UNITED STATES |

SECURITIES AND EXCHANGE COMMISSION |

Washington, D.C. 20549 |

|

SCHEDULE 14A INFORMATION |

|

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. ) |

|

Filed by the Registrant ý |

|

Filed by a Party other than the Registrant o |

|

Check the appropriate box: |

o | Preliminary Proxy Statement |

o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

o | Definitive Proxy Statement |

o | Definitive Additional Materials |

ý | Soliciting Material Pursuant to §240.14a-12 |

|

AAMES INVESTMENT CORPORATION |

(Name of Registrant as Specified In Its Charter) |

|

N/A |

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

|

Payment of Filing Fee (Check the appropriate box): |

ý | No fee required. |

o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| | |

| (2) | Aggregate number of securities to which transaction applies: |

| | |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | |

| (4) | Proposed maximum aggregate value of transaction: |

| | |

| (5) | Total fee paid: |

| | |

o | Fee paid previously with preliminary materials. |

o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| | |

| (2) | Form, Schedule or Registration Statement No.: |

| | |

| (3) | Filing Party: |

| | |

| (4) | Date Filed: |

| | |

| | | |

Searchable text section of graphics shown above

MERGER TRANSACTION

INVESTOR PRESENTATION

May 25, 2006

[LOGO]

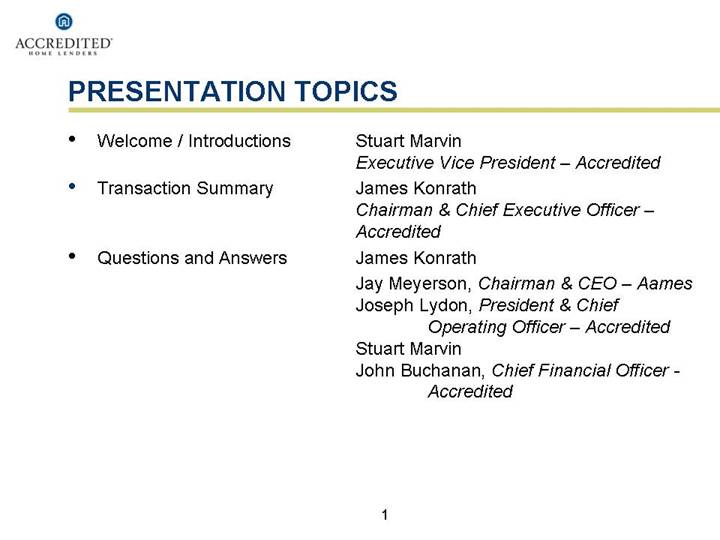

PRESENTATION TOPICS

• | | Welcome / Introductions | | Stuart Marvin

Executive Vice President – Accredited |

| | | | |

• | | Transaction Summary | | James Konrath

Chairman & Chief Executive Officer – Accredited |

| | | | |

• | | Questions and Answers | | James Konrath |

| | | | Jay Meyerson, Chairman & CEO – Aames

Joseph Lydon, President & Chief Operating Officer – Accredited |

| | | | Stuart Marvin |

| | | | John Buchanan, Chief Financial Officer - Accredited |

1

FORWARD-LOOKING STATEMENTS

Certain matters discussed in this presentation, including without limitation the expected benefits of the merger, constitute forward-looking statements within the meaning of the federal securities laws. Actual results and the timing of certain events could differ materially from those projected in or contemplated by these forward-looking statements due to a number of factors, including but not limited to: interest rate volatility and the level of interest rates generally; the nature and amount of competition and the availability of alternative loan products not offered by the company; general political and economic conditions; the sustainability of loan origination volumes; the availability of financing for the origination of mortgage loans; the ability of the company to sell or securitize mortgage loans; the company’s ability to grow its portfolio; the ability of the company to manage costs; and other risk factors as outlined in Accredited Home Lenders Holding Co.’s and Aames Investment Corporation’s annual reports on Form 10-K for the period ended December 31, 2005, their reports on Form 10-Q for the first quarter of 2006, and other documents filed with the SEC.

2

AGENDA – ACCREDITED/AAMES MERGER

• Overview

• Transaction Terms

• Rationale

• Expected Results

• Summary

• Questions and Answers

3

OVERVIEW

Accredited Home Lenders Holding Co. Will Acquire Aames Investment Corporation in a Merger Transaction

4

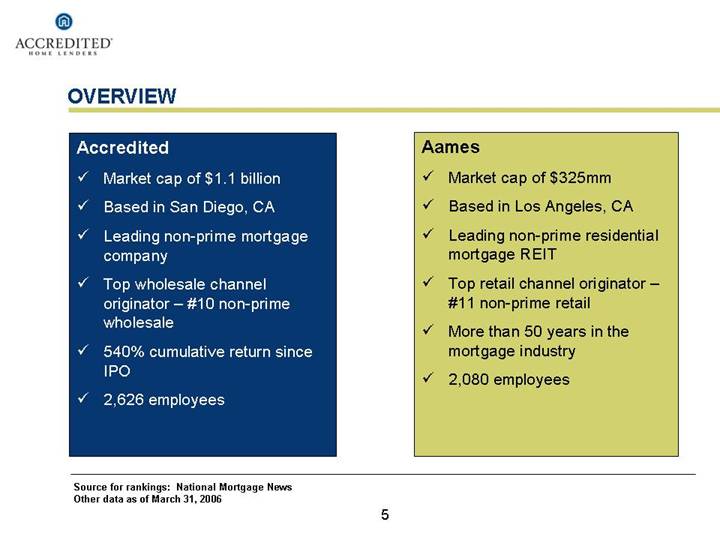

OVERVIEW | |

| |

Accredited | Aames |

| | |

• | Market cap of $1.1 billion | • | Market cap of $325mm |

| | | |

• | Based in San Diego, CA | • | Based in Los Angeles, CA |

| | | |

• | Leading non-prime mortgage company | • | Leading non-prime residential mortgage REIT |

| | | |

• | Top wholesale channel originator – #10 non-prime wholesale | • | Top retail channel originator – #11 non-prime retail |

| | | |

• | 540% cumulative return since IPO | • | More than 50 years in the mortgage industry |

| | | |

• | 2,626 employees | • | 2,080 employees |

Source for rankings: National Mortgage News

Other data as of March 31, 2006

5

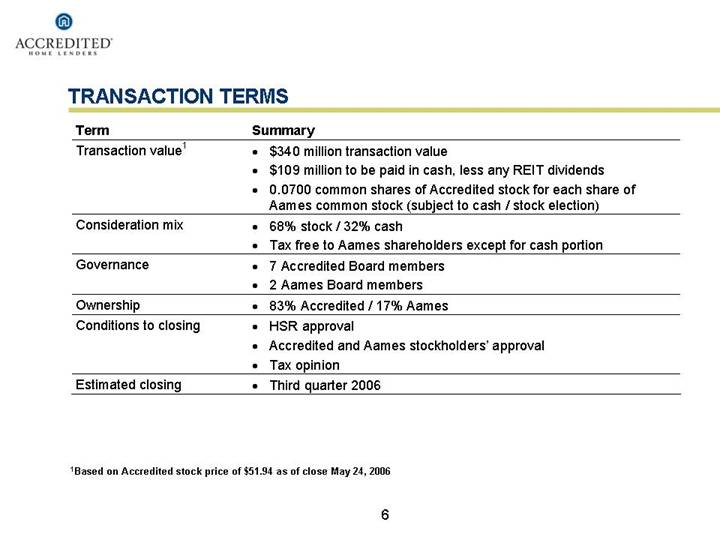

TRANSACTION TERMS

Term | | Summary |

Transaction value(1) | | • $340 million transaction value • $109 million to be paid in cash, less any REIT dividends • 0.0700 common shares of Accredited stock for each share of Aames common stock (subject to cash / stock election) |

Consideration mix | | • 68% stock / 32% cash • Tax free to Aames shareholders except for cash portion |

Governance | | • 7 Accredited Board members • 2 Aames Board members |

Ownership | | • 83% Accredited / 17% Aames |

Conditions to closing | | • HSR approval • Accredited and Aames stockholders’ approval • Tax opinion |

Estimated closing | | • Third quarter 2006 |

(1) Based on Accredited stock price of $51.94 as of close May 24, 2006

6

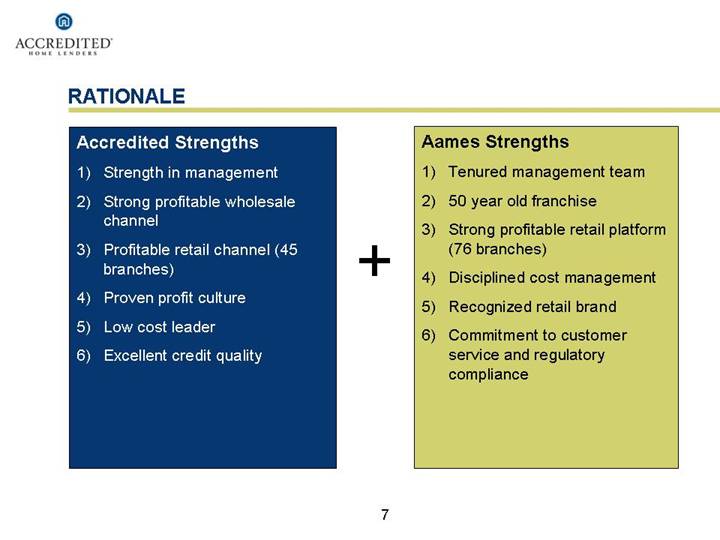

RATIONALE

Accredited Strengths | | Aames Strengths |

| | |

1) | Strength in management | + | 1) | Tenured management team |

| | | |

2) | Strong profitable wholesale channel | 2) | 50 year old franchise |

| | | |

3) | Profitable retail channel (45 branches) | 3) | Strong profitable retail platform (76 branches) |

| | | |

4) | Proven profit culture | 4) | Disciplined cost management |

| | | |

5) | Low cost leader | 5) | Recognized retail brand |

| | | |

6) | Excellent credit quality | 6) | Commitment to customer service and regulatory compliance |

7

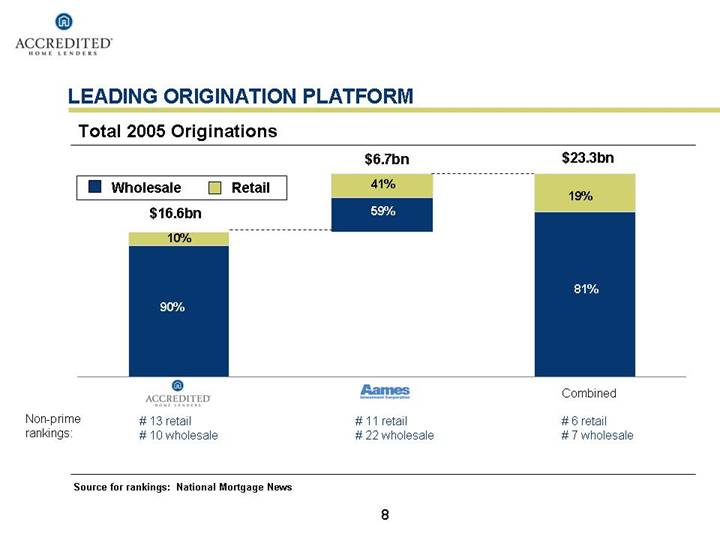

LEADING ORIGINATION PLATFORM

Total 2005 Originations

[CHART]

Non-prime rankings: | # 13 retail | # 11 retail | # 6 retail |

| # 10 wholesale | # 22 wholesale | # 7 wholesale |

Source for rankings: National Mortgage News

8

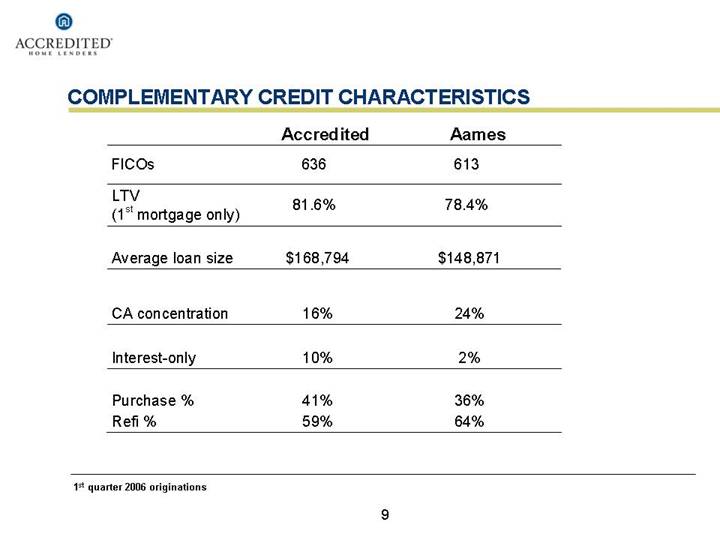

COMPLEMENTARY CREDIT CHARACTERISTICS

| | Accredited | | Aames | |

| | | | | |

FICOs | | 636 | | 613 | |

| | | | | |

LTV (1st mortgage only) | | 81.6 | % | 78.4 | % |

| | | | | |

Average loan size | | $ | 168,794 | | $ | 148,871 | |

| | | | | |

CA concentration | | 16 | % | 24 | % |

| | | | | |

Interest-only | | 10 | % | 2 | % |

| | | | | |

Purchase% | | 41 | % | 36 | % |

Refi% | | 59 | % | 64 | % |

| | | | | | | |

1st quarter 2006 originations

9

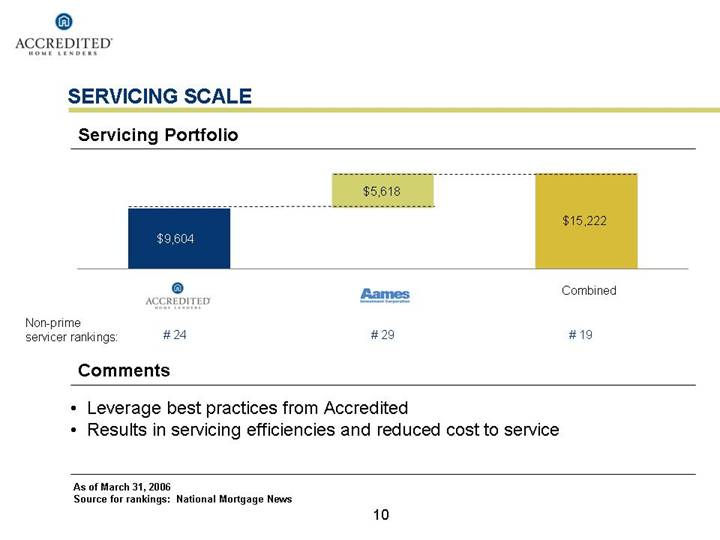

SERVICING SCALE

Servicing Portfolio

[CHART]

Non-prime servicer rankings: | # 24 | #29 | #19 |

Comments

• Leverage best practices from Accredited

• Results in servicing efficiencies and reduced cost to service

As of March 31, 2006

Source for rankings: National Mortgage News

10

SYNERGIES

• Costs

• Leverage scale in wholesale and retail platforms

• Eliminate redundant overhead

• Capital Markets

• Improved execution in whole loan sales

• Reduction in warehouse funding costs

• Single-seller asset-backed commercial paper conduit

• Tighter ABS spreads

• Management – Combine two strong management teams

• Taxes – Utilization of net operating loss carry-forward

11

MERGER HIGHLIGHTS

• Leverage remains consistent with Accredited’s historical levels

• Continued strong liquidity

• Cash portion of transaction financed with on-balance sheet cash

• Total financing capacity in excess of $7 billion, including $1 billion single-seller commercial paper conduit

• On-balance sheet loan portfolio of $14.3 billion

• Total retail branches = 116

• Total broker network in excess of 14,000

Note: Pro forma LHFI before mark-up

12

FINANCIAL IMPACT

• Accretive 5 – 10% to 2007 earnings

• Reduction in cost to originate

• Reduced cost of funds

• Better capital markets execution

• Reduction of administrative overhead

• First quarter post-closing dilutive impact on EPS of $1.00-$1.30 per share

• Approximately 4.4 million incremental shares issued at closing

• Revenue from LHFI and LHFS limited due to recording at fair value under purchase accounting

13

SUMMARY

• Strategic consolidation transaction in the sector

• Accretive in 2007

• Exceptional stockholder value creation

• Significant cost and operational synergies

• Improved scale in retail, wholesale, and servicing platforms

• Transaction value $340 million, approximately $109 million in cash

• Strong balance sheet

• Anticipated transaction close in third quarter 2006

14

ADDITIONAL INFORMATION

In connection with the pending transaction, Accredited Lenders Holding Co. (“Accredited”) will file with the SEC a Registration Statement on Form S-4 containing a Proxy Statement / Prospectus for the stockholders of Aames Investment Corporation (“Aames”). Aames stockholders are urged to read the Registration Statement and the Proxy Statement / Prospectus when they are available, as well as all other relevant documents filed or to be filed with the SEC, because they will contain important information about Accredited, Ames and the proposed transaction. The final Proxy Statement / Prospectus will be mailed to stockholders of Aames after the Registration Statement is declared effective by the SEC. Aames stockholders will be able to obtain the Registration Statement, the Proxy Statement / Prospectus and any other relevant filed documents for free at the SEC’s website (www.sec.gov). These documents can also be obtained for free from Accredited Home Lenders by directing a request to Investor Relations, 15090 Avenue of Science, San Diego, CA 92128.

Accredited, Aames and their respective directors and officers may be deemed to be participants in the solicitation of approvals from Aames stockholders in respect of the proposed transaction. Information regarding the participants of Accredited and Aames will be available in the Proxy Statement / Prospectus, which will be filed with the SEC. Additional information regarding the interests of such participants will be included in the Registration Statement containing the Proxy Statement / Prospectus that will be filed with the SEC.

16