100 F. Street, NE

Eternal Energy Corp. (“EERG”) is pleased to respond to the staff’s July 1, 2009, comment letter. Each comment has been transcribed, with EERG’s response immediately below.

If your management has not yet performed its assessment, we ask that you complete your evaluation and amend your filing within 30 calendar days to provide the required management’s report on internal control over financial reporting.

Please note that the failure to perform or complete management’s assessment adversely affects the company’s and its shareholders ability to avail themselves of rules and forms that are predicated on the current or timely filing of Exchange Act reports. For further information regarding these matters, please see Compliance and Disclosure Interpretation 115.02, which you can find on our website at the following address.

EERG evaluated its internal control over financial reporting as of December 31, 2008, in accordance with the requirements of Rule 13a-15(c) of Regulation 13A. The required management’s report on internal control over financial reporting is included in EERG’s amended Annual Report on Form 10-K for the Fiscal Year ended December 31, 2008.

Management did conclude that disclosure controls and procedures were effective as of December 31, 2008, and respectfully does not agree that its failure to include its report on internal control over financial reporting in EERG’s Annual Report on Form 10-K for the Fiscal Year then ended is evidence of ineffective disclosure controls and procedures. EERG’s disclosure in its amended Annual Report disclosure acknowledges the previous lack of inclusion and clarifies that its disclosure controls and procedures were effective at the time of filing such Annual Report, notwithstanding the omission of the required disclosure about internal controls over financial reporting.

The certifications of EERG’s principal executive officers at Exhibits 31.1 and 31.2, as filed with EERG’s amended Annual Report on Form 10-K for the Fiscal Year ended December 31, 2008, include the introductory language of paragraph 4, pertaining to their responsibility for establishing and maintaining internal control over financial reporting, and the language of paragraph 4(b), concerning the design of such control, to comply with Item 601(b)(31) of Regulation S-K.

EERG has both proven and unproven oil and gas properties. EERG’s one proven property, the West Ranch property in Texas, is the only oil and gas property subject to amortization. All of EERG’s other properties, which are unproven, are held for either future exploration or resale. Properties for which known reserves have not yet been determined are referred to as “prospects” within EERG’s financial statements and filing documents. As noted in its financial statements, EERG occasionally receives and accepts offers to sell individual prospects and all prospects are available for sale should a sufficiently attractive offer be received. Nonetheless, all prospects are included within the Company’s full cost pool. However, until exploratory wells are drilled, the acquisition costs associated with prospects are excluded from the Company’s amortization calculation. At this point in time, EERG has no defined plans to attempt exploratory drilling on any of its current prospects in the near future.

In each of the years ended December 31, 2008 and 2007, EERG sold one of its prospects, which up until the time of sale were unproven and thus included in the full cost pool but excluded from amortization. Once the prospect was sold, the capitalized costs were moved from the group excluded from amortization to the amortizable group. EERG did not record the sales of the unproven prospects as an adjustment to capitalized costs because the gain on the sale would have significantly altered the relationship between capitalized costs and proved reserves of oil and gas in the United States cost center. However, since in each instance the gain on the sale of the prospect (sales price less capitalized costs related to the prospect) exceeded more than 25% — 37% in 2007 and 41% in 2008 — of the amortizable cost base, EERG recorded the transaction on the statement of operations, showing revenue in the amount of the sales price and ‘cost of prospect sold’ in the amount of the related capitalized costs. In our attached amended financial statements, the revenue and cost of prospect sold have been netted and presented as ‘Gain on sale of unproven prospect’ in accordance with Reg S-X Rule 4-10(c)(6)(i).

Please also identify the documents in which you have filed the agreements governing your spud fee revenue arrangements in the exhibit listing on page 28.

If you have not filed these agreements, please submit them with your reply and file them as exhibits to comply with Item 601(b)(10)(ii)(B) of Regulation S-K.

In connection with its sale of its 5% equity interest in Pebble Petroleum in 2007, EERG received the contractual right to receive spud fees in connection with the initial drilling of eight exploratory wells on oil and gas leases owned by Pebble Petroleum. EERG recognized spud fee revenues for each of these wells when it received written notification from the owners of Pebble Petroleum that initial drilling activities had commenced. The amount of spud fees earned by EERG were stipulated in the Letter Agreement dated February 28, 2007, by and between Eternal Energy Corp., et al, which is incorporated by reference as Exhibit 10.19 in the Company’s 2007 10-K. At the time the spud fee revenue was recorded, collectability was not a concern due to the perceived financial strength of the paying company. As of the date of this letter, substantially all of the spud fees have been collected by EERG.

The financial statements included in EERG’s March 31, 2009, 10-Q contained the following disclosure:

“As of March 31, 2009, all eight of the initial wells have been drilled, for which the Company has earned $2,000,000 in spud fees. As a result of the litigation described in Note 6, as of March 31, 2009, the purchaser is holding $750,000 in spud fees owed to the Company in escrow until the legal matter is resolved. The Company does not believe that there is any merit to the claims asserted in the litigation and expects that the spud fees due to the Company will be collected. The timeframe for the settlement of this lawsuit is uncertain and, accordingly, the receivable has been classified as non-current.

“In May 2009, the Company collected $730,000 of spud fees receivable that were previously held in escrow (Note 5). A portion of the funds were used to settle amounts owed to Rover Resources in connection with the Company’s working interest in the Pebble Beach Prospect, totaling $444,835 (Note 5).”

EERG believes that this disclosure adequately discusses the collectability of the spud fees owed EERG as of the balance sheet date.

Please modify your disclosure to clarify how your determination of cost centers in consistent with Rule 4-10(c)(1) of Regulation S-X, which requires establishing cost centers on a county-by-country basis under the full cost methodology. Please understand that grouping costs of properties by country is a general requirement of the full cost rules and is not dependent on having occasional sales.

We expect companies using the full cost methodology to adhere to the guidance on interest capitalization in FIN 33, and to follow the guidance pertaining to the capitalization of costs associated with acquisition, exploration and development activities in Rule 4-10(c)(2) of Regulation S-X.

Please clarify your disclosure about your accounting for interest and internal costs under the full cost methodology as necessary and with sufficient details to understand your policy and advise us of the accounting and disclosure revisions that you believe would be necessary to comply with the guidance.

Please submit the disclosure that you propose to clarify your handling of these costs and advise us of any changes that you would need to make to your accounting to comply with this guidance. Please include details sufficient to understand the nature of costs included in your amortization base, and the manner by which you evaluate your capitalized costs for impairment.

EERG has modified its disclosure in Note 3 to clearly state that EERG’s cost centers which are established on a country-by-country basis and consist of the United States, Canada and the North Sea. EERG has further modified its disclosure in Note 3 to address the accounting treatment afforded to interest and internal costs under the full cost method. All interest and internal costs are capitalized, so long as those costs can be directly identified with acquisition, exploration, and development activities undertaken. Although EERG’s initial filing discussed the potential capitalization of interest costs, EERG has not incurred any interest costs to date. The modified disclosure more clearly states EERG’s oil and gas accounting policy and addresses the requirements of S-X Rule 4-10.

EERG has also modified the table included Note 6 to provide information on a cost center (country-by-country) basis.

Prior to January 1, 2006, EERG accounted for stock options, as permitted by SFAS 123, under the intrinsic value method described in APB 25. Under the intrinsic value method, no share-based employee compensation cost is recorded when the exercise price is equal to, or higher than, the market value of the underlying common stock on the date of grant. As of December 31, 2008 and for the two years then ended, there still remained stock options outstanding that were accounted for under APB 25.

The table showing the pro forma information was included to present the effect on the statement of operations had these stock options been accounted for using SFAS 123(R) rather than APB 25.

As discussed in the response to SEC comment 7, EERG has modified Note 6 to clarify oil and gas property costs (by cost center) that are excluded from amortization, the nature of such costs and the periods in which the costs were incurred. EERG has also modified the narrative portion of Note 6 which, on an unproven property-by-property basis, describes the current status of each property and the anticipated timing of the occurrence of activities which will cause the property’s costs to be included in the amortization computation. Currently, due to lack of adequate financing, none of EERG’s unproven properties are scheduled for exploration.

As of December, 31, 2008, EERG had only one producing property, located in Jackson County, Texas. The capitalized costs associated with the West Ranch property are disclosed in Note 6 (Oil and Gas Properties) to the December 31, 2008 financial statements (page F-15).

Note 6 to EERG’s 2008 financial statements includes a roll-forward schedule of exploration costs for the years ended December 31, 2008 and 2007. The Note has been amended to include exploration costs for the year ended December 31, 2007, as well as acquisition-related information for both 2007 and 2008.

Note 12 to EERG’s financial statements summarizes the standardized measure of discounted future net cash flows as of December 31, 2008. Note 12 has been amended to include information as of December 31, 2007, as well as to identify the change in the standardized measure of discounted future net cash flows from year to year. Given the limited production that occurred during 2008, the vast majority of the change in standardized measure of discounted future net cash flows from December 31, 2007 to December 31, 2008 was due to significant declines in oil and gas prices during 2008.

The certifications of EERG’s principal executive officers at Exhibits 31.1 and 31.2, as filed with EERG’s amended Annual Report on Form 10-Q for the Quarter ended March 31, 2009, include the introductory language of paragraph 4, pertaining to their responsibility for establishing and maintaining internal control over financial reporting, and the language of paragraph 4(b), concerning the design of such control, to comply with Item 601(b)(31) of Regulation S-K.

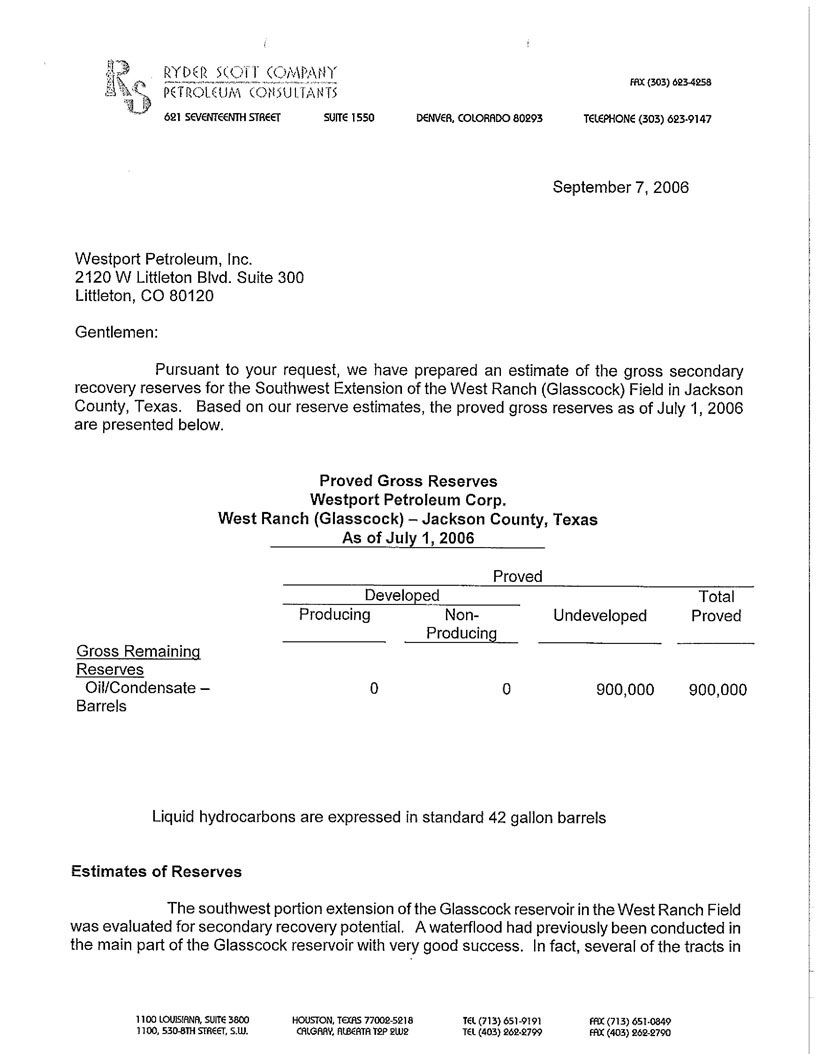

EERG has obtained a written consent from Ryder Scott Company, L.P., dated July 23, 2009, granting permission to refer to Ryder-Scott, and the referenced report prepared by Ryder Scott, in EERG’s amended 10-K for the year ended December 31, 2008. The report is attached as Exhibit 10.23 and the consent is attached as Exhibit 23.1 to the amended 10-K filing.

The Company has also expanded its disclosure regarding the Ryder Scott report to comply with SEC reporting standards.

Please explain to us (i) how this project has associated proved secondary reserves if it requires a pilot program; and (ii) why the reservoir water injectivity was not determined prior to your attribution of proved reserves.

EERG has attributed proved secondary reserves to the property for the following reasons:

Please furnish to us the technical information that provides conclusive support for the reasonable certainty of the recovery of these volumes. This information may include the items requested above. Please direct these engineering items to:

U.S. Securities and Exchange Commission

Attn: Ronald M. Winfrey

As disclosed in the financial statements accompanying the 2008 10-K and the March 31, 2009 10-Q, EERG does not currently have sufficient cash on hand to fund the entire cost of the waterflood project. However, EERG’s assets include receivables and deposits, the collection of which would be sufficient to fund a significant portion of the waterflood activities. Furthermore, EERG’s management believes that it has the ability to raise or borrow additional capital, as necessary, to proceed with the waterflood project if and when the economic conditions merit.

As discussed in Management’s Discussion and Analysis in both the 2008 10-K and the March 31, 2008 10-Q, EERG elected to temporarily shut in its West Ranch wells not only due to falling oil prices but also to divert operating capital to fund its defense of the Zavanna litigation. EERG’s management has always viewed the decision to shut in the wells as a temporary decision. At this time, EERG has no intention of permanently plugging or abandoning the wells and fully expects to re-open the wells at some point in the future.

As discussed with staff, attached to this response letter, as correspondence and not submitted as filed, are the marked-to-show changes versions of EERG’s 10-K/A and 10-Q/A initially responsive to staff’s comments.

/S/ Randolf W. Katz

Randolf W. Katz

ETERNAL ENERGY CORP.

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K/A

(Mark one)

| x | ANNUAL REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934. |

For the fiscal year ended December 31, 2008

OR

| o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934. |

For the transition period from to

Commission File No: 000-50906

ETERNAL ENERGY CORP.

(Exact Name of Registrant as Specified in its Charter)

| Nevada | | 20-0237026 |

| (State or Other Jurisdiction | | (I.R.S. Employer |

| of Incorporation or Organization) | | Identification No.) |

| 2549 W. Main Street, Suite 202 | 80120 | |

| Littleton, Colorado | (Zip Code) | |

| (Address and telephone number of Principal Executive Offices) | | |

(303) 798-5235

(Issuer’s Telephone Number, Including Area Code)

Securities registered under Section 12(b) of the Exchange Act: None

Securities registered under Section 12(g) of the Exchange Act: Common Stock, $0.001 par value

Indicate by check mark if the registrant is a well-known seasonal issuer, as defined in Rule 405 of the Securities Act.

Yes o No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes x No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K.

x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a small reporting company.

| | Large accelerated filer | o | | Accelerated Filer | o | |

| | | | | | | |

| | Non-accelerated filer | o | | Smaller reporting company | x | |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o No x

The aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of June 30, 2008, the last business day of the registrant’s most recently completed second fiscal quarter, was $9,801,000.

The number of shares outstanding of the registrant’s common stock as of April 8, 2009, was 44,550,000.

ETERNAL ENERGY CORP.

TABLE OF CONTENTS

| | | Page |

| | PART I | |

| | | |

| Item 1. | Business. | 4 |

| | | |

| Item 2. | Properties. | 10 |

| | | |

| Item 3. | Legal Proceedings. | 11 |

| | | |

| Item 4. | Submission of Matters to a Vote of Security Holders. | 11 |

| | | |

| | PART II | |

| | | |

| Item 5. | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchase of Equity Securities. | 11 |

| | | |

| Item 7. | Management’s Discussion and Analysis or Plan of Operation. | 12 |

| | | |

| Item 8. | Financial Statements and Supplementary Data. | 16 |

| | | |

| Item 9. | Changes In and Disagreements With Accountants on Accounting and Financial Disclosure. | 17 |

| | | |

| Item 9A(T). | Controls and Procedures. | 17 |

| | | |

| Item 9B | Other Information. | 18 |

| | | |

| | PART III | |

| | | |

| Item 10. | Directors, Executive Officers and Corporate Governance. | 18 |

| | | |

| Item 11. | Executive Compensation. | 20 |

| | | |

| Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters. | 21 |

| | | |

| Item 13. | Certain Relationships and Related Transactions, and Director Independence. | 22 |

| | | |

| Item 14. | Principal Accountant Fees and Services. | 23 |

| | | |

| | PART IV | |

| | | |

| Item 15. | Exhibits, Financial Statement Schedules. | 24 |

| | | |

| | SIGNATURES | 26 |

| | | |

| | FINANCIAL STATEMENTS AND NOTES | F-1 |

PART I

Item 1. Business.

Corporate History

Eternal Energy Corp. (“we,” “our,” “us” or the “Company”) was incorporated in Nevada on July 25, 2003, to engage in the acquisition, exploration, and development of natural resource properties. On November 7, 2005, we and a newly formed merger subsidiary wholly-owned by us completed a merger transaction with us as the surviving corporation (the “Merger”). In connection with the Merger, we changed our name to “Eternal Energy Corp.” from our original name, “Golden Hope Resources Corp.”

Business Overview

Since the Merger, we have been engaged in the exploration for petroleum and natural gas in the State of Nevada, the North Sea, and the Pebble Beach Project through the acquisition of contractual rights for oil and gas property leases and the participation in the drilling of exploratory wells.

On November 7, 2005, as part of the Merger transaction, we acquired contractual rights and interests in a joint venture with Eden Energy Corp. for the acquisition of oil and gas leases and drilling wells to explore for oil and natural gas reserves on the Big Sand Spring Valley Prospect located in Nye County, Nevada (the “BSSV Project”). As a result, we have rights to acquire a 50% working interest in approximately 82,184 gross acres, which rights expire in 2015 and which can be extended upon production from the leases. Effective April 17, 2006, we entered into a letter agreement with Eden Energy, with respect to our right to participate with Eden Energy in the exploration of oil and natural gas reserves located on approximately 77,000 gross and net acres of land in central eastern Nevada (the “Cherry Creek Project”). Effective November 30, 2006, we entered into an agreement with Eden Energy relative to the BSSV Project and Cherry Creek Project. The agreement provides for a release of our option in the Cherry Creek Project in exchange for an assignment of a 100% interest in the BSSV Project. The BSSV Project consists of approximately 102,000 Federal gross and net acres in Nevada. The leases are for a primary term of 10 years from and after July 1, 2005. The leases may be extended beyond the primary term by production or unitization of production there from. We are currently in discussions with another industry partner regarding a farm-out of our interest for the drilling of an initial test well on the prospect .

On November 29, 2005, we acquired rights to participate in the drilling of an exploratory well in a North Sea petroleum exploration project (the “Quad 14 Prospect ”) with International Frontier Resources Corporation (“IFR”), an oil and gas exploration company based in Calgary, Alberta, Canada. The Quad 14 Prospect contemplates the drilling, testing, completing, and equipping an initial exploratory test well on a 255 square kilometer block located in Quad 14 in the North Sea. The 255-kilometer acreage block is located 24 kilometers south of the 639 million barrel Claymore oil field, 20 kilometers south of the 132 million barrel Scapa oil field, and nine kilometers north of the 592 billion cubic foot Goldeneye natural gas field. The agreement with IFR was amended effective May 19, 2006, to provide for Oilexco Incorporated as the operator, to decrease the percentage of the drilling costs we will fund from 15% to 12.50%, and to change our working interest in the Quad 14 Project from 10% to 9.1875%. This well was commenced on or about March 27, 2007 and was plugged and abandoned on or about April 9, 2007 because no hydrocarbons were encountered in commercial quantities.

On January 30, 2006, we acquired our second petroleum exploration project in the North Sea. We entered into an agreement with IFR to participate in the drilling of an exploratory well in a 970 square kilometer acreage block located in Quad 41 and Quad 42 in the North Sea (the “Quad 41/42 Prospect ”). We have a 10% working interest in the Quad 41/42 Prospect . The initial well on the Quad 41/42 Prospect commenced on or about July 28, 2007, was drilled to a total depth of approximately 6,000 feet, and was plugged and abandoned on or about August 17, 2007 after the well encountered sub-economic gas reserves. We are a party to a dispute regarding the scope and existence of our obligation to participate in the drilling of the initial test well on this Prospect . In connection with that dispute, our USD$1,500,000 is currently held in the trust account of IFR’s lawyer’s. We continue to review the relevant agreements to determine appropriate courses of action to resolve this dispute.

In the fourth quarter of 2006, we entered into a series of agreements, a result of which was we acquired 15% of the capital stock of Pebble Petroleum, Inc. (“Pebble”), as well as the following rights and interests in the Pebble Beach Project:

| - | a USD$250,000 spud fee for each of the first eight wells drilled by Pebble on the Pebble Beach Project; |

| - | a five percent gross overriding royalty from each well drilled on certain acreage that Pebble holds rights to in western Canada (no capital outlay or other expenses to be required by us); and |

| - | a 10% interest in a joint venture with a subsidiary of Pebble; the joint venture will explore and develop certain prospects located in the northern United States (we pay 10% of all costs incurred) (collectively, “Interests”). |

In April 2007, we sold our stock in Pebble to Heartland Resources Inc., a petroleum and natural gas exploration company whose shares are listed on the TSX-Venture Exchange (“Heartland”), subject to the satisfaction of certain material terms and conditions, completion of the financing, completion of satisfactory due diligence and title reviews, approval of the TSX Venture Exchange, and other terms and conditions that are consistent with similar transactions in the oil and gas industry, in exchange for (i) our nominal initial aggregate subscription price of our shares in Pebble ($300), (ii) payment on a CDN$882,000 convertible note due to us by Pebble, (iii) retaining all of our Interests, and (iv) during the five-year period following the closing of the agreement with Heartland, for every 1,000 barrels of oil Pebble produces on average per day for 30 consecutive days, receiving 250,000 shares in Heartland, up to a maximum of 1.25 million shares. Brad Colby, our president and director, is also a director of Heartland and the president of Pebble. Mr. Colby declared his interest in Heartland and Pebble to our Board of Directors and abstained from voting on any matters relating to either company. In August of 2007, Mr. Colby resigned as president of Pebble and did not stand for re-election to Heartland’s Board of Directors.

In August 2007, Heartland changed its name to Ryland Oil Corporation (“Ryland”). Pebble has acquired approximately 355,009 gross and net acres in the Pebble Beach Project in western Canada in which the Company owns a five percent gross overriding royalty. In addition, Ryland’s US subsidiary has acquired approximately 61,412 gross and 35,145 net acres in the Pebble Beach Project in the northern United States, in which the Company owns a 10% working interest. Pebble has drilled eight wells on the project to date. Final results from the drilling operations are pending. In connection with the Interests, Pebble paid us USD$1,250,000 in respect of the first five wells drilled and placed USD$750,000 in the trust account of its lawyers in respect of the drilling of the next three wells. We anticipate that these funds will remain in trust until our litigation with Zavanna LLC has been resolved.

Starting in May 2007, we entered into a series of agreements to acquire a 75% working interest in the SW extension of the West Ranch field in Jackson County, Texas. This property currently has the capability to produce approximately 20 barrels of oil per day principally from the Ward formation at a depth of 5,750 feet. Ryder Scott Company has reviewed the property and ascribed 900,000 barrels of gross (8/8th) proved undeveloped reserves to the Glasscock formation at an approximate depth of 5,600 feet. These reserves were assigned strictly on a technical basis and were not subject to an economic analysis. Therefore, the calculation of these reserves is not compliant with SEC guidelines. The report indicates that the technical analysis was based on the technical guidelines of the SPE / WPC reserve definitions.

In December 2007, initial work to implement the first phase of a field wide waterflood of the Glasscock formation was commenced. The initial phase consists of the use of four injector wells. This first phase of work was expected to be completed by the end of January 2008; however, field work performed to date has required further study for proper well-bore stimulation of the water injection wells. Specifically, it was determined that two of the four injector wells had previously been used to dispose of waste water and other drilling material resulting in wellbore damage. We believe that the damage to the two wellbores is correctible and does not have any impact on the ultimate recoverability of the associated reserves as a result of future waterflooding. Current plans call for completion of the pilot program well work by the end of 2009, at which time water injection should begin. Revenues generated from anticipated production as a result of the completion of the first phase of the waterflood are expected to be used to fund a portion, if not all, of the remaining waterflood activities.

In the fourth quarter of 2007, we entered into a series of agreements with a related party to acquire the right to pursue a down-hole gas/water separation (“DGWS”) opportunity, primarily in western Canada. We have formed a wholly owned subsidiary in Canada, EERG Energy, ULC, in which to pursue this opportunity. During 2008, we failed to drill the required number of wells stipulated by the DGWS agreements and, as a result, lost our exclusive right to utilize the DGWS technology. In December 2008, the option to extend the technology licenses was mutually terminated by our Company and the related party.

In December 2007, we purchased a 640-acre mineral lease from the State of Utah, the first lease on a new prospect in the Paradox Basin in Utah (the “Steamroller Project”). During the next six months, we acquired an additional 10,782 gross and 9,860 net acres on the Steamroller Project. Ryland’s US subsidiary was our partner on the Steamroller Project with each company owning 50% of the project. In June 2008, we sold our 50% interest in the Steamroller Project to Roadrunner Oil & Gas, Inc. Gross proceeds from the sale totaled $1,190,135. The Company recognized a $936,678 on the transaction.

We will require additional funds to implement the work programs set forth above. These funds may be raised through equity financing, debt financing, or other sources, which may result in further dilution in the equity ownership of our shares. There is no assurance that we will be able to obtain financing on favorable terms, or if at all. In addition, there is no assurance that we will be able to maintain our operations at a level sufficient for an investor to obtain a return on his investment in our common stock. Also, we may continue to be unprofitable. Furthermore, the continuing litigation with Zavanna LLC may adversely affect our ability to obtain additional capital and to effectuate our business plan.

Competitors

The oil and gas industry is intensely competitive. We compete with numerous individuals and companies, including many major oil and gas companies, which have substantially greater technical, financial and operational resources and staffs. Accordingly, there is a high degree of competition for desirable oil and gas leases, suitable properties for drilling operations and necessary drilling equipment, as well as for access to funds. There are other competitors that have operations in the Nevada area and the presence of these competitors could adversely affect our ability to acquire additional leases.

Government Regulations

Our oil and gas operations are subject to various United States federal, state and local governmental regulations. Matters subject to regulation include discharge permits for drilling operations, drilling and abandonment bonds, reports concerning operations, the spacing of wells, and pooling of properties and taxation. From time to time, regulatory agencies have imposed price controls and limitations on production by restricting the rate of flow of oil and gas wells below actual production capacity in order to conserve supplies of oil and gas. The production, handling, storage, transportation and disposal of oil and gas, by-products thereof, and other substances and materials produced or used in connection with oil and gas operations are also subject to regulation under federal, state, provincial and local laws and regulations relating primarily to the protection of human health and the environment. To date, expenditures related to complying with these laws, and for remediation of existing environmental contamination, have not been significant in relation to the results of operations of our company. The requirements imposed by such laws and regulations are frequently changed and subject to interpretation, and we are unable to predict the ultimate cost of compliance with these requirements or their effect on our operations.

Research and Development

Our business plan is focused on a strategy of maximizing the long-term exploration and development of our oil and gas leases in the Pebble Beach Project; and the SW Extension of the West Ranch field in Jackson County, Texas. To date, execution of our business plan has largely focused on acquiring prospective oil and gas leases and/or operating existing wells located in the SW Extension of the West Ranch field. Accordingly, we have expended zero funds on research and development in each of our last two fiscal years. It is our intention to develop a future exploration and development plan.

Employees

As of April 8, 2009, our only employees were Bradley M. Colby, our President, Chief Executive Officer and Treasurer, Kirk A. Stingley, our Chief Financial Officer, and Craig Phelps, our Vice President of Engineering, each of whom are full-time employees. We do not expect any material changes in the number of employees over the next 12-month period. We do and will continue to outsource contract employment as needed. However, if we are successful in our initial and any subsequent drilling programs we may retain additional employees.

RISK FACTORS

Ownership of our common stock involves a high degree of risk; you should consider carefully the factors set forth below, as well as other information contained in this Annual Report.

There is no assurance that we will operate profitably or will generate positive cash flow in the future.

If we cannot generate positive cash flows in the future, or raise sufficient financing to continue our normal operations, then we may be forced to scale down or even close our operations. In particular, additional capital may be required in the event that:

| | § | drilling and completion costs for further wells increase beyond our expectations; or |

| | § | we encounter greater costs associated with general and administrative expenses or offering costs. |

The occurrence of any of the aforementioned events could adversely affect our ability to meet our business plans.

We will depend almost exclusively on outside capital to pay for the continued exploration and development of our properties. Such outside capital may include the sale of additional stock and/or commercial borrowing. Capital may not continue to be available if necessary to meet these continuing exploration and development costs or, if capital is available, it may not be on terms acceptable to us. The issuance of additional equity securities by us would result in a significant dilution in the equity interests of our current stockholders. Obtaining commercial loans, assuming those loans would be available, will increase our liabilities and future cash commitments.

If we are unable to obtain financing in the amounts and on terms deemed acceptable to us, we may be unable to continue our business and as a result may be required to scale back or cease operations for our business, the result of which would be that our stockholders would lose some or all of their investment.

A decline in the price of our common stock could affect our ability to raise further working capital and adversely impact our operations.

A prolonged decline in the price of our common stock could result in a reduction in the liquidity of our common stock and a reduction in our ability to raise capital. Because our operations have been primarily financed through the sale of equity securities, a decline in the price of our common stock could be especially detrimental to our liquidity and our continued operations. Any reduction in our ability to raise equity capital in the future would force us to reallocate funds from other planned uses and would have a significant negative effect on our business plans and operations, including our ability to develop new projects and continue our current operations. If our stock price declines, we may not be able to raise additional capital or generate funds from operations sufficient to meet our obligations.

If we are not successful in continuing to grow our business, then we may have to scale back or even cease our ongoing business operations.

Our success is significantly dependent on a successful acquisition, drilling, completion and production program. We may be unable to locate recoverable reserves or operate on a profitable basis. If our business plan is not successful, and we are not able to operate profitably, investors may lose some or all of their investment in us.

Trading of our stock may be restricted by the SEC's "Penny Stock" regulations which may limit a stockholder's ability to buy and sell our stock.

The U.S. Securities and Exchange Commission has adopted regulations that generally define "penny stock" to be any equity security that has a market price (as defined) less than $5.00 per share or an exercise price of less than $5.00 per share, subject to certain exceptions. Our securities are covered by the penny stock rules, which impose additional sales practice requirements on broker-dealers who sell to persons other than established customers or "accredited investors." The term "accredited investor" refers generally to institutions with assets in excess of $5,000,000 or individuals with a net worth in excess of $1,000,000 or annual income exceeding $200,000 or $300,000 jointly with their spouse. The penny stock rules require a broker-dealer, prior to a transaction in a penny stock not otherwise exempt from the rules, to deliver a standardized risk disclosure document in a form prepared by the SEC which provides information about penny stocks and the nature and level of risks in the penny stock market. The broker-dealer also must provide the customer with current bid and offer quotations for the penny stock, the compensation of the broker-dealer and its salesperson in the transaction and monthly account statements showing the market value of each penny stock held in the customer's account. The bid and offer quotations, and the broker-dealer and salesperson compensation information, must be given to the customer orally or in writing prior to effecting the transaction and must be given to the customer in writing before or with the customer's confirmation. In addition, the penny stock rules require that prior to a transaction in a penny stock not otherwise exempt from these rules, the broker-dealer must make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser's written agreement to the transaction. These disclosure requirements may have the effect of reducing the level of trading activity in the secondary market for the stock that is subject to these penny stock rules. Consequently, these penny stock rules may affect the ability of broker-dealers to trade our securities. We believe that the penny stock rules discourage investor interest in and limit the marketability of, our common stock.

NASD sales practice requirements may also limit a stockholder’s ability to buy and sell our stock.

In addition to the “penny stock” rules described above, the NASD has adopted rules that require that in recommending an investment to a customer, a broker-dealer must have reasonable grounds for believing that the investment is suitable for that customer. Prior to recommending speculative low priced securities to their non-institutional customers, broker-dealers must make reasonable efforts to obtain information about the customer’s financial status, tax status, investment objectives and other information. Under interpretations of these rules, the NASD believes that there is a high probability that speculative low priced securities will not be suitable for at least some customers. The NASD requirements make it more difficult for broker-dealers to recommend that their customers buy our common stock, which may limit your ability to buy and sell our stock and have an adverse effect on the market for our shares.

Trading in our common shares on the OTC Bulletin Board is limited and sporadic, making it difficult for our stockholders to sell their shares or liquidate their investments.

Our common shares are currently quoted on the OTC Bulletin Board. The trading price of our common shares has been subject to wide fluctuations. Trading prices of our common shares may fluctuate in response to a number of factors, many of which will be beyond our control. The stock market has generally experienced extreme price and volume fluctuations that have often been unrelated or disproportionate to the operating performance of companies with no current business operation. There can be no assurance that trading prices and price earnings ratios previously experienced by our common shares will be matched or maintained. These broad market and industry factors may adversely affect the market price of our common shares, regardless of our operating performance.

In the past, following periods of volatility in the market price of a company's securities, securities class-action litigation has often been instituted. Such litigation, if instituted, could result in substantial costs for us and a diversion of management's attention and resources.

Our securities are considered highly speculative.

Our securities must be considered highly speculative, generally because of the nature of our business and the early stage of our exploration and development operations. We are engaged in the business of exploring and, if warranted, developing commercial reserves of oil and gas. Our properties are in the exploration stage only and are without known reserves of oil and gas. Accordingly, we have neither generated any material revenues nor realized a profit from our operations to date and there is little likelihood that we will generate any material revenues or realize any profits in the short term. Any profitability in the future from our business will be dependent upon locating and developing economic reserves of oil and gas, which itself is subject to numerous risk factors as set forth herein. Since we have not generated any material revenues, we expect that we will need to raise additional monies through the sale of our equity securities or debt in order to continue our business operations.

As our properties are in the exploration stage there can be no assurance that we will establish commercial discoveries on our properties.

Exploration for economic reserves of oil and gas is subject to a number of risk factors. Few properties that are explored are ultimately developed into producing oil and/or gas wells. Our properties are in the exploration stage only and are without proven reserves of oil and gas. We may not establish commercial discoveries on any of our properties.

The potential profitability of oil and gas ventures depends upon factors beyond our control.

The potential profitability of oil and gas properties is dependent upon many factors beyond our control. For instance, world prices and markets for oil and gas are unpredictable, highly volatile, potentially subject to governmental fixing, pegging, controls, or any combination of these and other factors, and respond to changes in domestic, international, political, social, and economic environments. Additionally, due to worldwide economic uncertainty, the availability and cost of funds for production and other expenses have become increasingly difficult, if not impossible, to project. These changes and events will likely materially affect our financial performance.

Adverse weather conditions can also hinder drilling operations. A productive well may become uneconomic in the event water or other deleterious substances are encountered which impair or prevent the production of oil and/or gas from the well. In addition, production from any well may be unmarketable if it is impregnated with water or other deleterious substances. The marketability of oil and gas which may be acquired or discovered will be affected by numerous factors beyond our control. These factors include the proximity and capacity of oil and gas pipelines and processing equipment, market fluctuations of prices, taxes, royalties, land tenure, allowable production and environmental protection. These factors cannot be accurately predicted and the combination of these factors may result in us not receiving an adequate return on invested capital.

Competition in the oil and gas industry is highly competitive and there is no assurance that we will be successful in acquiring the leases.

The oil and gas industry is intensely competitive. We compete with numerous individuals and companies, including many major oil and gas companies, which have substantially greater technical, financial and operational resources and staffs. Accordingly, there is a high degree of competition for desirable oil and gas leases, suitable properties for drilling operations, and necessary drilling equipment, as well as for access to funds. We cannot predict if the necessary funds can be raised or that any projected work will be completed. Our budget anticipates our acquisition of additional acreage. This acreage may not become available or if it is available for leasing, that we may not be successful in acquiring the leases. There are other competitors that have operations in areas of potential interest to the Company and the presence of these competitors could adversely affect our ability to acquire additional leases.

The marketability of natural resources will be affected by numerous factors beyond our control which may result in us not receiving an adequate return on invested capital to be profitable or viable.

The marketability of natural resources which may be acquired or discovered by us will be affected by numerous factors beyond our control. These factors include market fluctuations in oil and gas pricing and demand, the proximity and capacity of natural resource markets and processing equipment, governmental regulations, land tenure, land use, regulation concerning the importing and exporting of oil and gas and environmental protection regulations. The exact effect of these factors cannot be accurately predicted, but the combination of these factors may result in us not receiving an adequate return on invested capital to be profitable or viable.

Oil and gas operations are subject to comprehensive regulation, which may cause substantial delays or require capital outlays in excess of those anticipated, causing an adverse effect on us.

Oil and gas operations are subject to federal, state, and local laws relating to the protection of the environment, including laws regulating removal of natural resources from the ground and the discharge of materials into the environment. Oil and gas operations are also subject to federal, state, and local laws and regulations which seek to maintain health and safety standards by regulating the design and use of drilling methods and equipment. Various permits from government bodies are required for drilling operations to be conducted; no assurance can be given that such permits will be received. Environmental standards imposed by federal, provincial, or local authorities may be changed and any such changes may have material adverse effects on our activities. Moreover, compliance with such laws may cause substantial delays or require capital outlays in excess of those anticipated, thus causing an adverse effect on us. Additionally, we may be subject to liability for pollution or other environmental damages which we may elect not to insure against due to prohibitive premium costs and other reasons. To date we have not been required to spend any material amount on compliance with environmental regulations. However, we may be required to do so in future and this may affect our ability to expand or maintain our operations.

Exploration and production activities are subject to certain environmental regulations, which may prevent or delay the commencement or continuance of our operations.

In general, our exploration and production activities are subject to certain federal, state and local laws and regulations relating to environmental quality and pollution control. Such laws and regulations increase the costs of these activities and may prevent or delay the commencement or continuance of a given operation. Compliance with these laws and regulations has not had a material effect on our operations or financial condition to date. Specifically, we are subject to legislation regarding emissions into the environment, water discharges and storage and disposition of hazardous wastes. In addition, legislation has been enacted which requires well and facility sites to be abandoned and reclaimed to the satisfaction of state authorities. However, such laws and regulations are frequently changed and we are unable to predict the ultimate cost of compliance. Generally, environmental requirements do not appear to affect us any differently or to any greater or lesser extent than other companies in the industry.

We believe that our operations comply, in all material respects, with all applicable environmental regulations. We are not fully insured against all possible environmental risks.

Exploratory drilling involves many risks and we may become liable for pollution or other liabilities, which may have an adverse effect on our financial position.

Drilling operations generally involve a high degree of risk. Hazards such as unusual or unexpected geological formations, power outages, labor disruptions, blow-outs, sour gas leakage, fire, inability to obtain suitable or adequate machinery, equipment or labor, and other risks are involved. We may become subject to liability for pollution or hazards against which we cannot adequately insure or which we may elect not to insure. Incurring any such liability may have a material adverse effect on our financial position and operations.

Any change to government regulation/administrative practices may have a negative impact on our ability to operate and our profitability.

The laws, regulations, policies or current administrative practices of any government body, organization or regulatory agency in the United States or any other jurisdiction, may be changed, applied or interpreted in a manner which will fundamentally alter the ability of our company to carry on our business. The actions, policies or regulations, or changes thereto, of any government body or regulatory agency, or other special interest groups, may have a detrimental effect on us. Any or all of these situations may have a negative impact on our ability to operate and/or our profitably.

Our Bylaws contain provisions indemnifying our officers and directors against all costs, charges and expenses incurred by them.

Our Bylaws contain provisions with respect to the indemnification of our officers and directors against all costs, charges and expenses, including an amount paid to settle an action or satisfy a judgment, (i) actually and reasonably incurred and (ii) in a civil, criminal or administrative action or proceeding to which he is made a party by reason of his being or having been one of our directors or officers.

Investors' interests in us will be diluted and investors may suffer dilution in their net book value per share if we issue additional shares or raise funds through the sale of equity securities.

In the event that we are required to issue any additional shares or enter into private placements to raise financing through the sale of equity securities, investors' interests in us will be diluted and investors may suffer dilution in their net book value per share depending on the price at which such securities are sold. If we issue any such additional shares, such issuances also will cause a reduction in the proportionate ownership and voting power of all other stockholders. Further, any such issuance may result in a change in our control.

Our Bylaws do not contain anti-takeover provisions, which could result in a change of our management and directors if there is a take-over of us.

We do not currently have a stockholder rights plan or any anti-takeover provisions in our Bylaws. Without any anti-takeover provisions, there is no deterrent for a take-over of our company, which may result in a change in our management and directors.

Our independent auditors have expressed a reservation that we can continue as a going concern.

Our operations have been limited to general administrative operations and a limited amount of exploration. Our ability to continue as a going concern is dependent on our ability to raise additional capital to fund future operations and ultimately to attain profitable operations. Accordingly, these factors raise substantial doubt as to our ability to continue as a going concern.

Item 2. Properties.

Effective April 17, 2006, we entered into a letter agreement with Eden Energy with respect to our right to participate with Eden Energy in the Cherry Creek Project. Effective November 30, 2006, we entered into an agreement with Eden Energy relative to the BSSV Project and Cherry Creek Project. The agreement provides for a release of our option in the Cherry Creek Project in exchange for an assignment of a 100% interest in the BSSV Project. The BSSV Project consists of approximately 102,000 Federal gross and net acres in Nevada. The leases are for a primary term of 10 years from and after July 1, 2005. The leases may be extended beyond the primary term by production or unitization of production there from. In 2007 and 2008, we elected not to pay lease rentals on certain of the acreage and currently own approximately 52,957 gross and net acres in the BSSV Project.

The Quad 14 Project entitles us the right to acquire a 9.1875% working interest in oil and gas licenses covering our approximately 255 square kilometer acreage block located in Quad 14 Project in the North Sea. The Quad 41/42 Project entitles us the right to acquire a 10% working interest in oil and gas licenses covering a 970 square kilometer acreage block located in Quad 41 and Quad 42 in the North Sea. Pursuant to the agreement and the actions of the parties, the expiration date of the licenses for the North Sea projects was extended from October 2007 to October 2011.

The agreement with Pebble provides us with a five percent overriding royalty interest in approximately 355,009 gross and net acres in western Canada. The Pebble agreement also provides us with a 10% working interest in approximately 61,412 gross and 35,145 net acres in the northern United States. The acreage under these agreements has various expiration dates.

We own a 75% working interest in the SW Extension of the West Ranch field in Jackson County, Texas. This property includes approximately 1,000 gross and net acres that is principally held by production.

We do not own any other properties.

Item 3. Legal Proceedings.

On November 20, 2007, our Company and our chief executive officer were served with a summons and complaint, styled Zavanna LLC, a Colorado limited liability company; Prairie Petroleum, Inc, a Colorado corporation; Trapper Oil Company, Inc., a Colorado corporation; Zavanna Canada Corporation, a Nova Scotia unlimited liability company v. Brad Colby; Eternal Energy, Inc., a Nevada corporation; Pebble Petroleum, Inc., a British Columbia corporation; Steven Swanson; Fairway, LLC, a Colorado limited liability company; ABC Corporation; DEF Limited Partnership; and John Doe 1-10, District court, City and County of Denver, Colorado case No. 07-CV-10775. Plaintiffs pled claims for relief against our CEO and us, among other persons, for breach of contract, misappropriation of confidential and proprietary information and of trade secret and claims under the Colorado Uniform Trade Secrets Act, fraud, declaratory relief declaring any agreements of release to be void and unenforceable as they were obtained by fraudulent inducement, declaration of accounting and constructive trust for all proceeds and profits from the alleged misappropriation, injunctive relief for return of all allegedly misappropriated information and cessation of use, civil theft of business values, and tortuous interference with contract. Plaintiffs seek compensatory and punitive damages in an unspecified amount, prejudgment interest, declaratory relief, injunctive relief, accounting, and attorneys’ fees. We believe that the causes of action are without merit and intend to defend our rights and those of our CEO vigorously. On January 17, 2008, our Company and our CEO filed a countersuit, claiming abuse of process, intentional interference with an existing business and contractual relations, commercial disparagement and conspiracy, which we intend to prosecute vigorously. In September 2008, the Company filed a motion to compel Zavanna to produce certain documents supporting their claims against the Company. In February 2009, the court ruled in favor of the Company’s motion to compel. The litigation is currently considered to be in the discovery phase. As of April 8, 2009, no determination can be made as to the ultimate outcome of either the original proceeding or our Company’s countersuit.

We are not currently a party to any other material legal proceedings.

Item 4. Submission of Matters to a Vote of Security Holders.

No matter was submitted to a vote of security holders, through the solicitation of proxies or otherwise, during the fourth quarter of the fiscal year covered by this report.

PART II

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities.

Our common stock, par value $.001, has been dually quoted on the Pink Sheets and the OTC Bulletin Board under the symbol “EERG” since November 7, 2005; however, active trading in the market of our common stock did not commence until February 2, 2006. The following table sets forth the high and low bid prices for our common stock for the periods indicated, as reported by YAHOO! Finance. Such quotations reflect inter-dealer prices, without retail mark-up, mark-down or commissions, and may not necessarily represent actual transactions.

| | | Bid | |

| | | High | | | Low | |

| Year ended December 31, 2008: | | | | | | |

| First Quarter | | $ | 0.15 | | | $ | 0.05 | |

| Second Quarter | | | 0.34 | | | | 0.10 | |

| Third Quarter | | | 0.23 | | | | 0.08 | |

| Fourth Quarter | | | 0.17 | | | | 0.04 | |

Year ended December 31, 2007 : | | | | | | | | |

| First Quarter | | | 0.64 | | | | 0.39 | |

| Second Quarter | | | 0.49 | | | | 0.17 | |

| Third Quarter | | | 0.26 | | | | 0.11 | |

| Fourth Quarter | | | 0.11 | | | | 0.03 | |

As of April 8, 2009, there were approximately 23 holders of record of our common stock.

We have never declared or paid any cash dividends on our common stock. For the foreseeable future, we expect to retain any earnings to finance the operation and expansion of our business.

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

THE FOLLOWING PRESENTATION OF OUR MANAGEMENT'S DISCUSSION AND ANALYSIS SHOULD BE READ IN CONJUNCTION WITH THE FINANCIAL STATEMENTS AND OTHER FINANCIAL INFORMATION INCLUDED ELSEWHERE IN THIS REPORT.

A Note About Forward-Looking Statements

This Annual Report on Form 10-K contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 that are based on current management's expectations. These statements may be identified by their use of words like “plans,” “expect,” “aim,” “believe,” “projects,” “anticipate,” “intend,” “estimate,” “will,” “should,” “could” and other expressions that indicate future events and trends. All statements that address expectations or projections about the future, including statements about our business strategy, expenditures, and financial results are forward-looking statements. We believe that the expectations reflected in such forward-looking statements are accurate. However, we cannot assure you that such expectations will occur.

Actual results could differ materially from those in the forward looking statements due to a number of uncertainties including, but not limited to, those discussed in this section. Factors that could cause future results to differ from these expectations include general economic conditions, further changes in our business direction or strategy, competitive factors, oil and gas exploration uncertainties, and an inability to attract, develop, or retain technical, consulting or managerial agents or independent contractors. As a result, the identification and interpretation of data and other information and their use in developing and selecting assumptions from and among reasonable alternatives requires the exercise of judgment. To the extent that the assumed events do not occur, the outcome may vary substantially from anticipated or projected results, and accordingly, no opinion is expressed on the achievability of those forward-looking statements. No assurance can be given that any of the assumptions relating to the forward-looking statements specified in the following information are accurate, and we assume no obligation to update any such forward-looking statements. You should not unduly rely on these forward-looking statements, which speak only as of the date of this Annual Report, except as required by law; we are not obligated to release publicly any revisions to these forward-looking statements to reflect events or circumstances occurring after the date of this report or to reflect the occurrence of unanticipated events.

Industry Outlook

The petroleum industry is highly competitive and subject to significant volatility due to numerous market forces. Crude oil and natural gas prices are affected by market fundamentals such as weather, inventory levels, competing fuel prices, overall demand and the availability of supply.

Worldwide oil prices rose throughout 2007 and reached historical highs during the last half of 2008, before tumbling amid worldwide economic crisis. Continued economic instability could impact demand, caused by a consumer shift to alternative fuel sources and/or supply, driven largely by concerns regarding the economic viability of extracting natural resources, thus affecting crude oil prices.

Oil prices have significantly affected profitability and returns for upstream producers. Oil prices cannot be predicted with any certainty. Historically, the WTI price has averaged approximately $47 per barrel over the past ten years. However, during that time, the industry has experienced wide fluctuations in prices. While local supply/demand fundamentals are a decisive factor affecting domestic natural gas prices over the long term, day-to-day prices may be more volatile in the futures markets, such as on the NYMEX and other exchanges, making it difficult to forecast prices with any degree of confidence. Over the last ten years, the NYMEX gas price has averaged approximately $5.67 per Mcf.

Restatement of the 2007 Financial Statements

In March 2009, we discovered that that certain transactions reported in our 2007 financial statements were reported incorrectly. Given the materiality of the affected transactions and related account balances, we have elected to restate our 2007 financial statements in order to correct the error. As a result, we have revised our discussion of the results of operations for the fiscal year ended December 31, 2007 vs. 2006 accordingly.

Results of Operations for the Fiscal Year Ended December 31, 2008 vs. 2007

Our business plan includes the acquisition of interests in oil and gas exploratory prospects, and in some cases, such as the Pebble Beach Project and Steamroller Project, we may sell all or part of our interest. The nature of these transactions is that they occur irregularly and, therefore, our operating results may fluctuate significantly from period to period.

We recognized $750,000 in spud fee revenue in 2008 and $1,249,991 in spud fee revenue in 2007 in connection with the drilling of three and five wells, respectively. As of December 31, 2008, all eight of the initial wells for which the Company is entitled to receive spud fees under the terms of its agreement with Pebble Petroleum have been drilled. As a result of the Company's involvement in the Zavanna litigation, as discussed below, spud fees relating to the drilling of the final three wells, totaling $750,000, are being held in escrow until the lawsuit is resolved.

The Company acquired a 75% working interest in the West Ranch property through a series of transactions occurring in 2007 and began recognizing oil and gas revenues and operating expenses relating to the West Ranch property in the fourth quarter of 2007. Oil and gas revenues and operating costs for the year ended December 31, 2008 totaled $142,838 and $504,786, respectively, compared to $317,135 and $369,516 for 2007. Falling oil prices led us to temporarily shut-in the producing wells on the West Ranch property during the latter part of 2008. We also elected to temporarily delay further development of the West Ranch wells in order to divert working capital to other projects and to fund its legal defense in the Zavanna litigation.

In May 2007, we sold our 5% equity interest in Pebble, which held a working interest in the Pebble Beach prospect. The Pebble Beach prospect contained no proven reserves and, accordingly, was included in our non-amortizable pool of oil and gas properties. Proceeds from the sale totaled $877,353, resulting in a gain on the transaction of $871,278.

In June 2008, we sold our 50% working interest in certain properties located in Colorado and Utah (the "Steamroller prospect"). Proceeds from the sale totaled $1,190,135, versus associated costs of $251,457, resulting in a gain on the sale of $938,678. The Steamroller prospect contained no proven reserves and, accordingly, was included in our non-amortizable pool of oil and gas properties. We had originally intended to participate in the exploration and development of the Steamroller prospect; however, the decision was made to dispose of the prospect to ease cash restrictions resulting from the Company being named in litigation brought forth by Zavanna LLC, et al, as described below. Proceeds from the sale of prospects were used to bolster our working capital position.

During 2008, the operator for the Quad 14 prospect returned $121,453 to us that had been previously held on deposit to fund exploratory drilling costs. The Company had fully impaired its investment in the Quad 14 prospect in 2007 when the results of the exploratory drilling program failed to discover economically viable reserves. Accordingly, we have recognized the refunded monies as revenue in the current period.

As indicated in the footnotes to the financial statements, the Company capitalizes all acquisition and exploration related costs related to a prospect on a country-by-country basis. Such costs are included in our non-amortizable pool until it can be determined whether the prospect contains any economically recoverable oil or gas reserves. We recognized $1,538,416 in impairment expense in 2007 in connection with the abandonment of the Quad 14 and Quad 41 / 42 properties. No exploratory wells were abandoned in 2008. Our 2008 statement of operations contains impairment expense of $2,782 related to residual costs associated with the abandonment of the Quad 14 property, for which we were not billed until the current period. Additional residual costs may be received during 2009 as the final accounting for the Quad 14 project is completed. We do not expect these residual costs, if any, to have a material effect on the Company’s future financial statements.

As of December 31, 2008, we had $1,599,021 on deposit relating to the drilling of the Quad 41/ 42 prospect. We are currently disputing our obligation to participate in the drilling of the Quad 41/42 exploratory well. As a result, no amounts held on deposit have been released to the project’s operator. Our management is attempting to determine what amount, if any, we are obligated to pay related to the drilling of the Quad 41/42 exploratory well and what amount of deposited funds, if any, could be returned to the Company.

General and administrative expenses increased from $627,543 for the year ended December 31, 2007 to $703,720 for the year ended December 31, 2008. An analysis of the increase and decreases in general and administrative expenses and the relevant components follows:

| | § | As a result of the hiring our Chief Financial Officer in June 2008 and our Vice President of Engineering in August 2007, the Company's payroll and related expenses for year ended December 31, 2008 increased by $155,913 from 2007. |

| | § | In November 2007, the Company applied for and obtained directors' and officers' insurance. We did not carry such coverage previously. The addition of the directors' and officers' insurance premiums, along with the increase in health insurance premiums associated with the hiring of the Company's Chief Financial Officer (June 2008) and Vice President of Engineering (August 2007), resulted in an increase in total insurance expense of $64,200 from 2007 to 2008. |

| | § | Investor relations expense decreased by $21,386 from 2007 to 2008, primarily because all investor relations activities were assumed by our Company's chief financial officer upon hire in June, 2008. Previously, we outsourced our investor relations activities to a third party. |

| | § | Travel expense for the year ended December 31, 2008 decreased by $67,878 from 2007, largely due to the fact that we have not pursued the acquisition of additional oil and gas prospects as aggressively as in 2007. Participation in the litigation with Zavanna LLC, et al, severely hampered our ability to pursue additional exploration and its development opportunities in the current year. |

| | § | The Company incurred $72,000 of settlement expenses in 2007 associated with a private placement of the Company's common stock. No such expenses were incurred in 2008 and we did not engage in any common stock transactions during the year. |

Stock-based compensation expense for 2008 increased by $152,038 as a result of granting stock options to members of the Company's management upon hire and/or to recognize performance.

Legal expense for the year ended December 31, 2008 totaled $425,937, which represents an increase of $246,141 from 2007. The majority of the current year's legal fees were incurred in connection with our defense of the litigation brought forth by Zavanna LLC, et al. Though there is no guaranty that we will successfully do so, we hope to recoup all of our legal expenditures relating to this action as part of the countersuit that we have filed against Zavanna LLC, et al.

Depreciation, depletion and amortization expense for the year ended December 31, 2008 increased by $196,872 from the same period in 2007 as a result of depleting capitalized costs related to the West Ranch property and the write-off of certain down-hole gas/water separation technology assets that we acquired in early 2008.

Year-to-date interest income for 2008 increased by $32,088 from the prior year primarily as a result of maintaining a higher cash balance due to proceeds received from the sale of the Steamroller prospect as well as the collection of spud fees during 2008.

Results of Operations for the Fiscal Years Ended December 31, 2007 vs. 2006

In June 2007, we sold our interest in Pebble Petroleum. Gross proceeds from the sale totaled $877,353, resulting in a gain of $871,238 on the transaction. The Pebble Beach prospect contained no proven reserves and, accordingly, was included in our non-amortizable pool of oil and gas properties. In accordance with the terms of the sale agreement, we are entitled to receive a spud fee of $250,000 for each of the first eight wells drilled on the property. Drilling of the first five wells commenced in 2007, resulting in the recognition of spud fee revenue of $1,249,991 for the year ended December 31, 2007. As a result of recognizing revenue for the first time in its existence, the Company evolved from a development stage company to an operating company.

At various times during the year ended December 31, 2007, we acquired additional working interests that totaled 75% in the SW Extension of the West Ranch property, located in Texas. Revenues generated from the sale of oil and gas extracted from the West Ranch property totaled $317,135 for the year ended December 31, 2007. We did not recognize any revenue from the production and sale of oil or gas in 2006.

We did not recognize any revenue in 2006, either from oil and gas sales or from the disposition of oil and gas prospects.

We follow the full cost method to account for our investments in oil and gas properties. Under the full cost method, acquisition, exploration and development costs are capitalized as incurred. Capitalized costs associated with properties containing proven reserves are included in our amortizable pool and depleted on the unit-of-production basis. Capitalized costs associated with oil and gas prospects, for which no proven reserves have yet been identified, are included in our non-amortizable pool. Until it is determined if there are proven reserves, the properties are assessed annually to ascertain whether impairment has occurred. For each cost center, capitalized costs are subject to the ceiling test, in which the costs shall not exceed the cost center ceiling. If unamortized costs exceed the cost center ceiling, the excess shall be charged to expense and separately disclosed during the period in which the excess occurs. In July 2007, we abandoned ours interest in the North Sea Quad 14 and 41/42 prospects after two exploratory wells failed to locate any economically viable oil and gas reserves. Accordingly, our investments in the Quad 14 and Quad 41/42 prospect, totaling $1,430,429, and $107,987, respectively, were written off. We are currently disputing our obligation to participate in the drilling of the Quad 41/42 exploratory well. As a result, monies placed on deposit by us to fund our share of drilling costs for the Quad 41/42 exploratory well have not been released to the operator.

Our share of the operating costs of the West Ranch Field for the year ended December 31, 2007 was $369,516. Prior to acquiring our 75% working interest in the West Ranch property, we did not own any producing properties. Accordingly, we did not recognize any oil and gas operating expenses in 2006.

General and administrative expenses increased from $538,909 for the year ended December 31, 2006 to $628,288 for the year ended December 31, 2007. An analysis of the increases in general and administrative expenses and the relevant components is as follows:

| | § | Consulting fees decreased from $65,416 in 2006 to $40,080 in 2007 as we replaced consultants with employees. As a result, payroll related costs increased from $146,351 in 2006 to $179,863 in 2007. In 2007 we commenced providing health insurance benefits for our employees at a cost of $24,469. |

| | § | In 2007, we incurred $72,500 in settlement costs in 2007 related to our untimely filing of the registration statement required by the private offering of our securities in 2006. No such costs were incurred in 2006. |

| | § | We incurred office support costs of $34,500 in 2006 from an entity controlled by the Company's president prior to establishing our own office administrative staff in 2007. |

| | § | The creation of a formal investor relations program in August 2006 resulted in investor relations expenses of $22,789 for the year ended December 21, 2006. 2007 marked the first complete year in which we maintained an investor relationship function. Cost incurred in 2007 associated with investor relations totaled $65,555. |

| | § | The amount of stock based compensation recognized by the Company in 2007 increased from $112,826 to $222,007 as a result of granting of stock options to our directors and our newly hired Vice President of Engineering. |

| | § | Travel related expenses increased by $66,249 in 2007 as we increased our pursuit of additional business opportunities. |

| | § | In 2006, we incurred $37,102 in costs to develop our website. There were no such costs incurred in 2007. |

| | § | We began leasing office space for our corporate operations in 2007. Rent expense for the 12 months ended December 31, 2007, net of sublease payments received, was $31,523 compared to $6,835 in the prior year. |

| | § | Professional fees increased by $21,974 in 2007 primarily as a result of higher accounting costs associated with using a contract CFO as well as higher annual audit fees. |

| | § | We recognized $52,165 in interest income in 2007 compared to $29,940 in 2006. The increase is primarily due to a more favorable rate earned on funds held on deposit for Quad 14 and Quad 41/42 drilling operations, which was partially offset by a decrease in the actual amounts held on deposit as a result of funding exploratory drilling costs. |

In October 2007, we acquired certain exploratory oil and gas leases and exclusive licenses to use a down-hole gas/water device from entities owned by our Chairman and Chief Executive Officer. We paid $125,000 for the oil and gas leases and are obligated to pay to such entity $250,000 on each of December 31, 2008 and December 31, 2009. These amounts may be paid in either cash or with shares of our common stock.

In addition, we reimbursed one of such entities $20,000 for amounts paid to Zavanna Canada Corp. We are required to drill and equip two wells, and may cancel this agreement after the two required wells have been drilled and the first $250,000 payment has been made.

One license agreement requires the Company to pay $25,000 in September 2007 and further requires the Company to purchase ten devices each year, beginning in 2008, at a cost of $4,000 per device in order to maintain exclusivity under the license agreement. In addition, the grantor of the license will receive a 1% royalty on each well using the device. The license expires in January 2012 and can be extended for 5 years at a cost of $300,000.