Please note that this is an English translation of the Declaration of Information. The original version is in Spanish. If there is any discrepancy between such versions, the Spanish version shall prevail. This Declaration of Information contains forward looking statements regarding Axtel, its subsidiaries and affiliates − anticipated synergies, growth plans, projected results and future strategies. Although these forward looking statements reflect management’s good faith beliefs, they involve known and unknown risks and uncertainties that may cause the Company’s actual results or outcomes to be materially different from those anticipated and discussed herein. These risks and uncertainties include, but are not limited to, our ability to realize the amount of the projected synergies and on the timetable projected, as well as economic, competitive, governmental and technological factors affecting Axtel’s operations, markets, products and prices, and other factors detailed in Axtel’s filings with the Securities and Exchange Commission which readers are urged to read carefully in assessing the forward−looking statements contained herein. Axtel undertakes no duty to update any of the projections contained herein.

AXTEL S.A. de C.V.

Blvd. Gustavo Díaz Ordaz Km. 3.33 No. L-1

Col. Unidad San Pedro, San Pedro Garza García, N.L.

C.P. 66215

+52(81) 8114-0000

www.axtel.com.mx

Mexican Stock Exchange symbol:“AXTELCPO”

DECLARATION OF INFORMATION IN THE EVENT OF RELEVANT CORPORATE RESTRUCTURE

Filed in accordance with article 35 of the General Rules Applicable to Securities Issuers and other Participants in the Stock Market.

Transaction Summary: The Relevant Corporate Restructure described herein consists of Axtel S.A. de C.V. (“Axtel” or the “Company") purchasing Avantel Infraestructura, S. de R.L. de C.V.’s (“Avantel Infraestructura”) assets, as well as all common stock of Avantel, S. de R.L. de C.V. (“Avantel Concesionaria”) and Avantel Infraestructura (the two companies together defined as “Avantel”) (the “Transaction”). The Transaction could also include the subscription and payment of Series B shares (as hereinafter defined), represented by CPOs (as hereinafter defined), by Telecomunicaciones Holding Mx, S. de R.L. de C.V. (“Tel Holding”), an indirect subsidiary of Citigroup Inc., for an amount equivalent to up to 10% of Axtel’s common stock. Under this scenario, proceeds from the Tel Holding equity subscription will be used to partially repay debt incurred to finance Avantel’s acquisition.

The transaction was structured based on a valuation of Avantel which represents a multiple of 4.5 times Enterprise Value to expected 2006 EBITDA (as hereinafter defined).

The transaction will significantly increase Axtel’s revenues, provide presence in over 200 cities and promote consolidation of Mexico’s telecommunications sector. The synergies and economies of scale which Axtel expects to obtain from the Transaction are mainly operating and maintenance efficiencies from combining two network infrastructures, a larger product offering, increased bargaining power with national and international vendors and savings in sales, general and administrative costs. We believe that the synergies and efficiencies which Axtel will obtain from the Transaction will increase the Company’s profitability ratios.

Additionally, the Transaction may include the subscription and payment by Tel Holding of Series B Shares in the form of CPOs representing up to 10% in equity participation in Axtel. To effect the above, the approval of: (i) an increase of Axtel’s capital by issuing Series B Shares in a number that is sufficient for Tel Holding to subscribe and pay for Series B Shares (in the form of CPOs) representing up to 10% in equity participation in Axtel; and (ii) the subscription and payment of the Series B Shares that will represent the increase by Tel Holding and any shareholders that elect to subscribe and pay for such Series B Shares in exercise of their preferential right referred to by Article 132 of the Mexican General Corporation Law will be submitted for consideration at Axtel’s Shareholders’ Meeting to be held next November 29, 2006. The new Series B Shares shall be subscribed and paid for Tel Holding through the CPOs Trust (as

this term is defined below) and credited to Tel Holding in the form of CPOs through S.D. Indeval, S.A. de C.V., a Securities Depository Firm (“INDEVAL”). All CPOs purchased by Tel Holding will be subject to a non-transfer term of 364 days, upon expiration of which term Tel Holding will become subject to all provisions applicable to purchases and sales by persons related to the issuer and who may have access to privileged information that are set forth in the Mexican Securities Market Law and in general provisions issued by the Mexican National Banking and Securities Commission (Comisión Nacional Bancaria y de Valores, CNBV) and the United States Securities and Exchange Commission (SEC).

Characteristics of the CPOs: The Corporate Restructure that is the subject matter hereof shall have no effect whatsoever on Axtel’s CPOs (each CPO representing 7 Series B Shares of Axtel) or the rights granted by them, nor it shall imply an exchange of certificates representing CPOs or the underlying Series B Shares. For more details on the characteristics of Axtel’s CPOs and underlying Series B Shares, please see the prospectus of Axtel’s CPOs global offering that is available at Axtel’s website at www.axtel.com.mx and the BMV’s website at www.bmv.com.mx. As a result of the Transaction and in case Tel Holding does, through the CPOs Trust, subscribe all or any portion of the Series B Shares that will represent the capital increase to be approved at Axtel’s Shareholders’ Meeting, Tel Holding will hold up to 10% in equity participation in Axtel, and the equity participation of each one of Axtel’s current shareholders will be diluted in the same percentage, except for the participation of any shareholder who elects to subscribe shares representing the increase in proportion to its equity participation in Axtel, in exercise of the preferential right that is available at the shareholders under Article 132 of the Mexican General Corporation Law.

All of Axtel’s CPOs and Shares of Stock are registered with the National Registry of Securities, and Axtel’s CPOs are listed in the Mexican Stock Exchange or BMV. The registration of Axtel’s CPOs and Shares of Stock with the National Registry of Securities is for informative purposes only and does not imply any endorsement of the recorded securities or the financial condition of Axtel. In case the capital increase described above is effected, Axtel will update the registration with the National Registry of Securities of all of its Shares of Stock and CPOs representing the increase.

Further, no Shares of Stock to be issued as a result of the above-mentioned capital increase will be offered, either directly or in the form of CPOs, to the general public in the United States of America or any jurisdiction other than Mexico. The Shares of Stock to be issued have not been and will not be registered, either directly or in the form of CPOs, under the United States Securities Act of 1933, or under the securities law of any State of the United States of America; or under the laws of any jurisdiction other than Mexico. Considering the above, the Shares of Stock to be issued shall not be offered, sold, delivered or transferred, directly or indirectly, in form of Shares of Stock or CPOs outside Mexico (including the United States of America), or to U.S. citizens or any person in the United States of America or in any jurisdiction other than Mexico.

Any request for clarification regarding the present declaration may be directed to Adrian de los Santos, Axtel’s Investor Relations Officer, at (5281) 8114-1226, or by e-mail at adelossantos@axtel.com.mx

The present Declaration of Information is available on the Internet on Axtel’s web site www.axtel.com.mx and on the BMV’s web site www.bmv.com.mx.

San Pedro Garza García, N.L., November 08, 2006

| | INDEX | Page |

| I. | Glossary | 1 |

| | | |

| II. | Executive Summary | |

| | 2.1 | Brief Description of Axtel | 3 |

| | 2.2 | Brief Description of Avantel | 3 |

| | 2.3 | Relevant Aspects of the Transaction | 3 |

| | | |

| III. | Information about the Transaction | |

| | 3.1 | Detailed Description of the Transaction | 4 |

| | 3.2 | Purpose of the Transaction | 6 |

| | 3.3 | Financing Sources and Related Expenses | 6 |

| | 3.4 | Date of Approval of the Transaction | 6 |

| | 3.5 | Accounting Treatment of the Transaction | 7 |

| | 3.6 | Tax Effects of the Transaction | 7 |

| | | |

| IV. | Information Concerning the Parties Involved in the Transaction | |

| | 4.1 | Axtel’s Information | |

| | | 4.1.1 | Name of the Company | 9 |

| | | 4.1.2 | Business description | 9 |

| | | 4.1.3 | Competitive Strengths | 9 |

| | | 4.1.4 | Description of Axtel’s development in the last year | 10 |

| | | 4.1.5 | Capital Stock Structure | 10 |

| | | 4.1.6 | Relevant Changes in the Financial Statements since the last annual report | 10 |

| | | | | |

| | 4.2 | Avantel’s Information | |

| | | 4.2.1 | Name of the Company | 11 |

| | | 4.2.2 | Business description | 11 |

| | | 4.2.3 | Competitive Strengths | 13 |

| | | 4.2.4 | Description of Avantel’s development in the last year | 14 |

| | | 4.2.5 | Capital Stock Structure | 14 |

| | | | | |

| V. | Risk Factors | 15 |

| | | |

| VI. | Selected Financial Information (proforma) | 17 |

| | | |

| VII. | Management’s Discussion and Analysis of Financial Condition and Results from Operations | 21 |

| | | |

I. Glossary of Terms and Definitions

Set forth bellow is a glossary with the definitions of the main terms and abbreviations used in this Declaration of Information:

| “Accival” | means Acciones y Valores Banamex, S.A. de C.V., Casa de Bolsa, member of Grupo Financiero Banamex. |

| | |

| “Adjusted EBITDA ” | means EBITDA less non cash items and other non recurring items. |

| | |

| “ADSs” | means American Depositary Shares, each representing 7 CPOs, and each CPO representing 7 Series B Shares. |

| | |

| “Agreement” | shall have the meaning that is assigned to it in page 4 hereof |

| | |

| “Avantel Concesionaria” | Avantel, S. de R.L. de C.V. |

| | |

| “Avantel Escindida 2” | shall have the meaning that is assigned to it in page 6 hereof. |

| | |

| “Avantel Infraestructura” | means Avantel Infraestructura, S. de R.L. de C.V. |

| | |

| “Avantel” | means Avantel Concesionaria and Avantel Infraestructura collectively. |

| | |

| “Axtel” or the “Company” | means Axtel, S.A. de C.V., and its subsidiaries, unless the context requires the term Axtel to refer only to Axtel, S.A. de C.V. |

| | |

| “Banamex” | means Banco Nacional de México, S.A. member of Grupo Financiero Banamex. |

| | |

| “BMV” | means Bolsa Mexicana de Valores, S.A. de C.V, (the Mexican Stock Exchange) |

| | |

| “CNBV” | means Comisión Nacional Bancaria y de Valores (the Mexican Securities and Banking Commission) |

| | |

| “Common Stock” | means common registered shares without par value, that represent the Company’s capital stock. |

| | |

| “CPOs Trust” | means Irrevocable Trust Agreement No. 80471 called AXTEL CPO’s, dated November 30, 2005, which was executed between the Company, as settlor, and Nacional Financiera, Sociedad Nacional de Crédito, Institución de Banca de Desarrollo, División Fiduciaria, as trustee, and is intended to create a procedure for the transfer of Series B Shares to the trust for issuance of CPOs that may be traded in the BMV. |

| | |

| “CPOs” | means non-redeemable Ordinary Participation Certificates issued by the CPOs Trust, each CPO representing 7 Series B Shares. |

| | |

| “Declaration of Information” | means this declaration of information including any exhibits hereto. |

| | |

| “EBITDA” | means operating income plus depreciation and amortization |

| | |

| “EMISNET” | means Mexican Stock Exchange’s Electronic Communication System with Securities Issuers. |

| | |

| “Enterprise Value” | means the stockholders’ equity (price per share times the number of outstanding shares) plus interest bearing debt less cash assets. |

| “Financial Statements” | means Axtel’s proforma consolidated financial statements for the years ended on December 31, 2004 and 2005, and for the periods ended on September 30, 2005 and 2006. |

| | |

| “GHz” | means Gigahertz (billions of cycles per second). Frequency relative to a time unit. |

| | |

| “INDEVAL” | means S.D. Indeval, S.A. de C.V., Institución para el Depósito de Valores (The Depositary Trust Company). |

| | |

| “INEGI” | means Instituto Nacional de Estadística Geografía e Informática (National Institute of Statistics, Geography and Data Processing). |

| | |

| “Major Shareholders” | shall have the meaning that is assigned to it in page 5 hereof. |

| | |

| “Mexican GAAP ” | means Generally Accepted Accounting Principles in Mexico. |

| | |

| “Mexico” | means the United Mexican States. |

| | |

| “MHz” | means Megahertz. Frequency in millions of cycles per second. In radio frequency, it refers to the number of electromagnetic radiations per second. |

| | |

| “pesos”, “M.N.” and “Ps. $ ” | means the legal tender in Mexico. |

| | |

| “SEC” | means the United States Securities and Exchange Commission. |

| | |

| “Series B Shares” | means common registered Series B Class I Shares, without par value, that represent the fixed portion of the Company’s capital stock. |

| | |

| “Shareholders’ Meeting” | shall have the meaning that is assigned to it in page 4 hereof. |

| | |

| “Subsidiarias AI” or “AI Subsidiaries” | means all subsidiaries of Avantel Infraestructura, S. de R.L. de C.V. |

| | |

| “Switches” | means equipment that channels incoming voice data and makes all required connections, thus allowing telephone calls to occur. |

| | |

| “Syndicated Loan” | means the syndicated loan agreement executed on June 30, 2005 between and among Avantel and Avantel Infraestructura and ABN Amro Bank, N.V. as the administrative agent and other financial institutions therein named. |

| | |

| “Tel Holding” | means Telecomunicaciones Holding Mx, S. de R.L. de C.V. |

| | |

| “Telmex” | means Teléfonos de México, S.A. de C.V. and/or Teléfonos del Noroeste, S.A. de C.V. |

| | |

| “Trustee” or “NAFIN” | means Nacional Financiera, Sociedad Nacional de Crédito, Institución de Banca de Desarrollo, División Fiduciaria, in its capacity of Trustee of the CPOs Trust. |

| | |

| “United States” | means the United States of America. . |

| | |

| “US$ or “dollars” | means legal tender of the United States of America. |

| | |

| “VAT” | |

II. Executive Summary

2.1. Brief Description of Axtel

Axtel is a Mexican telecommunications services provider offering a wide array of services, including local and long distance telephony, data and internet, virtual private networks (“VPNs”) and value added services to business and residential customers. Through a commercial agreement with Cablemas, the Company also provides video services in the city of Tijuana. Headquartered in Monterrey, Axtel also has presence in Guadalajara, Leon, Mexico City, Puebla, Toluca, Queretaro, San Luis Potosi, Aguascalientes, Saltillo, Cd. Juarez, Tijuana, Torreon, Veracruz, Chihuahua, Celaya and Irapuato. Axtel’s current technologies include fixed wireless access, point-to-point, point-to-multipoint, copper and fiber optic. As of September 30, 2006, Axtel had 733,067 lines, representing 444,583 customers, in service.

Axtel was founded in 1994 as Telefonía Inalámbrica del Norte, S.A. de C.V. In 1994, the Company changed its name to Axtel S.A. de C.V. The Company became public in December 2005. Axtel’s corporate and financial information can be found on the Internet on www.axtel.com.mx and on the BMV’s web site www.bmv.com.mx.

2.2. Brief Description of Avantel

Avantel Concesionaria and Avantel Infraestructura are related companies offering together local, national and international long distance and data services, through a “participation agreement”.

Avantel is telecommunications services provider to business and residential customers in Mexico. Avantel is the second-largest national and international long distance services provider in Mexico, and recently increased its participation in the data segment, including Internet access. Avantel operates a 7,700- km of long-haul fiber optic network covering almost 300 cities in Mexico.

Avantel is one of the leading Internet Protocol (“IP”) -based solutions providers in Mexico. Avantel’s IP solutions adapt to customer needs, and include intelligent voice and data solutions, VPNs, integrated telecommunications services and tailor-made solutions.

In 1994, Avantel Infraestructura (originally Avantel, S.A.) and Avantel Concesionaria (originally Avantel Servicios Locales S.A.) were created from joint-venture agreements between Grupo Financiero Banamex S.A. de C.V. (through Promotora de Sistemas de Teleinformática S.A. de C.V.), owning 55.5% in both companies, and MCI Telecommunications Corp., owning the remaining 44.5% in the two companies as well. On June 30, 2005, through various debt capitalization and equity transfer transactions, Avantel Infraestructura’s capital structure resulted in Banco Nacional de México S.A. owning 89.9%, Promotora de Sistemas de Teleinformática S.A. de C.V. 0.1% and MCI Telecommunications Corp. the remaining 10%. Avantel Concesionaria also changed to reflect a 55.5% ownership by Nueva Promotora de Sistemas de Teleinformática S.A. de C.V., Banco Nacional de México S.A. with a 34.5% and MCI Telecommunications Corp. with 10%.

2.3. Relevant Aspects of the Transaction

Valuation. The transaction was structured based on a valuation of Avantel, which represents a multiple of 4.5 times Enterprise Value to expected 2006 EBITDA based on Avantel’s accounting policies.

Consolidation in the Mexican telecommunications sector. Once the Transaction is closed, Axtel will become the second largest local, national and international long-distance and data services provider in Mexico, measured in revenues and EBITDA.

Improvement on profitability. It is expected that the Transaction will increase Axtel’s profitability based on the consolidation of two corporate structures and network infrastructures in a single company.

Improvement on growth. It is expected that the Transaction will boost Axtel’s growth from the expansion of the Company’s telecommunications infrastructure, increasing the revenues and customer’s base from an optimized operation.

Geographic expansion. Once the Transaction is closed, Axtel will have presence in over 200 cities throughout Mexico.

Ease of Integration. Axtel and Avantel’s management teams have maintained a very good relationship. Certain of Avantel’s top employees will be incorporated in Axtel’s team, once the Transaction is complete.

III. Information about the Transaction

3.1. Detailed Description of the Transaction

The Transaction consists of Axtel’s purchasing Avantel Infraestructura’s assets, followed by the acquisition of all common stock of Avantel Concesionaria, Avantel Infraestructura, Avantel Escindida 2 and Subsidiarias AI. Axtel will pay US$310.95 million for the assets and common stock involved in the Transaction, and will assume US$205.0 million in net debt liabilities outstanding of the companies mentioned above.

The Transaction could also include the subscription and payment for Series B shares, represented in CPOs, from Tel Holding, representing up to 10% of Axtel’s common stock. The issuance of new stock is subject to approval at Axtel’s shareholders meeting to take place on November 29, 2006 (“Shareholders’ Meeting”). Axtel’s shareholders will vote on (i) whether to approve the issuance of new shares in such amount that Tel Holding could be able to subscribe and pay for up to 10% of Axtel’s common stock, and (ii) the subscription and payment of new shares from Tel Holding and those shareholders that decide to exercise their subscription rights in accordance with article 132 of Mexico’s Ley General de Sociedades Mercantiles. The new Series B Shares would be subscribed and paid for by Tel Holding through the CPO Trust and credited in their favor by INDEVAL.

Axtel entered into a contract (the “Agreement”) with Banamex and Tel Holding in which the terms and conditions of the Transaction were agreed, and in which all parties involved agreed to take all actions and execute all documents necessarily to close the Transaction. Among other requirements, the Transaction is subject to (i) the final approval from Axtel’s shareholders, (ii) obtaining regulatory approvals from the Comisión Federal de Competencia and the Secretaría de Comunicaciones y Transportes, and (iii) the execution of final documents.

On October 31, 2006, Axtel called a Shareholders’ Meeting to approve the transaction, among other things. The Shareholders Meeting proxy was published in a local newspaper and presented to the BMV on the same day. The meeting is expected to take place on November 29, 2006.

The Transaction will be effected as follows:

| 3.1.1 | Purchase and Sale of Assets. On the closing date of the Transaction, Axtel will acquire Avantel Infraestructura’s assets for a consideration of US$485.0 million, plus value added tax thereon in the sum of US$72.75 million. This consideration will be paid from the proceeds of the funding to be obtained by Axtel and referred to in clause 3.3 below. |

| 3.1.2 | Acquisition of Equity Participation in Avantel and the AI Subsidiaries. On the closing date of the Transaction, Axtel and one of its subsidiaries will acquire partnership interests representing 100% of the capital of Avantel Concesionaria, Avantel Infraestructura, and Avantel Escindida 2, along with shares of stock representing 100% of the capital of each one of the AI Subsidiaries (except for any shares of stock owned by Avantel Infraestructura). A consideration of US$30.95 million will be paid for the partnership interests and shares of stock described above, which consideration is subject to adjustment pursuant to the adjustment procedure previously agreed between Axtel and Banamex. This consideration will be paid from the proceeds of the funding to be obtained by Axtel and referred to in clause 3.3 below. |

| 3.1.3 | Capital Increase and Subscription of Series B Shares (in the form of CPOs) by Tel Holding. The Company and Tel Holding will execute a subscription agreement (the “Subscription Agreement”) whereby Tel Holding will have the right, but will not be required, to subscribe and pay Series B Shares (in the form of CPOs) representing up to 10% in equity participation in Axtel. |

Under the Subscription Agreement the parties shall agree on the procedure for Tel Holding to subscribe and pay for Series B Shares (in the form of CPOs) through the CPOs Trust, so that the Series B Shares will be subscribed and paid for by NAFIN as trustee of the CPOs Trust and will become a part of the assets of the CPOs Trust, and (i) NAFIN will be instructed to deposit such Series B Shares with INDEVAL, and (ii) INDEVAL will be instructed to credit to Tel Holding the corresponding number of CPOs, at the rate of one CPO per each 7 Series B Shares that are deposited with INDEVAL.

Before the Shareholders’ Meeting, Tel Holding will inform the Company whether or not it intends to subscribe and pay for Series B Shares in the form of CPOs pursuant to the above terms, and the number of

Series B Shares, if any, that Tel Holding intends to subscribe and pay for, which in no event will represent more than a 10% equity participation in Axtel after giving effect to the increase.

In case Tel Holding does elect and agree to subscribe and pay for Series B Shares in the form of CPOs pursuant to the terms of the Subscription Agreement, Axtel will submit to the consideration of the Shareholders’ Meeting a proposal for approval of (i) an increase in Axtel’s capital stock by issuing Series B Shares in a number that is sufficient for Tel Holding to subscribe and pay for Series B Shares (in the form of CPOs) representing up to 10% in equity participation in Axtel, and (ii) the subscription and payment for Series B Shares representing the capital increase by Tel Holding and any shareholders that elect to subscribe and pay such Series B Shares in exercise of their preferential right referred to by Article 132 of the Mexican General Corporation Law. The new Series B Shares shall be subscribed and paid by Tel Holding through the CPOs Trust and credited to Tel Holding in the form of CPOs through INDEVAL, pursuant to the terms of the Subscription Agreement. The capital increase will, if applicable, be effected pursuant to the terms below:

| (a) | The capital increase and the issuance of Series B Shares shall be approved at the Shareholders’ Meeting to be held on November 29, 2006; |

| (b) | The subscription price for each Series B Share or CPO, as the case may be, shall be determined by the Shareholders’ Meeting or the board of directors of Axtel; |

| (c) | The Major Shareholders and all shareholders that so elect, will waive the preferential right that is available at them under Article 132 of the Mexican General Corporation Law at the Shareholders’ Meeting, in order to allow the subscription and payment by Tel Holding of the Series B Shares (in the form of CPOs) that are to be issued. All of Axtel’s shareholders that will not waive their preferential right shall have the right to subscribe and pay for Series B Shares to be issued in proportion to their equity participation in Axtel. |

| (d) | Axtel will use all proceeds to be obtained from the subscription and payment by Tel Holding and the shareholders to repay, to the extent permitted by such proceeds, the funding referred to in clause 3.3(i) below. |

After the capital increase described above, the Company will update the registration of its Shares of Stock with the National Registry of Securities.

No shares of stock to be issued as a result of the above-mentioned capital increase will be offered, either directly or in the form of CPOs, to the general public in the United States of America or any jurisdiction other than Mexico. The shares of stock to be issued have not been and will not be registered, either directly or in the form of CPOs, under the United States Securities Act of 1933, or under the securities law of any state of the United States of America; or under the laws of any jurisdiction other than Mexico. Considering the above, the shares of stock to be issued shall not be offered, sold, delivered or transferred, directly or indirectly, in form of shares of stock or CPOs outside Mexico (including the United States of America) or to U.S. citizens or any person in the United States of America or in any jurisdiction other than Mexico.

The Company and Tel Holding will execute the following agreements with respect to all CPOs to be acquired by Tel Holding as described above: (a) Restriction to Transfer. Tel Holding shall agree not to transfer any CPOs acquired by it, for a term of 364 days following the date of acquisition thereof, except in any specific cases previously agreed by Tel Holding and the Company; and (b) Assistance in the Sale. Tel Holding may request Axtel to assist in or sponsor, up to two times, the sale of Tel Holding’s CPOs, by developing and issuing placement prospectus and participating in securities trading meetings, provided three years have run from the acquisition and payment of the CPOs by Tel Holding, and the offering is made on any stock exchange where Axtel’s Shares of Stock and/or the securities that represent them, are traded.

| 3.1.4 | Shareholders Agreement. Thomas Lorenzo Milmo Zambrano, Maria Luisa Santos de Hoyos, Alberto Santos de Hoyos, Tomas Milmo Santos, and Impra Cafe, S.A. de C.V., Axtel’s current shareholders (the“Major Shareholders“) will execute a shareholders agreement pursuant to the terms of the Mexican Securities Market Law, whereby they will agree to vote or cause to be voted all Shares of Stock owned by them in order to approve all operations related to the Transaction at the Shareholders’ Meeting, and not to exercise their preferential right with respect to the capital increase to be approved at such Shareholders’ |

Meeting. Further, the Major Shareholders will execute an agreement to grant Tel Holding the right to designate one director and his/her alternate to Axtel’s board of directors to the extent they own (either directly or indirectly through an affiliate) between 7% and 10% of Axtel’s outstanding Shares of Stock. After execution of the agreements described above, such agreements will be made available to the investing public for inspection at Axtel’s offices, pursuant to the terms of the penultimate paragraph of article 49 of the Mexican Securities Market Law.

| 3.1.5 | Avantel’s Corporate Restructure. For perfection of all operations related to the Transaction, the following acts will be taken regarding Avantel’s corporate restructure: |

| (a) | Prior to the purchase of Avantel Infraestructura’s assets by the Company as described in clause 3.1.1 above, a direct or indirect subsidiary of Citigroup, Inc. will assume Avantel Infraestructura’s debt to Banamex of approximately US$14.0 million that resulted from several service agreements executed between Avantel and Banamex, and will capitalize such debt in Avantel Infraestructura. |

| (b) | Prior to the purchase of the partnership interests and shares of stock by the Company as described in clause 3.1.2 above, all partners of Avantel Infraestructura will be allowed to reduce the capital stock or withdraw their contributions on a pro-rata basis up to the sum of US$280.0 million. |

| (c) | Prior to the purchase of the partnership interests and shares of stock by the Company as described in clause 3.1.2 above, Avantel Infraestructura will be split up, provided that Avantel Infraestructura will survive from the spin off and two new companies - “Avantel Escindida 1” and “Avantel Escindida 2” - - will be formed. |

| (d) | Prior to the purchase of the partnership interests and shares of stock by the Company as described in clause 3.1.2 above, and by using all proceeds received by Avantel Infraestructura as consideration for the sale of assets described in clause 3.1.1 above, Avantel Infraestructura will fully repay its Syndicated Loan. |

3.2. Purpose of the Transaction

The purpose of the Transaction is to create value for Axtel’s shareholders from the expected benefits of synergies, scale benefits, larger national footprint and the ability to expand Axtel’s operations in a more rapid way, among other, which should increase the competitive advantages that Axtel currently has over its competitors.

3.3. Financing Sources and Related Expenses

Axtel is in the process of obtaining the following loans to finance the Transaction: (i) a US$205.0 million loan to partially finance the purchase of assets as described in section 3.1.1, which will be used by Avantel Infraestructura to completely repay the outstanding Syndicated Loan, (ii) a US$310.95 million bridge loan to partially finance the purchase of assets and the purchase of all common stock as described in section 3.1.1 and 3.1.2, and (iii) a bridge loan for Mexican peso equivalent of US$75 million to pay the Value Added Tax derived from the purchase of assets from Avantel Infraestructura.

Axtel, Banamex and Tel Holding have agreed that each one will be responsible for its own related expenses incurred during and derived from the negotiation and documentation of the Transaction, as well as from the compliance with the conditions contained in the Agreement.

If the equity subscription takes place, Axtel will use these funds to partially repay the new debt incurred to finance the Transaction.

3.4. Date of Approval of the Transaction

The execution of the Agreement by Axtel was approved by its Board of Directors on October 17, 2006, subject to the final approval by the Shareholders’ Meeting.

On October 31, 2006, Axtel called a Shareholders’ Meeting to approve the transaction, among other things. The Shareholders’ Meeting proxy was published on a local newspaper and presented to the BMV on the same day. The meeting is expected to take place on November 29, 2006.

3.5. Accounting Treatment of the Transaction

On May of 2004, the IMCP issued the B-7 Bulletin “Business Acquisitions” (“B-7”) which is mandatory for financial statements for periods which start on or after January 1, 2005. The B-7 provides updated rules for the accounting treatment of business acquisitions and investments in associated entities, and establishes, among other aspects, the adoption of a the purchase method as the only valuation rule for these operations. Likewise, the amortization of the goodwill is eliminated and will be subject to impairment rules.

Based on B-7, the accounting registration of the Transaction will proceed, once the conditions established on the Agreement are complied with and once the closing of the Transaction is carried out.

The Transaction consists of Axtel’s purchasing Avantel Infraestructura assets, follow-up by the acquisition of all common stock of Avantel Concesionaria, Avantel Infraestructura, Avantel Escindida 2 and Subsidiarias AI.

Axtel’s records will evidence:

| · | The purchase of assets from Avantel Infraestructura. |

| · | The investment in common stock of Avantel Concesionaria, Avantel Infraestructura, Avantel Escindida 2 and Subsidiarias AI. |

| · | The long term debt incurred to finance the Transaction. |

| · | The debt to finance the VAT, generated from the purchasing of Avantel Infraestructura assets, will be recorded under current liabilities. |

| · | The excess Transaction value above the net amount assigned to fairly-valued assets and liabilities will be recorded as goodwill. Ineligible intangible assets under the C-8 Bulletin will be accounted for as goodwill. |

| · | In some cases, the values given to some of the assets and liabilities acquired will exceed the value of the acquired entity. Such variation will be applied against the value of the intangible assets with no fair market value under the C-8 Bulletin. In case an excess still exists, this amount will be applied on a pro-rata basis according to the following guidelines: |

| 1. | All remaining intangible assets |

| 2. | Plant, property and equipment, except those classified as “FOR SALE” according to the C-15 Bulletin |

| 3. | Related investments and other permanent investments. Any other non-monetary long-term asset, except inventories and assets in excess of pension benefits according to the D-3 Bulletin |

The total Transaction value will be the amount paid for the assets of Avantel Infraestructura and the payment for all common stock of Avantel Concesionaria, Avantel Infraestructura and Avantel Escindida 2, as well as all direct costs related to the Transaction, such as fees of advisors, legal consultants, accountants and appraisers.

3.6. Tax Effects of the Transaction

Below is a summary of the major tax effects for Axtel of the Transaction in Mexico, provided that this summary is not intended to describe in detail all tax provisions that could be relevant for the holders of Axtel’s Shares of Stock and/or CPOs.

| 3.6.1. | Effects for Axtel. As already stated elsewhere in this Statement, the Transaction essentially consists of the purchase by Axtel of all of Avantel Infraestructura’s assets; the acquisition of all partnership interests and shares of stock of Avantel Concesionaria, Avantel Infraestructura, Avantel Escindida 2 and the AI Subsidiaries; the borrowing of money to restructure Avantel Concesionaria’s long-term debt, by obtaining the credit facilities described in clause 3.3 hereof; and the potential subscription and payment by Tel Holding for Series B Shares in the form of CPOs representing up to 10% of equity participation in Axtel. |

| (a) | Fixed assets are deductible items for purposes of payment of Mexican income tax, and a maximum |

permitted percentage of the original price of the assets may be deducted in each fiscal year. Axtel, as buyer, may deduct the investment it made in such assets.

The transfer of Avantel Infraestructura’s fixed assets is subject to payment of Mexican value added tax, which must be paid by the buyer to the transferring entity jointly with the selling price. According to the applicable law, Axtel may deduct the value added tax so paid from the value added tax payable by it for the same period, and Axtel may even apply the excess tax, if any, to the payment of any other taxes or request the refund of such excess tax.

All fixed assets acquired must be considered for determination of the taxable base for payment of Axtel’s corporate asset tax for the year, and any debt incurred may be reduced, as provided by the applicable laws.

| (b) | For Mexican income tax purposes, Axtel is not subject to payment of this tax in connection with its acquisition of shares issued by Mexico resident corporations. |

For purposes of this tax, the cost of all shares of stock and partnership interests acquired by Axtel may be subtracted from the price used for determination of a gain or loss upon transfer of said shares or partnership interests. In case of a gain, the gain must be added to the income for the fiscal year, and in case of a loss, the loss may be deducted, subject to compliance with all requirements set forth in Article 32 section XVII of the applicable law.

The transfer of shares of stock and partnership interests is not subject to payment of value added tax in Mexico.

Further, the cost of shares of stock is not considered as part of the taxable base for payment of Mexican corporate asset tax, in that the applicable law provides that shares of stock and partnership interests issued by Mexico resident corporations should not be considered for determination of such tax.

| (c) | Any borrowed money will accrue interest payable by Axtel, which interests may be deducted as they are earned for purposes of payment of Mexican income tax, subject to compliance with all requirements for deduction of such interests that are set forth in the applicable law. |

For purposes of Mexican income tax, the average yearly balances of debts and loans are compared at the end of each fiscal year. If the debt exceeds the loans, the excess multiplied by the annual inflation rate in Mexico results in an annual adjustment for accruable inflation. If the loans exceed the debt, the excess multiplied by such inflation rate results in an annual adjustment for deductible inflation. Axtel must consider all borrowed money for computation of the annual inflation adjustment for the fiscal year.

All borrowed money may be subtracted for determination of the taxable base for computation of the corporate asset tax payable for the fiscal year, pursuant to the provisions of the applicable law.

| (d) | All capital contributions made by Tel Holding and all shareholders that exercise their preferential rights to subscribe Axtel’s Series B Shares in the form of CPOs will not constitute an accruable income of Axtel for Mexican income tax purposes. |

IV. Information Concerning the Parties Involved in the Transaction

4.1. Axtel’s Information

4.1.1 Name of the Company

Axtel, S.A. de C.V.

4.1.2. Business Description

Axtel is considered one of the leading telecommunications services providers in Mexico, offering a wide array of services, including local and long distance telephony, data and internet to business and residential customers. Axtel had 733,067 lines, representing 444,583 customers in service, as of September 30, 2006. For the fiscal period ended December 31, 2005, Axtel generated revenues and operating income of Ps. $5,080.3 million and Ps. $612.3 million, respectively.

Axtel holds concessions to offer local and long distance telecommunications services nationwide. Axtel provides services using a hybrid wireline and fixed wireless local access network designed to optimize capital expenditures through the deployment of network access equipment based on specific customer requirements. Current network last-mile access options include fixed wireless access, point-to-point and point-to-multipoint wireless technologies, as well as metropolitan fiber rings. Since inception, Axtel has invested over Ps. $12.5 billion in its network, which includes 16 digital switches, 393 fixed wireless access sites, 143 point-to-multipoint sites (of which 139 are within fixed wireless access sites) and 683 kilometers of metropolitan fiber optic rings.

Axtel’s strategy is to continue to penetrate existing markets by offering a comprehensive portfolio of high quality, facilities-based voice, data, internet and value-added communications services and to cost-effectively enter into selective new markets with high growth and revenue opportunities. The Company’s current approach is to bundle multiple voice, data and internet services into integrated telecommunications solutions for businesses and high-usage residential customers. For the year ended December 31, 2005, and the nine months ended September 30, 2006, approximately 69% and 67% of the revenues were generated from business customers, respectively.

Axtel was founded in 1994 and in June 1996 the Company was awarded by the Mexican government a concession to install and operate a public telecommunications network for the offering of local and long distance telephony services in Mexico. In 1998 and 1999, Axtel won several spectrum auctions, including for 60 MHz at 10.5 GHz for point-to-multipoint access, for 112 MHz at 15 GHz and for 100 MHz at 23 GHz for point-to-point access and for 50 MHz at 3.4 GHz for fixed wireless access, which together allow Axtel to service the entire territory of Mexico.

4.1.3. Competitive Strengths

Leading Market Position. By being one of the first competitive providers to approach customers with bundled local, long distance voice and data services, Axtel believes that it is able to meet pent-up demand for an alternative service provider, as well as establishing brand awareness and customer relationships prior to market entry by emerging competitors. Axtel has benefited from ‘‘first-competitor-to-market’’ advantage by capturing what it estimates to be approximately 9% market share of the total addressable market in the twelve cities where it offers services. In Monterrey and Guadalajara, the first two markets where it launched operations in 1999, the Company estimates that it has achieved approximately 13% market share of its coverage market in both of these cities.

Comprehensive Voice and Data Service Portfolio. Axtel provides its customers an integrated bundle of services that includes local and long distance voice services, as well as Internet, data and other value-added services. The Company believes its comprehensive service portfolio enables it to build strong, long-term relationships with customers, thereby reducing churn and increasing the return on investment in network infrastructure. Furthermore, Axtel’s digital access, transport and switching network enable the Company to capture the current revenue opportunity in voice services, while also enabling it to provide data services as demand for those services continue to grow.

Flexible, Technologically Advanced, Reliable Digital Network. Axtel’s hybrid fixed wireless and wireline local access network structure allows the Company to enter new markets quickly and cost-effectively. As a result, the return on investment in network infrastructure has increased. By using the fixed wireless access

technology model, Axtel is able to quickly cover a substantial geographic area with minimal initial capital expenditures. Axtel does not incur incremental capital expenditures for last-mile connectivity until the customer subscribes to the Company’s service. As of September 30, 2006, Axtel’s network consisted of 16 digital switches, 393 fixed wireless access sites, 143 point-to-multipoint sites (of which 139 are within fixed wireless access sites) and 683 kilometers of metropolitan fiber optic rings in order to service the 733,067 lines in service.

4.1.4. Description of the Company’s Development in the Last Year

During the last twelve-month period ended on September 30, 2006, Axtel increased by 165,876 the number of lines in service, totaling 733,067 at the end of the period. Additionally, Internet subscribers increased from 43,065 as of the end of September 30, 2005, to 61,062 on September 30, 2006.

During the last twelve months ending on September 30, 2006, local calls amounted to 1,879.6 million, while long distance minutes amounted to 552.1 million. The total amount of minutes terminated in cellular lines reached 733.9 million.

During the first quarter of 2006, Axtel started operations in Torreon, Veracruz and Chihuahua. In May and August, the Company launched operations in Celaya and Irapuato, to reach coverage in seventeen cities in Mexico. During the third quarter of 2006, net additions from Torreon, Veracruz, Chihuahua, Celaya and Irapuato amounted to 10,389 lines.

In the third quarter of 2006, Axtel started a limited deployment of a new access technology based on WiMax (“Worldwide Interoperability for Microwave Access”), called Symmetry. This technology provides Internet access of up to 2 Mbps of bandwidth for the consumer or mass-market segment.

Revenues during the last twelve months terminated on September 30, 2006, amounted to Ps. $5,612.2 million, compared to Ps. $4,828.3 million during the same period in 2005. Operating income for the last twelve months terminated on September 30, 2006, amounted to Ps. $635.1 million, compared to Ps. $490.8 million during the same period in 2005.

4.1.5. Capital Structure of Axtel

Shareholders Name | Mexican / | | | | % |

| | International | Series A | Series B | Total | Total |

| Private Investors | Mexican | 24,791,336 | 985,751,429 | 1,010,542,765 | 35.57 |

| Impra Café, S.A. de C.V. (Subsidiary of Cemex S.A. CV) | Mexican | 7,420,873 | 301,709,814 | 309,130,687 | 10.88 |

| Rendall and Associates | International | - | 717,165 | 717,165 | 0.03 |

| Blackstone Capital Partners III Merchant Banking Fund, L.P. | International | - | 217,932,979 | 217,932,979 | 7.67 |

| Blackstone Family Investment Partnership III, L.P. | International | - | 4 | 4 | 0.00 |

| Tapazeca sprl | International | - | 64,359,651 | 64,359,651 | 2.27 |

| New Hampshire Insurance Company | International | - | 90,329,891 | 90,329,891 | 3.18 |

| LAIF X sprl (AIG-GE Capital Latam Fund) | International | - | 191,552,232 | 191,552,232 | 6.74 |

| WorldTel Mexico Telecom | International | - | 7,330,392 | 7,330,392 | 0.26 |

| General Public (Float) | | - | 949,041,100 | 949,041,100 | 33.41 |

TOTAL | | 32,212,209 | 2,808,724,657 | 2,840,936,866 | 100.00 |

4.1.6. Relevant Changes in Axtel’s Financial Statements

Since the last financial statements as of December 31, 2005, and as of the date of the present Declaration of Information, no significant changes in Axtel’s Financial Statements have been presented, except for the early-redemption of approximately 35% of the Company’s 11% Senior Notes due 2013 in the first quarter of 2006. This early repayment represented a debt reduction of US$88.0 million and an increase in amortization, interest expense and other income of US$2.5, US$10.1 and US$1.8 million respectively, in the first quarter of 2006.

4.2. Avantel’s Information

4.2.1. Name of the Companies

Avantel, S. de R.L. de C.V and Avantel Infraestructura, S. de R.L. de C.V

4.2.2. Business Description

Avantel, S. de R.L. de C.V. and Avantel lnfraestructura, S. de R.L. de C.V. are affiliated companies and partners of a joint venture that offers local, domestic and international long-distance telecommunication and data services in Mexico.

Avantel is a provider-of telecommunications services to business and residential customers in Mexico. Avantel is Mexico's second largest provider of domestic and international long distance telephone services and, recently, has increased its participation in the flourishing Internet and data transmission markets. Avantel operates a fiber optic network of approximately 7,700 kilometers that reaches almost 300 cities in Mexico.

Local Services Presence

Avantel provides local telecommunication services in 24 cities in Mexico, including Puebla, Mexico City, Veracruz, Cancun, Cuernavaca, Merida, Toluca, Pachuca, Monterrey, Chihuahua, Cd. Juarez, Tijuana, Reynosa, Queretaro, Guadalajara, Aguascalientes, Leon, Acapulco, Hermosillo, San Luis Potosi, Celaya, Torreon, Saltillo and Morelia.

Concessions

Avantel has the following concessions granted by the Secretaria de Comunicaciones y Transportes:

· 2 concessions at 929 MHz for radio-messaging services;

· 60 MHz at 10.5 GHz in three regions for point to multi-point access;

· 56 MHz at15 GHz and 268 MHz at 23 GHz for nationwide point to point transport;

· 112 MHz at 37 to 38.6 GHz in five regions;

· Concession to operate a local and public telephony network.

These concessions allow Avantel to provide local, domestic and international long-distance services; to buy or lease network capacity to generate, transmit and receive data, radio electric signals, images, voice, sounds and any other data sources; to provide value added services; operator-assisted services; video, audio and video conference call services, except for pay-tv services; music and digital audio services; and pre and post-paid phone cards.

Products and Services

Avantel offers a wide array of telecommunications services including local, domestic and international long-distance services, as well as network, data, integrated and value-added services.

Avantel is one of the leading providers of Internet-Protocol solutions in Mexico. Avantel's IP solutions are especially tailored to meet the diverse needs of companies of all sizes and sectors, and their scope ranges from intelligent voice and data transmission to virtual private networks (VPNs), integrated telecommunications packages and managed services. Avantel's network is one of the largest data and voice network infrastructures in Mexico.

The sharp decline in national and international long-distance tariffs in Mexico (over 60% from 1997 to year 2005) originated a re-design on Avantel’s business strategy to focus on providing bundled value-added voice and data services to business customers. Nowadays, Avantel is one of the most important providers of telecommunications services to the federal government and financial sector in Mexico.

Marketing, Sales and Distribution

Marketing. Avantel has focused its strategy on reinforcing its position as “Mexico's IP company”, and as one the leading value-added telecommunications services providers in Mexico, based on an IP platform. Avantel’s distribution channels include, among others, direct mail, radio, TV, newspapers, magazines and Internet advertising campaigns. Avantel’s web page was named as Mexico’s “Best network and telecommunications” web page in 2005 by Mexico’s Internet Association. Additionally, Avantel's marketing activities include the implementation of strategic programs with important companies in Mexico including Aeromexico, Banamex, Spira and Telemedic, among others.

Products and Services Sale. Avantel has an important sales force that focuses on the large and corporate business segment. The sales force in each office is responsible for sales, contract negotiation and account management. Additionally, Avantel also employs approximately 200 full and part-time telemarketing sales people to supplement sales efforts to residential and small business customers.

Distribution Channels. Among the main distribution channels used by Avantel are:

| · | Alternative Distribution Channels |

| · | Direct Sales (door-to-door strategy) |

Vendors

Vendor | Product |

Cisco Systems | Routers and network and data equipments |

Nortel Networks | Telecommunications Infrastructure and Switches |

Huawei Technologies | Telecommunications Infrastructure |

Hewlett Packard | Servers |

Ericsson | Digital microwaves |

NextNet | Customer premises equipment |

Patton | Analog telephone adapters |

Network

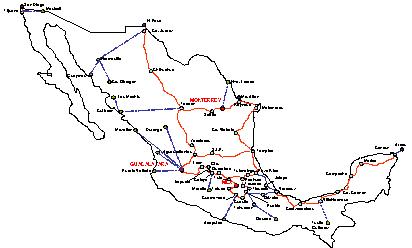

Avantel has invested over Ps. $16,718 million in network assets since 1994. Avantel’s network was built and operates within the reliability, redundancy and restoration standards of MCI in the USA. The following map shows Avantel’s current network, including ARCOS (“American Region Caribbean Ring System”, an underwater optic fiber cable connecting México, the USA, Central America’s east coast, South America’s north coast and parts of the Caribbean):

Avantel’s network key components are:

| · | Over 7,700 kilometers of long distance network; |

| · | Approximately 300 kilometers of metropolitan area fiber-optic facilities in Mexico City, Monterrey and Guadalajara, with Synchronous Digital Hierarchy ("SDH") architecture; |

| · | Local access in 24 cities, with 3 out of the 24 based on leased infrastructure; |

| · | Long distance access in 203 cities (140 cities are operated with leased infrastructure); |

| · | Four digital exchange systems capable of supporting both voice and data switched services, located in Mexico City (two), Guadalajara and Monterrey; |

| · | Two national monitoring and management centers (“NNMCs”) in Monterrey and Guadalajara. |

4.2.3. Competitive Strengths

Telecom Services Provider based on an IP platform. Avantel has focused its strategy and portfolio of products on IP technology. Avantel was one of the first companies to launch an Internet service fully operated on a 100% IP network, and, in 2000, completed the first Multiprotocol Label Switching ("MPLS”) network in Mexico that runs over an IP platform. Its IP focus permitted Avantel the bundling of products and services, in particular offering telephony services and dedicated Internet access as part of the same solution. For Avantel customers, the IP platform offers the advantage of product convergence and cost optimization. The IP platform allows Avantel to handle its own and customer’s increased data volume with no incremental network investments.

Diversified Products and Services Portfolio. Avantel provides a diversified portfolio of products and services including not only data and connectivity, but also integrated technology and communication services, such as managed security, infrastructure solutions, structured cable and network monitoring and contact centers. These products are designed to identify new business opportunities and additional needs within its customer base. This diversified product portfolio has positioned Avantel as one of the leading providers of data and telecommunications services to corporate and government clients in Mexico.

Proprietorship IT Management Model. The use of its own model has permitted Avantel the development of innovative IP-based products and services, like Probusiness, PyME Plus and NetVoice, to penetrate the consumer market. In 2005, Avantel was awarded the National Technology Award.

Provide Superior Customer Satisfaction. During 2003 and 2004, Avantel re-engineered various commercial and technology processes that permitted the alignment of its organizational areas with the needs of its customers. In early 2005, the company established specific functional goals in order to reduce response times and improve customer relations. Furthermore, Avantel has established dedicated sales teams for its largest business customers in order to identify business opportunities and needs early, as well as to offer cost-efficient and tailor-made integrated solutions.

Technologically Advanced Network. Since its inception in 1994, Avantel has invested over Ps. $16,718 million to build an extensive and modern telecommunications network. The advent of next generation technologies has allowed Avantel to exponentially increase its data and voice transmission capacity, as well as to create a state-of-the-art IP platform to provide advance services, like VPNs or NetVoice.

| 4.2.4. | Description of Avantel’s Development in the last Year |

During the first nine months of 2006, Avantel continued promoting its network, data, integrated services and voice products and services to business customers.

The increase in revenues is due mainly to new service contracts with government entities and corporate customers originated from a larger penetration of VPN network products, managed data solutions, like services provided to call centers and integrated services to important government customers.

Within the consumer segment, revenues from NetVoice increased 169%. NetVoice was awarded as the “Best Product of the Year” by VON Mexico during Expocom 2006.

During the last year, Avantel implemented the initial phase of SQM project, a system that tracks the availability and reliability levels agreed with customers. This project will help Avantel to further differentiate its customer service. On the other hand, Avantel reduced failure response and correction times to business and corporate customers by 51%.

In February 2006, Avantel received the National Technology Award for “Large Services Company”, awarded to companies that implement technology solutions to: (a) achieve competitive advantages for its business, and (b) translate these benefits to its customers and the community.

4.2.5. Capital Structure

Avantel Infraestructura (originally Avantel, S.A.) and Avantel Concesionaria (originally Avantel Servicios Locales S.A.) were created from joint-venture agreements between Grupo Financier Banamex S.A. de C.V. (through Promotora de Sistemas de Teleinformática S.A. de C.V.), owning 55.5% in both companies, and MCI Telecommunications Corp., owning the remaining 44.5% in the two companies as well, in 1994. On June 30, 2005, through various debt capitalization and equity transfer transactions, Avantel Infraestructura’s capital structure resulted in Banco Nacional de México S.A. owning 89.9%, Promotora de Sistemas de Teleinformática S.A. de C.V. 0.1% and MCI Telecommunications Corp. the remaining 10%. Avantel Concesionaria also changed to reflect a 55.5% ownership from Nueva Promotora de Sistemas de Teleinformática S.A. de C.V., Banco Nacional de México S.A. with a 34.5% and MCI Telecommunications Corp. with 10%.

On June 30, 2005, Avantel Infraestructura and certain subsidiaries, as associated companies, together with Avantel Concesionaria as associate, enacted a joint-venture or participation agreement, in order for Avantel Concesionaria to provide services and operate Avantel Infraestructura’s public telecommunications network. Avantel Concesionaria contributed the concessions, customer contracts and human resources to the joint-venture, while Avantel Infraestructura contributed the network infrastructure.

V. Risk Factors

Axtel has identified the following risk factors related to the Transaction which could significantly affect its prospects and profitability and could influence Axtel Shares’ price.

Additionally, the risk factors related to Axtel and the industry reflected in the prospectus of the public offering of Axtel CPOs, which is available at Axtel’s web site www.axtel.com.mx and at the BMV’s web site www.bmv.com.mx, should be considered. Finally, there is the possibility that Axtel’s operations may be affected by other risks which are unknown by Axtel or, are not currently considered significant.

The increase in Axtel’s leverage as a result of the Transaction, could significantly affect its growth and operation results.

To carry out the Transaction, Axtel will incur medium-term debt of approximately US$310.95 million to finance the acquisition of assets from Avantel Infraestructura as well as all common stock of Avantel Concesionaria, Avantel Infraestructura, Avantel Escindida 2 and Subsidiarias AI, and will assume approximately US$205.0 million of debt of Avantel due to the Transaction. Once the Transaction is closed, Axtel will have approximately US$705.0 million of total debt. Axtel’s level of debt will be significantly larger compared to current levels. The increase in the debt’s service costs could reduce the amount of cash, which would otherwise be available to invest in expansion or to meet other obligations. Likewise, the high level of leverage could reduce Axtel’s access to new financing sources on favorable terms, and with it, significantly affect its growth and operation results.

Lack of integration of Axtel’s and Avantel’s operations could have an adverse effect on the projected results due to the Transaction.

Once the Transaction is closed, Axtel will have to implement an integration plan for Avantel’s operation in Axtel. The success or failure of the projected results due to the Transaction will depend on the capacity of Axtel to integrate Avantel into its operations, and to maintain at the same time the operations of Axtel’s own business. On the other hand, accounting, financing and commercial practices used by Avantel are different from the practices used by Axtel, and it will be necessary to apply the practices Axtel has been using historically in the operation of Avantel. The lack of a successful integration of Avantel’s operations into Axtel could substantially reduce Axtel’s capacity to maintain and acquire new customers and have an adverse effect on the projected results of the Transaction.

Axtel may not have sufficient administrative, operational or financial resources to pursue its business strategy.

Upon the closing of the Transaction, Axtel’s administrative, operational and financial resources requirements will increase. The development of Axtel’s business and the installation and expansion of the network, services and customer base require significant expenditures. These expenditures, together with operating expenses, will adversely impact Axtel’s cash flow and profitability. If the Company is unable to meet the challenges that its growth presents, its results of operations and financial condition could be adversely affected.

The loss of Avantel’s main executives could affect Axtel’s operations.

The integration of Avantel’s administration and operations in Axtel is highly dependant on the participation of a number of key Avantel’s executives. Because these persons know Avantel’s administration and operation and have a lot of experience in the telecommunications industry, Axtel believes that the projected results of the Transaction will depend on the efforts of these individuals and, therefore, the loss of services of any of them in the short term, for any cause, could affect in a significant way Axtel’s operations and results.

Any delay in completing the Transaction may reduce or eliminate the benefits expected.

In addition to the required regulatory approvals, the Transaction is also subject to approval by Axtel’s shareholders, vendors and banks, among others. Any delay in completing the Transaction could cause Axtel not to realize some or all of the synergies that are expected to achieve if the Transaction is successfully completed within its expected timeframe.

Differences in the hiring process and employee management could have an adverse effect on the projected results due to the Transaction.

Once the Transaction is closed, Axtel will have to carry out an integration process for Avantel’s employees in Axtel. Derived from such integration process and as a result of the differences in the hiring terms and in the employees compensation scheme of Axtel and Avantel, it is possible that some labor, tax and social security contingencies may arise, which could have an adverse effect on the projected results of the Transaction.

The issuance of new Axtel Series B shares, which could be carried out as result of the Transaction, could dilute Axtel’s current shareholders and could result in a decrease in the CPOs market price.

As a result of the Transaction and of the common stock increase, Tel Holding might end up subscribing up to 10% of Axtel’s common stock. Those Axtel shareholders that do not exercise their subscription rights in accordance with Article 132 of the Ley General de Sociedades Mercantiles will suffer a dilution in their equity interest of the same percentage as Tel Holding’s subscription. Additionally, the common stock increase could result in a decrease in the market price of Axtel CPOs.

Reliance on Certain Vendors to Maintain Avantel Operations.

Avantel has heavily relied on Telmex’s dedicated links and last-mile-access network to provide services. If either one breaches the agreed contractual conditions and Telmex discontinues the provision of services to Avantel, there could be a significant effect on Avantel’s operations and an adverse effect on the projected results of the Transaction.

Dependence on certain important customers of Avantel.

There are some clients of Avantel that represent a significant portion of its revenues. During the fiscal year terminated on December 31, 2005, and the nine-month period terminated on September 30, 2006, the 20 main customers of Avantel generated approximately 30% of total revenues. In the event these customers breach some or all the conditions established in their respective commercial agreements, the Company’s revenues could be affected, and therefore, have an adverse effect on the projected results of the Transaction.

Increased dependence on the business or corporate segment

As a result of the Transaction, Axtel’s revenues generated by the business segment will increase from current 67% to 79%. This segment is being addressed by a number of carriers that offer competitive telecommunications services solutions in order to gain these accounts. Losing some of these customers could have an adverse effect on the projected results of the Transaction.

More aggressive competitive environment from representing a bigger competitor for Telmex and the remaining participants in Mexico’s telecommunications sector

Avantel has a significant participation in the provision of telecommunications services to the business segment in Mexico. As a result of the Transaction, Axtel’s presence in this market will increase significantly and might produce a more aggressive response from competitors, including Telmex, resulting in an overall price reduction. This price reduction scenario could have an adverse effect on the projected results of the Transaction.

Axtel might need additional financing

Axtel might require additional financing in the future to service the new indebtedness and fund the operations. We cannot assure you that we will have sufficient resources and that, if needed, any financing will be available in the future or on terms acceptable to us. In addition, our ability to incur additional indebtedness will be restricted by the terms of financial agreements currently in place or those new loans described in Section 3.3

VI. Selected Financial Information

The following selected financial information should be read in conjunction with “Management’s Discussion & Analysis of Financial Condition and Results from Operations”

The Selected Financial Information that is presented above has been prepared in accordance with Mexican GAAP.

The table below includes audited figures for the years ended 2004 and 2005, and unaudited figures for the nine month period ended on September 30, 2006. The table includes unaudited proforma data, adjusted to give effect as if the Transaction had closed. The unaudited proforma adjustments are based on currently available information and actual adjustments could differ materially from our current estimates. The unaudited proforma financial data do not purport to represent what our financial position actually would have been had the transaction reflected been consummated, or to project our financial position as of any future date. Accordingly, you should not place undue reliance on the unaudited proforma financial data set forth below.

The column of proforma adjustments includes the combined financial statements from Avantel Infraestructura, S. de R.L. and Subsidiaries and Avantel, S. de R.L. de C.V. (Avantel) for the years ended 2005 and 2004, adjusted for the accounting policies of the Company. The following are some of the differences of the accounting criteria between Avantel and the Company.

| a) | Revenue recognition derived from activation fees |

The financial statements include an adjustment to reflect the recognition of activation fees in the same accounting period in which the service was provided.

| b) | Recognition in cost of goods sold of the cost incurred in the billing process |

The financial statements include a reclassification showing a reduction in SG&A in the expense associated with the billing process, increasing cost of goods sold derived from such operation.

| c) | Recognition of leased interconnection links in SG&A |

The financial statements include a reclassification showing a reduction in cost of goods sold in Avantel, increasing such amount in SG&A in the proforma figures.

Financial Statements

| | | Year ended December 31, | |

| | | 2005 | | 2004 | |

| | | (Constant Pesos in millions as of September 30, 2006) | |

| | | | | | | | | | | | | | |

| | | Base Figures | | Proforma adjustments | | Proforma Figures | | Base Figures | | Proforma Adjustments | | Proforma Figures | |

| | | | | | | | | | | | | | |

Statement of Income Data: | | | | | | | | | | | | | |

| Revenues | | | 5,080.3 | | | 6,001.0 | | | 11,081.2 | | | 4,079.9 | | | 5,753.3 | | | 9,833.2 | |

| Cost of sales and operating expenses | | | (4,468.0 | ) | | (6,188.8 | ) | | (10,656.8 | ) | | (3,813.2 | ) | | (6,609.8 | ) | | (10,423.0 | ) |

| Income (loss) from operations | | | 612.3 | | | (187.8 | ) | | 424.5 | | | 266.6 | | | (856.5 | ) | | (589.9 | ) |

| Interest expense, net | | | (331.5 | ) | | (761.7 | ) | | (1,093.2 | ) | | (272.0 | ) | | (690.4 | ) | | (962.4 | ) |

| Foreign exchange gain (loss), net | | | 106.2 | | | 252.5 | | | 358.7 | | | (7.7 | ) | | (208.7 | ) | | (216.4 | ) |

| Monetary position | | | 55.6 | | | 350.2 | | | 405.8 | | | 68.4 | | | 599.7 | | | 668.1 | |

| Other income, net | | | 7.3 | | | 27.8 | | | 35.1 | | | 22.2 | | | 131.2 | | | 153.4 | |

| Income (loss) before income taxes and employee profit sharing | | | 450.0 | | | (319.1 | ) | | 130.9 | | | 77.5 | | | (1,024.7 | ) | | (947.2 | ) |

| Income tax and employee profit sharing expense | | | (159.0 | ) | | (66.7 | ) | | (225.7 | ) | | (159.0 | ) | | (91.4 | ) | | (250.4 | ) |

| Share of results in associated company | | | - | | | (2.9 | ) | | (2.9 | ) | | - | | | (1.9 | ) | | (1.9 | ) |

| Extraordinary item | | | - | | | - | | | - | | | - | | | 40.8 | | | 40.8 | |

| Net income (loss) | | | 290.9 | | | (388.7 | ) | | (97.8 | ) | | (81.5 | ) | | (1,077.2 | ) | | (1,158.7 | ) |

| | | | | | | | | | | | | | | | | | | | |

Operating Data: | | | | | | | | | | | | | |

| Depreciation and amortization | | | 1,156.1 | | | 1,162.77 | | | 2,318.7 | | | 1,057.8 | | | 1,478.3 | | | 2,536.2 | |

| Investment in fixed assets | | | 1,674.1 | | | 529.22 | | | 2,203.3 | | | 1,543.8 | | | (130.8 | ) | | 1,412.9 | |

| Net cash flow: | | | | | | | | | | | | | | | | | | | |

| Operating activities | | | 1,443.9 | | | 676.22 | | | 2,120.1 | | | 1,174.3 | | | 743.8 | | | 1,918.1 | |

| Investing activities | | | (1,729.8 | ) | | (628.0) | ) | | (2,357.8 | ) | | (1,618.5 | ) | | 84.1 | | | (1,534.4 | ) |

| Financing activities | | | 1,634.3 | | | (618.0) | ) | | 1,016.4 | | | (98.9 | ) | | (1,096.3 | ) | | (1,195.1 | ) |

| Total net cash flows | | | 1,348.5 | | | (569.8 | ) | | 778.7 | | | (543.1 | ) | | (268.4 | ) | | (811.5 | ) |

| Adjusted EBITDA | | | 1,768.3 | | | 974.8 | | | 2,743.2 | | | 1,324.5 | | | 621.9 | | | 1,946.3 | |

| Adjusted EBITDA as a percentage of Revenues | | | 34.8 | % | | 16.2 | % | | 24.8 | % | | 32.5 | % | | 10.8 | % | | 19.8 | % |

| | | Year ended December 31, | |

| | | 2005 | | 2004 | |

| | | (Constant Pesos in millions as of September 30, 2006) | |

| | | | | | | | | | | | | | |

| | | Base Figures | | Proforma adjustments | | Proforma Figures | | Base Figures | | Proforma Adjustments | | Proforma Figures | |

| | | | | | | | | | | | | | |

Balance Sheet Data: | | | | | | | | | | | | | |

| Cash and cash equivalents | | | 1,934.2 | | | (612.5 | ) | | 1,321.7 | | | 585.8 | | | (42.7 | ) | | 543.1 | |

| Net working capital investment | | | 37.0 | | | (758.1 | ) | | (721.1 | ) | | (164.5 | ) | | (1,083.7 | ) | | (1,248.2 | ) |

| Total assets | | | 11,080.9 | | | 6,457.6 | | | 17,538.5 | | | 9,126.8 | | | 7,111.5 | | | 16,238.3 | |

| Total debt | | | 2,900.3 | | | 5,687.8 | | | 8,588.1 | | | 2,318.7 | | | 6,141.0 | | | 8,459.8 | |

| Total liabilities | | | 3,841.8 | | | 7,923.5 | | | 11,765.3 | | | 3,210.9 | | | 8,188.7 | | | 11,399.5 | |

| Total shareholders’ equity | | | 7,239.1 | | | (1,465.9 | ) | | 5,773.2 | | | 5,916.0 | | | (1,077.2 | ) | | 4,838.8 | |

| Capital stock | | | 8,221.2 | | | - | | | 8,221.2 | | | 7,509.0 | | | - | | | 7,509.0 | |

| | | Nine months ended September 30, | |

| | | 2006 | | 2005 | |

| | | (Constant Pesos in millions as of September 30, 2006) | |

| | | | | | | | | | | | | | |

| | | Base Figures | | Proforma adjustments | | Proforma Figures | | Base Figures | | Proforma Adjustments | | Proforma Figures | |

| | | | | | | | | | | | | | |

Statement of Income Data: | | | | | | | | | | | | | |

| Revenues | | | 4,261.0 | | | 4,301.9 | | | 8,562.9 | | | 3,729.1 | | | 4,471.7 | | | 8,200.8 | |

| Cost of sales and operating expenses | | | (3,791.8 | ) | | (4,267.7 | ) | | (8,059.4 | ) | | (3,282.7 | ) | | (4,506.2 | ) | | (7,788.9 | ) |

| Income (loss) from operations | | | 469.2 | | | 34.2 | | | 503.4 | | | 446.4 | | | (34.5 | ) | | (411.9 | ) |

| Interest expense, net | | | (253.4 | ) | | (392.4 | ) | | (645.7 | ) | | (252.1 | ) | | (592.1 | ) | | (844.2 | ) |

| Foreign exchange (loss) gain, net | | | (35.6 | ) | | (103.7 | ) | | (139.3 | ) | | 82.5 | | | 216.9 | | | 299.4 | |

| Monetary position | | | 17.5 | | | 215.7 | | | 233.2 | | | 29.7 | | | 200.9 | | | 230.6 | |

| Other (expense) income, net | | | (17.4 | ) | | (16.6 | ) | | (34.0 | ) | | 4.1 | | | 14.4 | | | 18.5 | |

| Income (loss) before income taxes and employee profit sharing | | | 180.4 | | | (262.8 | ) | | (82.4 | ) | | 310.6 | | | (194.4 | ) | | 116.2 | |

| Income tax and employee profit sharing expense | | | (48.6 | ) | | (38.8 | ) | | (87.3 | ) | | (99.2 | ) | | (71.7 | ) | | (171.0 | ) |

| Share of results in associated company | | | - | | | (3.4 | ) | | (3.4 | ) | | - | | | (2.3 | ) | | (2.3 | ) |

| Net income (loss) | | | 131.8 | | | (304.9 | ) | | (173.1 | ) | | 211.4 | | | (268.4 | ) | | (57.1 | ) |

| | | | | | | | | | | | | | | | | | | | |

Operating Data: | | | | | | | | | | | | | | | | | | | |

| Depreciation and amortization | | | 1,048.7 | | | 818.6 | | | 1,867.3 | | | 841.1 | | | 768.6 | | | 1,609.7 | |

| Investment in fixed assets | | | 1,169.8 | | | 943.6 | | | 2,113.5 | | | 1,094.5 | | | 365.5 | | | 1,459.9 | |

| Net cash flow: | | | | | | | | | | | | | | | | | | | |

Operating activities | | | 1,225.1 | | | 986.6 | | | 2,211.7 | | | 895.5 | | | 397.2 | | | 1,292.7 | |

| Investing activities | | | (1,200.2 | ) | | (1,098.0 | ) | | (2,298.2 | ) | | (1,121.7 | ) | | (382.7 | ) | | (1,504.4 | ) |

| Financing activities | | | (896.3 | ) | | (199.2 | ) | | (1,095.5 | ) | | 700.4 | | | (584.7 | ) | | 115.7 | |

| Total net cash flows | | | (871.4 | ) | | (310.7 | ) | | (1,182.0 | ) | | 474.1 | | | (570.2 | ) | | (96.1 | ) |

| Adjusted EBITDA | | | 1,517.9 | | | 852.8 | | | 2,370.7 | | | 1,287.5 | | | 734.1 | | | 2,021.6 | |

| Adjusted EBITDA as a percentage of Revenues | | | 35.6 | % | | 19.8 | % | | 27.7 | % | | 34.5 | % | | 16.4 | % | | 24.7 | % |

| | | Nine months ended September 30, | |

| | | 2006 | | 2005 | |

| | | (Constant Pesos in millions as of September 30, 2006) | |

| | | | | | | | | | | | | | |

| | | Base Figures | | Proforma adjustments | | Proforma Figures | | Base Figures | | Proforma Adjustments | | Proforma Figures | |

| | | | | | | | | | | | | | |

Balance Sheet Data: | | | | | | | | | | | | | |

| Cash and cash equivalents | �� | | 1,062.9 | | | (923.2 | ) | | 139.7 | | | 1,059.9 | | | (612.9 | ) | | 447.0 | |

| Net working capital investment | | | 23.2 | | | (886.9 | ) | | (863.7 | ) | | 124.9 | | | (540.7 | ) | | (415.9 | ) |

| Total assets | | | 10,409.6 | | | 6,235.7 | | | 16,645.3 | | | 9,995.1 | | | 6,488.2 | | | 16,483.2 | |

| Total debt | | | 1,967.8 | | | 5,811.2 | | | 7,778.9 | | | 3,039.7 | | | 5,943.8 | | | 8,983.6 | |

| Total liabilities | | | 3,016.2 | | | 8,006.5 | | | 11,022.7 | | | 3,914.8 | | | 7,833.8 | | | 11,748.6 | |

| Total shareholders’ equity | | | 7,393.4 | | | (1,770.8 | ) | | 5,622.6 | | | 6,080.3 | | | (1,345.6 | ) | | 4,734.7 | |

| Capital stock | | | 8,221.2 | | | - | | | 8,221.2 | | | 7,509.0 | | | - | | | 7,509.0 | |

Adjusted EBITDA Reconciliation

| | | Year ended December 31, | |

| | | | | | | | | | | | | | |

| | | 2005 | | 2004 | |

| | | (Constant Pesos in millions as of September 30, 2006) | |

| | | | | | | | | | | | | | |

| | | Base Figures | | Proforma adjustments | | Proforma Figures | | Base Figures | | Proforma Adjustments | | Proforma Figures | |

| | | | | | | | | | | | | | |

| Net income (loss) | | | 290.9 | | | (388.7 | ) | | (97.8 | ) | | (81.5 | ) | | (1,077.2 | ) | | (1,158.7 | ) |