As filed with the Securities and Exchange Commission on September 27, 2021

1933 Act Registration File No. 333-[...]

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-14

| | | | | | | | | | | | | | | | | |

| REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933 | [ | X | ] |

| Pre-Effective Amendment No. | | | [ | | ] |

| Post-Effective Amendment No. | | | [ | | ] |

and/or

| | | | | | | | | | | | | | | | | |

| REGISTRATION STATEMENT UNDER THE INVESTMENT COMPANY ACT OF 1940 | [ | X | ] |

| Amendment No. | | | [ | | ] |

(Check appropriate box or boxes.)

BAIRD FUNDS, INC.

(Exact Name of Registrant as Specified in Charter)

777 East Wisconsin Avenue

Milwaukee, WI 53202

(Address of Principal Executive Offices, including Zip Code)

Registrant’s Telephone Number, including Area Code: (414) 765-3500

| | | | | | | | |

| Charles M. Weber, Esq. | | Copy to: |

| Robert W. Baird & Co. Incorporated | | Carol A Gehl, Esq. |

| 777 East Wisconsin Avenue | | Godfrey & Kahn, S.C. |

| Milwaukee, WI 53202 | | 833 Michigan Street, Suite 1800 |

| (Name and Address of Agent for Service) | | Milwaukee, WI 53202 |

Approximate Date of Proposed Public Offering: As soon as practicable after this Registration Statement becomes effective under the Securities Act of 1933, as amended.

It is proposed that this filing will become effective on October 27, 2021 pursuant to Rule 488 under the Securities Act of 1933, as amended.

No filing fee is required because of reliance on Section 24(f) of the Investment Company Act of 1940, as amended.

| | | | | |

| Title of Securities Being Registered: | Shares of common stock, $0.01 par value per share, of the Baird Equity Opportunity Fund |

Subject to completion dated September 27, 2021

The information in this Proxy Statement/Prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This Proxy Statement/Prospectus is not an offer to sell these securities, and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

BAIRD FUNDS, INC.

BAIRD SMALL/MID CAP VALUE FUND

777 East Wisconsin Avenue

Milwaukee, Wisconsin 53202

1-866-442-2473

www.BairdFunds.com

[•], 2021

Dear Shareholder,

We wish to provide you with some important information concerning your investment. After careful consideration, the Board of Directors (the “Board”) of Baird Funds, Inc. (the “Company”) has unanimously approved the reorganization of the Baird Small/Mid Cap Value Fund, a series of the Company (the “Target Fund”), with and into the Baird SmallCap Value Fund (the “Acquiring Fund” and together with the Target Fund, the “Funds”), also a series of the Company (the “Reorganization”). The Board approved the Reorganization on September 7, 2021.

If shareholders of the Target Fund approve the Reorganization, your shares would be exchanged for shares of the Acquiring Fund equal in value to the shares of the Target Fund that you currently hold. Robert W. Baird & Co. Incorporated (the “Advisor”) serves as the investment adviser for both Funds. Both Funds have the same investment objective and the Acquiring Fund will continue to invest in companies with small to medium market capitalizations, with a focus on smaller companies.

At the September 7, 2021 meeting, the Board also approved the retention of Greenhouse Funds LLLP (“Greenhouse”) as the subadvisor to the Acquiring Fund and a related subadvisory agreement, a new investment advisory agreement with the Advisor, a change in the Acquiring Fund’s diversification status and the adoption of a new name for the Acquiring Fund: “Baird Equity Opportunity Fund.” Shareholders of the Acquiring Fund have been asked to approve the new investment advisory agreement, the retention of Greenhouse and subadvisory agreement and related changes in a proxy statement that is separate from this Proxy Statement/Prospectus at a meeting scheduled for December 7, 2021. The Acquiring Fund will pay a higher annual advisory fee rate than the rate currently paid by the Target Fund. All changes to the Acquiring Fund are contingent upon the approval of the new advisory and subadvisory agreements by shareholders of the Acquiring Fund, and these changes are expected to take place concurrent with the closing of the Reorganization.

The Reorganization is subject to approval by shareholders of the Target Fund at a special meeting to be held on December 7, 2021, and is also subject to approval by shareholders of the Acquiring Fund of the new investment advisory and subadvisory agreements.

The Advisor recommended the Reorganization to the Board. The Board and the Advisor have recommended this proposal for the following reasons, as discussed in more detail in the proxy statement/prospectus:

•The Reorganization will allow shareholders of the Target Fund to continue to pursue their investment goals through a similar fund that invests in small- and mid-cap companies.

•The retention of a new sub-advisor for the combined Fund has the potential for improved net of fee performance.

•The Reorganization may benefit Fund shareholders by resulting in a combined fund with a larger asset base and greater prospects for long-term viability.

•The Reorganization is expected to qualify as tax-free to shareholders of the Target Fund.

•Other alternatives to the Reorganization included a liquidation of the Target Fund, which would be a taxable event for shareholders that are not tax exempt.

Based on these and other factors, the Board believes that the Reorganization is in the best interest of the Target Fund and its shareholders and the interests of the existing shareholders of the Funds will not be diluted. Accordingly, the Board recommends you vote FOR the proposed reorganization.

Your vote is important no matter how many shares you own. Voting your shares early will help prevent costly follow-up mail and telephone solicitation. The Proxy Statement/Prospectus provides greater detail about the proposal. The Board recommends that you read the enclosed materials carefully and vote FOR the proposal.

You may choose one of the following options: (i) to authorize a proxy to vote your shares (which is commonly known as proxy voting), or (ii) to vote in person at the meeting:

•Mail: Complete and return the enclosed proxy card(s).

•Internet: Access the website shown on your proxy card(s) and follow the online instructions.

•Telephone (automated service): Call the toll-free number shown on your proxy card(s) and follow the recorded instructions.

•In person: Attend the meeting on December 7, 2021.

Thank you for your response and for your continued investment in Baird Funds.

Sincerely,

Mary Ellen Stanek

President, Baird Funds, Inc.

BAIRD FUNDS, INC.

BAIRD SMALL/MID CAP VALUE FUND

777 East Wisconsin Avenue

Milwaukee, Wisconsin 53202

NOTICE OF SPECIAL MEETING OF SHAREHOLDERS

To be held on December 7, 2021

Notice is hereby given that a special meeting (the “Meeting”) of shareholders of the Baird Small/Mid Cap Value Fund, a series of Baird Funds, Inc. (the “Company’), will be held on December 7, 2021, at 1:30 p.m., local time, at 777 East Wisconsin Avenue, Galleria Conference Room (lobby level) Milwaukee, Wisconsin 53202 for the purpose of considering the following proposal, as well as any other business that may properly come before the Meeting or any adjournments or postponements thereof.

1. To approve an Agreement and Plan of Reorganization (the “Plan”) pursuant to which the Baird Small/Mid Cap Value Fund (the “Target Fund”) will be reorganized with and into the Baird SmallCap Value Fund, which would become the Baird Equity Opportunity Fund, and the transactions contemplated in the Plan.

The Board of Directors of the Company recommends that shareholders vote FOR the proposal. Only shareholders of record of the Target Fund at the close of business on October 22, 2021, the record date for the Meeting, are entitled to notice of and to vote at the Meeting and at any adjournments or postponements thereof.

By Order of the Board of Directors,

Charles M. Weber

Secretary of Baird Funds, Inc.

Milwaukee, Wisconsin

[•], 2021

| | |

| As a shareholder of the Target Fund, you are asked to attend the Meeting either in person or by proxy. Please note, shareholders who plan to attend the Meeting in person, will be required to adhere to the COVID-19-related policies in place at the Meeting location, which may include, without limitation, wearing a mask or cloth face covering while on the premises and practicing social distancing. In light of uncertainties relating to COVID-19, the Company reserves the flexibility to change the date, time, location or means of conducting the special meeting of shareholders. In the event of such a change, the Company will issue a press release announcing the change, available at [ ], and file the announcement on the Securities and Exchange Commission’s EDGAR system, among other steps, but may not deliver additional soliciting materials to shareholders or otherwise amend the proxy materials. If you plan to attend the Meeting in person, please bring a form of identification. Even if you plan to attend the Meeting in person, we urge you to authorize your proxy prior to the Meeting. You can do this in one of three ways by: (1) completing, signing, dating, and promptly returning the enclosed proxy card in the enclosed postage prepaid envelope, (2) calling a toll-free telephone number, or (3) using the Internet. Your prompt authorization of a proxy will help assure a quorum at the Meeting and avoid additional expenses associated with further solicitation. Voting by proxy will not prevent you from voting your shares in person at the Meeting. You may revoke your proxy before it is exercised at the Meeting by submitting to the Secretary of Baird Funds, Inc. a written notice of revocation or a subsequently signed proxy card (i.e., a later-dated proxy), or by attending the Meeting and voting in person. A prior proxy can also be revoked by proxy voting again through the website or toll-free number noted on the enclosed proxy card. Proxy cards and written notices of revocation must be received by the Target Fund prior to the Meeting. |

SUBJECT TO CHANGE, DATED [•],2021

PROXY STATEMENT/PROSPECTUS

Dated [•], 2021

FOR THE REORGANIZATION OF

BAIRD SMALL/MID CAP VALUE FUND

into

BAIRD SMALLCAP VALUE FUND

Each a series of Baird Funds, Inc.

777 East Wisconsin Avenue

Milwaukee, Wisconsin 53202

1-866-442-2473

www.BairdFunds.com

This Proxy Statement/Prospectus contains the information you should know before voting on the proposed reorganization. described below. Please read it carefully and retain it for future reference.

This Proxy Statement/Prospectus is being sent to you in connection with the solicitation of proxies by the Board of Directors (the “Board”) of Baird Funds, Inc. (the “Company”) for use at the special meeting (the “Meeting”) of shareholders of the Baird Small/Mid Cap Value Fund (the “Target Fund”) to be held on December 7, 2021, at 1:30 p.m., local time, at 777 East Wisconsin Avenue, Galleria Conference Room (lobby level), Milwaukee, Wisconsin 53202, and any adjournments or postponements thereof. At the Meeting, shareholders of the Target Fund will consider an Agreement and Plan of Reorganization (the “Reorganization Agreement”), which provides for the reorganization of the Target Fund into the Baird SmallCap Value Fund (the “Acquiring Fund” and together with the Target Fund, the “Funds”) (the “Reorganization”). Each of the Target Fund and the Acquiring Fund is a series of the Company, an open-end investment management company organized as a Wisconsin corporation.

The Board approved the Reorganization Agreement at a meeting held on September 7, 2021. At the September 7, 2021 meeting, the Board also approved a new investment advisory and a subadvisory agreement for the Acquiring Fund, a change in the diversification status of the Acquiring Fund to a “non-diversified” fund within the meaning of the Investment Company Act of 1940, and the adoption of a new name: “Baird Equity Opportunity Fund.” The proposed new subadvisor for the Acquiring Fund is Greenhouse Funds LLLP (“Greenhouse” or the “Subadvisor”), an affiliate of the Advisor. Shareholders of the Acquiring Fund have been asked to approve the new investment advisory agreement and the subadvisory agreement in a proxy statement separate from this Proxy Statement/Prospectus at a meeting scheduled for December 7, 2021 (the “Greenhouse Subadvisor Proposal”). Shareholders of the Acquiring Fund have also been asked to approve a change in the Fund’s diversification status. The foregoing changes to the Acquiring Fund are contingent upon shareholder approval of the Greenhouse Subadvisor Proposal, and are expected to take place on or about December 13, 2021, concurrent with the closing of the Reorganization.

Under the Reorganization Agreement, as of the closing date of the Reorganization, shareholders of the Target Fund will receive a class of shares of the Acquiring Fund equivalent in aggregate net asset value to the aggregate net asset value of their shares of the Target Fund, as follows:

| | | | | |

Baird Small/Mid Cap Value Fund

(Target Fund) | Baird Equity Opportunity Fund

(n/k/a Baird SmallCap Value Fund)

(Acquiring Fund) |

Institutional Class → | Institutional Class |

Investor Class → | Institutional Class |

The consummation of the Reorganization is subject to both approval of the Reorganization by shareholders of the Target Fund and approval of the Greenhouse Subadvisor Proposal by shareholders of the Acquiring Fund. If shareholder approvals are obtained, the consummation of the Reorganization and the change of the name of the Baird SmallCap Value Fund to the Baird Equity Opportunity Fund are expected to take place concurrently, and after the closing of the Reorganization, shareholders of the Target Fund would own shares of the Baird Equity Opportunity Fund. For ease of reference throughout the Proxy Statement/Prospectus, “Acquiring Fund” will be used to refer to Baird SmallCap Value Fund prior to the consummation of the proposed changes to the Fund and the Reorganization, and the term “Baird Equity Opportunity Fund” will be used for the Fund following the consummation of the proposed changes to the Fund and the Reorganization or in instances when the approval of the Greenhouse Subadvisor Proposal and consummation of the Reorganization has been assumed for discussion purposes. The Target Fund and the Acquiring Fund/Baird Equity Opportunity Fund are collectively referred to as the “Funds.”

If you need additional copies of this Proxy Statement/Prospectus or the proxy card, please contact Broadridge Financial Solutions, Inc. at [ ] or in writing at [ ]. Additional copies of the Proxy Statement/Prospectus will be delivered to you promptly upon request. To obtain directions to attend the Meeting, please call 1-866-442-2473. For a free copy of the Funds’ Semi-Annual and Annual Reports to Shareholders for the fiscal periods ended June 30, 2021 and December 31, 2020, respectively, please contact the Company at the telephone number and address listed above, or visit the Funds’ website at www.BairdFunds.com.

A copy of the form of the Reorganization Agreement is attached to this Proxy Statement/Prospectus as Appendix A.

A vote “FOR” the proposed Reorganization is essentially a vote to move your investment from the Target Fund into the Baird Equity Opportunity Fund. This Proxy Statement/Prospectus sets forth the basic information you should know before voting on the proposal and if the Reorganization is approved, investing in the Baird Equity Opportunity Fund. You should read it and keep it for future reference. It is both a Proxy Statement for the Meeting and a Prospectus for the Baird Equity Opportunity Fund. The Board of Directors of the Company recommends you vote “FOR” the Reorganization.

The following documents have been filed with the Securities and Exchange Commission (the “SEC”) and are incorporated by reference herein:

•The Statement of Additional Information relating to transactions described herein, dated [ ], 2021 (the “Reorganization SAI”);

•The Prospectus for the Target Fund and the Acquiring Fund, dated May 1, 2021, as supplemented to date (the “Fund Prospectus”); and

This Proxy Statement/Prospectus and the accompanying materials were first mailed to shareholders of the Target Fund on or about [•], 2021. Copies of the Reorganization SAI, Annual Report, Fund Prospectus and the Fund SAI are available upon request and without charge by writing to the address below by visiting the Company’s website or by calling (toll-free) the telephone number listed as follows:

Baird Funds, Inc.

c/o U.S. Bancorp Fund Services, LLC

P.O. Box 701

Milwaukee, Wisconsin 53201-0701

1-866-442-2473

www.bairdfunds.com

A preliminary Prospectus and Statement of Additional Information for the Baird Equity Opportunity Fund have been filed with the SEC and can be accessed at www.sec.gov.

The SEC has not approved or disapproved the Baird Equity Opportunity Fund shares to be issued in the Reorganization nor has it passed on the accuracy or adequacy of this Proxy Statement/Prospectus. Any representation to the contrary is a criminal offense.

Mutual fund shares are not deposits or obligations of, or guaranteed or endorsed by, any bank, and are not insured by the Federal Deposit Insurance Corporation. Mutual fund shares involve investment risk, including the possible loss of principal.

No person has been authorized to give any information or to make any representations other than those contained in this Proxy Statement/Prospectus and in the materials expressly incorporated herein by reference and, if given or made, such other information or representations must not be relied upon as having been authorized by the Funds.

Table of Contents

| | | | | |

| Page |

| PROPOSAL 1 APPROVAL OF THE REORGANIZATION AGREEMENT | |

| SUMMARY | |

| INFORMATION ABOUT THE REORGANIZATION | |

| VOTING INFORMATION | |

| ADDITIONAL INFORMATION ABOUT THE FUNDS | |

| AVAILABLE INFORMATION | |

| LEGAL MATTERS | |

| FINANCIAL HIGHLIGHTS | |

| APPENDIX A | |

| APPENDIX B | |

| APPENDIX C | |

PROPOSAL 1

APPROVAL OF THE REORGANIZATION AGREEMENT

SUMMARY

Summary. This Proxy Statement/Prospectus (the “Proxy Statement”) is related to the Reorganization of the Target Fund with and into the Acquiring Fund, each a series of the Company, pursuant to the terms of the Reorganization Agreement, which among other things involves (1) the transfer of all of the assets and liabilities of the Target Fund to the Acquiring Fund in exchange for Institutional Class shares of common stock of the Acquiring Fund (the “Acquiring Fund Shares”); (2) the assumption by the Acquiring Fund of the liabilities of the Target Fund; and (3) the distribution to the shareholders of each class of the Target Fund full and fractional shares of Institutional Class shares of the Acquiring Fund in redemption of all outstanding shares of common stock of the Target Fund (“Target Fund Shares”) and in complete liquidation of the Target Fund. The Reorganization will be effected pursuant to the terms and conditions of the Reorganization Agreement, and, if approved by shareholders of the Target Fund, is expected to close on or about December 13, 2021 (the “Closing Date”). You should read the entire Proxy Statement carefully, including the Reorganization Agreement, which is attached as Appendix A, because it contains details that are not in this summary.

At a meeting held on September 7, 2021 the Board approved the Reorganization Agreement and recommended that shareholders of the Target Fund approve the Reorganization. The consummation of the Reorganization is contingent upon both shareholder approval of the Reorganization and approval of the Greenhouse Subadvisor Proposal by shareholders of the Acquiring Fund as described above. If these shareholder approvals are obtained, upon the consummation of the Reorganization, each Investor Class and Institutional Class shareholder of the Target Fund will receive Institutional Class shares of the Acquiring Fund having an aggregate value equal to the aggregate value of the shares of the Target Fund held by that shareholder as of the Closing Date.

In considering whether to approve the Reorganization, you should note that:

•The closing of the Reorganization is scheduled to take place concurrent with certain changes that have been proposed for the Acquiring Fund, including the retention of Greenhouse as subadvisor and changes to the Fund’s investment strategy and name. If approved by shareholders of the Acquiring Fund, Greenhouse would replace the Advisor as the firm responsible for the day-to-day portfolio management of the Acquiring Fund, the Acquiring Fund would be managed according to Greenhouse’s investment strategy and, if approved by shareholders of the Acquiring Fund, the Acquiring Fund would be classified as a non-diversified Fund for purposes of the Investment Company Act of 1940, as amended (the “1940 Act”). The Acquiring Fund’s name would also change from “Baird SmallCap Value Fund” to “Baird Equity Opportunity Fund.”

•The Target Fund is required to invest primarily in small- and mid-cap securities. The Baird Equity Opportunity Fund would continue to invest in smaller companies and would be required to invest at least 80% of its net assets in equity securities (consisting of common stocks, preferred stocks, American Depositary Receipts (“ADRs”) or other depositary shares or receipts, rights, warrants, exchange-traded funds (“ETFs”), and options whose reference asset is an equity security or equity securities index ), assuming approval of the Greenhouse Subadvisor Proposal by shareholders of the Acquiring Fund.

•Similar to the Target Fund, the Baird Equity Opportunity Fund, would invest in small- and mid-cap companies, defined as companies with a market capitalization of less than $20 billion, with a focus on smaller companies. The portfolio manager of the Target Fund follows a strategy that focuses on value companies, whereas Greenhouse, as the subadvisor to the Baird Equity Opportunity Fund, would apply an opportunistic strategy

that will likely result in investments in a mix of value and growth companies. The Target Fund is currently categorized in, and the Baird Equity Opportunity Fund is expected to be categorized in, the “small blend” Morningstar category.

•The Baird Equity Opportunity Fund is expected to hold a more limited number of investments, typically 25-50 holdings.

•The Baird Equity Opportunity Fund would be permitted to purchase and sell options for hedging purposes and to enhance returns.

•The Baird Equity Opportunity Fund’s primary benchmark index is proposed to change from the Russell 2000® Value Index to the Russell 2000® Index.

•As discussed further below, the annual investment advisory fee rate for the Baird Equity Opportunity Fund is proposed to be 1.25%, which is higher than that currently in place for the Target Fund, due to the proposed subadvisory fee rate to be paid to Greenhouse, which the Advisor recommends due to the Advisor’s belief that Greenhouse’s management of the Fund will improve the potential for net of fee performance for shareholders of both Funds.

•Both gross and net expense ratios for shareholders of the Baird Equity Opportunity Fund are expected to be higher than those of the Target Fund. However, the Advisor has agreed to limit the Baird Equity Opportunity Fund’s annual fund operating expenses for Institutional Class shares and Investor Class shares through at least April 30, 2025, to 1.25% and 1.50%, respectively, subject to certain expense exclusions consistent with the Target Fund’s current expense cap agreement with the Advisor.

•Investor Class shareholders of the Target Fund will receive Institutional Class shares of the Baird Equity Opportunity Fund in the Reorganization and be exempt from the investment minimum otherwise applicable to Institutional Class shares.

•Shareholders of the Acquiring Fund are being solicited to approve the Greenhouse Subadvisor Proposal, and the Acquiring Fund’s adoption of the new investment strategy and name as well as consummation of the Reorganization are contingent upon shareholder approval of the Greenhouse Subadvisor Proposal at a special meeting to be held prior to the Meeting.

•The Reorganization is intended to qualify for federal income tax purposes as a tax-free reorganization pursuant to Section 368(a) of the Internal Revenue Code of 1986, as amended (the “Code”). Accordingly, neither the Target Fund nor its shareholders are expected to recognize any gain or loss for federal income tax purposes from the transactions contemplated by the Reorganization Agreement.

Reasons for the Reorganization. The Advisor recommended the Reorganization in connection with the Greenhouse Subadvisor Proposal for the Acquiring Fund. Greenhouse is a registered investment adviser based in Baltimore, Maryland with an established long-only U.S. equities strategy and is an affiliate of the Advisor. The Advisor recommended the retention of Greenhouse and the Reorganization following a strategic review of the Funds in light of their performance and scale challenges. The Reorganization will allow shareholders of the Target Fund to continue to pursue their investment goals through another equity fund with the same investment objective that invests in small- and mid-cap companies. In addition, the Advisor believes the retention of Greenhouse as subadvisor to the combined Fund has the potential for improved net of fee performance. The Advisor also believes the Reorganization may benefit shareholders by resulting in a combined Fund with a larger asset base and greater prospects for long-term viability. The Reorganization is expected to qualify as tax-free to shareholders of the Target

Fund for federal income tax purposes. Alternatives to the Reorganization included a liquidation of the Target Fund, which would be a taxable event for Target Fund shareholders that are not tax exempt.

The Advisor recommended, and the Board unanimously approved, the Reorganization of the Target Fund into the Acquiring Fund pursuant to the Reorganization Agreement. In considering the Advisor’s recommendation, the Board considered a number of factors, which are discussed in more detail under “Information About the Reorganization,” including potential alternatives to the Reorganization. In connection with the Greenhouse Subadvisor Proposal, the Board approved (1) a new investment advisory agreement authorizing the Advisor to delegate the day-to-day portfolio management to one or more subadvisors such as Greenhouse; (2) a new subadvisory agreement with Greenhouse; and (3) the reclassification of the Acquiring Fund from a “diversified” to a “non-diversified” fund within the meaning of the Investment Company Act of 1940, each subject to approval of the shareholders of the Acquiring Fund. As part of the Greenhouse Subadvisor Proposal, the Acquiring Fund will be renamed the “Baird Equity Opportunity Fund,” the principal strategies of the Acquiring Fund will be modified and the Acquiring Fund’s investment advisory fee will increase, as described in more detail below.

Comparison of Investment Objectives and Principal Investment Strategies. The following table compares the investment objectives and principal investment strategies of the Target Fund to those of the proposed Baird Equity Opportunity Fund.

Both Funds invest primarily in equity securities of small- to medium-market capitalizations. Both Funds invest principally in U.S. companies but each Fund may invest up to 15% of its total assets in foreign companies including American Depositary Receipts (“ADRs”). The Baird Equity Opportunity Fund may invest in exchange-traded funds (“ETFs”) and may also purchase and sell (or write) options to hedge its portfolio or enhance returns as part of its principal investment strategy. The Target Fund is diversified while the Baird Equity Opportunity Fund is anticipated to be non-diversified and will hold fewer companies. Each Fund’s portfolio manager considers environmental, social and governance (ESG) factors as part of the overall investment decision-making process.

| | | | | | | | |

| Target Fund | Baird Equity Opportunity Fund (subject to shareholder approval of the Greenhouse Subadvisor Proposal) |

| Investment Objective | To provide long-term capital appreciation.

| Same. |

| The investment objective is fundamental and may not be changed without shareholder approval. | |

| | |

| Principal Investment Strategies | The Fund normally invests at least 80% of its net assets, plus any borrowings for investment purposes, in a diversified portfolio of common stocks of companies with small-to-medium market capitalizations. | The Fund normally invests at least 80% of its net assets, plus any borrowings for investment purposes, in equity securities. However, the Fund will not borrow for investment purposes. |

| | |

| Small-to-medium market capitalization companies are defined as those with a maximum market capitalization of $17 billion at the time of investment.

| The Fund invests primarily in a select portfolio of equity securities of companies with small- to medium-market capitalizations (those with market capitalizations, at the time of purchase, of less than $20 billion). |

| | |

| | | | | | | | |

| Target Fund | Baird Equity Opportunity Fund (subject to shareholder approval of the Greenhouse Subadvisor Proposal) |

| Although the Fund invests principally in U.S. companies, the Fund may invest up to 15% of its total assets in equity securities (consisting of common stocks, ordinary shares and ADRs) of foreign companies that are traded on U.S. exchanges. | Although the Fund invests principally in U.S. companies, the Fund may invest up to 15% of its total assets in equity securities of foreign companies. |

| | |

| | Equity securities in which the Fund may invest include common stocks, preferred stocks, ADRs or other depositary shares or receipts, rights, warrants, ETFs, and options whose reference asset is an equity security or equity securities index. In addition to equity ETFs, the Fund may also invest in ETFs generally. The Fund may also purchase and sell (or write) options to hedge its portfolio or enhance returns. |

| | |

| | The Fund will normally hold a limited number (typically 25 to 50) of companies. However, the Fund may hold fewer or more companies from time to time and invest in companies with larger market capitalizations when the Subadvisor believes doing so will help efforts to achieve the Fund’s investment objective. |

| | |

| Number of Holdings and Market Capitalization | As of September 30, 2021, the Target Fund’s portfolio consisted of [•] holdings.

As of September 30, 2021, the Target Fund’s median market capitalization was $[•] billion. | The Fund will typically hold between 25-50 positions. As of September 30, 2021, the strategy to be employed by Greenhouse for the Fund consisted of [•] holdings.

As of September 30, 2021, the strategy to be employed by Greenhouse for the Fund had a median market capitalization of $[•] billion. |

| | |

| Investment Process/Philosophy | The Advisor seeks to identify industries and business models that it believes are priced at a discount to their true value because they are currently out of favor with the market or have earnings or profit potential that may be underestimated by Wall Street analysts. The Advisor seeks to purchase securities of small-to-medium capitalization companies believed to have favorable valuation characteristics and opportunities for increased growth. The Advisor primarily considers the following factors:

• Valuation – Low price/earnings, price/book and price/cash flow ratios. These characteristics are evaluated based upon a proprietary analysis of forecasted levels of profitability.

| In selecting investments for the Fund, the Subadvisor employs bottom-up research and fundamental analyses with a focus on companies that the Subadvisor believes possess a favorable risk/return profile. The Subadvisor seeks attractive opportunities for the Fund by evaluating industry dynamics and competitive forces as well as a company’s business model, earnings quality, profitability, cash flows, management acumen and demonstrated capital stewardship. Extensive financial modeling and valuation assessments are then used to calculate the expected risk and return, after which the Subadvisor exercises its experience and judgment to determine timing and position sizing.

The Subadvisor seeks companies with the following key attributes: |

| | |

| | | | | | | | |

| Target Fund | Baird Equity Opportunity Fund (subject to shareholder approval of the Greenhouse Subadvisor Proposal) |

| • Balance Sheet Strength – Above average projected net margins, returns on equity, returns on assets, free cash flow generation, and revenue and earnings growth rates; trends in balance sheet items, including inventories and accounts receivable and payable, are also scrutinized.

| • Large addressable market with a well-structured competitive landscape;

• Attractive business model with a sustainable competitive advantage;

• Stable or expanding profit margins and return on capital; |

| | |

| • Product Offering/Market Position – The company offers a valuable product or service and has a good market position within a viable industry. | • Positive and growing free cash flow;

• Disciplined management team practicing intelligent capital deployment; and |

| | |

| • Accounting Policies and Management – The company possesses sound financial and accounting policies and has a high quality management team with a track record of success. | • The presence or prediction of meaningful change includes business model, product set, management, capital allocation strategy and valuation. |

| | |

| The Advisor also considers environmental, social and governance (ESG) factors in selecting investments for the Fund. As a long-term, buy and hold investor, the Advisor includes ESG considerations as part of its overall investment decision-making. The Advisor believes ESG factors vary across companies, industries, and sectors and therefore does not apply exclusionary ESG screens in selecting investments for the Fund. | The Advisor also considers environmental, social and governance (ESG) factors in selecting investments for the Fund. As a long-term, buy and hold investor, the Advisor includes ESG considerations as part of its overall investment decision-making. The Advisor believes ESG factors vary across companies, industries, and sectors and therefore does not apply exclusionary ESG screens in selecting investments for the Fund. |

| | |

| The Advisor will typically sell a security held by the Fund when the investment thesis changes, the company’s fundamentals deteriorate, the Advisor identifies portfolio structure or risk management needs and/or the security’s valuation relative to its peer group is no longer attractive. | The Subadvisor considers the following factors, among others, in deciding to sell positions: when the price objective has been reached with no change to underlying fundamentals, when a significant negative event changes the Subadvisor’s view of the company’s prospects, when target catalysts are realized or when an investment loses its attractiveness relative to other potential opportunities. The Subadvisor will also trim or sell securities to manage the Fund’s risk related to position sizing. |

| | |

| | Although the Subadvisor’s target investment horizon is generally measured in years, the Subadvisor may from time to time engage in short-term trading for the Fund to take advantage of potential opportunities. |

| | | | | | | | |

| Target Fund | Baird Equity Opportunity Fund (subject to shareholder approval of the Greenhouse Subadvisor Proposal) |

| | |

| Cash or Similar Investments; Temporary Strategies | Under normal circumstances, each Fund may invest up to 20% of its net assets in cash or liquid reserves (such as U.S. government securities, money market mutual funds, repurchase agreements, commercial paper or certificates of deposit). Each Fund may invest up to 100% of its total assets in cash or similar short-term investment grade securities (such as U.S. government securities, money market mutual funds, repurchase agreements, commercial paper or certificates of deposit) as a temporary defensive position during adverse market, economic or political conditions and in other limited circumstances. To the extent a Fund engages in any temporary strategies or maintains a substantial cash position, the Fund may not achieve its investment objective. To the extent that a Fund invests in money market funds, there will be some duplication of expenses because the Fund would bear its pro rata portion of such money market fund’s management fees and operational expenses. | Same. |

Comparison of Principal Risks of Investing in the Funds. The Target Fund and the Baird Equity Opportunity Fund have identical investment objectives and invest in similar securities, and therefore the investment risks associated with an investment in the Target Fund are similar to those associated with an investment in the Baird Equity Opportunity Fund. However, because the Baird Equity Opportunity Fund is proposed to become a “non-diversified” Fund for purposes of the the 1940 Act, the risks are not the same. A discussion of the principal risks of investing in the Target Fund and the Baird Equity Opportunity Fund is set forth below. The following table sets forth the principal risks of each Fund. For ease of review, the risks that are the same for both Funds have been presented first.

| | | | | | | | |

| Target Fund | Baird Equity Opportunity Fund (subject to shareholder approval of the Greenhouse Subadvisor Proposal) |

| Principal Risks | | |

| Stock Market Risks | Stock prices vary and may fall, thus reducing the value of the Fund’s investments. Certain stocks selected for the Fund’s portfolio may decline in value more than the overall stock market. The U.S. and international markets have recently experienced extreme price volatility and reduced liquidity. Continuing market problems may have adverse effects on the Fund. | Same. |

| | |

| | | | | | | | |

| Target Fund | Baird Equity Opportunity Fund (subject to shareholder approval of the Greenhouse Subadvisor Proposal) |

| Management Risks | The Advisor’s judgments about the attractiveness, value and potential appreciation of particular companies’ stocks may prove to be incorrect. Such errors could result in a negative return to the Fund and a loss to you. | Same, except the Fund’s risk refers to the Subadvisor as follows:

The Subadvisor’s judgment about the attractiveness, value and potential appreciation of particular companies’ stocks may prove to be incorrect. Such errors could result in a negative return to the Fund and a loss to you. |

| | |

| Equity Securities Risks | Equity securities may experience sudden, unpredictable drops in value or long periods of decline in value. This change may occur because of factors that affect securities markets generally or factors affecting specific industries, sectors or companies in which the Fund invests. | Same. |

| | |

| Common Stock Risks | Common stocks are susceptible to general stock market fluctuations and to volatile increases and decreases in value as market confidence in and perceptions of their issuers change. Holders of common stocks are generally subject to greater risk than holders of preferred stocks and debt obligations of the same issuer because common stockholders generally have inferior rights to receive payments from issuers in comparison with the rights of preferred stockholders, bondholders and other creditors. | Same. |

| | |

| Small-to-Medium Market Capitalization Risks | Stocks of companies with small and medium market capitalizations involve a higher degree of risk than investments in the broad-based equities market. Small- to mid-capitalization stocks are often more volatile and less liquid than investments in larger companies, and are more likely to be adversely affected by poor economic or market conditions. In addition, small- to mid-capitalization companies may lack the management experience, financial resources and product diversification of larger companies, making them more susceptible to market pressures and business failure. | Same, except the Fund’s risk is titled “Smaller Market Capitalization Risks”. |

| | |

| Small Fund Risk | There can be no assurance that the Fund will grow to or maintain an economically viable size. | Same. |

| | |

| | | | | | | | |

| Target Fund | Baird Equity Opportunity Fund (subject to shareholder approval of the Greenhouse Subadvisor Proposal) |

| ESG Considerations Risk | Consideration of ESG factors in the investment process may cause the Advisor to forgo opportunities to invest in certain companies or to gain exposure to certain industries or regions and, therefore, carries the risk that, under certain market conditions, the Fund may underperform funds that do not consider such factors. There are not universally accepted ESG factors and the Advisor will consider them in its discretion. | Same, except the Fund’s risk refers to the Subadvisor as follows:

Consideration of ESG factors in the investment process may cause the Subadvisor to forgo opportunities to invest in certain companies or to gain exposure to certain industries or regions and, therefore, carries the risk that, under certain market conditions, the Fund may underperform funds that do not consider such factors. There are not universally accepted ESG factors and the Subadvisor will consider them in its discretion. |

| | |

| Foreign Securities Risks | Securities of foreign issuers and ADRs are subject to certain inherent risks, such as political or economic instability of the country of issue and government policies, tax rates, withholding of foreign taxes, prevailing interest rates and credit conditions that may differ from those affecting domestic corporations. Securities of foreign issuers and ADRs may also be subject to currency fluctuations and controls and greater fluctuation in price than the securities of domestic corporations. Foreign companies generally are subject to different auditing and financial reporting standards than those applicable to domestic companies.

| Same, except the Fund’s risk has been updated to be more current as follows:

Securities of foreign issuers and ADRs are subject to certain inherent risks, such as political or economic instability of the country of issue and government policies, tax rates, withholding of foreign taxes, prevailing interest rates and credit conditions that may differ from those affecting domestic corporations. Securities of foreign issuers and ADRs may also be subject to currency fluctuations and controls and greater fluctuation in price than the securities of domestic corporations. Foreign companies generally are subject to different auditing and financial reporting standards than those applicable to domestic companies. |

| | | | | | | | |

| Target Fund | Baird Equity Opportunity Fund (subject to shareholder approval of the Greenhouse Subadvisor Proposal) |

| The United Kingdom (UK) withdrew from the European Union (EU) on January 31, 2020 following a June 2016 referendum referred to as “Brexit.” Although the UK and EU agreed to a trade deal in December 2020, certain post-EU arrangements, such as those relating to the offering of cross-border financial services and sharing of cross-border data, have yet to be reached and the EU’s willingness to grant equivalency to the UK remains uncertain. There is significant market uncertainty regarding Brexit’s ramifications, and the range of possible political, regulatory, economic and market outcomes is difficult to predict. The uncertainty surrounding the UK’s economy, and its legal, political, and economic relationship with the remaining member states of the EU, may cause considerable disruption in securities markets, including decreased liquidity and increased volatility, as well as currency fluctuations in the British pound’s exchange rate against the U.S. dollar. | The United Kingdom (UK) withdrew from the European Union (EU) on January 31, 2020 following a June 2016 referendum referred to as “Brexit.” Although the UK and EU agreed to a provisional trade deal in December 2020 that was later ratified by the EU Parliament and entered into force on May 1, 2021, certain post-EU arrangements, such as those relating to the offering of cross-border financial services and sharing of cross-border data, have yet to be reached and the EU’s willingness to grant equivalency to the UK remains uncertain. There is significant market uncertainty regarding Brexit’s ramifications, and the range of possible political, regulatory, economic and market outcomes is difficult to predict. The uncertainty surrounding the UK’s economy, and its legal, political, and economic relationship with the remaining member states of the EU, may cause considerable disruption in securities markets, including decreased liquidity and increased volatility, as well as currency fluctuations in the British pound’s exchange rate against the U.S. dollar. |

| | |

Recent Market Events

| U.S. and international markets have experienced significant periods of volatility in recent months and years due to a number of economic, political, social and global macro factors including the impact of the coronavirus (COVID-19) global pandemic, which has resulted in a global health crisis, business interruptions, growth concerns in the U.S. and overseas, layoffs, rising unemployment claims, changed travel and social behaviors, reduced consumer spending, and fiscal, monetary and other government policy responses. The impact of the COVID-19 pandemic may last for an extended period of time. | Same, except the risk has been updated to be more current as follows:

U.S. and international markets have experienced significant periods of volatility in recent months and years due to a number of economic, political and global macro factors including the impact of the coronavirus (COVID-19) global pandemic which resulted in a public health crisis, business interruptions, growth concerns in the U.S. and overseas, travel restrictions, changed social behaviors, rising inflation, and reduced consumer spending. While U.S. and global economies are recovering from the effects of COVID-19 the recovery is proceeding at slower than expected rates and may last for a prolonged period of time. |

| | |

| | | | | | | | |

| Target Fund | Baird Equity Opportunity Fund (subject to shareholder approval of the Greenhouse Subadvisor Proposal) |

| Value-Style Investing Risks | Because the Fund focuses on value-style stocks, its performance may at times be worse than the performance of funds that focus on other types of stocks or that have a different investment style. Value-style investing may go out of favor with investors, negatively impacting the Fund’s growth and performance. Value stocks may also fail to appreciate as much as anticipated, and their intrinsic value may not be recognized by the broader market. | Not applicable. |

| | |

| Financial Sector Risks | The Fund may invest a relatively large percentage of its assets in the financial sector given its weighting in the Fund’s benchmark and, therefore, the Fund’s performance may be adversely affected by volatility in financial and credit markets. Financial services companies (e.g., banks and insurance companies) are subject to extensive government regulation, interest rate risk, credit losses and price competition, among other factors. | Not applicable. |

| | |

| Non-Diversified Fund Risks | Not applicable. | As a non-diversified fund, the Fund may invest a larger percentage of its assets in a smaller number of companies compared to a diversified fund. As a result, a decline in value of one or a few securities held by the Fund will more adversely impact the Fund’s performance than if the Fund’s assets were more evenly invested in a larger number of companies. The Fund’s share price can be expected to fluctuate more than that of a similar fund that is diversified. |

| | |

| Economic Sector Risks | Not applicable. | The Fund may invest a higher percentage of its total assets in one or more economic sectors, which may involve being overweight in those sectors relative to the Fund’s benchmark index. Adverse conditions impacting in those sectors may have a significant negative impact on the Fund’s absolute and relative performance. |

| | |

| | | | | | | | |

| Target Fund | Baird Equity Opportunity Fund (subject to shareholder approval of the Greenhouse Subadvisor Proposal) |

| Options Risks | Not applicable. | The Fund may purchase and sell (or write) call and put options. Options are subject to various types of risks, including market risk, liquidity risk, volatility risk, counterparty risk, legal risk and operations risk. With options purchased by the Fund, the risk is limited to the premium paid for the option as the underlying stock price moves in the opposite direction from desired and the option expires worthless. For options sold or written by the Fund, the primary risk is that the underlying stock price may move directionally away from the exercise price resulting in the option holder exercising the option and requiring the Fund to either deliver the securities (in the case of a call option) or pay for the securities (in the case of a put option) and recognize a significant loss. |

| | |

| ETF Risks | Not applicable. | You will indirectly bear fees and expenses charged by the ETFs in which the Fund invests, in addition to the Fund’s direct fees and expenses. Accordingly, your cost of investing in the Fund will generally be higher than the cost of investing directly in the ETF. The market price of ETF shares may trade at a discount to their net asset value or an active trading market for ETF shares may not develop or be maintained. ETFs in which the Fund invests typically will not be able to replicate exactly the performance of the underlying assets they track. |

| | |

| New Subadvisor Risks | Not applicable. | The Subadvisor has not previously served as a sub-adviser to a registered investment company. It is possible the Subadvisor may not achieve the Fund’s intended investment objective. |

| | |

| Portfolio Turnover Risks | Not applicable. | The Fund may from time to time buy and sell portfolio securities and other assets to rebalance the Fund’s exposure to various market sectors. Higher portfolio turnover may result in the Fund paying higher levels of transaction costs and generating greater tax liabilities for shareholders. Portfolio turnover risk may cause the Fund’s performance to be less than you expect. |

| | |

| | | | | | | | |

| Target Fund | Baird Equity Opportunity Fund (subject to shareholder approval of the Greenhouse Subadvisor Proposal) |

| Shareholder Concentration Risk | Not applicable. | A large percentage of the Fund’s shares may be held by a small number of shareholders, including persons and entities related to the Advisor. A large redemption by one or more of these shareholders could materially increase the Fund’s transaction costs and could increase the Fund’s ongoing operating expenses, which would negatively impact the remaining shareholders of the Fund. |

| | |

| Tax Risk | Not applicable. | Shareholders who are not tax-exempt may experience tax consequences as the Fund’s portfolio is transitioned to the Subadvisor’s strategy. The Fund will generate capital gains (or losses) on the sale of its portfolio securities. The amount of capital gains generated could be significant and the Fund would be required to distribute those capital gains to shareholders. You should consult your tax adviser for further information about federal, state and local tax consequences relative to your specific situation. |

Comparison of Fundamental and Non‑Fundamental Investment Policies and Restrictions. The investment restrictions and limitations applicable to the Baird Equity Opportunity Fund are substantially similar to those of the Target Fund. With respect to each Fund, except as required by the 1940 Act or the Code, any restriction that is expressed as a percentage is adhered to at the time of investment or other transaction; a later change in percentage resulting from changes in the value of a Fund’s assets will not be considered a violation of the restriction.

The Funds are subject to the following fundamental policies. Restrictions that are designated as fundamental policies cannot be changed without the approval of a majority of the outstanding voting securities of a Fund as determined under the 1940 Act. Under the 1940 Act, approval of a “majority of the outstanding voting securities” means approval by the lesser of (1) the holders of 67% or more of a Fund’s shares represented at a meeting of shareholders at which the holders of at least 50% of a Fund’s outstanding shares are present in person or by proxy or (2) more than 50% of the Fund’s outstanding shares. Additional information regarding each Fund’s investment limitations, other than the limitation regarding diversification, which is proposed to change for the Acquiring Fund as part of the Greenhouse Subadvisor Proposal, may be found in the Fund SAI, which is incorporated by reference into this Proxy Statement.

| | | | | | | | | | | |

| Fundamental Investment Restrictions and Policies |

| Policy | Target Fund | Baird Equity Opportunity Fund (subject to shareholder approval of the Greenhouse Subadvisor Proposal and the change in the Fund’s diversification status) | Differences |

| | | |

| Diversification | The Fund may not, with respect to 75% of its total assets, purchase the securities of any one issuer (except securities issued or guaranteed by the U.S. government, or its agencies or instrumentalities) if, as a result, (i) more than 5% of the Fund’s total assets would be invested in the securities of that issuer, or (ii) the Fund would hold more than 10% of the outstanding voting securities of that issuer. | The Fund may not, with respect to 50% of its total assets, purchase the securities of any one issuer (except securities issued or guaranteed by the U.S. government, or its agencies or instrumentalities) if, as a result, (i) more than 5% of the Fund’s total assets would be invested in the securities of that issuer, or (ii) the Fund would hold more than 10% of the outstanding voting securities of that issuer. | The Baird Equity Opportunity Fund is proposed to become a non-diversified fund. As a non-diversified fund, the Baird Equity Opportunity Fund may invest a greater percentage of its assets in the securities of a single issuer. |

| | | |

| | | | | | | | | | | |

| Fundamental Investment Restrictions and Policies |

| Policy | Target Fund | Baird Equity Opportunity Fund (subject to shareholder approval of the Greenhouse Subadvisor Proposal and the change in the Fund’s diversification status) | Differences |

| Borrowing | The Fund may (i) borrow from banks for temporary or emergency purposes (but not for leveraging or the purchase of investments), and (ii) make other investments or engage in other transactions permissible under the 1940 Act, which may involve a borrowing, including borrowing through reverse repurchase agreements, provided that the combination of (i) and (ii) shall not exceed 33 1/3% of the value of the Fund’s total assets (including the amount borrowed), less the Fund’s liabilities (other than borrowings). If the amount borrowed at any time exceeds 33 1/3% of the Fund’s total assets, the Fund will, within three days thereafter (not including Sundays, holidays and any longer permissible period), reduce the amount of the borrowings such that the borrowings do not exceed 33 1/3% of the Fund’s total assets. The Fund may also borrow money from other persons to the extent permitted by applicable laws. | Same. | None. |

| | | |

| Senior Securities | The Fund may not issue senior securities, except as permitted under the 1940 Act. | Same. | None. |

| | | |

| Underwriting | The Fund may not act as an underwriter of another issuer’s securities, except to the extent that the Fund may be deemed to be an underwriter within the meaning of the Securities Act of 1933, as amended, in connection with the purchase and sale of portfolio securities. | Same. | None. |

| | | |

| | | | | | | | | | | |

| Fundamental Investment Restrictions and Policies |

| Policy | Target Fund | Baird Equity Opportunity Fund (subject to shareholder approval of the Greenhouse Subadvisor Proposal and the change in the Fund’s diversification status) | Differences |

| Commodity Interests | The Fund may not purchase or sell physical commodities unless acquired as a result of ownership of other securities or other instruments (but this shall not prevent the Fund from purchasing or selling options, futures contracts or other derivative instruments, or from investing in securities or other instruments backed by physical commodities). | Same. | None. |

| | | |

| Loans | The Fund may not make loans if, as a result, more than 33 1/3% of the Fund’s total assets would be lent to other persons, except through (i) purchases of debt securities or other debt instruments, or (ii) engaging in repurchase agreements. | Same. | None. |

| | | |

| Concentration | The Fund may not purchase the securities of any issuer if, as a result, 25% or more of the Fund’s total assets would be invested in the securities of issuers, the principal business activities of which are in the same industry. | Same. | None. |

| | | |

| Real Estate | The Fund may not purchase or sell real estate, unless acquired as a result of ownership of securities or other instruments (but this shall not prohibit the Fund from purchasing or selling securities or other instruments backed by real estate or of issuers engaged in real estate activities). | Same. | None. |

The Funds are subject to the following non‑fundamental policies, which may be changed by the Board of Directors of the Company without shareholder approval:

| | | | | | | | | | | |

| Non-Fundamental Investment Policies |

| Policy | Target Fund | Baird Equity Opportunity Fund | Differences |

| | | | | | | | | | | |

| Short Sales | The Fund may not sell securities short, unless the Fund owns or has the right to obtain securities equivalent in kind and amount to the securities sold short, or unless it covers such short sale as required by the current rules and positions of the SEC or its staff, and provided that transactions in options, futures contracts, options on futures contracts, or other derivative instruments are not deemed to constitute selling securities short. | Same. | None. |

| | | |

| Securities on Margin | The Fund may not purchase securities on margin, except that the Fund may obtain such short-term credits as are necessary for the clearance of transactions; and provided that margin deposits in connection with futures contracts, options on futures contracts, or other derivative instruments shall not constitute purchasing securities on margin. | Same. | None. |

| | | |

| Securities of Other Investment Companies | The Fund may not purchase securities of other investment companies except in compliance with the 1940 Act and applicable state law. | Same. | None. |

| | | |

| Loans | The Fund may not make any loans, other than loans of portfolio securities, except through (i) purchases of debt securities or other debt instruments, or (ii) repurchase agreements. | Same. | None. |

| | | |

| Borrowing | The Fund may not borrow money except from banks or through reverse repurchase agreements or mortgage dollar rolls. | Same. | None. |

| | | | | | | | | | | |

| | | |

| 80% Policy | The Fund may not make any change in the Fund’s investment policy of investing at least 80% of its net assets in the investments suggested by the Fund’s name without first providing the Fund’s shareholders with at least a 60-day notice. | Same. | None. |

Comparison of Management, Management Fees, Sales Loads and Expense Limitation Agreements of the Target Fund and the Acquiring Fund. The following table compares the investment advisor, portfolio managers, management fees and expense limitations of the Target Fund to the Baird Equity Opportunity Fund. If the Reorganization is consummated, the Target Fund will continue to be managed by Robert W. Baird & Co. Incorporated as its investment advisor. In connection with the retention of Greenhouse as the Baird Equity Opportunity Fund’s subadvisor, the Baird Equity Opportunity Fund will have a new portfolio manager and will pay an increased advisory fee at an annual rate of 1.25% to the Advisor out of which the Advisor will pay a subadvisory fee at an annual rate of 1.00% to Greenhouse. Both Funds are no-load funds. The Advisor has entered into a contractual operating expense limitation agreement with the Target Fund providing that the Advisor will waive its management fees and/or pay expenses of the Target Fund to ensure that the Fund’s total annual fund operating expenses (excluding certain expenses) do not exceed 1.10% and 0.85% of the Target Fund’s average daily net assets for Investor Class and Institutional Class shares, respectively, through at least April 30, 2022. Subject to shareholder approval of the Greenhouse Subadvisor Proposal, the Advisor will enter into a contractual operating expense limitation agreement with the Baird Equity Opportunity Fund providing that the Advisor will waive its management fees and/or pay expenses of the Baird Equity Opportunity Fund to ensure that the Fund’s total annual fund operating expenses do not exceed 1.50% and 1.25% of the Baird Equity Opportunity Fund’s average daily net assets for Investor Class and Institutional Class shares, respectively (subject to certain expense exclusions consistent with the Target Fund’s current expense cap agreement with the Advisor), through at least April 30, 2025. The Baird Equity Opportunity Fund’s new operating expense limitation agreement does not permit the Advisor to recapture expenses it has borne through the agreement to the extent that the Baird Equity Opportunity Fund’s expenses in later periods fall below the annual rates set forth in such agreement or in previous agreements.

Pending shareholder approval of the Reorganization, the Target Fund will continue to be managed according to the Fund’s investment objective and strategies. The Target Fund may continue to experience portfolio turnover costs in connection with its normal investment operations.

If shareholders of the Acquiring Fund approve the Greenhouse Subadvisor Proposal, and shareholders of the Target Fund approve the Reorganization, it is anticipated that a substantial portion of the securities previously held by the Target Fund will be disposed of to align the resultant Baird Equity Opportunity Fund’s portfolio to Greenhouse’s investment strategy. The securities that will be sold and the amount and timing of such sales will depend on future events as Greenhouse evaluates market sectors that are favorable for investment under prevailing market and economic conditions, and will also be impacted by the outcome of another proposal being presented to the Acquiring Fund shareholders for the Acquiring Fund to operate as a non-diversified fund under the 1940 Act. If the shareholders of the Acquiring Fund approve that proposal, the resultant Baird Equity Opportunity Fund will be permitted to invest more assets in fewer companies than if the Acquiring Fund were to remain classified as a diversified fund under the 1940 Act. Based on the foregoing, Greenhouse cannot make any reasonable assumptions about the securities that it will sell, or the amount or timing of such sales, following the Reorganization as of the date of this Proxy Statement.

If the Reorganization is approved and shareholders of the Acquiring Fund approve the retention of Greenhouse as subadvisor, the Baird Equity Opportunity Fund is expected to experience higher portfolio turnover and increased trading costs following the Closing Date as Greenhouse aligns the combined Fund’s securities to the Baird Equity Opportunity Fund’s investment strategy. This could result in increased taxable distributions to shareholders of the Baird Equity Opportunity Fund. You should consult your tax advisor for further information about federal, state and local tax consequences relative to your specific situation.

| | | | | | | | |

| Target Fund | Baird Equity Opportunity Fund (subject to shareholder approval of the Greenhouse Subadvisor Proposal) |

| Investment Advisor | Robert W. Baird & Co. Incorporated

The Advisor was founded in 1919 and has its main office at 777 East Wisconsin Avenue, Milwaukee, Wisconsin 53202. The Advisor is owned indirectly by its employees through several holding companies. The Advisor is owned directly by Baird Financial Corporation (“BFC”). BFC is, in turn, owned by Baird Financial Group, Inc. (“BFG”), which is the ultimate parent company of the Advisor. Employees of the Advisor own substantially all of the outstanding stock of BFG. The Advisor manages the Funds’ investments subject to the authority of and supervision by the Board of Directors. The Advisor serves as the investment advisor to all series of Baird Funds, and also provides investment management services for individuals and institutional clients including pension and profit sharing plans. As of December 31, 2020, the Advisor had approximately $173.5 billion in assets under discretionary management. | Same. |

| | |

| Subadvisor | None. | Greenhouse Funds LLLP |

| | |

| | | | | | | | |

| Portfolio Manager | Michelle E. Stevens, CFA. Ms. Stevens has managed the Fund since its inception. Ms. Stevens joined the Advisor in December 2011 as a Managing Director and is a Senior Portfolio Manager for Baird Equity Asset Management. From October 2008 to December 2011, Ms. Stevens was Principal and the Chief Investment Officer of Riazzi Asset Management. From June 2001 through September 2008, Ms. Stevens was Principal, Portfolio Manager and Value Equity Chief Investment Officer at Transamerica Investment Management, LLC. | Joseph Milano, CFA. Mr. Milano is Founder and Chief Investment Officer of the Subadvisor, having served in such capacities since establishing the Subadvisor in June 2013. Mr. Milano is the portfolio manager of the Greenhouse Master Fund LP and Greenhouse Long Only Master Fund LP, two private funds of which the Subadvisor is the investment manager, and manages Greenhouse’s separately managed accounts. Mr. Milano previously served as portfolio manager of the T. Rowe Price New America Growth Fund from July 2002 until May 2013. Mr. Milano previously served as a vice president of T. Rowe Price, which he joined in 1996. Mr. Milano earned his B.A. from Duke University in 1994. |

| | |

| Management Fees | The Target Fund pays the Advisor, on a monthly basis, an annual management fee based on a percentage of the average daily net assets of the Fund of 0.75%. | The Baird Equity Opportunity Fund will pay the Advisor, on a monthly basis, an annual management fee based on a percentage of the average daily net assets of the Fund of 1.25%.

In addition, for its services to the Baird Equity Opportunity Fund, the Advisor (not the Fund) will pay Greenhouse a subadvisory fee at an annual rate of 1.00% of the Acquiring Fund’s average daily net assets. |

| | |

| Sales Loads | None. | None. |

| | |

| Expense Limitations | The Advisor has contractually agreed to waive management fees and/or reimburse other expenses in order to limit the Fund’s total annual fund operating expenses to 1.10% of average daily net assets for the Investor Class shares and 0.85% of average daily net assets for the Institutional Class shares. The Advisor’s expense reimbursement agreement includes the fees and expenses incurred by the Fund in connection with the Fund’s investments in other investment companies (to the extent, in the aggregate, such expenses exceed 0.0049% of the Fund’s net assets) and interest expense, but excludes taxes, brokerage commissions and extraordinary expenses. The agreement will continue in effect at least through April 30, 2022 and may only be terminated prior to the end of this term by or with the consent of the Board of Directors. | The Advisor has contractually agreed to waive management fees and/or reimburse other expenses in order to limit the Fund’s total annual fund operating expenses to 1.25% of average daily net assets for the Institutional Class shares and 1.50% of the average daily net assets for the Investor Class shares. The Advisor’s expense reimbursement agreement includes the fees and expenses incurred by the Fund in connection with the Fund’s investments in other investment companies (to the extent, in the aggregate, such expenses exceed 0.0049% of the Fund’s net assets) and interest expense, but excludes taxes, brokerage commissions and extraordinary expenses. The agreement will continue in effect at least through April 30, 2025 and may only be terminated prior to the end of this term by or with the consent of the Board of Directors. |

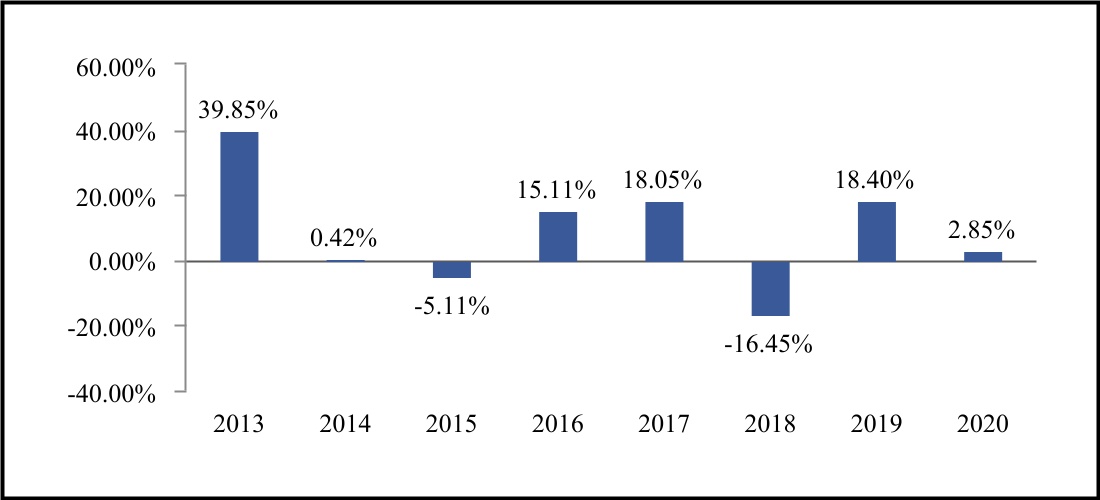

Comparison of Fund Performance. The following tables show historical performance of the Target Fund and the Acquiring Fund and provide some indication of the risks of investing in the Funds.

Tables I and III show how the total returns before taxes for each Fund’s Institutional Class shares have varied from year to year. Tables II and IV show how each Fund’s average annual total returns compare to those of a securities market index. Past performance (before and after taxes) does not guarantee future results. Investors may obtain updated performance information for the Funds at www.bairdfunds.com.

Table I

BAIRD SMALL/MID CAP VALUE FUND (Target Fund)

Calendar Year Returns for Institutional Class Shares

| | | | | | | | |

| Best quarter: | 4th quarter 2020 | 24.29% |

| Worst quarter: | 1st quarter 2020 | -28.00% |

Table II

| | | | | | | | | | | |

| Average Annual Total Returns as of December 31, 2020 |

| 1 Year | 5 Years | Since Inception (11/30/15) |

| Institutional Class | | | |

| Return Before Taxes | 0.48% | 5.94% | 4.85% |

| Return After Taxes on Distributions | 0.31% | 5.77% | 4.68% |

| Return After Taxes on Distributions and Sale of Fund Shares | 0.41% | 4.63% | 3.77% |

| Investor Class | | | |

| Return Before Taxes | 0.15% | 5.64% | 4.56% |

Russell 2500® Value Index (reflects no deduction for fees, expenses or taxes) | 4.88% | 9.43% | 8.26% |

Table III

BAIRD SMALLCAP VALUE FUND (Acquiring Fund)

The total return information presented below shows performance of the Institutional Class shares of the Acquiring Fund as it has been managed by the Advisor under its current investment strategy. If shareholders of the Acquiring Fund approve the Greenhouse Subadvisor Proposal, concurrent with the closing of the Reorganization, the Acquiring Fund would be renamed to the Baird Equity Opportunity Fund and managed by a new subadvisor, Greenhouse, under a new investment strategy. The performance record below does not illustrate the performance by Greenhouse or the proposed Baird Equity Opportunity Fund.

Calendar Year Returns for Institutional Class Shares

| | | | | | | | |

| Best quarter: | 4th quarter 2020 | 27.62% |

| Worst quarter: | 1st quarter 2020 | -27.11% |

Table IV

| | | | | | | | | | | |

| Average Annual Total Returns as of December 31, 2020 |

| 1 Year | 5 Years | Since Inception (5/1/12) |

| Institutional Class | | | |

| Return Before Taxes | 2.85% | 6.69% | 7.73% |

| Return After Taxes on Distributions | 1.56% | 5.96% | 7.14% |

| Return After Taxes on Distributions and Sale of Fund Shares | 2.58% | 5.20% | 6.18% |

| Investor Class | | | |

| Return Before Taxes | 2.54% | 6.43% | 7.46% |

Russell 2000® Value Index (reflects no deduction for fees, expenses or taxes) | 4.63% | 9.65% | 9.56% |

After-tax returns are shown only for Institutional Class shares for the Funds and after-tax returns for Investor Class shares will vary. After-tax returns for the Funds were calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor’s tax situation and may differ from those shown. After-tax returns are not relevant to investors who hold shares of the Funds through a tax‑deferred account, such as a 401(k) plan or an individual retirement account. The Return After Taxes on Distributions and Sale of

Fund Shares may be higher than other return figures when a capital loss occurs upon the redemption of Fund shares and provides an assumed tax benefit that increases the after‑tax return.

The Baird Equity Opportunity Fund will be the accounting and performance survivor following the Reorganization and, accordingly, the performance history of the Acquiring Fund will survive.

The Funds’ Fees and Expenses. The following table shows the current fees and expenses if you buy, hold and sell shares of the Target Fund compared to those of the Acquiring Fund (based on the semi-annual period ended June 30, 2021). The tables also reflect the pro forma combined fees and expenses for the Baird Equity Opportunity Fund after giving effect to the Reorganization assuming the Reorganization had occurred on the first day of the six-month period ended June 30, 2021. You may pay other fees, such as brokerage commissions or other fees to financial intermediaries, which are not reflected in the tables and examples below.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Target Fund | Before the Reorganization – the Acquiring Fund | Pro forma – After the Reorganization – the Baird Equity Opportunity Fund |

| Institutional | | Investor | | Institutional | | Investor | | Institutional | | Investor | |

Shareholder Fees (fees paid directly from your investment | None | | None | | None | | None | | None | | None | |

Annual Fund Operating Expenses (expenses you pay each year as a percentage of the value of your investment) | |

| Management Fees | 0.75% | | 0.75% | | 0.85% | | 0.85% | | 1.25% | | 1.25% | |

| Distribution (12b-1) Fees | None | | 0.25% | | None | | 0.25% | | None | | 0.25% | |

| Other Expenses | 0.68% | | 0.68% | | 0.62% | | 0.62% | | 0.39% | | 0.39% | |

| Total Annual Fund Operating Expenses | 1.43% | | 1.68% | | 1.47% | | 1.72% | | 1.64% | | 1.89% | |

| Less: Fee Waiver/Expense Reimbursement | -0.58% | (1) | -0.58% | (1) | -0.52% | (2) | -0.52% | (2) | -0.39% | (3) | -0.39% | (3) |

| Total Annual Fund Operating Expenses After Fee Wavier | 0.85% | | 1.10% | | 0.95% | | 1.20% | | 1.25% | | 1.50% | |

(1) Robert W. Baird & Co. Incorporated (the “Advisor”) has contractually agreed to waive management fees and/or reimburse other expenses in order to limit the Fund’s total annual fund operating expenses to 1.10% of average daily net assets for the Investor Class shares and 0.85% of average daily net assets for the Institutional Class shares. The Advisor’s expense reimbursement agreement includes the fees and expenses incurred by the Fund in connection with the Fund’s investments in other investment companies (to the extent, in the aggregate, such expenses exceed 0.0049% of the Fund’s net assets) and interest expense, but excludes taxes, brokerage commissions and extraordinary expenses. If such excluded expenses were incurred, Fund expenses would be higher. The Advisor is entitled to recoup the fees waived and/or expenses reimbursed within a three-year period from the time the expenses were incurred, provided that the aggregate amount actually paid by the Fund toward the operating expenses in any month (taking into account the recoupment) will not cause the Fund to exceed the lesser of: (1) the expense cap in place at the time of the fee waiver and/or expense reimbursement; or (2) the expense cap in place at the time of the recoupment. The agreement will continue in effect at least through April 30, 2022 and may only be terminated prior to the end of this term by or with the consent of the Board of Directors.

(2) Robert W. Baird & Co. Incorporated (the “Advisor”) has contractually agreed to waive management fees and/or reimburse other expenses in order to limit the Fund’s total annual fund operating expenses to 1.20% of average daily net assets for the Investor Class shares and 0.95% of average daily net assets for the Institutional Class shares. The Advisor’s expense reimbursement agreement includes the fees and expenses incurred by the Fund in connection with the Fund’s investments in other investment companies (to the extent, in the aggregate, such expenses exceed 0.0049% of the Fund’s net assets) and interest expense, but excludes taxes, brokerage commissions and extraordinary expenses. If such excluded expenses were incurred, Fund expenses would be higher. The Advisor is entitled to recoup the fees waived and/or expenses reimbursed within a three-year period from the time the expenses were incurred provided that the aggregate amount actually paid by the Fund toward the operating expenses in any month (taking into account the recoupment) will not cause the Fund to exceed the lesser of: (1) the expense cap in place at the time of the fee waiver and/or expense reimbursement; or (2) the expense cap in place at the time of the recoupment. The agreement will continue in effect at least through April 30, 2022 and may only be terminated prior to the end of this term by or with the consent of the Board of Directors.