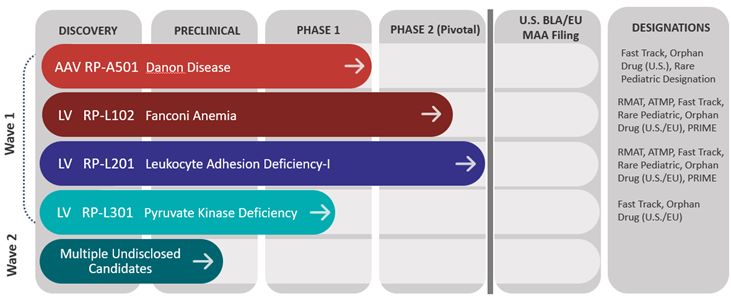

We are a clinical-stage, multi-platform biotechnology company focused on the development of first, only and best-in-class gene therapies, with direct on-target mechanism of action and clear clinical endpoints, for rare and devastating diseases. We have three clinical-stage ex vivo lentiviral vector (“LVV”) programs. These include programs for Fanconi Anemia (“FA”), a genetic defect in the bone marrow that reduces production of blood cells or promotes the production of faulty blood cells, Leukocyte Adhesion Deficiency-I (“LAD-I”), a genetic disorder that causes the immune system to malfunction and Pyruvate Kinase Deficiency (“PKD”), a rare red blood cell autosomal recessive disorder that results in chronic non-spherocytic hemolytic anemia. Of these, both the Phase 2 FA program and the Phase 1/2 LAD-I program are in potentially registration-enabling studies in the United States (“U.S.”) and Europe (“EU”). In addition, in the U.S., we have a clinical stage in vivo adeno-associated virus (“AAV”) program for Danon disease, a multi-organ lysosomal-associated disorder leading to early death due to heart failure. Additional work on a gene therapy program for the less common FA subtypes C and G is ongoing. We have global commercialization and development rights to all of these product candidates under royalty-bearing license agreements.

Effective December 2021, a decision was made to no longer pursue Rocket-sponsored clinical evaluation of RP-L401; this program was returned to academic innovators. Although we believe that gene therapy may be beneficial to patients afflicted with this disorder, we have opted to focus available resources towards advancement of RP-A501, RP-L102, RP-L201 and RP-L301, based on the compelling clinical data to date and potential for therapeutic advancement in these severe disorders of childhood and young adulthood.

Recent Developments

At-the-Market Offering Program

On February 28, 2022, we entered into the Sales Agreement with Cowen with respect to an at-the-market offering program pursuant to which the Company may offer and sell, from time to time at its sole discretion, shares through Cowen as its sales agent. The shares to be offered and sold under the Sales Agreement, if any, will be offered and sold pursuant to the Company’s shelf registration statement on Form S-3 (File No. 333-253756), which was filed with the SEC on March 2, 2021 and which became effective on September 10, 2021. We filed a prospectus supplement with the SEC on February 28, 2022 in connection with the offer and sale of the shares pursuant to the Sales Agreement. We will pay Cowen a cash commission of up to 3.0% of gross proceeds from the sale of the shares pursuant to the Sales Agreement. We also agreed to provide Cowen with customary indemnification and contribution rights and will also reimburse Cowen for certain expenses incurred in connection with the Sales Agreement. As of June 30, 2022, we sold 1.3 million shares of common stock pursuant to the at-the-market offering program for gross proceeds of $17.8 million, less commissions of $0.5 million for net proceeds of $17.3 million (see Note 7).

Gene Therapy Overview

Genes are composed of sequences of deoxyribonucleic acid (“DNA”), which code for proteins that perform a broad range of physiologic functions in all living organisms. Although genes are passed on from generation to generation, genetic changes, also known as mutations, can occur in this process. These changes can result in the lack of production of proteins or the production of altered proteins with reduced or abnormal function, which can in turn result in disease.

Gene therapy is a therapeutic approach in which an isolated gene sequence or segment of DNA is administered to a patient, most commonly for the purpose of treating a genetic disease that is caused by genetic mutations. Currently available therapies for many genetic diseases focus on administration of large proteins or enzymes and typically address only the symptoms of the disease. Gene therapy aims to address the disease-causing effects of absent or dysfunctional genes by delivering functional copies of the gene sequence directly into the patient’s cells, offering the potential for curing the genetic disease, rather than simply addressing symptoms.

We are using modified non-pathogenic viruses for the development of our gene therapy treatments. Viruses are particularly well suited as delivery vehicles because they are adept at penetrating cells and delivering genetic material inside a cell. In creating our viral delivery vehicles, the viral (pathogenic) genes are removed and are replaced with a functional form of the missing or mutant gene that is the cause of the patient’s genetic disease. The functional form of a missing or mutant gene is called a therapeutic gene, or the “transgene.” The process of inserting the transgene is called “transduction.” Once a virus is modified by replacement of the viral genes with a transgene, the modified virus is called a “viral vector.” The viral vector delivers the transgene into the targeted tissue or organ (such as the cells inside a patient’s bone marrow). We have two types of viral vectors in development, LVV and AAV. We believe that our LVV and AAV-based programs have the potential to offer a significant therapeutic benefit to patients that is durable (long-lasting).

The gene therapies can be delivered either (1) ex vivo (outside the body), in which case the patient’s cells are extracted and the vector is delivered to these cells in a controlled, safe laboratory setting, with the modified cells then being reinserted into the patient, or (2) in vivo (inside the body), in which case the vector is injected directly into the patient, either intravenously (“IV”) or directly into a specific tissue at a targeted site, with the aim of the vector delivering the transgene to the targeted cells.

We believe that scientific advances, clinical progress, and the greater regulatory acceptance of gene therapy have created a promising environment to advance gene therapy products as these products are being designed to restore cell function and improve clinical outcomes, which in many cases include prevention of death at an early age. The FDA approval of several gene therapies in recent years indicates that there is a regulatory pathway forward for gene therapy products.

Pipeline Overview

The chart below shows the current phases of development of Rocket’s programs and product candidates:

AAV Program:

Danon Disease:

Danon disease (“DD”) is a multi-organ lysosomal-associated disorder leading to early death due to heart failure. DD is caused by mutations in the gene encoding lysosome-associated membrane protein 2 (“LAMP-2”), a mediator of autophagy. This mutation results in the accumulation of autophagic vacuoles, predominantly in cardiac and skeletal muscle. Male patients often require heart transplantation and typically die in their teens or twenties from progressive heart failure. Along with severe cardiomyopathy, other DD-related manifestations can include skeletal muscle weakness, liver disease, and intellectual impairment. There are no specific therapies available for the treatment of DD and medications typically utilized for the treatment of congestive heart failure (CHF) are not believed to modify progression to end-stage CHF. Patients with end-stage CHF may undergo heart transplant, which currently is available to a minority of patients, is associated with short- and long-term complications and is not curative of the disorder in the long-term. RP-A501 is in clinical trials as an in vivo therapy for Danon disease, which is estimated to have a prevalence of 15,000 to 30,000 patients in the U.S. and the EU.

Danon disease is an autosomal dominant, rare inherited disorder characterized by progressive cardiomyopathy which is almost universally fatal in males even in settings where cardiac transplantation is available. Danon disease predominantly affects males early in life and is characterized by absence of LAMP2B expression in the heart and other tissues. Preclinical models of Danon disease have demonstrated that AAV-mediated transduction of the heart results in reconstitution of LAMP2B expression and improvement in cardiac function.

We currently have one adeno-associated viral vector program targeting DD, RP-A501. We have treated seven patients in the RP-A501 Phase 1 clinical trial, which enrolled for adult and pediatric male DD patients. This includes a first cohort evaluating a low-dose (6.7e13 genome copies (gc)/kilogram (kg)) in adult/older adolescent patients aged 15 or greater (n=3), a second cohort evaluating a higher dose (1.1e14 gc/kg) in adult/older adolescent patients aged 15 or greater (n=2), and we have initiated treatment in a pediatric cohort at a low dose level (6.7e13 gc/kg; n=2).

Data disclosed from our Phase 1 study of RP-A501 in November 2021 and January 2022 included safety and clinical activity results from the three patients treated with the low dose of 6.7e13 gc/kg and from two patients treated with the higher dose of 1.1e14 gc/kg, and initial safety information from the one pediatric patient (pediatric cohort is age 8-14 years) treated with the low dose of 6.7e13 gc/kg.

Efficacy assessments include evaluation of New York Heart Association (“NYHA”) Functional Classification, which is the most commonly used heart failure classification system. NYHA Class II is where a patient exhibits a slight limitation of physical activity, is comfortable at rest, and ordinary physical activity results in fatigue, palpitation and/or dyspnea. Class I is where a patient exhibits no limitation of physical activity and ordinary physical activity does not cause undue fatigue, palpitation and/or dyspnea. Brain natriuretic peptide (BNP) is a blood-based evaluation and a key marker of heart failure with prognostic significance in CHF and cardiomyopathies. Other efficacy parameters include echocardiographic measurements of heart thickness, most notably the thickness of the left ventricular posterior wall (LVPW), and importantly, measurement of LAMP2B gene expression both via immunohistochemistry and Western blot, as obtained via endomyocardial biopsy. Biopsied heart tissue is also evaluated on electron microscopy for evidence of DD-associated tissue derangements, including the presence of autophagic vacuoles and disruption of myofibrillar architecture, each of which are characteristic of DD-related myocardial damage.

In November 2021 and January 2022, data for the ongoing Phase 1 trial of RP-A501 was presented, including efficacy parameters for the low and high dose cohorts in patients aged 15 and older with at least 12 months follow-up (n=5). An improvement in NYHA Class (from II to I) was observed in three patients (two low-dose and one high-dose) who had closely monitored immunosuppression with follow-up greater than one year and stabilization was observed in one low-dose patient without a closely monitored immunosuppressive regimen. A substantial improvement in BNP, a key marker of heart failure, was observed in all three low-dose patients and one high-dose patient. Among the three low-dose patients, BNP decreased from a pretreatment baseline by 57% at 24 months, 79% at 18 months, and 75% at 15 months, respectively. In one high-dose patient, BNP decreased from a pretreatment baseline by 67% at 12 months. In patients with closely monitored immunosuppression (two low-dose and one high-dose) left ventricular (LV) posterior wall thickness improved (average 23% decrease compared to pretreatment baseline) and ejection fraction improved or stabilized (average 20% increase compared to pretreatment baseline) at 12 to 18 months on echocardiography. Severe and progressive wall thickening is a hallmark of the hypertrophic cardiomyopathy of Danon disease and is a major contributor to early mortality in male patients. Cardiac output remained normal for all patients with improved or stable left heart filling pressures as measured by cardiac catheterization. Three low-dose patients and one high-dose patient demonstrated improvements in the 6-minute walk test (6MWT). One low-dose patient improved from a pretreatment baseline of 443 meters (m) to 467 m at 24 months. The second low-dose patient improved from a pretreatment baseline of 405 m to 410 m at 18 months. The third low-dose patient improved from a pretreatment baseline of 427 m to 435 m at 15 months. One high-dose patient improved from a pretreatment baseline of 436 m to 492 m at 12 months. Evidence of sustained cardiac LAMP2B gene expression by immunohistochemistry and Western blot with qualitative improvement of vacuoles and cardiac tissue architecture on electron microscopy was observed at both dose levels. Sustained cardiac LAMP2B gene expression by immunohistochemistry was observed in all three patients with a closely monitored immunosuppressive regimen. Specifically, LAMP2B gene expression by immunohistochemistry in the low-dose (6.7e13 vg/kg) was 68% in one patient at Month 12 and 92% in another patient at Month 9. In one patient who received the high-dose (1.1e14 vg/kg), LAMP2B gene expression by immunohistochemistry was 100% at Month 12.

One of the patients receiving therapy on the high dose cohort had progressive heart failure and underwent a heart transplant at Month 5 following therapy. This patient had more advanced disease than the 4 other adult/older adolescent patients who received treatment in the low and high dose cohorts, as evidenced by diminished LV ejection fraction (35%) on echocardiogram and markedly elevated LV filling pressure prior to treatment. His clinical course was characteristic of DD progression. Assessments regarding gene transduction from the explanted heart are summarized below:

Explanted Heart

| • | Analysis of the explanted heart revealed significant fibrosis consistent with advanced DD. |

| • | Myocardial tissue from the explanted heart at 5 months post-treatment displayed 100% LAMP2B protein expression by immunohistochemistry throughout non-fibrotic cardiac regions including the ventricles and other essential targeted areas |

RP-A501 was generally well tolerated at the 6.7e13 gc/kg dose level, or lower dose. All observed adverse effects were reversible with no lasting sequelae. Early transaminase and creatinine kinase elevations returned to baseline or decreased. No unexpected and serious drug product-related adverse events or severe adverse events were observed in this low dose cohort. The most common adverse events were predominantly mild, not associated with clinical symptoms and were related to elevated transaminases post-treatment. Elevation in transaminases and creatinine kinases was observed in all three low-dose patients and returned to baseline levels within the first one to two months post-treatment. There was also a transient and reversible decline in platelets observed in these three patients. These changes were largely responsive to corticosteroids and other immunosuppressive therapies. All patients were given oral steroids to prevent or minimize potential immune-related events. Corticosteroids were associated with transient exacerbation of DD-associated skeletal myopathy, which resolved upon discontinuation of steroid therapy. At the higher dose administered (1.1e14 gc/kg), additional immunosuppressive therapies were stipulated and administered to mitigate the immune response associated with RP-A501. As disclosed in December 2020, one of the two patients receiving the 1.1e14 gc/kg dose had more advanced heart failure than the others, and was the heaviest patient treated to-date (receiving the highest absolute AAV9 dose). This patient experienced a non-persistent, immune-related event that was classified as a drug product-related serious adverse event. This thrombotic microangiopathy (“TMA”) event (which was later reclassified as a Sudden Unexpected Serious Adverse Reaction (“SUSAR”) was believed to be likely due to immune-mediated complement activation, resulting in reversible thrombocytopenia and acute kidney injury requiring eculizumab and transient hemodialysis. This patient regained normal kidney function within three weeks. (This event occurred in the same patient in whom RP-A501 was not associated with clinical stabilization or improvement, and who required a heart transplant 5 months post-therapy).

Following transplant, this patient has been clinically stable and reports resolution of a baseline skeletal myopathy that was present prior to treatment. Analysis of the explanted heart is described above. Of note, this patient had more advanced heart failure at time of treatment; the clinical protocol has been modified to exclude enrollment of DD with end-stage CHF/cardiomyopathy. In May 2021, 5 months after details of this event were disclosed and after recognition of complement-mediated TMA in other systemic AAV programs, the FDA placed the study on clinical hold. In response to the FDA’s clinical hold, we amended the trial protocol in order to enable more defined mechanisms for prevention, early recognition and management of complement-mediated adverse events. The FDA lifted the clinical hold on August 16, 2021 and dosing of the pediatric cohort was initiated in the fourth quarter of 2021.

Based on the activity observed in the low dose cohort and to mitigate complement-mediated TMA (safety concerns observed in the high dose cohort) and in agreement with the FDA, we are focusing on the low dose (6.7e13 gc/kg) and we will no longer administer doses of 1.1e14 gc/kg or higher in this trial. Additional safety measures have been implemented and are reflected in the updated trial protocol. These measures include exclusion of patients with end-stage heart failure, and a refined immunosuppressive regimen involving transient B- and T-cell mediated inhibition, with emphasis on preventing complement activation, while also enabling lower steroid doses and earlier steroid taper, with all immunosuppressive therapy discontinued 2-3 months following therapy. As announced in January 2022, the initial pediatric patient received RP-A501 therapy (6.7e13 gc/kg dose level) without evidence of significant complement activation and with stable platelet levels; there was no worsening of the patient’s baseline DD-related skeletal myopathy during the weeks following RP-A501. A second pediatric patient has also been treated under the program.

In May 2022, we presented new initial safety data for RP-A501 at the 25th Annual Meeting of the American Society of Gene and Cell Therapy (“ASGCT”). In the pediatric cohort, RP-A501 (6.7e13 gc/kg dose level) was well-tolerated in both patients as of the April 30, 2022 cut-off date. The patients were observed to have normal-range platelets, diminished complement activation relative to the adult cohorts, and no complement-related adverse events. The two patients received preventative treatment with an enhanced immunomodulatory regimen. No significant immediate or delayed toxicities have been observed as of the April 30, 2022 cut-off date. In the adult (age ≥15 years) low-dose cohort, RP-A501 was generally well-tolerated. All 4 adult (age ≥15 years) patients with observed immunomodulatory regimen compliance and preserved (>40%) left ventricular ejection fraction at baseline demonstrated disease modification across molecular, echocardiographic, and functional parameters. These patients demonstrated evidence of cardiac LAMP2B expression by immunohistochemistry. Echocardiograms showed stabilized or decreased cardiac wall thickness with improved or stabilized ejection fraction in these patients. Patients in the adult cohorts demonstrated sustained improvement or stabilization in Brain Natriuretic Peptide (BNP) and New York Heart Association (NYHA) class, 6-minute walk test and reported increases in physical activity. Adverse events were manageable with transient immunomodulation. All treatment-related adverse events in pediatric and adult cohorts were reversible with no lasting renal, hepatic, or other sequelae.

We look forward to presenting early efficacy data from the pediatric cohort with three to six months of follow-up in the third quarter of 2022. If early signals of efficacy and ongoing tolerability are demonstrated along with evidence of longer-term safety and efficacy in the adults, we expect these results to support FDA discussions on study design and endpoints in the fourth quarter of 2022 for our planned Phase 2 trial. Phase 2 trial planning activities are expected to begin in the fourth quarter of 2022.

Fanconi Anemia Complementation Group A (FANCA):

FA, a rare and life-threatening DNA-repair disorder, generally arises from a mutation in a single FA gene. An estimated 60 to 70% of cases arise from mutations in the Fanconi-A (“FANCA”) gene, which is the focus of our program. FA results in bone marrow failure, developmental abnormalities, myeloid leukemia, and other malignancies, often during the early years and decades of life. Bone marrow aplasia, which is bone marrow that no longer produces any or very few red and white blood cells and platelets leading to infections and bleeding, is the most frequent cause of early morbidity and mortality in FA, with a median onset before 10 years of age. Leukemia is the next most common cause of mortality, ultimately occurring in about 20% of patients later in life. Solid organ malignancies, such as head and neck cancers, can also occur, although at lower rates during the first two to three decades of life.

Although improvements in allogeneic (donor-mediated) hematopoietic stem cell transplant (“HSCT”), currently the most frequently utilized therapy for FA, have resulted in more frequent hematologic correction of the disorder, HSCT is associated with both acute and long-term risks, including transplant-related mortality, graft versus host disease (“GVHD”), a sometimes fatal side effect of allogeneic transplant characterized by painful ulcers in the GI tract, liver toxicity and skin rashes, as well as increased risk of subsequent cancers. Our gene therapy program in FA is designed to enable a minimally toxic hematologic correction using a patient’s own stem cells during the early years of life. We believe that the development of a broadly applicable autologous gene therapy can be transformative for these patients.

Each of our LVV-based programs utilize third-generation, self-inactivating lentiviral vectors to correct defects in patients’ HSCs, which are the cells found in bone marrow that are capable of generating blood cells over a patient’s lifetime. Defects in the genetic coding of HSCs can result in severe, and potentially life-threatening anemia, which is when a patient’s blood lacks enough properly functioning red blood cells to carry oxygen throughout the body. Stem cell defects can also result in severe and potentially life-threatening decreases in white blood cells resulting in susceptibility to infections, and in platelets responsible for blood clotting, which may result in severe and potentially life-threatening bleeding episodes. Patients with FA have a genetic defect that prevents the normal repair of genes and chromosomes within blood cells in the bone marrow, which frequently results in the development of acute myeloid leukemia (“AML”), a type of blood cancer, as well as bone marrow failure and congenital defects. The average lifespan of an FA patient is estimated to be 30 to 40 years. The prevalence of FA in the U.S. and EU is estimated to be approximately 4,000 patients in total. In light of the efficacy seen in non-conditioned patients, the addressable annual market opportunity is now believed to be 400 to 500 patients collectively in the U.S. and EU.

We currently have one ex-vivo LVV-based program targeting FA, RP-L102. RP-L102 is our lead lentiviral vector-based program that we in-licensed from Centro de Investigaciones Energéticas, Medioambientales y Tecnológicas (“CIEMAT”), which is a leading research institute in Madrid, Spain. RP-L102 is currently being studied in our Phase 2 registrational enabling clinical trials treating FA patients at the Center for Definitive and Curative Medicine at Stanford University School of Medicine (“Stanford”), the University of Minnesota, Great Ormond Street Hospital (“GOSH”) in London and Hospital Infantil de Nino Jesus (“HNJ”) in Spain. The trial is expected to enroll a total of ten patients from the U.S. and EU with the first patient in this Phase 2 trial treated in December 2019. Patients will receive a single intravenous infusion of RP-L102 that utilizes fresh cells and “Process B” which incorporates a modified stem cell enrichment process, transduction enhancers, as well as commercial-grade vector and final drug product.

Resistance to mitomycin-C, a DNA damaging agent, in bone marrow stem cells at a minimum time point of one year post treatment is the primary endpoint for our ongoing Phase 2 study. Per agreement with the FDA and EMA, engraftment leading to bone marrow restoration exceeding a 10% mitomycin-C resistance threshold could support a marketing application for approval.

In December 2020, we presented updated interim data from our FA program at the 62nd American Society of Hematology (“ASH”) Annual Meeting. The FA data presented at the ASH Annual Meeting were from seven of the nine patients treated (out of twelve patients enrolled) as of October 2020 in both the U.S. Phase 1 and global Phase 2 studies of RP-L102 for FA. Patients in these studies received a single intravenous infusion of “Process B” RP-L102 which incorporates a modified stem cell enrichment process, transduction enhancers, as well as commercial-grade vector. Preliminary data from these studies support “Process B” as a consistent and reproducible improvement over “Process A” which was used in earlier academic FA studies.

Seven patients had follow-up data of at least two-months and three of the seven patients had been followed for twelve-months or longer. As patients are treated with gene therapy product without the use of a conditioning regimen, the data indicated that RP-L102 was generally well-tolerated with no significant safety issues reported with infusion or post-treatment. One drug related serious adverse event of Grade 2 transient infusion-related reaction was observed. In five out of the seven patients for whom there was follow-up data, evidence of preliminary engraftment was observed, with bone marrow (“BM”) vector copy numbers (“VCNs”) from 0.16 to 0.22 (long-term follow-up only) and peripheral VCNs ranging from 0.01 (2-month follow-up) to 0.11 (long-term follow-up). Further, two of the three patients with greater than 12-months follow-up showed evidence of increasing engraftment, mitomycin-C (“MMC”) resistance and stable blood counts, which suggests a halt in the progression of bone marrow failure. The third patient with greater than 12-month follow-up contracted Influenza B nine months post-treatment resulting in progressive BM failure, for which, such patient received a successful bone marrow transplant at 18 months post-treatment.

In May 2021, we presented positive clinical data at the 24th Annual Meeting of the ASGCT. The preliminary data from the Phase 1/2 trials presented in a poster at ASGCT were from nine pediatric patients and showed increasing evidence of engraftment in at least six of the nine patients, including two patients with at least 15-months of follow-up and four patients with at least 6-months of follow-up. RP-L102 demonstrated a highly favorable tolerability profile with all subjects being treated without conditioning and with no sign of dysplasia. One patient experienced a Grade 2 transient infusion-related reaction.

In December 2021, we presented encouraging clinical data at the 63rd Annual Meeting of the American Society of Hematology (ASH). The preliminary results from the Phase 1/2 trials were presented in a poster at ASH were from eleven pediatric patients and showed increasing evidence of engraftment in at least six of eight patients for whom there are at least 12 months of follow-up, including bone marrow progenitor cell resistance to mitomycin-C (MMC) ranging from 16-63% in six patients (bone marrow cells in FA patients are highly sensitive to DNA-damaging agents including MMC; this susceptibility to DNA damage is believed to mediate the FA-associated bone marrow failure and predisposition to malignancy. In addition to the development of MMC-resistance in BM hematopoietic cells, sustained peripheral VCN levels were seen in six of seven patients with at least 12-months of follow-up. One patient experienced an Influenza B infection approximately 9 months following treatment with concomitant progressive hematologic failure requiring allogeneic hematopoietic stem cell transplant, which was administered successfully; the remaining patients have not required transfusions. RP-L102 demonstrated a highly favorable tolerability profile with all subjects being treated without cytotoxic conditioning and no signs of dysplasia. The only RP-L102 related serious adverse event to-date has been a Grade 2 transient infusion-related reaction in one patient.

In May 2022, we presented updated data for RP-L102 at ASGCT's 25th Annual Meeting. Five of nine evaluable patients as of the April 4, 2022 cut-off date had increased resistance to MMC in bone marrow-derived colony forming cells, ranging from 21% to 42% at 12 to 18 months, increasing to 51% to 94% at 18 - 21 months. The primary endpoint has been achieved, based on a trial protocol in which statistical and clinical significance requires a minimum of five patients to attain increased MMC resistance at least 10% above baseline at two or more timepoints, and concomitant evidence of genetic correction and clinical stabilization. A sixth patient has displayed evidence of progressively increasing genetic correction as evidenced by peripheral VCN. Three additional patients were less than 12 months post-treatment at the time of presentation. One patient had progressive bone marrow failure following therapy and underwent successful allogeneic transplant as previously disclosed. The tolerability profile of RP-L102 appears favorable with no signs of dysplasia, clonal dominance or oncogenic integrations; as previously reported, one patient experienced a RP-L102 Grade 2 transient infusion-related reaction, which resolved without any additional clinical sequelae.

Based on achievement of the primary endpoint in our potentially pivotal Phase 2 study for Fanconi Anemia, we have begun dialogue around biologics license application (“BLA”) preparations for initiating BLA planning activities. Additional data readouts for the Fanconi Anemia program are expected in the fourth quarter of 2022.

Leukocyte Adhesion Deficiency-I (LAD-I):

LAD-I is a rare autosomal recessive disorder of white blood cell adhesion and migration, resulting from mutations in the ITGB2 gene encoding for the Beta-2 Integrin component, CD18. Deficiencies in CD18 result in an impaired ability for neutrophils (a subset of infection-fighting white blood cells) to leave blood vessels and enter tissues where these cells are needed to combat infections. As is the case with many rare diseases, accurate estimates of incidence are difficult to confirm; however, several hundred cases have been reported to date. Most LAD-I patients are believed to have the severe form of the disease. Severe LAD-I is notable for recurrent, life-threatening infections and substantial infant mortality in patients who do not receive an allogeneic HSCT. Mortality for severe LAD-I has been reported as 60 to 75% by age two in the absence of allogeneic HCST.

We currently have one

ex-vivo program targeting LAD-I, RP-L201. RP-L201 is a clinical program that we in-licensed from CIEMAT. We have partnered with UCLA to lead U.S. clinical development efforts for the LAD-I program. UCLA and its Eli and Edythe Broad Center of Regenerative Medicine and Stem Cell Research is serving as the lead U.S. clinical research center for the registrational clinical trial for LAD-I, and HNJ and GOSH serving as the lead clinical sites in Spain and London, respectively. This study has received a $7.5 million CLIN2 grant award from the California Institute for Regenerative Medicine (“CIRM”) to support the clinical development of gene therapy for LAD-I.

The ongoing open-label, single-arm, Phase 1/2 registration-enabling clinical trial of RP-L201 has treated four severe LAD-I patients to assess the safety and tolerability of RP-L201 to date. The first patient was treated at UCLA with RP-L201 in the third quarter 2019. Enrollment is now complete in both the Phase 1 and 2 portions of the study; 9 patients have received RP-L102 at 3 investigative centers in the U.S. and Europe.

In December 2021, we presented positive clinical data at the 63rd Annual Meeting of ASH. The ASH oral presentation included preliminary data from eight of nine severe LAD-I patients, as defined by CD18 expression of less than 2%, who received RP-L201 treatment as of the November 8, 2021, data cut-off date. Eight patients had follow-up data of at least three months, and four of the eight patients had been followed for 12 months or longer. All infusions of RP-L201 were well tolerated and no drug product-related serious adverse events were reported. Evidence of preliminary efficacy was observed in all eight evaluable patients. All eight patients demonstrated neutrophil CD18 expression that exceeded the 4-10% threshold associated with survival into adulthood and consistent with reversal of the severe LAD-I phenotype including six patients with at least 6 months of follow-up. Peripheral blood VCN levels have been stable and in the 0.54 – 2.94 copies per genome range. No patients had LAD-I related infections requiring hospitalization after hematopoietic reconstitution post-RP-L201. Additional updates presented in January 2022 included a ninth patient achieving CD18 expression of 61% at 3 months, with the preliminary observation that all nine of nine patients have demonstrated 26% to 87% CD18 expression at timepoints ranging from 3 to 24 months following RP-L102, with stable CD18 expression levels for each patient subsequent to month 3.

In May 2022, we presented updated data at ASGCT’s 25th Annual Meeting. The presentation included interim efficacy and safety data at three to 24 months of follow-up after infusion for all nine treated patients and overall survival data, including survival data for the seven patients with at least 12 months of follow-up after infusion as of the March 9, 2022 cut-off date. All patients, aged three months to nine years, demonstrated sustained CD18 restoration and expression on more than 10% of neutrophils (range: 20%-87%, median: 56%). At one year, the overall survival without allogeneic hematopoietic stem cell transplantation across the cohort is 100% based on the Kaplan-Meier estimate. As of the data cut-off, all nine patients are alive and clinically stable. All patients demonstrated a statistically significant reduction in the rate of all-cause hospitalizations and severe infections, relative to pre-treatment. Evidence of resolution of LAD-I-related skin rash and restoration of wound repair capabilities has been shown along with sustained phenotypic correction. The tolerability profile of RP-L201 has been highly favorable in all patients with no RP-L201-related adverse events. Adverse events related to other study procedures, including busulfan conditioning, have been previously disclosed and consistent with the tolerability profiles of those agents and procedures.

We have initiated discussions with the FDA on BLA filing plans for RP-L201 for the treatment of severe LAD-I and we anticipate a BLA filing in the first half of 2023.

Pyruvate Kinase Deficiency (PKD):

Red blood cell PKD is a rare autosomal recessive disorder resulting from mutations in the pyruvate kinase L/R (“PKLR”) gene encoding for a component of the red blood cell (“RBC”) glycolytic pathway. PKD is characterized by chronic non-spherocytic hemolytic anemia, a disorder in which RBCs do not assume a normal spherical shape and are broken down, leading to decreased ability to carry oxygen to cells, with anemia severity that can range from mild (asymptomatic) to severe forms that may result in childhood mortality or a requirement for frequent, lifelong RBC transfusions. The pediatric population is the most commonly and severely affected subgroup of patients with PKD, and PKD often results in splenomegaly (abnormal enlargement of the spleen), jaundice and chronic iron overload which is likely the result of both chronic hemolysis and the RBC transfusions used to treat the disease. The variability in anemia severity is believed to arise in part from the large number of diverse mutations that may affect the PKLR gene. Estimates of disease incidence have ranged between 3.2 and 51 cases per million in the white U.S. and EU population. Industry estimates suggest at least 2,500 cases in the U.S. and EU have already been diagnosed despite the lack of FDA-approved molecularly targeted therapies. Market research indicates the application of gene therapy to broader populations could increase the market opportunity from approximately 250 to 500 patients per year.

We currently have one ex-vivo LVV-based program targeting PKD, RP-L301. RP-L301 is a clinical stage program that we in-licensed from CIEMAT. The IND for RP-L301 to initiate the global Phase 1 study cleared in October 2019. This program has been granted US and EMA orphan drug disease designation.

This global Phase 1 open-label, single-arm, clinical trial is expected to enroll six adult and pediatric PKD patients in the U.S. and Europe. The trial will be comprised of three cohorts to assess RP-L301 in young pediatric (age 8-11), older pediatric (age 12-17) and adult populations. The trial is designed to assess the safety, tolerability, and preliminary activity of RP-L301, and initial safety evaluation will occur in the adult cohort before evaluation in pediatric patients. Stanford will serve as the lead site in the U.S. for adult and pediatric patients, HNJ will serve as the lead site in Europe for pediatrics, and Hospital Universitario Fundación Jiménez Díaz will serve as the lead site in Europe for adult patients. In July 2020, we treated the first patient in our clinical trial of RP-L301.

In December 2021, we presented positive clinical data at the 63rd Annual Meeting of ASH. The ASH poster presentation included preliminary data from two adult patients with severe anemia and substantial transfusion requirements who were treated as of the November 3, 2021 cut-off date. Each of these patients had experience extensive PKD-related disease complications including hepatic iron overload. Both patients have had marked improvement in hemoglobin levels, from baselines of 7.4 and 7.0 g/dL to 12-month values of 13.3 and 14.8 g/dL respectively; this represents an improvement from severe (Hb <8g/dL) to normal levels. Both patients have been transfusion independent subsequent to post-treatment hematopoietic reconstitution. Anemia resolution has been accompanied by marked improvement in additional markers of hemolysis, including bilirubin, erythropoietin, and reticulocyte counts. RP-L301 has been well tolerated in these adult patients, with no drug product related serious adverse events or infusion-related complications observed through 12-months post-treatment. Both patients have reported improved quality of life (QOL) following treatment with increases on FACT-An and additional designated QOL evaluations sustained through 12 months following therapy.

In May 2022, we presented updated data at the 25th Annual Meeting of the ASGCT. The presentation included data from two adult patients with severe or transfusion-dependent anemia as of the April 13, 2022 cut-off date. At 18 months post-infusion, both patients had sustained transgene expression, normalized hemoglobin, improved hemolysis, no red blood cell transfusion requirements post-engraftment and improved quality of life both reported anecdotally and as documented via formal quality of life assessments. The tolerability profile of RP-L301 appears favorable, with no RP-L-301-related serious adverse events through 18 months post-infusion. Transient transaminase elevation was seen in both patients post-therapy/conditioning, with no clinical stigmata of liver injury and subsequent resolution without clinical sequelae. The pediatric cohort is currently enrolling.

Enrollment in the PKD pediatric cohort is ongoing, and additional Phase 1 data are expected in the fourth quarter 2022.

Infantile Malignant Osteopetrosis (IMO):

IMO is a genetic disorder characterized by increased bone density and bone mass secondary to impaired bone resorption. During normal growth and development small areas of bone are constantly being broken down by special cells called osteoclasts, then made again by cells called osteoblasts. In IMO, the cells that break down bone (osteoclasts) do not work properly, which leads to the bones becoming thicker and not as healthy. Untreated IMO patients may suffer from a compression of the bone-marrow space, which results in bone marrow failure, anemia, and increased infection risk due to the lack of production of white blood cells. Untreated IMO patients may also suffer from a compression of cranial nerves, which transmit signals between vital organs and the brain, resulting in blindness, hearing loss and other neurologic deficits.

IMO represents the autosomal recessive, severe variants of a group of disorders characterized by increased bone density and bone mass secondary to impaired bone resorption. IMO typically presents in the first year of life and is associated with severe manifestations leading to death within the first decade of life in the absence of allogeneic HSCT, although HSCT results have been limited to-date and notable for frequent graft failure, GVHD and other severe complications.

Approximately 50% of IMO results from mutations in the TCIRG1 gene, resulting in cellular defects that prevent osteoclast bone resorption. As a result of this defect, bone growth is markedly abnormal. It is estimated that IMO occurs in 1 out of 250,000-300,000 within the general global population, although incidence is higher in specific geographic regions including Costa Rica, parts of the Middle East, the Chuvash Republic of Russia, and the Vasterbotten Province of Northern Sweden.

Effective December 2021, the Company made a decision to no longer pursue Rocket-sponsored clinical evaluation of RP-L401; this program was returned to academic innovators. The Company has opted to focus available resources towards advancement of RP-A501, RP-L102, RP-L201 and RP-L301, based on the compelling clinical data to date and potential for therapeutic advancement in these severe disorders of childhood and young adulthood.

cGMP Manufacturing

Our state-of-the-art, 103,720 square foot manufacturing facility in Cranbury, New Jersey. has been scaled up to manufacture AAV drug product for a planned Phase 2 pivotal trial in Danon disease. The facility also houses lab space for R & D and quality. We recently consulted with the FDA on CMC (chemistry, manufacturing, and controls) (“CMC”) requirements to start AAV cGMP manufacturing at our in-house facility as well as potency assay plans for a Phase 2 pivotal trial in Danon disease. To further strengthen our manufacturing and commercial capabilities we appointed Mayo Pujols, one of the most seasoned cell and gene therapy technical operations and manufacturing leaders in the industry, as our Chief Technical Officer.

Strategy

We seek to bring hope and relief to patients with devastating, undertreated, rare pediatric diseases through the development and commercialization of potentially curative first-in-class gene therapies. To achieve these objectives, we intend to develop into a fully-integrated biotechnology company. In the near and medium-term, we intend to develop our first-in-class product candidates, which are targeting devastating diseases with substantial unmet need, develop proprietary in-house analytics and manufacturing capabilities and continue to commence registration trials for our currently planned programs. We expect to submit our first biologics license application (“BLA”) for the LAD program in the first half of 2023. In the medium and long-term, pending favorable data, we expect to submit BLAs for the rest of our suite of clinical programs, and establish our gene therapy platform and expand our pipeline to target additional indications that we believe to be potentially compatible with our gene therapy technologies. In addition, during that time, we believe that our currently planned programs will become eligible for priority review vouchers from the FDA that provide for expedited review. We have assembled a leadership and research team with expertise in cell and gene therapy, rare disease drug development and product approval.

We believe that our competitive advantage lies in our disease-based selection approach, a rigorous process with defined criteria to identify target diseases. We believe that this approach to asset development differentiates us as a gene therapy company and potentially provides us with a first-mover advantage.

Financial Overview

Since our inception, we have devoted substantially all of our resources to organizing and staffing the company, business planning, raising capital, acquiring or discovering product candidates and securing related intellectual property rights, conducting discovery, R&D activities for our product candidates and planning for potential commercialization. We do not have any products approved for sale and have not generated any revenue from product sales. From inception through June 30, 2022, we raised net cash proceeds of approximately $697.8 million from investors through both equity and convertible debt financing to fund operating activities.

To date, we have not generated any revenue from any sources, including from product sales, and we do not expect to generate any revenue from the sale of products in the near future. If our development efforts for product candidates are successful and result in regulatory approval or license agreements with third parties, we may generate revenue in the future from product sales.

Operating Expenses

Research and Development Expenses

Our R&D program expenses consist primarily of external costs incurred for the development of our product candidates. These expenses include:

| • | expenses incurred under agreements with research institutions and consultants that conduct R&D activities including process development, preclinical, and clinical activities on our behalf; |

| • | costs related to process development, production of preclinical and clinical materials, including fees paid to contract manufacturers and manufacturing input costs for use in internal manufacturing processes; |

| • | consultants supporting process development and regulatory activities; |

| • | costs related to in-licensing of rights to develop and commercialize our product candidate portfolio. |

We recognize external development costs based on contractual payment schedules aligned with program activities, invoices for work incurred, and milestones which correspond with costs incurred by the third parties. Nonrefundable advance payments for goods or services to be received in the future for use in R&D activities are recorded as prepaid expenses.

Our direct R&D expenses are tracked on a program-by-program basis for product candidates and consist primarily of external costs, such as research collaborations and third-party manufacturing agreements associated with our preclinical research, process development, manufacturing, and clinical development activities. Our direct R&D expenses by program also include fees incurred under license agreements. Our personnel, non-program and unallocated program expenses include costs associated with activities performed by our internal R&D organization and generally benefit multiple programs. These costs are not separately allocated by product candidate and consist primarily of:

| • | salaries and personnel-related costs, including benefits, travel, and stock-based compensation, for our scientific personnel performing R&D activities; |

| • | facilities and other expenses, which include expenses for rent and maintenance of facilities, and depreciation expense; and |

| • | laboratory supplies and equipment used for internal R&D activities. |

Our direct R&D expenses consist principally of external costs, such as fees paid to investigators, consultants, laboratories and CROs in connection with our clinical studies, and costs related to acquiring and manufacturing clinical study materials. We allocate salary and benefit costs directly related to specific programs. We do not allocate personnel-related discretionary bonus or stock-based compensation costs, costs associated with our general discovery platform improvements, depreciation or other indirect costs that are deployed across multiple projects under development and, as such, the costs are separately classified as other R&D expenses.

The following table presents R&D expenses tracked on a program-by-program basis as well as by type and nature of expense for the three and six months ended June 30, 2022 and 2021.

| | | Three Months Ended June 30, | | | Six Months Ended June 30, | |

| | | 2022 | | | 2021 | | | 2022 | | | 2021 | |

| Direct Expenses: | | | | | | | | | | | | |

| Danon Disease (AAV) RP-A501 | | $ | 9,568 | | | $ | 4,507 | | | $ | 15,942 | | | $ | 8,307 | |

| Leukocyte Adhesion Deficiency (LVV) RP-L201 | | | 7,044 | | | | 3,864 | | | | 10,095 | | | | 10,270 | |

| Fanconi Anemia (LVV) RP-L102 | | | 4,557 | | | | 2,013 | | | | 9,087 | | | | 5,608 | |

| Pyruvate Kinase Deficiency (LVV) RP-L301 | | | 632 | | | | 562 | | | | 1,486 | | | | 2,421 | |

Infantile Malignant Osteopetrosis (LVV) RP-L401 (1) | | | - | | | | 449 | | | | 190 | | | | 1,245 | |

| Other product candidates | | | 3,776 | | | | 1,179 | | | | 7,030 | | | | 1,871 | |

| Total direct expenses | | | 25,577 | | | | 12,574 | | | | 43,830 | | | | 29,722 | |

| Unallocated Expenses | | | | | | | | | | | | | | | | |

| Employee compensation | | $ | 6,964 | | | $ | 5,078 | | | $ | 12,511 | | | $ | 9,741 | |

| Stock based compensation expense | | | 2,889 | | | | 3,148 | | | | 5,207 | | | | 6,064 | |

| Depreciation and amortization expense | | | 1,060 | | | | 1,194 | | | | 1,887 | | | | 2,370 | |

| Laboratory and related expenses | | | 1,291 | | | | 835 | | | | 2,518 | | | | 1,482 | |

| Legal and patent fees | | | - | | | | (16 | ) | | | - | | | | 41 | |

| Professional Fees | | | 629 | | | | 358 | | | | 1,190 | | | | 827 | |

| Other expenses | | | 2,946 | | | | 1,359 | | | | 5,007 | | | | 2,592 | |

| Total other research and development expenses | | | 15,779 | | | | 11,956 | | | | 28,320 | | | | 23,117 | |

| Total research and development expense | | $ | 41,356 | | | $ | 24,530 | | | $ | 72,150 | | | $ | 52,839 | |

| (1) | Effective December 2021, a decision was made to no longer pursue Rocket-sponsored clinical evaluation of RP-L401; this program was returned to academic innovators. |

We cannot determine with certainty the duration and costs to complete current or future clinical studies of product candidates or if, when, or to what extent we will generate revenues from the commercialization and sale of any of our product candidates that obtain regulatory approval. We may never succeed in achieving regulatory approval for any of our product candidates. The duration, costs, and timing of clinical studies and development of product candidates will depend on a variety of factors, including:

| • | the scope, rate of progress, and expense of ongoing as well as any clinical studies and other R&D activities that we undertake; |

| • | future clinical study results; |

| • | uncertainties in clinical study enrollment rates; |

| • | changing standards for regulatory approval; and |

| • | the timing and receipt of any regulatory approvals. |

We expect R&D expenses to increase for the foreseeable future as we continue to invest in R&D activities related to developing product candidates, including investments in manufacturing, as our programs advance into later stages of development and as we conduct additional clinical trials. The process of conducting the necessary clinical research to obtain regulatory approval is costly and time-consuming, and the successful development of product candidates is highly uncertain. As a result, we are unable to determine the duration and completion costs of R&D projects or when and to what extent we will generate revenue from the commercialization and sale of any of our product candidates.

Our future R&D expenses will depend on the clinical success of our product candidates, as well as ongoing assessments of the commercial potential of such product candidates. In addition, we cannot forecast with any degree of certainty which product candidates may be subject to future collaborations, when such arrangements will be secured, if at all, and to what degree such arrangements would affect our development plans and capital requirements. We expect our R&D expenses to increase in future periods for the foreseeable future as we seek to further development of our product candidates.

The successful development and commercialization of our product candidates is highly uncertain. This is due to the numerous risks and uncertainties associated with product development and commercialization, including the uncertainty of:

| • | the scope, progress, outcome and costs of our clinical trials and other R&D activities; |

| • | the efficacy and potential advantages of our product candidates compared to alternative treatments, including any standard of care; |

| • | the market acceptance of our product candidates; |

| • | obtaining, maintaining, defending, and enforcing patent claims and other intellectual property rights; |

| • | significant and changing government regulation; and |

| • | the timing, receipt, and terms of any marketing approvals. |

A change in the outcome of any of these variables with respect to the development of our product candidates that we may develop could mean a significant change in the costs and timing associated with the development of our product candidates. For example, if the FDA or another regulatory authority were to require us to conduct clinical trials or other testing beyond those that we currently contemplate for the completion of clinical development of any of our product candidates that we may develop or if we experience significant delays in enrollment in any of our clinical trials, we could be required to expend significant additional financial resources and time on the completion of clinical development of that product candidate.

General and Administrative Expenses

General and administrative expenses consist primarily of salaries and related benefit costs for personnel, including stock-based compensation and travel expenses for our employees in executive, operational, finance, legal, business development, and human resource functions. In addition, other significant general and administrative expenses include professional fees for legal, consulting, investor and public relations, auditing, and tax services as well as other expenses for rent and maintenance of facilities, insurance and other supplies used in general and administrative activities. We expect general and administrative expenses to increase for the foreseeable future due to anticipated increases in headcount to support the continued advancement of our product candidates. We also anticipate that as we continue to operate as a public company with increasing complexity, we will continue to incur increased accounting, audit, legal, regulatory, compliance and director and officer insurance costs as well as investor and public relations expenses.

Interest Expense

Interest expense for the three and six months ended June 30, 2022, is related to our financing lease obligation for the Cranbury, NJ facility. Interest expense for the three and six months ended June 30, 2021, related to the 2021 Convertible Notes which converted into common stock on August 2, 2021, the 2022 Convertible Notes, which were redeemed and converted into common stock in April 2021, and the financing lease obligation for the Cranbury, NJ facility.

Interest Income

Interest income is related to interest earned from investments and cash equivalents.

Critical Accounting Policies and Significant Judgments and Estimates

There have been no material changes in our critical accounting policies and estimates in the preparation of our condensed consolidated financial statements during the three months ended June 30, 2022 compared to those disclosed in our 2021 Form 10-K.

Results of Operations

Comparison of the Three Months Ended June 30, 2022 and 2021

| | | Three Months Ended June 30, | |

| | | 2022 | | | 2021 | | | Change | |

| | | | |

| Operating expenses: | | | | | | | | | |

| Research and development | | $ | 41,356 | | | $ | 24,530 | | | $ | 16,826 | |

| General and administrative | | | 12,854 | | | | 9,518 | | | | 3,336 | |

| Total operating expenses | | | 54,210 | | | | 34,048 | | | | 20,162 | |

| Loss from operations | | | (54,210 | ) | | | (34,048 | ) | | | (20,162 | ) |

| Research and development incentives | | | - | | | | - | | | | - | |

| Interest expense | | | (465 | ) | | | (251 | ) | | | (214 | ) |

| Interest and other income, net | | | 669 | | | | 501 | | | | 168 | |

| Amortization of premium on investments - net | | | (396 | ) | | | (727 | ) | | | 331 | |

| Total other expense, net | | | (192 | ) | | | (477 | ) | | | 285 | |

| Net loss | | $ | (54,402 | ) | | $ | (34,525 | ) | | $ | (19,877 | ) |

Research and Development Expenses

R&D expenses increased $16.8 million to $41.3 million for the three months ended June 30, 2022 compared to the three months ended June 30, 2021. The increase in R&D expenses was primarily driven by an increase in manufacturing and development costs of $11.3 million, an increase in compensation and benefits of $1.9 million due to increased R&D headcount and an increase in laboratory supplies of $1.4 million.

General and Administrative Expenses

G&A expenses increased $3.3 million to $12.9 million for the three months ended June 30, 2022, compared to the three months ended June 30, 2021. The increase in G&A expenses was primarily driven by an increase in commercial preparation expenses which consists of commercial strategy, medical affairs, market development and pricing analysis of $1.4 million, an increase in compensation and benefits of $0.9 million due to increased G&A headcount, an increase in legal expense of $0.5 million, and an increase in stock compensation expense of $0.3 million.

Other Expense, Net

Other expense, net decreased by $0.3 million to $0.2 million for the three months ended June 30, 2022, compared to the three months ended June 30, 2021. The decrease in other expense, net was primarily driven by reduced interest expense of $0.2 million associated with the 2022 Convertible Notes that were redeemed in April 2021 and the 2021 Convertible Notes that were converted in August 2021.

Comparison of the Six Months Ended June 30, 2022 and 2021

| | | Six Months Ended June 30, | |

| | | 2022 | | | 2021 | | | Change | |

| | | | |

| Operating expenses: | | | | | | | | | |

| Research and development | | $ | 72,150 | | | $ | 52,839 | | | $ | 19,311 | |

| General and administrative | | | 24,624 | | | $ | 20,431 | | | | 4,193 | |

| Total operating expenses | | | 96,774 | | | | 73,270 | | | | 23,504 | |

| Loss from operations | | | (96,774 | ) | | | (73,270 | ) | | | (23,504 | ) |

| Research and development incentives | | | - | | | | 500 | | | | (500 | ) |

| Interest expense | | | (928 | ) | | | (1,980 | ) | | | 1,052 | |

| Interest and other income, net | | | 1,291 | | | | 1,412 | | | | (121 | ) |

| Amortization of premium on investments - net | | | (973 | ) | | | (1,366 | ) | | | 393 | |

| Total other expense, net | | | (610 | ) | | | (1,434 | ) | | | 824 | |

| Net loss | | $ | (97,384 | ) | | $ | (74,704 | ) | | $ | (22,680 | ) |

Research and Development Expenses

R&D expenses increased $19.3 million to $72.2 million for the six months ended June 30, 2022 compared to the six months ended June 30, 2021. The increase in R&D expenses was primarily driven by an increase in manufacturing and development costs of $11.8 million, an increase in laboratory supplies of $2.8 million, an increase in compensation and benefits of $2.8 million due to increased R&D headcount, offset by a decrease in R&D non-cash stock-based compensation expense of $0.9 million.

General and Administrative Expenses

G&A expenses increased $4.2 million to $24.6 million for the six months ended June 30, 2022, compared to the six months ended June 30, 2021. The increase in G&A expenses was primarily driven by an increase in commercial preparation expenses which consists of commercial strategy, medical affairs, market development and pricing analysis of $2.2 million, an increase in compensation and benefits of $1.5 million due to increased G&A headcount, an increase in legal expense of $1.0 million, offset by a decrease of $0.7 million in G&A stock-based compensation expense.

Other Expense, Net

Other expense, net decreased by $0.8 million to $0.6 million for the six months ended June 30, 2022, compared to the six months ended June 30, 2021. The decrease in other expense, net was primarily driven by reduced interest expense of $1.0 million associated with the 2022 Convertible Notes that were redeemed in April 2021 and the 2021 Convertible Notes that were converted in August 2021, as well as a decrease of $0.5 million in research and development incentives due to the receipt of the New York State R&D tax credit in 2021.

Liquidity, Capital Resources and Plan of Operations

We have not generated any revenue and have incurred losses since inception. Operations of the Company are subject to certain risks and uncertainties, including, among others, uncertainty of drug candidate development, technological uncertainty, uncertainty regarding patents and proprietary rights, having no commercial manufacturing experience, marketing or sales capability or experience, dependency on key personnel, compliance with government regulations and the need to obtain additional financing. Drug candidates currently under development will require significant additional R&D efforts, including extensive preclinical and clinical testing and regulatory approval, prior to commercialization. These efforts require significant amounts of additional capital, adequate personnel infrastructure, and extensive compliance-reporting capabilities.

Our drug candidates are in the development and clinical stage. There can be no assurance that our R&D will be successfully completed, that adequate protection for our intellectual property will be obtained, that any products developed will obtain necessary government approval or that any approved products will be commercially viable. Even if our product development efforts are successful, it is uncertain when, if ever, we will generate significant revenue from product sales. We operate in an environment of rapid change in technology and substantial competition from pharmaceutical and biotechnology companies.

Our consolidated financial statements have been prepared on the basis of continuity of operations, realization of assets and the satisfaction of liabilities in the ordinary course of business. Rocket has incurred net losses and negative cash flows from its operations each year since inception. We had net losses of $97.4 million for the six months ended June 30, 2022, and $169.1 million for the year ended December 31, 2021. As of June 30, 2022 and December 31, 2021, we had an accumulated deficit of $589.3 million and $491.9 million, respectively.

As of June 30, 2022, we had $321.4 million of cash, cash equivalents and investments. We expect such resources would be sufficient to fund our operating expenses and capital expenditure requirements into the first half of 2024. We have funded our operations primarily through the sale of our equity and debt securities.

In the longer term, our future viability is dependent on our ability to generate cash from operating activities or to raise additional capital to finance our operations. If we raise additional funds by issuing equity securities, our stockholders will experience dilution. Any future debt financing into which we enter may impose upon us additional covenants that restrict our operations, including limitations on our ability to incur liens or additional debt, pay dividends, repurchase our common stock, make certain investments and engage in certain merger, consolidation, or asset sale transactions. Any debt financing or additional equity that we raise may contain terms that are not favorable to us or our stockholders. Our failure to raise capital as and when needed could have a negative impact on our financial condition and ability to pursue our business strategies.

Cash Flows

| | | Six Months Ended June 30, | |

| | | 2022 | | | 2021 | |

| Cash used in operating activities | | $ | (78,262 | ) | | $ | (62,809 | ) |

| Cash provided by investing activities | | | 15,794 | | | | 20,178 | |

| Cash provided by financing activities | | | 17,322 | | | | 9,907 | |

| Net change in cash, cash equivalents and restricted cash | | $ | (45,146 | ) | | $ | (32,724 | ) |

Operating Activities

During the six months ended June 30, 2022, operating activities used $78.2 million of cash and cash equivalents, primarily resulting from our net loss of $97.4 million offset by net non-cash charges of $17.7 million, including non-cash stock-based compensation expense of $13.6 million, accretion of discount on investments of $1.0 million, and depreciation and amortization expense of $1.8 million. Changes in our operating assets and liabilities for the six months ended June 30, 2022, consisted of an increase in accounts payable and accrued expenses of $2.5 million and an increase in our prepaid expenses of $1.1 million.

During the six months ended June 30, 2021, operating activities used $62.8 million of cash and cash equivalents, primarily resulting from our net loss of $74.7 million offset by net non-cash charges of $18.6 million, including non-cash stock-based compensation expense of $15.2 million and depreciation of $1.4 million. Changes in our operating assets and liabilities for the six months ended June 30, 2021 consisted of a decrease in accounts payable and accrued expenses for $9.0 million and an increase in our prepaid expenses of $1.0 million.

Investing Activities

During the six months ended June 30, 2022, net cash provided by investing activities was $15.8 million, primarily resulting from proceeds of $163.7 million from the maturities of investments, offset by purchases of investments of $143.0 million, and purchases of property and equipment of $4.8 million.

During the six months ended June 30, 2021, net cash provided by investing activities was $20.2 million, consisting of proceeds of $180.6 million from the maturities of investments, offset by purchases of investments of $158.6 million, and purchases of property and equipment of $1.8 million.

Financing Activities

During the six months ended June 30, 2022, financing activities provided $17.3 million of cash, primarily resulting from net proceeds of $17.2 million from the sale of shares through our at-the-market facility.

During the six months ended June 30, 2021, net cash provided by financing activities was $9.9 million, consisting of issuance of common stock, pursuant to exercises of stock options.

Contractual Obligations and Commitments

There were no material changes outside the ordinary course of our business to the contractual obligations specified in the table of contractual obligations included in “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in our 2021 Form 10-K. Information regarding contractual obligations and commitments may be found in Note 10 of our unaudited consolidated financial statements in this Quarterly Report on Form 10-Q. We do not have any off-balance sheet arrangements that are material or reasonably likely to become material to our financial condition or results of operations.

Recently Issued Accounting Pronouncements

There were no recent accounting pronouncements that impacted the Company, or which had a significant effect on the consolidated financial statements.

| Item 3 | Quantitative and Qualitative Disclosures About Market Risk |

Not Applicable

Item 4 | Controls and Procedures |

Evaluation of Disclosure Controls and Procedures

Our management, with the participation of our principal executive officer and our principal financial officer, evaluated, as of the end of the period covered by this Quarterly Report on Form 10-Q, the effectiveness of our disclosure controls and procedures. Based on that evaluation of our disclosure controls and procedures as of June 30, 2022, our principal executive officer and principal financial officer concluded that our disclosure controls and procedures as of such date are effective at the reasonable assurance level. The term “disclosure controls and procedures,” as defined in Rules 13a-15(e) and 15d-15(e) under the Exchange Act, means controls and other procedures of a company that are designed to ensure that information required to be disclosed by a company in the reports that it files or submits under the Exchange Act are recorded, processed, summarized, and reported within the time periods specified in the SEC’s rules and forms. Disclosure controls and procedures include, without limitation, controls and procedures designed to ensure that information required to be disclosed by us in the reports we file or submit under the Exchange Act is accumulated and communicated to our management, including our principal executive officer and principal financial officer, as appropriate to allow timely decisions regarding required disclosure. Management recognizes that any controls and procedures, no matter how well designed and operated, can provide only reasonable assurance of achieving their objectives and our management necessarily applies its judgment in evaluating the cost-benefit relationship of possible controls and procedures.

Inherent Limitations of Internal Controls

Because of its inherent limitations, internal control over financial reporting may not prevent or detect misstatements. Therefore, even those systems determined to be effective can provide only reasonable assurance with respect to financial statement preparation and presentation. Projections of any evaluation of effectiveness to future periods are subject to the risk that controls may become inadequate because of changes in conditions, or that the degree of compliance with the policies or procedures may deteriorate.

Changes in Internal Control over Financial Reporting

There were no changes in our internal control over financial reporting (as defined in Rules 13a-15(f) and 15d-15(f) under the Exchange Act) during the three months ended June 30, 2022, that have materially affected, or are reasonably likely to materially affect, our internal control over financial reporting.

PART II – OTHER INFORMATION

From time to time, the Company may be subject to various legal proceedings and claims that arise in the ordinary course of its business activities. Although the results of litigation and claims cannot be predicted with certainty, the Company does not believe it is party to any other claim or litigation the outcome of which, if determined adversely to the Company, would individually or in the aggregate be reasonably expected to have a material adverse effect on its business. Regardless of the outcome, litigation can have an adverse impact on the Company because of defense and settlement costs, diversion of management resources and other factors.

Our material risk factors are disclosed in Item 1A of our 2021 Form 10-K. There have been no material changes from the risk factors previously disclosed in such filing.

Recent volatility in capital markets and lower market prices for our securities may affect our ability to access new capital through sales of shares of our common stock or issuance of indebtedness, which may harm our liquidity, limit our ability to grow our business, pursue acquisitions or improve our operating infrastructure and restrict our ability to compete in our markets.

Our operations consume substantial amounts of cash, and we intend to continue to make significant investments to support our business growth, respond to business challenges or opportunities, develop new solutions, retain or expand our current levels of personnel, improve our existing solutions, enhance our operating infrastructure, and potentially acquire complementary businesses and technologies. Our future capital requirements may be significantly different from our current estimates and will depend on many factors, including the need to:

| • | finance unanticipated working capital requirements; |

| • | continue to advance our product candidates through clinical development; |

| • | continue our efforts to expand our pipeline of development programs; |

| • | develop proprietary in-house analytics and manufacturing capabilities; |

| • | pursue acquisitions or other strategic relationships; and |

| • | respond to competitive pressures. |

Accordingly, we may need to pursue equity or debt financings to meet our capital needs. With uncertainty in the capital markets and other factors, such financing may not be available on terms favorable to us or at all. If we raise additional funds through further issuances of equity or convertible debt securities, our existing stockholders could suffer significant dilution, and any new equity securities we issue could have rights, preferences, and privileges superior to those of holders of our common stock. Any debt financing secured by us in the future could involve additional restrictive covenants relating to our capital-raising activities and other financial and operational matters, which may make it more difficult for us to obtain additional capital and to pursue business opportunities, including potential acquisitions. If we are unable to obtain adequate financing or financing on terms satisfactory to us, we could face significant limitations on our ability to invest in our operations and otherwise suffer harm to our business.

| Item 2. | Unregistered Sales of Equity Securities and Use of Proceeds |

None.

Item 3. | Defaults Upon Senior Securities |

None.

| Item 4. | Mine Safety Disclosures |

Not applicable.

None

Exhibit Number | Description of Exhibit |

| Agreement and Plan of Merger and Reorganization, dated as of September 12, 2017, by and among Inotek Pharmaceuticals Corporation, Rocket Pharmaceuticals, Ltd., and Rome Merger Sub (incorporated by reference to Exhibit 2.1 to the Company’s Current Report on Form 8- K (001-36829), filed with the SEC on September 13, 2017) |

| Seventh Amended and Restated Certificate of Incorporation of Rocket Pharmaceuticals, Inc., effective as of February 23, 2015(incorporated by reference to Exhibit 3.1 to the Company’s Annual Report on Form 10-K (001-36829), filed with the SEC on March 31, 2015) |

| Certificate of Amendment (Reverse Stock Split) to the Seventh Amended and Restated Certificate of Incorporation of the Registrant, effective as of January 4, 2018 (incorporated by reference to Exhibit 3.1 to the Company’s Current Report on Form 8-K (001-36829), filed with the SEC on January 5, 2018) |

| Certificate of Amendment (Name Change) to the Seventh Amended and Restated Certificate of Incorporation of the Registrant, effective January 4, 2018 (incorporated by reference to Exhibit 3.2 to the Company’s Current Report on Form 8-K (001-36829), filed with the SEC on January 5, 2018) |

| Certificate of Amendment to the Seventh Amended and Restated Certificate of Incorporation of the Registrant, effective as of June 25, 2018 (incorporated by reference to Exhibit 3.1 to the Company’s Current Report on Form 8-K (001-36829), filed with the SEC on June 25, 2019 |

| Amended and Restated By-Laws of Rocket Pharmaceuticals, Inc., effective as of March 29, 2018 (incorporated by reference to Exhibit 3.2 to the Company’s Current Report on Form 8-K (001-36829), filed with the SEC on April 4, 2018) |

| Certification of Principal Executive Officer pursuant to Rule 13a-14(a) or Rule 15d-14(a) of the Securities Exchange Act of 1934, as adopted pursuant to Section 302 of the Sarbanes-Oxley Act of 2002 |

| Certification of Principal Financial Officer pursuant to Rule 13a-14(a) or Rule 15d-14(a) of the Securities Exchange Act of 1934, as adopted pursuant to Section 302 of the Sarbanes-Oxley Act of 2002 |

| Certification of Principal Executive Officer and Principal Financial Officer pursuant to 18 U.S.C. Section 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 |

| 101.INS | Inline XBRL Instance Document. |

| 101.SCH | Inline XBRL Taxonomy Extension Schema Document. |

| 101.CAL | Inline XBRL Taxonomy Extension Calculation Document. |