Windstream Investor Call

Announcement of Acquisition of PAETEC

August 1, 2011

“Safe Harbor” Statement

2

Regulation G Disclaimer

This presentation includes certain non-GAAP financial measures, which have been adjusted to include or exclude items that are related to strategic

activities or other events, specific to the time and opportunity available. For the periods presented, Windstream‘s strategic activities included the

acquisitions of Iowa Telecommunication Services, Inc. ("Iowa Telecom") on June 2, 2010, Hosted Solutions Acquisitions, LLC (“Hosted Solutions”) on

December 1, 2010 and Q-Comm Corporation (“Q-Comm”) on December 2, 2010. In addition, adjustments related to the proposed acquisition of

PAETEC Holding Corp. (“PAETEC”) are included. Windstream believes the presentation of supplemental measures of operating performance provides a

more meaningful comparison of our operating performance for the periods presented. A reconciliation of the non-GAAP financial measures used in this

presentation to the most directly comparable GAAP measure has been posted to our investor relations website at www.windstream.com/investors.

The non-GAAP financial measures used by Windstream may not be comparable to similarly titled measures used by other companies and should not be

considered in isolation or as a substitute for measures of performance or liquidity prepared in accordance with GAAP.

Safe Harbor Statement

Windstream claims the protection of the safe-harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of

1995. Forward-looking statements, including statements regarding the completion of the acquisition and expected benefits of the acquisition, are

subject to uncertainties that could cause actual future events and results to differ materially from those expressed in the forward-looking

statements. These forward-looking statements are based on estimates, projections, beliefs and assumptions that Windstream believes are

reasonable but are not guarantees of future events and results. Actual future events and results of Windstream may differ materially from those

expressed in these forward-looking statements as a result of a number of important factors. Factors that could cause actual results to differ

materially from those contemplated above include, among others: receipt of required approvals of regulatory agencies; the possibility that the

anticipated benefits from the acquisition cannot be fully realized or may take longer to realize than expected; the possibility that costs or

difficulties related to the integration of PAETEC operations into Windstream will be greater than expected; the ability of the combined company to

retain and hire key personnel; and those additional factors under the caption “Risk Factors” in Windstream’s Form 10-K for the year ended Dec. 31,

2010, and in subsequent Securities and Exchange Commission filings. In addition to these factors, actual future performance, outcomes and results

may differ materially because of more general factors including, among others, general industry and market conditions and growth rates, economic

conditions, and governmental and public policy changes. Windstream undertakes no obligation to update or revise any forward-looking statements,

whether as a result of new information, future events or otherwise. The foregoing review of factors that could cause Windstream's actual results to

differ materially from those contemplated in the forward-looking statements should be considered in connection with information regarding risks

and uncertainties that may affect Windstream's future results included in Windstream’s filings with the Securities and Exchange Commission a

t www.sec.gov.

Additional Information

3

Additional Information

This communication relates to the proposed merger transaction pursuant to the terms of the Agreement and Plan of Merger, dated as of July 31,

2011, among PAETEC Holding Corp. ("PAETEC"), Windstream Corporation ("Windstream") and Peach Merger Sub, Inc., a wholly-owned subsidiary of

Windstream.

Windstream will file with the Securities and Exchange Commission (“SEC”) a registration statement on Form S-4 in connection with the transaction

that will include the proxy statement of PAETEC, which also will constitute a prospectus of Windstream. PAETEC will send to its stockholders the

proxy statement/prospectus regarding the proposed merger transaction. PAETEC and Windstream urge investors and security holders to read the

proxy statement/prospectus and other documents relating to the merger transaction when they become available, because they will contain

important information about PAETEC, Windstream and the proposed transaction. Investors and security holders may obtain a free copy of the Form

S-4 and the proxy statement/prospectus and other documents relating to the merger transaction (when available) from the SEC’s website at

www.sec.gov, PAETEC’s website at www.paetec.com and Windstream’s website at www.windstream.com. In addition, copies of the proxy

statement/prospectus and such other documents may be obtained free of charge (when available) from Windstream, upon written request to

Windstream Investor Relations, 4001 Rodney Parham Road, Little Rock, Arkansas 72212 or by calling (866) 320-7922, or from PAETEC, by directing a

request to PAETEC Holding Corp., One PAETEC Plaza, Fairport, New York 14450, Attn: Investor Relations, telephone: (585) 340-2500.

This communication shall not constitute an offer to sell or the solicitation of an offer to sell or the solicitation of an offer to buy any securities, nor

shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or

qualification under the securities laws of any such jurisdiction. No offer of securities shall be made except by means of a prospectus meeting the

requirements of Section 10 of the Securities Act of 1933, as amended.

Certain Information Regarding Participants

PAETEC and its directors and executive officers may be deemed, under SEC rules, to be participants in the solicitation of proxies from PAETEC’s

stockholders with respect to the proposed merger transaction. Security holders may obtain information regarding the names, affiliations and

interests of such individuals in PAETEC’s Annual Report on Form 10-K/A for the year ended December 31, 2010, which was filed with the SEC on

April 12, 2011, and its definitive proxy statement for the 2011 annual meeting of stockholders, which was filed with the SEC on April 20, 2011.

Additional information regarding the interests of such individuals in the proposed merger transaction will be included in the proxy

statement/prospectus relating to the proposed transaction when it is filed with the SEC. These documents may be obtained free of charge from

the SEC’s website at www.sec.gov, PAETEC’s website at www.paetec.com and Windstream’s website at www.windstream.com.

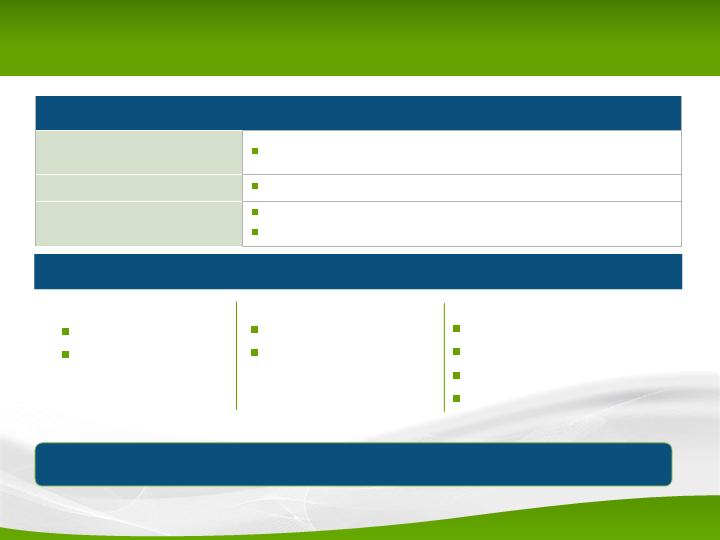

Compelling Transaction Rationale

4

Accelerates revenue and cash flow growth profile

Pro forma business and broadband services will represent ~70% of revenues

Creates nationwide network with deep fiber footprint of ~100,000 fiber route

miles

Enhances capabilities in strategic growth areas: data services / fiber / data

centers

Provides diverse, attractive customer base of medium and large businesses

Offers attractive financial benefits

Annual run-rate pre-tax opex synergies of ~$100 million

FCF accretive in first full year, excluding merger and integration costs

Significant tax attributes with net present value of ~$250 million

Annual usage of ~$130 million in each of the next 5 years

Slightly deleveraging with synergies

Transaction Summary

5

Transaction Structure:

100% stock

Fixed Exchange Ratio:

0.460 shares of Windstream stock for each PAETEC share

Implied offer price of $5.62, 27% premium to current price

Pro Forma Ownership:

87% Windstream shareholders/ 13% PAETEC shareholders

Transaction Value:

$2.3 billion, including PAETEC net debt of $1.4 billion as of

3/31/11

Estimated Synergies:

~$100 million of annual run-rate pre-tax opex synergies by

year 3

Tax benefits:

$1.4 billion of PAETEC NOLs with NPV of ~$250 million

Annual usage of ~$130 million in each of the next 5 years

Estimated Transaction Multiples(1):

6.0x 2011E Adj. OIBDA (before run-rate synergies)

4.3x 2011E Adj. OIBDA (after run-rate synergies and

adjusted for PV of NOLs)

(1) Multiples based on midpoint of PAETEC adjusted EBITDA guidance

Transaction Summary (continued)

6

No Financing Contingencies

External committed financing combined with revolver

availability

Pro Forma 3/31/11 LTM Net

Leverage:

3.7x before run-rate synergies

3.5x after run-rate synergies

Dividend Practice:

Maintain Windstream annual dividend of $1.00 per share

Strengthens payout ratio

Closing Conditions:

FCC, HSR, applicable state-level regulatory approvals

PAETEC shareholder vote

Anticipated Time to Closing:

~6 months

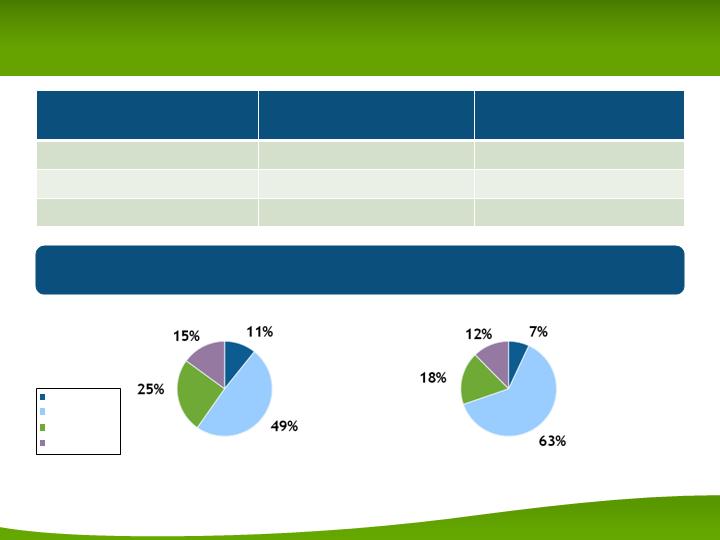

Attractive Financial Profile

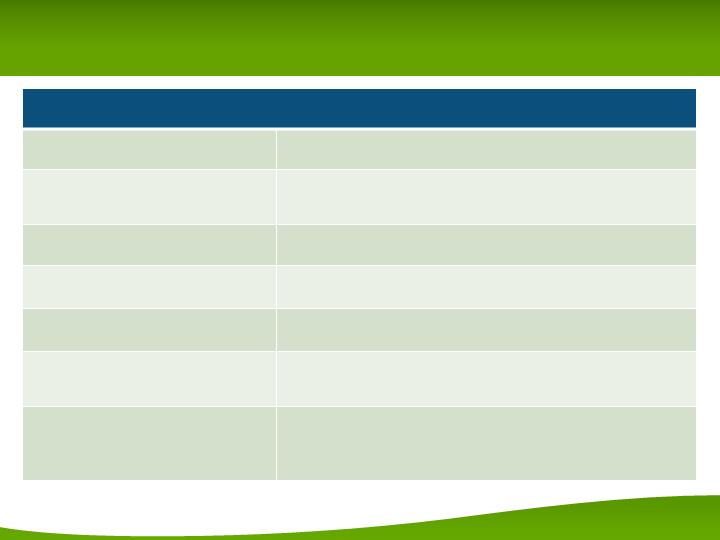

7

($ millions)

Windstream

Legacy (1)

Windstream / PAETEC

Pro Forma (2)

Total Revenues

$4,120

$6,193

Adjusted OIBDA

$2,059

$2,415/$2,515(3)

Leverage

3.6x

3.7x/3.5x(3)

(1) PF for Windstream acquisitions; LTM ended 3/31/11

(2) Pro forma for Cavalier and Xeta; LTM ended 3/31/11

(3) Includes run-rate synergies of $100 million

Consumer BB

Business

Consumer Other

Switched Access/USF

Windstream

Windstream / PAETEC

Business & Broadband are ~ 70% of 1Q11 Pro Forma Revenues

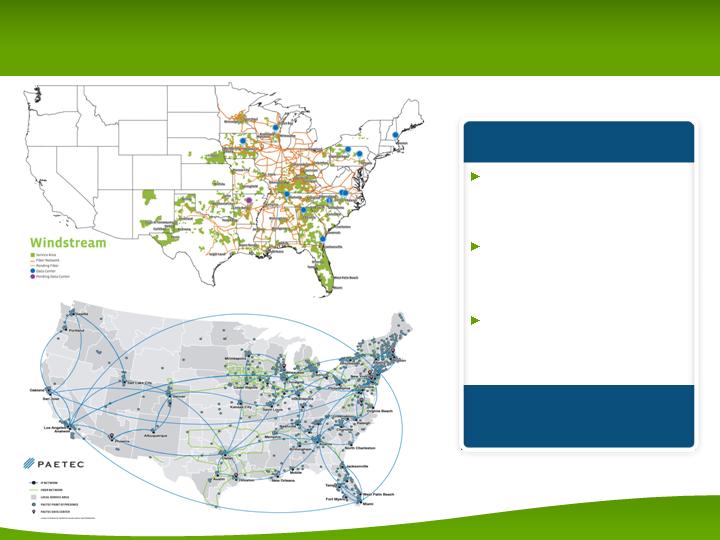

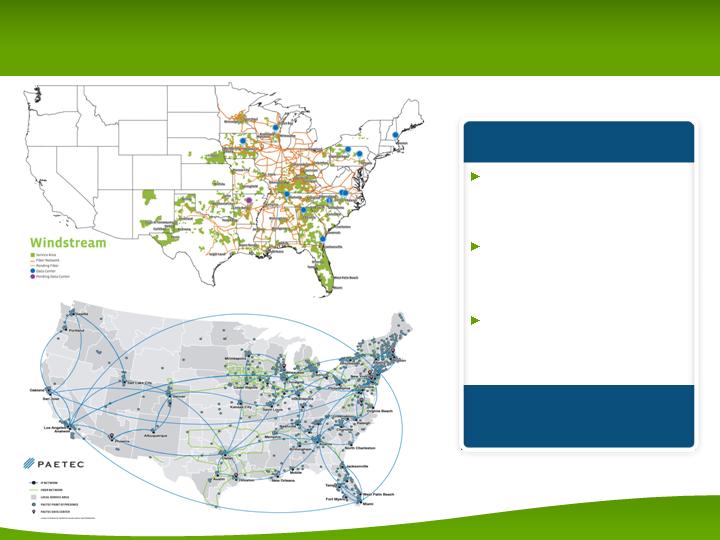

Creates Nationwide Network with Deep Fiber Footprint

8

Nationwide fiber network

of ~100,000 fiber route

miles

20 data centers with

services offered

nationwide

Improved capability to

serve multi location

business customers

Key Highlights

Extensive national footprint

improves the cost structure

and enhances capabilities

Nationwide Network and Enhanced Capabilities Improve

Growth Profile

9

Extensive national footprint with deep fiber

Enhanced ability to service multi-location customers

Additional geographic expansion opportunities

Significant capacity to meet future bandwidth demand

Route diversity for improved security and reliability

Enhanced capabilities in strategic growth areas

Advanced data services: MPLS, Ethernet, VLS

Fiber transport / wireless backhaul

Data centers: Managed services, hosted services,

virtualization, collocation

Equipment and professional services

Network design

Cross-selling opportunities to an attractive customer base

Ethernet

MPLS

Wireless Backhaul

Hosting Services

Source: Frost & Sullivan 2010; SNL Kagan/NPRG 2009; Barclays/IDC 2011; NPRG 2009

(1) Growth represents 2010-2012 CAGR for the US

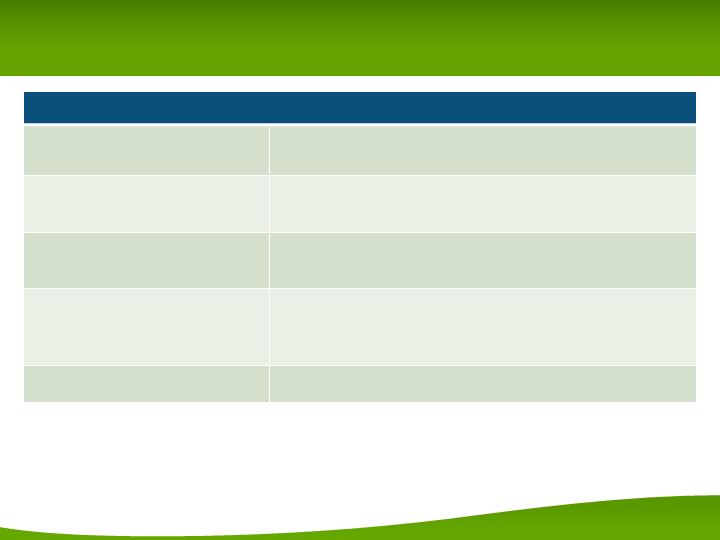

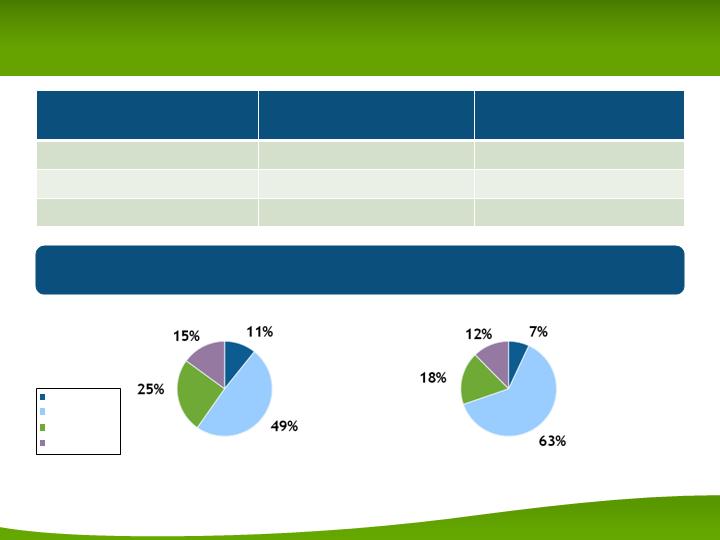

Combination Creates Meaningful Synergies

10

Targeting Approximately $100 Million in Opex Synergies

Operating Cost Synergies

~$100 million run-rate synergies annually by year 3

Capex Synergies

~$10 million run-rate annually by year 3

Integration Costs

~$50 million of opex in year 1

~$55 million of capex over 3 years

NuVox

Iowa Telecommunications

Hosted Solutions

Q-Comm (largely complete)

D&E Communications

Lexcom

Valor

CT Communications

2006-2007

2010

2009

Integration Activities from Prior Acquisitions Substantially Complete

WIN has the Experience & Track Record of Successful Integrations

A Great Strategic Combination

11

Accelerates

Growth

Enhances

Capabilities

Offers Attractive

Financial Benefits

Accelerates revenue and cash flow growth profile

Pro forma business and broadband services will

represent ~70% of revenues

Enhances capabilities in strategic growth

areas

Complementary product set to leverage

across a larger platform

Offers attractive financial benefits

Free cash flow accretive

Meaningful synergies - ~$100M / year

Significant tax assets – NPV of ~$250M

Slightly deleveraging after synergies

Creates a New Fortune 500 Company Offering Investors

a Unique Combination of Growth & Yield

Q&A

12