SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE TO

(Rule 14d-100)

Tender Offer Statement Under Section 14(d)(1) or Section 13(e)(1)

of the Securities Exchange Act of 1934

BIOFORM MEDICAL, INC.

(Name of Subject Company (Issuer))

VINE ACQUISITION CORP. (OFFEROR)

MERZ GMBH & CO. KGAA. (PARENT OF OFFEROR)

(Names of Filing Persons)

COMMON STOCK, $0.01 PAR VALUE PER SHARE

(Title of Class of Securities)

09065G 107

(CUSIP Number of Class of Securities)

Matthias Vogt

Member of the Management Board and Chief Financial Officer

Merz GmbH & Co. KGaA

Eckenheimer Landstrasse 100

Frankfurt am Main 60318

Germany

+49 69-1503-0

(Name, address and telephone number of person authorized to receive notices

and communications on behalf of filing persons)

With a copy to:

Keith A. Flaum, Esq.

Lorenzo Borgogni, Esq.

Dewey & LeBoeuf LLP

1950 University Avenue, Suite 500

East Palo Alto, California 92612

(650) 845-7000

CALCULATION OF FILING FEE

| | |

| Transaction Valuation*: N/A | | Amount of Filing Fee*: N/A |

| * | A filing fee is not required in connection with this filing as it relates solely to preliminary communications made before the commencement of a tender offer. |

| ¨ | Check the box if any part of the fee is offset as provided by Rule 0-11(a)(2) and identify the filing with which the offsetting fee was previously paid. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| x | Check the box if the filing relates solely to preliminary communications made before the commencement of a tender offer. |

| | |

| Amount previously paid: $ N/A | | Form or registration no.: N/A |

| |

| Filing Party: N/A | | Date Filed: N/A |

| x | third-party tender offer subject to Rule 14d-1. |

| ¨ | issuer tender offer subject to Rule 13e-4. |

| ¨ | going-private transaction subject to Rule 13e-3. |

| ¨ | amendment to Schedule 13D under Rule 13d-2. |

Check the appropriate boxes below to designate any transactions to which the statement relates:

Check the following box if the filing is a final amendment reporting the results of the tender offer: ¨

This filing on Schedule TO relates to a planned tender offer by Vine Acquisition Corp. (“Acquisition Sub”), a Delaware corporation and an indirect wholly-owned subsidiary of Merz GmbH & Co. KGaA (“Merz”), to purchase all of the outstanding shares of common stock, $0.01 par value per share, of BioForm Medical, Inc. (“BioForm Medical”), a Delaware corporation, to be commenced pursuant to an Agreement and Plan of Merger, dated as of December 31, 2009, by and among Merz, Acquisition Sub and BioForm Medical. Attached hereto is a copy of the slides accompanying a presentation given by Merz on January 11, 2010.

Forward-Looking Statements

This document contains forward-looking statements, including those relating to Merz’s anticipated acquisition of BioForm Medical and expected benefits of the transaction, such as the introduction of new products and products under development, or the timing thereof, the ability to obtain, and the timing of, future U.S. regulatory clearances and approvals, including for Polidocanol and Bocouture®/XEOMIN® neurotoxin, the potential for future growth in Merz’s worldwide aesthetics and dermatological business, the impact that the acquisition would have on Merz’s competitive positioning and future growth in its worldwide aesthetics and dermatological business, and the growth in the aesthetic market, generally. Forward-looking statements may contain words such as “expect,” “believe,” “may,” “can,” “should,” “will,” “forecast,” “anticipate” or similar expressions, and include the assumptions that underlie such statements. These statements are subject to known and unknown risks and uncertainties that could cause actual results to differ, even materially, from those stated or implied, including but not limited to: the risk that the transaction will not be consummated in a timely manner or at all if, among other things, fewer than a majority of the shares of BioForm Medical common stock are tendered, clearance under the Hart-Scott-Rodino Antitrust Improvements Act of 1976, as amended, is not obtained, or other closing conditions are not satisfied; the successful integration and performance of the acquired business; unknown, underestimated or undisclosed commitments or liabilities; the effectiveness of internal controls; Merz’s ability to: (i) realize synergies expected to result from the acquisition; (ii) successfully commercialize purchased products; (iii) develop, deliver and support a broad range of products, expand its markets, and develop new markets; (iv) attract, motivate and retain key employees; and (v) obtain and protect intellectual property rights in key technologies; and other risks described in BioForm Medical’s filings with the U.S. Securities and Exchange Commission (the “SEC”). All forward-looking statements are based on managements’ estimates, projections and assumptions as of the date hereof and are subject to risks and uncertainties, which may cause actual results to differ, even materially, from the statements contained herein. Undue reliance should not be placed on forward-looking statements, which speak only as of the date they are made. Neither Merz nor BioForm Medical undertake any obligation to update publicly any forward-looking statements to reflect new information, events or circumstances after the date they were made, or to reflect the occurrence of unanticipated events.

Additional Information and Where to Find It

The tender offer described herein has not commenced. This announcement is for informational purposes only and is neither an offer to purchase nor a solicitation of an offer to sell shares of BioForm Medical. At the time the tender offer is commenced, Merz and its acquisition subsidiary will file with the SEC a Tender Offer Statement on Schedule TO with the SEC, and BioForm Medical will file with the SEC a Solicitation/Recommendation Statement on Schedule 14D-9 with respect to the tender offer.

The tender offer will be made solely by the Tender Offer Statement. Holders of shares of BioForm Medical common stock are urged to read the Tender Offer Statement (including the Offer to Purchase, related Letter of Transmittal and all other offer documents) and the Solicitation/Recommendation Statement when they become available, because they will contain important information that holders of shares of BioForm Medical common stock should consider before making any decision regarding tendering their securities.

Stockholders of BioForm Medical will be able to obtain free copies of the Tender Offer Statement, the Tender Offer Solicitation/Recommendation Statement and other documents filed with the SEC by Merz and BioForm Medical through the web site maintained by the SEC at www.sec.gov. In addition, investors and security holders will be able to obtain free copies of these documents by contacting the Investor Relations department of BioForm Medical at 650-286-4003 or by mailing a request to the information agent for the tender offer, MacKenzie Partners, Inc., 105 Madison Avenue, New York, New York 10016; by calling toll free at 1-800-322-2885 or call collect 212-929-5500; and at tenderoffer@mackenziepartners.com.

Merz Pharmaceuticals Company Introduction JP Morgan Conference, January 11, 2010 |

2 | Page • This presentation contains forward-looking statements, including those relating to Merz’s anticipated acquisition of BioForm Medical and expected benefits of the transaction. • Forward-looking statements are based on managements’ estimates, projections and assumptions as of the date of this presentation and are therefore subject to risks and uncertainties -- including but not limited to: the risk that the transaction will not be consummated in a timely manner or at all; and other risks described in BioForm Medical’s filings with the U.S. Securities and Exchange Commission -- which may cause actual results to differ, even materially, from the statements contained in this presentation. • Neither Merz nor BioForm Medical undertakes any obligation to update publicly any of these forward-looking statements. Forward Looking Statements |

3 | Page Information Concerning the Tender Offer • The tender offer described in this presentation has not yet commenced, and this presentation is for informational purposes only and is neither an offer to purchase nor a solicitation of an offer to sell shares of BioForm Medical. • The tender offer will be made solely by a Tender Offer Statement on Schedule TO, which will be filed with the SEC by Merz and its acquisition subsidiary. BioForm stockholders are urged to read the Tender Offer Statement, as well as the Solicitation/Recommendation Statement on Schedule 14D-9 to be filed with the SEC by BioForm Medical, when they become available, because they will contain important information that BioForm stockholders should consider before making any decision regarding tendering their shares. • BioForm stockholders will be able to obtain free copies of the Tender Offer Statement, the Solicitation/ Recommendation Statement and other documents filed with the SEC by Merz and BioForm Medical, through the web site maintained by the SEC at www.sec.gov or by contacting the Investor Relations department of BioForm Medical or the information agent for the tender offer, MacKenzie Partners, at 1-800-322-2885 or collect at 212-929-5500. |

4 | Page 4 Merz Pharma: Germany’s fifth largest R&D driven pharma company (fiscal year 2008 / 2009 figures)… Note: 2009 figures Source: Merz Subsidaries Headquarters Frankfurt/M., Germany Family-owned ~1,745 Pharma employees world-wide (+ 7,8%) Pharma sales €590M (+ 8%) |

5 | Page 5 … with strong research and franchises Note: 2009 figures Source: Merz Memantine (Namenda) Mederma® Xeomin® Alzheimer's Disease Scar / Hair treatment Neurology Dermatology Dystonia/ Spasticity Aesthetic franchise #2 global Rx drug First company to market pure Botulinum toxin #1 in US |

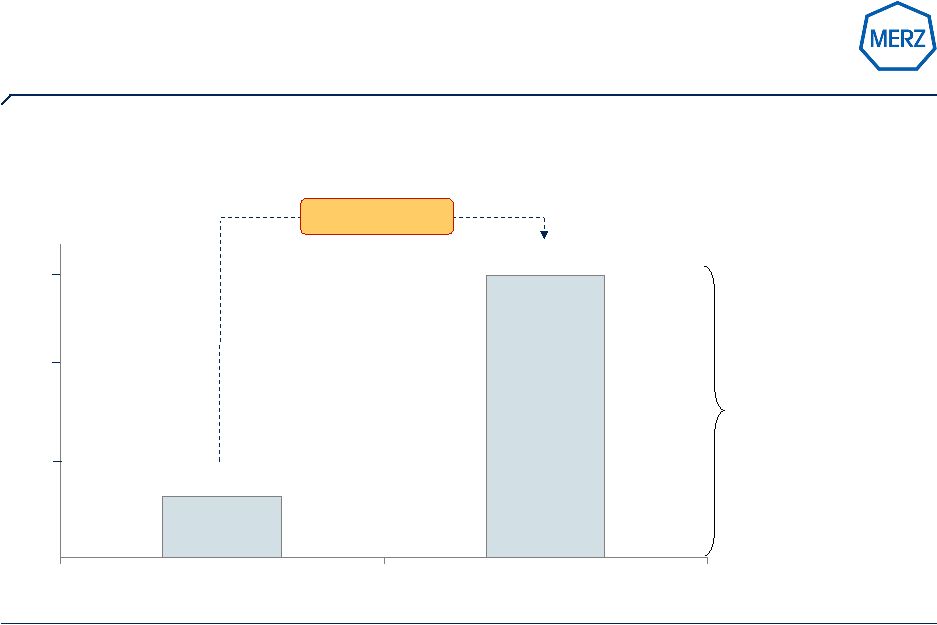

6 | Page 6 1 MS = Value market share Note: Daiichi Asubio to be launched in 2011 //Source: Merz; IMS Strong partnerships (Forest / Lundbeck / Daiichi Sankyo) lead to number 2 position worldwide, Memantine with continued double digit growth ww in Q1 2009 / 2010 0.3 (~12%) 2003 / 2004 1.5 (~22%) Memantine sales world-wide in $bn (MS 1 ) 2008 / 2009 1.0 0.5 Merz (Axura®) in cooperation with Forest (Namenda®) & Lundbeck (Ebixa®) 58% CAGR 1.5 |

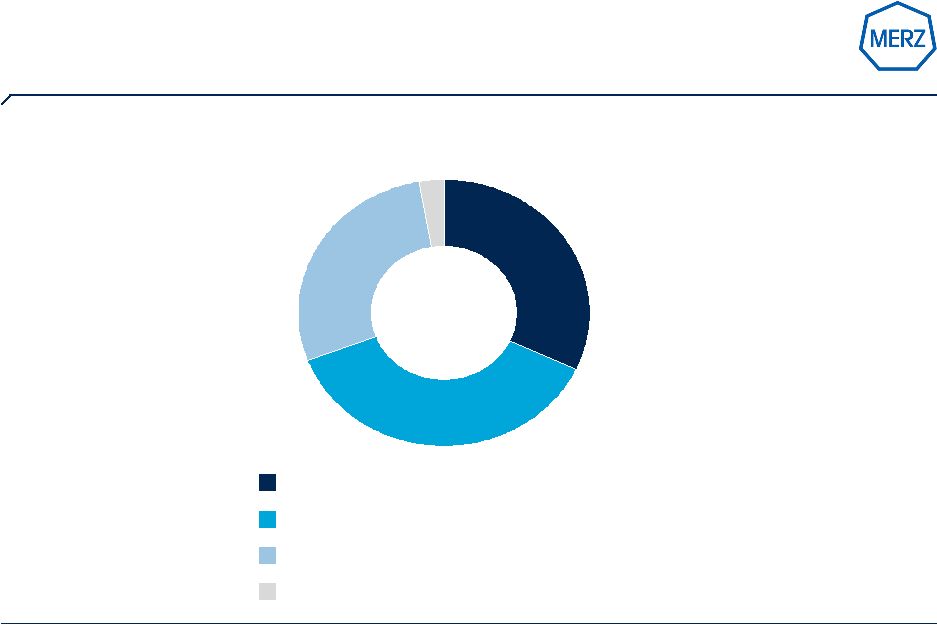

7 | Page 7 Source: Merz annual report 2008 / 2009 US fastest growing major region and largest market for Merz (Sales Merz Pharma Group 2008/09 – by region) Germany: € 187,8 m (+ 6%) Rest of Europe: € 164,4 m (+ 6%) USA: € 220,8 m (+ 11%) Other regions: € 16,8 m (+ 13%) € 589,8 million: growth 8% |

8 | Page Solid financial performance provides strength for R&D, licensing & M&A (all figures in € M) 477,5 546,5 589,8 185,4 221,8 267,9 0 100 200 300 400 500 600 700 2006/07 2007/08 2008/09 Net revenues EBIT before R&D R&D 2006/07 2007/08 2008/09 EBIT-Margin before R&D 38,8% 40,6% 45,4% R&D 60,1 87,1 132,0 R&D in % of Net revenues 12,6% 15,9% 22,4% Investment in assets 24,5 28,3 26,8 Cash development 119,5 128,3 196,6 € M |

9 | Page We target highly attractive market segments… Specialty CNS / Movement Disorders Aesthetic Medicine Tinnitus – Market size: $5 bln+ – Growth: >10% – Market size: $2 bln+ – Growth: >10% – Market size: $1 bln+ – Growth: N/A Alzheimers – Market size: $5 bln+ – Growth: >10% Key considerations: – High unmet medical need – Aging population – High R&D risk Key considerations: – Unmet medical need – Niche market – Spasticity market not exploited Key considerations: – self paid – new treatment options – market with growth potential Key considerations: – High unmet medical need – 5% of population affected – Potential market shaper Strategy to establish own presence and sales force only in specialty markets |

10 | Page … that allow us to obtain a prominent market position Merz today • Memantine: global #2 • Attractive early stage pipeline • Xeomin: global roll out of the next generation Neurotoxin • Attractive injectable portfolio under global role out • Global commercial position under build up • Only effective treatment for tinnitus (Phase III trials ongoing) • A leading specialty niche CNS • Top 3 global player in Aesthetics • Neramexane established as the first in category treatment for Tinnitus • Attractive Ear disease pipeline Merz aspiration Specialty CNS Aesth. Med. ENT |

12 | Page We have established an attractive CNS pipeline….. Phase II Phase III Phase I Subm. Memantine Botulinum Neurotoxin Typ A Neramexane CNS Phase 0 Filing Tinnitus Nystagmus Merz Pharmaceuticals Alzheimer- Dementia Parkinson MRZ 99030 MRZ 8456 Spasticity (EU) Blepharospasm / Torticollis spasmodicus (US) Moderate to severe Alzheimer dementia (Japan) |

13 | Page …and with Xeomin ® / Bocouture ® the next generation Botulinum Neurotoxin Type A under global roll out NT201 Unique features: • free of complexing proteins • low potential for antibody formation • stable without refrigeration • established efficacy and safety |

15 | Page Our Vision: to become one of the world’s most admired aesthetics brands Belotero ®1 Novabel ® Bocouture ® / Xeomin ® We are under global roll out of a competitive range of products to fulfill physician’s and patient needs… 1 licensed only in selected territories |

16 | Page … and just launched with Novabel ® based on Geleon TM technology a new class of fillers in Europe The versatile shaper, gentle and powerful Novabel 150µm 30 Erythrocytes 7,5 µm Thrombocytes 1,5µm-3,0 µm Adipocytes 70-120µm Memory shape effect: even after passing narrow tissue structures „Geleons“ are able to recapture their original perfect round shape |

17 | Page Our way forward in growing our Aesthetics operations • Expand global presence by acquisition of BioForm Medical • Emphasize own development efforts and address unmet needs • Seek portfolio acquisition and licensing opportunities to further build our global presence & network |

18 | Page Merz + BioForm Medical: Strengthening our foundation in Aesthetics Expands product offering with additional innovative, quality aesthetics treatment options Able to offer dermal fillers based on three distinct technologies • RADIESSE® hydroxylapatite filler • Belotero®, hyaluronic acid filler (under development for the US) • Novabel®, biocompatible brown algae filler (under development for the US) Innovative aesthetics products (under development for the US market) • Polidocanol, a sclerotherapy agent • Bocouture®/XEOMIN®, a neurotoxin free of complexing protein Increases direct commercial presence • +75 reps and +25 clinical trainers in the U.S. World-class talent. Strong cultural fit • BioForm Medical’s team to join Merz Building on Merz’s history of providing innovative and effective products to the aesthetic medical community |

19 | Page Transaction Overview (1)€1 = US$1.433. Based on exchange rate at 12/31/09 (2)Subject to the tender of a majority of the outstanding shares of BioForm Medical common stock, regulatory approvals, customary closing conditions Purchase Price Consideration Expected Closing Transaction Structure • US$253 million (€177 million ) equity value • US$5.45 per share via cash tender offer – 60% premium to BFRM closing stock price on 12/31/09 – 55% premium to 30-day BFRM average closing stock price • BioForm Medical to become a wholly-owned subsidiary of Merz and renamed Merz Aesthetics • First quarter of calendar year 2010 2 1 |

20 | Page Neramexane in Tinnitus |

21 | Page 21 Tinnitus is a widespread condition Note: Objective Tinnitus not considered Source: American Tinnitus Association (ATA); Datamonitor Description of Tinnitus Perception of sound (e.g. ringing, hissing, buzzing) in the absence of external equivalent Tinnitus prevalence: 5-7% Impaired signal processing in ear and brain can lead to manifestation of sound Multiple causes can lead to "ringing" in the ear that normally disappears 5% 4% 5% 7% 5% Tinnitus 6% Asthma 9% Migraine 7% Diabetes II High estimation Conservative estimation |

| Page 22 No treatment proven to be effective 1. Biesinger, (1998), Stat. Tin. HNO, 46 2. Hahn, A, Int tinnitus J (2008). 3. Desloovere, C HNO 36 (1988); Desloovere, C, Laryngo-Rhino-Otol 73 (1994) 4. Arzneimittelkommission: Dtsch. Ärztbl. 92 (1995) 5. Cochrane 2004 6. Smith et al 2005 J Ethnopharmparmacol 100(12) 7. Folmer Ear Nose Throat J (2004) 8. Robinson, Hear Res 226 (2005) 9. Baldo, Cochrane (2006) 10. Cochrane 2007 Jan 24; Cochrane Database 2005 12. Savage, J, BMJ evidence 2007 13. Martinez, Cochrane 2007 |

23 | Page However, …… total costs for society of ~ $32bn 1. Calculated as human capital method assuming $1,350 per year per treated patient; 75% of 13.5M treated patients in working age; Note: Chronic headache causes an estimated cost of $27M and chronic back pain ~$170M. Top 7 countries: US, JP, UK, DE, FR, IT, ES Source: Petermann (2005); National Center for Health Statistics; Coles: Epidemiology of tinnitus; Axelsson: tinnitus: a study; Pilgrimm: tinnitus in der BRD; Merz expert interviews 0 10 20 30 40 9 - 12 Treatment 7 - 9 Doctors’ fees & Diagnostics 12 - 15 28 - 36 Total Cost in bn$ Average chronic patient misses 3 weeks of work per year Tinnitus-induced costs for society in top 7 markets 1 Indirect costs |

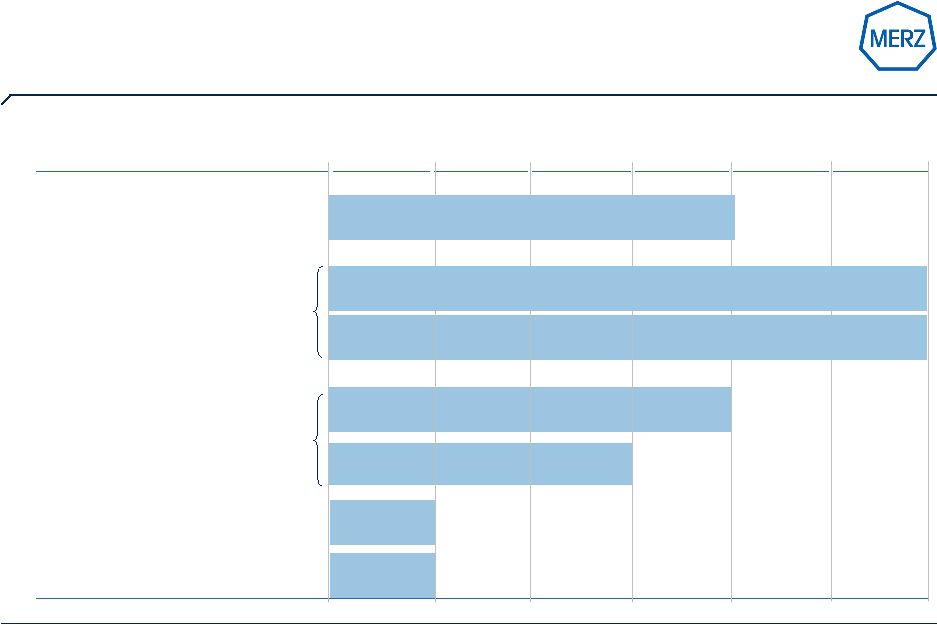

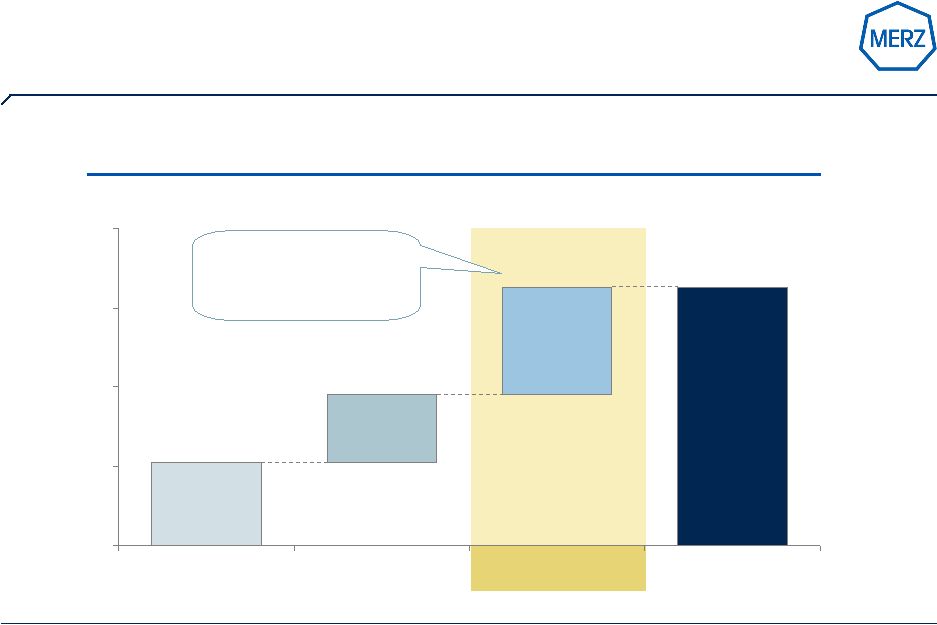

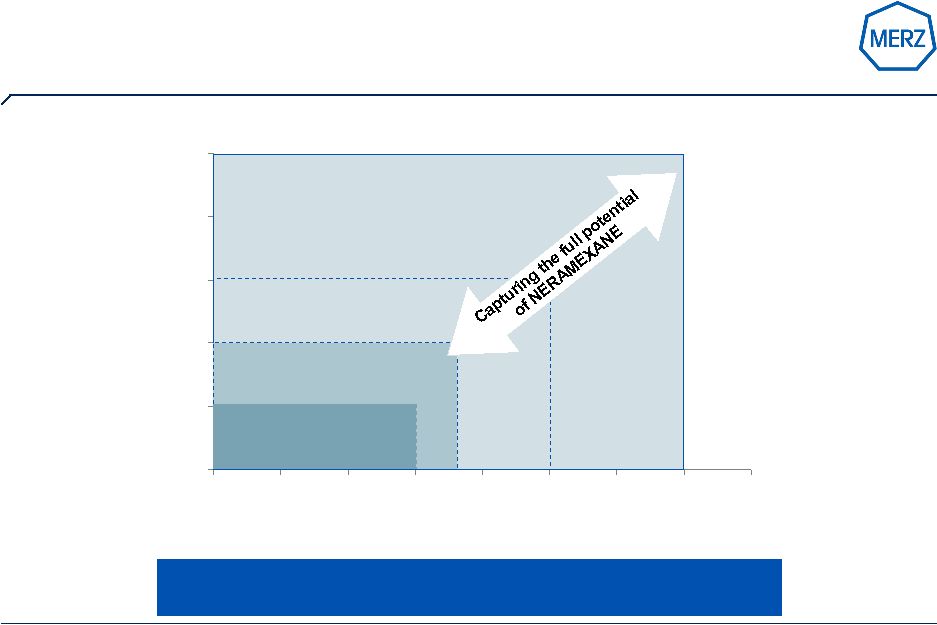

24 | Page Patient share in target segment Average NER DDD in $ Neramexane with blockbuster potential ~ $ 8 bn equals current Tinnitus Market ~$ 4 bn ~$ 2 bn Market potential of NERAMEXANE will exceed $ 1bn by far ~$ 1bn |

25 | Page 25 "...sleep comfortable!" "...stay in work!" 1. TBF12 >9; HADS <10; disease duration <12 month 2. vs. Placeb: +18% of patients with improvement and -16% of patients worse 3. e.g., sport, seeing friends, restaurant visits; +18% of patients with improvement and -8% of patients worse 4. vs. placebo Source: Merz market research; Merz Phase II trial "...enjoy life!" +23% +37% +2h +49% Additional hours/day without annoyance Patients with improved social life Patients with better capability to work Tailor made, multiple receptor mode of action First-time high quality phase II trial in tinnitus (n>400) Clean safety profile proven in 1,500 individuals Good tolerability Convenient oral treatment Neramexane – first oral Tinnitus Medication in Phase III Sustainable global market exclusivity based upon comprehensive IP package (substance, synthesis and use patents) Largest Phase III program ever in Tinnitus well on track Neramexane key facts Encouraging phase II efficacy in relevant patient population Additional patients sleep well! 4 3 2 1 |

26 | Page Neramexane – more than a wild card • Significant unmet medical need • Vastly untapped market - the patient is waiting • Strong scientific rationale • Solid initial clinical data • Strong IP Portfolio • Strong Japanese Partner on board - ENT specialist Kyorin Phase III clinical trials ongoing, first results 2nd quarter 2010; further partnership discussions initiated |

28 | Page Merz Pharma: continued growth in specialty segments Our future growth will be based on • an innovative pipeline from own R&D, R&D collaborations and licensing • a commitment and financial capability to invest into our own organisations to expand our international footprint, • further building partnerships for our products and • selectively pursuing M&A We are determined to • build an international company out of a strong German heritage • establish leadership positions in Medical Aesthetics, Specialty CNS and Tinnitus |