- BATL Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

8-K/A Filing

Battalion Oil (BATL) 8-K/AEntry into a Material Definitive Agreement

Filed: 14 Nov 05, 12:00am

Acquisition of RAM Energy, Inc. by

Tremisis Energy Acquisition Corporation

Road Show Presentation

November 14, 2005

The attached slide show was previously filed with the Securities and Exchange Commission on November 14, 2005 as

part of Amendment No. 1 (“Amendment”) to the Current Report on Form 8-K originally filed by Tremisis Energy

Acquisition Corporation with the Securities and Exchange Commission on October 26, 2005 (“October 2005 8-K”).

Tremisis is holding presentations for certain of its stockholders, as well as other persons who might be interested in

purchasing Tremisis’ securities, regarding its merger with RAM Energy, Inc., as described in the October 2005 8-K and

Amendment. The attached slide show, as well as the October 2005 8-K and Amendment (and exhibits thereto) are being

distributed to attendees of today’s presentation.

Earlybirdcapital, Inc. (“EBC”), the managing underwriter of Tremisis’ initial public offering (“IPO”) consummated in May

2004, is assisting Tremisis in these efforts without charge, other than the reimbursement of its out-of-pocket expenses.

Tremisis and its directors and executive officers, and EBC may be deemed to be participants in the solicitation of proxies

for the special meeting of Tremisis stockholders to be held to approve the merger.

Stockholders of Tremisis and other interested persons are advised to read, when available, Tremisis’ preliminary proxy

statement and definitive proxy statement in connection with Tremisis’ solicitation of proxies for the special meeting

because these proxy statements will contain important information. Such persons can also read Tremisis’ final

prospectus, dated May 12, 2004, for a description of the security holdings of the Tremisis officers and directors and of

EBC and their respective interests in the successful consummation of this business combination. The definitive proxy

statement will be mailed to stockholders as of a record date to be established for voting on the merger. Stockholders will

also be able to obtain a copy of the definitive proxy statement, without charge, by directing a proxy statement and

definitive proxy statement, once available, and the final prospectus can also be obtained, without charge, at the

Securities and Exchange Commission’s Internet site (http://www.sec.gov).

1

RAM Energy, Inc.

Disclosure Statement

This document contains forward-looking statements within the meaning of Section

27A of the Securities Act of 1933, as amended, and Section 21E of the Securities

Exchange Act of 1934, as amended. All statements, other than statements of historical

fact, including, without limitation, statements regarding RAM’s financial position,

business strategy, plans and RAM’s management’s objectives and its future operations,

and industry conditions, are forward-looking statements. Although RAM believes that

the expectations reflected in such forward-looking statements are reasonable, RAM can

give no assurance that such expectations will prove to be correct. Important factors

that could cause actual results to differ materially from RAM’s expectations (“Cautionary

Statements”) include, without limitation, the actual qualities of RAM’s oil and natural gas

reserves, future production levels, future prices and demand for oil and natural gas, the

results of RAM’s future exploration and development activities, future operating and

development costs, the effect of existing and future laws and governmental regulations

(including those pertaining to the environment), the results of future financing efforts,

and the political and economic climate of the United States. All subsequent written and

oral forward-looking statements attributable to RAM, or persons acting on RAM’s behalf,

are expressly qualified in their entirety by the Cautionary Statements.

3

COMPANY CONTACTS

TREMISIS

RAM

LAWRENCE S. COBEN LARRY E. LEE

CHAIRMAN AND CEO CHAIRMAN AND CEO

ISAAC KIER

JOHN LONGMIRE

TREASURER

SR VP AND CFO

212-397-1464

918-663-2800

KATHLEEN HEANEY

INVESTOR RELATIONS

203-803-3585

4

Tremisis-RAM Merger

Transaction Overview

Tremisis and RAM to merge to create new publicly traded entity -

RAM Energy Holdings, Inc.

Tremisis to issue 25.6 mm shares to RAM shareholders

Tremisis to pay $30 mm to RAM shareholders

Total transaction value of approximately $300 mm

Tremisis shareholders will own 23% and RAM shareholders will

own 77% of outstanding common stock post merger

Tremisis will designate one member of the Board and the majority

of the Board will be independent

5

Excellent Fundamentals of Oil

& Gas Industry

Oil & Gas supply/demand fundamentals create strong pricing

environment for the foreseeable future

Limited inventory of high quality domestic drilling prospects

Drilling economics are excellent despite increasing service

costs

6

Company Highlights

Founded in 1987

Exploration and production company focused in Oklahoma,

Texas and Louisiana

Management team with significant experience

Growth through selected acquisitions, development drilling and

exploitation

Drilling success rate of 92% since 1989

7

Investment Highlights

Experienced management team with successful track record

High quality, diversified portfolio of long-lived producing assets

Large inventory of PUD drilling locations and recompletion

projects

Growth potential in emerging resource plays

Balanced growth strategy

Increased access to capital markets

Excellent fundamentals of Oil & Gas Industry

Attractive valuation

8

Valuation Overview

RAM

Peers

(5)

55.0

11.9

2.0x

$26.58

71.0

14.0

1.3x

0.57x

TEV/Reserves ($/BOE)

TEV/PV-10

Reserve Life Index(in Years)

% Proved Developed

Net Asset Value per Share

(1) Pro Forma the merger

(4)

(4) PV-10 is based on YE 2004 proved reserves and prices as reported by RAM and Peers

$15.42

$9.61

Price/NAV

(2)

(1)

not include RAM’s unproved reserves or oil and gas gathering and processing assets,

(3) Peer group estimates are based on First Call Analysts’ Consensus estimates

(5) NAV is based on PV-10% of proved reserves and pricing at September 30, 2005 and does

also does not include exercise of outstanding warrants

(3)

(2) Peers include ABP, BEXP, CRZO, CWEI, DPTR, EPEX, DGP, PLLL

9

Company Overview

10

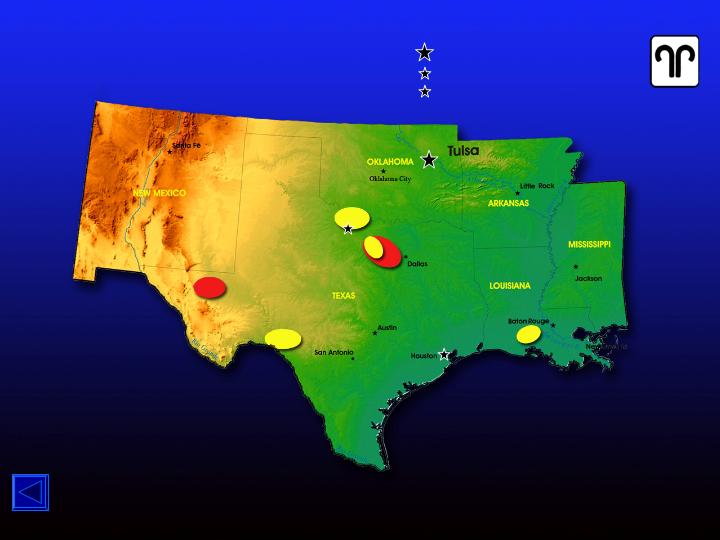

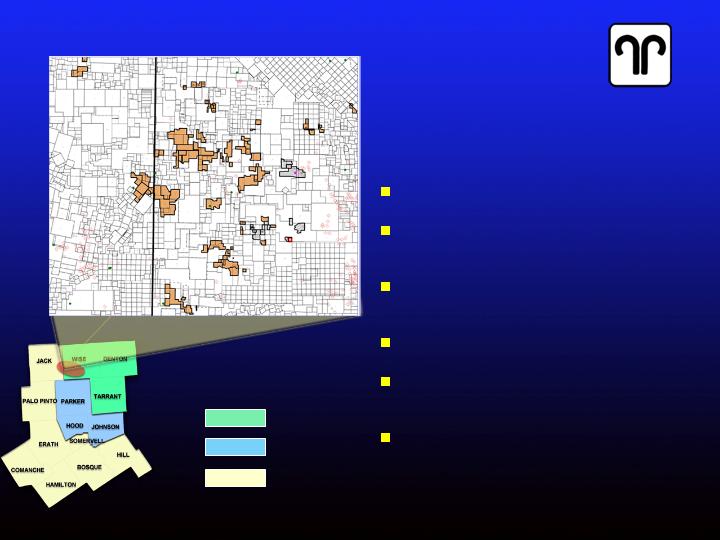

Principal Fields

Emerging Resource Areas

Tulsa Office

Tulsa Office

Houston-District Office

Electra-Field Office

I

II

III

IV

A

B

I Electra/Burkburnett

II Egan

III Boonsville

IV Vinegarone

A Barnett Shale –

Fort Worth Basin

Reeves County, TX

B Barnett & Woodford Shale -

Areas of Interest

11

Company Highlights

Experienced management team with successful track record

19.7 MMBOE total Proved Reserves with PV-10% of $445 million

238 undrilled PUD locations and 187 recompletion projects

Stable production and long-life reserves

Operate over 89% of PV-10% proven reserve value

Significant acreage position in emerging resource areas

As of September 30, 2005

12

Investment Highlights

Experienced management team with successful track record

Senior management average experience of over 25 years

Management will have significant ownership of combined company

Significant growth in reserves, production and EBITDA

92% success rate in drilling since 1989

Completed 20 acquisitions totaling $400 mm

Technical and operating experience in a variety of geographic and

geologic areas

13

Investment Highlights

High quality, diversified portfolio of long-lived producing assets

19.7 MMBOE of Proved Reserves with PV-10% of $445 mm

Developed reserves represent 71% of total proved reserves

Reserve life index of 14 years

Operate 89% of proved reserves

Balance of oil (60%) and gas (40%)

Situated in prolific producing basins with a long history of production

and multiple pay zones

As of September 30, 2005

14

Investment Highlights

Large inventory of PUD drilling locations and recompletion

projects

Low risk infill drilling/recompletion program

238 PUD drilling locations with estimated CAPEX of $39.7 mm

187 recompletion projects with estimated CAPEX of $6.5 mm

Low finding and development costs

15

Investment Highlights

Growth potential in emerging resource plays

Barnett Shale – Fort Worth Basin

Largest and most active natural gas field in Texas

28,000 gross and 6,800 net acres, all HBP leasehold

127 horizontal drilling locations with 23%-36% WI

Operating partners: Chief Oil & Gas and EOG Resources

Current proved reserves exclude Barnett Shale potential

Barnett Shale and Woodford Shale – Reeves County, TX

Exploration play

70,000 gross and 11,000 net acres

Keys to success are horizontal drilling and fracture stimulation

Current proved reserves exclude Reeves County potential

16

Investment Highlights

Balanced growth strategy

Exploitation and development of significant inventory of projects

Accelerate development of Barnett Shale – Fort Worth Basin

Increase exploration activity in Barnett and Woodford Shale –

Reeves County

Pursue selected acquisition opportunities

Strategy allows the Company to adjust quickly and

capitalize on economic conditions

17

Investment Highlights

Increased access to capital markets

Acceleration of $85 mm CAPEX drilling/recompletion program

Refinance long term debt with new credit facility, providing

additional liquidity

Opportunistically access equity markets to improve balance sheet

Warrants provide potential additional equity (approximately $63 mm)

18

Property Overview

Stable production and long-life reserves

Oil and gas fields with multiple pay zones

Low-cost development projects

Operate over 89% of reserve value

Substantial emerging resource position

19

Proved Reserves

126

568

5.8

Undeveloped

$445

$1,174

19.7

Total Proved

319

606

13.9

Developed

SEC Pricing: Oil=$63.62/BBl Gas=$12.70/MCF

PV-10%

$MM

FNR

$MM

MMBOE

As of September 30, 2005

20

Proved Reserves Overview

Total Proved Reserves: 19.7 MMBOE

71%

29%

Developed

PUD

60%

40%

Oil

Natural Gas & NGL’s

As of September 30, 2005

21

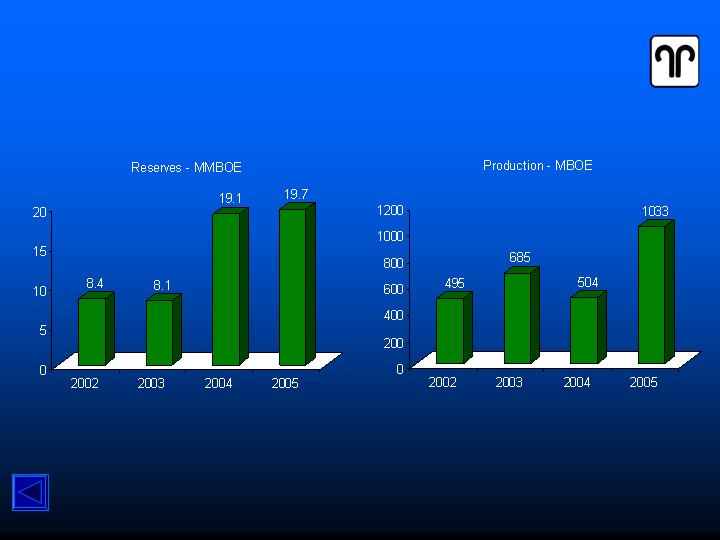

Proven Reserves and

Production

(2)

(1)

(2)

(1) Results are affected by acquisitions and dispositions during each of the periods

(2) As of September 30, 2005

(1)

(1)

22

RAM Proved Reserve Summary

2004

2005

Beginning reserves (MMBOE)

Production

Property Sales

Additions & Revisions

Ending reserves (MMBOE)

Finding Costs Per BOE

As of September 30, 2005

8.1

19.1

(1.0)

13.7

1.8

19.1

19.7

$6.50

$6.04

(2.0)

(0.2)

(0.5)

23

Drilling Success Rate

0

Dry Holes……….

4

4

Currently Drilling

or Completing…

450

52

Total………………

Success Ratio…..

410

48

36

Producers………

Drilling Results

(2) Excluding wells in progress

(1) Since 1989 through September 30, 2005

(1)

(2)

Total

Wells

FY2005

Wells

92%

100%

24

Drilling / Recompletion Projects

25

As of September 30, 2005

$ in millions

Proved Reserves

Projects

Future

Capital

PUD Locations

238

$39.7

Recompletions

187

$6.5

Total Proved

425

$46.2

Barnett Shale Locations

127

$38.8

Total Projects

552

$85.0

Principal Fields

84%

84%

Percent of total Proved Reserves

$34.4

$374.4

1.2

16.2

Vinegarone

Total

$56.6

1.3

Egan

$60.2

3.2

Boonsville

As of September 30, 2005

PV-10%

MMBOE

Property:

$223.2

10.5

Electra/Burkburnett

$ in millions

26

Summary Financial and

Operating Data

$ 27.7

$ 5.1

$ 9.1

EBITDA

1,033

504

685

Production(MBOE)

$ 48.3

$ 17.7

$ 20.5

Oil & Gas Revenue

YTD

Ended

9/30/05

2004

2003

$ In Millions

* Results are affected by acquisitions and dispositions during each of the periods.

27

Investment Highlights

Experienced management team with successful track record

High quality, diversified portfolio of long-lived producing assets

Large inventory of PUD drilling locations and recompletion

projects

Growth potential in emerging resource plays

Balanced growth strategy

Increased access to capital markets

Excellent fundamentals of Oil & Gas Industry

Attractive valuation

28

Appendix

I.

Principal Fields

II.

Emerging Resource Areas

III.

Officers and Management

IV.

Hedging Positions

V.

Glossary of Terms

29

I. Principal Fields

Electra/Burkburnett Area, Wichita and Wilbarger

Counties, Texas

Egan Field, Acadia Parish, Louisiana

Boonsville Area, Jack and Wise Counties, Texas

Vinegarone Field, Val Verde County, Texas

30

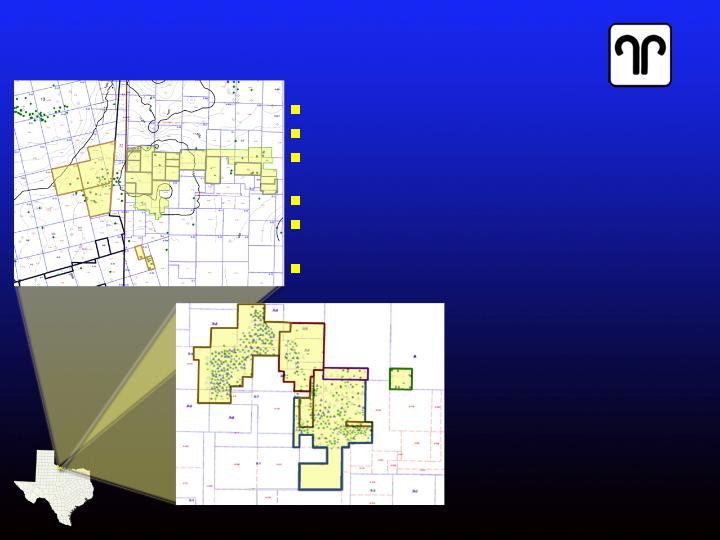

Electra/Burkburnett Area, Wichita and

Wilbarger Counties,Texas

Proved reserves of 10,540 MBOE

PV-10% = $223.2 million

Net monthly production of over 56,000

BOE from 490 producers

209 identified PUD drilling locations

100% WI ownership & operational

control

Gas plant and gathering system

As of September 30, 2005

31

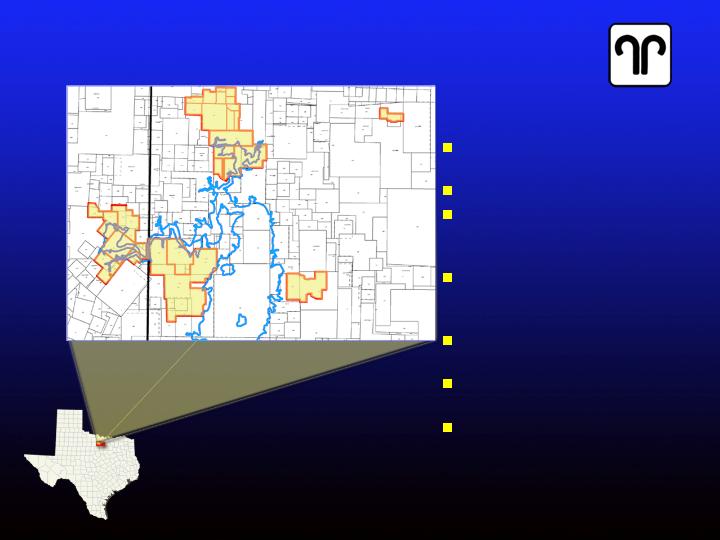

Egan Field, Acadia Parish, Louisiana

Proved reserves of 1,712 MBOE

PV-10% = $56.6 million

Net monthly production of over

8,000 BOE from 11 producers

Multizone recompletion

potential in 10 existing

wellbores

Operating and ownership

control of field

Seismic analysis may lead to

future drilling opportunities

As of September 30, 2005

32

Boonsville Area, Jack and Wise Counties, Texas

Proved reserves of 3,171

MBOE

PV-10% = $60.2 million

Net monthly production of

over 19,000 BOE from 89

producers

22 identified drilling

locations and numerous

low-cost workovers

Operating control of 88

producing wells

Producing wells hold

Barnett Shale rights

25 miles of gas gathering

system

As of September 30, 2005

33

Vinegarone Field, Val Verde County, Texas

Proved reserves of 1,186 MBOE

PV-10% = $34.4 million

Net monthly production of over

6,500 BOE from 7 non-operated

producers

7 identified infill wells to be

drilled

Long-lived natural gas field

As of September 30, 2005

34

II. Emerging Resource Areas

Barnett Shale - Fort Worth Basin, Jack and Wise

Counties, Texas

Barnett and Woodford Shale -Exploration Project,

Reeves County, Texas

35

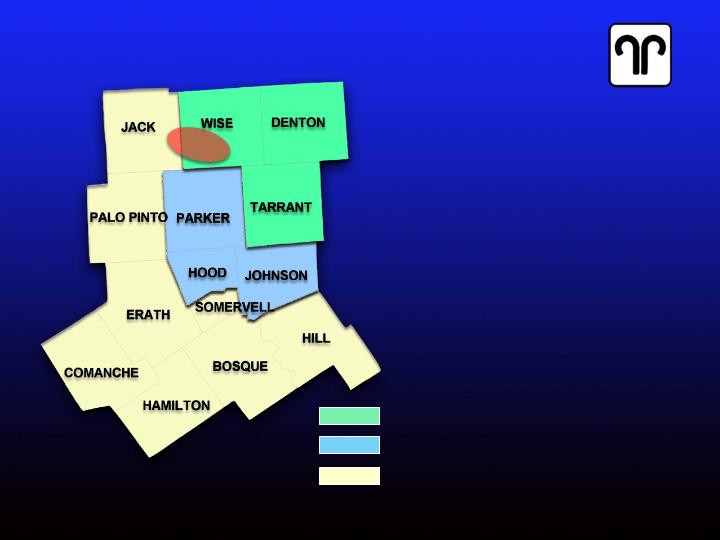

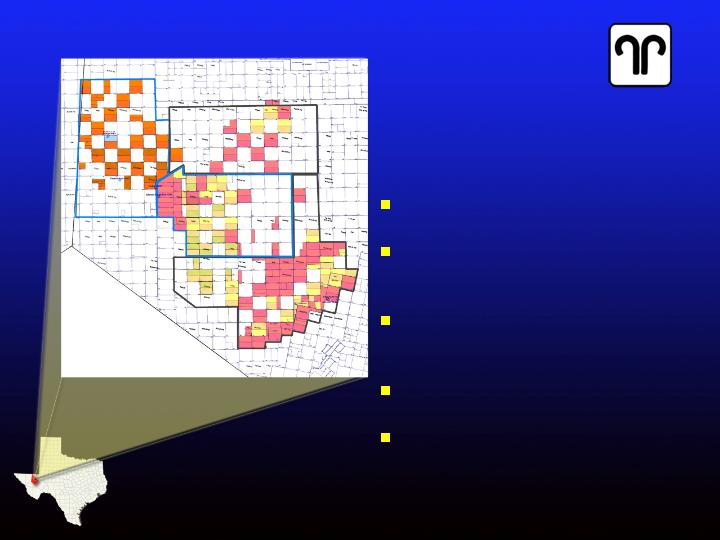

Core

Tier 1

Tier 2

Emerging Resource Area - Barnett Shale

Industry

1.1 Bcfed from over 3,600 wells

Wells: 4,000’ – 11,000’;

$400 M - $2,600 M

Major activity focused on Denton,

Wise, Tarrant, Johnson and

Parker counties

Gas production established in

Hood, Jack, Erath and Palo

Pinto counties

Map Source: Pickering Energy Partners

Fort Worth Basin

36

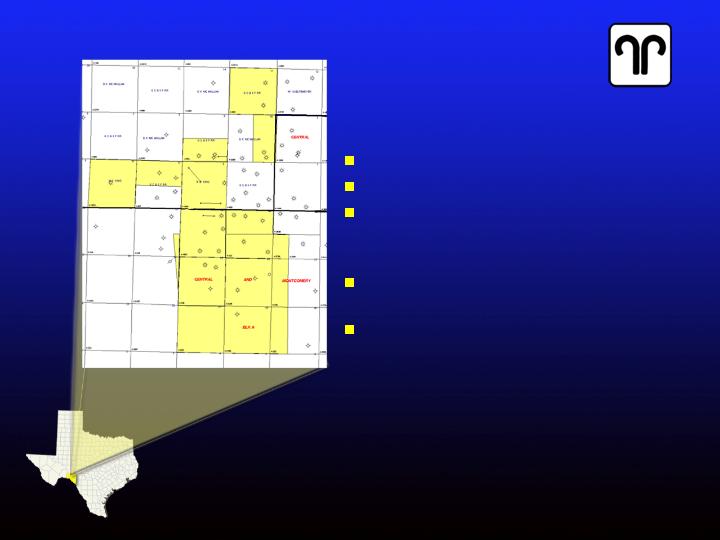

Barnett Shale, Jack and Wise Counties, Texas

RAM Acreage

Located in the largest natural gas

field in Texas

Own WI ranging from 23-36% in

nearly 28,000 gross acres lying

within a 43 square mile area

127 locations identified for

horizontal drilling on HBP

leasehold

Over 80% of the acreage lies in

“core” area*

Commercial production on this

acreage has been confirmed by

multi-well drilling

Current proved reserves exclude

any Barnett Shale potential

Core

Tier 1

Tier 2

*Per Pickering Energy Partners, Inc. October 2005

titled “The Barnett Shale, Visitors Guide to the Hottest

Gas Play in the US”

37

Barnett Shale and Woodford Shale, Exploration

Project, Reeves County, Texas

RAM Acreage

Exploration play - 70,000 gross

acres (11,000 net)

Estimated thickness of the Barnett

is between 400’-700’ and the

Woodford varies from 200’-400’

Capital risk minimized through

third-party drilling commitments

to earn farmout agreements

Participating interests range from

6.25-18.75%

Keys to success are horizontal

drilling and fracture stimulation

38

28 Years

16 Years

Production Accounting Manager

Forrest Fischer

4 Years

4 Years

Product Marketing Manager

Brandon Lee

34 Years

8 Years

Operations Engineer

Mike Kaiser

20 Years

5 Years

Senior Reservoir Engineer

Ronald Strawser

33 Years

7 Years

Reservoir Engineering Manager

Sherman Hyatt

33 Years

8 Years

Operations Manager

John Frick

Engineering &

Operations:

29 Years

6 Months

Vice President Finance

John Cox

28 Years

16 Years

Sr. Vice President, Land & Exploration

Drake Smiley

32 Years

15 Years

Sr. Vice President, CFO

John Longmire

37 Years

16 Years

Sr. Vice President, Operations

Larry Rampey

30 Years

22 Years

Chairman, CEO

Larry Lee

Officers:

INDUSTRY

EXPERIENCE

RAM

EXPERIENCE

TITLE

NAME

III. Officers and Management

39

*Consultant to RAM

27 Years

11 Years

Average Experience

30 Years

16 Years

Drilling/Completion Supervisor

Dennis Pratt

20 Years

13 Years

Drilling/Completion Supervisor

Gary Gibson

20 Years

13 Years

Drilling/Completion Supervisor

Mark Newton

31 Years

16 Years

Electra Operations Manager

Jacky Simmons

Field Operations:

28 Years

6 Years

Senior Geologist

Rick Erickson*

26 Years

1 Year

Senior Geologist

Manny Redifer

25 Years

8 Years

Land Manager

Tully Davis

Land and Geology:

INDUSTRY

EXPERIENCE

RAM

EXPERIENCE

TITLE

NAME

III. Officers and Management

40

IV. Hedging Positions

As of September 30, 2005

41

Year

per day

Price

per day

Price

per day

Price

per day

Price

2005

1,500

$40.00

500

$46.00

6,000

$6.00

6,000

$8.47

2006

1,750

$42.15

1,500

$60.56

5,247

$6.23

5,247

$8.60

2007

1,000

$35.00

1,000

$69.74

1,233

$7.00

1,233

$11.95

2005

500

$55.75

-

-

2006

-

-

5,000

$9.50

Secondary Floors

Secondary Floors

Crude Oil (Bbls)

Natural Gas (Mmbtu)

Primary Floors

Ceilings

Floors

Ceilings

Natural gas floors and ceilings for 2007 are for January through March and natural gas secondary floors for

2006 are for April through October.

BOE - Barrel of Oil Equivalent

BOE is comprised of the following product types:

Oil: 1 barrel = 1 BOE NGL: 42 gallons = 1 BOE Natural Gas: 6 Mcf’s = 1 BOE

Mcf –Million cubic feet

NGL - Natural Gas Liquids

MBOE – Thousand Barrels of Oil Equivalent

MMBOE – Million Barrels of Oil Equivalent

FNR – Future net revenue is the net cash flow over the life of the reserves

PV-10% - Present value of Future Net Revenue less severance taxes and operating cost discounted at 10%

PDP -Proved developed reserves of oil and gas that can be expected to be recovered through existing

equipment and operating methods

PUD -Proved undeveloped reserves of oil and gas are reserves that are expected to be recovered from new

wells on undrilled acreage, or from existing wells where a relatively major expenditure is required for

recompletion

HBP – Held by production extends the lease beyond its primary term and in most cases has a currently

producing well on the lease

PF – Pro Forma

WI -Working Interest is theinterest owned in an oil and gas lease

Reserve Life Index – total volume of proved reserves divided by current year’s production

V. Glossary of Terms

42