As filed with the Securities and Exchange Commission on March 22, 2004

Registration No. 333-

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

AFFIRMATIVE INSURANCE HOLDINGS, INC.

(Exact name of Registrant as specified in its charter)

| | | | |

| Delaware | | 6331 | | 75-2770432 |

(State or other jurisdiction

of incorporation or organization) | | (Primary Standard Industrial

Classification Code Number) | | (I.R.S. Employer Identification Number) |

4450 Sojourn Drive, Suite 500

Addison, Texas 75001

(972) 728-6300

(Address, including zip code, and telephone number, including area code, of Registrant’s principal executive offices)

Timothy A. Bienek

Executive Vice President and Chief Financial Officer

Affirmative Insurance Holdings, Inc.

4450 Sojourn Drive, Suite 500

Addison, Texas 75001

(972) 728-6300

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

| | | | |

John W. McCullough Vice President and Associate General Counsel Vesta Insurance Group, Inc. 3760 River Run Drive Birmingham, Alabama 35243 (205) 970-7000 | | James F. Hughey, Jr. Balch & Bingham LLP 1901 Sixth Avenue North Suite 2600 Birmingham, Alabama 35203 (205) 251-8100 | | Brian J. Fahrney Sidley Austin Brown & Wood LLP Bank One Plaza 10 South Dearborn Street Chicago, Illinois 60603 (312) 853-7000 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this Registration Statement.

If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ¨

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If delivery of the prospectus is expected to be made pursuant to Rule 434, please check the following box. ¨

CALCULATION OF REGISTRATION FEE

| | | | | | |

Title of Each Class of Securities to Be Registered | | Proposed Maximum Aggregate Offering Price (1) | | Amount of Registration Fee |

|

Common Stock, $0.01 par value per share | | $ | 258,750,000 | | $ | 32,784 |

| (1) | Estimated solely for the purpose of calculating the amount of the registration fee in accordance with Rule 457(o) under the Securities Act of 1933, as amended. |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the Securities and Exchange Commission declares our registration statement effective. This prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

Subject to completion, dated , 2004

Shares

Common Stock

$ per share

| • | Affirmative Insurance Holdings, Inc. is offering shares and the selling stockholders are offering shares. We will not receive any proceeds from the sale of our shares by the selling stockholders. |

| • | We anticipate that the initial public offering price will be between $ and $ per share. |

| • | This is our initial public offering and no public market currently exists for our shares. |

| • | Proposed trading symbol: Nasdaq National Market — AFFM |

This investment involves risk. See “Risk Factors” beginning on page 8.

| | | | | | |

| | |

| | | Per Share

| | Total

|

Public offering price | | $ | | | $ | |

Underwriting discount | | $ | | | $ | |

Proceeds, before expenses, to Affirmative Insurance Holdings, Inc. | | $ | | | $ | |

Proceeds, before expenses, to the selling stockholders | | $ | | | $ | |

| | | | | | | |

The underwriters have a 30-day option to purchase up to additional shares of common stock from us and additional shares of common stock from the selling stockholders to cover over-allotments, if any.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

Piper Jaffray

William Blair & Company

Sandler O’Neill & Partners, L.P.

The date of this prospectus is , 2004.

[INSIDE FRONT COVER ARTWORK]

[Graphic represents map of the United States, with three groups of states shaded to indicate (1) those states in which we distribute policies through our retail stores and independent agencies; (2) those states in which we distribute policies solely through independent agencies; and (3) those states in which we distribute policies solely through unaffiliated underwriting agencies.

Graphic also indicates each DMA® in which we operate retail stores and identifies the corresponding retail brand by logo.]

TABLE OF CONTENTS

You should rely only on the information contained in this prospectus. We have not, and the underwriters have not, authorized any other person to provide you with different information. This prospectus is not an offer to sell, nor is it seeking an offer to buy, these securities in any state where the offer or sale is not permitted. The information in this prospectus is complete and accurate as of the date on the front cover, but the information may have changed since that date.

i

Unless otherwise indicated or the context otherwise requires, in this prospectus:

| | • | references to “Affirmative,” “we,” “us” and “our” mean Affirmative Insurance Holdings, Inc. and its subsidiaries, collectively; |

| | • | references to “Vesta” mean Vesta Insurance Group, Inc. and its subsidiaries, collectively; |

| | • | references to “our insurance companies” mean Affirmative Insurance Company and Insura Property & Casualty Insurance Company, collectively; |

| | • | references to “our underwriting agencies” mean A-Affordable Managing General Agency, Inc., American Agencies General Agency, Inc., Affirmative Insurance Services, Inc. and Space Coast Underwriters Insurance Agency, Inc., collectively; |

| | • | references to “our retail agencies” mean the various legal entities operating our retail agency business under our A-Affordable®, Driver’s ChoiceSM, InsureOne® and Yellow Key® brands, collectively; |

| | • | insurance industry data and our market share or ranking in the industry were derived from the most current data compiled by A.M. Best Company, Inc., which we refer to as “A.M. Best;” and |

| | • | the term “DMA®” is a registered trademark of Nielsen Media Research, Inc., which we refer to as “Nielsen.” |

ii

SUMMARY

The items in the following summary are described in more detail later in this prospectus. This summary provides an overview of selected information and does not contain all of the information that you should consider. Therefore, you should also read the more detailed information set out in this prospectus and the consolidated financial statements and related notes included in this prospectus.

Business of Affirmative Insurance Holdings, Inc.

We are a growing producer and provider of non-standard automobile insurance policies to individual consumers in highly targeted geographic markets. Non-standard personal automobile insurance policies provide coverage to drivers who find it difficult to obtain insurance from standard insurance companies due to their lack of prior insurance, age, driving record, limited financial resources or other factors. These policies generally require higher premiums than standard policies for comparable coverage. We currently offer our products and services in selected markets within 11 states, including Texas, Illinois and California. Based upon information from A.M. Best, the 11 states in which we operate collectively represent approximately 50.0% of the non-standard personal automobile insurance market, or approximately $15.8 billion in direct premiums written in 2002.

Our business is led by a group of seasoned insurance professionals with significant expertise and experience in acquiring, integrating, building and managing non-standard personal automobile insurance operations. Between 2001 and 2003, our operations consisted of underwriting and retail agencies that produced non-standard personal automobile insurance policies for various insurance companies, including those of our ultimate parent, Vesta Insurance Group, Inc. During this period, our total agency revenues grew from $6.2 million to $147.1 million, and our total agency pretax income grew from a loss of $3.1 million to pretax income of $20.9 million. Substantially all of this growth was achieved through the acquisition of six regionally-branded underwriting agencies and/or retail agencies in 2001 and 2002, coupled with our post-acquisition implementation of disciplined underwriting, pricing and claims practices.

For periods prior to December 31, 2003, we also managed Vesta’s non-standard personal automobile insurance business, or the NSA Business, and Vesta reported the financial results of this business in a separate financial reporting segment. As of December 31, 2003, Vesta transferred to us two insurance companies and all future economic interest in the NSA Business. From 2001 to 2003, Vesta reported that the total revenues for the NSA Business grew from $14.6 million to $192.3 million, net premiums earned grew from $10.2 million to $167.4 million and pretax income grew from $3.9 million to $9.2 million.

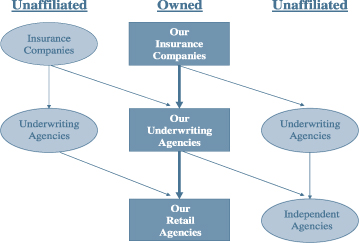

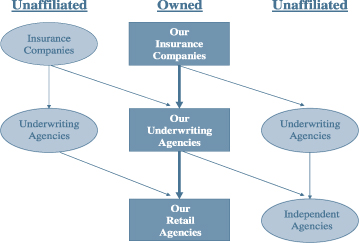

We believe the keys to our past profitability and our long-term success are our ability to deploy and manage multiple distribution channels and our flexible operating model. Our operations are comprised of three distinct components:

| | • | Insurance companies, which possess the insurance licenses and capital necessary to issue insurance policies; |

| | • | Underwriting agencies, which supply centralized infrastructure and personnel required to design and service insurance policies that are distributed through retail agencies; and |

| | • | Retail agencies, which provide multiple points of sale under established local brands with personnel licensed and trained to sell insurance policies to individual consumers. |

We own two insurance companies, four underwriting agencies and four branded retail agencies with 140 retail store locations serving Illinois, Texas, Missouri, Indiana and South Carolina. These three operating components often function as a vertically integrated unit, capturing all of the premiums, and associated

1

risk, and commissions and fees generated from the sale of each insurance policy. However, each of these components also works with unaffiliated entities on an unbundled basis, either functioning independently or in conjunction with one or both of the other two components. We believe that this flexible operating structure allows us to maximize sales penetration and profitability through various industry cycles better than if we employed a single, vertically integrated operating model.

Our historical revenues consisted primarily of commissions and fees earned by our underwriting agencies for premiums they produced. Beginning January 1, 2004, our revenues will also include net premiums earned by our insurance companies. We measure the total gross premiums written from which we derive either of these components of revenue as our Total Controlled Premium. The following table displays our Total Controlled Premium by distribution channel for the year ended December 31, 2003:

| | | | | | |

| | | Total

Controlled

Premium

| | % of Total

| |

| | | (dollars in millions) | |

Our underwriting agencies: | | | | | | |

Our retail stores | | $ | 117.9 | | 30.6 | % |

Independent agencies | | | 157.3 | | 40.8 | |

Unaffiliated underwriting agencies | | | 110.5 | | 28.6 | |

| | |

|

| |

|

|

Total | | $ | 385.7 | | 100.0 | % |

| | |

|

| |

|

|

Of this Total Controlled Premium of $385.7 million, approximately $324.8 million, comprising 100.0% of the NSA Business, was written or reinsured by Vesta’s insurance companies, and approximately $60.9 million was written by Old American County Mutual Fire Insurance Company, an unaffiliated insurance company, and reinsured by unaffiliated reinsurers.

In addition to contributing to our Total Controlled Premium, our retail stores also sell non-standard personal automobile insurance policies, complementary insurance products and ancillary non-insurance products on behalf of third parties for which we receive commissions and fees. During 2003, our retail stores collected approximately $7.6 million from third parties for the sale of such policies and products.

Our retail stores are operated under four brand names — A-Affordable®, Driver’s ChoiceSM, InsureOne®, and Yellow Key® — each of which was developed over a significant period of time by its previous owners. In contrast to the traditional state-by-state marketing approach that is common practice in our industry, we have adopted a more targeted approach using Nielsen’s designated market area, or DMA®, as the fundamental marketing focus in our retail operation. A DMA® is a geographically distinct region, often a city and its surrounding metropolitan area, that Nielsen defines based on its analysis of mutually exclusive television viewing areas. We believe that segmenting our geographic markets into DMAs® facilitates the concentration of our advertising and brand support activities, allowing us to more cost-effectively manage and leverage each regional brand.

Our Strengths

Our mission is to create and sustain superior returns for our stockholders throughout industry cycles. We believe we have developed certain strengths that help us achieve our mission, including:

| | • | Return-on-equity focused culture. Our corporate culture instills a rigorous, data-driven, return-on-equity discipline on all of our business units and functional areas; |

| | • | Underwriting discipline. Our underwriting practices employ highly-developed pricing segmentation, product differentiation and frequent competitive market analysis that allow us to modify our pricing and product design to respond quickly to market conditions; |

2

| | • | Flexible operating model. Our operating model allows us the flexibility to integrate or unbundle our products and services over multiple distribution channels to better manage our business through industry cycles; |

| | • | Strong retail branding. We believe our retail agencies are among the most recognized brands in each of their respective markets, providing us a competitive advantage and enabling us to better attract customers; |

| | • | Effective claims handling techniques. We are focused on best practices claims handling processes that are regularly measured, audited and upgraded; |

| | • | Acquisition expertise. Our management team’s significant experience and expertise in identifying, acquiring and integrating non-standard personal automobile insurance operations expand our opportunities in a highly fragmented industry; |

| | • | Metrics-driven, analytical management approach. We believe that all aspects of our operation are best managed with a metrics-driven approach that bases our decisions on a continual measurement and analysis of pertinent and specific data; and |

| | • | Experienced management team. Our executive management team has an average of 17 years of experience in the insurance industry and an average of 11 years of experience focusing on the non-standard personal automobile insurance industry. |

Our Growth Strategy

Our growth strategy, which is driven by a strong commitment to organic growth complemented by acquisition activity, is comprised of the following:

| | • | Increase sales through existing retail stores. We intend to expand brand awareness and sales at our retail stores through the extension of our targeted advertising initiatives; |

| | • | Open new retail stores. We plan to open new retail stores to increase our penetration in current DMAs® and extend our brands into new DMAs®; |

| | • | Leverage and develop independent agency relationships. We will continue to deepen our relationships with our existing network of approximately 1,800 independent agencies and develop new relationships with other independent agencies to expand our distribution network both within our existing markets and in new markets; |

| | • | Expand and establish relationships with unaffiliated insurance companies and underwriting agencies. We intend to expand existing relationships and establish new relationships with unaffiliated insurance companies and underwriting agencies to increase the volume of premiums that we produce or underwrite; |

| | • | Offer additional complementary and ancillary products. We will opportunistically broaden or change our complementary and ancillary product offerings to meet our customers’ needs; and |

| | • | Engage in acquisitions. We will continue to identify and evaluate acquisition prospects in new DMAs® and, to a more limited extent, in our existing DMAs® to the extent we believe they will strengthen our geographic presence or brand awareness in a cost-effective manner. |

Our Formation and Separation from Vesta Insurance Group, Inc.

We were incorporated in Delaware on June 25, 1998. From inception through 2000, former management pursued a strategy to distribute and underwrite non-standard personal automobile insurance through the Internet and a related call center. In December 2000, Vesta Insurance Group, Inc. acquired a controlling interest in us and hired Thomas E. Mangold, our current Chief Executive Officer, to wind down prior operations and implement our current strategy. Between December 2000 and the date of this prospectus, Vesta increased its ownership in us to its current level of 98.1% of our issued and outstanding capital stock.

3

In preparation for this offering, we and Vesta engaged in several transactions to transfer the non-standard personal automobile insurance underwriting operations of Vesta to us. Effective December 31, 2003, we acquired 100.0% of the stock of our two insurance companies — Affirmative Insurance Company and Insura Property & Casualty Insurance Company — from Vesta in exchange for shares of our common stock. We accounted for our acquisition of our two insurance companies as a pooling of interests. Accordingly, our audited consolidated financial statements included in this prospectus reflect our historical results of operations and the results of Affirmative Insurance Company and Insura, on a combined basis, as if this transaction had been consummated prior to the periods presented. However, because these companies historically ceded 100.0% of their premiums, losses and loss adjustment expenses to Vesta’s lead insurer, Vesta Fire Insurance Corporation, our historical insurance company segment results of operations include only certain revenues, primarily policy fees, that were not ceded to Vesta Fire and do not include the historical underwriting results of operations related to the policies written by these insurance companies. As a result, we include supplemental information regarding Vesta’s non-standard underwriting segment in this prospectus beginning on page 44, which reflects the historical financial results of operations of the NSA Business for the years ended December 31, 2003, 2002 and 2001.

Also effective December 31, 2003, Vesta restructured its internal reinsurance arrangements relating to non-standard personal automobile insurance policies. This reinsurance restructuring effectively transferred to Affirmative Insurance Company and Insura all of the losses and loss adjustment expenses that occur after December 31, 2003, and all premiums earned after that date, on the NSA Business. Vesta retained all loss and loss adjustment expense reserves as of December 31, 2003 related to the NSA Business and remains liable for any losses and allocated loss adjustment expenses associated with this business that occurred on or prior to December 31, 2003. We anticipate that we will complete the process of transitioning the writing of all new and renewal non-standard personal automobile insurance business written by Vesta’s other insurance company subsidiaries to our insurance companies during 2004, after which time all new and renewal policies will be issued by our insurance companies.

Our audited consolidated balance sheet as of December 31, 2003 reflects the impact of this reinsurance restructuring. However, because we have determined that this restructuring of Vesta’s internal reinsurance does not constitute a business combination within the meaning of Statement of Financial Accounting Standards No. 141,Business Combinations, our audited consolidated statements of operations included in this prospectus do not include any underwriting results of the NSA Business. The underwriting results of the NSA Business will be reflected in our audited consolidated statements of operations in future periods commencing January 1, 2004.

Risk Factors

An investment in our common stock involves a significant degree of risk. We urge you to carefully consider all of the information described in the section entitled “Risk Factors” beginning on page 8.

Office Location

Our principal executive office is located at 4450 Sojourn Drive, Suite 500, Addison, Texas 75001, and our telephone number is (972) 728-6300. Our website address is www.affirmativeholdings.com. The information found on our website is not, however, a part of this prospectus and any reference to our website is intended to be an inactive textual reference only and is not intended to create any hypertext link.

4

The Offering

Common stock offered:

| | |

By Affirmative Insurance Holdings, Inc. | | shares |

| |

By selling stockholders | | shares |

| |

Total | | shares |

| |

Common stock outstanding after the offering | | shares |

| |

Offering price | | $ per share |

| |

Use of proceeds | | We intend to contribute $ million of the net proceeds that we receive from this offering to our insurance companies, which will increase their statutory surplus. This additional capital will permit us to reduce our reinsurance purchases and retain more gross premiums written over time. We intend to use the remainder of the net proceeds for general corporate purposes. |

| |

| | | We will not receive any of the proceeds from the sale of shares of our common stock by selling stockholders. |

| |

Proposed Nasdaq National Market symbol | | AFFM |

| |

Dividend policy | | We currently expect to pay an annual dividend of $ per share of our common stock payable on a quarterly basis. The payment of dividends will be at the discretion of our board of directors. |

The number of shares of our common stock outstanding after this offering excludes:

| | • | shares of common stock issuable upon exercise of outstanding options, including options granted under our 1998 Omnibus Incentive Plan, at a weighted average exercise price of $ per share; and |

| | • | additional shares of common stock reserved for future grants under our 2004 Stock Incentive Plan, of which shares will be issuable upon the exercise of options granted at the time of this offering at an exercise price equal to the initial public offering price. |

Unless otherwise stated, all information in this prospectus:

| | • | assumes that the underwriters have not exercised their over-allotment option to purchase up to shares of common stock; |

| | • | assumes no outstanding options have been exercised since December 31, 2003; and |

| | • | has been adjusted to reflect a -for-one split of our common stock, effected through a stock dividend that occurred on , 2004. |

5

Summary Financial Information

The following table provides a summary of our historical consolidated financial and operating data as of the dates and for the periods indicated. We derived the summary historical data as of December 31, 2003 and for the years ended December 31, 2003, 2002 and 2001 from our audited consolidated financial statements included in this prospectus. The following table also includes unaudited pro forma financial information about how the transfer to us by Vesta of all economic interests in the NSA Business beginning January 1, 2004 may have affected our net income if the results of the NSA Business had been combined for the year ended December 31, 2003. Such unaudited pro forma financial information does not necessarily reflect the results of operations that may have actually resulted had the transfer of the NSA Business to us occurred prior to the year ended December 31, 2003, and should not be taken as necessarily indicative of our future results of operations. In conjunction with this summary and in order to more fully understand this summary financial information, you should also read “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated financial statements and the accompanying notes included in this prospectus, as well as “Unaudited Pro Forma Financial Information.”

| | | | | | | | | | |

| | | Years Ended December 31,

| |

| | | 2003

| | 2002

| | 2001

| |

| | | | | | | (predecessor

basis)(1) | |

| | | (in thousands, except share and

per share data) | |

Statement of Operations Data:(2) | | | | | | | | | | |

Revenues: | | | | | | | | | | |

Commissions and fees | | $ | 103,946 | | $ | 84,907 | | $ | 5,802 | |

Net investment income | | | 189 | | | 484 | | | 1,645 | |

Realized gains | | | 449 | | | — | | | 844 | |

Other income | | | — | | | — | | | 77 | |

| | |

|

| |

|

| |

|

|

|

Total revenues | | | 104,584 | | | 85,391 | | | 8,368 | |

Expenses: | | | | | | | | | | |

Commission expense | | | 15,868 | | | 17,750 | | | 883 | |

Employee compensation and benefits | | | 37,088 | | | 31,721 | | | 4,487 | |

Operating expenses | | | 16,417 | | | 9,520 | | | 3,945 | |

Other expenses | | | 4,378 | | | 3,372 | | | 821 | |

| | |

|

| |

|

| |

|

|

|

Total expenses | | | 73,751 | | | 62,363 | | | 10,136 | |

Net income (loss) before income taxes, minority interest and equity in unconsolidated subsidiaries | | | 30,833 | | | 23,028 | | | (1,768 | ) |

Income tax expense | | | 11,025 | | | 8,610 | | | 608 | |

Minority interest, net of income taxes | | | 403 | | | 703 | | | 74 | |

Equity interest in unconsolidated subsidiaries, net of income taxes | | | 348 | | | — | | | — | |

| | |

|

| |

|

| |

|

|

|

Net income (loss) | | $ | 19,057 | | $ | 13,715 | | $ | (2,450 | ) |

| | |

|

| |

|

| |

|

|

|

Net income (loss) per share: | | | | | | | | | | |

Basic | | | | | | | | | | |

Diluted | | | | | | | | | | |

Book value per share | | | | | | | | | | |

Weighted average shares: | | | | | | | | | | |

Basic | | | | | | | | | | |

Diluted | | | | | | | | | | |

| | | |

Pro forma net income (loss) | | $ | 18,467 | | | | | | | |

Pro forma net income (loss) per share: | | | | | | | | | | |

Basic | | | | | | | | | | |

Diluted | | | | | | | | | | |

footnotes on following page

6

| | | | | | |

| |

| | | As of December 31, 2003

|

| | | Actual

| | Adjusted(3)

|

| | | (in thousands) |

Balance Sheet Data: | | | | | | |

Total assets | | $ | 314,579 | | $ | |

Notes payable | | | 10,020 | | | |

Total liabilities | | | 201,202 | | | |

Total stockholders’ equity | | | 113,377 | | | |

| (1) | On December 28, 2001, Vesta’s ownership interest increased to 92% of the voting power of our capital stock. At that time, we adopted push down accounting. Our statement of operations data for the year ended December 31, 2001 is presented above on our historical basis, as push down accounting was not appropriate prior to December 28, 2001 and no material adjustments exist for the period from December 28, 2001 to December 31, 2001. See Note 2 to our consolidated financial statements on page F-8 of this prospectus. |

| (2) | Prior to acquiring our insurance companies effective December 31, 2003, our continuing operations were comprised of our non-standard personal automobile insurance underwriting and retail agency operations. The business written by our insurance companies was 100.0% reinsured by Vesta Fire in accordance with a quota share reinsurance agreement. As a result of this internal reinsurance, the historical financial statements of Affirmative Insurance Company and Insura include only certain revenues, primarily policy fees that were not ceded to Vesta Fire. |

| (3) | The historical consolidated balance sheet as of December 31, 2003, as adjusted, gives effect to the sale of shares of our common stock by us in this offering at an assumed initial public offering price of $ per share. |

7

RISK FACTORS

An investment in our common stock involves a number of risks. You should carefully consider the risks described below, together with the other information contained in this prospectus, before you decide to buy our common stock.

Risks Related to Affirmative Insurance Holdings, Inc.

Because of our significant concentration in non-standard personal automobile insurance, our profitability may be adversely affected by negative developments and cyclical changes in that industry.

Substantially all of our gross premiums written and commission and fee income is generated from sales of non-standard personal automobile insurance policies. As a result of our concentration in this line of business, negative developments in the business, economic, competitive or regulatory conditions affecting the non-standard personal automobile insurance industry could have a negative effect on our profitability and would have a more pronounced effect on us compared to more diversified companies. Examples of such negative developments are increasing trends in automobile repair costs, automobile parts costs, used car prices, medical care expenses and increased regulation, as well as increased litigation of claims and higher levels of fraudulent claims. All of these events can result in reduced profitability. In addition, the non-standard personal automobile insurance industry historically is cyclical in nature, characterized by periods of severe price competition and excess underwriting capacity followed by periods of high premium rates and shortages of underwriting capacity. These fluctuations in the non-standard personal automobile insurance business cycle may negatively impact our profitability.

Intense competition could adversely affect our profitability.

The non-standard personal automobile insurance business is highly competitive and, except for regulatory considerations, there are relatively few barriers to entry. Our insurance companies compete with other insurance companies that sell non-standard personal automobile insurance policies through independent agencies as well as with insurance companies that sell such policies directly to their customers. Our retail agencies and independent agencies that sell our insurance products compete both with these direct writers and with other independent agencies. Therefore, our competitors are not only large national insurance companies, but also smaller regional insurance companies and independent agencies. Some of our competitors have substantially greater financial and other resources than we have and may offer a broader range of products or competing products at lower prices. In addition, given the current favorable pricing conditions, existing competitors may attempt to increase market share by lowering rates and new competitors may enter this market, particularly larger insurance companies that do not presently write non-standard personal automobile insurance. In this environment, we may experience a reduction in our underwriting margins or sales of our insurance policies may decrease as individuals purchase lower-priced products from other insurance companies. A loss of business to competitors offering similar insurance products at lower prices or having other competitive advantages could negatively affect our revenues and profitability.

Our success depends on our ability to price accurately the risks we underwrite.

The results of our operations and the financial condition of our insurance companies depend on our ability to underwrite and set premium rates accurately for a wide variety of risks. Rate adequacy is necessary to generate sufficient premiums to pay losses, loss adjustment expenses and underwriting expenses and to earn a profit. In order to price our products accurately, we must collect and properly analyze a substantial amount of data; develop, test and apply appropriate rating formulas; closely monitor and timely recognize changes in trends and project both severity and frequency of losses with reasonable accuracy. Our ability to undertake these efforts successfully, and as a result price our products accurately, is subject to a number of risks and uncertainties, some of which are outside our control, including:

| | • | the availability of sufficient reliable data and our ability to properly analyze available data; |

8

| | • | the uncertainties that inherently characterize estimates and assumptions; |

| | • | our selection and application of appropriate rating and pricing techniques; and |

| | • | changes in legal standards, claim settlement practices, medical care expenses and automobile repair costs. |

Consequently, we could underprice risks, which would negatively affect our profit margins, or we could overprice risks, which could reduce our sales volume and competitiveness. In either event, the profitability of our insurance companies could be materially and adversely affected.

If our actual losses and loss adjustment expenses exceed our gross loss and loss adjustment expense reserves, we will incur a charge to earnings.

We maintain reserves to cover our estimated ultimate liability for losses and related loss adjustment expenses for both reported and unreported claims on insurance policies issued by our insurance companies. The establishment of appropriate reserves is an inherently uncertain process, involving actuarial and statistical projections of what we expect to be the cost of the ultimate settlement and administration of claims based on historical claims information, estimates of future trends in claims severity and other variable factors such as inflation. Due to the inherent uncertainty of estimating reserves, it has been necessary, and will continue to be necessary, to revise estimated future liabilities as reflected in our reserves for claims and related expenses.

Before Vesta transferred our insurance companies to us effective December 31, 2003, these insurance companies had ceded 100.0% of the business that they wrote to Vesta Fire Insurance Corporation, a wholly owned subsidiary of Vesta, as part of an intercompany reinsurance agreement. As a result, while our gross loss and loss adjustment expense reserves totaled approximately $58.5 million as of December 31, 2003, our net loss and loss adjustment expense reserves were zero as of that date. In connection with the acquisition of our insurance companies from Vesta, this intercompany reinsurance agreement was terminated as of December 31, 2003, and our insurance companies began accruing loss and loss adjustment expense reserves subject only to third-party reinsurance arrangements. Although Vesta Fire remains liable for all of our losses and loss adjustment expenses occurring on or prior to December 31, 2003 on policies issued by our insurance companies, we are subject to primary liability with respect to these policies. Consequently, if Vesta Fire cannot satisfy its obligations to us, we must ultimately pay losses and loss adjustment expenses for which we have no corresponding reserves.

We cannot be sure that our ultimate losses and loss adjustment expenses will not materially exceed our reserves. To the extent that our reserves prove to be inadequate in the future, we would be required to increase our reserves for losses and loss adjustment expenses and incur a charge to earnings in the period during which such reserves are increased, which could have a material and adverse impact on our financial condition and results of operations. In addition, we have a limited history in establishing reserves, and the historic development of our reserves for losses and loss adjustment expenses may not necessarily reflect future trends in the development of these amounts.

We may be unable to reduce our risk and increase our underwriting capacity through reinsurance arrangements.

We use reinsurance to attempt to limit the risks associated with our insurance policies and increase the underwriting capacity of our insurance companies. Qualifying reinsurance increases the underwriting capacity of our insurance companies by decreasing their aggregate net liability on the reinsured policies for insurance regulatory purposes. The gross premiums written that were ceded to unaffiliated reinsurers on the NSA Business for the year ended December 31, 2003 were $145.3 million, or 44.7%, of the gross premiums written.

The availability, cost and structure of reinsurance protection is subject to prevailing market conditions, which are outside our control. Poor conditions in the reinsurance market could cause us to retain more

9

risk than we would otherwise desire to retain or reduce our volume of business, either of which could impact our profitability.

In addition, in order for our reinsurance contracts to qualify for reinsurance accounting and thereby provide the additional underwriting capacity we desire, the reinsurer must, among other things, assume significant risk and have a reasonable possibility of a significant loss. If state insurance regulators deem that our existing or future reinsurance contracts do not meet these criteria, we would not receive credit for the reinsurance and would not be able to increase our ability to write business based on this reinsurance.

If our reinsurers do not pay our claims in a timely manner, we may incur losses.

Although our reinsurers are liable to us to the extent we transfer risk to the reinsurers, we remain ultimately liable to our policyholders on all risks reinsured. Consequently, if any of our reinsurers cannot pay their reinsurance obligations, or dispute these obligations, we remain liable to pay the claims of our policyholders. In addition, our reinsurance agreements are subject to specified contractual limits on the amounts and types of losses covered, and we do not have reinsurance coverage to the extent our losses exceed those limits or are not of the type reinsured. As of December 31, 2003, we had a total of $94.5 million of receivables from reinsurers. Our largest receivable from a single reinsurer was $87.6 million from Vesta Fire and certain of Vesta’s insurance company affiliates. Vesta Fire and its affiliates currently maintain a financial strength rating of “B” (Fair) from A.M. Best, which is the seventh highest of 15 rating levels, and is currently under review by A.M. Best with negative implications. According to A.M. Best, “B” ratings are assigned to insurers that have a fair ability to meet their current obligations to policyholders, but are financially vulnerable to adverse changes in underwriting and economic conditions. If any of our reinsurers are unable or unwilling to pay amounts they owe us in a timely fashion, we could suffer a significant loss which would have a material adverse effect on our business and results of operations.

Because we intend to reduce our use of quota share reinsurance, we will retain more risk, which could result in losses.

We currently use quota share reinsurance primarily to increase our underwriting capacity and to reduce our exposure to losses. Quota share reinsurance is a form of pro rata reinsurance arrangement in which the reinsurer participates in a specified percentage of the premiums and losses on every risk that comes within the scope of the reinsurance agreement in return for a portion of the corresponding premiums. After the closing of this offering, we intend to reduce, but not eliminate, our use of quota share reinsurance. As a result, we will retain and earn more of the premiums we write, but we will also retain more of the related losses. Reducing our use of quota share reinsurance will increase our risk and exposure to such losses, which could have a material adverse effect on our business, financial condition and results of operations.

We are subject to comprehensive regulation that may restrict our ability to earn profits.

We are subject to comprehensive regulation and supervision by government agencies in Illinois, the state in which our insurance company subsidiaries are domiciled, as well as in the states where our subsidiaries sell insurance products, issue policies and handle claims. Certain states impose restrictions or require prior regulatory approval of certain corporate actions, which may adversely affect our ability to operate, innovate, obtain necessary rate adjustments in a timely manner or grow our business profitably. These regulations provide safeguards for policyowners and are not intended to protect the interests of stockholders. Our ability to comply with these laws and regulations and to obtain necessary regulatory action in a timely manner is and will continue to be critical to our success.

| | • | Required licensing. We operate under licenses issued by various state insurance authorities. If a regulatory authority denies or delays granting a new license, our ability to enter that market quickly or offer new insurance products in that market might be substantially impaired. |

10

| | • | Transactions between insurance companies and their affiliates. Transactions between our insurance companies and their affiliates generally must be disclosed to state regulators, and prior approval of the applicable regulator generally is required before any material or extraordinary transaction may be consummated. State regulators may refuse to approve or delay approval of such a transaction, which may impact our ability to innovate or operate efficiently. |

| | • | Regulation of insurance rates and approval of policy forms. The insurance laws of most states in which we operate require insurance companies to file insurance rate schedules and insurance policy forms for review and approval. If, as permitted in some states, we begin using new rates before they are approved, we may be required to issue refunds or credits to our policyholders if the new rates are ultimately deemed excessive or unfair and disapproved by the applicable state regulator. Accordingly, our ability to respond to market developments or increased costs in that state can be adversely affected. |

| | • | Restrictions on cancellation, non-renewal or withdrawal. Many states have laws and regulations that limit an insurance company’s ability to exit a market. For example, certain states limit an automobile insurance company’s ability to cancel or not renew policies. Some states prohibit an insurance company from withdrawing from one or more lines of business in the state, except pursuant to a plan approved by the state insurance department. In some states, this applies to significant reductions in the amount of insurance written, not just to a complete withdrawal. These laws and regulations could limit our ability to exit or reduce our writings in unprofitable markets or discontinue unprofitable products in the future. |

| | • | Other regulations. We must also comply with regulations involving, among other things: |

| | — | the use of non-public consumer information and related privacy issues; |

| | — | the use of credit history in underwriting and rating; |

| | — | limitations on the ability to charge policy fees; |

| | — | limitations on types and amounts of investments; |

| | — | the payment of dividends; |

| | — | the acquisition or disposition of an insurance company or of any company controlling an insurance company; |

| | — | involuntary assignments of high-risk policies, participation in reinsurance facilities and underwriting associations, assessments and other governmental charges; |

| | — | reporting with respect to financial condition; and |

| | — | periodic financial and market conduct examinations performed by state insurance department examiners. |

Compliance with laws and regulations addressing these and other issues often will result in increased administrative costs. In addition, these laws and regulations may limit our ability to underwrite and price risks accurately, prevent us from obtaining timely rate increases necessary to cover increased costs and may restrict our ability to discontinue unprofitable relationships or exit unprofitable markets. These results, in turn, may adversely affect our profitability or our ability or desire to grow our business in certain jurisdictions. The failure to comply with these laws and regulations may also result in actions by regulators, fines and penalties, and in extreme cases, revocation of our ability to do business in that jurisdiction. In addition, we may face individual and class action lawsuits by our insureds and other parties for alleged violations of certain of these laws or regulations.

11

Regulation may become more extensive in the future, which may adversely affect our business.

We cannot assure you that states will not make existing insurance-related laws and regulations more restrictive in the future or enact new restrictive laws. New or more restrictive regulation in any state in which we conduct business could make it more expensive for us to conduct our business, restrict the premiums we are able to charge or otherwise change the way we do business. In such events, we may seek to reduce our writings in, or to withdraw entirely from, these states. In addition, from time to time, the United States Congress and certain federal agencies investigate the current condition of the insurance industry to determine whether federal regulation is necessary. We are unable to predict whether and to what extent new laws and regulations that would affect our business will be adopted in the future, the timing of any such adoption and what effects, if any, they may have on our operations, profitability and financial condition.

For example, in 2003, legislation was passed in Texas that has been described as comprehensive insurance reform affecting the homeowners and automobile insurance business. With respect to non-standard personal automobile insurance, the most significant provisions provide for additional rate regulation and limitations on the use of credit scoring and territorial distinctions in underwriting and rating risks. In the fiscal year ended December 31, 2003, approximately 28.5% of our Total Controlled Premium was written on policies issued to customers in Texas. Currently, all of these policies are written by Old American, a Texas county mutual insurance company. We and many of our competitors contract with Texas county mutual insurance companies primarily because these entities historically have not been subject to state rate regulation applicable to other insurance companies. Although the new reforms are significant, the primary rate regulation provisions do not apply directly to our business in Texas due to an exemption that applies to certain county mutual insurance companies, including Old American. However, because the Texas Commissioner of Insurance has been given broader rulemaking authority under the new law, we cannot determine the ultimate impact this legislation will have on our business until certain rules are developed by the Commissioner. Any rule changes that would bring the regulation of county mutual insurance companies more closely in line with the regulation of other property and casualty insurance companies conducting business in Texas would likely increase our regulatory costs and reduce our rate flexibility, which could make our relationship with Old American less profitable and prompt us to change the way we underwrite risk in Texas.

Our insurance companies are subject to minimum capital and surplus requirements, and our failure to meet these requirements could subject us to regulatory action.

Our insurance companies are subject to risk-based capital standards and other minimum capital and surplus requirements imposed under applicable state laws, including the laws of their state of domicile, Illinois. The risk-based capital standards, based upon the Risk-Based Capital Model Act adopted by the National Association of Insurance Commissioners, or NAIC, require our insurance companies to report their results of risk-based capital calculations to state departments of insurance and the NAIC.

Any failure by one of our insurance companies to meet the applicable risk-based capital or minimum statutory capital requirements imposed by the laws of Illinois or other states where we do business could subject it to further examination or corrective action imposed by state regulators, including limitations on our writing of additional business, state supervision or liquidation. Any changes in existing risk-based capital requirements or minimum statutory capital requirements may require us to increase our statutory capital levels, which we may be unable to do. As of December 31, 2003 the capital ratios of both of our insurance companies exceeded the highest level for regulatory action under the risk-based capital guidelines.

12

Our failure to pay claims accurately could adversely affect our business, financial results and capital requirements.

We must accurately evaluate and pay claims that are made under our policies. Many factors affect our ability to pay claims accurately, including the training and experience of our claims representatives, the culture of our claims organization and the effectiveness of our management, our ability to develop or select and implement appropriate procedures and systems to support our claims functions and other factors. Our failure to pay claims accurately could lead to material litigation, undermine our reputation in the marketplace, impair our image and negatively affect our financial results.

In addition, if we do not train new claims employees effectively or if we lose a significant number of experienced claims employees, our claims department’s ability to handle an increasing workload as we grow could be adversely affected. In addition to potentially requiring that growth be slowed in the affected markets, we could suffer decreased quality of claims work, which in turn could lower our operating margins.

If we lose key personnel or are unable to recruit qualified personnel, our ability to implement our business strategies could be hindered.

Our success depends in part upon the continued services of our key executives, including Thomas E. Mangold, Chief Executive Officer, President and Chairman of the Board of Directors; M. Sean McPadden, Executive Vice President; Katherine C. Nolan, Executive Vice President; and Timothy A. Bienek, Executive Vice President and Chief Financial Officer. We have entered into employment agreements with Mr. Mangold, Mr. McPadden, Ms. Nolan and Mr. Bienek, as described in “Management — Employment Agreements with Executive Officers,” which we expect will become effective upon the closing of this offering. We do not have key person insurance on the lives of any of our executive officers. Our success will also depend on our ability to attract and retain additional executives and personnel. The loss of any of our officers or other key personnel or our inability to recruit and retain qualified personnel could prevent us from fully implementing our business strategies and could materially and adversely affect our business, growth and profitability.

We may encounter difficulties in implementing our strategies of expanding into new markets and acquiring agencies.

Our growth strategy includes expanding into new geographic markets, introducing additional insurance and non-insurance products and acquiring the business and assets of underwriting and retail agencies. Our future growth will face risks, including risks associated with our ability to:

| | • | obtain necessary licenses; |

| | • | properly design and price our products; |

| | • | identify, hire and train new claims and sales employees; |

| | • | identify agency acquisition candidates; and |

| | • | assimilate and integrate the operations, personnel, technologies, products and information systems of the acquired companies. |

We may also encounter difficulties in connection with implementing our growth strategy, including unanticipated expenditures, damaged or lost relationships with customers and independent agencies and contractual, intellectual property or employment issues relating to companies we acquire. In addition, our growth strategy may require us to enter into a geographic or business market in which we have little or no prior experience.

Further, any potential agency acquisitions may require significant capital outlays, and if we issue equity or convertible debt securities to pay for an acquisition, these securities may have rights, preferences or privileges senior to those of our common stockholders or the issuance may be dilutive to our existing

13

stockholders. Once agencies are acquired, we could suffer increased costs, disruption of our business and distraction of our management if we are unable to smoothly integrate the agencies into our operations. Our expansion will also continue to place significant demands on our management, operations, systems, accounting, internal controls and financial resources. Any failure by us to manage our growth and to respond to changes in our business could have a material adverse effect on our business and profitability and could cause the price of our common stock to decline.

Our financial results may be adversely affected by conditions in the states where our business is concentrated.

Our business is concentrated in 11 states. As of December 31, 2003, approximately 28.5% of our Total Controlled Premium related to policies issued to customers in Texas, 21.8% to customers in Illinois and 16.4% to customers in California. Our revenues and profitability are therefore subject to prevailing regulatory, legal, economic, demographic, competitive and other conditions in these states. Changes in any of these conditions could make it less attractive for us to do business in these states and could have an adverse effect on our financial results.

Our underwriting operations are vulnerable to a reduction in the amount of business written by independent agencies.

For the year ended December 31, 2003, independent agencies were responsible for approximately 57.2% of the gross premiums written produced by our underwriting agencies. As a result, our business depends in part on the marketing efforts of independent agencies and on our ability to offer insurance products and services that meet the requirements of these independent agencies and their customers. Independent agencies are not obligated to sell or promote our products, and since many of our competitors rely significantly on the independent agency market, we must compete with other insurance companies and underwriting agencies for independent agencies’ business. Some of our competitors offer a larger variety of products, lower prices for insurance coverage or higher commissions, and we therefore may not be able to continue to attract and retain independent agencies to sell our insurance products. A material reduction in the amount of business our independent agencies sell would negatively impact our revenues.

If we are unable to establish and maintain relationships with unaffiliated insurance companies to sell their non-standard personal automobile policies through our underwriting agencies and retail stores, our profitability may suffer.

Our underwriting agencies and retail stores sell non-standard personal automobile insurance policies both for our insurance companies and for unaffiliated insurance companies. If we are unable to establish and maintain relationships with such unaffiliated insurance companies, we would have a more limited inventory of non-standard personal automobile insurance policies to sell. In such an event, if our insurance companies do not adjust pricing to maintain our policy sales volume, we might experience a net decline in our sales volume of non-standard personal automobile insurance policies, which would decrease our profitability.

Our largely fixed cost structure with respect to our retail stores would work to our disadvantage if our sales volume at our retail stores were to decline significantly.

Our expenses relating to our retail store operations are largely fixed, including the leasing costs for our retail space and employee compensation expenses for our sales personnel in the retail stores. If we are unable to maintain our sales volume of non-standard personal automobile policies at our retail stores, we may be forced to close some of our retail store locations or lay off store personnel to manage our fixed expenses. These actions in turn could harm our profitability and likely would detract from our future growth potential.

14

Our failure to maintain a commercially acceptable financial strength rating of our insurance companies could significantly and negatively affect our ability to implement our business strategies successfully.

Financial strength ratings are important in establishing the competitive position of insurance companies and could have an effect on an insurance company’s sales. A.M. Best, generally considered to be a leading authority on insurance company ratings and information, has currently assigned our insurance companies ratings of “B” (Fair). A.M. Best assigns 15 ratings to insurance companies, which range from “A++” (Superior) to “F” (In Liquidation). According to A.M. Best, “B” ratings are assigned to insurers that have a fair ability to meet their current obligations to policyholders, but are financially vulnerable to adverse changes in underwriting and economic conditions. A.M. Best’s ratings reflect its opinion of an insurance company’s financial strength, operating performance and ability to meet its obligations to policyholders and are not evaluations directed to potential or current investors in our common stock or recommendations to buy, sell or hold our common stock. The “B” ratings currently assigned to our insurance companies are the same ratings assigned to Vesta’s insurance companies. In March 2004, A.M. Best placed these ratings under review with negative implications. Our insurance companies’ ratings are subject to change at any time and may be revised downward or revoked at the sole discretion of A.M. Best. We believe that A.M. Best will, in connection with this offering, re-evaluate our insurance companies’ ratings on a stand-alone basis, and the ratings assigned as a result of this expected re-evaluation may be lower than our insurance companies’ current ratings.

Because lenders and reinsurers will use our A.M. Best ratings as a factor in deciding whether to transact business with us, the current ratings of our insurance companies or their failure to maintain the current ratings may dissuade a financial institution or reinsurance company from conducting any business with us or may increase our interest or reinsurance costs.

We face litigation which, if decided adversely to us, could adversely impact our financial results.

We are named as a defendant in a number of lawsuits, including a purported class action lawsuit. These lawsuits are described more fully in “Business — Legal Proceedings.” Litigation, by its very nature, is unpredictable and the outcome of these cases is uncertain. The precise nature of the relief that may be sought or granted in any lawsuits is uncertain and may, if these lawsuits are determined adversely to us, negatively impact our earnings.

In addition, potential litigation involving new claim, coverage and business practice issues could adversely affect our business by changing the way we price our products, extending coverage beyond our underwriting intent or increasing the size of claims. Recent examples of some emerging issues include a growing trend of plaintiffs targeting automobile insurers in purported class action litigation relating to claims handling practices such as total loss evaluation methodology and the alleged diminution in value to insureds’ vehicles involved in accidents and the relatively new trend of plaintiffs targeting insurers, including automobile insurers, in purported class action litigation which seeks to recharacterize installment fees and other allowed chargers related to insurers’ installment billing programs as interest that violates state usury laws or other interest rate restrictions. The effects of these and other unforeseen emerging claims, coverage and business practice issues could negatively impact our revenues or our methods of doing business.

Adverse securities market conditions can have a significant and negative impact on our investment portfolio.

Our results of operations depend in part on the performance of our invested assets. As of December 31, 2003, $6.6 million of our investment portfolio was invested in fixed income securities. Effective January 1, 2004, we received $19.3 million in fixed income securities from Vesta for settlement of reinsurance transactions and intercompany balances. Certain risks are inherent in connection with fixed maturity securities including loss upon default and price volatility in reaction to changes in interest rates and general market factors. In general, the fair value of a portfolio of fixed income securities increases or

15

decreases inversely with changes in the market interest rates, while net investment income realized from future investments in fixed income securities increases or decreases along with interest rates. In addition, some of our fixed income securities have call or prepayment options. This could subject us to reinvestment risk should interest rates fall and issuers call their securities. We attempt to mitigate this risk by investing in securities with varied maturity dates, so that only a portion of the portfolio will mature at any point in time. Furthermore, actual net investment income and/or cash flows from investments that carry prepayment risk, such as mortgage-backed and other asset-backed securities, may differ from those anticipated at the time of investment as a result of interest rate fluctuations. An investment has prepayment risk when there is a risk that the timing of cash flows that result from the repayment of principal might occur earlier than anticipated because of declining interest rates or later than anticipated because of rising interest rates. The fair value of our fixed income securities was $25.9 million, following the settlements with Vesta effective January 1, 2004. If market interest rates were to change 1.0% (for example, the difference between 5.0% and 6.0%), the fair value of our fixed income securities would change approximately $958,000. The change in fair value was determined using duration modeling assuming no prepayments.

We rely on our information technology and telecommunications systems, and the failure of these systems could disrupt our operations.

Our business is highly dependent upon the successful and uninterrupted functioning of our information technology and telecommunications systems. We rely on these systems to process new and renewal business, provide customer service, make claims payments and facilitate collections and cancellations, as well as to perform actuarial and other analytical functions necessary for pricing and product development. As a result, the failure of these systems could interrupt our operations and adversely affect our financial results.

Severe weather conditions and other catastrophes may result in an increase in the number and amount of claims filed against us.

Our business is exposed to the risk of severe weather conditions and other catastrophic events, such as rainstorms, snowstorms, hail and ice storms, hurricanes, tornadoes, earthquakes, fires and other events such as explosions, terrorist attacks and riots. The incidence and severity of catastrophes and severe weather conditions are inherently unpredictable. Such conditions generally result in higher incidence of automobile accidents and an increase in the number of claims filed, as well as the amount of compensation sought by claimants.

As a holding company, we are dependent on the results of operations of our operating subsidiaries to meet our obligations and pay future dividends.

We are organized as a holding company, a legal entity separate and distinct from our operating subsidiaries. As a holding company without significant operations of our own, we are dependent upon dividends and other payments from our operating subsidiaries, which include our agency subsidiaries and our insurance company subsidiaries. We cannot pay dividends to our stockholders and meet our other obligations unless we receive dividends and other payments from our operating subsidiaries, including our insurance company subsidiaries.

State insurance laws limit the ability of our insurance company subsidiaries to pay dividends and require our insurance company subsidiaries to maintain specified minimum levels of statutory capital and surplus. In addition, for competitive reasons, our insurance companies need to maintain financial strength ratings which require us to maintain certain levels of capital and surplus in those subsidiaries. The need to maintain these capital and surplus levels may affect the ability of our insurance company subsidiaries to pay dividends to us. Without regulatory approval, the aggregate maximum amount of dividends that can be paid in 2004 to us by our insurance company subsidiaries is approximately $3.7 million. The aggregate maximum amount of dividends permitted by law to be paid by an insurance company does not necessarily indicate an insurance company’s actual ability to pay dividends. The actual ability to pay dividends may be

16

further constrained by business and regulatory considerations, such as the impact of dividends on surplus, which could affect an insurance company’s ratings, competitive position, amount of premiums that can be written, and ability to pay future dividends. State insurance regulators have broad discretion to limit the payment of dividends by insurance companies and our rights to participate in any distribution of assets of our insurance company subsidiaries are subject to prior claims of policyholders and creditors, except to the extent that our rights, if any, as a creditor are recognized. As a result, a prolonged, significant decline in the profits of our insurance company subsidiaries or regulatory action limiting dividends could subject us to shortages of cash because our insurance company subsidiaries would not be able to pay us dividends.

We have no operating history as a stand-alone entity and may experience difficulty in transitioning to an independent public company.

We have no operating history as an independent company. Prior to this offering, we operated our business as a subsidiary of Vesta and we relied on Vesta for assistance with certain financial, administrative, managerial and other matters. Following the offering, we will have our own credit, banking and reinsurance relationships and will perform our own financial and investor relations functions. We may not be able to develop and implement the infrastructure necessary to operate successfully as an independent company, and even if successful, the development of such an infrastructure may require a substantial amount of time and resources and divert our management’s attention away from our business.

In addition, upon completion of this offering, we will become a publicly traded company and we will be independently responsible for complying with the various regulatory requirements applicable to public companies. We will incur increased costs as a result of being a public company, particularly in light of recently enacted and proposed changes in laws, regulations and listing requirements. Our business and financial condition may be adversely affected if we are unable to effectively manage these increased costs and public company regulatory requirements.

Risks Related to Our Common Stock and This Offering

Our historical consolidated and unaudited pro forma financial information is not necessarily representative of the results we would have achieved as a stand-alone company and may not be a reliable indicator of our future results.

The historical consolidated and unaudited pro forma financial information included in this prospectus does not necessarily reflect the financial condition, results of operations or cash flows we would have achieved as a stand-alone company during the periods presented or those we will achieve in the future. This is primarily a result of the following factors:

| | • | Our historical consolidated financial statements have been presented to reflect on a combined basis our historical results of operations, comprised of our underwriting and retail agency operations, and the historical results of operations of the two insurance companies we acquired from Vesta effective December 31, 2003. As a result of Vesta’s internal reinsurance program prior to this time, the historical financial statements of our insurance companies do not include the underwriting results of the insurance companies, but only certain revenues, primarily policy fees that were not ceded pursuant to this internal reinsurance arrangement. Consequently, our historical consolidated financial information is not necessarily representative of the results we would have achieved had we operated our insurance companies independently from Vesta prior to December 31, 2003, and may not be a reliable indicator of our future results. |

| | • | The unaudited pro forma financial information presented in this prospectus is intended to provide information about how Vesta’s transfer to us of the future economic interest in the NSA Business as a result of reinsurance transactions effective December 31, 2003 might have affected our historical financial statements if the results of this business had been combined for the year ended December 31, 2003. This pro forma information does not necessarily |

17

| | reflect the results of operations that actually would have resulted had we controlled the NSA Business in these prior periods, nor should they be taken as necessarily indicative of our future results of operations. |

Vesta has the ability to exert significant influence over our affairs and may have interests that differ from those of our other stockholders.

After the offering, Vesta will own approximately % of our common stock, % assuming the underwriters’ over-allotment option is exercised in full, and may have the ability to exert substantial influence over our policies and affairs. Vesta may continue to have the power to affect significantly the election of our board of directors and approve any action requiring stockholder approval, including amendments to our charter or bylaws and mergers or sales of substantially all of our assets. The interests of Vesta may differ from the interests of our other stockholders in some respects.

Future sales of shares of our common stock by existing stockholders in the public market, including Vesta, or the possibility or perception of such sales, could adversely affect the market price of our stock.

After giving effect to this offering, our existing stockholders will beneficially own approximately % of our outstanding shares of common stock, % assuming the underwriters’ over-allotment option is exercised in full. In addition, we have entered into an agreement with Vesta whereby we are obligated to register the shares of common stock that Vesta will own after this offering. Some of these shares have been pledged to Vesta’s credit facility lender and will remain subject to this pledge after this offering. Under the terms of the pledge, Vesta’s lender has the right to sell the pledged shares in the event that Vesta defaults under its credit facility agreement. Vesta and all of our executive officers and directors have entered into 180-day lock-up agreements as described in “Registration Rights and Lock-Up Agreements.” These lock-up agreements are subject to certain exceptions and the shares covered thereunder may be released for resale by approval of Piper Jaffray & Co. on behalf of the underwriters. Sales of substantial amounts of our common stock in the public market by Vesta, its lender or any of our other stockholders, or the possibility or perception that such sales could occur, could cause market prices for our common stock to fall. If such sales or the perception of such sales causes a decline in the market price for our common stock, it may be more difficult for us to raise additional capital in the equity markets.

There is no existing public market for our common stock and an active trading market may never develop.

The initial public offering price for our common stock will be determined through our negotiations with the underwriters and may not bear any relationship to the market price at which it will trade after this offering. Before this offering there was no public trading market for our common stock and one may never develop or be sustained after this offering. If a market does not develop or is not sustained, it may be difficult for you to sell your shares of common stock at an attractive price or at all. We cannot predict the prices at which our common stock will trade. It is possible that in some future quarter our operating results may be below the expectations of financial market analysts and investors and, as a result of these and other factors, the price of our common stock may decline.

The price of our common stock may be volatile.

The trading price of our common stock following the offering may fluctuate substantially. The price of our common stock after this offering may be higher or lower than the price you pay, depending on many factors, some of which are beyond our control and may not be related to our operating performance. These fluctuations could be significant and could cause you to lose part or all of your investment in our shares of common stock. Factors that could cause fluctuations include, but are not limited to, the following:

| | • | price and volume fluctuations in the overall stock market from time to time; |

| | • | variations in our actual or anticipated operating results or changes in the expectations of financial market analysts; |

18

| | • | investor perceptions of the non-standard personal automobile insurance industry in general and our company in particular; |

| | • | the operating and stock performance of comparable companies; |

| | • | the actual or perceived financial condition of Vesta; |

| | • | market conditions in the insurance industry in general and any significant volatility in the market price and trading volume of insurance companies; |

| | • | general economic and securities market conditions and trends; |

| | • | major catastrophic events; |

| | • | sales of large blocks of our stock or sales by insiders; or |

| | • | departures of key personnel. |

You will experience immediate and substantial dilution upon your purchase of our common stock in this offering.

Based on an assumed initial offering price of $ per share, the midpoint of the range set forth on the cover page of this prospectus, and after deducting the estimated underwriting discount and our pro rata share of the estimated offering expenses, our net tangible book value as of December 31, 2003, after giving effect to this offering, would be $ per share of common stock. Accordingly, purchasers of our common stock through this offering will suffer immediate dilution in net tangible book value per share of $ . In the event that we issue additional common stock in the future, including shares that may be issued upon the award of restricted stock or the exercise of options and other rights granted under our employee benefit plans, purchasers of our common stock in this offering may experience additional future dilution.

Certain provisions of our organizational documents, as well as applicable insurance laws and Delaware corporate law, could impede an attempt to replace or remove our management or prevent the sale of our company, which could diminish the value of our common stock.