Exhibit 3.1

CERTIFICATE OF DESIGNATION,

PREFERENCES, RIGHTS AND LIMITATIONS

of

8% AUTOMATICALLY CONVERTIBLE PREFERRED STOCK

of

HALCÓN RESOURCES CORPORATION

Pursuant to Section 151 of the Delaware General Corporation Law

Halcón Resources Corporation, a Delaware corporation (the “Corporation”), certifies that pursuant to the authority contained in its Amended and Restated Certificate of Incorporation, and in accordance with the provisions of Section 151 of the Delaware General Corporation Law (the “DGCL”), its Board of Directors (the “Board”) has adopted the following resolution creating a series of Preferred Stock, par value $0.0001 per share, designated as 8% Automatically Convertible Preferred Stock:

RESOLVED, that a series of the class of authorized $0.0001 par value Preferred Stock of the Corporation is hereby created, and that the designation and amount thereof and the voting powers, preferences and relative, participating, optional and other special rights of the shares of such series, and the qualifications, limitations or restrictions thereof are as follows:

1.Designation and Amounts.

This series of Preferred Stock is designated as the “8% Automatically Convertible Preferred Stock” (the “Convertible Preferred”) and the number of shares initially constituting such series shall be 15,000, which number may be decreased (but not increased) by the Board without a vote of the stockholders;provided,however, that such number may not be decreased below the number of then currently outstanding shares of Convertible Preferred and shares of Convertible Preferred issuable on exercise of rights to acquire Convertible Preferred.

2.Rank.

The Convertible Preferred shall rank senior to the $0.0001 par value common stock (“Common Stock”) of the Corporation, and any other class or series of stock issued by the Corporation ranking junior as to the Convertible Preferred with respect to payment of dividends, or upon liquidation, dissolution or winding up of the Corporation (collectively, “Junior Securities”). The Convertible Preferred shall rank junior to all Senior Securities with respect to both the payment of dividends and the distribution of assets on liquidation, winding up and dissolution. “Senior Securities” means any class or series of stock issued by the Corporation ranking senior to the Convertible Preferred with respect to payment of dividends, or upon liquidation, dissolution or winding up of the Corporation.

3.Dividends.

(a) Commencing April 6, 2013 (“Grace Period Expiration Date”), the holders of the Convertible Preferred shall be entitled to receive out of any assets legally available therefor dividends on each outstanding share of Convertible Preferred at the rate of 8% per annum of the

1

Liquidation Preference (as defined inSection 4(a)) per share from the earliest original issue date of any shares of the Convertible Preferred (the “Issue Date”), payable quarterly in cash, subject toSection 3(c), on March 31, June 30, September 30 and December 31 of each year (each a “Dividend Payment Date”), beginning June 30, 2013, when, as and if declared by the Board, in accordance with the preference and priority described inSection 2 with respect to any payment of any dividend on the Common Stock or any other class or series of stock of the Corporation. Such dividends shall accrue on a daily basis from the Issue Date, whether or not in any period the Corporation is legally permitted to make the payment of such dividends and whether or not such dividends are declared. Neither conversion on or after the Grace Period Expiration Date nor redemption of the Convertible Preferred on or after the Grace Period Expiration Date shall affect any holder’s right to receive any accrued but unpaid dividends on such Convertible Preferred. Notwithstanding any other provision herein, no dividends shall be payable or accrue on the Convertible Preferred if conversion, as described inSection 5, occurs before the Grace Period Expiration Date.

(b) Dividends shall be calculated on the basis of the time elapsed from but excluding the last preceding Dividend Payment Date (or the Issue Date in respect to the first dividend payable on June 30, 2013) to and including the Dividend Payment Date or any final distribution date relating to conversion or redemption or to a dissolution, liquidation or winding up of the Corporation. Dividends payable on the shares of Convertible Preferred for any period of less than a full calendar year shall be prorated for the partial year on the basis of a 360-day year of twelve, 30-day months.

(c) To the extent any accrued dividends are not declared and paid in full in cash on a Dividend Payment Date, the Liquidation Preference of each share of Convertible Preferred outstanding as of such Dividend Payment Date shall automatically be increased by an amount equal to the unpaid amount of the dividend that shall have accrued on such share to and including the Dividend Payment Date, effective as of the date immediately following such Dividend Payment Date. The Liquidation Preference, as so adjusted, shall thereafter be used for all purposes hereunder, including for purposes of the accrual of future dividends in accordance withSection 3(a), the determination of the Liquidation Preference in accordance withSection 4(a) and the determination of the number of shares of Common Stock into which the shares of Convertible Preferred are convertible in accordance withSection 5(b). The adjustment of the Liquidation Preference as provided in thisSection 3(c) shall satisfy in full the Corporation’s obligation to pay dividends on the applicable Dividend Payment Date, and following such adjustment under no circumstance shall dividends be deemed to be accrued or in arrears with respect to any period prior to and including such Dividend Payment Date.

(d) Dividends payable on each Dividend Payment Date shall be paid to record holders of the shares of Convertible Preferred as they appear on the Corporation’s books at the close of business on the 10th Business Day (hereinafter defined) immediately preceding the respective Dividend Payment Date or on such other record date as may be fixed by the Board in advance of a Dividend Payment Date, provided that no such record date shall be less than 10 or more than 60 calendar days preceding such Dividend Payment Date. If a Dividend Payment Date is not a Business Day, then any dividend declared in respect of such date shall be due and payable on the first Business Day following such Dividend Payment Date. Dividends paid in cash on shares of Convertible Preferred in an amount less than the total amount of such dividends at the time

2

payable shall be allocated pro rata on a share by share basis among all shares outstanding. “Business Day” means any day other than a Saturday, Sunday or a day on which banking institutions in New York, New York are authorized or obligated by law or executive order to close.

(e) So long as any shares of Convertible Preferred are outstanding, no dividend or other distribution, whether in liquidation or otherwise, shall be declared or paid, or set apart for payment on or in respect of, any Junior Securities, nor shall any Junior Securities be redeemed, purchased or otherwise acquired for any consideration prior to the stated maturity thereof (or any money be paid to a sinking fund or otherwise set apart for the purchase or redemption of any such Junior Securities), without the prior consent of the holders of a majority of the outstanding shares of Convertible Preferred voting together as a separate class. So long as any shares of Convertible Preferred are outstanding and without the prior consent of the holders of a majority of the outstanding shares of Convertible Preferred voting together as a separate class, no dividend or other distribution, whether in liquidation or otherwise, shall be declared or paid, or set apart for payment on or in respect of, any Parity Securities, nor shall any Parity Securities be redeemed, purchased or otherwise acquired for any consideration prior to the stated maturity thereof (or any money be paid to a sinking fund or otherwise set apart for the purchase or redemption of any such Parity Securities), unless (i) if there are any accrued and unpaid dividends on the Convertible Preferred or such Parity Stock, such dividend or distribution shall be allocated to pay such accrued and unpaid dividends on the Convertible Preferred and such Parity Stock, pro rata based on the amount of such accrued and unpaid dividends and (ii) if all accrued and unpaid dividends have been paid on the Convertible Preferred and such Parity Stock, such dividends and distributions shall be allocated pro rata to the holders of the Convertible Preferred and the Parity Stock based on the respective liquidation preferences thereof. “Parity Security” means any class or series of stock issued by the Corporation ranking on parity with the Convertible Preferred with respect to payment of dividends, and upon liquidation, dissolution or winding up of the Corporation.

4.Liquidation Preference.

(a)Distribution Amount. In the event of any liquidation, dissolution or winding up of the Corporation, either voluntary or involuntary, the holders of the Convertible Preferred shall be entitled to receive, in accordance with the preference and priority described inSection 2 as to any distribution of any assets of the Corporation to the holders of any other class or series of shares, the amount of $74,453 per share of Convertible Preferred (the “Initial Liquidation Preference”), as the same may be adjusted pursuant toSection 3(c), plus any accrued but unpaid dividends thereon (together, the “Liquidation Preference”). “Liquidation Rate” means an amount equal to (i) the Liquidation Preference divided by (ii) the Initial Liquidation Preference. To the extent the available assets are insufficient to fully satisfy the Liquidation Preference, then the holders of the Convertible Preferred shall share ratably in such distribution in the proportion that each holder’s shares bears to the total number of shares of Convertible Preferred outstanding. No payment on account of any such liquidation, dissolution or winding up of the Corporation shall be paid to the holders of the shares of Convertible Preferred or the holders of any Parity Securities unless there shall be paid at the same time to the holders of the shares of Convertible Preferred and the holders of any Parity Securities amounts in proportion to the respective full preferential amounts to which each is entitled with respect to such distribution.

3

For purposes of thisSection 4(a), absent the consent of holders of 66 2/3% of the Convertible Preferred, a Change of Control occurring after the Issue Date shall be deemed to be a liquidation, dissolution or winding-up of the Corporation;provided, however, that payments on account of such Change of Control may not be made unless such payment complies with the “restricted payment” limitations set forth in Section 4.4 of that certain indenture dated as of July 16, 2012 governing the Corporation’s senior notes due 2020 or that certain indenture dated as of November 6, 2012 relating to the Corporation’s senior notes due 2021 (the “Indentures”), and similar provisions of any other indenture governing senior notes of the Corporation;provided, however, that the provisions of such other indentures, when considered together with the Indentures, do not create any greater limitation on the Corporation’s ability to make any payment to the holders of the Convertible Preferred upon a Change of Control than is imposed by the Indentures. “Change of Control” shall be deemed to have occurred upon (A) the acquisition at any time by a “person” or “group” (as such terms are used in Sections 13(d) and 14(d)(2) of the Securities Exchange Act of 1934 (the “Exchange Act”)), other than a person or group who or which is the beneficial owner (as defined in Rule 13d-3 under the Exchange Act), directly or indirectly, of 5% or more of the Corporation’s common stock on the Issue Date, of securities (excluding shares of Convertible Preferred and common stock issuable upon conversion of the Convertible Preferred) representing more than 50% of the combined voting power in the election of directors of the then outstanding securities of the Corporation or any successor of the Corporation; (B) approval by the Corporation or any of its subsidiaries of any sale or disposition of substantially all of the assets of the Corporation and its subsidiaries, taken as a whole; or (C) approval by the stockholders of the Corporation of any merger, consolidation or statutory share exchange to which the Corporation is a party as a result of which the persons who were stockholders immediately prior to the effective date of the merger, consolidation or share exchange shall have beneficial ownership of less than 50% of the combined voting power in the election of directors of the surviving corporation.

(b) After payment of the full amount payable to the holders of Convertible Preferred pursuant toSection 4(a), and subject to the rights of holders of Junior Securities other than the Common Stock, the holders of Common Stock shall share in the distribution of the remaining available assets of the Corporation under the Corporation’s Amended and Restated Certificate of Incorporation.

(c) Written notice of any liquidation, dissolution or winding up of the Corporation, stating the payment date or dates when and the place or places where the amounts distributable in such circumstances shall be payable, shall be given by first class mail, postage prepaid, not less than 15 days prior to any payment date stated therein, to the holders of record of the shares of Convertible Preferred at their respective addresses as the same shall appear in the records of the Corporation.

5.Conversion.

The Convertible Preferred shall be convertible into Common Stock in accordance with the following:

(a)Conversion Rate. Each share of Convertible Preferred shall initially at the Issue Date be convertible into ten thousand (10,000) shares of Common Stock (subject to adjustment as set forth herein, the “Conversion Rate”), and each fractional share of Convertible Preferred shall at the Issue Date be convertible into a proportionate number of shares of Common Stock.

4

(b)Automatic Conversion. The Convertible Preferred shall automatically convert into Common Stock on the day (the “Conversion Date”) immediately following the last to occur of: (1) approval by the stockholders of the Corporation, and filing with the Secretary of State of the State of Delaware (in each case, in accordance with the requirements of the DGCL and the Corporation’s Amended and Restated Certificate of Incorporation and Fourth Amended and Restated Bylaws) of an amendment to the Amended and Restated Certificate of Incorporation of the Corporation increasing the number of shares of Common Stock that the Corporation is authorized to issue from 336,666,666 shares to the amount of authorized, unissued and unreserved shares necessary to convert the all of the Convertible Preferred shares; (2) approval by the stockholders of the Corporation in accordance with the requirements of the New York Stock Exchange (“NYSE”) (or other principal securities market upon which the Corporation’s securities may then be listed or traded) of the issuance of the Common Stock to be issued upon conversion of the Convertible Preferred in accordance with the terms hereof (the “Conversion Stockholder Approval”); (3) approval of the NYSE (or other principal securities market upon which the Corporation’s securities may then be listed or traded) of the listing of the Common Stock to be issued upon conversion of the Convertible Preferred in accordance with the terms hereof; and (4) to the extent applicable, termination of the waiting period under the Hart-Scott-Rodino Antitrust Improvements Act of 1976. Each share of Convertible Preferred shall be convertible into such number of fully paid and non-assessable shares of Common Stock as is determined by dividing (i) the Liquidation Rate determined pursuant toSection 4 as of the Conversion Date by (ii) the Conversion Rate in effect on the Conversion Date (subject to adjustment pursuant hereto). Upon the automatic conversion of the Convertible Preferred, each holder shall be deemed to own the number of shares of Common Stock into which the holder’s shares of Convertible Preferred are converted. Promptly thereafter the holder shall surrender the certificate or certificates representing the Convertible Preferred that were converted at the office of the Corporation or of the transfer agent for such shares, or at such other place designated by the Corporation. Such surrender may be made by registered mail with return receipt requested, properly insured, by hand or by overnight courier. The Corporation shall, promptly upon receipt of such certificates representing the Convertible Preferred shares that have been converted, deliver to such holder, a certificate or certificates for the number of shares of Common Stock to which such holder shall be entitled. At the close of business on the Conversion Date, each holder shall be deemed to be the beneficial owner of the shares of Common Stock, and the Convertible Preferred theretofore held by such holder shall no longer be outstanding.

(c)Certificates as to Adjustments. Upon the occurrence of any adjustment of the Liquidation Preference or Liquidation Rate pursuant toSection 3(c), or the occurrence of any adjustment or readjustment of the Conversion Rate pursuant hereto, the Corporation at its expense shall promptly compute such adjustment or readjustment in accordance with the terms hereof and the principal financial officer of the Corporation shall verify such computation and prepare and furnish to each holder of Convertible Preferred a certificate setting forth such adjustment or readjustment and showing in detail the facts upon which such adjustment or readjustment is based. The Corporation shall, upon the written request at any time of any holder of Convertible Preferred, furnish or cause to be furnished to such holder a like certificate prepared by the Corporation setting forth (i) such adjustments and readjustments and (ii) the number of shares of Common Stock or other securities and the amount, if any, of other property which at the time would be received upon the conversion of each share of Convertible Preferred.

5

(d)Notice of Record Date. If the Corporation takes a record of the holders of any class of securities for the purpose of determining the holders thereof who are entitled to receive any dividend (other than a cash dividend) or other distribution, any security or right convertible into or entitling the holder thereof to receive additional shares of Common Stock, or any right to subscribe for, purchase or otherwise acquire any shares of stock of any class or any other securities or property, or to receive any other right, the Corporation shall mail to each holder of Convertible Preferred at least ten days prior to the date specified therein, a notice specifying the date on which any such record is to be taken for the purpose of such dividend, distribution, security or right and the amount and character of such dividend, distribution, security or right.

(e)Issue Taxes. The Corporation shall pay any and all issue and other taxes, excluding any income, franchise or similar taxes, that may be payable in respect of any issue or delivery of shares of Common Stock on conversion of shares of Convertible Preferred;provided,however, that the Corporation shall not be obligated to pay any transfer taxes resulting from any transfer requested by any holder in connection with any such conversion.

(f)Reservation of Stock Issuable Upon Conversion. From and after the satisfaction of the condition set forth inSection 5(b)(1), the Corporation shall at all times reserve and keep available out of its authorized but unissued shares of Common Stock, solely for the purpose of effecting the conversion of the shares of the Convertible Preferred, such number of its shares of Common Stock as shall from time to time be sufficient to effect the conversion of all outstanding shares of the Convertible Preferred, and if at any time the number of authorized but unissued shares of Common Stock shall not be sufficient to effect the conversion of all then outstanding shares of the Convertible Preferred, the Corporation will take such corporate action as may, in the opinion of its counsel, be necessary to increase its authorized but unissued shares of Common Stock to such number of shares as shall be sufficient for such purpose, including, without limitation, engaging in best efforts to obtain the requisite stockholder approval.

(g)Fractional Shares. No fractional shares of Common Stock shall be issued upon the conversion of any share or shares of Convertible Preferred. All shares of Common Stock (including fractions thereof) issuable upon conversion of more than one share of Convertible Preferred by a holder thereof shall be aggregated for purposes of determining whether the conversion would result in the issuance of any fractional share. If, after the aforementioned aggregation, the conversion would result in the issuance of a fraction of a share of Common Stock, in lieu of issuing any fractional share, the fraction shall be rounded up or down to the nearest whole number of shares.

(h)Reorganization or Merger. In case of any reorganization or any reclassification of the capital stock of the Corporation or any consolidation or merger of the Corporation with or into any other corporation or corporations or a sale of all or substantially all of the assets of the Corporation to any other person, if such transaction is not treated as a liquidation, dissolution or winding up as provided inSection 4, then, as part of such reorganization, consolidation, merger or sale, provision shall be made so that each share of Convertible Preferred shall thereafter be convertible into the number of shares of stock or other securities or property (including cash) to

6

which a holder of the number of shares of Common Stock deliverable upon conversion of such share of Convertible Preferred would have been entitled upon the record date of (or date of, if no record date is fixed) such event and, in any case, appropriate adjustment (as determined by the Board) shall be made in the application of the provisions herein set forth with respect to the rights and interest thereafter of the holders of the Convertible Preferred, to the end that the provisions set forth herein shall thereafter be applicable, as nearly as equivalent as is practicable, in relation to any shares of stock or the securities or property (including cash) thereafter deliverable upon the conversion of the shares of Convertible Preferred.

6.Anti-Dilution Adjustments.

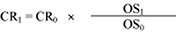

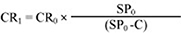

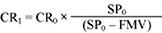

(a)Adjustment for Change in Capital Stock.If, after the Convertible Preferred is issued, the Corporation: (i) pays a dividend or makes another distribution payable in shares of Common Stock on the Common Stock; (ii) subdivides the outstanding shares of Common Stock into a greater number of shares; or (iii) combines the outstanding shares of Common Stock into a smaller number of shares; then the Conversion Rate in effect immediately prior to the record date for such dividend or distribution, or the effective date of such share split or share combination, shall be adjusted by the Corporation based on the following formula:

where

CR0 = the Conversion Rate in effect immediately prior to such “Ex-Dividend Date” (the first date upon which a sale of the Common Stock does not automatically transfer the right to receive the relevant distribution from the seller of the Common Stock to the buyer) or effective date;

CR1 = the new Conversion Rate in effect immediately after such Ex-Dividend Date or effective date;

OS0 = the number of shares of Common Stock outstanding immediately prior to such Ex-Dividend Date or effective date; and

OS1 = the number of shares of Common Stock outstanding immediately prior to such Ex-Dividend Date or effective date but after giving effect to such dividend, distribution, share split or share combination.

If any dividend or distribution described in thisSection 6(a) is declared but not so paid or made, the new Conversion Rate shall be readjusted to the Conversion Rate that would then be in effect if such dividend or distribution had not been declared.

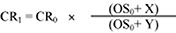

(b)Adjustment for Rights Issue. If, after the Convertible Preferred is issued, the Corporation distributes to all, or substantially all, holders of shares of Common Stock any rights, warrants or options entitling them to subscribe for or to purchase shares of Common Stock at an exercise price per share of Common Stock less than the average of the closing prices of the Common Stock for each trading day in the 10-consecutive trading day period ending on the

7

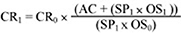

trading day immediately preceding the time of announcement of such issuance (other than any rights, warrants or options that by their terms will also be issued to holders upon conversion of their Convertible Preferred into Common Stock), then the Conversion Rate in effect immediately prior to the Ex-Dividend Date for such distribution shall be adjusted by the Corporation in accordance with the following formula:

where

CR0 = the Conversion Rate in effect immediately prior to the Ex-Dividend Date for such distribution;

CR1 = the new Conversion Rate in effect immediately after the Ex-Dividend Date for such distribution (i.e., the Conversion Rate in effect before trading commences on the morning after the Ex-Dividend Date);

OS0 = the number of shares of Common Stock outstanding immediately prior to the Ex-Dividend Date for such distribution;

X = the number of shares of Common Stock issuable pursuant to such rights, warrants or options; and

Y = an amount equal to (A) the number of shares of Common Stock issuable pursuant to such rights, warrants or options multiplied by the aggregate price payable to exercise such rights, warrants or options divided by (B) the average of the closing prices of the Common Stock for each trading day in the 10-consecutive trading day period ending on the trading day immediately preceding the date of announcement for the issuance of such rights, warrants or options.

For purposes of thisSection 6(b), in determining whether any rights, warrants or options entitle the holders to subscribe for or purchase shares of Common Stock at less than the average of the closing prices for each trading day in the applicable 10-consecutive trading day period, there shall be taken into account any consideration the Corporation receives for such rights, warrants or options and any amount payable on exercise thereof, with the value of such consideration, if other than cash, to be determined in good faith by the Board.

If any right, warrant or option described in thisSection 6(b) is not exercised prior to the expiration of the exercisability thereof, the new Conversion Rate shall be readjusted by the Corporation to the Conversion Rate that would then be in effect if such right, warrant or option had not been so issued.

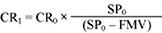

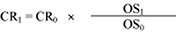

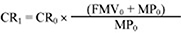

(c)Adjustment for Other Distributions. If, after the Convertible Preferred is issued, the Corporation distributes to all, or substantially all holders of its Common Stock shares of capital stock, evidences of indebtedness or other assets or property, excluding: (i) dividends, distributions, rights, warrants or options referred to inSection 6(a) orSection 6(b); (ii) dividends or distributions paid exclusively in cash; and (iii) Spin-Offs described below in thisSection 6(c), then the Conversion Rate will be adjusted by the Corporation based on the following formula:

8

where

CR0 = the Conversion Rate in effect immediately prior to the Ex-Dividend Date for such distribution;

CR1 = the new Conversion Rate in effect immediately after the Ex-Dividend Date for such distribution;

SP0 = the average of the closing prices of the Common Stock for each trading day in the 10-consecutive trading day period ending on the trading day immediately preceding the Ex-Dividend Date for such distribution; and

FMV = the fair market value (as determined in good faith by the Board) of the shares of capital stock, evidences of indebtedness, assets or property distributed with respect to each outstanding share of Common Stock on the earlier of the record date or the Ex-Dividend Date for such distribution.

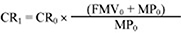

With respect to an adjustment pursuant to thisSection 6(c), where there has been a payment of a dividend or other distribution to all, or substantially all, holders of Common Stock of shares of capital stock of any class or series, or similar equity interest, of or relating to any subsidiary of the Corporation or other business unit of the Corporation (a “Spin-Off”), then the Conversion Rate in effect immediately before the close of business on the effective date of the Spin-Off will be adjusted by the Corporation based on the following formula:

where

CR0 = the Conversion Rate in effect immediately prior to the effective date of the Spin-Off;

CR1 = the new Conversion Rate after the Spin-Off;

FMV0 = the average of the closing prices of the capital stock or similar equity interest distributed to holders of Common Stock applicable to one share of Common Stock over the 10-consecutive trading days after, and including, the effective date of the Spin-Off; and

MP0 = the average of the closing prices of the Common Stock over the 10-consecutive trading days after, and including, the effective date of the Spin-Off.

An adjustment to the Conversion Rate made pursuant to the immediately preceding paragraph will occur on the 10th trading day from, and including, the effective date of the Spin-Off; provided, that, in respect of any conversion within the 10 trading days following, and including, the effective date of any Spin-Off, references within thisSection 6(c) to 10 trading days shall be deemed replaced with such lesser number of trading days as have elapsed between the effective date of such Spin-Off and the Conversion Date in determining the applicable Conversion Rate.

9

If any such dividend or distribution described in thisSection 6(c) is declared but not paid or made, the new Conversion Rate shall be readjusted by the Corporation to be the Conversion Rate that would then be in effect if such dividend or distribution had not been declared.

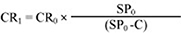

(d)Adjustment for Cash Dividends. If, after the Convertible Preferred is issued, the Corporation makes any cash dividend or distribution to all, or substantially all, holders of its outstanding Common Stock, then the Conversion Rate in effect immediately prior to the Ex-Dividend Date for such distribution shall be adjusted by the Corporation based on the following formula:

where

CR0 = the Conversion Rate in effect immediately prior to the Ex-Dividend Date for such distribution;

CR1 = the new Conversion Rate in effect immediately after the Ex-Dividend Date for such distribution;

SP0 = the average of the closing prices of the Common Stock for each trading day in the 10-consecutive trading day period ending on the trading day immediately preceding the Ex-Dividend Date for such distribution; and

C = the amount in cash per share that the Corporation distributes to holders of its Common Stock.

If any dividend or distribution described in thisSection 6(d) is declared but not so paid or made, the new Conversion Rate shall be readjusted by the Corporation to the Conversion Rate that would then be in effect if such dividend or distribution had not been declared.

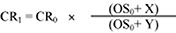

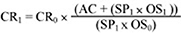

(e)Adjustment for Common Stock Repurchases. If, after the Convertible Preferred is issued, the Corporation or any of its subsidiaries effects a purchase of all or a portion of the shares of Common Stock by the Corporation pursuant to a tender offer or exchange offer or any other offer available to substantially all holders of Common Stock (“Pro Rata Repurchase”), to the extent that the cash and value of any other consideration included in the payment per share of its Common Stock exceeds the Closing Price of a share of its Common Stock on the trading day following the effective date of such Pro Rata Repurchase, then the Conversion Rate in effect immediately prior to the effective date of such Pro Rata Repurchase shall be adjusted by the Corporation based on the following formula:

10

where

CR0 = the Conversion Rate in effect immediately prior to the effective date of such Pro Rata Repurchase;

CR1 = the new Conversion Rate in effect after such Pro Rata Repurchase;

AC = the aggregate value of all cash and any other consideration (as determined in good faith by the Board) paid or payable for the Common Stock purchased in such Pro Rata Repurchase;

OS0 = the number of shares of Common Stock outstanding immediately prior to such Pro Rata Repurchase;

OS1 = the number of shares of Common Stock outstanding immediately after the effective date of such Pro Rata Repurchase (after giving effect to such Pro Rata Repurchase); and

SP1 = the average of the closing prices of the Common Stock for each trading day in the 10-consecutive trading day period commencing on the trading day following the effective date of such Pro Rata Repurchase.

The adjustment to the Conversion Rate under thisSection 6(e) will occur on the 10th trading day from, and including, the trading day following the effective date of such Pro Rata Repurchase; provided, that, in respect of any conversion within 10 trading days immediately following, and including, the effective date of such Pro Rata Repurchase, references in thisSection 6(e) with respect to 10 trading days shall be deemed replaced with such lesser number of trading days as have elapsed between the effective date of such Pro Rata Repurchase and the Conversion Date in determining the Conversion Rate.

(f)Notice of Adjustments. Whenever the Conversion Rate is adjusted, the Corporation shall promptly mail to holders of Convertible Preferred a notice of the adjustment, with such notice briefly stating the facts requiring the adjustment and the manner of computing it. The Corporation shall also deliver an Officers’ Certificate with respect to the adjustment.

7.Redemption of Convertible Preferred.

(a) On August 15, 2021, if any shares of Convertible Preferred are then outstanding, a redemption event (“Redemption Event”) shall be deemed to have occurred.

(b) Within 10 days after a Redemption Event, the Corporation shall mail a written notice (the “Redemption Notice”) to each holder of record of the Convertible Preferred at the address last shown on the records of the Corporation for such holder, notifying such holder of the redemption which is to be effected, the date on which the redemption of the Convertible Preferred shall occur (which day (the “Redemption Date”) must be within 30 days of the Redemption Event), the place at which payment may be obtained and calling upon each such holder to surrender to the Corporation, in the manner and at the place designated, a certificate or certificates representing the total number of shares of Convertible Preferred held by such holder.

11

On or after the Redemption Date, each holder of Convertible Preferred then outstanding shall surrender to the Corporation the certificate or certificates representing the shares of Convertible Preferred owned by such holder as of the Redemption Date, in the manner and at the place designated in the Redemption Notice, and thereupon an amount equal to the Liquidation Preference per share of Convertible Preferred shall be payable to the order of the person whose name appears on such certificate or certificates as the owner thereof and each surrendered certificate shall be canceled.

8.Corporation’s Dealings with Holders of Convertible Preferred. No payments shall be made to holders of Convertible Preferred, and no redemptions of Convertible Preferred shall be made, unless the right to receive such payments or participate in such redemptions are made available to all holders of Convertible Preferred on a pro rata basis based on the number of shares of Convertible Preferred such holder holds.

9.Consent Rights. The Corporation shall not undertake the following actions without the approval by the vote or written consent of the holders of at least 66 2/3% of the shares of Convertible Preferred then outstanding, voting together as a single class:

(a) amend, alter, waive, repeal or modify (whether by merger, consolidation or otherwise) any provision of the Amended and Restated Certificate of Incorporation (including any filing or amending of a Certificate of Designation for any Senior Securities or Parity Securities) or Fourth Amended and Restated Bylaws of the Corporation so as to adversely affect or otherwise impair any of the rights, preferences, privileges, qualifications, limitations or restrictions of, or applicable to, the Convertible Preferred;

(b) authorize, issue or increase the authorized amount of any class of Senior Securities or Parity Securities;

(c) increase or decrease (other than by redemption or conversion) the authorized number of shares of Convertible Preferred;

(d) liquidate, dissolve or wind up the Corporation in any form of transaction; or

(e) enter into any agreement regarding, or any transaction or series of transactions resulting in, a Change of Control unless provision is made in the agreement effecting such transaction for the redemption of the Convertible Preferred underSection 4.

10.Voting Rights.

(a)General Voting Rights. So long as any shares of Convertible Preferred are outstanding, holders of Convertible Preferred shall be entitled to vote on all matters submitted to a vote of the holders of the Corporation’s Common Stock, including with respect to the election of directors of the Corporation;provided,however, that notwithstanding the foregoing, to the extent prohibited under the rules of the NYSE (or such principal securities exchange upon which the Corporation’s Common Stock is then listed), the holders of Convertible Preferred shall not be entitled to vote on: (i) any proposal to increase the authorized shares of Common Stock under the Amended and Restated Certificate of Incorporation of the Corporation in order to permit the conversion of shares of Convertible Preferred into shares of Common Stock in accordance with

12

the terms hereof, or (ii) any proposal required under the rules of such exchange to authorize the issuance of the shares of Common Stock to the Convertible Preferred holders upon the conversion of the Convertible Preferred in accordance with the terms hereof. Each holder of Convertible Preferred shall be entitled to such number of votes as the number of shares of Common Stock into which such Convertible Preferred holder’s shares of Convertible Preferred would be convertible at the time of the record date for any such vote and for the purpose of such calculation, shares of Common Stock sufficient for the full conversion of all shares of the Convertible Preferred shall be deemed to be authorized for issuance under the Amended and Restated Certificate of Incorporation of the Corporation on such date and shall be included in such calculation;provided,however, that notwithstanding the foregoing, until such time as the Conversion Stockholder Approval has been obtained, the aggregate number of votes entitled to be cast by the Convertible Preferred shall not exceed 19.99% of the voting power of the Common Stock outstanding immediately prior to the issuance of the Convertible Preferred, applied on a pro rata per share basis, among all holders of Convertible Preferred.

(b)Board Representation.

(i) If by the Grace Period Expiration Date, the Conversion Stockholder Approval has not been obtained and there is no director appointed Petro-Hunt, L.L.C. and Pillar Energy, LLC (collectively, “Petro-Hunt”) serving on the Board pursuant to the terms of the Reorganization and Interest Purchase Agreement, dated October 19, 2012, among Halcón Energy Properties, Inc., Petro-Hunt L.L.C. and Pillar Energy, LLC, the holders of the Convertible Preferred, exclusively and as a separate class, shall be entitled to elect one member of the Board, subject to such individual satisfying all legal and governance requirements mandated by the NYSE or applicable law regarding service as a director of the Corporation and to the reasonable approval of the Board or any committee established by the Board to address specified governance issues. The director elected under thisSection 10(b) is referred to as the “Preferred Director”. On or as promptly as possible after the Issue Date, the Board shall take or cause to be taken such corporate action as shall be necessary to increase the size of the Board to permit the election of the Preferred Director.

(ii) The election of the Preferred Director shall occur (A) at the annual meeting of stockholders, (B) at any special meeting of stockholders if such meeting is called for the purpose of electing directors, (C) at any special meeting of holders of shares of Convertible Preferred called by holders of not less than a majority of the outstanding shares of Convertible Preferred or (D) by the written consent of holders of a majority of the outstanding shares of Convertible Preferred entitled to vote for the Preferred Director in the manner and on the basis as otherwise provided by law. At any meeting having as a purpose the election of the Preferred Director, the presence, in person or by proxy, of holders of not less than one-third (1/3) of the outstanding shares of Convertible Preferred shall be required and sufficient to constitute a quorum of such class for the election of the Preferred Director. The holders of shares of Convertible Preferred shall be entitled to notice of any stockholders’ meeting in accordance with the Fourth Amended and Restated Bylaws of the Corporation and notice of any other matter submitted to a vote of stockholders.

13

(iii) If at any time when any share of Convertible Preferred is outstanding the Preferred Director should cease to be a Preferred Director for any reason, the vacancy may be filled by the vote or written consent of the holders of the outstanding shares of Convertible Preferred, voting together as a separate class, in the manner and on the basis specified above or as otherwise provided by law. Subject to satisfaction of all legal and governance requirements mandated by the NYSE or applicable law regarding service as a director of the Corporation and to the reasonable approval of the Board or any committee established by the Board to address specified governance issues, the Preferred Director elected or appointed to fill a vacancy shall serve the remainder of the term for which his or her predecessor was elected or appointed, subject, however, to his or her prior death, resignation, retirement, disqualification, or removal.

(iv) The Preferred Director may be removed with or without cause by, and only by, the affirmative vote of the holders of not less than a majority of the outstanding shares of Convertible Preferred, given either at a special meeting of the holders of Convertible Preferred duly called for that purpose, or by written consent of the holders of Convertible Preferred.

(c)Calling a Meeting. The holders of not less than 20% of the shares of Convertible Preferred outstanding may request the calling of a special meeting of the holders of Convertible Preferred, which meeting shall thereupon be called by the Chief Executive Officer, President, an Executive Vice President or the Secretary of the Corporation. Notice of such meeting shall be given to each holder of record of Convertible Preferred by mailing a copy of such notice to such holder at such holder’s last address as the same appears on the books of the Corporation. Such meeting shall be called for a time not earlier than 20 days and not later than 60 days after such request and shall be held at such place as specified in such request. If such meeting shall not be called within 20 days after such request, then the holders of not less than 20% of the shares of Convertible Preferred outstanding may designate in writing any holder of Convertible Preferred to call such meeting on similar notice at the expense of the Corporation. Any holder of Convertible Preferred so designated shall have access to the stock books of the Corporation relating to Convertible Preferred for the purpose of calling a meeting of the holders pursuant to these provisions.

(d)Action Without Meeting. With respect to actions by the holders of Convertible Preferred upon those matters on which such holders are entitled to vote as a separate class, such actions may be taken without a meeting by the written consent of such holders who would be entitled to vote at a meeting having voting power to cast not less than the minimum number of votes that would be necessary to authorize or take such action at a meeting at which all holders of the Convertible Preferred entitled to vote were present and voted.

11.Status of Reacquired Shares of Convertible Preferred. Shares of outstanding Convertible Preferred reacquired by the Corporation (including shares of Convertible Preferred that shall have been redeemed pursuant to the provisions hereof) or cancelled upon conversion into Common Stock shall have the status of authorized and unissued shares of Preferred Stock, undesignated as to series, and subject to later designation and issuance by the Corporation in accordance with its Amended and Restated Certificate of Incorporation.

12.Preemptive Rights. Holders of Convertible Preferred shall not be entitled to any preemptive, subscription or similar rights in respect to any securities of the Corporation, except as specifically set forth herein.

14

13.Notices. Any notice required by the provisions hereof to be given to the holders of Convertible Preferred shall be deemed given if deposited in the United States Mail, first class postage prepaid, and addressed to each holder of record at his or her address appearing on the books of the Corporation. Any notice required by the provisions hereof to be given to the Corporation shall be deemed given if deposited in the United States Mail, first class postage prepaid, and addressed to the Corporation at 1000 Louisiana, Suite 6700, Houston, Texas 77002, or such other address as the Corporation shall provide in writing to the holders of Convertible Preferred.

14.Amendments. With the consent or approval of the holders of at least a majority of the Convertible Preferred then outstanding, the Corporation may amend or modify any of the foregoing rights, privileges and preferences with respect to the shares of Convertible Preferred, provided that no such amendment may materially and adversely affect a holder of Convertible Preferred without the holder’s approval. Notwithstanding the foregoing, the Corporation may amend or modify (i) the consent rights described inSection 9 of the holders of Convertible Preferred and (ii) any other rights described herein requiring consent or approval of the holders of 66 2/3% of the Convertible Preferred only with the approval by the vote or written consent of the holders of at least 66 2/3% of the Convertible Preferred then outstanding.

15

IN WITNESS WHEREOF, the undersigned has executed this Certificate as of December 5, 2012.

| | |

| HALCÓN RESOURCES CORPORATION |

| |

| By: | | /s/ Floyd C. Wilson |

| Name: | | Floyd C. Wilson |

| Title: | | Chief Executive Officer |

[SIGNATURE PAGETO CERTIFICATEOF DESIGNATION, PREFERENCE, RIGHTSAND LIMITATIONS

(8% AUTOMATICALLY CONVERTIBLE PREFERRED STOCK) – HALCÓN RESOURCES CORPORATION]