UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

[X] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year endedMarch 31, 2008

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from _____ to _____

COMMISSION FILE NUMBER000-51773

GREENLITE VENTURES INC.

(Exact name of registrant as specified in its charter)

| NEVADA | 91-2170874 |

| State or other jurisdiction of incorporation or organization | (I.R.S. Employer Identification No.) |

| | |

| 810 Peace Portal Drive, Suite 201 | |

| Blaine, WA | 98230 |

| (Address of principal executive offices) | (Zip Code) |

| | |

| (360) 318-3028 | |

| Issuer's telephone number | |

| | |

| Securities registered pursuant to Section 12(b) of the Act: | NONE. |

| | |

| Securities registered pursuant to Section 12(g) of the Act: | Common Stock, $0.001 Par Value Per Share. |

Indicate by check mark if the registrant is a well-known seasoned issuer as defined by Rule 405 of the Securities Act.

Yes [ ] No [X]

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes [ ] No [X]

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the

Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required

to file such reports), and (2) has been subject to such filing requirements for the past 90 days.Yes [X] No [ ]

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (s229.405 of this chapter) is

not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information

statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a

smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting

company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer [ ] | Accelerated filer [ ] |

| Non-accelerated filer [ ] | Smaller reporting company [X] |

| (Do not check if a smaller reporting company) | |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act).Yes [X] No [ ]

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference

to the price at which the common equity was sold, or the average bid and asked price of such common equity, as of the last

business day of the registrant’s most recently completed second fiscal quarter:$777,333 based on a price of $0.20, being

the average bid and asked price for the registrant’s common stock as quoted on the OTC Bulletin Board onSeptember 28, 2007.

Indicate the number of shares outstanding of each of the registrant’s classes of common stock, as of the latest practicable

date.As of July 7, 2008, the registrant had 11,366,666 shares of common stock outstanding.

GREENLITE VENTURES INC.

ANNUAL REPORT ON FORM 10-K

FOR THE YEAR ENDED MARCH 31, 2008

TABLE OF CONTENTS

Page 2 of 31

PART I

The information in this discussion contains forward-looking statements. These forward-looking statements involve risks and uncertainties, including statements regarding the Company's capital needs, business strategy and expectations. Any statements contained herein that are not statements of historical facts may be deemed to be forward-looking statements. In some cases, you can identify forward-looking statements by terminology such as "may", "will", "should", "expect", "plan", "intend", "anticipate", "believe", "estimate", "predict", "potential" or "continue", the negative of such terms or other comparable terminology. Actual events or results may differ materially. In evaluating these statements, you should consider various factors, including the risks described below, and, from time to time, in other reports the Company files with the United States Securities and Exchange Commission (the “SEC”). These factors may cause the Company's actual results to differ materially from any forward-looking statement. The Company disclaims any obligation to publicly update these statements, or disclose any difference between its actual results and those reflected in these statements.

As used in this Annual Report, the terms “we,” “us,” “our,” “Greenlite,” and “the Company” mean Greenlite Ventures Inc., unless otherwise indicated. All dollar amounts in this Annual Report are expressed in U.S. dollars, unless otherwise indicated.

ITEM 1. BUSINESS.

OVERVIEW

We were incorporated on December 21, 2000 under the laws of the State of Nevada. We are an exploration stage company engaged in the acquisition and exploration of mineral properties. We hold a 100% interest mineral claim that we refer to as the “Magnolia” mineral claim. We have not earned any revenues to date. We do not anticipate earning revenues until such time as we enter into commercial production of our mineral properties. We are presently in the exploration stage of our business and we can provide no assurance that we will discover proven reserves on our properties, or if such deposits are discovered, that we will enter into further substantial exploration programs.

Our plan of operation is to carry out exploration work on our claim in order to ascertain whether it possesses proven reserves of gold, silver, copper and iron. We will not be able to determine whether or not our mineral claim contains proven reserves, until appropriate exploratory work is done and an economic evaluation based on that work concludes economic viability. If the results of our exploration program do not reveal viable commercial mineralization, we may decide to abandon our claim and acquire new claims for exploration. The acquisition of additional claims will be dependent upon our possessing sufficient capital resources at the time to purchase such claims. If no funding is available, we may be forced to abandon our operations. We have not entered into any discussions, understandings, arrangements or other agreements, preliminary or otherwise, for acquiring any additional mineral claims and/or funding arrangements for the purpose of acquiring additional mineral claims. We can provide no assurance to investors that our mineral claim contains a mineral deposit until appropriate exploratory work is done and an evaluation based on that work concludes that further work programs are justified.

RECENT CORPORATE DEVELOPMENTS

We have experienced the following significant corporate developments since our last quarter ended December 31, 2007:

| 1. | On January 24, 2008, we issued a total of 500,000 shares of common stock on conversion of our 10% convertible notes originally issued on November 30, 2006. The shares were issued solely to non-US persons in reliance of Regulation S of the Securities Act of 1933 (the “Securities Act”). |

| | |

| 2. | On February 4, 2008, John Curtis, our then Chief Executive Officer, President and sole director, and Howard Thomson entered into a share transfer agreement (the “Share Transfer Agreement”) pursuant to which Howard Thomson agreed to purchase 4,980,000 shares of our common stock from |

Page 3 of 31

| John Curtis for an aggregate purchase price of $4,980, being $0.001 per share (the “Share Transfer”). Closing of the Share Transfer occurred on February 16, 2008. |

| | |

| 3. | Effective February 16, 2008, upon the closing of the Share Transfer, John Curtis resigned and Howard Thomson replaced Mr. Curtis as our sole director and as our Chief Executive Officer and President. There were no disagreements between Mr. Curtis and the Company regarding any matter relating to the Company’s operations, policies or practices. |

| | |

| 4. | Also effective February 16, 2008. Mr. Thomson replaced Douglas King as our Chief Financial Officer, Secretary and Treasurer. There were no disagreements between Mr. King and the Company regarding any matter relating to the Company’s operations, policies or practices. |

| | |

| 5. | On February 16, 2008, we entered into a management consulting agreement with Howard Thomson. Pursuant to the terms of the agreement, Mr. Thomson is to be paid consulting fees of $750 per month, in consideration of which Mr. Thomson has agreed to act as our Chief Executive Officer, Chief Financial Officer, President, Secretary and Treasurer. Mr. Thomson may be granted, subject to the approval of the Company’s Board, incentive stock options to purchase shares of our common stock in such amounts and at such times as the Board, in its absolute discretion, may from time to time determine. The term of the agreement is for a period expiring at the close of business on February 16, 2010, unless otherwise terminated pursuant to the terms of the agreement or extended by the Board. |

COMPETITION

We are a mineral resource exploration company. We compete with other mineral resource exploration and development companies for financing and for the acquisition of new mineral properties. Many of the mineral resource exploration and development companies with whom we compete have greater financial and technical resources than we do. Accordingly, these competitors may be able to spend greater amounts on acquisitions of mineral properties of merit, on exploration of their mineral properties and on development of their mineral properties. In addition, they may be able to afford greater geological expertise in the targeting and exploration of mineral properties. This competition could result in competitors having mineral properties of greater quality and interest to prospective investors who may finance additional exploration and development. This competition could adversely impact our ability to finance further exploration and to achieve the financing necessary for us to develop our mineral properties.

The mineral exploration industry, in general, is intensively competitive and, even if commercial quantities of ore are discovered, a ready market may not exist for the sale of the ore. Numerous factors beyond our control may affect the marketability of any substances discovered. These factors include market fluctuations, the proximity and capacity of natural resource markets and processing equipment, government regulations, including regulations relating to prices, taxes, royalties, land tenure, land use, importing and exporting of minerals and environmental protection. The exact effect of these factors cannot be accurately predicted, but the combination of these factors may result in us not receiving an adequate return on invested capital.

COMPLIANCE WITH GOVERNMENT REGULATION

We are required to comply with all regulations, rules and directives of governmental authorities and agencies applicable to the exploration of minerals in the Province of British Columbia, Canada. The main agency that governs the exploration of minerals in the Province of British Columbia, Canada, is the Ministry of Energy, Mines and Petroleum Resources (the “Ministry of Mines’).

The Ministry of Mines manages the development of British Columbia's mineral resources, and implements policies and programs respecting their development while protecting the environment. In addition, the Ministry of Mines regulates and inspects the exploration and mineral production industries in British Columbia to protect workers, the public and the environment.

The material legislation applicable to us is the Mineral Tenure Act, administered by the Mineral Titles Branch of the Ministry of Mines, and the Mines Act as well as the Health, Safety and Reclamation Code and the

Page 4 of 31

Mineral Exploration Code. The Mineral Tenure Act and its regulations govern the procedures involved in locating, recording and maintaining mineral titles in British Columbia. The Mineral Tenure Act also governs the issuance of leases which are long term entitlements to minerals, designed as production tenures. The Mineral Tenure Act does not apply to minerals held by crown grant or by freehold tenure.

All mineral exploration activities carried out on a mineral claim or mining lease in British Columbia must be in compliance with the Mines Act. The Mines Act applies to all mines during exploration, development, construction, production, closure, reclamation and abandonment. It outlines the powers of the Chief Inspector of Mines, to inspect mines, the procedures for obtaining permits to commence work in, on or about a mine and other procedures to be observed at a mine. Additionally, the provisions of the Health, Safety and Reclamation Code for mines in British Columbia contain standards for employment, occupational health and safety, accident investigation, work place conditions, protective equipment, training programs, and site supervision. Also, the Mineral Exploration Code contains standards for exploration activities including construction and maintenance, site preparation, drilling, trenching and work in and about a water body.

Additional approvals and authorizations may be required from other government agencies, depending upon the nature and scope of the proposed exploration program. If the exploration activities require the falling of timber, then either a free use permit or a license to cut must be issued by the Ministry of Forests. Items such as waste approvals may be required from the Ministry of Environment, Lands and Parks if the proposed exploration activities are significantly large enough to warrant them. Waste approvals refer to the disposal of rock materials removed from the earth which must be reclaimed. An environmental impact statement may be required.

Our mineral claim will expire on July 31, 2008. The minimum exploration work that must be performed or the fee payable in lieu of exploration work for keeping our claim current is equal to approximately $8.17 ($8.40 CDN) annually per hectare. Our mineral claim consists of 450 hectares. As our mineral claim is effective until July 31, 2008, we must file confirmation of the completion of exploration work in the minimum amount of approximately $3,677 (CDN$3,780) or make a payment in lieu or exploration work in the minimum amount by July 31, 2008. If we fail to complete the minimum required amount of exploration work or fail to make a payment in lieu of this exploration work, then our mineral claim will lapse on July 31, 2008, and we will lose all interest that we have in our mineral claim. We intend to pay the required fee or perform the minimum exploration work required to meet this amount to extend our mineral claim for an additional year upon the expiry of our mineral claim on July 31, 2008, unless the results of our exploration program indicate that the claim is not commercially viable.

ENVIRONMENTAL REGULATIONS

We are required to sustain the cost of reclamation and environmental remediation for all exploration work undertaken. Both reclamation and environmental remediation refer to putting disturbed ground back as close to its original state as possible. Other potential pollution or damage must be cleaned up and renewed along standard guidelines outlined in the usual permits. Reclamation is the process of bringing the land back to its natural state after completion of exploration activities. Environmental remediation refers to the physical activity of taking steps to remediate, or remedy, any environmental damage caused. The amount of these costs is not known at this time as we do not know the extent of the exploration program that will be undertaken beyond completion of the recommended work program. Because there is presently no information on the size, tenor, or quality of any resource or reserve at this time, it is impossible to assess the impact of any capital expenditures on earnings, our competitive position or us in the event a potentially economic deposit is discovered.

Prior to undertaking mineral exploration activities, we must make application under the British Columbia Mines Act for a permit, if we anticipate disturbing land. A permit is issued within 45 days of a complete and satisfactory application. We do not anticipate any difficulties in obtaining a permit, if needed. The initial exploration activities on the Magnolia Claim (grid establishment, geological mapping, soil sampling, and geophysical surveys) do not involve ground disturbance and as a result do not require a work permit. Any follow-up trenching and/or drilling will require permits, applications for which will be submitted well in advance of the planned work.

Page 5 of 31

If we enter the production phase, the cost of complying with permit and regulatory environment laws will be greater because the impact on the project area is greater. Permits and regulations will control all aspects of the production program if the project continues to that stage. Examples of regulatory requirements include:

| - | Water discharge will have to meet drinking water standards; |

| | |

| - | Dust generation will have to be minimal or otherwise re-mediated; |

| | |

| - | Dumping of material on the surface will have to be re-contoured and re-vegetated with natural vegetation; |

| | |

| - | An assessment of all material to be left on the surface will need to be environmentally benign; |

| | |

| - | Ground water will have to be monitored for any potential contaminants; |

| | |

| - | The socio-economic impact of the project will have to be evaluated and, if deemed negative, will have to be re-mediated; and |

| | |

| - | There will have to be an impact report of the work on the local fauna and flora including a study of potentially endangered species. |

EMPLOYEES

We have no employees as of the date of this Annual Report other than our sole officer. We conduct our business largely through agreements with consultants and arms-length third parties.

RESEARCH AND DEVELOPMENT EXPENDITURES

We have not incurred any research or development expenditures since our inception.

PATENTS AND TRADEMARKS

We do not own any patents or trademarks.

Page 6 of 31

ITEM 1A. RISK FACTORS.

The following are some of the important factors that could affect our financial performance or could cause actual results to differ materially from estimates contained in our forward-looking statements. We may encounter risks in addition to those described below. Additional risks and uncertainties not currently known to us, or that we currently deem to be immaterial, may also impair or adversely affect our business, financial condition or results of operation.

If we do not obtain additional financing, our business will fail.

As of March 31, 2008, we had cash in the amount of $179. Our business plan calls for significant expenses in connection with the exploration of our mineral claim. We have completed Phases I and II of our exploration program and commenced Phase III of our exploration program. Our current operating funds are insufficient to complete the balance of Phase III of our exploration program. In order for us to complete the balance of Phase III of our exploration program, we will need to obtain additional financing. Obtaining additional financing would be subject to a number of factors, including the market prices for the mineral property and gold, silver, copper and iron. These factors may make the timing, amount, terms or conditions of additional financing unavailable to us.

We have yet to attain profitable operations and because we will need additional financing to fund our exploration activities, our accountants believe that there is substantial doubt about our ability to continue as a going concern.

We have incurred a net loss of $303,765 for the period from December 21, 2000 (inception) to March 31, 2008, and have no revenues to date. Our future is dependent upon our ability to obtain financing and upon future profitable operations from the development of our mineral claim. These factors raise substantial doubt that we will be able to continue as a going concern.

Our financial statements included with this Annual Report have been prepared assuming that we will continue as a going concern. Our auditors have made reference to the substantial doubt as to our ability to continue as a going concern in their audit report on our audited financial statements for the year ended March 31, 2008. If we are not able to achieve revenues, then we may not be able to continue as a going concern and our financial condition and business prospects will be adversely affected.

Because of the speculative nature of exploration of mining properties, there is substantial risk that no reserves will be found and our business will fail.

We are in the initial stages of exploration of our mineral claim, and thus have no way to evaluate the likelihood that we will be able to operate the business successfully. We were incorporated on December 21, 2000 and, to date, have been involved primarily in organizational activities and the acquisition of the Magnolia Claim. We have not earned any revenues as of the date of this report. Potential investors should be aware of the difficulties normally encountered by new mineral exploration companies and the high rate of failure of such enterprises. The search for valuable minerals as a business is extremely risky. We may not find reserves of gold, silver, copper, and iron in our mineral claim. Exploration for minerals is a speculative venture necessarily involving substantial risk. The expenditures to be made by us on our exploration program may not result in the discovery of commercial quantities of ore. The likelihood of success must be considered in light of the problems, expenses, difficulties, complications and delays encountered in connection with the exploration of the mineral property that we plan to undertake. Problems such as unusual or unexpected formations and other conditions are involved in mineral exploration and often result in unsuccessful exploration efforts. In such a case, we would be unable to complete our business plan.

Even if we discover proven reserves of precious metals on our mineral claim, we may not be able to successfully commence commercial production.

Our mineral claim does not contain any known bodies of ore. If our exploration programs are successful in discovering proven reserves on our mineral claim, we will require additional funds in order to place the Magnolia Claim into commercial production. The expenditures to be made by us in the exploration of our mineral claim in all probability will be lost as it is an extremely remote possibility that the mineral claim will contain proven reserves. The funds required for commercial mineral production can range from several

Page 7 of 31

million to hundreds of millions. We currently do not have sufficient funds to place our mineral claim into commercial production. Obtaining additional financing would be subject to a number of factors, including the market prices for gold, silver, copper and iron, and the costs of exploring for or mining these materials. These factors may make the timing, amount, terms or conditions of additional financing unavailable to us. Because we will need additional financing to fund our exploration activities, there is substantial doubt about our ability to continue as a going concern. At this time, there is a risk that we will not be able to obtain such financing as and when needed.

We have no known mineral reserves and if we cannot find any we will have to acquire additional mineral claims or cease our operations.

We have no mineral reserves. If we do not find a mineral reserve containing gold or if we cannot explore the mineral reserve, either because we do not have the money to do it or because it will not be economically feasible to do so, we will have to cease operations and investors will lose their investment. Mineral exploration, particularly for gold, is highly speculative. It involves many risks and is often non-productive. The chances of finding reserves on our mineral property are remote and funds expended on exploration will likely be lost. If the results of exploration do not reveal mineral reserves, we may decide to abandon our claim and acquire new claims for exploration. The acquisition of additional claims will be dependent upon our possessing sufficient capital resources at the time in order to purchase such claims. If no funding is available, we may be forced to abandon our operations. We have not entered into any discussions, understandings, arrangements or other agreements, preliminary or otherwise, for acquiring any additional mineral claims and/or funding arrangements for the purpose of acquiring additional mineral claims.

Because we anticipate that our operating expenses will increase prior to our earning revenues, we may never achieve profitability.

Prior to completion of our exploration stage, we anticipate that we will incur increased operating expenses without realizing any revenues. We therefore expect to incur significant losses into the foreseeable future. We recognize that if we are unable to generate revenues from the exploration of our mineral claim, we will not be able to earn profits or continue operations. There is no history upon which to base any assumption as to the likelihood that we will prove successful, and we can provide investors with no assurance that we will generate any revenues or ever achieve profitability. If we are unsuccessful in addressing these risks, our business will most likely fail.

Because of the inherent dangers involved in mineral exploration, there is a risk that we may incur liability or damages as we conduct our business.

The search for valuable minerals involves numerous hazards and risks normally incident to exploring for and developing mineral properties. As a result, we may become subject to liability for such hazards, including pollution, cave-ins, unusual or unexpected geological formations, environmental pollution, personal injuries, flooding, changes in technology or mining techniques, periodic interruptions, industrial accidents, and other hazards against which we cannot insure or against which we may elect not to insure. At the present time we have no coverage to insure against these hazards and have no plans to insure against these hazards. The payment of such liabilities may have a material adverse effect on our financial position.

Because our executive officers have only agreed to provide their services on a part-time basis, they may not be able or willing to devote a sufficient amount of time to our business operations, which may cause our business to fail.

Our sole executive officer, Howard Thomson, is employed on a full time basis by other companies. Mr. Thomson expects to expend approximately ten hours per week on our business. Competing demands on his time may lead to a divergence between his interests and the interests of other shareholders.

Page 8 of 31

As we undertake exploration of our mineral claim, we will be subject to compliance with government regulation that may increase the anticipated cost of our exploration program.

There are several governmental regulations that materially restrict mineral exploration. We will be subject to the laws of the Province of British Columbia as we carry out our exploration program. We may be required to obtain work permits, post bonds and perform remediation work for any physical disturbance to the land in order to comply with these laws. While our planned exploration program budgets for regulatory compliance, there is a risk that new regulations could increase our costs of doing business and prevent us from carrying out our exploration program.

If we receive positive results from our exploration program and we decide to pursue commercial production, we may be subject to an environmental review process that may delay or prohibit commercial production.

If the results of our geological exploration program indicate reserves on our mineral claim, and we decide to pursue commercial production of our mineral claim, we may be subject to an environmental review process under the Federal and Provincial Environmental Assessment Acts (“EAA”). Compliance with an environmental review process may be costly and may delay commercial production. Permits and regulations will control all aspects of any production program if the project continues to that stage because of the potential impact on the environment. Permits, issued by the British Columbia Ministry of Energy, Mines and Petroleum Resources under the provisions of the British Columbia EAA, are required for approval of reclamation programs. Permits, issued by the Ministry of Environment, Lands and Parks under the provisions of the Federal EAA, are required for any air emissions and water discharges from a minesite.

Both reclamation and environmental remediation refer to putting disturbed ground back as close to its original state as possible. Other potential pollution or damage must be cleaned up and renewed along standard guidelines outlined in the usual permits. Reclamation is the process of bringing the land back to its natural state after completion of exploration activities. Environmental remediation refers to the physical activity of taking steps to remediate, or remedy, any environmental damage caused. The amount of these costs is not known at this time as we do not know the extent of the exploration program that will be undertaken beyond completion of the recommended work program. Because there is presently no information on the size, tenor, or quality of any resource or reserve at this time, it is impossible to assess the impact of any capital expenditures on earnings, our competitive position or us in the event a potentially economic deposit is discovered.

Prior to undertaking mineral exploration activities, we must make an application under the British Columbia Mines Act for a permit, if we anticipate disturbing land. A permit is issued within 45 days of a complete and satisfactory application, and can cost $100 to $500, depending on the scope of the permit. We do not anticipate any difficulties in obtaining a permit, if needed. The initial exploration activities on the Magnolia Claim (grid establishment, geological mapping, soil sampling, and geophysical surveys) do not involve ground disturbance and as a result do not require a work permit. Any follow-up trenching and/or drilling will require permits, applications for which will be submitted well in advance of the planned work.

If we enter the production phase, the cost of complying with permit and regulatory environment laws will be greater because the impact on the project area is greater. Permits and regulations will control all aspects of the production program if the project continues to that stage. Examples of regulatory requirements include:

| (i) | Water discharge will have to meet drinking water standards; |

| (ii) | Dust generation will have to be minimal or otherwise re-mediated; |

| (iii) | Dumping of material on the surface will have to be re-contoured and re-vegetated with natural vegetation; |

| (iv) | An assessment of all material to be left on the surface will need to be environmentally benign; |

| (v) | Ground water will have to be monitored for any potential contaminants; |

| (vi) | The socio-economic impact of the project will have to be evaluated and if deemed negative, will have to be remediated; and |

| (vii) | There will have to be an impact report of the work on the local fauna and flora including a study of potentially endangered species. |

Page 9 of 31

An environmental review process would be required if we plan to construct a large producing mine facility. We would be required to apply under the British Columbia EAA for a determination as to whether an environmental review would be required. Furthermore, there is the possibility that we would not be able to proceed with commercial production upon completion of the environmental review process if government authorities did not approve our mine or if the costs of compliance with government regulation adversely affected the commercial viability of the proposed mine.

Title to our mineral claim is registered in the name of another person. Our failure to register legal title to the claim in our name may result in the loss of our interest in the claim.

Under British Columbia law, title to British Columbia mineral claims can only be held by individuals, British Columbia corporations or foreign corporations extra-provincially registered in British Columbia. Since we are a Nevada corporation and we are not extra-provincially registered in British Columbia, Canada, we are not legally allowed to hold claims in British Columbia. Therefore, title to the Magnolia Claim is not held in our name. Title to the claim is being held in trust by Lorrie Ann Archibald, a British Columbia resident from whom we purchased our mineral claim. In the event Ms. Archibald were to transfer legal title to our mineral claim to another party, we may not have a claim against the third party and may be forced to commence an action against Ms. Archibald. There is no assurance that we would succeed in recovering legal title to our mineral claim or recover damages from Ms. Archibald in such instance.

Because our sole executive officer does not have formal training specific to the technicalities of mineral exploration, there is a higher risk that our business will fail.

Howard Thomson, our sole executive officer and sole director, does not have any formal training as geologists or in the technical aspects of management of a mineral exploration company. Our management lacks technical training and experience with exploring for, starting, and operating a mine. With no direct training or experience in these areas, our management may not be fully aware of the specific requirements related to working within this industry. Our management’s decisions and choices may not take into account standard engineering or managerial approaches mineral exploration companies commonly use. Consequently, our operations, earnings, and ultimate financial success could suffer irreparable harm due to management’s lack of experience in this industry.

Because our sole executive officer and sole director, Howard Thomson, owns 43.8% of our outstanding common stock, investors may find that corporate decisions influenced by Mr. Thomson are inconsistent with the best interests of other stockholders.

Howard Thomson, our sole executive officer and sole director, controls 43.8% of the issued and outstanding shares of our common stock. Accordingly, in accordance with our Articles of Incorporation and Bylaws, Mr. Thomson is able to control who is elected to our board of directors and thus could act, or could have the power to act, as our management. The interests of Mr. Thomson may not be, at all times, the same as those of other shareholders. Since Mr. Thomson is not simply a passive investor but is also one of our active executives, his interests as an executive may, at times, be adverse to those of passive investors. Where those conflicts exist, our shareholders will be dependent upon Mr. Thomson exercising, in a manner fair to all of our shareholders, his fiduciary duties as an officer or as a member of our board of directors. Also, Mr. Thomson will have the ability to significantly influence the outcome of most corporate actions requiring shareholder approval, including the merger of our company with or into another company, the sale of all or substantially all of our assets and amendments to our Articles of Incorporation. This concentration of ownership with Mr. Thomson may also have the effect of delaying, deferring or preventing a change in control of Greenlite which may be disadvantageous to minority shareholders.

Because our stock is a penny stock, shareholders will be more limited in their ability to sell their stock.

The SEC has adopted rules that regulate broker-dealer practices in connection with transactions in penny stocks. Penny stocks are generally equity securities with a price of less than $5.00, other than securities registered on certain national securities exchanges or quoted on the Nasdaq system, provided that current price and volume information with respect to transactions in such securities is provided by the exchange or quotation system.

Page 10 of 31

Because our securities constitute “penny stocks” within the meaning of the rules, the rules apply to us and to our securities. The rules may further affect the ability of owners of shares to sell our securities in any market that might develop for them. As long as the trading price of our common stock is less than $5.00 per share, the common stock will be subject to rule 15g-9 under the Exchange Act. The penny stock rules require a broker-dealer, prior to a transaction in a penny stock, to deliver a standardized risk disclosure document prepared by the SEC, that:

| 1. | contains a description of the nature and level of risk in the market for penny stocks in both public offerings and secondary trading; |

| | |

| 2. | contains a description of the broker’s or dealer’s duties to the customer and of the rights and remedies available to the customer with respect to a violation to such duties or other requirements of securities laws; |

| | |

| 3. | contains a brief, clear, narrative description of a dealer market, including bid and ask prices for penny stocks and the significance of the spread between the bid and ask price; |

| | |

| 4. | contains a toll-free telephone number for inquiries on disciplinary actions; |

| | |

| 5. | defines significant terms in the disclosure document or in the conduct of trading in penny stocks; and |

| | |

| 6. | contains such other information and is in such form, including language, type, size and format, as the SEC shall require by rule or regulation. |

The broker-dealer also must provide, prior to effecting any transaction in a penny stock, the customer with: (a) bid and offer quotations for the penny stock; (b) the compensation of the broker-dealer and its salesperson in the transaction; (c) the number of shares to which such bid and ask prices apply, or other comparable information relating to the depth and liquidity of the market for such stock; and (d) a monthly account statements showing the market value of each penny stock held in the customer's account. In addition, the penny stock rules require that prior to a transaction in a penny stock not otherwise exempt from those rules; the broker-dealer must make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser's written acknowledgment of the receipt of a risk disclosure statement, a written agreement to transactions involving penny stocks, and a signed and dated copy of a written suitably statement. These disclosure requirements may have the effect of reducing the trading activity in the secondary market for our stock.

ITEM 2. PROPERTIES.

We own a 100% interest in the Magnolia Claim. We do not own any property other than the Magnolia Claim. We rent office space at Suite 201, 810 Peace Portal Drive, Blaine, WA 98230, consisting of approximately 80 square feet, at a cost of $200 per month. This rental is on a month-to-month basis without a formal contract.

THE MAGNOLIA MINERAL CLAIM

We acquired our 100% interest in the Magnolia Claim pursuant to an agreement (the “Mineral Claim Purchase Agreement”) dated April 30, 2002 with Lorrie Ann Archibald of North Vancouver, British Columbia, Canada for consideration of $4,000. Ms. Archibald has executed an undated Bill of Sale transferring title to the Magnolia Claim to us. We intend to file the Bill of Sale with the British Columbia mineral titles office upon our independent geologist’s recommendation to proceed with Phase IV of our planned geological exploration program.

Title to our mineral claim is not held in our name. Title to the claim is recorded in the name of Lorrie Ann Archibald in trust, a British Columbia resident from whom we purchased our mineral claim. In the event Ms. Archibald were to transfer legal title to our mineral claim to another party, we may not have a claim against the third party and may be forced to commence an action against Ms. Archibald. There is no assurance that we would succeed in recovering legal title to our mineral claim or recover damages from Ms. Archibald in such instance.

Page 11 of 31

Description and Location of the Magnolia Mineral Claim

The Magnolia Claim comprises one mineral claim with a total area of 450 hectares, located on Texada Island, British Columbia, Canada, 6.2 miles north of Gillies Bay. The Magnolia Claim property is accessible by gravel road. Texada Island is the largest island in the Strait of Georgia approximately 70 miles west northwest of Vancouver, British Columbia, Canada. The island is accessible by regular government ferry service or by charter service.

The Magnolia Claim is recorded with the Ministry of Energy, Mines and Petroleum Resources, British Columbia, Canada, under the following name, tag and tenure number:

| Name of Mineral Claim | Tag Number | Tenure Number | Expiry Date |

| MAGNOLIA 1 | 222774 | 392905 | July 31, 2008 |

Recorded title to the property is held in the name of Lorrie Ann Archibald. We hold a 100% beneficial interest in the property pursuant to the Mineral Claim Purchase Agreement with Ms. Archibald. The property boundary contains one reverted crown grant claim not owned by us. The Province of British Columbia owns the land covered by the mineral claim. To our knowledge, there are no aboriginal land claims that might affect our title to the mineral claim or the Province’s title of the property.

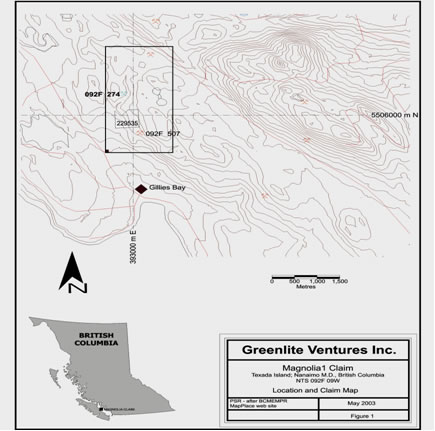

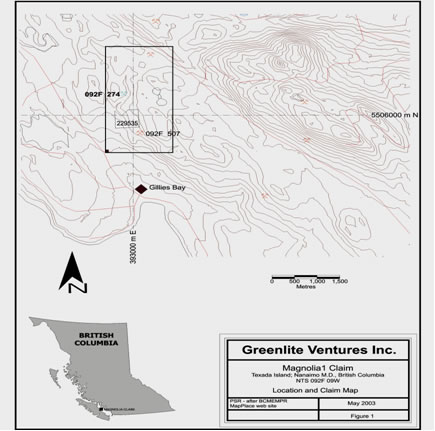

Location, Access and Physiography

The Magnolia Claim property is located on Texada Island, B.C., one kilometre north of the Town of Gillies Bay, see Figure 1 below. Texada Island is the largest island in the Strait of Georgia, and lies 110 km west-northwest of Vancouver, British Columbia. The island is accessible from Vancouver by car and ferry combinations either directly via Powell River on the mainland or through the Town of Comox on Vancouver Island. Alternatively, charter air service is available. Road access to and within the property consists of a gravel central road and the paved Gillies Bay - Vananda highway, which provide access to the northeastern and southwestern boundaries of the property, respectively.

Page 12 of 31

Figure 1 - Magnolia Claim

Exploration History of the Magnolia Claim

The Magnolia Claim is located on Texada Island, British Columbia, Canada, one kilometer north of the Town of Gillies Bay. Texada Island has a long history of mining and exploration for gold, copper and iron ore that began with the discovery of magnetite in 1873. Numerous pits, trenches, adits and at least one shaft on the Magnolia Claim property attest to previous, mostly unrecorded exploration of the property. A shaft was sunk, before 1914, to a depth of 27 meters (90 feet) and some drifting done. In 1975 a magnetometer and electromagnetic (VLF) survey was conducted in conjunction with geological mapping on and around the Cap Sheaf.

Reconnaissance-scale geologic mapping, prospecting, and soil/rock geochemical surveys were conducted in the area during 1984 and 1985 and an electromagnetic survey was run over the south end of the present claim in 1988. An airborne geophysical survey was conducted in August 1988. Aerodat Ltd. flew 175 line kilometers over an area partially covered by the prospecting and soil sampling were conducted over a portion of the existing claim. In April 1991, reconnaissance scale ground magnetic and electromagnetic surveys were carried out. In February 1992, further soil sampling and geophysical surveys together with limited geological mapping were conducted. In January 1994, a 1,500 meter long baseline was established for survey control for geological mapping in the Capsheaf area.

Property Geology and Mineralization

Texada Island is located along the Canadian Cordillera. The oldest rocks mapped on the island are on the southeastern tip of the island. Various stocks and minor intrusions, ranging in composition from gabbro through the more common diorite to quartz monzonite intrude the volcanics and limestone on the island. These have been radiometrically dated as Middle to Upper Jurassic, and may correlate with the Coast Plutonic Complex on the mainland or the island Intrusions on Vancouver Island.

Page 13 of 31

Recommendations of Geological Report and the Proposed Geological Exploration Program

We engaged Paul Reynolds, B.Sc., P.Geo., to prepare a geological evaluation report on the Magnolia Claim. Mr. Reynolds is a professional geoscientist registered in good standing with the Association of Professional Engineers and Geoscientists of British Columbia.

We received the geological evaluation report on the Magnolia Claim prepared by Mr. Reynolds on May 4, 2002. This report is entitled "Summary Report on the Magnolia Property". The geological report summarizes the results of the history of the exploration of the mineral claim, the regional and local geology of the mineral claim and the mineralization and the geological formations identified as a result of the prior exploration. The geological report also gives conclusions regarding potential mineralization of the mineral claim and recommends a further geological exploration program on the mineral claim.

In his geological report, Mr. Reynolds, recommended that a four phase exploration program, be undertaken on the property to assess its potential to host high grade gold mineralization within quartz and sulphide veins. The costs of the planned fourth phase, consisting of diamond drilling and/or mechanical trenching, are undetermined and are subject to positive results from earlier exploratory work. The four phase program consists of the following:

| Phase | Exploration Program | Status | Cost |

Phase I |

A thorough assessment of the known showings along with basic geological mapping and rock sampling. |

Completed in April, 2003. |

$4,003 |

Phase II |

Prospecting, geological outcrop mapping, and detailed soil sampling in areas of interest. |

Completed in August, 2005.

|

$6,100

|

Phase III |

Soil sampling and geological mapping to be conducted on a flagged grid within prospective areas identified by the two previous phases was completed in January, 2007.

An additional recommended exploration phase consisting of expanding a flagged survey grid and a magnetic survey over the grid is intended to be completed. |

Initial phase Completed in January, 2007

Additional exploration to be completed during the summer exploration season of 2008 |

$6,238

$5,000

|

| Phase IV | Subject to positive results from the previous phases, mechanical trenching and/or diamond drilling. | To be determined based on the Results of Phase III. | To be determined based on the Results of Phase III. |

The phased program of exploration activities is intended to generate and prioritize targets to test by trenching or drilling. The initial exploration activities on the Magnolia Claim (grid establishment, geological mapping, soil sampling, and geophysical surveys) do not involve ground disturbance and as a result do not require a work permit. Any follow-up trenching and/or drilling will require permits. Applications are expected to be submitted well in advance of the planned work.

Our cash on hand as of March 31, 2008 is $179.As at the date of this Annual Report, we have completed Phases I, II and the initial portion of Phase III of our exploration program at a cost of $16,341. We have insufficient cash on hand to pay the estimated costs of the remainder of Phase III approximately in the amount of $5,000. Accordingly, we will require additional financing in order to proceed with any additional

Page 14 of 31

work beyond Phase III of our exploration program. Although we have a wide ranging projected exploration program, we do not know how much money will ultimately be needed for exploration. Further work must then be carried out to determine the extent of the gold, silver, copper or iron mineralization, if any, in order to proceed with Phase IV and to determine whether it might be economically viable to mine over the long term. Therefore, costs of exploration are not limited to the initially described four-phase exploration program.

Current State of Exploration

Our mineral claim presently does not have any proven mineral reserves. Our planned exploration program is exploratory in nature and no mineral reserves may ever be found. Results of our exploration program are intended only to define potential exploration targets, and significant and costly exploration work will be needed if initial results warrant further effort.

Phase I Exploration Results – Completed April, 2003

Phase I of our exploration program, consisting of a thorough assessment of the known showings along with basic geological mapping and rock sampling, was conducted on April 18 and 19, 2003 at a cost of $4,003. Our geologist visited the Magnolia Claim property during this period, at which time the Capsheaf showing was relocated and several traverses were made in the suspected area of the Milner Trench on the property. Four rock samples were collected from the Capsheaf area of the property.

The results of our Phase I exploration indicated that there are two known gold and copper bearing skarn zones on the Magnolia property, Capsheaf and Southcap. These zones appear to be associated with intersecting northwest and northeast trending fault zones. Our geologist recommended that this area be further prospected and mapped in more detail. Based on the results of Phase I of our exploration program, our geologist recommended that we proceed with Phase II of our exploration program.

Phase II Exploration Results – Completed August, 2005

Phase II was completed in August, 2005 at a cost of $6,100. During the period from April, 2005 through August, 2005, a program of grid establishment and soil geochemical sampling was conducted on the Magnolia Claim property. A survey grid, comprised of 10 east-west oriented lines of 900 metres length, spaced at 100 metre intervals was established across a portion of the Magnolia Claim property. A total of nine kilometres of grid was surveyed and stations established at 25 metre intervals.

A total of 188 soil samples were collected at 50 metre intervals along the lines. Soils were collected at a depth of approximately 30 centimetres utilizing a grub hoe and shovel. Samples were marked with the grid location. If no soil was present at a proposed sample site, the site was moved east or west until a suitable sample could be collected. Soil samples were shipped to Acme Analytical Laboratories Ltd., in Vancouver, British Columbia, Canada, for analysis.

We received the final Phase II report from our geologist dated November 22, 2005. The results of the Phase II exploration revealed several coincident copper, iron and gold soil anomalies occurring within the area between the Capsheaf and Southcap showings located at the north and south ends of the soil grid respectively. Our geologist recommended that these anomalies be followed up by ground magnetics and detailed geological mapping as part of Phase III of our exploration program.

Phase III Exploration – Initial Phase Completed January, 2007

The initial portion of Phase III was completed in January, 2007. We received a report on Phase III of our exploration program dated March 19, 2007 from Paul Reynolds, our consulting geologist. Pursuant to the report, the Phase III exploration included a magnetic survey that was conducted over the grid established in 2005. The magnetic survey was conducted over the entire grid for a total of nine line kilometres. The results of the survey showed four north-south trending, strong magnetic highs. These appear to be broken by north trending and northwest trending faults. The report concluded that many of the gold in soil anomalies discovered during the 2005 soil geochemical survey are coincident with or on the periphery of magnetic highs.

Based on the results of the survey, Mr. Reynolds recommended that we conduct further exploration on the Magnolia property consisting of expanding the flagged survey grid to the property limits and conducting a

Page 15 of 31

property wide magnetic survey over this grid. In conjunction with the magnetic survey, Mr. Reynolds recommended geological mapping and prospecting be conducted over the flagged grid in particular, areas with coincident magnetic and geochemical anomalies and that further soil sampling should be extended 200 metres north and south of the existing grid. We intend to complete the remaining portion of Phase III during the summer exploration season of 2008.

ITEM 3. LEGAL PROCEEDINGS.

We are not a party to any legal proceedings and, to our knowledge, no such proceedings are pending, threatened or contemplated.

ITEM 4. SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS.

No matters were submitted to our security holders during the fourth quarter of our fiscal year ended March 31, 2008.

Page 16 of 31

PART II

ITEM 5. | MARKET FOR REGISTRANT’S COMMON EQUITY, RELATEDSTOCKHOLDERMATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES. |

Our shares of common stock commenced trading on the Over-The-Counter Bulletin Board (the “OTC Bulletin Board”) under the symbol “GLTV” on March 22, 2007. The following table indicates the high and low bid prices of the common shares obtained during the periods indicated:

| | 2008 | | 2007 |

| | | | | | |

| | High | Low | | High | Low |

| | | | | | |

| First Quarter ended June 30 | $ 0.00 | $ 0.00 | | $ N/A | $ N/A |

| Second Quarter ended September 30 | $ 0.00 | $ 0.00 | | $ N/A | $ N/A |

| Third Quarter ended December 31 | $ 0.00 | $ 0.00 | | $ N/A | $ N/A |

| Fourth Quarter ended March 31 | $ 0.00 | $ 0.00 | | $ 0.20 | $ 0.00 |

The high and low price quotes of our common stock as set out in the table above are as quoted on the OTC Bulletin Board. The market quotations provided reflect inter-dealer prices, without retail mark-up, mark-down or commission and may not represent actual transactions.

PENNY STOCK RULES

The SEC has adopted rules that regulate broker-dealer practices in connection with transactions in penny stocks. Penny stocks are generally equity securities with a price of less than $5.00, other than securities registered on certain national securities exchanges or quoted on the Nasdaq system, provided that current price and volume information with respect to transactions in such securities is provided by the exchange or system. The penny stock rules require a broker-dealer, prior to a transaction in a penny stock not otherwise exempt from those rules, to deliver a standardized risk disclosure document prepared by the SEC, which: (a) contains a description of the nature and level of risk in the market for penny stocks in both public offerings and secondary trading; (b) contains a description of the broker's or dealer's duties to the customer and of the rights and remedies available to the customer with respect to a violation of such duties or other requirements of securities laws; (c) contains a brief, clear, narrative description of a dealer market, including bid and ask prices for penny stocks and significance of the spread between the bid and ask price; (d) contains a toll-free telephone number for inquiries on disciplinary actions; (e) defines significant terms in the disclosure document or in the conduct of trading in penny stocks; and (f) contains such other information and in such form as the SEC shall require by rule or regulation. The broker-dealer also must, prior to effecting any transaction in a penny stock, provide the customer with: (a) bid and offer quotations for the penny stock; (b) the compensation of the broker-dealer and its salesperson in the transaction; (c) the number of shares to which such bid and ask prices apply, or other comparable information relating to the depth and liquidity of the market for such stock; and (d) monthly account statements showing the market value of each penny stock held in the customer's account. In addition, the penny stock rules require that, prior to a transaction in a penny stock that is not otherwise exempt from those rules, the broker-dealer must: (a) make a special written determination that the penny stock is a suitable investment for the purchaser and (b) receive from the purchaser his or her written acknowledgement of receipt of the determination and a written agreement to the transaction.

These disclosure requirements may have the effect of reducing the trading activity in the secondary market for our stock and therefore stockholders may have difficulty selling those securities.

REGISTERED HOLDERS OF OUR COMMON STOCK

As of July 7, 2008, we had 127 registered shareholders and 11,366,666 shares of our common stock issued and outstanding. We believe that a large number of stockholders hold stock on deposit with their brokers or investment bankers registered in the name of stock depositories.

Page 17 of 31

DIVIDENDS

We have neither declared nor paid any cash dividends on our capital stock since our inception and do not contemplate paying cash dividends in the foreseeable future. It is anticipated that earnings, if any, will be retained for the operation of our business. Our board of directors will determine future dividend declarations and payments, if any, in light of the then-current conditions they deem relevant and in accordance with the Nevada Revised Statutes.

There are no restrictions in our articles of incorporation or in our bylaws which prevent us from declaring dividends. The Nevada Revised Statutes, however, do prohibit us from declaring dividends where, after giving effect to the distribution of a dividend:

| | (a) | We would not be able to pay our debts as they become due in the usual course of business; or |

| | | |

| | (b) | Our total assets would be less than the sum of our total liabilities plus the amount that would be needed to satisfy the rights of shareholders who have preferential rights superior to those receiving distributions. |

RECENT SALES OF UNREGISTERED SECURITIES

None.

ITEM 7. MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATION.

PLAN OF OPERATION

Our business plan is to proceed with the exploration of the Magnolia Claim to determine whether there are proven reserves of gold, silver, copper, iron or other metals. As at the date of this Annual Report, we have completed Phases I, II and the initial portion of Phase III of our exploration program at a cost of $16,341.

We plan to complete the balance of Phase III at an estimated cost of $5,000 during the summer exploration season of 2008. Once the results from Phase III are received, we will assess whether to proceed to any further exploration phases. In making this determination, we will make an assessment as to whether the results from Phases I, II and III are sufficiently positive to enable us to obtain the financing necessary to proceed. This assessment will include an assessment of our cash reserves, the price of minerals and the market for financing of mineral exploration projects at the time of our assessment. Problems such as unusual or unexpected formations and other conditions are involved in mineral exploration and often result in unsuccessful exploration efforts. If the results of exploration do not reveal viable commercial mineralization, we may decide to abandon our claim and acquire new claims for exploration.

Cash Requirements

We anticipate that we will incur over the next twelve months the following expenses:

Category | Planned Expenditures over the

Next Twelve Months |

| Professional Fees | $15,000 |

| Management Fees | $9,000 |

| Office Expenses/Rent | $3,600 |

| Mineral Exploration Expenses | $5,000 |

| TOTAL | $32,600 |

Our total expenditures over the next twelve months are anticipated to be approximately $32,600. As at March 31, 2008, we had cash in the amount of $179. As such we will require additional financing to fund our

Page 18 of 31

operations over the next twelve months. In addition, there are no assurances that the actual costs of completing this exploration program will not exceed our estimates of those costs. If the actual costs of the exploration program are substantially greater than what we have estimated, or if we decide to proceed beyond Phase III of our proposed exploration program, of which there is no assurance, we will be required to seek additional financing.

RESULTS OF OPERATIONS

| Summary of Year End Results | | | | | | |

| | Year Ended March 31 | | Percentage | |

| | 2008 | | 2007 | | Increase / (Decrease) | |

| Revenue | $- | | $- | | n/a | |

| Expenses | (71,779) | | (52,274) | | 37.3% | |

| Net Income (Loss) | $(71,779) | | $(52,274) | | 37.3% | |

Revenues

We have not earned any revenue since inception. We do not anticipate earning revenues until such time as we enter into commercial production of our mineral property. We are presently in the exploration stage of our business and we can provide no assurance that we will discover proven reserves on our property, or if such deposits are discovered, that we will enter into further exploration programs.

Expenses

Our expenses for the year are outlined in the table below:

| | | | | | | |

| | | Year Ended March 31 | | | Percentage | |

| | | 2008 | | | 2007 | | | Increase / (Decrease) | |

| Accounting | $ | 17,380 | | $ | 23,200 | | | (25.1)% | |

| Bank Charges | | 228 | | | 10 | | | 2,180% | |

| Consulting | | 1,750 | | | -- | | | n/a | |

| Exploration and Development | | 2,485 | | | -- | | | n/a | |

| Interest | | 4,096 | | | 1,658 | | | 147.0% | |

| Legal | | 26,382 | | | 19,558 | | | 34.9% | |

| Office Administration | | 10,500 | | | 25 | | | 41,900% | |

| Regulatory Expenses | | 5,893 | | | 5,309 | | | 11.0% | |

| Rent | | 2,400 | | | 2,400 | | | n/a | |

| Telephone | | 347 | | | 114 | | | 204.4% | |

| Travel and Entertainment | | 318 | | | -- | | | n/a | |

| Total Expenses | $ | 71,779 | | $ | 52,274 | | | 37.3% | |

The majority of our expenses for the year ended March 31, 2008 consisted of accounting and legal expenses in connection with meeting our ongoing reporting obligations under the Securities Exchange Act of 1934. The additional legal expenses during the year ended March 31, 2008 relate primarily to fees incurred in connection with our change in control.

Office administration fees increased significantly as a primarily result of the fact that we paid management consulting fees to our sole executive officer and our former executive officer during the fiscal year 2008.

Page 19 of 31

We anticipate that our expenses will increase significantly as we continue to undertake our plan of operation and pursue our exploration program for the Magnolia Claim. Our expenses will continue to increase if our board of directors decides to proceed beyond Phase III of our exploration program. However, there are no assurances that such a determination will be made.

LIQUIDITY AND CAPITAL RESOURCES

| Cash Flows | | |

| | Year Ended March 31 |

| | 2008 | 2007 |

| Net Cash from (used in) Operating Activities | $(72,691) | $(36,995) |

| Net Cash from Investing Activities | -- | -- |

| Net Cash from Financing Activities | 49,000 | 50,000 |

| Net Increase in Cash During Period | $(23,691) | $13,005 |

| Working Capital | | | |

| | | | Percentage |

| | At March 31, 2008 | At March 31, 2007 | Increase / (Decrease) |

| Current Assets | $3,278 | $23,870 | (86.3)% |

| Current Liabilities | (34,543) | (23,356) | 47.9% |

| Working Capital Deficit | $(31,265) | $514 | (6,182.7)% |

Our cash on hand as of March 31, 2008 was $179. Accordingly, we do not have sufficient cash to meet the anticipated costs of completing the remainder of Phase III of our exploration program and to pay our anticipated operating expenses for the next twelve months. Additionally, if our board of directors decides to proceed through to Phase IV of our exploration program, of which there is no assurance, we will need additional financing in order to complete Phase IV. There is no assurance that we will be able to acquire such additional financing on terms that are acceptable to us, or at all.

Financing Requirements

Since our inception, we have used our common stock to raise money for our property acquisition, for corporate expenses and to repay outstanding indebtedness. We have not attained profitable operations and are dependent upon obtaining financing to pursue any extensive exploration activities. For these reasons, our auditors stated in their report to our audited financial statements for the year ended March 31, 2008 that they have substantial doubt about our ability to continue as a going concern.

On July 25, 2007, we approved a private placement offering of up to 350,000 units at a price of $0.15 US per Unit pursuant to Regulation S of the Securities Act. Each Unit consists of one share of our common stock and one share purchase warrant. Each warrant entitles the holder to purchase an additional share of our common stock at a price of $0.15 US per share for a period of one (1) year from the date the Units were issued. On November 7, 2007, we issued 266,666 Units at a price of $0.15 US per Unit to non-U.S. persons in reliance of Regulation S of the Securities Act. The balance of the offering has not been closed and there is no assurance that the remaining Units will be sold.

We anticipate continuing to rely on equity sales of our common shares in order to continue to fund our business operations. Issuances of additional shares will result in dilution to our existing shareholders. There is no assurance that we will achieve any of additional sales of our equity securities or arrange for debt or other financing for to fund our planned mining, development and exploration activities.

Page 20 of 31

OFF-BALANCE SHEET ARRANGEMENTS

We have no significant off-balance sheet arrangements that have or are reasonably likely to have a current or future effect on our financial condition, changes in financial condition, revenues or expenses, results of operations, liquidity, capital expenditures or capital resources that is material to stockholders.

CRITICAL ACCOUNTING POLICIES

The preparation of financial statements in conformity with United States generally accepted accounting principles requires our management to make estimates and assumptions that affect the reported amount of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates. Our management routinely makes judgments and estimates about the effects of matters that are inherently uncertain.

We have identified certain accounting policies, described below, that are most important to the portrayal of our current financial condition and results of operation.

Exploration Stage Company

We have been in the exploration stage since our formation and have not yet realized any revenues from our operations. We are primarily engaged in the acquisition and exploration of mining properties. Upon the location of commercially minable reserves, we plan to prepare for mineral extraction and enter the development stage. To date, the exploration stage of our operations has consisted of contracting with a geologist to sample and assessing the mining viability of our mineral claim.

Mineral Rights

Mineral rights and related exploration costs have been expensed as their recoverability is presumed to be insupportable during the exploration stage.

Pro Forma Compensation Expense

We account for costs of stock-based compensation in accordance with APB No. 25, "Accounting for Stock Based Compensation" instead of the fair value based method in SFAS No. 123. No stock options have been issued by us.

Use of Estimates

Management uses estimates and assumptions in preparing our financial statements in accordance with generally accepted accounting principles. Those estimates and assumptions affect the reported amounts of assets and liabilities, the disclosure of contingent assets and liabilities, and the reported revenues and expenses.

Page 21 of 31

ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA.

| 1. | Report of Independent Registered Public Accounting Firm; |

| | |

| 2. | Balance Sheets as at March 31, 2008 and March 31, 2007; |

| | |

| 3. | Statement of Operations and Accumulated Deficit for the years ended March 31, 2008, March 31, 2007, and for the period from inception on December 21, 2000 to March 31, 2008; |

| | |

| 4. | Statement of Changes in Stockholders’ Equity (Deficiency) for the period from inception on December 21, 2000 to March 31, 2008; |

| | |

| 5. | Statement of Cash Flows for the years ended March 31, 2008, March 31, 2007, and for the period from inception on December 21, 2000 to March 31, 2008; |

| | |

| 6. | Notes to Financial Statements. |

Page 22 of 31

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Board of Directors

Greenlite Ventures Inc.

Blaine, Washington

We have audited the accompanying balance sheet of Greenlite Ventures Inc., an exploration stage company, as of March 31, 2008 and March 31, 2007 and the related statements of operations and accumulated deficit, changes in stockholders’ equity/(deficit), and cash flows for the years then ended, and for the period December 21, 2000 (date of inception) to March 31, 2008. These financial statements are the responsibility of the management of Greenlite Ventures Inc. Our responsibility is to express an opinion on these financial statements based on our audits.

We conducted our audits in accordance with standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements referred to above present fairly, in all material respects, the financial position of Greenlite Ventures Inc. as of March 31, 2008 and March 31, 2007, and the results of its operations, changes in stockholders’ equity/(deficit) and cash flows for the years then ended, and for the period December 21, 2000 (date of inception) to March 31, 2008, in conformity with accounting principles generally accepted in the United States of America.

Our audit was made for the purpose of forming an opinion on the basic financial statements taken as a whole. The supplemental statement of operating expenses is presented for the purposes of additional analysis and is not a required part of the basic financial statements, and in our opinion, is fairly stated in all material respects in relation to the basic financial statements taken as a whole.

The accompanying financial statements have been prepared assuming that the Company will continue as a going concern. As discussed in Note 7 to the financial statements, the Company has suffered recurring losses from operations, which raise substantial doubt about its ability to continue as a going concern. The financial statements do not include any adjustments that might result from the outcome of this uncertainty.

Sarna & Company

Certified Public Accountants

Westlake Village, California

June 25, 2008

F-1

GREENLITE VENTURES INC.

(AN EXPLORATION STAGE COMPANY)

BALANCE SHEET

| ASSETS | | | | | | |

| | | | | | | |

| | | MARCH 31, | | | MARCH 31, | |

| | | 2008 | | | 2007 | |

| | | | | | | |

| | | | | | | |

| Current Assets: | | | | | | |

| Cash | $ | 179 | | $ | 23,870 | |

| Receivable – Trust Account | | 2,899 | | | -0- | |

| Prepaid Expenses | | 200 | | | -0- | |

| | | | | | | |

| Total Current Assets | | 3,278 | | | 23,870 | |

| | | | | | | |

| TOTAL ASSETS | $ | 3,278 | | $ | 23,870 | |

| | | | | | | |

| LIABILITIES AND STOCKHOLDERS' EQUITY/(DEFICIT) | |

| | | | | | | |

| Current Liabilities: | | | | | | |

| Accounts Payable and Accrued Expenses | $ | 19,789 | | $ | 21,698 | |

| Loans Payable Stockholders | | 9,000 | | | -0- | |

| Interest Payable | | 5,754 | | | 1,658 | |

| | | | | | | |

| Total Current Liabilities | | 34,543 | | | 23,356 | |

| | | | | | | |

| | | | | | | |

| Long Term Debt | | -0- | | | 50,000 | |

| | | | | | | |

| Stockholders' Equity/(Deficit): | | | | | | |

| Common Stock, $0.001 par value | | | | | | |

| 100,000,000 shares authorized, | | | | | | |

| 11,366,666 and 10,600,000 | | | | | | |

| shares issued | | 11,366 | | | 10,600 | |

| Additional Paid in Capital | | 261,134 | | | 171,900 | |

| Deficit Accumulated During | | | | | | |

| The Exploration Stage | | (303,765 | ) | | (231,986 | ) |

| | | | | | | |

| Total Stockholders' Equity/(Deficit) | | (31,265 | ) | | (49,486 | ) |

| | | | | | | |

| TOTAL LIABILITIES AND | | | | | | |

| STOCKHOLDERS' EQUITY/(DEFICIT) | $ | 3,278 | | $ | 23,870 | |

See Notes to Financial Statements

F-2

GREENLITE VENTURES INC.

(AN EXPLORATION STAGE COMPANY)

STATEMENT OF OPERATIONS AND ACCUMULATED DEFICIT

| | | | | | | | | DEC. 21, 2000 | |

| | | | | | | | | (Date of Inception) | |

| | | YEAR ENDED | | | YEAR ENDED | | | to | |

| | | MARCH 31, 2008 | | | MARCH 31, 2007 | | | MARCH 31, 2008 | |

| | | | | | | | | | |

| Revenues | $ | -0- | | $ | -0- | | $ | -0- | |

| | | | | | | | | | |

| Operating Expenses | | (71,779 | ) | | (52,274 | ) | | (303,765 | ) |

| | | | | | | | | | |

| Loss Before Provision for | | (71,779 | ) | | (52,274 | ) | | (303,765 | ) |

| Income Taxes | | | | | | | | | |

| | | | | | | | | | |

| Provision for Income Taxes | | -0- | | | -0- | | | -0- | |

| | | | | | | | | | |

| Net Loss | | (71,779 | ) | | (52,274 | ) | | (303,765 | ) |

| | | | | | | | | | |

| Accumulated Deficit, | | | | | | | | | |

| Beginning of Period | | (231,986 | ) | | (179,712 | ) | | -0- | |

| | | | | | | | | | |

| Accumulated Deficit, | | | | | | | | | |

| End of Period | $ | (303,765 | ) | $ | (231,986 | ) | $ | (303,765 | ) |

| | | | | | | | | | |

| Net Loss per Share | $ | (0.01 | ) | $ | (0.00 | ) | $ | (0.04 | ) |

| | | | | | | | | | |

| Weighted Average | | | | | | | | | |

| Shares Outstanding | | 10,762,500 | | | 10,600,000 | | | 8,424,999 | |

See Notes to Financial Statements

F-3

GREENLITE VENTURES INC.

(AN EXPLORATION STAGE COMPANY)

STATEMENT OF CHANGES IN STOCKHOLDERS' EQUITY/(DEFICIT)

| | Common Stock | | | Additional | | | Accumulated | | | Total | |

| | | | | Dollar | | | Paid in | | | Deficit | | | Stockholders' | |

| | Shares | | | Amount | | | Capital | | | | | | Equity/(Deficit) | |

| | | | | | | | | | | | | | | |

| Balances, December 21, 2000 | | | | | | | | | | | | | | |

| (Date of Inception) | ---- | | $ | ---- | | $ | ---- | | $ | ---- | | $ | ---- | |

| | | | | | | | | | | | | | | |

| Stock Subscriptions Received | | | | | | | | | | | | | | |

| $0.001 per share | | | | | | | | | | | | | | |

| February 14, 2001 | ---- | | | ---- | | | 2,500 | | | ---- | | | 2,500 | |

| | | | | | | | | | | | | | | |

| Net Loss, Period Ended | | | | | | | | | | | | | | |

| March 31, 2001 | ---- | | | ---- | | | ---- | | | (1,310 | ) | | (1,310 | ) |

| | | | | | | | | | | | | | | |

| Balances, March 31, 2001 | ---- | | $ | ---- | | $ | 2,500 | | $ | (1,310 | ) | $ | 1,190 | |

| | | | | | | | | | | | | | | |

| Stock Subscriptions Received | | | | | | | | | | | | | | |

| $0.001 per share | | | | | | | | | | | | | | |

| February 25, 2002 | ---- | | | ---- | | | 2,500 | | | ---- | | | 2,500 | |

| | | | | | | | | | | | | | | |

| Common Stock Issued | | | | | | | | | | | | | | |

| $0.001 per share | | | | | | | | | | | | | | |

| February 28, 2002 | 7,500,000 | | | 7,500 | | | (5,000 | ) | | ---- | | | 2,500 | |

| | | | | | | | | | | | | | | |

| Net Loss, Period Ended | | | | | | | | | | | | | | |

| March 31, 2002 | ---- | | | ---- | | | ---- | | | (8,244 | ) | | (8,244 | ) |

| | | | | | | | | | | | | | | |

| Balances, March 31, 2002 | 7,500,000 | | $ | 7,500 | | | ---- | | $ | (9,554 | ) | $ | (2,054 | ) |

| | | | | | | | | | | | | | | |

| Common Stock Issued | | | | | | | | | | | | | | |

| $0.05 per share | | | | | | | | | | | | | | |

| November 30, 2002 | 1,400,000 | | | 1,400 | | | 68,600 | | | ---- | | | 70,000 | |

| | | | | | | | | | | | | | | |

| Net Loss, Period Ended | | | | | | | | | | | | | | |

| March 31, 2003 | ---- | | | ---- | | | ---- | | | (29,203 | ) | | (29,203 | ) |

| | | | | | | | | | | | | | | |