FORM 6-K

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

of the Securities Exchange Act of 1934

For the month of May 2006

Commission File Number 333-114196

AXTEL, S.A. DE C.V.

(Translation of Registrant’s name into English)

Blvd. Gustavo Diaz Ordaz 3.33 No. L-1

Col. Unidad San Pedro

San Pedro Garza Garcia, N.L.

Mexico, CP 66215

(52)(81) 8114-0000

(Address of Principal Executive Offices)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F x Form 40-F o

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): _________

Note: Regulation S-T Rule 101(b)(1) only permits the submission in paper of a Form 6-K if submitted solely to provide an attached annual report to security holders.

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): _________

Note: Regulation S-T Rule 101(b)(7) only permits the submission in paper of a Form 6-K if submitted to furnish a report or other document that the registrant foreign private issuer must furnish and make public under the laws of the jurisdiction in which the registrant is incorporated, domiciled or legally organized (the registrant’s “home country”), or under the rules of the home country exchange on which the registrant’s securities are traded, as long as the report or other document is not a press release, is not required to be and has not been distributed to the registrant’s security holders, and, if discussing a material event, has already been the subject of a Form 6-K submission or other Commission filing on EDGAR.

Indicate by check mark whether the registrant by furnishing the information contained in this Form, the registrant is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes o No x

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): 82-_____

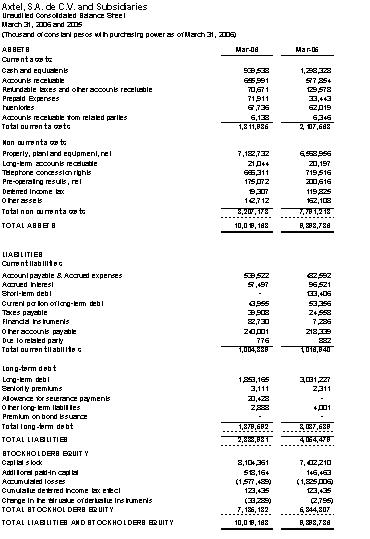

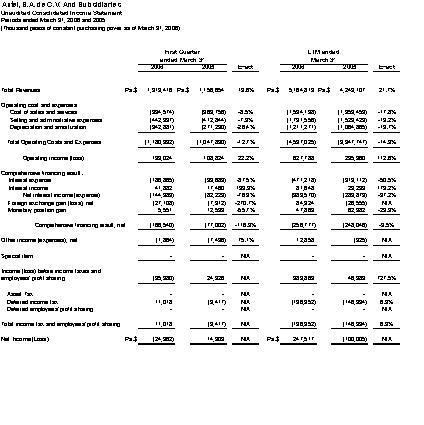

Axtel, S.A. de C.V., one of the leading telecommunications services providers in Mexico, today announced its unaudited first quarter results ended March 31, 2006. Figures in this release are based on Mexican GAAP, stated in constant pesos (Ps.) as of March 31, 2006. Comparisons in pesos are in real terms, that is, adjusted for inflation.

Revenues

We derive our revenues from:

| — | Local calling services. We generate revenue by enabling our customers to originate and receive an unlimited number of calls within a defined local service area. Customers are charged with a flat monthly fee for basic service, a per call fee for local calls (“measured service”), a per minute usage fee for calls completed on a cellular line (“calling party pays,” or CPP calls) and a monthly fee for value added services and internet access when requested by the customer. |

| — | Long distance services. We generate revenues by providing long distance services (domestic and international) for our customers’ completed calls. |

| — | Other services. We generate revenues from other services, which include activation fees for new customers as well as data, interconnection and dedicated private line services charged on a monthly basis. |

Revenues from operations

Revenues from operations increased to Ps. 1,313.4 million in the first quarter of year 2006 from Ps. 1,156.7 million for the same period in 2005, an increase of Ps. 156.8 million or 14%. Our lines in service at the end of the first quarter of 2006 increased to 648,402 from 490,231 at the end of the same period in 2005, an increase of 32%.

Revenues from operations increased to Ps. 5,164.8 million for the twelve-month period ended March 31, 2006 from Ps. 4,243.1 million for the same period in 2005, an increase of Ps. 921.7 million or 22%.

We derived our revenues from the following sources:

Local services. Local service revenues increased to Ps. 956.3 million for the three-month period ended March 31, 2006 from Ps. 814.1 million for the same period ended in 2005, an increase of Ps. 142.2 million or 17%. For the twelve month period ended March 31, 2006, local services increased to Ps. 3,738.9 million from Ps. 3,017.3 million recorded in the same period in 2005, an increase of Ps. 721.6 million or 24%. Higher number of lines in service reflected in the monthly rent and a higher cellular consumption were the main drivers of these increases.

Long distance services. Long distance service revenues increased to Ps. 106.0 million for the three-month period ended March 31, 2006 from Ps. 104.3 million in the same period in 2005, an increase of Ps. 1.7 million or 2%. For the twelve month period ended March 31, 2006, long distance services increased to Ps. 457.3 million from Ps. 409.6 million registered in the same period in 2005, an increase of Ps. 47.7 million or 12%.

Other services. Revenue from other services increased to Ps. 251.1 million in the first quarter of 2006 from Ps. 238.3 million in the same period in 2005, an increase of Ps. 12.9 million or 5%. Other services revenue increased to Ps. 968.6 million for the twelve month period ended March 31, 2006 from Ps. 816.2 million for the same period in year 2005, an increase of Ps. 152.4 million or 19%.

Consumption

Local Calls. Local calls increased to 448.1 million for the three-month period ended March 31, 2006 from 348.3 million for the same period ended in 2005, an increase of 99.8 million or 29%. For the twelve month period ended March 31, 2006, local calls increased to 1,714.9 million from 1,274.9 million recorded in the same period in 2005, an increase of 440.0 million calls or 35%. A higher number of lines in service was the main driver for these increases.

Cellular (“Calling Party Pays”). Minutes of use of calls completed to a cellular line increased to 174.0 million for the three-month period ended March 31, 2006 from 126.9 million in the same period in 2005, an increase of 47.0 million or 37%. For the twelve month period ended March 31, 2006, cellular minutes increased to 644.5 million from 461.6 million registered in the same period in 2005, an increase of Ps. 182.8 million or 40%.

Long distance. Long distance minutes increased to 123.0 million for the three-month period ended March 31, 2006 from 103.8 million in the same period in 2005, an increase of 19.2 million or 19%. For the twelve-month period ended March 31, 2006, long distance minutes increased to 499.7 million from Ps. 386.1 million registered in the same period in 2005, an increase of Ps. 113.5 million or 29%.

Cost of Revenues and Operating Expenses1

Cost of Revenues. For the three-month period ended March 31, 2006, the cost of revenues was Ps. 394.6 million, an increase of Ps. 30.8 million compared with the same period of year 2005. For the twelve month period ended March 31, 2006, the cost of revenues reached Ps. 1,594.2 million, an increase of Ps. 240.7 million in comparison with the same period in year 2005. Both increases were mainly due to a higher consumption in cellular minutes.

Gross Profit. Gross profit is defined as revenues minus costs of revenues. For the first quarter of 2006, the gross profit accounted for Ps. 918.8 million, an increase of Ps. 125.9 million or 16%, compared with the same period in year 2005. For the twelve month period ended March 31, 2006, our gross profit increased to Ps. 3,570.6 million from Ps. 2,889.7 million recorded in the same period of year 2005, an increase of Ps. 681.0 million or 24%.

Operating expenses. For the first quarter of year 2006, operating expenses grew Ps. 30.1 million or 7%, totaling Ps. 442.9 million compared to Ps. 412.8 million for the same period of year 2005. This increase was partially due to the opening of three new cities during the quarter. For the twelve month period ended March 31, 2006, operating expenses increased Ps. 202.1 million coming from Ps. 1,529.4 million in 2005 to Ps. 1,731.6 million in 2006. This increase was attributable primarily to salaries, rents, sales commissions and network maintenance based on the current operational level of the Company.

Adjusted EBITDA. The Adjusted EBITDA was Ps. 475.9 million for the three-month period ended March 31, 2006 as compared to Ps. 380.1 million for the same period in 2005, an increase of 25%. As a percentage of total revenues it was 36% for the three-month period ended March 31, 2006. For the twelve month period ended March 31, 2006 it increased to Ps. 1,839.1 million from Ps. 1,360.2 million in the same period in year 2005, an increase of Ps. 478.8 million, or 35%. For additional detail on the Adjusted EBITDA Reconciliation, go to Axtel’s web site at www.axtel.com.mx.

Depreciation and Amortization. As a result of the continuing expansion of our asset base, depreciation and amortization increased to Ps. 342.9 million for the three-month period ended March 31, 2006 from Ps. 271.2 million for the same period in year 2005, an increase of Ps. 71.7 million or 26%. Depreciation and amortization for the twelve-month period ended March 31, 2006 reached Ps. 1,211.3 million from Ps. 1,064.9 million in the same period in year 2005, an increase of Ps. 146.4 million or 14%.

________________________

1 Our costs are categorized as follows:

Cost of revenues include expenses related to the termination of our customers’ cellular and long distance calls in other carriers’ networks, as well as expenses related to billing, payment processing, operator services and our leasing of private circuit links. Operating expenses include costs incurred in connection with general and administrative matters which incorporate compensation and benefits, the costs of leasing land related to our operations and costs associated with sales and marketing and the maintenance of our network. Depreciation and amortization includes depreciation of all communications network and equipment and amortization of pre-operating expenses and the cost of spectrum licenses.

Operating Income (loss). Operating income increased to Ps. 133.0 million for the three-month period ended March 31, 2006 compared to an operating income of Ps. 108.8 million registered in the same period in year 2005, an increase of Ps. 24.2 million or 22%. For the twelve month period ended March 31, 2006 our operating income reached Ps. 627.8 million when compared to the income registered in the same period of year 2005 of Ps. 295.4 million, an increase of Ps. 332.4 million or 113%.

Comprehensive financial result. The comprehensive financial loss was Ps. 166.5 million for the three-month period ended March 31, 2006, compared to a loss of Ps. 77.0 million for the same period in 2005. This increase was a result of exercising the equity claw-back provision of the 11% Senior Notes due 2013 at a 111% redemption price that took place during the first quarter of 2006. For the twelve month period ended March 31, 2006 this effect was offset by a foreign exchange gain. For the twelve-month period ended March 31, 2006, amounted to Ps. (256.8) million, compared to Ps. (248) million recorded in the same period of 2005, an increase of Ps. (8.8) million.

Capital Expenditures. Axtel invested Ps. 378.2 million in fixed assets during the first quarter of 2006 vs. Ps. 342.3 million during the same period in 2005, a 10% increase. For the twelve month period ended March 31, 2006, Axtel invested Ps. 1,686.2 million in fixed assets compared to Ps. 1,503.0 million in the same period of year 2005, an increase of Ps. 183.2 million. This investment was targeted towards the expansion of our network infrastructure in current and new cities.

Highlights. On February 22, 2006 Axtel early-redeemed approximately 35% of their 11% Senior Notes due 2013. Additionally, during the first quarter of 2006, Axtel launched operations in three additional cities, increasing Axtel’s presence to a total of 15 cities.

About Axtel

AXTEL is one of the leading fixed-line telecommunications providers in Mexico. It offers local services, national and international long distance services, internet and value-added services. It provides a basic telecom infrastructure in Mexico through its intelligent network, offering a wide range of services to all its markets. Headquartered in Monterrey, AXTEL also has presence in Guadalajara, Leon, Mexico, Puebla, Toluca, Queretaro, San Luis Potosi, Aguascalientes, Saltillo, Cd. Juarez, Tijuana, Chihuahua, Torreón and Veracruz.

Visit AXTEL on the web at www.axtel.com.mx

For additional information please contact:

Adrian de los Santos

Investor Relations

adelossantos@axtel.com.mx

**Financial Tables will Follow**

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | Axtel, S.A. de C.V. By: /s/ Jose Antonio Velasco Jose Antonio Velasco Managing Director |

|